Abstract

Conditioned geographical clustering is the strategy of grouping portions of a REIT’s property portfolio within a contiguous region to exploit economies of scale through spatial proximity. This paper examines the impact of conditioned geographical clustering on REIT operational efficiency and value. Our results suggest REITs create value by employing a strategy of property clustering and that operational efficiency is the primary channel through which increases in value are achieved. In addition, results suggest conditioned geographic clustering mitigates the REIT geographical diversification discount. Our findings support an optimal degree of property clustering within the 5th to 35th percentiles of the sample distribution and suggest the optimal cluster size has a radius between 50 and 75 miles.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Equity Real Estate Investment Trusts (REITs) are firms designed to manage portfolios of income-generating real estate with a regulatory mandate of distributing 90% or more of their earnings to shareholders in the form of dividends to maintain their pass-through tax status.Footnote 1 The primary goal of a REIT manager is to effectively and profitably operate real estate assets; therefore, managers must seek ways to enhance their operational efficiency to increase firm value and shareholder wealth. The existing literature suggests REITs often produce gains in value by exploiting cost-reducing strategies and improving management effectiveness. Strategies include exploiting economies of scale through expanding their property portfolio or property-type specialization, maximizing output from the minimum and correct proportions of inputs (technical and X-efficiency), and/or reducing overall expenses relative to operational revenues (operational efficiency). Research finds evidence favoring some of these strategies while suggesting other strategies produce mixed results (e.g., Beracha et al., 2019a; Highfield et al., 2021; Nicholson & Stevens, 2021). We extend the REIT literature by examining if conditioned geographical clustering, a strategy of grouping portions of firm’s property portfolio within a functional radius, produces gains in operational efficiency and firm value that are distinct from other scale economies gains such as those from size, property type concentration, or agglomeration. Footnote 2

We hypothesize REITs systematically and strategically create dense, contiguous property groups to exploit economies of scale benefits such as enhanced local market expertise and cost reductions associated with general and administrative expenses such as property maintenance, supervision, and management. The positive effects of property clustering partially explain why REITs that acquirebetter reflect the more controllable property portfolios reconfirming a geographical focus experience positive wealth effects, as reported by Campbell et al. (2003). We expect efficiency improvements to be more significant as REITs select the correct proportion of their portfolios to cluster and hypothesize there is an optimal cluster size, in terms of the number of properties and area of the cluster, that maximizes operational efficiency and firm value. We also hypothesize economy of scale benefits from clustering mitigate the geographical diversification discount, allowing RETs to benefit from more geographically dispersed portfolios.

To test our hypotheses, we geolocate all properties owned by equity REITs between 1993 and 2019 and identify property clusters using an unsupervised learning algorithm that defines clusters based on a pre-specified distance radius and cluster size. Our results suggest moderate property clustering significantly improves REIT operational efficiency relative to REITs with extremely high or low degrees of clustering. We also find moderate degrees of property clustering are associated with higher REIT valuations. Specifically, we find REITs with a degree of clustering between the 5th and 35th percentile of the clustering distribution to experience the most significant efficiency and firm value increases. Based on these results, we conclude efficiency gains created by employing a functional strategy of conditioned geographical clustering create wealth for shareholders. Extensions to our analysis show the optimal cluster radius is between 50 and 75 miles and that the geographic diversification discount can be mitigated by conditioned geographical clustering. Our results are robust to various models and property cluster specifications.

Our findings contribute to the REIT literature in several distinct ways. This is the first paper to investigate the impact of conditioned geographical clustering on REIT operational efficiency and value. We empirically unveil a channel leading to significant operational efficiency improvements and higher valuation; this is relevant since Beracha et al. (2019a, b) find operational efficiency to be a significant determinant of REIT operating and market performance. In addition, we find that the increases in value are achieved mainly through the channel of operational efficiency. We also observe that a property clustering strategy creates value through other channels which we theorize are related to gains in informational efficiency. Moreover, our results offer guidance on the size and degree of property clustering to create more efficiency and value gains in REITs. Finally, our findings imply the REIT geographical diversification discount can be alleviated through a practicable strategy that produces significant performance improvements.

The remainder of the paper is organized as follows. The next section provides a summary of the background literature. Then, we describe our data and sample selection. Following, we describe our empirical strategy and present our results covering the relationship between conditioned geographic clustering and operational efficiency as well as firm value. Finally, the last section concludes.

Efficiency, Economies of Scale and REIT Performance

Operational efficiency, factors contributing to efficiency, and the effect of efficiency on firm value continue to be important topics of debate in the REIT literature. Beracha et al. (2019a, b) find more operationally efficient REITs display better operational results, higher cumulative stock returns, higher firm values, lower levels of credit risk, and less stock return volatility. Research also links REIT size, management types, firm structure, and other firm characteristics/performance measures to operational efficiency.Footnote 3 Nicholson and Stevens (2021) note there are four broad categories of factors impacting REIT operating efficiency: (1) economies of scale; (2) widening product offerings; (3) the relationship between operational expenses and revenue/income; and (4) the effectiveness of generating output with an efficient input mix (x-efficiency).

Economies of scale (or scale economies) broadly refers to cost advantages as the size of the REIT, defined by the number of properties, portfolio size, or property type concentration, increases. REITs potentially benefit from economies of scale through at least five channels. First, as the size of the portfolio increases, the REIT may experience reductions in general administration and management expenses, such as those from insurance, landscaping, maintenance, and advertising (Mueller, 1998; Ambrose et al., 2005; Kim, 1986; Ambrose et al., 2019; Bers & Springer, 1998; Capozza & Seguin, 1998; Linneman, 1997). The reduction in general administration and management expenses may result from sharing fixed costs across an increasing number of properties or from intermediate suppliers such as maintenance crews exploiting their scale economies. Second, larger REITs may have access to more financial resources, allowing them to access better debt terms and achieve a lower cost of capital (Ambrose et al., 2019; Mueller, 1998). Third, larger REITs may establish a strong brand image and achieve economies of scale in marketing, effectively capturing quality tenants (Ambrose, et al., 2000). Fourth, larger REITs may have more financial resources, thereby allowing them to utilize higher quality personnel, which increases efficiency and shareholder value through better decision-making (Ambrose et al., 2000). Finally, larger REITs may generate informational advantages by focusing on a specific market, markets with similar characteristics, or similar property types (Ambrose et al., 2000).

Prior literature produces mixed results with regards to economies of scale and REIT performance, and there are three strands in the literature. The first strand, Bigger is better, finds larger REITs to perform better through gains in management efficiency, reduced expenses, large entry size, lower leverage, property foci specialization, property location concentration, and other comparative advantages over smaller REITs (Allen & Sirmans, 1987; Linneman, 1997; Bers & Spring, 1997; Highfield et al., 2021; Isik & Topuz, 2017; Campbell et al., 2003). The second strand, Smaller is better, finds evidence that smaller REITs are more profitable, suggesting smaller portfolios are managed more effectively (McIntosh & Liang, 1991; McIntosh et al., 1995; Mueller, 1998; Ambrose et al., 2000). The final strand in the literature generally proposes economies of scale eroded at the turn of the millennium implying REITs grew too fast, suggesting an optimal REIT size to achieve maximum efficiency and value (Miller et al., 2006; Topuz & Isik, 2009).

Counteracting scale economies are dis-economies of scale, which are defined by rising per unit cost as the size or concentration of the REIT increases. Ambrose et al. (2019) states three main mechanisms through which larger firms may be subject to dis-economies of scale: (1) the straining of specialist resources; (2) requiring additional resources to manage activities; and (3) the loss or a reduction in motivation and creativity that may be achieved by smaller REITs. Topuz et al. (2005) and Yang (2001) find empirical evidence suggesting REITs eventually experience dis-economies of scale as size continually increases.

A related concept to scale economies is economies of density defined as the cost savings to the firm resulting from the spatial proximity of the firm’s suppliers or customers. For example, Holmes (2011) examines Wal-Mart store openings and finds Wal-Mart maintains high store density and a continuous store network to (1) reduce the burden of setting up a distribution network; (2) reduce the transportation costs of goods; and (3) decrease response time when faced with demand shocks. Previous empirical research also shows economies of density exist in the airline (Caves et al., 1984) and the electric power industries (Roberts, 1986). Economies of density potentially arise when a REIT creates dense property clusters, and we posit there are two main benefits related to operational efficiency. First, and like the scale economies argument above, the REIT may experience reductions in general administration and management fees, such as maintenance fees. Second, dense property clusters may allow REIT managers to gain informational advantages in the markets where the clusters are located, thereby allowing managers to make better decisions.

From the perspective of firm value, the impact of dense property clusters is less clear as research documents a tradeoff between firm value and local market risk exposure. Previous empirical research establishes a positive relationship between geographic concentration and firm value (Campbell et al., 2003; Hartzell et al., 2014). More recently, Feng et al. (2021) find the benefit of geographical diversification is conditioned on the level of firm transparency, where less transparent firms benefit from geographic concentration while more transparent firms benefit from diversification; thus, an additional benefit to REITs from creating dense property clusters is increases in management effectiveness through increased ability to monitor properties and property managers. Conversely, Zhu and Lizieri (2022) suggest REITs with more geographically concentrated portfolios observe higher risk when the portfolio is exposed to more volatile property markets, but if portfolios are geographically diversified, the effect of local market risk dissipates. The findings of Zhu and Lizieri (2022) highlight the downside of dense property clusters – increased exposure to local market risk – which may lead to declines in portfolio performance. The evidence of whether conditioned geographic clustering is beneficial or detrimental to REIT efficiency and value remains inconclusive and additional research on the impact of the spatial distribution of a REIT’s property portfolio on efficiency and value is warranted.

Data

We employ annual accounting and property portfolio data on listed, U.S. equity REITs between 1993 and 2019 from S&P Global Market Intelligence. Our sample consists of 3,441 REIT-year observations for 310 unique REITs. Each REIT-year observation has a set of underlying properties, and there are approximately 660,000 property-year observations of about 85,000 unique properties. The underlying REIT-owned properties are distributed across the United States with properties in every state. In general, properties tend to be concentrated near concentrations of population and economic activity. States with the highest concentration of properties are Texas (12% of all property observations), California (10%), and Florida (9%) and the top five Metropolitan Statistical Areas in terms of property concentration are New York, Dallas, Washington DC, Atlanta, and Los Angeles.

Dependent Variables: Operational Efficiency and Firm Value

We employ two REIT operational efficiency ratios (OERs) following Beracha et al. (2019a,b). Operational efficiency is broadly defined as total operating expenses divided by total revenues. More specifically, OER1 is calculated as the ratio of total expenses minus real estate depreciation and amortization to total revenue, and OER2 is defined as the ratio of total expenses minus real estate depreciation and amortization minus rental operating expenses to total revenue less expense reimbursements. Given the construct of the OERs, higher OER values denote less operational efficiency and vice versa. As explained in Beracha et al. (2019b), to better reflect the more controllable cash flow-related expenses associated with each REIT, the two OER variations account for real estate depreciation and amortization and for property operational expense reimbursements. We employ these operational efficiency measures in our study since findings in Beracha et al. (2019a, b) show OERs are significant factors contributing to operational performance, price and credit risk, stock returns, and firm value.

We also create two new efficiency measures to explore potential channels through which conditioned geographic clustering impacts firm efficiency. The first measure, Managerial efficiency, is the ratio of general and administrative expenses relative to the total revenue. In contrast, the second measure, Other efficiency, represents total expenses minus general and administrative expenses minus real estate depreciation and amortization relative to total revenue. Our two new measures of efficiency effectively split OER1 into two components: (1) the component related to general and administrative expenses; and (2) all other expenses. Similar to OER1 and OER2, higher values denote lower operational efficiency, while lower values represent higher operational efficiency.

To measure firm value, we employ Tobin’s Q and Firm Q (Capozza & Seguin, 2003; Eichholtz et al., 2019; Hartzell et al., 2014; Beracha et al., 2019a). We calculate Tobin’s Q as the ratio of the market value of equity plus the book value of debt to the book value of assets and Firm Q as the ratio of the implied market capitalization plus total assets minus the book value of equity to total assets.

Conditioned Geographical Clustering

A cluster is a contiguous region of space with a higher density of a REIT’s properties relative to the surrounding area. We identify clusters using the density-based spatial clustering of application with noise (DBSCAN) unsupervised learning algorithm.Footnote 4,Footnote 5 The DBSCAN algorithm classifies each point (i.e., property) as a core point, a border point, or a noise point based on the minimum number of points (M) in a cluster and the distance radius (R).Footnote 6 A core point has at least M other points within distance R of itself, while a border point has at least one core point within distance R. Noise points are those not classified as a core or border point. A cluster is then defined as every core point within distance R of any other core point in the cluster, as well as any border point within distance R of at least one core point in the cluster. There are two required inputs for the DBSCAN algorithm: (1) the minimum cluster size and (2) the distance radius. We employ a minimum cluster size of one and posit efficiency gains from conditioned geographical clustering begin once a second property is located near the first property. The existing literature does not provide guidance on the proper size of a cluster (in miles); therefore, we examine six different distance radii: (1) 5 miles; (2) 12.5 miles; (3) 25 miles; (4) 50 miles; (5) 75 miles; and (6) 100 miles.

We run the DBSCAN algorithm for each REIT-year observation in our sample for the six alternate distance radii. We use the resulting information to calculate a Cluster Average variable, representing the degree of clustering for a REIT in a particular year. Cluster Average is defined as the weighted average of the cluster size with weights determined by the size of the property measured in square feet relative to the aggregate square footage of all properties in the REIT portfolio for a given year.Footnote 7 Eq. (1) displays the formula for the Cluster Average variable for REIT i in year t.

In Eq. (1), \(j\) represents the size of the cluster, \({N}_{it}\) represents the largest cluster size for REIT i in year t, \({w}_{jit}\) is the square footage of all properties within a cluster of size j for REIT i in year t and \({S}_{it}\) represents the square footage of all properties owned by REIT i in year t.Footnote 8 If the value of Cluster Average is one, then the REIT consists of all free-standing properties (i.e., only clusters of size one in the portfolio). Larger values of Cluster Average represent higher degrees of clustering. We also use the cluster information for a radius of 50 miles to identify the percent of a REIT’s portfolio that are stand-alone properties (Stand-Alone). We then compare the percentage of stand-alone properties on a year-to-year basis to calculate the change in stand-alone properties (Stand-Alone Change), in percentage points.

Panels A through D of Fig. 1 display four REIT-year observations with approximately the same number of properties, the same level of geographic diversification as measured by a region-level Herfindahl index, but with different degrees of clustering. Panel A shows a low clustered REIT with a Cluster Average value of 1.96 while Panel D shows a high clustered REIT with a Cluster Average value of 78.58. Panels B and C display REITs with medium-low and medium-high clustering, respectively. Panels A through D illustrate that, even for REITs with an equal level of geographic dispersion, there may be significant variation in the level of clustering; thus, while clustering and geographical diversification are related, they are distinct measures.

Degrees of clustering examples. Notes: The figures above show the distribution of properties and the corresponding value of the Cluster Average variable using a distance radius of 50 miles for four different REITS with approximately the same number of properties and the same level of geographic diversification using a region level Herfindahl index

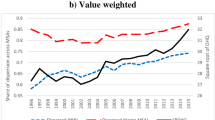

Figure 2 displays dispersion and clustering trends between 1993 and 2019 to further distinguish between geographic dispersion and property clustering. Panel A depicts the increase in average REIT geographic diversification measured by the average distance of REIT properties to their geographic mean and the average distance of REIT properties to REIT headquarters. The trends in Panel A illustrate evidence of increasing geographic diversification in REITs despite documented geographical diversification discounts. For example, the average distance to the geographic mean increased from 488 miles in 1993 to 667 miles in 2019 – a 36% increase. Panel B displays an increase in average cluster size between 1993 and 2019. For example, the average cluster size defined by a 50-mile radius increased from 12.7 in 1993 to 45.5 in 2019 – a 257% increase. Panels A and B of Fig. 2 show that the increase in geographic diversification is concurrent with increases in cluster sizes. If geographic diversification and property clustering are the same, then geographic diversification should decrease as property clusters increases or vice versa; however, the trends in Panels A and B of Fig. 2 show geographic diversification and property clustering are both increasing between 1993 and 2019, which provides additional evidence that the two are distinct measures.

Time series graphs of REIT aggregate geographical diversification and property clustering. Notes: Panel A displays trends on REITs’ geographic dispersion between 1993 and 2019. We employ two measures of dispersion: 1) the average distance of REIT properties to their geographic mean (solid line) and the average distance of REIT properties to the REIT headquarters (dashed line). Panel B displays trends in REITs’ average cluster size. We employ two different radii to identify clusters: 50 miles (solid black line) and 75 miles (dashed line). Trends in Panels A and B represent average values of the corresponding measure across all REITs in a particular year

Control Variables

Following Hartzell, Sun and Titman (2014), we control for property-type and geographical diversification by building Herfindahl indices as measures of concentration specified in Eq. (2).

where Pi is the proportion of assets invested in geographic location or property type i, based on property size. Property-type diversification is based on SNL REIT property classifications, while geographic diversification is calculated based on three orderings: by Metropolitan Statistical Areas (MSAs)Footnote 9, State, and National Council of Real Estate Investment Fiduciaries (NCREIF) regions.Footnote 10 We examine three different geographic diversification orderings following Hartzell et al. (2014) who explain the benefits and limitations of the alternative geographical classifications. Following prior literature, we use the negative of the Herfindahl Index so that the diversification measures increase as the degree of diversification increases (e.g. Hartzell et al., 2014; Beracha et al., 2019a, b); thus, a value of -1 indicates complete concentration and larger values, in absolute terms, represents greater diversification.

Economic theory posits agglomeration economies provide positive externalities to firms located near concentrations of economic activity (Melo et al., 2009). This notion is supported by empirical research emphasizing the benefits of agglomeration to firm productivity (Henderson, 1986; Henderson, 2003; Rosenthal & Strange, 2004; Greenstone et al., 2010; Koster et al., 2014). Agglomeration economies represent a potentially influential factor in a REIT manager’s property location decisions as REIT managers may cluster properties to take advantage of agglomeration economies instead of the benefits derived from a conditioned geographical clustering strategy, thus, ignoring the potential impacts of agglomeration economies potentially introduces omitted variable biases into the estimates. We control for potential agglomeration impacts on REIT efficiency and firm value by calculating a measure of nearby economic activity (Agglomeration) based on the concentration of all nearby REIT properties. We calculate Agglomeration using the DBSCAN algorithm with a minimum cluster size of 1 and a cluster radius of 2 miles. The formula to calculate the agglomeration variable is as follows. Footnote 11

In Eq. (3), \(l\) represents the size of the cluster, \({M}_{t}\) represents the largest cluster size in year \(t\), \({w}_{lit}\) is the square footage of all properties within a cluster of size \(l\) for REIT \(i\) in year \(t\), and \({S}_{it}\) represents the square footage of all properties within REIT i in year t. If the value of Agglomeration is one, then no properties owned by a REIT are located near other concentrations of economic activity. Larger values of Agglomeration represent higher degrees of properties located near concentrations of economic activity.

Leverage is calculated as the ratio of REIT total debt to total assets. Size is measured as the natural logarithm of total market capitalization. Firm age is defined as the natural logarithm of one plus the smaller of either the number of years since a REIT’s initial public offering or the number of years since the firm adopted REIT status. REI Growth is the growth rate of real estate investments as defined by S&P Global Market Intelligence. Self-managed is a binary variable specifying if a REIT manages the day-to-day operations of its own properties (value of 1) or if the properties are managed by a subsidiary (value of 0). Finally, Self-advised is a binary variable indicating if the company makes acquisition and management decisions internally (value of 1) or if it is externally advised (value of 0). We winsorize Tobin’s Q, Firm Q, OER1, OER2, Managerial efficiency, Other efficiency, Leverage, Size, Firm age, and REI Growth at the 1% level to mitigate the influence of outliers.

Summary Statistics

Panel A of Table 1 provides descriptive statistics for our dependent variables. The average Tobin’s Q is 1.19 and the mean Firm Q is 1.32 with standard deviations of .37 and .41, respectively. The average raw operational efficiency ratios are .67 for OER1 and .45 for OER2, which mirror the averages reported by Beracha et al. (2019a). The average value for Managerial efficiency is 0.08 suggesting it accounts for 12 percent of OER1, while the average value for Other efficiency is 0.58 suggesting it accounts for 87 percent of OER1.

Panel B displays summary statistics for our clustering measures (Cluster Average) defined by the various distance radii. The mean values are interpreted as the average degree of clustering, defined by the weighted average of all clusters within a REIT-year (i.e., for a radius of 50 miles, the average REIT-year has 33.69 properties in a cluster). The minimum value for each distance radii is 1, indicating at least one REIT-year observation has an average of 1 property in every cluster. The degree of clustering and the large dispersion for the Cluster Average variable is significantly influenced by the distance radius employed. For example, at a distance radius of 25 miles the average degree of clustering is 19.61 with a range between 1 and 225.86 while at a distance radius of 75 miles the average degree of clustering is 48.77 with a range between 1 and 3,738.70. We investigate the optimal cluster size in section 5.5.

Figure 3 further illustrates the distribution of Cluster Average variable for a distance radius of 50 miles, and, at this distance, the DBSCAN algorithm identifies 109,726 clusters. Panel A of Fig. 3 shows the distribution of all clusters by cluster size. Of the 109,726 clusters, 51,880 (47%) have 1 property, 36,735 (33%) contain between 2 and 5 properties, 9,172 (8%) contain between 6 and 10 properties, 10,041 (9%) contain between 11 and 49 properties, and 8,098 (2%) have greater than 49 properties. Panel B of Fig. 3 shows the average number of clusters by size across all observations. The average REIT-year has 16 clusters with 1 property, 6.3 clusters with 2 properties, 3.8 clusters with 3 properties, 2.7 clusters with 4 properties, 2.2 clusters with 5 properties, 1.9 clusters with 6 properties, and 1.25 clusters with 7 or more properties.

Panel C of Table 1 presents summary statistics for other key variables. Agglomeration has a mean value of 170.92, indicating the average REIT has properties located near approximately 171 other REIT properties in a given year. Agglomeration has a range between 1 and 1,246 indicating there is at least one REIT where all its properties are isolated (more than 2 miles from any other REIT property) and at least one REIT owns properties concentrated in areas of extremely dense economic activity. Self-advised and Self-managed show average values of .89 and .80, respectively, suggesting most REITs in our sample make internal management decisions as well as self-manage their operations. The averages of the geographic HHIs range from − 0.46 (Region HHI) to -0.27 (MSA HHI), and, as expected, the level of geographic diversification increases (larger values in absolute terms) as the geographical classification becomes more specific (e.g. from Regions to MSAs). The average Property HHI is -0.73 indicating REITs tend to concentrate on a particular property type. The average ratio of total debt to total assets (Leverage) is .50, the average Firm age is 2.30, and the average REI growth is 19.03. Finally, 18% of the average REIT’s portfolio are stand-alone properties and the average year-to-year change in stand-alone properties is -0.01 (-1 percentage points).

Univariate Analyses

For a preliminary understanding of the relationship between clustering and operational efficiency, we create unconditional, two-way fractional-polynomial prediction plots of OER1 (Panel A) and Tobin’s Q (Panel B) versus the degree of clustering using two distance radii – 50 and 75 miles – and display these plots in Fig. 4.Footnote 12 The predictive plots in Panel A are convex to the origin, which implies extreme values of low or high clusters are less operationally efficient relative to moderate clustering. The plots in Panel B are concave down, which implies moderate degrees of clustering increase firm value relative to extreme degrees of clustering. Figure 4 generally suggests REITs can increase operational efficiency and create value by employing a strategy of conditioned geographical clustering, but a strategy of no clustering or extreme clustering reduces operational efficiency and value. In addition, the plots in Fig. 4 suggest an optimal cluster size and clustering below or beyond the optimal size leads to efficiency and value declines.Footnote 13

Univariate relationship between firm value/operational efficiency and the degree of clustering. Note: Panel A shows the unconditional, two-way fractional polynomial prediction plots between OER 1 versus the degree of clustering using two distance radii – 50 miles (solid line) and 75 miles (dashed line). Panel B shows the unconditional, two-way fractional polynomial prediction plots between Tobin’s Q and the degree of clustering using two distance radii – 50 miles (solid line) and 75 miles (dashed line)

Empirical Design and Results

Operational Efficiency and Clustering

The curvilinear predictive plots in Fig. 4 as well as previous research (Yang, 2001) suggest a linear model to predict operational efficiency and firm value may lead to erroneous estimates in our analysis. Although such curvilinear relationships can be approximated using non-linear functions such as a second-degree polynomial, doing so imposes a strict functional form and may introduce bias in the estimates. Instead, we estimate the relationship using ordinary least square regression and a piecewise linear spline function, which allows us to better model the curvilinear relationship between the variables (Friday et al., 1999; Dolde & Knopf, 2010; Brounen et al., 2012; Gyamfi-Yeboah et al., 2012; Tang & Mori, 2017). The advantage of a piecewise linear regression is that it allows for multiple changes in the slope coefficient of the variable of interest and does not impose functional form assumptions on the data.

Our specification to examine the relationship between operational efficiency and the degree of property clustering has the following functional form:

In Eq. (4), the dependent variable, \({Y}_{it}\), represents the operational efficiency (OER1 or OER2) for REIT i in year t. The independent variables of interest are discrete bins of the Cluster Average variable represented by \({\varvec{Z}}_{\varvec{it}}\) and the coefficients of interest are represented in vector \(\varvec{\beta }\). Each \({\beta }_{j}\) represents the net change in operational efficiency to a REIT in Cluster Average bin \(j\) conditional on the other covariates and relative to the base group. A positive value of \({\beta }_{j}\) indicates operational efficiency declines (an increase in OER1) for a REIT in Cluster Average bin \(j\) while a negative value indicates operational efficiency increases (a decrease in OER1).

To discretize the Cluster Average variable, we search for low and high cutoff values such that REIT-Year observations in the middle of the Cluster Average distribution are statistically more operationally efficient or valuable relative to observations in the extremes.Footnote 14 Among the models with statistically significant effects, we then choose the model with the best Akaike Information Criterion (AIC) and Bayesian Information Criterion (BIC) fit statistics. We consider four sets of extreme values (1) the 1st and 99th percentiles; (2) the 5th and 95th percentiles; (3) the 10th and 90th percentiles; and (4) the 25th and 75th percentiles. For OER1, the best fitting model employs a cluster radius of 75 miles and extreme values defined by the 5th and 95th percentiles. Subsequent analysis (discussed in Section "Conditioned Geographical Clustering") shows the best fitting model for Tobin’s Q employs a cluster radius of 50 miles and extreme values defined by the 5th and 95th percentiles. Given the dichotomy between the cluster radius and extreme values providing the best fit, we choose to build our main model using extreme values defined by the 5th and 95th percentiles but always present results for the 50-mile and 75-mile radii. The final step to discretize the Cluster Average variable is to divide moderate clustering values into terciles; thus, the three bins representing moderate degrees of clustering are defined by the 5th to 35th percentiles, the 35th to 65th percentiles and the 65th to 95th percentiles.Footnote 15

To facilitate an adequate interpretation of the results, we employ three different combinations of the discretized Cluster Average bins since we are limited to include, at most, N-1 bins in any specification. Our first model (Model 1) examines moderate clustering bins relative to the extreme values; thus, the estimated coefficients are interpreted relative to the extreme (high and low) clustering groups. In other words, a negative estimate associated with a moderate, discretized clustering bin indicates moderate clustering increases operational efficiency relative to extreme degrees of clustering. Model 2 examines the upper clustering bins relative to the extreme low clustering bin while Model 3 examines the lower clustering bins relative to high clustering bins. In Model 2 (3), significant negative coefficients associated with any bin would indicate that, relative to the extreme low (high) degree of clustering, a higher (lower) level of clustering increases operational efficiency.

Xit is a vector of control variables that includes a measure of geographic diversification (Region HHI), the REIT’s leverage (Leverage), the age of the REIT (Age), and the growth of real estate investments (REI Growth).Footnote 16 More importantly, \({\varvec{X}}_{\varvec{i}\varvec{t}}\) includes three variables for other types of scale economies: (1) property type diversification (Property HHI); (2) the size of the REIT (Size); and (3) the degree to which a REIT’s properties are located near concentrations of economic activity (Agglomeration); thus, our estimates are conditioned, and therefore distinct, from these type of scale economies.Footnote 17 We also include binary variables capturing the impact of Self-advised and Self-managed. Following Hartzell et al. (2014), the model includes weights for each property type and region interacted with year indicator variables to account for macroeconomic shocks impacting each property type or geographic region in a given year. Finally, we cluster the standard errors at the firm level to account for a lack of temporal independence within REITs.

Table 2 presents results examining the relationship between clustering and operational efficiency (OER1) for the specification with moderate clustering divided into terciles. Columns (1)–(3) display estimates when clusters are defined using a 50-mile radius while columns (4)–(6) display estimates when clusters are defined by a 75-mile radius. The estimates for Model 1 in columns (1) and (4) show moderate degrees of clustering significantly improve operational efficiency relative to extreme high or low degrees of clustering. The largest increases in efficiency occur for those REITs with degree of clustering between the 5th and 35th percentiles (-0.139) of the distribution; however, the increase in efficiency is also statistically significant for those firms with degrees of clustering between the 35th and 65th percentile and the 65th and 95th percentile. These results suggest moderate degrees of property clustering result in operational efficiency gains.

Columns (2) and (5) of Table 2 show that, relative to a degree of property clustering above the 95th percentile, firms with a degree of clustering below the 5th percentile are less efficient; however, the effect is only statistically significant when clusters are defined using a 50-mile radius. More importantly, the estimated coefficients for bins representing moderate degrees of clustering are significantly negative (indicating an increase in efficiency) for the bins representing degrees of clustering between the 5th and 35th percentiles and the 35th and 65th for the 50-mile radius and for all moderate clustering bins in the 75-mile radius. Similar to the results from model 1, we find the largest increases in efficiency for firms with a degree of clustering between the 5th and 35th percentiles; however, the estimated coefficients for each bin representing moderate degrees of clustering are not statistically different from each other. Finally, the results in columns (3) and (6) of Table 2 show that, relative to firms with a low degree of clustering (below the 5th percentile), those with moderate degree of clustering (and even extreme high clustering in the case of the model for the 50-mile radius) observe increases in efficiency. Our findings also show the largest efficiency gains are concentrated in the first, moderate clustering bin (5th to 35th percentiles) and subsequent bins yield lower efficiency gains with the statistical significance disappearing when reaching the bin representing the 95th percentile; thus, our estimates also suggest that scale economies from clustering eventually diminish.

Similar to previous empirical studies, we find operational efficiency to increase as the portfolio size increases suggesting that increases in portfolio size leads to cost savings for REITs.Footnote 18 We find statistically insignificant impacts for property type diversification and agglomeration, which suggests there are no significant efficiency gains from concentrating on a particular property type or from locating properties near concentrations of economic activity. We also find Self-Advised and Self-Managed REITs are more efficient, but the impact is not statistically different from zero.

Extensions on OER and Conditioned Geographic Clustering

We consider three extensions to the analysis examining the relationship between operational efficiency and conditioned geographic clustering. Our first extension examines potential sources of efficiency gains through which conditional geographic clustering impacts operational efficiency. To do so, we employ the specification in Eq. (4) but substitute Managerial efficiency and Other efficiency as the dependent variable, alternatively. Panel A of Table 3 displays select coefficients when Managerial efficiency is the dependent variable while Panel B displays select coefficients for Other efficiency.Footnote 19 Similar to previous research, we find scale economies related to general administrative and management expenses to exist in REITs, and more specifically, we find that as portfolio size increases, Managerial efficiency increases as well (Mueller, 1998; Ambrose et al., 2005; Kim, 1986; Ambrose et al., 2019; Bers & Springer, 1998; Capozza & Seguin, 1998; Linneman, 1997). The results in panel A also show that a strategy of creating dense property clusters leads to managerial efficiency gains above and beyond those generated by scale economies related to portfolio size; thus, we conclude a channel through which conditioned geographic clustering impacts efficiency is greater managerial efficiency. Comparing the estimates in Panel A of Table 3 to the corresponding estimates in Table 2 reveals that increases in managerial efficiency may account for approximately 20–40% of efficiency gains from conditioned geographic clustering.

The results in Panel B of Table 3 shows that conditioned geographic clustering has a statistically significant impact on Other efficiency, suggesting there are additional channels through which conditional geographic clustering affects overall operational efficiency. A comparison of the coefficients with those in Table 2 reveals that efficiency gains to Other efficiency, may account for 60–80% of the overall efficiency gains. Due to data limitations, we are unable to breakdown Other efficiency into subcategories to determine the exact source of the efficiency gains; however, we posit the efficiency gains potentially arises from factors such as: informational advantages of focusing on specific geographic markets; the establishment of expertise and brand image in a geographic area, which increases the effectiveness of marketing; or decreases in informational opacity due to enhanced monitoring potential.

Our second extension examines the impact on operational efficiency when a REIT increases the percentage of stand-alone properties in its portfolio (i.e. REIT expands its portfolio to new geographical areas). As free-standing properties may require a separate set of expenses that cannot be shared with other properties in the portfolio due to their geographic isolation, we expect operational efficiency to decrease as REITs add more stand-alone properties to their portfolio. To measure the impact of increases in stand-alone properties on operational efficiency, we create five binary variables indicating if the Stand-alone change percentage exceeds a pre-determined threshold and include each variable in Eq. (4). Our pre-determined threshold values are increases of 0%, 1%, 5%, 10%, and 15% of a REIT’s portfolio, and we present select coefficients in Table 4.Footnote 20 The results suggest that when the change in stand-alone properties is low (≤ 1 percentage point) there is no impact on a REIT’s operational efficiency; however, as the percentage point change increases, the decline in operational efficiency increases and is statistically significant. We posit the decline in operational efficiency arises due to the geographic isolation of stand-alone properties, which prohibits the REIT from sharing some expenses across properties in the portfolio and since informational asymmetries may arise from the incursion into new markets.

The third and final extension examines if there are differential impacts to REITs based on whether or not the firm outsources its management. We address this by including a series of interaction terms between the Self-Managed variable and the discretized clustering bins in Eq. (4). We omit these results for brevity, but find there to be no statistical difference between self-managed and externally-managed REITs with respect to conditioned geographic clustering.

Clustering and Firm Value

We next investigate whether improvements in operating efficiency stemming from conditioned geographical clustering translate into increases in firm value or if firm value gains are achieved from a clustering strategy that are apart from gains in operational efficiency. Our empirical specification follows the specification presented in Eq. (4) and discussed in Section 4.1; however, there are two major modifications to the specification. First, the dependent variable \({Y}_{it}\) now represents firm value (Tobin’s Q and Firm Q, alternatively). Second, we include an orthogonalized measure of operational efficiency since previous research demonstrates a relationship between operational efficiency and firm value (Beracha et al., 2019a, b). The orthogonalization process consists of regressing conditional geographical clustering on operational efficiency to collect the residual term. That is, the orthogonalized operational efficiency variable represents the error term after regressing each set of moderate clustering bins, discussed in Section 4.1, on the efficiency measure. Effectively, the orthogonalization splits the operational efficiency variable into two components, the parts related and unrelated to conditioned geographic clustering, and allows us to examine if clustering impacts firm value through channels other than efficiency. We present the orthogonalization regression results in Table 5; congruent with results in Table 2, conditional geographical clustering bin coefficients are statistically significant in every model specification.

Table 6 presents results examining the relationship between property clustering and firm value measured by Tobin’s Q. Similar to Table 2, in Table 6 we present results for the 50-mile and 75-mile radii since these two radii have the best AIC and BIC model fit statistics. The estimates in columns (1) and (4) show moderate degrees of clustering improve firm value relative to extreme high or low degrees of clustering; however, the estimated coefficients are not statistically significant for the 35th to 65th and 65th to 95th bins using a 75-mile radius. The largest increases in values occur for firms with a degree of clustering between the 5th and 35th percentiles, and the estimated coefficients for the 5th to 35th percentile bin are statistically different from the other moderate clustering bins in column (1).

Results in columns (2) and (5) of Table 6 show that, relative to REITs with a degree of clustering above the 95th percentile, firms with moderate degrees of clustering are significantly more valuable. The estimated coefficients for bins representing moderate degrees of clustering are all significantly positive, indicating an increase in value in relation to REITs with extremely high degrees of clustering. For the 50-mile radius specification, we find the largest increase in value is for the 5th to 35th percentile bin followed by firms with a degree of clustering below the 5th percentile; however, these results are not statistically different. For the 75-mile radius specification, we observe the largest increase in value for firms with a degree of clustering below the 5th percentile followed by firms with a degree of clustering between the 5th to 35th percentile, similarly, these coefficients are not statistically different.

Finally, the results in columns (3) and (6) in Table 6 suggest that, relative to firms with a degree of clustering below the 5th percentile, firms with an extremely high or moderate degree of clustering observe relatively lower firm values; however, these results are only statistically significant for the 75-mile radius specification in the 35th to 65th and 65th to 95th percentile bins. In fact, albeit marginally significant, the coefficient for the 5th to 35th percentile bin in the 50-mile radius specification is the only positive among the results. In general, results in Table 6 suggest that moderate degrees of property clustering (particularly for degrees of clustering between the 5th and 35th percentile of the distribution) are associated with higher firm value.

The results in Table 6 align with the increases in operational efficiency reported in the prior section. Table 6 shows increases in operational efficiency are significantly and positively associated with firm value as reported by Beracha et al. (2019a); thus, more efficient REITs create more value. Similar to Hartzell et al. (2014), we observe a geographical diversification discount; that is, as REIT increase their geographical exposure, firm value tends to decrease. In regards to other types of scale economies, we find the size of a REIT (Size) and the degree of concentration near economic activity (Agglomeration) to have positive and statistically significant impacts on firm value while property type diversification has negative but statistically insignificant impacts. The results provide evidence REITs benefit from scale economies. We also find REITs with more debt, older REITs and self-managed REITs to be more valuable. We posit the channels through which efficiency and values gains are generated is reduced monitoring costs (Feng et al. 2021) and local market expertise (Campbell et al., 2003; Cronqvist et al., 2001; and Hartzell et al., 2014). Altogether, we conclude conditioned geographical clustering generates firm value through gains in operational efficiency and potentially from gains in informational efficiency.Footnote 21

Further Examination of the Relationship Between Clustering, Operational Efficiency, and Firm Value

Tables 2 and 6 suggest moderate clustering is related to increases in operational efficiency and firm value. Supporting this notion, Fig. 5 presents further graphical evidence that increases in firm value arise due to efficiency gains from moderate clustering. Panel A of Fig. 5 plots coefficients using model 1, OER1 as the dependent variable, and a cluster radius of 50 miles for each extreme value and discretized bin relative to each bins’ mid-point.Footnote 22 Panel B of Fig. 5 displays the corresponding estimates when Tobin’s Q serves as the dependent variable. We identify trends in the data by fitting a polynomial of degree 4 through each data series.

Estimated coefficients by moderate clustering bin on OER 1 and Tobin’s Q. Notes: Panel A shows the estimated coefficients from Table 2, column 1 while Panel B shows the estimated coefficients from Table 4, column 1. We plot the mid-point of each moderate clustering bin on the x-axis. We calibrate both graphs to zero for ease of exposition, but the estimates should be interpreted relative to the base group, which consists of observations with degrees of clustering below the 5th percentile or above the 95th percentile

The curves of best fit in Panels A and B of Fig. 5 appear quasi-symmetric representations of each other. Panel A shows a large increase in operational efficiency for the first moderate clustering bin (5th to 35th percentile, represented by the 20th percentile midpoint) followed by a decrease in efficiency for the second moderate clustering bin (35th to 65th percentile, represented by the 50th percentile midpoint), and then a slight increase for the third moderate clustering bin (65th to 95th percentile, represented by the 80th percentile midpoint) before returning to the baseline (calibrated to zero). Panel B displays a large increase in firm value for the first moderate clustering bin, following by a decline in firm value with the second moderate clustering bin and then a secondary increase in value for the third moderate clustering bin. The graphical evidence shows clustering increasing efficiency and firm value and, in addition, that larger increases in operational efficiency results in larger increases in firm value.

Property Clustering and the Geographical Diversification Discount

We next examine the relationship between conditioned geographical clustering and the REIT geographical diversification discount. Our results confirm the REIT geographical diversification discount reported in previous empirical studies (e.g. Hartzell et al., 2014; Feng et al., 2021). Nonetheless, extant literature shows the geographical diversification discount is mitigated by certain factors such as increased levels of monitoring, more transparency, and efficient managerial decisions. We examine whether REITs following a conditioned geographical clustering strategy can mitigate the geographical diversification discount since our previous results demonstrate that property clustering leads to increases in operational efficiency and firm value. To examine this, we peruse model (1) of the specification in Eq. (4) using Tobin’s Q as the dependent variable. We discretize the Region HHI variable into quartiles and include binary variables representing the three highest quartiles in Eq. (4) in place of the continuous Region HHI variable. We include the three highest quartiles so that the discount is measured relative to the most geographically concentrated REITs (those with the lowest absolute values in the Region HHI variable). The use of binary variables allows us to identify the average treatment effect within each quartile. We then calculate the pairwise linear combinations of each moderate clustering bin and Region HHI quartile to examine if clustering can mitigate diversification discounts.

In Columns 1 and 3 of Table 7, we present baseline results to confirm the presence of the diversification discount.Footnote 23 Relative to the most geographically concentrated REITs, the coefficients for the three largest Region HHI Diversification quartiles are negative and statistically significant. More importantly, the magnitude of the coefficient, in absolute terms, increases as the level of geographical diversification rises. Overall, the results in Columns (1) and (3) support previous empirical findings – as geographical diversification increase, firm value decreases. In columns (2) and (4) of Table 7, we include the clustering score bin variables. Column (2) employs clusters bins defined by a 50-mile radius and column (4) employs cluster bins using a 75-mile radius. The coefficients’ signs and magnitudes for the clustering bin variables follow those presented in Table 6; that is, despite the introduction of the Region HHI Diversification quartile binary variables, the benefits of property clustering on firm value persist. We continue to observe that moderate clustering creates value relative to strategies of extreme low or high clustering.

Table 8 presents the pairwise, linear combination of each moderate clustering bin and Region HHI quartile, and results suggest the geographical diversification discount is mitigated if REITs employ a strategy of property clustering. Panel A of Table 8 shows results for clusters formed employing a radius of 50 miles; these results suggest REITs with no property clusters observe a significant geographical diversification discount, and that the discount increases as REITs are more geographically diversified. However, when REITs employ a strategy of moderate property clustering, the linear combination of the clustering estimate and the diversification estimate always decreases, in absolute magnitude, relative to the no-clustering estimate. All the linear combinations are negative except for the linear combinations of the 5th to 35th moderate clustering bin and the 25th to 50th and 50th to 75th HHI Region quartiles. The positive linear combination suggests the gains from clustering outweigh the diversification discount. In Panel A of Table 8, all linear combinations are statistically insignificant except for the linear combination of 35th to 65th and 65th to 95th clustering bins with the 75th to 100th HHI Region quartile. Panel B of Table 8 shows the same results as in Panel A but with property clusters built employing a 75-mile radius. These results continue to suggest that REITs employing a moderate clustering strategy can mitigate the geographical diversification discount.

Optimal Cluster Size

As discussed in Section 3.2, extant literature does not provide guidance for proper cluster size. Thus, we examine the optimal cluster size defined by the distance radius. There are practical implications for examining the optimal cluster size as the results may better inform REIT managers in their property location choices. We plot the estimated coefficients from the specification in Eq. (4) for distance radii of 5 miles, 12.5 miles, 25 miles, 50 miles, 75 miles, and 100 miles.

In particular, we graph the estimates from model 1, where the base group is defined to be firms with a degree of clustering below the 5th percentile or above the 95th percentile. These graphs are displayed in Panel A (OER1) and Panel B (Tobin’s Q) of Fig. 6. To illustrate trends in the data, we fit quadratic polynomials through the estimated coefficients.

Estimated coefficients by distance radius. Notes: Panel A plots the estimated coefficients for the moderate clustering bins for the specification in Eq. (4) with the dependent variable as OER 1 and the clustering base group set to observations with a degree of clustering below the 5th percentile or above the 95th percentile. Panel B plots the estimated coefficients for the moderate clustering bins for the specification in Eq. (4) with the dependent variable as Tobin’s Q and the clustering base group set to observations with a degree of clustering below the 5th percentile or above the 95th percentile. For each panel we estimate the specification over clusters defined by distance radii of: 1) 5 miles; 2) 12.5 miles; 3) 25 miles; 4) 50 miles; 5) 75 miles; and 6) 100 miles

Panel A shows REITs with a degree of clustering between the 5th and 35th percentile experience the largest increase in efficiency followed by the 35th to 65th group and then the 65th to 95th group. Correspondingly, Panel B shows firms with a degree of clustering between the 5th and 35th percentile consistently experience the highest increase in value, followed by firms with a degree of clustering between the 35th and 65th and then by the 65th to 95th percentile group. The fitted values for the upper bins cross between radii of 20 and 40 miles. More importantly, the relative rankings reveal firms with the largest increase in efficiency experience the largest increase in firm value. In other words, firms with a degree of clustering between the 5th and 35th percentile experience the greatest efficiency gains and the largest value gains. Firms with a degree of clustering between the 35th and 65th percentile experience the next largest increase in efficiency and experience the next largest increase in firm value. Figure 6 additionally suggests that the optimal cluster size has radii between 40 and 80 miles (a circumference of 80 to 160 miles). The plots show peak values for efficiency gains between radii of 50 and 70 miles while the strongest increases in firm value occur between 40 and 60 miles. These results correspond to our prior findings of best AIC and BIC fit statistics observed for models employing 50 and 75-mile radii.

Conclusion

This paper examines the extent to which a strategy of conditioned geographical clustering impacts REIT operational efficiency and firm value. Our findings suggest REITs that employ a moderate property clustering strategy achieve significant gains in operational efficiency and firm value that are primarily driven by improvements in managerial efficiency that are above and beyond those generated by economies of scale. Our empirical analyses additionally suggest that, although gains in operational efficiency are a significant driver of gains in value, there are other positive consequences to conditioned geographical clustering which we posit can be attributed to gains in informational efficiency (i.e. reductions in monitoring costs, gains in local market expertise, and decreases in informational opacity). In fact, our results suggest that, relative to REITs with moderate degrees of clustering, extreme high or low degrees of clustering create significant operational inefficiencies and reductions in firm value. More specifically, we find that an optimal degree of clustering is situated between the 5th and 35th percentile of the distribution and that the optimal cluster radius is between 50 and 75 miles as suggested by the magnitude of our clustering degree bin coefficients and model fit statistics. Finally, although the well-documented REIT geographical diversification discount persists, we find that REIT managers who geographically allocate their property portfolio in clusters of moderate size are able to mitigate the geographical diversification discount and achieve economies of scale leading to increases in efficiency and higher firm valuations relative to REITs with extreme low or high degrees of clustering.

The findings in this paper are relevant to REIT stakeholders since it provides guidance on a conditioned geographical clustering strategy that dissipates the orthodox REIT geographical diversification discount with a practicable strategy.

Data Availability

Data employed in this paper is available upon request.

Notes

National Association of Real Estate Investment Trusts (NAREIT): https://www.nareit.com/what-reit (last accessed on June 20, 2022).

Agglomeration economies refers to benefits from spatial proximity to concentrations to economic activity (external factors contributing to scale economies).

Available through ERSI’s ArcGIS Pro package.

Our analysis relies on accurate spatial location data for individual properties. 98.15% of properties have longitude and latitude data or address information that allows us to geocode their location. To correct for missing location information, we exclude REIT-year observations where more than 50% of the properties are missing coordinate data or a property address. We also exclude all properties without coordinate data and addresses from the clustering calculations.

For a complete discussion on the DBSCAN algorithm see Ester et al. (1996).

S&P Global Market Intelligence data measures REIT property sizes using inconsistent metrics that are dependent on REIT property focus. We overcome this inconsistency issue by employing a measurable unit multiplier (converter) provided by S&P Global Market Intelligence that translates the multiple size metrics (e.g. apartment units, number of beds, hotel rooms, self-storage units) into a consistent square foot measurement for each real property in our sample.

To calculate the missing property sizes, we replace the missing values with the national average of the property size by primary and secondary property types.

We employ the US Census Bureau’s 2010 MSA definitions. When employing the MSA-level classification, if a property is located outside of a formally identified MSA, we place properties in their respective state.

Hartzell, Sun and Titman (2014) suggest that alternative specifications of geographical diversification that allows us to explore for differences when considering the pros and cons of more specific or broad geographical orderings which may provide an indication of the robustness of our findings.

We test various radii and find any radius over 2 miles generated excessively large clusters covering entire regions of the United States.

We present a table of mean values for select variables in Appendix Table C as an additional univariate analysis.

We thank several anonymous reviewers for identifying potential efficiency and value impacts arising: 1) when REITs locate properties nears other properties within the same asset class; 2) from MSA-specific risk factors; 3) from gateway cities; and 4) year specific effects. We calculate additional control variables representing the percent of properties in a cluster that are of the same asset class as the REIT (Localization Economies), a measure of MSA risk (MSA Risk) following Zhu and Lizieri (2022), and a measure of gateway city concentration (Gateway) following Feng (2022). We use the 2010 MSA definition for the following cities as gateway cities: 1) Boston; 2) Chicago; 3) Los Angeles; 4) New York; 5) San Francisco; and 6) Washington D.C. We also include year fixed effects in addition to the property type and region weights interacted with the year dummy variables. We find the inclusion of the additional controls does not significantly impact our results. Appendix J discusses the calculation of MSA Risk and Localization Economics. We present the results for OER1 in Appendix Table K and the results for Tobin’s Q in Appendix Table L.

Thresholds of 0%, 1% and 5% represent the 50th percentile, 90th percentile and 95th percentile of the Stand-along change distribution respectively. A complete table of coefficients is presented in Appendix Table P.

In our main model there are 5 bins: 1) below the 5th percentile (mid-point of 2.5); 2) 5th to 35th percentiles (mid-point of 20); 3) 35th to 65th percentiles (mid-point of 50); 4) 65th to 95th percentiles (mid-point of 80); and 5) above the 95th percentile (mid-point of 97.5). In Model 1, the base group consists of below the 5th percentile and above the 95th percentile; there, the estimated coefficients for bins is constant term. For ease of exposition, we calibrate Panels A and B to a baseline of 0.

A complete table of coefficients is presented in Appendix Table R.

References

Allen, P. R., & Sirmans, C. F. (1987). An analysis of gains to acquiring firm’s shareholders: The special case of REITs. Journal of Financial Economics, 18(1), 175–194.

Ambrose, B. W., Ehrlich, S. R., Hughes, W. T., & Wachter, S. M. (2000). REIT economies of scale: Fact or fiction. Journal of Real Estate Finance and Economics, 20(2), 211–224.

Ambrose, B. W., Fuerst, F., Mansley, N., & Wang, Z. (2019). Size effects and economies of scale in European real estate companies. Global Finance Journal, 42, 1–17.

Ambrose, B. W., Highfield, M. J., & Linneman, P. D. (2005). Real estate and economies of scale: the case of REITs. Real Estate Economics, 33(2), 323–350.

Anderson, R., Fok, R., Springer, T., & Webb, J. (2002). Technical efficiency and economies of scale: A non-parametric analysis of REIT operating efficiency. European Journal of Operational Research, 139(3), 598–612.

Anderson, R., & Springer, T. (2003). REIT selection and portfolio construction: Using operating efficiency as an indicator of performance. Journal of Real Estate Portfolio Management, 9(1), 17–28.

Beracha, E., Feng, Z., & Hardin, W. G. (2019a). REIT operational efficiency and shareholder value. Journal of Real Estate Research, 41(4), 513–553.

Beracha, E., Feng, Z., & Hardin, W. G. (2019b). REIT operational efficiency: Performance, risk, and return. Journal of Real Estate Finance and Economics, 58, 408–437.

Bers, M., & Springer, T. (1997). Economies-of-scale for Real Estate Investment Trusts. Journal of Real Estate Research, 14(3), 275–290.

Bers, M., & Springer, T. (1998). Sources of scale economies for REITs. Real Estate Finance, 14(4), 47–56.

Brounen, D., Kok, N., & Ling, D. C. (2012). Shareholder composition, share turnover, and returns in volatile markets: The case of international REITs. Journal of International Money and Finance, 31, 1867–1889.

Campbell, R. D., Petrova, M., & Sirmans, C. F. (2003). Wealth effects of diversification and financial deal structuring: Evidence from REIT property portfolio acquisitions. Real Estate Economics, 31(3), 347–366.

Capozza, D. R., & Seguin, P. J. (1998). Managerial style and firm value. Real Estate Economics, 26(1), 131–150.

Capozza, D. R., & Seguin, P. J. (2003). Insider ownership, risk sharing and Tobin’s Q-ratios: Evidence form REITs. Real Estate Economics, 31(3), 367–404.

Caves, D. W., Christensen, L. R., & Swanson, J. A. (1984). Economies of density versus economies of scale: Why trunk and local service airline costs differ. RAND Journal of Economics, 15, 471–489.

Cronqvist, H., Högfeldt, P., & Nilsson, M. (2001). Why agency costs explain diversification discounts. Real Estate Economics, 29(1), 85–126.

Dolde, W., & Knopf, J. D. (2010). Insider ownership, risk, and leverage in REITs. Journal of Real Estate Economics and Finance, 41, 412–432.

Eichholtz, P., Holtermans, R., Kok, N., & Yonder, E. (2019). Environmental performance and the cost of debt: Evidence from commercial mortgages and REIT bonds. Journal of Banking & Finance, 102, 19–32.

Ester, M., Kriegel, H. P., Sander, J., & Xu, X. (1996). A density-based algorithm for discovering clusters in large spatial databases with noise. In kdd (Vol. 96, No. 34, pp. 226–231).

Feng, Z. (2022). How to apply property-level information in real estate research. [Unpublished manuscript].

Feng, Z., Ooi, J., & Wu, Z. (2023). Analyzing the impacts of property age on REITs and the reasons why REITs own older properties. Journal of Real Estate Finance and Economics. https://doi.org/10.1007/s11146-023-09961-0

Feng, Z., Pattanapanchai, M., Price, S. M., & Sirmans, C. F. (2021). Geographic diversification in real estate investment trusts. Real Estate Economics, 49(1), 267–286.

Friday, H. S., Sirmans, G. S., & Conover, C. M. (1999). Ownership structure and the value of the firm: The case of REITs. Journal of Real Estate Research, 17(1), 71–90.

Greenstone, M., Hornbeck, R., & Moretti, E. (2010). Identifying agglomeration spillovers: Evidence from winners and losers of large plant openings. Journal of Political Economy, 188, 536–598.

Gyamfi-Yeboah, F., Ziobrowski, A. J., & Lambert, S. (2012). REITs’ Price Reaction to Unexpected FFO Announcements. Journal of Real Estate Finance of Economics, 45, 622–644.

Hartzell, J. C., Sun, L., & Titman, S. (2014). Institutional investors as monitors of corporate diversification decisions: Evidence from real estate investment trusts. Journal of Corporate Finance, 25, 61–72.

Henderson, J. V. (1986). Efficiency of resource usage a city size. Journal of Urban Economics, 19, 47–70.

Henderson, J. V. (2003). Marshall’s scale economies. Journal of Urban Economics, 53, 1–28.

Highfield, M. J., Shen, L., & Springer, T. M. (2021). Economies of scale and the operating efficiency of REITs: A revisit. Journal of Real Estate Economics and Finance, 62, 108–138.

Holmes, T. J. (2011). The diffusion of Wal-Mart and economies of density. Econometrica, 79(1), 253–302.

Isik, I., & Topuz, J. C. (2017). Meet the born efficient financial institutions: Evidence from the boom years of US REITs. Quarterly Review of Economics and Finance, 66, 70–99.

Kim, H. Y. (1986). Economies of scale and economies of scope in multiproduct financial institutions: Further evidence from credit unions. Journal of Money Credit and Banking, 18(2), 220–226.

Koster, H. R. A., Van Ommeren, J., & Rietveld, P. (2014). Agglomeration economies and productivity: a structural estimate approach using commercial rents. Economica, 81, 63–85.

Lewis, D., Springer, T., & Anderson, R. (2003). The cost efficiency of Real Estate Investment Trusts: An analysis with a Bayesian Stochastic Frontier Model. Journal of Real Estate Finance and Economics, 26(1), 65–80.

Linneman, P. (1997). Forces changing the real estate industry forever. Wharton Real Estate Review, 1(1), 1–12.

McIntosh, W., & Liang, Y. (1991). An examination of the small-firm effect within the REIT industry. Journal of Real Estate Research, 6(1), 9–17.

McIntosh, W., Ott, S. H., & Liang, Y. (1995). The wealth effects of real estate transactions: The case of REITs. Journal of Real Estate Research, 10(3), 299–307.

Melo, P. C., Graham, D. J., & Noland, R. B. (2009). A meta-analysis of estimates pf urban agglomeration economies. Regional Science and Urban Economics, 39(3), 332–342.

Miller, S. M., Clauretie, T. M., & Springer, T. M. (2006). Economies of scale and cost efficiencies: A panel data stochastic frontier analysis of real estate investment trusts. The Manchester School, 74(4), 483–499.

Miller, S. M., & Springer, T. M. (2007). Cost improvements, returns to scale, and cost inefficiencies for real estate investment trusts Economics Working Papers (Vol. 200705). University of Connecticut.

Mueller, G. (1998). REIT size and earnings growth: Is bigger better, or a new challenge? Journal of Real Estate Portfolio Management, 4(2), 149–157.

Nicholson, J. R., & Stevens, J. A. (2021). REIT operational efficiency: External advisement and management. Journal of Real Estate Finance and Economics, 65, 127–151.

Roberts, M. J. (1986). Economies of density in size in the production and delivery of electric power. Land Economics, 62, 378–397.

Rosenthal, S. S., & Strange, W. C. (2004). Evidence on the nature and source of agglomeration economies. Handbook of Regional and Urban Economics, 4, 2119–2171.

Tang, C. K., & Mori, M. (2017). Sponsor ownership in Asian REITs. Journal of Real Estate Finance and Economics, 55, 265–287.

Topuz, J. C., Darrat, A. F., & Shelor, R. M. (2005). Technical, allocative, and scale efficiencies of REITs: An empirical inquiry. Journal of Business Finance and Accounting, 32(9–10), 1961–1994.

Topuz, J. C., & Isik, I. (2009). Structural changes, market growth and productivity gains of US real estate investment trusts in the 1990s. Journal of Economics and Finance, 33, 288–315.

Yang, S. (2001). Is bigger better? A re-examination of the scale economies of REITs. Journal of Real Estate Portfolio Management, 7(1), 67–77.

Zhu, B., & Lizieri, C. (2022). Local Beta: Has local real estate market risk been priced in REIT returns? Journal of Real Estate Finance and Economics. https://doi.org/10.1007/s11146-022-09890-4

Acknowledgements

We appreciate the thorough review and helpful comments by two anonymous referees. We thank Dr. William Hardin, Dr. Erik Devos, Dr. Jeffrey DiBartolomeo, Dr. Norman Maynard and other participants of the 2022 American Real Estate Society Meeting for their insightful comments. We also acknowledge the support from Dr. H. Shelton Weeks and the Lucas Institute for Real Estate Development & Finance. Authors have no competing interests to declare. All errors are our own.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interest

Authors have no competing interests to declare.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Below is the link to the electronic supplementary material.

ESM 1

(DOCX 214 KB)

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Huerta, D., Mothorpe, C. The Impact of Property Clustering on REIT Operational Efficiency and Firm Value. J Real Estate Finan Econ (2024). https://doi.org/10.1007/s11146-023-09973-w

Accepted:

Published:

DOI: https://doi.org/10.1007/s11146-023-09973-w

Keywords

- REIT property clustering

- REIT efficiency

- REIT economies of scale

- REIT value

- REIT conditioned geographical clustering