Abstract

We construct a parametric family of (modified) divide-the-dollar games: when there is excess demand, some portion of the dollar may disappear and the remaining portion is distributed in a bankruptcy problem. In two extremes, this game family captures the standard divide-the-dollar game of Nash (Econometrica 21:128–140, 1953) (when the whole dollar vanishes) and the game studied in Ashlagi et al. (Math Soc Sci 63:228–233, 2012) (when the whole dollar remains) as special cases. We first show that in all interior members of our game family, all Nash equilibria are inefficient under the proportional rule if there are ‘too many’ players in the game. Moreover, in any interior member of the game family, the inefficiency increases as the number of players increases, and the whole surplus vanishes as the number of players goes to infinity. On the other hand, we show that any bankruptcy rule that satisfies certain normatively appealing axioms induces a unique and efficient Nash equilibrium in which everyone demands and receives an equal share of the dollar. The constrained equal awards rule is one such rule.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In a seminal article that practically started a new research agenda (later named, the Nash program), Nash (1953) introduced the Nash demand game (ND). A particular version of the game where the bargaining frontier is linear, called the divide-the-dollar game (DD), has been widely used since then by researchers in various disciplines, such as economics, political science, international relations, philosophy, and biology. Despite its simplicity, it still captures the two essential characteristics of bargaining situations: (i) joint interest in reaching an agreement and (ii) conflict of interest over which agreement to reach.Footnote 1 In DD, all players simultaneously submit their demands from the dollar. If the sum of demands is less than or equal to one, then every player receives his demand. If the sum of demands is greater than one (i.e., the excess demand case), then in what is sometimes referred to as the punishment clause, each player receives a zero payoff. It can be argued that this harsh punishment prevents collective greediness in equilibrium, yet it cannot alleviate multiplicity. In particular, DD has infinitely many Nash equilibria: any strategy profile in which the sum of demands is one is a Nash equilibrium.

The Nash bargaining solution (see Nash 1950) proposes a unique outcome in the equivalent axiomatic representation of the game: equal division. Various other scholars also provided support for equal division in symmetric bargaining games (Schelling 1960; Nydegger and Owen 1975; Roth and Malouf 1979; Young 1993; Van Huyck et al. 1995; Skyrms 1996; Bolton 1997). If the multiplicity of equilibria in a game is descriptive of reality, there may be no need to look for ways to superficially induce a unique equilibrium. However, in the light of all the support (including the experimental results) provided for equal division in DD, this is probably not one of those cases. Nash (1953) was the first one to attempt obtaining equal division as the unique equilibrium outcome (to provide a stronger strategic support for the Nash bargaining solution) by modifying the rules of the game. Brams and Taylor (1994, p. 213) wrote that “DD treats harshly bidders whose total claim exceeds 100. Is it possible to render its payoff structure more reasonable, in some sense, and also to induce egalitarian behavior ... as well as the egalitarian outcome ...?” Along these lines, many scholars changed the rules of DD in ways that mimic ‘reasonable’ arbitration or conflict-resolution mechanisms. We review the relevant literature in Sect. 2.

In the current paper, we also focus on the punishment clause. As mentioned above, even if the sum of demands is only marginally/negligibly greater than one, each player receives a zero payoff in DD. We wonder about the strategic implications of using less severe (or more reasonable) alternatives. Along those lines, we introduce a parameter, \(\alpha \in {\mathbb {R}}_+\), into the model, which can be interpreted as the severity or toughness of the punishment rule. When \(\alpha = 0\), the whole surplus (i.e., the dollar) is still fully distributed to the players. This is basically ‘no punishment’ for excess demand. For finite values of \(\alpha\), the surplus to be distributed is less than one and the exact value of it depends directly on the excess demand. For instance, when \(\alpha = 2\), if the sum of demands is 1.25, then a surplus of \(1 - 2 \times (1.25 - 1)=0.5\) would be distributed. As \(\alpha\) approaches infinity, any excess demand leads to a complete disappearance of the surplus. This gives us a one-parameter family of modified DDs, where \(\alpha = 0\) corresponds to the modified DD studied in Ashlagi et al. (2012) and \(\alpha \rightarrow \infty\) corresponds to the standard version in Nash (1953). Then, we study the Nash equilibria of the members of this game family with a particular focus on the efficiency and equitability of the divisions they induce.

The fact that a positive-valued surplus will be distributed to the players when there is excess demand requires an allocation rule to be specified. Similar to Ashlagi et al. (2012), we acknowledge that cases in which the sum of demands is greater than the value of the surplus can be considered as bankruptcy problems. Hence, any well-known bankruptcy rule becomes a natural candidate for the allocation rule. In our equilibrium analysis, we first focus on the proportional rule, arguably the most prominent bankruptcy rule in the literature. Later, we study a family of bankruptcy rules described by various axioms as well as another prominent bankruptcy rule satisfying those axioms, namely the constrained equal awards rule.

We present our main results here in a non-technical fashion without going into specific details. Denoting the number of players by n, we first show that if n is sufficiently high, then in any interior member of our game family, there exists no efficient equilibrium under the proportional rule. That is to say, the sum of demands is greater than one in any Nash equilibrium, and as such, the surplus to be divided is less than one. If \(n \le \alpha +1\), however, then there only exists a collection of efficient equilibria in which each player demands no less than \(\frac{1}{\alpha + 1}\), and if there are \(\alpha +1\) players, then there is a unique Nash equilibrium where each player demands and receives \(\frac{1}{n}\). Comparative static analyses on \(\alpha\) and n reveal further insights: (i) changes in \(\alpha\) have a non-monotonic impact on inefficiency; and (ii) given \(n > \alpha +1\), the inefficiency increases as n increases, while the surplus completely vanishes as n approaches infinity. Second, we provide three sets of sufficient conditions on the bankruptcy rule under which certain desirable equilibrium properties are achieved: efficiency, equitability conditional on efficiency, and efficiency and equitability. The set of bankruptcy rules that satisfies those conditions is non-empty, as we show that the constrained equal awards rule satisfies them all. Under this rule, we show that there is a unique equilibrium in which each player demands and receives \(\frac{1}{n}\) in any interior member of our game family. Hence, it is shown that the constrained equal awards rule induces a unique equilibrium, which is efficient and equitable.

To the best of our knowledge, this is the first paper to produce inefficient equilibria in modified DDs (under complete information).Footnote 2 The proportional rule satisfies various appealing normative properties and is widely used in real-life settings. However, this rule does not induce any efficient equilibrium if the number of players is too high. The existence of inefficient (or wasteful) equilibria allows us to present a new perspective for the severe punishment rule employed in DD: if the punishment rule cannot be changed frequently, but the number of players can increase, then it may be safer for an efficiency-oriented authority to impose the most severe punishment, which would guarantee the efficiency of equilibrium. On the other hand, we also show that there are multiple benefits of using the constrained equal awards rule: (i) unique equilibrium, (ii) efficiency, and (iii) equal division. It is worth emphasizing that these benefits are all present in any interior member of our game family and for any number of players. Accordingly, for an efficiency-oriented authority, it may be even safer to employ the constrained equal awards rule in case of bankruptcy, especially when the authority does not have much control on the punishment factor or the number of players.

The organization of the paper is as follows: Sect. 2 reviews the literature on DD and its modifications that induce equal division as the unique equilibrium outcome. Section 3 introduces the model. Section 4 presents the equilibrium and comparative static analyses. Section 5 concludes.

2 Related literature

As we briefly mentioned above, Nash (1953) made the first attempt to single out the equal division equilibrium in ND. More precisely, a step function determines the feasibility of the demand vector: if the demand vector is an element of the feasible bargaining set, then the function takes a value of one, but if not, then it takes a value of zero no matter how close the demand vector is to the boundary of the feasible set. In the same article, the author replaced this function by another function whose value is one on the feasible set and drops to zero in a continuous fashion outside of the set. He then studied the equilibrium of the perturbed game. In the limit and under some regularity conditions, as the alternative ‘smooth’ function converges to the original step function, he showed that the only equilibrium is the one that coincides with the Nash bargaining solution of the corresponding bargaining problem.Footnote 3

Later, it was Brams and Taylor (1994) who focused on DD and proposed three modifications, in all of which the unique equilibrium turns out to be equal division. Along similar lines, various researchers came up with different modifications of DD that induce equal division in equilibrium. We will be brief here since the detailed descriptions of these models can be found in other works (see, for instance, Karagözoğlu and Rachmilevitch 2018; Dizarlar and Karagözoğlu 2021). Understandably, all of these papers modified the punishment clause or the excess demand case.Footnote 4 Some of the modifications added a second (or third, and so on) stage to the game (e.g., Brams and Taylor 1994; Bossert and Tan 1995; Dutta 2012; Cetemen and Karagözoğlu 2014; Karagözoğlu and Rachmilevitch 2018; Rachmilevitch 2020b), whereas others introduced alternative allocation rules in case the sum of demands is greater than the surplus (e.g., Brams and Taylor 1994; Anbarci 2001; Ashlagi et al. 2012; Rachmilevitch 2017, 2020a; Dizarlar and Karagözoğlu 2021).Footnote 5

Our model is inspired by the smoothing approach of Nash (1953). In this paper we smooth the punishment (i.e., the amount subtracted from the dollar in the excess demand case). As in Ashlagi et al. (2012), our model resorts to the axiomatic literature on bankruptcy problems to modify the rules of DD in the excess demand case. As in Kıbrıs and Kıbrıs (2013), who embedded the bankruptcy problem in a strategic setting, we treat the bankruptcy rule as a model parameter. Along these lines, our paper shares something in common with a number of papers in the bankruptcy games literature such as Chun (1989), Sonn (1992), García-Jurado et al. (2006), Habis and Herings (2013), Li and Ju (2016), Tsay and Yeh (2019), and Hagiwara and Hanato (2021), as we also provide a strategic support for the constrained equal awards rule. Finally, similar to Rachmilevitch (2017), we construct a parametric family of games and study their equilibria. As mentioned earlier, the family of games we construct captures the standard DD as a special case on one extreme (completely vanishing dollar in the excess demand case) and the modified DD studied in Ashlagi et al. (2012) on the other (completely preserved dollar in the excess demand case).

3 The model

In the divide-the-dollar game (DD), a finite set of players \(N = \{1,2, \ldots , n\}\) try to divide a finite real-valued surplus among themselves. This surplus is usually taken as one dollar. As a strategy, every player \(i \in N\) makes a claim by demanding \(c_i \in C_i \equiv [0,1]\) portion of the dollar. The set of strategy profiles (i.e., claims vectors) is denoted by \(C \equiv \prod _{i \in N} C_i = [0,1]^n\).

Every player has strictly monotonic preferences over the amount he collects. The payoff structure of the game is governed by a division rule, \(F: C \rightarrow {\mathbb {R}}^n_+\). In DD, it is assumed that if \(\sum _{i \in N} c_i \le 1\), then \(F_i(c) = c_i\) for every \(i \in N\), where \(F_i(c)\) denotes the amount player i receives under the strategy profile c; but if otherwise, \(F_i(c) = 0\) for every \(i \in N\). The latter can be interpreted as the punishment clause in that if players’ demands are not compatible (i.e., the excess demand case), then no player ends up with a positive payoff. It is said that an outcome is efficient if \(\sum _{i \in N} {F_i (c)} = 1\).

The main modification we make is related to the punishment clause. In case \(\sum _{i \in N} c_i > 1\), instead of giving a zero payoff to each player, we treat the situation as a bankruptcy (or claims) problem (see Ashlagi et al. 2012 for a similar treatment). More precisely, the amount of excess demand is multiplied by a linear punishment factor \(\alpha \in [0, \infty )\), which returns the amount of surplus that will vanish. The remaining surplus is distributed in a bankruptcy problem. Naturally, in this case, F becomes a bankruptcy rule.

Now, we present the formal definitions of a bankruptcy problem and a bankruptcy rule. In a bankruptcy problem, a finite real-valued surplus \(E \ge 0\) is distributed among a finite number of agents, located in the set \(N = \{1,2, \ldots , n\}\). The distribution is based on a given claims vector, c, over the surplus, which contains a claim \(c_i \in {\mathbb {R_+}}\) for every \(i\in {N}\).

Definition 3.1

(Bankruptcy problemFootnote 6) A bankruptcy problem is a pair (c, E) \(\in {{\mathbb {R}}^n_+ \times \mathbb {R_+} }\), where \(c \equiv {(c_i)_{i \in N}}\) is the claims vector and E is the surplus, such that \(\sum _{i \in N} {c_i} \ge E\). We denote the set of all such bankruptcy problems with \(\zeta ^N\).

Definition 3.2

(Bankruptcy rule) A bankruptcy rule is a function that associates with each bankruptcy problem (c, E) \(\in {\zeta ^N}\) an awards vector R(c, E) \(\in {{\mathbb {R}}^n_+}\), such that \(\sum _{i \in N} {R_i (c,E)} = E\) and \(R_i(c,E) \le c_i\) for every \(i \in {N}\).

The proportional rule is the most commonly used bankruptcy rule (Thomson 2019, p. 22). It distributes the surplus proportionally with respect to the claims.

Definition 3.3

(Proportional rule (\({\mathcal {P}}\))) For each \((c,E) \in \zeta ^N\), and for every \(i \in N\), the proportional rule distributes the surplus as

Another prominent bankruptcy rule that we will use in our analysis is the constrained equal awards rule. It distributes the surplus as equally as possible, subject to the constraint that no agent receives more than his claim.

Definition 3.4

(Constrained equal awards rule (\({\mathcal {C}}\))) For each \((c,E) \in \zeta ^N\), and for every \(i \in N\), the constrained equal awards rule distributes the surplus as

where \(\lambda\) is such that \(\sum _{i \in N} {{\mathcal {C}}_i (c,E)} = E\).

As we mentioned earlier, we update the punishment clause in line with the literature reviewed in Sect. 2. Our formal definition is as follows:

Definition 3.5

In the modified version of DD with n players, denoted by \(DD^*(n,\alpha ,R)\), given a strategy profile \(c \in C\), if \(\sum _{i \in N} {c_i} \le 1\), then every player still gets what he claims; but if \(\sum _{i \in N} {c_i} > 1\), then the game evolves into a bankruptcy problem (c, E) where the surplus

is distributed according to the bankruptcy rule R.

The interpretation is that if players make greedy claims (collectively), with their sum exceeding one, a punishment clause is triggered such that a portion of the dollar disappears. The remaining portion is distributed in a bankruptcy problem based on the players’ original claims. The whole dollar can disappear, but the remaining surplus is not allowed to be negative.

4 The results

A road map for this section is in order. After some preliminary observations, we first study the sets of Nash equilibria for all games in our family under the proportional rule. We also provide comparative static analyses on \(\alpha\) and n. Later, having observed that the proportional rule does not induce any efficient equilibrium outcome under certain conditions, we provide sufficient conditions on the bankruptcy rule to guarantee efficiency and equitability. Finally, our positive results under the constrained equal awards rule follow from our axiomatic analysis.

4.1 On the proportional rule

We start with the following observations.

Remark 4.1

When \(\alpha = 0\), independent of which claims are made, no portion of the dollar disappears, so that the respective bankruptcy problem is always (c, 1). It follows that \(DD^*(n,0,R)\) corresponds to a game proposed by Ashlagi et al. (2012) for any bankruptcy rule R. In the other extreme, as \(\alpha \rightarrow \infty\), the respective bankruptcy problem is always (c, 0), which implies that each player would end up with zero. It follows that \(DD^*(n,\infty , \cdot )\) corresponds to the standard DD.

The next two results immediately follow:

Proposition 4.1

(Ashlagi et al. 2012) In \(DD^*(n,0,{\mathcal {P}})\), there exists a unique Nash equilibrium in which every player demands the entire dollar and receives \(\frac{1}{n}\). The outcome is efficient.

Proposition 4.2

(Nash 1953) For any bankruptcy rule R, any efficient division of the dollar can be sustained as a Nash equilibrium in \(DD^*(n,\infty ,R)\).

We start by noting that, in \(DD^*(n,\alpha ,R)\), any strategy profile c that satisfies for every \(i \in N\), \(\alpha \left( \sum _{j \in N {\setminus } \{i\}} {c_j} - 1 \right) \ge 1\) constitutes a Nash equilibrium, since any claim is a best response for player i as it leads to the bankruptcy problem (c, 0). This is a zero-surplus equilibrium where no player receives a positive payoff. That being said, in the following equilibrium analyses, we concentrate on positive-surplus equilibria where at least one player ends up with a positive payoff.

Similar to Proposition 4.1, our first results focus on the proportional rule. Here, we turn our attention to the interior members of our game family (i.e., when \(\alpha \in (0,\infty )\)).

Proposition 4.3

Assume that \(\alpha \in (0,\infty )\) and \(n > \alpha +1\). Then, there does not exist any efficient Nash equilibrium in \(DD^*(n,\alpha ,{\mathcal {P}})\).

Proof

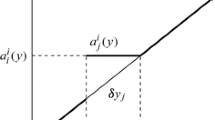

Suppose, for a contradiction, that there exists an efficient Nash equilibrium. Given that \(\alpha > 0\), if the sum of claims exceeds one, some portion of the dollar disappears, so that the respective outcome will be inefficient for sure. This implies that an efficient Nash equilibrium \(c^*\) should satisfy \(\sum _{i \in N} c^*_i = 1\). Consider an arbitrary player \(i \in N\). Suppose that player i deviates from \(c^*_i\) when the other players choose \(c^*_{-i}\). It is easy to see that the deviation cannot be to some strategy \(c_i < c^*_i\). Suppose that player i deviates to \(c^*_i + \varepsilon\) for some \(\varepsilon > 0\). Such a deviation yields a payoff of

and it occurs if that payoff is greater than \(c^*_i\). The deviation occurs if

That is, player i would deviate if any such \(\varepsilon\) exists. Accordingly, the no-deviation condition can be written as \(1 - (\alpha + 1) c^*_i \le 0\).

Now, suppose that the efficient Nash equilibrium we consider is such that \(c^*_i = \frac{1}{n}\) for every \(i \in N\). Since \(n > \alpha + 1\), by assumption, it follows that \(c^*_i < \frac{1}{\alpha + 1}\). As such, the current \(c^*_i\) does not satisfy the no-deviation condition above. This is a contradiction. For any other strategy profile that could constitute an efficient Nash equilibrium, there always exists a player \(i \in N\) with \(c^*_i< \frac{1}{n} < \frac{1}{\alpha + 1}\), which again leads to a contradiction. Therefore, there does not exist any efficient Nash equilibrium. \(\square\)

The intuition behind this result is that the proportional rule gives strong ‘free-riding’ incentives. More precisely, starting from a demand vector where the sum of demands is equal to one, any player has an incentive to unilaterally deviate and increase his claim, because the proportional rule is strictly claims monotonic, and thus always favors such an upward deviation, whereas the cost from that deviation (due to the punishment clause) is commonly shared.Footnote 7 Let us show this with a simple example. Take a three-player game with \(\alpha =1\) and start with an efficient claims vector, say \(c=(0.2, 0.3, 0.5)\). It is easy to see that if player 1 unilaterally deviates to \(c'_1 = 0.3\), he receives \(\frac{0.3}{0.3+0.3+0.5}(1-0.1) = \frac{0.27}{1.1} > 0.2\). Similarly, if player 2 unilaterally deviates to \(c'_2 = 0.4\), he receives \(\frac{0.36}{1.1} > 0.3\), and if player 3 unilaterally deviates to \(c'_3 = 0.6\), he receives \(\frac{0.54}{1.1} > 0.5\).

We understand that an efficient outcome cannot be sustained in equilibrium under the proportional rule if there are too many players in the game. The following proposition investigates whether the converse is possible (and if so, to what extent) when the number of players is sufficiently small.

Proposition 4.4

Assume that \(\alpha \in (0,\infty )\) and \(n \le \alpha +1\). Then, any strategy profile such that the sum of claims is 1 and every player demands no less than \(\frac{1}{\alpha + 1}\) is a Nash equilibrium of \(DD^*(n,\alpha ,{\mathcal {P}})\). There does not exist any other type of Nash equilibrium in \(DD^*(n,\alpha ,{\mathcal {P}})\). For the special case of \(n = \alpha +1\), the respective game has a unique Nash equilibrium, which is \(\left( \frac{1}{n}, \ldots , \frac{1}{n} \right)\).

Proof

Consider a strategy profile \(c \in C\) as a candidate for a Nash equilibrium. We know that any player would deviate to a slightly higher demand if \(\sum _{i \in N} c_i < 1\).

Instead, suppose that \(\sum _{i \in N} c_i > 1\). This means that there is a bankruptcy problem. Consider an arbitrary player \(i \in N\). Letting \(\sum _{j \in N {\setminus } \{i\}} c_j = {\bar{c}}\), player i’s payoff can be written as

Taking the first-order condition and solving for \(c_i\) yields

Since the respective second-order condition holds, this equation characterizes the best responses of player i. Considering the best responses of all players simultaneously, and then solving the respective system of equations, we find that

so that

Now, if \(n = \alpha + 1\), we have \(\sum _{i \in N} c^*_i = 1\), but then this contradicts with the supposition that \(\sum _{i \in N} c_i > 1\). Hence, no such equilibrium exists if \(n = \alpha + 1\). Furthermore, since Eq. (1) is an increasing function of n, we find that \(\sum _{i \in N} c^*_i < 1\) for lower values of n, i.e., when \(n < \alpha + 1\). This also contradicts with the supposition. Hence, no such equilibrium exists if \(n < \alpha + 1\).

The only remaining possibility is that a Nash equilibrium is efficient, if it exists. Accordingly, as a final case, assume that \(\sum _{i \in N} c_i = 1\). As we have shown in the proof of Proposition 4.3, player i makes a deviation if \(1 - (\alpha + 1) c_i > 0\). Thus, a Nash equilibrium does not occur if \(c_i < \frac{1}{\alpha + 1}\) for some player \(i \in N\). On the other hand, if \(c_i \ge \frac{1}{\alpha + 1}\) for every \(i \in N\), we know that no player deviates. This verifies that c is a Nash equilibrium under the respective conditions. Finally, assuming that \(n = \alpha +1\), one can observe that the only strategy profile satisfying the respective conditions is where every player demands \(\frac{1}{n}\). \(\square\)

Corollary 4.1

As \(\alpha \rightarrow \infty\), the set of Nash equilibria in \(DD^*(n,\alpha ,{\mathcal {P}})\) coincides with the equilibrium set in DD (also see Proposition 4.2).

The proposition above shows that for a given number of players, as \(\alpha\) increases, the equilibrium inefficiency disappears as soon as \(\alpha \ge n-1\). This indicates that, from a design perspective, the severity of the punishment must be above a critical level to avoid inefficient equilibria. This is required to undermine the free-riding incentives inherent in the way the excess demand is handled. As a matter of fact, a social planner can directly implement equal division as the unique Nash equilibrium by setting \(\alpha = n-1\).

In what follows, we return to the cases in which there is no efficient Nash equilibrium and investigate the extent of inefficiency as a function of the linear punishment factor and the number of players. In that regard, we first provide a complete equilibrium analysis under the assumption that \(n > \alpha +1\).

Proposition 4.5

Assume that \(\alpha \in (0,\infty )\) and \(n > \alpha +1\). If \(\alpha \le \frac{n-1}{n^2-n+1}\), then there is a unique Nash equilibrium in \(DD^*(n,\alpha ,{\mathcal {P}})\) in which every player demands the entire dollar. If \(\alpha > \frac{n-1}{n^2-n+1}\), then there is a unique Nash equilibrium \(c^*\) in \(DD^*(n,\alpha ,{\mathcal {P}})\) such that for every \(i \in N\):

Proof

Consider a strategy profile \(c \in C\) as a candidate for a Nash equilibrium. We know that any player would deviate to a slightly higher demand if \(\sum _{i \in N} c_i < 1\). And, by Proposition 4.3, we also know that \(\sum _{i \in N} c_i \ne 1\). Hence, the only case to consider is when \(\sum _{i \in N} c_i > 1\), which surely leads to a bankruptcy problem.

Consider an arbitrary player \(i \in N\). Letting \(\sum _{j \in N {\setminus } \{i\}} c_j = {\bar{c}}\), player i’s payoff can be written as

As we have shown in the proof of Proposition 4.4, it can be found that

solves all the respective first-order conditions simultaneously.

Assume that \(\alpha \le \frac{n-1}{n^2-n+1}\). Then, we have \(c^*_i \ge 1\). This indicates a corner solution where every player chooses to demand the highest amount possible. The unique Nash equilibrium occurs when every player demands the entire dollar. Conversely, assume that \(\alpha > \frac{n-1}{n^2-n+1}\). Then, we have \(c^*_i < 1\). And since \(\sum _{i \in N} c^*_i > 1\), we verify that this is a Nash equilibrium. \(\square\)

As mentioned earlier, \(\alpha = 0\) corresponds to the model studied in Ashlagi et al. (2012). Since \(0 \le \frac{n-1}{n^2-n+1}\), we can easily see from the proposition above that there exists a unique equilibrium under the proportional rule. In that equilibrium, players do not behave in an egalitarian fashion (every player demands the whole dollar) yet the outcome turns out to be egalitarian (every player receives an equal share).

Using the results reported above, one can identify the extent of inefficiency, which can be defined as the disappeared amount of surplus: \(\alpha \left( \sum _{i \in N} c_i - 1 \right)\). Then, the next results follow:

Corollary 4.2

In \(DD^*(n,\alpha ,{\mathcal {P}})\), for a given \(n \ge 2\), if \(\alpha \le \frac{n-1}{n^2-n+1}\), as \(\alpha\) increases, the inefficiency increases; whereas if otherwise, as \(\alpha\) increases, the inefficiency decreases, while there remains no inefficiency when \(\alpha \ge n-1\).

Proof

Assume that \(\alpha \le \frac{n-1}{n^2-n+1} < n-1\). Then, according to Proposition 4.5, every player demands the entire dollar in the unique equilibrium. The inefficiency can be calculated as \(\alpha (n - 1)\). This value increases as \(\alpha\) increases.

Assume that \(\frac{n-1}{n^2-n+1}< \alpha < n-1\). Then, according to Proposition 4.5, every player \(i \in N\) demands \(c^*_i\) as given in (2). The inefficiency can be calculated as

By taking its derivative with respect to \(\alpha\), we see that its value decreases as \(\alpha\) increases.

Finally, if \(n-1 \le \alpha\), then an efficient equilibrium emerges, as shown in Proposition 4.4. \(\square\)

Corollary 4.3

In \(DD^*(n,\alpha ,{\mathcal {P}})\), for a given \(\alpha \in (0, \infty )\) and starting from \(n > \alpha +1\), as n increases, the inefficiency increases (i.e., the size of the surplus to be distributed decreases). In fact, as \(n \rightarrow \infty\), the dollar completely vanishes.

Proof

As shown in the proof of Corollary 4.2, when \(n > \alpha +1\), the amount of inefficiency can be calculated as \(\alpha (n-1)\) if \(\alpha \le \frac{n-1}{n^2-n+1} < n-1\) and as

if \(\frac{n-1}{n^2-n+1}< \alpha < n-1\). By taking their derivatives with respect to n, we see that either inefficiency value increases as n increases. The former result follows by the observation that the two inefficiency values are equal to each other at the critical value when \(\alpha = \frac{n-1}{n^2-n+1}\).

For the latter result, as \(n \rightarrow \infty\), we see that the interval \(\left( \frac{n-1}{n^2-n+1}, n- 1\right) \rightarrow (0, \infty )\), so that it includes \(\alpha\). In the same limit, the value of (3) approaches 1. The whole dollar vanishes. \(\square\)

The intuition for these results is as follows: Given the severity of punishment, as the number of players increases, free-riding becomes more attractive since the loss generated by an increase in a player’s demand is shared by a greater number of people, which decreases his share of the burden. This leads to lower levels of efficiency. Similarly, as long as \(\alpha \le \frac{n-1}{n^2-n+1}\), an increase in the punishment does not avoid free-riding incentives but increases the vanishing portion of the dollar. On the other hand, if the punishment is sufficiently severe, then an increase in \(\alpha\) leads to higher efficiency levels due to more suppressed free-riding incentives.

4.2 Equal division as the unique equilibrium outcome

As we understood that the proportional rule does not always induce an efficient outcome, we now investigate which bankruptcy rules guarantee that an inefficient outcome is not observed in equilibrium and which bankruptcy rules yield an efficient and equitable outcome in equilibrium. In that regard, we define three axioms.

The following axiom stipulates that if an initially given claims vector is replaced by a weakly dominated claims vector, which in turn weakly dominates the initial awards vector, then the same awards vector would still be chosen (see Thomson 2019, pp. 196–197).Footnote 8

Axiom 1

(Claims decrease invariance (CDI)) Consider any bankruptcy problem, (c, E), and any claims vector, \(c'\), such that \(R_i(c,E) \le c'_i \le c_i\) for any \(i \in N\). Then, \(R(c,E) = R(c',E)\).

Our second axiom states that for any agent who initially receives a payoff lower than his claim, an increase in the surplus value will lead to a strict improvement in his payoff. It is a weakening of another well-known axiom, strict endowment monotonicity (see Thomson 2019, p. 96).

Axiom 2

(Full-compensation–conditional strict endowment monotonicity (FCCSEM)) Consider any two bankruptcy problems, (c, E) and \((c,E')\), with \(E < E'\). For any \(i \in N\), if \(R_i(c,E) < c_i\), then \(R_i(c,E) < R_i(c,E')\).

Finally, our third axiom is due to Herrero and Villar (2001).Footnote 9 It states that any agent with a claim less than or equal to the average surplus must be paid his claim. It is a weakening of another well-known axiom, conditional full compensation (see Thomson 2019, pp. 76–77).

Axiom 3

(Equal-division-conditional full compensation (EDCFC)) Consider any bankruptcy problem, (c, E). For any \(i \in N\), if \(c_i \le \frac{E}{n}\), then \(R_i(c,E) = c_i\).

The next proposition shows that a bankruptcy rule that satisfies Axioms 1 and 2 does not induce an inefficient Nash equilibrium.Footnote 10

Proposition 4.6

Assume that \(\alpha \in (0,\infty )\). In \(DD^*(n,\alpha ,R)\), if R satisfies CDI and FCCSEM, then there does not exist any inefficient Nash equilibrium.

Proof

Suppose, for a contradiction, that there exists an inefficient Nash equilibrium, say \(c^* \in C\).

If \(\sum _{i \in N} c^*_i < 1\), we know that any player would deviate to a slightly higher demand. This is a contradiction. Instead, assume that \(\sum _{i \in N} c^*_i > 1\). Since \(\alpha > 0\), we know that some portion of the dollar disappeared. Let the remaining portion be denoted by E. There exists some player \(i \in N\) with \(R_i(c^*,E) < c^*_i\). We can show that there is a profitable deviation downward for that player. To prove this claim, consider an alternative strategy \(c'_i = c^*_i - \varepsilon\) for a sufficiently small \(\varepsilon > 0\). Note that \(R_i(c^*,E)< c'_i < c_i\). Let \(c' = \left( c'_i, c^*_{-i}\right)\). Since R satisfies CDI, given that \(R_i(c^*,E) \le c'_i \le c_i\) for any \(i \in N\), we have \(R(c^*,E) = R(c',E)\). Now, if a deviation to \(c'_i\) occurs, then a smaller amount of dollar disappears. The new endowment would be \(E' = E + \alpha \varepsilon\). Moreover, since \(R_i(c^*,E) = R_i\left( c',E\right)\) and \(R_i(c^*,E) < c'_i\), we have \(R_i\left( c',E\right) < c'_i\). And given that R satisfies FCCSEM, we have \(R_i\left( c',E\right) < R_i\left( c',E'\right)\).

These imply that \(R_i(c^*,E) < R_i\left( c',E'\right)\), so that a deviation to \(c'_i\) is indeed profitable. This is a contradiction. Therefore, there is no inefficient Nash equilibrium. \(\square\)

The next proposition shows that if the employed bankruptcy rule satisfies Axiom 3, then among all efficient divisions, only one of them is a Nash equilibrium.

Proposition 4.7

Assume that \(\alpha \in (0,\infty )\). In \(DD^*(n,\alpha ,R)\), if R satisfies EDCFC, then there exists a unique efficient Nash equilibrium, which is \(\left( \frac{1}{n}, \ldots , \frac{1}{n} \right)\).

Proof

Consider any strategy profile \(c \in C\), such that \(\sum _{i \in N} c_i = 1\), but \(c_i < \frac{1}{n}\) for some player \(i \in N\). We can show that player i deviates to \(c'_i = c_i + \varepsilon\) for a sufficiently small \(\varepsilon > 0\). To prove this claim, note that player i directly receives \(c_i\) in this strategy profile, since a bankruptcy does not occur. However, after a deviation to \(c'_i\) the game evolves into the bankruptcy problem \(\left( \left( c'_i, c_{-i}\right) , E'\right)\) where \(E' = 1 - \alpha \varepsilon\). We find that

which is equivalent to

This inequality holds since \(c_i < \frac{1}{n}\) and \(\varepsilon\) is sufficiently small. The fact that R satisfies EDCFC implies \(R_i\left( \left( c'_i, c_{-i}\right) , E'\right) = c'_i\). Finally, since \(c'_i > c_i\), we conclude that a deviation to \(c'_i\) is profitable.

To complete the proof, consider the strategy profile \(c^* \in C\) such that \(c^*_i = \frac{1}{n}\) for any \(i \in N\). There is no profitable unilateral deviation from this strategy profile. This is because the corresponding deviation analysis follows similarly, as above. However, in the current case, it is impossible to find a sufficiently small \(\varepsilon > 0\), because since \(c^*_i = \frac{1}{n}\), it turns out that \(1 - n c^*_i = 0\) and \(\varepsilon \le 0\). Given that nobody deviates from \(c^*\), we conclude that \(c^*\) is a Nash equilibrium. As a matter of fact, it is the only efficient Nash equilibrium. \(\square\)

The next result is straightforward.

Corollary 4.4

Assume that \(\alpha \in (0,\infty )\). In \(DD^*(n,\alpha ,R)\), if R satisfies CDI, FCCSEM, and EDCFC, then there exists a unique Nash equilibrium, which is \(\left( \frac{1}{n}, \ldots , \frac{1}{n} \right)\).

In Proposition 4.8 below, we show that there exists at least one bankruptcy rule that satisfies the three axioms we presented earlier. In fact, this is another well-known bankruptcy rule from the existing literature: the constrained equal awards rule.Footnote 11\(^,\)Footnote 12

Proposition 4.8

The constrained equal awards rule satisfies CDI, FCCSEM, and EDCFC.

Proof

First, we note that Stovall (2014) proved that the constrained equal awards rule satisfies CDI. Second, for FCCSEM, we can refer to Thomson (2019) for the claimed result. Finally, for EDCFC, this is another result from the literature (see Herrero and Villar 2001). \(\square\)

From Corollary 4.4 and Proposition 4.8, it directly follows that under the constrained equal awards rule, in any interior member of our game family, there is a unique Nash equilibrium, where both the equilibrium behavior (i.e., demands) and the equilibrium outcome (i.e., division) are egalitarian. Clearly, such an outcome is also efficient. The intuition for this result is related to the fact that the constrained equal awards rule does not give any incentive to players to increase their demands when every player has a claim greater than equal to \(\frac{1}{n}\); given the existence of a punishment, it actually gives an incentive to players with demands over \(\frac{1}{n}\) to lower their demands toward \(\frac{1}{n}\). It is this incentive scheme inherent in the constrained equal awards rule that prevents free-riding and the inefficiency resulting from such behavior.

5 Conclusion

Three things inspired the current work: (i) disproportionate punishment embedded in DD, (ii) the multiplicity of equilibria in DD and the various types of support provided for the equal division equilibrium, and (iii) Nash (1953)’s smoothing approach. We constructed a parametric family of modified DDs. The parameter that defines this family can be interpreted as the severity of punishment in the case of excess demand.

First, for all interior members of our game family, we show that all Nash equilibria are inefficient under the proportional rule if the number of players is sufficiently high. The comparative static analyses reveal economically intuitive results: (i) starting from an already inefficient equilibrium, as the number of players increases, free-riding incentives become stronger (e.g., costs are shared with more people), and as a result, the equilibrium inefficiency increases; (ii) as the number of players goes to infinity, the whole dollar vanishes; and (iii) for a given number of players, it is possible to avoid inefficiency in equilibrium by increasing the toughness of the punishment. The last result can be interpreted as a support for the seemingly disproportionate punishment clause, which has been subject to criticism. More precisely, if the rules of the game are not easy to change but the number of players may increase, it may be on the safe side for the authority to impose the toughest possible punishment, which will surely induce an efficient equilibrium no matter what the number of players is. To our knowledge, ours is the first model to produce inefficient equilibria in a modified DD framework. It is the existence of such equilibria that allows us to reinterpret the disproportionate punishment in DD and to provide a new efficiency-oriented perspective.

It is also interesting to observe the changes in the nature of equilibria under the proportional rule for different values of \(\alpha\): (i) when \(\alpha =0\), there is a unique and efficient Nash equilibrium, where each player demands the whole dollar and receives \(\frac{1}{n}\), (ii) for intermediate values of \(\alpha\), there is a critical value for \(\alpha\) below which all equilibria are inefficient, and (iii) as \(\alpha \rightarrow \infty\), there are infinitely many Nash equilibria, all of which are efficient.

Second, we provide a sufficient condition (i.e., CDI + FCCSEM) on the bankruptcy rule to avoid inefficiency in equilibrium for all interior members of our game family and for any number of players. Later, we also provide a sufficient condition (i.e., CDI + FCCSEM + EDCFC) on the bankruptcy rule to induce a unique Nash equilibrium, where each player demands and receives \(\frac{1}{n}\) (i.e., equal division). The good news is that such a set of bankruptcy rules is non-empty, as we show that the constrained equal awards rule satisfies all three axioms. Accordingly, given that the constrained equal awards rule induces a unique Nash equilibrium for any interior member of our game family, which is efficient and equitable, it can be argued that an authority who wants to guarantee efficiency and equal division without being concerned about the number of players and/or policy adjustments on the punishment factor should prefer the constrained equal awards rule to other alternatives.

Notes

Leininger et al. (1989) showed the existence of inefficient equilibria in a sealed-bid bargaining game with incomplete information.

To the best of our knowledge, only Carlsson (1991) treated the case where the sum of demands is less than the dollar. Using an ad-hoc surplus partition rule, the author showed that the way the remainder is allocated can influence the equilibrium in a bargaining game where players can make errors.

The free-riding tendency observed here is similar to the ‘cheating’ tendency observed in a model of tacit collusion with Cournot competition: given that all the other firms stick to their quotas, a firm’s best response is to produce more than its quota despite the fact that this will lead to an equilibrium price lower than the monopoly price. The reason is that the gains from an increased production compensates the losses from a decreased price.

Stovall (2014) calls the same axiom “independence of irrelevant alternatives”.

The authors introduce the axiom under the name of “exemption”. We use the name given in Thomson (2019).

As it can be seen from our proof, one needs to find a profitable deviation from any inefficient strategy profile to prove such a result. Since CDI is only concerned with payoff invariance, it cannot be sufficient to find an increase in payoff after an individual deviation. From this perspective, FCCSEM could be sufficient for the claimed result, however since \({\mathcal {P}}\) satisfies FCCSEM but not CDI (see Stovall 2014; Thomson 2019), and since it is shown in this paper that an inefficient Nash equilibrium is possible under that rule, we can conclude that FCCSEM is also not sufficient for this result.

The converse result does not hold, since another bankruptcy rule that satisfies all three axioms can be constructed. As an example, consider a rule that operates as follows: In any given bankruptcy problem (c, E), let \(i^* \in N\) be the agent who has the maximum claim among all agents \(i \in N\) with \(c_i \le \frac{E}{n}\). The rule awards \(c_i\) to any agent \(i \in N\) with \(c_i \le c_{i^*}\) and awards \(c_{i^*}\) to any agent j with \(c_j > c_{i^*}\). If there is some excess surplus, then it is given to the latter type of agents by using a weighted gains rule (as in Moulin 2000).

The reader is referred to the Appendix for the independence of these axioms.

References

Abreu D, Pearce D (2015) A dynamic reinterpretation of Nash bargaining with endogenous threats. Econometrica 83:1641–1655

Anbarci N (2001) Divide-the-dollar game revisited. Theory Decis 50:295–304

Anbarci N, Rong K, Roy J (2019) Random-settlement arbitration and the generalized Nash solution: one-shot and infinite-horizon cases. Econ Theory 68:21–52

Andreozzi L (2010) An evolutionary theory of social justice: choosing the right game. Eur J Polit Econ 26:320–329

Ashlagi I, Karagözoğlu E, Klaus B-E (2012) A non-cooperative support for equal division in estate division problems. Math Soc Sci 63:228–233

Basak D, Deb J (2020) Gambling over public opinion. Am Econ Rev 110:3492–3521

Bolton GE (1997) The rationality of splitting equally. J Econ Behav Org 32:365–381

Bossert W, Tan G (1995) An arbitration game and the egalitarian bargaining solution. Soc Choice Welf 12:29–41

Brams SJ, Taylor AD (1994) Divide the dollar: three solutions and extensions. Theory Decis 37:211–231

Carlsson H (1991) A bargaining model where parties make errors. Econometrica 59:1487–1496

Cetemen ED, Karagözoğlu E (2014) Implementing equal division with an ultimatum threat. Theory Decis 77:223–236

Chun Y (1989) A noncooperative justification for egalitarian surplus sharing. Math Soc Sci 17:245–261

Dizarlar A, Karagözoğlu E (2021) Kantian equilibria of a class of Nash bargaining games. Working paper

Dutta R (2012) Bargaining with revoking costs. Games Econ Behav 74:144–153

Ellingsen T, Miettinen T (2008) Commitment and conflict in bilateral bargaining. Am Econ Rev 98:1629–1635

García-Jurado I, González-Díaz J, Villar A (2006) A non-cooperative approach to bankruptcy problems. Span Econ Rev 8:189–197

Habis H, Herings PJJ (2013) Stochastic bankruptcy games. Int J Game Theory 42:973–988

Hagiwara M, Hanato S (2021) A strategic justification of the constrained equal awards rule through a procedurally fair multilateral bargaining game. Theory Decis 90:233–243

Herrero C, Villar A (2001) The three musketeers: four classical solutions to bankruptcy problems. Math Soc Sci 42:307–328

Karagözoğlu E, Rachmilevitch S (2018) Implementing egalitarianism in a class of Nash demand games. Theory Decis 85:495–508

Kıbrıs Ö, Kıbrıs A (2013) On the investment implications of bankruptcy laws. Games Econ Behav 80:85–99

Leininger W, Linhart PB, Radner R (1989) Equilibria of the sealed-bid mechanism for bargaining with incomplete information. J Econ Theory 48:63–106

Li J, Ju Y (2016) Divide and choose: a strategic approach to bankruptcy problems. Mimeo, New York

Moulin H (2000) Priority rules and other asymmetric rationing methods. Econometrica 68:643–684

Moulin H (2002) Axiomatic cost and surplus sharing. In: Arrow K, Sen A, Suzumura K (eds) Handbook of social choice and welfare, vol 1. Elsevier, Amsterdam

Nash JF (1950) The bargaining problem. Econometrica 18:155–162

Nash JF (1953) Two person cooperative games. Econometrica 21:128–140

Nydegger RV, Owen G (1975) Two person bargaining: an experimental test of Nash axioms. Int J Game Theory 3:239–249

Rachmilevitch S (2017) Punishing greediness in divide-the-dollar games. Theory Decis 82:341–351

Rachmilevitch S (2020a) An implementation of the Nash bargaining solution by iterated strict dominance. Econ Lett 188:108960

Rachmilevitch S (2020b) Rewarding moderate behavior in a dynamic Nash demand game. Int J Game Theory 49:639–650

Rasmusen E (2019) Back to bargaining basics: a breakdown model for splitting a pie. Mimeo, New York

Roth A, Malouf MWK (1979) Game theoretic models and the role of information in bargaining. Psychol Rev 86:574–594

Schelling TC (1960) The strategy of conflict. Harvard University Press, Cambridge

Skyrms B (1996) Evolution of the social contract. Cambridge University Press, Cambridge

Sonn S (1992) Sequential bargaining for bankruptcy problems. Mimeo, New York

Stovall J (2014) Collective rationality and monotone path division rules. J Econ Theory 154:1–24

Thomson W (2003) Axiomatic and game-theoretic analysis of bankruptcy and taxation problems: a survey. Math Soc Sci 45:249–297

Thomson W (2015) Axiomatic and game-theoretic analysis of bankruptcy and taxation problems: an update. Math Soc Sci 74:41–59

Thomson W (2019) How to divide when there isn’t enough: from Aristotle, the Talmud, and Maimonides to the axiomatics of resource allocation. Cambridge University Press, Cambridge

Tsay M-H, Yeh C-H (2019) Relations among the central rules in bankruptcy problems: a strategic perspective. Games Econ Behav 113:515–532

Van Huyck J, Battalio R, Mathur S, Van Huyck P (1995) On the origin of convention: evidence from symmetric bargaining games. Int J Game Theory 24:187–212

Young PH (1993) An evolutionary model of bargaining. J Econ Theory 59:145–168

Acknowledgements

We would like to thank the associate editor, two anonymous reviewers, Nejat Anbarci, and Shiran Rachmilevitch for useful comments and suggestions. We also thank Tara Sylvestre for language editing. The authors do not have any competing interests to declare. The usual disclaimers apply.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

This Appendix shows that, in Corollary 4.4, none of our axioms is implied by the other two axioms.

\(\diamond\) A rule that satisfies CDI and EDCFC, but not FCCSEM: Let \({\dot{R}}\) be a weighted gains rule for some vector of positive weights, \(w = \left( w_1, \ldots , w_n\right)\) (see Moulin 2000). As such, for any bankruptcy problem (c, E), we have \({\dot{R}}_i(c,E) = \min \{\lambda w_i, c_i\}\) for every \(i \in N\) where \(\lambda\) is such that \(\sum _{i \in N} {{\dot{R}}_i (c,E)} = E\).

The rule \({\dot{R}}\) satisfies CDI, because any agent \(i \in N\) with \({\dot{R}}_i(c,E) < c_i\) collects an award of \(\lambda w_i\). After a decrease in his claim to some \(c'_i \ge {\dot{R}}_i(c,E)\), it can be seen that \(\min \{\lambda w_i, c'_i\} = \lambda w_i\), so that his award does not change. The rule \({\dot{R}}\) also satisfies FCCSEM, because any increase in the endowment amount increases \(\lambda\), so that all unsatisfied agents become better-off.

However, \({\dot{R}}\) does not satisfy EDCFC for the weights vector \(w = (1,2,3,4)\). For that, consider an example with \(N= \{1,2,3,4\}\), \(c=(20, 40, 60, 80)\), and \(E = 100\). Then, \(\lambda\) is found to be 10, so that the awards vector is \({\dot{R}}(c,E) = (10,20,30,40)\). But now, although \(c_1 = 20 < 25 = \frac{100}{4} = \frac{E}{n}\), we have \({\dot{R}}_1(c,E) = 10 < c_1\).

\(\diamond\) A rule that satisfies CDI and EDCFC, but not FCCSEM: Let \({\bar{R}}\) be defined as follows. In any given bankruptcy problem (c, E), let \(i^* \in N\) be the agent who has the maximum claim among all agents \(i \in N\) with \(c_i \le \frac{E}{n}\). The rule \({\bar{R}}\) awards \(c_i\) to any agent \(i \in N\) with \(c_i \le c_{i^*}\) and awards \(c_{i^*}\) to any agent j with \(c_j > c_{i^*}\). If there is some excess surplus, then it is given to the remaining agents lexicographically following an order of their index numbers. That is, the remaining surplus is given to agent 1 until his award reaches his claim; if there is still some excess surplus, it is given to agent 2 until his award reaches his claim; and so on.

The rule \({\bar{R}}\) satisfies CDI, because any agent \(i \in N\) with \({\bar{R}}_i(c,E) < c_i\) needs to have \(c_i > c_{i^*}\), so that after he collects \(c_{i^*}\), the rest of his award was given according to his index number. Given that he is unsatisfied, a decrease in his claim to some \(c'_i \ge {\bar{R}}_i(c,E)\) cannot change his award. The rule \({\bar{R}}\) also satisfies EDCFC, by definition.

However, \({\bar{R}}\) does not satisfy FCCSEM. For that, consider an example with \(N= \{1,2,3,4\}\), \(c=(10, 60, 20, 90)\), and \(E = 100\). Then, from the first part of the rule definition, we know that \(i^* = 3\), so that agents collect (10, 20, 20, 20) at first. The excess surplus is 30. It cannot be given to agent 1 since he is already fully compensated. It is then given to agent 2, and since there is no surplus left, the process stops here. We find that \({\bar{R}}(c,E) = (10, 50, 20, 20)\). Now, if we increase the surplus to \(E' = 105\), following similar steps, we can find \({\bar{R}}(c,E') = (10, 55, 20, 20)\). But then, although \({\bar{R}}_4(c,E) < c_4\), we have \({\bar{R}}_4(c,E') = {\bar{R}}_4(c,E)\).

\(\diamond\) A rule that satisfies FCCSEM and EDCFC, but not CDI: Let \({\tilde{R}}\) be defined as follows. In any given bankruptcy problem (c, E), let \(i^* \in N\) be the agent who has the maximum claim among all agents \(i \in N\) with \(c_i \le \frac{E}{n}\). The rule \({\tilde{R}}\) awards \(c_i\) to any agent \(i \in N\) with \(c_i \le c_{i^*}\) and awards \(c_{i^*}\) to any agent j with \(c_j > c_{i^*}\). If there is some excess surplus, then it is given to the latter type of agents by using the proportional rule.

The rule \({\tilde{R}}\) satisfies FCCSEM, because any agent \(i \in N\) with \({\tilde{R}}_i(c,E) < c_i\) needs to have \(c_i > c_{i^*}\), so that after he collects \(c_{i^*}\), the rest of his award was given using the proportional rule, and it is known that \({\mathcal {P}}\) satisfies strict endowment monotonicty (see Thomson 2019), which implies FCCSEM. The rule \({\tilde{R}}\) also satisfies EDCFC, by definition.

However, \({\tilde{R}}\) does not satisfy CDI. For that, consider an example with \(N= \{1,2,3,4\}\), \(c=(10, 60, 20, 90)\), and \(E = 100\). Then, from the first part of the rule definition, we know that \(i^* = 3\), so that agents collect (10, 20, 20, 20) at first. The excess surplus is 30, which is then divided between agents 2 and 4 using the proportional rule. Given their claims, they additionally get the 2/5th and 3/5th of that excess surplus, respectively. As such, we find that \({\tilde{R}}(c,E) = (10, 32, 20, 38)\). Now, if we decrease agent 4’s claim to \(c'_4 = 60\), we can find \({\tilde{R}}(c',E) = (10, 35, 20, 35)\), so that the awards vector changes following an allowed decrease in claims.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Karagözoğlu, E., Keskin, K. & Sağlam, Ç. (In)efficiency and equitability of equilibrium outcomes in a family of bargaining games. Int J Game Theory 52, 175–193 (2023). https://doi.org/10.1007/s00182-022-00814-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-022-00814-3

Keywords

- Bankruptcy problem

- Bargaining

- Constrained equal awards rule

- Divide-the-dollar game

- Efficiency

- Equal division

- Proportional rule