Overview

- Includes supplementary material: sn.pub/extras

Part of the book series: Springer Proceedings in Mathematics & Statistics (PROMS, volume 151)

Buy print copy

About this book

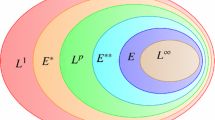

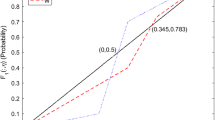

This volume presents five surveys with extensive bibliographies and six original contributions on set optimization and its applications in mathematical finance and game theory. The topics range from more conventional approaches that look for minimal/maximal elements with respect to vector orders or set relations, to the new complete-lattice approach that comprises a coherent solution concept for set optimization problems, along with existence results, duality theorems, optimality conditions, variational inequalities and theoretical foundations for algorithms. Modern approaches to scalarization methods can be found as well as a fundamental contribution to conditional analysis. The theory is tailor-made for financial applications, in particular risk evaluation and [super-]hedging for market models with transaction costs, but it also provides a refreshing new perspective on vector optimization. There is no comparable volume on the market, making the book an invaluable resource for researchers working in vector optimization and multi-criteria decision-making, mathematical finance and economics as well as [set-valued] variational analysis.

Similar content being viewed by others

Keywords

Table of contents (11 papers)

-

Front Matter

-

Surveys

-

Front Matter

-

-

Special Topics

-

Front Matter

-

Editors and Affiliations

Bibliographic Information

Book Title: Set Optimization and Applications - The State of the Art

Book Subtitle: From Set Relations to Set-Valued Risk Measures

Editors: Andreas H Hamel, Frank Heyde, Andreas Löhne, Birgit Rudloff, Carola Schrage

Series Title: Springer Proceedings in Mathematics & Statistics

DOI: https://doi.org/10.1007/978-3-662-48670-2

Publisher: Springer Berlin, Heidelberg

eBook Packages: Mathematics and Statistics, Mathematics and Statistics (R0)

Copyright Information: Springer-Verlag Berlin Heidelberg 2015

Hardcover ISBN: 978-3-662-48668-9Published: 22 November 2015

Softcover ISBN: 978-3-662-51139-8Published: 23 August 2016

eBook ISBN: 978-3-662-48670-2Published: 21 November 2015

Series ISSN: 2194-1009

Series E-ISSN: 2194-1017

Edition Number: 1

Number of Pages: XII, 331

Number of Illustrations: 16 b/w illustrations

Topics: Calculus of Variations and Optimal Control; Optimization, Quantitative Finance, Order, Lattices, Ordered Algebraic Structures, Continuous Optimization