Abstract

A plethora of empirical work explored finance-income-environment nexus, aims to investigate high CO2 emissions determinants, over the last few couples of decades. The prior empirical work assist the idea that finance and income have diverse impacts on the environment. The lack of consensus on finance-income-environment nexus in the Central and Eastern European Countries in the perspective of Belt and Road Initiative need to be examined. Therefore, the present study explores the nexus between financial development, income level, and environmental quality for a panel of eighteen Central and Eastern European Countries, over the period of 1980–2016. The Dynamic Seemingly Unrelated Regression, the Fully Modified Ordinary Least Squares, and the Dumitrescu-Hurlin panel casualty approaches are employed. The environmental Kuznets curve hypothesis also investigated for both time series panel and country-wise. The Dynamic Seemingly Unrelated Regression long-run panel results reveal that (i) financial development index and income negatively impact on environmental quality; (ii) energy consumption is the key determinant of CO2 emissions and reduces environmental quality; (iii) urbanization and trade both enhance environmental quality via reduction of carbon emissions; and (iv) the environmental Kuznets curve hypothesis supported for the selected panel countries. The country-wise results depict that increase in environmental quality occurs due to increase in financial development (in four countries), income level (in five countries), trade (in five countries), and urbanization (in eight countries). However, the environmental quality decreases due to the increase in financial development (in six countries), income level (in eight countries), energy consumption (in twelve countries), trade (in six countries), and urbanization (in five countries). The environmental Kuznets curve hypothesis supported for five Central and Eastern European Countries. Additionally, the causality results confirmed the presence of feedback relationships among income and environmental quality, and financial development and energy consumption. Thus, we conclude that income level and financial development are the main drivers behind high carbon dioxide emissions in CEECs. The finding of the study opens up new insight for appropriate policymaking.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Over the past few decades, climate change and greenhouse gas emissions are severe global environmental issues. The high environmental degradation might have negative impacts on the environment of Central and Eastern EuropeanFootnote 1 Countries (CEECs) (Calel and Dechezleprêtre 2016). The excessive burning of fossil fuels along with other human activities cause a high concentration of greenhouse gas (GHG) emissions, which highly impact on human beings (Charfeddine and Khediri 2015). The high concentration of GHG emissions causes global warming via a continuous rise in global temperature (i.e., 1.02 C0 rise over 1900–2015). Global environmental issues need serious attention along with the establishment of appropriate policies for better decision-making (Bagayev and Lochard 2017). Environmental pollutions effectuate serious respiratory diseases and malnutrition and are threats to sustainable human life (Wang et al. 2016). According to the World Health Organization (WHO) report, environmental pollution is one of the major health risk, which caused 7 million deaths in 2010.

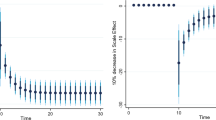

The abrupt rise in GHG and carbon emissions attracted the world’s attention. In 1995, the United Nations Framework Convention on Climate Change (UNFCCC) called for an annual conference to demonstrate how to control GHG emissions and global warming. However, in 2015, a total of 196 countries become members of the UNFCCC. The Kyoto protocol was brought for the developed countries’ objectives to minimize their GHG emissions. Though, in the first- and second amendment of the Kyoto protocol, the high emitter countries such as the USA, India, and Canada did not approved the protocol except several industrialized and European Union countries, therefore, the Kyoto protocol not became a global agreement for the control of GHG emissions. The UNFCC was held in ParisFootnote 2 in late 2015, where the participated countries assure the control of global warming (Dogan and Inglesi-lotz 2017). Figure 1a indicates the trend of carbon emissions for CEECs, over the period of 1980–2016. The tendency of CO2 emissions from 1990 to 1998 decreased for the analyzed panel countries. The highest reduction in emissions occurred during 1997, while rapid increase found during 1989.

The European countries highly rely on coal consumption to meet their industry energy needs as high coal consumption leads to high carbon emissions, which is a hazard to human life. In this regard, the US environmental assistance program was initiated in the Central and East European Countries (CEECs), to meet their environmental demand. In 1991, a small number of projects were initiated in Hungary and Poland. Later on, such projects expended to the other CEECs. Other efforts also made to strengthen the institution’s proficiencies concerning environmental enhancement. The Environmental Protection Agency (EPA) and the Agency for International Development (AID) significantly contributed via increasing investments in these regions for environmental protection (GAO 1994). More recently, Zugravu-Soilita et al. (2008) probe that during the 1990s, the greenhouse gas emissions extremely declined in the European countries. The mitigation in GHG emissions (such as nitrogen oxide, sulfur dioxide, nitrogen, and solids, and other suspended particles) took place from 30 to 70%, from 1993 to 2000.

Acknowledging, energy consumption causes high global warming and emissions worldwide. However, the state-of-the-art on energy-economic literature determines the key dynamics causing environmental degradation. The prior literature also provides some recommendations for future policy implication to control high emissions. The environmental Kuznets curve (EKC) is the main framework in this regard to investigating the growth-environment nexus (Canas et al. 2003). The pioneering work of Grossman and Krueger (1995) established the long-run relationship between income per capita and environment. The EKC is an inverted U-shaped curve, demonstrating that in the initial stage of economic development, an increase in income per capita causes high emissions. However, after achieving a certain income per capita level, then further increase in income decreases environmental deterioration (Charfeddine and Mrabet 2017). Along with income, finance might have impacts on the environment.

The massive recession of financial crises occurred during 2007–2008, which hit the world economy. It was one of the great global economic recession after the Great Misery of the 1930s. The great financial crises in 2009 not only hit the USA but also influence the CEECs with negative growth (except Poland). The income dropped to 5%, for countries like Romania, Hungary, the Czech Republic, and Slovenia. While for other Baltic states’ countries like Lithuania, Latvia, and Estonia, the income level dropped to 10%, respectively. Also, the unemployment rate increased from 6.4 to 12.1%, during 2008–2012 (Brzezinski 2018). Immediately, after the financial and economic crises, a sharp financial and economic growth is observed in the new EU and CEECs (Gardó and Martin 2010). The financial openness can positively be coupled with financial development (measured as a stock market capitalization % of GDP and private credit % of GDP) for ten CEE economies (Hagen and Von Siedschlag 2008). Figure 1b shows the trend of the income level of CEECs. The tendency of income level from 1980 to 2016 is somewhat constant, and the highest recession in income level was observed during 1992. The high-income level was perceived during 2016.

Financial development can play a key role in economic development, and it might have a positive or negative impact on carbon emissions (Mahdi Ziaei 2015). The financial development has both a wealth and scale effect on an economy. Regarding wealth effect, the expansion of the financial market during financial development stimulate the convenient provision of wealth and capital to their customers at a low rate. The standard of living goes up, and households purchase big-ticket items (i.e., cars, air conditions, houses, and other electronic appliances), which causes high energy consumption and emissions (Du et al. 2012; Abbasi and Riaz 2016). The development of both capital and financial market lead to the extension of production scales. The production requires more financial assistance to purchase large-scale fresh equipment and also to build fresh production lines. It shows the scale effect of financial development over CO2 emissions. Financial development also has a structural or technological effect on CO2 emissions (Du et al. 2012). The expansion of the capital market and financial development attract more foreign direct investments in the region with advanced technology, investments, and research and development (R&D), which may curb high emissions. The development of financial market assists easily finance provision for investment in high environmental friendly projects. It exhibits the presence of a correlation between financial development and carbon emissions. Figure 1c illustrates the trend of financial development index for selected CEECs. The tendency of financial development is constant during 1980–1991. But the reduction in financial development is observed during 1999–2000, while again a gradual increase is observed onwards.

This empirical work contributes to the existing body of literature in the following ways: (i) to the best of our beliefs, this study in hands is an attempt to investigate the impact of financial development and income on environment in the Central and Eastern European Countries (CEECs), a perspective on Belt and Road Initiative. This study will provide a deeper and thorough understanding of the economic-finance-environment nexus and will apprehend its adverse environmental impact on CEECs. (ii) The lack of consensus on the nexus between financial development and the environment in the CEECs on the Belt and Road perspective will provide a better understanding regarding the role of finance in the environment. The empirical work assist the idea that financial development along with income level might provide diverse results regarding the environment (for different regions around the globe), therefore, it will be justified with the Central and Eastern European Countries perspective. The possible presence of the EKC hypothesis for both panel and country-wise analyses will be investigated and further the study will also suggest the imperative environmental enhancement initiative steps. Following Richmond and Kaufmann (2006), the presence of EKC in an economy means that an increase in income can enhance both environmental quality and living standards. Moreover, this study uses the second-generation econometric techniques which provide reliable results.

The rest of the paper is structured as follows: “Literature review” provides literature review; “Data construction and descriptive analysis” covers data construction and descriptive analysis; “Materials and methods” composes on materials and methods; “Results and discussions” consists on empirical results and discussion; “Concluding remarks and policy suggestions” comprises on concluding remarks and policy suggestions.

Literature review

The economic-environmental relationship was initially introduced by Kuznet (1955). The EKC phenomenon was initially introduced by WDR (1992) and termed “environmental Kuznets curve” by Panayotou (1993). Later, the pioneering work of Grossman and Krueger (1995) fascinated many researchers, academics, and economists. The EKC phenomenon is an inverted U-shape link between income and environment. Therefore, different studies used different variables to measure environmental pollution/degradation, for instance sulfur dioxide, carbon dioxide, nitrogen, etc. Al-Mulali et al. (2015a) and Yin et al. (2019) used sulfur dioxide (SO2), while most of the recent empirical work used CO2 emissions as an indicator of environmental pollution (Farhani et al. 2014; Shahbaz et al. 2014; Tang and Tan 2015; Keho 2017; Salahuddin et al. 2017; Saud et al. 2018). Some determinants of pollutions were used in the prior literature, and the most common is GDP. The financial development also used the prominent determinant of environmental pollution (Ozturk and Acaravci 2013a; Shahbaz et al. 2013a, b; Lau et al. 2014; Farhani and Ozturk 2015; Dogan and Inglesi-lotz 2017; Salahuddin et al. 2017; Ali et al. 2018b; Haseeb et al. 2018; Saud et al. 2018; Yin et al. 2019). The EKC hypothesis argues that at the early stage of economic development, an increase in income and industrialization causes high emissions and after reaching the income to a certain threshold level, a further increase in income reduces CO2 emissions. The turning point is the result of more progressive, wealthy communities and advances industrialization enacting in a way to efficiently use energy and gain high growth, by taking care of the environment. The EKC hypothesis attracts the attention of the scholars towards environmental policies. A large number of literature exists on the EKC hypothesis. The EKC hypothesis investigated in different countries and regions by employing various econometric techniques. A number of recent literature validated the EKC hypothesis in panel studies: Al-mulali et al. (2015b) in the upper middle- and high-income countries; Apergis and Ozturk (2015) in Asian countries; Baek (2015) in Arctic countries; Dogan et al. (2015) in OECD countries; Kasman et al. (2015) in new EU member and candidate countries; Zaman et al. (2016) in East Asia and Pacific, non-OECD countries, and European Union and high-income OECD countries; Alam et al. (2016) in Brazil, China, India, and Indonesia; Nasreen et al. (2017) for South Asian economies; Saud et al. (2019) for Belt and Road Initiative countries; and Haseeb et al. (2018) for BRICS countries. However, massive number of empirical works also validated the EKC hypothesis in different countries, such as Lau et al. (2014) in Malaysia; Ozturk and Acaravci (2013a) in Turkey; Yavuz (2014) in Turkey; Tiwari et al. (2012) in India; Katircioǧlu (2014) in Singapore; Shahbaz et al. (2014) in Tunisia; Balaguer and Cantavella (2016) in Spain; and Li et al. (2016) in China. On the other hand, a large number of literature investigated but not confirmed the EKC hypothesis in both panel and country-based studies, such as Ozcan (2013) in 12 Middle East countries; Ajmi et al. (2015) in G7 economies; Dogan and Turkekul (2015) in the USA; Farhani and Ozturk (2015) in Tunisia; Le (2016) in sub-Saharan African countries; Liu et al. (2017) in Asian economies; and Ali et al. (2017) in Pakistan. Hence, all the above literature provide mixed and inconclusive results for different countries and regions.

A plethora of empirical work investigates the nexus between financial development, income, and environment for single countries, such as Ozturk and Acaravci (2013a) who examined the causal association among financial development, CO2 emissions, income, energy consumption, and trade, from 1960 to 2007. The cointegration test results show that financial development has an insignificant impact on CO2 emissions. However, trade has a positive and significant impact on CO2 emissions. The finding of the study supports the presence of the EKC hypothesis for Turkey. Sehrawat et al. (2015) investigate the impact of financial development, energy consumption, and economic growth on environmental degradation in India, for the period of 1971 to 2011. The finding of the study explores that financial development stimulates environmental degradation. Energy consumption, urbanization, and economic growth also increase environmental degradation. The EKC hypothesis was also validated by their study. Similarly, Shahbaz et al. (2016) re-visited the impact of financial development on environmental quality in Pakistan, over the period of 1985Q1 to 2014Q4. This empirical work used financial development index by taking bank-based and stock market-based financial development indicators. The financial development of bank-based increases environmental degradation. By using data of Iran, Moghadam and Dehbashi (2017) explored the effect of trade and financial development on environmental quality from 1970 to 2011. The results indicate that financial development decreases environmental quality, while trade openness enhances environmental quality. The EKC hypothesis was also supported by the study. Similarly, Mesagan (2018) examined the role of financial development and other environmental determinants for Nigeria during 1981–2016. The empirical finding revealed that income, trade, financial development, and energy consumption were significantly related to the environmental degradation index. The results for urbanization and investments are insignificant in the model. A bidirectional causal relationship was found between energy consumption and environmental degradation. However, unidirectional causal relationships were found running from income and urbanization towards environmental degradation. Ali et al. (2018a) investigate the dynamic impacts of energy consumption, economic growth, financial development, trade openness, and emissions for Nigeria, during 1971–2010. The finding of the study shows that financial sector development, economic growth, and energy consumption feed environment by high emissions, while trade openness reduces CO2 emissions. Salahuddin et al. (2017) investigated the effect of financial development, electricity consumption, foreign direct investment, and economic growth on CO2 emissions for Kuwait, from 1980 to 2013. The finding demonstrates that foreign direct investment, electricity consumption, and economic growth stimulate emissions in both the long run and short run. The causality results show that economic growth, foreign direct investment, and electricity consumption causes CO2 emssions. Summing up the above literature, for single-country analysis, it was observed that financial development, income, trade, and energy consumption have diverse impacts on CO2 emissions for different countries.

This strand shows the finance-economic-environment relationship for panel studies. Nasreen and Anwar (2015) investigated the impact of economic growth and financial development on environmental degradation by using three income level panels. The finding of the study revealed that financial development mitigates environmental degradation in the high-income panel and enhances in the low-income panel, respectively. The EKC hypothesis was accepted for all the panels. The Granger causality test results show that financial development and CO2 emissions have a bidirectional causal relationship in the high-income panel. The unidirectional causal association was found running from financial development to CO2 emissions in the low- and middle-income panels. Using 19 emerging economies data, Saidi and Mbarek (2016) examined the influence of income, urbanization, trade, and financial development on carbon dioxide emissions for emerging countries for the period 1990–2013. The finding shows that financial development and urbanization mitigate CO2 emissions. It infers that urbanization and financial development have positive impacts on environmental quality. The EKC hypothesis was not supported in the case of emerging economies. The causality results show the positive monotonic relationship between emissions and income. Jamel and Maktouf (2017) examined the relationship between financial development, economic growth, trade openness, and carbon emissions for a panel of 40 European countries, over the period of 1985–2014. The finding of the study confirmed the bidirectional causal associations among GDP and financial sector development, financial sector development and trade openness, GDP and pollution, GDP and trade openness, and trade openness and pollution. Nasreen et al. (2017) investigated the nexus between financial stability, energy consumption, economic growth, and CO2 emissions in South Asian countries for the period of 1980 to 2012. The results show that financial stability significantly contributes to enhancing environmental quality. This study validates the environmental Kuznets curve (EKC) hypothesis for South Asian economies. The unidirectional causal relationship was found coming from financial stability towards CO2 emissions, in Pakistan and Sri Lanka. Keho (2017) revisited the energy consumption and economic growth effect on carbon emissions for a panel of 59 economies. The finding infers that energy consumption is the main culprit behind high CO2 emissions for all panels. The EKC hypothesis was found for sub-Saharan, American, and European countries at all quantiles, while a low level of CO2 emissions for MENA and Asian countries. Using a sample of 12 selected Small Island Developing States, Seetanah et al. (2018) examine the impact of financial and economic development on environmental degradation from 2000 to 2016. The results show that economic growth negatively impacts environmental degradation, and financial development has an insignificant impact on CO2 emissions. The EKC hypothesis was validated for the selected panel countries in the short run. By taking OBORI 52 countries’ data, Hafeez et al. (2018) examine the effect of finance on environmental degradation, over the period of 1980–2016. The result of the study revealed that finance has a positive impact on environmental degradation. This study did not found the EKC hypothesis. The bidirectional causal relationship was confirmed between finance and environmental degradation. Saud et al. (2019) probe the nexus between economic growth, financial development, and environment for 59 Belt and Road Initiative countries, from 1980 to 2016. The results infer that financial development, trade openness, and FDI stimulate environmental quality. The EKC hypothesis was validated for the selected panel (and also for country-wise). The bidirectional causal link was found among financial development and environment, foreign direct investment and environment, environment and electricity consumption, economic growth and environment, and trade and environment. By using BRICS panel countries’ data, Haseeb et al. (2018) investigate the relationship between financial development, globalization, and carbon emissions. The results of the study infer that financial development and energy consumption are positively contributing to CO2 emissions, whereas urbanization and globalization have an insignificant link with CO2 emissions. The EKC hypothesis was also validated in this study. The bidirectional causal relationships were found among financial development and CO2 emissions, energy consumption and CO2 emissions, and economic growth and square of economic growth with CO2 emissions. The unidirectional causal association was found running from urbanization and globalization towards CO2 emissions. Using the 21 Kyoto Annex countries’ data, Financeiro (2018) examined the impact of income, urbanization, financial development, and trade openness on CO2 emissions, from the period 1970 to 2016. The long-run results show that income stimulates CO2 emissions, while financial development and urbanization hurt environment, and the EKC hypothesis was accepted by all models used. The causality results shows that CO2 emissions have bidirectional causal relationships with income, financial development, urbanization, and trade in the short run. Concluding the above panel empirical literature, it shows that an increase in financial development and income have different impacts on environmental quality.

In another recent study, Pata (2018) investigated the dynamic relationships among financial development, economic growth, total renewable energy consumption, urbanization, hydropower consumption, alternative energy consumption, and CO2 emissions for Turkey, over the period of 1974–2014. The results show that financial development, economic growth, and urbanization feed environment. Economic growth causes high environmental degradation, followed by urbanization and financial development, respectively. The alternative energy consumption, renewable energy consumption, and hydropower consumption do not affect emissions. The sufficient evidence validates the EKC for Turkey. Khan et al. (2018) examine the long-run relationships among improved sanitation, financial development, urbanization, forest area, renewable energy, trade, and greenhouse gas emissions for a panel of 24 lower-middle-income countries (America, Europe, Asia, and Africa), from 1990 to 2015. The finding revealed that financial development (in Asia and Africa), improved sanitation (in Asia, Africa, and America), urbanization (in Europe and America), trade openness (in Africa), forest area (in Asia, Europe, and America), and renewable energy (in all panels) have reciprocal associations with GHG emissions. The bidirectional causal associations were found among financial development and forest, urbanization and forest, energy use and renewable energy, urbanization and GHGs, and renewable energy and forest (for Asia), improved sanitation and forest (for America, Asia, Africa), and financial development and improved sanitation (for Europe).

The above empirical literature presents blended results for different countries and regions worldwide, by using different measures of financial development. Hence, the prior empirical work presents inconclusive and mixed results regarding finance-economic-environment nexus. The summary of the literature review is presented in Table 1.

Data construction and descriptive analysis

This study covers panel data set over the period of 1980–2016 for eighteen Central and Eastern European Countries (CEECs).Footnote 3 The data of income (real gross domestic product per capita in constant 2010 USD), energy consumption (kg of oil equivalent per capita), trade openness (total exports and imports of goods and services percent of GDP), and urbanization (urban population percent of total) are borrowed from the “World Development Indicator” website (WDI 2017). Carbon dioxide emission (tons per capita) is used as a proxy to measure environmental quality, as a dependent variable. The data for CO2 emissions was retrieved from the BP Statistical Review. The data of financial development index (it is an aggregate of financial institution index and financial market index) was retrieved from the IMF website (IMF 2017). This study used financial development index (FD) as a proxy to measure financial development. It is because the financial development index makes the impact of financial development more comprehensive in the study (Ali et al. 2018b). Numerous literature used different indicators for financial development such as domestic credit provision to financial sector ratio of GDP, domestic credit provision to banking sector ratio of GDP, domestic credit provision to private sector ratio of GDP, the turnover ratio as a share of GDP, and broad money. All these measures might highly correlate and can produce biased results for financial development (Tyavambiza and Nyangara 2015). Also, this study used the longest available data for the analyzed variables. The variables and their definition are reported in Table 2.

The descriptive statistics of all the analyzed variables, which are mean, maximum, and minimum, are tabulated in Table 3. The descriptive statistics shows a rough sketch of the analyzed indicators of the panel countries.

The country-wise (time series) summary statistics of eighteen CEECs, over the period of 1980–2016, for the analyzed variables (i.e., carbon emissions (CO2), energy consumption (EC), financial development index (FD), income (GDP), trade (TRA), and urbanization (URB)) are tabulated in Table 3. The statistics show that during the period, high variation in carbon emissions is observed i.e., a maximum of 1.192 tons per capita for Estonia and minimum − 0.309 for Albania. The mean value of CO2 emissions fluctuates from 1.076 to 0.160 (Estonia to Albania) tons per capita. The variation in energy consumption fluctuates maximum from Estonia 3.794 kg of oil equivalent per capita to a minimum for Macedonia 0.080. The highest mean value of energy consumption is 3.634 for the Czech Republic, and the lowest is 2.844 for Albania. The financial development highest score is − 0.215 for Poland to − 2.661 for Bulgaria (maximum to minimum). According to the World Development Indicator (2016), its mean value fluctuates from − 0.375 to − 0.902 (Poland to Belarus). The income level per capita varies from a maximum of 4.405 US$ for Slovenia to 0.209 US$ for Macedonia. Its mean values vary from 4.302 to 3.220 (Slovenia to Moldova). There is also high variation in trade from maximum 2.268% of GDP for the Slovak Republic to minimum 0.115% of GDP for Macedonia. Trade mean values vary from 2.157 to 1.737 (the Czech Republic to Albania). Urbanization varies from maximum 1.890% of total urbanization for Belarus to 0.010% of total urbanization for Lithuania. The mean score varies from 1.871 to 1.619 (the Czech Republic to Bosnia and Herzegovina).

Materials and methods

Model specification

This study investigates the nexus among financial development, income level, and the environment by incorporating energy consumption, urbanization, and trade as additional functions into the model. The financial development index (FD) as a measure for financial development. Financial development might have an impact on emissions through business and consumer effects. A strong financial system during financial development may facilitate customers via the high provision of finance at a low cost. It increases the purchasing power of customers and consumers, which leads to purchases of high energy consumption big-ticket items. The uses of high energy consumption items, such as purchase of houses, automobiles, and other high energy consumption household’s appliances, have impact on environmental quality. The provisions of high debts at low rate stimulate investment opportunities, and the expansions of existing businesses or establishment of new ones which might enhances energy consumption and carbon emissions (Mahalik et al. 2016). Trade can affect income level and energy consumption through technique, scale, and comparative advantage (Gozgor 2017; Zafar et al. 2018). The impact of trade either increase or decrease CO2 emissions which depends upon the comparative advantage of an economy’s dirty/cleaner industries (Seetanah et al. 2018). Similarly, urbanization causes high environmental degradation via high CO2 emissions (Sehrawat et al. 2015). Following the above theoretical background, we develop the following model function Eq. (1):

All data is transformed into their natural logarithmic form to smoothen the data (Shahbaz et al. 2016; Zafar et al. 2018). Following Kasman et al. (2015) and Haseeb et al. (2018), the logarithmic transformation of Eq. (1) and by specifying the EKC model can be re-written as follows:

where

- αi & δit:

-

country-specific fixed effects and deterministic trends respectively

- t :

-

timeframe for each country

- i :

-

number of selected panel countries

- μ it :

-

the error term

Here, β1, β2, β3, β4, β5, and β6 represent the long-run elasticities of CO2 emissions concerning financial development index (FD), real income (GDP), energy consumption (EC), urbanization (U), and trade (TR), respectively.

We expect that β1 is positive (Mahalik et al. 2016; Seetanah et al. 2018), and β2 and β3 are expected to be positive and negative concerning the EKC hypothesis to be true for CEECs (Dar and Asif 2017).

The sign of β4 is expected to be positive, as high energy consumption causes high CO2 emissions resulting in degrade environmental quality (Dar and Asif 2017).

The sign of β5 is expected to be positive, as urbanization causes high energy consumption which results in high CO2 emission that occurs (Sehrawat et al. 2015).

The sign of β6 could be positive or negative depending upon the development of panel countries (Seetanah et al. 2018).

The negative association indicates the panel countries are less polluted, while the positive sign indicates the presence of high pollutions.

Econometric methodology

The methodology of this empirical investigation is composed of the following steps: (i) the cross-sectional dependence test; (ii) the CIPS and CADF panel unit root tests; (iii) the Westerlund cointegration test; (iv) the DSUR and DOLS long-run estimation approaches; and (iv) the Dumitrescu-Hurlin panel causality approach. It is important to mention here that the econometric analyses were performed with the help of the following software: Microsoft Excel, Origin-Pro 2016, Stata/MP 13.0, and EViews 9.5.

B-P LM and Pesaran’s LM tests

Before probing the stationary properties of the examined variables, it is imperative to investigate the cross-sectional dependence in the panel data. Without taking into account, the cross-sectional dependence in data may provide biased results. The existence of cross-sectional dependence is very common in the panel data due to various reasons; for instance, countries are sharing board sharing, trade agreements, technology spillover, financial recession spillover, and so on. In doing so, this study employs Lagrange multiplier (LM) and cross-sectional dependence approaches which were suggested by Breusch and Pagan (1980) and Pesaran (2004), respectively. The following Eq. (3) is used by CD test to examine the cross-sectional dependence in the panel data.

where CD explains cross-sectional dependence, N indicates the cross-sections in the panel, and T represents the time span. The cross-sectional correlation of errors between i and j is explained ρij. The LM test uses the following Eq. (4), to investigate the cross-sectional dependence in panel data.

where i indicates the cross-sections in the panel and t represents the time span. The null hypothesis for both methods explains that cross-sections in the panel are independent. Here, the alternative hypothesis explains that cross-sections in the panel are dependent on each other.

The CADF and CIPS panel, and ADF and P-P time series tests

After examining the cross-sectional dependency among the cross-sections in the panel data, next, we have to check the integration order of the examined variables. In the applied economics literature, some unit root methods have been introduced to check the integration properties, since the CD and LM tests confirm the evidence of the existence of cross-sectional dependence in the data. Therefore, the second-generation unit root test was used for reliable results. To this end, this study uses CIPS and CADF unit root tests, suggested by Pesaran (2007). These tests can overcome the issue of cross-sectional while checking the unit root order of the analyzed variables. The CIPS test uses the following Eq. (5) to test the unit root order in the presence of cross-sectional dependence.

where xit and εit explain the considered variable and the residuals of the model, respectively. i and t indicates the cross-sections in the panel and time period, respectively. The null hypothesis for both methods explains that data series contain unit root; however, alternative hypothesis explains that data series are stationary.

The cross-sectional dependence-augmented CIPS panel unit root test is suggested by Pesaran (2007), which uses the following Eq. (6):

where CADFi indicates the cross-sectional augmented Dickey-Fuller statistics.

Additional to the CADF and CIPS panel unit root test, we also use the time series (country-wise) unit root tests to check the stationarity in the time series data, before long-run fully modified ordinary least square (FMOLS) estimation. To this end, the ADF test suggested by Dickey et al. (1979) and P-P test suggested by Phillips and Perron (1988) tests are employed.

Westerlund cointegration test

In the presence of cross-sectional dependence, the Pedroni panel cointegration and other first-generation cointegration test results may not be reliable because of ignorance of the cross-sectional dependence among the cross-sections in the panel data. The Westerlund (2007) cointegration test takes into account such issue. The Westerlund proposed four error correction-based panel cointegration tests, which do not impose any common-factor restriction. Moreover, this test takes into account the various forms of heterogeneity in the panel data. The Westerlund cointegration test divided these four basic statistics into two different groups. The first group of statistics can be referred to as group statistics (Gτ and Gα), which examines the alternative hypothesis of cointegration for the entire panel, whereas the second one is the panel statistics (Pτ and Pα), which states that at least one cross-section in the panel is cointegrated. The Westerlund panel cointegration method uses the following equation to test the cointegration among the selected variables.

where i and t indicate the cross-sections in the panel and time span, respectively. εit and dt explain the residuals of the model and the deterministic components in the model, respectively. The null hypothesis which referred no cointegration is tested through the error correction term. The null hypothesis suggests that there is no cointegration among the variables, and alternative hypothesis suggests that cointegration is present among them.

Long-run estimation approaches

Since the Westerlund panel cointegration test has confirmed the presence of long-run equilibrium relationship among the analyzed variables. The next step is to calculate the elasticities of financial development, square of income, energy consumption, income, urbanization, and trade with CO2 emissions. There are numerous approaches available to estimate the long-run relationship among the variables of interest. The results produced by using the first-generation methods may not be reliable in the existence of cross-sectional dependence in the panel data. Keeping the issues of heterogeneity and cross-sectional dependence in mind, this study employs the DSUR long-run estimation approach suggested by Mark et al. (2005). The DSUR method is robust to heterogeneity and cross-sectional dependence. In case if the value of T is greater than the value of N (T > N), still DSUR estimator as a good predictor and may provide consistent normal distribution (Dogan and Seker 2016a), where T indicates the time period and N represents the sample size (Dogan and Seker 2016b).

Furthermore, the FMOLS estimator was used for country-wise (time series) analysis. The fully modified ordinary least square estimator has been preferred over the ordinary least square estimator (Lee 2007), because of its effectiveness in solving the endogeneity issue and also due to eliminating the serial correlation in the error term (Li et al. 2011). Therefore, this study uses FMOLS estimator.

The Dumitrescu-Hurlin panel causality approach

Accompanying with the DSUR panel long-run estimation results, it is important to recognize the direction of the causal associations among the analyzed variables for appropriate policy making. There are numerous Granger causality approaches available in the applied economics literature. The first generations of Granger causality approaches may not be effective in the presence of cross-sectional dependence, for example, a VECM approach. It is argued in the economic literature that beyond the selected time, the VECM approach can not appropriately capture the strength in the causal association. Therefore, due to such limitation, the result drawn through VECM causality may not be reliable (Sehrawat et al. 2015). Therefore, this study employs the Dumitrescu and Hurlin (2012) panel causality test.

Results and discussions

Cross-sectional dependence test results

The Pesaran (2004) and Breusch and Pagan (1980) LM test results are tabulated in Table 4. The results show the presence of cross-sectional dependence among the analyzed countries in the heterogeneous panel data. All the variables are highly significant at the 1% significance level, as the probability values are below 0.01 (0.01 > P). Thus, FDI, GDP, EC, U, T, and CO2 emissions are cross-sectionally dependent.

The result of the CADF and CIPS panel unit root test

The outcomes of the CIPS and CADF panel unit root tests are posted in Table 5. The results infer that all the variables are non-stationary at level (except trade) and stationary at first differences [I (1)]. It means that all the analyzed variables are integrated of order one. The variables are significant at 1%, and 5%, level of significance.

ADF and P-P time series

Similarly, the ADF and P-P country-wise unit root test results are tabulated in Table 10 in the Appendix. The results infer that all the variable at first difference is significant at 1%, 5%, and 10% level of significance. The evidence shows that all the variables are stationary at first differences [I (1)]. Table 10 is included in the Appendix.

Results of Westerlund cointegration test

The Westerlund cointegration results are presented in Table 6. The outcomes of the test show that probability statistics and group statistics are significant at 1% level of significance, which infer the rejection of the null hypothesis at a 1% level of significance. Hence, the long-run cointegration association exists among the analyzed variables.

DSUR panel estimation results

The Dynamic Seemingly Unrelated Regression (DSUR) test results are listed in Table 7. The coefficient estimates of all the tested variables are highly significant at 1% significance level. The coefficient of income is positive and significant (1.569), and the coefficient of the square of income is negative and significant (− 0.207), respectively, by keeping all else the same. It infers that income and the square of income have a positive and negative impact on carbon emissions, respectively. More precisely, at the initial stage of economic development, an increase in income feeds environment by high CO2 emissions, which reduce environmental quality. In other words, initially, an increase in income level causes high environmental degradation. On the other hand, an increase in the square of income has a negative impact on carbon emissions, signifying an enhancement in environmental quality. It is because when the income level reaches a certain threshold level of per capita, further increase in income leads to reduce CO2 emissions. This tendency is yielding empirical support to the validation of the EKC hypothesis for the CEECs. In other words, this phenomenon shows the presence of a U-shaped relationship between carbon emissions and income. Our results support the finding of the prior literature: Al-mulali et al. (2015b) for upper middle- and high-income countries; Apergis and Ozturk (2015) for Asian countries; Awad and Abugamos (2017) for MENA regions; Bekhet and Othman (2017) for Malaysia; Nasreen et al. (2017) for South Asian economies; Jamel and Maktouf (2017) for 40 European economies; Pata (2018) for Turkey; Saud et al. (2019) for 59 Belt and Road Initiative countries; Financeiro (2018) for 21 Kyoto Annex countries; and Haseeb et al. (2018) for BRICS economies. The real income per capita boosts the level of CO2 emissions up to the threshold level and then start to mitigate emissions. One of the possible reasons behind this phenomenon can be due to the high caring about their environmental quality. The strict environmental regulations along with a high tax on polluting industries may also have a significant positive impact on environmental quality.

The coefficient of financial development has a positive and significant impact on carbon emissions. In other words, a 1% increase in financial development can decrease environmental quality by 0.055%, keeping all else constant. The positive impact of financial development with respect to CO2 emissions is in line with Shahbaz et al. (2016) for Pakistan, Dar and Asif (2017) for India, Moghadam and Dehbashi (2017) for Iran, Pata (2018) for Turkey, Ali et al. (2018a) for Nigeria, and Haseeb et al. (2019) for BRICS. This infers the incremental impact of financial development on the environmental quality of CEECs. One of the possible reasons behind this finding can be due to the easy provision of financial resources to high polluting firms and investors. The low-cost provision of financial resources leads to high investment in energy consumption projects and purchases of energy consumption products. This tendency increases high energy use and degrades environmental quality via high carbon emissions. This supports the view of Shahbaz et al. (2016).

The reported results for energy consumption demonstrate that energy consumption has a significant positive impact on CO2 emissions. This result infers that a 1% rise in consumption of energy leads to 1.085% increase in CO2 emissions in the CEECs. It means that an increase in energy consumption causes environment degradation by high CO2 emissions. In other words, an increase in energy consumption degrades environmental quality in the CEECs. Our result is in line with Jahangir Alam et al. (2012) for Bangladesh; Farhani and Ozturk (2015) for Tunisia; Omri (2013) for MENA countries; Shahbaz et al. (2013a) for Malaysia; Shahbaz et al. (2014) for Tunisia; Javid and Sharif (2016) for Pakistan; Dar and Asif (2017) for India; Mesagan (2018) and Ali et al. (2018a) for Nigeria; Shahbaz et al. (2018) for France; and Ilham (2018) for eight ASEAN countries. It is a well-known fact that energy is the key factor in the production of goods and services. It is quite hard to stop its consumption in the productions purposes in the long run. Therefore, the possibility behind high energy consumption and high CO2 emissions can be due to the lack of advanced technologies and innovative methods of production. The CEECs need to extend their shares in the renewable energy mix to enhance the efficient utilization of energy with low emissions. High non-renewable energy consumption causes high emissions (Jebli et al. 2016). Hence, reduction in consumption of fossil fuels, adoption of energy-efficient technology, and innovative methods of production can not only enhance energy efficiency but can also enhance environmental quality by low emissions.

The estimated result from Table 7, shows that trade has positive and significant impacts on environmental quality. A 1% increase in trade decreases carbon emissions by 0.185%, in the long run. More precisely, the net impact of trade has a positive impact on enhancing environmental quality for CEECs. Our result is in line with the Dogan and Turkekul (2015) for the USA; Ozturk et al. (2015) for 93 countries; and Farhani and Ozturk (2015) for Tunisia. The result reveals that trade is a significant determinant of environmental quality. This may occur due to the reason that during the implication of strong environmental policies in the regions, the production of polluting goods in the manufacturing sector reduces. The other possibility can be due to the transfer of polluting industries to other lax environmental regulated economies. Trade triggers the induction of green environmental technology, knowledge transfer, and bring a fresh method of productions. It reduces high energy consumption with efficient production of goods. Our explanation supports the views of Moghadam and Dehbashi (2017).

Finally, the coefficient of CO2 emissions concerning urbanization is significant and negative. It infers that urbanization is positively contributing to enhancing environmental quality, by keeping all else constant. The result shows that a 1% increase in urbanization reduces CO2 emissions by − 0.183%. More precisely, urbanization improves environmental quality. Our result is in line with Sharif Hossain (2011) for new industrialized countries; Al-mulali et al. (2015a) for 129 countries; and Ozturk et al. (2015) for 144 countries. This finding shows that the CEECs are aware of environmental safety. Therefore, it specifies the efficient urban planning by the policymakers. The rapid urbanization in the Central and Eastern European Countries will mitigate emissions along with environmental degradations. This view supports the literature (Ozturk et al. 2015).

Country-wise long-run results

The country-wise long-run results are provided in Table 8. The results show that an increase in financial development significantly stimulates CO2 emissions for six Central and Eastern European Countries (Albania, Bulgaria, the Czech Republic, Estonia, Hungary, and Belarus). In other words, financial development degrades environmental quality by enhancing environmental pollutions. The positive impact of financial development concerning CO2 emissions is in good agreement with some prior studies (Mahalik et al. 2016; Salahuddin and Alam 2016; Bekhet and Othman 2017; Hafeez et al. 2018; Saud et al. 2018). In contrast, the estimated coefficient of financial development concerning CO2 emissions is negative and significant for four countries (Bosnia and Herzegovina, Romania, Moldova, and Latvia). It shows that financial development enhances environmental quality in four countries. This result supports the finding of Al-Mulali et al. (2015c), and Khan et al. (2017). The insignificant impact of financial development on CO2 emissions was found for eight countries (Croatia, Macedonia, Poland, Serbia, the Slovak Republic, Slovenia, Ukraine, and Lithuania).

The reported results infer that an increase in energy consumption significantly and positively stimulates carbon emissions for 12 countries (Albania, Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Macedonia, Romania, Poland, Slovenia, Belarus, and Moldova as well). More precisely, high energy consumption causes high CO2 emissions, which diminish environmental quality. This result is in line with Jalil and Feridun (2011), Al-Mulali et al. (2015a), and Farhani and Ozturk (2015). Energy is one of the key determinants of economic growth; therefore, the above high emitting countries should practice efficient energy sources which might diminish the adverse impact on the environment. The insignificant impact was also detected for 6 countries (Bosnia and Herzegovina, Serbia, the Slovak Republic, Ukraine, Lithuania, and Latvia).

The coefficient of real income to CO2 emissions is positive for 8 countries (Bosnia and Herzegovina, Croatia, Poland, Serbia, the Slovak Republic, Slovenia, Ukraine, and Latvia). Moreover, we find the significant negative impact of the square of per capita income for 5 countries (Croatia, Poland, Serbia, the Slovak Republic, and Ukraine). So, there is enough evidence regarding the validation of the EKC hypothesis for 5 countries (Croatia, Poland, Serbia, the Slovak Republic, and Ukraine). This result is in line with Bekhet and Othman (2017), Khalid and Moemen (2017), and Zhang et al. (2017). However, the coefficient of real income has a significant negative impact on CO2 emissions for seven countries (Albania, the Czech Republic, Hungary, Macedonia, Romania, Belarus, and Lithuania) and the square of real income has a significant positive impact on carbon emissions for 6 countries (Bosnia and Herzegovina, Bulgaria, Estonia, Slovenia, Moldova, Latvia). The results show the absence of the EKC hypothesis. Further, the insignificant impact was found for 3 countries (Bulgaria, Estonia, and Moldova).

The impact of trade on CO2 emissions is significant and positive for 6 countries (Estonia, Poland, the Slovak Republic, Ukraine, and Lithuania). This result is in line with Al-Mulali et al. (2015b), Saidi and Mbarek (2016), and Ozcan and Apergis (2017). Our result supports the pollution heaven hypothesis, where an increase in real income rises demand for green environment. As once income rises, the polluted and dirty industries are switching towards lax environmental regulation economies. On the other hand, trade also has a significant and negative impact on CO2 emissions for 5 countries (Croatia, Hungary, Macedonia, Slovenia, and Ukraine). The negative results are similar to the prior literature like Shahbaz et al. (2013a, b, c) and Salahuddin et al. (2016). In fact, in the case of trade in the CEECs, it brings green environmental-friendly technologies to domestic soil and restricts polluted goods and technology. The insignificant impact of trade on carbon emissions is found for 7 countries (Albania, Bosnia and Herzegovina, Bulgaria, the Czech Republic, Romania, Serbia, and Moldova). It means that no effect dominates the other one, which results in the net effect of trade that becomes insignificant. This explanation supports the view of Farhani et al. (2014).

The estimated results for urbanization reveal that urbanization stimulates carbon emissions for 5 countries (Bosnia and Herzegovina, Estonia, Macedonia, Belarus, and Lithuania). This result is similar to Sharif Hossain (2011), Farhani and Ozturk (2015), and Kasman et al. (2015). In contrast, trade and CO2 emissions have a significant negative impact on 8 countries (Bulgaria, Croatia, the Czech Republic, Hungary, Poland, Slovenia, Ukraine, and Latvia). The insignificant impact was found for 5 countries (Albania, Romania, Serbia, the Slovak Republic, and Moldova).

Furthermore, additional (country-wise) time series additional stability test results are provided in the Appendix (see Table 11).

Dumitrescu-Hurlin panel causality results

The DH panel causality test results are provided in Table 9. A bidirectional Granger causality exists among energy consumption and environmental quality. This result is in good agreement with prior studies (Shahbaz et al. 2013c, 2015; Ajmi et al. 2015; Dogan and Turkekul 2015; Farhani and Ozturk 2015). We find evidence of a bidirectional causal relationship between income and environmental quality. This result is similar to the finding of Cherni and Essaber Jouini (2017), Dogan and Turkekul (2015), Seker et al. (2015), and Shahbaz et al. (2013c). The presence of a bidirectional causal relationship was detected between the square of income and environmental quality. This result supports the view of Seker et al. (2015). Income and trade also have a bidirectional causal relationship. Similar results were found by prior literature (Dogan and Seker 2016a; Tiwari et al. 2012). Two-way causal link was found between urbanization and income. This result supports the view of Dogan and Turkekul (2015). Income and financial development also have a bidirectional causal link. Our result is in line with Farhani and Ozturk (2015). Trade and square of income were also found to be a bidirectional causal link. Similar result was found by Dogan and Seker (2016a). Financial development and trade have a two-way causal link. This result is similar to Farhani and Ozturk (2015) and Dogan and Seker (2016a). Similarly, urbanization and energy consumption; income and energy consumption; financial development and energy consumption; energy consumption and the square of income; urbanization and trade; financial development and the square of income; and urbanization and square of income also have bidirectional causal relationships. Further, unidirectional causal relationships are found coming from trade and urbanization to environmental quality, and energy consumption to trade. A one-way causal link is found coming from energy consumption to trade. Our result supports the finding of Farhani and Ozturk (2015).

Concluding remarks and policy suggestions

Climate change and GHG emissions are important environmental issues. The economies are making efforts to mitigate such issues globally. In this regard, financial development might play an important role in the environment. This study investigates the nexus between financial development, income level, and the environment in the EKC framework by using panel data of Central and Eastern European Countries, over the period of 1980–2016. The cross-sectional dependence test, the CADF, and CIPS panel unit root tests and the Westerlund cointegration test are employed before the long-run estimations. By our empirical finding, the key conclusion of the study is as follows:

It concluded that financial development index and environmental quality are negatively associated. More specifically, an increase in financial development and income worsen environmental quality via high carbon emissions in the Central and Eastern European Countries. Similarly, energy consumption also has an adverse impact on environmental quality via high CO2 emissions. It is interesting that both urbanization and trade predict positive linkage with enhancing environmental quality. Increase in urbanization and trade improves environmental quality by reduction in CO2 emissions. We conclude that holding a U-shape relationship or bearing the environmental Kuznets curve (EKC) hypothesis countries should boost their income through high production of goods and services in the long run. It will boost the environmental quality of these countries through the reduction of emissions and will assure sustainable development.

The country-wise long-run estimation offers similar outcomes to panel countries. However, most of the countries offer different findings; it might be due to the variations in finance, economic, energy use, and other related economic factors of each country. We conclude from the finding that the increase in environmental quality occurs due to an increase in financial development in 4 countries (Bosnia and Herzegovina, Romania, Moldova, and Latvia); income in 5 countries (Croatia, Poland, Serbia, the Slovak Republic, and Ukraine); trade in 5 countries (Croatia, Hungary, Macedonia, Slovenia, and Ukraine); and urbanization in 8 countries (Bulgaria, Croatia, the Czech Republic, Hungary, Poland, Slovenia, Ukraine, and Latvia). However, the environmental quality decreases due to increase in financial development in 6 countries (Albania, Bulgaria, the Czech Republic, Estonia, Hungary, and Belarus); income in 8 countries (Bosnia and Herzegovina, Croatia, Poland, Serbia, the Slovak Republic, Slovenia, Ukraine, and Latvia); energy consumption in 12 countries (Albania, Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Macedonia, Romania, Poland, Slovenia, Belarus, and Moldova); trade in 6 countries (Estonia, Poland, the Slovak Republic, Ukraine, and Lithuania); and urbanization in 5 countries (Bosnia and Herzegovina, Estonia, Macedonia, Belarus, and Lithuania). The EKC hypothesis bears for 5 Central and Eastern European Countries (Croatia, Poland, Serbia, the Slovak Republic, and Ukraine).

The feedback effect was found between income and environmental quality. The causal relationship between financial development and energy consumption is found to be bidirectional. The energy consumption causes degradation of environmental quality and vice versa. Financial development causes an increase in income, and subsequently, income causes financial development. The bidirectional causal association exists between financial development and square of income. Trade causes financial development, and subsequently, financial development causes trade. Similarly, trade causes an increase in income level and vice versa. Income causes high energy consumption, and energy consumption causes an increase in income. Urbanization has a bidirectional causal association with income, trade, and energy consumption in the CEECs. Furthermore, trade causes energy consumption and CO2 emissions, while urbanization causes CO2 emissions in the Central and Eastern European Countries.

The findings of our study suggest some important implications for Central and Eastern European Countries. The evidence shows that financial development, income, and energy consumption degrade environmental quality in the CEECs. It is a common perception that energy plays a crucial role in enhancing the income level of an economy. Its reduction in consumption might reduce the income level. On the other hand, for the sake of economic development, increase in energy consumption reduces environmental quality via high CO2 emissions. To keep the economies on the development track, renewable energy sources should be preferred instead of fossil fuel consumption. The renewable energy sources will not only enhance the income level of these economies but will also reduce energy crises, energy cost, energy need, and also its consumption. Further, it will increase energy efficiency along with environmental quality. Our explanation supports the view of Halkos and Tzeremes (2014). During financial development, the easy availability of financial resources at lower cost encourage purchasing of energy consumption technology and products which feed the environment via high CO2 emissions. The adoption of fresh environmental green technology can improve both economic development and environmental quality. The government should encourage the financial institutions to invest in the green energy projects and renewable energy sector. The government should establish policies regarding green energy resources, green technology, and energy-efficient infrastructures. Further, the reduction of coal consumption can significantly improve environmental efficiency (Long et al. 2018). The presence of the EKC hypothesis urge policy. As an increase in income level reduces environment quality of the CEECs for a short time, but for the long-term growth, it should be taken in notice during formulating appropriate policies.

Notes

According to the report, the “Central and Eastern Europe” refers to Bulgaria, Albania, the Czech Republic, Poland, Romania, Hungary, Slovakia, the Baltic states (Latvia, Lithuania, and Estonia), and the former republics of Yugoslavia. Czechoslovakia was separated into two countries, the Czech Republic and Slovakia, on Jan. 1, 1993.

Adaptation of the Paris Agreement, online available: http://unfccc.int/resource/docs/2015/cop21/eng/l09r01.pdf.

Albania, Bosnia and Herzegovina, Bulgaria, Croatia, the Czech Republic, Estonia, Hungary, Macedonia, Romania, Poland, Serbia, the Slovak Republic, Slovenia, Belarus, Ukraine, Moldova, Lithuania, and Latvia. Additionally, we exclude Montenegro country from our analysis on the basis of inappropriateness of data.

Abbreviations

- EU:

-

European Union

- CEECs:

-

Central and Eastern European Countries

- EKC:

-

Environmental Kuznets curve

- CD:

-

Cross-sectional dependence

- CADF:

-

Cross-sectional augmented Dickey-Fuller

- LM:

-

Lagrange multiplier

- CIPS:

-

Cross-sectional Im, Pesaran and Shin

- DSUR:

-

Dynamic Seemingly Unrelated Regression

- DOLS:

-

Dynamic Ordinary Least Square

- FMOLS:

-

Fully modified ordinary least squares

- ARDL:

-

Autoregressive distributed lag

- DH:

-

Dumitrescu-Hurlin panel casualty

- VECM:

-

Vector error correction model

- WHO:

-

World Health Organization

- MENA:

-

Middle East and North Africa region

- UNFCC:

-

United Nations Framework Convention on Climate Change

- EPA :

-

Environmental Protection Agency

- SSIDS:

-

Selected Small Island Developing States

- AID:

-

Agency for International Development

- OECD:

-

Organization for Economic Co-operation and Development

- BRICS:

-

Brazil, Russia, India, China, and South Africa

- OBORI:

-

One Belt One Road Initiative

- BRI:

-

Belt and Road Initiative

- ASEAN:

-

Association of Southeast Asian Nations

- GDP:

-

Income

- U:

-

Urbanization

- SO2 :

-

Sulfur dioxide

- CO2 :

-

Carbon dioxide

- GHG:

-

Greenhouse gasses

- EQ:

-

Environmental quality

- EC:

-

Energy consumption

- FD:

-

Financial development index

- BRI:

-

Belt and Road Initiative

- N:

-

Cross-sectional in the panel

- T:

-

Time period

- μit :

-

Error term

- αi & δit :

-

Country-specific fixed effects and deterministic trends

- β :

-

Long-run elasticity of the analyzed variable(s)

- Xit :

-

Considered variable

- i :

-

Cross-sectional in the panel

- ε it :

-

Residuals of the model

- d t :

-

Deterministic components

- Gτ and Gα :

-

Group statistics

- Pτ and Pα :

-

Panel statistics

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Ajmi AN, Hammoudeh S, Nguyen DK, Sato JR (2015) On the relationships between CO2 emissions, energy consumption and income: the importance of time variation. Energy Econ 49:629–638. https://doi.org/10.1016/j.eneco.2015.02.007

Alam MM, Murad MW, Noman AHM, Ozturk I (2016) Relationships among carbon emissions, economic growth, energy consumption and population growth: testing environmental Kuznets curve hypothesis for Brazil, China, India and Indonesia. Ecol Indic 70:466–479. https://doi.org/10.1016/j.ecolind.2016.06.043

Ali G, Ashraf A, Bashir MK, Cui S (2017) Exploring environmental Kuznets curve (EKC) in relation to green revolution: a case study of Pakistan. Environ Sci Pol 77:166–171. https://doi.org/10.1016/j.envsci.2017.08.019

Ali HS, Law SH, Lin WL, Yusop Z, Chin L, Bare UAA (2018a) Financial development and carbon dioxide emissions in Nigeria: evidence from the ARDL bounds approach. GeoJournal:1–15. https://doi.org/10.1007/s10708-018-9880-5

Ali Q, Khan MTI, Khan MNI (2018b) Dynamics between financial development, tourism, sanitation, renewable energy, trade and total reserves in 19 Asia cooperation dialogue members. J Clean Prod 179:114–131. https://doi.org/10.1016/j.jclepro.2018.01.066

Al-Mulali U, Saboori B, Ozturk I (2015a) Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy 76:123–131. https://doi.org/10.1016/j.enpol.2014.11.019

Al-mulali U, Tang CF, Ozturk I (2015a) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22:14891–14900. https://doi.org/10.1007/s11356-015-4726-x

Al-Mulali U, Sheau-Ting L, Ozturk I (2015b) The global move toward Internet shopping and its influence on pollution: an empirical analysis. Environ Sci Pollut Res 22:9717–9727. https://doi.org/10.1007/s11356-015-4142-2

Al-mulali U, Weng-wai C, Sheau-ting L, Hakim A (2015b) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Indic 48:315–323. https://doi.org/10.1016/j.ecolind.2014.08.029

Al-Mulali U, Solarin SA, Ozturk I (2015c) Investigating the presence of the environmental Kuznets curve (EKC) hypothesis in Kenya: an autoregressive distributed lag (ARDL) approach. Nat Hazards 80:1729–1747. https://doi.org/10.1007/s11069-015-2050-x

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Indic 52:16–22. https://doi.org/10.1016/j.ecolind.2014.11.026

Awad A, Abugamos H (2017) Income-carbon emissions nexus for Middle East and North Africa countries: a semi-parametric approach. Int J Energy Econ Policy 7:152–159. Retrived from: http://www.econjournals.com/index.php/ijeep/article/view/4010/2740. Accessed 16 June 2018

Baek J (2015) Environmental Kuznets curve for CO2 emissions: the case of Arctic countries. Energy Econ 50:13–17. https://doi.org/10.1016/j.eneco.2015.04.010

Bagayev I, Lochard J (2017) EU air pollution regulation: a breath of fresh air for Eastern European polluting industries? J Environ Econ Manag 83:145–163. https://doi.org/10.1016/j.jeem.2016.12.003

Balaguer J, Cantavella M (2016) Estimating the environmental Kuznets curve for Spain by considering fuel oil prices (1874-2011). Ecol Indic 60:853–859. https://doi.org/10.1016/j.ecolind.2015.08.006

Bekhet HA, Othman NS (2017) Impact of urbanization growth on Malaysia CO2 emissions: evidence from the dynamic relationship. J Clean Prod 154:1–29. https://doi.org/10.1016/j.jclepro.2017.03.174

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47:239–253. https://doi.org/10.2307/2297111

Brzezinski M (2018) Income inequality and the Great Recession in Central and Eastern Europe. Econ Syst 42:219–247. https://doi.org/10.1016/j.ecosys.2017.07.003

Calel R, Dechezleprêtre A (2016) Environmental policy and directed technological change: evidence from the European carbon market. Rev Econ Stat 98:173–191. https://doi.org/10.2139/ssrn.2041147

Canas Â, Ferrão P, Conceição P (2003) A new environmental Kuznets curve? Relationship between direct material input and income per capita: evidence from industrialised countries. Ecol Econ 46:217–229. https://doi.org/10.1016/S0921-8009(03)00123-X

Charfeddine L, Khediri KB (2015) Financial development and environmental quality in UAE: cointegration with structural breaks. Renew Sust Energ Rev 55:1–14. https://doi.org/10.1016/j.rser.2015.07.059

Charfeddine L, Mrabet Z (2017) The impact of economic development and social-political factors on ecological footprint: a panel data analysis for 15 MENA countries. Renew Sust Energ Rev 76:138–154. https://doi.org/10.1016/j.rser.2017.03.031

Cherni A, Essaber Jouini S (2017) An ARDL approach to the CO2 emissions, renewable energy and economic growth nexus: Tunisian evidence. Int J Hydrog Energy 42:29056–29066. https://doi.org/10.1016/j.ijhydene.2017.08.072

Dar JA, Asif M (2017) Is financial development good for carbon mitigation in India? A regime shift-based cointegration analysis. Carbon Manag 8:435–443. https://doi.org/10.1080/17583004.2017.1396841

Dickey DA, Fuller WA, Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74:427–431. https://doi.org/10.2307/2286348

Dogan E, Inglesi-lotz R (2017) Analyzing the effects of real income and biomass energy consumption on carbon dioxide (CO2) emissions: empirical evidence from the panel of biomass-consuming countries. Energy. 138:721–727. https://doi.org/10.1016/j.energy.2017.07.136

Dogan E, Seker F (2016a) An investigation on the determinants of carbon emissions for OECD countries: empirical evidence from panel models robust to heterogeneity and cross-sectional dependence. Environ Sci Pollut Res 23:14646–14655. https://doi.org/10.1007/s11356-016-6632-2

Dogan E, Seker F (2016b) Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renew Energy 94:429–439. https://doi.org/10.1016/j.renene.2016.03.078

Dogan E, Turkekul B (2015) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213. https://doi.org/10.1007/s11356-015-5323-8

Dogan E, Seker F, Bulbul S (2015) Investigating the impacts of energy consumption, real GDP, tourism and trade on CO2emissions by accounting for cross-sectional dependence: a panel study of OECD countries. Curr Issue Tour 20:1–19. https://doi.org/10.1080/13683500.2015.1119103

Du L, Wei C, Cai S (2012) China economic review economic development and carbon dioxide emissions in China: provincial panel data analysis. China Econ Rev 23:371–384. https://doi.org/10.1016/j.chieco.2012.02.004

Dumitrescu E, Hurlin C (2012) Testing for granger non-causality in heterogeneous panels. Econ Model 29:1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22:1–15. https://doi.org/10.1007/s11356-015-4767-1

Farhani S, Chaibi A, Rault C (2014) CO2emissions, output, energy consumption, and trade in Tunisia. Econ Model 38:426–434. https://doi.org/10.1016/j.econmod.2014.01.025

Financeiro D (2018) Financial development, income, trade and urbanization on CO2 emissions: new evidence from Kyoto Annex Countries. RISUS - J Innov Sustain 9:17–37. https://doi.org/10.24212/2179-3565.2018v9i3p17-37

GAO (1994) Environmental issues in Central and Eastern Europe: U.S. efforts to help resolve institutional and f’inancial problems. Online link: https://www.gao.gov/assets/160/154482.pdf [Accessed date: 13-03-2018]

Gardó S, Martin R (2010) The impact of the global economic and financial crisis on central eastern and southeastern Europe: a stock-taking exercise. Eur Cent Bank, Ocational Pap 114:1–68. https://doi.org/10.2139/ssrn.1635773

Gozgor G (2017) Does trade matter for carbon emissions in OECD countries? Evidence from a new trade openness measure. Environ Sci Pollut Res 24:27813–27821. https://doi.org/10.1007/s11356-017-0361-z

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110:353–377 Online link: http://web.econ.ku.dk/nguyen/teaching/Grossman%20and%20Krueger%201995.pdf [Accessed date: 09-02-2018]

Hafeez M, Chunhui Y, Strohmaier D, Ahmed M, Jie L (2018) Does finance affect environmental degradation : evidence from One Belt and One Road Initiative region ? Environ Sci Pollut Res 25:9579–9592. https://doi.org/10.1007/s11356-018-1317-7

Hagen J Von Siedschlag I (2008) Managing capital flows: experiences from Central and Eastern Europein: Working Paper No. 234. Online link: https://www.econstor.eu/dspace/bitstream/10419/50147/1/576827711.pdf [Accessed date: 06-03-2018]

Halkos GE, Tzeremes NG (2014) The effect of electricity consumption from renewable sources on countries’ economic growth levels: evidence from advanced, emerging and developing economies. Renew Sust Energ Rev 39:166–173. https://doi.org/10.1016/j.rser.2014.07.082

Haseeb A, Xia E, Danish, Baloch MA, Abbas K (2018) Financial development, globalization, and CO2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res 25:31283–31296. https://doi.org/10.1007/s11356-018-3034-7

Haseeb A, Xia E, Saud S, Ahmad A, Khurshid H (2019, 2012) Does information and communication technologies improve environmental quality in the era of globalization? An empirical analysis. Environ Sci Res. https://doi.org/10.1007/s11356-019-04296-x

Ilham MI (2018) Economic development and environmental degradation in ASEAN. J Ilmu Ekon 7:103–112. https://doi.org/10.15408/sjie.v7i1.6024

IMF (2017) International Monetary Fund. Online link: https://www.imf.org/external/index.htm [Accessed date: 17-04-2018]

Jahangir Alam M, Ara Begum I, Buysse J, Van Huylenbroeck G (2012) Energy consumption, carbon emissions and economic growth nexus in Bangladesh: cointegration and dynamic causality analysis. Energy Policy 45:217–225. https://doi.org/10.1016/j.enpol.2012.02.022

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33:284–291. https://doi.org/10.1016/j.eneco.2010.10.003

Jamel L, Maktouf S (2017) The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ Financ 5:1–25. https://doi.org/10.1080/23322039.2017.1341456

Javid M, Sharif F (2016) Environmental Kuznets curve and financial development in Pakistan. Renew Sust Energ Rev 54:406–414. https://doi.org/10.1016/j.rser.2015.10.019

Jebli MB, Youssef SB, Ozturk I (2016) Testing environmental Kuznets curve hypothesis: the role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol Indic 60:824–831. https://doi.org/10.1016/j.ecolind.2015.08.031

Kasman A, Duman YS, Shahbaz M et al (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Econ Model 44:97–103. https://doi.org/10.1016/j.econmod.2014.10.022

Katircioǧlu ST (2014) Testing the tourism-induced EKC hypothesis: the case of Singapore. Econ Model 41:383–391. https://doi.org/10.1016/j.econmod.2014.05.028

Keho Y (2017) Revisiting the income, energy consumption and carbon emissions nexus: new evidence from quantile regression for different country groups. Int J Energy Econ Policy 7:356–363 Online link: http://www.econjournals.com/index.php/ijeep/article/view/4772/3100 [Accessed date: 15-05-2018]

Khalid Z, Moemen MA (2017) Energy consumption, carbon dioxide emissions and economic development: evaluating alternative and plausible environmental hypothesis for sustainable growth. Renew Sust Energ Rev 74:1119–1130. https://doi.org/10.1016/j.rser.2017.02.072

Khan MTIY, Rizwan M, Ali Q (2017) Dynamic relationship between financial development, energy consumption, trade and greenhouse gas: comparison of upper middle income countries from Asia, Europe, Africa and America. J Clean Prod 161:567–580. https://doi.org/10.1016/j.jclepro.2017.05.129

Khan MTI, Yaseen MR, Ali Q (2018) The dependency analysis between energy consumption, sanitation, forest area, financial development, and greenhouse gas: a continent-wise comparison of lower middle-income countries. Environ Sci Pollut Res 25:1–28. https://doi.org/10.1007/s11356-018-2460-x

Kuznet S (1955) Economic growth and income inequality. Am Econ Rev 45:1–28. https://doi.org/10.1126/science.151.3712.867-a

Lau LS, Choong CK, Eng YK (2014) Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: DO foreign direct investment and trade matter? Energy Policy 68:490–497. https://doi.org/10.1016/j.enpol.2014.01.002

Le T-H (2016) Dynamics between energy, output, openness and financial development in sub-Saharan African countries. Appl Econ 48:914–933. https://doi.org/10.1080/00036846.2015.1090550

Lee G (2007) Long run equilibrium relationship between inward FDI. J Econ Dev 32:183–192 Online link: http://www.jed.or.kr/full-text/32-2/8.pdf [Accessed date: 19-01-2018]