Abstract

Although West African nations are flourishing economically of late, they still have environmental issues due to the high rate of emissions in the bloc. Despite the worsening environmental condition, there have been limited studies on the causal agents of this situation in the region. Therefore, drawing strength from the United Nations’ Sustainable Development Goals (SDGs) and their targeted impacts of 2030, this study explored the nexus between financial development and environmental sustainability in West Africa (WA) for the period 1990 to 2016. The cross-sectional autoregressive distributed lag (CS-ARDL) estimator alongside the cross-sectionally augmented distributed lag (CS-DL) and the cross-sectional augmented error correction (CAEC) estimators were engaged to examine the elastic effects of the explanatory variables on the explained variable and from the results, financial development was harmful to environmental sustainability in WA through high carbon emissions. Also, control variables foreign direct investments, energy consumption, industrialization, and population growth were detrimental to the sustainability of the environment. On the causal connections amid the series, a unidirectional causality from financial development and population growth to carbon emissions was uncovered. Also, feedback causalities between foreign direct investments and carbon emissions, between energy consumption and the effluents of carbon, and between industrialization and environmental pollution were unraveled. Based on the findings, the study recommended among others that the countries should integrate environmental welfare objectives into their financial development policies. Also, the nations should ensure that their citizens have access to energy that is affordable, reliable, sustainable, and modern (SDG 7). Finally, improvement in energy efficiency, sustainable infrastructure, and good use of resources (SDG 12) should be promoted by the nations. The above recommendations if seriously taken into consideration will help the region to combat climate change and its impacts, which is the focus of SDG 13. The main flaw of this exploration was the lack of data for some specific time periods. Therefore, in future when such data become available, similar investigations could be carried out to confirm the robustness of the study’s results.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The rising levels of carbon dioxide emissions and other greenhouse gases (GHG) have recently drawn widespread condemnation. The above hazards are largely caused by activities such as agricultural production, industrialization, urbanization, and other economic activities that are connected to the utilization of dirty energies of which financial sector development is no exception. Financial development could influence environmental sustainability due to its linkage with economic development and energy utilization that are key agents of environmental pollution (Ehigiamusoe and Lean 2019; Kakar 2016; Topcu and Payne 2017). Growth in the financial sector contributes to environmental sustainability by assisting businesses to embrace innovative energy efficient technologies that are not damaging to the environment. This point aligns that of Shahbaz (2009) who postulated that a robust financial sector reduces energy emissions by improving proficiency in the energy zone. Financial sector development also boosts the funding of environmentally friendly projects at reduced costs and increases the inflow of foreign investments that are connected to technological innovations that improve the environment (Abbasi and Riaz 2016; Tamazian et al. 2009). A well-developed financial system not only stimulate the financing of eco-friendly projects by making resources economical, but also penalizes corporates that damage the atmosphere by restricting their access to credit (Yang et al. 2020). According to Nasreen et al. (2017), an advanced financial sector boosts economic growth as well as environmental performance. Thus, nations with strong financial systems have pleasant ecologies than those with weak financial systems.

On the other hand, financial development could be detrimental to environmental sustainability, because it could be a source of finance for many ecologically unfriendly activities undertaken in nations (Khan et al. 2019). Backing the claim of Khan et al. (2019), Mensah et al. (2021) opined that most countries, especially in Africa are under pressure to grow economically and their primary concern are always to increase productivity rather than to conserve their environments. According to the authors, a greater percentage of economic activities undertaken in nations are being funded by the financial sector. However, the activities, which are mostly carbon-intensive, only target economic expansion rather than developing technologies to help protect the environment. Therefore, progress in the financial sector could indirectly influence the greening of environments due to the high rate of pollution associated with the execution of economic activities. Also, robust financial systems help consumers to obtain credits to buy high-polluting items like automobiles, washing machines, air conditioners, and electrical devices among others, that degrade the environment (Kizito et al., 2020). Moreover, advancements in stock markets help to boost the financial position of establishments which empowers them to acquire new machines and other equipment for their operations, thereby surging the rate of energy consumption and, subsequently, high carbon emissions (Sadorsky 2010; Zhang 2011). This point agrees with Abokyi et al. (2019) who indicated that financial development encourages capital investments which in turn increases production, thereby degrading the environment, particularly in fossil-fuel-dependent economies.

The outcome of prior explorations on the linkage between financial development and environmental sustainability are mixed. Studies like Nathaniel et al. (2020), Adebayo and Odugbesan (2020), Gök (2020), and Tahir et al. (2021), among others, affirmed financial development as harmful to environmental sustainability, while those of Umar et al. (2020), Ahmad et al. (2020a), Godil et al. (2021), Bekhet et al. (2017), and Adams and Klobodu (2018), among others, confirmed financial development as friendly to the environment. However, studies like Adebayo and Rjoub (2020), Jiang and Ma (2019), Ziaei (2015), and He et al. (2020), among others, established financial development as a trivial determinant of environmental sustainability. Disparities in the outcomes might be as a result of the adoption of different econometric methods, variations in the proxies used, nature of data employed, the types of countries studied, differences in geographical location, variations in study period, economic and econometric considerations not taken into account, and functional forms of the models specified among others. The lack of consensus on the financial development-environmental sustainability linkage implies more explorations on the nexus between the variables are warranted. Therefore, a study in the context of West Africa was deemed relevant. The analysis focused on West African countries, because developing economies are more vulnerable to environmental pollution than advanced economies supporting that of Argyriou (2019).

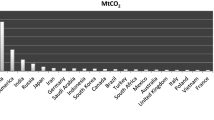

Until recently, climate change issues in the region have been neglected, with much concentration on policies that advance economic growth. Weak financial systems, inadequate investments in energy technologies, over-reliance on fossil fuels, and limited consumption of clean energies, among others, have made the region one of the key emitters of GHG in the globe. According to the World Resources Institute (2010), the West African region’s GHG effluents represented 2.03% of the world figure. In the year 2014, GHG emanations in West Africa was dominated by Nigeria (50%), followed by Cote d’Ivoire (4%), Mali (4%), and Ghana (4%). Combined, these four nations emitted more than 60% of the total GHG effusions in the region. Burkina Faso, Senegal, Guinea, and Niger were each responsible for 3% of the region’s GHG emissions, while Benin contributed 2% of the total. Togo, Sierra Leone, and the Gambia accounted for 1% each, while Liberia, Guinea-Bissau, and Cape Verde emitted less than 1% each. While growth in the West Africa economy is commendable, factors that deteriorate the eco-system of the region should also be seriously taken into consideration. Therefore, studying the financial development-environmental sustainability linkage in West Africa to help come out with suggestions to meet the sustainable development goals (SDGs), especially goal 13, was well in line. According to SDG 13, GHG effusions should be reduced to zero by 2050 to help bring global warming to below 1.5 °C.

The study contributes to extant literature as follows: firstly, to the best of our knowledge, this is the first study to examine the financial development-environmental sustainability linkage in the context of West Africa, while controlling for foreign direct investments, energy consumption, industrialization, and population growth at the same time to help minimize the consequences associated with the issue of omitted viable bias. Controlling for the above variables was also essential, because countries in West Africa have suffered a variety of economic shocks, which could have a significant impact on the level of financial development and environmental sustainability in the bloc. Unlike other studies, this exploration secondly contributed to literature by adopting vigorous econometric methods to investigate the connection amid financial development and environmental sustainability in West Africa. For instance, the cross-sectional autoregressive distributed lag (CS-ARDL) estimator alongside the cross-sectionally augmented distributed lag (CS-DL) and the cross-sectional augmented error correction (CAEC) estimators were engaged to examine the coefficients of the regressors. These econometric methods were adopted because they are resilient to cross-sectionally dependent and heterogeneous datasets (Chudik et al. 2016). The estimators were also engaged because they control for endogeneity which may arise due to reverse causal associations between variables in a model. The methods were further used, because they address serial correlation, and common correlation bias issues in datasets (Zeraibi et al. 2021). Studies like Ouoba (2017) for West Africa; Omoke et al. (2020), Adewuyi and Awodumi (2017), Abokyi et al. (2019), and Alege et al. (2016) for some selected countries in West Africa; and Namahoro et al. (2021) for cross regions of Africa among others all failed to employ the aforestated econometric techniques in their analysis. Finally, the methods we employed were so advantageous that we did not need to depend on instrumental variables, which to Herzer et al. (2017) are a bit difficult to find. Besides instrumental variables are unreliable when slope parameters are not the same across the panel (Pesaran and Smith 1995).

A well-outlined analytical procedure was followed in conducting the research. Firstly, cross-sectional dependence test was conducted to examine whether the error terms of the model were cross-sectionally correlated or not. Afterwards, a test to assess homogeneity or heterogeneity in the slope parameters was performed. At the third stage, unit root tests were undertaken to determine the integration order of the variables. This was then followed by cointegration tests to examine whether the investigated series were cointegrated in the long-run or not. At the fifth step of the analysis, the elastic effects of the explanatory variables on the explained variable was explored, whilst the final stage examined the causalities between the variables. This study is relevant because it provides new insights and viable options for formulating environmentally friendly policies that could improve the financial systems and ecologies of the countries. The study is also viable because it will stimulate green consumption and production patterns in the region in line with SDG 12 of the United Nations. According to that goal, consumption and production patterns that are sustainable promote resource and energy efficiency, long-term infrastructure, green jobs, as well as better standard of living. The study is further pertinent, because it will make companies more aware of the importance of monitoring, assessing, and disclosing environmental impacts when it comes to the management of carbon and climate risks. The exploration finally adds to the body of knowledge on the relationship between financial development and environmental sustainability. This could serve as a resource material for future researchers who may want to research further on the topic understudy. Originality of the study transpires from the fact that key macroeconomic variables that influence environmental pollution in West Africa were used for the analysis. The study is also original because the methods engaged are well detailed, and the results are appropriately reported and discussed. Following this section is the “Literature review” section which outlines the various literature that supported the topic understudy. In the third section “Model and data,” the specified model, data source, and the analytical procedure that was followed in conducting the study are brought to light, while the fourth section “Empirical results” presents the results of the exploration. In the fifth section “Discussion of the results,” discussions of the results are reported, while the “Conclusions and policy recommendations” form the sixth section of the investigation. Finally, limitations and suggestions for further explorations is the subject of seventh section “Limitations and suggestions for further studies.”

Literature review

According to the World Bank, the financial sector includes institutions, instruments, markets, and legal and regulatory frameworks that facilitate credit-based transactions. Fundamentally, financial sector development entails lowering financial system costs (World Bank 2012). Development in the financial sector produces information on investments, encourages foreign capital inflows, and optimizes the inflows of capital (Beck et al. 2010; Čihák et al. 2012; Beck et al. 2000; Levine 2005; World Bank 2012). The affiliation between financial development and environmental sustainability has been researched immensely. The findings are however varying. For example, Murshed (2021) studied a selection of South Asian countries and confirmed financial development as detrimental to environmental sustainability in the nations. This research is very essential; however, generalization of its finding for all economies in the globe will be unfair, because it was confined to only South Asian countries. If other nations were to form part of the sample, the outcome might be different. Liu et al. (2021) undertook a research on China and affirmed financial development as friendly to environmental sustainability in the country. This discovery backs that of Omoke et al. (2020) for Nigeria, but contrast that of Doğanlar et al. (2021) for Turkey. These conflicting discoveries imply the financial development-environmental sustainability argument is endless and calls for more explorations. Naqvi et al. (2021) investigated 155 countries from 1990 to 2017. From the revelations, financial development was harmful to the environment of low-incomeeconomies. This research is extremely essential; however, care should be taking when interpreting its finding, because it was limited to only 155 nations. If other countries were to be considered for the analysis, the outcome might not be the same.

Zeraibi et al. (2021) studied ASEAN-5 countries from 1985 to 2016 and established financial development as damaging to environmental sustainability. The study adopted the CS-ARDL estimator to explore the coefficients of the covariates. Care should therefore be taking when interpreting the results, because if other econometric methods were to be used for that purpose, the results might vary. Ibrahim and Vo (2021) researched on 27 industrialized economies from 1991 to 2014. Disclosures of the study affirmed financial development as harmful to environmental sustainability. This exploration is very pertinent; however, it will be unfair to generalize its finding for all economies in the world, because it was confined to only 27 industrialized nations. If other economies were to be incorporated into the investigation, the outcome might be different. Godil et al. (2020) established financial development as beneficial to the ecology of Turkey. This discovery aligns that of Baloch et al. (2019) for BRI nations, but contrasts that of Uddin et al. (2017) for 27 highest emitting countries. The above contrasting findings symbolizes that the financial development-ES debate is ceaseless and calls for more investigations. Le and Ozturk (2020) investigated 47 economies from 1990 to 2014. From the revelations, financial development worsened environmental sustainability in the countries. The study utilized the common correlated effects mean group (CCEMG), dynamic common correlated effects mean group (DCCEMG), and the augmented mean group (AMG) methods to examine the parameters of the regressors. Care should therefore be exercised when interpreting the results, because if other estimators were to be used to explore the coefficients of the predictors, the results might not be the same.

Ahmed et al. (2021) conducted a study on Japan and affirmed financial development as detrimental to environmental sustainability in the country. The exploration adopted the symmetric and the asymmetric techniques in its analysis. Therefore, generalizing the outcome for all nations in the globe would be unfair, because if other econometric methods were to be engaged for that purpose, the discovery might be different. Aluko and Obalade (2020) researched on 35 SSA economies from 1985 to 2014. Applying the AMG technique to estimate the elasticities of the regressors from 3 diverse models, positive and negative effects of financial development on environmental sustainability were observed. The conflicting discoveries even from the same study underscores the fact that more explorations on the financial development-environmental sustainability linkage is still warranted. Kayani et al. (2020) undertook an investigative study on the top ten carbon emitters in the globe and disclosed a noticeably positive affiliation between financial development and environmental pollution. The study is very vital since it adds to the literature on the financial development-environmental sustainability connection. However, care should be taken when interpreting the results, because the exploration was confined to only ten countries. If other economies were to form part of the analysis, the results might be different.

Boutafeh and Saadaoui (2020) conducted an asymmetric study on 22 African nations and discovered that positive financial development shocks were essential in advancing environmental sustainability in the short-term. However, in the long-term, financial development was harmful to the environment. The study recommended amongst others that African governments should formulate policies that favor the financial systems of the nations, and should make the funding of green projects less vulnerable to adverse shocks in the economy. The ARDL-PMG approach was adopted to explore the coefficients of the predictors. This signifies that care should be taken when interpreting the results, because if other econometric approaches were to be engaged, the discoveries might not be the same. Usman et al. (2021a) analyzed the financial development-environmental sustainability connection in Asia and established a bilateral association amidst financial development and environmental sustainability. This research is very useful; however, its finding cannot be made general for all economies in the globe, because it was limited to only Asian countries. If other nations were to form part of the sample, varying discoveries might be disclosed. For the period 1998 to 2016, Raghutla and Chittedi (2020) undertook a research on the BRICS countries and confirmed financial development as advantageous to the environment. This disclosure aligns that of Aluko and Obalade (2020) for Nigeria, but varies from Destek and Manga (2020) for big emerging market (BEM) economies. The conflicting discoveries symbolizes that more investigations on the financial development-CO2 excretions affiliation are warranted.

Zheng-Zheng et al. (2020) conducted a study on 30 Chinese provinces. From the CS-ARDL estimates of the exploration, financial development raised environmental sustainability pollution in the provinces. This research is very vital; however, interpretation of its outcome warrants some care, because the study was limited to some selected provinces in the country. If all the provinces were to form part of the sample, the outcome might be different. Yang et al. (2021) performed an investigation on GCC economies and confirmed financial development as detrimental to environmental sustainability. The FMOLS and the CCE econometric techniques were used to explore the parameters of the regressors. It will therefore be unfair to generalize the results for all countries in the globe, because if other methods were to be considered for that role, the outcome might be diverse. An exploration by Lahiani (2020) affirmed financial development as friendly to the ecology of China. This finding collaborates that of Saidi and Mbarek (2017), but contrasts that of Hussain et al. (2020). The conflicting discoveries signposts that the debate on the connection amid financial development and environmental sustainability is ceaseless and demands for more investigations. Bayar et al. 2020) researched on 11 post-transition European economies and found financial development and environmental degradation to be negatively related. The study employed the DSUR technique to explore the elasticities of the covariates. This suggests that interpretation of the finding demands some care, because if other econometric approaches were to be used for the analysis, the outcome might not be the same. Nwani and Omoke (2020) probed the financial development-environmental sustainability connection in Brazil and established financial development as harmful to environmental sustainability. The study adopted the dynamic ARDL estimator to explore the influence of the regressors on the criterion variable. Therefore, care should be taken when interpreting the finding, because if other estimators were to be considered for that purpose, the discovery might be different.

Kizito et al. (2020) undertook a research on 58 economies. From the DCCE and the GMM estimation methods, financial structure minimized the rate of pollution in the nations. Specifically, bank-based financial development helped to improve environmental sustainability in the nations. However, the influence of market-based financial development on the environment was weak. A nonlinear connection amidst financial development and environmental sustainability was also affirmed. The study recommended amongst others that countries that wanted to improve the quality of their environments should develop their bank-based financial systems. Also, the nations should prioritize the development and repositioning of their stock markets to help improve their environments. The results of the exploration are interesting. However, the fact that the discoveries are conflicting even in the same study signifies that the interpretation of the findings demands some care. Majeed et al. (2020) explored the affiliation between financial development and environmental pollution in Pakistan from 1972 to 2018. From the revelations, asymmetric connection between financial development and environmental pollution was established, as the emanation of carbon was largely influenced by adverse shocks in financial development both in the short and the long-term. On the dynamic multiplier analysis, the negative effect of financial development on carbon emissions was higher than the positive effect. Conclusively, assuming symmetric influence of financial development on environmental pollution could be misleading. This research is very essential; however, care should be taken when interpreting the results, because the study was limited to only Pakistan. If other countries were to be included in the sample, the findings might not be the same.

Acheampong et al. (2020) researched on the linkage between financial development and environmental sustainability of 83 economies for the period 1980 to 2015. From the discoveries, financial market development improved environmental sustainability in the advanced and emerging financial economies. However, an opposite impact was disclosed for frontier financial economies. For the standalone financial economies, there was no direct association amidst the series. The inconsistency in the findings indicates that the affiliation between financial development and environmental sustainability is incessant and calls for more investigations. Ye et al. (2021) undertook an investigation on Malaysia from 1987 to 2020. From the disclosures, financial development worsened environmental sustainability in the country. The study used the ARDL technique to explore the elasticities of the predictors. Care should therefore be taking when interpreting the finding, because if other econometric methods were to be used for that purpose, the outcome might be dissimilar. Shahbaz et al. (2020) performed a research on Saudi Arabia and found a U-shape and an inverted N-shape association between financial development and environmental pollution. Also, a feedback affiliation between financial development and environmental pollution was observed. This study is extremely insightful; however, it will be unfair to generalize its results for all countries in the world, because it was confined to only Saudi Arabia. If other nations were to be part of the sample, the outcome might not be the same. Neog and Yadava (2020) studied India from 1980 to 2014 and disclosed a trivial relationship between financial development and environmental pollution. However, asymmetric association amid the series in the long-term was affirmed. It was recommended among others that authorities should ensure there was proper transition of financial development towards projects that were not damaging to the nation’s environment. This exploration is very pertinent; however, care should be observed when interpreting the results, because the study was skewed to only India. If other economies in Asia or other parts of the globe were to form part of the sample, the findings might be dissimilar.

Summarily, explorations on the nexus between financial development and environmental sustainability have produced conflicting results. While Yang et al. (2021), Murshed (2021), Doğanlar et al. (2021), Naqvi et al. (2021), Zeraibi et al. (2021), Ibrahim and Vo (2021), Le et al. (2020), Ahmed et al. (2021), Kayani et al. (2020), Destek and Manga (2020), and Zheng-Zheng et al. (2020), among others, affirmed financial development as damaging to environmental quality, Liu et al. (2021), Omoke et al. (2020), Godil et al. (2020), Baloch et al. (2019), Boufateh and Saadaoui (2020), Raghutla and Chittedi (2020), Aluko and Obalade (2020), Lahiani (2020), and Bayar et al. (2020), among others, on the other hand, confirmed financial development as friendly to environmental sustainability. Irrespective of the numerous explorations on the connection between financial development and environmental sustainability, studies of such type are missing for West Africa to the best of our knowledge. This research was therefore undertaken to help fill that gap.

Model and data

Model specification and theoretical foundation

Changes in environmental sustainability are thought to be closely linked to developments in the financial sector (Zheng-Zheng et al. 2020). However, there is no consensus with regard to this linkage, since financial development could improve, worsen, or exert no influence on environmental sustainability (Gök 2020). To add to the financial development-environmental sustainability debate, an exploration in the context of West Africa was deemed essential. In this exploration, environmental sustainability was represented by carbon emissions, because it plays a crucial role in ongoing deliberations on ecological protection, climate change mitigation, and long-term growth (Kizito et al. 2020). Besides, studies like Lahiani (2020), Liu et al. (2021), Le and Ozturk (2020), Bayar et al. (2020), and Usman et al. (2021b), among others, used carbon emissions as a proxy of environmental pollution. To comprehensively analyze the linkage between financial development and environmental sustainability in West Africa, the following econometric function was proposed;

where CO2 emissions was the response variable which proxied environmental sustainability (ES) and FD denotes financial development which was the main explanatory variable. Foreign direct investments (FDI), energy consumption (EC), industrialization (IND), and population growth (POP) were controlled for to help minimize OVB issues. The variables specified in Eq. 1 were expressed as a linear combination with respective parameter estimates in a panel data format as:

where β1, β2,β3, β4, and β5 are the slope parameters of FD, FDI, EC, IND and POP respectively and ⍺i and uit are the constant and error terms correspondingly. Finally, the investigated countries are epitomized by i, while the time frame is denoted by t. To help minimize heteroscedasticity and data fluctuation issues, all the series in Eq. 2 were log-transformed and the resulting specification became:

where ln CO2, lnFD, lnFDI, lnEC, lnIND, and lnPOP are the log transformations of CO2, FD, FDI, EC, IND, and POP respectively. After the variables had been log-transformed, their coefficients could be viewed as elasticities. We expected the influence of financial development on environmental pollution to be either negative or positive. For example, if the financial sector in West Africa develops, it will be easy for private enterprises to access finance to back their operations. This could lead to more industrial activities dominated by the consumption of dirty energies, resulting in high environmental pollution (Sadorsky 2010). Similarly, if financial development is linked to increased access to consumer credit at the household level, the demand for carbon-intensive home equipment may rise, causing the rate of effusions in the region to also rise (Acheampong 2019). Under these scenarios, the marginal influence of financial development on environmental pollution was expected to be positive \( \left({\beta}_1=\frac{\partial {lnCO}_{2 it}}{\partial {lnFD}_{it}}>0\right). \) Contrarily, financial development could attract green investments into West Africa leading to environmental pollution abatement. Also, financial development could trigger investments in research and development, resulting in environmental pollution mitigation via technological innovations. Further, if the financial sector in West Africa is well developed, it could encourage investments in green projects that could ensure environmental quality (Tamazian and Rao 2010). The effect of financial development on environmental pollution under these scenarios was projected to be negative \( \left({\beta}_1=\frac{\partial {lnCO}_{2 it}}{\partial {lnFD}_{it}}<0\right). \) The coefficient of foreign direct investments was projected to be positive \( \left({\beta}_2=\frac{\partial {lnCO}_{2 it}}{\partial {lnFDI}_{it}}>0\right) \)if foreign investments was linked to the establishment of carbon-intensive industries in the region, validating the pollution haven hypothesis (Ahmad et al. 2020b; Minh 2020). Otherwise, foreign direct investments was to adversely influence environmental pollution \( \left({\beta}_2=\frac{\partial {lnCO}_{2 it}}{\partial {lnFDI}_{it}}<0\right) \)if those investments were connected to green and well-advanced technologies that could help to improve environmental quality in the region. This supports the hypothesis of pollution halo (Demena and Afesorgbor 2020). The marginal influence of energy utilization on the effluents of carbon was to be positive \( \left({\beta}_3=\frac{\partial {lnCO}_{2 it}}{\partial {lnEC}_{it}}>0\right) \)if the energies consumed in West Africa were carbon-intensive(Adebayo et al. 2021; Yang et al. 2021). Otherwise, the consumption of energy was to have an adverse influence on environmental pollution \( \left({\beta}_3=\frac{\partial l{nCO}_{2 it}}{\partial {lnEC}_{it}}<0\right) \) if the energy utilized in the region added to environmental quality (Alharthi et al. 2021; Adebayo and Kirikkaleli 2021). Industrialization was to pose a positive influence on carbon exudates \( \left({\beta}_4=\frac{\partial {lnCO}_{2 it}}{\partial {lnIND}_{it}}>0\right), \) if industrial activities undertaken in West Africa were high-polluting due to the consumption of dirty energies (Rehman et al. 2021a; Rauf et al. 2020). Contrarily, if activities executed at the industrial level of the region were linked to the utilization of clean energies, then, industrialization was to have a negative influence on environmental pollution \( \left({\beta}_4=\frac{\partial {lnCO}_{2 it}}{\partial {lnIND}_{it}}<0\right) \) backing those of Chowdhury et al. (2020b) and Congregado et al. (2016). Finally, if population growth was linked to the consumption of dirty energies at both the industrial and the domestic levels, then its impact on the effusions of carbon was to be positive \( \left({\beta}_5=\frac{\partial {lnCO}_{2 it}}{\partial {lnPOP}_{it}}>0\right), \) validating those of Naseem et al. (2020a) and de Silva Mendonça et al. (2020). However, the elasticity of population growth was to be negative \( \left({\beta}_5=\frac{\partial {lnCO}_{2 it}}{\partial {lnPOP}_{it}}<0\right), \) if the growth in population was connected to the utilization of energies from renewable and efficient sources (Begum et al. 2015).

Data source and descriptive statistics

A balanced panel data on the 16 countries of West Africa from 1990 to 2016 was used for the analysis. The starting (1990) and ending (2016) periods of the exploration were influenced by the availability of data. Specifically, data on environmental sustainability (carbon emissions) was available on yearly basis from 1990 to 2016, after which it ceased to be available. To therefore avoid measurement errors due to data interpolations, the study was confined to the aforestated period. All data utilized for the exploration was obtained from the World Bank’s database (WDI, 2010). Details on the investigated variables and the sampled countries are shown in Table 1.

Summary statistics on the series are shown in Table 2. From the table, population growth had the uppermost average value, while carbon emissions had the lowest average value. Moreover, energy consumption exhibited high volatility with standard deviation of 2.824, while industrialization exhibited the least volatility with a standard deviation of 0.578. One can therefore remark that the maximum level of risk was associated with energy consumption, while the minimum level of risk was linked to industrialization. Also, all the series were skewed negatively except energy consumption. In terms of kurtosis, the distributions of energy consumption and environmental pollution were platykurtic, while the rest had leptokurtic shaped distributions. Normality of the variables’ distributions were examined via the Jarque-Bera test. From the test’s discoveries, the hypothesis that the series were distributed normally could not be accepted. The correlation between the variables were also examined, and from the discoveries shown in Table 2, all the series had significantly positive association with environmental degradation. This suggests that a surge in the variables led to a surge in environmental pollution and vice-versa. Further, the variance inflation factor and tolerance tests were less than 5 and greater than 0.2 correspondingly. This signifies the absence of collinearity amidst the predictors. Finally, the regressors loaded very well under either comp 1, comp 2, or comp 3 based on the principal components analysis (PCA) results depicted in Table 3. This signpost that the variables had the attributes of environmental sustainability in West Africa.

Analytical procedure

According to Talib et al. (2021), Zeqiraj et al. (2020), Herzer et al. (2017), and Li et al. (2020a), unobserved common factors like global epidemics, climate change, global financial crises, global technological progress, spread of diseases, and cross-border pollution between nations that vary overtime could lead to dependencies in residual terms, thereby yielding erroneous regression outcomes if they are not controlled. Therefore, as a first step, residual cross-sectional dependence (CD) were assessed via the CD test of Pesaran (2004). In panel data setting, models often suffer from issues pertaining to slope heterogeneity, which could lead to biased results and the choice of wrong econometric methods, if they are ignored (Mensah et al. 2021; Musah et al. 2021a,,b). Therefore following the works of Li et al. (2021), Mensah et al. (2019), and Li et al. (2020b), the Pesaran and Yamagata (2008) homogeneity test was conducted at the second stage to establish whether the slope coefficients were homogeneous or heterogeneous. This test was preferred over other homogeneity tests in that they control for residual cross-sectional dependence and also produce reliable outcomes (Dong et al. 2019). At the third phase, the Cross-sectionally Augmented Dickey-Fuller(CADF) test and the Cross-sectional Im, Pesaran and Shin (CIPS) test for stationarity that are resilient to residual CD were conducted to study the variables’ order of integration. This was then followed by the Westerlund and Edgerton (2007) test (hereafter W-E test) and the Durbin-Hausman(DH) test to assess the cointegration attributes of the variables. The W-E test unlike the conventional cointegration tests is robust to heterogeneity and residual CD issues. It also offers consistent results even in small sample sized datasets (Bhattacharya et al. 2018). The error correction model of the W-E test is stated as:

where θi denotes the term of adjustment. The W-E test is made up of two panel statistics namely Pa and Pt and two group statistics namely Ga and Gt. The group statistics of the test are expressed as:

where Gτ and Gα are the group mean statistics, θi is the error correction parameter, \( {\hat{\theta}}_i \) is the semiparametric kernel estimator of θi, and \( SE\left({\hat{\theta}}_i\right) \) is the conventional standard error of \( {\hat{\theta}}_i \). The panel statistics on the other hand are stated as;

where Pτ and Pα are the panel mean statistics and \( {\hat{\theta}}_i \) is the common error correction estimator. In the context of the DH test, two test statistics namely panel statistics (DHp) and group statistics (DHg) are produced. The two test statistics are expressed as:

where \( {\overset{\sim }{\phi}}_i \)and \( {\overline{\phi}}_i \) are the instrumental variable (IV) estimators of ϕi. While the DHp assumes that ϕi = ϕ, the DHg does not. The null and the alternative hypothesis of the tests are stated as (\( {H}_o:{\phi}_i<1\ for\ {\forall}_i^{\prime } \)) and (\( {H}_o:{\phi}_i=1\ for\ {\forall}_i^{\prime } \)) correspondingly. At the fourth stage, the CS-ARDL estimator was first engaged to examine the elasticities of the covariates. This method is meritous in that it is resilient to residual CD, endogeneity, heterogeneity, and weakly exogenous regressors; it offers consistent outcomes even if the error terms are flanked by unit roots; it is vigorous to feedback effects from the lagged criterion variable to the current values of the covariates; and it computes both short and long-term parameters of regressors (Chudik et al. 2016). However, the CS-ARDL estimator could yield biased outcomes if the number of lags (py, px) are mis-specified(Talib et al., 2021). Following Chudik et al.(2016), the exploration’s CS-ARDL model, augmented with additional lags of cross-sectional averages to control for common factors, was expressed as:

where \( \overline{\mathit{\ln}{CO}_2} \), \( \mathit{\ln}\overline{FD} \), \( \overline{lnFDI} \), \( \overline{lnEC,} \)\( \overline{lnIND\ } \), and \( \overline{lnPOP} \) represent the cross-sectional means of CO2, FD, FDI, EC, IND, and POP respectively; wi denotes the effect specifications of unobserved economies; λij symbolizes the effect of the lagged criterion variable; β1j, . . , β5j are the coefficients of the lagged input series; γ1j, …, γ6j are the average cross-sectional values of the lagged series; and p denotes the cross-sectional mean lags. It is important to note that p is not compulsorily equal to py or px and could be chosen based on \( p=\left[\sqrt[3]{T}\right] \) as in Chudik and Pesaran (2015). To check robustness of the CS-ARDL estimates, the CS-DL estimator of Chudik et al. (2016) was also employed. Unlike the CS-ARDL estimator, the CS-DL estimator relies on a DL representation and is therefore not more sensitive to the selection of lag length (Herzer et al. 2017). In addition, the estimator permits one to directly estimate the long-run coefficients and also allows for weak cross-sectional correlations and residual factor error structure (Chudik and Pesaran 2015). In line with Chudik et al. (2016), the study’s CS-DL estimator, augmented with cross-sectional averages to control for common factors, is expressed as:

where θi is the parameter of the regressors; \( \overline{y} \) and \( \overline{x} \) are the cross-sectional means of the criterion and the explanatory variables correspondingly; \( {p}_{\overline{y}} \)and \( {p}_{\overline{x}} \)are the lags of the cross-sectional means; and γyi, j and \( {\gamma}_{x, it}^{\prime } \) are the parameters of the lagged means of the cross-sections. The CAEC estimator which builds on the techniques outlined in Gengenbach et al. (2015), Eberhardt and Presbitero (2015), and Chudik and Pesaran (2015) was further engaged to check the robustness of the CS-ARDL estimates. The CAEC model depicted in Eq. 13 was formulated to help explore the elasticities of the covariates;

where \( {\varphi}_i=-\left(1-\sum \limits_{j=1}^{p_y}{\lambda}_{ij}\right) \), \( {\theta}_i=\frac{\sum_{j=0}^{p_x}{\beta}_{ij}}{1-{\sum}_j^{p_y}{\lambda}_{ij}} \), \( {\lambda}_{ij}^{\ast }=-\sum \limits_{m=j+1}^{p_y}{\lambda}_{im},j=1,2,\dots, {p}_y-1 \), \( {\beta}_{ij}^{\ast }=-\sum \limits_{m=j+1}^{p_x}{\beta}_{im},j=1,2,\dots, {p}_x-1. \)

From Monte Carlo simulations in Chudik et al. (2016), the CS-ARDL, CS-DL, and the CAEC estimators produced reasonable results, even in small samples. However, the CS-DL estimator performed worse than the other two. We therefore chose the former as our main estimator, with the others serving as a robustness check. Lastly, the causality test of Dumitrescu and Hurlin (2012) (hereafter D-H test) was adopted to unravel the causal affiliations between the variables. This test was used because of its robustness to heterogeneity and residual CD. The D-H causality test could be stated officially as in Eq. 14, if Y and X are the explained and the explanatory series respectively.

where M denotes the number of lags, γi signifies the constant term, αi(m) symbolizes the autoregressive coefficients, and δi(m) represents the regression coefficients. Based on Eq. 14, the following specifications were developed for the causal connections amidst the series;

where γ1, …, γ6 are constant parameters to be estimated; α1, …, α6 are the autoregressive coefficients; and δ1, …, δ30 are parameters of the input variables. Under this test, two statistics namely W-statistics and Z-statistics are computed. These tests are expressed as:

where Wi, t is the Wald statistic and E(Wi, t) and Var(Wi, t) are the expectation and variance of that statistic respectively. The null and the alternative hypothesis of the D-H causality test are expressed as:

From the above, if X does not Granger cause Y, then we fail to reject the null hypothesis of no causality. However, if X Granger causes Y then the above hypothesis can be rejected.

Empirical results

Cross-sectional dependence and slope heterogeneity tests results

Because the ignorance of CD in cross-country studies could result in biased and spurious estimations (Munir et al. 2020; Zeraibi et al. 2021; Mensah et al. 2019), this exploration primarily employed the CD test proposed by Pesaran (2004) to examine the contemporaneous correlations amidst the countries. Discoveries of the test are depicted in Table 4, and from the findings, there was residual CD in the panel, contrasting that of Li et al. (2020a). Just like the issue of CD, the existence of heterogeneity in slope parameters may lead to biased regression estimates (Li et al. 2020b). According to Zeraibi et al. (2021), slope heterogeneity occurs when there are country-specific dissimilarities amidst cross-sectionalunits, and because the studied countries are not the same across the region, there was the need to examine the existence of heterogeneity or otherwise in the slope coefficients. Therefore, toeing the line of Musah et al. (2020a, b) and Mensah et al. (2020), the homogeneity test of Pesaran and Yamagata (2008) indicated in Table 5 was undertaken for that purpose. From the findings, there was heterogeneity in the slope parameters supporting that of Li et al. (2021) and Mensah et al. (2021).

Unit root and cointegration tests results

Stationarity analysis is essential for establishing the integration properties of variables (Qin et al., 2021; Musah et al. 2021a, b). Since there were dependencies in the residual terms, the application of conventional stationarity tests could yield biased outcomes (Murshed and Dao 2020; Murshed et al. 2020a, b). Therefore, following Musah et al. (2020c), Murshed et al. (2020c), and Musah et al. (2021a), the modern unit root tests shown in Table 5 were undertaken to assess whether the integration order of the variables met the requirements of the ensuing econometric methods to be engaged or not. From the results, all the variables were integrated of order 1, validating the studies of Musah et al. (2021b) and Li et al. (2020b). Cointegration association amid series is a prerequisite for estimating the elasticities of covariates (Rehman et al. 2021b; Murshed and Alam 2021). Hence, following Sharif et al. (2019), Bekun et al. (2019), and Kirikkaleli and Kalmaz (2020), the cointegration tests exhibited in Table 6, which are vigorous to dependencies and heterogeneity, were performed to establish whether the series met the integration conditions of the estimators to be employed or not. From the discoveries, the variables under consideration exhibited a long-term cointegration association, collaborating those of Musah et al. (2020a, b) and Phale et al. (2021).

Model estimation and causality results

After establishing dependencies and heterogeneity in the panel, it was worthwhile to engage regression estimators that could account for the above issues in the elasticity estimation process. Therefore, following Talib et al. (2021), Zeqiraj et al. (2020), Walid (2020), Zheng-Zheng et al. (2020), and Kamah and Riti (2021), the CS-ARDL estimator, which is robust to the above issues, was firstly used to examine the parameters of the regressors. From the results shown in Table 6, financial development was not friendly to the environment, reducing its quality by 9.825%. Also, foreign direct investments, energy utilization, industrialization, and population growth were detrimental to the environment of West Africa, deteriorating its quality by 2.251%, 4.356%, 2.129%, and 3.119% correspondingly. The error correction term (ECT) was significantly negative at the level of 1%. −0.857 being the ECT value implies 85.7% of disequilibrium in environmental pollution was rectified in West Africa. The diagnostic tests results underscored the fitness of the model based on the appropriate R2, root mean square error, and significant F-statistic values. The CD test statistic also validated the hypothesis of no residual CD in the model. It was pertinent to check the robustness of the CS-ARDL estimator. Therefore, the CS-DL and the CAEC estimates were also computed. From the results also depicted in Table 6, there were variations in the weight of the coefficients and some of the significance levels of the two estimators when compared to the principal estimator, however, the parameters of the predictors in terms of sign across the three estimators were the same. Also, the diagnostic tests under the CS-DL and the CAEC estimators were in line with that of the CS-ARDL estimator, justifying the robustness of the results. The elastic effects of financial development, foreign direct investments, energy consumption, industrialization, and population growth on CO2 emissions are displayed in Fig. 1.

The traditionally adopted Engle and Granger (1987) test for causality is inefficient in handling heterogeneity and dependencies in panel data sets (Fig. 2). Therefore, following Li et al. (2021) and Zeraibi et al. (2021), the D-H causality test was employed to unearth the causal associations amidst the series. From the discoveries indicated in Table 7, a one-way causality between financial development and carbon emissions was unraveled. Also, a reciprocal affiliation amidst foreign direct investments and environmental pollution was disclosed. A feedback causality amid energy utilization and environmental degradation was further affirmed. Likewise, a mutual connection between industrialization and the exudates of carbon was revealed. Finally, a one-directional causality from population growth to the effusions of carbon was uncovered.

Discussion of the results

After confirming cointegration affiliation amidst the series, the CS-ARDL estimator was first engaged to examine the coefficients of the regressors. From the results, a 1% rise in financial development escalated carbon emissions by 9.825%. The positive connection between financial development and environmental pollution implies financial policies undertaken in West Africa were not environmentally sustainable. A possible explanation of this discovery is that the loans obtained by private entities in the region have been used predominantly in establishing carbon-intensive industries that worsened environmental quality in the region. Also, the financial sector helped to provide credit to individuals at minimal interest rates. This influenced residents to adopt luxurious lifestyles by acquiring high polluting goods that worsened environmental quality in the region. As product and service demands surged in the region, financial institutions further helped to advance the production capacities of establishments leading to more energy utilization, and subsequently, high emissions. This point is in line with Sun et al. (2020), Nosheen et al. (2019), and Nasir et al. (2019) who reported that growth in the financial sector help to boost product scale developments, leading to more emissions. Governments in the countries should therefore formulate policies that could influence businesses and the general public to direct the facilities they obtain from the financial sector into environmentally gainful projects. Also, developments in the financial sector could improve environmental sustainability in the countries, if they are linked to clean energy technologies. Studies by Zeraibi et al. (2021), Doğanlar et al. (2021), and Ibrahim and Vo (2021) align with the above discovery, but those of Boufateh and Saadaoui (2020), Guo and Hu (2020), and Safi et al. (2020).

Foreign direct investment was also harmful to the environment of West Africa. A 1% rise in foreign direct investments intensified the emanation of carbon by 2.251%. This disclosure suggests that developed economies took advantage of lax environmental regulations to establish high-polluting industries in the region, thereby worsening environmental quality. The above discovery is in tandem with the hypothesis of pollution haven. In an increasingly integrated world economy, this hypothesis posits that differences in the stringency of environmental protection between emerging and established economies may provide a comparative advantage in attracting foreign investments. Technological advancements and globalization further influence foreign entities to move their operations to other countries. While this action is beneficial to the home economies, it is detrimental to the host nations because most of the operations undertaken by foreign corporates in the host economies are not ecologically friendly. According to Bulus and Koc (2021), host countries should be blamed for the surge in pollution in their environments, because while home nations are busy protecting their economies via strict environmental regulations, host nations ignore environmental pollution, by focusing on economic advancements and the eradication of poverty and unemployment. The study’s discovery is however contrary to the halo hypothesis. According to the hypothesis, foreign direct investment-transferred high-tech and best management practices contribute to create halos that reduce emissions by imposing positive externalities. In other words, the influxes of foreign direct investment can help to improve environmental conditions in host countries by bringing in green technologies and best management practices. To the theory, the technologies and management practices affiliated to foreign direct investment inflows are more energy efficient that lead to lower emissions (Nadeem et al. 2020; Omri and Hadj 2020). The positive influence of foreign direct investment on environmental pollution uncovered by this exploration collaborates those of Vo and Ho (2021), Pavlović et al. (2021), Nawaz et al. (2021), and Bulut et al. (2021), but varies from those of Neves et al. (2020) and Ergun and Rivas (2020).

Similarly, energy utilization reduced environmental sustainability via the increase in emissions. A 1% surge in energy consumption raised environmental pollution by 4.356%. This finding is not surprising, because countries in West Africa are always under pressure to grow economically, and their primary concern are on productivity improvements to the detriment of environmental quality. However, expansion in the scale of productivity cannot be accomplished without the utilization of energy, which is mostly dominated by fossil fuels that are extremely carbon-intensive. Therefore, transitioning to green energy is the best solution for countries in West Africa. This suggestion is essential because all the economies in West Africa are predominantly fossil fuel dependent. The country’s existing power plants are inextricably linked to fossil fuel supply, exerting negative pressures on their environment. Migrating from dirty energies to the utilization of clean energy can therefore help to improve environmental sustainability in the region. This point is in line with Zeraibi et al. (2021) and Usman et al. (2021b) who opined that transitioning to green energy was the superlative way to help boost environmental sustainability in nations. However, Nathaniel and Khan (2020) disagreed with the above authors as they uncovered a trivial connection amid clean energy and environmental quality proxied by ecological footprint. Also, enacting regulations to help protect businesses and the environment could be advantageous to the nations. This point supports the Porter hypothesis (PH) that environmental rules safeguard the environment and increase the profitability and competiveness of companies via product quality improvements and advancements in production processes (Porter and van der Linde 1995). According to the hypothesis, innovation is the factor that balances the cost-benefit analysis between economic competition and the environment. In countries that adopt stronger environmental policies, the theory posits that international trade promotes efficiency and innovation, potentially resulting in net cost reduction and a boost in comparative advantage.

The positive association between energy consumption and environmental degradation discovered by this study aligns with those of Ouédraogo et al. (2021), Ali et al. (2021), and Nasrullah et al. (2021), but conflicts that of Mesagan et al. (2020), Gyamfi et al. (2021), and Qing et al. (2020).

The elasticity estimates further disclosed industrialization as harmful to environmental sustainability in West Africa. Ceteris paribus, a 1% rise in industrialization promoted exudates of carbon in the region by 2.129%. This disclosure signpost that the movement from an agrarian economy to an industrial economy is not the only cause of high emissions in the region, but the shift from small and medium-scaled production to large-scaled production is also to blame for the bloc’s worsening emission rates. Also, the growth of industrial activities in West Africa necessitates considerable improvements in the public infrastructural network. However, building and maintaining such infrastructural network demands large volumes of energy, which end up polluting the environment. Explorations by Rehman et al. (2021c), Ullah et al. (2020), and Mahmood et al. (2020) are in agreement with this disclosure, but those of Zhou and Li (2020), Appiah et al. (2021), and Chowdhury et al. (2020a) are varying to the above revelation. Finally, population growth was disadvantageous to environmental sustainability in West Africa. All factors held constant, a 1% surge in population growth raised the effluents of carbon by 3.119%. This finding suggests that the ecological demands of the population did not add to environmental quality in the region. Also, the West African region has a high population density because so much of its populace live in cities. A greater percentage of individuals in these areas use high-polluting items that degrades the environment. This revelation is contrary to the claim by Liu et al. (2017) and Ahmed and Wang (2019) that population density decreases environmental deterioration through fostering economies of scale in enterprises and the provision of public services, resulting in technological innovation and resource efficiency. The finding however supports those of Salari et al. (2021), Rehman et al. (2021a), Aluko and Obalade (2020), and Naseem et al. (2020b) who affirmed POP as detrimental to ES. It was worthwhile to examine the robustness of the CS-ARDL estimates. Therefore, the CS-DL and the CAEC estimates were also explored. From the findings, the coefficients of the two methods in terms of weight and significance were varying from that of the CS-ARDL estimator. However, the estimated findings with respect to sign under the two methods were generally in line with that of the main estimator. Also, the diagnostic outcomes of the two estimators were consistent to that of the principal estimator. One can therefore conclude that the study’s results are accurate and reliable. Monte Carlo simulations by Chudik et al. (2016) on the three adopted estimators offered some interesting outcomes. From the simulations, all the estimators produced reasonable results. However, the CS-DL estimator performed worse than the other two. This supports the outcome of our exploration, when the coefficients are compared.

The long-run estimators adopted for the study only explored the elasticities of the covariates, but did not disclose the causal directions amidst the series. Therefore, the D-H causality test was used to examine the structure of causalities between environmental sustainability (proxied by carbon emissions) and each of the regressors. As earlier stated, the above test accounts for residual CD and heterogeneity in panel units (Juodis et al. 2021), hence its adoption. From the causality results, a causation from financial development to environmental pollution was disclosed. A potential explanation for this outcome is that stock markets in the bloc act as viable agents of economic situations. This greatly influence the trust of consumers and establishments, leading to increased consumption and production, thereby surging the rate of carbon emissivities due to the extreme utilization of dirty energies. Studies by Shahzad et al. (2017) and Cetin et al. (2018) confirmed this disclosure; however, those by Dogan and Turkekul (2016) and Zaidi et al. (2018) are contradictory to the above. Also, a feedback causality between foreign direct investments and carbon emissions was discovered. This signifies that foreign investments and environmental pollution in the region were mutually reinforcing such that an upsurge in foreign investments led to an upsurge in the effusions of carbon and the opposite. The revelations of To et al. (2019) and Balsalobre-Lorente et al. (2019) are in alignment with the discovery; however, those by Lee (2013) and Dogan and Turkekul (2016) contrast the above outcome. Additionally, a two-way causality between energy utilization and carbon emissions was affirmed. This result implies energy consumption intensifications stimulated environmental degradation and contrariwise. Explorations by Afridi et al. (2019) and Saud et al. (2019) back this discovery; however, those of Shahzad et al. (2017) and Cetin et al. (2018) vary from the above. Likewise, a bilateral connection amid industrialization and environmental pollution was confirmed. This finding implies the two series were predictive powers of each other. Thus, fluctuations in one variable affected the other reciprocally. Empirical investigations by Al-Mulali and Ozturk (2015) and Liu and Bae (2018) are consistent with the study’s disclosure; however, that of Afawubo and Nguedam (2016) deviate from the above. Finally, population growth caused the excretion of carbon in the region. This submits that the effusions of carbon in the region was being driven by population growth but not the opposite. Therefore, lowering the rate of population growth will reduce the level of effusions in the bloc but not the reverse. The finding agrees with Wang et al. (2018a, b), but contrasts that of Sulaiman and Abdul-Rahim(2018).

Conclusions and policy recommendations

Although West African nations are flourishing economically of late, their growth patterns have slowed due to the worsening environmental quality in the region. Irrespective of the poor environmental situation in the bloc, studies to examine the connection between macroeconomic factors and environmental sustainability in the region are scarce. This study therefore sought to explore the linkage between financial development and environmental sustainability in West Africa for the period 1990 to 2016. To achieve the above goal, econometric methods that are vigorous to residual CD, heterogeneity, and endogeneity, among others, were considered for the analysis. From the discoveries, there were CD and heterogeneity in the studied panel. Also, the studied variables were stationary with no unit root and were substantially cointegrated in the long-term. The CS-ARDL estimator alongside the CS-DL and the CAEC estimators were engaged to examine the influence of the regressors on the regressand, and from the discoveries, financial development was harmful to environmental sustainability in West Africa via high carbon emissions. Also, foreign direct investments, energy consumption, industrialization, and population growth were not beneficial to environmental quality in the region. On the causalities between the variables, a unidirectional causation from financial development to environmental pollution was uncovered. Also, feedback causalities between foreign direct investments and carbon excretions, amid energy utilization and environmental degradation, and between industrialization and carbon emissions were unraveled. Finally, a single-directional causality from population growth to environmental pollution was discovered.

The study discovered financial development as a key agent of environmental pollution. This implies the financial systems in the region are harmful to environmental sustainability. Therefore, in line with Zeraibi et al. (2021), the nations should incorporate environmental sustainability objectives into their financial development arrangements. Also, a large portion of credit given to private entities should be allocated to the ones that are friendly to the environment. Additionally, credits taken for clean projects should be subsidized by the governments. When this is done, the emanation of carbon associated with financial development in the countries will be minimized. Further, green financing is an ideal way through which environmental sustainability could be improved. Therefore, governments in the countries should introduce green bonds to entice borrowers to invest into clean projects. This point is consistent with Majeed (2016) who confirmed green financing as a key factor in achieving sustainable development goals. According to the authors, financial institutions boost environmental sustainability by offering finances for green investments and energy-efficient technologies. Finally, authorities in the countries should encourage financial institutions to invest in research and development (R&D) that will facilitate technological innovations in the region. This is because technological innovations have been proven as effective in regulating the rate of CO2 emissivities in the globe. This point aligns with Zhang (2011) who viewed financial development as beneficial to the environment, because it introduces green technologies that promote environmental sustainability. The above point also supports Tamazian et al. (2009) who indicated financial development as essential to environmental sustainability because it brings along innovative and green technologies that help to conserve the ecology. According to the authors, energy-efficient technologies connected to financial development can encourage consumers to direct their investments towards environmentally friendly projects.

Also, foreign direct investments improved environmental degradation in West Africa, validating the pollution haven hypothesis (PHH). This is not amazing given the fact that West Africa economies rely on foreign investments to fuel their economic growth. Therefore, in line with Nawaz et al. (2021), clean foreign direct investments along with aggressive environmental management systems should be pursued by the nations in order to achieve long-term growth. In addition, foreign direct investments on power development infrastructure in the region has predominantly concentrated on electricity generation using polluting fuels. Therefore, authorities in West Africa should focus on attracting foreign direct investments that are connected to the generation of clean energy. This point collaborates that of Mahalik et al. (2020) whose study suggested that governments should direct foreign energy investments towards the generation of clean energies like solar, wind, and biomass, rather than dirty energies like coal, oil, and natural gas among others. We further suggest that governments in the region should either set strong environmental regulations for high-polluting foreign establishments or should support foreign corporations whose undertakings help to improve environmental sustainability in the bloc. For instance, authorities can set high tax rates for foreign entities whose production and consumption activities are carbon-intensive, while lowering the rates for their counterparts who are into environmentally friendly operations. In line with SDG 12, the study also recommends that, companies in the countries, particularly large and transnational ones should implement sustainable development practices into their reporting cycle.

Additionally, energy consumption significantly positively explained environmental pollution in West Africa. This indicates that energy utilized in the region did not help to improve environmental sustainability. Therefore, countries in the bloc should shift to the consumption of renewable energy, which is viewed as beneficial to the environment. In other words, the countries should boost their renewable energy utilization capacities by enacting policies that could help to facilitate the transition of clean energies across the region. Studies by Zeraibi et al. (2021) and Tahir et al. (2021) offered similar suggestions to help advance environmental sustainability in the countries they investigated. Also, investments in technological innovations can help the countries to overcome the barriers that traditionally inhibited their renewable energy generation capacities. Since renewable energy facilities need to be equipped with modern technologies before they could function efficiently (Zeraibi et al. 2021), investments in technological innovations could help to advance the clean energy generation capacities of the nations. This point further supports Tahir et al. (2021) who postulated that investments in R&D could contribute to renewable energy technologies required for generating large volumes of green energy. Following SDG 7, the nations should ensure that their citizens have access to energy that is clean, affordable, reliable, sustainable and modern. According to SDG 7, energy utilization represents of over 60% of worldwide GHG emissions. While renewables currently provide about 17% of global energy consumption, the IPCC predicts that this must increase to roughly 85% by 2050 to avoid the worst effects of climate change.

Similarly, industrialization was harmful to environmental quality in West Africa. It is therefore pertinent for the nations to sustainably transform their production processes in an environmentally friendly manner to help expedite their economic advancements, and also conserve their respective ecologies. Replacing dirty energies with clean energies is the best way in meeting the aforesaid objective. Besides, investment in technology is a viable means of preventing the growth polluting industries in the region. Authorities should therefore note this in their environmental development plans. Nations in West Africa seem to be engaging in unordered and blind industrial practices that lead to high carbon emissions in the bloc. Therefore, following Mensah et al. (2021) green industrial reforms should be formulated to help improve environmental sustainability in the region. Finally, population growth significantly positively explained environmental pollution in West Africa. This symbolizes that population growth worsened environmental sustainability in the countries. The study therefore suggests a trade-off between the rise in population growth and environmental sustainability in the region. Given that the nations in the bloc, compared to others, are lagging behind in terms of economic advancements, it will be extremely costly for the countries to sacrifice environmental quality for population growth. Therefore, green and sustainable policies affiliated to the growth in population should be formulated by authorities to help conserve the nations’ environment. The above recommendations if seriously taken into consideration will help the region to combat climate change and its impacts, which is the focus of SDG 13.

Limitations and suggestions for further studies

Even though the study accomplished its goal, there were still some inherent limitations. Firstly, the study period was influenced by data availability. Specifically, data on environmental sustainability (carbon emissions) was available on yearly basis from 1990 to 2016, after which it ceased to be available. To therefore avoid measurement errors due to data interpolations, the study was limited to the period 1990 to 2016. Also, financial development which was the main explanatory variable was surrogated by only domestic credit to private sector. Future studies can incorporate other financial development proxies like deposits to GDP and private debt securities to GDP among others, into their analysis. Similarly, carbon dioxide emissions was used to proxy environmental sustainability. It is therefore suggested that further explorations should consider other surrogates of environmental quality like ecological footprint among others. Additionally, econometric techniques like the CS-ARDL, CAEC, and the CS-DL estimators among others were considered for the investigation. Care should therefore be taken when interpreting the study’s results, because if different econometric methods were to be considered for the analysis, the discoveries might not be the same. Furthermore, the study was limited to only countries in West Africa. Therefore, generalizing its findings for all nations in Africa or the rest of the world will be unfair. In examining the financial development-environmental sustainability connection in the bloc, the study controlled for foreign direct investments, energy consumption, industrialization, and population growth. Future investigations on the same topic can control for other macro-economic variables like globalization, international trade, remittances inflow, inflation, exchange rate, interest rate, institutional quality, and technological innovations among others. Also analyzing the moderating role of some of the aforementioned series in the link between financial development and environmental sustainability in the region would be worthwhile for policy directions. The study was finally panel in nature. Similar studies on the same region should be reduced to individual country level to help policymakers and other relevant parties design and implement vigorous environmental protection policies.

Availability of data and materials

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Change history

01 April 2024

This article has been retracted. Please see the Retraction Notice for more detail: https://doi.org/10.1007/s11356-024-32885-y

Abbreviations

- GHG:

-

Greenhouse gases

- FD:

-

Financial development

- ES:

-

Environmental sustainability

- WA:

-

West Africa

- WRICAIT:

-

World Resources Institute Climate Analysis Indicators Tool

- FDI:

-

Foreign Direct Investments

- EC:

-

Energy consumption

- IND:

-

Industrialization

- POP:

-

Population growth

- AMG:

-

Augmented mean group

- DCCEMG:

-

Dynamic common correlated effects mean group

- CCEMG:

-

Common correlated effects mean group

- CCE:

-

Common correlated effects

- DCCE:

-

Dynamic common correlated effects

- GMM:

-

Generalized method of moments

- W-E:

-

Westerlund and Edgerton

- DH:

-

Durbin-Hausman

- PHH:

-

Pollution haven hypothesis

- PH:

-

Porter hypothesis

- CS-ARDL:

-

Cross-sectional autoregressive distributed lag

- CS-DL:

-

Cross-sectionally augmented distributed lag

- CAEC:

-

Cross-sectional augmented error correction

- WDI:

-

World Development Indicators

- CADF:

-

Cross-sectionally Augmented Dickey-Fuller

- CIPS:

-

Cross-sectional Im, Pesaran and Shin

- FMOLS:

-

Fully modified ordinary least squares

- ARDL:

-

Autoregressive distributed lag

- DSUR:

-

Dynamic seemingly unrelated regression

- ECT:

-

Error correction term

- ASEAN:

-

Association of Southeast Asian Nations

- BRI:

-

Belt and Road Initiative

- ARDL:

-

Autoregressive distributed lag

- PMG:

-

Pooled mean group

- BRICS:

-

Brazil, Russia, India, China, and South Africa

- GCC:

-

Gulf Cooperation Council

- D-H:

-

Dumitrescu and Hurlin

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Abokyi E, Appiah-Konadu P, Abokyi F, Oteng-Abayie EF (2019) Industrial growth and emissions of CO2 in Ghana: the role of financial development and fossil fuel consumption. Energy Rep 5:1339–1353

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Acheampong AO, Amponsah M, Boateng E (2020) Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ 88:104768. https://doi.org/10.1016/j.eneco.2020.104768

Adams S, Klobodu EK (2018) Financial development and environmental degradation: does political regime matter? J Clean Prod 197:1472–1479. https://doi.org/10.1016/j.jclepro.2018.06.252

Adebayo TS, Kirikkaleli D (2021) Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: application of wavelet tools. Environ Dev Sustain. https://doi.org/10.1007/s10668-021-01322-2

Adebayo TS, Odugbesan JA (2020) Modeling CO2 emissions in South Africa: empirical evidence from ARDL based bounds and wavelet coherence techniques. Environ Sci Pollut Res 28:9377–9389. https://doi.org/10.1007/s11356-020-11442-3

Adebayo TS, Rjoub H (2020) Assessment of the role of trade and renewable energy consumption on consumption-based carbon emissions: evidence from the MINT economies. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14754-0

Adebayo TS, Kirikkaleli D, Adeshola I, Oluwajana D, Akinsola GD, Osemeahon OS (2021) Coal consumption and environmental sustainability in South Africa: the role of financial development and globalization. Int J Renew Energ Dev 10(3):527–52\. https://doi.org/10.14710/ijred.2020.34982

Adewuyi AO, Awodumi OB (2017) Biomass energy consumption, economic growth and carbon emissions: fresh evidence from West Africa using a simultaneous equation model. Energy 119:453–471. https://doi.org/10.1016/j.energy.2016.12.059

Afawubo K, Nguedam NC (2016) Are urbanization, industrialization and CO2 emissions cointegrated. In 65th Annual meeting of the French Association.

Afridi MA, Kehelwalatenna S, Naseem I, Tahir M (2019) Per capita income, trade openness, urbanization, energy consumption, and CO2 emissions: an empirical study on the SAARC Region. Environ Sci Pollut Res 26(29):29978–29990

Ahmad M, Jiang P, Majeed A, Raza MY (2020a) Does financial development and foreign direct investment improve environmental quality? Evidence from belt and road countries. Environ Sci Pollut Res 27(19):23586–23601