Abstract

This study investigates the impact of globalization, financial development, and energy utilization on environmental sustainability in the Gulf Cooperation Council (GCC) countries. GCC countries are currently experiencing higher demand and utilization of energy resources, high global integration, and improvements in the financial sector that poses serious environmental sustainability challenges. We have employed a relatively comprehensive proxy, i.e., ecological footprint for environmental sustainability and more advanced and robust econometric strategies (second-generation) to examine the impact of globalization, financial development, and energy utilization on environmental sustainability in the GCC countries, which have a significant departure from the extant literature. The results of this study show that globalization, financial development, and energy utilization are significantly deteriorating the environmental quality in the GCC countries. Additionally, in order to account for the national heterogeneity, we have performed country-specific analysis and interestingly, results reveal that globalization, financial development, and energy utilization negatively influence the environmental sustainability in each sample country that is consistent with the findings of overall panel. Furthermore, the findings are robust to various robustness checks that we have performed for checking the reliability of our main findings. This study also offers some useful policy implications to the stakeholder in general and specifically concerning the GCC countries for promoting their environmental sustainability.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Currently, sustainable development is a priority/leading goal for every country across the world. Sustainable development is an inclusive concept that is comprised of three pillars, such as economic, social, and environmental sustainability. However, a major hurdle in materializing the sustainable development goal is the environmental degradation that results from the increasing emission of greenhouse gasses (GHGs). It has become a major challenge for sustainable development and relatively a high concern for the world community due to its hazardous effects on human health and ecological conditions (Ulucak et al. 2019).

Environmental suitability has attracted huge scholarly attention in the extant literature and it is still a heated debate among scholars. The researchers have examined and reported the various determinants of environmental quality and recommend sources to build a sustainable environment. Among others, recently, the globalization, financial development, and energy utilization are considered the major determinants of environmental quality and got a huge attention. Specifically, the existing literature (e.g., Yang et al. 2020; Godil et al. 2020; Lahiani 2020; Munir et al. 2020; Shahbaz et al. 2019; Rehman et al. 2019; Maa et al. 2011) studied the effect of globalization, financial development, and energy utilization on environmental quality (proxy with CO2 emissions). However, the existing literature still has not reached a consensus regarding the specific effects of aforementioned variables on environmental quality.

In the existing environmental quality literature, scholars have commonly used carbon dioxide (CO2) emission to proxy for environmental sustainability/quality. However, CO2 emission as a proxy of environmental degradation is subject to wide criticism. Researchers argue that CO2 emission constitutes only a small portion of the overall environment scenario and it also does not fully capture the environmental degradation (Sabir and Gorus 2019; Zafar et al. 2019a, b; Al-Mulali and Ozturk 2015). Similarly, Bartelmus (2008) articulated that although CO2 emission is commonly analyzed in environmental literature, however, there are some other factors, e.g., quality of soil, forest, cropping, and water, that are severely vulnerable to the ecological threats, although these factors are an important part of the ecosystem but got limited attention in the existing literature.

In the same vein, Ulucak and Apergis (2018) argued that CO2 emission is not an inclusive proxy of environmental sustainability; specifically, it does not consider the stocks of resources, e.g., oil, soil, mining, and forests. Nevertheless, there is a need to employ a comprehensive proxy in environmental quality modeling that mimics the limitations associated with CO2 emissions and provides useful insight to policymakers about environmental sustainability. In this context, ecological footprint (EFP) is broadly recognized as a more comprehensive indicator of environmental degradation specifically the environmental sustainability (Solarin 2019; Ozcan et al. 2019; Bilgili and Ulucak 2018; Lin et al. 2018; Ulucak and Lin 2017). Hence, recently, environmental literature widely uses the EFP for the proxy of ecological sustainability in the empirical studies such as Saud et al. (2020), Destek and Sinha (2020), Ahmed and Wang (2019) and Chen et al. (2010).

Global Footprint Network states that the EFP “measures the ecological assets that a given population requires to produce the natural resources it consumes”. This indicator is comprised of six types of different environmental areas for instance cropland, grazing land, fishing grounds, built-up land, forest land, and carbon footprint and it portrays the broad concept of environmental sustainability. To the best of our knowledge, there is no available scholarly evidence on the role of globalization, financial development, and energy utilization in environmental quality by using the EFP in context of the Gulf Cooperation Council (GCC) countries. The GCC integration is composed of six Gulf countries (i.e., Saudi Arabia, United Arab Emirates, Bahrain, Qatar, Oman, and Kuwait) which are rich in energy resources, e.g., it owns 19.8% of the global natural gas reserves (BPSTATS 2019) and UAE, Qatar, and Saudi Arabia are among the highest CO2 emitters in the world (Wilson 2009). The fossil fuel–based natural resources are an important pillar of these economies and these countries used the revenue generated from exports of fossil fuel in industrial development, which causes the serious harm to the environmental quality (Omri et al. 2015).

Furthermore, these countries are having a small share of renewable energy sources in their energy = mix and depend heavily on fossil fuel–based energy. In this scenario, the demand of energy consumption in this group of countries owing to population growth, urbanization, and economic development is increasing and poses a serious challenge to environmental quality (Ansari et al. 2020). The GCC countries are experiencing a significant rise in the energy demand, for example, Qatar required the highest energy demand among others and its energy demands are expected to rise from 10 to 15% between 2010 and 2020 (Bekhet et al. 2017). They also articulated that these blocks of countries contribute 2.4% of the global GHGs and interestingly, as compared to the European Union (EU) countries, CO2 emission from this region is higher. Furthermore, Ansari et al. (2020) argued that these countries are having higher per capita income which could indirectly contribute to environmental degradation by increasing the demand and luxurious consumption (an income effect).

Another contemporary subject in the academic debate is globalization, which has a huge and multidimensional effect on the socio-economic perspective of human beings across the world (Saud et al. 2020). In this regard, globalization is defined as a complex phenomenon, which is comprised of economic, social, cultural, technological, and environmental interaction among nations (Rennen and Martens 2003). Currently, the world is experiencing an unprecedented cross-national, economic, social, and political interaction, which has significant effects on environmental quality (Hoekstra and Wiedmann 2014). Similarly, the GCC countries are also more oriented towards the world integration. According to the KOF globalization index, GCC countries are continuously progressing in terms of global integration (becoming more globalized) which potentially have significant environmental consequences. However, Hoekstra and Wiedmann (2014) stated that globalization has increased the ecological effect due to the rise in human demand on the ecosystem that consequently leads to unsustainable EFP. Interestingly, the majority of the existing literature focused on the impact of globalization has reported the diverse evidence in various contextual settings. For example, Yang et al. (2020), Yilanci and Gorus (2020), Koçak and Ulucak (2019), and Balsalobre-Lorente et al. (2020) studied the impact of globalization on the environment and reported a negative influence of globalization on the environment, whereas Etokakpan et al. (2020) and Chishti et al. (2020) reported a positive impact of globalization on environmental quality.

Globalization also results in the integration of cross-national financial sectors and leads to greater financial development, which is a significant determinant of the economic environment and environmental quality. However, the nexus between financial development and environmental quality are very complex. Both theoretical and empirical literature hold the contrasting evidence regarding the role of financial development in environmental degradation. For example, financial development positively influences the environment (Lu 2018; Bekhet et al. 2017; Shahbaz et al. 2016). In contrast, financial development and environmental quality have significantly adverse relationship in various contextual settings (Saidi and Mbarek 2017; Dogan and Seker 2016; Omri et al. 2015). The financial sector in GCC countries is making remarkable progress. Specifically, credit growth in the GCC countries has increased rapidly (Sturm et al. 2008). The higher expansion of money supply in GCC countries potentially accelerates the economic activities in the private sector (Bridges et al. 2014). Hence, the developed financial sector of GCC countries will expand the economic activities and it will exert more pressure on the environmental sustainability.

Foregoing discussion revealed/established that globalization, financial development, and energy utilization have diversified repercussions on the environmental sustainability and GCC countries are currently experiencing their higher demand and energy consumption, more global integration, and improvements in the financial sector. Hence, environmental sustainability is a serious challenge for the GCC countries, although there are wide concerns in GCC countries concerning with EFP. However, literature divulges a scarcity of scholarly evidence on the impact of the aforementioned variables (i.e., globalization, financial development, and energy utilization) on environmental quality. More specifically, to the best of our knowledge, there is no available scholarly evidence on the role of globalization, financial development, and energy utilization in the environmental quality by using the EFP in context of GCC countries. Hence, it is imperative to study the dynamic impact of globalization, financial development, and energy utilization on environmental sustainability in GCC countries and help the policymakers in general and specifically in particular GCC countries in more pragmatic environmental planning and optimal environmental sustainability.

On the given backdrop, the current study makes several contributions to the existing environmental literature. The GCC countries are currently in the critical development phase and experiencing a remarkable rise in global integration (Sturm et al. 2008), financial development (Bekhet et al. 2017), and energy demand (Kinninmont 2010) which have potentially serious repercussions for the environmental quality. Interestingly, energy utilization and financial development play a vital role in the development process of an economy (Bekhet et al. 2017) and hence cannot be sacrificed. This reality has posed a practical challenge for the policymakers in GCC countries to take urgent measures for combating the upcoming climate challenge potentially provoked by the rise in energy utilization, financial development, and globalization while maintaining the economic growth process. However, to the best of knowledge, there is no scholarly evidence on the effects of globalization, energy utilization, and financial development in the GCC context. Taking this opportunity, this is the first study that investigates the effects of given variables on environmental quality in the GCC countries and offers several valuable policy implications to stakeholders.

The findings suggest that globalization, financial development, and energy utilization are adversely influencing the environmental quality in the case of GCC countries and there is a dire need for urgent policy intervention to reverse this relationship and make the sustainable economic growth process in the GCC countries. Furthermore, this study is the first that has employed EFP to approximate environmental quality and studied its dynamic nexus between globalization, financial development, and energy utilization in the context of GCC countries and supplements the existing literature. Prior literature on the subject used CO2 emission to proxy environmental quality, which is widely criticized by researchers for its incomprehensive nature. Hence, this study uses EFP, a more comprehensive proxy of environmental quality that gives more inclusive insight to the policymakers concerning the nexus between globalization, financial development, and energy utilization in GCC countries. Additionally, the current study has used relatively advanced and robust econometric strategies for empirical analysis which adds to the efficient and reliability of our findings for environmental implications.

The rest of this study is organized as follows: Section 2 presents the literature review. Section 3 contains the data description and model specification, Section 4 provides a methodological framework, Sections 5 concludes the empirical results and discussion and finally, Section 6 discusses the conclusion and policy implications.

Literature review

The nexus between globalization, financial development, energy utilization, and ecological footprint has been documented in various empirical studies and these studies discussed in the following headings.

Globalization and the environment

There is an emerging debate on the impact of globalization on environmental quality. Theoretically, the existing literature identified three main mechanisms which globalization influences the environmental quality, namely scale, composition, and technique effect (Grossman and Krueger 1995; McAusland 2010). According to the scale effect, increase in globalization will enhance the investment and production of goods that augments the energy utilization and thereby increased the CO2 emissions which leads to increase the environmental degradation (Destek and Sarkodie 2019). The composition effect implies that the effect of globalization on environmental quality depends on the changes in an industrial structure of particular country due to globalization (Zaidi et al. 2019). However, globalization results in the expansion of a low GHG emission industry (e.g., service industry) and contraction of high GHGs emitting industry then total emission will reduce and globalization will not be hazardous for the environment and vice versa (Brock and Taylor 2005). Lastly, the technique effect represents via several channels by which globalization influences the level of GHG emission by the households and industries and ultimately effect on environmental quality. These channels include several changes in the environmental protection, regulation, and technological innovation or eco-friendly technology transfer induced by globalization (Lin et al. 2016). In this perspective, Wang et al. (2019) argued that globalization significantly promotes the technological advancement and hence reduces the environmental degradation. Several empirical studies examined the effect of globalization on environmental degradation and reported diverse findings.

Recently, Saud et al. (2020) studied the influence of FD on environmental degradation proxied with EFP and reported that globalization has the ability to reduce the environmental degradation in the case of One Belt One Road (OBOR). Furthermore, they argued that globalization brings green technologies and innovative methods of production which boosts the economic growth with minimum emissions and lend support for the technique effect of globalization. In the same vein, Yang et al. (2020) applied the Generalized Method of Moments (GMM) to scrutinize the association between energy consumption, globalization, and the environment in 97 countries. The findings revealed that globalization has a significantly favorable effect on environmental quality and this evidence is consistent with the ecological modernization theory. Similarly, Ibrahiem and Hanafy (2020) examined the dynamic relationship among globalization, real income, fossil fuel, and ecological footprint in the case of Egypt spanning from 1971 to 2014. The results revealed that fossil fuel consumption enhances the environmental pollution while globalization reduces the CO2 emission. Furthermore, a similar effect of globalization on environmental quality exists in emerging economies (Ulucak et al. 2020).

On the other hand, several studies have reported an adverse effect of globalization on environmental sustainability. For instance, Yilanci and Gorus (2020) studied the impact of globalization on ecological footprints in 14 Middle East and North Africa (MENA) countries from 1981 to 2016. The findings revealed that globalization undermines the environmental quality through scale effects. Likewise, Usman et al. (2020a) examined the links among renewable energy, globalization, and EFP and reported that renewable energy reduces the EFP, while globalization augments the environmental degradation by increasing the fossil fuel consumption and strongly supports the channel of scale effect. Suki et al. (2020) inspected the nexus between globalization and environmental sustainability in Malaysia from 1970 to 2018. Their empirical evidence indicated that globalization significantly enhances the environmental pollution due to fact that most of the industries rely on fossil-based energy (i.e., coal, oil, and natural gas) in the sample countries. Similarly, Le and Ozturk (2020) found that globalization undermines environmental quality. They contend that globalization negatively influences the environment quality due to low trade barriers and poor environmental governance/weak environmental regulation in the sample countries. The given review of the literature shows that globalization has a diverse effect on environmental quality and the academic literature still does not reach any consensus.

Financial development and environment

Theoretically, researchers hold contradictory viewpoints about the effect of financial development (hereafter FD) on environmental quality. Several studies explored that FD could help to minimize the environmental degradation by channelizing investment in renewable energy infrastructures and by providing funds to the enterprises for eco-friendly technological innovation and/or technology transfer from advanced countries (Islam et al. 2013; Tamazian et al. 2009; Dasgupta et al. 2001). Contrary to this, some studies examined that FD increases the environmental degradation by providing funds at a lower cost to the enterprises for expansion of their production facilities and on the other hand FD could also provide consumption finance to the individual that increase the purchase of energy-intensive equipment, e.g., automobile and other appliance (Nwani and Omoke 2020; Dogan and Seker 2016). In the results of such arguments, FD significantly enhances the energy utilization and increases the GHG emission that leads to increase the environmental degradation.

Many researchers have explored the link between FD and ecological footprint across the globe and found the diverse evidence (Charfeddine and Kahia 2019; Salahuddin et al. 2018; Katircioğlu and Taşpinar 2017). In their empirical studies, Bayar et al. (2020) used the dynamic seemingly unrelated cointegration regressions (DSUR) estimator to observe the nexus between FD and environment in 11 post-transition European economies and the result demonstrated that FD and energy utilization worsen the environmental quality. Similarly, Hussain et al. (2020) examined FD and globalization with environment sustainability represented by CO2 emissions. Interestingly, the results explored that FD and globalization are positively correlated with environmental degradation indicating that the financial sector is not offering a significant opportunity to green energy technologies in sample countries. Likewise, Godil et al. (2020) probed the causal link among the tourism, FD, and ecological footprint for Turkey state during the spanning from 1986 to 2018. The outcome of this empirical study revealed that FD, globalization, and tourism were significant with environmental degradation.

However, several empirical studies reported the environment-friendly role of FD in different panels. Among others, recently, Lahiani (2020) tested the influence of FD on ecological footprint and found that FD contributes to promote the environmental quality in the case of China because FD provides funds to enterprises for environmental projects, which enhance the level of productivity and minimize the energy utilization. Similarly, Saidi and Mbarek (2017) studied the association among FD and environmental sustainability using the GMM model from 1990 to 2013. The results of the study indicated that FD negatively influences the environmental quality and further results suggest that green financial reforms to reverse this relationship. However, Dogan and Seker (2016) evaluated the impact of FD on the environmental degradation from 1985 and 2011. The results show that an increase in FD enhances the environmental degradation in the long-run. However, Zaidi et al. (2019) documented the negative association between FD and environmental degradation suggesting that FD could offer a significant opportunity to eco-friendly technology which helps to improve the environmental quality. Similar findings are reported by Zafar et al. (2019a) in the context of OECD economies.

In sum, the literature shows that the effect of FD on environmental quality could be positive or negative. The aggregate effect would be determined by the relative size of positive and negative effects.

Energy utilization and environment

Energy utilization is a principal driving factor for the process of economic growth and development of all the countries. However, it is also a major source of GHGs that are hazardous for the environmental quality (Pan et al. 2020). Specifically, the use of fossil fuels is associated with GHG emission and environmental degradation. Hence, countries need to reduce or control the use of fossil fuels to reduce the GHG emission and thereby ensure the environmental sustainability. In this context, the researchers suggested that the government can participate by increasing the energy efficiency and by replacing fossil energy with other alternative renewable energy resources (Mahalik et al. 2020). Usman et al. (2020b) examined the link of FDI, energy utilization, and trade openness with the environment in 33 upper-middle income (UMIC) countries during the period from 1994 to 2017. The results expressed that FDI and energy utilization enhance the environmental degradation. Similarly, Nathaniel et al. (2020) analyzed the GDP, urbanization, renewable energy, trade openness, and ecological footprint nexus in the case of CIVETS countries from 1990 to 2017. The outcome of the study documented that renewable energy and trade openness significantly improve the environmental quality, whereas GDP growth and urbanization significantly enhance the environmental degradation. Yang et al. (2020) contended that energy utilization worsens the environmental quality in 97 global economies due to the usage of massive fossil fuel in the production process.

In another massive study, Baz et al. (2020) examined the link of GDP and energy utilization on the environment quality from 1971 to 2014. The study applied the nonlinear-autoregressive distributed lag (ARDL) method for performing the empirical investigation. The empirical results indicated that energy utilization and GDP are deteriorating the environmental quality due to the high use of fossil fuel–based energy. Based on such findings, this study further suggested policymakers should install advanced environment-friendly production technologies and shift their resources from fossil fuel to renewable energy resources. In the same vein, Danish et al. (2020) documented that a positive association between renewable energy and environmental quality and suggested that an increase in renewable energy utilization tends to improve the environmental quality. Similarly, Sharif et al. (2020) reported that renewable energy utilization reduces the environmental degradation in Turkey. For the nineteen developed and developing economies, Apergis et al. (2010) investigated the association between environmental sustainability and energy utilization from 1984 to 2007. The results of this study revealed that energy utilization is positive associated with environmental degradation. Likewise, Asongu et al. (2020) explored the dynamic nexus between energy utilization and environmental sustainability. The outcomes of the study indicated that energy utilization is a key element of environmental degradation. Given this review of literature shows that the utilization of fossil fuel energy deteriorates the environmental quality; however, the adverse effect of energy utilization on the environmental quality can be reduced by enhancing the efficiency of energy utilization and shifting to the renewable and low polluting energy resources.

Economic growth, urbanization, and environment

A large number of studies have investigated the connection between urbanization, economic growth, and CO2 emissions, e.g., Destek and Sinha (2020) and Anser et al. (2020), and reported that economic growth and urbanization are significantly associated with environmental degradation. Therefore, we have employed the economic growth and urbanization as controls for environmental degradation. In this regard, Ahmed et al. (2020a, b) investigated the association between GDP, human capital, urbanization, and environmental sustainability measure by the ecological footprint in the case of China from 1970 to 2016. The results indicated that urbanization significantly enhances the environmental degradation along with the GDP growth. Furthermore, the study also found that enhanced human capital improves the environmental quality. Similarly, Nathaniel et al. (2020) examined the link of urbanization, GDP, and renewable energy utilization with ecological footprint. The findings of the study documented that urbanization and GDP enhanced the environmental pollution because coal is the major source of fossil fuel energy to fulfill the energy demand of the urban population in these countries. Likewise, Ahmed et al. (2020b) evaluated the influence of urbanization, human capital, and economic growth on the environmental sustainability from 1971 to 2014. Their findings show that urbanization and GDP are positively linked with environmental pollution emphasized that enlarged economic activities are probably associated with the massive use of fossil fuel energies in G-7 countries. In the same sense, Rahman and Vu (2020) examined the role of urbanization and GDP growth on environmental sustainability in the case of Canadian economy. The findings of the empirical analysis concluded that urbanization and GDP enhanced environmental degradation. In another pioneer study, Danish et al. (2020) investigated the association of natural resources, GDP, and urbanization with environmental sustainability in BRICSFootnote 1 countries during the time period from 1992 to 2016. The outcomes of the study reported that natural resources, urbanization, and energy utilization reduce the environmental degradation in the long-run. In sum, both economic growth and urbanization significantly explain the environmental quality and must be included in the model to avoid omitted variables bias.

Data, model specification, and methodology

Data presentation and descriptive statistics

The main objective of this study is to explore the long-run association between globalization, financial development, economic growth, energy utilization, urbanization, and ecological footprint by employing the longitudinal data from 1990 to 2017 for six Gulf Cooperation Council (GCC) countries named as Oman, Bahrain, Saudi Arab, Kuwait, United Arab Emirates, and Qatar. The variable ecological footprint (EFP) is measured in an aggregate of six comprehensive indicator such as built-up land, fishing grounds, cropland, grazing land, carbon, and forest land footprints in term of global hectares per capita; the data of globalization index (GLO) is calculated in an aggregate of political, social, and economic globalization; the financial development index (FD) data from the international monetary fund (IMF) consists of a recently developed financial development index by utilizing different complex and multidimensional type of financial development indicators. The financial development index comprises financial institutions and financial markets according to their efficiency, depth, and access. The range of this FD index is between 0 and 1. However, we converted it into 0 and 100 due to comfortableness with all other variables as accomplished by Usman et al. (2020c, d). The data of GDP per capita is measured in constant 2010 US dollars; energy utilization (EC) is calculated in kilograms of oil equivalent per capita, and the data of urbanization (URB) is taken in total urban population. The data of GDP, energy utilization, and urbanization are extracted from World Development Indicator (World Bank 2019). The data of financial development is gathered from IMF (2019) and the data on globalization is extracted from Dreher (2006) and finally, the data of ecological footprint is retrieved from Global Footprint Network (GFPN 2019).

Table 1 explores the descriptive statistics of the analyzed variables employed in this article. This explores that the largest and smallest average value of EFP is 2.831 in Qatar and 0.238 Kuwait, respectively. The most globalize country from GCC economies is Kuwait which shows the highest mean value (4.301), while the least globalized economy is Oman that shows the lowest mean value (3.800). The highly financially developed country is Qatar (11.151) and the lowest financially developed economy is Saudi Arabia (2.937). The highest mean value of GDP (11.151) explores that Qatar is the most developed country, while the lowest mean value (9.581) shows that the poorest country is Oman in the GCC region. The maximum value of energy consumption (10.004) is observed in the case of Qatar which explores the most energy utilized country, while the least energy utilized country is Kuwait (7.189). On average, the most urbanized country is Saudi Arabia (17.136), while the lowest value of urbanization (12.987) in the case of Bahrain and (12.998) Qatar state, respectively.

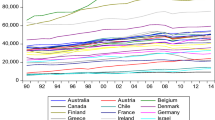

Table 2 explores the correlation matrix of the concerned variable from the GCC countries. The highly positive correlation (0.718) is observed between energy utilization and GDP per capita, while a highly negative correlation (−0.465) exists between urbanization and energy utilization. Appendix Figs. 2–7 reveal the trend comparison of all GCC countries of concerned variables over the five-year interval data (1990–2017).

Model specification

This study examined the influence of globalization, financial development, energy utilization, urbanization, and economic growth on the ecological footprint in the case of GCC countries. For this intention, the panel version of the econometric model is expressed as follows:

In Eq. 1, EFP shows the total ecological footprint; GLO indicates the globalization index; FD illustrates as financial development index; GDPPC denotes the economic growth per capita; EC indicates the energy utilization; and URB presents the total urban population; i and t denote the six GCC countries and given time dimension (1990–2017), respectively. To overcome the chances of heteroscedasticity and data sharpness, all variables are transformed into the natural logarithmic algorithm. Thus, Eq. 1 is expressed as follows:

where, in Eq. 2, β0 = ln A0 denotes the constant term and the term μit shows the contemporaneous error term, i and t denote the cross-section (countries) and given time periods respectively. β1, β2, β3, β4, and β5 signify the elasticity of candidate variables.

Methodological frameworks

Cross-sectional dependence tests

In most of the cases, panel data estimation strategies ignore the problem of cross-sectional dependency (CSD) that may produce bias and misleading information and unreliable results (forecasting error). The possible CSD exists due to the presence of a geographical and spatial effect, externalities, unknown mutual shocks, individual-specific effects and financial, globalization, and economic integration (Usman et al. 2020b). Therefore, there is a dire requirement to check this serious CSD problem, whether it exists or not across all cross-sections. In order to detect this problem, we employed four different CSD tests, such as Pesaran (2004a, b); Breusch and Pagan (1980); Pesaran et al. (2008); and finally, bias-corrected scaled LM test (Baltagi et al. 2012). Pesaran (2004a, b) proposed a CSD test that is described in Eq. 3 as follows:

Pesaran et al. (2008) proposed another CSD test named as biased-adjusted CSD test that can be expressed in Eq. 4 as follows:

where i and t denote the individual cross-sections and time dimensions, respectively, while the term p^ij denotes the estimated multivariate cross-sectional correlation of error terms across all cross-sections i and j.

This study also employs another CSD test which is Lagrange Multiplier (LM) type CSD test. However, one key disadvantage of LM test is that this test may produce misleading outcomes when the cross-sections are greater than time periods (N > T). In this scenario, Pesaran (2004a, b) proposed another CSD test on the basis of same way like Lagrange multiplier test statistics. It also in the form of a scaled version of Lagrange multiplier test statistics. The mathematical expression of Pesaran (2004a, b) is presented in Eq. 5 as follows:

The functional form of Breusch and Pagan (1980) CSD test is formulated in Eq. 6 as follows:

where the term \( p{\hat{\mkern6mu}}_{ij}^2 \) shows the residual estimated correlated parameters from ordinary least square regression. The null and alternative hypothesis of all abovementioned cross-sectional dependence test is presented in Eqs. 7 and 8 as follows:

Against

Considering the results of CSD from Table 3, the null hypothesis of no CSD among cross-sections is rejected at 1% significance level according to all four different CSD tests. These results indicating that an unpredictable shock (positive or negative) that occurred in one of these GCC countries may spill over the other countries. The presence of CSD implies that second-generation econometric procedure will generate more robust and consistent outcomes.

Panel unit root test

After testing the cross-sectional dependence of data, the very next step of the empirical investigation is to check the integration order and stationarity level of all concerned variables. To do this intention, initially, the current study employed two first-generation unit root tests named as Maddala and Wu (MW), and I’m Pesaran and Shin (IPS) as proposed by (Maddala and Wu 1999; Im et al. 2003). However, the main drawback of first-generation unit root tests is unable to consider the CSD problem in the dataset. Therefore, to address this CSD issue, Pesaran (2007) developed second-generation stationarity tests named as cross-sectionally augmented Im, Pesaran, and Shin (CIPS), and cross-sectionally augmented Dickey-Fuller (CADF) tests that tackle this possible CSD problem. Unlike the first-generation panel stationarity tests, Pesaran supplements the ADF regressions with mean of the cross-section at a level and their first integrated order I(1) of every cross-section to eliminate the CSD problem. The Pesaran (2007) CADF test statistics is described in Eq. 9 as follows:

where \( {\overline{y}}_{t-1} \) denotes the mean of cross-sections at a lagged level for all N cross-sections and T periods, while the term Δ\( {\overline{y}}_{t-j} \) denoted as the first integration order of cross-section means for every cross-section. The Pesaran (2007) CIPS test statistics is expressed in Eq. 10 as follows:

where ti (N, T) explores the t-statistics in CADF regression from Eq. 5.

The outcomes of IPS and Maddala and Wu unit root tests are reported in Table 4 which are quite similar, signifying that all variables are following the process of unit root at level, but it turns to stationary after their first integration order I(1). Simultaneously, the findings of second-generation panel unit root tests are also reported in Table 4, indicating that they fail to reject the null hypothesis of no stationary at a level. In contrast, all variables are stationary at integrated of the first difference I(1) in the panel of all six GCC countries. These findings of all unit root tests indicate that all concerned variables used in the current study are stationary and it is useful to check long-run cointegration among variables.

Westerlund cointegration test

Unlike the first-generation panel cointegration tests, Westerlund (2007) proposed a second-generation cointegration test which addresses the problem of CSD in the dataset. This test is based on structural dynamics against the first-generation based on residual dynamics. Westerlund cointegration test explores two group test statistics (Gτ and Ga) and two-panel test statistics (Pτ and Pa). The null hypothesis of both group and panel test statistics shows the absence of cointegration relationship among variables H0: αi = 0 and the alternative hypothesis H1: αi < 0 explores the long-run cointegration exists at least in one group or one panel, where the term αi denotes the weighted average of estimated slope parameters for each cross-section i with individual t-ratios. The error correction technique of Westerlund cointegration test is expressed in Eq. 11 as follows:

where dt = (1, t)′ contains the deterministic trend and intercept components for all i cross-sections with δ′i = (δi1and δ2i)′ and i and t denote the unit of all cross-sections and time dimensions, respectively. Test statistics from group cointegration is estimated by the given Eqs. 12 and 13 as follows:

Test statistics from panel cointegration can be estimated by the following Eqs. 14 and 15 as follows:

where Ψi indicates the convergence speed of adjustment from short-run to long-run equilibrium.

Fully modified ordinary least square cointegration regression

After revealing the long-run cointegration among series, we further estimate the magnitude of long-run elasticity by employing a fully modified ordinary least square (FMOLS) approach (Pedroni 2001). The superiority of the FMOLS approach is to overcome the issue of serial correlation, simultaneity bias, and endogeneity problem from the estimated coefficients of the longitudinal dataset (Ozcan 2013; Rahman and Velayutham 2020). It also produces robust outcomes in the case of a small sample (micronumerasticity) that illustrates the non-parametric technique of regression estimates. For panel dataset, Pedroni (2001) suggests the following cointegrated system in Eq. 16 as follows:

where X and Z are the vectors of cointegrated. The mathematical form of FMOLS estimates is expressed in Eq. 17 as follows:

where \( {\hat{\upbeta}}_{\mathrm{GFM},n}^{\ast } \) denotes the FMOLS regression coefficient applied to an individual for all cross-sections n and the concerned t-statistic coefficient that can be presented in Eq. 18 as follows:

Finally, in order to check the robustness of this test, Neal (2015) provided a two-stage least square (2SLS) version of this estimator such as a common correlated effect with 2SLS simulation (referred as CCE-2SLS) to account for any cross-sectional dependency and endogenous regressors. The estimator of long-run elasticity enlarges on common correlated effect (CCE) and dynamic common correlated effect (DCCE) by employing different instrument set to additionally capture for endogenous regressors in static as well as dynamic models (Neal 2015). The mathematical expression of the static CCE-2SLS model is expressed in Eq. 19 as follows:

where the vector \( {\hat{Z}}_{it} \) denotes the independent variables vector of static model. Now in the same way for considering the process of data generation structure, the current study will present only the static version process of CCE estimator with the help of 2SLS simulation (CCE-2SLS).

Panel causality test

The final step of econometric analysis is to discover the causality relationship among analyzed variables. Therefore, the current study employed Dumitrescu and Hurlin (2012) at which takes into account the CSD problem. The Dumitrescu and Hurlin (D-H) granger non-causality test is based on individual Wald test statistics of averagely non-causality relationships across all individual units (Usman et al. 2020c). The panel D-H causality test is formulated in Eq. 20 as follows:

where X and Z denote the estimated observables; \( {\beta}_i^j \)and \( {\lambda}_i^j \)show the estimates of regression parameters and estimates of autoregressive parameters, and these are assumed to fluctuate across individual cross-sections. The null hypothesis was estimated by average Wald test statistics that is expressed in Eq. 21 as follows:

where Wi,T denotes the Wald test statistic of all individuals for the unit of every cross-section. The null and alternative hypothesis of D-H causality test is presented in Eqs. in 22 and 23 as follows:

Results and discussion

Results of panel cointegration tests

In order to confirm the long-run association among variables, whether it exists or not, we checked the long-run relationship among variables. In the presence of cross-sectional dependency among variables, first-generation cointegration tests may produce biased, inconsistent, and unreliable; therefore, the findings from these tests might provide misleading information about long-run cointegration among variables. Thus, the second-generation cointegration Westerlund (2007) test is employed. The outcomes of this test are expressed in Table 5. At first glance, it can be observed that the outcomes of the Westerlund cointegration test are quite mixed. The results illustrate that this test failed to reject the null hypothesis of no cointegration for Ga and Pa with asymptotic and robust probability values. However, the results for Gτ and Pτ provide sufficient evidence to reject the null hypothesis of no cointegration with asymptotic and robust probability values. This confirms that the variables of globalization, financial development, energy consumption, economic growth, urbanization, and ecological footprint contain long-run cointegration over the period from 1990 to 2017 in the GCC region.

Results of long-run elasticity estimates

To further explore the long-run relationship among concerned variables such as GLO, FD, GDPPC, EC, URB, and EFP variables in the cointegration relation of each panel using the fully modified ordinary least square (FMOLS) and the common correlated effects with two-stage least square (CCE-2SLS) procedure, the results of FMOLS test are reported in Table 6. The results show that GLO has a positive and significant effect on the environmental deficit (EFP). More specifically, a 1% increase in GLO will lead to an increase of 0.478% in the long-term at 1% significance level. This finding confirms that GLO is the main factor for environmental degradation. Consistent with these findings, GCC countries need to about the transformation of environmental-friendly technology and define strict rules and regulations (R&R) for polluted sourced industries, which contribute to more environmental degradation. This segment of results is found in similar lines with the finding of previous studies such as Ansari et al. (2020), Akadiri et al. (2020), Etokakpan et al. (2020). Besides, the findings disclose that there established a positive and significant association among financial development (FD) and ecological footprint (EFP), and the results explore that a 1% influence in FD will lead to an increase the environmental degradation by 0.615%. This scenario concludes that FD endorses employment opportunities through high investment incentives, which enhances the demand for energy utilization due to high economic growth in the cost of ecological sustainability (Shahbaz and Lean 2012). The results are consistent with the finding of Amin et al. (2020), Ibrahiem (2020), and Saud et al. (2020). The results of this article suggest that the developing states of an economy must consider two important interlinked concerns: economic development and environmental sustainability.

Regarding the coefficient of economic growth, it has also a significant positive impact on EFP in GCC countries. More specifically, a 1% increase in GDPPC will lead to an increase in the EFP by 0.841%. It shows that an augmentation in real income leads to a reduction in environmental quality; this is due to GCC economies going from first to last for structural transformation (from oil-based economies to financially developed and industrial economies). Moreover, the economic growth of these countries is based on the fabrication of basic primary goods that are more energy-intensive without considering the environmental laws. Thus, this consequently leads to deterioration of the environmental quality. Our results are consistent with the findings of Usman et al. (2020b), Khalid et al. (2020), and Solarin et al. (2017). On contrary, Shahbaz et al. (2013) affirmed that GDP growth enhances the environmental quality and this is only possible through the appliance of eco-efficient technologies.

The elasticity of energy utilization is also statistically significant and positive, demonstrating that a 1% influence in energy utilization is linked with a 0.702% rise in EFP. The conventional sources of energy consumption cause environmental damages as energy is engendered from fossil fuels and it is commonly observed that fossil fuels generate waste material, release mercury, and emit carbon dioxide which raises the carbon footprint level. This finding is similar to those found by Wasti and Zaidi (2020), Khan et al. (2020), Usman et al. (2020d) and Yang et al. (2020). There is a common consensus on the adverse impact of energy consumption on environmental quality (Inglesi-Lotz and Dogan 2018). In this row, one possible strategy to battle for environmental humiliation should be provided to financially support for organizations to spotlight on cheaper production from the utilization of renewable energy consumption. The second possible strategy should be to implement policies to increase the household’s awareness of different types of energy utilization and their effects on environmental quality. Finally, concerning the connection between urbanization (URB) and environment deficit, the findings explore a positive but insignificant relationship between urbanization and EFP in the panel of GCC countries.

Results of country-wise long-run elasticity estimates

The long-run panel data investigation is before deliberated in the previous part of this study. Nevertheless, the dynamic links between globalization, financial development, energy utilization, and ecological footprint for country-specific are remarkable. Additionally, this study explores the long-run investigation of the ecological footprint for the time series data of each GCC country. The FMOLS method is applied for the estimation of long-run analysis and results are provided in Table 7. The result indicates that GLO has a positive influence on the ecological footprint in GCC countries. Especially, a 1% increase in GLO will enhance the environmental damages in the case of 4 GCC countries such as Bahrain, Kuwait, Qatar, and UAE with 0.589%, 0.335%, 0.551%, and 0.755%, respectively. In GCC countries, UAE has a more globalized country (Gygli et al. 2019) and globalization in UAE increased from 40.6% in 1971 to 74.13% in 2017. This result illustrates that globalization enhances the use of energy, which in turn upsurges the ecological footprint. It might be due to that technology shift through foreign direct investment and trade openness is not well-organized and energy saving in these countries, which makes the globalization, might increase the ecological footprint. So, the policymakers should impose a Pigouvian tax on those industries which emit CO2 more than the threshold level and deteriorate the environmental quality. These results coincide with the findings of Ansari et al. (2020) and Bekun et al. (2020). Furthermore, the outcome of FD indicates that it has a statistically significant and positive influence on the ecological footprint in GCC countries. A 1% increase in FD leads to an increase in the ecological footprint in the case of Kuwait, Qatar, Saudi Arabia, and UAE by 1.172%, 0.988%, 0.393%, and 0.510%, respectively. Consequently, such results advocate that the government should help to establish a well-developed financial system with public-private partnerships (PPP) that these activities tend to finance in more technological innovation instead of scale expansion. The financial sector can perform a vital role in subsidiary research and development (R&D), aiming at evolving renewable and cleaner energy. These results are consistent with the finding of Amin et al. (2020), Ibrahiem (2020), and Usman et al. (2020c). Conversely, the coefficient of economic growth (GDPPC) has a positive and statically significant influence on the ecological footprint in GCC countries; particularly, 1% increase in GDPPC leads to 1.599%, 1.868%, 0.683%, 0.108%, 0.716%, and 0.391% increase the EFP in the case of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and UAE countries. These findings show that an increase of economic activity has departed hand in hand with continued environmental deprivation. Furthermore, the long-run elasticity of ecological footprint related to energy utilization has a positive impact in the case of all GCC countries. More precisely, a 1% increase in energy consumption will lead to increase the EFP in the case of Bahrain, Kuwait, Oman, Saudi Arabia, and UAE by 1.774%, 0.034%, 0.756%, 1.615%, 0.173%, and 0.831%, respectively. The GCC countries hold almost a 3rd of established global crude oil reserves and 5th of the world gas reserves countries (BP 2018). By 2025, it is predictable that GCC countries’ population will reach approximately 60 million; moreover, the total electrical energy consumption will be reached to 1095 TWh. The main power (fuels) in GCC countries used for electricity generation is natural gas tailed by crude oil and the other is divided among diesel, light oil, renewable sources, and heavy fuel oil (BP 2018). Due to these concerns, we recommend to policymakers and central body, the government will provide more incentives to investors of the private sector in clean and green power generation. Furthermore, the technology of these countries should be shifted from their conventional energy sources to clean and renewable energy sources. These results are in line with the finding of Yang et al. (2020), Usman et al. (2020a, b), Khalid et al. (2020). Furthermore, the coefficient of the urban population (URB) has a negative and statically significant influence on EPF in the case of Qatar and Saudi Arabia countries. To some extent, the abovementioned results prove that the urbanized population performs a vital part in overcoming the ecological footprint in these countries. Specifically, a 1% increase in URB will lead to an increase in environmental pollution in the case of Qatar and Saudi Arabia by − 0.045% and − 0.463%, respectively. These findings coincide in line with the finding of Wang et al. (2014). Besides, urban population demonstrated the positive influence on the ecological footprint in the case of Oman depicting that a 1% increase in URB will lead to increase the EFP by 0.204% in long-run and these findings are consistent with the previous study of Anser et al. (2020) and Khoshnevis Yazdi and Dariani (2019). The impact of URB can be explained through the concept that the duration of initial phase of urbanization, the transportation system of such countries is expanded, increase the demand of electronic commodities and increased the amount of financial institutions are established. All these indicators increase the demand for conventional energy sources, consequently, which in turn increase the ecological footprint level of particular country (Akadiri et al. 2020).

For robustness analysis, the current study performed our estimation results using an alternative method, i.e., common correlated effect with 2SLS simulation (referred to as CCE-2SLS).Footnote 2 To do this intention, we employ the common correlated effect approach of Pesaran (2006) and Chudik and Pesaran (2015) with two-stage least squares (2SLS). Table 6 also reports the findings of the regressions analysis by employing the CCE-2SLS method. In sum, the findings of this method are consistent with the findings of the FMOLS approach as reported in Table 6.

Results of panel Dumitrescu and Hurlin (D-H) pairwise non-causality test

Finally, the last step of the econometric procedure of empirical analysis is to discover the causality relationship among candidate variables, i.e., globalization, financial development, per capita income, energy utilization, urbanization, and ecological footprint. Once the long-run cointegration is confirmed, there should be a unidirectional or bidirectional causality relationship that exists among variables/series. We explore this relationship within the panel D-H causality framework which can counter the problem of cross-sectional dependency. The causality relationship exists between two series (y and x) if the current value of x is forecasted by employing the lag value of y series (Intisar et al. 2020).

Table 8 reveals that a unidirectional causality relationship is discovered from EFP to GLO, from EFP to FD, from EFP to GDPPC, from FD to GLO, from FD to GDPPC, from FD to EC, and from FD to URB in the whole panel of GCC countries. In contrast, a bidirectional causality relationship is discovered between EC and EFP, between URB and EFP, between EC and GLO, between URB and GLO, between URB and GDPPC, between EC and GDPPC, and finally between EC and URB (Table 8; Fig. 1). However, there is no causal relationship observed between per capita income and globalization. Our empirical results are consistent with some previous studies (i.e., Bello et al. 2018; Wang and Dong 2019; Khalid et al. 2020; and Usman et al. 2020b, c, d) in the case of different panel countries. The findings drawn from Table 8 and Fig. 1 will provide significant help to central authority and policymakers in formulating and implementation of efficient policies (control pollution level) for the GCC countries in the future.

Conclusion and policy suggestion

To examine the role of globalization, financial development with energy utilization and determination of environmental degradation, the current article investigates the dynamic impact of globalization, financial development, economic growth, energy consumption, and urbanization on ecological footprint during the period from 1990 to 2017 in the case of GCC countries. To do this intention, the ecological footprint, a more aggregate variable (based on six different environmental indicators) is utilized to quantify the environmental degradation in current research (Wang et al. 2019). For such reasons, the association among these under-examined variables is inspected by utilizing the second-generation approach, which addresses the problem of slope heterogeneity and cross-sectional dependency (CSD) across cross-sections.

The problem of CSD among GCC countries is the projected situation due to trade agreements, globalization, and financial and economic integration, and our empirical results verify that CSD is valid across GCC economies. Therefore, we employed a second-generation methodology to estimate the robust and consistent results. First- and second-generation panel unit tests suggest that all variables are following the unit root property at a level while, after taking the first difference, it turns to be stationary at I(1). Furthermore, Westerlund cointegration test confirms the existence of long-run relationships among concerned variables. In order to examine the empirical estimation, the magnitude of long-run coefficients/elasticity of concerning variables, fully modified ordinary least square (FMOLS), and common correlated effect mean group with 2SLS (CCE-2SLS) estimation approaches were applied. Consistent with the FMOLS estimation approach, it is observed that globalization, financial development, and primary energy utilization are significantly deteriorating the environmental quality in the GCC region. More specifically, country-specific results discover that financial development, energy utilization, and globalization have a positive influence in increasing the level of ecological footprint while urbanization has an adverse effect on the ecological footprint in the case of Qatar and Saudi Arabia state. Moreover, the outcomes of panel D-H causality test show that a unidirectional causality is running from ecological footprint to globalization, from ecological footprint to financial development, from ecological footprint to GDP growth, from financial development to globalization, from financial development to GDP growth, from financial development to energy utilization, and from financial development to urbanization in the case of GCC countries. In contrast, the bidirectional causality relationship discovered between energy utilization and ecological footprint, among urbanization and ecological footprint, between energy utilization and globalization, between urbanization and globalization, between urbanization and GDP growth, between energy utilization and GDP growth, and finally between energy utilization and urbanization in GCC region.

Based on these findings, we recommend the following policy implication to the governments, policymakers, and stakeholders in general and specifically concerning GCC countries for environmental sustainability. Firstly, since the globalization boosts the economy in GCC countries; however, it adversely influencing the environmental quality and hinders sustainable development in GCC countries. Therefore, we recommend to the policymakers in GCC countries they should not ignore the globalization factor in the policy framework regarding a sustainable environment and strike a balance between the economic benefits of globalization and its hazardous effects on environmental sustainability. The policymakers should encourage foreign direct investment only in the environmentally sustainable sectors and must welcome that investment in pollution-free industry, which brings environmentally friendly production technologies, skills, and methods in the GCC countries. In this context, governments can use legal and regulatory frameworks that discourage environmentally unsustainable foreign capital investment and incentivizing environmental-friendly investment through tax rebates, etc.

Secondly, the positive nexuses between financial development and environmental quality indicate that financial development in GCC countries is environmentally unsustainable. A plausible reason for such unsustainable financial development in GCC is that the enterprises are focusing on the expansion of their production scale rather than using credit finance for developing or importing environmentally friendly production technologies. Therefore, we suggest the government should devise strict financial regulations and monitoring mechanisms regarding environmentally sustainable finance, to divert substantial financial resources for building environmentally friendly production facilities either through research and development (R&D) or technology transfer from technologically advanced countries. Finally, energy utilization also yields a positive impact on environmental quality in the GCC countries. Energy utilization is essential for economic development; therefore, we suggest to policymakers in GCC countries to devise a policy framework for enhancing the cost-effective renewable energy resources to alleviate the issue of environmental sustainability without compromising the pace of economic development.

While the current study has significant policy implications, it has also some limitations that can be addressed in future research. Firstly, this study is focused only on six GCC countries; therefore, the findings of this study cannot be generalized in other countries. Therefore, we recommend the researchers in the future to examine the nexuses between globalization, financial development, energy utilization, and environmental sustainability by taking global sample. Secondly, globalization and financial development are complex and multidimensional variables; however, the current study only investigates the holistic impact of both globalization and financial development on environmental degradation. Future studies can also determine the impact of each dimension of globalization (i.e., social, economic, and political) and financial development (i.e., financial deepening, financial access, and financial efficiency) on environmental quality to help policymakers in devising a more comprehensive policy for achieving a sustainable environment. Furthermore, future research can also examine the conditioning role of green macroprudential regulations and institutional quality in the relationship between globalization, financial development, and environmental quality for more instructive policy implications.

Data availability

The datasets used and/or analyzed during the current study are variability from the corresponding author on reasonable request.

Notes

Brazil, Russia, India, China, and South Africa

The regression of CCE-2SLS is estimated applying the STATA command: XTCCE which provided by Neal (2015) (http://fmwww.bc.edu/repec/bocode/x/xtcce.ado). The possible endogenous series are instrumented with using their first two lags in the regression.

References

Ahmed Z, Wang Z (2019) Investigating the impact of human capital on the ecological footprint in India: an empirical analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05911-7

Ahmed Z, Asghar MM, Malik MN, Nawaz K (2020a) Moving towards a sustainable environment: the dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China [forthcoming]. Res Policy 67:101677. https://doi.org/10.1016/j.resourpol.2020.101677

Ahmed Z, Zafar MW, Ali S, Danish (2020b) Linking urbanization, human capital, and the ecological footprint in G7 countries: an empirical analysis. Sustain Cities Soc 55:102064. https://doi.org/10.1016/j.scs.2020.102064

Akadiri SS, Alola AA, Bekun FV, Etokakpan MU (2020) Does electricity consumption and globalization increase pollutant emissions? Implications for environmental sustainability target for China. Environ Sci Pollut Res 27:25450–25460. https://doi.org/10.1007/s11356-020-08784-3

Al-Mulali U, Ozturk I (2015) The effect of energy consumption, urbanization, trade openness, industrial output, and the political stability on the environmental degradation in the MENA (Middle East and North African) region. Energy. 84:382–389. https://doi.org/10.1016/j.energy.2015.03.004

Amin A, Dogan E, Khan Z (2020) The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Sci Total Environ 740:140127. https://doi.org/10.1016/j.scitotenv.2020.140127

Ansari MA, Ahmad MR, Siddique S, Mansoor K (2020) An environment Kuznets curve for ecological footprint: Evidence from GCC countries. Carbon Manag 11:1–14. https://doi.org/10.1080/17583004.2020.1790242

Anser MK, Alharthi M, Aziz B, Wasim S (2020) Impact of urbanization, economic growth, and population size on residential carbon emissions in the SAARC countries. Clean Techn Environ Policy 22:923–936. https://doi.org/10.1007/s10098-020-01833-y

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69:2255–2260. https://doi.org/10.1016/j.ecolecon.2010.06.014

Asongu SA, Agboola MO, Alola AA, Bekun FV (2020) The criticality of growth, urbanization, electricity and fossil fuel consumption to environment sustainability in Africa. Sci Total Environ 712:136376. https://doi.org/10.1016/j.scitotenv.2019.136376

Balsalobre-Lorente D, Driha OM, Shahbaz M, Sinha A (2020) The effects of tourism and globalization over environmental degradation in developed countries. Environ Sci Pollut Res 27(7):7130–7144. https://doi.org/10.1007/s11356-019-07372-4

Baltagi BH, Feng Q, Kao C (2012) A Lagrange Multiplier test for cross-sectional dependence in a fixed effects panel data model. J Econ 170:164–177. https://doi.org/10.1016/j.jeconom.2012.04.004

Bartelmus P (2008) Quantitative eco-nomics: how sustainable are our economies? https://doi.org/10.1007/978-1-4020-6966-6

Bayar Y, Maxim LD, Maxim A (2020) Financial development and CO2 emissions in post-transition European union countries. Sustain. 12:1–15. https://doi.org/10.3390/su12072640

Baz K, Xu D, Ali H, Ali I, Khan I, Khan MM, Cheng J (2020) Asymmetric impact of energy consumption and economic growth on ecological footprint: using asymmetric and nonlinear approach. Sci Total Environ 718:137364. https://doi.org/10.1016/j.scitotenv.2020.137364

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132. https://doi.org/10.1016/j.rser.2016.11.089

Bekun FV, Yalçiner K, Etokakpan MU, Alola AA (2020) Renewed evidence of environmental sustainability from globalization and energy consumption over economic growth in China. Environ Sci Pollut Res 27:29644–29658. https://doi.org/10.1007/s11356-020-08866-2

Bello MO, Solarin SA, Yen YY (2018) The impact of electricity consumption on CO2 emission, carbon footprint, water footprint and ecological footprint: the role of hydropower in an emerging economy. J Environ Manag 219:218–230. https://doi.org/10.1016/j.jenvman.2018.04.101

Bilgili F, Ulucak R (2018) Is there deterministic, stochastic, and/or club convergence in ecological footprint indicator among G20 countries? Environ Sci Pollut Res 25:35404–35419. https://doi.org/10.1007/s11356-018-3457-1

BP p.l.c (2018) Statistical review of world energy 2018, BP statistical review of world energy

BPSTATS (2019) BP statistical review of world energy statistical review of world, 68th edition, The Editor BP Statistical Review of World Energy

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47:239. https://doi.org/10.2307/2297111

Bridges J, Gregory D, Nielsen M, Pezzini S, Radia A, Spaltro M (2014) The impact of capital requirements on bank lending. SSRN Electron J. https://doi.org/10.2139/ssrn.2388773

Brock WA, Taylor MS (2005) Chapter 28 Economic growth and the environment: a review of theory and empirics, in: handbook of economic growth. https://doi.org/10.1016/S1574-0684(05)01028-2

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213. https://doi.org/10.1016/j.renene.2019.01.010

Chen DD, Gao WS, Chen YQ, Zhang Q (2010) Ecological footprint analysis of food consumption of rural residents in China in the latest 30 years, in: agriculture and agricultural science Procedia. https://doi.org/10.1016/j.aaspro.2010.09.013

Chishti MZ, Ullah S, Ozturk I, Usman A (2020) Examining the asymmetric effects of globalization and tourism on pollution emissions in South Asia. Environ Sci Pollut Res 27:27721–27737. https://doi.org/10.1007/s11356-020-09057-9

Chudik A, Pesaran MH (2015) Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J Econ 188:393–420. https://doi.org/10.1016/j.jeconom.2015.03.007

Danish, Ulucak R, Khan SUD (2020) Determinants of the ecological footprint: role of renewable energy, natural resources, and urbanization. Sustain Cities Soc 54:101996. https://doi.org/10.1016/j.scs.2019.101996

Dasgupta S, Laplante B, Mamingi N (2001) Pollution and capital markets in developing countries. J Environ Econ Manag 42:310–335. https://doi.org/10.1006/jeem.2000.1161

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489. https://doi.org/10.1016/j.scitotenv.2018.10.017

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic co-operation and development countries. J Clean Prod 242:118537. https://doi.org/10.1016/j.jclepro.2019.118537

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085. https://doi.org/10.1016/j.rser.2016.02.006

Dreher A (2006) Does globalization affect growth? Evidence from a new index of globalization. Appl Econ 38:1091–1110. https://doi.org/10.1080/00036840500392078

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29:1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Etokakpan MU, Adedoyin FF, Vedat Y, Bekun FV (2020) Does globalization in Turkey induce increased energy consumption: insights into its environmental pros and cons. Environ Sci Pollut Res 27:26125–26140. https://doi.org/10.1007/s11356-020-08714-3

Global Footprint Network (2019) Ecological Footprint data explored. https://data.footprintnetwork.org/?_ga=2.7296946.149831906.1606291266-2090921687.1605624496#/countryTrends?cn=5001&type=BCtot,EFCtot. Accessed 20 June 2020

Godil DI, Sharif A, Rafique S, Jermsittiparsert K (2020) The asymmetric effect of tourism, financial development, and globalization on ecological footprint in Turkey. Environ Sci Pollut Res 27:40109–40120. https://doi.org/10.1007/s11356-020-09937-0

Grossman GM, Krueger AB (1995) Economic growth and the environment. The Quarterly Journal of Economics 110(2):353–377. https://doi.org/10.2307/2118443

Gygli S, Haelg F, Potrafke N, Sturm J-E (2019) The KOF globalisation index-revisited the review of international organizations. Rev Int Organ 14:543–574. https://doi.org/10.1007/s11558-019-09344-2

Hoekstra AY, Wiedmann TO (2014) Humanity’s unsustainable environmental footprint. Science (80- ). https://doi.org/10.1126/science.1248365

Hussain HI, Slusarczyk B, Kamarudin F, Thaker HMT, Szczepańska-Woszczyna K (2020) An investigation of an adaptive neuro-fuzzy inference system to predict the relationship among energy intensity, globalization, and financial development in major ASEAN economies. Energies 13. https://doi.org/10.3390/en13040850

Ibrahiem DM (2020) Do technological innovations and financial development improve environmental quality in Egypt? Environ Sci Pollut Res 27:10869–10881. https://doi.org/10.1007/s11356-019-07585-7

Ibrahiem DM, Hanafy SA (2020) Dynamic linkages amongst ecological footprints, fossil fuel energy consumption and globalization: an empirical analysis. Manag Environ Qual Int J 31:1549–1568. https://doi.org/10.1108/MEQ-02-2020-0029

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115:53–74. https://doi.org/10.1016/S0304-4076(03)00092-7

IMF (2019) International Monetary Fund, International Monetary Fund data explored. http://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B. Accessed 20 June 2020

Inglesi-Lotz R, Dogan E (2018) The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub- Saharan Africa’s Βig 10 electricity generators. Renew Energy 123:36–43. https://doi.org/10.1016/j.renene.2018.02.041

Intisar RA, Yaseen MR, Kousar R, Usman M, Amjad Makhdum MS (2020) Impact of trade openness and human capital on economic growth: a comparative investigation of asian countries. Sustain. 12. https://doi.org/10.3390/su12072930

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model. https://doi.org/10.1016/j.econmod.2012.09.033

Katircioğlu ST, Taşpinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sust Energ Rev 68:572–586. https://doi.org/10.1016/j.rser.2016.09.127

Khalid K, Usman M, Mehdi MA (2020) The determinants of environmental quality in the SAARC region: a spatial heterogeneous panel data approach. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10896-9

Khan MK, Khan MI, Rehan M (2020) The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ Innov 6:1–13. https://doi.org/10.1186/s40854-019-0162-0

Khoshnevis Yazdi S, Dariani AG (2019) CO2 emissions, urbanisation and economic growth: evidence from Asian countries. Econ Res Istraz 32:510–530. https://doi.org/10.1080/1331677X.2018.1556107

Kinninmont J (2010) The GCC in 2020 : resources for the future. Economist Intelligence Unit

Koçak E, Ulucak ZŞ (2019) The effect of energy R&D expenditures on CO 2 emission reduction: estimation of the STIRPAT model for OECD countries. Environ Sci Pollut Res 26:14328–14338. https://doi.org/10.1007/s11356-019-04712-2

Lahiani A (2020) Is financial development good for the environment? An asymmetric analysis with CO2 emissions in China. Environ Sci Pollut Res 27:7901–7909. https://doi.org/10.1007/s11356-019-07467-y

Le HP, Ozturk I (2020) The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ Sci Pollut Res 27:22680–22697. https://doi.org/10.1007/s11356-020-08812-2

Lin B, Omoju OE, Nwakeze NM, Okonkwo JU, Megbowon ET (2016) Is the environmental Kuznets curve hypothesis a sound basis for environmental policy in Africa? J Clean Prod 133:712–724. https://doi.org/10.1016/j.jclepro.2016.05.173

Lin W, Li Y, Li X, Xu D (2018) The dynamic analysis and evaluation on tourist ecological footprint of city: take Shanghai as an instance. Sustain Cities Soc 37:541–549. https://doi.org/10.1016/j.scs.2017.12.003

Lu WC (2018) The impacts of information and communication technology, energy consumption, financial development, and economic growth on carbon dioxide emissions in 12 Asian countries. Mitig Adapt Strateg Glob Chang 23:1351–1365. https://doi.org/10.1007/s11027-018-9787-y

Maa C, Ju MT, Zhang XC, Li HY (2011) Energy consumption and carbon emissions in a coastal city in China. Procedia Environ Sci 4:1–9. https://doi.org/10.1016/j.proenv.2011.03.001

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxf Bull Econ Stat 61:631–652. https://doi.org/10.1111/1468-0084.61.s1.13

Mahalik MK, Mallick H, Padhan H (2020) Do educational levels influence the environmental quality? The role of renewable and non-renewable energy demand in selected BRICS countries with a new policy perspective. Renew Energy 164:419–432. https://doi.org/10.1016/j.renene.2020.09.090

McAusland C (2010) Globalisation’s direct and indirect effects on the environment, in: Globalisation, transport and the environment. https://doi.org/10.1787/9789264072916-4-en

Munir Q, Lean HH, Smyth R (2020) CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: a cross-sectional dependence approach. Energy Econ 85:104571. https://doi.org/10.1016/j.eneco.2019.104571

Nathaniel S, Nwodo O, Sharma G, Shah M (2020) Renewable energy, urbanization, and ecological footprint linkage in CIVETS. Environ Sci Pollut Res 27:19616–19629. https://doi.org/10.1007/s11356-020-08466-0

Neal BT (2015) Estimating heterogeneous coefficients in panel data models with endogenous regressors and common factors. Work Pap

Nwani C, Omoke PC (2020) Does bank credit to the private sector promote low-carbon development in Brazil? An extended STIRPAT analysis using dynamic ARDL simulations. Environ Sci Pollut Res 27:31408–31426. https://doi.org/10.1007/s11356-020-09415-7

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252. https://doi.org/10.1016/j.eneco.2015.01.008

Ozcan B (2013) The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: a panel data analysis. Energy Policy 62:1138–1147. https://doi.org/10.1016/j.enpol.2013.07.016

Ozcan B, Ulucak R, Dogan E (2019) Analyzing long lasting effects of environmental policies: evidence from low, middle and high income economies. Sustain Cities Soc 44:130–143. https://doi.org/10.1016/j.scs.2018.09.025

Pan XX, Chen ML, Ying LM, Zhang FF (2020) An empirical study on energy utilization efficiency, economic development, and sustainable management. Environ Sci Pollut Res 27:12874–12881. https://doi.org/10.1007/s11356-019-04787-x

Pedroni P (2001) Purchasing power parity tests in cointegrated panels. Rev Econ Stat 83:727–731. https://doi.org/10.1162/003465301753237803

Pesaran HM (2004a) General diagnostic tests for cross-section dependence in panels. Fac Econ. https://doi.org/10.17863/CAM.5113