Abstract

The role of financial development for the environment has been extensively debated but the empirical results largely remain inconclusive. Empirical studies generally assume symmetric relationships, which can produce biased results. This study investigates the role of asymmetries in shaping the relationship of financial development (FD) with the environment by employing nonlinear autoregressive distributed lag (NARDL) model over the period 1972–2018. The structural unit root test of Zivot and Andrews indicates that all variables are integrated of order one and bound tests confirm long run relationship between the variables. The results validate the asymmetric association between FD and the environment as CO2 emissions are largely affected by negative shocks in FD in the short and long run. The dynamic multiplier analysis also supports the results by showing the dominance of a higher impact of a negative component of FD on carbon emissions than a positive component. This study concludes that assuming the symmetric effect of FD on CO2 emissions might be misleading. The study suggests that the policy makers may strive to achieve high growth rates using environmentally friendly financial development. Moreover, the negative asymmetric impact of FD needs to be considered in the development of financial sector.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

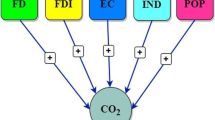

Economic policies are largely focused on achieving high and sustained growth rates. However, prioritizing growth rates also adversely affects the ecosystem services. Increasing energy use along with increasing economy’s growth can lead to higher air and water pollution, loss of biodiversity and global warming. Among all greenhouse gases, CO2 emission is considered as serious threat to the environment as it comprises almost 75% of total greenhouse gass [1, 2]. There are various causes of high carbon emissions such as population growth [3], financial development (FD) [4], energy consumption, urbanization and trade openness [5, 6].

From the last few years, the relationship between FD and environmental quality has become important with the expansion of green financing. Green financing helps to control the growth of carbon emissions by facilitating climate friendly and carbon-reducing projects. Moreover, FD decreases the level of CO2 emissions by providing the research and development projects, introducing new and environmentally friendly technologies, and by facilitating financial and technical assistance to firms [7, 8].

Whereas, FD can also pollute the economies by damaging the ecosystem services. Because the extensive use of energy for production leads to higher CO2 emissions, depletion of natural resources and health related issues [9,10,11,12]. Moreover, financial assistance of financial market leads to more purchase of machinery and automobiles which in turn increase the carbon emissions [13]. Thus, financial sector can create environmental related issues by increasing the process of production and economic growth [4, 14,15,16]. The empirical results largely remain inconclusive. Empirical studies generally assume symmetric relationships, which can be misleading. This study aims to investigate the asymmetric impacts of FD on CO2 emissions for Pakistan.

Pakistan is facing the issue of deteriorating air quality because of rapid increase in carbon dioxide and nitrogen oxide emissions [17]. In Pakistan, more than 60% of electricity is produced through thermal sources, which cause high carbon emissions. Pakistan contributes 0.8% in global greenhouse gases, but it faces disproportionately large consequences of climate change. An estimated annual cost of environmental problems in Pakistan amounts to 6% of its GDP [18].

According to Khan [19] financial development mostly increases the level of carbon emission in Pakistan through the channel of economic growth. The State Bank of Pakistan (SBP), however, has taken the step to control environmental stress in the economy by promoting clean investment projects. SBP has signed an agreement with International Finance Corporation (IFC) to facilitate green financing [20]. JS Bank of Pakistan has approved Green Climate Fund (GCF). This motivates us to study the relationship between FD and environmental quality for Pakistan.

The study contributes in the literature by examining the asymmetric impacts of FD on CO2 emissions for Pakistan over the period 1972–2018. The asymmetric effect is captured by employing NARDL technique. NARDL is considered an efficient technique for exploring asymmetric impact where asymmetry explains whether positive or negative effect is dominant. To the best of our knowledge, this is the first study which investigates the asymmetric effect of FD on CO2 emissions in Pakistan. The previous studies mostly explored symmetric effects of FD on carbon emission. In the presence of asymmetric effects of FD on environment assuming symmetric relationships can give misleading results. This study examines the asymmetric impact of FD on the environment by employing NARDL.

The remaining study is structured in following sequence adapted from Engo [21]: Sect. 2 provides the related literature review. Section 3 explains the hypothesis specification, data and methodology. Section 4 reports the results and their interpretation. Finally, Sect. 5 concludes the study.

2 Literature Review

Financial development plays a vital role in influencing environmental quality [22]. The literature suggests both positive and negative effects of financial development on the environment. Yuxiang and Chen [11] argued that financial development reduces the emissions level by providing financial assistance to domestic firms for environmentally clean technologies. Moreover, Frankel and Rose [23] argued that financial market efficiently provides financial resources to domestic firms to support eco-friendly technologies for production processes.

Contrary, financial development can also lower the quality of environment in following ways [11]. Financial assistance to domestic firms can enhance the manufacturing activities, which lead to high CO2 emissions and land degradation. Similarly, FD can enhance the level of CO2 emissions if it attracts such foreign investment which promotes high energy consumption in the host county. Moreover, consumer credit leads more automobiles and machinery which consume more energy.

Other than assuming the only theoretical viewpoints, various studies have empirically analyzed the relationships between FD and CO2 emissions. Using panel data analysis, a group of the studies shows that FD decreases the CO2 emissions. Al-Mulali et al. [24] by taking the panel data of 129 countries show that FD leads to better environment through its negative influence on carbon emissions. Siddique et al. [6] by employing panel cointegration examine the FD and CO2 nexus for South Asia over the time period 1983–2013. They explore that FD reduces the carbon dioxide emissions. Majeed and Mazhar [25] examine the relationship of FD with the environment quality using a global panel data. They also confirm the favorable role of financial sector for the quality of environment.

Some studies find mixed evidence. For example, Onanuga [26] investigates the FD and carbon dioxide emission nexus for Sub Saharan Africa. He argued that FD reduces the carbon emissions in upper middle-income countries and increases the carbon emissions in lower middle-income and low-income countries. Some studies show that FD deteriorates the environment. For example, Tsaurai [11] examines the relationship between FD and CO2 for West African countries and finds out that FD increases the CO2.

Many studies found out mixed evidence on the relationship of FD with environment by employing ARDL approach of estimation using time series data. On one side, Jalil and Feridun [27] for China, Shahbaz et al. [28] for Indonesia and Alom et al. [29] for Bangladesh show that FD decreases the CO2 emissions. On the other hand, Zhang [12] for China, Shahbaz and Lean [9] for Tunisia, Tang and Tan [10] for Malaysia and Boutabba [30] for India examine the CO2 and FD nexus. One major limitation of these studies is that they employ linear ARDL approach to investigate the relationship of FD with the environment.

Recently, some studies reinvestigated the relationship between FD and the environment by employing non-linear ARDL. Ahmad et al. [31] investigated the asymmetric impact of financial development on carbon emission for China over the period 1980 to 2014 by employing NARDL. They showed that there exists a symmetric association between FD and carbon emission. Whereas, Lahiani [32] showed that FD has asymmetric impact on carbon emission in the case of China by applying NARDL.

In sum, many studies such as Zhang [12], Tang and Tan [10], Yuxiang and Chen [8], Onanuga [26], Ahmad et al. [31], Lahiani [32] have investigated the FD and CO2 nexus. However, these studies conducted empirical analysis by employing ARDL approach of estimation. Whereas, Ahmad et al. [31] and Lahiani [32] examined the asymmetric impact of FD on carbon emission for China. To the best of our knowledge, the asymmetric association between FD and the environment is not explored in the context of Pakistan. This study fills this research gap by empirically investigating the asymmetric effects of FD on carbon dioxide emissions for Pakistan over the period 1972–2018.

3 Hypothesis specification, data and methodology

3.1 Hypothesis

Our aim is to explore the type of relationship between FD and environmental quality that whether association between concerned variables is symmetric or asymmetric. Thus, the proposed null and alternative hypothesis is as follows:

Ho

There is asymmetric relationship between FD and CO2 emissions.

HA

There is symmetric relationship between FD and CO2 emissions.

3.2 Data and data sources

This study explores the asymmetric association between FD, economic growth, energy use and carbon dioxide emissions for Pakistan over the period 1972 to 2018. The data of all variables is taken from World Bank [33]. The dependent variable is CO2 emissions. Whereas, FD, economic growth and energy use are taken as explanatory variables. All the variables are taken in the log form. The description of the variables is presented in Table 1.

3.3 Empirical model

Following the study of Ahmad et al. [17] the simple regression model in linear form can be written as

where, CO2 is carbon dioxide emissions, FD is financial development, EG is economic growth and EU is energy use.

3.3.1 Model specification: ARDL

To explore the impact of FD on carbon dioxide emissions, we first use the standard method of ARDL. Equation 2 represents ARDL framework

In Eq. 2 the coefficients attached with difference operators (\({\alpha }_{1}\),\({\alpha }_{2}\),\({\alpha }_{3}\),\({\alpha }_{4}\)) measure short run dynamics, whereas, the terms with first lagged captures the long run relationship. In the next step, to estimate the short dynamics the error correction model (ECM) can be expressed in following form:

where, ECTt-1 is the error correction term and η indicates the speed of adjustment. We expect the negative relationship between ECM and dependent variable.

3.3.2 Model specification: NARDL

The long run relationship between variables can be estimated through ARDL, ECM, and Granger causality. But these linear models do not consider the nonlinear nature of the variables. To consider the nonlinear behavior of variables, Shin et al. [34] developed the method of NARDL by extending the Pesaran et al. [35] bound test approach.

The methodology of NARDL has been previously used by Ibrahim [36] for investigating the oil and food prices nexus, Bildirici and Ozaksoy [37] for the association between economic growth and woody consumption in South Africa, Bayramoglu and Yildirim [38] for the energy use and economic growth nexus in USA and Fareed et al. [39] for the nexus of tourism, terrorism and economic growth and Kumar et al. [40] for the asymmetric relationship between tourism and growth in Cook Island.

Equation 4 is the modified version of Eq. 1 in which the FD is composed into two separate groups namely positive and negative groups. Here, our parameters are; \({\beta =(\beta }_{o},{\beta }_{1}^{+},{\beta }_{2}^{-} {\beta }_{3},{\beta }_{4},)\) and \({FD}_{t}={FD}_{O}+ {FD}_{t}^{+}+{FD}_{t}^{-}\) are the vector of unknown long run (LR) parameters. Where \({FD}_{t}^{+} and {FD}_{t}^{-}\) represent the partial sum of negative and positive variation in \({FD}_{t}\):

The above-mentioned equation is based on positive and negative partial sum decomposition for examining the asymmetric effect of FD on CO2. Equation for NARDL is constructed following the methodology of Shin et al. [34]:

where (p, a, h and n) are the lag order. In Eq. 4 there is a chance of problem of hidden cointegration because of which Eq. 4 is not able to deliver correct interpretation of estimated asymmetric coefficient. To tackle this problem restriction is imposed on coefficient of Eq. 4 such as \(\beta _{1}^{ + } = ~{\raise0.7ex\hbox{${ - \vartheta _{2}^{ + } ~}$} \!\mathord{\left/ {\vphantom {{ - \vartheta _{2}^{ + } ~} {\delta _{1} }}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${\delta _{1} }$}}\) and \(\beta _{2}^{ - } = ~{\raise0.7ex\hbox{${ - \partial _{3}^{ - } ~}$} \!\mathord{\left/ {\vphantom {{ - \partial _{3}^{ - } ~} {\delta _{1} }}}\right.\kern-\nulldelimiterspace} \!\lower0.7ex\hbox{${\delta _{1} }$}}.\) The SR (short run) effect of increase in FD on carbon emission is estimated with \({\sum\nolimits_{i=0}^{n} \varnothing }_{i}^{+}\) whereas the SR impact of reduction in FD on carbon emission is estimated with \({\sum\nolimits_{i=0}^{n} \varnothing }_{i}^{-}\). So, this equation estimates the asymmetric impact of both SR & LR impact of FD on carbon dioxide emissions.

The ECM (error correction model) of Eq. 6 is portrayed as:

where \({\Pi }_{i} , {\mathrm{\rm P}}_{i}\) and \({\mathrm{\rm H}}_{i}\) are the SR coefficients and \({\Psi }_{i}^{+}, {\Psi }_{i}^{-}\) represent the short run symmetry adjustment. Moreover, \({\Omega }_{i}\) refers to coefficient of error correction term.

The process of NARDL consists of following steps; The first step in NARDL is to apply unit root test. The purpose of unit root test is to confirm that all the variables are integrated of order 0 or 1 or have mixed results, but no variable is integrated of order 2. To find the order of cointegration the traditional “Augmented Dickey Fuller” and “Phillips Perron” test of unit root are applied.

In the next step, through the method of Ordinary Least Squares Eq. 6 is formulated. In other words, in this step we generate the positive and negative series of FD as we want to examine asymmetric impact of FD on carbon dioxide. After formulating the Eq. 6 for improving the final form of NARDL model general to specific method has been employed by lowering insignificant lags. In the next step, a test for estimating the long LR association between the variables (included in the model) is employed by adopting the procedure of bounds testing techniques. The test consists of Wald F-test. The null hypothesis is, Ho: \({\delta }_{1}={\vartheta }_{2}^{+}={\partial }_{3}^{-}={\gamma }_{4}={\tau }_{5}=0\) whereas alternative is H1:\({\delta }_{1}\ne {\vartheta }_{2}^{+}\ne {\partial }_{3}^{-}\ne {\gamma }_{4}\ne {\tau }_{5}\ne 0\). Lastly, with the presence of cointegration the SR and LR asymmetric impact of FD on carbon dioxide is estimated. Moreover, “asymmetric cumulative multiplier effect” of one % change in \({FD}_{t-i}^{+}\) and \({FD}_{t-i}^{-}\) is formulated as:

It should be observed that as b → ∞,\({K}_{b}^{+}\)→\({\beta }_{1}^{+},\) & \({K}_{b}^{-}\)→\({\beta }_{2}^{-}\).

4 Results and discussion

The initial step in time series investigation is to check stationarity of series. The stationary of variables is essentially important for ruling out the possibility of spurious estimates. The ARDL bound test specifies that there should be no variable integrated of order two [I (2)] in the analysis. This study applied ADF and PP tests by including both intercept and trend components of the series. Table 2 illustrates the results obtained from these tests indicating that EG, CO2, FD and EU are integrated of order one [I (1)]. In other words, these variables are non-stationary at level but become stationary at first difference, thereby fulfilling the condition that no variable is integrated of order two [I (2)].

However, according to Perron [41] the results from ADF can be misleading when there are structural breaks in the data. Therefore, to confirm the integrating order of variables in the presence of structural breaks, Zivot and Andrews [8] unit root test is also applied and the results are represented in Table 3. The findings validate that all the variables used are I (1) and hence there is no series integrated of order 2 in the model.

After analysing the stationary the next step is to select the optimal lag and estimate the co-integrating relationship among the variables. Table 4 presents optimal lag specification criteria. This study selected the specification with the lags of (1, 0, 2, 0) based on Akaike Information Criterion (AIC).

This study employed Autoregressive distributed lag (ARDL) approach presented by Pesaran et al. [35]. One of the advantages of ARDL bound test is that it does not impose restriction on co-integration. Table 5 represents the results obtained through ARDL bound test. The results show that long run association exists between the variables as the null hypothesis of no co-integration is rejected.

After detecting the presence of long run relationship among the variables, the long run coefficients are estimated through ARDL approach. The results reported in Table 6 imply that the LR effect of FD on the environment is significant and positive. As the estimates indicate that 1% increase in FD leads to 0.12% incline in CO2 emissions. This rise indicates that the banking sector in Pakistan is not inducing environment friendly investments. To put differently, practicing green banking is not prevalent in Pakistan. The credit availability to private sector is available without any discrimination between clean and non-clean utilization of energy. Hence, FD takes place in Pakistan at the expense of rise in CO2. This finding is in accordance with Ahmad et al. [31] for China. The association between energy usage and CO2 is significantly positive. The coefficient suggests that CO2 emissions rise by 0.851% as a result of 1% upsurge in energy use. The result supports the findings of Ahmad et al. [31]. Furthermore, 1% increase in economic growth also raises CO2 emissions by 0.91%. This finding is supported by number of studies such as Ahmad et al. [31] and Lahiani [32].

Moving to the short run association between CO2 emissions and its potential determinants, Table 7 shows that the error correction mechanism exists. Further, convergence of variables to equilibrium is speedy since the ECT is negative and significant at 1% level of significance. The lag term of economic growth is negative and significant at 5% level of significance in the short run. However, energy use and FD are boosting CO2 emissions in Pakistan.

5 Estimates of non-linear auto regressive distributed lag (NARDL)

NARDL is employed to estimate the asymmetries in long-run and short-run associations between FD and CO2 emissions. The results of NARDL bounds test is reported in Table 8. The calculated F-statistics (5.429) exceeds the upper bounds critical value at 1% level of significance indicating that no-linear co-integration exists.

Moving to asymmetric ARDL, Table 9 represents estimated long run coefficients. The results show that there is asymmetric long-run relationship between FD and CO2 emissions. Due to the positive shock in FD, there is no significant impact on CO2 emissions. However, the emissions decrease by 0.182% because of the negative shock in FD. It implies that as FD decreases, production scale declines and carbon emissions fall significantly. Furthermore, decrease in FD also affects services related to consumption credit, thereby impeding the expansion of social consumption of various goods such as automobiles and electrical devices (Cetin et al. [42]). Similarly, ineffectively performing stock market reflects slow growth, thereby decreasing the confidence of investors. As a result, production and consumption activities are reduced, thereby lowering energy use and carbon emissions [13, 12]. Furthermore, the results show that there is significant difference in CO2 emissions in response to negative and positive shock in FD. The findings also reflect asymmetry in the form of sign of the coefficients. Therefore, there is asymmetric impact of FD on carbon emissions in Pakistan considering different significance, elasticity’s direction and the variation in FD.

Among control variables, the economic growth is strong and significant contributor to the rise in carbon emissions. This coefficient is close to the coefficient obtained from ARDL model. The positive association between economic growth and carbon emissions implies that the rise in GDP is achieved at the cost of environmental degradation. The demand for manufactured goods increases with higher income levels. Resultantly, industrialization takes place leading to environmental damage in the absence of eco-friendly production techniques. This result is in line with the findings of Aye and Edoja [43]. The impact of energy use on carbon emission is also positive and statistically significant. This positive sign implies that the sources which are used for fulfilling energy requirements in Pakistan are not environment friendly. In Pakistan most of the energy requirements are based on combustion of fossil fuel. This source of non-renewable energy is one of the major reasons of high emissions in the atmosphere (Aye and Edoja [43]).

Turning to the short-run estimates, the results show that CO2 emissions react to asymmetric variations in FD even in the short-run. However, the size of asymmetry between CO2 emissions and negative shock in FD is high and significant. The results show that the positive shock in FD is insignificant suggesting that the rise in FD cannot significantly contribute to the rise in CO2 emission in Pakistan. Therefore, the increase in FD cannot raise the carbon emissions and the fall in FD can decrease the emissions in Pakistan. Moreover, the error correction term is negative and significant confirming that adjustment towards equilibrium takes place and its pace is fast. In diagnostic tests, adjusted R-square suggests that our model has a good fit, Lagrange multiplier test for autocorrelation shows that there is issue of autocorrelation and Jarque–Bera test indicates that residuals are normally distributed. The Wald test also fails to accept the null hypothesis of LR symmetry, thereby re-confirming the presence of LR asymmetric effects of FD (Table 10).

We also disintegrate negative and positive components of FD through asymmetrical ARDL approach. Figure 1 represents the disintegrated negative component while Fig. 2 shows positive constituent of FD obtained through NARDL.

After analysing NARDL model the stability of the parameters is checked. Figure 3 illustrates that the parameters and variance are stable based on cumulative sum (CUSUM) and CUSUM of the squares at the 5% level of significance.

For plotting non-linearity, the dynamic multiplier graph is presented. This graph assesses the adjustment of asymmetry in LR because of negative and positive shocks in FD. The asymmetric adjustment is evident from positive and negative change curves at a particular time period. The dynamic multiplier graph in Fig. 4 shows that the negative shocks of FD has stronger effect on CO2 emissions as compared to the positive shocks.

6 Conclusion

This study examines the relationship among FD, economic growth, energy use and carbon emissions for Pakistan over the period 1972–2018. The empirical analysis is done by employing ARDL and NARDL models. The empirical results of NARDL validate the asymmetric associations between FD and CO2 as the emissions are largely affected by negative shocks in FD. The finding of ARDL shows that in the long run FD has significantly positive impact on carbon emissions in Pakistan. Furthermore, the dynamic multiplier analysis demonstrates that the negative shock of FD has stronger effect on CO2 as compared to the positive shocks. Moreover, the impact of economic growth and energy use is positive and highly significant indicating that both are the major contributors to enhanced carbon emissions in Pakistan.

Based on these findings, this study recommends several policies. First, as fall in FD negatively affects CO2 emissions, the policy makers may consider the development of financial sector while formulating environment protection policies. This can be done by regulating financial institutions and providing loan facilities for clean and carbon-free projects. Second, the impact of negative shocks in FD may also be worth considering while formulating financial sector policies. Third, as the result show that economic growth and energy use enhance carbon emissions, Pakistani government may strive to achieve high growth rate while decreasing carbon emissions through less utilization of coal. Similarly, reduction in the emissions maybe achieved by utilizing environment friendly sources of energy.

Further, it is evident from the findings that FD is a crucial determinant of CO2 emissions in Pakistan therefore, future forecast regarding FD and CO2 may be taken under consideration concerning China Pakistan Economic Corridor (CPEC)’ relevance in Pakistan’s economy. This study suggests that future studies can employ same methodology for other developing countries. Moreover, analysis can be done by applying other significant determinants of carbon emissions such as trade balance, vector specialization, globalization, total employment, and global value chain.

References

Majeed MT, Mumtaz S (2017) Happiness and environmental degradation: a global analysis. Pak J Commerce Soc Sci 11(3):753–772

Sirag A, Matemilola BT, Law SH, Bany-Ariffin AN (2018) Does environmental kuznets curve hypothesis exist? Evidence from dynamic panel threshold. J Environ Econ Policy 7(2):145–165

Dietz T, Rosa EA (1997) Effects of population and affluence on CO2 emissions. Proc Natl Acad Sci 94(1):175–179

Yuxiang K, Chen Z (2010) Financial development and environmental performance: Evidence from China. Environ Dev Econ 16(1):1–19

Majeed MT, Luni T (2019) Renewable energy, water, and environmental degradation: a global panel data approach. Pak J Commerce Soc Sci 13(3):749–778

Siddique HMA, Majeed MT, Ahmad HK (2016) The impact of urbanization and energy consumption on CO2 emissions in South Asia. South Asian Stud 31(2):745–757

Bello AK, Abimbola OM (2010) Does the level of economic growth influence environmental quality in Nigeria: a test of environmental Kuznets curve (EKC) hypothesis. Pak J Soc Sci 7(4):325–329

Zivot E, Andrews DWK (1992) Further evidence on the great crash, oil price shock and the unit root hypothesis. J Bus Econ Stat 10:251–270

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Tang CF, Tan BW (2014) The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Qual Quant 48(2):781–797

Tsaurai K (2019) The impact of financial development on carbon emissions in Africa. Int J Energy Econ Policy 9(3):144–153

Zhang YJ (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Gul F, Usman M, Majeed MT (2018) Financial inclusion and economic growth: a global perspective. J Bus Econ 10(2):133–152

Majeed MT, Noreen A (2018) Financial development and output volatility: a cross-sectional panel data analysis. Lahore J Econ 23(1):97–141

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32(1):137–145

Khan S, Majeed MT (2019) Decomposition and decoupling analysis of carbon emissions from economic growth: a case study of Pakistan. Pak J Commerce Soc Sci 13(4):868–891

Khan A, Jamil F, Khan NH (2019) Decomposition analysis of carbon dioxide emissions in Pakistan. SN Appl Sci 1(9):1012

Khan MA (2008) Financial development and economic growth in Pakistan: evidence based on autoregressive distributed lag (ARDL) approach. South Asia Econ J 9(2):375–391

Mumtaz MZ, Smith ZA (2019) Green finance for sustainable development in Pakistan. Islamabad Policy Res Inst J 2:1–34

Engo J (2019) Decoupling analysis of CO2 emissions from transport sector in Cameroon. Sustain Cities Soc 51:101732

Sanderson H, Irato DM, Cerezo NP, Duel H, Faria P, Torres EF (2019) How do climate risks affect corporations and how could they address these risks? SN Appl Sci 1(12):1720

Frankel J, Rose A (2002) An estimate of the effect of common currencies on trade and income. Q J Econ 117(2):437–466

Al-Mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22(19):14891–14900

Majeed MT, Mazhar M (2019) Financial development and ecological footprint: a global panel data analysis. Pak J Commerce Soc Sci 13(2):487–514

Onanuga, O.T. (2017). The impact of economic and financial development on carbon emissions: evidence from Sub-Saharan Africa. University of South Africa, Unpublished Doctoral Thesis.

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Shahbaz M, Hye QMA, Tiwari AK, Leitão NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sustain Energy Rev 25:109–121

Alom K, Uddin ANM, Islam N (2017) Energy consumption, CO2 emissions, urbanization and financial development in Bangladesh: vector error correction model. J Glob Econ Manage Bus Res 9(4):178–189

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Ahmad M, Khan Z, Ur Rahman Z, Khan S (2018) Does financial development asymmetrically affect CO2 emissions in China? An application of the nonlinear autoregressive distributed lag (NARDL) Model. Carbon Manage 9(6):631–644

Lahiani, A. (2019). Is financial development good for the environment? An asymmetric analysis with CO2 emissions in China. Environ Sci Pollut Res 1–9

World Bank (2019). World Development Indicators. Washington, DC: World Bank. https://data.worldbank.org/products/wdi. Accessed 20 Sept 2019

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. Festschrift in honor of Peter Schmidt. Springer, New York, pp 281–314

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16(3):289–326

Ibrahim MH (2015) Oil and food prices in Malaysia: a nonlinear ARDL analysis. Agric Food Econ 3(1):2–15

Bildirici M, Ozaksoy F (2017) The relationship between woody biomass consumption and economic growth: nonlinear ARDL and causality. J For Econ 27:60–69

Bayramoglu AT, Yildirim E (2017) The relationship between energy consumption and economic growth in the USA: a non-linear ARDL bounds test approach. Energy Power Eng 9(03):170–185

Fareed Z, Meo MS, Zulfiqar B, Shahzad F, Wang N (2018) Nexus of tourism, terrorism, and economic growth in Thailand: new evidence from asymmetric ARDL cointegration approach. Asia Pac J Tour Res 23(12):1129–1141

Kumar N, Kumar RR, Kumar R, Stauvermann PJ (2019) Is the tourism–growth relationship asymmetric in the Cook Islands? Evidence from NARDL cointegration and causality tests. Tour Econ. https://doi.org/10.1177/1354816619859712

Perron P (1989) Testing for a unit root in a time series with a changing mean. J Bus Econ Stat 8(2):153–162

Cetin M, Ecevit E, Yucel AG (2018) The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: empirical evidence from Turkey. Environ Sci Pollut Res 25(36):36589–36603

Aye GC, Edoja PE (2017) Effect of economic growth on CO2 emission in developing countries: evidence from a dynamic panel threshold model. Cogent Econ Finan 5(1):1379239

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Majeed, M.T., Samreen, I., Tauqir, A. et al. The asymmetric relationship between financial development and CO2 emissions: the case of Pakistan. SN Appl. Sci. 2, 827 (2020). https://doi.org/10.1007/s42452-020-2627-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s42452-020-2627-1