Abstract

The rapid growth of agriculture has led to a significant increase in energy utilization and CO2 emissions. Agriculture performs a pivotal role in improving every country’s economy. The current study has the main objective to analyses the long-run impact of agricultural CO2 discharge on economic growth, energy consumption (electricity utilization in the agriculture sector), financial development, foreign direct investment (FDI), and population for India. For the period 1978–2018, we applied ADF, PP, ERS, and KPSS unit root and Z&A and CMR structural interval tests to evaluate the stability and breaks in the data set. We check the cointegration of study variables through ARDL, Engle–Granger, and Johansen’s cointegration approaches. The findings of the long-run analysis showed a cointegration among the variables, which reveals that an escalation in economic growth and financial development refine the natural environment, while the upsurge in FDI and population further deteriorate the climate in India. However, agricultural sector electricity use shows an insignificant association with CO2 emissions for both periods. On the basis of results, we recommend that legislators should offer an environment that provides opportunities for financial development and economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The United Nations (Food and Agriculture Organization 2016) analyzed agriculture, fisheries, and forestry sectors regarding greenhouse gases (GHGs) and found that emissions from these sectors are nearly twofold in the previous five decades and possibly will rise to 30% in the future. Similarly, the agricultural emissions have increased by 14%, which mounted from 4.7 billion tons (in 2001) to 5.3 billion tons of carbon dioxide equivalent (in 2011). This rise is mainly because of the growth in developing countries’ average agricultural production levels (FAO 2016). Agriculture plays a central part in the Indian economy and acts as the cornerstone of the economy. The agriculture sector, apart from raw material supplying, offers employment options to the significant portion of the populace and also provides other goods along with food items to maintain and improve the quality of life.

The agriculture sector in India accounts for approximately 18% of the total GDP growth and more than 50% of the rural population associated with this sector. Indian agriculture comprised of five subsectors, i.e., major and minor crops, fisheries, forests, and livestock. The total share of major crops in value addition and GDP is 23.60% and 15.4%, respectively. Similarly, minor crops contribute 11% to value addition and 2% to GDP, while the value addition in forestry, livestock, and fishing are 2.10%, 25.5%, and 12.5%, respectively, and 0.4%, 5.22%, and 4.10% to GDP (GOI 2018). Consequently, the huge contributions made by these agriculture subsectors in India can, therefore, be liable for the production of CO2 emissions. The adverse effects of CO2 emissions from the agricultural sector, followed by a rise in GHGs on the earth’s surface, are complicated for every country in the world, irrespective of population and economy scale.

The floods in India and Australia, tsunamis in Japan, earthquakes in Haiti, and forest fires in Russia are the leading catastrophes that occurred recently, which might result from ecological disasters. Apart from human beings, all these factors significantly destroyed sustainable resources, including wildlife, agrarian production, land, forests, and infrastructure. The environmental and economic analyst perceives that these disastrous incidents are the leading cause of economic and financial turmoil and have a profound ecological implication (Shahbaz et al. 2013b).

Most of the developing countries have begun working toward financial activities that are environmentally sustainable. However, economic activities often require fossil fuels to produce energy, thereby increases CO2 emissions. These poisonous materials raise the GHGs level and harm the environment, which has led to forming environmentally friendly organizations. These organizations have contributed significantly to global cleanliness campaigns by supporting such arrangements, where both the natural environment and people can address their environmental and socioeconomic concerns (Apak and Atay 2013). Furthermore, financial growth is used as a substitute to attain a better climate, but the carbon emission correlation as a driving force to energy consumption is still a big issue for economic development. In this scenario, decreasing CO2 implies a reduction in the progress of the economy, which a country is reluctant to rely on; therefore, novel solutions are needed to accomplish both sustainable economic and environmental objectives. Shahbaz et al. (2013b) argued that these ecological problems exist since the 1960s. Since then, the awareness and impact of the detrimental effects of environmental degradation between legislators, social scientists, and biodiversity advocacy groups at an international and domestic level have also enhanced. Many countries formulate administrative plans to tackle pollution and deterioration of the environment to advance economic growth.

The current research varies from earlier studies and has four significant contributions to the evolving literature related to environmental quality studies. (1)We conceived agricultural carbon emissions concerning some additional leading indicators in India because of its massive dependence on agriculture. (2) We utilized multiple unit root tests (ADF, PP, KPSS, and ERSFootnote 1) to examine the data stationarity and also analyses structural breaks with the use of Zivot–Andrews and Clemente Montanes Reyes tests. (3) ARDL methodology is applied to review the short- and long-term link between economic growth, FDI, monetary progress, population, energy consumption (power usage in agriculture), and CO2 emissions in India. (4) To check robustness, we applied Johansen and Engle–Granger cointegration tests to approve long-term correlations between variables. Current paper intends to observe the co-integrating long-run nexus among financial growth and CO2 in India from 1978 to 2018, with the use of Engle–Granger, Johansen, and ARDL-bound cointegration tests. In the past, limited studies assessed the influence of financial development on agricultural CO2 emission as a measure of environmental quality. Due to lack of studies, the gap can be filled through this study and contributes significantly to the emerging literature.

The remaining paper is arranged as follows: Sects. 2 and 3 stated literature view and materials and econometric methods, respectively. Moreover, Sect. 4 enclosed the results and discussions, while the fifth section summarizes recent research by providing a conclusion and offer possible suggestions with policy implications.

2 Literature review

In India, various studies in the past have been carried out to determine the financial growth, energy usage, and economic evolution effect on CO2 emission (Pao and Tsai 2011; Sehrawat et al. 2015; Boutabba 2014; Shahbaz et al. 2017). An investigation was carried out by Pandey and Rastogi (2019), using time series data to test the long-term association between energy consumption and ecological degradation for India from 1971 to 2017. The findings draw the conclusion that India must take drastic action to curb the growing greenhouse gas emissions. The study of Sikdar and Mukhopadhyay (2018) examined the impact of CO2 emissions, power consumption, GDP, and changing of economic structure in India between 1971 and 2012. The results disclosed that energy consumption, GDP, and economic structure augmenting CO2 emissions. Furthermore, a long-term association between CO2 emissions, financial growth, electricity utilization, and economic growth was observed in India, and the findings show insignificant effects of financial development on CO2 emissions (Dogan and Seker 2016; Omri et al. 2015).

Shahbaz et al. (2013b) assessed the financial development, coal, trade, and growth influence on the environmental quality for South Africa and found that increase in economic growth raises CO2 while financial growth decreases it. Their outcomes further show that usage of coal is a significant contributor to environmental degradation; however, trade openness helps to increase the environmental quality by minimizing the expansion of energy contaminants in South Africa. Thorough time series analysis, Ozturk and Acaravci (2013) analyze the association between growth, power depletion, trade openness, financial growth, and CO2 for Turkey. Outcomes of the study indicate that trade openness and economic progression significantly influence the CO2 emission, while financial development has an insignificant relationship with CO2. Jalil and Feridun (2011) studied the effect of energy, financial, and economic development on CO2 by adopting a time series analysis in China and found contrary results of monetary growth on pollution by stating that financial sector development won’t occur at the cost of environmental degradation. Shahbaz et al. (2013a) studied the correlation between monetary growth, trade openness, monetary expansion, energy use, and CO2 discharges in Indonesia from 1975 to 2011. They found that progress in economy and utilization of energy raised CO2 emissions, while trade openness and financial growth abate it. The energy use, financial growth, GDP, and CO2 interaction was investigated by Dar and Asif (2018) for Turkey between 1976 and 1986. The results of time series analysis showed a reduction in CO2 as economic activity and energy use raises, while financial development expands CO2 emissions. Likewise, Jamel and Derbali (2016) investigated the correlation by using time series data, between consumption of energy, growth, and CO2 for eight Asian countries from 1991 to 2013, and their results demonstrated that both independent variables significantly influence the CO2 emission.

The investigation made by Ahmad et al. (2018) for China’s five western provinces proved that tourism has a negative effect on the climate of Ningxia, Gansu, Qinghai, and Shanxi, while the long-term adverse impact on CO2 from energy use and economic growth is higher than tourism. Magazzino (2016a, b) considered financial growth, energy usage levels, prices of oil, and growth liaison by applied ARDL and VAR method for Italy during the period of 1960–2014. The results of ARDL have shown long-run cointegration between the variables and specified that economic development and oil prices significantly influenced energy consumption levels. Simultaneously, VAR approach explained the short-term results, which stated that real economic growth substantially impacted the energy use. Moreover, Rauf et al. (2018a) extended the literature by analyzing the panel of 47 countries related to Belt and Road Initiative (BRI) nations from 1980 to 2016. Their results accredited that apart from trade openness, all the other variables (energy utilization, economic evolution, monetary expansion, urbanization, and investment structure) adversely affect the environment. Rauf et al. (2018b) utilized the EKC hypothesis to investigate 65 BRI countries from 1981 to 2016. The stated results authenticate the mean group model for all six regions and EKC hypothesis verified by the pooled mean group for progressed European economies yet not appropriate for others. Indeed, developed and developing nations are linking together to reduce CO2 emissions without distracting sustainable growth. After restructuring and opening up the Chinese economy, its structure has changed rapidly, and agriculture and services are very helpful in promoting economic development in today’s competitive world. Subsequently, research conducted by Rauf et al. (2018c) investigating the interplay between energy use, industrial growth, service sector, and CO2 emissions for China during 1971–2016. The results revealed that energy consumption, services sector, and industrial growth affect the environment adversely; the economic output has a long-term positive effect, while the service sector and economic production have a short-term damaging impact on the environment of China. In addition, a long-term correlation between variables was confirmed in the case of India during 1985–2017. Where, electricity and gas utilization has a negative impact on India’s agricultural GDP. After evaluated valuable information, the present study made a contribution by using agricultural emission as an alternate of environmental sustainability with the addition of money market fiscal measures and population in modeling the relation between financial growth and ecological aspects in the case of India.

3 Research methodology

The conceptual framework of current research derives from extended production theory, which perceives power consumption as a valuable source in addition to capital and workforce. The energy consumption might be directly related to the CO2 emission once it is incorporated into the production mechanism. The extended production theory provides the basis for using financial industry growth as the structure of technological development. It is based on increased financial growth, which can improve production and economic prosperity. The extended production theory has been used in recent empirical studies to scrutinize the correlation among financial growth, energy usage, and CO2 emission (Shahbaz et al. 2016; Hafeez et al. 2018). However, the agriculture sector carbon dioxide emissions make this analysis novel from existing literature. Additionally, the log–log model parameters, in comparison with simple linear–linear arrangements, will minimize the time series data intensity and provide reliable results (Iheanacho 2016).

3.1 Econometric model

The specification of empirical models of present research preceded the evolving literature on financial growth and CO2 discharges, which explores the nexuses between energy, economic evolution, financial development, and CO2 emissions. Furthermore, apart from agricultural emissions, this research also incorporates the population to differentiate our empirical analysis from previous studies (Shahbaz et al. 2013b; Jalil and Feridun 2011; Rauf et al. 2018d). These researchers discussed financial growth in their analytical work. Therefore, following their studies, the model of CO2 emission in India can be defined as follows:

The log-linear specification has been used in current investigation to evaluate the link between regress and repressor variables, and derived model defined as follows:

where CO2 represents agriculture sector carbon dioxide emissions, EG stands for economic growth, while EC symbolizes total energy consumption in the agriculture segment. The FD and FDI simultaneously specified financial development and foreign direct investment. \({ \curlywedge }_{1} ,{ \curlywedge }_{2} ,{ \curlywedge }_{3} ,{ \curlywedge }_{4} ,{ \curlywedge }_{5}\) are the estimated coefficients, whereas \({ \curlywedge }_{0}\) and \(\varepsilon_{t}\) indicates a constant term and stochastic error term, respectively. In the last, ln signifies the natural log form of the variables. Furthermore, the presented study analyses the response of economic and financial development on CO2 emanations from the agriculture sector of India by employed time series data set from 1978 to 2018. The data were sourced from the Food and Agriculture Organization (FAO 2016), the Government of India Statistics (GOI 2018), and World Development Indicators (WDI 2019). The overview of the research parameters is enclosed in Table 1.

3.2 Autoregressive distributed lag (ARDL) approach

The ARDL procedure suggested by Pesaran et al. (2001) was applied to assess the long-run cointegration link across the variables. The ARDL approach has various advantages compared with other conventional techniques. Firstly, it is possible to measure the long and short-run variable impressions. Secondly, this method is equally good, as in the case of a small sample size. Thirdly, this approach can be used even if the selected variables are stationary at a level I(0), the first difference I(1), or a mixture of the two (Irfan and Shaw 2017). The following are the ARDL-bound test cointegration equations:

where \(\theta_{0 }\) denotes constant term, \(\sigma\) represents long-term relationships, \(\theta\) specifies short-term error correction dynamics, while \(\mu_{t}\) signifies the error term. The ARDL method utilizes a bound F statistic test to observe the long-term cointegration among the desired variables. In this test, the null supposition specified no long-term cointegration, whereas cointegration existed amid variables in alternative hypotheses. Furthermore, this bound test has two boundaries, i.e., low and high critical bounds; if the estimated F statistics value crosses the higher bound limit, then long-term cointegration relation be there, and null hypothesis is rejected. In contrast, if computed F statistics amount is less than the lower boundary then no long-term cointegration among variables and null hypotheses cannot be denied (Pesaran et al. 2001; Narayan 2005).

Conversely, in case F statistics value is between these two bounds, then the outcome is indecisive. We applied the Akaike information criterion (AIC) for lag length. After selecting the ideal lag dimensions and estimating the model, the equation of short and long-run ARDL model is followed as:

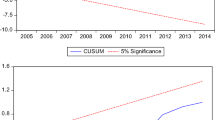

where the error correction term is expressed with \({\text{ECT}}_{t - 1}\) and is indicated for a long-run stability adjustment speed. To test the empirical model fitness, several analytical tests (Ramsey RESET, serial correlation, and heteroscedasticity) were used in this research. Also, the stability of the model was assured by employed CUSUMFootnote 2 and CUSUMSQFootnote 3 tests.

4 Results

4.1 Descriptive and correlation information

Summary statistics and correlation matrix outcomes were explained in Table 2 and suggested that all the data series (CO2, EG, EC, FDI, and POP) are generally distributed except FD (as indicated through Jarque–Bera values); however, the ARDL method can fix the non-normality issues. Similarly, Table 2 also exhibits correlation test outcomes, which confirms a significant positive correlation between economic growths, power use in the agricultural sector, population, and FDI with CO2, whereas the strong negative association is noticed between financial development and CO2 emissions.

4.2 Unit root analysis

Before proceeding toward the cointegration testing, the first step is to check the integration levels of the study variables. The ARDL procedure is used once the parameters are assimilated at I(0) or I(1) or integrated fractionally. To do so, well-known ADF, PP, KPSS, and ERS unit root measures are used to validate the data stationarity. The results of the above-mentioned unit root tests were presented in Table 3, which suggested the stationarity of all variables at I(0) and I(1). This result allows us to proceed for ARDL-bound testing technique proposed by Pesaran et al. (2001) and Pesaran and Shin (1998).

Likewise, the outcomes of Zivot–Andrews (Z&A) and Clemente Montanes Reyes (CMR) structural break unit root analyses are described in Table 4. The findings showed that the majority of the data series have the unit root issue at level; however, they become stationary at the first difference. Therefore, estimates specified that all the variables are stable at the desired level even when the structural breaks were present, and the bound testing approach could be used. Bounds testing method is exercised to inspect the effects of long-run cointegration; as a result, we utilized this technique in the present study and reported their findings in Table 5.

The first equation \(F_{{{\text{CO}}_{2} }}\) (CO2/EG, EC, FD, FDI, POP) outcome of an ARDL cointegration assessment indicates long-run cointegration relationship existence at a 5% critical level when using CO2 emission as a dependent variable. Similarly, the second and third equations of the FEG (EG/CO2, EC, FD, FDI, POP) and FEC (EC/EG, CO2, FD, FDI, POP) confirms no cointegration relation between the variables when economic growth and energy consumption has been used an explanatory parameter. Furthermore, fourth equation FFD (FD/EC, EG, CO2, FDI, POP) of ARDL-bound test used FD as a dependent variable, and the findings affirmed the occurrence of the long-run co-integrating association among variables. Moreover, the fifth equation FFDI (FDI/FD, EC, EG, CO2, and POP) results of the ARDL-bound test indicate no long-term cointegration relation between variables, where foreign direct investment operated as the explanatory parameter.

The final equation FPOP (POP/FDI, FD, EC, EG, and CO2) of the ARDL-bound test employed population as a dependent variable, and the results stated a long-run cointegration. Subsequently, Table 6 includes the findings of the Johansen cointegration method while applying trace and max eigenvalue indicators to evaluate the strength of the long-term effects further. The statistical values of both trace and max-eigenvalues are reported to be high compared with the decisive value on a 5% level of significance, indicating a long-term correlation between variables.

In addition, to validate the Johansen’s cointegration testing results, we applied the Engle–Granger (EG) cointegration test (Saud et al. 2019). The dual step error-based analysis of Engle–Granger primarily regressed dependent variable (CO2) on independent variables (EG, FDI, EC, FD, and POP) and measured the equation residuals. Table 7 shows the estimated residuals evaluated through the ADF unit root check. The calculated residuals remain stagnant at level, and this is a sign that variables are cointegrated at the first step. Additionally, the affirmation across the second step would effectively ensure the long-term cointegration between the variables. Subsequently, Table 8 possesses the first difference residuals reverted from its lagged residuals in a simple OLS methodology. The OLS estimated residuals (New-1) inferences showed significance at 5% and confirmed a long-term relation among the variables. Therefore, refusing to endorse the null proposition as opposed to an alternative is the proof of data series being cointegrated.

The estimated outcomes of an ARDL approach in the long and short-run are presented in Table 9. The current research considers agricultural sector CO2 emission being a dependent variable, whereas agriculture sector electricity utilization, economic growth, foreign direct investment, financial development, and population were employed as an independent variable. The long-run outcomes of economic growth indicate a significant inverse relation to CO2 emission from the agriculture sector at a 1% critical level. The estimated coefficient of EG demonstrates that a rise of 1% in economic growth will diminish the CO2 by 0.44%; it shows that progress in growth helps the environment to get better in India. The results of the study endorse the empirical evidence in the literature that fostering greener energy resources promotes economic growth, which increases the environmental efficiency. The estimated effects of existing research are aligned with prior studies. The study of Maji et al. (2016) confirmed that power usage and economic growth destroy the environment in BRI countries. Kasman and Duman (2015) reported an inverse link among economic growth and CO2, which suggests that financial growth helps to increase the quality of the environment in Nigeria. However, our results contradict the finding of Magazzino (2016a, b), who stated that growth positively and considerably influences the CO2 discharges.

The agricultural sector energy use coefficient is positive and insignificant, and these outcomes endorse the earlier research results (Zhang and Gao 2016; Choi et al. 2012). High energy consumption causes severe deterioration of the environment (Chen et al. 2011). Innovative carbon-free energies, such as nuclear and wind, along with advanced technology, are conducive to improve environmental quality (Islam et al. 2013). The results of the long-term analysis indicate that financial development is negatively significant at a 1% significance level. The outcome illustrates a 1% upturn in the coefficient value of financial development has the potential to decrease agricultural CO2 emissions by 0.09% and elevate environment conditions in India. Financial development findings are consistent with earlier studies results. Rauf et al. (2018b) reported in the case of the Belt and Road region that monetary expansion massively damages the natural environment. In Turkey (Dar and Asif 2018; Chen et al. 2011) stated that financial growth increases the efficiency of the environment.

Furthermore, the findings of the FDI coefficient suggest the positive and robust long-term impact on CO2 emission in India, which implies that FDI enhances environmental deterioration. In addition, the long-run population coefficient findings are also positively and significantly correlated with CO2 emissions, indicating that a 1% rise in population can lead to a 1.02% increase in environmental pollution. The population growth can raise the land openness for agriculture, housing, and certain associated business activities. The present study results are consistent with the recent study of Munir and Ameer (2018).

The short-run outcomes of the ARDL approach are described in Table 9. These findings show an insignificant and positive relationship between EG and CO2, EC and CO2, and FDI and CO2, which specified that growth, foreign direct investment, and electricity depletion has no empirical effect on Indian environmental degradation. Furthermore, the consequence of financial development at CO2 radiations in short-term analysis shows a significant negative relation, which implies that a 1% upsurge in financial growth reduces agricultural sector CO2 emissions by 0.12%, and made positive development to the environment. The outcomes of FD-CO2 relations are intuitive with the previous study of Saud et al. (2019), which has confirmed that intensified financial growth enhanced environmental quality. In addition, the short-run results show a significant positive link between population and CO2 emissions, implying a 1% increase in population would raise CO2 emissions by 9.04%.

Several diagnostic assessments were made to verify the ARDL model’s steadiness, i.e., Breusch–Godfrey for serial correlation, White for parameter stability, Ramsey RESET for model specifications, and CUSUM and CUSUMQS for parameter stability. Diagnostic test results are presented in Table 10, and the inferences show the stability of the model regarding serial correlation, white heteroscedasticity, and Ramsey RESET test. Likewise, Fig. 1 displayed the findings of CUSUM and CUSUMQS, which confirm the accuracy of the parameters.

The pair-wise Granger causality test findings between variables were postulated in Table 11, which indicates a unidirectional causality from EG → CO2 at a 10% significance level, and hence negate the null supposition of economic growth. Meanwhile, the proposition of CO2 does not granger cause EG cannot be opposed. The CO2 granger cause EC and FD, which suggest a unidirectional causality from CO2 → EC, and CO2 → FD, and hence reject the null assumption that CO2 does not granger cause electricity consumption and financial development at 1% and 5% significance level, simultaneously. However, the supposition of electricity consumption and financial development does not granger cause CO2 cannot be overruled. Furthermore, there exists a bidirectional causality among CO2 → POP, which suggests the denial of a null proposition of population and CO2 emission at a 5% level of significance.

5 Conclusions

The current study reviewed the influence of economic growth (EG), financial development (FD), consumption of electricity in the agriculture (EC), population (POP), and foreign direct investment (FDI) on environment value (CO2) in India from 1978 to 2018. The current study employed various econometric techniques such as ADF, PP, KPSS, and ERS unit root; Z&A, CMR structural break unit root tests, and Engle–Granger, Johansen, and ARDL cointegration methodologies to understand the direction of possible causal association among above mention variables. The results of the ARDL, Engle–Granger, and Johansen cointegration approach establish a long-run co-integrating relationship between EG, FD, EC, POP, FDI, and CO2.

The coefficient values of EG and FD had an adverse effect on CO2 in the longer-run, which specifies an escalation of 1% in financial activity and monetary expansion will minimize CO2 discharges and stimulate reliability of the Indian climate by 0.44% and 0.09% correspondingly. In contrast, long-term results of POP and FDI have significant positive impacts on CO2. This result shows that an increase of 1% in population and foreign direct investment will raise the pollution level and damage the quality of the environment further in India by 1.02% and 1.66%, respectively. However, electricity use from the agriculture sector does not affect the CO2 in the long-term. Moreover, the current paper also applied pairwise Granger causality analysis to ascertain the course of causality, and the outcomes showed unidirectional relation among financial progress and CO2 emanations; while, the causality regarding population and CO2 was bidirectional.

The findings of the present study recommend that government and legislators have to escalate economic growth and financial development as such developments can enrich the environmental quality in India. As observed from the results, the guidelines for CO2 reduction in terms of energy use and overall growth cannot be conclusive, as financial development is also required for greenhouse gas reduction strategies. Consequently, financial development is derived from enriching environmental attributes in the Indian agriculture sector. The implications of the policy can be drawn from recent studies, such as the use of the financial industry through the banking system and encourage green investment and energy-efficient portfolios. The financial monitoring policies should be defined for corporations and businesses, and they should be given some interest and other incentives on eco-friendly production activities.

In this regard, the federal government should assist the money markets by introducing a sound strategy that will reduce the emissions and create a permanent supply for the development of new technological resources that can lead toward the low-carbon emission nation. Additionally, efficient capital and money markets may be a better substitute policy option; thus, companies can reduce their cash flow risk and trigger the necessary funds through portfolio divergence, which will be extremely beneficial in the long run to set up a technology foundation. Finally, the present study extends the scope for future researches, where researchers can use our empirical methodology to raise awareness between economic development, usage of energy, and CO2 emissions in the agriculture sector in countries apart from India. Further, the nonlinear ARDL (NARDL) may use as an alternate of the current study’s ARDL methodology or upgraded by developing a financial development index instead of practicing a single component as an economic advancement deputation. The present study used aggregated data on CO2 emissions for India; however, utilization of disaggregate scale data (by industry) to probe the interconnection between income, financial development, and CO2 emission in the future may offer some better understanding. Consequently, it can also help policymakers to formulate monetary and fiscal policies that are environmentally friendly.

Notes

ADF Augmented Dickey–Fuller, PP Phillips Perron, KPSS Kwiatkowski, Phillips, Schmidt and Shin, ERS Elliot, Rothenberg and Stock point optimal.

Cumulative sum of recursive residuals.

Cumulative sum of recursive residual squares.

References

Ahmad, F., Draz, M., Su, L., Ozturk, I., & Rauf, A. (2018). Tourism and environmental pollution: Evidence from the one belt one road provinces of Western China. Sustainability, 10(10), 3520.

Apak, S., & Atay, E. (2013). Renewable energy financial management in the EU’s enlargement strategy and environmental crises. Procedia-Social and Behavioral Sciences, 75, 255–263.

Boutabba, M. A. (2014). The impact of financial development, income, energy, and trade on carbon emissions: Evidence from the Indian economy. Economic Modelling, 40, 33–41.

Chen, Y., Zhang, S., Xu, S., & Li, G. Y. (2011). Fundamental trade-offs on green wireless networks. IEEE Communications Magazine, 49(6), 30–37.

Choi, Y., Zhang, N., & Zhou, P. (2012). Efficiency and abatement costs of energy-related CO2 emissions in China: A slacks-based efficiency measure. Applied Energy, 98, 198–208.

Dar, J. A., & Asif, M. (2018). Does financial development improve environmental quality in Turkey? An application of endogenous structural breaks based cointegration approach. Management of Environmental Quality: An International Journal, 29(2), 368–384.

Dogan, E., & Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074–1085.

FAO (Food and Agriculture Statistics). (2016). Food and Agriculture Organization of the United States. http://www.fao.org/faostat/en/#data/IG. Accessed 15 Sept 2019.

GOI. (2018). Ministry of Statistics and Programme Implementation, Government of India.

Hafeez, M., Chunhui, Y., Strohmaier, D., Ahmed, M., & Jie, L. (2018). Does finance affect environmental degradation: Evidence from one belt and one road initiative region? Environmental Science and Pollution Research, 25(10), 9579–9592.

Iheanacho, E. (2016). The impact of financial development on economic growth in Nigeria: An ARDL analysis. Economies, 4(4), 26.

Irfan, M., & Shaw, K. (2017). Modeling the effects of energy consumption and urbanization on environmental pollution in South Asian countries: A nonparametric panel approach. Quality & Quantity, 51(1), 65–78.

Islam, F., Shahbaz, M., Ahmed, A. U., & Alam, M. M. (2013). Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Economic Modelling, 30, 435–441.

Jalil, A., & Feridun, M. (2011). The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Economics, 33(2), 284–291.

Jamel, L., & Derbali, A. (2016). Do energy consumption and economic growth lead to environmental degradation? Evidence from Asian economies. Cogent Economics & Finance, 4(1), 1170653.

Kasman, A., & Duman, Y. S. (2015). CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: A panel data analysis. Economic Modelling, 44, 97–103.

Magazzino, C. (2016). Energy consumption, real GDP, and financial development nexus in Italy: An application of an auto-regressive distributed lag-bound testing approach. In Proceedings 2nd international conference on energy production and management, Ancona (Vol. 205, pp. 21–32).

Magazzino, C. (2016b). The relationship between CO2 emissions, energy consumption and economic growth in Italy. International Journal of Sustainable Energy, 35(9), 844–857.

Maji, I. K., Habibullah, M. S., & Yusof-Saari, M. (2016). Emissions from agricultural sector and financial development in Nigeria: An empirical study. International Journal of Economics & Management, 10(1), 173–187.

Munir, K., & Ameer, A. (2018). Effect of economic growth, trade openness, urbanization, and technology on environment of Asian emerging economies. Management of Environmental Quality: An International Journal, 29(6), 1123–1134.

Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from cointegration tests. Applied Economics, 37(17), 1979–1990.

Omri, A., Daly, S., Rault, C., & Chaibi, A. (2015). Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Economics, 48, 242–252.

Ozturk, I., & Acaravci, A. (2013). The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Economics, 36, 262–267.

Pandey, K. K., & Rastogi, H. (2019). Effect of energy consumption & economic growth on environmental degradation in India: A time series modelling. Energy Procedia, 158, 4232–4237.

Pao, H.-T., & Tsai, C.-M. (2011). Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy, 36(1), 685–693.

Pesaran, M. H., & Shin, Y. (1998). An autoregressive distributed-lag modelling approach to cointegration analysis. Econometric Society Monographs, 31, 371–413.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Rauf, A., Liu, X., Amin, W., Ozturk, I., Rehman, O. U., & Hafeez, M. (2018a). Testing EKC hypothesis with energy and sustainable development challenges: A fresh evidence from Belt and Road Initiative economies. Environmental Science and Pollution Research, 25(32), 32066–32080.

Rauf, A., Liu, X., Amin, W., Ozturk, I., Rehman, O., & Sarwar, S. (2018b). Energy and ecological sustainability: Challenges and panoramas in belt and road initiative countries. Sustainability, 10(8), 2743.

Rauf, A., Liu, X., Amin, W., Rehman, O. U., & Sarfraz, M. (2018). Nexus between industrial growth, energy consumption and environmental deterioration: OBOR challenges and prospects to China. In 5th International conference on industrial economics system and industrial security engineering (IEIS) (pp. 1–6). IEEE.

Rauf, A., Zhang, J., Li, J., & Amin, W. (2018d). Structural changes, energy consumption and Carbon emissions in China: Empirical evidence from ARDL bound testing model. Structural Change and Economic Dynamics, 47, 194–206.

Saud, S., Chen, S., & Haseeb, A. (2019). Impact of financial development and economic growth on environmental quality: An empirical analysis from Belt and Road Initiative (BRI) countries. Environmental Science and Pollution Research, 26(3), 2253–2269.

Sehrawat, M., Giri, A., & Mohapatra, G. (2015). The impact of financial development, economic growth and energy consumption on environmental degradation: Evidence from India. Management of Environmental Quality: An International Journal, 26(5), 666–682.

Shahbaz, M., Hye, Q. M. A., Tiwari, A. K., & Leitão, N. C. (2013a). Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renewable and Sustainable Energy Reviews, 25, 109–121.

Shahbaz, M., Islam, F., & Butt, M. S. (2016). Finance–growth–energy nexus and the role of agriculture and modern sectors: Evidence from ARDL bounds test approach to cointegration in Pakistan. Global Business Review, 17(5), 1037–1059.

Shahbaz, M., Tiwari, A. K., & Nasir, M. (2013b). The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy, 61, 1452–1459.

Shahbaz, M., Van Hoang, T. H., Mahalik, M. K., & Roubaud, D. (2017). Energy consumption, financial development and economic growth in India: New evidence from a nonlinear and asymmetric analysis. Energy Economics, 63, 199–212.

Sikdar, C., & Mukhopadhyay, K. (2018). The nexus between carbon emission, energy consumption, economic growth and changing economic structure in India: A multivariate cointegration approach. The Journal of Developing Areas, 52(4), 67–83.

WDI. (2019). World Bank country facts. Washington, USA. World Development Indicators. https://data.worldbank.org/country/india?view=chart. Accessed 15 Sept 2019.

Zhang, L., & Gao, J. (2016). Exploring the effects of international tourism on China’s economic growth, energy consumption and environmental pollution: Evidence from a regional panel analysis. Renewable and Sustainable Energy Reviews, 53, 225–234.

Funding

This research was supported by the Heilongjiang Province Philosophy and Social Science planning Office Project, “Belt and Road” initiative, China and countries along the agricultural capacity cooperation implementation mechanism research (Project Number: 18JLD310).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Naseem, S., Guang Ji, T., Kashif, U. et al. Causal analysis of the dynamic link between energy growth and environmental quality for agriculture sector: a piece of evidence from India. Environ Dev Sustain 23, 7913–7930 (2021). https://doi.org/10.1007/s10668-020-00953-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-020-00953-1