Abstract

Speedy development of the large-sized retail outlets empowers the emergence of dominant retailers, as a result of power transformation from suppliers to retailers. In this paper, we model a market comprised of a dominant entrant retailer, a weaker incumbent counterpart, and a common supplier from which both retailers source products. The retailers are quantity-competing, and the dominant retailer is entitled to determine the wholesale price it purchases, while the incumbent retailer accepts the price offered by the supplier. Besides, the incumbent retailer is assumed to hold private information about market demand. We investigate the collaboration strategy for the supplier which either cooperates with the dominant entrant retailer or with the vulnerable incumbent counterpart. Our result reveals that the supplier’s strategy depends on subtle considerations of multiple factors such as terminal market demand state, the demand fluctuation, the expected market demand and the dominant retailer’s wholesale price.

Access provided by CONRICYT-eBooks. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

With popularization and application of big data and the cloud, enterprises in supply chains are confronted with a complicated environment where unprecedented progress and enormous challenges co-exist. Competition between retailers for original resources is updated to the fight for information. More accurate information brings the advantage of significant profit potential and helps win competitiveness. From another front, rapidly growing dominance of large retailers has relocated the traditional power between supply and demand. The consumer demand-oriented market entitles the retailers more governance in supply chain structures. Despite that information dissemination in the presence of dominant retailers captures increasing attention, relative studies are still sparse. This motivates our study to fill in the research gap.

2 Problem Description

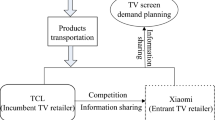

Following the above-mentioned reality, we consider a supply chain consisting of one common upstream supplier (he) and two differentiated downstream retailers. One retailer is considered to be a dominant entrant retailer (she), while the other is a weak incumbent retailer (it). Specifically, there are two significant differences between retailers: first, the incumbent has exact acquaintance with the market demand due to his long-term immediate and continuous contact with consumers, whereas the entrant only knows the distribution of the demand information as her common knowledge (and so does the supplier), see [1, 2]. Second, despite being a new comer in the supply chain, the entrant is endowed with the ability to dictate the wholesale price to the supplier, however, the incumbent’s wholesale price is formulated by the supplier, see [3]. All participants are profit-maximizers.

Taking into consideration the factors influencing the terminal market, we reasonably model the market price to follow the inverse demand function [4], which is linear and downward sloping such that \(P=A-B(q_{i}+q_{e})\), where P represents the market’s clearing price. The intercept A is assumed to be random, and takes two possible values of \(A_H\) or \(A_L\) (\(A_{H}>A_{L}>0\)): the high type \(A_{H}\) occurs with probability \(p\in (0,1)\), and the low one \(A_{L}\) with the probability \(1-p\). We define \(\delta \) as the difference between the two of market demand realizations so that \(\delta =A_H-A_L\); \(-B\) is the demand function’s slope. Without loss of generation, we assume \(B=1\). We denote \(q_{i}\) and \(q_{e}\) as the incumbent’s and entrant’s order quantities, respectively. Also, the expected market demand is defined as \(\mu =pA_{H}+(1-p)A_{L}\). The supplier provides the incumbent a wholesale price \(w_{i}\), whereas the entrant has the power to set the wholesale price \(w_{e}\) by herself. For simplicity, the entrant’s wholesale price is assumed to be exogenous. We also normalize the marginal supply cost and other fixed costs to zero, which will not change our results qualitatively.

Initially, the accurate terminal market demand state is the incumbent’s private information. The supplier merely has a sense of the demand’s distribution and offers the incumbent a wholesale price contract. Once the incumbent places its order quantity, the private information about the actual market demand is faithfully leaked to the supplier. In presence of the two differentiated retailers, the supplier is confronted with collaboration choices about its cooperation partner. Specifically, the potential advantages when collaborating with the dominant entrant may prompt the supplier to choose “hug her close” policy. Under such condition, the supplier would leak the incumbent’s demand state to the entrant voluntarily. Consequently, the terminal market demand information of this supply chain is completely transparent to all participants. From another front, the entrant’s governance superiority on bargaining power may provide incentive for the supplier to stand in line with the weak incumbent, i.e., collaboration with the vulnerable incumbent retailer. Accordingly, supplier would conceal the actual market demand state to the entrant. Without information leaked from the supplier, the entrant has to place her order on the basis of her estimated market demand.

In the following, Sect. 3 analyzes the scenario of information leakage, where the supplier collaborates with the dominant entrant retailer. The alternative choice of cooperating with the vulnerable incumbent retailer is investigated in Sect. 4. Section 5 compares these two modalities of cooperation and derives all participants’ equilibrium strategies. Section 6 gives the conclusion to close this paper.

3 Information Leakage

In this section, we derive equilibrium strategies for all the supply chain members under the information leakage scenario where the supplier chooses to collaborate with the dominant entrant retailer.

At the outset, the incumbent observes the actual terminal market demand information, which takes either the high type \(A_{H}\) or the low one \(A_L\). The supplier provides the wholesale price contract \(w_{iH}^{Y}\) or \(w_{iL}^{Y}\) to the incumbent, where the superscript “Y” expresses the scenario that the supplier says “Yes” to information leakage. Afterwards, the incumbent responds by appointing its order quantity \(q_{iH}^{Y}\) or \(q_{iL}^{Y}\). In this way, the supplier acquires the demand information from the incumbent, and then leaks to the entrant. Sequentially, the entrant places her order quantity \(q_{eH}^{Y}\) or \(q_{eL}^{Y}\) on account of this information. Finally, two retailers sell products to end consumers when demand uncertainty is resolved and market gets clear.

Note that the analysis processes are similarly formulated under the scenarios of high and low market uncertainty realizations, we thereafter elaborate on the circumstance when the incumbent observes a high market potential. Under such case, the supplier offers wholesale price \(w_{iH}^{Y}\) to the incumbent, and the incumbent places order quantity \(q_{iH}^{Y}\) with the supplier. Signing a deal with the entrant, the supplier may leak the actual demand information to its partner. As a result, the market demand state is no longer the incumbent’s private information but rather a piece of transparent information to all participants. Afterwards, the entrant determines her order \(q_{eH}^{Y}\) according to this accurate information. Therefore, when the supplier’s choice is collaboration with the dominant entrant retailer under that the terminal market demand state is high, the profit of the incumbent and the entrant is respectively given by

The Cournot competition between two retailers with complete information for the demand system is described as

Apart from providing products to both retailers, the supplier plays a dual role in the supply chain, that is, he serves as the wholesale price setter for the incumbent and also a information transmitter for the entrant. Therefore, his profit consists of two sources:

On account of the sequential moves between the supplier and incumbent, they play a standard Stackelberg game with complete information, where the supplier is the leader and the incumbent is the follower.

The following proposition demonstrates the unique pure strategy equilibrium and the corresponding participants’ profits for the scenario of collaboration with the dominant entrant retailer.

Proposition 1

When the market demand state is high and the supplier chooses to cooperate with the dominant entrant:

-

(i)

The supplier offers the incumbent the wholesale price \(w_{iH}^{*Y}=\displaystyle \frac{A_{H}+2w_{e}}{4}\).

-

(ii)

The incumbent orders \(q_{iH}^{*Y}=\displaystyle \frac{A_{H}}{6}\). The incumbent’s corresponding profit is \(\pi _{iH}^{Y}=\displaystyle \left( \frac{A_{H}}{6}\right) ^2\).

-

(iii)

The entrant orders \(q_{eH}^{*Y}=\displaystyle \frac{5A_{H}-6w_{e}}{12}\). The entrant’s corresponding profit is \(\pi _{eH}^{Y}=\displaystyle \left( \frac{5A_{H}-6w_{e}}{12}\right) ^2\).

4 Information Concealment

In this section, we look for equilibrium strategies under the information concealment scenario where the supplier chooses to collaborate with the vulnerable incumbent retailer.

Unlike collaboration with the dominant entrant retailer, when the supplier chooses to align with the weak incumbent, he should conceal the incumbent’s private information, i.e., the terminal market demand state from the entrant. Thus, the entrant only places her order quantity according to her expected market demand.

At first, the incumbent observes the actual terminal market demand information, either to be high or low. The supplier provides the wholesale price contract \(w_{iH}^{N}\) or \(w_{iL}^{N}\) to the incumbent, where the superscript “N” expresses the scenario that the supplier says “No” to information leakage. Afterwards, the incumbent responds by appointing its order quantity \(q_{iH}^{N}\) or \(q_{iL}^{N}\). In this way, the supplier acquires the demand information from the incumbent, and keep this information secret. Sequentially, the entrant places her order quantity \(q_{eH}^{N}\) or \(q_{eL}^{N}\) on account of the expected market demand. Finally, both retailers sell their products to the terminal market where demand uncertainty is realized.

We follow the similar assumption as in Sect. 3 that the demand uncertainty is realized to be high. Therefore, when the supplier’s choice is to collaborate with the vulnerable incumbent retailer and the terminal market demand state is high, the incumbent and entrant seek to maximize the respective profit

Different from the analysis in Sect. 3, the supplier acts as a price setter and a secret keeper for the incumbent in the no leakage case. His profit is thus formulated as

The following proposition demonstrates the unique pure strategy equilibrium and the corresponding participants’ profits for the scenario that collaboration with the dominant entrant retailer.

Proposition 2

When the market demand state is high and the supplier chooses to cooperate with the vulnerable incumbent:

-

(i)

The supplier offers the incumbent the wholesale price

$$\begin{aligned} w_{iH}^{*N}&=\big [(48A_{H}-20A_{L}+24w_{e})-(24A_{H}-21A_{L}-30w_{e})p-(A_{H}+6w_{e})p^2 \\&\quad +(A_{H}-A_{L})p^3\big ]\big /6(16+p-p^2). \end{aligned}$$ -

(ii)

The incumbent orders

$$\begin{aligned} q_{iH}^{*N}\!=\!\frac{(12A_{H}-5A_{L}+6w_{e})-(3A_{H}-4A_{L}+3w_{e})p-(A_{H}-A_{L}+3w_{e})p^2}{3(16+p-p^2)}. \end{aligned}$$The incumbent’s corresponding profit is

$$\begin{aligned} \pi _{iH}^{N}\!=\!\left[ \!\frac{(12A_{H}\!-\!5A_{L}\!+\!6w_{e})\!-\!(3A_{H}\!-\!4A_{L}\!+\!3w_{e})p\!-\!(A_{H}\!-\!A_{L}\!+\!3w_{e})p^2}{3(16+p-p^2)}\!\right] ^2. \end{aligned}$$ -

(iii)

The entrant orders

$$\begin{aligned} q_{e}^{*N}&=\big [(40A_{L}-48w_{e})\!+\!(42A_{H}-37A_{L}-18w_{e})p\!-\!(A_{H}+4A_{L}-18w_{e})p^2\! \\&\quad -(A_{H}-A_{L})p^3\big ]\big /6(16+p-p^2). \end{aligned}$$The entrant’s corresponding profit is

$$\begin{aligned} \pi _{e}^{N}&=\big [(40A_{L}-48w_{e})+(42A_{H}-37A_{L}-18w_{e})p-(A_{H}+4A_{L}-18w_{e})p^2 \\&\quad -(A_{H}-A_{L})p^3\big ]^2\big /36(16+p-p^2)^2. \end{aligned}$$

5 The Supplier’s Equilibrium Strategy

This section, we calculate the supplier’s profits under the above two mechanisms and show the supplier’s equilibrium strategy.

Corollary 1

Comparing the supplier’ profit under the collaboration scenario with the vulnerable incumbent retailer and that with the dominant entrant retailer, there is a threshold \(\delta _{H}\) such that

-

(a)

if \(\delta <\delta _{H}\), then \(\pi _{sH}^{N}<\pi _{sH}^{Y}\);

-

(b)

if \(\delta \ge \delta _{H}\), then \(\pi _{sH}^{N}\ge \pi _{sH}^{Y}\);

Corollary 1 reveals that the supplier’s cooperation choice strategically alters due to different terminal market demand state. Specifically, when the market is prosperous, the information is less valuable so that the supplier prefers to collaborate with the entrant to gain greater revenue. Conversely, when the market tolerates great fluctuations, the actual demand information becomes much valuable, and hence the supplier is willing to align with the incumbent to keep the information away from the entrant.

6 Conclusions

With the tremendous development of information technology and widespread application of big data, information dissemination has attracted attention from a growing number of experts and scholars. When the dominant retailer takes over the leadership of setting wholesale price, the supplier loses his governance in the supply chain management and needs to respond strategically in terms of choosing its supply chain partner. Our work contributes to give such managerial hints to the supplier. If the market demand is upbeat, to work with the dominant retailer could bring the supplier more profit. On the contrary, when the terminal market demand is fluctuating greatly, the supplier is suggested to huddle together with the vulnerable retailer for warmth.

References

Anand, K.S., Goyal, M.: Strategic information management under leakage in a supply chain. Manag. Sci. 55(3), 438–452 (2009)

Kong, G., Rajagopalan, S., Zhang, H.: Revenue sharing and information leakage in a supply chain. Manag. Sci. 59(3), 556–572 (2013)

Geylani, T., Dukes, A.J., Srinivasan, K.: Strategic manufacturer response to a dominant retailer. Mark. Sci. 26(2), 164–178 (2007)

Liao, C.N., Chen, Y.J., Tang, C.S.: Heterogeneous farmers and market selection. Manuf. Serv. Oper. Manag. (2017, in press)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this paper

Cite this paper

Wang, Y., Tang, W., Zhao, R. (2018). Supplier’s Information Strategy in the Presence of a Dominant Retailer. In: Chao, F., Schockaert, S., Zhang, Q. (eds) Advances in Computational Intelligence Systems. UKCI 2017. Advances in Intelligent Systems and Computing, vol 650. Springer, Cham. https://doi.org/10.1007/978-3-319-66939-7_30

Download citation

DOI: https://doi.org/10.1007/978-3-319-66939-7_30

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-66938-0

Online ISBN: 978-3-319-66939-7

eBook Packages: EngineeringEngineering (R0)