Abstract

Building on past research regarding the operating efficiency of Real Estate Investment Trusts (REITs) and recognizing the substantial changes in this industry since the turn of the millennium, we examine REIT efficiency over the period 2001–2015. Using both time-varying stochastic frontier and linear models of costs, revenues, and performance measures, we find evidence showing that the REIT industry is slowly moving away from both cost and revenue efficiency over time; however, size remains positively correlated with efficiency. Despite the rapid expansion of asset sizes and evidence of diminishing efficiencies of scale, larger REITs still enjoy comparative advantages over smaller REITs in both revenue (production) and costs. We also find evidence that post-recession efficiencies exceed pre-recession efficiencies, and we document modest evidence of the “weeding-out” of inefficient enterprises during the market downturn. The results suggest, through a diverse set of measures, that additional efficiency opportunities for REITs may be achievable through continued growth and consolidation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the first two decades of this Millennium, the US equity REIT industry has experienced a complete market cycle. REIT industry market capitalization tripled from 2001 to 2006, and then a large part of this growth was erased during the “Great Recession.” The REIT industry bounced back during the market recovery with significant consolidation and increases in market capitalization.Footnote 1 While the asset size of the average REIT more than doubled from 2001 to 2015, the market cap of the average REIT increased more than five-fold during this same period.Footnote 2

Using REIT operating data from the 1990s to the early 2000s, several early studies found evidence of economies of scale for REITs (e.g., Bers and Springer 1997; Ambrose et al. 2005). However, given the post-Millennial expansion of the REIT industry and growth in the size of the average REIT, some have questioned the ability of the REIT industry to continue its trend of growth and consolidation. Generally, it is expected that economies of scale will eventually disappear as the size of an individual REIT exceeds its optimal design point. REITs that continue to grow beyond this point will likely experience diseconomies of scale. In any event, one expects the size of the average REIT to eventually plateau. However, despite the substantive changes in the market environment of REITs since the early 2000s, the extant literature remains relatively silent with regard to the continued existence of REIT economies of scale in the modern era.

In this study, we examine the existence of operating efficiencies, including scale economies, in US equity REITs from 2001 to 2015. For clarification and consistency in language, we define economies of scale (scale economies) as a proportionate saving in costs gained by an increased level of production. More directly, costs increase at a lower rate than size increases. We define efficiency (X-efficiency) as the effectiveness with which a given set of inputs is used to produce a given level of output. That is, a firm is X-efficient if it is producing the maximum output (revenue) from the minimum quantity (technical efficiency) and correct proportions (allocative efficiency) of inputs such as labor, capital, and technology.

Our study examines the impact of firm size on REIT costs and profitability during both market contraction and expansion. As part of our analysis, we address the following issues. First, despite the rapid growth of REITs in the recent past, we examine the potential of scale economies as motivation for continued growth and consolidation in the REIT industry. Second, we consider whether size affects REIT revenue (production) and cost efficiencies during the growth, contraction, and recovery stages of the market cycle. Finally, we attempt to deduce whether or not the industry downturn during the “Great Recession” distorted the relationships between equity REIT size and operating efficiency.

To examine the motivation for continued growth and consolidation, in the spirit of Lewis et al. (2003) and Miller et al. (2006), we employ a time-varying stochastic frontier approach to monitor changes in REIT cost efficiency over the period 2001–2015. Compared to the time-invariant frontier models utilized in earlier studies, our time-varying frontier models allow the inefficiency function to vary over time. The time-varying frontier model is ideal for studying REITs from 2001 to 2015 given the complete market cycle observed during this period.

Our results suggest that the cost efficiency of the average equity REIT is 54% of the most efficient REIT operating on the stochastic efficiency frontier.Footnote 3 Although the US equity REIT industry is slowly moving away from cost efficiency over time, size is still positively correlated with REIT cost efficiency. We also use the time-varying stochastic frontier approach to monitor changes in REIT revenue efficiency. Our findings are consistent with those of the cost analysis. We find size remains positively correlated with REIT revenue efficiency throughout our sample period. Although our model suggests the US equity REIT market is slowly moving away from revenue efficiency over time, this trend is not statistically significant.

To examine cost and revenue efficiencies over the market cycle, we employ a series of linear models with various cost and revenue measures as the dependent variables, parsing the data by time periods. The results confirm the stochastic frontier analysis in that, despite the rapid expansion of size and some evidence of diminishing efficiencies of scale, larger REITs still enjoy comparative advantages over smaller REITs in both cost savings and revenue growth.

Finally, we find evidence that post-recession (recovery) cost and revenue efficiencies exceed pre-Recession efficiencies, perhaps due to the “weeding-out” of inefficient enterprises during the market downturn. Limiting our analysis to REITs that were operating prior to the recession, we find modest evidence that REITs which survived the downturn market of 2007–2008 (Survivors) were larger, had higher operating revenue levels, lower operating expense levels, and lower debt-to-asset ratios.

Literature Review

Early research on economies of scale for REITs focuses almost exclusively on economies of cost. Generally speaking, these studies show that scale economies indeed existed with respect to costs, providing a substantive reason for continued growth of the industry and in the size of individual REITs in the early 1990s. For example, using trans-log cost functions, Bers and Springer (1997) find significant evidence of cost economies of scale for the period 1992–1994, a period of time where REITs were transitioning into the “modern REIT era.”

Soon thereafter, frontier methodologies were introduced to examine the relationship between size and levels of efficiency in REITs. Using data envelopment analysis (DEA), Anderson et al. (2002) find most REITs operating at increasing returns to scale over the 1992–1996 study period. They also find that REITs are inefficient as a result of poor input utilization and the failure to operate at constant returns to scale. A later paper by Topuz et al. (2005) determines that the inefficiency of REITs is a consequence of a high level of input use and not a result of an incorrect mix of inputs. Using a time-invariant stochastic frontier model on data during the period of 1995–1997, Lewis et al. (2003) find most REITs enjoying increasing returns to scale. Alternatively, Ambrose et al. (2000) find no evidence of economies of scale for multifamily REITs from 1990 to 1997.

Using a longer sample period of 1990–2001, Ambrose et al. (2005) examine REIT growth in terms of revenue generation and profitability, as well as the traditional cost-based frontier model. The results from their time-invariant stochastic frontier model confirm economies of scale in terms of costs. Furthermore, they find large companies have superior ability in lowering costs, specifically in G&A expenses. They also find a direct relationship between firm profitability and firm size, but the magnitude of these documented advantages diminishes as REIT size increases. They also find that REIT risk decreases with size.

It should be noted that much of this early research coincided with the transition of the REIT sector into the “modern REIT era” following the Tax Reform Act of 1993 and the REIT Modernization Act of 1999. Prior to the passage of these two pieces of legislation, there were fewer REITs, firms were smaller on average, and property portfolios were generally more ad-hoc. The REITs of the modern era tend to be substantially larger, more vertically integrated, more institutional, and professionally managed. Using a more recent data series of 1995–2003, Miller et al. (2006) find little evidence of scale economies and they document diseconomies of scale in some cases. Similarly, Topuz and Isik (2009) note that REIT efficiency increased during the early- to mid-1990’s, but average productivity declined and technology regressed, suggesting that REITs may have overextended themselves as most were suffering from diseconomies of scale by the late 1990’s. Thus, as study periods enter into the new millennium the evidence of scale economies is not as apparent.

The general conclusion of Miller et al. (2006) and Topuz and Isik (2009) is that economies of scale eroded by the turn of the millennium and they present modest evidence of diseconomies of scale. The implication is that REITs grew too big, and scale economies are only available with smaller REITs. Their findings suggest that, as the industry has evolved and become more institutional, REIT managers have responded to the perception that analysts and investors expect growth. Thus, REIT managers may have grown REITs purely for the sake of growth, not for benefits resulting from increased scale or scope. In fact, Xu and Ooi (2018) look at individual REIT growth opportunities over the 1992–2012 period and find that 44.5% of these opportunities are suboptimal or result in decreasing returns to scale. Further, they find that larger REITs were more likely to engage in these suboptimal expansions.Footnote 4

Interestingly, Isik and Topuz (2017) present a different perspective: new REITs outperform established REITs; that is, REITs are born efficient. The outperformance of new firms is attributed to many factors including smart regulations, timing, a larger entry size, lower leverage, property focus, and location. The idea is that the new generation of REITs are born large and efficient. So, scale matters, but the markets still assess the quality of size and growth.Footnote 5

Data and Descriptive Statistics

To examine the issue of REIT efficiency in the new millennium, we obtain a sample of 2360 firm-years for 297 unique publicly-traded U.S. equity REITs from January 2001 to December 2015. Company information and the financial data for each REIT are obtained from S&P Global Market Intelligence (formerly SNL Financial). The variables used in the study are defined in Table 1.

Table 2 provides the descriptive statistics of the overall sample.Footnote 6 Panel A of Table 2 provides the descriptive statistics for the continuous variables, and Panel B of Table 2 shows the descriptive statistics of the discrete variables. Highlighting the importance of advising and management structure identified by Ambrose et al. (2005), approximately 90.4% of the sample observations are from internally-advised REITs. Likewise, approximately 78.5% of the sample are identified as self-managed REITs.Footnote 7 At the high end, retail REITs account for 20.7% of the sample. At the low end, storage REITs account for approximately 2.6% of the sample. Interestingly, about 3.6% of the REIT-year observations have a leverage ratio over 80%, while 52.5% of the sample has a leverage ratio between 50% and 80%.

Panel C of Table 2 provides the distribution of observations by year, allowing for identification of unique REITs observed as well as mean values for Total Assets and Market Capitalization each year. As noted earlier, REITs experienced a dramatic period of growth in both total assets and market capitalization over the sample period. Interestingly, the average level of total assets did not decline until after the end of the downturn market (2010 and 2011), and then only slightly. However, market capitalization was slashed over 48% from the end of 2006 to the end of 2008, and the 2006 level of market capitalization was not eclipsed until 2011. It is also interesting that average market capitalization of equity did not exceed average total assets until 2012.

To examine changes to the efficiency of the REIT industry over time, we parse the 2001–2015 sample period into the following sub-periods based on their distinct market conditions:

-

(1).

The Growth Market (2001–2006), 40.7% of our observations: During this period, the FTSE NAREIT All-Equity REIT Index increased 223.3%;

-

(2).

The Downturn Market (2007–2008), 11.2% of our observations: During this period, the FTSE NAREIT All-Equity REIT Index declined by 47.5%; and

-

(3).

The Recovery Market (2009–2015), 48.1% of our observations: During this period, the FTSE NAREIT All-Equity REIT Index increased by 187.4%.Footnote 8

Panel A of Table 3 provides descriptive statistics of our primary variables of interest across the three sub-periods noted above. Panel B of Table 3 goes on to provide tests for statistical difference in mean values across these market condition sub-periods. While the data clearly indicates that the average Recovery Market (2009–2015) REIT is substantially different from the average Growth Market (2001–2006) REIT for most variables considered, asset growth and leverage are noticeably similar. In fact, the first column shows that asset growth statistically declined from the Growth Market (2001–2006) period to the Downturn Market (2007–2008) period. REIT asset growth has since increased, but the increase is not statistically significant.

Similarly, Panel B of Table 3 also shows that REITs relied heavily on debt during the Downturn Market (2007–2008), increasing average total debt by approximately $702 million and increasing the average leverage ratio by 2.77%. In fact, we find over that the number of observations with a high leverage ratio increased by a statistically significant 2%, and the number of observations with moderate leverage increased by a statistically and economically significant 8%. Following the financial crisis, REITs did not continue to increase leverage. Instead, the average REIT’s total debt fell a statistically insignificant amount ($30.77 million) from the Downturn Market (2007–2008) to the Recovery Market (2009–2015). However, thanks to declining debt and increasing total assets, the average leverage ratio fell by a statistically and economically significant 3.23%. Moreover, the percentage of moderate leverage firms declined by 11% from the Downturn Market (2007–2006) to the Recovery Market (2009–2015), falling below the Growth Market (2001–2006) period by a statistically significant 4%.

Methods

Stochastic Frontier Model for Costs and Revenues

For our first method of analysis, we follow the time varying stochastic frontier model introduced in Aigner et al. (1977) and Meeusen and van den Broeck (1977). This method allows a firm’s deviations from its optimal frontier (inefficiency) to vary over time. Each specification yields an estimate of efficiency based on the frontier under consideration, cost or revenue. Whereas cost efficiency measures how efficiently a REIT produces output, revenue efficiency measures how effectively a REIT sells its output. Compared to the time-invariant efficiency assumptions made in Ambrose et al. (2005) and Lewis et al. (2003), our time-varying frontier model is more appropriate for our study period due to the drastic changes which have occurred in the REITs industry during our 15-year observation period.

The Cost Frontier

We begin with a cost frontier analysis documented by Kumbhakar and Lovell (2003) where the actual cost expended in producing a bundle of outputs is compared to the minimum cost necessary for production of the that same bundle of outputs. Empirically, the model assumes that expenses for REIT i at time t, Expensesi,t, follows eq. (1):

where xi, t is a vector of a REIT’s attributes that affect expenses at time t. As in Berger and Mester (1997), the efficiency parameter, λi, t, calculated as \( \frac{{Minimum\ Expenses}_{i,t} Required}{{Observed\ Expenses}_{i,t}} \), represents the sample’s cost efficiency and has values between 0 and 1. When λi, t has a value of 1, it implies that REIT i is minimizing expenses without any relative inefficiency. That is, the most efficient firm under the cost frontier specification receives, by construction, a score of 1. Whereas λi, t <1 implies that REIT i has an inefficient operating cost structure in year t. Finally, exp(vi, t) represents random shocks that REIT i faces at time t. As noted by Rogers (1998), “this estimate of cost efficiency includes both technical efficiency, using too many inputs to produce [output quantities], and allocative efficiency, using sub-optimal proportions of each of the inputs and outputs given the prevailing market prices.”Footnote 9

Taking the natural logarithm of both sides of eq. (1) yields the following:

assuming that there are n input factors which affect REIT costs, and the cost function is linear in natural logarithmic form. If we denote − ln(λi, t) as ui, t, we can rewrite eq. (2) as:

where ui, t ≥ 0 since 0 ≤ λi, t ≤ 1.Footnote 10 The time-varying inefficiency variable ui, t from t = 1 to t=Ti can be expressed as:

where \( {u}_i\sim {N}^{+}\left(\mu, {\sigma}_u^2\right) \). The estimate η indicates the magnitude and trend of REIT inefficiency, with η < 0 indicating that the level of inefficiency of the industry increases over time and η > 0 indicating the level of inefficiency of the industry decays to the base level.

More specifically, we estimate the following stochastic frontier model with time-varying techniques to show how REIT operating efficiency evolves over time.

where ln(Expensesi, t) is the natural logarithm of total operating expenditures reported by REIT i in year t. Sizei, t is the amount of total assets held or the market capitalization of REIT i in year t.

Using the stochastic frontier model, cost efficiency is measured as the distance between the observed expenses and the minimum cost frontier assuming no inefficiency. That is, the cost efficiency measure is REITs actual costs as a percentage of their optimal costs. This measure takes on values in the range (0, 1), with 1 being efficient. Also, the coefficients on the variables measuring REIT size are indicators of scale efficiency.

Finally, using the translog specification, the cost elasticity can be calculated as follows:

where β1 is the estimated coefficient for ln(Size) and β2 is the estimated coefficient for ln(Size)2. The elasticity is calculated using the estimated coefficients from the models and values of the variable measuring REIT size.Footnote 11

The Revenue Frontier

For revenue, we employ original specification of the Aigner et al. (1977) and Meeusen and van den Broeck (1977) model where the actual revenue generated by a particular bundle of outputs is compared to the maximum possible revenue for the same bundle of inputs.Footnote 12 Empirically, the model assumes output prices are exogenous and production quality, or revenue, for REIT i at time t, Revenuei,t, follows Eq. (7):

where xi, t is a vector of inputs that REIT i uses to produce revenue at time t. The efficiency estimate λi, t, calculated as \( \frac{Observed\ {Revenue}_{i,t}}{{Maximum\ Revenue}_{i,t}\ achievable} \), represents the sample’s managerial efficiency and has values between 0 and 1. Again, when λi, t has a value of 1, it implies that REIT i is maximizing revenue without any inefficiency. Whereas λi, t taking the value of 0 implies that REIT i is too inefficient to produce revenue in year t. As noted by Rogers (1998), in the revenue frontier, “inefficiency results from the improper choice of input or output quantities.” Finally, like before, exp(vi, t) represents random shocks that REIT i faces at time t.

Taking the natural logarithm of both sides of eq. (7) yields the following:

assuming there are n input factors which affect REIT production, and the production function is linear in natural logarithmic form. If we denote − ln(λi, t) as ui, t, we can rewrite eq. (8) as:

where ui, t ≥ 0 since 0 ≤ λi, t ≤ 1. Same as in the cost frontier model, the time-varying inefficiency variable ui, t from t = 1 to t=Ti in the revenue model is expressed as:

where \( {u}_i\sim {N}^{+}\left(u,{\sigma}_u^2\right) \). The parameter η indicates the magnitude and trend of REIT managerial inefficiency, with η < 0 indicating that the level of inefficiency of the industry increases over time and η > 0 indicating the level of inefficiency of the industry decreases to the base inefficiency level ui .

We estimate the following time-varying stochastic frontier model show how REIT operating efficiency evolves over time.

where ln(Revenuei, t) is the natural logarithm of total revenue reported by REIT i in year t. Sizei, t is the amount of total assets held or the market capitalization of REIT i in year t.

For interpretation, the revenue efficiency is measured as the ratio of REITs actual revenue as a percentage of their optimal revenue. The values of this measure have a range of (0, 1) with 1 indicating efficiency.

Linear Models for Costs and Revenues

To supplement the stochastic frontier model, we use the following linear model to examine various factors which may affect REIT efficiency under different market conditions:

where the dependent variables, yi, t, for the individual models are selected accounting measures of REIT costs and revenue (production).

The extant literature attributes the reduction of general and administrative costs (G&A Expenses) and financing costs to be drivers of REIT managerial efficiency (see for example Bers and Springer 1997; Bers and Springer 1998; Capozza and Seguin 1998; and Ambrose et al. 2005). If economies of scale exist in REITs, general and administrative costs are most likely to decrease as REITs grow larger because these costs are not directly related to the operation of investment properties. Similarly, the REIT’s cost of debt is expected to decrease as a REIT grows because larger REITs have better access to institutional capital. To estimate the scale efficiency effects for expenses, we use the traditional measures of G&A Expense / Total Revenue and Cost of Debt, defined as total interest expense divided by total debt.

Next, we use four financial ratios to estimate the scale efficiency effects associated with revenue (production). Asset Turnover, defined as Total Revenue/Total Assets, is an indicator of the efficiency with which a REIT is deploying its assets in generating revenue. The Property ROA, defined as Net Operating Income/Total Assets, also increases with increases in operating efficiency. Ceteris paribus, a higher Property ROA indicates that a REIT achieves a higher rate of return from its real estate assets. The last two measures, NOI / Total Revenue and FFO / Total Revenue, consider the percentage of revenue derived from real estate investments.

To account for other factors that may affect these profitability and cost measures, a vector of time-varying REIT characteristics,xi, j, t, is incorporated into the analysis. This includes variables such as the REIT’s Leverage Ratio, Annual Asset Growth, and binary variables to account for the REIT’s management style (self or external), advising type (internal or external), geographic (regional) location, and investment focus. Changes to a REIT’s financial leverage impact both the risk and the return of a REIT as a REIT grows in size. Annual Asset Growth, measured as the year-over-year percentage change in a REIT’s total assets, accounts for the impact of the rate of growth on scale efficiencies. A faster growing REIT is burdened with larger transaction costs which may serve to delay the recognition of any efficiencies. While externally-managed REITs have been shown to appear to be less efficient because they benefit more by an increase in asset size (Anderson et al. 2000), self-management of a REIT has also been shown to be associated with less efficiency (Miller et al. 2006). We also include year indicator variables to control for market conditions that affect the performance of all REITs in a given year. Following Petersen (2009), the standard error is clustered at the firm level for all linear models examined.

Crisis Consolidation Hypothesis

As noted earlier, when comparing the Recovery Market (2009–2015) to the Growth Market (2001–2006), it appears that many of the variables changed significantly as a result of the “great recession.” Examination of Panel B of Table 3 shows several statistically and economically significant changes from the Growth Market (2001–2006) to the Downturn Market (2007–2008); however, the changes from the Downturn Market (2007–2008) to the Recovery Market (2009–2015) are relatively fewer in number, the most notable exceptions are the increase in Market Capitalization and the decrease in leverage.

Looking closer at Panel B of Table 3, we note that the REIT industry continued to grow in Total Assets during the Downturn Market (2007–2008), but not Market Capitalization. This is consistent with Mulherin and Womack (2015) who document 17 REIT mergers during the Downturn Market (2007–2008); REITs may not have disappeared, but they may have consolidated.Footnote 13 Given we find evidence of changes from pre-recession to post-recession, and given the consolidation in the number of REITs during this important period, we hypothesize that the industry underwent a “weeding-out” of smaller, less efficient enterprises during the market downturn.

To evaluate this hypothesis, we first identify all REITs in our sample in 2006, the last year of the Growth Market (2001–2006). We then parse the 2006 sample based on downturn market ex-post survival outcomes. That is, for all 2006 REIT observations, we identify those reporting results in 2009 (Survivors) and those which do not report results in 2009 (Non-Survivors).Footnote 14 These summary statistics are presented in Table 4.

While the magnitude of the means for most variables are economically different for Survivors vs. Non-Survivors, due to the relatively small size of the two subsamples, only a few variables appear to be statistically different. Specifically, we find that mean values for NOI/Total Revenue and FFO/Total Revenue are statistically and economically larger for Survivors versus Non-Survivors. We also find evidence that Survivors have statistically smaller leverage ratios than Non-Survivors. Finally, as shown in Panel B of Table 4, Hotels are more likely to be Non-Survivors while Industrial REITs were more likely to be Survive. In fact, no storage or industrial REITs failed during the Downturn Market (2007–2008).

Second, we identify the determinants of a REIT’s downturn market ex-post survival outcomes. That is, we examine the characteristics which impact the likelihood of a REIT in 2006 remaining in the sample to report in the year following the great recession, 2009. Using the Growth Market (2001–2006) subsample, we estimate the following time-series cross-sectional logit model:

where, as mentioned above, Survivori is a binary variable equal to one (1) if a REIT i meets both of the following conditions (A) reports in 2006 and (B) reports results for 2009, zero (0) otherwise.Footnote 15 While the main variable of interest is size, measured as ln(Total Assetsi,t), the logit model also includes measures for revenue efficiency (Operating Revenue / Total Assetsi,t), cost efficiency (Operating Expenses / Total Assetsi,t), leverage (Leverage Ratioi,t), and binary variables for advising status, management status, and property focus. If the industry experienced a “weeding-out” of smaller, inefficient enterprises during the Downturn Market (2007–2008), we expect to find a positive coefficient on ln(Total Assets), a positive coefficient on Operating Revenue / Total Assets, and a negative coefficient on Operating Expenses / Total Assets.

As a third method of examining this hypothesis, we utilize the time varying stochastic frontier model discussed in Section 4.1 to compute the cost and revenue efficiency of firms which weathered the great recession and survived from 2006 to 2009 (Survivor) compared to those which did not survive from 2006 to 2009 (Non-Survivor). Similar to the panel logit model, if the industry underwent a “weeding-out” of inefficient enterprises during the Downturn Market (2007–2008), we would expect to find that REITs which survived the crisis had higher efficiency parameters for both costs and revenue in the period prior to the great recession, Growth Period (2001–2006).

Results

Results on Cost Efficiency

Table 5 displays the estimated results for the stochastic frontier model of REIT cost efficiency. The dependent variable is ln(Total Expenses). REIT size is alternatively measured with ln(Total Assets) in Model 1 and with ln(Market Capitalization) in Model 2. Finally, Model 3 includes both ln(Market Capitalization) and ln(Total Assets). In all cases, REIT size measures are included in the quadratic form to assess whether scale effects, if present, diminish as expected as size increases.

The coefficients for ln(Total Assets) in Model 1 indicate that costs decrease at a decreasing rate as the size of the REIT, measured by assets, increases. Calculating the elasticity of costs with respect to assets for Model 1 using Eq. 6 results in a cost elasticity of:

where 7.339 is the mean value of ln(Total Assets) over the 2001–2015 study period.

A cost elasticity value of less than one (1) is evidence of economies of scale because an increase in total assets results in a decrease in unit costs while keeping the input costs constant. At the mean value of ln(Total Assets) of 7.339, the elasticity measure of 0.1742 suggests that a 1% increase in ln(Total Assets) corresponds to a 0.17% increase in costs.

As shown in Model 2, the results for ln(Market Capitalization) also suggest that costs decrease as REIT size increases. In fact, all three models support the possible existence of scale economies over the 2001–2015 study period, but the estimated η constants for all three models are negative (ranging between −0.014 and − 0.018), implying that the level of cost efficiency of the REIT industry as a whole is slightly worsening over time. This trend is not surprising given the size of REITs has been increasing during our sample period.

Figure 1 plots the average REIT cost efficiency measure λ by year from 2001 to 2015 with the REITs divided into terciles by size: large REITs, mid-size REITs and small REITS. As noted previously, λi, t, represents the sample’s cost efficiency and has values between 0 and 1.Footnote 16 When λi, t has a value of 1, it implies that REIT i is minimizing expenses without any inefficiency. That is, the most efficient firm under the cost frontier specification receives, by construction, a score of 1. Whereas λi, t approaching 0 implies that REIT i has an inefficient operating cost structure in year t.

REIT Cost Efficiency by Year and REIT Asset Size Terciles Company information and financial data are from S&P Global Market Intelligence (formerly SNL Financial). The sample consists of 2360 REIT-year observations on 297 unique publicly-traded U.S. equity REITs from January 2001 to December 2015. The REIT cost efficiency parameter, λi, t, is calculated as \( \frac{{Minimum\ Expenses}_{i,t} Required}{{Observed\ Expenses}_{i,t}} \), represents the sample’s cost efficiency and has values between 0 and 1 where λi, t = 1 implies that REIT i is minimizing expenses without any relative inefficiency. Each point in Fig. 1 represents the average efficiency parameter for a given tercile for a given year

Figure 1 shows that large REITs are more cost efficient than mid-sized and small REITs after 2005 despite the industry level cost efficiency level is slowly declining over time as the average REIT size keeps growing. The largest REITs have done better at maintaining their levels of cost efficiency throughout the sample period. Interestingly, mid-size REITs are furthest away from the efficient frontier and therefore relatively less efficient than both larger and smaller REITs.

Table 6 reports the results for the panel model measuring the impact of REIT size on general and administrative (G&A) expenses and the cost of debt. In each panel the first column reports the results based on the entire sample period, 2001–2015. The remaining three columns provide results for the three sub-periods described earlier: the Growth Market (2001–2006), the Downturn Market (2006–2007), and the Recovery Market (2009–2015).

Panel A of Table 6 presents the results where G&A Expense / Total Revenue is the dependent variable. The coefficient estimates for ln(Total Assets) for the entire 15-year study period and the two non-recession sub-periods suggest that G&A expenses as a percentage of total revenue declines as REIT size increases, a result that supports the existence of scale economies. Confirming the univariate analysis, the magnitude of the cost efficiencies for the post-crisis period, Recovery Market (2009–2015), is larger than that of the pre-crisis period, Growth Market (2001–2006). Consistent with the findings of Ambrose et al. (2005), our results indicate strong scale economies associated with G&A expenses, and the rate of asset growth and the degree of leverage are not shown to impact G&A cost efficiencies. These results are also consistent with a Malhotra et al. (2019) who examine REIT cost efficiencies over smaller sub-sample period of 2012–2016.Footnote 17

Panel B of Table 6provides the panel model results for the Cost of Debt, the REIT’s average cost of debt measured as total interest expense divided by total debt. As shown in the left column, the coefficient estimates for ln(Total Assets) for the entire 15-year observation period are statistically significant and indicate that the average cost of debt increases at a decreasing rate with the size of the REIT. This result counters earlier period studies that show economies of scale with respect to debt costs; however, Panel B also shows that this finding is very time specific. The sub-period analysis shows this positive relation only exists during the Growth Market (2001–2006). However, although the sign on the coefficient is negative, potentially suggesting a return to the results of previous studies that show economies of scale with respect to borrowing costs, there is no statistical evidence for either economies or diseconomies of scale associated with the REIT’s cost of debt for the Recovery Market (2009–2015).

Results on Revenue Efficiency

Table 7 displays the stochastic frontier model results for REIT revenue efficiency with the dependent variable ln(Total Revenue). REIT size is alternatively measured with ln(Total Assets) in Models 1 and 3 and with ln(Market Capitalization) in Models 2 and 4.Footnote 18 In all cases, REIT size is included in the quadratic form to assess whether scale effects, if present, diminish as expected as size increases. A control variable, ln(Total Expenses), is included for Models 1 and 2, whereas Models 3 and 4 include the natural log of individual components of total expenses as control variables.

For all models, the coefficient estimates for both ln(Total Assets) and ln(Market Capitalization) are positive and significant, indicating that total revenue increases with the size, both book and market values, of the REIT. For example, Model 1 shows a ln(Total Revenue) increases in Total Assets, implying large REITs have a comparative higher revenue efficiency level than that of smaller REITs. However, as shown by a negative and statistically significant coefficient for the quadratic terms, the marginal effects diminish as REITs grow larger on the basis of total assets. However, in Model 2, a positive and statistically significant coefficient for the quadratic size term ln(Market Capitalization)2 shows that the marginal effects become larger as REITs grow. The results for Models 3 and 4 using individual components of expense as control variables, are similar to those using overall total expenses as a control variable (Models 1 and 2).

Overall, the results from the stochastic frontier models show that REIT total revenue increases at a decreasing rate as REITs grow when size is measured by total assets. As shown, the estimated η for Models 1 and 3 are non-negative, implying that the level of revenue efficiency of the REIT industry as a whole is increasing over time. However, we note the magnitude of η (0.006 and 0.000, respectively) is immaterial and statistically insignificant.

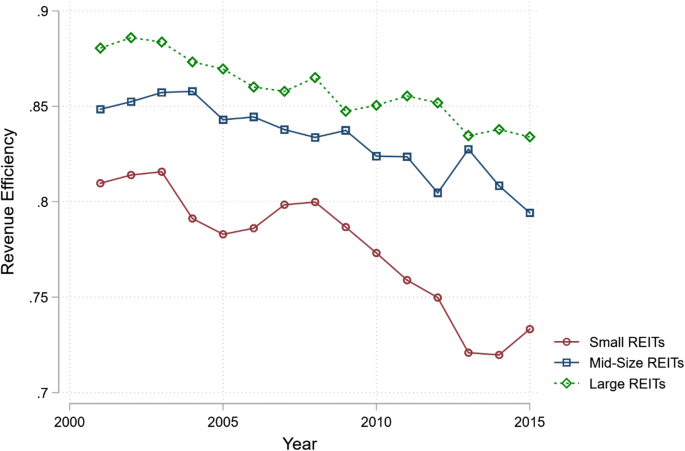

Similar to the analysis for cost efficiency parameters, Fig. 2 plots the average REIT revenue efficiency measure by year from 2001 to 2015 delineated by REIT size terciles.Footnote 19 In the case of revenue, large REITs have a higher level of efficiency compared to that of smaller REITs despite all equity REIT terciles have drifted away from the efficient revenue frontier. Again, large REITs have better maintained their revenue efficiency over time; however, whereas mid-size REITs were the least cost efficient, Fig. 2 shows that smaller REITs are the least revenue efficient.Footnote 20

REIT Revenue Efficiency by Year and REIT Asset Size Terciles Company information and financial data are from S&P Global Market Intelligence (formerly SNL Financial). The sample consists of 2360 REIT-year observations on 297 unique publicly-traded U.S. equity REITs from January 2001 to December 2015. The revenue efficiency estimate λi, t, is calculated as \( \frac{Observed\ {Revenue}_{i,t}}{{Maximum\ Revenue}_{i,t}\ achievable} \), represents the sample’s managerial efficiency and has values between 0 and 1 where λi, t= 1 implies that REIT i is maximizing revenue without any inefficiency. λi, t= 0 implies that REIT i is too inefficient to produce any revenue in year t. Each point in Fig. 2 represents the average efficiency parameter for a given tercile for a given year

As before, we estimate panel models to estimate the impacts of REIT size, as measured with total assets, on a variety of accounting measures relating to revenue. Table 8 displays the results where each measure of revenue (production) is evaluated in a separate panel. In each panel, the first column reports the results based on the entire sample period, 2001–2015. The remaining three columns provide results for the three sub-periods described earlier.

Panel A of Table 8 shows the results for the linear model where the dependent variable is Asset Turnover Ratio (%), defined as the REIT total revenue divided by total assets expressed as a percentage. The results over the entire study period and throughout the sub-periods show that ln(Total Assets) does not statistically impact a REIT’s asset turnover ratio. In addition, asset growth decreased efficiency over the entire study period, but sub-period analysis shows an insignificant relationship during and after the financial crisis. Interestingly, high financial leverage corresponds to higher asset turnover during all periods except for the Downturn Market of 2007–2008.

Panel B of Table 8 shows the results of the analysis of property returns. The dependent variable is the Property ROA (%), measured as the net operating income (NOI) from the REIT’s properties divided by total assets and expressed as a percentage. For the full sample and sub-periods, the results show property returns are positively and statistical significantly correlated with REIT asset size. However, the negative coefficient on the quadratic term shows again that revenue efficiency is increasing at a decreasing rate as the size of REITs increase. Although growth is negatively correlated with property returns, the coefficient is only weakly significant in the Recovery Market (2009–2015), suggesting the REITs in the post-crisis period are growing without hindering their property ROA. Interestingly, we find that revenue efficiency increases with higher leverage (except in the Downturn Market of 2007–2008).

Panels C of Table 8 displays panel model results for NOI / Total Revenue (%), the ratio of net operating income to total revenue expressed as a percentage. If economies of scale exist in REITs, this return measure should increase as REIT size increases, and Panel C confirms that NOI / Total Revenue (%) increases at a decreasing rate for the entire study period and for all three sub-periods as REIT asset size increases. Further confirming the “growth is good” story, the coefficient for Annual Asset Growth is positive and significant in all periods except the Downturn Market (2007–2008).

Panel D of Table 8 shows a similar relationship for FFO / Total Revenue (%), the ratio of funds from operations to total revenue expressed as a percentage. In this case, the statistical significance is weak for the Growth Market (2001–2006) and the Downturn Market (2007–2008), but the scale economies become noticeably stronger during the Recovery Market (2009–2015). Unlike the NOI measure, the coefficient for Annual Asset Growth is insignificant for FFO / Total Revenue across all study periods. Also, leverage has a strong negative impact on FFO / Total Revenue.

Results on Crisis Consolidation Hypothesis

As noted in Section 4.3, we hypothesize that the industry underwent a “weeding-out” of smaller, less efficient enterprises during the market downturn. To evaluate this hypothesis we first seek to understand the determinants of REITs which existed in 2006 and survived the Downturn Market (2007–2008). The results of our time-series cross-sectional Logit model with the binary dependent variable Survivor are presented in Table 9. Model 1 is the base model, and Model 2 includes binary variables to control for internal advisors, self-management, and property focus.

Consistent with our hypothesis, Model 1 shows that surviving REITs (Survivor = 1) are larger, have higher ratios of operating revenue to total assets (Operating Revenue / Assets), have lower levels of operating expenses to total assets (Operating Expense / Assets), and have lower levels of leverage (Leverage Ratio). Inclusion of the control variables in Model 2 produces similar results, but the statistical significance of leverage is reduced.

Turning to the time-varying stochastic frontier analysis, in Fig. 3 and Fig. 4 we plot estimated efficiency levels by survival outcome. Figure 3 shows that, although the efficient frontier for surviving REITs is monotonically decreasing, surviving REITs had higher cost efficiency levels than non-survivors prior to the great recession. Non-survivors had dramatic increases in cost efficiency during the first few years of the Growth Market (2001–2006), closing the gap with survivors, but efficiency levels declined rapidly for non-survivors between 2005 and 2006.

REIT Cost Efficiency by Year and Downturn Market Ex-Post Survival Outcomes Company information and financial data are from S&P Global Market Intelligence (formerly SNL Financial). The sample consists of 2360 REIT-year observations on 297 unique publicly-traded U.S. equity REITs from January 2001 to December 2015. The REIT cost efficiency parameter, λi, t, is calculated as \( \frac{{Minimum\ Expenses}_{i,t} Required}{{Observed\ Expenses}_{i,t}} \), represents the sample’s cost efficiency and has values between 0 and 1 where λi, t = 1 implies that REIT i is minimizing expenses without any relative inefficiency. Survivor is a binary variable equal to one (1) if the REIT meets both of the following conditions: (A) established between 2001 and 2006 and (B) reports results for 2009. A Non-Survivor is a binary variable equal to one (1) for a REIT which meets condition (A) but fails to meet condition (B). A Non-Survivor (Survivor = 0) is a REIT which reported in 2006 but did not report in 2009 because it was acquired or otherwise ceased operations in 2007 or 2008. Each point in Fig. 3 represents the average efficiency parameter for a given subsample (Survivor or Non-Survivor) for a given year

REIT Revenue Efficiency by Year and Ex-Post Survival Outcomes Company information and financial data are from S&P Global Market Intelligence (formerly SNL Financial). The sample consists of 2360 REIT-year observations on 297 unique publicly-traded U.S. equity REITs from January 2001 to December 2015. The revenue efficiency parameter,λi, t, is calculated as \( \frac{Observed\ {Revenue}_{i,t}}{{Maximum\ Revenue}_{i,t}\ Achievable} \), represents the sample’s managerial efficiency and has values between 0 and 1. λi, t= 1 implies that REIT i is maximizing revenue without any inefficiency. λi, t= 0 implies that REIT i is too inefficient to produce any revenue in year t. Survivor is a binary variable equal to one (1) if the REIT meets both of the following conditions: (A) established between 2001 and 2006 and (B) reports results for 2009. A Non-Survivor is a binary variable equal to one (1) for a REIT which meets condition (A) but fails to meet condition (B). A Non-Survivor (Survivor = 0) is a REIT which reported in 2006 but did not report in 2009 because it was acquired or otherwise ceased operations in 2007 or 2008.

As shown in Fig. 4, REIT revenue efficiency shows a similar, but not as elegant, story. While revenue efficiency for survivors was relatively steady, revenue efficiency for non-survivors spiked in the early years of the Growth Market (2001–2006) only to collapse from 2003 to 2006. Overall, the results from the logit models and the time-varying stochastic frontier analysis is consistent with the hypothesis that smaller, less efficient REITs were the primary casualties of the great recession.

Conclusion

While early studies find significant cost economies of scale (e.g., Bers and Springer 1997; Anderson et al. 2002; and Ambrose et al. 2005) for REITs, other studies (e.g., Miller et al. 2006; and Topuz and Isik 2009) find that cost economies were disappearing in the early 2000’s. Despite significant changes to the U.S. financial markets since the turn of the millennium, the literature has remained relatively silent on the overall efficiency and presence of economies of scale in the ever growing REIT industry, especially leading up to and beyond the 2008 financial crisis.

In this study, we examine the existence of scale economies and evaluate the cost and revenue efficiency of 407 US equity REITs covering the period 2001–2015. Our study encapsulates a sample period that includes a major market downturn and thus provides a comprehensive analysis detailing the impact of asset size on REIT operating efficiency during both market recession and expansion. We use both a time varying stochastic frontier approach and a set of linear panel models to document changes in REIT operating efficiency levels over this complete market cycle.

With respect to expenses, the historical measure of scale economies, the stochastic frontier model shows REITs having scale efficiencies that are slowly eroding over time. The average REIT in our sample spends 56% more (average inefficiency of 0.65 versus optimal inefficiency of 1) that a REIT operating on the efficient frontier. When examined in terciles, we find that large REITs continue to enjoy the highest levels of cost efficiency, with mid-size REITs being the least cost efficient.

The panel models for costs provide several additional insights. First, consistent with previous studies, G&A expenses as a percentage of total revenue decline significantly as a REITs increase their total assets. The magnitude of this effect is especially strong since the beginning of the Recovery Market (2009–2015). Also, apparent diseconomies of scale in the cost of debt disappear in the Recovery Market (2009–2015), suggesting that larger REITs may again have access to cheaper debt after the financial crisis, a result that is very much in line with previous (mostly pre-2000 study periods) research in this area.

Looking at revenues, the stochastic frontier model results show that the revenue efficiency of REITs has remained remarkably stable over the study period, with the average REIT making 82% of the optimal revenue assuming no inefficiency. In fact, the relative stability REIT efficiency, the stochastic frontier approach shows no drastic changes in the revenue efficiency measure after the 2007–2008 financial crisis. Throughout three sub-periods, larger REITs remain more revenue efficient than their smaller counterparts, and small REITs are the least revenue efficient.

Using several proxies for revenue (production), the results of our linear panel models suggest that US equity REITs achieve operational efficiencies in revenue (production) as they expand their asset holdings. This is primarily shown through higher property returns and higher revenue ratios: NOI / Total Revenue (%), Property ROA (%), and FFO / Total Revenue (%). Consistent with findings of extant literature, all of these efficiencies are increasing at a decreasing rate with size.

Finally, we find evidence that post-recession (recovery) cost and revenue efficiencies exceed pre-recession efficiencies, perhaps due to the “weeding-out” of smaller, inefficient REITs during the Downturn Market (2007–2008). Limiting our analysis to REITs which were operating prior to the recession, we find modest evidence that REITs which survived the downturn market of 2007–2008 (Survivors) were larger, had higher operating revenue levels, lower operating expense levels, and lower debt-to-asset ratios. Then, employing time-varying stochastic frontier analysis, we evaluated efficiency levels by survival outcome. We find that surviving REITs had both higher cost efficiency levels and higher revenue efficiency levels than non-survivors prior to the great recession.

In sum, while the evidence on operating efficiencies (stochastic frontier model) suggests that the overall level of operating efficiency for US equity REITs remains stable, we document evidence that economies of scale still exist in this industry. While we find evidence that the great recession led to consolidation of smaller, less efficient REITs, our models show that there are still economies of scale and efficiencies for larger REITs. Thus, it is likely that the equity REIT industry will continue to experience growth and consolidation in the foreseeable future.

Notes

The Great Recession (https://www.federalreservehistory.org/essays/great_recession_of_200709)

According to the REIT Industry Financial Snapshot (https://www.reit.com/data-research/data/industry-snapshot) as of September 2017, equity REIT market capitalization reached an all-time high of $1.043 trillion, with the average REIT having a market cap of $5.5 billion.

The results from our stochastic frontier model for cost efficiency indicate a λ = 1.83. As noted by when computed as mean relative efficiency, this figure is inverted, 1/λ, to give 0.54 on a scale of (0,1). See p. 438 of Meeusen and van den Broeck (1977).

Feng et al. (2011) provide a thorough review of the literature on equity REIT research.

Some REIT-year observations do not have complete income statement data recorded in S&P Global Market Intelligence. When available, the income statement data was supplemented with Compustat data as a secondary source.

Self-Advised and Self-Managed binary variables are set according to the date the firm elects self-advised or self-managed status.

The monthly and annual index data for the FTSE Nareit U.S. Real Estate Index Series is available at the following: https://www.reit.com/data-research/reit-indexes/annual-index-values-returns. The Index values used are as follows: 3002.97 (December 31, 2000); 8185.75 (December 31, 2006); 5097.46 (December 31, 2008); 14,650.51 (December 31, 2015).

Badunenko et al. (2008) demonstrate that input prices, which are generally unknown at the firm level, are not necessary to estimate allocative efficiency.

The elasticity measure shows negative elasticities disappearing at a value of ln(Total Assets) of approximately 2.5, corresponding to Total Assets of $12.18 million. While this result is confounded by the time component of the panel data, the small REIT size at which this happens suggests that any REITs on the downslope of the inverse U-shaped cost curve occurred early in the study period. Numerical analysis also suggests that all REIT observations had elasticities less than one (1), suggestive of economies of scale.”

Devaney and Weber (2005) utilize a directional output distance function to construct a risk/return frontier. Their process identifies firm performance as a production process in which each REIT produces a desirable output (return) and an undesirable output (risk) using inputs of managerial effort and financial capital.

These results compare closely to the significant decline in the number of REITs during the Downturn Market (2007–2008) shown in Panel C of Table 2 as well as the significant increase in REIT total assets during the Downturn Market (2007–2008) shown in Panel B of Table 3. Mulherin and Womack (2015) also document evidence of 22 mergers in 2006 alone. To limit our sample to REITs which were merged or otherwise eliminated during the Downturn Market (2007–2008), we require a REIT to report in 2016 to be considered a Survivor or Non-Survivor.

The 20 Non-Survivors have the following SNL Institution Keys: 102919, 102,986, 102,987, 103,005, 103,147, 103,158, 103,168, 103,198, 103,627, 113,002, 4,002,566, 4,076,915, 4,082,048, 4,089,416, 4,089,963, 4,092,926, 4,093,258, 4,093,270, 4,106,641, and 4,110,503.

For completeness, a non-survivor is a REIT which meets condition (A) but fails to meet condition (B) because it was acquired otherwise ceased operations in 2007 or 2008.

When we examine the cost efficiencies for all individual REITs in the sample by year, we find that cost efficiency measures, λ_(i,t), range between a minimum of 0.389 to a maximum of 0.952.

Malhotra et al. (2019) use data from Mergent Online to evaluate economies of scale in REITs over the period 2012–2016. They find that REIT operating expenses increase less than proportionately with increases in total assets.

Models using both Total Asset Value and Market Capitalization to jointly measure the size of a REIT failed due to convergence issues.

When we examine revenue efficiency for each individual REIT in the sample by year, we find that revenue efficiency measures, λ_(i,t), range between a minimum of 0.322 to a maximum of 0.984.

When size is measured by market capitalization the results of the frontier models show that REIT total revenue is increasing at an increasing rate as REITs grow, but again the estimated η constants are negative and imply that the level of revenue efficiency of the REIT industry is decreasing over time.

References

Aigner, D., Lovell, C., & Schmidt, P. (1977). Formulation and estimation of stochastic frontier production function models. Journal of Econometrics, 6(1), 21–37.

Ambrose, B. W., Ehrlich, S. R., Hughes, W. T., & Wachter, S. M. (2000). REIT economies of scale: Fact or fiction. Journal of Real Estate Finance and Economics, 20(2), 211–224.

Ambrose, B. W., Highfield, M. J., & Linnemann, P. D. (2005). Real estate and economies of scale: The case of REITs. Real Estate Economics, 33(2), 323–350.

Anderson, R. I., Fok, R., Springer, T. M., & Webb, J. (2002). Technical efficiency and economies of scale: A non-parametric analysis of REIT operating efficiency. European Journal of Operational Research, 139, 598–612.

Anderson, R. I., Lewis, D., & Springer, T. M. (2000). Operating efficiencies in real estate: A critical review of the literature. Journal of Real Estate Literature, 8(1), 3–18.

Badunenko, O., Fritsch, M., & Stephan, A. (2008). Allocative efficiency measurement revisited – Do we really need input prices? Economic Modeling, 25, 1093–1109.

Berger, A. N., & Mester, L. J. (1997). Inside the black box: What explains difference in the efficiencies of financial institutions? Journal of Banking & Finance, 21, 895–947.

Bers, M., & Springer, T. M. (1997). Economies-of-scale for real estate investment trusts. Journal of Real Estate Research, 14(3), 275–291.

Bers, M., and Springer, T.M. (1998). Sources of scale economies for real estate investment trusts. Real Estate Finance, (winter/spring) 37–44.

Capozza, D. R., & Seguin, P. J. (1998). Managerial style and firm value. Real Estate Economics, 26(1), 131–150.

Devaney, M., & Weber, W. (2005). Efficiency, scale economies, and the risk/return performance of real estate investment trusts. Journal of Real Estate Finance and Economics, 31(3), 301–317.

Feng, Z., Price, S. M., & Sirmans, C. F. (2011). An overview of equity real estate investment trusts (REITs): 1993-2009. Journal of Real Estate Literature, 19(2), 307–341.

Isik, I., & Topuz, J. C. (2017). Meet the “born efficient” financial institutions: Evidence from the boom years of US REITs. The Quarterly Review of Economics and Finance, 66, 70–99.

Kumbhakar, S. C., & Lovell, C. A. K. (2003). Stochastic frontier analysis. Cambridge: Cambridge University Press.

Lewis, D., Springer, T. M., & Anderson, R. I. (2003). The cost efficiency of real estate investment trusts: An analysis with a Bayesian stochastic frontier model. Journal of Real Estate Finance and Economics, 26(1), 65–80.

Malhotra, D., Wang, X., and Poteau, R. (2019). Does size matter in the management of real estate investment trusts? Working Paper, Thomas Jefferson University.

Meeusen, W., & van den Broeck, J. (1977). Efficiency estimation from cobb-Douglas production functions with composed error. International Economic Review, 18(2), 435–444.

Miller, S. M., Clauretie, T. M., & Springer, T. M. (2006). Economies of scale and cost efficiencies: A panel data stochastic frontier analysis of real estate investment trusts. The Manchester School, 74(4), 483–499.

Mulherin, J. H., & Womack, K. S. (2015). Competition, auctions and negotiations in REIT takeovers. The Journal of Real Estate Finance and Economics, 50(2), 151–180.

Petersen, M. A. (2009). Estimating standard errors in finance panel data sets: Comparing approaches. Review of Financial Studies, 22(1), 435–480.

Rogers, K. E. (1998). Nontraditional activities and the efficiency of US commercial banks. Journal of Banking & Finance, 22(4), 467–482.

Topuz, J. C., Darrat, A., & Shelor, R. (2005). Technical, allocative and scale efficiencies of REITs: An empirical inquiry. Journal of Business Finance and Accounting, 32(9), 1961–1968.

Sun, L., Titman, S., & Twite, G. J. (2015). REIT and commercial real estate returns: A postmortem of the financial crisis. Real Estate Economics, 43(1), 8–36.

Topuz, J. C., & Isik, I. (2009). Structural changes, market growth and productivity gains of US real estate investment trusts in the 1990’s. Journal of Economics and Finance, 33, 288–315.

Xu, R., & Ooi, J. T. L. (2018). Good growth, bad growth: How effective are REITs’ corporate watchdogs. Journal of Real Estate Finance and Economics, 57(1), 64–86.

Acknowledgments

The data for this project is funded by the Robert W. Warren Chair of Real Estate at Mississippi State University. The authors appreciate comments and suggestions provided by Erik Devos, Zifeng Feng, David Harrison, Bennie Waller, and seminar participants at the 2018 American Real Estate Society Annual Meeting, the 2018 Southern Finance Association meeting, and the 2019 American Real Estate Society Annual Meeting. All errors remain the property of the authors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Highfield, M.J., Shen, L. & Springer, T.M. Economies of Scale and the Operating Efficiency of REITs: A Revisit. J Real Estate Finan Econ 62, 108–138 (2021). https://doi.org/10.1007/s11146-019-09741-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-019-09741-9