Abstract

n players choose investment levels that determine a bargaining problem. Investments model pre-bargaining preparations such as arming and hiring legal aid—costly actions that turn out to be beneficial only if the agents do not reach an agreement. In the bargaining problem, payoffs are distributed according to an exogenously given bargaining solution. Investment influences positively the investor’s disagreement payoff, but it also has a cost, which is modeled as a shrinkage of the feasible set. Two types of shrinkage are considered. Under either one, the investment is a waste from an ex-post point of view, because the agents end up reaching an agreement. The equilibrium level of wastefulness is increasing in the bargaining solution’s disagreement sensitivity. The Kalai-Smorodinsky solution is less disagreement sensitive than the Nash solution, and is therefore better.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Bargaining situations are often preceded by a stage in which agents invest in their fallback positions, although they can benefit directly from this investment only in case of conflict, which never materializes—because after the fallback investments have been made, a compromise is reached between the bargaining parties. For example, before the beginning of negotiations, each party “lawyers up,” because if negotiations break down the parties go to court, and each side prepares for this eventuality, although it does not materialize in equilibrium. International disputes are another example: a country benefits from having a strong army, even if, in equilibrium, all jets remain in their hangars. By its sheer presence, a strong army/strong legal team steers the terms of the deal in the agent’s favor. This effect rationalizes costly pre-bargaining activities, despite the fact that the investment could have been spent more productively, by increasing the parties’ joint surplus, rather than the individual fallback positions.

In Nash’s (1950) bargaining model, a bargaining problem is defined as a pair, (S, d), where S is the set of feasible utility allocations, out of which a single allocation needs to be selected, and d is some Pareto inefficient point of S that specifies the players’ fallback positions (the “disagreement point”). A bargaining solution is a function that assigns a feasible utility allocation to every problem. Such a problem (S, d) can be used as a building block in a 2-stage game that models the aforementioned phenomenon: first, the players make investments that determine the feasible set and the disagreement point, where investment by player i affects favorably the disagreement payoff \(d_i\) but hurts the feasibility set S; next, given (S, d), payoffs are distributed according to some exogenously given bargaining solution. Below I study such 2-stage games.

I start with the basic model, in which each player i chooses an investment level, \(a_i\in [0,1]\). The investments determine a feasible set and a disagreement point as follows:

-

(I) The feasible set is \(\lambda (a_1,\ldots ,a_n)\cdot S\), where S is some fixed set and \(\lambda \) is a shrinkage function that satisfies \(\lambda (0,\cdots ,0)=1\) and is strictly decreasing; that is, the greater pre-bargaining investment is, the larger the shrinkage is.

-

(II) The disagreement point is \((a_1-\frac{1}{n}\sum a_i,\cdots ,a_n-\frac{1}{n}\sum a_i)\). Namely, in the event of disagreement, each player’s payoff is equal to the advantage above, or disadvantage below, the average investment.

The rationale for (I) is that every dollar spent in preparations is a waste from the social point of view, irrespective of who spent it. For example, in the international relations context, every dollar a country spends in improving its military capabilities is a waste in the following sense: given that armed conflict does not materialize in equilibrium, the dollar could have been directed to alternative productive usages within the country, and at least theoretically could have been used to increase welfare in other countries. In the legal example mentioned above, every dollar spent on “lawyering up” is lost if no one goes to court in equilibrium.

The rationale for (II) is that “disagreement” means “fight.” More formally, given disagreement, the players participate in a zero-sum game, and the vector \((a_1-\frac{1}{n}\sum a_i,\cdots ,a_n-\frac{1}{n}\sum a_i)\) stands for the equilibrium-payoffs in this game. In this game, improving i’s position goes hand-in-hand with hurting i’s opponents, and all that matters is how one stands with respect to others. Being above average is advantageous and translates to a positive payoff, whereas being below translates to a negative payoff.Footnote 1\(^,\)Footnote 2

A bargaining solution’s disagreement sensitivity is the degree to which an increment in one’s disagreement payoff increases one’s solution payoff. Under some conditions, the basic model has a unique equilibrium. The equilibrium investment level is increasing in the bargaining solution’s disagreement sensitivity. This investment is wasteful, because in equilibrium everybody invests the same amount, so the disagreement point does not change (it remains the origin), but the feasible set shrinks. Thus, disagreement sensitivity implies a Pareto ranking of bargaining solutions.

Next, I turn to the modified model, where the effect of investments on the disagreement point is the same as in the basic model, but the shrinkage of the feasible set is different. In the modified model, there is no “uniform shrinkage” across all dimensions, but an individual shrinkage. Specifically, if player i’s investment is \(a_i\), the i-th coordinate of the feasible set shrinks by a factor \([1-c(a_i)]\), where c is an increasing convex function. Under the assumption that the bargaining solution is scale covariant, the results are the same as those of the basic model: there exists a unique equilibrium, and the equilibrium wastefulness is increasing in the bargaining solution’s disagreement sensitivity.

The two models express different views on pre-bargaining investment. In the basic model, every dollar invested in non-socially-productive pre-bargaining activity is a lost dollar that could have been divided in some way between the players, regardless of who invested it. By contrast, in the modified model, it does matter who invested it; for example, a dollar invested in “lawyering up” by player i affects players i and j differently.

In both models, the equation defining the equilibrium assumes the following form:

where \(\Delta (S,\mu )>0\) is a term that measures the bargaining solution’s disagreement sensitivity, E(S) is the egalitarian payoff in the problem whose feasible set is S and whose disagreement point is the origin, and MC is the marginal cost of investment.Footnote 3 In both models, the above equation has a unique solution. The equation implies that the scope of cooperation, as measured by E(S), has a positive effect, in the sense of tempering the incentives for wasteful pre-bargaining investment, while disagreement sensitivity works in the opposite direction. The equation also shows that there are “increasing returns to cooperation”: if E(S) increases, there is both a first order effect—namely, a larger collective pie—and a second order effect, which manifests in a lower incentive to invest in wasteful activity.

The rest of the paper is organized as follows. Sect. 1.1 reviews the literature. Preliminaries are in Sect. 2. The results concerning general bargaining solutions (in the basic model) are described in Sect. 3, and those concerning scale covariant solutions (in the modified model) in Sect. 4. Section 5 contains an application to an economic environment. Sections 6 and 7 compare the main solutions in the literature—the Nash solution (Nash 1950) and the Kalai-Smorodinsky solution (Kalai and Smorodinsky 1975). Conditions are described under which the latter is less disagreement sensitive than the former, and is therefore better. Section 8 concludes. Appendix A is dedicated to mappings of investment levels to disagreement points, and Appendix B contains proofs that are omitted from the main text.

1.1 Related Literature

The paper most closely related to the present one is by Anbarcı et al. (2002), who studied a 2-stage game in the first stage of which each of two players splits a budget between “guns” and “labor.” These choices determine a cooperative bargaining problem that the players face at the second stage. Investing in guns improves one’s disagreement payoff, while investing in labor expands the feasible set. Anbarcı et al. (2002) compared three bargaining solutions in this environment: the egalitarian solution (Kalai 1977), the equal-loss solution (Chun 1988), and the Kalai-Smorodinsky solution. Of these three solutions, the egalitarian solution induces the most wasteful pre-bargaining behavior, the equal-loss solution induces the most efficient behavior, and the Kalai-Smorodinsky solution is in between the two. Although my environment is different from that of Anbarcı et al. (2002), the economic phenomenon being modeled is essentially the same. The advantages of the analysis proposed here are that (1) the ranking of the bargaining solutions is not confined to the aforementioned trio, but is applicable to any solution (if it satisfies certain mild properties), and (2) that the analysis is valid for any number of players \(n\ge 2\). To the best of my knowledge, besides the present paper, Anbarcı et al. (2002) is the only one that applies the 2-stage structure to a bargaining context, in which the feasible set and disagreement point are determined endogenously, with a tradeoff between them. Some other papers consider bargaining that is preceded by a pre-bargaining stage, but in these papers either d is determined endogenously and S is fixed, or the other way around.

A classic example of a 2-stage game with an endogenous d is Nash’s threats game (Nash 1953), where S consists of the utility allocations that are obtainable in a given normal-form game, and d is determined by the play of this game. After d is determined, the Nash bargaining solution is applied. The players play the d-choice interaction knowing that final payoffs are determined by the Nash bargaining solution. This model has been revisited by several authors in economics and game theory. For example, DeBrock and Roth (1981) considered a version of this model in order to address a certain pathological strike pattern in labor-management disputes—the “discontinuous strike,” where the duration of the strike is spread over time. For example, the workers strike for one period, then work for one period, then strike again. DeBrock and Roth showed that this unusual pattern can arise in equilibrium of a Nash-threat-style-model, in the first stage of which the choice of d is one of strike and lockout dates. Another application of Nash’s threats-model can be found in a seminal paper by Grossman and Hart (1986), who considered two firm owners who interact in periods \(t=0,1\) as follows: at \(t=0\) each owner i takes an action \(a_i\) and at \(t=1\), when \(a=(a_1,a_2)\) is given, each owner needs to take one more decision, but these, as opposed to the \(a_i\)’s, are contractible. The a-choice game is played under the assumption that the Nash bargaining solution is applied in the second stage.

An example of a game in which S is determined before bargaining appears in a classic paper by Kalai and Samet (1985). The authors considered a bargaining game prior to which each player decides which alternatives in the feasible set to veto, and the solution is applied to the bargaining problem the feasible set of which consists of the non-vetoed alternatives. Kalai and Samet showed that it is a dominant strategy not to veto anything if and only if the solution is monotonic, which means that if the solution is symmetric then it is the egalitarian one.

The 2-stage structure expresses the idea that first the players “set the stage,” and only then they “play the game.” Setting the stage is done non-cooperatively, but once the players start to play the game they have at their disposal various tools of cooperative game theory’s toolbox, such as the ability to communicate and sign contracts. This structure has been studied in a variety of non-bargaining contexts, in which a first stage involves strategic behavior and a second stage involves cooperation. For example, Brandenburger and Stuart (2007) studied a 2-stage model in the first stage of which the players make simultaneous strategic choices, s, which determine a transferable-utility (TU) game that they face in the second stage, V(s). In V(s), player i’s payoff is \(u_i(s)=\alpha _i M_i+(1-\alpha _i)m_i\), where \(M_i\) and \(m_i\) are i’s maximum and minimum core-payoffs in V(s) and \(\alpha _i\in [0,1]\) is an exogenous parameter.Footnote 4 The utilities \(\{u_i(s)\}\) describe a normal-form game, which is analyzed non-cooperatively. Another example is provided by Kıbrıs and Kıbrıs (2013), who studied a model in the first stage of which investors make investments in a firm that may either succeed or go bankrupt, and in the latter case a bankruptcy rule is applied. Kıbrıs and Kıbrıs compared different rules in terms of the total investment and the welfare that they induce.

Costly investment that improves one’s disagreement position, and therefore ultimately improves one’s payoff, has been studied in a variety of economic contexts. For example, de Meza and Lockwood (2010) studied a matching model in which agents invest is non-productive education to improve their outside option, which increases the bargained-payoff obtained upon a match. Another example is given by the hold-up problem (e.g., Rogerson 1992), in which strategic behavior precedes a cooperative phase.

2 Preliminaries

2.1 Disagreement Points and Feasible Sets

A bargaining problem (problem, for short) is a pair (S, d), where \(S\subset {\mathbb {R}}^n\) is the feasible set of utility allocations that can be achieved if all players cooperate, and \(d\in S\)—the disagreement point—is the utility allocation that prevails if no cooperation is reached. In the models below, there is an initial disagreement point and an initial feasible set, and both can be affected by the players’ pre-bargaining investments.

The initial disagreement point is \(d=\mathbf{0} \equiv (0,\cdots ,0)\). Given the investments \((a_1,a_2,\cdots ,a_n)\) the resulting disagreement point is \((a_1-\frac{1}{n}\sum a_i,\cdots ,a_n-\frac{1}{n}\sum a_i)\).

The initial feasible set is S, and the investments shrink it; this shrinkage is different in the two models, and each shrinkage will be described when I turn to the respective model. The initial set S is closed, convex and comprehensive; the last requirement means \(x\in S\Rightarrow y\in S\), for every \(y\le x\).Footnote 5\(^,\)Footnote 6 Additionally, \(\mathbf{0} \in \text {int}S\) and S is non-leveled,Footnote 7 where being non-leveled means that S’s strong and weak Pareto frontiers coincide: \(P(S)=WP(S)\), where \(P(S)\equiv \{s\in S:x\gneqq s\Rightarrow x\notin S\}\) and \(WP(S)\equiv \{s\in S:x> s\Rightarrow x\notin S\}\). I denote the strong/weak frontier by \(\partial S\). For \(n=2\), the set \(\partial S\cap {\mathbb {R}}_+^2\) can conveniently be described by a boundary function \(\phi :[0,m]\rightarrow {\mathbb {R}}_+\), where \(m>0\) is some number, and \(\phi \) is strictly decreasing and concave, and satisfies \(\phi (m)=0\). I refer to such boundary functions in Sect. 5. In everything that follows except Theorem 5, it is assumed that S is symmetric, which means that \(x\in S\) implies \(\pi x\in S\) for every permutation \(\pi \) on \(\{1,,\cdots ,n\}\), where \(\pi x\equiv (x_{\pi (1)},\cdots ,x_{\pi (n)})\).Footnote 8

2.2 Bargaining Solutions

A bargaining solution (solution, for short), generically denoted by \(\mu \), is a function that assigns a unique feasible point to every problem, \(\mu (S,d)\in S\). I assume that all solutions under consideration satisfy the following four properties, in the statements of which (S, d) is an arbitrary problem.

- 1.:

-

Efficiency: \(\mu (S,d)\in \partial S\).

- 2.:

-

Anonymity: If S is symmetric then for every permutation \(\pi \) the following holds: \(\mu (S,\pi d)=\pi \mu (S,d)\).

- 3.:

-

Homogeneity: \(\mu (c S,cd)=c\mu (S,d)\) for all \(c>0\). Let \(e^i\) denote the i-th unit vector (\(e^i_j=1\) for \(j=i\), \(e^i_j=0\) for \(j\ne i\)).

- 4.:

-

Disagreement monotonicity: For every \(r>0\) and every i:

$$\begin{aligned} \mu _i(S,d+re^i)\ge \mu _i(S,d). \end{aligned}$$

Efficiency and Anonymity are self-explanatory, and Homogeneity is a standard factoring condition. Disagreement monotonicity expresses the idea around which the present paper pretty much revolves.Footnote 9

Throughout the paper, I refer to the following solutions, which are well-studied in the literature. The Kalai-Smorodinsky solution KS (Kalai and Smorodinsky 1975) assigns to each (S, d) the point \(\partial S\cap \text {conv}\{d,b(S,d)\}\), where \(b_i(S,d)\equiv \text {max}\{s_i:s\in S,s\ge d\}\);Footnote 10 the Nash solution N (Nash 1950) assigns to each (S, d) the maximizer of \(\Pi _i(x_i-d_i)\) over \(x\in \{s\in S: s\ge d\}\); the egalitarian solution E (Kalai 1977) assigns to each (S, d) the point \(\partial S\cap \{d+\delta \cdot \mathbf{1} :\delta \ge 0\}\);Footnote 11 the equal-loss solution EL (Chun 1988) assigns to each (S, d) the point \(\partial S\cap \{b(S,d)-\delta \cdot \mathbf{1} :\delta \ge 0\}\). All these solutions satisfy properties 1-4.Footnote 12

Let M denote the set of solutions that satisfy properties 1-4.

2.3 Disagreement Sensitivity

Disagreement monotonicity says that the solution should respond positively to disagreement point changes, but it does not say what the degree of such a response is. The following definition addresses this degree, in the context of comparing two solutions. Say that \(\mu \) is more disagreement sensitive than \(\nu \) given S if for any disagreement point \(d\in \text {int}S\) with \(d_1=\cdots =d_n\), the following holds for every \(r>0\) and every i:

In words, an increment in one’s disagreement payoff is more beneficial under \(\mu \) than it is under \(\nu \).Footnote 13

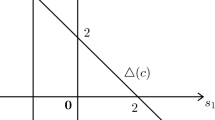

Given that S and \(\mu \) are fixed, let player 1’s solution payoff, as a function of the disagreement point, be defined as:

Let \(f^{S,\mu }_i\equiv \frac{\partial f^{S,\mu }}{\partial d_i}\) and let:

By Disagreement monotonicity \(f_1^{S,\mu }\ge 0\), and the combination of Efficiency and Anonymity further implies that \(f_i^{S,\mu }\le 0\) for all \(i>1\). Therefore \(\Delta (S,\mu )\ge 0\). This expression measures \(\mu \)’s level of disagreement sensitivity, given the feasible set S.Footnote 14 It may be zero in some cases, but in most of what follows I focus on the following:

The solutions in \(\sigma (S)\) are defined by a “local strictness” property: arbitrarily small increments in one player’s disagreement payoff have sufficient influence on the bargaining outcome. Such influence is required for an interior equilibrium: for players to make positive investments in equilibrium, the benefits of investments need to be sufficiently substantial. A given solution may be an element of \(\sigma (S')\) for some \(S'\), but not of \(\sigma (S'')\) for another \(S''\). For example, in the 2-person case \(N\in \sigma (\text {comp}\{(0,0),(1,0),(0,1)\})\) but \(N\notin \sigma (\text {comp}\{(0,0),(1,0),(0,1),(\frac{3}{4},\frac{3}{4})\})\).

The solution \(\mu \) is locally more disagreement sensitive than \(\nu \) given S if (1) holds for all sufficiently small r’s. A sufficient condition for this ranking between \(\mu \) and \(\nu \) is that \(\Delta (S,\mu )>\Delta (S,\nu )\). This fact will be useful in Sect. 7, where the Nash and Kalai-Smorodinsky are locally ranked on a particular class of n-person problems.

3 The Basic Model

As described in the Introduction, the basic model is as follows: the players simultaneously choose investment levels, \((a_1,\cdots ,a_n)\), where \(a_i\in [0,1]\), and these determine the payoffs. The payoffs are:

where \(\lambda \) is a function that shrinks the initial feasible set, depending on pre-bargaining investment. More specifically, \(\lambda :[0,1]^n\rightarrow {\mathbb {R}}_{+}\) is symmetric, strictly decreasing, differentiable, and satisfies \(\lambda (0,\cdots ,0)=1\) and the following Inada conditions:

-

(i) \(-\frac{\partial \lambda }{\partial a_i}|_{(0,\cdots ,0)}<\frac{\Delta (S,\mu )}{E(S)}\);

-

(ii) \(-\frac{\partial \lambda }{\partial a_i}|_{(1,\cdots ,1)}>\frac{\Delta (S,\mu )}{E(S)}\).

Additionally, \(-\frac{\partial \lambda }{\partial a_i}|_{(a,\cdots ,a)}\) is increasing in a, which means that the investment-induced cost is convex: pre-bargaining investment becomes more and more harmful as investment increases. Finally, it is assumed that \(\mathbf{1} \equiv (1,\cdots ,1)\in \text {int}\lambda (\mathbf{1} )\cdot S\). This, together with the fact that S is comprehensive, implies that \((a_1-\frac{1}{n}\sum a_i,\cdots ,a_n-\frac{1}{n}\sum a_i)\in \text {int}\lambda (a_1,\cdots ,a_n)\cdot S\) for every possible investment profile \((a_1,\cdots ,a_n)\). That is, every investment profile induces a well-defined bargaining problem.

Denote this game by \(\Gamma (S,\mu )\). An equilibrium of \(\Gamma (S,\mu )\) means a symmetric and interior pure Nash equilibrium; namely, a profile of a common investment level \((a^*,\cdots ,a^*)\), where \(0<a^*<1\), such that \(a^*\) is optimal for each player given that any other player chooses \(a^*\).

Theorem 1

Let \(\mu \in \sigma (S)\). Then \(\Gamma (S,\mu )\) has a unique equilibrium.

The proof, which appears in Appendix B, is entirely technical—a derivation of a FOC and verification that it has a unique solution. The intuition behind it is simple: the marginal benefit of pre-bargaining investment is decreasing, the marginal cost is increasing, and the intersection between them is unique. Given a feasible set S and a solution \(\mu \in \sigma (S)\), denote the equilibrium investment level by \(a^*(S,\mu )\).

Theorem 2

Let \(\mu ,\nu \in \sigma (S)\) be such that \(\mu \) is more disagreement sensitive than \(\nu \) given S. Then \(\Gamma (S,\mu )\)’s equilibrium-investment is weakly larger than that of \(\Gamma (S,\nu )\). That is, \(a^*(S,\mu )\ge a^*(S,\nu )\).

Let \(\mu \) be the solution. Because in equilibrium the selected utility allocation is such that each player obtains \(E(\lambda ^* S)\), where \(\lambda ^*=\lambda (a^*(S,\mu ),\cdots ,a^*(S,\mu ))\), any pre-bargaining investment is pure waste. Therefore, Theorem 2 implies a Pareto ranking of bargaining solutions.

4 The Modified Model

In the basic model, pre-bargaining investment shrinks the feasible set uniformly in all dimensions. I now turn to the case of private cost, where investment by player i shrinks only the i-th coordinate of the feasible set. More specifically, the investment profile \((a_1,\cdots ,a_n)\) is mapped into the following bargaining problem:

where \(c:[0,1]\rightarrow [0,1]\) is an increasing and strictly convex function that satisfies \(c(0)=0\), \(c'(0)=0\) and \(\text {lim}_{a\rightarrow 1}c'(a)=\infty \). Additionally, \((1-c(1))\cdot {\mathbf {1}}\in \text {int}S\). Call this the modified model and denote it by \({\tilde{\Gamma }}(S,\mu )\). As in the previous section, an equilibrium means a symmetric, pure and interior Nash equilibrium.

With this impact of pre-bargaining investment, both equilibrium existence and Pareto ranking of solutions can still be obtained, provided that attention is restricted to scale covariant solutions, i.e., those that satisfy the following property:

- 5.:

-

Scale Covariance: \(\mu (l\circ S, l\circ d)=l\circ \mu (S,d)\), for every vector of positive linear transformations \(l=(l_1,\cdots ,l_n)\).

Let:

The following are the counterparts of Theorems 1 and 2.

Theorem 3

Let \(\mu \in {\tilde{\sigma }}(S)\). Then \({\tilde{\Gamma }}(S,\mu )\) has a unique equilibrium.

Theorem 4

Let \(\mu ,\nu \in {\tilde{\sigma }}(S)\) be such that \(\mu \) is more disagreement sensitive than \(\nu \) given S. Then \({\tilde{\Gamma }}(S,\mu )\)’s equilibrium-investment is weakly larger than that of \({\tilde{\Gamma }}(S,\nu )\). That is, \(a^*(S,\mu )\ge a^*(S,\nu )\).

5 An Economic Environment

The above analysis can be applied to economic models, where the physical reality is described explicitly. Here is an example of such an application.

Consider two individuals, each endowed with a physical resource of size 1.Footnote 15 They simultaneously choose investment levels \(a_i\in [0,1]\), which can be understood in physical terms, as fractions of the resource. As in the previous sections, the investments give rise to a disagreement point and a feasible set. The disagreement point is as before, \((\frac{a_1-a_2}{2},\frac{a_2-a_1}{2})\), and the feasible set is \(S=\{s\in {\mathbb {R}}^2:s_1+s_2\le F(1-a_1)+F(1-a_2)\}\), where F is a production function. Specifically, F is increasing, differentiable, has diminishing marginal product, and satisfies \(F(0)=0\). This setting maps into the basic model, where the shrinkage function is given by \(\lambda (a_1,a_2)\equiv \frac{ F(1-a_1)+F(1-a_2)}{2F(1)}\). If the marginal products at zero and one are sufficiently large and sufficiently small, then the Inada conditions (i) and (ii) hold, and the analysis in Sect. 3 applies. Note that the basic model is the relevant one here, because utility is transferable.

The above model is not one of economic fundamentals in the full sense of the word, because, as before, the disagreement point is taken to be the utility image of some un-specified zero-sum interaction. For a more physical/fundamental version of the model, one could take “disagreement” to be a contest, in which the players split a fraction \(\eta \in (0,1)\) of the total available resource in the proportions \((\frac{a_1}{a_1+a_2},\frac{a_2}{a_1+a_2})\).Footnote 16 Under this specification, however, the analysis in Sect. 3 no longer applies. An analysis of this alternative model is a task for future research.

6 The Nash and Kalai-Smorodinsky Solutions in 2-Person Problems

The most interesting comparison is between the Nash and Kalai-Smorodinsky solutions. According to Sects. 3 and 4, ordering them by disagreement sensitivity indicates which one induces greater welfare.Footnote 17 The following theorem describes circumstances in which such an ordering obtains in the 2-person case. In the theorem, the feasible set is not required to be symmetric.

Theorem 5

Let \(n=2\). Suppose that S’s boundary function, \(\phi \), is differentiable and strictly concave. Then the Nash solution is more disagreement sensitive than the Kalai-Smorodinsky solution given S.

In proving Theorem 5 I will refer to the 2-person relative utilitarian solution (RU), which is defined as follows: it assigns to each (S, d) the maximizer of \(\frac{x_1}{b_1(S,d)}+\frac{x_2}{b_2(S,d)}\) over \(x\in \{s\in S: s\ge d\}\).Footnote 18

Proof of Theorem 5:

Let S be a symmetric feasible set with a differentiable and strictly concave boundary function \(\phi \); w.l.o.g, suppose that \(b(S,\mathbf{0} )=(1,1)\). Consider an increment of player 1’s disagreement-point-value from zero to \(r\in (0,1)\). After shifting the new disagreement point back to the origin and considering the individually-rational part of the resulting feasible set (the part that dominates the origin), the frontier is described by the function \(g:[0,1-r]\rightarrow {\mathbb {R}}_+\), where \(g(x)\equiv \phi (x+r)\). Call this new feasible set \(S'\).

KS implies a payoff-ratio of \(\frac{KS_2(S',\mathbf{0} )}{KS_1(S',\mathbf{0} )}=\frac{\phi (r)}{1-r}\). Since N is always “sandwiched” in between KS and RU,Footnote 19 it is enough to show that \(RU(S',\mathbf{0} )\) is to the right of \(KS(S',\mathbf{0} )\). Therefore, with \(t\equiv RU_1(S',\mathbf{0} )\), what needs to be established is:

The FOC defining \(RU(S',\mathbf{0} )\) is \(\frac{\phi (r)}{1-r}=-\phi '(t+r)\), hence it is enough to show that \(\frac{\phi (t+r)}{t}<-\phi '(t+r)\), or:

where \(t=t(r)\). Note that (2) holds as equality when \(r=0\) since in this case \(t(r)=t(0)=N_1(S,\mathbf{0} )\) and then the equality-version of (2) is the FOC associated with the Nash solution. Therefore, it is enough to show that the derivative of (2)’s RHS w.r.t r exceeds that of the LHS. Namely, that:

or:

By Disagreement Monotonicity, \(t'\ge 0\).Footnote 20 Therefore, since \(\phi \) is differentiable and strictly concave, the LHS is negative, and the RHS is positive. \(\square \)

Anbarcı (2008) proved that the 2-person N is more disagreement sensitive than the 2-person KS in constant elasticity problems (CES), where the boundary function has the form \(\phi (x)=(1-x^\gamma )^{1/\gamma }\) for some \(\gamma \in (1,\infty )\). Theorem 5 generalizes his result. For instance, Theorem 5 is not confined to symmetric sets, and CES sets are symmetric.

The downside of Theorem 5 is that it is a technical result, which does not reflect an obvious economic intuition. In some sense, this is not surprising, because if there was an obvious economic reason for the higher disagreement sensitivity of the Nash solution then it would appear in other problems as well, without the smooth-frontier qualification. This, however, is not the case. For example, if S is a 2-person set that is the comprehensive hull of \(\text {conv}\{(0,0),(1,0),(0,1),(t,t)\}\), for some \(t\in (\frac{1}{2},1)\), then the order reverses: KS is more disagreement sensitive than N given this S.Footnote 21

In the 2-person case, the Nash and the Kalai-Smorodinsky solutions can also be easily ranked relative to the egalitarian solution.

Proposition 1

Let \(n=2\) and let S be a feasible set. Then the egalitarian solution is more disagreement sensitive than the Nash solution given S.

Proof

Make the above assumptions and consider, w.l.o.g, an increment of player 1’s disagreement payoff from zero to some \(r>0\). This change has no influence on the utilitarian point—it remains \(E(S,\mathbf{0} )\)—but the egalitarian point moves to the right; since the Nash solution point is “sandwiched” in the utilitarian and egalitarian points (Rachmilevitch 2015), it follows that E is more disagreement sensitive than N. \(\square \)

Proposition 2

Let \(n=2\) and let S be a feasible set. Then the egalitarian solution is more disagreement sensitive than the Kalai-Smorodinsky solution given S.

Sketch of proof: The arguments are analogous to the ones from Proposition 1’s proof, the only exception being that the role of utilitarian point is replaced by that of the equal-loss solution EL: geometric considerations imply that E is more disagreement sensitive than KS, because KS is “sandwiched” between E and EL. \(\square \)

7 A Class of n-Person Problems on Which the Kalai-Smorodinsky Solution is “locally best”

Let \({\mathcal {S}}_n\) be the class of n-person feasible sets S of the following form:

where \(c>0\) and g is a twice differentiable, strictly convex and strictly increasing function that satisfies \(g(0)=g'(0)=0\). W.l.o.g, I set \(c=1\). I also assume that \(g'\cdot h'\) is an increasing function, where \(h\equiv g^{-1}\). An example of an element of \({\mathcal {S}}_n\) is the positive part of the n-sphere, \(S=\{x\in {\mathbb {R}}_+^n:\sum _{i=1}^n x_i^2\le 1\}\).

Note that \({\mathcal {S}}_2\) is a subclass of the 2-person sets considered in Theorem 5.

The following result says that on \({\mathcal {S}}_n\), the disagreement sensitivity of the Kalai-Smorodinsky solution is locally zero.

Theorem 6

\(\forall S\in {\mathcal {S}}_n\): \(\Delta (S,KS)=0\) .

Proof

Let \(S\in {\mathcal {S}}_n\) and let g be the function from the definition of S (i.e., from (6)). Consider increasing player 1’s disagreement payoff from zero to \(r>0\). It is not hard to check that in the resulting problem the Kalai-Smorodinsky solution assigns the following payoffs:

for some \(x=x(r)\).Footnote 22 Since \(x\cdot \frac{h(1-g(r))}{h(1)}\) is weakly decreasing in r, it follows that:

Clearly \(x'\ge 0\). And, at \(r=0\) the second term is zero, hence \(x'(0)=0\). To use the notation of Sect. 2.3, \(x'=f_1^{S,KS}\), and the desired formula follows. \(\square \)

The following is an obvious consequence of Theorem 6.

Corollary 1

Let \(S\in {\mathcal {S}}_n\) and \(\mu \in \sigma (S)=\{\mu \in M:\Delta (S,\mu )>0\}\). Then \(\mu \) is locally more disagreement sensitive than the Kalai-Smorodinsky solution given S.

To complete the picture, it remains to find out whether the Nash solution can play the role of \(\mu \) from Corollary 1. The following result provides the affirmative answer.

Theorem 7

\(\forall S\in {\mathcal {S}}_n\): \(\Delta (S,N)>0\).

Proof

Let \(S\in {\mathcal {S}}_n\) and let g be the function from the definition of S (i.e., from (6)). Consider increasing player 1’s disagreement payoff from zero to \(r>0\). The FOC associated with the Nash solution is:

where \(x=x(r)\) is player 1’s payoff. Deriving both sides with respect to r gives:

Assume by contradiction that \(x'(0)=0\). Then at \(r=0\) the (7)’s LHS becomes zero, therefore:

The LHS is positive and the RHS is non-positive—a contradiction. \(\square \)

The relation between the Nash and Kalai-Smorodinsky solutions on \({\mathcal {S}}_n\) is summarized in the following corollary.

Corollary 2

On \({\mathcal {S}}_n\), the Nash solution is locally more disagreement sensitive than the Kalai-Smorodinsky solution.

8 Conclusion

I introduced the concept of disagreement sensitivity, which can be used for ranking any two bargaining solutions, provided that they satisfy certain basic properties: Efficiency, Anonymity, Homogeneity, and Disagreement monotonicity. Ranking solutions based on disagreement sensitivity implies a Pareto ranking. Given a 2-person problem with strictly convex frontier, the Kalai-Smorodinsky solution is less disagreement sensitive than the Nash solution, and is therefore better. The ranking of these solutions also extends, in a local sense, to a class of smooth n-person problems.

The comparison of solutions is non-trivial because it is carried out, to a large extent, under the umbrella of the cooperative approach to bargaining. The typical line of work in cooperative bargaining is to postulate axioms, which, by nature, are binary criteria: a solution either satisfies a certain axiom, or it does not. In the present paper, by contrast, the key property is disagreement sensitivity, which, despite its “axiomatic roots,”Footnote 23 is not a yes-or-no property, but describes a continuum along which different solutions can be placed.

The paper also highlights the fruitfulness of a 2-stage framework that embeds a well-known piece of theory at the second-stage, and then asks what can be learned about this theory if more considerations are brought into the picture through the first stage.

A shortcoming of the present paper is that the entire influence of the economic activity is summarized strictly based on two features of the bargaining problem: the feasible set and the disagreement point. On one hand, this may not seem like a serious shortcoming, because these are the only ingredients of a Nash bargaining problem. On the other hand, one may think about further aspects of the problem that could be dealt with more explicitly, in particular the ideal point. Sertel (1992) studied 2-stage 2-person bargaining model in which the ideal point plays a surprisingly important role. In the pre-bargaining stage of his model, each player can change the feasible set by committing to donate a portion of her would-be payoff to the opponent. In equilibrium, and under the assumption that the Nash solution is employed, only the player with the maximum ideal payoff makes a donation.

One could consider also a model in which a player’s bargaining-problem-payoff is just one component in her overall payoff, into which the investment cost enters in a separable way. That is, with \(u_i\) denoting player i’s utility, the following formula applies:

where \(c_i\) is the investment-cost function. The FOC obtained from this utility specification is qualitatively different from those of the models that were studied in the current paper; consequently, it may be that the definition of disagreement sensitivity needs to be amended to be applicable to this alternative specification. A comprehensive exploration this alternative model is a direction for future research. Another direction for future research is the analysis of the economic model that was described at the end of Sect. 5.

Notes

Expressing relative advantages and disadvantages in this way is not new to game theoretic models. See, e.g., Kalai and Kalai (2013), as well as the papers mentioned in footnote 9 of their paper.

One could think of more general ways to map the investments to a disagreement point. I address this issue in Appendix A, where I show that if the mapping satisfies several basic properties, it is necessarily of the form postulated above.

In the basic model \(MC=-\frac{\partial \lambda }{\partial a_i}\) and in the modified model \(MC=c'\).

The core is assumed to be non-empty.

Vector inequalities: uRv if and only if \(u_i R v_i\) for all i, for both \(R\in \{>,\ge \}\); \(u\gneqq v\) if and only if \(u\ge v\) and \(u\ne v\).

Given a non-empty set \(X\subset {\mathbb {R}}^n\), the smallest comprehensive set that contains it—its comprehensive hull—is denoted \(\text {comp}X\).

\(\text {int}S\) denotes the interior of S.

Because Theorem 5 is the only exception to the rule, in the other results I do not mention explicitly that symmetry is imposed.

It is assumed that r is sufficiently small, so that the problem on the LHS is well-defined.

b(S, d) is called the ideal point of (S, d).

As noted in the Introduction, I abuse notation a little and use the symbol E(S) to denote the egalitarian payoff in the problems whose feasible set is S and whose disagreement point is the origin; namely, I use E(S) to denote \(E_i(S,\mathbf{0} )\).

That these solutions satisfy properties 1-3 is well-known (and easy to verify). Disagreement monotonicity of most solutions is established in Thomson (1987). Some solutions have axiomatizations that are based on Disagreement monotonicity or closely related axioms. In particular, the egalitarian solution (Bossert 1994; Rachmilevitch 2011a) and the Kalai-Smorodinsky solution (Rachmilevitch 2011b).

By Efficiency and Anonymity, \(\mu (S,d)=\nu (S,d)\), hence (1) can be written as \(\mu _i(S,d+re^i)-\mu _i(S,d)\ge \nu _i(S,d+re^i)-\nu _i(S,d)\).

\(\Delta (S,\mu )\) is defined on the basis of \(f^{S,\mu }\), which speaks of player 1’s payoff. Clearly, because of Anonymity this concept could equally be defined on the basis of the payoff of any other player.

I consider two individuals merely for simplicity of exposition; the generalization to n individuals is straightforward.

\(\eta =1\) corresponds to a generate case of “no-bargaining,” where the disagreement point lies on the frontier of the feasible set.

Both N and KS are scale covariant.

This is a well-defined solution on problems of the type described in Theorem 5, but not on all problems (e.g., it is not well-defined if the feasible set is the comprehensive hull of the unit simplex).

To see this, consider a feasible set with the boundary function \(\phi \), S, and disagreement point (0, 0). Suppose that \(b(S,(0,0))=(1,\beta )\). The point selected by RU is the egalitarian one, and the hyperplane tangent to the feasible set at this point has slope \(\beta \) (in absolute value). As player 1’s disagreement point increases to \(r>0\), the segment \(\text {conv}\{(r,\phi (r)),(1,0)\}\) has slope steeper than 1; therefore, the point selected by RU is to the right of the originally-selected point.

The proof of this fact is a basic (if a bit lengthy) exercise, hence it is omitted.

Computing the exact value of x is easy, but is not necessary for the arguments to be invoked momentarily.

By “axiomatic roots” it is meant that disagreement sensitivity is an extension (and, in a way, a refinement) of disagreement monotonicity.

References

Anbarcı N (2008) Relative responsiveness of bargaining solutions to changes in status-quo payoffs. Atlantic Econ J 36:293–299

Anbarcı N, Skaperdas S, Syropoulos C (2002) Comparing bargaining solutions in the shadow of conflict: how norms against threats can have real effects. J Econ Theory 106:1–16

Bossert W (1994) Disagreement point monotonicity, transfer responsiveness, and the egalitarian bargaining solution. Social Choice Welfare 11:381–392

Brandenburger A, Stuart H (2007) Biform games. Manag Sci 53:537–549

Cao X (1982) December. Preference functions and bargaining solutions. In: 1982 21st IEEE conference on decision and control, pp 164–171. IEEE

Chun Y (1988) The equal-loss principle for bargaining problems. Econ Lett 26:103–106

DeBrock LM, Roth AE (1981) Strike two: labor-management negotiations in major league baseball. Bell J Econ 12:413–425

de Meza D, Lockwood B (2010) Too much investment? A problem of endogenous outside options. Games Econ Behav 69:503–511

Grossman SJ, Hart OD (1986) The costs and benefits of ownership: a theory of vertical and lateral integration. J Polit Econ 94:691–719

Kalai E (1977) Proportional solutions to bargaining situations: interpersonal utility comparisons. Econometrica 45:1623–1630

Kalai A, Kalai E (2013) Cooperation in strategic games revisited. Q J Econ 128:917–966

Kalai E, Samet D (1985) Monotonic solutions to general cooperative games. Econometrica 53:307–327

Kalai E, Smorodinsky M (1975) Other solutions to Nash’s bargaining problem. Econometrica 43:513–518

Kıbrıs Ö, Kıbrıs A (2013) On the investment implications of bankruptcy laws. Games Econ Behav 80:85–99

Nash JF (1950) The bargaining problem. Econometrica 18:155–162

Nash J (1953) Two-person cooperative games. Econometrica 21:128–140

Rachmilevitch S (2011) Disagreement point axioms and the egalitarian bargaining solution. Int J Game Theory 40:63–85

Rachmilevitch S (2011) A characterization of the Kalai-Smorodinsky bargaining solution by disagreement point monotonicity. Int J Game Theory 40:691–696

Rachmilevitch S (2015) The Nash solution is more utilitarian than egalitarian. Theory Decision 79:463–478

Rachmilevitch S (2016) Egalitarian-utilitarian bounds in Nash’s bargaining problem. Theory Decision 80:427–442

Rogerson WP (1992) Contractual solutions to the hold-up problem. Rev Econ Stud 59:777–793

Sertel MR (1992) The Nash bargaining solution manipulated by pre-donations is Talmudic. Econ Lett 40:45–55

Thomson W (1987) Monotonicity of bargaining solutions with respect to the disagreement point. J Econ Theory 42:50–58

Acknowledgements

This paper summarizes a project on which I have worked during my sabbatical at Northwestern University, in the academic year 2017-2018. I am grateful to the Kellogg School of Management and to my host, Alvaro Sandroni, for their hospitality. I am also grateful for the helpful comments of seminar participants at Northwestern, and of the participants at the BEET conference at Columbia University. Vincent Crawford, Ronen Gradwohl, and a couple of anonymous referees deserve special thanks for their effective comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: The Disagreement Point

Suppose that given the profile of investments a, the resulting disagreement point is h(a), for some function h. Denote by \(h^*\) the specific function I have assumed above, namely \(h^*(a)\equiv (a_1-\frac{1}{n}\sum a_i,\cdots ,a_n-\frac{1}{n}\sum a_i)\). I will now show that \(h^*\) is the only function (from \([0,1]^n\) to \({\mathbb {R}}^n\)) that satisfies the following properties.

-

1.

Zero-sum: \(\sum _{i=1}^nh_i(a)=0\) for all a.

-

2.

Anonymity: If \(\pi ^{ij}\) is the permutation that swaps i and j, then \(h_i(\pi ^{ij}\circ a)=h_j(a)\).

-

3.

Mixture: For every two investment profiles a and \(a'\) that satisfy \(a_i=a_i'\) and every \(\theta \in [0,1]\): \(\theta h_i(a)+(1-\theta )h_i(a')=h_i(\theta a+(1-\theta )a')\).

-

4.

Normalization:

$$\begin{aligned} h_i(e^j)=\left\{ \begin{array}{ll} 1-\frac{1}{n} &{} \text {if }\,{j=i}\\ -\frac{1}{n} &{} \text {otherwise} \end{array}\right. \end{aligned}$$

Properties 1-2 is obvious. Property 3 can be justified on the following game-theoretic grounds: suppose that the players could choose their investment at random. Then, from the standpoint of every individual player, any (pure) investment level is associated with a lottery, the uncertainty being due to the randomization of others. Knowledge of preference over such lotteries is necessary for the analysis of such a game, and the Mixture property says that these preferences are of the expected utility variety. Note that this applies to the modified model (but not to the basic one). Finally, property 4, as its name suggests, is nothing but a normalization; there is no loss of generality is assuming this specific normalization if the function is homogeneous of degree one.

Proposition 3

An h-function is Zero-sum and satisfies Anonymity, Mixture and Normalization if and only if \(h=h^*\).

Proof

It is clear that \(h^*\) satisfies these properties, hence I will only prove uniqueness. Let h be a function that satisfies the properties. I will prove, w.l.o.g, that \(h_1(a)=a_1-\frac{1}{n}\sum _ia_i\). By Anonymity and Mixture, \(h_1(a)=h_1(a_1,c,\cdots ,c)\), where \(c\equiv \frac{\sum _{i=2}^na_i}{n-1}\). By Zero-sum and Anonymity, \(h_1(a)=h_1(a_1,c,\cdots ,c)=h^*_1(a)=h_1^*(a_1,c,\cdots ,c)=0\) if \(c=a_1\), so suppose that \(c\ne a_1\); w.l.o.g, \(a_1>c\). Note that:

The first equality is due to Mixture, the second follows from the combination of Zero-Sum, Anonymity and Mixture, and the third is by Normalization. Taking \(\theta =1-\frac{c}{a_1}\) delivers the desired result. \(\square \)

Appendix B: Proofs

Proof of Theorem 1:

Make the theorem’s assumptions. W.l.o.g, consider player 1. His goal is to chose \(a_1\) in order to maximize the following expression:

which, by Homogeneity of \(\mu \), is equal to:

The FOC is:

Equilibrium existence is equivalent to the existence of a solution to the above equation that satisfies \(a_1=a_2=\cdots =a_n\equiv a\). At such equal-investment point the FOC boils down to:

or

By the boundary conditions on \(\lambda \), (5) has a unique solution. \(\square \)

Lemma 1

Let \(\mu \) and \(\nu \) be such that \(\mu \) is more disagreement sensitive than \(\nu \) given S. Then \(f_1^{S,\mu }|_{d=\mathbf{0} }\ge f_1^{S,\nu }|_{d=\mathbf{0} }\) and \(f_i^{S,\mu }|_{d=\mathbf{0} }\le f_i^{S,\nu }|_{d=\mathbf{0} }\) for all \(i>1\). In particular, \(\Delta (S,\mu )\ge \Delta (S,\nu )\).

Proof

Since \(\mu \) is more disagreement sensitive than \(\nu \) given S,

hence

Taking \(r\downarrow 0\) gives \(\frac{\partial \mu _1}{\partial d_1}|_\mathbf{0 }\ge \frac{\partial \nu _1}{\partial d_1}|_\mathbf{0 }\), or:

Due to Efficiency and Anonymity, (6) implies that the following holds for all \(i>1\):

By analogous arguments to the one mentioned above,

The combination of (7), (8), and the fact that \(f_1^{S,\mu },f_1^{S,\nu }\ge 0\) implies \(\Delta (S,\mu )\ge \Delta (S,\nu )\). \(\square \)

Proof of Theorem 2:

Consider (5). By Lemma 1, an increase in disagreement sensitivity increases (5)’s LHS (weakly), hence the convexity of \(-\lambda \) implies that the investment-level cannot decrease. \(\square \)

Proof of Theorem 3:

Make the theorem’s assumptions. W.l.o.g, consider player 1. His goal is to chose \(a_1\) in order to maximize the following expression:

By Scale Covariance of \(\mu \), this expression is equal to:

The FOC at \(a_1=a_2=\cdots =a_n\equiv a\) is:

By the conditions imposed on c, (9) has a unique solution. \(\square \)

Proof of Theorem 4:

By Lemma 1, (9)’s LHS is higher under the more disagreement sensitive solution. \(\square \)

Rights and permissions

About this article

Cite this article

Rachmilevitch, S. Pre-bargaining Investment Implies a Pareto Ranking of Bargaining Solutions. Group Decis Negot 31, 769–787 (2022). https://doi.org/10.1007/s10726-022-09782-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10726-022-09782-1