Abstract

The current world is seeking balance between achieving economic and financial growth and shielding earth’s environment. The 13th goal (climate action) among 17 Sustainable Development Goals (SDGs) is an outcome of the same concern. The ample body of the literature tries to analyse the inter-linkages among financial development, economic growth, globalisation and greenhouse gas (GHG) emissions, but their results do not reach a consensus. The BRICS (Brazil, Russia, India, China and South Africa) nations have emerged as a dominant force in recent years, but their growth stories are tainted with the increased environmental issues. The present study tries to analyse the same nexus from 1991 to 2020 using Autoregressive Distributed Lag (ARDL) approach for BRICS nations. The empirical findings suggest strong long-run and short-run positive implications of financial development, and negative implications of economic growth and globalisation on GHG emissions in all four nations except China. The study is distinct as it extensively analyses the interdependence between GHG emissions and financial development using 9 different sub-indices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Financial development has contributed to unprecedented growth of nearly all the economies. However, increased economic and financial development demand more of energy resources, giving steady rise to Greenhouse Gas (GHG) emissions and raising environmental concerns to all developing and developed nations. Environmental degradation is now universal problem that threatens the existence of biological diversity. The 13th goal among all 17 Sustainable Development Goals (SDGs) is related to climate action that aims at taking urgent measures to combat climate change and its impact. One of the ways to achieve the aforesaid objective is assimilating climate change measures into domestic policies, strategies and planning. The first step towards incorporating them into national policies is to identify the causes that trigger the deterioration of environmental quality.

Emerging economies especially BRICS (Brazil, Russia, India, China and South Africa) nations embraced the 'BRICS Leaders Xiamen Declaration' in September, 2017, reasserting their pledge to implement the 2030 program for sustainable development fully. They commit to enhance co-operation on climate change through expanding green-financing in the areas of prevention of air and water pollution, waste management and biodiversity conservation. Jim O’Neill, the mastermind behind the initialism of ‘BRIC’ in 2001 (now BRICS), revisits the alliance for scrutinising the performance during last two decades. He opines that the performance of emerging economies, especially BRICS will be the most significant in determining the economic growth of the world in coming decade. The collective size of the BRICS has already surpassed European Union and is advancing towards attaining the size of the USA (United States of America) (O’Neill 2021). Wilson and Purushothaman (2003) forecasts that the BRICS nations have the potential to be larger than G6 (US, UK, France, Japan, Germany, and Italy) in US dollar terms before 2040 considering their capital accumulation and productivity.

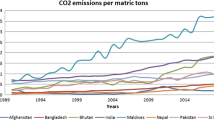

The BRICS countries have emerged as a significant force that constitute more than 41 percent of the world’s population, 16 percent of the world’s trade, and contributes nearly one fourth of the world’s GDP (Papa 2017; Patra 2021). Though being small in number (only 5 countries), the group has potential to move critical mass towards achieving sustainable development goals (SDGs). These economies rely heavily on consumption of conventional and non-conventional energy resources to sustain their swift economic development and become global contributor of GHG emissions (Chishti et al. 2021). In 2018, the group accounted for 36,573 Mt of CO2 emission; 42 percent of the global GHG emissions, which is almost double (24 percent) the G7 (US, UK, France, Japan, Germany, Italy, and Canada) (Kirton and Larionova 2022). As per the latest compilation by Peters et al. (2011), Andrew and Peters (2021), and Friedlingstein et al. (2022), the global contribution of BRICS in terms of MtCO2 is soaring high and reached almost 46 percent (Refer Fig. 1 and 2).Footnote 1 This discussion compels to analyse the major causes of environmental degradation.

Recent studies show the linkages among financial development, economic growth and GHG emissions. Financial development promotes innovation processes to develop environmentally sustainable technologies to many areas including energy sector (Álvarez-Herránz et al. 2017; Duque‐Grisales et al. 2020; Ozcan et al. 2020). Financial development promotes technological improvements through adoption of new products or processes that stimulate less emission and reduce energy consumption (Birdsall and Wheeler 1993; Abbasi & Riaz 2016; Law et al. 2018). Contrary to the above arguments, increased investment through financial developments can also elevate energy consumption and there by affect the environment adversely (Jensen 1996; Ogbeifun & Shobande 2022). Financial development and economic growth give rise to Foreign Direct Investments (FDI) and Foreign Institutional Investments (FII) towards emerging economies like India (Gandhi et al. 2013; Dhingra et al. 2016). FDI augments the transfer of technology, expertise and know-how that promotes adoption of green technologies and reduces the carbon footprints (Pantelopoulos 2022). Few studies explore the association between trade openness and financial development. Beck (2003) suggests that industries prevailing in the countries having high-trade openness ratios depend highly on external financing. The increased trade flow in terms of external financing support the haven hypothesis (Copeland and Taylor 1994), where firms locate their production in the countries having fewer environmental regulations and serve as a catalyst in worsening the environmental quality (Frutos-Bencze et al. 2017; Zamil et al. 2019).

Some of the previous studies attempt to analyse the impact of financial development, economic growth and globalisation in OECD countries, N-11 countries and BRICS countries using panel data analysis. Somehow, these kinds of econometric approaches fail to highlight the criticality and distinctiveness of particular nation when studied in a group. On the contrary, some of the literature tried to analyse particular nation and are not able to compare the results across nations. Based on the information the author has, no attempt has yet been made to analyse the BRICS nations keeping their individual characteristics unimpaired. Additionally, most of the studies tried to analyse the influence of independent variables on CO2 emissions (proxy for environmental deterioration), whereas GHG emissions is more comprehensive measure of the gases that degrade the environmental quality. This study will add up to an existing literature by assimilating both of the aspects discussed above. The study uses Autoregressive Distributed Lag (ARDL) model estimation to examine BRICS economies separately and highlights critical differences of their results. This approach is most preferred as it allows researchers to consider both I(0) and I(1) series. The use of different measures of financial development (9 different indices) makes it unique, as no literature shows the extensive and comprehensive analysis of financial development with GHG emissions. The study may play a pivotal role in taking corrective measures and constructing policy framework to attenuate the GHG emissions and may help the government of these economies in achieving their SDGs.

The rest of the paper is organised as follows. The second section outlines the key studies and literature in the same direction briefly. The variables, data and methodology are discussed in section three. Section four talks about empirical findings and interpretation, whereas the last section discusses about conclusion and policy implications.

2 Literature review

The research related to Environmental Kuznets Curve (EKC) gained momentum among policy makers and academicians with the acceptance of 17 SDGs by United Nations in 2015, where in the 13th goal is related to climate actions or environmental quality. Recent studies try to analyse the nexus of different independent variables (such as economic growth, financial growth, globalisation, fiscal policies, commercial or trade policies, and tourism) and environmental quality (dependent variable). Sarkodie and Ozturk (2020), and Weimin et al. (2020) try to analyse the impact of economic growth; Majeed and Mazhar (2019), and Chishti and Sinha (2022) assess the impact of financial growth; the studies of Danish et al. (2018), Chishti et al. (2020), and Jahanger et al. (2022) consider globalisation as an independent variable; Ullah et al. (2020a, b) focuses on effects of fiscal policy instruments; Weimin and Chishti (2021) assess the effects of commercial policies; Ullah et al. (2020b) scrutinise the asymmetric impact of oil price changes; Chishti et al. (2020) find asymmetrical effects of tourism and globalisation. Majorly the studies focus on highlighted independent variable by considering different combinations of some of the mentioned variables.

2.1 Economic growth and quality of environment

Some of the pioneering studies to analyse the relationship between economic growth and environmental quality are carried out by various researchers using different econometric techniques. For example, Stern et al. (1996); Suri and Chapman (1998); Munasinghe (1999); Dasgupta et al. (2002); Dinda (2005); Jalil & Mahmud (2009). Stern (2004), Dinda (2004) and Sarkodie & Strezov (2019) offer exhaustive literature review on EKC hypothesis, but do not reach to any consensus with respect to the nature of relationship. Rauf et al. (2018), Danish et al. (2019) and Sarkodie & Ozturk (2020) claim that once the economic growth reaches the optimum level, pollution starts declining. Gill et al. (2018) clearly state that the idea behind EKC of “Grow now clean later” imposes huge environmental costs. This change can be irreversible and can threaten the sustainability of the earth. Thus, the prime question that needs to be answered is, whether the economic growth should be achieved at the cost of ecological quality or we need to take immediate measures to combat environmental degradation by taking policy measures explicitly at local, national and world level (Barbier 1997). Since long World Bank has up-held that the economic growth gives rise to per capita income and in turn brings down the poverty and increases environmental quality. Beckerman (1992) supports the argument by postulating economic growth as the most pragmatic weapon to combat environmental ills. Manufacturers with insightful knowledge and recognition make more investment in development of environment friendly technologies causing positive shocks to CO2 emissions and curb environmental contamination (Weimin et al. 2022). Conversely, economic growth leads to increased production and consumption causing more pressure on environmental resources, thus harming the environment (Georgescu-Roegen 1986; Daly 1991; Rothman 1998).

2.2 Financial development and quality of environment

Many research augments the nexus of globalisation, economic growth and environmental quality by adding financial development as one of the variables. They explain that globalisation speeded economic development, and financial development is one of the facets of economic growth. A well-developed financial sector facilitates credit at lower cost to projects that keep the environmental concerns on priority. Efficient financial markets promote trading in global pollution rights and helps in CO2 reduction in overall environment (Tamazian et al. 2009). Positive shocks through financial innovation in the form of market expansion, risk minimisation, innovations (product/process/organisational), investment diversification, optimum resource allocation, and higher research on financial system have positive environmental impact (Chishti and Sinha 2022). Several studies find evidence that capital market which is the main pillar of financial development rewards the firms’ equities with higher valuation if firms’ environmental performance is good (Hamilton 1995; Klassen and McLaughlin 1996; Lanoie et al. 1998). Thus, countries with well-developed financial markets are benefited by superior environment quality (Dasgupta et al. 2001; Zhang 2011; Majeed and Mazhar 2019). There are some counter arguments, too. The upsurge in credit facility through financial development increases the purchase of automobiles, electronic gadgets, and mechanical machineries that affects the environment negatively. The credit facilities when provided to expand business, replace old machinery or buying new plant and machinery can increase the CO2 concentration in particular country (Zhang and Zhang 2018).

2.3 FDI, trade openness and quality of environment

Rock (1996) and Chua (1999) recognise the significance of influence of FDI on environmental performance. The improved financial system attracts more of foreign direct investments (FDI), although the influence of flow of FDI on environment quality is contentious. Xing and Kolstad (2002) find positive association between the sulphur emissions and inflow of FDI in US. Danish et al. (2018) reveal in their study that increased FDI in response to financial development causes environmental degradation. Dogan et al. (2022) rightly point out in their study that well developed and industrialised economies should focus on endorsing the use of renewable energy resources to lessen GHG emissions and improve environmental quality. Conversely, Eskeland & Harrison (2003) find the evidence that foreign technology based plants are significantly more efficient than the domestic technology based plants. Their findings also support pollution haven hypothesis weakly. Investment in technologies especially Information Communication Technology (ICT) can give rise to consumption of clean energy and check the detrimental effects to environment (Chishti and Dogan 2022). Liang (2006) also finds that the FDI and air pollution are negatively associated. Along with FDI, trade openness is also considered one of the variables that contribute to financial development and globalisation (Boutabba 2014). The studies of Jahanger et al. (2022) and Chishti et al. (2020) support the argument that the increased globalisation increases the ill-effects of environmental pollutants.

To sum up, all the discussed studies show diverse and differing results. These differences may arise depending upon the time-period, variation in data-sets, other controlled parameters, territory, order of integration of parameters, and approach to analyse the data. To evaluate the nexus in BRICS economies, the following hypotheses have been framed.

H1

Economic growth intensifies environmental degradation.

H2

Financial development lessens environmental degradation.

H3

Globalisation upturns environmental degradation.

To the best of knowledge the author has, all the studies in the field of globalisation, economic growth, financial development and environmental quality nexus consider majorly three factors as a proxy for financial development, viz. domestic credit by private sector as a percentage of GDP, domestic credit to private sectors by banks as a percentage of GDP and domestic credit to private sector by financial sector (Majeed and Mazhar 2019; Yao et al. 2021). Since the introduction of financial development index in the year 2016 by IMF (Svirydzenka 2016), researchers start using the same index instead of the 3 measures discussed above. But all these studies use the overall single index known as Financial Development Index (FDI) in their study (baloch et al. 2020; Usman et al. 2022); however, FDI is made up of 2 sub-indices related to financial institutions and financial markets, and these two sub-indices of financial institutions and markets are again sub-divided into 3–3 more indices related to access, depth and efficiency. No study has yet been contemplated to analyse the impact of these different dimensions of financial development on environmental quality. This study is novel attempt as it uses 4 different models of estimation to analyse this multi-dimension concept vis-à-vis GHG emissions along with other variables, namely economic growth, trade openness and foreign direct investments.

3 Variables, data and methodology

3.1 Variables and data

The current study empirically examines the role of financial development and economic growth on degradation of environmental quality in BRICS (Brazil, Russia, India, China and South Africa) economies using yearly data from 1991 to 2020. The availability of data is the prime reason for selection of the time period. The dataset comprises of the variables which represent the financial development, economic growth, and GHG emissions. The unprecedented financial development and economic growth are outcomes of globalisation; therefore, representative variables of globalisation are also considered to analyse the relationship. As stated by IMF, financial development is a multidimensional process which is based on depth, access and efficiency of financial institutions (banks, insurance companies, mutual funds, and pension funds) and markets (stock and bond markets) (Svirydzenka 2016). Based on the above argument, IMF created a final overall index called Financial Development Index (FD) along with the eight sub-indices, namely Financial Institution Access (FIA), Financial Institution Depth (FID), Financial Institution Efficiency (FIE), Financial Institution Index (FII), Financial Market Access (FMA), Financial Market Depth (FMD), Financial Market Efficiency (FME), and Financial Market Index (FMI). All these indices are used as a proxy of financial development. GDP per capita (current US$) and inflation in consumer prices (annual % change) are used as proxy of economic growth. As per the study of Khan and Roy (2011), trade openness (TO) – the ratio of foreign trade (value of import plus export) to GDP, is considered as major driving force of globalisation; therefore, the share of total trade to GDP and Foreign Direct Investment (FDI) are used as the proxy of globalisation. Finally, data on GHG (measured in Million tonnes of CO2 equivalent) are used as a proxy of environmental degradation. The data for financial development are collected from IMF. The data for economic growth (GDP and inflation) and globalisation (TO and FDI) are downloaded from the World Development Indicators of the World Bank. The data for GHG emissions are collected from World Energy and Climate Statistics of Enerdata.Footnote 2

3.2 Econometric approach

In econometric analysis, most of the time series data are troubled with the problem of auto-correlation or presence of trend. Thus, it is crucial to check the presence of trend, unit root and level of co-integration of all considered variables. Initially, data series are normalised by taking natural log of the observations. For the convenience purpose, LN (log natural) is not added before the names of all the data series. Before applying ADF test, presence of deterministic trend is identified (if present) and the series is made trend stationary by regressing it against time variable. The residuals so obtained are then used as the variable series for further analysis. The present study uses Augmented Dickey–Fuller (ADF) test to check the stationarity of the data series. All considered series can be categorised as stationary at level (with or without trend) or stationary at first difference (with or without trend). In this study, representative variables of particular BRICS nations are integrated of order 0, i.e. I(0) or 1, i.e. I(1). No series is integrated of order 2; hence, estimation of Autoregressive Distributed Lag (ARDL) is the most appropriate technique.

3.3 Model specification

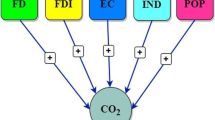

The long-run influence of independent variables financial growth, economic growth, and globalisation on dependent variable greenhouse gas emissions is analysed using 4 different empirical models. The all four models consider GDP per capita (GDP), inflation, trade openness (TO) and foreign direct investment (FDI) as independent variables and greenhouse gas emissions (GHG) as dependent variable invariably. Only independent variable(s) related to financial development keeps on changing as follows and are represented through Eqs. 1, 2, 3, and 4.

3.3.1 First model

Financial development index (FD).

3.3.2 Second model

Financial Institution Access (FIA), Financial Institution Depth (FID) and Financial Institution Efficiency (FIE).

3.3.3 Third model

Financial Market Access (FMA), Financial Market Depth (FMD), Financial Market Efficiency (FME).

3.3.4 Fourth model

Financial Institution Index (FII) and Financial Market Index (FMI)

where \({\alpha }_{0}\) is the drift term and \({\varepsilon }_{t}\) is the white noise error term. \({\beta }_{n}\)(where n= 1, 2,…,7) are output elasticities of independent variables.

The above general models cannot be applied directly as some of the data series are integrated of order one, i.e. I(1), and some are integrated of order zero, i.e. I(0). Therefore, to carry out further analysis ARDL long-run bounds test (Pesaran et al. 2001) approach is used, as this tool has unique advantages than any other cointegration techniques. First, the applicability of this approach to the mix of I(0) and I(1) series (but none of the series should be I(2)), second, the sufficient number of lags used by the model to generate general to specific model, and third, consistency and robustness of the results even when the data size is small (Azam et al. 2021). The most important advantage of this approach is that it estimates long-run and short-run coefficients simultaneously. The all four equations in ARDL bounds test are reparameterised as Eq. (5):

where l, m, n, p, q and r are the lagged indices. \(\mathcal{F}\mathcal{D}\) is the representative variable of different considered data series related to financial development for all four models discussed above using Eqs. 1, 2, 3 and 4. \({\lambda }_{i}\) are coefficients of lags of the dependent variable, and \({\alpha }_{i}\), \({\beta }_{i}\), \({\gamma }_{i}\), \({\delta }_{i}\) and \({\eta }_{i}\) are coefficients of lags of independent variables. Constant term and white noise error term is represented by c and \({\varepsilon }_{t}\), respectively.

Equation (5) can be further reparameterised in error correction form using the following equation:

where, \({\theta }_{1}\), \({\theta }_{2}\), \({\theta }_{3}\), \({\theta }_{4}\), \({\theta }_{5}\) and \({\theta }_{6}\) are the long-run parameters and derived from the original parameters in Eq. (5). \({\varepsilon }_{t}\), \(\Delta\) and c are the white noise error term, difference operator and intercept, respectively. Here,

The null hypothesis is \({H}_{0}:{\theta }_{1}={\theta }_{2}={\theta }_{3}={\theta }_{4}={\theta }_{5}={\theta }_{6}=0\) of no cointegration among variables against the alternative hypothesis \({H}_{1}:{\theta }_{1}\ne {\theta }_{2}\ne {\theta }_{3}\ne {\theta }_{4}\ne {\theta }_{5}\ne {\theta }_{6}\ne 0\) of the presence of cointegrating vector(s) through F-statistics. The two sets of Fcritical values—lower and upper bound—are provided by Pesaran et al. (2001). If Fcalculated > Fcritical (Upper bound), there is cointegration among the considered variables. If Fcalculated < Fcritical (Lower bound), there is no cointegration among the considered variables. If Fcritical (Lower bound) > Fcalculated. < Fcritical(Upper bound), the inference is inconclusive.

Equation (6) can be revised to get error correction model shown below as Eq. (7):

where \(\pi\) is the error correction term which exhibits the speed of adjustment of long-run cointegrated vector to equilibrium. The \(\pi\) should be significant with negative sign.

Apart from the above discussed methodology, residual diagnostic tests of serial correlation and heteroskedasticity are also carried out. Finally, the Granger causality test is carried out to identify the direction of causation for all considered variables vis-à-vis GHG emissions.

4 Empirical findings and interpretation

The use of advanced econometrics preconditions identifying order of integration for each of the considered series. Table 1 represents the results of popular unit root test; Augmented Dickey–Fuller (ADF) test which provides evidence for nonstationarity or stationarity of the time series. If we observe the results of Brazil, the statistics highlighted using bold letters indicate that FIE, FMA and FME series have deterministic trend. Therefore, these series are regressed on time to make them trend stationary first. The residual from this regression then represents time series that is trend-free. ADF test statistics show that the series GHG, FMA, FME and GDP have no stochastic trend as the statistics are highly significant at 5 percent level, i.e. they are stationary at level and thus I(0). Series FD, FIA, FID, FIE, FII, FMD, FMI, Inflation, TO and FDI are having significant test statistics at first difference, proving the presence of unit root at level and absence of unit root in differenced series. Hence, these series are integrated of order 1 or I(1). For Russia, GHG, FIA and TO series are trend stationary at level, whereas FID and FII series are having presence of unit root at level and significant deterministic trend. Therefore, these series are firstly detrended by regressing against trend variable and then checked for the presence of unit root. After confirming nonstationarity, they are differenced once and found stationary. Thus, these two series are integrated of order one. Rest of the series FD, FIE, FMA, FMD, FME, FMI, GDP and inflation are I(1). Results of India are quite different as all the series are I(1), where FIA and FII are converted to trend stationary, too. The results of China show that GHG, FID, FMA, FMD, FMI and GDP series are I(1) with deterministic trend and FD, FIA, FII, FME and TO are I(1) without the presence of significant trend. Series FIE and inflation are having absence of stochastic trend at level, and FDI is trend stationary at level. South Africa is having all I(1) series except FME and FDI. GDP is converted into trend stationary first and residuals so obtained classify it as an I(1).

Table 2 represents the correlation coefficients of GHG series with all other considered variables. Most of the correlation coefficients of Brazil and South Africa are very high and positive except for inflation which is negative. For Russia, the correlation coefficients are comparatively low except inflation which is 0.5102 with positive sign. Russia is the only country with positive correlation statistics for inflation. It is interesting to note that for Russia and China, FDI is negatively correlated with GHG emissions.

This study is novel from previous studies as it has used total 9 different indicators of financial development, viz. FD, FIA, FID, FIE, FII, FMA, FMD, FME and FMI. Correlation between financial development index and different measures of financial development in terms of depth, access and efficiency is represented in Table 3 along with indicators of globalization (TO and FDI) and economic growth (GDP and inflation). It is obvious that FD is highly correlated positively with FD, FIA, FID, FIE, FII, FMA, FMD, FME and FMI. GDP is also having high correlation with FD series. Inflation series of all countries are negatively correlated with FD series.

The ARDL estimation results for Brazil are presented in Table 4. As per the discussed methodological approach 4 models are estimated. First model is the results of ARDL estimation where out of 9 data series of financial development (FD, FIA, FID, FIE, FII, FMA, FMD, FME and FMI) only FD is considered along with GDP, inflation (both are proxy for economic development), TO and FDI (both are proxy for globalization) to check the long-run as well as short-run dependence. D(variable) and D(variable(-1)) represent the coefficient of a particular variable at first and second lag, respectively. To avoid the problem of over-parameterization, the lag length has been selected using SBC (Schwarz Bayesian Criterion), as it imposes harsher penalty for including more variables in a model compared to AIC (Akaike information criterion). All estimated models consider maximum 2 lags of any variable in this analysis. In Table 4, the level variables show the results of ARDL long-run form and bounds test, whereas lagged variables represent the results of error correction form. In model 1, the coefficients of all level variables are highly significant at either 5 or 10 percent level except Inflation. The F-statistics (5.292117) is above the upper critical value (3.21), suggesting the presence of long-run bound relationship or integrating vector as per the study of Pesaran et al. (2001). The error correction regression also supports the findings of long-run integration as the coefficient of error correction term, represented by CointEq(−1)*, is negatively significant. As per the results, the speed of adjustment coefficient is −0.442, indicating all considered variables reverse to long-run equilibrium at the speed of 44.2 percent. In other words, 44.2 percent equilibrium is restored in the first year. Most of the coefficients of lagged variables are also significant indicating the presence of short-run causality. In models 2 and 3, three variables related to financial institutions, namely FIA, FID and FIE, and 3 variables related to financial markets, viz. FMA, FMD and FME, are considered along with other independent variables of economic growth and globalisation to estimate the models, respectively. The results of model 2 and 3 are quite similar with the results of 1. Both the models are having significant long-run (level) variables indicating the presence of co-integrated relationship. Further, CointEq(−1)* coefficients are highly significant with the speed of adjustment of 55.3and 53.9 for model 2 and 3, respectively. Short-run (at lag1 and 2) coefficients are also significant for most of the independent variables except few which were dropped by the software (EViews) itself while estimating error correction form. In the last model (model 4), representative index of financial institutions (FII) and financial markets (FMI) are considered. The results of fourth model are similar to the results of all 3 models where financial development, economic growth and globalisation are significant. The CointEq−1)* coefficient is also highly significant with the negative sign, confirming the long-run bound effect. The speed of correction is 41.5 percent in the first year. Short-run coefficients at the first and second lags are also significant, proving short-run effects on dependent variable. The F-statistics for all 2,3, and 4 models are above the upper critical limit of 3.21. The coefficients of all financial growth related indicators are highly significant in long-run with negative sign. These findings are concurrent with the findings of Shahbaz et al. (2016) and Muhammad and Khan (2019). They explain that the outflow of money from well-developed financial institutions provide required support to environment-friendly and energy-saving projects or start-ups. Further, by investing in R & D and green technologies, they also help the businesses to adopt energy-efficient processes and technologies which further reduce the overall cost of business and preserve the quality of environment. Except financial development series, all other independent variables (GDP, TO and FDI) are significant with positive coefficients. These results are consistent with the results of Suri and Chapman (1998), Danish et al. (2019), Majeed and Mazhar (2019) and Sharif et al. (2020). The higher economic growth (GDP) and globalization (TO and FDI) accelerate the economic activities like investments, manufacturing, operations, consumption, there by contributing towards more GHG emissions. In models 1, 2 and 4, inflation is insignificant in the long run, but in model 3, it is significant with negative sign. The plausible reason for negative sign can be attributable to a decreased economic activity or slow-down in an economy with an increased inflation which brings down GHG emissions in turn.

Table 5 represents the ARDL estimation results for Russia. The 4 models are estimated in a similar way to Brazil. When the ARDL long-run form and bounds test was applied on data series of Russia, all the long-run coefficients are found insignificant for all level series except for model 3 and FII in model 4, although the F-statistics values of ARDL bounds test for models 1, 3 and 4 are above the upper critical (Pesaran et al. (2001)) value (3.21), suggesting the long-run relationship among all considered variables. For model 2, the F-statistics (2.654181) is falling between lower critical bound (2.17) and upper critical bound (3.21), suggesting inconclusive inference of ARDL bounds test. Further, the error correction term (ECT), that is, CointEq(-1)* coefficient is negative and highly significant for all 4 models. The speed of adjustment to achieve long-run equilibrium for models 1, 3 and 4 is 19.5%, 68.58% and 41.72%, respectively. In model 3, inflation series is found insignificant, which is similar to the results of Brazil. The slope coefficients of considered variables at first and second lag suggest short-run influence on GHG emissions. It is interesting to note that for variables related to financial growth, short-run coefficients are having negative value at many places, suggesting non-detrimental effect of financial growth on GHG emissions.

ARDL estimation results of India are given in Table 6. Although most of the long-run variables are statistically insignificant in established models except few in model 3(FMA, FMD, FME, GDP and FDI), CointEq(-1)* coefficients and F-statistics for all 4 models provide proof of the presence of long-run relationship among considered variables. Slope coefficients of considered variables at the first and second lags are also significant at many places, suggesting the presence of short-term influence. The results of China are very similar to the results of India in the long run. The analysis of China reveals that most of the significant coefficients of short-run in all 4 models are having positive sign, which is quite unusual as compared other considered economies (Refer Table 7). The results directly indicate about the increased level of GHG emissions along with growth of economy. No doubt China emits more GHG than the entire developed nations combined (“China Emissions Exceed All Developed Nations Combined” 2021). The results of China are in accordance with the study of Danish et al. (2018).

It can clearly be inferred from the results of ARDL estimation of South Africa that the financial development related indicators are having negative sign of significant coefficients at most of the places, suggesting their limiting effect on GHG emissions. Almost all the short-run coefficients at the first and second lags are highly significant, suggesting strong short-run influence on dependent variable. The results related to GDP are quite interesting as most of the coefficients (long run and short run) are significant with negative sign except for model 1, which is contradictory to the results of Brazil, Russia, India, and China. The error correction terms are also having significant negative values, and the speed of achieving the long-run equilibrium is 35.59%, 79.40%, 93.8% and 17.48% for models 1, 2, 3 and 4, respectively (Refer Table 8).

Table 9 represents the diagnostic tests of residuals of estimated ARDL models (all 4 models) of BRICS countries. For serial correlation, the Breusch–Godfrey Serial Correlation LM test is applied on residuals so obtained. The null hypothesis of this test is “No serial correlation”. The F-statistics of this test suggest that residuals of all the 4 models of BRICS nations are not serially autocorrelated as they are highly insignificant (thus, null hypothesis cannot be rejected) except models 1 and 4 of Brazil, and model 3 of China. For detecting the heteroskedasticity, Breusch–Pagan–Godfrey Heteroskedasticity test is carried out. The null hypothesis here is that the error variance is homoskedastic. The results in Table 9 show that the F-statistics is highly insignificant for all estimated ARDL models, suggesting that the error terms do not suffer from heteroskedasticity.

The popular causality test developed by Granger (1969) is used to detect direction of causality between GHG and other considered variables FD, FIA, FID, FIE, FII, FMA, FMD, FME, FMI, GDP, inflation TO and FDI. The results of pair-wise Granger causality are displayed in Table 10. Majority of the F-statistics values are insignificant for Brazil, Russia, India, China and South Africa. The results of Brazil are quite probable and resemble the theoretical assumptions where causation is running from FD, FIE, and GDP to GHG. The two variables FMD and FME share bi-direction causality with GHG emissions. For Russia, FD and FID Granger cause GHG. The results of India show that FIA, FMD, TO and FDI have unidirectional causality running towards GHG. FID and FII share bidirectional causality with GHG. It is important to note that results of TO and FDI are only significant for India among all other BRICS economies. The results of China state that GHG Granger causes all other variables except inflation and trade openness (which do not show any causality either way), which is quite opposite to prevailing theories on GHG emissions. FIA and GDP significantly granger cause GHG in South Africa.

5 Conclusion and policy implications

Since 1750, the industrial activities by modern society have raised the atmospheric GHG emissions by nearly 50%. Human activities like clearing of forests for agricultural land, industrialisation, and use of fossil fuels have escalated the concentration of GHG (IPCC 2021). Global warming and climate change have now become burning issue that need to be addressed immediately. Increased climate vulnerability is inseparable from growth and development in emerging economies like BRICS. Since the Paris Agreement on climate change in 2015, BRICS have established a new institutional framework that guides distinct and shared actions. The time has arrived to analyse whether BRICS without compromising their commitment to SDGs still able to achieve financial growth. The current study is a step towards the same objective. The study tries to analyse the dynamic relationship between GHG emissions and financial development, economic growth, and globalisation by using the data from 1991 to 2020. The long-run and short-run linkages are analysed using Autoregressive Distributed Lag (ARDL) model estimation, as the considered series are not integrated of the same order. Long-run bounds test and error correction model are applied to estimate long-run and short-run coefficients. Granger causality test is applied to confirm the direction of short-run causation.

The results of ARDL estimation especially error correction form confirm the long-run relationship of GHG emissions with financial development, economic growth and globalisation. All the error correction terms and F-statistics based on Pesaran et al. (2001) table turn out to be highly significant. While estimating long-run bounds test, it is observed that the long-run coefficients of financial development-related series (especially overall financial development, financial institution access, financial institution efficiency and financial market efficiency) are having negative sign in most of the estimated models, suggesting a favourable impact of financial development on GHG emissions. This result is very much contradictory to the results of Dar and Mohammad (2017), but quite similar to the results of Baloch et al. (2020) and Majeed and Mazhar (2019). While analysing the nexus between economic growth and GHG emissions, the positive sign of GDP coefficients is observed, suggesting the detrimental effect of economic growth on GHG emissions. Russia is the only nation where the sign of GDP-related coefficients are negative, indicating complimentary effect of economic growth on GHG emissions. In many cases, the coefficients related to inflation, trade openness, and FDI are insignificant. For Brazil, India and China, the coefficients of trade openness are significant with positive sign, which suggest that that trade openness increases the GHG emissions in these countries. It is interesting that in most of the cases where FDI coefficients are significant, they are having positive sign, but in case of China these coefficients are significant with negative sign, suggesting the technological advancement in China through FDI. For short-run coefficients, no generalization can be made as the signs of these coefficients are not consistent across 4 models.

The findings put forward some serious implications as the environmental detriments will not fade away in a blink of an eye, but require some concrete measures from the government in the direction of sustainable development. Though this study identifies that financial development is having positive impact on environmental condition, but to sustain the same state one has to seriously keep watch on the actions of financial systems of BRICS economies. Structural policies need to be framed in such a way that the financial sectors keep on providing credits to effective and environment friendly projects. Priority sector lending must include credits to energy efficient projects and processes. Before sanctioning loans to industries, banks must see that the money is going towards the sustainable development. The loans must be given in fragments and financial sectors especially banking system must be vigilant before releasing fresh fund every time. Incentives may be given to firms that keep environmental issues in forefront over profits. It is inferred from the analysis that economic growth deters the environment. Reasons for such impact may be the overuse of natural resources to increase productivity and improper waste management system. As per the report of British Telecommunications (2016), the government seek to incorporate smart manufacturing, smart energy and smart building concepts in their strategic program to achieve sustainable growth. Government may compel the adoption of smart technologies to agriculture, energy, construction and manufacturing. Globalisation stimulates global alliance and integration by abolishing trade restrictions. Researchers have already established strong linkages among stock and bond markets of BRICS economies (Dhingra and Patel 2021). Time has come that BRICS nations must collaborate by sharing technical know-how and innovations in energy sectors to combat environmental issues. Foreign Direct Investments may be discouraged if they are bringing out-dated technologies to developing nations.

At last, countries should envisage optimal policies that emphasize on coexistence rather arbitration between environment and economic growth (Uchiyama 2016). There should be concordance among policies related to financial development, economic growth, globalisation and sustainable environmental conditions.

6 Limitations and Future Scope

GHG emissions can be explained with the wide array of other parameters in the context of economic growth, financial development, and globalisation. But some of the parameters are dropped from the analysis having the complications as follows: (1) series with high covariance with other considered series to avoid the problem of multicollinearity, (2) series with order of integration 2, i.e. I(2), such as urbanization and fossil fuel energy consumption, which makes the use of ARDL approach redundant, and (3) series with unavailable data for the considered time period. Owing to the simplicity, flexibility, and generalizability of the considered approach, the similar studies may be carried out for different group of countries like G7, N-11 (Next 11—Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, the Philippines, Turkey, South Korea, and Vietnam) in future.

Notes

Data have been aaccessed through http://emissions2017m.globalcarbonatlas.org/en/CO2-emissions on 12/12/2022.

References

Andrew R, Peters G (2021) The Global Carbon Project’s fossil CO2 emissions dataset. Zenodo: Geneva, Switzerland

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Álvarez-Herránz A, Balsalobre D, Cantos JM, Shahbaz M (2017) Energy innovations-GHG emissions nexus: fresh empirical evidence from OECD countries. Energy Policy 101:90–100

Azam A, Rafiq M, Shafique M, Yuan J (2021) Renewable electricity generation and economic growth nexus in developing countries: An ARDL approach. Econ Res-Ekonomska Istraživanja 34(1):2423–2446

Baloch MA, Ozturk I, Bekun FV, Khan D (2020) Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: does globalization matter? Bus Strateg Environ 30(1):176–184

Barbier EB (1997) The economic determinants of land degradation in developing countries. Philosoph Transact Royal Soc London. Series b: Biol Sci 352(1356):891–899. https://doi.org/10.1098/rstb.1997.0068

Beck T (2003) Financial dependence and international trade. Rev Int Econ 11(2):296–316

Beckerman W (1992) Economic growth and the environment: whose growth? whose environment? World Dev 20(4):481–496

Birdsall N, Wheeler D (1993) Trade policy and industrial pollution in Latin America: where are the pollution havens? J Environ Develop 2(1):137–149

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

China emissions exceed all developed nations combined (2021) In BBC News. Available at https://www.bbc.com/news/world-asia-57018837. Retrieved on 15/08/2022

Chishti MZ, Sinha A (2022) Do the shocks in technological and financial innovation influence the environmental quality? Evidence from BRICS economies. Technol Soc 68:101828

Chishti MZ, Ullah S, Ozturk I, Usman A (2020) Examining the asymmetric effects of globalization and tourism on pollution emissions in South Asia. Environ Sci Pollut Res 27(22):27721–27737

Chishti MZ, Ahmad M, Rehman A, Khan MK (2021) Mitigations pathways towards sustainable development: assessing the influence of fiscal and monetary policies on carbon emissions in BRICS economies. J Clean Prod 292:126035

Chishti MZ, Dogan E (2022) Analyzing the determinants of renewable energy: the moderating role of technology and macroeconomic uncertainty. Energy & Environment. https://doi.org/10.1177/0958305X221137567

Chua S (1999) Economic growth, liberalization, and the environment: A review of the economic evidence. Annu Rev Environ Resour 24:391–430

Copeland BR, Taylor MS (1994) North-South trade and the environment. Q J Econ 109(3):755–787

Daly HE (1991) Steady-state economics, 2nd ed. with new essays, Island press, Covelo, California

Danish WB, Wang Z (2018) Imported technology and CO2 emission in China: collecting evidence through bound testing and VECM approach. Renew Sustain Energy Rev 82(3):4204–4214

Danish BMA, Mahmood N, Zhang JW (2019) Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci Total Environ 678:632–638

Dar JA, Asif M (2017) Is financial development good for carbon mitigation in India? a regime shift-based cointegration analysis. Carbon Management 8(5–6):435–443

Dasgupta S, Laplante B, Mamingi N (2001) Pollution and capital markets in developing countries. J Environ Econ Manag 42(3):310–335

Dasgupta S, Laplante B, Wang H, Wheeler D (2002) Confronting the environmental Kuznets curve. J Econ Perspect 16(1):147–168

Dhingra VS, Patel P (2021) An empirical analysis of BRICS bond market integration. SCMS J Ind Manage 18(1):22–36

Dhingra VS, Gandhi S, Bulsara HP (2016) Foreign institutional investments in India: an empirical analysis of dynamic interactions with stock market return and volatility. IIMB Manag Rev 28(4):212–224

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49(4):431–455

Dinda S (2005) A theoretical basis for the environmental Kuznets curve. Ecol Econ 53(3):403–413

Dogan E, Chishti MZ, Alavijeh NK, Tzeremes P (2022) The roles of technology and Kyoto protocol in energy transition towards COP26 targets: Evidence from the novel GMM-PVAR approach for G-7 countries. Technol Forecast Soc Chang 181:121756

Duque-Grisales E, Aguilera-Caracuel J, Guerrero-Villegas J, García-Sánchez E (2020) Does green innovation affect the financial performance of Multilatinas? the moderating role of ISO 14001 and R&D investment. Bus Strateg Environ 29(8):3286–3302

Eskeland GS, Harrison AE (2003) Moving to greener pastures? multinationals and the pollution haven hypothesis. J Dev Econ 70(1):1–23

Friedlingstein P, O’Sullivan M, Jones MW, Andrew RM, Gregor L, Hauck J, Zheng B (2022) Global carbon budget 2022. Earth System Sci Data 14(11):4811–4900

Frutos-Bencze D, Bukkavesa K, Kulvanich N (2017) Impact of FDI and trade on environmental quality in the CAFTA-DR region. Appl Econ Lett 24(19):1393–1398

Gandhi S, Bulsara HP, Dhingra VS (2013) Changing trend of capital flows: the case of India. Inter J Manage Stud 20(2):71–104

Georgescu-Roegen N (1986) The entropy law and the economic process in retrospect. East Econ J 12(1):3–25

Gill AR, Viswanathan KK, Hassan S (2018) The environmental kuznets curve (EKC) and the environmental problem of the day. Renew Sustain Energy Rev 81(2):1636–1642

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37(3):424. https://doi.org/10.2307/1912791

Hamilton JT (1995) Pollution as news: Media and stock market reactions to the toxics release inventory data. J Environ Econ Manag 28(1):98–113

IPCC (2021) Summary for Policymakers. In: Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Masson-Delmotte V, Zhai P, Pirani A, Connors SL, Péan C, Berger S, Caud N, Chen Y, Goldfarb L, Gomis MI, Huang M, Leitzell K, Lonnoy E, Matthews JBR, Maycock TK, Waterfield T, Yelekçi O, Yu R, Zhou B, (eds.)]. Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA, pp. 3−32, https://doi.org/10.1017/9781009157896.001

Jahanger A, Chishti MZ, Onwe JC, Awan A (2022) How far renewable energy and globalization are useful to mitigate the environment in Mexico? application of QARDL and spectral causality analysis. Renew Energy 201:514–525

Jalil A, Mahmud SF (2009) Environment Kuznets curve for CO2 emissions: a cointegration analysis for China. Energy Policy 37(12):5167–5172

Jensen VMH (1996) Trade and Environment: The pollution haven hypothesis and the industrial flight hypothesis: some perspectives on theory and empirics. University of Oslo, Centre for Development and the Environment

Khan AM, Roy PA (2011) Globalization and the determinants of innovation in BRICS versus OECD economies: A macroeconomic study. J Emerg Knowl Emerging Markets 3:28–45

Kirton J, Larionova M (2022) The First Fifteen Years Of The BRICS. Inter Organisat Res J 17(2):7–30. https://doi.org/10.17323/1996-7845-2022-02-01

Klassen RD, McLaughlin CP (1996) The impact of environmental management on firm performance. Manage Sci 42(8):1199–1214

Lanoie P, Laplante B, Roy M (1998) Can capital markets create incentives for pollution control? Ecol Econ 26(1):31–41

Law SH, Lee WC, Singh N (2018) Revisiting the finance-innovation nexus: Evidence from a non-linear approach. J Innov Knowl 3(3):143–153

Liang G (2006) International business and industry life cycle: theory, empirical evidence and policy implications. In Paper accepted for presentation at the annual conference on corporate strategy, Berlin, 19–20 May

Majeed MT, Mazhar M (2019) Financial development and ecological footprint: a global panel data analysis. Pakistan J Commer and Soc Sci (PJCSS) 13(2):487–514

Muhammad B, Khan S (2019) Effect of bilateral FDI, energy consumption, CO2 emission and capital on economic growth of Asia countries. Energy Rep 5:1305–1315

Munasinghe M (1999) Is environmental degradation an inevitable consequence of economic growth: tunneling through the environmental Kuznets curve. Ecol Econ 29(1):89–109

O’Neill J (2021) Is the emerging world still emerging?. Financ Develop

Ogbeifun L, Shobande OA (2022) A reevaluation of human capital accumulation and economic growth in OECD. J Public Affairs 22(4):e2602

Ozcan B, Tzeremes PG, Tzeremes NG (2020) Energy consumption, economic growth and environmental degradation in OECD countries. Econ Model 84:203–213

Pantelopoulos G (2022) Higher education, gender, and foreign direct investment: evidence from OECD countries. Ind High Educ 36(1):86–93

Papa M (2017) Can BRICS lead the way to sustainable development?. UNA-UK. Available at https://www.sustainablegoals.org.uk/can-brics-lead-way-sustainable-development/ Retrieved on 24/08/2022

Patra MD (2021) BRICS Economic Bulletin. BRICS India 2021. Available at https://brics2021.gov.in/brics/public/uploads/docpdf/getdocu-72.pdf

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Economet 16(3):289–326

Peters GP, Minx JC, Weber CL, Edenhofer O (2011) Growth in emission transfers via international trade from 1990 to 2008. Proc Natl Acad Sci 108(21):8903–8908

Rauf A, Liu X, Amin W, Ozturk I, Rehman OU, Hafeez M (2018) Testing EKC hypothesis with energy and sustainable development challenges: a fresh evidence from belt and road initiative economies. Environ Sci Pollut Res 25(32):32066–32080

Rock MT (1996) Toward more sustainable development: The environment and industrial policy in Taiwan. Develop Policy Review 14(3):255–272

Rothman DS (1998) Environmental kuznets curves—real progress or passing the buck?: a case for consumption-based approaches. Ecol Econ 25(2):177–194

Sarkodie SA, Ozturk I (2020) Investigating the environmental Kuznets curve hypothesis in Kenya: a multivariate analysis. Renew Sustain Energy Rev 117:109481

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020) Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: Evidence from Quantile ARDL approach. Sustain Cities Soc 57:102–138

Stern DI (2004) The rise and fall of the environmental Kuznets curve. World Dev 32(8):1419–1439

Stern DI, Common MS, Barbier EB (1996) Economic growth and environmental degradation: the environmental Kuznets curve and sustainable development. World Dev 24(7):1151–1160

Suri V, Chapman D (1998) Economic growth, trade and energy: implications for the environmental Kuznets curve. Ecol Econ 25(2):195–208

Svirydzenka K (2016) Introducing a new broad-based index of financial development. IMF working paper no. 16/5. https://ssrn.com/abstract=2754950

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253

British Telecommunications (BP) (2016) The role of ICT in reducing carbon emissions in the EU. Available at https://www.bt.com/bt-plc/assets/documents/digital-impact-and-sustainability/our-approach/our-policies-and-reports/ict-carbon-reduction-eu.pdf.

Uchiyama K (2016) Environmental Kuznets curve hypothesis. In: Uchiyama K (ed) Environmental Kuznets curve hypothesis and carbon dioxide emissions. Springer Japan, Tokyo, pp 11–29. https://doi.org/10.1007/978-4-431-55921-4_2

Ullah S, Chishti MZ, Majeed MT (2020a) The asymmetric effects of oil price changes on environmental pollution: evidence from the top ten carbon emitters. Environ Sci Pollut Res 27:29623–29635

Ullah S, Majeed MT, Chishti MZ (2020b) Examining the asymmetric effects of fiscal policy instruments on environmental quality in Asian economies. Environ Sci Pollut Res 27:38287–38299

Usman M, Jahanger A, Makhdum MSA, Balsalobre-Lorente D, Bashir A (2022) How do financial development, energy consumption, natural resources, and globalization affect Arctic countries’ economic growth and environmental quality? Adv Panel Data Simulat Energy 241:122515

Weimin Z, Chishti MZ (2021) Toward sustainable development: assessing the effects of commercial policies on consumption and production-based carbon emissions in developing economies. SAGE Open 11(4):21582440211061580

Weimin Z, Chishti MZ, Rehman A, Ahmad M (2022) A pathway toward future sustainability: assessing the influence of innovation shocks on CO2 emissions in developing economies. Environ Dev Sustain 24(4):4786–4809

Wilson D, Purushothaman R (2003) dreaming with BRICs: the path to 2050. Goldman Sachs Global Econ Paper 99:1–24

Xing Y, Kolstad CD (2002) Do lax environmental regulations attract foreign investment? Environ Resour Econ 21(1):1–22

Yao X, Yasmeen R, Hussain J, Shah WUH (2021) The repercussions of financial development and corruption on energy efficiency and ecological footprint: Evidence from BRICS and next 11 countries. Energy 223:120063

Zamil AAA, Hasan S, Baki SMJ, Adam JM, Zaman I (2019) Emotion detection from speech signals using voting mechanism on classified frames. In 2019 International conference on robotics, electrical and signal processing techniques (ICREST), IEEE 281–285

Zhang YJ (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Zhang Y, Zhang S (2018) The impacts of GDP, trade structure, exchange rate and FDI inflows on China’s carbon emissions. Energy Policy 120:347–353

Funding

This work is supported by Seed grant received from Sardar Vallabhbhai National Institute of Technology, Surat, Gujarat, India. Grant No.: 2021-22/DOMH/01.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Dhingra, V.S. Financial development, economic growth, globalisation and environmental quality in BRICS economies: evidence from ARDL bounds test approach. Econ Change Restruct 56, 1651–1682 (2023). https://doi.org/10.1007/s10644-022-09481-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09481-6