Abstract

The present study aims to analyze the influence of stock market and financial institution development on carbon emissions by incorporating the role of renewable energy consumption and foreign direct investment in the function of carbon emissions on G20 member countries from 1981–217. Further, the empirical analysis is carried out on the full sample and sub-samples of developed and developing economies by employing panel econometric techniques. The findings confirm that the stock market development index reduces carbon emissions in the full sample and developed countries while increases carbon emissions in developing countries. However, the index of financial institution development increases carbon emissions in the full sample and developed countries but effect is found insignificant in the case of developing economies. The renewable energy consumption reduces the level of environmental degradation across the panels. Similarly, foreign direct investment increases environmental quality in the full sample and emerging economies while impede environmental quality in the developed economies. On the basis of empirical results, this study recommends policy implications.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The environmental degradation and global warming have been most challenging and debated serious environmental issues in our time. These issues have attracted the considerable attention of policymakers and researchers. Greenhouse gases emission is the primary cause of global warming, of all the pollutants, carbon emission is the most influential gas behind global warming (Acheampong 2019). The report of International Energy Agency (2018) indicates that the lower price of fossil fuel, weaker energy efficiency efforts and global economic growth are the most influential elements causing the rise in CO2 emissions and consequently global warming.

One of the major solutions to decrease the growth of carbon emissions is investing in environmental friendly projects. The previous literature suggests that among the investments in renewable energy, foreign direct investment, and financial development are vital to fund clean energy projects (Sbia et al. 2014; Doytch and Narayan 2016; Kutan et al. 2018; Salim et al. 2017). Foreign direct investment may not only financing source but also transfer of advanced foreign and green technology to the host country. The innovative production process increases energy efficiency which stimulates the development of renewable energy sector. The renewable energy has low carbon content and therefore the more use of it will mitigate the carbon emissions (Islam et al. 2013; Sbia et al. 2014; Paramati et al. 2016; Mazzucato and Semieniuk 2018).

The development of financial sector has important implications for environmental degradation but the prior studies on the relationship between financial development and carbon emissions remain uncertain. Theoretically, financial development reduces environmental degradation through technological development, research and investments that in turn can boost the economic growth, and consequently reduce the carbon emissions (Dasgupta et al. 2002; Claessens and Feijen 2007; Tamazian et al. 2009). Contrarily, Jensen (1996) argues that financial development could fuel industrialization, which may cause industrial pollution and thus increases the environmental degradation. Furthermore, financial development can have direct and indirect effects on the environmental quality. One of the most direct effects that when there is developed financial system, consumers have easy access to cheap money to buy big items which consume energy a lot and can affect demand for energy (Sadorsky 2011; Shahbaz and Lean 2012; Çoban and Topcu 2013; Kahouli 2017) which may consequently decrease the environmental quality. Businesses also benefit from developed financial system because it enables businesses to have access to financial capital easily and less costly. Additionally, improved stock market can also affect business through providing them additional sources of funding, which let them to expand their existing business or create new ones (Sadorsky 2010, 2011; Çoban and Topcu 2013). These expansion activities of businesses can enhance the demand of energy and carbon emissions. Moreover, increased stock market activity affects consumer and business confidence through generating a wealth effect. Thus, increased confidence of business and consumer could boost economic growth and prosperity which in turn increases energy consumption and environmental pollution (Sadorsky 2010, 2011; Çoban and Topcu 2013).

While the financial development impact on carbon emissions is theoretically inconsistent, the existing empirical literature findings remain unclear. One empirical literature strand argues that financial development plays a significant role in reduction of carbon emissions (Tamazian et al. 2009, Tamazian and Rao 2010; Jalil and Feridun 2011; Shahbaz et al. 2013a; Dogan and Turkekul 2016). The other strand of empirical literature argues that financial development increases environmental degradation (Zhang 2011; Shahbaz et al. 2016; Usman et al. 2020). The last strand of empirical studies is the one which find insignificant relationship between financial development and carbon emissions (Çoban and Topcu 2013; Ozturk and Acaravci 2013; Omri et al. 2015; Bekhet et al. 2017). Thus, there is still a need to explore the nexus between financial development and carbon emissions due to contradictory and unclear findings of previous studies. Furthermore, the majority of exiting empirical studies have utilized different and a single indicator of financial development to investigate the financial development impact on environmental pollution. King and Levine (1993) suggest that the use of different financial development indicators has different implications for economic growth while Sadorsky (2011); Kakar (2016); Shahbaz et al. (2016) and Yao and Tang (2020) argue that different measures of financial development have disparate impact on environmental degradation. Furthermore, the financial system is composed of stock markets and financial institutions. The financial system more heavily depends on financial institutions in developing countries whereas the stock market is the main driver of the financial system in developing countries (Zeqiraj et al. 2020). Thus, in this study, we differentiate the effects of financial institutions development and stock market development on CO2 emissions.

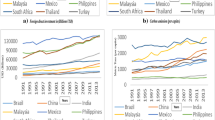

The G20 countries cover the world leading economies such as G7 countries and distinctive emerging economies such as BRICS economies. The G20 economies play a significant role in the global economy as they account for 86% of global GDP in 2017. The G20 nations are also responsible for most of the carbon emissions as they are largest energy consumers, they account for 74% of current global carbon emissions. The recent literature has focused on heterogeneity between developed and less developed economies in terms of environment degradation because information disclosure is more adequate in developed economies, and investor preferences are stronger for environment friendly projects (Finger et al. 2018; Ehigiamusoe and Lean 2019; Acheampong et al. 2020). Thus, G20 nations provide important setting to explore the heterogeneity between developed and developing nations in the nexus among financial development, renewable energy consumption, FDI, trade openness, per capita income, urbanization, and carbon emissions.

In the existing literature, this study contributes in many ways. First, to the best of author’s knowledge, this is the first attempt which differentiates between stock market development and financial institutions development to investigate the effect of disaggregated financial development on carbon emissions in G20 economies. Levine and Zervos (1998) argue that stock market development and financial institutions development can have separate effects on economic growth; therefore it is important to include disaggregated measures of stock market development and financial institution development to examine the effect of financial development on carbon emissions. Second, most of the previous studies have used a single and simple proxy for financial development such as private credit to GDP or stock market capitalization to conclude the financial development impact on environmental degradation; however, financial development is complicated in nature and multi-dimensional (Svirydzenka 2016). Given this, in this paper, we use up-to-date indices of stock market and financial institution developed by the International Monetary Fund (IMF). Particularly, the construction of these indicators is based on multi-dimensional information of depth, access, and efficiency of financial markets and financial institutions, respectively. Third, we also explore the effect of renewable energy consumption on carbon emissions. Fourth, we split a panel of the G20 economies into developed and developing economies to investigate the heterogeneity across countries. Last, this study employs the Durbin-Hausman panel co-integration tests to investigate the long-run linkage among the variables while the long-run elasticities are explored using the common correlation effect-mean group (CCEMG) model.

Literature review

Financial development and carbon emissions relationship

The evidence on the effect of financial development on environment degradation can be easily categorized into three groups due to the mix findings. The first group of empirical studies suggests that financial development has a negative impact on carbon emissions. For instance, Tamazian and Rao (2010) applied GMM and random effect model to analyze the financial liberalization effect on carbon emissions in 24 transition economies. Their results showed that institutional quality and financial development reduce carbon emissions. In the case of China, Jalil and Feridun (2011) employed autoregressive distributed lag (ARDL) approach to examine the impact of financial development on environmental degradation and found that financial development improves the quality of environment. Similarly, Shahbaz et al. (2013b) found that financial development reduces environmental pollution in case of Malaysia. Using GMM, Hao et al. (2016) explored the relationship between financial development and environmental quality in 29 provinces of China and found that financial efficiency improves environmental quality by lowing carbon emissions. In the same way, Xing et al. (2017) showed that financial development can reduce carbon emissions in China by employing ARDL approach. Furthermore, Khan et al. (2018) employed fully modified ordinary least squares (FMOLS) to examine the linkages between financial development and environmental degradation in three Asian-developing countries, namely, Bangladesh, India, and Pakistan and found that financial development has a significant negative relationship with carbon emissions. Acheampong (2019) investigated the relationship between financial market development and environmental degradation in heterogeneous financial economies and found that financial market development decreases degradation of environment in the developed and emerging financial economies.

The second group of empirical studies suggests that the relationship between financial development and carbon emissions is positive. For example, in case of Tunisisa, Farhani and Ozturk (2015) employed ARDL to examine the causal relationships among carbon emissions, financial development, economic growth, energy consumption, and urbanization. The results of their findings revealed financial development has a positive relationship with environmental pollution. Shahbaz et al. (2016) explored the impact of stock market development and banks sector development on environmental quality in Pakistan by employing asymmetric ARDL and found that bank sector development impedes the environment. In another study, Javid and Sharif (2016) reported that financial development has a positive linkage with environmental degradation in Pakistan. Using cointegration approach in case of Malaysia, Maji et al. (2017) examined the correlation between financial development and sectoral carbon emissions. They found that improvement in financial sector reduces environmental quality. Ehigiamusoe and Lean (2019) utilized cointegration approach to examine the effect of financial development on carbon emissions in 120 countries. Their empirical results revealed that financial development has a positive relationship with carbon emissions in the case of full sample. The last group of empirical studies provides no significant nexus between financial development and carbon emissions (see Ozturk and Acaravci 2013; Omri et al. 2015; Dogan and Turkekul 2016; Jamel and Maktouf 2017).

Stock market development and carbon emissions relationship

Some empirical studies have examined the impact of stock market development on carbon emissions. For instance, Tamazian et al. (2009) explored the impact of stock market development on carbon emissions in Brazil, Russia, India, and China (BRIC) countries. They used stock market value added to measure stock market development. Their results illustrated that stock market development is associated with the decline in carbon emissions. Zhang (2011) explored the influence of stock market development on environmental degradation along with other financial development variables in the case of China. The author found that China’s stock market has a relatively larger influence on carbon emissions but the influence of its efficiency is very limited. Using ARDL approach, Abbasi and Riaz (2016) investigated the nexus between stock market development and carbon emissions for Pakistan over the period 1970 to 2011. Their study used ratio of stock market capitalization to GDP and ratio of stock market traded to GDP as proxies for stock market development. They reported that financial development plays a significant role in mitigation of carbon emissions but only during the period of financial liberalization. Further, Paramati et al. (2018) examined the role of stock market on environmental degradation by incorporating energy efficiency, economic growth and population density as an additional determinants in developed and emerging economies across the globe. They used different measures for stock market development. Their findings established that stock market indicators have a significant negative relationship with carbon emissions in developed economies while positively correlated with carbon emissions in the case of emerging economies. A very recent study by Zeqiraj et al. (2020) explored the dynamic linkage between stock market development and carbon emissions with the role of technological innovation and renewable energy in low-carbon economies over the period 1980–2016. Their study used market capitalization as an indicator for stock market development. They demonstrated that stock market development increases intensity of carbon emissions in both the short and long runs.

Renewable energy consumption and carbon emissions relationship

Renewable energy not only plays a vital role to meet the energy needs but also serves a vital role in the reduction of global environmental degradation because it has low carbon content compared to non-renewable energy. The literature on the impact of renewable energy consumption on environmental degradation recently increased. For instance, Apergis and Payne (2010) used a panel error correction model to explore the causal relationship between carbon emissions and renewable energy consumption in developed and developing countries. Their results revealed that renewable energy consumption does not play an important role in reduction of carbon emissions. Similarly, Farhani and Shahbaz (2014) employed FMOLS and dynamic ordinary least squares (DOLS) to check the effects of renewable and non-renewable energy consumption on carbon emissions in MENA countries for the period 1980–2009. They showed that both renewable and non-renewable energy consumption have a positive effect on carbon emissions. In the case of Vietnam, Al-Mulali et al. (2015) found insignificant relationship between renewable energy and environmental pollution. Using FMOLS and DOLS estimations, Bilgili et al. (2016) found that renewable energy consumption helps to improve the environmental quality in OECD countries. In contrast, Bulut (2017) identified a positive link between clean energy and carbon emissions in Turkey. Inglesi-Lotz and Dogan (2018) investigated the effects of renewable and non-renewable energy on carbon emissions for big 10 electricity generators in Sub-Saharan African countries. Their findings revealed that consumption of renewable energy improves the environmental quality. Chen and Lei (2018) investigate the impacts of technological innovation and renewable energy on carbon emissions by employing quantile regression technique in 30 countries and found that renewable energy does not help in reduction of carbon emissions in high emissions countries due to the small use of renewable energy. More recently, Acheampong et al. (2020) found that renewable energy helps to improve the environmental quality by employing GMM and fixed effects models in 46 Sub-Saharan African countries.

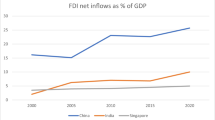

FDI and carbon emissions relationship

Theoretically, the relationship between FDI and environmental degradation can be positive or negative, it depends on which channel is dominant. According to the pollution haven hypothesis, the weaker environmental policies in the developing countries give opportunities to new investment projects which are restricted for environmental reasons in the developed countries. On the contrary, the pollution halo hypothesis argues that flow of FDI to developing countries helps in the transfer of management practices and advanced technology that reduces environmental degradation. According to these hypotheses, the effect of FDI on carbon emissions can be different, for this reason, the empirical studies have reached different conclusions. For example, Hitam and Borhan (2012) found that foreign direct investment increases environmental degradation in Malaysia. Similarly, Omri et al. (2015) applied dynamic simultaneous-equation model to examine the causal interactions between economic growth, FDI, and carbon emissions in 54 countries. Their results revealed bidirectional causality between FDI and carbon emissions. Using FMOLS, Shahbaz et al. (2015) showed that FDI increases environmental degradation in high-, middle-, and low-income countries and thus support the pollution heaven hypothesis (PHH). In the case of Vietnam, Vinh (2015) also deeply supported the PHH hypothesis. Paramati et al. (2016) investigated the effect of FDI on clean energy and carbon emissions across emerging economies and found that FDI inflow increases carbon emissions as well as clean energy consumption. In the case of five ASEAN countries, Baek (2016) used pooled mean group (PMG) and showed that FDI has a positive relationship with carbon emissions. Using ARDL, Solarin and Al-Mulali (2018) investigated the effect of FDI on environment degradation in Ghana and found that FDI tends to increase carbon emissions. Bah and Azam (2017) revealed FDI inflows increases carbon emissions in South Africa countries. In a recent study, Khan and Ozturk (2020) employed FMOLS to examine the linkage between FDI and environmental pollution in 17 countries from Asia and reported that inward FDI increases carbon emissions, supporting PHH.

On the contrary, Lee and Brahmasrene (2013) employed fixed effect and cointegration approaches and shows that economic growth has a positive relationship with environmental degradation while FDI has a negative relationship with environmental degradation in European Union countries. Similarly, Lee (2013) applied cointegration and fixed effect models to examine the contribution of FDI to carbon emissions in G20 countries and found that FDI significantly increases economic growth whereas it reduces carbon emissions in the sample countries from 1971 to 2009. In a sectoral level analysis, Pazienza (2015) found that FDI helps to improve the environmental quality in OECD countries. Using Chinese regional-level and city-level data, Zhang and Zhou (2016) and Jiang et al. (2019) reported that FDI has a negative effect on carbon emissions. Zhu et al. (2016) utilized quantile regression to investigate the impact of FDI on carbon emissions in ASEAN-5 countries. Their results indicated that the effect of FDI on carbon emissions is heterogeneous across quantiles. Overall, they found that FDI has a negative effect on carbon emissions. However, some studies found insignificant or heterogeneous effect of FDI on carbon emissions (see Rezza 2013; Shaari et al. 2014; Keho 2015; Tasri and Karimi 2019).

Based on the above literature, we can conclude that further empirical studies are necessary to elucidate the inconsistent results of the existing literature. Moreover, most of the previous studies have utilized a single and simple proxies to measure financial development. However, financial development is a multi-faceted concept. Therefore, this paper contributes in the existing literature using the newly developed indices of financial development by the IMF to investigate the influence of disaggregate financial development on carbon emissions by incorporating the role of renewable energy usage and FDI inflows in G20 countries.

Methodology and data

Methodology

Given that the objective is to examine the impacts of disaggregated financial development (bank sector development and equity market development), renewable energy and FDI on carbon emissions in a panel of 20 group (G20) countries. To achieve the objectives of this study, this study uses the IPAT model proposed by Ehrlich and Holdren (1971). This theoretical model suggests that the aggregate population, economic development, and technological advancement are main determinants of environmental issues. Later, Dietz and Rosa (1997) extend the IPAT basic model to a stochastic version which is commonly known as the Stochastic Impacts by Regression on Population, Affluence, and Technology (STIRPAT) model. Following STIRPAT model, we use the following benchmark models:

Where GDPI, FDI, TO, URB, REC, SMDI, and FIDI represent carbon emissions, GDP income per capita, trade openness, urbanization, renewable energy consumption, stock market development index, and financial institution development index. Vi represents individual fixed country effects while i represents the countries (i = 1,…….., N), and time period is indicated by the subscript t (t = 1,………, T). To estimate the models of this study, we employ following methodologies for empirical analysis.

Cross-section dependence (CD) and panel unit-root tests

We start our empirical analysis by employing the cross-sectional dependence test introduced by Pesaran (2004) in order to examine the degree of residual cross-section dependence among the sample countries. The null hypothesis of the CD test is cross-sectional independence, while alternative hypothesis is cross-sectional dependence among the sample countries. Next, this study uses a second-generation panel unit-root test of Pesaran (2007) to identify the order of integration in the respective variables. The Pesaran (2007) panel unit-root test is known as cross-sectional augmented panel unit root (CIPS) and works under the assumption of cross-sectional dependence. The null hypothesis is a unit root while alternative hypothesis is no unit root in the data sets. If entire variables are cointegrated in the same order, then this demonstrates that the level values of entire variables are non-stationary and stationary at the first difference. This finding may suggest that all of these variables are cointegrated and may have a long-run relationship.

Panel cointegration test

In the next step of analysis, this study investigates the long-run equilibrium among the variables under study by applying panel cointegration approaches. To explore the long-run relationship, this study makes use of the Durbin-Hausman test (Westerlund 2008). Especially, this test allows for cross-sectional dependence in the data sets. Additionally, it does not heavily rely on a prior knowledge of the variables integration order included in the modeling method and apply under very general conditions. The null hypothesis of no-cointegration is tested against the alternative hypothesis of integration for the Durbin-Hausman test.

Methodology for long-run elasticities

Finally, this study employs a panel approach which considers both time and cross-section dimensions of the data to find out the long-run CO2 emissions elasticities based on the Eqs. (1) and (2). This approach is the common correlation effect-mean group (CCEMG) developed by Pesaran (2006). According to Pesaran (2006), and Chudik and Pesaran (2015), the CCEMG approach is advantageous because it allows for cross-sectional dependence in the regression errors and the parameters can be heterogeneous in the long-run.

Data

In this study, we use data over the period 1981–2017 from G20 countriesFootnote 1. The carbon emissions (CO2) are measured in metric tons, the renewable energy consumption (REC) is measured in kilowatt-hours from renewable sources (e.g., hydropower, solar, wind, geothermal, biomass and biofuels), the foreign direct investment (FDI) is measured in constant 2011 US dollars, the real GDP is measured in constant 2011 US dollars, the trade openness (TO) is sum of imports and exports as a percentage of GDP, and URB is urbanization measured using total urban population.

To our research objective, we utilize disaggregated indicators of financial development because some of previous studies have argued that different indicators of financial market and institution development could have different impacts on energy consumption and economic growth (see Levine and Zervos 1998; Sadorsky 2011; Kakar 2016). Given that, we consider separate indicators of stock market and financial institution development rather than using aggregated form of financial development. In this paper, we use stock market development index and financial institution development index developed by IMF; these indices range between 0 and 1 (see Svirydzenka 2016). The utilization of the IMF financial development indicators has various advantages over the World Development indicators. Firstly, the IMF financial development indicators are developed by using the complex and multi-dimensional information which include depth, access, and efficiency. Further, it offers separate indicators for stock market and financial institution development using different variables. The financial development indicators data is obtained from the IMF databaseFootnote 2, while data for carbon emissions, FDI, real GDP, trade openness, and urbanization are obtained from the World Development Indicators (WDI)Footnote 3. Finally, the data for renewable energy consumption is attained from the International Energy Statistics (IEA)Footnote 4.

Descriptive statistics

Table 1 presents the descriptive statistics of the variables. The statistics show that the mean of carbon emissions is 2.13% with a standard deviation of 1.75% in G20 member countries. On average, the renewable energy consumption is 7.36% in G20 economies while the inflow of FDI has a mean of 0.793%. The rate of average economic growth is 9.58% while the economies have average level of trade openness about 3.75%. The growth rate of average urbanization in the sample economies is about 4.19%. Regarding the disaggregated indicators of financial development, the descriptive statistics show that the average value of stock market development index is about 0.574 while financial institution development index has a mean of 0.728. Additionally, the statistics show that the mean value of stock market development index is high compared to financial institution development index.

Results and discussions

Analysis of cross-sectional dependence (CD) and panel unit root tests

As a first step of the empirical analysis, we investigate the cross-sectional dependence in our respective variables. It is important to determine the existence of cross-sectional dependence among the sample countries for selection of the estimation approach. For this purpose, this study employs cross-sectional dependence of Pesaran (2004). The results of CD test are reported in Table 2. The results of CD test indicate that the null hypothesis is rejected for entire variables at 1% significance level, suggesting that all of the variables are cross-sectional dependent. Further, we apply a second-generation panel unit-root test (CIPS) recommended by Pesaran (2007) to identify the order of integration in our variables under study. This is another important step for selecting appropriate econometric approaches. Table 3 reports the results of CIPS test. The results indicate that the null-hypothesis of a unit root (non-stationary) cannot be rejected for all variables under consideration that is in the full sample, developed, and developing countries of G20 panel. However, when CIPS test is applied on the first difference data series, then the null hypothesis rejected at 1% significance level, indicating that the all variables are stationary at the first difference order. Thus, the results confirm that all of the variables are integrated of same order that is 1(1).

Analysis of the long-run relationship

The above analysis of panel unit root test confirms the presence of a long-run equilibrium relationship among the consider variables. Therefore, we apply the Durbin-Hausman test by Westerlund (2008) to explore the long-run relationship among the variables of Eqs. (1) and (2). Table 4 reports the results for panel co-integration test. The findings of the DHg and DHp tests demonstrate that the null hypothesis of no co-integration is rejected at 1% significance level. This implies that the long-run equilibrium relationship exit across both the equations. The results hold their robustness not only for a full panel but also for sub-panels of the study.

Analysis of the long-run elasticities of CO2 emissions

To investigate the dynamic impacts of stock market development, financial institution development, renewable energy consumption, and FDI on carbon emissions, this study applies the common correlation effect-mean group (CCEMG) model of Pesaran (2006) to estimate the long-run relationships described in Eqs. (1) and (2). This approach takes into account the cross-sectional dependence and slope heterogeneity. Moreover, we transform all of the variables data into natural logarithms, thus the estimated coefficients from the CCEMG model can be interpreted as long-run elasticities.

The findings of panel estimation are reported in Table 5. The results show that the effect of stock market development on carbon emissions is not significant for the full sample due to heterogeneity. However, the results for developed countries point out that the stock market development index is negatively correlated with carbon emissions while it is positively correlated with carbon emissions in case of developing countries, respectively. This suggests that the carbon emissions reduce by 0.174% due to increase 1% in stock market development while in case of developing countries, the carbon emissions increase by 0.099%. This evidence on the developed economies suggests that listed firms in the financial markets might be adopting more environmentally friendly technologies due to the strict environmental laws. This evidence further supports the argument of Zagorchev et al. (2011) that financial markets in developed economies facilitate advance technologies that improve environment quality. The similar results are concluded by Paramati et al. (2018) who found a negative relationship between stock market variable and carbon emissions in developed countries. For developing countries, the evidence shows that stock market development index enhancement increases carbon emissions which suggesting that listed firms in the underdeveloped financial market do not engage more in environmental friendly activities due to the lack of proper regulations. Our results are in line with that of Abbasi and Riaz (2016) and Acheampong et al. (2020); they found that financial market development increases environmental degradation in developing economies.

The results further show that the index of financial institution development possesses a positive and significant influence on carbon emissions for the full sample and developed economies. Alternatively, financial institution development is not significantly correlated with carbon emissions per capita in case of developing countries. A 1% increase in financial institution development index raises carbon emissions by 0.138% and 0.101% for full sample and developed economies of G20, respectively. For a panel of developed and G20 countries, a positive and significant relationship between financial institution development index and carbon emissions implies that financial development through financial institutions degrade the environment in developed countries. This could be that financial institutions of these economies are allocating the financial resources to environmentally unsustainable projects, and this result supports the empirical findings of Çoban and Topcu (2013) who demonstrated that financial institution development does not improve the environmental quality. However, for developing countries, financial institution development is not significantly correlated with carbon emissions, and this evidence is consistent with the findings of previous empirical studies which noted that financial institution development has insignificant impact on the environment (Omri et al. 2015; Dogan and Turkekul 2016; Maji et al. 2017). On the other hand, this evidence contradicts the findings of Zhang (2011), who indicated that the financial institution facilitate the businesses investment scales which boost economic growth and carbon emissions. The difference between findings could be attributed to the use of different estimation technique.

The impact of renewable energy consumption on carbon emissions is found negative and significant at 1% significance level in all the models and across the panels. The results are implying that increase in renewable energy consumption improves the environmental quality in all the panels. This evidence is consistent with the findings of many empirical studies which show that renewable energy consumption has inverse relationship with carbon emissions. For instance, Al-Mulali and Ozturk (2016) reported that renewable energy consumption has a negative effect on carbon emissions in advance economies. Similarly, Sinha and Shahbaz (2018) documented that renewable energy consumption improves quality of environment in case of India. Stiglitz (2002) also found that renewable energy consumption helps in accomplishing the agenda of sustainable development because renewable energy produces through wind, hydropower, and solar which are low carbon energy forms, and that maintain sustainable global economic growth without environment degradation. Conversely, our evidence on renewable energy consumption contradicts with the findings of Farhani and Shahbaz (2014), who indicated that renewable energy consumption increases the environmental degradation.

The correlation between FDI inflows and carbon emissions is negative and significant in the case of full sample and developing countries while positive in the case of developed countries. The estimated coefficients are − 0.142 for the full sample, − 0.097 for developing countries while 0.102 for developed countries. The implication is that FDI inflows improve the quality of the environment in developing countries whereas it deteriorates the environment quality in developed economies. A possible explanation is that FDI brings advanced technology and innovations into developing economies which has positive effect on energy efficiency and production activities and in result greener technology helps in reduction of carbon emissions in developing economies. On contrary, developed economies do not depend for technology transfer on FDI inflows; these economies might be not paying much attention on controlling of pollutants and have converted these FDI inflows into inefficient manufacturing activities, and this result contradicts the findings of Lee (2013), who found that FDI has an inverse relationship with environment degradation in advanced economies while consistent with the findings of Baek (2016). The finding on developing economies is in line with the prior findings of empirical studies which establish a negative link between FDI inflows and degradation of environment (Pazienza 2015; Zhang and Zhou 2016; Jiang et al. 2019; Solarin and Al-Mulali 2018).

The findings show a positive and significant relationship between economic growth (per capita GDP) and carbon emissions at 1% and 5% in full sample and sub-samples, respectively. The positive and significant correlation between economic growth and carbon emissions implies that economic growth in these economies increases carbon emissions. Our results are in line with the findings of Tamazian and Rao (2010) which indicated that the economic growth has a positive and significant impact on the degradation of environment. For other control variables, trade openness exerts a positive and significant effect on carbon emissions at 10% in the full sample and sub-samples. The implication is that trade openness increases carbon emissions growth in both developed and developing economies of G20. Thus, polices related to trade liberalization will worsen the environment quality in both developed and emerging economies of a panel of G20. Our results are in line with the empirical findings of Ren et al. (2014), Ahmed et al. (2017), and Acheampong et al. 2020, which noted that trade openness increases carbon emissions but contradicts with the findings of Abid (2017), who noted that trade openness reduces carbon emissions in EU countries. For the case of full sample and developed economies, we find that urbanization exerts a negative and significant impact on carbon emissions and this confirms the theory of compact city, while for developing economies; the results indicate that urbanization increases carbon emissions. The rapid urbanization in developed economies helps cities to increase scale of economies which further help to reduce carbon emissions while in developing countries, the scale of economies are minimal (Poumanyvong and Kaneko 2010).

Conclusion and policy implications

The literature on the link between disaggregated financial development and environmental pollution is scant. The empirical evidence is contradictory and very few studies have investigated the relationship between disaggregated financial development and carbon emissions. In this study, we investigate the effect of stock market and financial institution development on carbon emissions and also explore the relationship between renewable energy, FDI inflows, and carbon emission in the full sample, developed, and developing countries of 20 economies (G20) over the period 1981–2017. The results of the panel co-integration test indicate that there is significant long-run relationship among the underlying variables.

Using CCEMG model, the results on long-run elasticities of present study reveal that stock market development mitigate carbon emissions in the full sample and developed economies while increases the carbon emissions in the developing economies of G20. However, development in financial institutions increases carbon emissions in the case of G20 economies and developed economies but the relationship is insignificant in developing countries. The empirical results reveal significant heterogeneity on the effects of stock market development and financial institution development on carbon emissions across the panels. The results confirm that the renewable energy improves the quality of environment by reducing carbon emissions in all panels. We also find that FDI inflows decrease environmental degradation in case of developing and group of G20 economies.

Given these outcomes, our study has important policy implications. The empirical findings regarding renewable energy consumption indicate that it has a decreasing effect on the carbon emissions intensity. The implication is that the share of renewable energy should increase in total energy consumption. This study is also demonstrated that FDI mitigates the growth of carbon emissions in the developing countries. The policymakers of these economies should redesign such polices which attract more FDI inflows from the major economies because it brings innovative production process to the host country. Therefore, this will help to achieve sustainable development and low carbon emissions. Additionally, the findings show that trade openness has a degrading effect on the environment in these economies. The implication is that policy authorities should implement a stringent environmental regulatory framework to improve the trade openness effect on environmental pollution.

The empirical findings indicate that the stock market development improves the environmental quality in the developed economies while degrades in the developing economies of G20. The policymakers in developed countries might have instructed and implemented all listed firms on the stock exchange to adopt greener technologies to mitigate the carbon emissions. In contrast, based on the findings of developing economies, we recommend that the policymakers in developing market economies should initiate effective polices that will promote to adopt greener technologies, which will lead to reduce green-house gasses and improve the environmental quality. For financial institution development, the implication is that financial institutions should provide cheap credit to firms or industries which are committed to investing in environmental friendly projects and also encourage them to invest in environmental sustainability projects. Future studies can be extended this study by investigating the effect of financial development on carbon emissions including the role of other factors such as technological innovation and institutional development. Furthermore, this study can be extended to investigate heterogeneity across economies such as high-income, middle-income, and lower-income economies.

Availability of data and materials

The datasets analyzed during the study are available in the website of IMF database, World Development Indicators (WDI) and International Energy Statistics (IEA).

Notes

Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea, Turkey, UK, and USA.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Abid M (2017) Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of EU and MEA countries. Journal of Environmental Management 188:183-194

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Acheampong AO, Amponsah M, Boateng E (2020) Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ 88:104768

Ahmed K, Bhattacharya M, Shaikh Z, Ramzan M, Ozturk I (2017) Emission intensive growth and trade in the era of the Association of Southeast Asian Nations (ASEAN) integration: an empirical investigation from ASEAN-8. J Clean Prod 154:530–540

Al-Mulali U, Ozturk I (2016) The investigation of environmental Kuznets curve hypothesis in the advanced economies: the role of energy prices. RenewSust Energ Rev 54:1622–1631

Al-Mulali U, Ozturk I, Lean HH (2015) The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat Hazards 79(1):621–644

Apergis N, Payne JE (2010) Renewable energy consumption and economic growth: evidence from a panel of OECD countries. Energy Policy 38(1):656–660

Baek J (2016) A new look at the FDI–income–energy–environment nexus: dynamic panel data analysis of ASEAN. Energy Policy 91:22–27

Bah MM, Azam M (2017) Investigating the relationship between electricity consumption and economic growth: Evidence from South Africa. Renew Sust Energ Rev 80:531–537

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132

Bilgili F, Koçak E, Bulut Ü (2016) The dynamic impact of renewable energy consumption on CO2 emissions: a revisited Environmental Kuznets Curve approach. Renew Sust Energ Rev 54:838–845

Bulut U (2017) The impacts of non-renewable and renewable energy on CO 2 emissions in Turkey. Environ Sci Pollut Res 24(18):15416–15426

Chen W, Lei Y (2018) The impacts of renewable energy and technological innovation on environment-energy-growth nexus: new evidence from a panel quantile regression. Renew Energy 123:1–14

Chudik A, Pesaran MH (2015) Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. J Econ 188(2):393–420

Claessens S, Feijen E (2007) Financial sector development and the millennium development goals. The World Bank

Çoban S, Topcu M (2013) The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ 39:81–88

Dasgupta S, Laplante B, Wang H, Wheeler D (2002) Confronting the environmental Kuznets curve. J Econ Perspect 16(1):147–168

Dietz T, Rosa EA (1997) Environmental impacts of population and consumption. In: Environmentally significant consumption: Research directions, pp 92–99

Dogan E, Turkekul B (2016) CO 2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Doytch N, Narayan S (2016) Does FDI influence renewable energy consumption? An analysis of sectoral FDI impact on renewable and non-renewable industrial energy consumption. Energy Econ 54:291–301

Ehigiamusoe KU, Lean HH (2019) Effects of energy consumption, economic growth, and financial development on carbon emissions: evidence from heterogeneous income groups. Environ Sci Pollut Res 26(22):22611–22624

Ehrlich PR, Holdren JP (1971) Impact of population growth. Science 171(3977):1212–1217

Farhani S, Ozturk I (2015) Causal relationship between CO 2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676

Farhani S, Shahbaz M (2014) What role of renewable and non-renewable electricity consumption and output is needed to initially mitigate CO2 emissions in MENA region? Renew Sust Energ Rev 40:80–90

Finger M, Gavious I, Manos R (2018) Environmental risk management and financial performance in the banking industry: a cross-country comparison. J Int Financ Mark Inst Money 52:240–261

Hao Y, Zhang ZY, Liao H, Wei YM, Wang S (2016) Is CO 2 emission a side effect of financial development? An empirical analysis for China. Environ Sci Pollut Res 23(20):21041–21057

Hitam MB, Borhan HB (2012) FDI, growth and the environment: impact on quality of life in Malaysia. Procedia Soc Behav Sci 50:333–342

Inglesi-Lotz R, Dogan E (2018) The role of renewable versus non-renewable energy to the level of CO2 emissions a panel analysis of sub-Saharan Africa’s Βig 10 electricity generators. Renew Energy 123:36–43

Islam F, Shahbaz M, Ahmed AU, Alam MM (2013) Financial development and energy consumption nexus in Malaysia: a multivariate time series analysis. Econ Model 30:435–441

Jalil A, Feridun M (2011) The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Econ 33(2):284–291

Jamel L, Maktouf S (2017) The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ Finance 5(1):1341456

Javid M, Sharif F (2016) Environmental Kuznets curve and financial development in Pakistan. Renew Sust Energ Rev 54:406–414

Jensen AL (1996) Beverton and Holt life history invariants result from optimal trade-off of reproduction and survival. Can J Fish Aquat Sci 53(4):820–822

Jiang H, Hu YC, Lin JY, Jiang P (2019) Analyzing China’s OFDI using a novel multivariate grey prediction model with Fourier series. Int J Intel Comp Cyber 12

Kahouli B (2017) The short and long run causality relationship among economic growth, energy consumption and financial development: Evidence from South Mediterranean Countries (SMCs). Energy Econ 68:19–30

Kakar ZK (2016) Financial development and energy consumption: evidence from Pakistan and Malaysia. Energ Source Part B 11(9):868–873

Keho Y (2015) Is foreign direct investment good or bad for the environment? Times series evidence from ECOWAS countries. Econ Bull 35(3):1916–1927

Khan MA, Ozturk I (2020) Examining foreign direct investment and environmental pollution linkage in Asia. Environ Sci Pollut Res 27(7):7244–7255

Khan MTI, Ali Q, Ashfaq M (2018) The nexus between greenhouse gas emission, electricity production, renewable energy and agriculture in Pakistan. Renew Energy 118:437–451

King RG, Levine R (1993) Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics 108(3):717–73

Kutan AM, Paramati SR, Ummalla M, Zakari A (2018) Financing renewable energy projects in major emerging market economies: Evidence in the perspective of sustainable economic development. Emerg Mark Financ Trade 54(8):1761–1777

Lee JW (2013) The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55:483–489

Lee JW, Brahmasrene T (2013) Investigating the influence of tourism on economic growth and carbon emissions: Evidence from panel analysis of the European Union. Tour Manag 38:69–76

Levine R, Zervos S (1998) Stock markets, banks, and economic growth. Am Econ Rev:537–558

Maji IK, Habibullah MS, Saari MY (2017) Financial development and sectoral CO 2 emissions in Malaysia. Environ Sci Pollut Res 24(8):7160–7176

Mazzucato M, Semieniuk G (2018) Financing renewable energy: who is financing what and why it matters. Technol Forecast Soc Change 127:8–22

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Econ 48:242–252

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Paramati SR, Ummalla M, Apergis N (2016) The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ 56:29–41

Paramati SR, Alam MS, Apergis N (2018) The role of stock markets on environmental degradation: A comparative study of developed and emerging market economies across the globe. Emerg Mark Rev 35:19–30

Pazienza P (2015) The relationship between CO2 and Foreign Direct Investment in the agriculture and fishing sector of OECD countries: Evidence and policy considerations. Intel Ekon 9(1):55–66

Pesaran MH (2004) General diagnostic tests for cross-sectional dependence in panels. Empir Econ:1–38

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Poumanyvong P, Kaneko S (2010) Does urbanization lead to less energy use and lower CO2 emissions? A cross-country analysis. Ecol Econ 70(2):434–444

Ren S, Yuan B, Ma X, Chen X (2014) International trade, FDI (foreign direct investment) and embodied CO2 emissions: A case study of Chinas industrial sectors. China Econ Rev 28:123–134

Rezza AA (2013) FDI and pollution havens: evidence from the Norwegian manufacturing sector. Ecol Econ 90:140–149

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39(2):999–1006

Salim R, Yao Y, Chen GS (2017) Does human capital matter for energy consumption in China? Energy Econ 67:49–59

Sbia R, Shahbaz M, Hamdi H (2014) A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ Model 36:191–197

Shaari MS, Hussain NE, Abdullah H, Kamil S (2014) Relationship among foreign direct investment, economic growth and CO2 emission: a panel data analysis. Int J Energy Econ Policy 4(4):706

Shahbaz M, Lean HH (2012) Does financial development increase energy consumption? The role of industrialization and urbanization in Tunisia. Energy Policy 40:473–479

Shahbaz M, Tiwari AK, Nasir M (2013a) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013b) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Model 35:145–152

Shahbaz M, Nasreen S, Abbas F, Anis O (2015) Does foreign direct investment impede environmental quality in high-, middle-, and low-income countries? Energy Econ 51:275–287

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy 119:703–711

Solarin SA, Al-Mulali U (2018) Influence of foreign direct investment on indicators of environmental degradation. Environ Sci Pollut Res 25(25):24845–24859

Stiglitz JE (2002) Participation and development: Perspectives from the comprehensive development paradigm. Rev Dev Econ 6(2):163–182

Svirydzenka K (2016) Introducing a new broad-based index of financial development.

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32(1):137–145

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253

Tasri ES, Karimi K (2019) Emission study and pollution heaven hypothesis in economic development of developed country.

Usman O, Akadiri SS, Adeshola I (2020) Role of renewable energy and globalization on ecological footprint in the USA: implications for environmental sustainability. Environ Sci Pollut Res 27:30681–30693

Vinh CTH (2015) The two-way linkage between foreign direct investment and environment in Vietnam–from sectoral perspectives. Foreign Trade University

Xing T, Jiang Q, Ma X (2017) To facilitate or curb? The role of financial development in China’s carbon emissions reduction process: a novel approach. Int J Environ Res Public Health 14(10):1222

Yao X, Tang X (2020) Does financial structure affect CO2 emissions? Evidence from G20 countries. Financ Res Lett 34:101791

Zagorchev A, Vasconcellos G, Bae Y (2011) Financial development, technology, growth and performance: Evidence from the accession to the EU. J Int Financ Mark Inst Money 21(5):743–759

Zeqiraj V, Sohag K, Soytas U (2020) Stock market development and low-carbon economy: The role of innovation and renewable energy. Energy Econ 91:104908

Zhang YJ (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Zhang C, Zhou X (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sust Energ Rev 58:943–951

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248

Funding

Not applicable

Author information

Authors and Affiliations

Contributions

UMME HABIBA: conception, writing, analysis; Rahil Irfan Ahmad: data collection; Cao Xingbang: supervision. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable

Consent for publication

Not applicable

Competing interests

The authors declare that they have no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Habiba, U., Xinbang, C. & Ahmad, R.I. The influence of stock market and financial institution development on carbon emissions with the importance of renewable energy consumption and foreign direct investment in G20 countries. Environ Sci Pollut Res 28, 67677–67688 (2021). https://doi.org/10.1007/s11356-021-15321-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15321-3