Abstract

Simultaneous achievement of sustainable development goals (SDGs), especially energy efficiency (SDG 7), economic growth (SDG 8), and pollution reduction (SDG 13), has been a major challenge among the developing countries. Besides, there is absence of a study which quantifies clean production (net growth-emission effects) and energy import efficiency (net growth-energy import effects) as indicators of sustainable growth. Thus, this current study examines this issue for South Africa and Nigeria at aggregate and sectoral levels between 1981 and 2015 using simultaneous equation models and threshold regression analysis. Evidence of the sustainable growth cannot be established for South Africa and Nigeria with and without structural break. Further, the analysis shows that, with respect to Nigeria, keeping petroleum import per capita above the respective threshold enhances the environmental quality as aggregate and sectoral outputs increase. However, the CO2 emission can only induce increased GDP per capita when the petroleum import is below the threshold level. In South Africa’s case, although maintaining petroleum import beyond the threshold may increase CO2 emission per capita associated with high aggregate output per capita, such emission exhibits a negligible reverse impact on output per capita. Results are found to vary across both lower and upper threshold regimes for sectors. Policy recommendations are discussed in the conclusion.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Countries all over the world are now struggling to achieve sustainable development (Rosen 2009; and Oyedepo 2012). This aspiration has led to the articulation of the Millennium Development Goals (MDGs) which has been transformed into sustainable development goals (SDGs). Sustainable development can be referred to as development that takes care of the requirements of the current generation without jeopardizing the ability of the upcoming generation to satisfy their own needs (United Nations 1987). The 2002 World Summit on Sustainable Development identified social, economic, and environmental sustainability as the three pillars of sustainable development (Oyedepo 2012). A combination of two of the pillars (economic and environmental sustainability) forms sustainable growth which means long-run growth achieved with energy efficiency and low carbon development (clean production). Thus, the general assumption is that growth should contribute to energy resource conservation and environmental upgrading, while energy and environment should support growth (Zuo and Ai 2011; Hu et al. 2011; Omer 2008). This means that, while energy and environment support growth, the benefits generated should reflect in energy adequacy (saving) and improvement in environmental quality (Fang et al. 2020).

There have been debates in the literature concerning whether the interaction among growth, energy, and environment is complementary or trade-off. A school of thought argued that factors substitution and technical change can successfully downgrade the role of resources (energy and environment) in economic growth (Solow 1993, 1997; Bretschger 2005). However, another school of thought (ecological economists) stated that the substitution between inputs (capital, labor, and resources) and technical advancement have limited role to play in addressing the resources scarcity problem (Stern 1997; Cleveland et al. 1984; and Hall et al. 2003). According to Hall et al. (2003), most productivity growth arose from increased energy consumption, while technical change engendered by innovations largely increase productivity via consumption of more energy. A balanced view is that market-oriented energy and environmental policies can induce the introduction of new technologies that reduce energy utilization and environmental degradation during production process (Porter and van der Linde 1995, 1999).

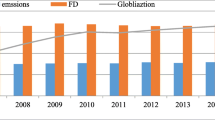

The seventeen sustainable development goals (17 SDGs) include low energy consumption (SDG 7), economic growth (SDG 8), and reduction in impact of climatic change (SDG 13). The need to achieve complementarity among the three SDGs was stressed in a recent special report of the Intergovernmental Panel on Climate Change on Global Warming (IPCC 2018). In the major industrialized countries in Africa, particularly South Africa and Nigeria, a significant proportion of refined petroleum products consumed are imported.Footnote 1 For instance, in Nigeria and South Africa, the total import of refined petroleum products was generally higher during 2000–2015 than the earlier years.Footnote 2 In 2009 alone, the import of refined petroleum was greater than the domestic output of refined petroleum in Nigeria by about 225%, though this difference fell to about 78% in 2012 (US Energy Information Administration (USEIA) 2010). Also, fuel imports in South Africa and Nigeria reached about 15% and 20% of total merchandise imports (respectively) in 2012. During the same period, the gross domestic product per capita in these countries was relatively higher than the earlier years (World Bank, on-line).Footnote 3 In contrast to the observed upward trends in petroleum import per capita and GDP per capita in the two countries, carbon emissions per capita fell marginally from 10.36 metric tons in 1984 to 9.15 metric tons in 2015. However, despite the fact that the average petroleum import per capita in South Africa (39.4 l) and Nigeria (43.7 l) is close during the study period, the mean GDP per capita in South Africa (US $6625.40) is five times greater than that of Nigeria (US $1639.80), while the mean carbon emission per capita in South Africa (9265.85 k tones) is fifteen times higher than that of Nigeria (606.13 tons). This suggests differences in the growth-energy-environment links in the two countries. There is therefore the need for empirical investigation to ascertain the links as claimed by Lin and Agyeman (2019). It should be stated that earlier related studies on Nigeria and South Africa (such as Maji 2015, Ackah 2015 and Adejumo 2019) focused on the role of either total or clean energy on productivity (economic growth) or the growth-emission link but ignored the potential bidirectional link between the variables, the particular role of the import component of the total energy, and the link of these variables with the environment.

In the light of the above, the emerging issues are as follows: (1) what is the nature of output-energy (import)-emission nexus in South Africa and Nigeria? (2) Are there sectoral differences in the output-energy (import)-emission nexus in these countries? (3) To what extent has energy import contributed to sustainable growth in the countries? Despite the importance of these policy questions, little or no study has addressed them over time.

This article highlights a number of shortcomings in the literature on the output-energy-growth nexus and contributes in the following ways. First, although there are many studies on the link between energy variety (including oil), growth, and emission (see Adewuyi and Awodumi 2017a, b for detailed review), there is dearth of specific studies on the energy import-growth-emission nexus.Footnote 4 This represents a major deficiency in related literature. Although few studies exist on drivers of energy import, such studies show an overwhelming concentration on crude oil, but most crude oil importing countries refined the crude for re-exporting with only a fraction of the product retained for economic activities. Thus, it may be difficult to measure the net effect of the crude oil import on growth without considering the petroleum import. Only four studies are identified for Africa (Ziramba 2010 for South Africa; Marbuah 2017 for Ghana; Adewuyi 2016 and Adewuyi and Awodumi 2020 for Nigeria) despite the heavy dependent of most developing countries, especially African countries, on energy (crude or refined petroleum) import in production activities. Second, most of the existing studies analyzed the drivers of energy import in which income or economic growth plays a key role but did not recognize the fact that energy import could also propel growth. Thus, such analysis could lead to simultaneity bias which could only be solved using simultaneous equitation model. Besides, the role of energy import in pollution was neglected, while the possibility of the effect of structural changes (breaks) was also ignored. Causality analysis undertaken in most of these studies (including Adewuyi and Awodumi 2020) has been based on bivariate framework which is not rigorous given the complexity of economic relationship, while threshold analysis that can aid policy analysis was not conducted. Moreover, these studies focused on only aggregate analysis but failed to verify the sectoral links which limit policy lessons that could be drawn. Above all, a major shortcoming in the literature is the absence of a study (to the best of our knowledge) that quantifies net growth-emission effects (clean production) and net growth-energy import effects (energy import efficiency) as indicators of sustainable growth.

Fourth, empirical estimates could aid the projection of future energy import demand required to attain specific growth and pollution targets set for the economies as contained in the development policy and planning documents. They could also help in the evaluation of the energy efficiency of the economy and also provide a basis for analyzing the potential impact of public policies (such as government energy subsidy program) on aggregate and sectoral outputs and emissions. Given the association between energy consumption, output, and environmental pollution, this study would be helpful in the assessment of the level of achievement of some SDGs and development of policies for managing the negative environmental effects of energy import used in the production activities.

This present study, therefore, quantifies and analyzes the link between refined petroleum import, economic growth, and carbon emission in South Africa and Nigeria at aggregate and sectoral levels using the most recent multivariate Granger causality method and simultaneous equation model which correct for structural breaks, while threshold analysis was also done to aid policy analysis. This quantification and analysis enable us to provide robust evidence of lack of clean production and energy import efficiency in South Africa and Nigeria.

The rest of this study is organized in a way such that Section 1.2 presents stylized facts on petroleum import, economic growth, and carbon emissions in South Africa and Nigeria while Section 2 contains the review of literature. Section 3 covers the theory and methodology employed in the study and Section 4 presents and discusses the empirical results. Section 5 summarizes and concludes the article with policy implications.

Literature review

Theoretical literature

It can be stated that the existing theoretical explanation of the nexus among energy consumption, economic growth, and carbon emissions exist in pairs. The literature isolates the growth-energy (import), growth-environmental quality, and energy (import)-environmental quality links to provide partial description of the complex relationship among the variables (Adewuyi and Awodumi 2020).

On the growth-energy (import) nexus, four hypotheses dominate the literature: the growth, conservation, feedback, and neutrality hypotheses (Payne 2009; Ozturk 2010; Omri 2014). According to the growth hypothesis, unidirectional causality runs from energy consumption to economic growth, following its critical role in promoting economic growth. The conservation hypothesis suggests that a unidirectional causality run from economic growth to energy consumption, as increase in real per capital income raises the level of economic activities necessitating high energy use. Also, while the feedback hypothesis indicates bidirectional causality between energy consumption and economic growth, neutrality hypothesis implies absence of causal link between them with relatively negligible influence on each other. In addition, Bahmani-Oskooee and Economidou (2009) is among the literature that discusses the import-led growth hypothesis, which is on the role of imports in creating opportunities for growth through import-induced access to affordable inputs including energy. The growth-led import hypothesis is also about the importance of growth in facilitating imports including inputs such as energy.

The relationship between economic growth and environmental quality is popularly explained using the environmental Kuznets Curve (EKC) hypothesis. The hypothesis establishes that environmental pollution rises with income at low level of per capita income but declines as per capita income increases beyond a certain point (Grossman and Krueger 1995). Recent applications of this hypothesis include Boubellouta and Kusch-Brandt (2020) for EU28 + 2 countries, Churchill et al. (2020) for Australia, and Halliru et al. (2020) for the Economic Community of West African States. Environmental quality can also promote or hinder growth via its influence on the critical production inputs such as labor and capital. For instance, negative environmental effect (pollution) on human health (illness) will affect productivity and growth (Adewuyi and Awodumi 2017b).

With respect to energy (import)-environmental quality link, it should be stated that, while some energy products such as fossil fuel and coal generate pollution, others such as hydroelectricity, wind, and solar are environmentally friendly (clean) energy sources. Thus, environmental quality depends on the type of energy use. However, considering the harmful effect of pollution, the less the demand for energy source engenders high quantity of carbon emissions if there are equally affordable alternatives (Adewuyi and Awodumi 2017b). Given that some energy products are imported, it is imperative to state that trade facilitates access to some energy products such as crude oil and refined petroleum products. Therefore, in an energy import–dependent country, the nexus between energy and environment is a function of availability of energy via trade. The trade (import)-environment nexus is summarized under the Pollution-Haven hypothesis where countries import energy products that generate unfavorable effect on their environment, and Pollution-Halo hypothesis in which energy-related imports contribute to clean production and environment (Aller et al. 2015; Aklin 2016; Cherniwchan 2017). Going by the Heckscher-Ohlin trade theory, comparative advantage and pattern of trade lie in resource abundance. Thus, in some developing countries, the environment (natural resources) dictates pattern of trade (export of pollution-intensive primary product), while pattern of trade (import of refined or manufactured goods) also dictates the environment quality (measured by quantity of pollution). Thus, these developing countries export and import pollution-intensive goods (Copeland and Taylor 2005). The comprehensive linkage among growth, energy, and environment is still missing in the theoretical literature, which informs the partial analysis of this relationship in the empirical literature.

The theoretical analysis of the energy-growth-emission nexus can also be discussed based on the concept of sustainable economic development and the debates on the role of energy in production. As stated in the “Introduction” section of this study, there are three pillars of sustainable economic development: social, economic, and environmental sustainability (World Summit on Sustainable Development, 2002; and Oyedepo 2012). Alignment of two of the pillars (economic and environmental sustainability) generates sustainable growth which implies attainment of long-run growth with energy efficiency and low carbon development. Thus, while energy and environment foster growth, the gains obtained should lead to energy adequacy and improvement in environmental quality (Zuo and Ai 2011; Hu et al. 2011; Omer 2008; Fang et al. 2020). The debates on the significance of energy in production have been well summarized in the “Introduction” section.

Empirical literature

A number of studies have been conducted, especially within the last decade, across countries and regions on the link of energy consumption (renewable and non-renewable) with economic growth or carbon emission or both.Footnote 5 Only few studies specifically considered the role of oil consumption (combination of locally produced and imported) in the trivariate relationship (see Adewuyi and Awodumi 2017a for studies reviewed) while those that covered oil import (crude or refined) focused on only the drivers of such import. First, specific studies on Nigeria and South Africa are reviewed. Second, a general review of the literature is conducted consisting of studies on oil-growth nexus, oil-growth-emission nexus, and lastly, studies on drivers of oil import.

Literature on Nigeria and South Africa

The growth-energy (import)-emissions nexus has also been investigated in Sub-Saharan Africa, particularly Nigeria and South Africa. In Nigeria, Adewuyi and Awodumi (2017b) estimated a simultaneous equation model to establish a complete feedback effects among biomass energy, carbon emissions, and economic growth between 1980 and 2010. Subsequently, Halliru et al. (2020) employed panel quantile regression technique for six West African countries (including Nigeria) and reported a U-shaped relationship between carbon emission and economic growth over 1970–2017. In a similar analysis, Awodumi and Adewuyi (2020) adopted nonlinear autoregressive distributed lag technique (NARDL) to show that both positive and negative changes in petroleum consumption reduce economic growth but promote environmental quality during the 1980–2015 period. In contrast, autoregressive distributed lag technique (ARDL) estimates of Adejumo (2019) reveal that economic growth worsens environmental quality in the country between 1970 and 2014, while the reverse effect is negligible. Adewuyi and Awodumi (2020) found no evidence of bivariate Granger causality among energy resource import, carbon emissions, and Nigeria’s economic growth during 1980–2019. Further analysis of import of petroleum products by Adewuyi (2016) indicates a positive role of economic growth between 1984 and 2013.

In the case of South Africa, Toda and Yamamoto Granger causality test results employed by Ziramba (2009) suggest feedback causal links between oil consumption and industrial production. Moreover, Ziramba (2010) utilized data ranging from 1980 to 2006 in a PMG panel ARDL analysis to show that import demand for crude oil is positively affected by economic growth in the country. Using Pairwise Dumitrescu-Hurlin Panel causality approach for the same country, Azam (2019) found significant bidirectional causality between growth and each of energy consumption and carbon emissions, but a unidirectional causality running from energy consumption to carbon emissions. Granger causality estimates of Bildirici and Bakirtas (2014) found neutral link between oil (and natural gas) consumption and economic growth in the country between 1980 and 2011.

In Sub-Saharan Africa, including Nigeria and South Africa, Bah et al. (2020) confirmed the inverted U-shaped link between growth and environmental pollution (EKC hypothesis) during 1971–2012. FMOLS estimates of Behmiri and Manso (2013) reveal significant feedback effect between carbon emission and economic growth for South Africa, but neutral in the case of Nigeria. Further, Mensah et al. (2019) PMG panel ARDL estimation method provides evidence of bidirectional causal link between fossil fuel energy consumption and each of economic growth and carbon emissions among SSA countries.

It is clear from the above review that, although some studies exist on South Africa and Nigeria, only three of such studies cover energy import (Ziramba 2010 for South Africa; Adewuyi 2016 & Adewuyi and Awodumi 2020 for Nigeria). Besides, Adewuyi and Awodumi (2020), which extended analysis of output-emission linkage to energy import, is based on bivariate Granger causality framework that cannot reveal direct, indirect and joint effects of the variables on each other. This study is also limited in terms of coverage or scope (only aggregate without sectoral analysis) and robustness of analysis which can be achieved using complementary approaches such as multivariate Granger causality, simultaneous equation model, and threshold regression analysis as evident in this study. It is also limited because of its inability to quantify indicators of sustainable growth (clean production and energy import efficiency) which is part of the focus of this present study.

General studies on oil (import)-growth-emission nexus

Empirical literature provides considerable support for the critical role of oil consumption in the growth process. For instance, ECM-Granger causality approach of Zou and Chau (2006) revealed unidirectional causality running from oil consumption to economic growth (growth hypothesis) in China between 1953 and 2002. Using the impulse response function and bootstrap corrected causality methods, Pereira and Pereira (2010) found that oil, as well as coal and natural gas, caused economic growth in Portugal during the 1977–2003 period. These findings are further confirmed among a group of 42 countries by Halkos and Tzeremes (2011), in Cameroon by Wandji (2013), among the G-6 countries by Chu and Chang (2012), a panel of 49 countries by Chu (2012) and Akhmat and Zaman (2013) for the case of South Asia. Similar reports were made in the short-run by Behmiri and Manso (2014) (Latin America) and Lach (2015) (Poland). It should be stated that few studies also showed that causality runs from economic growth to oil consumption rather than the other way round. These include Ali and Harvie (2013), Lean and Smyth (2014), and Zheng and Luo (2013) for Libya, Malaysia, and China, respectively.

Irrespective of the time horizon, some studies confirmed the feedback hypothesis between oil consumption and economic growth. This hypothesis is evident in studies conducted for China (Yuan et al. 2008; and Zhang and Yang 2013), the 27 OECD countries (Behmiri and Manso 2012a), Portugal (Behmiri and Manso 2012b), Eurasia (Bildirici and Kayıkçı 2013), BRICS countries (Azam 2019), Saudi Arabia (Alkhathlan and Javid 2013), Malaysia (Saboori and Sulaiman 2013; and Park and Yoo 2014), the Philippines (Lim et al. 2014), and G20 (Pao and Chen 2018).

Few studies also investigated the carbon emission implication of the link between growth and oil consumption. Al-Mulali (2011) and Apergis and Payne (2014) showed evidence of a bidirectional causality between carbon emission and economic growth among MENA countries and 7 Central American countries, respectively. In Wuhan, China, Rao and Yan (2020) demonstrated that the interaction between industrial waste gas emissions and industrial wastewater emissions is detrimental for economic growth. This finding is not confirmed among the European Union countries where Balsalobre-Lorente and Leitão (2020) discovered positive influence of carbon emission on growth, following climate change and greenhouse gas implication of high industrial activities. However, Bloch et al. (2012) reported that causality only runs from growth to carbon emission in China, a finding validated in the short-run among 10 MENA countries by Farhani and Shahbaz (2014). Thus, Ali et al. (2020) reported a U-shaped link between economic growth and environmental degradation among European countries, but Dong et al. (2020) confirmed reducing effect of growth on carbon emission in China’s industrial sector.

For OECD and the selected 22 African countries, Shafiei and Salim (2014) and Mensah et al. (2019) revealed that the link between non-renewable energy consumption and carbon emission (as well as growth) is bidirectional. A number of studies however proved that non-renewable energy caused carbon emission with no feedback effect. This result was observed for EU countries by Dogan and Sekan (2016a) and Bolük and Mert (2014), top renewable energy countries by Dogan and Sekan (2016b), and Turkey by Dogan (2015).

Most of the studies on oil import have shown overwhelming interest on the drivers of oil import (including growth) but ignored its relationship with carbon emission. However, there appears to be a consensus in the energy import literature on the significant role of income or economic growth in oil import demand, which is evident across the few available studies. Although studies have largely concentrated on Asian economies, some works have been done in few other regions. For example, Zhao and Wu (2007) revealed that industrial and transport output growth has significant long-run positive impact on crude oil import in China during the year 1995–2006. Also, Ghosh (2009) showed that income has positive and unidirectional causal effect on crude oil import in India between 1970 and 2006. Kim and Baek (2013) obtained similar results in the case of Korean during the 1986–2010 period, although their results indicated that oil price is more important in the short-run. Also, the simulation results of Adams et al. (2000) portrayed that the economic growth has positive effect on crude oil import in Thailand during 1992–2010. However, Mardiana et al. (2013) reported that for the case of Indonesia, oil import (crude oil and petroleum product) is more affected by transportation fuel consumption while the role of economic growth is insignificant.

Camacho-Gutiérrez (2010) provided an empirical evidence that the US import demand for Mexican crude oil responds positively to changes in income between 1990 and 2010. Moore (2011) found support for this result in Barbados from 1998 to 2009. This positive effect of economic growth on crude oil import has also been validated in West Africa. For instance, Marbuah (2017) found that income has increasing impact on crude oil import in Ghana from 1980 to 2012. Also, Altinay (2007) showed that income has both short-run and long-run impacts on import demand for crude oil in Turkey during the 1980–2005 period, while for the same country, Ozturk and Arisoy (2016) obtained related results after analyzing data covering 1966–2012. In contrast to this finding, Ediger and Berk (2011) found that changes in crude oil imports in the same country are not significantly affected by economic growth during 1968–2007. The findings for Spain appear to contrast markedly from those obtained for other countries. This is evident in the analysis conducted by Balaguer et al. (2015), where unidirectional causality runs from aggregate energy import to economic growth from 1900 to 2012. Further, Fedoseeva and Zeidan (2018) reported income as the most significant driver of European energy imports.

In conclusion, the foregoing shows that the existing studies in this area suffer from a number of shortcomings. The studies on bivariate oil-growth nexus and the few studies on trivariate oil-growth-emission link are inconclusive given their diverse findings and concentrations in Asia and developed countries, with very few studies on Africa. Also, literature on energy import is just developing as shown by the review while only four studies are identified for Africa (Ziramba 2010 for South Africa; Marbuah 2017 for Ghana; Adewuyi 2016 & Adewuyi and Awodumi 2020 for Nigeria) despite the heavy dependent of most developing countries, especially African countries, on energy (crude or refined petroleum) import in production activities. Most studies analyzed the drivers of energy import in which income or economic growth plays a key role but did not recognize the fact that energy import could also propel growth. Thus, such analysis could lead to simultaneity bias and unreliable model estimates. Besides, the role of energy import in pollution was neglected, while the possibility of the effect of structural breaks was also ignored. Causality analysis conducted in most of these studies has been based on bivariate framework which is not robust given the complexity of economic relationship, while threshold analysis that can aid policy analysis was not conducted. Moreover, these studies focused on only aggregate analysis but failed to investigate the sectoral links which limit policy implications that could be drawn. There is no study that quantifies net growth-emission effects (clean production) and net growth-energy import effects (energy import efficiency) as indicators of sustainable growth.

This present study therefore fills (or addresses) the above highlighted gaps (or shortcomings) by quantifying and analyzing the link among refined petroleum import, economic growth, and carbon emission in Nigeria and South Africa at aggregate and sectoral levels using the most recent multivariate Grange causality approach and simultaneous equation model (correct for structural breaks) with threshold regression analysis. The above discussions are summarized in Table 10 in Appendix 1.

Theory and methods

Theory

According to sustainable development literature, a sustainable economic growth can be achieved only when the relative contribution of income or output to achieving energy efficiency and improved environmental quality (clean production) is more than the relative contributions of input of energy and environment to output (Zuo and Ai 2011; Hu et al. 2011; Omer 2008; Yu et al. 2006; Yang et al. 2004). This implies that the net effect of growth-emission nexus leads to fall in emission (low carbon development–clean production) combined with the net effect of growth-energy nexus which should be a reduction in energy use (energy conservation–energy efficiency). Thus, there is a need for an empirical investigation of the energy-growth-pollution nexus through which the validity of the foregoing can be ascertained for the countries of interest in this study. Investigating the energy (import)-growth-pollution nexus requires an integrated approach that combines endogenous growth model with energy import demand and pollution production models.

Growth model

The endogenous growth model emphasizes the role of human capital development [L(H)—knowledge] apart from physical labor and capital (L and K—primary inputs) as well as technological efficiency (A) in driving long-run real economic (income) growth (Y) (Romer 1996; and Jones and Manuelli 1997).

Equation 1 can be expressed in per capita terms as follows:

where y = output per capita; k = investment per capita or capital-labor ratio; H = human capital development; and a = productivity growth or efficiency parameter, which is driven by some factors including imported petroleum per capita (em) and environmental quality (carbon emission per capita—co2), financial development (F), and trade openness (T). Productivity growth or efficiency parameter can be given as follow:

Imported refined petroleum (em) has been seen as either a critical intermediate input in the production process (Shahbaz et al. 2013; Dasgupta and Roy 2015) or a facilitator of efficiency of primary inputs (Adewuyi and Awodumi 2017b). Environmental quality has also been argued to facilitate productivity and efficiency (or otherwise) of the primary inputs depending on the level of carbon emission (co2) from production and its effects on human (labor) health. Other drivers of productivity and long-run growth are human capital development (measured as % of primary school enrolment in gross enrolment-H), financial development (measured as % of private sector credit in total credit -“F”), and trade openness (measured as % of total trade in GDP -“T”) (Shahbaz et al. 2013; Dasgupta and Roy 2015; and Adewuyi and Awodumi 2017b).

Substituting for “a” in Eq. 2, we have Eq. 4; we have an extended growth model expressed in per capita form as follows:

In the energy-growth literature, four hypotheses are commonly used to describe the link between economic growth and energy consumption. These are the conservation hypothesis, the growth hypothesis, the feedback hypothesis, and the neutrality hypothesis (Adewuyi and Awodumi 2017a, b). The conservation hypothesis suggests that economic growth raises the level of energy consumption through increased economic activities across all sectors. In most countries, petroleum products remain the largest form of energy used in industries and other sectors, and for developing economies, these products are largely imported. Higher incomes could however create incentives for an economy to adopt alternative energy sources such as renewable energy which tends to reduce petroleum import. The growth hypothesis holds that energy consumption drives economic growth as it represents a major input in the production processes by facilitating the functioning of both capital and labor. According to the feedback hypothesis, there exists bidirectional link between growth and energy consumption while the neutrality hypothesis states that no causal link exists between energy consumption and growth.

Energy (import) demand model

Based on the imperfect substitution model with budget constraint and utility function of a representative consumer which contains two goods—local and foreign products—the constrained optimization problem will yield demand function for both local and imported goods (Goldstein and Khan 1985; Narayan and Smyth 2005; and Adewuyi 2016). Summing import demand function of all consumers in the economy gives an aggregate import demand function in which the quantity of import demand (M) is a direct function of the level of aggregate real income of the importing country(Y) and relative price (RP) which is the ratio of import price and domestic price of substitutes or import competing goods.

Assuming that import demand includes energy products, therefore, energy import (EM) model in line with Adewuyi (2016) and Mensah et al. (2016) is specified as follows:

This means that the aggregate energy import (EM) demand depends on real income level (Y) and relative price (RP). Thus, high real income encourages energy (petroleum) import while high relative price discourages it. Energy (import) demand model accounts for the role of physical capital (K) which requires energy to function; financial capital (F) which is required to finance import; and environmental conditions (CO2 emissions) which determines the kind of energy used (Mensah et al. 2016; and Adewuyi and Awodumi 2017b). We have the following equation in per capita term:

Pollution (carbon emissions) production model

The consideration of carbon emission implication of the energy-growth nexus becomes imperative as economic growth largely rests on increased energy (petroleum) consumption. Output (goods) and carbon emission (bads) are joint output in the production process (Adewuyi and Awodumi 2017b). Also, a high carbon emission has been variously associated with a high fossil fuel consumption required to compliment primary inputs (Apergis et al. 2018; Ma et al. 2019). Thus, the production of carbon emission (CO2) depends on the level of real economic activities (output) or income (Y); petroleum consumption, which is mainly imported (EM); physical capital (K); and financial development (F) and trade openness (T).

In per capita terms, Eq. 8a can be written as:

Energy (import)-growth-emission nexus

A simultaneous equation model can then be specified for the link between energy import, economic growth, and environmental quality (pollution) as follows:

Methods

Following from the foregoing theoretical framework, the study first adopts multivariate linear and nonlinear Granger causality to establish the causal relationship among the variables. It thereafter employs simultaneous equation approach as well as dynamic threshold technique to provide more robust estimates of the empirical analysis.

Multivariate linear and nonlinear Granger causality test

This study employs the most recent multivariate Granger causality method by Bai et al. 2018 which is a refinement of the previous approach discussed in Bai et al. (2011). It was noticed that the central limit theory prescribed by Hiemstra and Jones (1994) and enlarged by Bai et al. (2010) as well as applied by Bai et al. (2011) is invalid for statistical inference (Bai et al. (2018)). This led to its re-estimation of the probabilities and reestablishment of the central limit theory that support the new test statistic developed by Bai et al. (2018).

Starting with Bai et al. (2011), the multivariate linear Granger causality method can be used to test the linear relationship between two vectors of different stationary time series say Xt = (x1,t, ..., xn1, j) and Yt = (y1,t, ..., yn2, j), where there are n1 + n2 = n series in total, and then the following n-equation VAR system can be applied as follows:

VAR framework

where \( {A}_{x\left[{n}_1\times 1\right]} \) and \( {A}_{y\left[{n}_2\times 1\right]} \) are two vectors of intercept terms; Axx(L)[n1 × n1], Axy(L)[n1 × n2], Ayx(L)[n2 × n1], and Ayy(L)[n2 × n2] are matrices of lag polynomials and ex,t and eyz,t are corresponding residual terms.

In order to test the multivariate causal relationship between vectors X and Y, the following null hypotheses H01: Axy(L) = 0, H02: Ayx(L) = 0 and both are tested and there are four different situations for the causality relationships which include:

-

1)

Unidirectional causality occurs from Y to X if H01 is rejected but H02 is not rejected.

-

2)

There is unidirectional causality from X to Y if H02 is rejected but H01is not rejected.

-

3)

Feedback relation occurs when both H01 and H02 are rejected.

-

4)

Xt and Yt are not related (independent) when both H01 and H02 are not rejected.

Meanwhile, if the time series are cointegrated, then a restricted VAR (ECM-VAR) is employed to test the causality relationship between two vectors of non-stationary time series. In doing so, let Xt = (X1, t,…, Xn,t) and Yt = (y1, t,…,yn,t) and let Xit = Xit and Yit = Yit be the corresponding stationary differencing series such that there are n1 + n2 = n series in total. Thereafter, if Xt and Yt are cointegrated, then the ECM-VAR model below can be adopted:

ECM-VAR framework

where ecmt-1 is the lag 1 case error correction model parameter and ∝x[n1 × 1] and ∝y[n2 × 1] are vector of coefficients of ecmt-1 term. Equation 13 shows that causation can occur through either the lagged dynamic terms or the error correction term. Thus, one could test the null hypotheses of H01: Axy(L) = 0 and/or H02: Ayx(L) = 0 to identify the causality relationship.

According to Bai et al. (2010) and Bai et al. (2011), multivariate nonlinear causality is also conceptually similar to bivariate nonlinear causality test developed by Baek and Brock (1992) and subsequently refined by Hiemstra and Jones (1994). In order to identify any nonlinear Granger causality relationship between two vectors of the time series, say Xt = (X1, t,…,Xn,t)′ and Yt = (Y1, t,…,Yn,t)′ in the multivariate scheme, one has to first obtain the residuals from either the VAR or ECM-VAR model above and thereafter apply a nonlinear Granger causality test to the residual series.

In the new procedure for estimating the linear (and nonlinear) Granger causality by Bai et al. (2018), all series are standardized such that a common standard deviation (1) is shared, (Yt − mean(Yt))/SD(Y1t), where SD is the standard deviation.

Simultaneous equation model

In consistency with the theoretical framework earlier presented and the empirical literature on growth (Barro, 2003 and Shahbaz et al. 2013), energy import demand (Adewuyi 2016; Mensah et al. 2016), and environmental Kuznets curve (Grossman and Krueger 1995), this study re-specifies Eqs. 9 to 11 in log-linear and per capita terms and also captures the effect of structural break in petroleum import:

where GDPPC = GDP per capita; PIMPC = petroleum import pen capita; CO2PC = carbon emission per capita; PCAP = physical capital; HCAP = human capital; FDEV = financial development; TO = trade openness; EXR = exchange rate; and PIMPDU = petroleum import structural break dummy. εt, πt, and μt are the stochastic terms. These variables are well defined and measured in Table 1.

The same simultaneous equation model is specified for each sector, but the output variable (GDPPC) is replaced by the respective sector’s GDP such that AGDPPC, MGDPPC, and SGDPPC are the per capital output in the model for agricultural, manufacturing, and service sectors, respectively. The study adopts both three-stage least square (3SLS) and system generalized method of moments (sys-GMM) to estimate the specified simultaneous equation models. These techniques provide a robust estimator that accounts for the inherent contemporaneous correlation of the error terms and correlation among the explanatory variables (endogeneity). Owing to data availability constraint, empirical analysis in this study covers the period of 1981–2015. Also, all missing valuesFootnote 6 are interpolated using 5-year average while all the series are used in their natural log form.

Threshold approach

This study further investigates the contingency effects of petroleum import on the link between carbon emissions and economic growth. The threshold regression approach suggested by Hansen (1999, 2000) is therefore adopted to explore the nonlinear behavior of carbon emission and economic growth in the presence of petroleum import. Based on the two-regime threshold regression, the following model is specified for both aggregate and sectoral analyses using petroleum import as a threshold variable:

where I(.) is 1 when the argument in parenthesis is valid, and 0 if otherwise. The threshold variable is the petroleum import per capita (PIMPC) which is used to categorize the sample into two regimes such that regime 1 represents the samples below the threshold and regimes 2 are those above the threshold. Also, the effect of carbon emission per capita on GDP per capita is β1 and β2 within the low and high regime, respectively (Eq. 17) while the impact of GDP per capita on the carbon emission per capita is θ1 and θ2 respectively (Eq. 18). The unknown threshold parameter is γ and ϕ in the respective equation while the random variable is μt and пt, respectively.

Similarly, by employing GDPPC as threshold variables, we have:

In the same vein, utilizing CO2PC as threshold variables leads to the following:

The procedures for estimating the threshold regression of Hansen (1999, 2000) follow three stages. The first step involves the computation of the sum of square errors (SSE) for a given threshold. Next is the estimation of \( \hat{\gamma}\left( and\ \hat{\phi}\right) \) by minimizing the sum of squares. Consequently, an F test is conducted to determine the existence of a threshold effect and to test the null hypothesis of linearity (such as H0: β1= β2; and H0: θ1=θ2 in the threshold models in Eqs. 17 and 18). The F test is computed as:

A threshold effect is said to exist if the null hypothesis is rejected. Using Hansen’s (1996) heteroscedasticity-consistent Lagrange multiplier (LM) test for thresholds, Hansen (1999, 2000) proposed a “bootstrap” method to compute the asymptotic distribution statistics using likelihood ratio to test the significance of threshold effect. Specifically, since the bootstrap procedure attains the first-order asymptotic distribution, the associated p-values are asymptotically valid and reliable.

Empirical results and discussion

Preliminary analysis

The descriptive statistics of the variables used in the regression analysis is presented in Table 2. The statistics show that the average GDP per capita, manufacturing output per capita, and service output per capita are higher in South Africa than in Nigeria. Also, the average petroleum import per capita is higher in Nigeria (44 l) than in South Africa (39 l), but the mean level of carbon emission per capita is 9266 thousand metric tons in South Africa compared to 606 thousand metric tons in Nigeria. In terms of the variability, the GDP per capita appears to be the most volatile among the variables of interest in both countries with the standard deviation of 462.01 and 626.20 for Nigeria and South Africa respectively. In the same vein, all sectoral outputs are more volatile in South Africa than Nigeria, except the service output. Similarly, variability is observed to be larger in South Africa for petroleum import capita and carbon emission per capita than in Nigeria. The trends of aggregate and sectoral outputs, energy import, and carbon emissions for South Africa and Nigeria are presented in Figs. 7, 8, 9, and 10 in Appendix 2.

As reported in Table 3, the results of correlation analysis show weak association among explanatory variables but modest association between petroleum import per capita and agricultural output per capita for Nigeria. In the case of South Africa, a weak correlation is generally observed in most of the explanatory variables. Moreover, existence of structural break in petroleum import per capita is noticed in Nigeria and South Africa as test results indicate 2000 and 1998 as break dates, respectively. Consequently, in addition to conventional unit root tests (ADF, PP, and KPSS), unit root with structural break test (Perron 2006) and nonlinear unit root tests (KSS and Kruse) were conducted. The overall results from these tests suggest mixed level of stationarity among the series, which further informs the use of both linear and nonlinear estimation techniques, as well as SEM modelling as the series are used in the estimation accordingly (Table 4). All original unit root results are contained in Tables 11, 12, 13, 14, 15 in Appendix 3.Footnote 7

Granger causality among petroleum import, output, and carbon emission

The results of the multivariate linear and nonlinear Granger causality tests conducted among aggregate and sectoral output, petroleum import, and carbon emission (in per capita terms) are reported in Table 5. For both Nigeria and South Africa, there is no evidence of nonlinear Granger causality among the variables for almost all the models. At the aggregate level, results for Nigeria show that linear and nonlinear causality runs from GDP to carbon emissions and petroleum import without any feedback. This suggests that economic growth can cause the petroleum import-carbon emission link in Nigeria, which may be traced to the ability to promote the use of carbon-reducing techniques in the face of continual consumption of petroleum import. Further, unidirectional linear causality moves from carbon emissions to petroleum import and GDP, and from petroleum import to carbon emissions and GDP. Thus, concerns for the environment can alter the relationship between income growth and consumption of imported petroleum products, just as changes in petroleum imports have serious implication for growth-environment nexus in the country. At sectoral level, linear Granger causality is observed to run jointly from carbon emission and petroleum import per capita to each of Nigeria’s agricultural and service output while the reverse causality is only valid for the case of manufacturing output. This indicates that, in the presence of petroleum import, concern for the environment has major influence on agricultural and service output performance, while manufacturing output yields a major influence on the relationship between petroleum import and the environment. However, for the agricultural and manufacturing sectors, output and petroleum import jointly Granger cause carbon emissions. For service sector, feedback effect is found. Moreover, carbon emission combined with each of agricultural and service output to produce unidirectional causality running to petroleum import. While this effect is not observed for the manufacturing sector, the reverse causality is evident. There is therefore evidence of different multivariate links at sectoral levels producing important impacts on each variable in Nigeria.

In the case of South Africa, results from aggregate analysis could only establish linear Granger causality jointly running from carbon emissions and GDP to petroleum import, with similar finding observed in the service sector. In the agricultural sector, unidirectional linear Granger causality runs from output to carbon emissions and petroleum import and from carbon emissions to output and petroleum import. Thus, agricultural output performance is important for the link between consumption of imported petroleum products and environmental pollution, which may in turn dictate the relationship between agricultural output and petroleum import. There is also linear Granger causality running jointly from carbon emission and agricultural output to petroleum import. For the manufacturing sector, carbon emissions Granger causes output and petroleum import, while this import causes both output and carbon emissions. Thus, environmental targets have important simultaneous consideration for manufacturing output and petroleum imports, which may mediate the link between manufacturing output and pollution.

The foregoing results of the multivariate causality method provide evidence of linear, direct, indirect (mediating and joint), and simultaneous effects of the variables on one another. In order to properly capture these effects, there is a need to set up a simultaneous equation model which will not only clearly show the effects but will also resolve the potential endogeneity issue and provide empirical estimates that will permit the calculation of net effects of growth-emission nexus and net effect of growth-energy import link that will serve as indicator of the levels of attainment of sustainable growth in South Africa and Nigeria. These estimates would be useful for policy analysis.

Results from simultaneous equations model (SEM)

The complete link, as well as magnitude of impact, among energy import, economic growth, and carbon emissions is further investigated using simultaneous equation model in the presence of a number of control variables. The article estimates both the three-stage least square (3SLS) and the system generalized method of moments (sys-GMM) with similar results, both in sign and magnitude. This possibility is confirmed in the literature as multiple-equation GMM tends to reduce to full-information instrumental variable (IV) efficient estimator when conditional homoscedasticity is present. It ultimately reduces to 3SLS when all the equations have identical set of IVs (Hayashi 2000; and Adewuyi and Awodumi 2017b). The preference for 3SLS over the other instrumental variable (IV) approaches (2SLS and GMM) is based on the idea that it could correct for both endogeneity problem and contemporaneous correlation of the error terms across equations (Hayashi 2000; and Adewuyi and Awodumi 2017b). Hansen tests, which are used to verify the validity of the instruments employed, are insignificant for all the models, suggesting that the instruments are valid.

The full results from the 3SLS are provided in Appendix 3 (Tables 16, 17, 18, and 19) for aggregate and sectoral (agricultural, manufacturing, and service) output. For the purpose of clarity, summarized 3SLS results are used in the aggregate and sectoral analyses below with figures. Further analysis is conducted by examining the achievement of sustainable economic growth (SEG) in South Africa and Nigeria via the validation of the proposition that SEG is achieved when the contribution of income per capita to the improvement in environmental quality and energy efficiency outweighs the relative contribution of both petroleum import and environment to income growth (Zuo and Ai 2011; Hu et al. 2011; Omer 2008;). This means the attainment of clean production (or low carbon development) and energy efficiency.

Petroleum import, aggregate output, and carbon emissions in South Africa and Nigeria

Based on the 3SLS estimates of the SEM, the nexus among petroleum import, aggregate output, and carbon emission is presented in Fig. 1. It can be seen that, with and without accounting for structural break in petroleum import, there are incomplete links among the variables. Therefore, growth-emission nexus occurs in both South Africa and Nigeria, while petroleum import-emission nexus exists only in Nigeria. However, petroleum import-growth nexus is observed only without accounting for structural break in both countries.

When structural break in petroleum import is considered, growth and emission have significant negative effect on each other in both South Africa and Nigeria (Table 6). This means that 1% rise in growth in South Africa and Nigeria reduces emission by 2.005% and 2.930%, respectively, while 1% increase in emission also reduces growth by 0.491% and 0.298%, respectively. This yielded the net effects of 1.514% and 2.632% reduction in emission, respectively, supporting the low carbon development or clean production aspect of the sustainable development (Zuo and Ai 2011). This feedback (bidirectional) hypothesis is confirmed by Apergis and Payne (2014) for the case of 7 Central American countries. Further, with and without accounting for structural break, petroleum and emission have significant negative effect on each other in Nigeria, a bidirectional relationship that is also supported by Al-Mulali (2011) and Azam (2019). Thus, 1% rise in petroleum import reduces emission by 0.180%, while 1% increase in emission also reduces petroleum import by 4.115%, and the net effect is 3.935% reductions in petroleum import. For South Africa, only emission has significant positive effect on petroleum import in the absence of structural break. This means that 1% rise in emission increases petroleum import by 1.820%. Also, in the absence of structural break, growth and petroleum import have significant positive effect on each other in both South Africa and Nigeria. Thus, 1% rise in petroleum import raises output in South Africa and Nigeria by 0.110% and 0.142%, respectively, while 1% rise in output also increases petroleum import by 7.302% and 5.443% respectively, and the net effects are 7.192% and 5.301% increases in petroleum import, respectively. These results indicate the existence of feedback hypothesis between petroleum import and economic growth, in line with Saboori and Sulaiman (2013), Lim et al. (2014), Park and Yoo (2014), and Azam (2019).

Against the above analysis, the proposition that sustainable growth can be attained with clean production or low carbon development (arising from the net effect of growth-emission nexus) and energy efficiency (stemming from the net effect of growth-petroleum import nexus) cannot be established for South Africa and Nigeria irrespective of the assumption of structural break in the analysis. Specifically, although the net effect of growth-emission nexus (which is clean production) is established for both countries, considering the structural break, the net effect of growth-petroleum import nexus cannot be estimated for them due to statistically insignificant results. Also, although the net effect of growth-petroleum import nexus is established, without considering the structural break, the net effect of growth-emission nexus cannot be estimated for the countries due to statistically insignificant results. Besides, the estimated net effect of growth-petroleum import nexus is positive and high in terms of energy use, which means energy inefficiency.

Petroleum import, agricultural output, and carbon emissions in South Africa and Nigeria

The relationship among petroleum import, agricultural sector output, and carbon emission is shown in Fig. 2 which is derived from the results of the 3SLS. There are overwhelming partial (bivariate) links between the variables. Without accounting for a structural break, growth-emission nexus exists in both South Africa and Nigeria (also hold accounting for structural break in Nigeria’s case). Further, petroleum import-emission nexus occurs in Nigeria without accounting for structural break, while it exists in South Africa accounting for a structural break. However, growth-petroleum import nexus occurs only in Nigeria without accounting for a structural break. Complete output-energy-emission link exist for Nigeria when a structural break is not considered.

Without accounting for structural break, growth and emission generate significant negative effect on each other in South Africa but reveal significant positive effect in Nigeria (Table 6). A significant negative bidirectional impact is exhibited accounting for structural break only in Nigeria’s case. Thus, 1% rise in growth engenders a fall in emission by 0.952%, while similar increase in emission leads to 1.039% reduction in growth in South Africa. Also, 1% improvement in economic growth in Nigeria raises (reduces) the level of carbon emission by 0.338% (1.093%) as a similar increase in emission contributes 2.882% (0.673%) to the increase (reduction) in the economic growth without (considering) the influence of structural break (Table 6). These bidirectional links between growth and emission were confirmed by Adewuyi and Awodumi (2017b) in 7 West African countries, including Nigeria. In Nigeria, the net effects are 0.087% fall in emission and 2.544% rise in output with and without structural break, respectively, and this further confirms the proposition of Zuo and Ai (2011). In South Africa, the net effect is 0.141% reduction in output.

Further, petroleum import and emission produce negative effect on each other in Nigeria (without accounting for a structural break), while they also generate similar effect in South Africa (accounting for structural break). Therefore, 1% increase in petroleum import leads to 0.261% fall in emission in Nigeria, while a similar rise in emission results in 3.846% fall in petroleum import and the net effect is 3.585% fall in Nigeria’s petroleum import. In the case of South Africa, 1% increase in petroleum import leads to 0.041% fall in emission, while a similar rise in emission results in 4.44% falls in petroleum import and the net effect is 4.399% fall in South Africa’s petroleum import. These findings are supported by Al-Mulali (2011) and Shafiei and Salim (2014) for MENA and OECD countries, respectively.

Moreover, growth and petroleum import exert positive impact on each other only in Nigeria (without accounting for structural break). Thus, 1% rise in growth leads to 1.30% increase in petroleum import while a similar rise in petroleum import raises growth by 0.771% in Nigeria yielding a net effect of 0.529% increase in Nigeria’s petroleum import. While the results for the case of South Africa supports the growth hypothesis similar to Awodumi and Adewuyi (2020) for Angola, Egypt, and Nigeria, the findings for Nigeria follow the feedback hypothesis in the energy-growth literature as confirmed by Ziramba (2009) in the author’s hypothesis between crude oil and economic growth in South Africa. Thus, there is no evidence of complete links among petroleum import, growth, and carbon emission in the agricultural sector in both countries.

The foregoing analysis of the agricultural sector shows evidence of positive net effect on the environment (with or without a structural break) and increasing net effect on petroleum import (without a structural break) in Nigeria. In South Africa, there is an evidence of negative net effect on output without accounting for a structural break. Thus, the sustainable growth proposition (existence of clean production or low carbon development and energy efficiency) in the agricultural sector could not be established in both countries. In particular, although in Nigeria, the net effect of growth-emission nexus suggests a clean production, the net effect of growth-petroleum import nexus suggests energy inefficiency. In the case of South Africa, the net effect of growth-emission nexus does not support a clean production while the net effect of growth-petroleum import nexus cannot be determined as estimates are statistically insignificant.

Petroleum import, manufacturing output, and carbon emissions in South Africa and Nigeria

Following the results of the 3SLS, the petroleum import-manufacturing output-emission nexus is shown in Fig. 3. There is a complete link among the variables in both countries when the structural break in petroleum import is taken into consideration. However, while a complete link still exists among the variables in the absence of structural break in the case of Nigeria, it does not occur in South Africa. Thus, there is only a growth-emission link in South Africa in the absence of structural break.

For the manufacturing sector, with and without considering a structural break in petroleum import (estimates are very close), emission and growth exert positive effect on each other (2.238% and 0.417%) in Nigeria (Table 6). A similar positive effect also occurs between petroleum import and growth (0.573% and 1.478%). However, emission and petroleum import have negative effect on each other (−3.859% and − 0.358%). Thus, while the net effect of emission-growth nexus is 1.821% increase in output, the net effect of petroleum import-growth nexus is 0.905% increase in petroleum import and that of emission-petroleum import nexus is 2.551% fall in petroleum import. Overall, while the growth rises by 1.821%, that of petroleum import declines by 1.646%. These results appear not compatible with sustainable development as suggested by Zuo and Ai (2011) that the contribution of growth to energy efficiency and environment is lower than those contributed by energy input (import) and environment. This is more plausible following the call for improved sustainability and energy conservation of industrial production by Safarzadeh et al. (2020).

Recognizing the structural break, emission and growth exert positive effect on each other (0.664% and 1.239%) in South Africa. A similar positive effect also occurs between petroleum import and growth (0.103% and 6.244%). However, emission and petroleum import have negative effect on each other (−6.521% and − 0.158%). Thus, while the net effect of emission-growth nexus is 0.575% increase in emission, the net effect of petroleum import-growth nexus is 5.141% increase in petroleum import and that of emission-petroleum import nexus is 6.363 fall in petroleum import. Overall, while emission rises by 0.575%, petroleum import growth declines by 1.222%. In the absence of structural break, emission and growth generate positive effect on each other. Thus, 1% rise in emission raises growth by 0.632% while similar increase in growth raises emission by 1.089%. The net effect rises in emission by 0.457%. Irrespective of the influence of structural break, complete feedback hypothesis is supported among all petroleum import, carbon emission, and economic growth in both countries (except South Africa without structural break) in the manufacturing sector.

The implications of the above analysis for sustainable growth are evident. The sustainable growth proposition is not established in both countries in the manufacturing sector regardless of the existence of structural break in petroleum import. Specifically, with or without the structural break, the emission-growth nexus in Nigeria generates a positive net effect on output contributing to a clean production or low carbon development, but the petroleum import-growth nexus yields increasing net effect on petroleum import producing energy inefficiency. For South Africa, the net effects of emission-growth nexus and petroleum import-growth nexus raise emission and petroleum import, respectively, in the presence of the structural break. For the same country, similar increasing net effect on carbon emission is found (for the emission-growth nexus), though an insignificant petroleum import-growth nexus is revealed when the structural break is not considered. Thus, in South Africa, there is no evidence of clean production and energy efficiency in the manufacturing sector.

Petroleum import, service sector output, and carbon emissions in South Africa and Nigeria

Based on the estimates from the 3SLS, the petroleum import-service output-emission links are exhibited in Fig. 4. With and without structural break in petroleum import, there are partial links among the variables in both countries. With respect to South Africa, emission-growth nexus occurs with and without considering the structural break. However, for Nigeria, emission-petroleum import nexus exists without recognizing the structural break.

With and without structural break in petroleum import, emission and growth produce positive effect on each other (0.300% and 2.851%) in the service sector in the case of South Africa (Table 6). The net effect rises in emission by 2.551%. These results are in line with Apergis and Payne (2014), Adewuyi and Awodumi (2017b), and Huo et al. (2020) for 7 Central American countries, 7 West African countries, and 30 provinces of China, respectively. However, for Nigeria, emission and petroleum import exert negative effect on each other (− 3.392% and − 0.660%) when the structural break is not recognized. The net effect is fall in petroleum import by 2.732%. This bidirectional effect is reported by Al-Mulali (2011) for MENA countries. In both countries, growth hypothesis is confirmed between petroleum import and economic growth in the service sector, as confirmed by Awodumi and Adewuyi (2020) where petroleum consumption is found to have a significant effect on the economic growth in Angola, Egypt, and Nigeria.

The implication of the above analysis is that sustainable growth, which combines clean production and energy efficiency, cannot be confirmed in the service sector for South Africa and Nigeria, regardless of the structural break. In South Africa, the negative net effect of the emission-growth nexus on the environment could not support clean production while the growth-petroleum import nexus could not be determined. Also, estimates could not provide support for both the emission-growth nexus and growth-petroleum import nexus in Nigeria.

The summary of the interactions among GDP per capita, petroleum import per capita, and carbon emission per capita are further presented in Figs. 5 and 6 (based on Table 6) for model with and without petroleum import structural break, respectively. Complete significant interactive effects are found among these variables in the Nigerian manufacturing sector irrespective of the effect of the structural break in petroleum import. However, in South Africa, this link is only confirmed in this sector when such break is accounted for. This is indicative of the heavy dependence on imported refined petroleum products for manufacturing activities in these countries. While the consumption of such product contributes immensely to increase in manufacturing output, the carbon emission implication is enormous. In the same vein, increase in economic activities in this sector yields higher output that encourages further consumption of imported refined petroleum products with similar emission implication, which in turn affects the manufacturing productivity through the state of health of the labor force. This nexus is also confirmed for Nigeria for the aggregate and agricultural output when the structural break is neglected. Generally, feedback and partial impacts are common among the variables in both countries, though these effects vary with and without accounting for structural break in petroleum import.

The robustness of the above analyzed results obtained from the 3-stage least squares (3SLS) estimator is checked by estimating the simultaneous equation model with system generalized method of moments (sys-GMM). As stated earlier, the results obtained are very similar in signs and magnitudes of the coefficients of the explanatory variables. The similarity in the results is highlighted in the econometrics literature given that multiple-equation GMM is likely to collapse to full-information instrumental variable (IV) efficient estimator with the presence of conditional homoscedasticity. System-GMM eventually diminishes to 3SLS since the three equations estimated in this study have identical set of IVs (Hayashi 2000; and Adewuyi and Awodumi 2017b). However, the 2SLS could not produce better results. Given that the results are robust with two different estimators, we proceed to carry out further analysis using threshold regression that could provide a framework for policy analysis.

Threshold analysis of energy (petroleum) import-carbon emission-growth nexus

The study conducts further analysis to determine the optimal level of per capita petroleum import, carbon emission, and economic growth that is necessary to spur sustainable economic growth. The optimal levels of per capita petroleum import below (regime 1) or above (regime 2) for which the additional import of this energy mediates the link between economic growth and carbon emission are reported in Table 7.Footnote 8 The threshold value of petroleum import per capita for the effect of GDP per capita on carbon emission per capita is 3.42 for aggregate analysis for the case of Nigeria. For the same country, the results show that below the threshold level of petroleum import per capita, aggregate and service GDP per capita do not exert significant effect on carbon emission per capita while the manufacturing GDP per capita has an escalating effect on the carbon emission per capita. However, over this regime, the agricultural GDP per capita has a reducing effect on the carbon emission per capita. Above the threshold, the aggregate and all sectoral output per capita contribute significantly to the reduction in the carbon emission per capita. In South Africa, the threshold level of petroleum import per capita varies across sectors. Nevertheless, both the aggregate and manufacturing output per capita raise the level of CO2 per capita significantly in both regimes (above and below the threshold). However, while the agricultural output per capita has a significant positive influence on the carbon emission per capita only in regime 2, the service output per capita has a similar effect only in regime 1.

The threshold values of the petroleum import per capita for which it mediates the effect of carbon emission per capita on GDP per capita is the same as the aggregate for all sectors considered in Nigeria but they vary across sectors in South Africa.Footnote 9 In Nigeria, the influence of carbon emission per capita on aggregate, as well as manufacturing output per capita, is significantly positive and negative below and above the threshold (3.88 and 3.87, respectively). For other sectors (Agriculture and Service), carbon emission per capita has a reducing effect on the output per capita in both regimes. In South Africa, the impact of the carbon emission per capita on the aggregate and service output per capita is significant (positive) only in regime 1 while a similar significant impact is observed only in regime 2 for the agricultural sector. For the same country, this emission per capita exerts a significant positive influence on the manufacturing output per capita in both regimes.

Generally, in Nigeria, GDP per capita has a reducing effect on the carbon emission per capita above the threshold level at aggregate and sectoral levels. Thus, keeping petroleum import per capita above the respective threshold enhances environmental quality as production activities increase. However, the CO2 emission can only induce increased GDP per capita when the petroleum import is below the threshold level. There is therefore a policy dilemma for the country, which implies that the government must strive to achieve optimal utilization of energy import so as to attain a low carbon development via increasing the application of carbon-reducing production techniques as income increases.

In South Africa, a significant positive feedback effect is found between the carbon emissions per capita and output per capita in both regimes for the manufacturing sector. Thus, keeping petroleum import below the threshold value may manage the adverse effect of higher output on the environment. However, results vary across both threshold regimes for other sectors. This may reflect the varied level of utilization and sensitivity of the sectors to petroleum requirements. Consequently, in the agricultural and service sectors, keeping petroleum import below and above the threshold (respectively) is important, as such neither raise the carbon emission per capita nor reduce the output per capita significantly. On the aggregate, although maintaining the petroleum import beyond the threshold may increase the CO2 emission per capita which is associated with high output per capita, such emission exhibits negligible reverse impact on output per capita.

The optimal levels of per capita carbon emission below or above which an increase in the level of CO2 emission per capita has implication for the link between GDP per capita and petroleum import per capita are presented in Table 8. For the case of Nigeria, the threshold value of carbon emission per capita remains the same (6.46) for aggregate and sectoral analysis. Above or below this threshold, petroleum import per capita exerted positive effect on aggregate and agricultural output per capita. However, the impact of this import on manufacturing GDP per capita and service GDP per capita is significantly positive only below and above the threshold levels, respectively. In South Africa, the aggregate and service output per capita are positively affected by the levels of petroleum import per capita in both regimes, but the impact of this import exerts a similar effect on the manufacturing output only below the threshold. For agricultural sector, no significant effect of this import on output is observed in both regimes.

The threshold level of carbon emission per capita remains the same (6.46) across sectors in Nigeria but varies in South Africa. For the effect of per capita output on petroleum import per capita, the results for Nigeria show that aggregate, agricultural, and service output increase per capita import of petroleum products below or above carbon emission threshold levels. The influence of the manufacturing output per capita on petroleum import per capita is only significant (positive) in regime 1. In South Africa, the per capita output has a significant (positive) impact on the petroleum import per capita only in regime 1 for the aggregate, manufacturing, and service sectors. The effect of the agricultural output per capita on this import is negligible either below or above the threshold level of the CO2 emission per capita.

These results suggest that the increase in petroleum import largely promotes in the economic growth both at aggregate and sectoral levels irrespective of the level of carbon emissions in both countries. However, keeping carbon emission below its threshold levels enhances the positive influence of economic growth on petroleum import per capita in both countries. Interestingly, as carbon emission rises above the threshold in South Africa, the effect of growth on petroleum import is neutralized at aggregate and sectoral levels, respectively.

With the GDP per capita as the threshold variable, the link between the CO2 emission per capita and the petroleum import per capita is reported in Table 9. In Nigeria, the CO2 emission per capita has positive influence on petroleum import per capita in regime 1 across all sectors, but its effect is either negative or negligible in regime 2. In South Africa, no significant impact of carbon emission per capita is observed in all sectors in both regimes, except in the case of manufacturing where significant effect on petroleum import per capita exists in regime 2. For the reverse effect, petroleum import per capita has significant (positive) effect on carbon emission per capita in Nigeria regime 1 in all sectors except agriculture, whereas this effect is only significant in the manufacturing (negative) and service (positive) sectors. In South Africa, the petroleum import per capita has a significant (positive) impact on carbon emission in regime 1 only in the agricultural sector, but this effect is significant (negative) in all sectors in regime 2, except in agriculture.

These results imply that keeping economic growth in Nigeria below the respective threshold levels reduces petroleum import, following the improvement in environmental quality, which in turn could result from less importation of petroleum products. As the economic growth rises above the threshold, any increase in carbon emission tends to discourage further import of refined petroleum product. In South Africa, the economic growth appears to have no influence on the effect of carbon emission on petroleum import, as this impact largely remains insignificant below or above the threshold levels of growth. However, as the economy grows beyond the threshold, carbon emission tends to fall, which may underscore the role of carbon-reducing technology.

Conclusion and policy recommendations

The study investigates the links among refined petroleum import, economic growth, and carbon emission in South Africa and Nigeria both at aggregate and sectoral levels between 1981 and 2015. These links were analyzed using the most recent multivariate Granger causality approach (Bai et al. 2018) and simultaneous equation model (correct for structural breaks in petroleum imports) as well as threshold regression analysis.

The estimates from the simultaneous equation models were used to analyze the possibility of sustainable economic growth in South Africa and Nigeria via the computation of net effects of growth-emission nexus (clean production) and growth-energy import nexus (energy efficiency). There is no evidence of sustainable economic growth in the two countries. In respect of the aggregate economy, although the net effect of growth-emission nexus (which yields clean production) is established for South Africa and Nigeria, considering the structural break, the net effect of growth-petroleum import nexus cannot be estimated for them due to statistically insignificant results. Also, although the net effect of growth-petroleum import nexus (which yields energy inefficiency) is established, without considering the structural break, the net effect of growth-emission nexus cannot be estimated for the countries due to statistically insignificant results.

The results for the agricultural sector show that, for Nigeria, although the net effect of growth-emission nexus indicates a clean production, the net effect of growth-petroleum import nexus suggests energy inefficiency. For South Africa, the net effect of growth-emission nexus does not support a clean production while the net effect of growth-petroleum import nexus cannot be determined as estimates are statistically insignificant.