Abstract

We examine four variations of a model in which oligopolistic retailers compete in a downstream market and one of them is a large retailer that has its own exclusive supplier. We demonstrate that an increase in the buyer power of the large retailer vis-à-vis its supplier leads to a fall in the retail price and an improvement in consumer welfare. More interestingly, we find that the beneficial effects of an increase in buyer power are large when the intensity of downstream competition is low, with the effects being the largest in the case of downstream monopoly.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Increased concentration in the retail industry and the tremendous success of giant retailers—such as Wal-Mart, Carrefour, and Tesco—has raised awareness and concerns regarding the impact of retailer buyer power in many countries.Footnote 1 This has led to a growing literature that analyzes the effects of buyer power on consumer prices and social welfare. They include von Ungern-Sternberg (1996), Dobson and Waterson (1997), Chen (2003), Erutku (2005), Mills (2010), and Inderst and Valletti (2011).Footnote 2

As will be discussed in Sect. 2, a notable finding from this literature is that the presence of competition in the downstream retail market is necessary for buyer power to benefit consumers and improve welfare. What is less clear, however, is how the welfare consequences of buyer power are affected by changes in the intensity of retail competition. For example, is it the case that buyer power is more beneficial to consumers when retail competition is more intense? The answer to such a question will be of great assistance to competition authorities that are charged with assessing the effects of rising buyer power (Chen 2007).

In this paper, we study the interaction between buyer power in an upstream market and competition intensity in a downstream market. To do so, we examine four variations of a model in which oligopolistic retailers compete in a downstream market and each retailer pays a linear wholesale price for its supplies. We separate buyer power from the intensity of downstream competition by assuming that only one of those retailers is large and possesses buyer power vis-à-vis its supplier. This allows us to isolate the effects of retailer buyer power from those that are associated with a change in the intensity of downstream competition.

Our analysis shows that the wholesale and retail prices indeed fall and consequently consumer welfare improves following an increase in the buyer power of the large retailer. This is true even in the case where the large retailer is a monopoly in the downstream market. Surprisingly, however, it is not the case that increased buyer power is more beneficial to consumers when the downstream competition is more intense. To the contrary, we find that the marginal effects of an increase in buyer power are large when the intensity of downstream competition is low, with the largest effects for a downstream monopoly. This suggests that buyer power and downstream competition can be viewed as substitutes.

The paper is organized as follows: In Sect. 2, we discuss the relevant literature in more detail. Our analysis starts in Sect. 3 with an examination of a model in which homogeneous retailers engage in quantity competition. In Sect. 4, we extend the model to incorporate product differentiation among retailers and consider both quantity competition and price competition. We offer concluding remarks in Sect. 5.

2 Literature Review

Our work is closely related to von Ungern-Sternberg (1996) and Dobson and Waterson (1997). They show that larger retailer buyer power, as reflected through an increase in concentration at the retail level, leads to reduced consumer prices and higher social welfare only if the competition at the retail level is fierce. Specifically, von Ungern-Sternberg (1996) compares two theoretical models: one model where an upstream supplier sells to Cournot oligopoly retailers and the other with perfect competition in the retail market. He finds that only in the model of perfect competition does a decrease in the number of retailers lead to lower consumer prices.

Dobson and Waterson (1997) use a similar model where a monopoly supplier negotiates with Bertrand oligopoly retailers who offer differentiated services. Their analysis shows that consumer prices fall with a reduction in the number of retailers only if retailers are considered by consumers as very close substitutes. Since Bertrand competition in the case of homogeneous firms leads to the same equilibrium as perfect competition, this finding by Dobson and Waterson can be viewed as a generalization of von Ungern-Sternberg (1996).

As pointed out by Chen (2003), the analyses in von Ungern-Sternberg (1996) and Dobson and Waterson (1997) capture the combined effects of both buyer power and seller power of retailers because increased concentration in the retail market enhances both types of market power simultaneously. To isolate the effects of buyer power, Chen (2003) examines a situation where an upstream supplier sells to a group of retailers that consist of a dominant firm with buyer power and a large number of price-taking fringe firms. He demonstrates that the presence of downstream competition by fringe retailers is crucial in driving the welfare effects of buyer power.Footnote 3 Therefore, a common theme from these analyses is that competition in the retail market is necessary for buyer power to benefit consumers and improve social welfare.

Our study of the interaction between buyer power and downstream competition is also related to Galbraith (1952), in which he argued that buyer power was a substitute for competition: “In the typical modern market of few sellers, the active restraint [on the exercise of private economic power] is provided not by competitors but from the other side of the market by strong buyers” (Galbraith 1952, p. 119). However, Galbraith’s hypothesis has received little support from the existing theoretical analyses of buyer power. One contribution of the present paper is that it identifies an environment in which buyer power and competition can indeed be viewed as substitutes.

3 A Model of Homogeneous Retailers

There are two levels of markets: In the downstream market are a group of n (>2) retailers. These retailers purchase their supplies from the upstream market. In this section, we assume that retail services are homogeneous and that retailers compete in quantity. Let \(q_{i}\) (i = 1, 2,…,n) denote the quantity sold by retailer i, and let \(Q = \sum\nolimits_{i = 1}^{n} {q_{i} }\) denote the total quantity that is sold by all n retailers. The inverse demand function in the retail market is represented by \(p = P\left( Q \right)\). The demand curve is downward-sloping, which implies \(P' < 0\). Moreover, we impose the following assumptions on the higher order derivatives: \(P'' \le 0\), \(P''' \le 0\), and \(P''Q/P' \le 1\).Footnote 4 It is easy to verify that a linear demand function satisfies all of these assumptions.

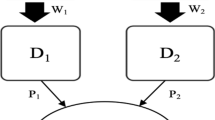

To separate the effects of buyer power from those of downstream competition, we assume that one of the n retailers, retailer R 1, is in a bilateral monopoly relationship with its supplier, while the remaining retailers obtain their supplies in a competitive market. The idea here is that R 1 is a large chain store that sells in many geographic markets, one of which is the focus of the present analysis. Because of its large scale, this chain retailer is able to induce a supplier to be its exclusive source of supply.

We use parameter \(\gamma \in [0\,,\;1]\) to denote the amount of buyer power R 1 possesses vis-à-vis its supplier, with \(\gamma = 0\) indicating no buyer power and \(\gamma = 1\) representing the other extreme where the retailer dictates the terms of trade with the supplier. Our analysis, however, will focus on situations where \(\gamma\) falls between these two extreme values: \(\gamma \in (0\,,\;1)\).

The motivation for the exclusive relationship between retailer R 1 and its supplier is that it generates efficiency gains that reduce the supplier’s unit cost of production. As pointed out by Dukes et al. (2006), a supplier can achieve reductions in transaction costs when it deals with a large-volume retailer because of economies of scale in transportation or procurement costs. Moreover, large retailers, such as Wal-Mart, are known to have superior consumer databases, which can help a supplier to reduce the cost of resolving demand uncertainties and streamline the flow of goods from raw materials to checkout counter (Useem et al. 2003). These efficiency gains create incentives for R 1 and a supplier to enter into an exclusive arrangement.

Accordingly, we assume that R 1’s supplier has a lower marginal cost of production than do other suppliers that sell in the competitive upstream market. Let \(c_{s}\) denote the marginal cost of R 1’s supplier and c the marginal cost of other suppliers. We assume c s < c.

To be clear, R 1’s supplier has the freedom to leave the exclusive relationship and sell its product in the competitive market. But it would then forgo the efficiency gains that are associated with selling to R 1, and would have the same unit cost of production, c, as all of the other suppliers.

Each retailer incurs two types of costs: the wholesale price that it pays to its supplier, and a constant marginal cost of providing retailing services. The latter is normalized to zero.Footnote 5

The firms in this model play a two-stage game: At stage 1, the large retailer R 1 negotiates with its supplier over the wholesale price w for the units that are sold in this market. At stage 2, all retailers compete in quantity in the downstream market.

We will model the bargaining game at stage 1 in two ways: In Sect. 3.1, we take a general approach and postulate that the wholesale price (\(w\)) is a generic function of retailer R 1’s buyer power (\(\gamma\)) and other parameters of the model, particularly \(n\) (the number of downstream competitors). In Sect. 3.2, we consider a more specific model where \(w\) is determined by the generalized Nash bargaining solution (Harsanyi and Selton 1972).

Before proceeding to analyze this model, we pause to discuss three assumptions in this model: First, we have assumed that the amount of buyer power (γ) is independent of the market concentration in the downstream market (as measured by n). Here we have in mind a situation where the buyer power of a large retailer comes from being in a large number of markets rather than being large in a particular market. This is motivated, in part, by the observation that the colossal scale of retailers such as Wal-Mart is driven more by the fact that it operates in a large number of geographic markets worldwide than from having a large market share in any particular local market.Footnote 6 We suppose that an increase in the retailer’s buyer power is brought about by its expansion into an additional geographic market either through de novo entry or through the acquisition of an existing retailer.

Second, we have assumed that the supplier and the retailer negotiate over a linear wholesale price w. In so doing, we are following the common approach in many existing models, such as von Ungern-Sternberg (1996), Dobson and Waterson (1997), and Inderst and Valletti (2011). In reality, contracts between retailers and suppliers are often more complex. We treat the linear price as an approximation of situations where the supplier and the retailer have a conflict of interests over the level of the wholesale price, with the supplier preferring a higher wholesale price and the retailer preferring the opposite. As will be discussed in the concluding remarks, our results are relevant to situations of non-linear contracts as long as such contracts do not align the interests of the supplier and the retailer in such a way that they both want the same wholesale price.

Third and finally, we have assumed that a supplier’s marginal cost of production is constant. This assumption eliminates the type of efficiency losses that are associated with monopsony power. In the textbook model of monopsony, for example, a single buyer faces an upward-sloping supply curve, and consequently the quantity supplied falls as the buyer forces down the price. This will not occur in the present model as long as the price is above the supplier’s (constant) marginal cost. Therefore, this model does not encompass the traditional antitrust concerns over buyer power that a lower price would lead to reduced supply.

3.1 Generic Bargaining Function

As indicated earlier, we will first use a generic function to represent the relationship between R 1’s wholesale price and the parameters in the model. Specifically, let \(W(\gamma ,n)\) denote this relationship. We supress \(c\) and \(c_{s}\) in this function because our interest is in the effects of \(\gamma\) and \(n\). We assume that \(W(\gamma ,n)\) satisfies the following conditions in the relevant range of parameters:

Assumption I

\(\partial W/\partial \gamma < 0\)

Assumption II

\(\partial W/\partial n < 0\)

Assumption III

\(W(\gamma ,n) \in [c_{s} ,c]\)

Assumption I says that an increase in retailer R 1’s buyer power enables it to obtain a lower wholesale price. This assumption rules out situations where buyer power has no impact on the wholesale price. Assumption II states that R 1’s wholesale price is lower if there are more competitors in the retail competition. This is consistent with the intuition that increased competition intensity in the downstream market would put more pressure on both the retailer and its supplier to reduce the wholesale price.

Assumption III reflects the idea that retailer R 1 cannot force its supplier to accept a price below the latter’s marginal cost of production. On the other hand, the retailer would not want to enter into the exclusive relationship if the wholesale price is to be higher than \(c\). Note that in instances where \(w > c_{s}\), the double marginalization problem exists between R 1 and its supplier.

By assuming a generic bargaining function, we circumvent the need to specify a mechanism through which the retailer’s large size translates into buyer power. In the literature, it has been shown that a larger size confers more buyer power to a retailer because it improves the retailer’s outside option, strengthens its bargaining power or bargaining position, or weakens the supplier’s bargaining position (Katz 1987; Inderst and Valletti 2011; Inderst and Wey 2011; Chen 2014). The generic bargaining function could be applicable to these different mechanisms.

In Sects. 3.2 and 4, we will show that Assumptions I to III are satisfied in situations where increased buyer power manifests itself through stronger bargaining power for R 1 in the generalized Nash bargaining problem. This is true in all three types of downstream competition that we will consider: quantity competition among homogeneous retailers, quantity competition among differentiated retailers, and price competition among differentiated retailers.Footnote 7

To solve the model, we start with the second stage of the game where each retailer chooses the quantity to sell given the wholesale prices. Their profit-maximization problems are:

for retailer \(R_{1}\), and

for other retailers \(R_{i}\)(i = 2,…,n). The first-order conditions of these optimization problems are:

The assumptions on the demand function ensure that the second-order conditions are satisfied.

Since all retailers other than \(R_{1}\) are identical, they sell the same quantity in equilibrium. Setting \(q_{i} = q_{I}\) for i ≠ 1, the above equations implicitly define \(q{}_{1}\) and \(q_{I}\) as functions of w, c, and n. But given the focus of this analysis on buyer power and downstream competition, we will supress c and write the equilibrium quantities at stage 2 in the form \(q{}_{1}(w,n)\) and \(q_{I} (w,n)\).

Conducting comparative statics on (3) and (4), it is straightforward to find that \(\partial q{}_{1}(w,n)/\partial w < 0\), \(\partial q{}_{I}(w,n)/\partial w > 0\), \(\partial q{}_{1}(w,n)/\partial n < 0\), and \(\partial q{}_{I}(w,n)/\partial n < 0\). In other words, a higher wholesale price for retailer R 1 decreases its quantity but increases the quantity of all other retailers. A larger number of retailers reduces the quantity of every retailer. Using these results, we derive:

Equation (5) implies that a higher wholesale price for retailer R 1 leads to a smaller total quantity and hence a higher retail price in equilibrium, while (6) says that a larger number of retailers increases the total quantity sold and thus reduces the retail price.

Now we are in a position to examine how buyer power and retail market concentration affect consumer welfare and social welfare. In this model, consumer welfare and social welfare are represented by consumer surplus and total surplus, respectively.

Assumption I and (5) imply that:

ThereforeFootnote 8:

Proposition 1

An increase in the buyer power of retailer R 1 reduces the equilibrium price in the retail market. Consumer welfare and social welfare are higher as a result.

A major departure of our model from von Ungern-Sternberg (1996) and Dobson and Waterson (1997) is that we have separate measures of retailer buyer power and retailer seller power. In our model, the buyer power of R 1 stems from its extension into multiple downstream markets, rather than from its expansion in a given downstream market. Accordingly, an increase in buyer power is not accompanied by a simultaneous rise in downstream market power. That is why an increase in buyer power in our model is beneficial for consumers and social welfare.

To be more specific, an increase in the buyer power of retailer \(R_{1}\) reduces its wholesale price, making itself a more aggressive competitor in the retail market. Retail price falls because of the intensified competition among retailers. The lower retail price raises consumer welfare. Moreover, social welfare is higher for two reasons: First, the reduction in wholesale price reduces the double marginalization problem between retailer \(R_{1}\) and its supplier. This improves the efficiency in the relationship between these two firms. Second, the lower wholesale price enables \(R_{1}\) to expand its market share at the expense of other retailers.Footnote 9 This enhances social welfare because \(R_{1}\) has a more efficient supplier.

Turning to the effects of downstream competition, recall that in Dobson and Waterson (1997) a reduction in the number of retailers can lead to lower consumer prices and higher social welfare if the competition at the retail level is sufficiently intense. By measuring buyer power separately from the concentration in the retail market, our analysis yields a different conclusion with regard to the impact of increased retail concentration:

Proposition 2

A more concentrated retail market (i.e., a smaller number of retailers) leads to a higher retail price. Consumer welfare is lower as a result. Social welfare falls if \(c - c_{s}\) is sufficiently small.

The harm to consumers caused by increased retail concentration comes from two sources, as represented by the two terms in:

The first term on the right-hand side of (8) says that the retail price is higher because the total quantity is smaller in a more concentrated market. This is the conventional source of harm to consumers. The second term is related to the large retailer’s buyer power. It stems from Assumption II (\(\partial W/\partial n < 0\)), which implies that the large retailer would settle for a higher wholesale price when the competitive pressure in the retail market is lower. The higher wholesale price then causes the retail price to rise further.

The impact of increased retail concentration on social welfare, however, is less clear-cut. The ambiguity arises because, under the assumption that \(c > c_{s}\), the increased concentration is associated with the elimination of a retailer whose supplier has higher marginal cost than that of the large retailer. This generates an efficiency gain that reduces the loss that is associated with the lessening of competition. But this efficiency gain would not be sufficient to offset completely the loss if the difference in marginal costs (\(c - c_{s}\)) is small. Later in Sect. 3.2—where the wholesale price is determined by the generalized Nash bargaining solution—we will present a precise condition on \(c - c_{s}\) under which social welfare falls unambiguously.

Propositions 1 and 2 have interesting policy implications: Merger reviews by competition authorities in many countries have traditionally focused on market power on the seller side rather than on the buyer side.Footnote 10 In the case of a merger between two retailers, this approach typically involves the examination of individual geographic markets to ensure that (after the merger) there is sufficient competition among retailers in each local market. Propositions 1 and 2 combined suggest that this traditional approach to merger reviews can actually work reasonably well even in a situation where the merger also enhances the buyer power of the merged entity. By preventing the downstream market from becoming more concentrated, the competition authority would ensure that the post-merger retail price will not rise and may possibly fall.

Finally, we examine the interaction between buyer power and the intensity of downstream competition. The question we want to address here is whether the impact of buyer power is larger or smaller when the retail market becomes more concentrated.

Proposition 3

If \(\partial^{2} W/\partial n\partial \gamma > 0\) , the reduction in retail price in response to an increase in the buyer power of retailer R 1 decreases with the number of retailers; in other words, the smaller is the number of retailers, the greater is the reduction in retail price.

Proposition 3 suggests that when the downstream market is less competitive, an increase in buyer power may bring about a greater decrease in retail price and consequently a larger gain in consumer surplus. This result is surprising because intuitively the pressure for a retailer to pass on the cost savings from a lower wholesale price to consumers is stronger when there is more intense competition among retailers. This intuition might suggest that the reduction in retailer price that results from the exercise of buyer power should be smaller when the retail market is less competitive.

However, this intuition is incorrect for two reasons. First, it is not always the case that a retailer would pass on a larger fraction of a cost saving when the competition in the retail market is more intense. To see this, consider the two extreme cases of retail market structure: one where retailer R 1 is a monopolist, and the other where it faces a very large number of competitors. In the former case, it is well-known that the monopoly retailer would pass on a fraction—for example, ½ in the case of linear demand function—of a cost saving (e.g., a reduction in wholesale price) to consumers. But in the latter case, the retailer would practice limit pricing regardless of its costs (recall that \(c_{s} < c\)); and, consequently, it would not pass on any of the cost saving.

Second, the intuition misses the fact that the margin between the retail price and the marginal cost of production is also higher when the retail market is less competitive. Hence, there is more room for the retail price to fall in response to the increased buyer power, and Proposition 3 shows that this is indeed what happens in equilibrium if \(\partial^{2} W/\partial n\partial \gamma > 0\).

Note that \(\partial^{2} W/\partial n\partial \gamma\) is the derivative of \(\partial W/\partial \gamma\) with respect to \(n\) and the sign of \(\partial W/\partial \gamma\) is negative. Hence, \(\partial^{2} W/\partial n\partial \gamma > 0\) implies that an increase in buyer power brings about a larger reduction in wholesale price when the retail market is more concentrated. For a given pass-through rate (\(\partial p/\partial w\)), the larger reduction in wholesale price then leads to a greater fall in the retail price.

This begs the question: Does \(\partial^{2} W/\partial n\partial \gamma > 0\) hold under plausible circumstances? Below we will show that this is indeed true in cases where the demand function is linear and the wholesale price is determined by the generalized Nash bargaining solution.

3.2 Generalized Nash Bargaining with a Linear Demand Function

Now we assume that the outcome of the negotiation at stage 1 is determined by the generalized Nash bargaining solution. In order to derive a closed-form solution to the wholesale price, we consider a linear demand function, \(P(Q) = a - bQ\) with \(a > 0\) and \(b > 0\). To ensure that every retailer sells a positive quantity in equilibrium, we assume that \(a > 2c - c_{s}\).

Let \(\pi_{1}\) and \(\pi_{s}\) denote the profits of retailer R 1 and its supplier, respectively. Because of their exclusive relationship, their disagreement payoffs (i.e., their inside options) are both zero. The supplier has the outside option of producing and selling the good in the competitive market. But in doing so, the supplier would lose the efficiency gains that are associated with the exclusive relationship and thus it would be just like other suppliers with marginal cost c. The outside option of retailer R 1 is to purchase the good in the competitive market at the price c.Footnote 11

Taking into consideration the Outside Option Principle (Binmore et al. 1986), we write the generalized Nash bargaining problem as:

where γ∈(0,1) measures R 1’s relative bargaining power. Recall that in Sect. 3.1, γ is the measure of the retailer’s buyer power against its supplier. Accordingly, here we use retailer R 1’s bargaining power as the measure of its buyer power.

We offer three justifications for this approach: The first justification is based on the well-known observation that the generalized Nash bargaining solution can be derived from the equilibrium in the Rubinstein bargaining game in the limit case where the duration between offers and counter-offers is infinitesimally small (see, e.g., Muthoo 1999). The players’ relative bargaining power is then a function of their time discount rates. It seems plausible that as a retailer becomes larger, it will be able to access the capital market at a lower rate of interest, which implies a smaller time discount rate. This, in turn, translates into stronger bargaining power for the retailer.

Next, as shown in Chen (2014), a larger retailer has a stronger incentive to invest in the quality of its negotiation team, thus leading to stronger bargaining power. Finally, even if the buyer power manifests itself through other channels, it ultimately increases the retailer’s “slice of the pie”.Footnote 12 Thus, a larger γ is a reasonable proxy for an increase in buyer power in such situations.

Using the linear demand function, we solve the Cournot equilibrium at stage 2 to find:

Substituting (10) and (11) into R 1’s and its supplier’s profits, we can solve the generalized Nash bargaining problem (9). We do so in two steps. First, we suppose that the constraints in (9) are not binding and derive the Nash bargaining solution under the assumption that \(c_{s} < w < c\):

Second, we investigate whether the solution satisfies this assumption. Using (12), we can verify that \(w^{N} > c_{s}\), which indicates that the supplier’s outside option is not binding in equilibrium. On the other hand, \(w^{N} \le c\) implies that \(\gamma \ge \gamma_{L}\), where:

Thus, retailer R 1’s outside option is not binding only if its buyer power exceeds the threshold given in (13).Footnote 13 In the case where its buyer power is below this threshold, the Outside Option Principle implies that the negotiated wholesale price would be \(w = c\), and the equilibrium is independent of R 1’s buyer power. In this case, a small increase in the buyer power would have no effect as long as the increased value of γ does not exceed \(\gamma_{L}\).

With regard to Assumption I, we differentiate (12) to find:

Accordingly, Assumption I is satisfied as long as \(\gamma \ge \gamma_{L}\). In essence, this assumption ensures that retailer R 1 has a meaningful amount of buyer power that would allow it to have a material influence on the wholesale price.

Differentiating (12) with respect to n, we obtain:

which implies that Assumption II is satisfied. The constraints in (9) ensure that Assumption III holds as well.

Since Assumptions I–III are all satisfied, we conclude that Propositions 1–3 hold in the present case. Furthermore, it is easy to show that the condition specified in Proposition 3,

is indeed true. Therefore:

Corollary 1

Suppose that the demand function is linear and the wholesale price is determined by the generalized Nash bargaining solution. Then the smaller is the number of retailers, the greater is the reduction in the wholesale and retail prices in response to an increase in the buyer power of retailer R 1 .

To gain a more precise, and more complete, understanding of the intuition behind Proposition 3 and Corollary 1, note that the equilibrium retail price can be viewed as a function of \(w = W(\gamma ,n)\) and \(n\). To be more specific, using (11) and (12) we can write the equilibrium retail price in the form \(\tilde{P}(W(\gamma ,n),n)\). Noting that \(\partial^{2} \tilde{P}/\partial w^{2} = 0\), we have:

The right-hand side of (17) identifies two channels through which downstream competition influences the marginal impact of buyer power on retail price. First, a more concentrated retail market (i.e., a smaller \(n\)) enlarges the reduction in wholesale price that is associated with an increase in buyer power, as is indicated by (16). If we hold the pass-through rate \(\partial \tilde{P}/\partial w\) constant, this leads to a larger decrease in the retail price. Second, the pass-through rate itself is affected by the number of retailers. From (11) we obtain:

which implies that for a given reduction in wholesale price, the retail price falls by a larger magnitude when there are fewer retailers. In both instances, therefore, an increase in buyer power leads to a larger reduction in the retail price when the market is more concentrated.

The policy implication of Proposition 3 and Corollary 1 is interesting. It suggests that a competition authority does not necessarily have to be more concerned about the effects of buyer power in a more concentrated retail market. A concentrated retail market is not desirable in terms of consumer and social welfare. But a merger that enhances the buyer power of the merged entity without increasing the sellers’ concentration in the retail market can be welfare-improving.

Proposition 3 and Corollary 1 also suggest that buyer power and downstream competition can be viewed as substitutes in terms of their effects on consumers. The idea that buyer power and competition are substitutes is a major element in Galbraith’s (1952) countervailing power hypothesis. So far, however, this idea has received very little theoretical support. Our analysis provides more rigor to this idea and identifies an environment where it holds true.

With the additional structure of a linear demand function and the Nash bargaining solution, we are able to be more specific about the condition given in Proposition 2:

Corollary 2

Suppose that the demand function is linear and the wholesale price is determined by the generalized Nash bargaining solution. Then a more concentrated retail market reduces social welfare if \(c - c_{s} < (a - c)/(n + 2)\).

Given the results we have obtained so far, it is natural to ask: What would happen if the downstream market is instead served by a monopoly?

The answer, it turns out, is “the same results”. Propositions 1–3 and Corollaries 1–2 continue to hold for the presence of a retailer monopoly. Mathematically, our model of oligopolistic retailers converges to that of a monopoly when \(n = 1\). In other words, we can obtain the equilibrium prices and quantities under a monopoly by setting \(n = 1\) in (10)–(12).

Three implications of the preceding paragraph are worth noting: First, an increase in the buyer power of the monopoly retailer reduces equilibrium wholesale price and retail price, and improves both consumer and social welfare. In other words, the effects of buyer power in the case of a monopoly retailer are qualitatively the same as those in the oligopolistic retail market. This conclusion is in sharp contrast to von Ungern-Sternberg (1996) and Dobson and Waterson (1997), in which increased buyer power in a highly concentrated retail market is detrimental to consumer and social welfare.

Second, an increase in the buyer power of retailer R 1 causes a greater reduction in the wholesale and retail price in the monopolistic retail market than in the oligopolistic retail market. Therefore, the benefit of increased buyer power to consumers is the largest when the competition in the retail market is the weakest.

Third, if a merger to monopoly in this retail market also enhances R 1’s buyer power, it would have ambiguous effects on consumer welfare and social welfare. On the one hand, the increased retail concentration would harm consumers and reduce total surplus (under the condition specified in Proposition 2 or Corollary 2). On the other hand, the enhanced buyer power benefits consumers and increases social welfare. The net impact, of course, will depend on the magnitude of the buyer power effect relative to that of increased concentration.

4 Product Differentiation

While the homogeneous retailer model studied in Sect. 3 has the advantage of simplicity and elegance, it misses an important characteristic of many retail markets: product differentiation among retailers. In reality, retailers can be differentiated in several aspects, such as locations and services.

In this section, we extend our analysis to take into account retailer differentiation. Specifically, suppose that retailer i (=1, 2,…, n) faces the following inverse demand function:

where \(\theta \in (0,1)\) measures the degree of substitutability between two retailers. The larger is the value of \(\theta\), the higher is the degree of substitutability. Unless specified otherwise, the remaining aspects of the model are the same as those in Sect. 3.2.

In this model of differentiated retailers, we will consider both quantity competition and price competition in the downstream market. Because of space limits, we will focus our discussions on the robustness of our most interesting results from Sect. 3: those regarding the interaction between buyer power and downstream competition (in particular, Proposition 3 and Corollary 1).

4.1 Quantity Competition

Here we continue to assume that the retailers compete in quantity. To distinguish these results from the case of homogenous retailers, we use superscript \(C\) to denote the equilibrium in the case of quantity competition among differentiated retailers. Solving the equilibrium at stage 2 using the demand function (19), we obtain:

Since \(w \ge c_{s}\), the assumption \(a > 2c - c_{s}\) ensures that \(q_{I}^{C}\) is positive for any \(\theta \in (0,1)\).

Substituting (20) into the profits of retailer R 1 and its supplier, we solve (9) to find the Nash bargaining solution in this case:

Similar to Sect. 3.2, the constraint \(w \le c\) holds as long as the buyer power exceeds a certain threshold; i.e., \(\gamma \ge \gamma_{L}^{C}\) where:

As in Sect. 3.2, we assume \(\gamma \ge \gamma_{L}^{C}\) to focus on the situation where R 1 has a meaningful amount of buyer power to be able to influence its own wholesale price.Footnote 14

From (21), we find:

As in the case of homogeneous retailers, an increase in R 1’s buyer power reduces its wholesale price. This enables us to obtain the following results:

Proposition 4

Suppose that retailers are differentiated and they compete in quantity. Then:

Proposition 4 states that an increase in the buyer power of retailer R 1 reduces not only its own retail price but also the prices of all of the other retailers. The smaller is the number of retailers, the greater is the reduction in the wholesale price and in the retail prices in response to an increase in R 1’s buyer power. These findings are, of course, qualitatively the same as those in Sect. 3.

4.2 Price Competition

Now suppose that the retailers engage in price competition. To solve the Bertrand competition equilibrium at stage 2, we invert the inverse demand function (19) to obtain the following demand function:

We use superscript B to denote the equilibrium under price competition. At stage 2 of the game, each retailer chooses its price to maximize its profits. Solving these profit-maximization problems, we find the equilibrium prices at stage 2:

where \(p_{I}^{B}\) is the price of retailer R i (i = 2,…, n).

As can be seen from (26) and (27), the algebra in the case of price competition is more intricate than that of quantity competition. To make the analysis tractable, we use a slightly simpler version of the generalized Nash bargaining problem to determine the wholesale price: Specifically, we assume that retailer R 1 and its supplier negotiate over the split of per-unit surplus \(p_{1} - c_{s}\). In other words, we consider the following bargaining problem:

Using the same procedure as in Sect. 3.2, we find the equilibrium wholesale price:

provided that the value of \(\gamma\) exceeds a certain threshold: \(\gamma_{L}^{B}\). The precise expression of \(\gamma_{L}^{B}\) is quite complicated and thus is relegated to the “Appendix”.

Using (26), (27), and (29), we are able to obtain the following results that are qualitatively the same as Proposition 4:

Proposition 5

Suppose retailers are differentiated and they compete in prices. Then

Propositions 4 and 5 demonstrate that our main findings in Sect. 3 are robust to the incorporation of retailer product differentiation and are valid under both quantity competition and price competition. Larger buyer power in the hands of retailer R l reduces the prices of all retailers. The smaller is the number of retailers, the greater is the reduction in the wholesale and retail prices in response to an increase in R 1’s buyer power.

5 Concluding Remarks

By studying four variations of a model that isolates the effects of buyer power from those of the downstream competition, we have demonstrated that enhanced buyer power of a large retailer reduces retail prices and improves consumer welfare, and this is true even in the case where the retail market is served by a monopolist. More interestingly, the beneficial effect of the increased buyer power on consumer welfare is larger when the intensity of downstream competition is lower, with the effect being the largest in the case of downstream monopoly.

These findings have practical implications for how a competition authority should deal with cases where a merger between two retailers does not increase the concentration of retailer markets but enhances the buyer power of the retailers. Such a case may arise if the two merging retailers sell in different geographic markets.Footnote 15 Even in a case where the two retailers have overlaps in some geographic markets, a competition authority typically would either reject the merger or require divestiture by the merging retailers in those local markets where post-merger concentration is deemed too high.Footnote 16 What this means is that, in practice, buyer power becomes an issue in a merger analysis only after the concerns over retail concentration have already been dealt with.

In such cases, a competition authority may want to know the answer to questions such as, “will competition in the retail markets ensure that post-merger exercise of buyer power does not harm consumers?”; or in a case where the pre-merger concentration in the retail markets is high, “should we still be concerned about the exercise of buyer power even though the merger does not increase the concentration in each retail market?”

Our analysis provides an answer to these questions. First, it suggests that the traditional approach to merger reviews, under which a competition authority focuses on maintaining competition in local retail markets, can work reasonably well even in a situation where the merger enhances the buyer power of the merged entity in the upstream market. By preventing the downstream market from becoming more concentrated, the competition authority can ensure that post-merger retail prices will not rise and may even fall.

Second, it is not necessarily the case that an increase in buyer power is more beneficial to consumers and social welfare when the downstream competition is more intense. In our model, the opposite is true: The beneficial effects of an increase in buyer power are larger when the downstream competition is less intense.

Third and finally, the competition authority does not necessarily have to be more concerned about the effects of buyer power in a more concentrated retail market. A concentrated retail market is not desirable, but a merger that that enhances the buyer power of the merged entity without increasing the concentration in the retail market can mitigate the negative effects of high concentration.

An important assumption in our model is that a per-unit price is used in the contract between the large retailer R 1 and its supplier. If we change this assumption and suppose, instead, that the contract takes the form of a two-part tariff, the equilibrium can be qualitatively different. Specifically, the retailer and the supplier may be able to set the wholesale price w to maximize their joint-profits and use the fixed fee to divide the joint profits.Footnote 17 If this is the case, an increase in the retailer’s buyer power will simply enlarge its share of the joint profits, but it will have no impact on retail price or welfare.

A two-part tariff and a single per-unit price represent the two extremes in the ability of the retailer and the supplier to negotiate a wholesale price that maximizes their joint profits. With a two-part tariff, both of them want the joint-profit-maximizing wholesale price because they can divide the maximum joint-profits through the fixed fee. With a single per-unit price, on the other hand, the division of the joint profits can be done only through the wholesale price; and as a result, their interests are diametrically opposed, with the supplier preferring a higher and the retailer preferring a lower wholesale price.

It is an empirical question whether a retailer and its supplier are always able to align their interests in a way that enables them to choose the efficient (i.e., joint-profit-maximizing) wholesale price. While it is true that contracts between retailers and their suppliers often contain more terms of trade than a single per-unit price, there are important exceptions. Wal-Mart, for example, is famous for boiling everything down to a wholesale price in their negotiations with suppliers (Useem et al. 2003). Even with more complex contracts, retailers and their suppliers do not always choose the efficient wholesale price due to various information and incentive issues that exist in the real world. Indeed, evidence shows that inefficiencies exist in the relationship between retailers and their suppliers (Buzzell et al. 1990; Dawar and Stornelli 2013).

The results we have obtained in this paper would continue to hold qualitatively as long as the supplier and the retailer differ in their most-preferred wholesale price. In such a situation, an increase in the retailer’s buyer power will manifest itself, at least in part, through a lower wholesale price, and the lower wholesale price will have the effects that are examined in this paper.

Finally, it is important to note that this analysis is conducted under the assumption of constant marginal costs of production by the upstream supplier. This assumption implies that the quantity sold by the supplier to the large retailer does not decrease in response to a marginal reduction in the wholesale price. To the contrary, a greater quantity will be sold to the large retailer as the lower wholesale price enables the latter to sell more in the retail market. Therefore, by design our model does not take into account the possibility of reduced supply in response to a lower wholesale price. Accordingly, our conclusions may not be applicable to cases where buyer power concerns are caused by possible reductions in the quantity supplied in an upstream market.

Notes

Specifically, Chen (2003) shows that as the dominant retailer gains more buyer power, the retail price will decrease but the welfare effects will depend on the market share of the dominant retailer and the difference in the costs between the dominant retailer and the other retailers. When the number of fringe retailers is sufficiently large, increased buyer power will improve social welfare.

These assumptions on the second- and third-order derivatives of \(P(Q)\) ensure that the second-order condition of each firm’s profit-maximization problem is satisfied and that the pass-through rate of a higher wholesale price is smaller when the downstream market becomes more competitive. The role of the pass-through rate is discussed in Sect. 3.2 after Eq. (17).

Hence, we assume that all retailers have the same retailing costs. For an analysis on how a difference in retailing costs affects the distribution of profits among retailers and suppliers, see Dukes et al. (2006).

Indeed, early examples of retailer power given by Galbraith (1952) were the major chain stores in the first half of the twentieth century, such as A&P and Sears, Roebuck. In these examples, it was their large sizes that stemmed from selling in many local markets that conferred on these retailers the power to obtain lower prices from their suppliers.

However, it is beyond the scope of this paper to demonstrate that these assumptions hold for every possible mechanism of buyer power.

The proofs of all propositions and corollaries are relegated to the “Appendix”.

Here retailer R 1 is able to purchase a larger quantity from its supplier despite the lower wholesale price because the price is still above the supplier’s (constant) marginal cost of production.

This can be seen from the scant attention that was paid to buyer power in past merger-enforcement guidelines in Canada, the E.U., and the U.S. Over time, however, competition authorities are becoming more cognizant of potential buyer-power issues in merger reviews. For example, in 2014 the U.S. Department of Justice (DOJ) objected to the acquisition of Hillshire Brands by Tyson Foods on the ground that the transaction would likely reduce competition for purchases of sows from farmers (US Department of Justice 2014). The merger was approved after Tyson Foods agreed to divest its sow-buying business that competed directly against Hillshire’s sow slaughter business. Further, buyer power considerations were central to the DOJ’s concerns in its evaluation of the Comcast-NBCU merger and the proposed Comcast-Time Warner Cable merger. See Rogerson (2013) for a detailed discussion of these concerns in the Comcast-NBCU merger case.

In principle, inside options and outside options are concepts in non-cooperative bargaining theory. However, as explained in Muthoo (1999), the inside option point corresponds to the disagreement point, and the outside option point constrains the set of possible agreements in the Nash bargaining problem. The latter result is known as the Outside Option Principle. That is why the inside options enter the Nash product while the outside options are included as constraints in (9) below.

In the literature, a number of authors have examined the sources of buyer power. They include Katz (1987), Chipty and Snyder (1999), Montez (2007), Inderst and Wey (2007, 2011), Inderst and Valletti (2011), and Chen (2014). Among them, Montez (2007) poses the question, “Why bake a larger pie when getting a smaller slice?”

For example, the consolidation in European retail markets involved a significant number of cross-border mergers (Inderst and Wey 2007, p. 45). In particular, Wal-Mart entered several EU countries via a string of acquisitions, including that of Asda (UK) and Wertkauf (Germany).

In 1999, for example, Canada’s Competition Bureau approved two mergers of grocery retail chains after the merging parties agreed to divest certain stores in those local markets where they had significant overlaps. In each case, the two retail chains operated primarily in separate parts of the country and they overlapped in only a small number of local markets before the merger (Competition Bureau 1999a, b). In the U.K., the Competition Commission approved the acquisition of Safeway by Wm Morrison Supermarkets conditional on the divestiture of over 50 stores to address adverse competition effects of the merger in various local retail markets (Competition Commission 2003).

The fixed fee could take the form of a slotting allowance, which is a lump sum payment made by the supplier to the retailer. Indeed, if we incorporate a two-part tariff into the price competition model in IV.2, we can show that such a payment would arise if the retailer’s buyer power is sufficiently strong. Details are available upon request.

References

Battigalli, P., Fumagalli, C., & Polo, M. (2007). Buyer power and quality improvement. Research in Economics, 61, 45–61.

Binmore, K., Rubinstein, A., & Wolinksky, A. (1986). The Nash bargaining solution in economic modelling. RAND Journal of Economics, 17, 176–188.

Buzzell, R. D., Quelch, J., & Salmon, W. J. (1990). The costly bargain of trade promotion. Harvard Business Review, 68(2), 141–149.

Chen, Z. (2003). Dominant retailers and the countervailing power hypothesis. RAND Journal of Economics, 34, 612–625.

Chen, Z. (2007). Buyer power: Economic theory and antitrust policy. Research in Law and Economics, 22, 17–40.

Chen, Z. (2014). Supplier innovation in the presence of buyer power. Carleton Economic Papers, 2014-03. Retrieved September 10, 2015 from Carleton University, Department of Economics Web Site: http://carleton.ca/economics/wp-content/uploads/cep14-03.pdf

Chipty, T., & Snyder, C. M. (1999). The role of outlet size in bilateral bargaining: A study of the cable television industry. Review of Economics and Statistics, 81, 326–340.

Competition Bureau. (1999a). Backgrounder: Loblaw Companies Limited—acquisition of Provigo Inc. in Quebec and Ontario. Released on August 12, 1999.

Competition Bureau. (1999b). Backgrounder: Sobeys Inc. acquisition of certain assets of the Oshawa Group Limited. Released on December 22, 1999.

Competition Commission. (2003). Safeway plc and Asda Group Limited (owned by Wal-Mart Stores Inc); Wm Morrison Supermarkets PLC; J Sainsbury plc; and Tesco plc: A report on the mergers in contemplation. Retrieved November 10, 2012 from http://webarchive.nationalarchives.gov.uk/+/http://www.competition-commission.org.uk/rep_pub/reports/2003/481safeway.htm

Dawar, N., & Stornelli, J. (2013). Rebuilding the relationship between manufacturers and retailers. MIT Sloan Management Review, 54(2), 83–90.

Dobson, P. W., & Waterson, M. (1997). Countervailing power and consumer prices. Economic Journal, 107, 418–430.

Dukes, A. J., Gal-Or, E., & Srinivasan, K. (2006). Channel bargaining with retailer asymmetry. Journal of Marketing Research, 43, 84–97.

Erutku, C. (2005). Buying power and strategic interactions. Canadian Journal of Economics, 38, 1160–1172.

Galbraith, J. K. (1952). American capitalism: The concept of countervailing power. Boston: Houghton Mifflin.

Harsanyi, J. C., & Selton, R. (1972). A generalized Nash solution for two-person bargaining games with incomplete information. Management Science, 18, 80–106.

Inderst, R., & Valletti, T. M. (2011). Buyer power and the “waterbed effect”. Journal of Industrial Economics, 59, 1–20.

Inderst, R., & Wey, C. (2007). Buyer power and supplier incentives. European Economic Review, 51, 647–667.

Inderst, R., & Wey, C. (2011). Countervailing power and dynamic efficiency. Journal of the European Economic Association, 9, 702–720.

Katz, M. L. (1987). The welfare effects of third degree price discrimination in intermediate goods markets. American Economics Review, 77, 154–167.

Mills, D. E. (2010). Buyer power and industry structure. Review of Industrial Organization, 36, 213–225.

Montez, J. V. (2007). Downstream mergers and producer’s capacity choice: Why bake a larger pie when getting a smaller slice? RAND Journal of Economics, 38, 948–966.

Muthoo, A. (1999). Bargaining theory with applications. Cambridge: Cambridge University Press.

OECD. (1998). Roundtable on buying power of multiproduct retailers. Retrieved November 10, 2012 from http://www.oecd.org/dataoecd/1/18/2379299.pdf

OECD. (2004). Roundtable on competition and regulation in agriculture: Monopsony buying and joint selling. Retrieved November 10, 2012 from http://www.oecd.org/dataoecd/7/56/35910977.pdf

OECD. (2008). Policy roundtables: Monopsony and buyer power. Retrieved November 10, 2012 from http://www.oecd.org/dataoecd/38/63/44445750.pdf

Rogerson, W. P. (2013). Vertical mergers in the video programming and distribution industry: The case of Comcast NBCU (2011). In J. E. Kwoka Jr & L. J. White (Eds.), The antitrust revolution: Economics, competition, and policy (6th ed., pp. 534–575). New York: Oxford University Press.

U.S. Department of Justice. (2014). Justice Department requires divestiture in Tyson Foods Inc. acquisition of the Hillshire Brands Company. Department of Justice news release, August 27, 2014.

Useem, J., Schlosser, J., & Kim, H. (2003). One nation under Wal-Mart. Fortune, 147(4), 65–67.

von Ungern-Sternberg, T. (1996). Countervailing power revisited. International Journal of Industrial Organization, 14, 507–520.

Acknowledgments

For comments we thank Gamal Atallah, Rose Anne Devlin, Can Erutku, Patrick Rey, Anindya Sen, Roger Ware, Larry White, the participants at the 2012 EARIE conference, and two anonymous referees. Financial assistance from the Social Sciences and Humanities Research Council of Canada is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs of Propositions and Corollaries

Appendix: Proofs of Propositions and Corollaries

Proof of Proposition 1

The first statement of this proposition follows from (7). Consumer welfare is measured by consumer surplus, given by

By Assumption I and Eq. (5), we find that

Social welfare is measured by total surplus, which can be written as

Differentiating (33) and use the retailers’ optimization conditions, we obtain

The sign of (34) is determined by (5), \(\partial q_{1} /\partial w < 0\), \(\partial q_{I} /\partial w > 0\), Assumptions I and III, and \(q_{1} \ge q_{I}\) (because \(w \le c\)). □

Proof of Proposition 2

The first statement of this proposition follows from Assumption II, (5), (6), and (8). Differentiating (31) with respect to \(n\), we obtain:

the sign of which is determined by (5), (6), and Assumption II. Differentiating (33), we find:

The signs of the first two terms on the RHS of (36) are positive, while the sign of the third term is indeterminate. However, the third term vanishes if \(c = c_{s}\) (in which case \(w = c_{s}\) by Assumption III). By continuity, \(\partial TS/\partial n > 0\) if \(c - c_{s}\) is sufficiently small. □

Proof of Proposition 3

From (5), we derive:

Differentiating (37) with respect to \(w\) and \(n\) (respectively), we find

Now differentiate (7) to obtain:

The sign of the first term on the RHS of (40) is positive by (38), (39) and Assumptions I and II. The sign of the second term is positive as well if \(\partial^{2} W/\partial n\partial \gamma > 0\). Hence the sign of (40) is positive under the same condition. □

Proof of Corollary 1

Follows from (16) and Proposition 3. □

Proof of Corollary 2

Using the linear demand function, we write the total surplus as:

Differentiate (41) to obtain:

which is positive if \(p - 2c + c_{s} > 0\). Using (11), we can show that the latter holds for all \(\gamma \in (0,\,1)\) if \(c - c_{s} < (a - c)/(n + 2)\). □

Proof of Proposition 4

To simplify presentation, define \(Z \equiv (2 - \theta )[2 + (n - 1)\theta ]\). Using (19), (20) and (23), we find:

From (23), we obtain:

□

Proof of Proposition 5

Define

It is easy to verify that \(T > 0\) and that \(Y/T > c\). Then the wholesale price in (29) can be written as \(W^{B} (\gamma ,n) = (1 - \gamma )Y/T + \gamma \,c_{s}\). Since \(Y/T > c\) and \(c > c_{s}\), we conclude that \(W^{B} (\gamma ,n) > c_{s}\) for \(\gamma \in (0,\;1)\). The threshold \(\gamma_{L}^{B}\) is obtained by solving \((1 - \gamma )Y/T + \gamma c_{s} = c\), which yields:

Differentiating (29), we find:

From (50), we obtain

where \(G \equiv [\theta^{2} (2n^{2} - 6n + 5) + \theta (4n - 7) + 2]a - [\theta^{2} (2n^{2} - 6n + 5) + \theta (2n - 3)]c,\) which is positive because \(a > c\).

Define \(S \equiv 2[1 + \theta (n - 2)][2 + \theta (n - 2)] - \theta^{2} (n - 1)\). Differentiating (26), we obtain

which is clearly positive if \(\theta^{2} (n - 2)n + 3\theta - 2 \ge 0\). In the case where \(\theta^{2} (n - 2)n + 3\theta - 2 < 0\), we can show that \((1 - \theta )[\theta^{2} (n - 2)^{2} + 3\theta (n - 2) + 2] > - \theta [\theta^{2} (n - 2)n + 3\theta - 2]\). Moreover, it can be verified that \(G > (Y - Tc_{s} )\) and \(S > T\). These imply that (53) is positive in this case as well.

Regarding the price of the retailers other than R 1, we obtain from their best response functions at stage 2

Differentiating (54) and using (52)–(53), we can verify that \(\partial p_{I}^{B} /\partial \gamma < 0\) and \(\partial^{2} p_{I}^{B} /\partial n\partial \gamma > 0\). □

Rights and permissions

About this article

Cite this article

Chen, Z., Ding, H. & Liu, Z. Downstream Competition and the Effects of Buyer Power. Rev Ind Organ 49, 1–23 (2016). https://doi.org/10.1007/s11151-016-9501-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-016-9501-8