Abstract

This paper examined the impacts of financial development on environmental quality in Malaysia, using the sum of financial access, depth, and efficiency as auxiliary variables for financial development from 1987 to 2020. The autoregressive distributed lag method was used to examine whether a level relationship (long run) existed among the variables. The paper found a long-run relationship among the variables. Financial development, population growth, economic growth, and energy usage positively significantly contribute to environmental degradation in both the short and long run, while squared economic growth significantly enhanced environmental quality in both the short and long run. Hence, environmental carbon Kuznets curve (ECKC) hold in Malaysia.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Environmental degradation is assumed a dangerous proportion, heightened concern by proponents of sustainable development in recent times. This socio-economic menace has drawn the attention of researchers and policymakers in both developed and developing economies. Increased attention is devoted to the problem of carbon dioxide emission in a developed country in recent times. The search for factors responsible for continuous increase in carbon dioxide emission is endless, and studies aimed at providing answers have produced mixed results. Human activities such as production, consumption, population, transportation, and urbanization, are regarded as the main determinants of carbon dioxide emissions. Financial development is associated with environmental quality. According to Zhang (2011), financial development influences environmental quality via three channels: Firstly, stock market development assists listed companies to lower financing costs, increase financing channels, diversifies risk, and optimizes asset/liability structure; this enables them to buy new installations and invest in new projects and consequently increase energy consumption and carbon emissions. Secondly, financial development might attract foreign direct investment, which enhances economic growth and exacerbates carbon emissions, hence increasing their carbon dioxide emission footprint (Zhang 2011). Also, a well-developed financial sector could aid in adopted energy-saving methods of production and environmentally friendly consumer products. Thus, the financial sector plays a major role in developing and developing countries’ economic development. Efficient management of the financial system allows countries to use financial resources productively, even with limited financial resources. This creates a socio-economic environment that is more favorable for the progress of innovation and stimulates economic development (Furuoka 2015). A well-developed and managed financial system attracts investors, boosts the stock market, and improves economic activities’ efficiency. Financial development is an essential part of every economy, promoting the economy’s stock market and banking activities. The financial sector attracts foreign direct investment, which aids in the financial system of a country by improving economic efficiency. There is a strong correlation between the financial system and economic activities (Sadorsky 2011).

There are two schools of thought concerning the effects of financial development on environmental quality. One view holds that efficient financial intermediation increases investment opportunity, increasing lending to firms and households. This will encourage firms and consumers to invest in new financial projects and purchase high earned consumable items, thereby raising energy consumption (such as refrigerators, air conditioners, television, automobiles, and machinery). The growing energy consumption, in turn, increased carbon dioxide emissions into the atmosphere and organic pollutants into the earth’s ecosystem (Abbasi and Riaz 2016; Bekhet et al. 2017; Shahbaz et al. 2010).

On the contrary, developed financial institutions and capital markets provide an opportunity for investable funds to renewable energy sector and loan as well as equity financing in funding green renewable energy projects, respectively. A well-developed financial system provides an avenue to offer credits for environmentally friendly projects at low financing costs. Besides, FDI may lead to local firms’ technological innovation, reducing energy usage (Jalil and Feridun 2011). Therefore, financial development might be an incentive for increased energy substitution (which reduces energy consumption and CO2 emission). The main idea is graphically explained in Fig. 1 below. Results or outcomes of research on financial development-environment quality nexus are ambiguous at best.

This research examines the relationship between carbon emissions and financial development in Malaysia, being a rapid financial developing economy. Following Acheampong’s (2019) suggestion, this study utilized five indicators throughout the 1987–2020 periods. This paper is premised on Acheampong (2019), augmented with financial developments to establish the long-run co-integration relationships among CO2 emissions, energy used, population, economic growth, financial development, and employed autoregressive distributive lag method. This research’s specific contribution to literature is twofold; firstly, this research employed broader measured financial development indices (depth, access, and efficiency). Secondly, it provides policymakers with a clear and econometrics base that could help in policy formation to improve Malaysia’s environmental quality and across the globe.

The rest of the paper is organized as follows: The “Brief literature review” section provides a brief literature review. The “Methodology and data” section gives detailed descriptions of methodology and data, while the “Empirical results and discussion” section discussed the empirical results obtained from our analysis, and the “Conclusion and policy implications” section concludes this research with policy implementations.

Brief literature review

Numerous studies have examined the relationship between financial development and carbon emission with diverse outcomes; this includes but is not limited to Ali et al.’s (2019) study of the dynamic links between carbon emissions and financial development in Nigeria, using ARDL bound test approach for the period of 1971–2010. They found financial development has a positive and significant impact on carbon emissions in both the long run and short run. Mesagan and Nwachukwu (2018) examine the determinant of environmental degradation using the ARDL bounds testing approach for 1981–2016. They generate environmental degradation index (GEDI) with the help of principal component analysis (PCA). They found financial development, energy consumption, trade, and income are significant determinants of environmental quality, while investment and urbanization are insignificant. Also, it finds no causal effect between capital investment, financial development, and environmental quality. Simultaneously, there was unidirectional causality from urbanization and income to environmental deprivation, and there is bidirectional causality between energy consumption and environmental degradation. Rafindadi (2016) examine the nexus between financial development, economic growth, energy consumption, trade openness, and CO2 emissions in Nigeria. Using time series data from 1971 to 2011 and employed the ARDL bound co-integration approach, the Zivot-Andrew structural break unit root test, Bayer-Hanck co-integration approach, and VECM model well as impulse response test. He found financial development and trade openness stimulates energy demand and reduces CO2emissions. Economic growth lowers energy demand but increases CO2 emissions while energy consumption has significantly increased CO2 emissions. He also found bidirectional causality between financial development and energy consumption and financial development and CO2emissions. There was the existence of feedback effect between economic growth and CO2 emissions.

Islam et al. (2013) also affirmed both long- and short-run relationships between financial development and CO2 emissions in Malaysia. Boutabba (2014) found financial development aggravates CO2 emissions in India. Jiang and Ma (2019) examined the nexus between financial development and carbon emissions, using a system generalized moment method for 155 countries by considering the countries’ heterogeneous nature by dividing the sample into two sub-groups: developed and emerging markets. The result indicated that financial developments significantly increase carbon emissions globally in emerging markets and developing countries. However, the effect on developed countries is insignificant. In the same vein, Abbasi and Riaz (2016) found that financial development is the main contributor to carbon dioxide emissions in small and emerging economies. Majeed and Mazhar (2019) examined the effects of financial development on environmental quality for a panel of 131 countries from 1971 to 2017. They found all financial development indicators: domestic credit to the private sector by banks, domestic credit to the private sector, and domestic credit provided by the financial sector significantly improve environmental quality by reducing the ecological footprint.

Comparatively, domestic credit to the private sector has a more substantial effect than other financial development measures and urbanization, while foreign direct investment (FDI), energy consumption, and GDP per capita worsen the environmental quality. Shahbaz et al., 2010 found that financial development is detrimental to environmental quality in Pakistan. Saleem et al. (2020) examined the role of GDP growth, sources of energy consumption, and other plausible hypothetical factors in CO2 emissions for selected Asian countries for the period of 1980–2015 using fully modified OLS. They found lower-income economies do not support the EKC hypothesis during high-income and upper-middle-income economies’ EKC hypothesis hold.

Aye and Edoja (2017) examined the effect of economic growth on CO2 emission using dynamic panel threshold framework. Using panel data drawn from 31 developing countries, they found economic growth has a negative effect on CO2 emission in the low growth countries but the positive effect in the high growth countries. Their finding does not support Environmental Kuznets Curve (EKC) hypothesis, but a U-shaped relationship was established. Also, energy consumption and population were also found to exert a positive and significant effect on CO2 emission. Bekhet et al. (2017) established that financial development is liable for rising carbon emissions in Gulf Cooperation Council (GCC) countries except for United Arab Emirates (UAE). (Kahouli (2017) established a unidirectional causal relationship between financial development and CO2 emissions in South Mediterranean economies (SMEs). However, Khan et al. (2018) found financial development reduces CO2 emissions in Pakistan and Bangladesh but accentuated CO2 emissions in India. Furthermore, a developed financial sector may bring down the cost of borrowing, promote investment in the clean energy sub-sector, and diminish CO2 emissions (Muhammad et al. 2011).

Haseeb et al. (2018) hypothesize that financial development policies encourage progress (advanced technology), cut CO2 emissions, and promote domestic production. Al-Mulali and Sab (2012) state that economic growth and energy consumption increases the aggregate demand; this will, in turn, increase demand for financial services, which could result in the financial sector setting up sound financial policies to control the amount of CO2 emissions. Also, Zhang (2011) discourses that financial development will lead to financial inefficiency, which causes CO2 emissions to rise. Haseeb et al. (2018) examined the effect of energy consumption and financial development for BRICS countries. They found energy consumption and financial developments are the main contributors to the carbon dioxide emissions and that the EKC hypothesis hold in BRICS economies. Siddique (2017) examined the impact of financial development and energy consumption on Pakistan’s CO2 emission from 1980 to 2015. He found energy consumption and financial development increased carbon dioxide emissions in Pakistan. Energy consumption and financial development enhance production and economic growth and increase carbon dioxide emissions (Siddique 2017).

However, studies that found financial development could play a positive role in curbing CO2 emission; Khan et al. (2017) found bidirectional causality between financial development and CO2 emissions in Asia. Riti et al. (2017) also reaffirmed financial development’s role in reducing CO2 emissions in 90 countries. Shahbaz et al. (2010) posit that financial development stimulates investment by risk-sharing. Tamazian and Rao (2010) employed the GMM approach to finding the effects of institutional, economic, and financial developments on CO2 emissions for transitional economies. They found that these factors aid in lowering CO2 emissions. Jalil and Feridun (2011) examined the impact of financial development, economic growth, and energy consumption on China’s environmental pollution using aggregate data over the period 1953–2006. They found financial development reduces CO2 emissions in China. Lee et al. (2015) examined the relationship between CO2 emissions and financial development in OECD countries; they found that financial development can help EU countries to lower their CO2 emissions and there is no evidence of EKC in EU countries. Xing et al. (2017) showed that financial development could improve China’s carbon emissions condition, and this impact does not only reflect the regional difference. On the contrary, Omri et al. (2015) found a neutral relationship between financial development and CO2 emissions in twelve MENA (the Middle East and North Africa) countries. Salahuddin et al. (2018) affirmed the neutral effect of financial development on CO2 emissions in Kuwait and Islam et al. (2013), Jiang and Ma (2019), and Baloch et al. (2018) also reported a neutral relationship between financial instability and CO2 emissions in Saudi Arabia. Recently, Acheampong (2019) investigates the direct and indirect effects of financial development on carbon emissions for a panel of 46 Sub-Saharan Africa countries over the period 2000–2015 using a dynamic system-GMM which investigated the impact of financial development on carbon emission intensity using the GMM approach throughout 1980–2015 using panel data of 83 countries. Pesaran et al. (2001) outlined that the overall financial development and its sub-measures reduce carbon emission intensity in developed and developing financial economies.

Methodology and data

Empirical model

Following the suggestion of Acheampong (2019) and Ang (2007), this research employed the autoregressive distributed lag method developed, whereas all other approaches required the variables in a time series regression equation are integrated of order one or at least of the same order, i.e., the variables are I(1), only ARDL or bound co-integration could be estimated irrespective of whether the underlying variables are I(0), I(1), or fractionally integrated, and fifth there is no need for lags length symmetry for the variables; in other words, each variable can take different lags depending on its relative importance in the mode (Pesaran et al. 2001).

Autoregressive distributive lags model

An autoregressive distributed lags model of order p and q is stated in general form ARDL (p, q) thus:

where yt is the dependent variable and xt vectors of explained variables, all of which are stationary variables, μ is the intercept, and εt is the white noise error term. All variables are assumed to be endogenous. Using the lag operator L applied to each component of a vector, LkXt = Xt = k, it is convenient to define the lag polynomial A(L) and vector polynomial B(L)

where \( A(L)=1-\sum \limits_{i=1}^p{\gamma}_i{L}^i \) and B(L)yt = βo + β1L + β2L2 + … + βqLP.

The general ARDL (p, q1, q2, …, pkqk) states as follows:

If the values of xt are treated as given, it is being uncorrelated with εt. OLS would be a consistent estimator. However, if xt is simultaneously determined with yt and E(xt, εt) ≠ 0, OLS would be an inconsistent estimator. As long as we can have assumed that the error term εt is a white noise process, or more generally, is stationary and independent of xt, xt − 1, … and yt, yt − 1, … the ARDL models can be estimated consistently with the ordinary least squares estimator. The long and short-run parameters could be estimated simultaneously.

To determine the effect of the dynamics of Eq. 1, we can invert Eq. 2 as a lag polynomial in y as:

The current value of y depends on the current and all previous values of x and ε

\( \frac{\partial {y}_t}{\partial {x}_t}={\beta}_0 \) is the multiplier impact

\( \frac{\partial {y}_{t+1}}{\partial {x}_t}={\beta}_1+{\gamma}_1{\beta}_0 \) one period effect

\( \frac{\partial {y}_{t+2}}{\partial {x}_t}={\gamma}_1{\beta}_1+{\gamma}_1^2{\beta}_0 \)second-period effect

\( \frac{\beta_0+{\beta}_1}{1-{\gamma}_1}\kern1em if\kern1em \mid {\gamma}_1\mid \) Long-run multiplier or long-run effect, this can generally be defined as:

where \( C\Big((L)=\frac{B(L)}{C(L)} \).

Assuming no shocks (disturbance) and stationary, the long-run relationship among the variables in the regression is:

where \( \overline{X} \) and \( \overline{Y} \) are the constant values of y and xi.

The mean lag is \( {\left.\frac{A^{\prime }(L)}{A(L)}\right|}_{L=1} \)

Now, we defined the error correction models (ECM) of Eq. 1 below.

ARD corrected model (error correction)

Given an autoregressive distributed lag model of order one ARDL (1,1) as follows:

We subtract yt-1 from Eq. 4:

We add/subtract β0xt − 1 to Eq. 5

Then multiply (β0 + β1)xt − 1 by \( \frac{\gamma -1}{\gamma -1} \) we get:

where \( \varphi =\frac{\beta_0+{\beta}_1}{1-\gamma }=\frac{B(L)}{A(L)} \)

\( \frac{B(L)}{A(L)} \) is the long-run multiplier in our long-run model Eq. 1, the error correction model of ARDL(1,1)

where \( \overline{\mu}=\frac{\mu }{1-\gamma },\overline{\gamma}=\gamma -1 \), Δyt consists of two components (plus disturbance): a short-run shock from Δxt and feedback toward equilibrium, or equilibrium error correction. To see this, note that in equilibrium yt = yt−1 = \( \overline{y} \) and xt = xt−1 = \( \overline{x} \), so Δyt = 0 and Δxt = 0. Then the ECM is:

\( 0=\overline{\gamma}\left[{y}_{t-1}-\right(\overline{\mu}+\varnothing {x}_{t-1} \))]

Therefore, \( {y}_{\mathrm{t}-1}-\Big(\overline{\mu}+\varnothing {x}_{\mathrm{t}-1} \)) represents the deviation from the equilibrium relationship.

\( y=\overline{\mu}+\varnothing x.{\beta}_1=\left(\gamma -1\right) \) is the marginal impact of this deviation on Δyt-1.

Co-integration

The traditional method for estimating co-integrating relationships, such as Engle and Granger’s (1987) and Johansen’s (1991) single equation approaches, such as fully modified ordinary least squares or dynamic least squares required all variables in the regression to be I(1), or by pretesting the variables in order to established data generating process and determination of variables that are I(0) and those that are I(1).

An ARDL co-integrating regression model is obtained by transforming Eq. 1 into differences and substituting the long-run coefficients from Eq. 8:

where

The co-integrating relationship coefficients’ standard error can be determined from the original regression’s standard errors employing the delta method.

Bounds testing

Using the co-integrating relationship form in Eq. 9, Acheampong et al. (2020) describe a methodology for testing whether the autoregressive distributed lag model contains a level (long run) relationship between the dependent and independent variables. The bound test procedure transforms in Eq. 9 into the following representation:

The test for the existence of level relationship (co-integration) is thus:

These coefficient estimates used in a testing level relationship can be determined from a regression of Eq. (1 or estimated directly from a regression Eq. 10

The test statistic based on Eq. 10 has a different distribution under the null hypothesis of no level relationships (no co-integration) depending on whether the regressor is all I(0) or they are all I(1). In which case, the distribution is nonstandard regardless of integration order, Acheampong et al. (2020) and Pesaran et al. (2001) provide critical values for the case where all repressors are I(0) and where all regressors are I(1). They suggested using these critical values as bounds for the more typical cases where the regressor are combinations of I(0) and I(1).

The estimated F-statistics is compared with Pesaran tabulated critical values to reject or accept the null hypothesis. If F-statistic value is less than Pesaran tabulated critical lower bound I(0): there is no co-integration; if F-statistic value is greater than Pesaran tabulated critical upper bound I(1): there is co-integration and if F-statistic value falls within the lower bound I(0) and upper bound I(1): the test is inconclusive.

Specification of model

For capturing the impact of financial development on environmental quality, the following empirical model is formulated:

Equation 11 is transformed into natural logarithms to ensure uniformity in the unit of measure and allows us to interpret the estimated parameters in terms of elasticity:

where

InCO2t is the natural log of carbon dioxide emission (a proxy for environmental quality) at time t, measured as metric tons per capita (Sources: World Development Indicators).

InENGt is the natural log of fossil fuel consumption at time t, measured as the percentage of total energy consumption (kg of oil equivalent per capita) (Sources: World Development Indicators).

InPOPt is the natural log of population density at time t, measured as no per square kilometer (Sources: World Development Indicators).

InGDPt is the natural log of gross domestic product at time t, measured in 2000 constant US dollars (Sources: World Development Indicators).

In(GDPt)2 is square of the natural log of gross domestic product (a proxy for economic growth) at time t, measured in 2000 constant US dollars (Sources: Author calculations).

InFDt is the natural log of financial development indicator at time t, matured as the sum of financial access, depth, and efficiency indices (Sources: International Monetary Fund, Financial Development Index Database)

The expected sign from an estimated coefficient of the variables is as follows: γ1 ≥ 0, γ2 ≥ 0, γ3≥0, γ4 ≥ 0, γ5≥0; in other words, an increase in production, energy use, and population will increase carbon dioxide emission while squared of production will decrease carbon dioxide emission, and improvement in financial development in an economy could lead to an increase or decrease in carbon dioxide emission depending on the application or the area of usage.

The error correction version of the ARDL model is specified thus:

All variables are defined in Eq. 12: ∆ is the difference operator and n is the maximum lag length, where ECT is the error correction term.

Bound test

H0 = δ1 = δ2 = δ3 = δ4 = δ5 = 0 is no level relationship vs. the alternative hypothesis of co-integration: H0 = δ1 = δ2 = δ3 = δ4 = δ5 ≠ 0; level relationship exists.

Data

Our study investigates the impact of financial development on environmental quality, the collision of renewable energy utilization, population growth, economic growth, and financial development on Malaysia’s environmental quality from 1987 to 2020. This research employed statistical tools to discover the dynamic linkages between financial development on environmental quality. Data on the desired variables have been collected from starting published world growth display on the World Bank websiteFootnote 1. These variables are financial development, renewable energy utilization taken as (proportion of whole ultimate power/per year), population growth/per year, GDP per capita (annual growth percent), and carbon dioxide emission (metric tons per capita) in the respective country. Furthermore, financial development indices are computed from depth, access, and efficiency, using these as a proxy for financial development in the country from 1987 to 2020. Moreover, all results reported in this research are carried out on R-environment, a user-friendly statistical analysis tool with the help of PLM package available online under https://cran.r-project.org/web/packages/plm/vignettes/plmpackage.html.

Empirical results and discussion

Exploration work of the data was done with the help of summary statistics presented in Table 1; energy use has the highest means while the gross domestic product has the lowest mean value of all the variables. In the same vein, energy use has the highest minimum and maximum values while the gross domestic product has the least minimum and maximum values. However, the standard deviation, which measured a variable’s variability, shows that carbon dioxide emission was the most volatile while financial development was the least volatile. Furthermore, carbon dioxide emission, financial development, and population were negatively skewed, while gross domestic product and energy use were positively skewed. All variables were non normally distributed as the Jar-Bera test’s probability values were greater than 0.05 for critical values at a 5% level of significance.

Next, we examined the stationarity of the variables with the help of the unit root test. The unit root test result is displayed in Table 2, indicating that all variables were not stationary at level except population, and they were different stationery. This implied that the variables were integrated of order one, i.e., I(1) except population, which is integrated of order zero, i.e., I(0) variable. We proceed with our co-integration analysis using the ARDL method.

Lag length selection

The first step in estimating the ARDL model is determining the optimal lag length for each variable’s variable. Using traditional unrestricted VAR procedures to determine symmetry lags length for all variables as in other autoregressive models does not provide optimal estimates for the ARDL model.

In Table 3, the result of lag lengths selection criteria of our model using four information criteria. The Akaike information criteria (AIC), Schwarz information criteria (SIC), Hannan-Quinn criteria (HQC), and adjusted R-squared (AR) provide the same lag lengths for individual variables.

However, adjusted R-squared (AR) showed error term has the first-order autocorrelation. Since the diagnostic test of AR fails for one of the OLS assumptions, we proceed to estimate co-integration among these variables with the selected ARDL (3, 0, 2, 3, 2, 2) model. And the underlines diagnostic test for these information criteria shows that these models are correctly specified; there is no first and second-order autocorrelation (serial correlation), no heteroscedasticity (homoscedasticity), no ARCH effect in residual, and are normally distributed. Hence, the selected model is suitable for inference. As stated by Acheampong et al. (2020), the serial correlation has consequences on a co-integration result, hence assessing diagnostics tests before embarking on the selected model’s co-integration estimate.

The autoregressive distributed lag bound test

The next step after appropriate lags has been determined is the estimate of the ARDL bound co-integration test. The test was carried out by estimating Eq. 14 and the normalization method for Eqs. 15–19 by taken each variable as a dependent variable as advocated by Acheampong et al. (2020) using selected lags 3, 0, 2, 3, 2, 2, and estimated autoregressive distributed lag model in Table 4.

This test involved restricting the first lagged level for all variables using the F-statistic through the Wald test (bound test) to determine the joint significance level. Table 4 revealed that carbon dioxide emission (CO2), financial development, gross domestic product (GDP), squared gross domestic product (GDP2), population (POP), and energy use (ENG) were jointly co-integrated (long-run relationship). The F-statistic from the bound test for

and

were greater than the upper bound of 3.79 Pesaran critical value 5% significance level, and five independent variables (k = 5) with no constant and trend, case I. Hence, these variables have a long-run relationship; that is, they commove in the long run. After the variables co-integrated, there must be an error correction model to determine the speed of adjustment in the short run when they might drift apart.

Having found that the variables are co-integrated, Table 5 presents the estimated result of a short-run model, while the long-run result is presented in Table 6. Financial development impacted positively on environmental quality in Malaysia. A 1% increase in financial development will lead to a 0.78% and 1.33% fall in Malaysia’s environmental quality, which is statistically significant in both the short and long run. This result is consistent with Ali et al. (2019) and Mesagan and Nwachukwu (2018) for Nigeria. These studies employed the ARDL approach and covered the period of 1971 to 2010, 1981–2018, and 1971–2011 respectively. Our findings confirmed their results. However, we employed a broader financial development measure (depth, access, and efficiency as a proxy of financial development indices). Our result is also consistent with Sadorsky (2011) and Zhang (2011) for China, Emerging Economies, and Central and Eastern European Frontier Economies. However, our result contradicted Haseeb et al. (2018), where they found financial development improved environmental quality. This result is no surprise, as more credit advances to businesses are geared towards installing new plants and expanding activities against the adoption of new technology and environmentally friendly or enhancing environmental quality in Malaysia. Adopting environmentally friendly/energy-saving consumer products is very low because old and outdated electronics, used cars, etc. are among the most patronized products by Malaysian consumers.

An increase in population leads to an increase in carbon dioxide emission in the short run. However, the first lag of population leads to a reduction in carbon emission in the short run. For instance, a 1% change in population will lead to a 316.5% increase in CO2 emission in the short run, while 1% increase in the first lags of the population will lead to a 421.4% reduction in CO2 in Malaysia. Also, the population has a positive and significant influence on environmental quality in the long run; a 1% t increase in population will lead to a 4.85% fall in environmental quality.

Furthermore, the gross domestic product has a significant positive impact on the environment; 1% increase in the gross domestic product will lead to an increase of 1.19% and 1.59% environmental degradation in the short run and long run, respectively. However, the squared gross domestic product has a significant negative impact on environmental quality. A 1% increase in the squared gross domestic product contributes −0.13% and −0.08% decrease in environmental quality in the short and long run. Having found that squared gross domestic product has a negative impact on CO2 emission, it implied that environmental carbon Kuznets curve (ECKC) hold in Malaysia. Our result is consistent with findings by Kahouli (2017). Finally, energy use has a significant positive impact on environmental quality, a 1% increase in energy use will contribute 1.61% and 1.09% fall in environmental quality in the short and long run, respectively. It implied that as we increase energy consumption, it contributes significantly to environmental degradation both in the short and long run. This result is in line with Tamazian and Rao (2010) for Pakistan and with Haseeb et al. (2018) for BRICS countries. Worthy of note is the additive impact of past carbon emissions on society’s current emission state. A 1% increase in past CO2 emissions will contribute to a 1.33% increase in Malaysia’s current environmental degradation.

The error correction term [ECT(-1)] is negatively and statistically significant, reinforcing the variable’s earlier co-integration relationship. This means any disequilibrium in the previous period, 21.8% are corrected each year, all things being equal. Also, Tables 5 and 6 showed adj. independent variables explain R-square 60% and 83% in short and long-run variation in the dependent variable. The joint significance given by F-statistics 4.23 p-value (0.00) and 26.83 (0.00) in the short and long run is that collectively the independent variables are a significant determinant of the dependent variable.

Diagnostic testing

The diagnostic test result for the functional form of the misspecification test is presented in Table 7. The analysis shows that the model is free from the function from misspecification bias, the error variance is Homoscedastic, no ARCH effect in the model, no first and second-order autocorrelation (serial correlation) in residual and residuals were normally distributed, and white noise in both short and long run as displayed.

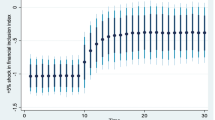

Also, the coefficient stability test shows that both short- and long-run coefficients were stable. The stability test results are graphically presented under Figs. 2 and 3 below. The green curve represents the CUSUM and CUSUM squared test curves, whereas the dotted line represents the lower and upper critical bound of 5% significance level.

The coefficients’stability is reflected from both the graphs, as the CUSUM and CUSUM squared curve operates within the lower and upper bound of 5% level of significance.

Short-run causality analysis

For determining the short-run causality from independent variables to dependent variables, the test was conducted on an economical result obtained from the short-run model by imposing joint restriction on change and lags of each variable via F-statistic Wald test; with null hypothesis, the variables are jointly zero. Table 8 presents short-run causality among variables in the carbon dioxide emission (CO2) model. Financial development, economic growth, energy use, and population cause carbon dioxide emission in the short run.

Conclusion and policy implications

The role of environmental quality on sustainable growth and development of the Malaysian economy cannot be overemphasized in policy formulation and implementation and its implication on the economy’s sustainability. This research examined the impacts of financial development on Malaysia’s environmental quality from 1987 to 2020. The study employed an autoregressive distributed lag method to examined the level relationship (long run) among the variable of interest: carbon dioxide emission (CO2), financial development, energy usage, economic growth, squared economic growth, and population.

Financial development, population, economic growth, and energy usage are significant positive contributors to environmental degradation in Malaysia’s short and long run, while squared economic growth significantly enhances ecological quality in both the short and long run. Environmental carbon Kuznets curve (ECKC) hold in Malaysia. Thus, our research findings are different from Acheampong’s (2019) conclusions who rejected the ECKC hypothesis for sub-Saharan Africa countries. The result further shows that this variable had a level relationship (long run), confirmed by the error correction term’s negative and statistical significance. That is any disequilibrium in the previous period, 21.8% is corrected in 1 year. Also, there is a short-run causal effect from financial development, economic growth, squared economic growth, energy usage, and population to carbon dioxide emission.

Policy implications

Finally, this research contributes to knowledge, has important policy implications, and presents future researchers’ lessons. The result emphasizes the need to channel financial resources toward clean energy projects and adopt new technology to improve carbon footprint to improve environmental quality. The government should take the lead in the adoption of renewable energy technology and decommissioning of nonrenewable technology aggressively in Malaysia, and adoption of population policy that aims at curbing explosive population growth of the past decades. This research recommends that while financial development delays the environment’s quality, financial institutions should boost industries to participate in environmentally friendly projects and provide credit at lower costs to firms committed to investing in environmental sustainability projects. The policy implications apply to Malaysia and are prolonged to other developed and developing economies across the globe. In the future, this research could extend this research by investigating the institutional context through which financial development and foreign direct investment impact environmental quality in developed countries.

Data availability

The data used in this research is available at https://data.worldbank.org/indicator.

Abbreviations

- ECKC:

-

environmental carbon Kuznets curve

- CO2 :

-

carbon dioxide emission

- GDP:

-

gross domestic product

- GDP2 :

-

squared gross domestic product

- POP:

-

population

- ENG:

-

energy use

- GMM:

-

generalized method of moment

- ADL:

-

autoregressive distributive lags model

- GEDI:

-

generate environmental degradation index

- PCA:

-

principal component analysis

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Acheampong AO, Amponsah M, Boateng E (2020) Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies Energy Economics 88:104768

Ali HS, Law SH, Lin WL, Yusop Z, Chin L (2019) Bare UAA. Financial development and carbon dioxide emissions in Nigeria: evidence from the ARDL bounds approach GeoJournal 84:641–655

Al-Mulali U, Sab CNBC (2012) The impact of energy consumption and CO2 emission on the economic growth and financial development in the Sub Saharan African countries. Energy 39:180–186

Ang JB (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35:4772–4778

Aye GC, Edoja PE (2017) Effect of economic growth on CO2 emission in developing countries: evidence from a dynamic panel threshold model Cogent Economics & Finance 5:1379239

Baloch MA, Meng F, Zhang J, Xu Z (2018) Financial instability and CO 2 emissions: the case of Saudi Arabia. Environ Sci Pollut Res 25:26030–26045

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Engle RF, Granger CW (1987) Co-integration and error correction: representation, estimation, and testing Econometrica: journal of the Econometric Society:251-276

Furuoka F (2015) Financial development and energy consumption: evidence from a heterogeneous panel of Asian countries. Renew Sust Energ Rev 52:430–444

Haseeb A, Xia E, Baloch MA, Abbas K (2018) Financial development, globalization, and CO 2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res 25:31283–31296

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33:284–291

Jiang C, Ma X (2019) The impact of financial development on carbon emissions: a global perspective. Sustainability 11:5241

Johansen S (1991) Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models Econometrica. Journal of the Econometric Society:1551–1580

Kahouli B (2017) The short and long run causality relationship among economic growth, energy consumption and financial development: evidence from South Mediterranean Countries (SMCs). Energy Econ 68:19–30

Khan MTI, Yaseen MR, Ali Q (2017) Dynamic relationship between financial development, energy consumption, trade and greenhouse gas: comparison of upper middle income countries from Asia. Europe, Africa and America Journal of cleaner production 161:567–580

Khan AQ, Saleem N, Fatima ST (2018) Financial development, income inequality, and CO 2 emissions in Asian countries using STIRPAT model. Environ Sci Pollut Res 25:6308–6319

Lee J-M, Chen K-H, Cho C-H (2015) The relationship between CO2 emissions and financial development: evidence from OECD countries. The Singapore Economic Review 60:1550117

Majeed MT, Mazhar M (2019) Financial development and ecological footprint: a global panel data analysis Pakistan. Journal of Commerce and Social Sciences (PJCSS) 13:487–514

Mesagan EP, Nwachukwu MI (2018) Determinants of environmental quality in Nigeria: assessing the role of financial development. Econometric Research in Finance 3:55–78

Muhammad S, Lean HH, Muhammad SS (2011) Environmental Kuznets curve and the role of energy consumption in Pakistan

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Rafindadi AA (2016) Does the need for economic growth influence energy consumption and CO2 emissions in Nigeria? Evidence from the innovation accounting test Renewable and Sustainable Energy Reviews 62:1209–1225

Riti JS, Shu Y, Song D, Kamah M (2017) The contribution of energy use and financial development by source in climate change mitigation process: a global empirical perspective Journal of cleaner production 148:882–894

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39:999–1006

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sust Energ Rev 81:2002–2010

Saleem H, Khan MB, Shabbir MS (2020) The role of financial development, energy demand, and technological change in environmental sustainability agenda: evidence from selected Asian countries Environmental Science and Pollution Research 27:5266–5280

Shahbaz M, Shamim SA, Aamir N (2010) Macroeconomic environment and financial sector’s performance: economeetric evidence from three traditional approaches The IUP Journal of Financial Economics 1:103-123

Siddique HMA (2017) Impact of financial development and energy consumption on. CO2 emissions: evidence from Pakistan Bulletin of Business and Economics 6(2):68–73

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies Energy Economics 32:137–145

Xing T, Jiang Q, Mass X (2017) To facilitate or curb? The role of financial development in China’s carbon emissions reduction process: a novel approach International Journal of Environmental Research and Public Health 14:1222

Zhang Y-J (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39:2197–2203

Code availability

All the results reported in this research are carried out in R-studio environment

Author information

Authors and Affiliations

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ye, Y., Khan, Y.A., Wu, C. et al. The impact of financial development on environmental quality: evidence from Malaysia. Air Qual Atmos Health 14, 1233–1246 (2021). https://doi.org/10.1007/s11869-021-01013-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11869-021-01013-x