Abstract

One of the solutions to climate change is the adoption and use of renewable energy sources. This understanding has driven Nigerian stakeholders to set a goal of achieving net–zero emissions by 2060. Capitalizing on the limitations of existing literature, this study employs a Quantile–on–Quantile (QQ) and quantile regression approach to investigate the impact of financial development on renewable energy consumption in Nigeria from 1960–2018. In addition, this research uses GDP per capita, energy price, and CO2 emissions as moderating variables to eliminate omitted variable bias. The outcome of the QQ technique showed that financial development supplies mixed shocks (positive and negative) to renewable energy consumption. The negative shocks are highly negative. The quantile regression result also showed that financial development influences renewable energy consumption negatively at the lower quantile (0.10–0.20) and the upper quantile (0.80–0.90). The policy implications are discussed for Nigeria.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Greenhouse gases (GHGs) include carbon dioxide emissions (CO2), methane emissions (CH4), nitrous oxide emissions (N2O), and fluorinated gases (EPA 2022). The largest contributor to GHGs is CO2 emissions. According to Carbon Brief (2022), global CO2 emissions increased by 0.8%, caused by land use and fossil fuel CO2 emissions. This negatively affects the environment by increasing temperature, rising sea levels, and altering ecosystems.

Due to these negative impacts, discussions on the best strategy to achieve net–zero emissions are ongoing. One of the pathways being discussed is for economies to transit from fossil fuel to renewable energy consumption. For this to be achieved, financial commitments and investments are required, emphasizing the role of a well–developed financial system. Demirguc–Kunt (2006) remarked that stable economies are built on a well–functioning financial system. Abdulraheem et al. (2016) also mentioned that a developed financial system allows for an even distribution of economic opportunities amongst economic agents. The World Bank (2016) stated that financial development; (i) encourages capital accumulation and technological progress, (ii) contributes positively to long–term growth, (iii) can reduce poverty and inequality because it allows credit to be easily accessible to the poor and vulnerable and (iv) contributes to Small and Medium Size Enterprises (SMEs) growth by providing easy access to finance for business purposes.

Financial development allows for easy access to capital and loans, reduces borrowing costs, mitigates financial risks, facilitates transparency between creditors and debtors, encourages cross–border investments, and enables countries to adopt cutting–edge technology for environmentally friendly industries (Sadorsky 2010; Ulucak 2021; Abbasi et al. 2022; Awosusi et al. 2022). Each of these factors facilitates renewable energy consumption. On the other hand, due to easy access to capital and loans, financial development can also boost the use of fossil fuels, which increases CO2 emissions. A rise in CO2 emissions depicts that renewable energy use is declining.

Financial development can be divided into financial institutions and financial markets. Financial institutions include central banks, commercial banks, investment companies, insurance companies, brokerage companies, and mortgage companies. The financial market entails the stock market, bond market, and other commodities (Svirydzenka 2016). These components can be further split into depth, access, and efficiency. This study focuses on the depth of financial development.

In attaining the Sustainable Development Goals (SDG7&13), renewable energy consumption has always been deliberation (Antonakakis et al. 2017). This is because renewable energy can spur economic progress, lessen the damaging effect of fossil fuels, and give rise to sustainable development practices (Khare et al. 2016; Wang & Wang 2020). Li et al. (2021) opined that notable structural shifts in energy, trade, economy, and society have emerged due to renewable energy. In addition, Wang et al. (2022) stated that 68% of global GHGs come from the energy sector, and fossil fuels contribute 44% to these emissions. Therefore, substituting fossil fuels for renewable energy sources can help solve climate change problems (Wang et al. 2023).

According to a report by IEA (2022), the global power mix will be transformed by using renewables, and it will become the biggest electricity source. In 2021, US$366 billion was invested in renewables. More than 50% of climate mitigation finance is allotted to hydropower, solar PV, and wind power (REN21, 2022). Also, renewable energy increased by eight exajoules from 2019 to 2021 (BP 2022). This growth is attributed to policy support that is strong in China, European Union, and Latin America. Therefore, since funding is needed to combat climate change, it is paramount to continue investigating financial development’s role in renewable energy consumption.

There needs to be more literature on how financial development impacts renewable energy consumption. More studies have focused on the financial development–energy consumption nexus. With this rationale, this research contributes to the existing literature in the following ways; (i) It uses a novel proxy for financial development, called domestic credit to the private sector by banks (% of GDP). This measures the financial depth and plays a major role in the stability of the Nigerian economy. Data from 1960–2020 showed that domestic credit to the private sector by banks in Nigeria averaged 12.31%, ranking the 121st position out of 131 countries. This is low compared to developed countries. The top countries are Hong Kong (258.45%), the USA (216.33%), and China (182.43%) (Global Economy 2020). (ii) It indirectly contributes to existing literature due to the inconclusive evidence of the financial development–renewable energy consumption nexus (Ozdeser et al. 2021; Shahbaz et al. 2021; Wang et al. 2021; Mukhtarov et al. 2022; Samour et al. 2022; Somoye et al. 2022; Jiakui et al. 2023). (iii) This paper incorporates some major determinants of renewable energy consumption, such as GDP per capita, energy price, and CO2 emissions. (iv) Nigeria is used as a case study in this research because of its potential across different parameters. According to World Bank (2022), Nigeria has the highest GDP (US$440.8 billion) and population size (211.4 million) among the Sub–Saharan African (SSA) countries. Nigeria has abundant renewable energy (solar, wind, biomass, and geothermal) and non–renewable energy sources (oil, gas, and coal). Nigeria is also one of the major oil players globally and is going through a series of energy crises in which renewable energy adoption can be a solution. (v) The quantile–on–quantile regression approach is employed in this study. Hung et al. (2022) explained that quantile–on–quantile regression has the advanced ability to combine quantile regression and non–parametric frameworks. It provides adequate information regarding the asymmetric impact of independent variables on the dependent variable across quantiles. In addition, it allows cross–dependence to be accessed between quantiles. This means that it is more policy informative than the mean–based estimation. (vi) The quantile regression approach is utilized as a robustness check for the quantile–on–quantile approach.

This study is organized as follows: The second section entails the literature review. The third section shows the theoretical framework, data, and methodology employed, while section four presents the empirical results. Section five concludes the study and recommends policies for implementation.

2 Literature review

This section examines the relationship between financial development, GDP per capita, energy price, CO2 emissions, and renewable energy consumption.

2.1 Financial development (FDE) and renewable energy consumption

In 119 non–OECD countries, Brunnschweiler (2010) found a significant positive impact of financial intermediation (commercial banking activities) on renewable energy produced. Its impact can be seen in non–hydropower renewable energy sources such as wind, solar, geothermal, and biomass. The study also stated that the renewable energy sector has picked up significantly since adopting the Kyoto Protocol. In 55 global countries, Fangmin & Jun (2011) found that financial intermediation is necessary for renewable energy projects, especially hydropower projects. Kim & Park (2016) opined that the impact of financial development (FDE) on renewable energy (REN) is highly dependent on external financing. In the case of Russia, Burakov (2017) found no causality between FDE and REN. Steffen (2018) found that project finance is more viable for renewable energy projects than fossil fuel-based projects in the case of low investment risk situations. Shahbaz et al. (2018) found that FDE hinders REN.

In 22 OECD countries, Pham (2019) stated that FDE has a significant and positive impact on REN. The study further revealed that the effect of FDE on REN depends on carbon intensity and the growth rate of innovation. A more significant effect is seen in countries with higher carbon intensity and growth of innovation. In India, Eren et al. (2019) used a Principal Component Analysis (PCA) to group the FDE variables and found that FDE is essential for REN. In China, Ji & Zhang (2019) further explained that FDE is necessary for the country's renewable energy usage to increase. The study further stated that there is a need for effective policies for REN to grow while paying attention to the renewable energy development path of the European Union. In addition, the capital market variable contributes more to REN than other FDE variables.

Using stock market development (SMD), banking sector development (BSD), and bond market development (BMD) variables to proxy for financial development in 28 European Union (EU) countries, Anton and Nucu (2020) discovered that FDE is an essential condition for REN. Further results, however, showed that SMD does not affect REN in new member states of the EU. This is because the stock market is still developing in these new countries, which makes it lack the financial depth to contribute to REN. In 15 top renewable energy consumption countries, Raza et al. (2020) showed that FDE influences REN positively and negatively depending on the threshold. Mukhtarov et al. (2020) acknowledged that FDE is crucial for REN in Azerbaijan. Khan et al. (2020) discovered that FDE is necessary for developing renewable energy. The study further explained that a well–developed financial system provides the right incentives for renewable energy investments. Qamruzzaman & Jianguo (2020) also showed that FDE impacts REN positively.

Wang et al. (2021) found that FDE impacts REN positively in the short-run and negatively in the long–run. The factor contributing to the long–run negative effect is the higher financial costs that discourage investments in renewable energy. In the top 10 investment countries, Raghutla et al. (2021) discovered that SMD's impact on REN is negative. The study discovered that to promote and finance REN, FDI inflows and R&D are essential. In BRICS countries, Isiksal (2021) established that expanding the financial sector significantly contributes to renewable electricity production. Koksal et al. (2021) found that FDE positively and significantly impacts REN. On the other hand, financial efficiency had no relationship with renewable energy demand. Saygin & Iskenderoglu (2021) found that the impact of FDE on REN depends on the FDE variable used. The banking sector variables have a negative impact, while the stock market variable has a positive impact. The research outcome of Shahbaz et al. (2021) also stated that FDE increases the demand for renewable.

2.2 GDP per capita (income) and renewable energy consumption

Omri and Nguyen (2014) studied 64 countries, dividing them into higher, middle, and lower-income countries. For higher and middle–income countries, income drives REN. However, for lower–income countries, income is statistically insignificant. Ergun et al. (2019) found a negative relationship between income and REN in African countries. Topcu & Tugcu (2020) explained that when there is a fair income distribution, REN will be impacted positively. The study further stated that when income inequality is reduced, it will increase people's ecological awareness, thereby increasing their economic concerns. This will contribute significantly to an increase in demand for a clean environment. The government can support or encourage this perspective through tax concessions and credit facilities for renewable energy investments.

Using a granger causality approach, Simionescu et al. (2020) found a positive relationship between income and REN. The study further stated that there is causality from income to REN, which implies that an increase in income enables people to consume more renewable energy sources. Iorember et al. (2020) revealed a unidirectional causality from GDP per capita to REN in Nigeria using the ARDL and VECM approach. Chen et al. (2021) explained that income increases REN in democratic countries, while in countries that are less democratic, there is a negative relationship between GDP per capita and REN. Shahbaz et al. (2021) argued that renewable energy consumption decreases as per capita income increases due to insufficient income.

2.3 Energy price (PRI) and renewable energy consumption

Asafu–Adjaye (2000) found a bidirectional causal relationship between PRI and energy consumption. Chang et al. (2009) found a positive relationship between PRI and REN in a higher economic growth regime. However, no relationship was found in a regime of lower economic growth. Using VAR and VECM methodologies, Yuan et al. (2010) explained that an increase in PRI will reduce household energy consumption in the long–run and reduce energy consumption in the short–run in the Chinese industrial sector. Moreno et al. (2012) found a positive relationship between PRI and REN. Nayan et al. (2013) revealed that PRI is one of the major determinants of energy consumption. In Denmark, Munrad et al. (2019) stated that PRI impacts energy consumption negatively and significantly. PRI also granger causes energy consumption in Denmark. In high and lower–middle–income countries, Wang et al. (2019) opined that PRI impacts energy consumption negatively. For upper-middle-income countries, the impact is positive. Chen et al. (2021) used real oil prices to proxy for PRI and found that increasing oil prices increase renewable energy consumption in less democratic countries. However, there is no significant relationship in democratic countries. Shahbaz et al. (2021) found that PRI is insignificant in determining renewable energy consumption. Alsagr & Van–Hemmen (2021) found a positive relationship between PRI and REN.

2.4 CO2 emissions and renewable energy consumption

Sardosky (2009) opined that CO2 emissions increase REN in France & UK and decrease REN in Japan in the long–run. However, in the short–run, the interactions among the variables are statistically insignificant, which could be a result of a relatively short sample period. In 19 developed and developing countries, Apergis et al. (2010) showed that CO2 emissions positively correlate with REN. Dogan & Ozturk (2017) explained that CO2 emissions contribute to the degradation of the environment in the USA. Shafiei & Salim (2014) revealed that REN reduces CO2 emissions in OECD countries. Using the Toda–Yamamoto causality approach, Menyah & Wolde–Rufae (2010) found a unidirectional causality moving from CO2 emissions to REN. Jaforullah & King (2015) explained that an increase in REN mitigates CO2 emissions. Using a VAR model, Kahia et al. (2016) found that the relationship between CO2 emissions and REN is negative in both causal directions. Sharif et al. (2020) found mixed results (positive and negative) among the top 10 polluting emission countries. Chen et al. (2019) found unidirectional causality from CO2 emissions to REN in the short–run. Using the Toda–Yamamoto causality approach, Kang et al. (2019) found no causality between CO2 emissions and REN in India. Using the NARDL methodology, Toumi and Toumi (2019) found that positive and negative shocks of CO2 emissions increase REN in the long–run, while in the short–run, a positive shock of CO2 emissions decreases REN. Alola et al. (2019) also found a feedback relationship between CO2 emissions and REN.

In summary, various studies have explored the connection among the chosen economic variables. However, they provide mixed evidence using diverse techniques, data, study periods, and countries. Also, limited literature dissects the role of financial development in renewable energy consumption. Therefore, this research unlocks a new discussion into the link among these economic variables. In addition, the literature reviewed has not incorporated the economic indicators for the case of Nigeria. Thus, this study fills the gap by utilizing the Quantile–on–Quantile and quantile regression approach for the Nigerian economy. The findings of this study provide fresh insights, enhancing theoretical and empirical research in this area. Figure 1 and Table 1 show the graphical relationship between the variables and the literature review summary, respectively.

3 Theoretical framework, data, and methods

In line with Qamruzzaman & Jianguo (2020), the theoretical framework of this study is based on four major assumptions: the supply–leading hypothesis, the demand–following hypothesis, the feedback hypothesis, and the neutrality hypothesis. The supply–leading hypothesis states that a causal flow moves from FDE to REN. The demand–following hypothesis shows a movement from REN to FDE. The feedback hypothesis demonstrates a bidirectional relationship between FDE and REN. Lastly, the neutrality hypothesis shows no causal relationship between FDE and REN.

Sardosky (2010) expressed that income and price are major determinants of energy consumption. Mukhtarov et al. (2022) stated that market uncertainties occur when there is high inflation. This study proxy’s energy prices with the consumer price index, a well–known indicator of inflation. All things being equal, a higher inflation rate leads to a decline in the purchasing power of consumers. Therefore, countries with high inflation rates will find it difficult to increase renewable energy consumption (Selmi et al. 2020).

Based on the Keynesian consumption function, there is a positive relationship between disposable income and consumption, with all other factors remaining constant. This means that as income increases, consumption also increases. Energy consumers will have more choices and capacity to use renewable energy as income increases. Based on the established theoretical viewpoint, the functional specification of this study is expressed as follows:

where REN is renewable energy consumption; FDE is financial development; GDP is Gross Domestic Product per capita; PRI is energy prices proxied by the consumer price index and; COE is CO2 emissions.

3.1 Data

The Data used in this study is annual data from 1960–2018. The variables employed are renewable energy consumption (REN), domestic credit to the private sector by banks (FDE), GDP Per Capita (GDP), Consumer Price Index (PRI), and CO2 Emissions (COE). FDE is a proxy for financial development, GDP is the proxy for income, and PRI is the proxy for energy prices. The dependent variable is REN, while the other variables are independent. In addition, the R software is used to obtain the QQ regression estimation results, while the Eviews software is used to obtain the Quantile regression estimation results. The variables description is presented in Table 2.

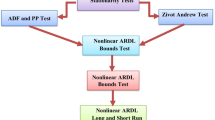

3.2 Method

3.2.1 Quantile–on–Quantile (QQ) approach

The QQ regression method is a modification of the traditional quantile regression approach (Adebayo et al. 2022). On the other hand, quantile regression is an extension of the classical regression technique. According to Yu et al. (2022), the QQ regression approach is an innovative technique for bivariate analysis, which provides richer and additional information than other estimation methods. In addition, this approach fills the deficit gap in other techniques; it performs well in an asymmetric environment, provides a more realistic picture of analysis, accounts for structural breaks, and can investigate an all–inclusive link between data series upper and low quantiles. From a policy perspective, the QQ regression technique contributes to policy development and supports contextual development from a methodological viewpoint (Adebayo 2022).

This paper used the QQ approach to analyze the impact of FDE, GDP, PRI, and COE on REN. This method was proposed by Sim & Zhou (2015) and adopted from the studies of (Seraj et al. 2020; Jiang et al. 2020). The regression model can be seen in Eq. 2.

Yt denotes the dependent variable at time t; Xt shows the independent variables shocks at time t, θ represents θth quantile, and μθt denotes quantile residue. βθ can be said to be an unknown factor in which the prior information is lacking. When a factor is unknown, βθ a first-order Taylor expansion is employed which will therefore be:

βθ (Xτ) is a partial derivative of βθ (Xt) with respect to independent variable shocks. Equation (3) can therefore be rewritten as:

A new equation can be derived by substituting Eq. (4) into Eq. (2). The equation therefore can be written as:

At the end, b0 and b1which are the linear regression estimates replaces β0 and β1. The minimization problem can therefore be estimated as:

The quantile loss function is (u) which can be written as ρθ (u) = (θ − (u < 0)). The indicator function is I and the kernel function is K. In weighing the neighborhood observations of Xt, the Gaussian Kernel is applied. In addition, as regards the distance observations of the distribution function, the weights have inverse linkage and can be written as:

The distribution functions can therefore be obtained that correspond with the quantile Xτ.

4 Empirical results and discussions

This section shows the descriptive statistics, BDS test, QQ result, and quantile regression result.

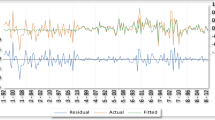

4.1 Descriptive statistics

Table 3 shows the descriptive statistics. On the measures of central tendency, COE has the highest mean and median values. In addition, COE has the highest maximum value, while FDE has the lowest minimum value. REN, FDE, GDP, and PRI are positively and normally skewed, while COE is negatively skewed. For kurtosis, REN is platykurtic (2.18 < 3), GDP is platykurtic (2.01 < 3) and COE is platykurtic (2.36 < 3). On the other hand, FDE is leptokurtic (4.74 > 3), and PRI is leptokurtic (5.62 > 3). Lastly, REN, FDE, and PRI are not normally distributed, while GDP and COE are normally distributed. Also, based on the selected data, the variable plots can be seen in Fig. 2.

4.2 BDS test

The BDS test developed by Broock et al. (1996) indicates if variables have a non–linear relationship. The result in Table 4 shows a non–linear relationship among the variables since the p–value is significant at the 1% level. This makes it appropriate for the QQ approach to be employed.

4.3 QQ empirical results and discussions

4.3.1 Financial development supply shocks to renewable energy consumption

The diagram in Fig. 3 shows the 3–axis (3D plots) for domestic credit to the private sector by bank supply shocks on renewable energy consumption. The z–axis shows the value of the slope coefficient. b1(θ, τ) measures the effect of the τtℎ quantile of domestic credit to the private sector by banks supply shock movements (x–axis) on the quantile of the renewable energy consumption θtℎ in each state (y–axis). From the empirical results, it is observed that FDE supplies mixed shock to REN. For example, the quantiles of FDE (0.05 to 0.45) supply negative shocks to the 0.05 REN quantile. These shocks to REN are highly negative. Its value reaches –2.30 on the z–axis, while the FDE (0.05 to 0.95) quantiles supply positive shocks to the 0.95 REN Quantile. This positive shock is 0.52 on the z–axis.

The negative shock of FDE on REN is because of the low financial development regime. Some of the attributes of a low financial development regime are uneasy access to credit and high lending rates. Access to credit and low lending rates will enable energy consumers to buy/invest in renewable energy products. As Nigeria moves to a high financial development regime, the impact of FDE on REN becomes positive and significant. In 15 top renewable energy countries, Raza et al. (2020) used three financial development variables to proxy for financial development and found a negative impact at low levels of financial development and a positive impact at high levels of financial development. Zeren and Koç (2014) also stated that the negative impact of financial development on energy consumption could result from financial exclusion. In China, Wang et al. (2021) found that FDE impacts REN positively in the short–run and negatively in the long–run. The negative impact is due to an underdeveloped financial sector. For example, when financial institutions are weak in structures, higher financial costs prevent renewable energy investments from occurring.

In 28 EU countries, Anton and Nucu (2020) found a positive impact between FDE and REN because of the efficient operation of the banking system. This enables the bank to finance renewable energy investments at a lower cost, enabling liquidity, capital accumulation, and technological innovation. Pham (2019) stated that increasing innovation is essential for developing renewable energy in 22 OECD countries. Other studies that showed a positive relationship between FDE and REN are (Mukhtarov et al. 2020; Khan et al. 2020; Brunnschweiler 2010). This study differs from other studies such as Burakov (2017), who found no causality between FDE and REN in Russia. The absence of causality between FDE and REN is due to the lack of significant incentives in the financial market of Russia to promote massive investment in green energy. Anton & Nucu (2020) also discovered that capital market development does not influence REN, while Assi et al. (2021) argued that FDE does not play a major role in REN in ASEAN economies.

4.3.2 GDP per capita supply shocks to renewable energy consumption

Figure 4 shows GDP per capita supply shocks to REN. The negative shocks to REN go from 0.05–0.7 quantiles of GDP to REN. Its slope in the extreme cases reaches –1.72 on Z–axis. Another significant negative shock goes from 0.55 GDP quantile to 0.75 quantiles of REN; its slope is –1.02. Regarding the positive shocks, three major shocks to REN are observed. The most positive shocks go from the 0.7 quantiles of GDP to 0.3 quantiles of the REN; its value is about 0.68. The second one goes from 0.95 quantiles of GDP to 0.05– 0.15 quantiles of REN. Their value is about 0.47. The third positive shock goes from 0.5 quantiles of GDP to 0.5 quantiles of REN; its value is 0.42.

Previous studies show that GDP per capita can have a positive, negative, or no impact on REN. The positive relationship is based on the premise that energy users will have better choices and additional income to spend on renewable energy sources as income grows. The studies that support a positive relationship include (Sardosky 2009; Omri & Nguyen 2014; Simionescu et al. 2020; Iorember et al. 2020). On the other hand, a negative relationship between GDP per capita and REN exists because African countries, including Nigeria, are still developing and characterized by low-income levels. With a low-income level, individuals will spend their limited income on maintaining their daily living. Also, low income will enable people to consume non–renewable energy sources due to affordability and accessibility. The result corresponds to the studies of (Ergun et al. 2019; Anton & Nucu 2020). Shahbaz et al. (2021) explained that insufficient income causes a negative relationship between GDP per capita and REN in 34 upper–middle–income countries. This study’s outcome contradicts the studies of (Al–mulali et al., 2013; Topcu & Togcu, 2020). These studies found no significant link between income and REN.

4.3.3 Energy price supply shocks to renewable energy consumption

Regarding the consumer price index (PRI), two significant shocks appear in Fig. 5. It shows that all PRI quantiles supply negative shocks to the 0.05 quantile of REN. The extreme shock runs from 0.05 quantile of PRI to 0.05 quantile of REN; its value is –0.45, while the quantiles 0.2–0.5 of PRI supply positive shocks to 0.8 quantile of REN; its slope is 0.29.

For Asian developing economies, Asafu–Adjaye (2000) found bidirectional causality between PRI and REN. Chang et al. (2009) for OECD countries found a positive relationship between PRI and REN. Yuan et al. (2010) explained that as energy price increases, household energy consumption will increase in the short-run and decrease in the long–run. Nayan et al. (2013) explained that energy price is a major determinant of REN. Using oil prices to proxy for the price, Wang et al. (2019) stated that energy impacted energy consumption negatively both in high and lower–middle–income countries, but it has a positive impact on energy consumption in upper–middle–income countries. On the contrary, the studies that found no relationship between PRI and REN include (Chen et al. 2021; Shahbaz et al. 2021).

4.3.4 CO2 emission supply shocks to renewable energy consumption

Figure 6 shows many positive shocks supplied by COE to REN. The most important shock runs from 0.15 quantile of COE to 0.7 quantiles of REN; its value is about 0.64. Other positive shocks arise from all quantiles of COE to 0.7 quantiles of REN; its value is about 0.46. Regarding the negative shocks, it can be noticed that the quantiles of COE 0.25 to 0.3 provide negative shocks to the 0.6 quantiles of REN; its value is –0.83.

There are different reasons why COE supplies mixed shock to REN. Positive shocks can be explained as energy stakeholders wanting to increase the share of renewable energy because of the adverse effect of CO2 emissions on the environment. This view is similar to the studies of Chen et al. (2019) for the Chinese economy, Toumi and Toumi (2019) for the KSA economy, and Apergis et al. (2010) for 19 developed and developing countries. On the other hand, a negative relationship shows that an increase in CO2 leads to the degradation of the environment. This finding is supported by the studies of (Shafiei & Salim 2014; Jaforullah & King 2015; Kahia et al. 2016). The study by Sardosky (2019) found no relationship between COE and REN.

In summary, it is observed that all independent variables asymmetrically impact the dependent variable. It supplies mixed shocks run to the dependent variable. Also, the study outcome shows that the negative shocks on the dependent variable are more extreme than the positive shocks.

4.4 Quantile regression results

The proponent of the quantile regression method is (Koenker & Bassett 1978). To use the quantile regression technique, the conditions of heteroskedasticity, serial correlation, and non–normality have to be satisfied. The model of this study satisfies each of the conditions. The quantile result is presented in Table 5. The result shows that GDP impacts REN positively across all quantiles. FDE impacts REN negatively at the lower quantile (0.10–0.20) and the upper quantile (0.80–0.90). In addition, the impact of COE on REN is negative across all quantiles. However, the impact is very small.

5 Conclusion and policy recommendations

This research examined the quantile relationship between financial development and renewable energy consumption in Nigeria from 1960–2018. Capitalizing on the limitations of existing literature, this study employs a Quantile–on–Quantile (QQ) and quantile regression approach. These methods are capable of providing information that is richer and sufficient as compared to other methods of estimation. In addition, this research uses GDP per capita, energy price, and CO2 emissions as moderating variables to eliminate omitted variable bias. The outcome of the QQ approach showed that financial development, GDP per capita, energy price, and CO2 emissions supply mixed shocks (positive and negative) to renewable energy consumption. The negative shocks for financial development are highly negative. In addition, the result for the quantile regression method showed that financial development impacts renewable energy consumption negatively at the lower Quantile (0.10–0.20) and the upper Quantile (0.80–0.90). The impact of COE on REN is negative across all quantiles. However, the effect is very small. The outcome of this study differs from other studies, which found no association among the economic indicators. This research, therefore, provides further recommendations.

Firstly, to boost renewable energy consumption/investments, policymakers must understand how financial development affects clean energy usage. Financial development can affect clean energy in different ways, such as direct, business, and wealth effects. The direct effect can be seen in the area of financial intermediation. The business effect can be seen in firms’ easy and better access to financial capital, and the wealth effect can be seen through the stock market development. Understanding these channels will pave the way for a competitive & sustainable energy industry and provide an immediate solution to Nigeria's low level of financial development. Secondly, local financial and economic development levels should be considered when formulating policies. Thirdly, policymakers should strengthen bank–based financial institutions. This will protect renewable energy investors, particularly private firms, from the volatility of the market. It will also encourage private businesses to take loans for renewable energy investments, which can make them achieve economies of scale. This can have a multiplier effect on the economy. Fourthly, necessary incentives should be created because they will increase the demand for loans for renewable energy investments. Incentives include reducing the lending rate, creating a renewable energy investment fund, and implementing favorable tax policies. This will reduce the financial burden or cost needed for renewable energy investment.

Finally, although this research used a novel QQ technique, it still has some suggestions for future research. Firstly, this study is based on a single–country analysis and utilizes a single financial development variable. Further studies should employ a panel framework and include additional financial development indicators, such as stock and bond market development. Secondly, the variables in this analysis were confined to REN, FDE, GDP per capita, PRI, and COE. Researchers should include other variables in their model to see how REN reacts to them. Thirdly, other studies should determine the impact of financial development on various renewable energy resources, especially for countries with diverse renewable energy sources. Finally, different and novel econometric techniques should be employed.

Availability of data and material

Data used in this study is annual data from 1960 – 2018. The variables used are renewable energy consumption (% of total final energy consumption) (REN), GDP Per Capita (Constant 2015 US$) (GDP), Consumer Price Index (2010 = 100) (PRI), and CO2 Emissions (kt) (COE). The dependent variable is REN while the other variables are independent variables. REN is the proxy for renewable energy consumption. GDP is the proxy for income. PRI is the proxy for energy price, while COE is the proxy for CO2 emissions. In addition, all data are sourced from World Bank (2018).

References

Abbasi, K.R., Hussain, K., Haddad, A.M., Salman, A., Ozturk, I.: The role of financial development and technological innovation towards sustainable development in Pakistan: fresh insights from consumption and territory-based emissions. Technol. Forecast. Soc. Change. 176, 121444 (2022). https://doi.org/10.1016/j.techfore.2021.121444

Abdulraheem, A., Ogbeide, F., &Adeboje, O. (2016). Determinants of Financial Sector Development in Nigeria.https://ndic.gov.ng/wp-content/uploads/2020/08/NDIC-Quarterly-Vol-34-No-12-2019-Article-Determinants-Of-Financial-Sector-Development-In-Nigeria.pdf

Adebayo, T.S.: Assessing the environmental sustainability corridor: linking oil consumption, hydro energy consumption, and ecological footprint in Turkey. Environ. Sci. Pollut. Res. (2022). https://doi.org/10.1007/s11356-022-23455-1

Adebayo, T.S., Rjoub, H., Akinsola, G.D., Oladipupo, S.D.: The asymmetric effects of renewable energy consumption and trade openness on carbon emissions in Sweden: new evidence from quantile-on-quantile regression approach. Environ. Sci. Pollut. Res. 29(2), 1875–1886 (2022). https://doi.org/10.1007/s11356-021-15706-4

Al-Mulali, U., Fereidouni, H.G., Lee, J.Y., Sab, C.N.B.C.: Examining the bi-directional long-run relationship between renewable energy consumption and GDP growth. Renew. Sustain. Energy Rev. 22, 209–222 (2013). https://doi.org/10.1016/j.rser.2013.02.005

Alola, A.A., Yalçiner, K., Alola, U.V., Saint Akadiri, S.: The role of renewable energy, immigration and real income in environmental sustainability target. Evidence from Europe’s largest states. Sci. Total Environ. 674, 307–315 (2019). https://doi.org/10.1016/j.scitotenv.2019.04.163

Alsagr, N., Van Hemmen, S.: The impact of financial development and geopolitical risk on renewable energy consumption: evidence from emerging markets. Environ. Sci. Pollut. Res. 28(20), 25906–25919 (2021). https://doi.org/10.1007/s11356-021-12447-2

Anton, S.G., Nucu, A.E.A.: The effect of financial development on renewable energy consumption. A Panel Data Approach. Renew. Energy 147, 330–338 (2020). https://doi.org/10.1016/j.renene.2019.09.005

Antonakakis, N., Chatziantoniou, I., Filis, G.: Energy consumption, CO2 emissions, and economic growth: an ethical dilemma. Renew. Sustain. Energy Rev. 68, 808–824 (2017). https://doi.org/10.1016/j.rser.2016.09.105

Apergis, N., Payne, J.E., Menyah, K., Wolde-Rufael, Y.: On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol. Econ. 69(11), 2255–2260 (2010). https://doi.org/10.1016/j.ecolecon.2010.06.014

Asafu-Adjaye, J.: The relationship between energy consumption, energy prices, and economic growth: time series evidence from Asian developing countries. Energy Econ. 22(6), 615–625 (2000). https://doi.org/10.1016/S0140-9883(00)00050-5

Assi, A.F., Isiksal, A.Z., Tursoy, T.: Renewable energy consumption, financial development, environmental pollution, and innovations in the ASEAN+ 3 group: evidence from (P-ARDL) model. Renew. Energy 165, 689–700 (2021). https://doi.org/10.1016/j.renene.2020.11.052

Awosusi, A.A., Adebayo, T.S., Rjoub, H., Wong, W.K.: How do financial development and renewable energy affect consumption-based carbon emissions? Math. Comput. Appl. 27(4), 73 (2022). https://doi.org/10.3390/mca27040073

BP (2022). Statistical Review of World Energy. https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

Broock, W.A., Scheinkman, J.A., Dechert, W.D., LeBaron, B.: A test for independence based on the correlation dimension. Economet. Rev. 15(3), 197–235 (1996). https://doi.org/10.1080/07474939608800353

Brunnschweiler, C.N.: Finance for renewable energy: an empirical analysis of developing and transition economies. Environ. Dev. Econ (2010). https://doi.org/10.1017/S1355770X1000001X

Burakov, D. (2017). Financial development, economic growth and renewable energy consumption in Russia. http://zbw.eu/econis-archiv/bitstream/11159/1398/1/1010645765.pdf

Carbon Brief (2022). Analysis: Global CO2 emissions from fossil fuels hit record high in 2022. https://www.carbonbrief.org/analysis-global-co2-emissions-from-fossil-fuels-hit-record-high-in-2022/

Chang, T.H., Huang, C.M., Lee, M.C.: Threshold effect of the economic growth rate on the renewable energy development from a change in energy price: evidence from OECD countries. Energy Policy 37(12), 5796–5802 (2009). https://doi.org/10.1016/j.enpol.2009.08.049

Chen, Y., Wang, Z., Zhong, Z.: CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew. Energy 131, 208–216 (2019). https://doi.org/10.1016/j.renene.2018.07.047

Chen, C., Pinar, M., Stengos, T.: Determinants of renewable energy consumption: importance of democratic institutions. Renew. Energy 179, 75–83 (2021). https://doi.org/10.1016/j.renene.2021.07.030

Demirguc-Kunt, A. (2006). Finance and economic development: Policy choices for developing countries (Policy Research Working Paper No. 3955).

Dogan, E., Ozturk, I.: The influence of renewable and non-renewable energy consumption and real income on CO2 emissions in the USA: evidence from structural break tests. Environ. Sci. Pollut. Res. 24(11), 10846–10854 (2017)

EPA (2022). Overview of Greenhouse Gases. https://www.epa.gov/ghgemissions/overview-greenhouse-gases

Eren, B.M., Taspinar, N., Gokmenoglu, K.K.: The impact of financial development and economic growth on renewable energy consumption: empirical analysis of India. Sci. Total Environ. 663, 189–197 (2019). https://doi.org/10.1016/j.scitotenv.2019.01.323

Ergun, S.J., Owusu, P.A., Rivas, M.F.: Determinants of renewable energy consumption in Africa. Environ. Sci. Pollut. Res. 26(15), 15390–15405 (2019). https://doi.org/10.1007/s11356-019-04567-7

Fangmin, L., Jun, W.: Financial system and renewable energy development: analysis based on different types of renewable energy situation. Energy Procedia 5, 829–833 (2011). https://doi.org/10.1016/j.egypro.2011.03.146

Global Economy (2020). Domestic credit to the private sector–Country rankings. https://www.theglobaleconomy.com/rankings/domestic_credit_private_sector/

Hung, N.T., Trang, N.T., Thang, N.T.: Quantile relationship between globalization, financial development, economic growth, and carbon emissions: evidence from Vietnam. Environ. Sci. Pollut. Res. (2022). https://doi.org/10.1007/s11356-022-20126-z

IEA (2022). Executive Summary. https://www.iea.org/reports/renewables-2022/executive-summary

Iorember, P.T., Goshit, G.G., Dabwor, D.T.: Testing the nexus between renewable energy consumption and environmental quality in Nigeria: the role of broad-based financial development. Afr. Dev. Rev. 32(2), 163–175 (2020). https://doi.org/10.1111/1467-8268.12425

Isiksal, A.Z.: The financial sector expansion effect on renewable electricity production: case of the BRICS countries. Environ. Dev. Sustain. 23(6), 9029–9051 (2021). https://doi.org/10.1007/s10668-020-01010-7

Jaforullah, M., King, A.: Does the use of renewable energy sources mitigate CO2 emissions? A reassessment of the US evidence. Energy Econ. 49, 711–717 (2015). https://doi.org/10.1016/j.eneco.2015.04.006

Ji, Q., Zhang, D.: How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128, 114–124 (2019). https://doi.org/10.1016/j.enpol.2018.12.047

Jiakui, C., Abbas, J., Najam, H., Liu, J., Abbas, J.: Green technological innovation, green finance, and financial development and their role in green total factor productivity: empirical insights from China. J. Clean. Product. 382, 135131 (2023). https://doi.org/10.1016/j.jclepro.2022.135131

Jiang, Y., Feng, Q., Mo, B., Nie, H.: Visiting the effects of oil price shocks on exchange rates: quantile-on-quantile and causality-in-quantiles approaches. North Am. J. Econ. Financ. 52, 101161 (2020). https://doi.org/10.1016/j.najef.2020.101161

Kahia, M., Kadria, M., &Aïssa, M.S.B.: What impacts of renewable energy consumption on CO2 emissions and the economic and financial development? A panel data vector autoregressive (PVAR) approach. In: 2016 7th International Renewable Energy Congress (IREC) (pp. 1–6) (2016). IEEE. doi:https://doi.org/10.1109/IREC.2016.7478912

Kang, S.H., Islam, F., Tiwari, A.K.: The dynamic relationships among CO2 emissions, renewable and non-renewable energy sources, and economic growth in India: evidence from time-varying Bayesian VAR model. Struct. Chang. Econ. Dyn. 50, 90–101 (2019). https://doi.org/10.1016/j.strueco.2019.05.006

Khan, H., Khan, I., Binh, T.T.: The heterogeneity of renewable energy consumption, carbon emission and financial development in the globe: a panel quantile regression approach. Energy Rep. 6, 859–867 (2020). https://doi.org/10.1016/j.egyr.2020.04.002

Khare, V., Nema, S., Baredar, P.: Solar–wind hybrid renewable energy system—a review. Renew. Sustain. Energy Rev. 58, 23–33 (2016). https://doi.org/10.1016/j.rser.2015.12.223

Kim, J., Park, K.: Financial development and deployment of renewable energy technologies. Energy Econ. 59, 238–250 (2016). https://doi.org/10.1016/j.eneco.2016.08.012

Koenker, R., Bassett, G., Jr.: Regression quantiles. Econ. J. Econ. Soc. (1978). https://doi.org/10.2307/1913643

Köksal, C., Katircioglu, S., Katircioglu, S.: The role of financial efficiency in renewable energy demand: evidence from OECD countries. J. Environ. Manag. 285, 112122 (2021). https://doi.org/10.1016/j.jenvman.2021.112122

Li, R., Wang, Q., Liu, Y., Jiang, R.: Per-capita carbon emissions in 147 countries: the effect of economic, energy, social, and trade structural changes. Sustain. Product. Consumpt. 27, 1149–1164 (2021). https://doi.org/10.1016/j.spc.2021.02.031

Menyah, K., Wolde-Rufael, Y.: CO2 emissions, nuclear energy, renewable energy and economic growth in the US. Energy Policy 38(6), 2911–2915 (2010). https://doi.org/10.1016/j.enpol.2010.01.024

Moreno, B., López, A.J., García-Álvarez, M.T.: The electricity prices in the European Union. The role of renewable energies and regulatory electric market reforms. Energy 48(1), 307–313 (2012). https://doi.org/10.1016/j.energy.2012.06.059

Mukhtarov, S., Aliyev, S., Zeynalov, J.: The effect of oil prices on macroeconomic variables: evidence from Azerbaijan. Int. J. Energy Econ. Policy 10(1), 72–80 (2020). https://doi.org/10.32479/ijeep.8446

Mukhtarov, S., Yüksel, S., Dinçer, H.: The impact of financial development on renewable energy consumption: evidence from Turkey. Renew. Energy 187, 169–176 (2022). https://doi.org/10.1016/j.renene.2022.01.061

Murad, M.W., Alam, M.M., Noman, A.H.M., Ozturk, I.: Dynamics of technological innovation, energy consumption, energy price and economic growth in Denmark. Environ. Prog. Sustain. Energy 38(1), 22–29 (2019). https://doi.org/10.1002/ep.12905

Nayan, S., Kadir, N., Ahmad, M., Abdullah, M.S.: Revisiting energy consumption and GDP: evidence from dynamic panel data analysis. Proc. Econ. Financ. 7, 42–47 (2013). https://doi.org/10.1016/S2212-5671(13)00216-5

Omri, A., Nguyen, D.K.: On the determinants of renewable energy consumption: international evidence. Energy 72, 554–560 (2014). https://doi.org/10.1016/j.energy.2014.05.081

Ozdeser, H., Somoye, O.A., Seraj, M.: The impact of financial development on energy consumption in Nigeria. OPEC Energy Rev. 45(2), 240–256 (2021). https://doi.org/10.1111/opec.12198

Pham, L.: Does financial development matter for innovation in renewable energy? Appl. Econ. Lett. 26(21), 1756–1761 (2019). https://doi.org/10.1080/13504851.2019.1593934

Qamruzzaman, M., Jianguo, W.: The asymmetric relationship between financial development, trade openness, foreign capital flows, and renewable energy consumption: fresh evidence from panel NARDL investigation. Renew. Energy 159, 827–842 (2020). https://doi.org/10.1016/j.renene.2020.06.069

Raghutla, C., Shahbaz, M., Chittedi, K.R., Jiao, Z.: Financing clean energy projects: new empirical evidence from major investment countries. Renew. Energy 169, 231–241 (2021). https://doi.org/10.1016/j.renene.2021.01.019

Raza, S.A., Shah, N., Qureshi, M.A., Qaiser, S., Ali, R., Ahmed, F.: Non-linear threshold effect of financial development on renewable energy consumption: evidence from panel smooth transition regression approach. Environ. Sci. Pollut. Res. 27, 32034–32047 (2020). https://doi.org/10.1007/s11356-020-09520-7

REN21 (2022). Renewables 2022 Global Status Report. https://www.ren21.net/gsr-2022/

Sadorsky, P.: Renewable energy consumption, CO2 emissions and oil prices in the G7 countries. Energy Econ. 31(3), 456–462 (2009). https://doi.org/10.1016/j.eneco.2008.12.010

Sadorsky, P.: The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5), 2528–2535 (2010). https://doi.org/10.1016/j.enpol.2009.12.048

Samour, A., Baskaya, M.M., Tursoy, T.: The impact of financial development and FDI on renewable energy in the UAE: a path towards sustainable development. Sustainability 14(3), 1208 (2022). https://doi.org/10.3390/su14031208

Saygin, O., Iskenderoglu, O.: The nexus between financial development and renewable energy consumption: a review for emerging countries. Environ. Sci. Pollut. Res. (2021). https://doi.org/10.1007/s11356-021-16690-5

Selmi, R., Bouoiyour, J., Wohar, M.E., Errami, Y.: Is there an effect of policy-related uncertainty on inflation? Evidence from the United States under Trump. Appl. Econ. 52(35), 3858–3873 (2020). https://doi.org/10.1080/00036846.2020.1723786

Seraj, M., Mar’I, M., Alhassan, A., &Turuc, F.: Causality Between Oil Prices and Exchange Rates: A Quantile-on-quantile Analysis. J. Energy Markets, 14(2) (2020) .https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3880347

Shafiei, S., Salim, R.A.: Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: a comparative analysis. Energy Policy 66, 547–556 (2014). https://doi.org/10.1016/j.enpol.2013.10.064

Shahbaz, M., Destek, M.A., Polemis, M.L.: Do foreign capital and financial development affect clean energy consumption and carbon emissions? Evidence from BRICS and next-11 countries. SPOUDAI-J. Econ. Bus. 68(4), 20–50 (2018)

Shahbaz, M., Topcu, B.A., Sarıgül, S.S., Vo, X.V.: The effect of financial development on renewable energy demand: the case of developing countries. Renew. Energy 178, 1370–1380 (2021). https://doi.org/10.1016/j.renene.2021.06.121

Sharif, A., Mishra, S., Sinha, A., Jiao, Z., Shahbaz, M., Afshan, S.: The renewable energy consumption-environmental degradation nexus in Top-10 polluted countries: fresh insights from quantile-on-quantile regression approach. Renew. Energy 150, 670–690 (2020). https://doi.org/10.1016/j.renene.2019.12.149

Sim, N., Zhou, H.: Oil prices, US stock return, and the dependence between their quantiles. J. Bank. Finance 55, 1–8 (2015). https://doi.org/10.1016/j.jbankfin.2015.01.013

Simionescu, M., Strielkowski, W., & Tvaronavičienė, M. Renewable energy in final energy consumption and income in the EU-28 countries. Energies. 13(9), (2020). 2280.file:///C:/Users/user/Downloads/energies-13–02280.pdf

Somoye, O.A., Ozdeser, H., Seraj, M.: Modeling the determinants of renewable energy consumption in Nigeria: evidence from autoregressive distributed lagged in error correction approach. Renew. Energy 190, 606–616 (2022). https://doi.org/10.1016/j.renene.2022.03.143

Steffen, B.: The importance of project finance for renewable energy projects. Energy Econ. 69, 280–294 (2018). https://doi.org/10.1016/j.eneco.2017.11.006

Svirydzenka, K.: Introducing a new broad-based index of financial development. IMF Working Papers. 16(05), 1. (2016). doi:https://doi.org/10.5089/9781513583709.001

Topcu, M., Tugcu, C.T.: The impact of renewable energy consumption on income inequality: evidence from developed countries. Renew. Energy 151, 1134–1140 (2020). https://doi.org/10.1016/j.renene.2019.11.103

Toumi, S., Toumi, H.: Asymmetric causality among renewable energy consumption, CO2 emissions, and economic growth in KSA: evidence from a non-linear ARDL model. Environ. Sci. Pollut. Res. 26(16), 16145–16156 (2019). https://doi.org/10.1007/s11356-019-04955-z

Ulucak, R.: A revisit to the relationship between financial development and energy consumption: is globalization paramount? Energy 227, 120337 (2021). https://doi.org/10.1016/j.energy.2021.120337

Wang, Q., Wang, L.: Renewable energy consumption and economic growth in OECD countries: a nonlinear panel data analysis. Energy 207, 118200 (2020). https://doi.org/10.1016/j.energy.2020.118200

Wang, Q., Su, M., Li, R., Ponce, P.: The effects of energy prices, urbanization and economic growth on energy consumption per capita in 186 countries. J. Clean. Prod. 225, 1017–1032 (2019). https://doi.org/10.1016/j.jclepro.2019.04.008

Wang, J., Zhang, S., Zhang, Q.: The relationship of renewable energy consumption to financial development and economic growth in China. Renew. Energy 170, 897–904 (2021). https://doi.org/10.1016/j.renene.2021.02.038

Wang, Q., Wang, X., Li, R.: Does urbanization redefine the environmental Kuznets curve? An empirical analysis of 134 Countries. Sustain. Cities Soc. 76, 103382 (2022). https://doi.org/10.1016/j.scs.2021.103382

Wang, Q., Zhang, F., Li, R.: Revisiting the environmental kuznets curve hypothesis in 208 counties: the roles of trade openness, human capital, renewable energy and natural resource rent. Environ. Res. 216, 114637 (2023). https://doi.org/10.1016/j.envres.2022.114637

World Bank (2016). Global Financial Development Report. https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/financial-development#:~:text=Importance%20of%20financial%20development&text=Additionally%2C%20it%20reduces%20poverty%20and,result%20in%20higher%20income%20generation.

World Bank (2022). World Bank Development Indicators. https://data.worldbank.org/

Yu, J., Tang, Y.M., Chau, K.Y., Nazar, R., Ali, S., Iqbal, W.: Role of solar-based renewable energy in mitigating CO2 emissions: evidence from quantile-on-quantile estimation. Renew. Energy 182, 216–226 (2022). https://doi.org/10.1016/j.renene.2021.10.002

Yuan, C., Liu, S., Wu, J.: The relationship among energy prices and energy consumption in China. Energy Policy 38(1), 197–207 (2010). https://doi.org/10.1016/j.enpol.2009.09.006

Zeren, F., Koç, M.: The nexus between energy consumption and financial development with asymmetric causality test: new evidence from newly industrialized countries. Int. J. Energy Econ. Policy 4(1), 83–91 (2014)

Acknowledgements

None.

Funding

There is no funding for this research.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

All authors have participated in (a) conception and design, or analysis and interpretation of the data; (b) drafting the article or revising it critically for important intellectual content; and (c) approval of the final version. This manuscript has not been submitted to, nor is under review at, another journal or other publishing venue. The authors have no affiliation with any organization with a direct or indirect financial interest in the subject matter discussed in the manuscript.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Somoye, O.A., Seraj, M., Ozdeser, H. et al. Quantile relationship between financial development, income, price, CO2 emissions and renewable energy consumption: evidence from Nigeria. Lett Spat Resour Sci 16, 2 (2023). https://doi.org/10.1007/s12076-023-00330-2

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s12076-023-00330-2