Abstract

This paper empirically examines the extent to which and how local economic growth and asset location affect firm growth based on a sample of US equity real estate investment trusts (REITs) from 2001 to 2016. Using the GDP growth rate by MSA and individual property data of REITs, we construct an aggregated measure of local economic growth for each REIT based on its asset locations in different metropolitan areas. We find that REIT firm growth (measured using both book value and market value of assets) is positively correlated with the lagged firm-level economic growth measure, indicating that REITs allocating assets in areas with higher economic growth tend to experience higher firm growth. Moreover, local economic growth enhances REIT growth mainly through the growth of equity (not through the growth of debt), as REITs with more assets in higher economic growth areas provide higher stock returns to shareholders. These findings suggest that local economic conditions have a significant impact on REIT firm growth and a REIT’s asset allocation strategy can play an important role in its long-term prospects.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Firm growth is important for economic development and employment (e.g., Moran and Ghoshal 1999; Sterk et al. 2021). Not surprisingly, there is extensive finance and economics literature on what influences firm growth. However, most studies focus on the impact of legal and financial systems (Demirgüç-Kunt and Maksimovic 1998), firm leverage (Lang et al. 1996), or technological innovation (Coad and Rao 2008). How a firm’s asset locations affect its growth has received limited attention in the literature.

Essentially, commercial real estate assets provide space to house economic activities in a local area (Fanning 2014). When local economic fundamentals are strong, demand for commercial space rises, which may improve local property market conditions and increase property values in the area. Despite the importance of local economic conditions to commercial real estate (CRE), few studies have been done to examine the effects of local economic growth on the growth of real estate firms.Footnote 1

Real Estate Investment Trusts (REITs), which are significant players in the real estate market, hold geographically dispersed assets in different metropolitan statistical areas (MSA) of the US.Footnote 2 Since 2001, the REIT sector has experienced dramatic growth in market capitalization and made key contributions to the US Economy.Footnote 3 Furthermore, the industry is expected to continue to consolidate, and REITs are likely to face strong future competition, given the potential benefits of economies of scale in real estate operations (Highfield et al. 2019).Footnote 4 Thus, due to the growing importance of the sector and the changing market structure, firm growth is a critical issue for REITs. Hence, it is imperative that REIT managers, shareholders and policymakers understand what influences REIT firm growth.

There is recent literature on the impacts of asset location on REIT performance and operations (e.g., Ling et al. 2018, 2019a; Ling et al. 2020). These studies suggest that the geography of a REIT’s assets is a critical determinant of its returns and productivity. However, the existing literature does not explicitly consider the impact of asset location on the firm growth of REITs.

In this paper, we examine the extent to which and how local economic growth and asset locations of property portfolios affect REIT firm growth. There are several possible reasons why local economic growth and asset location matter in REIT firm growth. First, strong local economic growth increases demand for commercial space. It is well recognized that local economic dynamics can differ from national dynamics. If a local area experiences strong economic growth, the demand for commercial space increases. Higher demand can lead to higher rent levels and occupancy rates, which increase the asset values of REIT portfolios in the local market. In other words, strong local economic growth provides the potential for asset values of REIT portfolios to grow in the area as the fundamental demand for commercial space is higher.

Second, high economic growth is typically associated with faster urban growth and development of other factors in the local area such as infrastructure and transportation systems, human capital, technology and regulatory environment. Because of the effects of agglomeration economies, operational efficiency of a REIT’s assets in areas with strong economic growth can be higher than that in other areas (e.g., Glaeser et al. 1992; Mitra 1999; Glaeser and Gottlieb 2009). Hence, when a REIT allocates more assets in an area with strong economic growth, it can potentially benefit from agglomeration economies in the area, which facilitates REIT firm growth.

Third, and perhaps more important, recent studies show geographic allocation decisions made by portfolio managers strongly impact the performance of property portfolios. The key argument is as follows. Commercial real estate markets are not quite efficient due to market frictions (e.g., illiquidity and market segmentation). As a result, portfolio managers have an opportunity to observe the effects of economic shocks on local market conditions over time, and they can adjust the portfolio allocations accordingly to achieve higher returns (Ling et al. 2019a). Thus, while portfolio managers face some trading constraints in the illiquid and segmented private property markets,Footnote 5 the ability to time property acquisitions and dispositions in different markets based on the expected asset performance can help REIT managers increase the asset values of their portfolios.

Taken together, due to the higher fundamental demand for commercial space, improvements of operational efficiency and productivity of assets resulting from agglomeration economies and the ability to time the market in asset disposition and acquisition decisions, we expect that REITs allocating more assets in areas with higher economic growth should experience higher firm growth.

To conduct the empirical analysis on the effects of local economic growth and asset location on a REIT’s firm growth, we employ a sample of equity REITs in the US from 2001 to 2016. The REIT sample provides an ideal setting to examine the effects of local economic growth and asset location on the growth of real estate firms. First, REITs are publicly traded real estate companies, and their properties are located in almost every metropolitan area in the US.Footnote 6 The property-level information of REITs is audited and highly reliable. During the sample period, there are 423,417 property-year observations on net book value and location of REIT assets (see Appendix Table 11). Property-level data enables us to accurately measure the geographic exposure of REIT assets and construct an aggregated measure of local economic growth across the different MSAs for each REIT.

Second, REIT growth relies heavily on external capital markets due to the regulatory requirement that REITs have to distribute at least 90% of their taxable income in the form of dividends. As a result, REIT investments are mostly funded by the issuance of debt or seasoned equity offerings, rather than by their internal funds (Ott et al. 2005). This helps us investigate whether the effects of the location factors on REIT firm growth is mainly through the equity or debt growth of REITs.

Third, recent research suggests that REIT managers face certain constraints or mandates for investments that limit their ability to adjust the portfolio allocations for higher returns. For example, Muhlhofer (Mühlhofer 2013) shows that the “dealer rule” reduces the flexibility that REIT managers can pursue higher appreciation returns by making asset disposition decisions. Thus, given these constraints and limitations, REIT managers cannot adjust their asset portfolio exposures consistently, so the impacts of local economic growth on REIT firm growth are likely to be persistent over time. In other words, after REIT managers make their asset allocation decisions, the effects of local economic growth and asset location on asset values are likely to be persistent for a while, as they cannot change the portfolio exposures whenever necessary due to the constraints.

To examine the effects of local economic growth and asset location on REIT firm growth, we construct an aggregated measure of local economic growth for each REIT based on its asset locations in different MSAs. Essentially, this measure is a value-weighted average of the MSA-level GDP growth for each REIT based on the values of its properties located in different MSAs. Net book value of REIT properties is used to calculate the aggregated measure since information on market value or economic value of individual properties of REITs is not available in our database. This firm-level measure (FirmGDPGrowth) can capture the cross-sectional differences of local economic growth among REITs based on their asset locations.Footnote 7

In the literature, a firm’s growth can be defined as the increase in a firm’s size over time (e.g., Penrose and Penrose 2009). Thus, we measure REIT firm growth using the change of the book value and the market value of assets. Both book value and market value of REIT assets are used since the REIT literature suggests market value of real estate assets is typically much larger than the book value. We then estimate a series of panel regressions of REIT firm growth on the lagged firm-level aggregated measure of local economic growth as well as other control variables. Furthermore, to examine how local economic growth and asset location influence REIT firm growth (i.e., the equity or debt growth), we run regressions of the local economic growth measure on the annual changes of total equity and total debt of REITs.

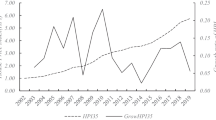

It is worth mentioning that a change in REITs’ property values in an MSA is unlikely to cause a significant change in the gross domestic product (GDP) of the area. Based on our data, the property values of REITs are relatively small compared to the total GDP in most of the MSAs. Specifically, the average total property value of a REIT’s assets in an MSA accounts for about 1‰ of the area’s GDP (see Fig. 1). Hence, we argue that the lagged firm-level measure of the local GDP growth of REITs (the key independent variable in the regressions) is exogenous relative to the growth of total asset values of individual REITs (the dependent variable). If there exists a positive correlation between the two variables, it is reasonable to believe that local economic growth affects REIT firm growth, not the other way around.

The Ratio of REIT Property Value to Local GDP at the MSA Level. This figure illustrates the means and medians of the ratio of total net book value of properties that each REIT holds to the corresponding GDP at the MSA-Level in our sample. The sample period is from 2001 to 2016. All variables are defined in Appendix Table 10.

Using S&P Global Market Intelligence data on US REITs and Bureau of Economic Analysis (BEA) data on the GDP by MSA, we first conduct a non-parametric analysis on the relation between REIT firm growth and the firm-level local economic growth measure using a quintile method ranked by FirmGDPGrowth. As expected, REITs with higher firm-level GDP growth tend to experience higher firm growth. The non-parametric test results show that the means (medians) of total assets’ growth of Quintile 5 REITs are significantly higher than those of Quintile 1 REITs.

Next, we examine the extent to which local economic growth and asset location of REIT portfolios affect REIT firm growth using the panel regression. The results show that REITs with more assets in high economic growth areas grow faster in their book value and market value of assets in the cross-section, after controlling for asset geographic concentration measures of REITs as well as other firm characteristics. These results are robust when an instrumental variable (IV) approach is used.

To understand how local economic growth and asset location affect REIT firm growth (i.e., the impact on equity growth or debt growth), we replace the firm growth measures with the equity growth and debt growth of REITs in the regressions. Interestingly, we find that the growth effect of local economic growth and asset location is mainly through equity growth of REITs, not through the debt growth as the literature largely states.

Moreover, we find that the local economic growth measures can explain the cross-sectional variation in stock returns of REITs. The expected returns, abnormal returns, and cumulative returns of REITs with higher FirmGDPGrowth are higher than the returns of REITs with more assets in slow economic growth areas, controlling for market risk factors. These findings imply that REITs’ asset locations and exposures to regional economies may not be fully priced into their stocks, as firm-level local GDP growth measures are associated with risk-adjusted stock returns. These results are consistent with Smajlbegovic (2019), which shows a firm’s stock returns are positively related to its economic activity forecasts of company-relevant regions in the cross-section.

To provide additional robustness checks, we examine whether local GDP growth influences the property value growth of REITs at the MSA level. We estimate a regression of REIT property value growth within an MSA on the MSA-level GDP growth for the top 100, 50, and 20 MSAs ranked by population in the US. We find a strong, positive relationship between these two variables, suggesting that when an MSA experiences higher GDP growth, the total property values of REITs in the MSA tend to be higher.

To the best of our knowledge, this is the first study to examine the effects of local economic growth and asset location on REIT firm growth. We propose a new aggregated measure of local economic growth for each REIT based on its asset locations and asset values. This measure extracts important information from local economic conditions at the MSA level, which typically experience boom or bust in market demand. Our results suggest that local macroeconomic conditions have an important impact on REIT firm growth. REIT portfolio managers should carefully evaluate their asset allocation strategies and consider investing in high economic growth areas, instead of simply expanding their footprints for growth purpose or engaging in empire building.

Our paper complements the growing literature on the role of geographic exposures of property portfolios on CRE performance (e.g., Ling et al. 2018, 2019a; Wang and Zhou 2020). We argue that asset location is not only an important determinant of CRE returns, but also a critical factor for a REIT’s long-term growth prospects. This paper has implications for REIT managers and shareholders on their decision-making, especially given that the REIT industry will continue to consolidate and that REITs may face stronger market competition in the future.

This study adds to the firm growth literature. Prior research emphasizes firm-specific characteristics such as firm size, age, and capital structure on firm growth (e.g., Hall 1987; Lang et al. 1996). We focus on the effects of a firm’s asset locations and the associated local economic conditions on firm growth. Using property-level information and data on the economic growth of an MSA where these properties are located, we show that a firm’s asset spatial pattern and the economic environment where the assets operate play a significant role in firm growth.

Our research also contributes to the existing finance literature that mainly focuses on the effects of the headquarters location (e.g., Kedia and Rajgopal 2009; and Carosi 2016). While a headquarters location is important for both managers and shareholders based on the information-based argument, the locations of a firm’s assets are vital. This is particularly relevant for service industries such as hospitality, retail, restaurant, health services, and financial services, where asset or branch location is essential for operations and revenues.

The remainder of this paper is organized as follows. Section 2 describes the data source, key variable constructions, and smarmy statistics. Section 3 illustrates the empirical specifications. Section 4 provides the main empirical findings and some additional analysis. Section 5 concludes with some thoughts on implications and future research.

Sample and Descriptive Statistics

Data Sources

A sample of US equity REITs from 2001 to 2016 is used for the empirical analysis.Footnote 8 We collect annual firm-level financial data and other related firm information from the S&P Global Market Intelligence (formerly known as SNL) database. For every REIT, we include the following variables: total assets, accumulated depreciation, total capitalization, total equity, total debt, funds from operations, net operating income, real estate depreciation and amortization, credit line drawn to available, cash, share price, dividend, common share outstanding, occupancy rate, real estate property type,Footnote 9 and the year initial public offering (IPO) or REIT status established.Footnote 10 Property-level data are also collected from the S&P Global. For each REIT’s property, we collect its net book value, location, and real estate property type. The net book value is commonly used to calculate the geographic concentration of REIT assets, as in Hartzell et al. (2014), Ling et al. (2018), and Beracha et al. (2019a, b). The summary statistics of the property level information can be found in Appendix Table 11.

Furthermore, institutional ownership data are from the 13F database by Thomson Reuters, and the market risk factors as well as risk-free rate data are from Kenneth French’s website.Footnote 11 The annual GDP growth data by metropolitan area are from the BEA.Footnote 12

Firm-Specific Local Economic Growth Measure

Similar to the value-weighted average return of a stock portfolio, we construct a firm-level local economic growth measure for each REIT each year. Specifically, we first sum up the net book values of a REIT’s properties by MSA in each year.Footnote 13 Then, the ratio of a REIT’s total property value in each MSA to its total property value is calculated for each year.Footnote 14 This ratio is the value-weight, W, which is used to construct the firm-specific local economic growth measure. Next, we identify the annual GDP growth rate for each MSA each year as G. Thus, the firm-level aggregated measure of local economic growth for a REIT (FirmGDPGrowth) is calculated as its property-value-weighted average of GDP growth rate by MSA. More formally, the measure is defined as:

where W represents the fraction of a REIT’s property value in MSA c to a REIT’s total property value, G represents the GDP growth in each MSA, i represents a firm, c represents an MSA, and t represents a year.

Figure 1 plots the means and medians for the ratio of REIT total property value over the GDP in the corresponding MSAs. Specifically, the total value of properties held by a REIT in an MSA on average accounts for 0.105% to 0.125% of the GDP in the area during the 2001–2016 sample period, while the mediums of the ratio range from 0.035% to 0.05%.Footnote 15

In the literature, local economic growth is generally influenced by factors such as technology (Fagerberg 1994), productivity growth (Bullard 2016), natural resources (Sachs and Warner 2001), human resources (Teixeira and Queirós 2016), and capital allocation (Beck and Levine 2002), but usually not by a single firm. Given the average ratio of REIT property value to the MSA GDP is very small (about 0.1%), we argue that the changes in local economic growth at the MSA-level are exogenous to firm asset growth rates of individual REITs. In other words, the share of the total property value of REITs is negligible compared to the size of the economy of an MSA. Thus, the relationship between local economic growth and firm growth should be straightforward. A reverse causality issue, i.e., asset growth of a REIT significantly changes the GDP of a metropolitan area, should not be a concern for the empirical analysis.

Firm Growth Measure

In the literature, a firm’s growth can be defined as the increase in a firm’s asset size over time (Penrose and Penrose 2009). Thus, we measure REIT firm growth in year t using the change of the book value as well as the market value of REIT assets from year t-1 to year t. The first firm growth measure is the log difference of the book value of assets. Considering the depreciation and amortization of real estate assets are non-cash charges that reduce earnings but not the actual cash flows, we adopt the second firm growth measure as the log difference of gross total assets, which equals total assets plus accumulated depreciation.

Since the market value of real estate assets is typically greater than the book value for commercial properties (e.g., Feng et al. 2019), another measure for firm growth is adopted as the log difference of total capitalization. This measure includes implied market value of equity, book value of debt, total preferred equity, preferred interest in operating partnership units, other mezzanine level items, and non-controlling interest. The fourth firm growth measure is the log difference of the current market value, which is calculated as the net operating income divided by the market-derived capitalization rate reported by the SNL database.Footnote 16 Moreover, we split the book value of assets into total equity and total debt, and compute the growth of equity and debt as the log difference of total equity and total debt, respectively.

Expected Return and Abnormal Return of Stocks

To measure the effect of local economic growth and asset location on REIT stock returns, we first estimate the annual expected return for every REIT using Fama-French (1993) three-factor model, Carhart (1997) four-factor model, and Fama-French (2015) five-factor model. Specifically, we run the following regressions during the sample period.

where Ri, t is the excess stock return of REIT i, Rm, t is the risk-free stock return of the market, SMBt (Small minus Big), HMLt (High minus Low), MOMt (Momentum), RMWt (Robust minus Weak), and CMAt (Conservative minus Aggressive) are the return to zero investment factor-mimicking portfolios designed to capture size, book-to-market effects, momentum, profitability, and investment risk at year t, respectively.

Then, we use the market return, the annual SMB, HML, MOM, RMW, and CMA risk factors, and the estimated factor loadings, as, γs, and βs, of the factor models [see Eq. (2)] to obtain the estimated expected return, \( {\hat{R}}_{i,t} \).

We also calculate the annual abnormal return using the realized return minus the estimated expected return. More formally, the abnormal return is defined as:

where ARi, t is the abnormal stock return of REIT i at year t and the other variables are as previously defined.

Control Variables

Following the literature, we include a number of control variables in the regressions. First, several basic firm characteristic variables used in the finance literature are added. They are: firm size, defined as the natural logarithm of total assets; firm age, the natural logarithm of one plus firms’ years since IPO;Footnote 17 firm leverage ratio (Leverage), the ratio of total assets to total equity; market-to-book equity ratio (Market-to-Book), the ratio of the market capitalization of the REIT to its total equity; and institutional ownership percentage, the percentage of shares that are owned by institutions.

Moreover, we include a few commonly used controls in the REIT literature. Since most REITs are liquidity constrained due to the 90% dividend rule, we add several financial liquidity measures: cash stock, defined as cash and cash equivalents scaled by total assets; cash flow, net operating income, and real estate depreciation and amortization scaled by total assets; credit line drawn/available, revolving credit lines drawn down as a percent of revolving credit lines available, as reported by SNL. We also add return on assets, defined as funds from operations divided by total assets.

In addition, the existing REIT literature suggests that location of properties in the Gateway cities (Boston, Chicago, Los Angeles, New York, San Francisco, and Washington, D.C.) matters in REIT performance and investment decisions (Ling et al. 2018). Thus, we create a variable, Gateway Cities Concentration, which is calculated as the ratio of a REIT’s assets invested in the six Gateway MSAs to its total assets.

Finally, one may argue that property portfolios of some REITs are more geography and property type diversified, while other REITs are more concentrated. This may influence the effect of local economic growth on REIT firm growth. Thus, we add two more control variables: a geographic diversification variable, defined as the negative of the Herfindahl Index of a REIT’s assets invested in different MSAs, and a property-type diversification variable, defined as the negative of the Herfindahl Index of a REIT’s assets invested in different property types. The definitions for the variables mentioned above are listed in Appendix Table 10.

Summary Statistics

We exclude firm-year observations without the firm-level local economic growth measure and total assets. Numeric variables are winsorized at the 1% and 99% tails of the distributions to avoid the influence of extreme observations. The final sample consists of 2174 firm-year observations from 2001 to 2016. The summary statistics for firm growth measures, FirmGDPGrowth measure, and firm characteristics used in the empirical analysis are reported in Table 1.

Specifically, the mean and median of FirmGDPGrowth, the main variable of interest, are 3.98% and 4.07%. For the firm growth measures, the average (median) total assets growth, gross total assets growth, total capitalization growth, and current market value growth are 11.3% (5.6%), 12% (6.7%), 12.2% (11.2%), and 14.4% (12%), respectively. The total asset growth measures are similar to the firm growth rates in Ling et al. (2019b). The mean and median equity (debt) growth rate are 12.9% (6.3%) and 12.1% (5.1%). In terms of stock performance, a typical firm has an average realized return of 13.5%, an average expected return from the Fama-French (1993), Carhart (1997) and Fama-French (2015) models of 12.3%, and an average abnormal return from those three models of 0%.

Figure 2 illustrates the evolution and distribution of the FirmGDPGrowth variable from 2001 to 2016. Panel A plots the mean, median, one standard deviation below the mean (Low) and above the mean (High). The figure is largely consistent with the business circle during the period. The local GDP growth of REITs increased from 2001 to 2004, and then started decreasing and hit the bottom in 2008. It bounced back from the financial crisis and slowly increased from 2009 to 2016. In Panel B, the distribution of the local GDP growth variable is symmetric while slightly left-skewed. Each bar represents a 1% change in GDP. One standard deviation below the mean (3.98%) local GDP growth is 1.82% and that above the mean is 6.13%, as shown by the blue lines.

Evolution and Distribution of the Firm-Level Local GDP Growth. This figure illustrates the evolution and distributions of the firm-level GDP growth variable (FirmGDPGrowth) of REITs in the sample. The sample period is from 2001 to 2016. All variables are defined in Appendix Table 10.

Empirical Methods and Specification

To investigate the effects of the local economic growth on firm growth, we start with a univariate analysis on the association between the growth of book value and market value of a firm’s assets and local economic growth. To do so, we create five portfolios sorted by the FirmGDPGrowth of REITs and examine the mean and median of the growth of book value and the market value of assets in these portfolios (i.e., total assets growth, gross total assets growth, total capitalization growth, and current market value growth, respectively).

Next, we regress the firm growth of REITs on their local GDP growth measure in the previous year while controlling for other firm characteristics as followsFootnote 18:

where FirmGrowthi, t is either the growth of book value of assets (total assets growth and gross total assets growth) or market value of assets (total capitalization growth and current market value growth) of REIT i at year t, and FirmGDPGrowthi, t − 1 is the value-weighted average GDP growth rate of REIT i at year t-1. The control variables in the regression include firm size, firm age, firm leverage ratio, return on assets, cash stock, cash flow, credit line drawn/available, market to book equity ratio, geographical and property type diversification, gateway cities concentration, and institutional ownership percentage. ηi represents real estate property type fixed effects, αt represents year fixed effects, and εi, t is the error term. The variables included in Eq. (4) are as defined earlier in the text and Appendix Table 10.

Following the literature (e.g., Ling et al. 2021), the independent variables (including the key variable, FirmGDPGrowth) in the panel regression are calculated at the end of year t-1 (i.e., using the information at the end of the previous year). As the business model for REITs is to own and operate income-producing real estate assets, the use of the lagged explanatory variables can capture the effects of local GDP growth on REIT firm growth.

A firm’s assets are equal to the sum of its equity and debt. To examine how local GDP growth influences REIT firm growth (equity growth or debt growth), we replace the dependent variables in Eq. (4) with the two components of REIT asset value to assess the effect of local GDP growth on the growth of equity and the growth of debt, respectively.

To examine the relationship between the local economic growth measure (FirmGDPGrowth) and the cross-sectional stock returns of REITs, we regress the estimated expected returns of REITs, \( {\hat{R}}_{i,t} \), and the annual abnormal returns, ARi, t, on their firm-specific local economic growth measure as follows:

where the dependent variable is either the expected returns, \( {\hat{R}}_{i,t} \), and the annual abnormal returns, ARi, t, of REIT i at year t. εi, t is the error term.

Empirical Results

The Growth of REIT Firm Assets

We first conduct a non-parametric analysis on the relation between REIT firm growth and the aggregated measure of local economic growth of REITs within each of these measurements’ quintile ranking. Table 2 presents the results from a quintile analysis that compares the mean and median total assets growth, gross total assets growth, total capitalization growth, and current market value growth of REITs sorted by FirmGDPGrowth. The results show that the spreads of the mean (median) of total assets growth, gross total assets growth, total capitalization growth, and current market value growth between the two extreme quintiles (the 5–1 spread) are 0.030 (0.026), 0.026 (0.026), 0.052 (0.059), and 0.042 (0.049), respectively. Each of these differences is statistically significant from the two-sample t-test or the two-sample Wilcoxon rank-sum test.

Next, the baseline results based on Eq. (4) are reported in Table 3. We find that REITs with more assets in high economic growth areas have, on average, higher firm growth, controlling for basic firm characteristics, financial performance, financial liquidity, and geographic and property type diversification. Specifically, Columns (1) and (2) show that the estimated coefficients of the lagged FirmGDPGrowth are both 0.009, statistical significance at the 1% level, based on either property type fixed effect or firm fixed effect. These results suggest that REITs with more properties located in higher economic growth areas tend to have higher growth in their total asset values. When the dependent variable is gross total assets growth, the estimated coefficients are also positive [0.009 in a property type and year FE model (Column 3) and 0.008 in a firm and year FE model (Column 4)]. Overall, the results indicate that a REIT’s asset growth is positively related to the local economic growth in the areas its assets are located.

In addition to the main coefficients of interest, the results show that REITs with larger size and older age tend to experience less growth. However, firms with higher market-to-book ratio and cash stock are associated with higher growth, which is in line with our expectations and largely consistent with the literature.

As mentioned earlier, given that the book value of assets of REITs usually underestimates the intrinsic value for REITs, we also measure firm growth using the market value of assets. The results from Eq. (4) with the growth of the market value of assets as the dependent variable are presented in Table 4.

In Columns (1) and (2), when the dependent variable is total capitalization growth, the estimated coefficients of the FirmGDPGrowth are positive (0.015 and 0.013), statistically significant at the 1% level. When the dependent variable is replaced by the current market value growth, as in Columns (3) and (4), the results are similar. These results indicate a positive relationship between the growth of the local economy and the growth of firms that own assets in the areas. In addition, note that the estimated coefficients of FirmGDPGrowth are greater than those in Table 3, where the growth of book value of assets is used.

Additional Analysis

The Growth of Equity and Debt

To understand how local GDP growth influences REIT firm growth, we decompose a firm’s total assets into two parts (total equity and total debt) and calculate the growth of equity and the growth of debt. Table 5 reports the results when the equity growth and debt growth are used as the dependent variables in the regressions. When the dependent variable is equity growth [Columns (1) and (2)], the estimated coefficients of the FirmGDPGrowth are positive (0.013 and 0.017), statistically significant at the 5% level. However, when the dependent variable is debt growth, the estimated coefficients are statistically insignificant, as shown in Columns (3) and (4).

These results indicate that local economic growth helps REITs increase their equity value, but it does not significantly increase the total amount of debt. One possible interpretation of the results is that investors may favor REITs with more assets in high economic growth areas as they perceive those REITs to have better financial performance. Thus, investors have stronger incentives to purchase the REIT stocks, and higher investor demand increases the equity value of the REITs.

The Cross-Section of Stock Returns

In this section, we examine how the local economic growth measure of REITs (FirmGDPGrowth) is related to their stock returns in the cross-section. This issue is relevant to the findings on growth of equity and debt in the previous section. We attempt to provide additional evidence on why local economic growth helps REITs increase their equity value. If investors do favor those REITs with more assets in high economic growth areas, the demand for those stocks would be high. Thus, we would expect that REITs allocating more assets in higher GDP growth areas should have higher stock returns.

We regress the estimated expected return of REITs, \( {\hat{R}}_{i,t} \), and the annual abnormal return, ARi, t, on their firm-specific local economic growth based on Eq. (5). Panel A of Table 6 presents the results from regressing the expected return on FirmGDPGrowth. The estimated coefficients of FirmGDPGrowth are 0.041 in all three specifications, significant at the 1% level. Consistent with our expectation, the positive correlation between local economic conditions and the expected stock return suggests that higher economic growth is associated with better stock performance.

In Panel B of Table 6, we regress the abnormal return of stocks on FirmGDPGrowth. The results show that firms with more assets in high GDP growth areas have, on average, higher abnormal stock returns, which could not be explained by the common market factors. Specifically, the estimated coefficients for FirmGDPGrowth in Column (1) is 0.016, and in Column (2) and (3) are 0.017, all being statistically significant at the 1% level.

The cross-sectional regression analysis on stock returns indicates that a portion of a REIT’s expected returns and abnormal returns cannot be explained by the common market factors, and it is instead associated with the local economic growth measure of REITs. As the property values and locations of the assets are different for each REIT, such information should be unique for each firm and not related to market-wide shocks. Thus, the findings provide additional evidence on why the total equity value of REITs tends to increase with firm-level local economic growth.

To determine whether cumulative stock returns are different between high and low local economic growth firms, we construct portfolios by sorting REITs based on their previous-year FirmGDPGrowth and examine the cumulative return differentials for a three-year period after the portfolio formation. Figure 3 plots the cumulative return differentials.

Cumulative Returns of Stock Portfolios Sorted by the Firm-level Local GDP Growth. This figure illustrates one-year to three-year cumulative returns of stock portfolios sorted by the firm-level local GDP growth (FirmGDPGrowth). Each year, we sort REITs based on their previous-year FirmGDPGrowth, and then place them into different groups. For instance, if a REIT’s FirmGDPGrowth is greater than the 70th percentile of the variable in year t (or 80th percentile), the firm is included in the high GDP growth portfolio in year t. If a REIT’s FirmGDPGrowth is less than the 30th percentile (or 20 percentile) in year t, it is included in the low GDP growth portfolio in year t. These portfolios are rebalanced each year. We calculate their one-year to three-year cumulative returns within each portfolio. Observations without FirmGDPGrowth and stock return information are excluded. All variables are defined in Appendix Table 10.

Based on the medium cumulative returns, the portfolios that consist of low FirmGDPGrowth REITs significantly underperform the portfolios that consist of high FirmGDPGrowth REITs. Specifically, the three-year cumulative return differential between the portfolio consisting of the bottom 30% (20%) of FirmGDPGrowth and the portfolio consisting of the top 30% (20%) is about 3.26% (6.91%), as shown in the left (right) figure. These results are consistent with the findings in Table 6 and suggest that the stock portfolios consisting of high FirmGDPGrowth REITs outperform the portfolios consisting of low FirmGDPGrowth REITs.

Overall, the findings of our paper are largely consistent with Ling et al. (2019b), who find a negative relation between asset growth rate and the future stock returns of REITs, but the negative effect of asset growth is mainly driven by the growth of debt, not by the growth in equity. While the focus of our paper is not on the effects of high asset growth on firm performance, we find that the firm-level local economic growth measure is positively associated with the equity value of REITs allocating more assets in high growth areas, but not with the total amount of debt. In this sense, our paper is in line with Ling et al. (2019b) as local economic growth and asset location increase the equity value of REITs, not the total amount of debt.

An Instrumental Variable Approach

So far, the analysis suggests a positive relation between firm growth and the lagged local economic growth of REITs. Given the small percentage of a REIT’s total property value over an MSA’s GDP, it is reasonable to believe that local economic growth affects REIT firm growth (see details in Section 2.2), not the other way around. However, one can argue that the locations and values of assets are an endogenous choice variable for a firm, so growth of a REIT could still influence its spatial patterns of assets. To further address the endogeneity issue, we run the regressions using an IV approach.

As an instrument for FirmGDPGrowth of a firm each year, we use the average firm-level GDP growth measure of other firms in the same year (i.e., for each individual firm, its IV is calculated as the average FirmGDPGrowth of firms in each year, excluding that individual firm). While endogeneity concerns may exist between the local economy and firm growth with an individual firm, arguably the FirmGDPGrowth of other firms should be independent of the FirmGDPGrowth of the individual firm. Table 7 reports the results for the IV approach. In Columns (1) to (4), the coefficients of the fitted value of the FirmGDPGrowth in the previous year are all positive (0.009, 0.009, 0.014, and 0.017) and statistically significant at the 5% or 1% level. The main finding of the positive relationship between the local economy and firm growth remains unchanged when the IV approach is used to control for endogeneity issues.

REIT Firm Growth and GDP Growth Based on REIT Headquarter Location

In addition to using the property-based GDP growth measure (FirmGDPGrowth), we also adopt an alternative GDP growth measure based on the GDP growth rate of a REIT’s headquarter MSA (i.e., HQGDPGrowth) for a robustness check.Footnote 19 Recent literature shows that the geography of a REIT’s property portfolios matters, as investors prefer to invest in REITs headquartered locally and local information affects the linkage between local asset concentrations and return outperformance (e.g., Ling et al. 2019c; Ling et al. 2021). Thus, one can argue that local economic conditions in the headquarters of REITs should play an important role in REIT firm growth. The results on the relationship between REIT firm growth and HQGDPGrowth are reported in Table 8. The coefficients of the HQGDPGrowth in the previous year are all positive (0.005, 0.004, 0.005, and 0.004). Three out of the four coefficients are statistically significant at the 5% level. These results provide additional evidence that REIT firm growth is positively related to their local economic conditions.

Property Growth and GDP Growth at the MSA Level

For additional robustness checks, we examine whether local economic growth influences the property value growth of all REITs in the MSA. Essentially, the regression analysis is to examine the effect of local economic growth on REIT firm growth at the MSA level. Table 9 presents the results based on regressions of REIT property value growth in an MSA on the MSA GDP growth for the US top 100, 50, and 20 MSAs ranked by population.Footnote 20 The estimated coefficients for GDP growth at the MSA level are 0.007, 0.006, and 0.009 for the top 100, 50, and 20 MSAs, all statistically significant at the 1% level. The positive relationship between the property value of all REITs in an MSA and the MSA GDP growth suggests that on average, when an MSA experiences high GDP growth, the total property values of REITs in the MSA are higher. This implies that local economic growth indeed helps to increase property values of REITs at the MSA level.

Conclusions

Many believe that the REIT industry will continue to grow and consolidate, and REITs will face much stronger market competition in the future. Meanwhile, REITs hold tens of thousands of commercial properties across different metropolitan areas in the US. Given the local nature of real estate business, one would expect that local economic conditions and asset location are important for the growth of real estate firms. Despite the importance of the issue, few studies have been done to examine the effects of local economic growth and asset location on REIT firm growth.

To fill this gap, this paper examines the extent to which and how local economic growth and asset location affect REIT firm growth. We construct a firm-level local economic growth measure using granular property-level data of REITs and MSA-level GDP growth data. REIT firm growth (measured using both book value and market value of assets) is positively correlated with the lagged firm-level economic growth measure, suggesting that REITs with more assets in high economic growth areas tend to have higher firm growth. Moreover, local economic growth enhances REIT firm growth mainly through the growth of equity (rather than the growth of debt), as REITs with more assets in higher economic growth areas provide high stock returns to shareholders. Finally, we find a positive relationship between the property value of all REITs in an MSA and the corresponding GDP growth rate of the MSA.

To our knowledge, this is the first study to examine the effects of local economic growth and asset location on REIT firm growth. The findings of the paper highlight the important impacts of local economic conditions on firm growth and suggest that a REIT’s asset allocation strategy can play an important role in its long-term growth prospect. To remain competitive in the future marketplace, REIT portfolio managers should carefully evaluate their asset allocation decisions and consider investing in high economic growth areas, instead of simply expanding their footprints or engaging in empire building.

This paper is consistent with and complements the existing literature. Asset location is not only an important determinant of CRE returns, but also a critical factor for a REIT’s firm growth and its long-term success. Moreover, our paper adds to the broad firm growth literature as a firm’s asset spatial pattern and local economic growth matters in firm growth. The results also shed light on corporate managers and shareholders in other service industries such as hospitality, restaurant, and banking, as asset or branch location is important for their operations and performance. Overall, this paper provides evidence for managers, investors, and policymakers to understand the impacts of local economic growth and asset location on firm growth.

Notes

Several studies in the literature examine the relationship between US residential investment and GDP growth at the aggregate level (e.g., Green 1997; Coulson and Kim 2000). Other papers, largely based on information asymmetry and agency cost theory, examine the impact of external financing on REIT firm growth (e.g., An et al. 2011; Ghosh and Sun 2014) or the role of corporate monitors in discouraging managerial opportunism and empire building (Xu and Ooi 2018).

See REITs’ assets across America at http://www.reitsacrossamerica.com/.

Many agree that 2001 is the beginning of the Modern REIT era. In 2016, the equity market capitalization of REITs reached $1 trillion, and a new Real Estate sector under the GICS standard was created by S&P Dow Jones Indices and MSCI Inc. Also, US REITs provided about 2.4 million full-time equivalent (FTE) jobs and generated $148.2 billion of labor income to the economy in 2018 (see www.reit.com).

In addition, see an article on the NAREIT website: https://www.reit.com/news/videos/reit-industry-likely-see-more-consolidation-real-estate-advisor-says. Some industry experts believe that there will be only three to four firms in each property type subsector of REITs in the future.

For instance, due to high transaction costs and illiquidity of assets, it is costly for real estate portfolio managers to adjust their portfolio quickly.

In 2019, the total number of REIT-owned properties was 54,606, with a total gross asset value of $1.7 trillion. See http://www.reitsacrossamerica.com/.

For example, suppose a REIT holds only two properties that are located in MSA #1 and MSA #2. The values of the two properties are $50 million each, and the GDP growth rates of the two MSAs are 2% and 4%, respectively. Then, the firm-level aggregated measure of local economic growth for this REIT based on its asset locations is calculated as: 0.5*2% + 0.5*4 = 3%. To control for geographic concentration of a REIT’s assets, we add a geographic diversification variable in the regression analysis based on the Herfindahl index of the REIT’s assets.

The sample period starts in 2001 because the GDP data by metropolitan area from BEA are available since 2001.

The real estate property types are casino, health care, hotel, industrial, manufactured home, multifamily, office, other retail, regional mall, self-storage, shopping center, specialty, and diversified, based on the classification provided by the S&P Global Market Intelligence database.

When accounting information is not available at year t but available at year t-1 and t + 1, the value for the variable at year t is replaced by the average of the values at year t-1 and year t + 1.

Kenneth R. French’s Data Library: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

See more details from https://www.bea.gov/data/gdp/gdp-metropolitan-area.

Net book value is used to construct the firm GDP growth measure since the database (SNL) does not provide market or economic value of REIT properties. In addition, following Ling et al. (2021), we use the adjusted cost of REIT properties to construct the FirmGDPGrowth variable. The results are similar to those based on net book value.

A very small number of REIT properties are located in rural areas, which are not part of an MSA. To make the total weight equal to 100%, we drop these properties in the sample. For robustness, we conduct the analysis without dropping those properties. The results are qualitatively similar, which are not reported in the paper for brevity.

The average value of total assets of REITs, consisting of properties in different areas, is about $3.5 billion.

Since our research focus is on the impact of local economic growth and asset location on overall firm growth of REITs, we use both book value and market value of REIT total assets. This is different from Ling, Ooi, and Xu (2019), which examines the impact of asset growth rate on the future stock performance. In their paper, the asset growth rate (ASSETG) is based on the book value of total assets.

In case the IPO date is not available, we calculate the firm age based on the year in which the REIT status is established.

We use a widely used approach for panel regressions in corporate finance, in which the robust t-statistics are corrected for clustering of residuals at the firm level, while controlling the time-series variation by adding year fixed effects (e.g., see Petersen 2009; Coles et al. 2014). An anonymous referee suggests us to use Fama-Macbeth two-stage model to control for the time-series variation in GDP growth and highlight the effect of asset allocation on REIT firm growth. We follow the suggestion and estimate Equation (4) using the Fama-MacBeth model. The results are largely consistent, suggesting that spatial allocation of assets is an important factor influencing firm growth. We appreciate an anonymous the referee for this valuable suggestion.

We appreciate an anonymous referee for this suggestion.

The recent literature documents that property portfolios of US equity REITs are concentrated in major MSAs (see Ling, Naranjo, Scheick, 2019).

References

An, H., Cook, D. O., & Zumpano, L. V. (2011). Corporate transparency and firm growth: Evidence from real estate investment trusts. Real Estate Economics, 39(3), 429–454.

Beck, T., & Levine, R. (2002). Industry growth and capital allocation: Does having a market-or bank-based system matter? Journal of Financial Economics, 64(2), 147–180.

Beracha, E., Feng, Z., & Hardin, W. G. (2019a). REIT operational efficiency: Performance, risk, and return. The Journal of Real Estate Finance and Economics, 58(3), 408–437.

Beracha, E., Feng, Z., & Hardin, W. G. (2019b). REIT operational efficiency and shareholder value. Journal of Real Estate Research, 41(4), 513–553.

Bullard, J. (2016). Higher GDP growth in the long run requires higher productivity growth. The Regional Economist, (October).

Carhart, M. M. (1997). On persistence in mutual fund performance. Journal of Finance, 52(1), 57–82.

Carosi, A. (2016). Do local causations matter? The effect of firm location on the relations of ROE, R&D, and firm SIZE with MARKET-TO-BOOK. Journal of Corporate Finance, 41, 388–409.

Coad, A., & Rao, R. (2008). Innovation and firm growth in high-tech sectors: A quantile regression approach. Research Policy, 37(4), 633–648.

Coles, J. L., Daniel, N. D., & Naveen, L. (2014). Co-opted boards. Review of Financial Studies, 27(6), 1751–1796.

Coulson, N. E., & Kim, M. S. (2000). Residential investment, non-residential investment and GDP. Real Estate Economics, 28(2), 233–247.

Demirgüç-Kunt, A., & Maksimovic, V. (1998). Law, finance, and firm growth. Journal of Finance, 53(6), 2107–2137.

Fagerberg, J. (1994). Technology and international differences in growth rates. Journal of Economic Literature, 32(3), 1147–1175.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56.

Fama, E. F., & French, K. R. (2015). A five-factor asset pricing model. Journal of Financial Economics, 116(1), 1–22.

Fanning, S.F. (2014). Market analysis for real estate – Concepts and applications in valuation and highest and best use, 2nd edition. Appraisal Institute.

Feng, Z., Hardin III, W. G., Wu, Z. (2019). Employee productivity and REIT performance. Real Estate Economics.

Ghosh, C., & Sun, L. (2014). Agency cost, dividend policy and growth: The special case of REITs. The Journal of Real Estate Finance and Economics, 48(4), 660–708.

Glaeser, E. L., & Gottlieb, J. D. (2009). The wealth of cities: Agglomeration economies and spatial equilibrium in the United States. Journal of Economic Literature, 47(4), 983–1028.

Glaeser, E. L., Kallal, H. D., Scheinkman, J. A., & Shleifer, A. (1992). Growth in cities. Journal of Political Economy, 100(6), 1126–1152.

Green, R. K. (1997). Follow the leader: How changes in residential and non-residential investment predict changes in GDP. Real Estate Economics, 25(2), 253–270.

Hall, B. H. (1987). The relationship between firm size and firm growth in the US manufacturing sector. Journal of Industrial Economics, 35, 583–606.

Hartzell, J. C., Sun, L., & Titman, S. (2014). Institutional investors as monitors of corporate diversification decisions: Evidence from real estate investment trusts. Journal of Corporate Finance, 25, 61–72.

Highfield, M. J., Shen, L., Springer, T. M. (2019). Economies of scale and the operating efficiency of REITs: A revisit. The Journal of Real Estate Finance and Economics, 1–31.

Kedia, S., & Rajgopal, S. (2009). Neighborhood matters: The impact of location on broad based stock option plans. Journal of Financial Economics, 92(1), 109–127.

Lang, L., Ofek, E., & Stulz, R. (1996). Leverage, investment, and firm growth. Journal of Financial Economics, 40(1), 3–29.

Ling, D. C., Naranjo, A., & Scheick, B. (2018). Geographic portfolio allocations, property selection and performance attribution in public and private real estate markets. Real Estate Economics, 46(2), 404–448.

Ling, D. C., Naranjo, A., & Scheick, B. (2019a). Asset location, timing ability and the cross-section of commercial real estate returns. Real Estate Economics, 47(1), 263–313.

Ling, D. C., Ooi, J. T., & Xu, R. (2019b). Asset growth and stock performance: Evidence from REITs. Real Estate Economics, 47(3), 884–927.

Ling, D. C., Wang, C, Zhou, T. (2019c). The geography of real property information and investment: Firm location, asset location and institutional ownership. Real Estate Economics, forthcoming.

Ling, D.C., Wang, C., Zhou, T. (2020). Asset productivity, local information diffusion, and commercial real estate returns. Working paper, Asset Productivity, Local information Diffusion, and Commercial Real Estate Returns.

Ling, D. C., Naranjo, A., Scheick, B. (2021). There's no place like home: Information asymmetries, local asset concentration, and portfolio returns. Real Estate Economics, Forthcoming.

Mitra, A. (1999). Agglomeration economies as manifested in technical efficiency at the firm level. Journal of Urban Economics, 45(3), 490–500.

Moran, P., & Ghoshal, S. (1999). Markets, firms, and the process of economic development. Academy of Management Review, 24(3), 390–412.

Mühlhofer, T. (2013). Why do REIT returns poorly reflect property returns? Unrealizable appreciation gains due to trading constraints as the solution to the short-term disparity. Real Estate Economics, 41(4), 814–857.

Ott, S. H., Riddiough, T. J., & Yi, H. C. (2005). Finance, investment and investment performance: Evidence from the REIT sector. Real Estate Economics, 33(1), 203–235.

Penrose, E., & Penrose, E. T. (2009). The theory of the growth of the firm (4th ed.). USA: Oxford University Press.

Petersen, M. (2009). Estimating standard errors in finance panel data sets: Comparing approaches. Review of Financial Studies, 22(1), 435–480.

Sachs, J. D., & Warner, A. M. (2001). The curse of natural resources. European Economic Review, 45(4–6), 827–838.

Smajlbegovic, E. (2019). Regional economic activity and stock returns. Journal of Financial and Quantitative Analysis, 54(3), 1051–1082.

Sterk, V., Sedláček, P. & Pugsley, B. (2021). The nature of firm growth. American Economic Review, 111, 547–579.

Teixeira, A. A., & Queirós, A. S. (2016). Economic growth, human capital and structural change: A dynamic panel data analysis. Research Policy, 45(8), 1636–1648.

Wang, C., & Zhou, T. (2020). Trade-offs between asset location and proximity to home: Evidence from REIT property sell-offs. The Journal of Real Estate Finance and Economics, 1–40.

Xu, R., & Ooi, J. T. (2018). Good growth, bad growth: How effective are REITs’ corporate watchdogs? The Journal of Real Estate Finance and Economics, 57(1), 64–86.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A1

Appendix A2

Rights and permissions

About this article

Cite this article

Feng, Z., Wu, Z. Local Economy, Asset Location and REIT Firm Growth. J Real Estate Finan Econ 65, 75–102 (2022). https://doi.org/10.1007/s11146-021-09822-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-021-09822-8