Abstract

When concentration in the retail market increases, retailers gain more market power towards the suppliers and they hence can achieve better wholesale prices. In the 1950s, Galbraith introduced the concept of countervailing power claiming that lower wholesale prices will pass on to consumer as lower retail prices. Consequently higher concentration may turn out to be beneficial for consumers. In this model where a monopolistic supplier sells an intermediate good to M large retailers who are Cournot competitors and a competitive fringe consisting of N retailers, we show that higher concentration does not decrease retail prices and results solely to a reallocation of profits between the supplier and large retailers, thus invalidating Galbraith’s conjecture. The same result carries on when the exogenously given level of bargaining power of large retailers increases.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1.1 Introduction

In 1952, John Kenneth Galbraith in his book “American Capitalism: The Concept of Countervailing Power” [8], introduced the concept of countervailing power as an inherent power in market economies, which works to the benefit of consumers in oligopolistic markets, i.e. in markets with small number of sellers who have the ability to manipulate prices.

In every market there are buyers and sellers. According to Galbraith, if one side of the market (e.g. the seller) enjoys gains of monopoly power then the other side (the buyer) will defend against the monopolization by developing its own monopoly power. As a result, the two forces will cancel each other to the benefit of the consumer. Big supermarkets like Carrefour in Europe or Wall-Mart in the U.S. are common examples in the business literature. Because of their size they manage to offset the power of suppliers, buying cheaper and offering their products at lower prices to the consumer.

The concept of countervailing power served as an additional argument in favor of the free market economy, able to perform a role akin to the “invisible hand” of Adam Smith, despite fierce criticism addressed by the economists in Galbraith’s time. However, until the 1990s there was no theoretical mathematical model to confirm or invalidate the beneficial role of countervailing power for consumers.

Over the last 20 years, the consequences of the countervailing power returned to the research scene, mainly because of the development of Industrial Organization. There has been a growing research interest both from a theoretical point of view,Footnote 1 and from the U.S. and E.U. competition authorities (reports Federal Trade Commission [6, 7], UK Competition Commission [3, 4], The European Commission [11]) on the consequences of horizontal mergers or acquisitions among retailers on consumer prices. It is known that in horizontal mergers retailers increase the countervailing power towards their suppliers-producers. This increase is reflected in practice by their ability to achieve better contractual terms towards suppliers, for example in terms of various discounts, better wholesale prices, better franchising terms. In the literature, the impact of countervailing power to consumers and the level of social welfare remains open, mostly because theoretical results are model specific.

Generally, competition authorities take a sceptic stance against mergers because they usually lead to higher concentration and more market power for firms to the detriment of consumers. In the context of vertical industrial relations higher concentration at the retail level has a double effect. On the one hand it increases the market power of retailers towards the consumers as sellers of final goods (oligopolistic power), on the other hand it increases their market power as buyers of the intermediate good (oligopsonistic/buyer power) against the supplier. The main research question is whether the reduction in costs for retailers will translate to lower prices for consumers or higher profits for the downstream firms. The answer is not obvious because it depends on the market structure (number and size of firms, production technologies), the degree of competition on the market of final goods (i.e. among retailers), the market of intermediate goods (among suppliers) and equally importantly the vertical contractual relations among firms and the type of contracts they use in their transactions (linear and non-linear contracts).

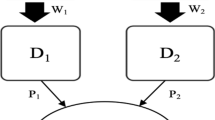

In this paper, we construct a model which consists of a monopolist of an intermediate good who sells it to a small number of large retailers M, who are Cournot competitors, as well as a large number of small retailers N, who are price takers. Consumers are represented by a demand function for the homogenous final good.

The model is constructed as a three stage game. In the first stage, the supplier chooses unilaterally a non-linear contract with the competitive firms and in the second stage it negotiates simultaneously with the large retailers about their respective contracts. We will assume that the outcome of negotiations is given by the generalized Nash bargaining program. We also assume that large retailers are symmetric, that is, they have the same technology. In the third stage large retail firms will strategically choose their quantities as Cournot players, taking as given the supply function of a competitive fringe.

As a solution to the above game we will use the concept of subgame perfect Nash equilibrium. Once we calculate the equilibrium we will do comparative statics with respect to the number of large retailers (that serves here as a proxy for countervailing power) and their degree of bargaining power so that we can clarify the effects of countervailing power on consumer prices and welfare. Our model combines the dominant firm-competitive fringe model with the Cournot model.

Our work shows that when concentration, as measured by the number of large retailers, increases, consumer prices stay constant. This result is interesting for two reasons. First, because it is contrary to the standard Cournot model result where prices go down when the number of sellers increases and second, because it provides a theoretical argument against Galbraith’s conjecture about the beneficial role of countervailing power. In fact we show that, in our context, countervailing power, represented either as the level of bargaining power or concentration, cannot benefit consumers, even in the presence of competition in the retail level, i.e. the price taking competitive fringe. Competition is a prerequisite in the models of Von Ungern-Sternberg [12], Dobson and Waterson [5] and Chen [1] for countervailing power to function for the benefit of consumers.

1.2 The Model

A single supplier denoted by s produces and sells an intermediate product to M + N retailers, M symmetric large retailers and a competitive fringe consisting of N symmetric retailers.Footnote 2 The number of firms is exogenous but we assume that M < N and there is no possibility of entry in the market. Retailers transform the intermediate good to a final one on a 1–1 basis, suffering some retail cost. We normalize the supplier’s cost to zero, without loss of generality.

Let m denote a large retailer and n a fringe firm. A large retailer has constant marginal retailing cost MC m = c m. The retail cost function of a fringe retailer is \(C(q_{n})=kq_{n}^{2}/2\) and so the fringe firm faces an increasing marginal cost, MC(q n) with MC ′(q n) > 0 and MC(0) = 0, where q n is the quantity of output produced by the fringe retailer. The overall marginal cost of a unit, including the input wholesale price w, is w m + c m for the large retailer and w n + MC(q n) for the fringe retailer. AC(q n) denotes the average retail cost function of a fringe retailer.

Consumers are represented by the inverse demand function p(Q) = a − bQ, for a, b > 0. We denote the total quantity purchased by large retailers by \( Q_{M}=\sum _{m=1}^{M}q_{m}\), where q m is the quantity bought by a single retailer m. The total quantity purchased by the small retailers is \(Q_{N}=\sum _{n=1}^{N} q_{n}\), where q n is the quantity bought by a single retailer n. Hence the total quantity is denoted by Q = Q M + Q N.

The timing of the game is the following:

At t = 1, the supplier makes a take-it-or-leave-it offer to each one of the fringe retailers simultaneously, a pair (F n, w n) consisting of a fee F n which is independent of the quantity purchased and a wholesale price w n for one unit of the intermediate good. The contract is binding once signed.

At t = 2, the supplier and the large retailers bargain simultaneously over a two-part tariff (F m, w m).

At t = 3, large retailers play a Cournot game among themselves, that is they choose how much to sell taking as given the supply function of the fringe retailers. Given their quantity choice, total quantity Q is sold at price p. Given p, each fringe retailer chooses how much input quantity q n to buy at w n and then sell at the final good price p.

1.3 Equilibrium

The concept of equilibrium that we use is that of subgame perfect Nash equilibrium. We proceed by backward induction.

At t = 3, each fringe retailer chooses how much to sell to consumers given the retail price p and the (F n, w n) contract that is already signed with the supplier. The fringe retailer’s problem is

Average cost is kq n∕2. Solving the first order condition dπ n∕dq n = 0, we obtain p − w n = MC(q n) with d 2 π n∕dq n = −k < 0 and so the supply function of a fringe firm and the total fringe supply are respectively

Solving for Q N we obtain

Let Q −m be the quantity chosen by all M retailers expect m. Then a large Cournot retailer chooses quantity q m so that

taking as given the choices of the rest of the large retailers Q −m and the total quantity supplied by the competitive fringe from (1.4). The reaction function of a large retailer is (see Appendix)

and since the large retailers are symmetric, Q −m = (M − 1)q m we obtain

which makes the total quantity \(Q_{M}^{\ast }=Mq_{m}^{\ast }\). Given (1.3), we obtain the consumer price as a function of the wholesale prices w m and w n.

At t = 2 the supplier bargains simultaneously with the set of large retailers over the (F m, w m) contract. We assume that the bargaining outcome is represented by the maximization of the following generalized Nash bargaining program where γ m ∈ (0, 1) is the degree of bargaining power of a large retailer m and \(\sigma =1-\sum _{m=1}^{M}\gamma _{m}\) that of the supplier, so that \(\sigma +\sum _{m=1}^{M}\gamma _{m}=1.\)

where the profit of the supplier is

and the profit function of a large retailer is

while \(\bar {\pi }_{s}\) and \(\bar {\pi }_{m}\) denote the players’ disagreement payoffs. Since a large retailer is unable to produce the final good without the provision of the essential input by the supplier, its disagreement payment is zero, \(\bar {\pi }_{m}=0,\) whilst the outside option of the supplier in case negotiations break down is the profit that can be obtained by supplying only to the fringe retailers, \(\bar {\pi } _{s}=N(F_{n}+w_{n}q_{c})>0,\) where q c = (a − w n)∕(k + bN) is the quantity sold at the market clearing retail price p c = (ak + bNw n)∕(k + bN). The solution to (1.8) is given by (see Appendix)

At the first stage of the game, t = 1, the supplier decides about the take-it-or-leave-it offer for the fringe retailers, taking as given p(w m, w n), Q N(w m, w n), Q M(w m, w n), F m, w m(w n) from the next stages. The supplier’s problem is

or equivalently

which gives the following optimal contract

Given the optimal contract \((F_{n}^{\ast },w_{n}^{\ast })\) at t = 1 we may now calculate the following values at the subgame perfect Nash equilibrium

Equilibrium profits, consumer surplus CS, total profits PS, and total surplus TS are

1.4 The Effects of Concentration and Bargaining Power on Retail Prices

In this model, countervailing power is represented by the degree of bargaining power γ of each large retailer, as in [1] or [2] and alternatively, by the degree of downstream concentration, which is given by the number of symmetric large retailers M, as in [12]. We also consider the effects of the fringe size N on equilibrium values. We obtain the following propositions.

Proposition 1.1

When the number of large retailers decreases, each large retailer obtains a lower wholesale price from the supplier and sells a higher quantity of the final good, while the fringe quantity, total quantity, consumer price, industry profits and total welfare remain constant.

Proof

In order to guarantee positive quantities at equilibrium, we have to assume that N < k(a − c m)∕bc m because \(q_{m}^{\ast }=[ak-c_{m}(k+bN)]/2bkM\). Calculating derivatives at equilibrium we have:

When the number of large retailers decreases, they obtain more bargaining power towards the supplier, so that they can achieve a lower wholesale price. Nevertheless, a lower wholesale price does not lead to a lower retail price at equilibrium. There are two conflicting effects. On the one hand, a lower wholesale price leads to a higher individual production, while on the other hand, fewer large retailers face relaxed competition and want to produce less. The first effect dominates so that large retailers increase individual production up to the level where total production, and hence retail price, remain constant. Moreover, the profit of a large retailer will not change, despite of the fact that its per unit profit increases due to the lower wholesale price. Any higher profit obtained is completely captured by a higher fixed fee charged by the supplier. However, when large retailers become fewer, the supplier’s profit increases, because the supplier collects fewer, yet higher fees. These findings are summarized in the following proposition.

Proposition 1.2

When the number of large retailers changes, the profits of the supplier and the consolidated profits of the large retailers move to opposite directions and their change is of the same magnitude.

Proof

\(\partial (M\pi _{m}^{\ast })/\partial M=\gamma \lbrack (ak-c_{m}(k+bN)]^{2}/4bk(k+bN)>0\) and \(\partial \pi _{s}^{\ast }/\partial M=-\gamma \lbrack (ak-c_{m}(k+bN)]^{2}/4bk(k+bN)<0\) so \((\partial (M\pi _{m}^{\ast })/\partial M)(\partial \pi _{s}^{\ast }/\partial M)<0\) and \( \partial (M\pi _{m}^{\ast })/\partial M+\partial \pi _{s}^{\ast }/\partial M=0.\)

At equilibrium, the size of the pie is invariant to the number of large retailers. The effect of a change of the number of retailers results solely in a redistribution of profits.

Next, we examine the effect of a change of the exogenously given level of bargaining power of the large retailers. The following proposition summarizes the neutrality of countervailing power:

Proposition 1.3

When the degree of bargaining power γ of large retailers increases, they pay a lower fee F m and their profits increase. They do not obtain any lower wholesale price and the retail price does not change at equilibrium.

Proof

\(-\partial \pi _{m}^{\ast }/\partial \gamma =\partial F_{m}^{\ast }/\partial \gamma =-[(ak-c_{m}(k+bN)]^{2}/4bk(k+bN)<0,\partial w_{m}^{\ast }/\partial \gamma =\partial p^{\ast }/\partial \gamma =0.\)

The proposition suggests that a higher level of bargaining power will lead to a lower fee for the large retailer, not a lower wholesale price. Consequently, the retail price will not change either. This is due to the fact that the level of wholesale price is set so as to maximize multilateral profits, hence a change in bargaining power can only lead to a reallocation of profits.

1.5 Conclusion

In this work we examine a particular retail market structure consisting of a set of large retailers with power over wholesale and retail prices and a set of small retailers who are price takers. We use the number of large retailers as a measure of the degree of concentration in the market. When concentration in the market increases, equilibrium wholesale prices become lower, nevertheless we show that equilibrium consumer prices and welfare remain constant. Since higher concentration is tantamount to higher countervailing power, we prove, contrary to Galbraith’s argument, that countervailing power is not effective in this model.

Alternatively, we use the degree of bargaining power as a proxy for countervailing power. Keeping the number of larger retailers constant, when large retailers obtain greater bargaining power exogenously, they achieve a lower fee, not a lower wholesale price. This is due to the fact that wholesale prices maximize the multilateral profits of the supplier and the large retailers in the negotiation process. Consequently, even if there were a positive pass-through rate from wholesale prices to consumer price, the consumer price cannot fall because the wholesale prices remain constant. Again, countervailing power is neutral.

Notes

- 1.

- 2.

We use capital letters M and N to denote the set, the last element of the set or the cardinality of the set, depending on the context. We use small letters m and n to denote a typical element or an index of the set M and N respectively. So we adopt the convention M = {1, …, m, …, M} and N = {1, …, n, …, N}.

References

Chen, Z.: Dominant retailers and the countervailing-power hypothesis. RAND J. Econ. 34, 612–25 (2003)

Christou, C., Papadopoulos, K.G.: The countervailing power hypothesis in the dominant firm-competitive fringe model. Econ. Lett. 126, 110–113 (2015)

Competition Commission: Supermarkets: a report on the supply of groceries from multiple stores in the United Kingdom. Cm 4842 (2000)

Competition Commission: The supply of grocery in the UK market investigation: provisional findings report (2007)

Dobson, P.W., Waterson, M.: Countervailing power and consumer prices. Econ. J. 107(441), 418–30 (1997)

Federal Trade Commission: Report on the FTC workshop on slotting allowances and other marketing practices in the grocery industry (2001)

Federal Trade Commission: Slotting allowances in the retail grocery industry: selected case studies in five product categories (2003)

Galbraith, J.K.: American Capitalism: The Concept of Countervailing Power. Houghton Mifflin, Boston (1952)

Gaudin, G.: Vertical bargaining and retail competition: what drives countervailing power? Econ. J. (2017). https://doi.org/10.1111/ecoj.12506

Inderst, R., Mazzarotto, N.: Buyer power in distribution. In: Collins W.D. (ed.) ABA Antitrust Section Handbook Issues in Competition Law and Policy. ABA Book Publishing, Chicago (2008)

The European Commission: Buyer Power and Its Impact on Competition in the Food Retail Distribution Sector of the European Union, prepared by Dobson and Consulting, DGIV Study Contract No. IV/98/ETD/078 (1999)

Von Ungern-Sternberg, T.: Countervailing power revisited. Int. J. Ind. Organ. 12, 507–519 (1996)

Acknowledgements

Konstantinos Papadopoulos gratefully acknowledges Research Grant no 87937 from the Aristotle University of Thessaloniki Research Committee.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendix

Appendix

1.1.1 Derivation of the Reaction Function of the Large Retailer q m(Q −m)

Using (1.4), the profit function of a Cournot retailer as defined in (1.5) can be written as

which we differentiate with respect to q m to obtain

1.1.2 Derivation of Bargaining Outcome (1.11) and (1.12)

Let \(\tilde {\pi }_{s}=Mw_{m}q_{m}+N(F_{n}+w_{n}q_{n})\) so that from (1.9) we can write \(\pi _{s}(F_{m},w_{m})=\tilde {\pi }_{s}+MF_{m}\). Let \( \tilde {\pi }_{m}=[p-c_{m}-w_{m}]q_{m}\) so that from (1.10) we can write \(\pi _{m}(F_{m,}w_{m})=\tilde {\pi }_{m}-F_{m}\). Cournot retailers are symmetric so \(\sum _{m-1}^{M}\gamma _{m}=M\gamma _{m}\) and given that \(\bar {\pi }_{m}=0\), (1.8) reduces to

The first order condition with respect to F m is

or

If we substitute \(\tilde {\pi }_{m}=[p-c_{m}-w_{m}]q_{m}\), \(\tilde {\pi } _{s}=Mw_{m}q_{m}+N(F_{n}+w_{n}q_{n})\) and \(\bar {\pi }_{s}=N(F_{n}+w_{n}q_{c})\) in (1.15) where q c = (a − w n)∕(k + bN) is the quantity sold at the market clearing retail price p c = (ak + bNw n)∕(k + bN) we end up with (1.11).

In order to find w m that solves (1.14), we introduce (1.15) in the objective function in (1.14) and we rearrange terms so that

Consequently, the maximization problem can be written as

because \((1-M\gamma _{m})^{\left ( 1-M\gamma _{m}\right ) }\gamma _{m}^{\ M\gamma _{m}}\) is a constant. Notice also that \(\bar {\pi }_{s}\) does not depend on w m, so, in fact, w m maximizes the multilateral profits of the supplier with the M Cournot retailers (efficiency of Nash bargaining solution). So

where \( Z=a^{2}k^{2}M+M(k+bN)^{2}(c_{m}+w_{m})(c_{m}-Mw_{m})+bMN(k+bN)[c_{m}(M-1)+2Mw_{m}]w_{n}-bN[k(1+M)^{2}+bM^{2}N]w_{n}^{2}+ak[M(k+bN)((M-1)w_{m}-2c_{m})+b(1+3M)Nw_{n}] \). The maximization of (1.16) with respect to w m will give (1.12).

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG, part of Springer Nature

About this chapter

Cite this chapter

Geronikolaou, G., Papadopoulos, K.G. (2018). Countervailing Power with Large and Small Retailers. In: Petrosyan, L., Mazalov, V., Zenkevich, N. (eds) Frontiers of Dynamic Games. Static & Dynamic Game Theory: Foundations & Applications. Birkhäuser, Cham. https://doi.org/10.1007/978-3-319-92988-0_1

Download citation

DOI: https://doi.org/10.1007/978-3-319-92988-0_1

Published:

Publisher Name: Birkhäuser, Cham

Print ISBN: 978-3-319-92987-3

Online ISBN: 978-3-319-92988-0

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)