Abstract

The objective of the study is to examine the impact of energy demand on carbon emissions in mediation of financial development and economic growth in a panel of 101 countries by using the time series data from 1995 to 2018. The study employed dynamic GMM estimator in order to reduce possible endogeneity in the given model. Further, the study used Granger causality and innovation accounting matrix (IAM) to find the causal relationships and variance error shocks between the variables. The results show that energy demand and FDI inflows increase carbon emissions, while financial development decreases carbon emissions across countries. Moreover, the results confirmed the inverted U-shaped relationship between income and emissions with a turning point of US$43,500. Among 101 countries, only 13 countries hold environmental Kuznets curve (EKC) hypothesis as their per capita income surpassed the stated turning point, while the remaining countries exhibit “race to the bottom” hypothesis. The feedback relationship is established between (i) income and carbon emissions, (ii) money supply and carbon emissions, and (iii) FDI inflows and energy demand across countries, whereas one-way linkages found in (i) carbon emissions to money supply, (ii) energy demand to money supply, (iii) money supply to FDI inflows and income, and (iv) energy demand to income across countries. The IAM analysis shows that energy demand, FDI inflows, and money supply will likely to increase carbon emissions, while money supply will decrease carbon emissions over a time horizon.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The balance between energy demand and carbon emissions is highly desirable in order to reduce negative environmental externalities in the form of exacerbation of GHG emissions and climate change that affect countries’ sustainable development projects (Sarkodie and Strezov 2019, Anser et al. 2020, etc.). The need of global renewable energy demand is increasing due to its greening effects on environment (Dietzenbacher et al. 2020, Chu and Hawkes 2020, Naz et al. 2019, etc.). Financial development is another important factor that would be helpful to reduce carbon emissions through financing in the eco-friendly production and technologies (Saud et al. 2020, Anton and Nucu 2020, Chen et al. 2019, etc.). Table 1 shows the current literature on energy and carbon emissions across countries.

Earlier literature widely discussed the different scenarios of EKC hypothesis, especially, Taguchi (2013) and Rasli et al. (2018) that are considered the main proponents, which presented the divergent views of EKC, including “new toxics pollutants,” “race to the bottom hypothesis,” “conventional EKC hypothesis,” and “revised EKC hypothesis.” The “conventional EKC hypothesis” stated that income is the main predictor that influenced the level of emissions, as higher income level would surpassed after some times to be helpful to reduce emissions intensity; however, it required more policy-oriented mechanism to limit emissions. Carbon pricing is the optimistic solution to achieve this target, and it benefited from generating extra revenues from carbon tax to spend on environmental conservation (Nassani et al. 2019). The parabola relationship could be found between income and emissions by adopting strict environmental regulations in the given hypothesis (Stern 2004). The second divergent view of EKC hypothesis is the emergence of “new toxic pollutants” phenomenon, as high-tech industrial production increases unregulated pollutants along with an increase in country’s income that never could be stopped until and unless the countries could signed on some environmental treaties to be conserved the natural environmental through regulated production (Karsch 2019). The “race to the bottom hypothesis” presented another divergent view of EKC, which provoked that higher income of the country leads to increase pollution intensity at certain point interval, which becomes constantly increasing after doubling the income. Thus, an ease of environmental regulations shifts the pollution base from developed to developing countries that exacerbate the pollution level. Thus, the need of initiating the environmental certifications is highly desirable for limiting the pollution shifts from developed to developing countries (Dinda 2004). The “revised EKC hypothesis” shows that country’s environmental reforms restrain income and pollution level due to growing public concern about environmental regulations, which although show a parabola relationship between the two variables; however, it is lower than the “conventional EKC” (Yao et al. 2019). Table 2 shows the energy-finance embodied EKC hypothesis across countries.

The present study has some novel contribution in the existing literature to distinguish it with the other studies, i.e., broad money supply is used as a financial development indicator in the study that is important in order to analyzed the financial deepening of the financial sector, while the previous studies largely used “domestic credit to private sector” as a financial instrument in order to observe the financial depth of the capital market. Further, energy demand is included in between financial indicator and carbon emissions as a mediator to get insights about the financial deepening effect on energy sector to reduce carbon abatement costs. Both the FDI inflows and economic growth simultaneous be used in the given nexus to substantiate “pollution haven” hypothesis and EKC hypothesis, respectively, under the capital market gains. Thus, these motivations bring to make this study more pragmatic and policy oriented. The main questions that also evolved in the key prescribed variables that used in this study are as follows:

-

To what extent financial market capitalize green energy projects to limit carbon emissions?

-

Does FDI inflows would be helpful to reduce carbon emissions through cleaner production technologies?

-

Whether continued economic growth improves environmental quality under green financing projects?

These questions would be highly needed to explore the given nexus for sustainable development across countries. The objectives of the study are as follows:

-

i)

To examine the impact of financial development, energy demand, and economic growth on carbon emissions across countries

-

ii)

To evaluate the EKC hypothesis and “pollution haven” hypothesis under financial development indicator

-

iii)

To analyze the causal relationship and variance error shocks among the variables

These objectives have been set to analyze the dynamic linkages among the studied variables at level and over a time horizon, which would give more insights into the future-oriented action plans towards reaching environmental sustainable goals at global scale.

Material, methods, results, and discussion

Table 3 shows the list of variables and their descriptive statistics for ready reference. The carbon emissions served as a “criterion” variable, while money supply, FDI inflows, energy demand, and GDP per capita served as predictors of the response variable. The maximum carbon emissions value is about 70.042 metric tons during the period of 1990–2018. The average growth in the money supply, on average, is far higher than the FDI inflows during the stipulated time period, which are about 57.45% relative to GDP in money supply and 3.64% in FDI inflows across countries. The maximum value of per capita income and energy demand reached US$92077.57 and 160.06 kg of oil equivalent, respectively.

The data of the candidate variables of 101 countries for a period of 1995–2018 are taken from World Bank (2019) data set. Table 4 shows the list of the sample countries for ready reference.

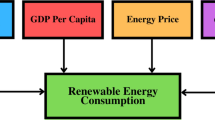

The study followed the Stern (2004) reduced form of equations where emissions are subject to be changed through increase in income at its second degree. The empirical equation of the study is further extended with the recent scholarly work of Yue et al. (2020), Nizam et al. (2020), and Khan et al. (2019) and illustrated in a schematic manner, i.e.:

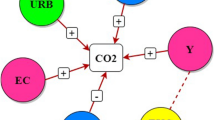

where CO2 shows carbon emissions, BMS shows broad money supply, ENU shows energy use, FDI shows FDI inflows, GDPpc shows per capita GDP, SQGDPpc shows square of GDPpc, and ƹ shows error term.

There are number of alternative panel statistical measures available in order to get sound inferences of the parameter of interests, not limited to the following, i.e., panel least squares regression, panel fixed effect versus random effect models, panel cointegration techniques, and panel instrumental variables techniques. The instrumental variable techniques have a distinct position among the rest of the methods, as it handles possible endogeneity issues among the regressors, for instance, two-stage least squares (2SLS) regression, 3SLS, and GMM estimator. These are the estimators used in different situations where the endogeneity issues become a major concern; hence, system and differenced GMM estimators are considered more reliable techniques where the number of cross-sections is larger than the variables of interest to get robust inferences. Thus, the study employed dynamic GMM estimator proposed by Arellano-Bond differenced estimator that gives robust inferences by minimizing possible endogeneity from the given data set. The endogeneity is handled by incorporating the first lagged of the criterion variable and predictor variables. The Hansen J statistics and instrumental rank checked the instrumental validity in the given model. Equation (2) shows the Arellano-Bond illustration as follows:

where z shows instrumental variables.

Table 5 shows the differenced GMM estimates of the given variables. The results show that the first lagged of the criterion variable has a positive sign that implies divergence in the carbon emissions data, which need sustainable policy instruments to mitigate carbon emissions across countries. The negative relationship is found between money supply and carbon emissions, which implies that financial development substantially decreases carbon emissions through initiating investment in the green financing projects (Hoque et al. 2019, Rani 2020, etc.), whereas the positive relationship found between energy demand and carbon emissions that provoked the viability of energy associated emissions, which could be reduced by shifting towards non-renewable to renewable energy fuels at global scale (Destek and Sinha 2020, Kabel and Bassim 2020, etc.). The emission intensity is increasing through financial liberalization policies, which substantiate “pollution haven” hypothesis in a panel of selected countries. The need of strict environmental regulations and use of cleaner production technologies would be the sustainable instruments for limiting dirty polluting industries at global scale (Dou and Han 2019, Shao et al. 2019, etc.).

The positive relationship exerts between GDPpc and carbon emissions at initial level, while it becomes negative relationship at its second degree coefficient value which tends to exhibit the inverted U-shaped relationship between them to support EKC hypothesis. The turning point of US$43,500 is required to achieve environmental sustainability agenda in the selected sample of the countries. On the basis of EKC turning point, only 13 countries are qualified to reduce carbon emissions through continued economic growth, which surpass the threshold level of US$43,500. Table 6 shows the qualified list of countries that could achieve EKC hypothesis through increasing their GDP per capita. The 13 countries listed in the given table show that the countries have an ability to achieve EKC hypothesis as their GDP per capita falls in the EKC threshold, while 88 countries have not yet achieved EKC hypothesis as their income level is far less than the threshold level. Thus, the “race to the bottom” hypothesis would be visible in the remaining countries.

Table 7 shows the estimates of VAR Granger causality, IRF, and VDA for ready reference. The results confirmed the feedback relationship between GDPpc and carbon emissions and FDI inflows and energy demand while the unidirectional causality running from carbon emissions to money supply, energy demand to money supply, money supply to FDI inflows and GDP per capita, and energy demand to GDP per capita. The results supported carbon-led finance, energy-led finance, finance-led growth, and energy-led growth hypothesis across countries.

The IRF estimates show that energy demand, FDI inflows, and GDP per capita will likely to increase carbon emissions, whereas money supply will decrease carbon emissions for the next 10-year time period. The forecast variance error shocks show that income will exert a greater magnitude in terms of influencing carbon emissions, while money supply will exert a least influenced to carbon emissions over a time horizon.

Conclusion and policy implications

The environmental sustainability agenda is highly provoked in the academic and research literature, which need sustainable policy instruments to mitigate carbon emissions across countries. This study focused on energy demand and carbon emissions in the mediation of financial development and economic growth in a diversified panel of countries, and it is utilized in the long-term time series data from 1995 to 2018 to obtain robust inferences. The results confirmed the EKC hypothesis, energy associated emissions, and “pollution haven” hypothesis across countries. The bidirectional causality found between income and carbon emissions and energy and FDI inflows, while unidirectional relationship is running from carbon emissions to financial development, financial development to FDI inflows and income, and energy demand to income across countries. The variance error shocks show that country’s income will exert a greater magnitude, while money supply will be least influence to carbon emissions for the next 10-year time period. The following policy implications are proposed to conserve global environment, i.e.:

-

i)

Financial development may played a vital role to improve environmental quality through initiated green financing projects, for instance, investment in the renewable energy sources, alternative energy fuels, startups sustainable projects, and to get equipped with efficient machinery for eco-friendly production.

-

ii)

Carbon pricing mechanism should be introduced in order to minimize the production of air pollutants, while at the same time the revenue generated from carbon tax would be spend for eco-friendly production, growing more plants, efficient waste recycling process, and carbon abatement cost. Thus, the advancement in the cleaner production process is key for achieving global environmental sustainability agenda.

-

iii)

High need for environmental regulation to conserve natural environment is imperative for long-term sustainable development. The efforts should be made to limiting the use of chemicals that affect ozone layer and introduced emissions – cap trading programs for controlling emissions.

These policy implications are highly important for governing environmental laws to protect natural environment.

References

Akram R, Chen F, Khalid F, Ye Z, Majeed MT (2020) Heterogeneous effects of energy efficiency and renewable energy on carbon emissions: evidence from developing countries. J Clean Prod 247:119122

Altıntaş H, Kassouri Y (2020) Is the environmental Kuznets curve in Europe related to the per-capita ecological footprint or CO2 emissions? Ecol Indic 113:106187

Anser MK, Yousaf Z, Zaman K, Nassani AA, Alotaibi SM, Jambari H, Khan A, Kabbani A (2020) Determination of resource curse hypothesis in mediation of financial development and clean energy sources: go-for-green resource policies. Res Policy 66:101640

Anton SG, Nucu AEA (2020) The effect of financial development on renewable energy consumption. A panel data approach. Renew Energy 147:330–338

Awodumi OB, Adewuyi AO (2020) The role of non-renewable energy consumption in economic growth and carbon emission: evidence from oil producing economies in Africa. Energy Strateg Rev 27:100434

Aziz N, Sharif A, Raza A, Rong K (2020) Revisiting the role of forestry, agriculture, and renewable energy in testing environment Kuznets curve in Pakistan: evidence from Quantile ARDL approach. Environ Sci Pollut Res 27:10115–10128

Badulescu D, Badulescu A, Simut R, Bac D, Iancu EA, Iancu N (2020) Exploring environmental Kuznets curve. An investigation on EU economies. Technol Econ Dev Econ 26(1):1–20

Bass A, Burakov D, Freidin M (2019) Does financial development matter for environmental Kuznets curve in Russia? Evidence from the autoregressive distributed lag bounds test approach. Int J Energy Econ Policy 9(4):334–341

Chen Q, Taylor D (2020) Economic development and pollution emissions in Singapore: evidence in support of the environmental Kuznets curve hypothesis and its implications for regional sustainability. J Clean Prod 243:118637

Chen S, Saleem N, Bari MW (2019) Financial development and its moderating role in environmental Kuznets curve: evidence from Pakistan. Environ Sci Pollut Res 26(19):19305–19319

Chu CT, Hawkes AD (2020) A geographic information system-based global variable renewable potential assessment using spatially resolved simulation. Energy 193:116630

Danish, Ulucak R, Khan SUD (2020) Determinants of the ecological footprint: role of renewable energy, natural resources, and urbanization. Sustain Cities Soc 54:101996

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic co-operation and development countries. J Clean Prod 242:118537

Dietzenbacher E, Kulionis V, Capurro F (2020) Measuring the effects of energy transition: a structural decomposition analysis of the change in renewable energy use between 2000 and 2014. Appl Energy 258:114040

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49(4):431–455

Dogan E, Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res 27:12717–12724

Dou J, Han X (2019) How does the industry mobility affect pollution industry transfer in China: empirical test on pollution haven hypothesis and porter hypothesis. J Clean Prod 217:105–115

Ehigiamusoe KU, Lean HH, Smyth R (2020) The moderating role of energy consumption in the carbon emissions-income nexus in middle-income countries. Appl Energy 261:114215

Farhani S, Balsalobre-Lorente D (2020) Comparing the role of coal to other energy resources in the environmental Kuznets curve of three large economies. Chin Econ 53(1):82–120

Gill AR, Hassan S, Haseeb M (2019) Moderating role of financial development in environmental Kuznets: a case study of Malaysia. Environ Sci Pollut Res 26(33):34468–34478

Gulistan A, Tariq YB, Bashir MF (2020) Dynamic relationship among economic growth, energy, trade openness, tourism, and environmental degradation: fresh global evidence. Environ Sci Pollut Res:1–11

Hoque N, Mowla M, Uddin MS, Mamun A, Uddin MR (2019) Green banking practices in Bangladesh: a critical investigation. Int J Econ Financ 11(3):58–68

Ike GN, Usman O, Sarkodie SA (2020) Testing the role of oil production in the environmental Kuznets curve of oil producing countries: new insights from method of moments quantile regression. Sci Total Environ 711:135208

Jin T, Kim J (2020) Investigating the environmental Kuznets curve for annex I countries using heterogeneous panel data analysis. Environ Sci Pollut Res:1–16

Kabel TS, Bassim M (2020) Reasons for shifting and barriers to renewable energy: a. Int J Energy Econ Policy 10(2):89–94

Karsch NM (2019) Examining the validity of the environmental Kuznets curve. Consilience 21:32–50

Khan KA, Zaman K, Shoukry AM, Sharkawy A, Gani S, Ahmad J et al (2019) Natural disasters and economic losses: controlling external migration, energy and environmental resources, water demand, and financial development for global prosperity. Environ Sci Pollut Res 26(14):14287–14299

Khattak SI, Ahmad M, Khan ZU, Khan A (2020) Exploring the impact of innovation, renewable energy consumption, and income on CO2 emissions: new evidence from the BRICS economies. Environ Sci Pollut Res:1–16

Magazzino C, Bekun FV, Etokakpan MU, Uzuner G (2020) Modeling the dynamic Nexus among coal consumption, pollutant emissions and real income: empirical evidence from South Africa. Environ Sci Pollut Res:1–11

Mahi M, Phoong SW, Ismail I, Isa CR (2020) Energy–finance–growth nexus in ASEAN-5 countries: an ARDL bounds test approach. Sustainability 12(1):article ID: 5

Mukhtarov S, Humbatova S, Seyfullayev I, Kalbiyev Y (2020) The effect of financial development on energy consumption in the case of Kazakhstan. J Appl Econ 23(1):75–88

Nassani AA, Awan U, Zaman K, Hyder S, Aldakhil AM, Abro MMQ (2019) Management of natural resources and material pricing: global evidence. Res Policy 64:101500

Naz S, Sultan R, Zaman K, Aldakhil AM, Nassani AA, Abro MMQ (2019) Moderating and mediating role of renewable energy consumption, FDI inflows, and economic growth on carbon dioxide emissions: evidence from robust least square estimator. Environ Sci Pollut Res 26(3):2806–2819

Nizam HA, Zaman K, Khan KB, Batool R, Khurshid MA, Shoukry AM et al (2020) Achieving environmental sustainability through information technology:“digital Pakistan” initiative for green development. Environ Sci Pollut Res:1–16

Phong LH (2019) Globalization, financial development, and environmental degradation in the presence of environmental Kuznets curve: evidence from ASEAN-5 countries. Int J Energy Econ Policy 9(2):40–50

Przychodzen W, Przychodzen J (2020) Determinants of renewable energy production in transition economies: a panel data approach. Energy 191:116583

Rahman HU, Ghazali A, Bhatti GA, Khan SU (2020) Role of economic growth, financial development, trade, energy and FDI in environmental Kuznets curve for Lithuania: evidence from ARDL bounds testing approach. Eng Econ 31(1):39–49

Rani L (2020) Green banking for sustainable development: initiatives by SBI & ICICI. Our Heritage 68(30):12271–12283

Rasli AM, Qureshi MI, Isah-Chikaji A, Zaman K, Ahmad M (2018) New toxics, race to the bottom and revised environmental Kuznets curve: the case of local and global pollutants. Renew Sust Energ Rev 81:3120–3130

Raza SA, Shah N, Khan KA (2020) Residential energy environmental Kuznets curve in emerging economies: the role of economic growth, renewable energy consumption, and financial development. Environ Sci Pollut Res 27(5):5620–5629

Saint Akadiri S, Alola AA, Olasehinde-Williams G, Etokakpan MU (2020) The role of electricity consumption, globalization and economic growth in carbon dioxide emissions and its implications for environmental sustainability targets. Sci Total Environ 708:134653

Sarkodie SA, Ozturk I (2020) Investigating the environmental Kuznets curve hypothesis in Kenya: a multivariate analysis. Renew Sust Energ Rev 117:109481

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Saud S, Chen S, Haseeb A, Khan K, Imran M (2019) The nexus between financial development, income level, and environment in central and eastern European countries: a perspective on belt and road initiative. Environ Sci Pollut Res 26(16):16053–16075

Saud S, Chen S, Haseeb A (2020) The role of financial development and globalization in the environment: accounting ecological footprint indicators for selected one-belt-one-road initiative countries. J Clean Prod 250:119518

Shahbaz M, Haouas I, Sohag K, Ozturk I (2020) The financial development-environmental degradation nexus in the United Arab Emirates: the importance of growth, globalization and structural breaks. Environ Sci Pollut Res:1–15

Shaheen A, Sheng J, Arshad S, Salam S, Hafeez M (2020) The dynamic linkage between income, energy consumption, urbanization and carbon emissions in Pakistan. Pol J Environ Stud 29(1):267–276

Shao Q, Wang X, Zhou Q, Balogh L (2019) Pollution haven hypothesis revisited: a comparison of the BRICS and MINT countries based on VECM approach. J Clean Prod 227:724–738

Stern DI (2004) The rise and fall of the environmental Kuznets curve. World Dev 32(8):1419–1439

Taguchi H (2013) The environmental Kuznets curve in Asia: the case of sulphur and carbon emissions. Asia Pac Dev J 19(2):77–92

Ullah A, Khan D (2020) Testing environmental Kuznets curve hypothesis in the presence of green revolution: a cointegration analysis for Pakistan. Environ Sci Pollut Res:1–17

Wasti SKA, Zaidi SW (2020) An empirical investigation between CO2 emission, energy consumption, trade liberalization and economic growth: a case of Kuwait. J Build Eng 28:101104

World Bank (2019) World development indicators. World Bank, Washington D.C

Yao S, Zhang S, Zhang X (2019) Renewable energy, carbon emission and economic growth: a revised environmental Kuznets curve perspective. J Clean Prod 235:1338–1352

Yue S, Munir IU, Hyder S, Nassani AA, Abro MMQ, Zaman K (2020) Sustainable food production, forest biodiversity and mineral pricing: interconnected global issues. Res Policy 65:101583

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Vo, X.V., Zaman, K. Relationship between energy demand, financial development, and carbon emissions in a panel of 101 countries: “go the extra mile” for sustainable development. Environ Sci Pollut Res 27, 23356–23363 (2020). https://doi.org/10.1007/s11356-020-08933-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-08933-8