Abstract

In the real world, economic covariates follow asymmetric and time-varying patterns. Therefore, it is imperative to integrate these effects while estimating environmental and economic relationships. Although prevailing literature reveals various emissions-deriving and eliminating factors, however, there is a dearth of empirical evidence that estimates the asymmetric and time-varying effect of globalization, natural resources, and financial development from a multidimensional perspective in China. In doing so, we employ the nonlinear autoregressive distributed lag (NARDL) and cross-wavelet modeling framework to explore the long- and short-run nonlinear and time-variant association between globalization, natural resources, financial development, and carbon emissions from 1980 to 2017. The NARDL method has the benefit of discriminating the long-term and short-term asymmetric carbon emission responses due to a positive and negative shock in our primary variables of interest. Mainly, the findings of NARDL estimations confirm that positive shocks in globalization and financial developments have a significant positive impact on carbon emissions, whereas negative shock in natural resources has a significant positive impact on carbon emissions. Similarly, the outcomes of continuous wavelet transformation and wavelet transformation coherence confirm the causal linkages between covariates; however, this effect varies across different time and frequency domains. These results imply that environmental researchers should consider asymmetric transmission channels and time–frequency associations among variables to devise long-term sustainable policies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

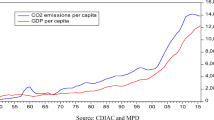

Greenhouse gas emissions from human activities are the primary driver of climate change. Among world-leading economies, China is placing itself as a global climate leader. Since 2004, China has surpassed the United States as the world's largest carbon emitter, accounting for 29% of global carbond dioxide (CO2) emissions (Fatima et al., 2021). China’s environmental challenges are not only effect locally, but their consequences have become worldwide due to globalization. Increasing economic growth with a low threat of environmental quality is a very important policy implication for China. Although there is an abundance of existing studies about energy, growth, and environment nexus (Razzaq et al., 2021; Al-Mulali et al. 2015), however, the role of globalization in financial development and natural resources gets little attention in the environmental debate. China is promoting economic globalization and secured distinction as the second-largest importer and the third-largest foreign direct investment provider (D Trindade d’Avila Magalhaes, 2018).

The straight pattern of growth undermines the sustainable use of the natural resources of China seriously. CO2 emissions in a country are not always determined solely by the level of income, financial growth, globalization, and the use of natural resources all can contribute (Li et al., 2021; Wang et al., 2020). More broadly, globalization is subjective and possess different definitions in terms of different perspectives (Looney & Frederiksen, 2004). It mainly applies to openness to markets, foreign direct investment (FDI), and finance. Usually, globalization is attributed to lower export-promoting tariffs and embraced with higher subsidies for companies to procure inputs and stimulate production (Acheampong et al., 2019). It regulates trade and economic development, which affects economic growth. The global economy is turning its attention to China. Moreover, higher growth potentials and opportunities in the Chinese market are further supported by international collaboration, and globalization is increasingly becoming a new financier. However, this growth is not persistent without negative consequences. Higher economic output spurs energy demand that further translates into higher emissions and environmental degeneration (Ahmed et al., 2016). The debate over globalization and CO2 emissions are deeply divided, with some studies supporting the positive effect of globalization (trade openness) on CO2 emissions and others opposing it. Sbia et al. (2014) analyzed that free-trade globalization will boost the atmosphere's quality by promoting energy efficiency (Han et al., 2021).

Similarly, according to Acheampong (2018), trade openness improves the efficiency of the environment. Several studies have claimed that foreign trade has a negative impact on environmental output in a variety of countries (for example, Solarin et al. (2017) in Malaysia; Shahbaz et al. (2014) in Tanzania; Xu et al. (2018) in Saudi Arabia; Acheampong et al. (2019) in Sub-Saharan Africa; and Shahbaz et al. (2015) in India). In particular, international trade-force regimes, among others, ignore environmental conservation laws to minimize development costs (Drezner, 2000). Financial development and globalization are imperative factors of economic growth and development that have a great impact on environmental quality (Acheampong et al., 2019). Financial development can lower subsidiary costs by expanding finance networks, allowing companies to invest more in new equipment, resulting in increased energy consumption and CO2 emissions. Islam et al., (2013) argued that financial development has a negative impact on environmental destruction. Similarly, Ozturk and Acaravci (2013) confirmed that increased trade transparency contributes to increased CO2 emissions in Turkey, while improved financial regulations and financial development will encourage better environmental quality. Besides, industrialization is driven by economic growth, which enhances natural resource development and magnifies agricultural productivity. Together, these factors lead to a growing amount of damaging and unnecessary waste production, which have contributed to the depletion of natural resources. The role of natural resources in the emissions nexus is imperative to explore the significant determinants of global emissions (Danish et al., 2019).

Notably, most of the economic and financial time series followed nonlinear behavior, which is not captured by conventional nonlinear models. The economic data can be affected by structural changes, financial shocks, and regional and global imbalances. Because of these reasons, the formation of economic variables follows an asymmetric trend (An et al., 2021a, 2021b). A few studies endorse the same using different economic variables such as Razzaq et al., (2020a, 2020b) explore asymmetric channels from tourism technology to carbon emissions in China; Lingyan (2021) explores asymmetric patterns between fiscal decentralization and carbon emissions in OECD countries; Chien et al. (2021) found asymmetric effects of information communication technology on carbon emissions in BRICS countries; He et al. (2021) argued nonlinear linkages between energy stocks, oil prices, and financial stress; Anwar et al., (2021a, 2021b) explored transport emissions and public–private partnership in an asymmetric framework (Anwar et al., 2021a); and Razzaq et al. (2020b) found a similar asymmetric link between emissions and COVID-19 in USA. It is argued that there can be a possibility of hidden cointegration, in which a cointegration relationship may be distinctly defined through positive or negative shocks in independent variables, which is ignored in linear models (Granger & Yoon, 2002; Razzaq et al., 2021).

Abovementioned studies highlight the importance of nonlinear and time-varying linkages` between different economic and financial covariates; however, there is no significant research found on the integration of globalization, financial growth, and natural resources, which has great relevance in the case of China. Therefore, this study examines the time-varying and nonlinear (asymmetric) connection between globalization, financial growth, natural resources, and CO2 emissions in a multidimensional framework. This study incorporates natural resources as a new determinant with globalization and financial development. The rationale for taking natural resources is derived from the fact that China is consuming the highest percentage of global natural resources and a larger contributor to CO2 emissions (Wu et al., 2018). Apart from that China is embodied with higher financial development and global integration, which makes this sample more relevant for this study.

To achieve these objectives, a nonlinear autoregressive distributed lag (NARDL) model is employed, which is presented by Shin et al. (2014). This can be a remarkable improvement over the linear econometric models. Additionally, this study employs a wavelet-based approach to analyze and quantify the time–frequency of CO2 emissions, globalization, financial growth, and natural resources (Goupillaud et al., 1984). Minimal research on the wavelet coherence method is available to investigate complex correlation or causality in previous literature. The exclusivity of wavelet analysis enables the disintegration into a sphere of two-way directional time-frequencies of one-way directional time data. It also allows the distinction to be formed between long-term and short-term behaviors.

The remaining part of the paper is planned as follows: Sect. 2 explains the related literature, Sect. 3 consists of the materials and methods, Sect. 4 describes the empirical results, and Sect. 5 concludes the paper with policy implications.

2 Literature review

This literature review is divided into three sections. The first section reviews the studies on globalization and CO2 emissions. The second section reviews natural resources and CO2 emissions, while the third section discusses financial development and CO2 emissions.

2.1 Globalization and carbon emissions

Numerous studies explored the role of globalization in CO2 emissions for a panel of countries and individual countries; however, a concrete consensus is still needed. For the economic growth and development of any country, globalization plays a critical role, but it also influences the quality of the environment by influencing CO2 emissions (Acheampong et al., 2019; Shahbaz et al., 2018). Nevertheless, scarce studies empirically showed the causal association between trade openness and CO2 emissions and the results of those who have conflicts (Ahmed et al., 2016). Grossman and Krueger (1995) argued that the openness of trade can influence environmental quality positively and negatively. The environmental impact of international trade depends on strategies applied in national economies, regardless of the size and level of development. During recent years, several studies probed trade liberalization's impacts on the quality of the environment using panel data (Shahbaz et al., 2017, 2018). From an individual country, Shahbaz et al., (2015, 2017) scrutinized the importance of trade openness in CO2 emissions (An et al., 2021a).

Shahbaz et al. (2017) used developed economies panel data and empirically evidenced that globalization has positive effects on CO2 emissions. In the sensitivity analysis, Acheampong and Boateng (2019) stated that globalization lessens CO2 emissions in the US, Brazil, Australia, and India while increases in the context of China. Cole et al. (2011) point out that the trade openness and its environmental impact are determined by the impurities involved in China. The argument further confirms the findings of Chang (2012), who claimed that pollutants are important to study the environmental impact of trade openness and foreign direct investment. The dynamic causal link concerning India's trade openness and CO2 emissions is explored by Tiwari et al. (2013), who believe that trade openness and CO2 emissions are positively correlated. Ling et al. (2015) find that trade openness is one of the factors causing improvement in environmental quality in Malaysia. Similarly, Solarin et al. (2017) evaluated the globalization impact on environmental quality and confirm that globalization accelerates CO2 emissions in Malaysia. Xu et al. (2018) in Saudi Arabia examined the impact of globalization on carbon emissions and found that economic globalization increases emissions of CO2.

2.2 Financial development and CO2 emissions

The financial sector is the strength of the economic growth and development of each country and also provides economic stability (Soukhakian, 2007); however, its negative impact on the environment cannot be neglected. The financial sector is heavily reliant on energy while stimulating economic growth and leads to unintended environmental consequences (Islam et al., 2013; Sadorsky, 2010; Shahbaz et al., 2017). The empirical outcomes on the link between financial development and CO2 emissions are mixed and yet insufficient. Two schools of thought explain this relationship. One group of researchers confirmed the negative relationship between the two variables in their results. Abbasi and Riaz (2016) pointed out that emissions can be reduced by opting for financial variables in Pakistan. Using panel data, Dogan and Seker (2016) explored that development in the financial sector regenerates environmental quality by minimizing emissions. Shahbaz et al. (2018) studied the same relationship for France and found the same findings. Saidi and Mbarek (2017) also considered this context for emerging economies and pointed out that environmental quality can be achieved through higher financial development. Haseeb et al. (2018) and Park et al. (2018) examined that financial development significantly mitigates environmental pollution in European Union (EU). Recently, Zafar et al. (2019) investigated the environmental impact of financial development in selected countries of the Organization for Economic Co-operation and Development (OECD) and found an emissions-decreasing effect of financial development.

The other group of researchers supports the positive relationship between financial development and CO2 emissions. For example, Zhang (2011) argued that financial development is an important contributor to CO2 emissions. Tang and Tan (2014) explored the relationship between CO2 emissions and financial developments in Malaysia. Their findings show that that CO2 emissions increased as a result of higher financial development. Al-Mulali et al. (2015) explored the same phenomenon in 23 countries of EU and indicate that financial development increases CO2 emissions. Farhani and Ozturk (2015) examined the role of financial development in increasing CO2 emissions in Tunisia. Javid and Sharif (2016) exhibited the same outcome in the context of Pakistan. Bekhet et al. (2017) proved that financial development significantly influences CO2 emissions except for the United Arab Emirates in Arab countries. Salahuddin et al. (2018) revealed that foreign direct investment and financial development positively and significantly influence CO2 emissions in Kuwait. Xu et al. (2018) observed financial development increases CO2 emissions in Saudi Arabia. Using the panel data, Zakaria and Bibi (2019) examined the association between institutional governance, financial inclusion, and environmental pollution and argued that financial development substantially degenerates the environment. Charfeddine and Kahia (2019) recently explained the amplified contribution of financial developments in accelerating emissions of CO2. Using panel data of China’s provinces, Guo et al. (2019) explore the financial development and CO2 emissions nexus and prove that the efficiency of financial development and volume of stock positively influence CO2 emissions. From ASEAN-5 countries, Nasir et al. (2019) argued that financial development deteriorates the environment by emitting CO2 emissions. In conclusion, the literature on CO2 emissions from financial development gives mixed results; thus, the current study appears worthy to be taken.

2.3 Natural resources and CO2 emissions

Natural resources are important for the development of each country. However, rapidly increasing urbanization and industrialization increased the demand for natural resources, which could lead to natural resource exploitation and environmental deterioration (Chen et al., 2018; Balta-Ozkan et al., 2015). Wu et al., 2018 explained that natural resource exploitation resulting from economic growth poses grave ecological concerns. The prevailing literature draws a direct link between natural resource consumption and economic growth indicators (Ahmed et al., 2016; Badeeb et al., 2017; Ben-Salha et al., 2018; Shahbaz et al., 2018). Shahabadi and Feyziand (2016) explored that natural resources attract foreign direct investment that improves environmental quality in highly industrialized countries by introducing energy-efficient technologies in the production process. Using the BRICS data, Dong et al., (2017) confirmed that the consumption of natural resources in an unsustainable manner poses serious environmental problems such as loss of forestation, scarcity of water, and global change (Khan et al., 2021; Razzaq et al., 2021; Yu et al. 2021).

From selected EU countries, Balsalobre-Lorente et al. (2018) found that CO2 emissions can be determined by natural resources, renewable electricity economic growth, and direct that rich natural resources import fossil fuels can help regulate and reduce CO2 emissions. Economic growth is born from an exploration of the country's natural resources; however, Destek and Sarcodia (2019) stated that overconsumption of natural resources affects the country's biological capacity, whereas amplifying its ecological footprint can lead to an environmental deficit. Most recently, Danish et al. (2019) researched the nexus between natural resources and CO2 emissions for BRICS economies. The outcomes mention that in Brazil, India, and China, natural resources may not be an influencing factor for CO2 emissions, while in the case of South Africa, natural resources are found to have significant contributors to CO2 emissions (Hu et al., 2021). Similarly, natural resources are known as a significant contributor to reducing the carbon level for Russia, thus contributing to the reduction of environmental pollution. Table 1 describes the findings of recent literature on CO2 emissions for China.

Finally, it is concluded that the environmental impact of globalization, financial development, and natural resources is inconclusive, which is mainly based on traditional linear methods. Due to the linearity assumption, any positive or negative shock in these variables may be set off by average effects. The time-varying feature is also missing in the empirical literature.

Therefore, the NARDL and wavelet-based empirical approach play a significant role in capturing positive/negative shocks and time-varying correlations among CO2 emissions, globalization, financial development, and natural resources.

3 Data and theoretical construction

3.1 Data arrangement

The data from the annual time series on globalization, carbon emissions, financial development, and natural resources are used in this study. The data period ranges from 1980 to 2017, and the choice of the time for this study depends upon the availability of the data. Data of natural resources are proxies by total natural resources rents as a percentage of GDP, CO2 emissions (metric tons per capita), and financial development measure by domestic credit to the private sector (% of GDP).

The data of all these variables are collected from World Development Indicators (World Bank, 2020). The globalization index is a cumulative index of social, political, and economic globalization sourced from KOF globalization database.

3.2 Theoretical construction

Before ensuing for economic modeling, there is a need to explain the theoretical framework. The impact of globalization on China’s economic growth and the domestic economy is unprecedented. China's international trade surpasses 16 times over the past 20 years (World Trade Organization (WTO)). Globally the largest economy that entered into the World Trade Organization (WTO) membership a few years ago in 2001. Currently, China is facing both negative and positive consequences of globalization that we cannot ignore (Wu et al., 2021). Globalization and financial development have increased due to reducing trade barriers in China, while increasing globalization causes their concerns about the environmental impact. Trade liberalization promoted by globalization accelerates the exchange of goods in free mode among countries and increased production that caused higher energy consumption and related emissions (Shahbaz et al., 2015). The association between globalization and CO2 emissions has also been explored by several studies (Shahbaz et al. 2016), but these studies have exhibited mixed outcomes.

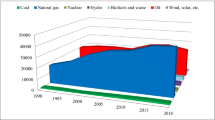

Financial development may both increase carbon emission and stimulate its reduction. On the one hand, financial development promotes more wealth and capital that can satisfy the need of customers for energy consumer products and encourage the demand for cars and houses. Consequently, it would become the reason for increasing CO2 emissions. According to the facts, China is the fourth resource abundance country in the world, ranked third in mineral resources, first in hydro resources and second in solar, and third in coal. Due to the massive population, per capita resources are less, and the depletion rate is higher. Also, the complex geographical conditions such as lower quality of resources and uneven distribution of natural resources put pressure on resource demand (Li et al., 2016a). Therefore, despite resource abundance, China is importing resources from other countries (Li et al., 2016b). Due to the rapid increase in globalization and industrialization, there is an increasing demand for natural resources, possibly leading to the destruction of natural resources and cause environmental degradation (Balta-Ozkan et al., 2015).

From the above debate, it is concluded that the relationship between CO2 emission, globalization, financial development, and natural resources can be positive and negative in China. Thus, the observed association is needed to analyze using the appropriate method. The associated model is depicted in Fig. 1.

3.3 Model construction and methodology

This paper adopts a nonlinear autoregressive distributed lag model (NARDL) model to analyze the asymmetric nonlinear impact of globalization, financial development, and natural resources on CO2 emissions in China. Besides NARDL, the study also employed a wavelet-based approach to finding the relationship between CO2 and GLOB, NR, and FD based on time–frequency. First, we propose the following linear equation.

where \({\text{CO}}_{{{\text{2t}}}}\),\({\text{GLOB}}_{{\text{t}}}\), \({\text{NR}}_{{\text{t}}}\), and \({\text{FD}}_{{\text{t}}}\) represent the carbon dioxide emissions, globalization, natural resources, and financial development, respectively, in China. The above relationship carried out the linear relationship between the variables, while the primary objective of this study is to explore the nonlinear association between CO2 emissions, globalization, natural resources, and financial development by employing the NARDL model presented by Shin et al. (2014).

This method is relatively flexible because it allows different orders of integration while estimations. It can be employed without restricting the same order of integration and can also equally acceptable for I (2). Moreover, Granger and Yoon (2002) proposed the hidden cointegration concept, by which cointegration relationships may be defined as the positive and negative constituents of underlying variables.

Following the empirical work of Ibrahim (2015), Lacheheb and Sirag (2019) accounting for the asymmetric relationship between CO2 emission, globalization, natural resource, and financial development our model can be specified as:

where \(\theta_{i}\) is allied with the parameters of the long-run. And the asymmetric effect of globalization, natural resource, and financial development is combined with positive changes \(GLOB^{ + }\), \(FD^{ + }\), and \(NR^{ + }\) and negative change \(GLOB^{ - }\), \(FD^{ - }\), and \(NR^{ - }\), respectively, while \(GLOB^{ + }\)\(GLOB^{ - }\), \(FD^{ + }\)\(FD^{ - }\), and \(NR^{ + }\)\(NR^{ - }\) are the partial sum of the square of positive and negative changes in globalization, financial development, and natural resource. The effect of the projected variables in the long-run is mentioned in Eq. (1), and the short-run coefficient is achieved by incorporating error correction depiction in Eq. (1) as mentioned below

Equation (4) stipulates an error correction term that combines the long-run and short-run coefficients; the variables with the symbol \(\Delta\) representing short-run coefficients, while the variables with the symbol \(a_{t} = \theta^{ + } b_{t}^{ + } + \theta^{ - } b_{t}^{ - }\) describing the long-run coefficients.

Equation (4) describes only the symmetric relationship between the anticipated variables. However, this model can transform into a nonlinear cointegration equation as:

The decomposition regression is as \(a_{t} = \theta^{ + } b_{t}^{ + } + \theta^{ - } b_{t}^{ - } + \mu_{t}\).

where \(\theta^{ + }\) and \(\theta^{ - }\) are associated with long-term coefficients, while \(b^{ + }\) and \(b^{ - }\) associated with short-term coefficients and \(b_{t}\) is a regressors vector disintegrated as

where \(b^{ + }\)\(b^{ - }\) designate the explanatory variables, which are parted into a partial sum of positive and negative changes next subsequent Eqs (6-11) equations describe the positive and negative change in globalization, natural resource, and financial development.

At the consequent stage, we will replace GLOB, NR, and FD in Eq. (4) by adding \({\text{GLOB}}^{ + }\)\({\text{GLOB}}^{ - }\)\({\text{NR}}^{ + }\)\({\text{NR}}^{ - }\), and \({\text{FD}}^{ + }\) \({\text{FD}}^{ - }\) variables. We will finalize the formulation of the NARDL model.

3.4 Cross-wavelet approach

In order to inspect time–frequency dependence between CO2 emissions, GLOB, NR, and FD, we employed wavelet coherence. It is a novel procedure, which decomposes one-dimensional time data into the two-dimensional time–frequency sphere. This way, we have established long-term and short-term causal links at the same time between model variables. Simultaneously, a multi-stage decomposition method is created to give a complete description to display the frequency-dependent behavior between variables. In wavelet analysis, the frame is usually replaced with lower to higher or higher to a lower frequency. The real economic relationship between variables is expected at an unequal (scale) level rather than the normal (average) aggregation level. A similar method is also used by Adebayo and Kirikkaleli (2021) and draws the empirical linkages between globalization, technology, energy consumption on carbon emissions in Japan.

3.5 Continuous wavelet transform

This study applied various procedures of wavelet transform, including wavelet decomposition based on discrete wavelet decomposition analysis (DWT), wavelet correlation, and continuous wavelet transform (CWT).

Analysis of time series \(\mathrm{x}(\mathrm{t})\) continuous wavelet transforms \({\text{W}}_{{\text{x}}} \left( {{\text{k}},{\text{l}}} \right)\) for wavelet (\({\uppsi }\)) is defined as:

The CWT basic feature is to decompose and then re-creating time series \(\left( {\text{t}} \right)\):

It is noted that wavelet transformations can maintain the different levels of energy at the given time series, and for power spectrum analysis, this advantage is used here as follows:

3.6 Wavelet transform coherence

To analyze the association between two-time series, this study follows a bivariate structure pronounced “wavelet coherence”. To adequately describe the “wavelet coherence”, we first need to elucidate cross-wavelet transform and power.

According to Torrence and Compo (1998), in the above equation, Wx (k, l) and Wy(k,l) signify the WTC of two-time series x(t) and y(t). Following Torrence and Webster (1999), the squared wavelet coherence equation as follows:

where the smoothing parameter is denoted by C and 0 ≤ \({\text{R}}^{2} \left( {{\text{k}},{\text{l}}} \right)\) ≤ 1 indicates the time smoothing process. If the variables correlate on a certain scale, the value of \({\text{R}}^{2} \left( {{\text{k}},{\text{l}}} \right)\) is closer to one, with a black line and a red color. On the contrary, \({\text{R}}^{2} \left( {{\text{k}},{\text{l}}} \right)\) is closer to zero if the time series variables are poorly correlated and appear blue.

4 Empirical results and discussion

Table 3 shows the descriptive statistics, reporting mean values, median, and range of variables, standard deviation, skewness, and kurtosis for the data distribution. Before estimating the long-run relationship, it is a prerequisite to confirm the variable’s order of integration. Therefore, we employ both unit root tests such as Augmented Dickey-Fuller (ADF) and Zivot-Andrews (1992) (ZA) to confirm the order of integration. The ZA unit-root test is superior in terms of considering the structural changes and time breaks in data. The results of both tests validate that all variables series have unit root, and stationarity properties obtain after the first difference. Moreover, the ZA test also confirms the structural breaks for CO2, NR, GLOB, and FD in the year 2014, 2016, 2002, and 2011, respectively in Table 2. These structural changes can be attributed but not limited to the replacement of ancient China's environmental law in 2014 for CO2, implementation of china's natural resources policy in the year 2015, joining of the WTO accord in the year 2001, and financial crises in the year 2011. In the Chinese economy, structural transformations direct NR, GLOB, and FD to effect CO2 contrarily for any positive and negative shocks in regressors while highlighting a time–frequency-based dependency. These dynamic and stochastic trends impede empirical estimations if the conventional empirical framework is applied. To address the same, the study utilizes the NARDL model along with novel wavelet coherence approaches that draw asymmetric as well as time–frequency varying relationships among model variables.

The results of the NARDL model are derived from Eq. (12), where Glob, FD, and NR are decomposed into positive and negative shocks, which are represented in Table 4. The F-Stat value (5.69) is higher than the critical value of upper-bound at 5%, confirming the existence of asymmetric cointegration among variables following Pesaran et al. (2001).

The overall results of the dynamic NARDL model are presented in Table 4, while long-term coefficients are calculated from the NARDL output presented in Table 5. The error correction term (ECM) confirms a long-run cointegrating relationship among model variables in the NARDL framework. ECM value signifies that any deviation from steady-state equilibrium will adjust with a 26.52% speed of adjustment. From Table 5, we find significant differences allied with positive and negative globalization, financial development, and natural resource shocks. The NARDL long-run findings show that (GLOB_POS) with a positive coefficient (0.0622) and a statistically significant effect on CO2 emissions, while (GLOB_NEG) with a negative coefficient (-0.8674) is the statistically insignificant impact of CO2 emissions. Similar results are echoed by Figge et al. (2017) who found that overall globalization increases ecological footprint. Dean (2002) noted that in China, trade openness globalization is worsening the quality of the environment via an improved trading term. These findings are also consistent with Khan et al., (2019) in high and upper-middle-income economies, Huang and Wang (2016), and Umar et al., (2020) in China.

Moreover, the long-run (NR_POS) shows a positive coefficient (0.2960) having a statistically insignificant impact on CO2 emission, while a negative coefficient of (NR_NEG) (0.2114) statistically significant impact on CO2 emission. This indicates that lessens natural resources will increase CO2 emissions over time in China. As economic growth rises, unpredictable use and exploitation of natural resources increase reliance on imports of fossil fuels contributes to an increase in CO2 emissions. In an alternative situation, abundant natural resources help to reduce imports of fossil fuels which reduce CO2 emissions (Danish et al., 2019). Moreover, continuously increasing demand for natural resources is likely to contribute to resource depletion and environmental degradation. (Balta-Ozkan et al., 2015).

The long-run positive shock (FD_POS) (0.0515) has a positive significant effect on CO2 emission level, while negative shock (FD_NEG) (-0.006) has no significant impact on CO2 emissions. It shows that a 1% increase in financial developments will increase CO2 emissions by 0.005% in China over time. The findings are consistent with Zhang (2011), who also confirmed that China's financial development is an important driver of CO2 emissions. Similarly, Boutabba (2014) also confirmed that FD has a long-run positive impact on CO2 emissions in the Indian economy. Bekhet and Othman (2017) confirmed that Malaysia's financial development contributes to CO2 emissions.

The diagnostic inspection of NARDL empirics is mentioned in Table 6 which mainly indicates the validity of empirical estimations. In diagnostic tests, we apply the Wald test, Jarque Bera test, Durbin-Watson (DW), and Brush-Pagan-Godfrey tests, which are helpful to check the validity and problems in NARDL models. The empirics of Table 6 indicate the normality in error terms, residuals, no heteroscedasticity, and no serial correlation.

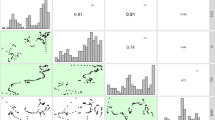

The CUSUM and CUSMQ have been checking the parameter stability or strength as the graphs in Fig. 2 show all test results and confirm that serial correlation is absent, no issue of heteroscedasticity, and in our model, residuals are normally distributed.

4.1 Wavelet decomposition analyses

After examining the nonlinear relationship between CO2 emissions, GLOB, FD, and NR, this study employed the wavelet-based analysis. The results are in line with existing literature, which mentions that an empirical model having different periods and the wavelet-based analysis can be considered more suitable for the dataset which contains many intervals. Therefore, this study wants to examine the time–frequency relationship between emissions of CO2, GLOB, FD, and NR in China. Figures 3 and 4 represent the difference of time series in the above variables. In the different series of real-time of all the variables are visible, with significant fluctuations. The series shows significant fluctuations and consequently creates environmental degradation. The sample period of globalization shows significant changes in the whole sample.

Further, wavelet-based analysis billets the stationary issues of the data series. If the data series is non-stationary, there is no need to process it in order to make it stationary as required by other traditional cointegration-based econometrics models. Figures 5, 6, 7, and 8 show a representation of multi-resolution analysis (MRA) of CO2 emissions, glob, natural resources, and financial development of order J = 6 using MODWT based on Daubechies, (1992) least asymmetric (LA) wavelet filter.Footnote 1 The orthogonal components are plotted in Figs. 5, 6, 7, and 8 (D1 to D6) for the representation of various frequency components of the actual series in detail and smooth components (S6). In the short and medium term, the graphical representation of the series shows that all series have many variations, but in the long term, the series becomes stable.

4.2 Continuous wavelet transform (CWT)

The study used CWT on globalization, economic development, natural resources, and CO2 emissions. CWT expands time series in time–frequency space where oscillations can be displayed in a very intuitive way. It is easy to understand as it delivers more information on graphical frequency. Figures 6, 7, 8, and 9 clearly show that all variables have different characteristics in different time zones of the series.

The CWT spectrum shows the activities of the series according to three different components: curve, time, and frequency. The figures show the results of the continuous wavelet power spectrum of CO2 emissions, globalization, financial development, and natural resources. It is easy to see that in the case of globalization, financial development and CO2 emissions seem more stable in the short and medium run as compared to the long run that means the effect of globalization and financial development on CO2 emission frequently occurred in short to medium term. In the case of natural resources, we have found some variations on small scales but lacks for a long time.

Note: Against the red noise, the thick black contour represents the 5% significance level. The color code for power ranges from blue (lower power) to red (high power). The X-axis represents the analyzed time scale, and the Y-axis reveals the period. Time scale 20, 40, 60, 80, 100, and 120 represent years 1990, 1995, 2000, 2005, 2010, and 2015, respectively.

4.3 Wavelet transform coherence (WTC)

The study also looked at the causal relationship between globalization, financial development, natural resources, and CO2 emissions using wavelet transform coherence (WTC) analysis. A local correlation between two CWTs can be considered as the WTC. The WTC finds sections in time–frequency spaces where two-time series co-vary. Figures 10, 11, 12, and 13 visualize both cyclical and anti-cyclical dependence between variables across different time dimensions.

The WTC results about globalization and CO2 emissions show that most rightward pointing arrows in thick black areas show that there is a positive correlation between globalization and CO2 emissions in China, except for 1988–1992 and between 2007 and 2010 because out-phase situations are found. The WTC visualizes the strongest causal relationship between financial development and CO2 emissions in China, an in-phase from 1993 to 2016. For natural resources, the WTC results explain that we are out-phase situations in the short run and long run and prove a weak correlation between natural resources and CO2 emissions.

5 Conclusion and policy implications

The empirical study pursues to determine the asymmetric and time-varying relationship between globalization, financial growth, and natural resources and CO2 emissions in China using data from 1984 to 2017. This analysis aims to unveil this relationship more thoroughly, methodically, and empirically to contribute to China's policies to reduce CO2 emissions. Because of the importance of nonlinearity and the time and frequency domains, the study used a wavelet-based model and the nonlinear ARDL (NARDL) method to account for short- and long-run volatility as well as abrupt shifts to ensure a short-run and long-run relationship between the variables. The NARDL method benefits from discrimination between asymmetric responses to CO2 emissions in both the short-run and long-run due to positive and negative shocks toward globalization, financial development, and natural resources in China.

The findings of this study confirm the asymmetric association between globalization, financial development, natural resources, and CO2 emissions. It is argued that in the long run, positive change in globalization has an increasing effect on CO2 emissions. Furthermore, our finding explores that in the long-run positive shock of financial development has a statistically significant impact, while a negative shock of financial development has an insignificant impact on CO2 emission. The results exhibit that financial developments have negative environmental consequences due to an increasing impact on CO2 emissions. Moreover, any positive shock in the short-run in natural resources has an insignificant impact on CO2 emissions, while long-run negative natural resource shocks have a significant impact on CO2 emissions, implying that a reduction in natural resources will increase CO2 emissions in the long-run.

Furthermore, the findings of the continuous wavelet transform and wavelet transform coherence also confirm the causal links between globalization, economic development, and CO2 emissions, but there is no strong co-movement found for natural resources. The results of the wavelet-based analysis are consistent with NARDL outcomes. The evidence suggests that ignoring the intrinsic nonlinearities may lead to misleading inference. The obtained evidence of asymmetry and time–frequency domain could be the major importance for more efficient climate policy decision making and predicting China’s CO2 emissions.

The findings of this study upshot valuable policy implications and recommendations. The outcomes spot that globalization unfriendly influences China’s environment. Despite the rising globalization, the process of globalization poses serious threats to China's environmental degradation. The increasing trend of globalization at the cost of environmental degradation may increase energy consumption and lead to depletion of natural resources and eventually results in global warming in China. In the current scenario of globalization, China needs to contribute more in the process of market incorporation with its regional trading partners by dropping or removing the globalization impact on CO2 emissions and removing trade barriers. Because the environment and social sustainability are the essential conditions of the sustainability of long-run globalization and improve economic development. The energy development strategy should include an energy conversion priority policy in China at the same time China should focus on developing renewable energy.

In order to curtail the emissions-driving impact of financial development and resource consumption, market-based policy tools are imperative to employed such as “carbon emissions market trading system (ETS)”. ETS motivate industrial sectors to reduce their ecological footprint by saving their net emissions and earning from the sale of excess carbon allowances in the secondary markets. Although China has started a few ETS projects, however, they need to be expanded across the whole country. Besides, stringent laws, higher environmental-related investment, and tax exemptions in the installation of energy-efficient production units help to reduce net emissions growth. The People's Republic of China needs more effort at emissions reduction policy. Otherwise, real carbon emissions may be undervalued and it has become a hurdle to meet the target of a 40% to 50% reduction in carbon emissions by 2030. Further, we urge that China should take measures to ensure the maintainable use of natural resources to minimize dependency on fossil fuels by restricting conventional energy in their system. Future research and development budgets should be allotted to explore renewable energy resources in the country.

Notes

The Daubechies (1992) “Least asymmetric wavelet filter DLA is widely used wavelet, because it provides the most accurate time-alignment between wavelet coefficient at various scales and the original time series, and it is applicable to wide range of data types”.

References

Abbasi, F., & Riaz, K. (2016). CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy, 90, 102–114.

Acheampong, A. O. (2018). Economic growth, CO2 emissions and energy consumption: What causes what and where? Energy Economics, 74, 677–692.

Acheampong, A. O., Adams, S., & Boateng, E. (2019). Do globalization and renewable energy contribute to carbon emissions mitigation in Sub-Saharan Africa? Science of the Total Environment, 677, 436–446.

Acheampong, A. O., & Boateng, E. B. (2019). Modelling carbon emission intensity: Application of artificial neural network. Journal of Cleaner Production, 225, 833–856.

Adebayo, T. S., & Kirikkaleli, D. (2021). Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: application of wavelet tools. Environment, Development and Sustainability, 1–26.

Ahmed, K., Mahalik, M. K., & Shahbaz, M. (2016). Dynamics between economic growth, labor, capital and natural resource abundance in Iran: An application of the combined cointegration approach. Resources Policy, 49, 213–221.

An, H., Razzaq, A., Haseeb, M., & Mihardjo, L. W. (2021a). The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the Belt and Road host countries: New evidence from Method of Moments Quantile Regression. Environmental Science and Pollution Research, 28(5), 5254–5270.

An, H., Razzaq, A., Nawaz, A., Noman, S. M., & Khan, S. A. R. (2021a). Nexus between green logistic operations and triple bottom line: evidence from infrastructure-led Chinese outward foreign direct investment in Belt and Road host countries. Environmental Science and Pollution Research, 1–24.

Anwar, A., Sharif, A., Fatima, S., Ahmad, P., Sinha, A., Khan, S. A. R., & Jermsittiparsert, K. (2021a). The asymmetric effect of public private partnership investment on transport CO2 emission in China: Evidence from quantile ARDL approach. Journal of Cleaner Production, 288, 125282.

Anwar, A., Siddique, M., Dogan, E., & Sharif, A. (2021a). The moderating role of renewable and non-renewable energy in environment-income nexus for ASEAN countries: Evidence from method of moments quantile regression. Renewable Energy, 164, 956–967.

Badeeb, R. A., Lean, H. H., & Clark, J. (2017). The evolution of the natural resource curse thesis: A critical literature survey. Resources Policy, 51, 123–134.

Balsalobre-Lorente, D., Shahbaz, M., Roubaud, D., & Farhani, S. (2018). How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy, 113, 356–367.

Balta-Ozkan, N., Watson, T., & Mocca, E. (2015). Spatially uneven development and low carbon transitions: Insights from urban and regional planning. Energy Policy, 85, 500–510.

Bekhet, H. A., Matar, A., & Yasmin, T. (2017). CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renewable and Sustainable Energy Reviews, 70, 117–132.

Bekhet, H. A., & Othman, N. S. (2017). Impact of urbanization growth on Malaysia CO2 emissions: Evidence from the dynamic relationship. Journal of Cleaner Production, 154, 374–388.

Ben-Salha, O., Dachraoui, H., & Sebri, M. (2018). Natural resource rents and economic growth in the top resource-abundant countries: a PMG estimation. Resources Policy. https://doi.org/10.1016/j.resourpol.2018.07.005

Boutabba, M. A. (2014). The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Economic Modelling, 40, 33–41.

Chang, C. C. (2010). A multivariate causality test of carbon dioxide emissions, energy consumption and economic growth in China. Applied Energy, 87(11), 3533–3537.

Chang, N. (2012). The empirical relationship between openness and environmental pollution in China. Journal of Environmental Planning and Management, 55(6), 783–796.

Charfeddine, L., & Kahia, M. (2019). Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renewable Energy, 139, 198–213.

Chen, Y., He, L., Li, J., & Zhang, S. (2018). Multi-criteria design of shale-gas-water supply chains and production systems towards optimal life cycle economics and greenhouse gas emissions under uncertainty. Computers & Chemical Engineering, 109, 216–235. https://doi.org/10.1016/j.compchemeng.2017.11.014.

Chien, F., Anwar, A., Hsu, C. C., Sharif, A., Razzaq, A., & Sinha, A. (2021). The role of information and communication technology in encountering environmental degradation: Proposing an SDG framework for the BRICS countries. Technology in Society, 65, 101587.

Cole, M. A., Elliott, R. J., & Zhang, J. (2011). Growth, foreign direct investment, and the environment: Evidence from Chinese cities. Journal of Regional Science, 51(1), 121–138.

Danish., Baloch, M. A., Mahmood, N., & Zhang, J. W. . (2019). Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Science of the Total Environment, 678, 632–638.

Daubechies, I. (1992). Ten Lectures on Wavelets (1st ed.). Rutgers University and AT & T Bell Laboratories, Pennsylvania. https://doi.org/10.1137/1.9781611970104

Dean, J. M. (2002). Testing the impact of trade liberalization on the environment: Theory and evidence. Canadian Journal of Economics, 35, 819–842.

Destek, M. A., & Sarkodie, S. A. (2019). Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Science of the Total Environment, 650, 2483–2489.

Dogan, E., & Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074–1085.

Dong, K., Sun, R., & Hochman, G. (2017). Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy, 141, 1466–1478.

Drezner, D. W. (2000). Bargaining, enforcement, and multilateral sanctions: When is cooperation counterproductive? International Organization, 54(1), 73–102.

Farhani, S., & Ozturk, I. (2015). Causal relationship between CO 2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environmental Science and Pollution Research, 22(20), 15663–15676.

Fatima, T., Shahzad, U., & Cui, L. (2021). Renewable and nonrenewable energy consumption, trade and CO2 emissions in high emitter countries: Does the income level matter? Journal of Environmental Planning and Management, 64(7), 1227–1251.

Figge, L., Oebels, K., & Offermans, A. (2017). The effects of globalization on Ecological Footprints: An empirical analysis. Environment, Development and Sustainability, 19(3), 863–876.

Goupillaud, P., Grossmann, A., & Morlet, J. (1984). Cycle-octave and related transforms in seismic signal analysis. Geoexploration, 23(1), 85–102.

Govindaraju, V. C., & Tang, C. F. (2013). The dynamic links between CO2 emissions, economic growth and coal consumption in China and India. Applied Energy, 104, 310–318.

Granger, C. W., & Yoon, G. (2002). Hidden cointegration. U of California, Economics Working Paper, (2002–02).

Grossman, G. M., & Krueger, A. B. (1995). Economic growth and the environment. The Quarterly Journal of Economics, 110(2), 353–377.

Guo, L. (2014). CO 2 emissions and regional income disparity: Evidence from China. The Singapore Economic Review, 59(01), 1450007.

Guo, M., Hu, Y., & Yu, J. (2019). The role of financial development in the process of climate change: Evidence from different panel models in China. Atmospheric Pollution Research.

Han, Y., Zhang, F., Huang, L., Peng, K., & Wang, X. (2021). Does industrial upgrading promote eco-efficiency? ─A panel space estimation based on Chinese evidence. Energy Policy, 154, 112–286. https://doi.org/10.1016/j.enpol.2021.112286.

He, X., Mishra, S., Aman, A., Shahbaz, M., Razzaq, A., & Sharif, A. (2021). The linkage between clean energy stocks and the fluctuations in oil price and financial stress in the US and Europe? Evidence from QARDL approach. Resources Policy, 72, 102021.

Hu, B., Wu, Y., Wang, H., Tang, Y., & Wang, C. (2021). Risk mitigation for rockfall hazards in steeply dipping coal seam: A case study in Xinjiang northwestern China. Geomatics Natural Hazards and Risk, 12(1), 988–1014. https://doi.org/10.1080/19475705.2021.1909147.

Huang, M., & Wang, B. (2016). Factors influencing CO2 emissions in China based on grey relational analysis. Energy Sources, Part a: Recovery, Utilization, and Environmental Effects, 38(4), 555–561.

Ibrahim, M. H. (2015). Oil and food prices in Malaysia: A nonlinear ARDL analysis. Agricultural and Food Economics, 3(1), 2.

Islam, F., Shahbaz, M., Ahmed, A. U., & Alam, M. M. (2013). Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Economic Modelling, 30, 435–441.

Jalil, A., & Feridun, M. (2011). The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Economics, 33(2), 284–291.

Jalil, A., & Mahmud, S. F. (2009). Environment Kuznets curve for CO2 emissions: A cointegration analysis for China. Energy Policy, 37(12), 5167–5172.

Javid, M., & Sharif, F. (2016). Environmental Kuznets curve and financial development in Pakistan. Renewable and Sustainable Energy Reviews, 54, 406–414.

Jayanthakumaran, K., Verma, R., & Liu, Y. (2012). CO2 emissions, energy consumption, trade, and income: A comparative analysis of China and India. Energy Policy, 42, 450–460.

Kalmaz, D. B., & Kirikkaleli, D. (2019). Modeling CO 2 emissions in an emerging market: Empirical findings from ARDL-based bounds and wavelet coherence approaches. Environmental Science and Pollution Research, 26(5), 5210–5220.

Kang, Y. Q., Zhao, T., & Yang, Y. Y. (2016). Environmental Kuznets curve for CO2 emissions in China: A spatial panel data approach. Ecological Indicators, 63, 231–239.

Kanjilal, K., & Ghosh, S. (2013). Environmental Kuznetscurve for India: Evidence from tests for cointegration with unknown structuralbreaks. Energy Policy, 56, 509–515.

Khan, M. K., Teng, J. Z., Khan, M. I., & Khan, M. O. (2019). Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Science of the Total Environment, 688, 424–436.

Khan, S. A. R., Razzaq, A., Yu, Z., Shah, A., Sharif, A., & Janjua, L. (2021). Disruption in food supply chain and undernourishment challenges: An empirical study in the context of Asian countries. Socio-Economic Planning Sciences, 101033.

Lacheheb, M., & Sirag, A. (2019). Oil price and inflation in Algeria: A nonlinear ARDL approach. The Quarterly Review of Economics and Finance.

Li, L., Lei, Y., He, C., Wu, S., & Chen, J. (2016b). Prediction on the Peak of the CO2 Emissions in China Using the STIRPAT Model. Advances in Meteorology, 2016.

Li, X., Li, Z., Jia, T., Yan, P., Wang, D., & Liu, G. (2021). The sense of community revisited in Hankow China: Combining the impacts of perceptual factors and built environment attributes. Cities, 111, 103–108. https://doi.org/10.1016/j.cities.2021.103108.

Li, T., Wang, Y., & Zhao, D. (2016a). Environmental Kuznets curve in China: New evidence from dynamic panel analysis. Energy Policy, 91, 138–147.

Ling, C. H., Ahmed, K., Muhamad, R. B., & Shahbaz, M. (2015). Decomposing the trade-environment nexus for Malaysia: What do the technique, scale, composition, and comparative advantage effect indicate? Environmental Science and Pollution Research, 22(24), 20131–20142.

Lingyan, M., Zhao, Z., Malik, H. A., Razzaq, A., An, H., & Hassan, M. (2021). Asymmetric impact of fiscal decentralization and environmental innovation on carbon emissions: Evidence from highly decentralized countries. Energy & Environment, 0958305X211018453.

Looney, R., & Frederiksen, P. C. (2004). An assessment of relative globalization in Asia during the 1980s and 1990s. Journal of Asian Economics, 15(2), 267–285.

Magalhães, Td. ’Ávila., & D. . (2018). The globaliser dragon: How is China changing economic globalisation? Third World Quarterly, 39(9), 1727–1749.

Nasir, M. A., Huynh, T. L. D., & Tram, H. T. X. (2019). Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging ASEAN. Journal of Environmental Management, 242, 131–141.

Ozturk, I., & Acaravci, A. (2013). The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Economics, 36, 262–267.

Park, Y., Meng, F., & Baloch, M. A. (2018). The effect of ICT, financial development, growth, and trade openness on CO 2 emissions: An empirical analysis. Environmental Science and Pollution Research, 25(30), 30708–30719.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Razzaq, A., Sharif, A., Ahmad, P., & Jermsittiparsert, K. (2020a). Asymmetric role of tourism development and technology innovation on carbon dioxide emission reduction in the Chinese economy: Fresh insights from QARDL approach. Sustainable Development, 2021(29), 176–193.

Razzaq, A., Sharif, A., Aziz, N., Irfan, M., & Jermsittiparsert, K. (2020). Asymmetric link between environmental pollution and COVID-19 in the top ten affected states of US: A novel estimations from quantile-on-quantile approach. Environmental research, 191, 110189.

Razzaq, A., Sharif, A., Najmi, A., Tseng, M. L., & Lim, M. K. (2021). Dynamic and causality interrelationships from municipal solid waste recycling to economic growth, carbon emissions and energy efficiency using a novel bootstrapping autoregressive distributed lag. Resources, Conservation and Recycling, 166, 105372.

Ren, S., Yin, H., & Chen, X. (2014). Using LMDI to analyze the decoupling of carbon dioxide emissions by China’s manufacturing industry. Environmental Development, 9, 61–75.

Sadorsky, P. (2010). The impact of financial development on energy consumption in emerging economies. Energy Policy, 38(5), 2528–2535.

Saidi, K., & Mbarek, M. B. (2017). The impact of income, trade, urbanization, and financial development on CO 2 emissions in 19 emerging economies. Environmental Science and Pollution Research, 24(14), 12748–12757.

Salahuddin, M., Alam, K., Ozturk, I., & Sohag, K. (2018). The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renewable and Sustainable Energy Reviews, 81, 2002–2010.

Sbia, R., Shahbaz, M., & Hamdi, H. (2014). A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Economic Modelling, 36, 191–197.

Shahabadi, A., & Feyzi, S. (2016). The relationship between natural resources abundance, foreign direct investment and environmental performance in selected oil and developed countries during 1996–2013. International Journal of Resistive Economics, 4(3), 101–116.

Shahbaz, M., Balsalobre-Lorente, D., & Sinha, A. (2019). Foreign direct Investment–CO2 emissions nexus in Middle East and North African countries: Importance of biomass energy consumption. Journal of Cleaner Production, 217, 603–614.

Shahbaz, M., Khan, S., Ali, A., & Bhattacharya, M. (2017). The impact of globalization on CO2 emissions in China. The Singapore Economic Review, 62(04), 929–957.

Shahbaz, M., Khraief, N., Uddin, G. S., & Ozturk, I. (2014). Environmental Kuznets curve in an open economy: A bounds testing and causality analysis for Tunisia. Renewable and Sustainable Energy Reviews, 34, 325–336.

Shahbaz, M., Mallick, H., Mahalik, M. K., & Loganathan, N. (2015). Does globalization impede environmental quality in India? Ecological Indicators, 52, 379–393.

Shahbaz, M., Shahzad, S. J. H., Mahalikfra, M. K., & Hammoudeh, S. (2018). Does globalisation worsen environmental quality in developed economies? Environmental Modeling & Assessment, 23(2), 141–156.

Shin, Y., Yu, B., & Greenwood-Nimmo, M. (2014). Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in honor of Peter Schmidt (pp. 281–314). Springer, New York, NY.

Solarin, S. A., Al-Mulali, U., & Sahu, P. K. (2017). Globalisation and its effect on pollution in Malaysia: The role of Trans-Pacific Partnership (TPP) agreement. Environmental Science and Pollution Research, 24(29), 23096–23113.

Soukhakian, N. (2007). Financial Development and Economic Growth in Iran: Evidence From Co-Integration and Causality Tests. International Journal of Economic Perspectives, 1(2).

Swiss Economic Institute. (2019, December 15). KOF Swiss Economic Institute. Retrieved from https://kof.ethz.ch/en/

Tang, C. F., & Tan, B. W. (2014). The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Quality & Quantity, 48(2), 781–797.

Tiwari, A. K., Shahbaz, M., & Hye, Q. M. A. (2013). The environmental Kuznets curve and the role of coal consumption in India: Cointegration and causality analysis in an open economy. Renewable and Sustainable Energy Reviews, 18, 519–527.

Torrence, C., & Compo, G. P. (1998). A practical guide to wavelet analysis. Bulletin of the American Meteorological Society, 79(1), 61–78.

Torrence, C., & Webster, P. J. (1999). Interdecadal changes in the ENSO–monsoon system. Journal of Climate, 12(8), 2679–2690.

Twerefou, D. K., Danso-Mensah, K., & Bokpin, G. A. (2017). The environmental effects of economic growth and globalization in Sub-Saharan Africa: A panel general method of moments approach. Research in International Business and Finance, 42, 939–949.

Umar, M., Ji, X., Kirikkaleli, D., Shahbaz, M., & Zhou, X. (2020). Environmental cost of natural resources utilization and economic growth: Can China shift some burden through globalization for sustainable development? Sustainable Development, 28(6), 1678–1688.

Wang, N., Sun, X., Zhao, Q., Yang, Y., & Wang, P. (2020). Leachability and adverse effects of coal fly ash: A review. Journal of Hazardous Materials, 396, 122–725. https://doi.org/10.1016/j.jhazmat.2020.122725.

Wang, S., Fang, C., Guan, X., Pang, B., & Ma, H. (2014). Urbanisation, energy consumption, and carbon dioxide emissions in China: A panel data analysis of China’s provinces. Applied Energy, 136, 738–749.

Wang, Y., Wang, Y., Zhou, J., Zhu, X., & Lu, G. (2011). Energy consumption and economic growth in China: A multivariate causality test. Energy Policy, 39(7), 4399–4406.

World Development Bank. (2020). World Development Indicators. Retrieved July 15, 2019, from http://databank.worldbank.org/data/reports.aspx?source=world-development-indicators#

Wu, B., Jin, C., Monfort, A., & Hua, D. (2021). Generous charity to preserve green image? Exploring linkage between strategic donations and environmental misconduct. Journal of Business Research, 131, 839–850. https://doi.org/10.1016/j.jbusres.2020.10.040.

Wu, S., Li, L., & Li, S. (2018). Natural resource abundance, natural resource-oriented industry dependence, and economic growth: Evidence from the provincial level in China. Resources, Conservation and Recycling, 139, 163–171.

Xu, Z., Baloch, M. A., Meng, F., Zhang, J., & Mahmood, Z. (2018). Nexus between financial development and CO 2 emissions in Saudi Arabia: Analyzing the role of globalization. Environmental Science and Pollution Research, 25(28), 28378–28390.

Yu, Z., Razzaq, A., Rehman, A., et al. 2021 Disruption in global supply chain and socio-economic shocks: a lesson from COVID-19 for sustainable production and consumption. Operations Management Research 1–16.

Zafar, M. W., Saud, S., & Hou, F. (2019). The impact of globalization and financial development on environmental quality: evidence from selected countries in the Organization for Economic Co-operation and Development (OECD). Environmental Science and Pollution Research, 1–17.

Zakaria, M., & Bibi, S. (2019). Financial development and environment in South Asia: the role of institutional quality. Environmental Science and Pollution Research, 1–12.

Zhang, Y. J. (2011). The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy, 39(4), 2197–2203.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Data availability

All data are openly available and sources of data are dully cited in the data section.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ling, G., Razzaq, A., Guo, Y. et al. Asymmetric and time-varying linkages between carbon emissions, globalization, natural resources and financial development in China. Environ Dev Sustain 24, 6702–6730 (2022). https://doi.org/10.1007/s10668-021-01724-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-021-01724-2