Abstract

The present research on the relationship between financial development and CO2 emissions has shown conflicting, inconsistent results. This study resolves this problem by examining the direct and indirect effects of financial development on CO2 emissions using the Environmental Kuznets Curve (EKC) analytical framework. Our scientific work for South Africa between 1960 and 2020 is built on the cutting-edge dynamic autoregressive distributed lag simulations technique. The findings, which were based on five different financial development metrics, show that financial development both temporarily and permanently lowers CO2 emissions. We further support the EKC theory’s applicability in the case of South Africa. More significantly, the results of the indirect channels show that financial development reduces the deleterious effects of economic growth, trade openness, and foreign direct investment on CO2 emissions while strengthening the role that energy utilization plays in promoting carbon emissions. Additionally, the pollution haven hypothesis (PHH), which is explored by employing trade openness and foreign direct investment variables, is predicated on the existence of an inefficient financial framework. When financial development reaches certain levels, PHH for both of these factors vanishes. Finally, technological innovation reduces CO2 emissions even when industrial value addition fuels them. In light of our empirical findings, this research offers some critical policy suggestions and novel viewpoints for South Africa as it implements national interventions to cut CO2 emissions and achieve its net-zero emission goals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Climate change is believed to occur in many different forms, ranging from environmental depletion of natural resources to water and air pollution (Udeagha and Ngepah 2022a, b). Consequently, combating global warming and climate change has become a top issue for both industrialized and developing nations globally in recent years. More crucially, since it is so significantly associated with the results of various macroeconomic parameters, climate change is seen to pose a danger to the health of the world economy (Udeagha and Muchapondwa 2022a). For instance, there is a connection between unpleasant environmental circumstances and climate change, which is thus likely to have negative effects on economic development, human health, the accumulation of natural and physical capital, and access to water, food, and land productivity. As a result, a global movement to aggressively tackle climate change has emerged in response to these socioeconomic and environmental challenges (Zia et al. 2021). As a result, practically all nations have accepted the Paris Climate Change Agreement (PCCA) and pledged to reduce their individual greenhouse gas (GHG) emission levels in order to fend off threats brought on by climate change (World Bank 2021). However, these countries have also pledged to work toward achieving the Sustainable Development Goals (SDG) agenda of the United Nations (UN) by putting in place the required laws to guarantee social, economic, and environmental sustainability by 2030 (Zeeshan et al. 2021).

Since it impacts every nation, climate change has grown to be a serious public health concern. As major GHG producers, many industrialized economies, such as China, India, Russia, Japan, the United States, and Germany, have a responsibility to protect the environment (World Bank 2021). It is essential that they work together and make sacrifices on an individual basis to combat global environmental damage. However, limiting CO2 emissions does result in lower output, which might impede the rise of productivity since doing so is linked to energy use, which is crucial for economic development (Tahir et al. 2021). Due to this situation, it is exceedingly difficult for these countries to participate in or implement programs that seek to reduce global CO2 emissions. This needs improved methods for achieving environmentally friendly economic growth and higher environmental standards. In pursuit of this goal, several policymakers worldwide have implemented a variety of initiatives to slow down environmental damage and combat climate change. (Li et al. 2022). One of these tactics, regarded to be a successful technique to raise environmental quality, is financial development.

Financial development is essential since it is the supply of financial resources connected to environmental and socioeconomic sustainability (Aljadani 2022). Economic growth and financial development are intertwined because institutional financing to private investors can boost the economy over the long run. In order to support renewable energy initiatives, a credible financial establishment can be useful since financial intermediation is crucial for improving environmental sustainability (Islam 2022). Energy usage and institutional quality are substantially impacted by financial growth, which lowers energy use. Additionally, having access to financial resources is made possible by a stable financial system, which improves living standards and spurs economic expansion. A matured financial structure and the accessibility of financial resources aid in the development of modern and efficient technologies that are more energy-efficient and environmentally sustainable, which eventually reduces pollution problems (Li et al. 2022). Additionally, financial development and capital market liberalization encourage corporate linkages, stimulate technical divisions to transfer green technology, and enable R&D to the host nation. In this direction, Majeed and Mazhar (2019) showed how financial development boosts environmental sustainability by encouraging clean and cutting-edge technologies, stimulating R&D initiatives, and providing enterprises with technical and financial assistance. Theoretical research has provided a number of arguments for why financial development is essential for addressing climate change. For instance, financial development makes it easier for both private and public sector investors to engage in clean energy projects, decreases risk diversification, and lowers intermediary costs (Nasir et al. 2019). A well-developed financial sector that attracts foreign direct investment leads to R&D projects that boost revenue and lessen environmental impact. The deployment of cutting-edge solutions is encouraged by considerable inflows of foreign direct investment, which improves the sustainability of the local and global environment.

Over time, CO2 emissions have increased along with the financial development of South Africa. The nation implemented several measures aimed at strengthening its financial institutions after transitioning to a constitutionally political framework in 1994, creating a robust financial basis (Udeagha and Muchapondwa 2022b; Adebayo et al. 2021; Adebayo and Odugbesan 2021). This upward trajectory was mostly sustained until 2007, when the nation went through a severe financial collapse as a result of the global financial crisis of 2007–2008 (Awodumi and Adewuyi 2021). Since that time, South Africa's economy, government finances, and CO2 emissions levels have all continued to expand steadily. In South Africa, financial resources are frequently exploited to further the nation’s financial and economic growth. Meanwhile, the nation’s strengthened financial system, which is largely dependent on financial resources, promotes investment efficiency, extends business prospects, enhances company performance, makes it possible for greater energy efficiency, and prevents environmental deterioration (Kohler 2013). Given this, one of the main strategies used by several administrations since 1994 to prevent environmental degradation has been to keep the country’s energy industry growing by providing adequate financial support (Haseeb et al. 2018). Increased credit allocation, investment rates, economic growth, and more environmentally friendly projects are all outcomes of South Africa's financial system, all of which work to slow down the environment's degradation (Adebayo et al. 2021; Adebayo and Odugbesan 2021; Adewuyi and Awodumi 2021). Additionally, the nation’s more effective, resilient, and productive financial intermediaries draw foreign direct investment, which makes a substantial contribution to economic growth and development. The government has unveiled a number of significant regulations to entice foreign companies to invest more in R&D and use stronger practices that support environmentally friendly practices and energy-efficient production. By implementing these eco-innovative techniques, the industrial structure of the nation changes from one that requires a lot of energy to one that uses less energy, hence lowering CO2 emissions (Shahbaz et al. 2013; Udeagha and Ngepah 2019). Generally, South Africa's excellent financial structure promotes energy-efficient technology, boosts product competitiveness, reduces manufacturing costs, and lowers energy prices in order to reduce CO2 emissions. The nation's financial system is also sophisticated and well organized with reliable banking regulations and a financial sector that is in the top ten in the world. South Africa is an interesting case study for examining the moderating impact of financial development in the typical EKC framework via the routes of economic growth, energy supply, trade openness, and foreign direct investment inflows because of all of these characteristics.

South Africa ranks as the 15th greatest CO2 producer in the world and is the major CO2 producer in the African continent (1.09 percent of worldwide pollution). The use of coal tends to be the main factor for the nation’s rising emission levels (Udeagha and Ngepah 2022c; Shahbaz et al. 2013). Coal is the primary energy source and a major source of emissions in South Africa. Coal accounts for around 77% of all power production, of which 2% is utilized for home energy production, 12% for the iron and steel sector, 33% for industrial facilities, and 53% for cogeneration (Udeagha and Breitenbach 2021). These characteristics make South Africa an ideal candidate for this inquiry.

Although previous research on the relationship between financial development and CO2 emissions has advanced, it has also brought up a number of serious issues. These components are part of the current study because they considerably advance the corpus of knowledge. As a consequence, we contribute to the expanding body of research on the following five dimensions of how financial development impacts the environment. First and foremost, this research represents the first attempt at an empirical examination of the moderating role that financial development plays in the EKC framework in South Africa. Using the EKC paradigm, the study examines whether financial development lowers CO2 emissions in South Africa. It also examines whether a well-organized financial sector may mitigate the harmful environmental consequences of income growth (economic growth). Second, the study examines and evaluates whether a higher level of financial development mediates the detrimental effects of energy usage, foreign direct investment, and trade openness on South Africa’s carbon emissions using the EKC framework and financial development as a mediator of the relationshipFootnote 1.

As these variables have been used to test whether the pollution haven hypothesis holds true for less developed countries, it is vital to stress that further study is needed to determine how financial development may indirectly effect CO2 emissions through these variables. This study is the first to attempt to lay out the circumstances under which the theory may be accurate or incorrect for South Africa. Our analysis thereby resolves the empirical puzzle of the pollution haven hypothesis for South Africa and the rest of the developing world. Third, this work employs the credible methodology pioneered by Brambor et al. (2006) to visually illustrate the environmental consequences of financial development as reflected in trade openness, foreign direct investment, energy consumption, and economic growth. We can evaluate the environmental marginal impacts of each of these factors at different financial development levels using this reputable technique, and we can systematically identify the financial development levels required to mitigate the adverse consequences. Despite the compelling modeling strategy put out by Brambor et al. (2006), earlier studies have disregarded it when evaluating the suggested association. Fourth, prior studies on the link between finance and CO2 emissions in a larger perspective, including the aforementioned research articles above, commonly used the basic ARDL model developed by Pesaran et al. (2001) as well as other cointegration procedures, which could only analyze the short- and long-term associations between all of the model’s variables. In contrast, by addressing the flaws and limitations in the application of the traditional ARDL approach by using an advanced econometric assessment, more precisely, Jordan and Philips (2018)'s novel dynamic ARDL simulations approach, this research significantly adds to the sparse body of methodological knowledge. The novel dynamic ARDL simulations methodology efficiently tackles the problems and limitations in the output explanations of the simple ARDL approach by conveniently simulating and depicting to forecast plots of (negative and positive) variations in the factors and observing the accompanying short-run and long-run relations between variables under evaluation. As a result, the investigation’s utilization of this novel methodology produces dependable and transparent outcomes. Finally, we differ from other research that evaluated and broadly described trade openness using standard trade intensity by carefully using the Squalli and Wilson innovative trade openness measure to reflect two components of trade openness—emphasizing trade's contribution to GDP and recognizing the magnitude of trade, particularly in comparison to foreign markets.

This paper is divided into the following sections: A brief discussion of the relevant literature is included in the portion that comes before. The strategy used to accomplish the objectives of this research is illustrated in the section under “Data and Econometric Methodology.” In “Results and Discussion,” the empirical data and an explanation of the results are provided with the necessary literature support. “Concluding observations and policy recommendations” are provided in the last part.

Literature Review and Research Gaps

In this part, we emphasize the theoretical and empirical research on the relationship between financial development and CO2 emissions.

Review of Previous Literature

The theoretical literature has a variety of justifications for highlighting the significance of financial development in lowering CO2 emissions (Ling et al. 2022). For instance, financial development reduces risk diversification, lowers intermediate costs, and makes it simpler for both private and public sector investors to invest in clean energy projects (Nasir et al. 2019). Frankel and Romer (1999) shown that the growth of a well-organized financial sector encourages foreign direct investment, which sparks R&D initiatives, increasing income and reducing environmental harm. The authors also agreed that significant inflows of foreign direct investment (FDI) encourage the adoption of cutting-edge technologies that enhance regional and global environmental sustainability.

Numerous empirical studies have been conducted on the impacts of financial development on the environment, but the conclusions from these studies have been contentious and contradictory across the range of experimental methodologies and economies considered. According to several studies, financial development encourages environmentally resourceful and energy-efficient operations by enabling enterprises to use more advanced technologies. By using these eco-innovative techniques, the nation's industrial structure transitions to eco-friendly production techniques, enhancing environmental sustainability. Additionally, according to this group of studies, a better financial system lowers CO2 emissions by enabling advancements in energy and technology, improving investment effectiveness, expanding business opportunities, and enhancing enterprise performance. It also facilitates an increase in energy efficiency, increases product competitiveness, lowers production costs, reduces energy costs, and promotes energy-efficient methods. The reduction of CO2 emissions is significantly aided by all of this.

For instance, a study by Zeeshan et al. (2021) that examined the link in 20 industrialized countries found a positive correlation where financial development helps to slow down environmental damage. By reducing CO2 emissions in the Sub-Saharan African countries under study, financial development improved environmental quality, according to Xuezhou et al. (2022), who used the panel vector autoregressive-generalized method of moment framework (PVAR-GMM) to study the relationship between financial development and fostering environmental quality. Similar to this, Usman et al. (2021) found that from 1995 to 2017, 52 advanced and emerging economies’ financial expansion reduced environmental pollution. The favorable impact of China’s financial growth was also noted by Li et al. (2022), who utilized the asymmetric ARDL framework to study the asymmetric effect. In a similar vein, Khan et al. (2022a, b) discovered that between 2002 and 2019, financial development enhanced environmental conditions globally. It increased environmental health in 184 countries, as Khan et al. (2021a, b, c) showed.

On the other side, financial development damages the sustainability of the environment, according to another body of study. Furthermore, according to this group, better-managed and higher-quality financial intermediation leads to more financial initiatives that give access to high-energy-demanding goods to both households and businesses (or manufacturers), hence raising CO2 emissions. The environment gets worse as a result of people’s (or businesses’) and families’ rising energy usage. Thus, financial development adds to an increase in CO2 emissions through energy use. This line of reasoning has also acknowledged the path taken by inflows of foreign direct investment as another element contributing to the increased pollution caused by financial development. Financial growth attracts FDI, which has a significant negative impact on ecosystems, especially in developing nations. These pollution-intensive giant enterprises move their operational processes, amplifying environmental deterioration in these less industrialized nations, given that it is more adaptable and less costly to adhere to poorly enforced environmental legislation than it is to follow the stringent environmental requirements that govern manufacturing processes in industrialized economies (Habiba et al. 2021; Ganda 2021).

Table 1 also provides a summary of studies that look at the relationship between financial development and CO2 emissions for additional cross-national and cross-regional evaluations.

Material and Methods

Utilizing the cutting-edge dynamic ARDL simulations model, this analysis investigates both direct and indirect effects of financial development on environmental quality. In order to depict the environmental implications of financial development as shown in trade openness, energy supply, economic growth, and foreign direct investment, the study also uses the sophisticated modeling technique established by Brambor et al. (2006).

Theoretical Underpinning

The link between financial development and CO2 emissions is theoretically subject to conflicting hypotheses. According to one school of thought, a sound financial system makes it easier to provide loans for research and development (R&D), which not only boosts business activities but also reduces CO2 emissions (Frankel and Romer 1999). Financial development accelerates technical advancements, which boost production growth and lower pollution emissions, in accordance with Zagorchev et al. (2011). Financial development is also considered to enhance the ability to offer businesses and consumers affordable finance so they may engage in sustainable energy initiatives (Halicioglu 2009). In fact, investing in renewable energy demands a quite substantial initial outlay that cannot be met without the financial sector’s active involvement (Tamazian and Rao 2010). Claessens and Feijen (2007) claim that reforms in the financial sector will improve enterprises’ governance structures and, as a result, lower CO2 emissions. This is another aspect of good financial development and climate mitigation. Theoretical studies by Baulch et al. (2018) reveal that Ho Chi Minh City citizens’ utilization of solar home systems is being severely restricted by cost limitations (Vietnam). Some researchers contend that more financial development may even lead to a rise in CO2 emissions, which runs counter to these beneficial effects of financial development on CO2 emissions. This viewpoint’s proponents contend that as financial inequality grows, industrialization accelerates and industrial pollution intensifies (Jensen 1996; Bank 2000). Furthermore, according to Zhang (2011), rapid financial development would make it easier to finance large consumer goods like refrigerators, air conditioners, vehicles, and homes, which will result in higher energy use and, ultimately, higher pollution emissions. The author also makes the case that increased financial development may result in an increase in FDI influx and, as a result, pollution emissions. Two further theoretical pathways through which financial development could exacerbate environmental deterioration are provided by Sadorsky (2011). These comprise the wealth effect pathway and the business effect route. The first channel claims that financial development is linked to the economy’s risk diversification, which might quicken the process of wealth creation. The second channel predicts that increased financial development and the associated lower cost of capital to entrepreneurs would result in an increase in commercial enterprise, including the employment of labor and equipment by enterprises. These two channels together will result in increased energy consumption and CO2 emissions (Acheampong 2019).

Functional Form

This study employs a robust EKC hypothesis framework and a methodologically rigorous methodology from earlier research to assess the moderating effect of financial development on CO2 emissions in South Africa. According to the EKC hypothesis, climate change gets worse as the economy grows, particularly in the early stages of a major transition. This is because the country is more concerned with achieving quicker economic growth than with reducing emissions, which causes environmental degradation to worsen as income rises. The strong and fundamental link between CO2 emissions and income is highlighted by this concept. Meanwhile, the stage of growth that is quickly industrializing results in larger degrees of environmental degradation. As the economy expands and moves away from manufacturing practices that have been characterized by agricultural production, environmental degradation increases. As a result, people become more concerned about environmental issues, which leads to the implementation of stricter pollution standards to improve ecosystem and biodiversity.

We present the traditional EKC hypothesis in the manner of Cole and Elliott (2003), Udeagha and Ngepah (2019), Udeagha and Breitenbach (2022), and Udeagha and Ngepah (2021a, b) as follows:

where CO2 is a measure for environmental quality,Footnote 2 TE represents technique effect, and SE denotes scale effect. When Eq. (1) is log-linearized, we have the following:

As pollution rises as a result of increased income, the scale effect increases CO2 emissions; on the other hand, the technique effect reduces it as much stricter pollution controls are adopted to curb rising emissions (Cole and Elliott 2003; Ling et al. 2015). As a result, the correctness of the EKC hypothesis necessitates that: \(\varphi >0\) and \(\beta <0\). The model accounts for both industrial value-added and technological innovation, as suggested by the literature. Thus, the following equation defines our benchmark modeling approach, which contains the primary effects excluding multiplicative interaction terms:

where \({InFD}_{t}\) denotes financial development; \(In{IGDP}_{t}\) stands for industrial value-added; \({InOPEN}_{t}\) signifies trade openness, \(In{FDI}_{t}\) denotes foreign direct investment; \(In{EC}_{t}\) signifies energy consumption; \({InTECH}_{t}\) is technological innovation; and all variables are in their natural log. \(\varphi ,\beta ,\psi ,\rho , \pi , \delta \tau and \omega\) are the estimable parameters in the model representing different elasticities while \({U}_{t}\) is the stochastic error term. To reflect the dynamic influence of CO2 emissions in the model, the paper employs the first lag of the dependent variable (\({\mathrm{In}CO2}_{t-1}\)).

While verifying the prevalence of the EKC hypothesis, we further argue that financial development can act as a moderating component in the relationship between economic expansion and CO2 emissions as Gill et al. (2019) highlighted and can be shown in the following model:

Similarly, the following relation can be used to investigate the moderating effect of financial development in the energy–pollution relationship:

Equally, the moderating influence of financial development on the link between foreign direct investment and CO2 emissions may be evaluated using the following relation:

In a similar vein, this paper looks at the moderating effect of financial development on ecosystems via the trade openness channel. To account for this, the following model is used:

We visually show and quantify the incremental effects at various degrees of financial development.

Variables and Data Sources

This research uses yearly dataset from 1960 to 2020. Table 2 summarily shows the variables and where data were sourced in this study.

Narayan and Popp’s Structural Break Unit Root Test

Because structural breaks are prevalent, the investigation accounts for them with the method suggested by Narayan and Popp (2010) as failing to do so might result in inaccurate and conflicting outcomes.

ARDL Bounds Testing Approach

In this research, the moderating impact of South Africa's financial development on its CO2 emissions is examined using the bounds testing approach. Before using those equations with multiplicative interacting parts, Eq. (3), our benchmark framework without multiplicative connecting components, is employed in the study as an illustration. Following Pesaran et al. (2001), we present the conventional ARDL bounds approach in the manner below:

The estimable long-run ARDL model is presented thus:

In Eq. (9), \(\omega\) denotes the variables' long-run variability. The SBIC is utilized to choose the appropriate lags. We present the short-term error correction framework as follows:

Dynamic Autoregressive Distributed Lag (Dynamic ARDL) Simulations Model

Jordan and Philips (2018) developed a novel dynamic ARDL simulations framework, that is employed in this study, to bypass the obstacles and flaws in the use of the basic ARDL approach. The new dynamic ARDL simulations framework effectively increases the accuracy and offers potential solutions in the outcome interpretations of the basic ARDL approach, in addition to being able to instantly display and plot to predict graphs of (negative and positive) changes in the various factors and also analyze the inextricably intertwined among the variables evaluated. As a result, the intriguing method employed in this study yields comprehensive and credible results. The sample space’s approximately Gaussian distributions enable this paper's dynamic ARDL error correction method to use 1000 simulation outcomes. The differences in the predictor factors and how they affect the results are also explored in the study's graphics. Our framework is defined by the model below:

Investigating the moderating impact of financial development on the growth–pollution nexus in South Africa is one of the study goals of this article. In the novel dynamic ARDL simulations methodology, Eq. (4) is modified as follows to explore the moderating influence of financial development on environment via economic growth channel:

To explore the moderating impact of financial development in the link between energy use and CO2 emissions, Eq. (5) in the novel dynamic ARDL simulations framework is expressed as follows:

The relationship between foreign direct investment and CO2 emissions in the following equation can potentially be used to measure the moderating impact of financial development:

The moderating influence of financial development on environment via the trade openness channel is investigated lastly by changing Eq. (7) in the novel dynamic ARDL simulations approach as follows:

The relevant models used in our inquiry are Eqs. (11), (12), (13), (14), and (15). As the innovative dynamic ARDL stimulations technique is implemented in these estimable equations, this study uses five financial development indicators that have been widely used in relevant work for robustness validation.

Empirical Results and Their Discussion

Summary Statistics

The evaluation of descriptive data is presented in Table 3, where the mean CO2 emissions, the minimum, and the technique effect (TE), the maximum, are, respectively, 0.361 and 60.316 in contrast to other factors. Based on its value, foreign direct investment (FDI) is what comes next. The Jarque–Bera statistics also show that our data series has a normal distribution.

Order of Integration of the Respective Variables

Table 4 shows that when different unit root tests are used, we observed that InSE, InTE, InM3GDP, InTDGDP, InDCPS, InDCFS, InFSDGDP, InTECH, InFDI, and InIGDP are all stationary. However, our investigation shows that InCO2, InEC, and InOPEN are only stationary at I(1). Moreover, the variables with a nonstationary level after the first differencing become stationary at I(1). This scientific finding suggests that none of the elements examined is I(2) and that all are either I(1) or I(0).

Lag Length Selection Results

Lag one is ascertained as being the most appropriate in our investigation, as illustrated by this strategy, which is displayed in Table 5’s results of various strategies for choosing optimal lags. The SIC is recognized to have achieved the minimum value compared to other methods and is demonstrated to have the smallest value in Table 5.

Cointegration Test Results

The elements under consideration interact throughout time, as seen in Table 6 (see Narayan 2005). Simply put, each of the variables we examined has a long-term impact on the environmental quality. We then carried out the novel dynamic ARDL model estimation.

Diagnostic Statistics Tests

Table 7 presents the results of all diagnostic tests used in the analysis showing that our model is well fitted as there are no identifiable econometric problems associated with the model.

Dynamic ARDL Simulations Model Results

This part is separated into two subsections for proper and efficient evaluation of the outcomes. While the first subcategory illustrates and explores the direct effects of financial development and other influencing factors on South Africa’s ecosystem, the second subdivision focuses solely on the discussions of financial development’s moderation effects (indirect effects) on CO2 emissions through the lenses of economic growth, energy use, trade openness, and foreign direct investment inflows.

Direct Effects of Financial Development on Environmental Quality (Baseline Results)

In Columns (1) through (5) of Table 8a, the findings of the direct impact of financial development on environmental protection using dynamic ARDL simulations model are shown. Our results show that the scale effect (InSE) and the technique effect (InTE) have a positive and negative influence on environmental quality, respectively. While the technique effect benefits the atmosphere, the scale effect, which is a representation of economic expansion, increases CO2 emissions. The empirical conclusion therefore confirms that the EKC theory is valid for South Africa. The outcomes are related to the fundamental change and technical advancement of the nation. Environmental regulations are implemented when public concern for the environment grows in order to promote the use of energy-efficient technologies and lessen emissions. These results support Udeagha and Breitenbach (2021)'s observations, which demonstrate the validity of the EKC theory for the Southern African Development Community (SADC) from 1960 to 2014. Udeagha and Ngepah (2019)’s investigation for South Africa further confirmed our result. Similarly, based on balanced yearly panel data, Ahmad et al. (2021) demonstrated that EKC existed in 11 developing economies from 1992 to 2014. Isik et al. (2021) validated this evidence in their analysis of G-7 nations from 1995 to 2015 for France, while EKC was not valid in the US, UK, Japan, Italy, Germany, and Canada. Additionally, EKC was found in South Africa from 1960 to 2020, according to Udeagha and Muchapondwa (2022a). Our evidence go against those of Minlah and Zhang (2021), who discovered that EKC hypothesis was not valid for Ghana. The EKC hypothesis is invalid, as shown by similar findings from Ozturk (2015), Sohag et al. (2019), Tedino (2017), and Mensah et al. (2018).

In 4 out of 5 scenarios of columns (1)-(5) of Table 8a, financial development has both long-run and short-run statistically significant, negative effect. These negative coefficients illustrate the direct influence of financial development on reducing South Africa’s CO2 emissions, as these results reflect the solitary consequences of financial development. The negative link indicates that South Africa’s financial industry has attained level of sophistication, as it distributes resources to eco-friendly projects and supports enterprises to employ new developmental techniques to improve production efficiency. Furthermore, financial deepening makes it easier to get finance for environmentally friendly energy capabilities and boosts the energy sector’s productivity levels in South Africa. Our findings are consistent with those of Zeeshan et al. (2021), who demonstrated that financial deepening reduces CO2 emissions in 20 developed nations from 2001 to 2018. This observation is supported by Xuezhou et al. (2022) that observed that financial development supports environmental sustainability. Likewise, Usman et al. (2021) showed that financial development helps 52 developed and developing nations reduce pollution. Our finding is further supported by Le and Hoang (2022) for developing, transition, and developed nations, and H. Khan et al. (2022a, b) for global viewpoint. Conversely, our results are not consistent with Weili et al. (2022) for Belt and Road countries, who found that a well-organized and higher-quality financial intermediation provides more financial projects that enable both members of households and firms (or industrialists) to access high-energy-demanding products, resulting in deterioration of environmental quality. Increased energy consumption by industrialists (or enterprises) and household members leads to increased environmental deterioration. Thus, through the energy consumption channel, financial development contributes to deteriorate environmental quality. Similar findings were obtained by Usman and Hammar (2021) for Asia Pacific Economic Cooperation (APEC).

Technological innovation (InTECH) reduces carbon emissions in South Africa based on our finding in the majority of metrics of financial development used. Our findings demonstrate that technical innovation improves the environment over the long run. In order to reduce the nation’s CO2 emissions, South Africa implemented a number of regulations to promote innovative ideas. Environmentally friendly technologies in South Africa encourage the use of less energy, increase accessibility to renewable energy sources, and improve environmental health. By maximizing energy efficiency through a variety of outlets, including changing the fuel system, adopting energy-efficient techniques, and leveraging end-of-pipe solutions, technological advancements contribute to lower CO2 emissions in South Africa. Essentially, South Africa’s significant R&D expenditures and technical advancement are what make technology advances so beneficial to the nation’s environmental health. The nation has implemented several initiatives to increase the government’s involvement in R&D, enabling it to gradually transition its industrial activities away from high-energy-intensive coal-based technologies and toward high-energy-efficient processes sparked by technical advancements. All of these forward-thinking changes that support technology innovation have significantly helped South Africa reduce CO2 emissions. Our empirical findings are complemented by the conclusions reached by Erdogan (2021). In the instance of South Africa, Udeagha and Muchapondwa (2022a) came to a similar conclusion that technological development helps achieve the goal of reducing emissions. Similar to this, Kou et al. (2022) demonstrated that technological progress plays an important part in developing a novel problem-solving blueprint of ground-breaking greenhouse gas reduction initiatives for transportation investment opportunities, and that the electric vehicles play an increasingly important role in overcoming considerable amount of carbon dioxide, which is released into the environment because of the utilization of nonrenewable sources in transport vehicles. Our results, however, differ with those of Dauda et al. (2021), who concluded that the advancement of technology in Sub-Saharan African countries increases CO2 emissions. Ngepah and Udeagha (2018) for sub-Saharan Africa further found similar results that innovations in technology leads to climate change.

The computed elasticities for short- and long-run energy consumption (InEC) are statistically significant and positive in most financial development indicators utilized. This information demonstrates that energy use in South Africa has a significant role in increasing environmental degradation. Energy use enhances greenhouse gases in Guangdong, China, according to research by Hu et al. (2021), which is consistent with our findings.

In many of the financial development measures employed, the short- and long-run computed elasticities on foreign direct investment (InFDI) are positively significant. As a result, our findings imply that more FDI contributes to deteriorating climate change in South Africa. “Because the country has a strategic strength in the exporting and manufacturing of filthy commodities, it has drawn a large amount of FDI, which contributes significantly to the nation’s carbon emissions. The adverse impact of FDI on the ecosystem in South Africa shows that FDI inflows help the nation to be among the globe’s “enclaves” for environmentally damaging corporations. Our findings are in accordance with those of Copeland and Taylor (2013), who alleged that environmentally hazardous manufacturers in economically advanced countries that make dirty commodities have relocated to less industrialized economies, consequently relocating the environmental issue of industrialized economies to such poor countries, and that this worsens of their pollution problems. South Africa has also gotten filthier as a result of weak pollution regulations and unscrupulous system, since the country specializes in the manufacture of dirty commodities, which contributes considerably to the rising CO2 emissions. FDI inflows have aided in the transformation of South Africa into a heavily polluted globalized production plant that sells most of its output back to world market. This real fact portrays the deep character of the South African economy, which is often regarded as one of Africa’s fastest growing economies. Consequently, regulators and decision makers should do more to confirm that overseas companies use latest, smarter, and relatively clean methods to transition from fossil fuel-based energy sources to renewables in order to reduce CO2 emissions as well as sustain the growth of eco-friendly industrial activities. However, South Africa’s CO2 emissions will be significantly reduced when fossil fuel-based resources are replaced with potential substitutes which including renewable resources. Doing so will, in the end, help in promoting long-term usefulness for decarbonization and continue to encourage the development of innovative solutions that enhance South Africa’s quality of the environment while also managing the climate change. Our findings corroborate those of Abdouli and Hammami (2017) that concluded in the instance of MENA nations that overseas investment has significantly increased carbon footprints and that proof of the pollution haven theory exists. Muhammad et al. (2021) as well as Udeagha and Ngepah (2021b, 2020) validated these research findings. The observations, however, counter Omri et al (2014) and Joshua et al. (2020), who found that overseas investment contributed substantially to reduce CO2 emissions in those regions investigated.

Trade openness (InOPEN) degrades South Africa’s environment across the majority of financial development variables investigated. This empirical conclusion suggests that trade openness causes environmental degradation over time when total bank deposits to GDP (TDGDP) is used as a measure of financial growth. Our findings were supported by Udeagha and Ngepah (2021a, b), who claimed that South Africa’s environmental quality has been adversely affected by trade openness. Concerns about the government officials and decision makers’ rising economic liberalization plans are inevitably raised by the trade liberalization’s tendency to increase emissions. Although trade openness promotes economic expansion, its environmental effects have largely gone unnoticed. Because South Africa exports a variety of goods to other countries, trade openness is primarily bad for the ecology there. As a result, the kind of globally traded goods that go into these baskets demand a lot of energy, which worsens the country’s environmental problems. For instance, South Africa has a market advantage in the shipping and mining of natural resources including precious gems, palladium, aluminum, magnetite, propylene, and plutonium, as well as other mineral resource energy commodities. The nation’s ecology has suffered considerably as a consequence of the constant extraction of these goods to meet the expanding demand of the overseas markets. Our conclusions are supported by Ibrahim and Ajide (2021a) for the G-7 countries. Our results, however, go against those of Ibrahim and Ajide (2021b), who demonstrated how trade openness improves the atmosphere for G-20 countries. Similar to this, Ibrahim and Ajide (2021c), who examined how trade openness affected 48 Sub-Saharan African nations’ efforts to promote green environment, concluded that it is both environmentally sustainable and ecologically responsible.

In most indicators of financial development, industrial value addition to GDP (InIGDP) positively influences environmental health in South Africa. An upsurge in CO2 emissions in South Africa is mostly due to the expansion of the manufacturing industry. South Africa has implemented a variety of reforms targeted at achieving industrialization and technological progress in order to minimize hunger and improve sustainable growth in the last few decades. To accomplish higher standards of living, employment generation, and social protection, fundamental transition of the economic system from agricultural production to greater industrialization has so far been considered as a requirement. Nevertheless, in South Africa, the rise of the manufacturing industries has led to a rise in CO2 emissions. Increasing industrial activities and their influence on the environment represent a danger to sustaining life on earth through basic needs and maintaining biodiversity. Carbon emissions from various aspects including factories, has a detrimental influence on the environment, which leads to the destruction of economically valuable endowments. Our results are in good agreement with those of Sohag et al. (2017) and Al Mamun et al. (2014), who found that growing manufacturing industries are detrimental to environmental sustainability. Intense industrialization, according to Tian et al (2014), is a contributor to climate change at the local and national scale. Our observations, nevertheless, contrasted with Lin et al. (2015), who claimed that rapid industrialization reduces CO2 emissions in Nigeria. Likewise, Ngepah and Udeagha (2019) observed that rising industrialization assisted to accomplish emission reduction target in South Africa.

The error correction term (ECT), which is significant and negative, is displayed in column (1) of Table 8a and indicates that the model converges at a rate of about 83% annually.

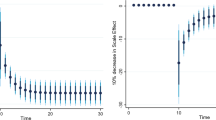

Figure 1 predicts the relationship between scale effect and CO2 emission. A rise in scale effect (economic growth) by 10% causes a steady increase in CO2 emissions. However, each 10% decrease in the contribution of the scale effect causes a proportional decrease in CO2 emissions.

The impulse response plot for scale effect (economic growth) and CO2 emissions. Figure 1 shows a 10% increase and decrease in scale effect and its influence on CO2 emissions where dots specify average prediction value. However, the dark blue to light blue line denotes 75, 90, and 95% confidence interval, respectively (Color figure online)

Figure 2 displays the impulse response curves with a 10% rise and reduction in technique effect. A 10% increase in technique effect reduces CO2 emissions, but a 10% decrease leads to escalation of CO2 emissions. A decrease in technique effect causes environmental degradation to increase over time; however, a 10% increase in technique effect causes a flat decrease in CO2 emissions. The advancement in technique effect cannot benefit the environment because CO2 emissions are still rising.

The impulse response plot for technique effect and CO2 emissions. Figure 2 shows a 10% increase and a decrease in technique effect and its influence on CO2 emissions where dots specify average prediction value. However, the dark blue to light blue line denotes 75, 90, and 95% confidence interval, respectively (Color figure online)

Figure 3 displays the impulse response curves for a 10% increase and decrease in financial development. It is possible to boost financial development by 10% in order to lower CO2 emissions, but it is also possible to decrease it by 10% without having a positive environmental effect. CO2 emissions grow over time as financial development declines; nevertheless, with every 10% gain in financial development, CO2 emissions fall by the same amount. However, this advancement in financial growth could be advantageous for the environment because CO2 emissions are still rising.

The impulse response plot for financial development (proxied by liquid liabilities as % of GDP) and CO2 emissions. Figure 3 shows a 10% increase and decrease in financial development and its influence on CO2 emissions where dots specify average prediction value. However, the dark blue to light blue line denotes 75, 90, and 95% confidence interval, respectively (Color figure online)

As seen in Fig. 4, a steady increase in trade openness over the long term greatly intensifies CO2 emissions. Contrarily, the decline in trade openness has an impact on the long-term improvement in environmental quality in South Africa.

The impulse response plot for trade openness and CO2 emissions. Figure 4 shows a 10% increase and decrease in trade openness and its influence on CO2 emissions where dots specify average prediction value. However, the dark blue to light blue line denotes 75, 90, and 95% confidence interval, respectively (Color figure online)

Figure 5 predicts a relationship between energy use and CO2 emissions. Any increase in energy use has a negative immediate impact on the environment. A decrease in energy consumption, on the other hand, aids in reducing CO2 emissions over time. Any further increases in energy consumption, however, result in an aggravation of air quality over time. However, the damage done to the ecosystem is irreversible.

The impulse response plot for energy consumption and CO2 emissions. Figure 5 shows a 10% increase and decrease in energy consumption and its influence on CO2 emissions where dots specify average prediction value. However, the dark blue to light blue line denotes 75, 90, and 95% confidence interval, respectively (Color figure online)

Figure 6 illustrates the forecast for the long-term impact of foreign direct investment (FDI) on the environment. Furthermore, the environmental quality is harmed by every 10% growth in FDI over time. However, any decrease in FDI also results in a decrease in CO2 emissions.

The impulse response plot for foreign direct investment inflows and CO2 emissions. Figure 6 shows a 10% increase and decrease in foreign direct investment and its influence on CO2 emissions where dots specify average prediction value. However, the dark blue to light blue line denotes 75, 90, and 95% confidence interval, respectively (Color figure online)

Figure 7 shows the impulse response curves for technological innovation increases and decreases of 10%. The environment is negatively impacted by a 10% decline in technical innovation, although CO2 emissions are reduced by 10% increases. Despite the fact that CO2 emissions rise over time as technological innovation drops, there is a flat decrease in CO2 emissions with every 10% increase in technical innovation. Because CO2 emissions are still increasing, this technological breakthrough can help the environment.

The Impulse Response Plot for technological innovation and CO2 emissions. Figure 7 shows a 10% increase and decrease in technological innovation and its influence on CO2 emissions where dots specify average prediction value. However, the dark blue to light blue line denotes 75, 90, and 95% confidence interval, respectively (Color figure online)

Figure 8 shows the impulse response curves for industrial value-added increases and decreases of 10%. In the short term, CO2 emissions increase gradually as the contribution of industrial value-added increases by 10%. Additionally, each 10% decrease in the contribution of the industrial value-added causes a commensurate decrease in CO2 emissions. On the other hand, as industrial value-added contributions steadily climb, CO2 emissions also rise over time. Any reduction in the industrial value-added appears to attenuate its long-term detrimental impacts on the ecosystem.

The Impulse Response Plot for industrial value-added and CO2 emissions. Figure 8 shows a 10% increase and decrease in industrial value-added and its influence on CO2 emissions where dots specify average prediction value. However, the dark blue to light blue line denotes 75, 90, and 95% confidence interval, respectively (Color figure online)

The model’s impact strength is investigated in this work to ensure its consistency. Pesaran and Pesaran (1997) presented the cumulative sum of recursive residuals (CUSUM) and cumulative sum of squares of recursive residual (CUSUMSQ) methods for this purpose. CUSUM and CUSUMSQ are visually represented in Figs. 13 and 14 (see Appendix), respectively. Traditionally, a parameter estimate is said to be consistent across the board if a plot is under a 5% critical bound threshold. We infer that the parameter estimates are consistent and predictable based on the forecast trajectory presented in Figs. 13 and 14 (see Appendix).

Moderating Role (Indirect Effects) of Financial Development on Environmental Quality

In Table 8a, columns (6)-(10) show the results of moderating impacts of financial development (as measured by five distinct indicators: M3GDP, TDGDP, DCPS, DCFS, and FSDGDP) on CO2 emissions through the income route, as measured by scale effect (SE). This paper empirically examines the moderating role of financial development in climate mitigation through economic growth path by means of joint terms between financial development and economic growth [i.e., In(M3GDP*SE), In(TDGDP*SE), In(DCPS*SE), In(DCFS*SE), and In(FSDGDP*SE)]. The estimated coefficients on the majority of joint effects are statistically significant and negative, implying that South Africa's well-organized and efficient financial system mitigates the adverse effect of income on CO2 emissions. In other words, South Africa’s robust financial system enables environmental degradation reduction by reducing pollutants and enhancing the importance of economic growth. Our findings are in line with earlier research, suggesting that financial development has an assuaging impact on the environment through income pathway (Khan and Ozturk 2021; Katircioglu and Taspinar, 2017; Chen et al. 2019; Cohen and Cohen 1983).

To empirically test the validity of financial development’s moderating role on the environment via energy use pathway, these effects are recorded in columns (1)-(5) of Table 8b by means of the multiplicative collaboration terms between financial development and energy consumption, namely In(M3GDP*EC), In(TDGDP*EC), In(DCPS*EC), In(DCFS*EC), and In(FSDGDP*EC). The estimated parameters on most joint terms have detrimental effects implying that the presence of a strong financial system greatly contributes to the escalation of environmental deterioration in South Africa via the energy consumption channel. On the one hand, because of South Africa’s well-organized and higher-quality financial intermediation, more financial projects are readily accessed by members of households, allowing them to purchase high-energy-demanding items, further aggravating environmental deterioration in the country. South Africa’s enhanced financial system, on the other hand, greatly improves enterprises’ access to greater financial backing for their operations and investments. These financial aids from the financial sector invariably enable industrialists and businesses to acquire high-energy-demanding items, which significantly increase energy consumption and, as a result, harm the environment. Increased energy consumption by industrialists (or enterprises) and household members leads to increased environmental deterioration. As a result, financial development increases South Africa’s CO2 emissions via the energy consumption channel. In contrast, Katircioğlu and Taşpinar (2017) found statistically insignificant evidence of mollifying effect of financial development on CO2 emissions via energy consumption route in Turkey.

The results of the moderating influence of financial development on CO2 emissions through the foreign direct investment path (denoted by In(M3GDP*FDI), In(TDGDP*FDI), In(DCPS*FDI), In(DCFS*FDI), and In(FSDGDP*FDI) and trade openness channel (using In(M3GDP*OPEN), In(TDGDP*OPEN), In(DCPS*OPEN), In(DCFS*OPEN), and In(FSDGDP*OPEN) are reported in columns (6)–(10) of Table 8c, respectively. Our model also considers the indirect impacts of financial development on environmental quality through foreign direct investment inflows and trade openness. As previously stated, financial development has a moderating effect on CO2 emissions not just through economic growth and energy usage, but also through other significant determinants of environmental quality. To evaluate pollution haven hypothesis, the energy–pollution literature particularly studies the environmental implications of FDI inflows and trade openness. The moderating effects of financial development on environmental quality via FDI inflows and trade openness channels are investigated and tested in this research. The estimated coefficients for long and short run for most multiplicative interaction terms for foreign direct investment inflows [see columns (6)-(10) of Table 8b] are statistically significant and negative. As a result, this empirical evidence demonstrates that South Africa’s robust financial system helps to mitigate the detrimental effects on the environment of foreign direct investment inflows. This is because South Africa’s well-organized and higher-quality financial intermediation attracts foreign direct investment, improves the use of funds received in the form of foreign direct investment, and, consequently,reduces the environmental damage. Thus, financial development improves environmental quality by mediating the pollution augmenting role of foreign direct investment inflows. Financial development reduces carbon pollution by enhancing the influence of FDI inflows. Our empirical findings are consistent with Khan and Ozturk (2021), who found that financial development immensely contributes to moderate the pollution augmenting effect of FDI in case of 88 emerging nations. Similarly, the majority of joint terms between financial development and trade openness (see Table 8c) are statistically significant and negative, implying that South Africa’s efficient and well-organized financial intermediation reduces CO2 emissions by moderating the pollution-enhancing role of trade openness. The empirical evidence confirms the contingency implications of financial development according to our assumptions. Both interaction components have negative and statistically significant coefficients, indicating that South Africa’s efficient financial system decreases CO2 emissions through foreign direct investment inflows and trade openness. Our findings are also similar with Khan and Ozturk (2021), who showed that in the instance of 88 developing countries, financial development helps to ameliorate the deleterious impacts of trade openness on environmental quality.

Even though the signs and significance for all of the moderating cases support our hypothesis that financial development plays a role in pollution emissions, these findings do not show how our moderating variables are related to emission levels at various levels of financial development. We follow Brambor et al. (2006) to have a pictorial representation of the association between CO2 emissions and all of these factors at various degrees of financial development. Their findings are represented visually in Figs. 9, 10, 11, and 12.

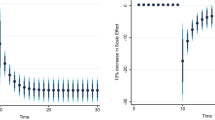

These findings show that the marginal effects of FDI, OPEN, economic growth, and energy use in South Africa are all influenced by the nation’s financial development. For example, in Fig. 9, where the moderating variable is liquid liabilities (M3) as a percentage of GDP in the connection between income and carbon emissions, the impacts of income on carbon emissions are positive for levels of this indicator below 2. The detrimental effects of economic growth on ecosystems become insignificant between 2 and 5. Furthermore, when the value of the financial indicator crosses 5, the link between economic growth and carbon emissions becomes negative, as predicted by the EKC theory. This backs up the nonlinear consequences of financial development as seen through the lens of economic growth. Additionally, the marginal effect of energy consumption on environmental quality (Fig. 10) demonstrates that the impact is statistically significant and positive as financial development increases. More financial projects that enable both members of households and enterprises (or industrialists) to obtain high-energy demanding items are available as a result of better-organized and higher-quality financial intermediation, occasioning an increase in CO2 emissions in the country. Increased energy consumption by industrialists (or enterprises) and household members leads to increased environmental deterioration. Thus, financial development adds to the degradation of the environment via energy use pathway. Similarly, the pollution haven theory is only true for both OPEN and FDI when financial intermediation is inadequate (Figs. 11 and 12). However, as financial development reaches a critical point, the detrimental consequences of trade openness and foreign direct investment on pollution levels vanish.

Conclusion and Policy Implications

Conclusion

Many countries and academics have repeatedly emphasized the problems caused by climate change and environmental deterioration. Since all of these alterations are being fuelled by increasing CO2 emissions, the world’s main challenge currently is working out ways to combat climate change without reducing energy consumption. One feasible solution to this problem is to transition to alternative energy sources, but this will need a major investment in environmentally friendly energy architecture. Emerging economies are particularly concerned about this situation because, although they do exploit their natural richness to spur economic change, they also lack the resources necessary to switch from nonrenewable to renewable energy sources. As a result, some experts agree that a nation’s financial prosperity may help to reduce pollution levels. This occurs because the growth of the financial sector minimizes credit costs, improves credit allocation, makes it easier to invest in green energy sources, and supports national knowledge-creation efforts through foreign investment.

Our research examines the environmental effects of financial development in South Africa from 1960 to 2020 in relation to these driving forces. Our findings (i) confirm the validity of the environmental Kuznets curve (EKC) hypothesis, showing that income intensifies global warming and climate change, but its square quickens environmental performance; (ii) financial development and technological innovation help mitigate climate change over the short and long terms; (iii) industrial growth, FDI, OPEN, and energy use raise CO2 emissions; (iv) financial development immeasurably moderates the pollution augmenting roles of economic growth, energy use, FDI and OPEN; (v) while high financial development mitigates the detrimental impacts of economic expansion, trade openness, and foreign direct investment on CO2 emissions, it exacerbates the pollution-inducing role of energy usage; (vi) furthermore, the confirmability of the pollution haven hypothesis (PHH), which is examined using factors like OPEN and FDI, is dependent on the presence of a weak financial system. PHH comes to an end for both of these elements when financial development reaches specific limitations.

Policy Implications

There are some significant policy ramifications of these findings for South Africa. The financial development variable’s negative value implies that financial intermediation is crucial to lowering South Africa’s pollution emissions. Therefore, the policies promoting the growth of financial institutions should receive special attention from policymakers. Without a consistent flow of funding to both private and public sector investors, it will be impossible to switch from polluting to clean energy projects. Only the competent financial system, which lowers the cost of financial intermediation in the economy, can ensure the availability of these enormous amounts of resources. The growth literature has previously emphasized the need of giving the financial sector’s expansion top priority for strong economic growth. The same is recommended in this analysis for reducing climate change. Our examination of the indirect pathways provides more evidence in support of these policy consequences. For instance, the EKC theory’s suggestion that policymakers in South Africa should wait for automatic environmental improvements through income is contradicted by the substantial moderating influence of financial development in the income-pollution nexus. Even before reaching the inflexion points of the EKC, South Africa may lessen the severity of the negative environmental effect of income through greater financial development. A similar policy statement may be made about the other two indirect routes, FDI and trade openness. Our empirical findings demonstrate that South Africa is currently lowering its pollution standards in order to benefit economically from trade and FDI flows. In spite of this, South Africa should not put limits on FDI or international trade in order to improve the quality of the environment. Rather, the effective use of foreign funds that results from financial development can lessen the negative environmental consequences of trade and FDI (Udeagha and Ngepah 2022d). In order to improve environmental quality, a robust financial system can complement trade and FDI inflows. These findings also demonstrate the need for a broader perspective when examining the influence of any macroeconomic development (such as trade openness, FDI, or economic growth) on environmental quality for both policymaking and future study. The only dependence on direct routes may, in certain situations, result in incorrect policy recommendations as well as an underestimation of the genuine efficacy of these advancements for the environment. Finally, these findings imply that energy management policies should be targeted for shorter time periods and should also include long-term strategic planning (Udeagha and Ngepah 2022e). Examples include encouraging energy studies that track carbon emissions, cleaner production technologies for manufacturing, and more intensive information activities in South Africa. For longer-term climate change mitigation, such policies should promote increased R&D spending.

Limitations and Potential Future Study Areas

Even though the current analysis produced robust empirical evidence in the context of South Africa, it has many limitations that might be considered in further analytical research. The insufficient availability of the data outside of the reference period, which limits the breadth of the time series analysis used, is one of the investigation’s fundamental problems. However, this work analyzed the environmental impacts of financial growth in South Africa through FDI, OPEN, energy consumption, and income using current time series data. Future research utilizing other econometric methods or micro-disaggregated pertinent data may focus on other emerging markets. Additional growth-related elements that were not considered in this study, such as institutional quality and natural resources, can be examined in future research. However, CO2 was employed in this study as an indicator of the quality of the environment. Additional research is required to determine whether consumption-based carbon emissions or other metrics of carbon footprints, such as chlorofluorocarbons, volatile organic compounds, hydrocarbons, unburned hydrocarbons, ground-level gaseous pollutants, sulfur compounds, and other short-lived climatological shocks, are better indicators of environmental quality in South Africa. The present research employs CO2 emissions as a reflection of biodiversity loss even though they are not the only factor that influences environmental sustainability. Future research should study this connection by considering additional environmental degradation factors, such as water pollution and hazardous pollution. By combining time series data with panel estimation techniques, further research may compare country-specific results to generic panel outputs using very much more advanced approaches. This can assist illuminate the existing evidence by providing a comparison analysis with the findings of this inquiry. The investigation’s narrow review of only one country is another significant issue. For a wider perspective, additional study in the African panel environment and other regions of the world should be considered.

Data Availability

The data relevant to this research are publicly available from the World Development Indicators or obtained from the authors by making a reasonable request.

Notes

Why were these four variables—energy consumption, economic growth, trade openness, and foreign direct investment—selected above others? First, the growth of financial services leads to an increase in energy requirements (Khan and Ozturk 2021); as a consequence, it is anticipated that financial development will have a positive impact on the process of energy utilization, which in turn influences CO2 emissions. Second, it is well known that, with very few exceptions, financial development often leads to faster economic growth and higher carbon emissions in the nations concerned (Khan and Ozturk 2021). Indeed, it is widely acknowledged that financial development is essential for economic growth and that reaching a high rate of economic growth, which results in environmental deterioration, is a need for such development (Chen et al. 2019). Economic expansion thus becomes a crucial pathway for financial development to raise CO2 emissions. Third, through trade route, the impact of financial development on CO2 emissions may also be seen. When trade liberalization goes beyond a specified point, labor begins to move to peripheral regions while capital stays concentrated in the core nations (Candou 2013). Capital transfers from the core to the periphery can only occur when the periphery has stable financial systems (Jalil and Feridun 2011). Fourth, a stable financial system makes it possible for banks to extend some loans to foreign enterprises. As a result, foreign direct investment (FDI) enters the nation, which is associated with technological improvements and a decrease in pollutant emissions (Katircioğlu and Taşpinar 2017). According to Hermes and Lensink (2003), a strong financial system is a requirement for the spread of technology brought about by FDI. Regarding these latter two indirect routes (trade openness and FDI), it is important to note that some prior research suggests that trade openness and FDI have a deleterious impact on the environmental quality of poor nations because of the pollution heaven hypothesis (PHH). In spite of the conflicting empirical evidence supporting PHH's validity (Solarin et al., 2017), our article explores whether financial development may help developing nations like South Africa solve the empirical conundrum of PHH theory.

In this study, we have utilized CO2 emissions as a stand-in for environmental quality because of the following reasons: First, since CO2 emissions account for the largest portion of greenhouse gas (GHG) emissions and are the easiest to measure and collect data for, many researchers have favored them in analyses of environmental quality (Aljadani 2022; Dagar et al. 2022; Islam 2022; Jahanger 2022). Second, there are now more CO2 emissions in the atmosphere, which has far-reaching effects including increased droughts, flooding, severe storms, melting glaciers, and rising sea levels (UNFCCC, 2017). Finally, because fossil fuel emissions of CO2 significantly contribute to global warming, our analysis employs CO2 emissions as a proxy for environmental quality.

References

Abdouli M, Hammami S (2017) Investigating the causality links between environmental quality, foreign direct investment and economic growth in MENA countries. Int Bus Rev 26(2):264–278

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Adebayo TS, Odugbesan JA (2021) Modeling CO2 emissions in South Africa: empirical evidence from ARDL based bounds and wavelet coherence techniques. Environ Sci Pollut Res 28(8):9377–9389

Adebayo TS, Kirikkaleli D, Adeshola I, Oluwajana D, Akinsola GD, Osemeahon OS (2021) Coal consumption and environmental sustainability in South Africa: the role of financial development and globalization. Int J Renew Energy Dev 10(3):527–536

Adewuyi AO, Awodumi OB (2021) Environmental pollution, energy import, and economic growth: evidence of sustainable growth in South Africa and Nigeria. Environ Sci Pollut Res 28(12):14434–14468

Ahmad M, Muslija A, Satrovic E (2021) Does economic prosperity lead to environmental sustainability in developing economies? Environmental Kuznets curve theory. Environ Sci Pollut Res 28(18):22588–22601

Al Mamun M, Sohag K, Mia MAH, Uddin GS, Ozturk I (2014) Regional differences in the dynamic linkage between CO2 emissions, sectoral output and economic growth. Renew Sustain Energy Rev 38:1–11

Aljadani A (2022) Assessment of financial development on environmental degradation in KSA: how technology effect? Environ Sci Pollut Res 29(3):4736–4747

Bank W (2000) Is globalization causing a „race to the bottom “in environmental standard. PREM Economic Policy Group Development Economics Group

Baulch B, Do TD, Le T-H (2018) Constraints to the uptake of solar home systems in Ho Chi Minh City and some proposals for improvement. Renew Energy 118:245–256

Brambor T, Clark WR, Golder M (2006) Understanding interaction models: improving empirical analyses. Polit Anal 14:63–82

Candau F (2013) Trade, FDI and migration. Int Econ J 27:441–461

Chen S, Saleem N, Bari MW (2019) Financial development and its moderating role in environmental Kuznets curve: evidence from Pakistan. Environ Sci Pollut Res 26(19):19305–19319

Claessens S, Feijen E (2007) Financial sector development and the millennium development goals. The World Bank, Washington, D.C.

Cohen J, Cohen P (1983) Applied multiple regression/correlation analysis for the behavioral sciences, 2nd edn. Erlbaum, Hillsdale, NJ

Cole MA, Elliott RJ (2003) Determining the trade–environment composition effect: the role of capital, labor and environmental regulations. J Environ Econ Manag 46(3):363–383

Copeland BR, Taylor MS (2013) Trade and the Environment. Princeton University Press

Dagar V, Khan MK, Alvarado R, Rehman A, Irfan M, Adekoya OB, Fahad S (2022) Impact of renewable energy consumption, financial development and natural resources on environmental degradation in OECD countries with dynamic panel data. Environ Sci Pollut Res 29(12):18202–18212

Dauda L, Long X, Mensah CN, Salman M, Boamah KB, Ampon-Wireko S, Dogbe CSK (2021) Innovation, trade openness and CO2 emissions in selected countries in Africa. J Clean Prod 281:125143

Erdogan S (2021) Dynamic nexus between technological innovation and buildings Sector’s carbon emission in BRICS countries. J Environ Manage 293:112780

Fakher HA, Panahi M, Emami K, Peykarjou K, Zeraatkish SY (2021a) New insight into examining the role of financial development in economic growth effect on a composite environmental quality index. Environ Sci Pollut Res 28(43):61096–61114

Fakher HA, Panahi M, Emami K, Peykarjou K, Zeraatkish SY (2021b) Investigating marginal effect of economic growth on environmental quality based on six environmental indicators: does financial development have a determinative role in strengthening or weakening this effect? Environ Sci Pollut Res 28(38):53679–53699

Frankel JA, Romer DH (1999) Does trade cause growth? Am Econ Rev 89(3):379–399

Ganda F (2021) The non-linear influence of trade, foreign direct investment, financial development, energy supply and human capital on carbon emissions in the BRICS. Environ Sci Pollut Res 28(41):57825–57841

Gill AR, Hassan S, Haseeb M (2019) Moderating role of financial development in environmental Kuznets: a case study of Malaysia. Environ Sci Pollut Res 26(33):34468–34478

Godil DI, Ahmad P, Ashraf MS, Sarwat S, Sharif A, Shabib-ul-Hasan S, Jermsittiparsert K (2021) The step towards environmental mitigation in Pakistan: do transportation services, urbanization, and financial development matter? Environ Sci Pollut Res 28(17):21486–21498

Habiba U, Xinbang C, Ahmad RI (2021) The influence of stock market and financial institution development on carbon emissions with the importance of renewable energy consumption and foreign direct investment in G20 countries. Environ Sci Pollut Res 28(47):67677–67688

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Pol 37:1156–1164

Haseeb A, Xia E, Baloch MA, Abbas K (2018) Financial development, globalization, and CO2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res 25(31):31283–31296

Hermes N, Lensink R (2003) Foreign direct investment, financial development and economic growth. J Dev Stud 40:142–163

Hsu CC, Quang-Thanh N, Chien F, Li L, Mohsin M (2021) Evaluating green innovation and performance of financial development: mediating concerns of environmental regulation. Environ Sci Pollut Res 28(40):57386–57397

Hu M, Chen S, Wang Y, Xia B, Wang S, Huang G (2021) Identifying the key sectors for regional energy, water and carbon footprints from production-, consumption-and network-based perspectives. Sci Total Environ 764:142821

Ibrahim RL, Ajide KB (2021a) Non-renewable and renewable energy consumption, trade openness, and environmental quality in G-7 countries: the conditional role of technological progress. Environ Sci Pollut Res 28(33):45212–45229

Ibrahim RL, Ajide KB (2021b) Disaggregated environmental impacts of non-renewable energy and trade openness in selected G-20 countries: the conditioning role of technological innovation. Environ Sci Pollut Res 28(47):67496–67510

Ibrahim RL, Ajide KB (2021c) Trade facilitation and environmental quality: empirical evidence from some selected African countries. Environ Dev Sustain 24(1):1282–1312

Isik C, Ongan S, Ozdemir D, Ahmad M, Irfan M, Alvarado R, Ongan A (2021) The increases and decreases of the environment Kuznets curve (EKC) for 8 OECD countries. Environ Sci Pollut Res 28(22):28535–28543

Islam M (2022) Does financial development cause environmental pollution? Empirical evidence from South Asia. Environ Sci Pollut Res 29(3):4350–4362

Jahanger A (2022) Impact of globalization on CO2 emissions based on EKC hypothesis in developing world: the moderating role of human capital. Environ Sci Pollut Res 29(14):20731–20751

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33:284–291

Jensen AL (1996) Beverton and Holt life history invariants result from optimal trade-off of reproduction and survival. Can J Fish Aquat Sci 53:820–822

Jordan S, Philips AQ (2018) Cointegration testing and dynamic simulations of autoregressive distributed lag models. Stand Genomic Sci 18(4):902–923

Joshua U, Bekun FV, Sarkodie SA (2020) New insight into the causal linkage between economic expansion, FDI, coal consumption, pollutant emissions and urbanization in South Africa. Environ Sci Pollut Res 27(15):18013–18024