Abstract

REITs are often assumed to be defensive assets having a low correlation with market returns. However, this dependence is not symmetric across the joint-return distribution. Disappointment-averse investors with state-dependent preferences attach (dis-)utility to investments exhibiting (lower-tail) upper-tail asymmetric dependence. We find strong empirical evidence that investors price this asymmetric dependence in the cross section of US REIT returns. In particular, we show that REIT stocks with lower-tail asymmetric dependence attract a risk premium averaging 1.3 % p.a. and REIT stocks exhibiting upper-tail asymmetric dependence are traded at discount averaging 5.8 % p.a. We find no evidence that the equity β is positively priced in US REIT returns. Our findings imply that traditional estimators of REIT cost of capital and performance measurement are likely to be substantially misrepresentative.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Many authors consider real estate investment trusts (REITs) to be defensive assets having a low correlation with market returns, that is having a CAPM β less than one (Chan et al. 1990; Glascock and Hughes 1995; Howe and Shilling 1990; Glascock et al. 2004; Hung and Glascock 2008). However, more recent research suggests that the dependence structure between REITs and the market is more complex than previously thought (James and Miffre 2009; Clayton and MacKinnon 2003). For example, Sun et al. (2015) provide evidence that the REIT sensitivity to market returns was particularly high during the global financial crisis of 2007-2008. This is consistent with a broader pattern whereby REIT returns are more highly correlated in market downturns than in upturns (Knight et al. 2005; Goldstein 1999).

This asymmetric dependence (AD) between REIT returns and market returns is well documented.Footnote 1 Several authors find evidence of AD between returns of well-diversified stock indices and infer that AD is not easily diversified away (Low et al. 2013; Alcock and Hatherley 2009; Hong et al. 2007; Hartmann et al. 2004; Patton 2004; Ang and Bekaert 2002; Longin and Solnik 2001; Erb et al. 1994). The existence and non-diversifiability of AD implies that CAPM β may not adequately describe the sensitivity of REIT returns to market movements. If REIT investors exhibit preferences for AD, then AD should be priced in US REIT returns independently of the price for CAPM β.

The primary objective of this paper is to determine the price of asymmetric dependence in US REIT returns. Our paper contributes to the existing literature on REIT return premia by exploring the price that REIT investors attach to lower-tail and upper-tail asymmetric dependence, independently of symmetric, linear dependence (CAPM β). A significant premium for asymmetric dependence is consistent with REIT investors being disappointment averse, rather than risk averse. Given the previously weak empirical support for CAPM β premium (Pai and Geltner 2007), our paper may provide useful insights on whether REIT investors are risk averse, disappointment averse, or both.

Asymmetric dependence is particularly important for US REIT investors for a number of reasons. First, REITs are often highly leveraged, which increases the level of AD in equity-holder returns (Alcock and Steiner 2016). Second, to the extent that AD attracts a return premium, REIT managers may have an incentive to increase their firm’s exposure to AD in order to report this return compensation as alpha (Alcock et al. 2013; Diamond and Rajan 2009; Goetzmann et al. 2007). Due to the diversified ownership provisions of REIT legislation, investors have few tools to minimize such rent-seeking behavior (Ghosh and Sirmans 2003). The ultimate tool available to investors is withdrawal of their capital, i.e. price protection. If REIT investors are more likely to use this tool, then AD may be more of a concern for REIT investments compared to other listed securities.

Finally, US REITs are required to distribute at least 90 % of their taxable income to investors in order to qualify for reduced corporate tax,Footnote 2 and so are less able to maintain a cash buffer to protect against unfavourable future market conditions (Bradley et al. 1998; Jensen 1986). REITs are exogenously cash constrained compared to other public firms. An et al. (2012) highlight that REITs are consequently more sensitive to liquidity crises: “Without access to bank lines of credit, REITs are at a disadvantage when competing with other firms in making acquisitions.” Footnote 3 The effect of market downturns on REITs may be thus more pronounced than the effect of market upturns (Bianchi and Guidolin 2014; Zhou and Anderson 2013; James and Miffre 2009; Simon and Ng 2009; Goldstein 1999). This increased downside sensitivity can further result in US REIT returns exhibiting lower-tail asymmetric dependence.

It has so far proven difficult to identify the price of AD independently of the price for CAPM β because most of the metrics employed to identify AD do not satisfy strict monotonicity and orthogonality conditions. We use an adjusted version of the J-statistic (Alcock and Hatherley 2016) that is monotonic, orthogonal to CAPM β, and is size and scale invariant. Consequently, it is ideally suited for exploring AD in an asset-pricing framework. Furthermore, the adjusted J-statistic can distinguish between two different types of AD: lower-tail asymmetric dependence (LTAD), where the correlation between stock and market returns is higher in the lower tail than in the upper tail of the joint-return distribution, and upper-tail asymmetric dependence (UTAD), where the correlation is higher in the upper tail than in the lower tail. The secondary objective of this paper is to determine the price sensitivity of US REITs to LTAD and UTAD, respectively.

Ultimately, investor preferences will determine whether or not AD is priced in the US REIT market. Disappointment-averse investors with state-dependent preferences, such as those described by Skiadas (1997), may demand a return premium to compensate for LTAD exposure. Elation-seeking investors with state-dependent preferences may accept a return discount for holding a UTAD asset. The J Adj statistic captures return characteristics consistent with the Skiadas (1997) framework of investor preferences.

We find strong empirical evidence that investors in US REITs demand a significant price for AD exposure. US REITs with LTAD attract a risk premium and US REITs exhibiting UTAD trade at a discount independently of the price of the CAPM β. The typical premium for LTAD in US REITs is 1.3 % per annum and the typical discount for UTAD in US REITs is 5.8 % per annum. Our findings are robust to controlling for a large number of commonly used REIT characteristics. The level of AD can predict US REIT returns up to three months ahead. Interestingly, we find no evidence that the CAPM β is priced in the cross section of US REIT returns. This finding is consistent with Pai and Geltner (2007), who claim that factors important for investors in US REITs are largely different from those relevant for investors in US equities. This is true for most of the standard risk factors. Nevertheless, we find that AD is relevant for investors in US REITs as well as US listed equities. Moreover, AD is the only covariate considered that has a t-value higher than the Harvey et al. (2014) critical value of 3.0.

The third contribution of this paper is to analyze the temporal trends of the level and price of AD in US REIT returns. The level of both LTAD and UTAD steadily increased until the 2007-2008 financial crisis. The level of LTAD and UTAD has been decreasing since the global financial crisis. The price of both LTAD and UTAD peaked during the crisis but remains a significant factor.

Our findings have important implications not only for asset pricing, but also for REIT cost of capital, internal capital allocation, strategic asset allocation, financial risk management, portfolio management and performance assessment. Based on our results, REIT investors do not value the CAPM β but place a considerable premium (discount) on REITs exhibiting LTAD (UTAD). REIT capital allocation and financing decisions are unique and differ substantially from industrial equities. This may explain why investors in REITs value firm-specific information differently.

Our paper is organized as follows. Section “Disappointment Aversion and Asymmetric Dependence” describes how disappointment-averse investors may value AD. In Section “Measuring Asymmetric Dependence”, we introduce the J Adj statistic. Section “Data and Empirical Design” describes the data and empirical design used to empirically examine our hypotheses. Section “Asymmetric Dependence Risk Premium” presents our main empirical results and identifies the temporal trends in AD pricing. We particularly explore the role of AD during the 2007-2008 financial crisis in Section “US REITs, Asymmetric Dependence and the 2007-2008 Financial Crisis” and verify the robustness of our results in Section “Robustness Checks”. Section “Conclusion” concludes.

Disappointment Aversion and Asymmetric Dependence

It has long been recognized that investors care differently about downside losses than they do about upside gains (Ang et al. 2006). This concept has progressed significantly from the classical notion of risk-aversion. Disappointment aversion is distinct from risk-aversion in that disappointment (or elation) violates separability axioms that impose independence across states. That is, outcomes in events that did not occur affect attitudes towards outcomes that did (Grant et al. 2001). Several authors develop the theoretical underpinnings of these preferences, including Gul (1991), Grant and Kajii (1998) and Skiadas (1997), all of whom axiomatically model disappointment aversion.

Under the Skiadas model of disappointment aversion, an individual is endowed with a family of conditional preference relations, one for each event. Grant et al. (2001) elegantly describe this as follows:

Suppose acts f and g yield the exact same outcomes on event E, but overall (unconditionally) g is preferred to f. Then, if the individual dislikes disappointment, since all else is equal by construction, she will be less unhappy in the event E if she chose f than if she chose g. That is, conditional on E, she prefers f to g. Skiadas defines such an agent as disappointment averse.

For example, consider two REIT stocks X and Y that have equal CAPM βs and expected returns. Let us further assume that Stock X displays a LTAD with the market, whereas the returns on stock Y follows a multivariate Normal (MVN) distribution with the market (i.e. symmetric dependence), as is described in Fig. 1. Under the standard assumptions of the CAPM, a risk-averse investor will be indifferent to investments in X or Y. However in the event of a major market drawdown, such as during the 2007-2008 financial crisis, a disappointment-averse investor may prefer stock Y over stock X since stock X is more likely to suffer losses in a situation when investors’ wealth is already low. This disappointment translates to investor dis-utility, and so disappointment-averse investors may demand a return premium in order to compensate them for the dis-utility associated with LTAD. Similarly, elation-seeking investors may accept a return discount in return for the greater utility derived from UTAD.

Linear Dependence vs Asymmetric Dependence. Scatter plot of simulated bivariate data with asymmetric dependence (a) and symmetric dependence (b). The dependence between X and Y may be described by a linear component of a higher order reflecting differences in dependence across the joint return distribution. A joint distribution that displays larger dependence in one tail compared to the opposite tail is said to display asymmetric dependence

The depiction of disappointment-averse investors having a family of conditional preference relations is the distinguishing feature of the Skiadas (1997) framework. This insight recognises that an agent may, for example, experience significant disappointment in the event of an extreme market drawdown and little or no disappointment in the event of a slight market drawdown. In the following section we describe a metric of AD that is designed to capture a family of conditional preferences, as described by Skiadas (1997). In contrast, Gul endows investors with a single Savage preference relation and denotes disappointment relative to the certainty equivalent of the investment return distribution. Ang et al.’s (2006) downside β is motivated by Gul’s (1991) description of disappointment aversion. For completeness, we compare our primary results with those found using downside β in Section “Robustness Checks”.

Measuring Asymmetric Dependence

Many different types of measures proposed by various authors were used previously to measure AD or downside risk. These are namely the downside β (Ang et al. 2006), copulas (Genest et al. 2009), H-statistic (Ang and Chen 2002) and the original version of J-statistic (Hong et al. 2007). Alcock and Hatherley (2016) argue that these metrics are inappropriate for asset pricing purposes as they do not satisfy a strict monotonicity and orthogonality of the metric value and AD. Alcock and Hatherley (2016) introduce an adjusted version of the J-statistic (Hong et al. 2007) that captures AD independently of the CAPM β. The Adjusted J-statistic (J Adj) is consistent with the family of preferences of a Skiadas (1997) agent and is size and scale invariant.

The calculation of the J Adj is defined by the following procedure. We replicate the Alcock and Hatherley (2016) procedure and unitize the data so that all data sets have the same β and standard deviation of model residuals, which forces the J statistic to be invariant to the linear dependence and the level of idiosyncratic risk.Footnote 4 Wethen calculate the J Adj on the unitized data sets as follows:

where \(\hspace *{-.5pt}\tilde {\rho }^{+} \hspace *{-.5pt}=\hspace *{-.2pt} \left \{ \tilde {\rho }^{+}(\delta _{1}), \tilde {\rho }^{+}(\delta _{2}), ..., \tilde {\rho }^{+}(\delta _{N}) \right \}\) and \(\tilde {\rho }^{-} \hspace *{-.5pt}=\hspace *{-.5pt} \left \{ \tilde {\rho }^{-}(\delta _{1}), \tilde {\rho }^{-}(\delta _{2}),..., \tilde {\rho }^{-}(\delta _{N}) \right \}\), 1 is N×1 vector of ones, \(\hat {\Omega }\) is an estimate of the variance-covariance matrix. The exceedance correlations are defined as

Hong et al. (2007) show that \(J \sim {\chi _{N}^{2}}\) and Alcock and Hatherley (2016) add that \(|J^{Adj}| \sim {\chi _{N}^{2}}\) . With symmetric dependence the value of J Adj will be close to zero. A significant and non-zero value of J Adj provides an evidence of asymmetry between lower and upper-tail exceedance correlations.

The Alcock and Hatherley (2016) adjusted-J statistic (J Adj) is a non-parametric statistic measuring relative exceedance correlations. J Adj separates the tail dependence from non-normal characteristics of returns (Alcock and Hatherley 2016). It does not depend on any distributional assumptions, consistent with the recommendation of Stapleton and Subrahmanyam (1983) and Kwon (1985). Adjusting the J statistic developed by Hong et al. (2007) forces the standard deviation of model residuals to be identical for all data sets, which allows us to separate the downside risk from other firm specific risk. The idiosyncratic risk is priced when investors do not hold sufficiently diversified portfolios (Fu2009, Campbell et al. 2001, Merton1987). We therefore control for idiosyncratic risk, consistent with the Alcock and Hatherley (2016) adjustment. The J Adj is significant when higher-order, asymmetric dependence structure exists in the data.

A positive value of J Adj indicates upper-tail asymmetric dependence. A negative value of J Adj indicates lower-tail asymmetric dependence. Following Alcock and Hatherley (2016), we separate the UTAD and LTAD by creating J Adj+ and J Adj− using indicator function \(\mathbb {I}_{c}\), which takes value of 1 when condition c is satisfied and zero otherwise.

Any measure of asymmetric dependence, including the J Adj, is based on relatively small number of extreme positive or negative joint returns and so is likely to suffer a high likelihood of Type II error. To mitigate this, we use daily data in our analysis. Nevertheless, our results will necessarily be conservative.

Data and Empirical Design

We use continuously compounded daily total returns of all NYSE-listed REITs described by CRSP database.Footnote 5 Our data starts in January 1992 with the introduction of the umbrella partnership REIT (UPREIT) regulation and ends in December 2013. We restrict our data sample to common shares of listed US REITs (share code 18) with exchange code equal to 1 (NYSE only). We apply a liquidity rule to remove REIT time series with more than 50 % of zero or missing daily returns. Our final sample consists of 373 distinct REITs with 792,510 firm-return observations.

We collect daily data on permno, price, holding period return and number of shares outstanding. We collect book value data using the CRSP/Compustat Merged database for the unique permno identifiers. We retrieve the Total Common/Ordinary Equity data. We proxy the risk free rate by the 1 month T-bill rate collected from the Kenneth R. French Data Library. The market return proxy is the CRSP Value Weighted return of all NYSE, AMEX and NASDAQ stocks also collected from the Kenneth R. French Data Library. The excess daily returns are computed as the difference between the daily holding return and the daily risk free rate.

We estimate the risk premia using both in-sample and out-of-sample estimation methods. We employ the Ang et al. (2006) contemporaneous regression method to generate in-sample estimates of the risk premia for each factor. We run the in-sample cross-sectional regressions each month rolling forward using a 12 month window. The short rolling window allows us to account for time variations in risk premia or the individual risk factors. For each month t, we calculate the relevant variables for all stocks with data in months t−12 to t. We estimate the J Adj-statistic using daily excess returns following the definition from Eq. 1 and using the following levels of exceedances δ={0,0.2,0.2,0.6,0.8,1}, consistent with Hong et al. (2007) and Alcock and Hatherley (2016).

We use continuous compounding to convert daily excess returns into monthly excess returns. We calculate market capitalization as the absolute value of the product of the close share price and total shares outstanding. Firm size is then the average log value of firm’s market capitalization over the 12 months. Book-to-market ratio is the average ratio of the book value of equity to the market capitalization over the 12 months. Firm coskewness and cokurtosis are estimated using daily observations from the 12 months of data. The idiosyncratic risk is proxied by the standard deviation of CAPM residuals estimated on daily data from the 12 months.

We employ the Fama and MacBeth (1973) intertemporal regression method to generate out-of-sample estimates of the risk premia for each factor. For each month t, we calculate the relevant predictors on data from t−12 to t. Mean monthly excess returns from t+1 are regressed on information from the preceding 12 months, consistent with Fama and MacBeth (1973).

Finally, we explore the predictive ability of the J Adj (out-of-sample) using future three-month (six-month) mean monthly-excess returns. All relevant variables are calculated on data from t−12 to t and mean excess returns are calculated on data from t to t+3 (t+6).

In all our regressions, we apply the Newey and West (1987) procedure to test for statistical significance with overlapping windows and use the Newey and West (1994) automatic lag selection.

Asymmetric Dependence Risk Premium

Descriptive Statistics

Descriptive statistics for the variables used in our cross-sectional regressions are presented in Table 1. The mean J Adj is negative (-1.575). This finding is consistent with Huang and Wu (2015), who find that LTAD is more prevalent in US REITs. Knight et al. (2005) provide similar conclusions in the UK REIT market. Our sample is comprised of 66 % of LTAD US REITs with a mean value of J Adj− of -5.331 and 34 % US REITs that exhibit UTAD with a mean J Adj+ of 5.140.

In our sample, the equally-weighted average monthly excess return on US REITs is 1.0 % and the equally-weighted average CAPM β is 0.643. The equally-weighted average β, β − and β + have similar values (0.643, 0.674 and 0.632, respectively). This suggests a lack of asymmetry in the linear dependence of US REIT returns with those of the market. Taking together, these statistics suggest that there is a significant AD despite no evidence of asymmetry in the linear dependence.

Factor Correlation and Double Sorted Portfolios

The correlation between the individual risk factors is presented in Table 2. There is a relatively high degree of correlation between β and cokurtosis (65 %), size and cokurtosis (55 %) and β and size (49 %). We test for potential multicollinearity using the variance inflation factor index (VIF) (Belsley 1991) and find no evidence of a strong or moderate multicollinearity (VIF < 5 for all our variables). The correlations between the J Adj and other covariates are unremarkable with a possible exception of coskewness. In order to better understand the correlation structures, we double sort our sample into J Adj and coskewness, as well as J Adj and β deciles.

The results from the double-sorting procedure are described in Table 3, where Panel A depicts mean excess returns sorted into β and J Adj and Panel B presents mean excess returns sorted in coskewness and J Adj. When considering the double sorts in coskewness and J Adj deciles, mean excess returns are monotonically decreasing in J Adj deciles and relatively constant across the coskewness deciles. After controlling for J Adj, coskewness does not appear to have any significant effect on excess returns. The difference in excess returns between the lowest and the highest J Adj decile is positive for most of the coskewness deciles. The mean excess returns are monotonically decreasing in J Adj deciles. That is, a higher value of AD is associated with a lower excess return.

When considering mean excess returns sorted in β and J Adj deciles, there appears to be little evidence of a correlation between β and excess returns. The relation between the J Adj is more straightforward for almost every β decile, the difference in excess returns between the lowest and the highest J Adj decile is positive for most of the β deciles.

The Price of Asymmetric Dependence

We now turn our attention to the in-sample estimates of the risk premia from the contemporaneous (Ang et al. 2006) regressions. After controlling for β, size, book-to-market ratio, past returns, idiosyncratic risk, coskewness and cokurtosis, the J Adj is negatively correlated with contemporaneous excess returns, see Table 4. That is, AD in REIT returns are associated with a significant price. This is consistent with REIT investors demanding a risk premium for LTAD and REIT investors willing to accept a discount for UTAD. This price of AD is independent of any premium attached to β. The J Adj is strongly significant having the highest t-statistic of all risk factors. The J Adj is the only risk factor considered with a t-statistic that exceeds the Harvey et al. (2014) level of 3.0.Footnote 6

The typical risk premium for AD in US REITs, where we define a typical price (premium or discount) to be the factor price sensitivity multiplied by the average factor value, −0.004×(−1.575), is 0.6 % per annum. Huang and Wu (2015) show that by accounting for AD in US REITs, an investor can outperform the market and generate higher excess returns that the market. Our findings go one step further and show that this is also reflected in the price of individual US REITs.

The significant factors from the Ang et al. (2006) contemporaneous regression are J Adj, firm size, past excess return and cokurtosis. Interestingly, neither the CAPM β nor idiosyncratic risk are significant in the cross section of US REIT returns. This is despite of high levels of idiosyncratic risk that real-estate funds managers often need to manage.

At least 75 % of all assets in REITs must be invested in real estate, cash or US Treasury,Footnote 7 which may lower the ability to diversify risk. Nevertheless, we find that idiosyncratic risk is insignificant implying that US REIT investors do not value idiosyncratic risk (Fu 2009; Campbell et al. 2001; Merton 1987).

We estimate the out-of-sample sensitivity of future one-month excess returns to our AD measure (J Adj) using the Fama and MacBeth (1973) intertemporal regression method. We find that the J Adj is also significant in the out-of-sample regression and the coefficient associated with J Adj is (−0.005) and the typical price attached to average level of J Adj is (−0.005)×(−1.575), that is 0.8 % per annum. The coefficient of the J Adj a from the out-of-sample regression is the only risk factor with a t-statistic that exceeds the Harvey et al. (2014) critical value of 3.0.

The CAPM β is not significant in the in-sample regression but is significant in the out-of-sample specification, although it has a negative coefficient. Indeed, the CAPM β coefficient is negative in all our regressions, whether it is significant or not. The out-of-sample regression procedure yields qualitatively similar results to the in-sample regression, which suggests that our results are robust to different regression specifications.

We also explore the power of J Adj to predict future excess returns over longer investment horizons, Table 4, columns 3 and 4. We find that the J Adj can predict excess returns up to three months ahead.

Lower-Tail Asymmetric Dependence vs Upper-Tail Asymmetric Dependence

We quantify the price associated with LTAD and UTAD separately and re-run our regressions using the J Adj− and J Adj+ measure of LTAD and UTAD. After controlling for other factors, our measure for LTAD (J Adj-) and UTAD (J Adj+) are both contemporaneously and intertemporally correlated with excess returns, see Table 5, columns 1 and 2. The J Adj- (J Adj+) is positively (negatively) correlated with US REIT excess returns. This implies that a higher degree of LTAD (UTAD) leads to higher (lower) excess returns. The typical premium for LTAD in US REITs is 1.3 % and the typical discount for UTAD in US REITs is 5.8 %. The premium for LTAD and discount associated with UTAD compares favorably with the typical premium for AD of 0.6 % and is substantial compared to the commonly assumed market price of risk of 6.0 % (Fernandez et al. 2014).

Our findings are consistent with investors with state-dependent preferences, where outcomes in events that did not occur also affect attitudes towards the outcome that occurred. This is different from risk-aversion, which is independent across states. In particular, the significant premium (discount) for LTAD (UTAD) is consistent with disappointment-averse (elation-seeking) REIT investors possessing a family of conditional preferences as described by Skiadas (1997). Ang et al. (2006) propose an alternative measure of disappointment, downside β, which is consistent with investors endowed with Gul (1991) preferences.

The main difference between the Skiadas (1997) and Gul (1991) preferences is entrenched in the identification of the conditional preference relations. Gul (1991) endows investors with a single Savage preference relation and denotes disappointment relative to the certainty equivalent of the investment return distribution. Skiadas (1997) recognises that an agent may, for example, experience significant disappointment in the event of an extreme market drawdown and little or no disappointment in the event of a slight market drawdown. Skiadas (1997) therefore assumes a family of conditional preference relations while Gul (1991) works with a single preference relation.

The conditional CAPM βs are consistent with investors endowed with Gul (1991) preferences, in which the conditional measure of linear dependence is measured using a certainty equivalent, e.g. conditioning on market excess return being lower (market downturn) or greater (market upturn) than zero. The J Adj, on the other hand, assumes that investors have Skiadas (1997) preferences, because the J Adj is measured using conditional exceedance correlations with a family of exceedances.

The conditional βs are insignificant, and the J Adj− and J Adj+ are both significant in the in-sample Ang et al. (2006) regressions, Table 10. Out of sample, the J Adj+ is significant in predicting excess returns up to three months ahead. Our results suggest that US REIT investors are endowed with a family of state-dependent preferences, as described by Skiadas (1997). We provide further discussion and comparison of the two competing measures of asymmetric dependence in the robustness Section “Robustness Checks”.

We illustrate relative risk premia of US industrial equities and US REITs in Table 6. The CAPM β is not priced in US REITs, but is significant in US equities. This implies that the standard mean-variance preference framework is not well-represented by US REIT investors. Our finding of insignificant CAPM β is consistent with Pai and Geltner (2007), who claim that factors important for investors in US REITs are largely different from those relevant for investors in US equities. Investors in REITs are more concerned with asymmetric dependence rather than linear dependence. This finding is consistent with investors using pricing mechanisms to protect against risk.

AD measured by the J Adj is relatively more important for REIT investors than industrial equity investors since AD is the only factor significant in all our pricing regressions for REITs (except size and momentum). This has important implications for cost of capital of US REITs. The price of AD is likely to represent a greater proportion of US REIT cost of capital relatively to the cost of capital of US industrial equities.

Based on our results, REIT investors do not value the symmetric dependence (CAPM β) but place a considerable premium (discount) on REITs exhibiting LTAD (UTAD). For a US REIT exhibiting lower-tail asymmetric dependence in returns, neglecting the information about the level of asymmetric dependence may lead to serious underestimation of firm cost of capital. Without the AD information, REIT managers may accept projects that will ultimately lead to a destruction of shareholders’ wealth. Our findings have important implications not only for cost of capital but also for internal capital allocation, strategic asset allocation, financial risk management, portfolio management and performance assessment.

We further test the predictive ability of J Adj− and J Adj+ using three-month and six-month future returns. The J Adj+ can predict excess returns up to three months ahead. The J Adj− is significant only in the in-sample regressions, whereas the J Adj+ is significant in all of our regressions except the six-month predictive regression, see Table 5.

The traditional tests of stock return predictability may reject null hypothesis too frequently if the predictor variable is persistent (Campbell and Yogo 2006). In all our regressions, we account for the artificial persistence created by the presence of overlapping data by incorporating the Newey and West (1987) procedure to calculate t-statistics with the Newey and West (1994) automatic lag selection method to determine the lag length.

In addition, we also examine potential persistence in the J Adj by estimating the coefficients of the autoregressive (AR) process of J Adj for each US REIT in our sample. We use non-overlapping estimates of J Adj calculated using daily data from 12-month rolling window periods, Fig. 2. There is no significant AR coefficient, hence we accept that the J Adj is not persistent. Therefore, our results are robust to any persistence concerns.

The autocorrelation function (ACF): J Adj. ACF: 12-month J Adj. The autocorrelation function is computed using a J Adj computed on 12-month non-overlapping periods using daily excess returns. One lag represents a 12-month period. We restrict our attention to REIT stocks listed on the NYSE between January 1992 and December 2013

LTAD and UTAD Migration Probability

We now explore the empirical probability that a US REIT with past LTAD continues to exhibit LTAD. This is not the same as persistence. Here, we are only concerned with migrations between the LTAD and UTAD firm-return observations. This information is important from the investor perspective as LTAD is related with a return premium and UTAD attracts a return discount. The information about whether REIT is LTAD or UTAD in a given time period thus completely changes the outlook on return prediction. We estimate the migration probabilities between LTAD and UTAD as follows. First, we use non-overlapping 12-month periods of daily data to estimate J Adj− and J Adj+. In the next step, we calculate migration probabilities for each US REIT from our sample individually. Table 7 presents mean migration probabilities between LTAD (J Adj−) and UTAD (J Adj+) firm characteristics.

We find that if a US REIT exhibits LTAD, it has a 70.95 % probability of being LTAD twelve months in the future. US REITs exhibiting UTAD are approximately equally likely to be UTAD in twelve months (with 49.87 % probability). This implies that the LTAD characteristic is more stable than the UTAD characteristic.

Temporal Trends in AD Pricing

The Skiadas (1997) framework of disappointment-averse investor preferences is state-dependent, which implies that investor sensitivity to AD may change over time. If investor perception of investment outcome changes over time, it may lead to time-series variations in AD.

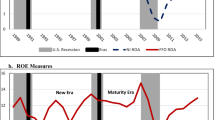

The level of lower-tail and upper-tail asymmetric dependence of US REITs both rise to a peak and then start to decline suggesting a change in the temporal trend in the level of AD, see Fig. 3. The risk premium associated with LTAD is relatively stable with a slight decrease in the last years of our sample. The discount attached to UTAD is steadily decreasing since 2000. The market risk premium has increased since 2009 but still remains insignificant in explaining excess returns.

Time Variations: Mean Factor Loadings. This figure depicts the mean factor loading for β, J Adj− and J Adj+ at a given month, t, between January 2000 and December 2013 using the past 12 months of daily excess returns. We proxy the market portfolio with the NYSE, AMEX and NASDAQ stocks and the risk free rate with the 1 month T-bill rate. The estimate is calculated using all historical data up to and including time t. The vertical line corresponds to the failure of Lehman Brothers in September 2008

The temporal development of AD risk variations suggests an existence of a structural break around the 2007-2008 financial crisis. The vertical line in Figs. 3 and 4 corresponds to the failure of Lehman Brothers in September 2008. The changes in AD level and price before and after the crisis are further analyzed in Section “US REITs, Asymmetric Dependence and the 2007-2008 Financial Crisis”.

Time Variations: In-sample Mean Factor Sensitivity. This figure depicts the factor sensitivity per unit of standard deviation of given risk factor using the in-sample asset pricing procedure where cross-sectional regressions are computed every month rolling forward. At a given month t, the average of the next 12 excess monthly returns is regressed against β, idiosyncratic risk, J Adj, coskewness and cokurtosis estimated using the next 12 months of daily excess return data, and size (Log-size), book-to-market ratio (BM) and the average past 12-monthly excess return (Past Ret), computed as at time t. We proxy the market portfolio with the NYSE, AMEX and NASDAQ stocks and the risk free rate with the 1 month T-bill rate. All regressors are Winsorised at the 1 % and 99 % level at each month. We restrict our attention to REIT stocks listed on the NYSE between January 1992 and December 2013. The Premium for β, Coskewness and Cokurtosis between January 2000 and December 2013 is given by the time series mean factor sensitivity using all historical sensitivity estimates up to and including time t. The vertical line corresponds to the failure of Lehman Brothers in September 2008

US REITs, Asymmetric Dependence and the 2007-2008 Financial Crisis

The US REIT market was severely hit by the 2007-2008 financial crisis with a 60 % decrease in The National Association of Real Estate Investment Trusts (NAREIT) All Equity Index over the period from September 2008 until February 2009 (Sun et al. 2015). This fall in REIT market value is substantial compared to the decrease in the National Council of Real Estate investment Fiduciaries (NCREIF) Property index of 15 % over the same time period.

A number of authors study the performance of REITs during the 2007-2008 financial crisis. Zhou and Anderson (2012) provide evidence that extreme risks are higher in REIT markets relative to stocks, which is even more pronounced after the crisis. An et al. (2015) suggest that the the increased crash risk of REITs after the crisis is due to the changing ownership structure of REITs. They find that with a higher institutional ownership (from 34 % in 1994 to 75 % in 2011), crash risk for REIT stocks becomes significantly higher relatively to non-REIT stocks. Besides the increased exposure of REIT investors to risk, the diversification benefits of REITs have changed considerably over time and practically vanished in the crisis (Jz and Zhong 2013; Knight et al. 2005).

Existing literature provides several explanations for this change in REIT-return behavior. Das et al. (2015) argue that there was a structural change in the investor decision-making process around the crisis. Before the crisis, institutional investors in REITs created their investment decisions based on sentiment in the private market. During and after the crisis, investors switched their capital from illiquid private markets to more liquid REIT markets (Das et al. 2015). Zhou and Anderson (2013) claim that during the crisis, investors switched from passive externally-managed entities into active self-managed ones and became more responsive to market conditions. The investor herding behavior is stronger in declining markets and during turbulent conditions (Zhou and Anderson 2013) and the market value of liquidity increased significantly during the crisis (Hill et al. 2012).

As a consequence of the 2007-2008 financial crisis, the US Government introduced new rules to issue elective stock dividends to help satisfy the dividend requirement of REITs. Devos et al. (2013) study the impact of these rules on REIT dividend policy and find that only 17 REITs used these rules and there was no difference in cash flows between REITs that issued these selective dividends compared to the REITs that did not. According to Case et al. (2012a), it is rather the level of leverage that influences the decisions to pay stock dividends instead of cash flow levels among US REITs. Moreover, (Sun et al. 2015) find that REITs with higher debt to asset ratios and shorter maturity fell more during the 2007-2008 financial crisis.

Because of the evidence of a widespread impact of the 2007-2008 financial crisis on US REITs, we examine whether the level of AD and the investor sensitivity to AD changed after the crisis. We choose the collapse of Lehman Brothers in September 2008 as our structural break point between the two sub-samples. We summarize the mean levels and standard deviations of CAPM β, J Adj, J Adj− and J Adj+ in the “pre-crisis” (before September 2008) and “post-crisis” (after September 2008) periods in Table 8. The mean CAPM β in the pre-crisis period was 0.433 while the post-crisis mean CAPM β is 1.228. This finding suggests that after the 2007-2008 financial crisis, US REITs became less defensive instruments and the diversification benefits have decreased, which is consistent with empirical findings of Jz and Zhong (2013) and Knight et al. (2005). This difference in mean β before and after the crisis is significantly different with p-value lower than 0.01 %, tested using the two-sample T-test for difference in means with unequal standard deviations, see Table 8.

The level of asymmetric dependence (both LTAD and UTAD) has decreased after the crisis. The mean value of J Adj was -1.935 before the crisis and -0.536 after the crisis, which suggests that the asymmetries in exceedance correlations decreased. The mean J Adj is significantly different before and after the crisis. The mean factor sensitivity towards J Adj and J Adj− is also significantly lower. However, the sensitivity to J Adj+ remains unchanged after the crisis. The results from the tests of significant differences in means for factor levels and factor sensitivities of CAPM β, J Adj, J Adj− and J Adj+ are summarized in Table 8.

The level of AD as well as AD sensitivity have decreased after the crisis. This change in the REIT risk-return characteristics is consistent with findings of other authors (Jz and Zhong 2013; Knight et al. 2005). Nevertheless, the J Adj still remains one of the few significant risk factors explaining the cross section of US REIT returns.

Robustness Checks

To ensure robustness of our evidence of AD in US REIT returns, we employ various checks using alternative downside measures and alternative regression specifications.

Alternative Downside Measures

Ang et al. (2006) build upon the Gul (1991) preference theory to rationalize investor incentives for downside β (β −) and upside β (β +). In the Gul (1991) framework, state-dependent investors may feel disappointed if an investment outcome is worse than the certainty equivalent of the investment return distribution. There is only one reference point (the certainty equivalent) that differentiates between bad outcomes and good outcomes, which is consistent with the definition of the downside and upside β.

We define the downside and upside β as β −=cov(R i ,R m |R m <0)/var(R m |R M <0) and β +=cov(R i ,R m |R m >0)/var(R m |R M >0), respectively. The downside and upside βs are similar in mean (0.677 vs 0.627) and standard deviation (0.570 vs 0.571), Table 1. There is no evidence of any difference in linear dependence of US REIT returns in the market downturns and upturns.

We compare the two downside risk measures, J Adj and β −, in several ways. First, we double sort US REIT monthly excess returns into β − deciles and then into J Adj deciles in Table 9, Panel A. The mean monthly excess returns in β − deciles are relatively constant. There is therefore no evidence that β − captures any valuable information or is valued by investors. The difference in excess returns between the lowest and the highest J Adj decile is positive in most of the β − deciles, which suggests that J Adj is a relevant risk factor independent from β −. The correlation between the J Adj and the downside β is less than 5 %, which implies that the value of J Adj provides a different information than downside β.

We replicate the same procedure for β + in Table 9, Panel B. Mean excess returns are not monotonic in β + and the difference in mean excess returns between the lowest and the highest J Adj decile is again positive in most of the β + deciles. The J Adj is superior to the downside and upside β in explaining the cross-sectional return variations.

Further, we include β − and β + into the value-weighted in-sample cross-sectional regressions and report our results in Table 10. Regression I from Table 10 contains the conditional β measures and control variables whereas Regressions II and III from Table 10 use the conditional βs, control variables as well as the J Adj or J Adj− and J Adj+, respectively, as variables explaining US REIT excess returns. Both β − and β + are insignificant in all our regressions. On the other hand, J Adj is significant with a t-statistic that exceeds the Harvey et al. (2014) t-statistic level of 3.0 in Regression II from Table 10.

Our results suggest that the marginal price-setting investor is not endowed with a set of Gul (1991) preferences (β − and β + are insignificant). However, we find a strong evidence consistent with the marginal price-setting investor endowed with a family of conditional preferences as described by Skiadas (1997).

Alternative Regression Specifications

We provide several additional tests to verify the robustness of our results. In Table 11, we estimate equally-weighted in-sample cross-sectional regressions and conclude that the J Adj is significant in the equally-weighted regressions.

Next, we explore the effect of US REIT stock return volatility on our results. We exclude the top quintile, decile and vigintile of the most volatile stock returns, re-estimate the out-of-sample cross-sectional regressions and summarize our results in Table 12. Our main results are qualitatively robust to the exclusion of the most volatile US REIT stocks.

In our last test, we change the specification of the rolling window period and use six months to five years of data with daily, weekly and fortnightly frequency to validate our results. The CAPM β remains insignificant across all our regressions from Tables 13 and 14.

Our results remain qualitatively unchanged when using alternative data specification. The coefficient associated with the J Adj is significant and negative in all the regressions from Tables 13 and 14.

Conclusion

REITs are generally considered to have a low correlation with the market, which provides desirable diversification qualities. We provide new evidence that shows that these diversification benefits are diminished for most of US REITs because of existence of the lower-tail asymmetric dependence. We also quantify investor sensitivity to this asymmetric dependence in the US REIT market. We find a strong empirical evidence that AD in US REIT returns are related with a significant price. This is consistent with the theory of disappointment aversion described by Skiadas (1997).

Our main results suggest that the marginal price-setting disappointment-averse investor demands a premium to hold a REIT exhibiting LTAD averaging at 1.3 % per annum. The typical return discount associated with UTAD is 5.8 % per annum, which suggests that US REIT investors are willing to accept a substantially lower return in favor for holding a UTAD asset. The price of AD (both LTAD and UTAD) is independent from the CAPM β. Interestingly, we find that neither the CAPM β nor idiosyncratic risk are priced in US REIT returns.

Our measure for AD (the J Adj) is a significant factor explaining US REIT returns in the in-sample, out-of-sample and predictive regressions with future returns of up to three months ahead. The J Adj is the only significant covariate considered with a t-statistic higher that the Harvey et al. (2014) critical value of 3.0. The statistical significance is strong and our results are robust to various changes in regression specifications, which implies that investors value AD in the cross section of US REIT returns.

Notes

See for example Huang and Wu 2015; Zimmer 2015; Bianchi and Guidolin 2014; Case et al. 2012b; Hoesli and Reka 2013; Rong and Trück 2010; Simon and Ng 2009; Patel and Nimmanunta 2009; Lizieri et al. 2007; Knight et al. 2005; Chatrath et al. 2000; Goldstein 1999; Lizieri and Satchell 1997a, (Lizieri and Satchell 1997b). The existence of AD is not specific to REIT markets only. There also exists a substantial literature on the existence of AD in the US stock market, see (Low et al. 2013; Bollerslev and Todorov 2011; Bali et al. 2009; Hatherley and Alcock 2007; Hong et al. 2007; Ang et al. 2006; Post and Van Vliet 2006; Hartmann et al. 2004; Patton 2004; Ang and Bekaert 2002; Ang and Chen 2002; Longin and Solnik 2001; Erb et al. 1994).

26 US Code, Section 857 - Taxation of real estate investment trusts and their beneficiaries.

During the 2008-2009 financial crisis, the REIT market experienced a dramatic decline in market value. The FTSE NAREIT U.S. Real Estate Index fell from its index value of 213.68 in January 2007 to 63.41 in March 2009 (Case et al. 2012a).

We unitize β in each data set before the J-statistic is estimated. That is for each set \(\left \{ R_{it},R_{mt} \right \}_{t=1}^{T}\), we get \(\hat {R}_{it} = R_{it} - \beta R_{mt}\), where R i t and R m t is continuously compounded return on asset i and market, and \(\beta = \textup {cov}(R_{it}, R_{mt})/\sigma _{R_{mt}}^{2}\). The first transformation implies that \(\beta _{\hat {R}_{it},R_{mt}} = 0\). This enables us to standardise the data to get identical standard deviation of the CAPM regression residuals and get \(R_{mt}^{S}\) and \(\hat {R}_{it}^{S}\). The final transformation step sets the \(\hat {\beta }\) to 1 by letting \(\tilde {R}_{mt} = R_{mt}^{S}\) and \(\tilde {R}_{it} = \hat {R}_{it}^{S} + R_{mt}^{S}\).

We limit our sample to NYSE only due to differing listing requirements of the remaining stock exchanges in the US. NYSE provides a market for well-established companies, which are expected to have a more stable stock price development. NYSE offers the highest level of disclosure of information of all the stock exchanges in the US, and contains relatively large companies with a more stable performance and operating history.

This t-statistic level of 3.0 is set by Harvey et al. (2014) to account for data mining, correlation among the tests and missing data issues.

US Code 26, Section 856.

References

Alcock, J., & Hatherley, A. (2009). Asymmetric dependence between domestic equity indices and its effect on portfolio construction. Australian Actuarial Journal, 15(1), 143–180.

Alcock, J., & Hatherley, A. (2016). Characterizing the asymmetric dependence. Forthcoming Review of Finance. doi:10.1093/rof/rfw022.

Alcock, J., & Steiner, E. (2016). Fundamental drivers of dependence in REIT returns. Forthcoming The Journal of Real Estate Finance and Economics. doi:10.1007/s11146-016-9562-3.

Alcock, J., Glascock, J., & Steiner, E. (2013). Manipulation in US REIT investment performance evaluation: Empirical evidence. The Journal of Real Estate Finance and Economics, 47(3), 434– 465.

An, H., Hardin, W., & Wu, Z. (2012). Information asymmetry and corporate liquidity management: Evidence from real estate investment trusts. The Journal of Real Estate Finance and Economics, 45(3), 678–704.

An, H., Wu, Q., & Wu, Z. (2015). REIT crash risk and institutional investors. The Journal of Real Estate Finance and Economics pp 1–32.

Ang, A., & Bekaert, G. (2002). International asset allocation with regime shifts. Review of Financial Studies, 15(4), 1137–1187.

Ang, A., & Chen, J. (2002). Asymmetric correlations of equity portfolios. Journal of Financial Economics, 63(3), 443–494.

Ang, A., Chen, J., & Xing, Y. (2006). Downside risk. Review of Financial Studies, 19(4), 1191–1239.

Bali, T.G., Demirtas, K.O., & Levy, H. (2009). Is there an intertemporal relation between downside risk and expected returns? Journal of Financial and Quantitative Analysis, 44(04), 883–909.

Belsley, D.A. (1991). A guide to using the collinearity diagnostics. Computer Science in Economics and Management, 4(1), 33–50.

Bianchi, D., & Guidolin, M. (2014). Can linear predictability models time bull and bear real estate markets? Out-of-sample evidence from REIT portfolios. The Journal of Real Estate Finance and Economics, 49(1), 116–164.

Bollerslev, T., & Todorov, V. (2011). Tails, fears, and risk premia. The Journal of Finance, 66(6), 2165–2211.

Bradley, M., Capozza, D.R., & Seguin, P.J. (1998). Dividend policy and cash-flow uncertainty. Real Estate Economics, 26(4), 555–580.

Campbell, J.Y., & Yogo, M. (2006). Efficient tests of stock return predictability. Journal of Financial Economics, 81(1), 27–60.

Campbell, J.Y., Lettau, M., Malkiel, B.G., & Xu, Y. (2001). Have individual stocks become more volatile? An empirical exploration of idiosyncratic risk. Journal of finance, 56(1).

Case, B., Hardin, W.G., & Wu, Z. (2012a). REIT dividend policies and dividend announcement effects during the 2008–2009 liquidity crisis. Real Estate Economics, 40(3), 387–421.

Case, B., Yang, Y., & Yildirim, Y. (2012b). Dynamic correlations among asset classes: REIT and stock returns. The Journal of Real Estate Finance and Economics, 44(3), 298–318.

Chan, K.C., Hendershott, P.H., & Sanders, A.B. (1990). Risk and return on real estate: Evidence from equity REITs. Real Estate Economics, 18(4), 431–452.

Chatrath, A., Liang, Y., & McIntosh, W. (2000). The asymmetric REIT-beta puzzle. Journal of Real Estate Portfolio Management, 6(2), 101–111.

James, C.S.S., & Miffre, J. (2009). Conditional correlations and Real Estate Investment Trusts. Journal of Real Estate Portfolio Management, 15(2), 173–184.

Clayton, J., & MacKinnon, G. (2003). The relative importance of stock, bond and real estate factors in explaining REIT returns. The Journal of Real Estate Finance and Economics, 27(1), 39–60.

Das, P.K., Freybote, J., & Marcato, G. (2015). An investigation into sentiment-induced institutional trading behavior and asset pricing in the REIT market. The Journal of Real Estate Finance and Economics pp 1–30.

Devos, E., Ong, S.E., Spieler, A.C., & Tsang, D. (2013). REIT institutional ownership dynamics and the financial crisis. The Journal of Real Estate Finance and Economics, 47(2), 266–288.

Diamond, D.W., & Rajan, R.G. (2009). The credit crisis: Conjectures about causes and remedies. The American Economic Review, 99(2), 606.

Erb, C.B., Harvey, C.R., & Viskanta, T.E. (1994). Forecasting international equity correlations. Financial analysts journal, 50(6), 32–45.

Fama, E.F., & MacBeth, J.D. (1973). Risk, return, and equilibrium: Empirical tests. The Journal of Political Economy pp 607–636.

Fernandez, P., Linares, P., & Fernández acín, I. (2014). Market risk premium used in 88 countries in 2014: A survey with 8,228 answers. Available at SSRN 2450452.

Fu, F. (2009). Idiosyncratic risk and the cross-section of expected stock returns. Journal of Financial Economics, 91(1), 24–37.

Genest, C., Gendron, M., & Bourdeau-Brien, M. (2009). The advent of copulas in finance. The European Journal of Finance, 15(7-8), 609–618.

Ghosh, C., & Sirmans, C. (2003). Board independence, ownership structure and performance: evidence from real estate investment trusts. The Journal of Real Estate Finance and Economics, 26(2-3), 287–318.

Glascock, J., & Hughes, W. (1995). NAREIT identified exchange listed REITs and their performance characteristics: 1972-1991. Journal of Real Estate Literature, 3(1), 63–83.

Glascock, J.L., Michayluk, D., & Neuhauser, K. (2004). The riskiness of REITs surrounding the October 1997 stock market decline. The Journal of Real Estate Finance and Economics, 28(4), 339–354.

Goetzmann, W., Ingersoll, J., Spiegel, M., & Welch, I. (2007). Portfolio performance manipulation and manipulation-proof performance measures. Review of Financial Studies, 20(5), 1503–1546.

Goldstein, M.A. (1999). REIT return behavior in advancing and declining stock markets. Real Estate Finance.

Grant, S., & Kajii, A. (1998). AUSI expected utility: An anticipated utility theory of relative disappointment aversion. Journal of Economic Behavior & Organization, 37 (3), 277–290.

Grant, S., Kajii, A., & Polak, B. (2001). Different notions of disappointment aversion. Economics Letters, 70(2), 203–208.

Gul, F. (1991). A theory of disappointment aversion. Econometrica: Journal of the Econometric Society pp 667–686.

Hartmann, P., Straetmans, S., & De Vries, C.G. (2004). Asset market linkages in crisis periods. Review of Economics and Statistics, 86(1), 313–326.

Harvey, C.R., Liu, Y., & Zhu, H. (2014). ANd the cross-section of expected returns. Tech. rep., National Bureau of Economic Research.

Hatherley, A., & Alcock, J. (2007). Portfolio construction incorporating asymmetric dependence structures: A user’s guide. Accounting & Finance, 47(3), 447–472.

Hill, M.D., Kelly, G.W., & Hardin, I.I.I.W.G. (2012). Market value of REIT liquidity. The Journal of Real Estate Finance and Economics, 45(2), 383–401.

Hoesli, M., & Reka, K. (2013). Volatility spillovers, comovements and contagion in securitized real estate markets. The Journal of Real Estate Finance and Economics, 47(1), 1–35.

Hong, Y., Tu, J., & Zhou, G. (2007). Asymmetries in stock returns: Statistical tests and economic evaluation. Review of Financial Studies, 20(5), 1547–1581.

Howe, J.S., & Shilling, J.D. (1990). REIT advisor performance. Real Estate Economics, 18(4), 479–500.

Jz, H., & Zhong, Z.K. (2013). Time variation in diversification benefits of commodity, REITs, and TIPS. The Journal of Real Estate Finance and Economics, 46(1), 152–192.

Huang, M., & Wu, C.C. (2015). Economic benefits and determinants of extreme dependences between REIT and stock returns. Review of Quantitative Finance and Accounting, 44(2), 299–327.

Hung, S.Y.K., & Glascock, J.L. (2008). Momentum profitability and market trend: evidence from REITs. The Journal of Real Estate Finance and Economics, 37 (1), 51–69.

Jensen, M.C. (1986). Agency cost of free cash flow, corporate finance, and takeovers. Corporate Finance, and Takeovers American Economic Review, 76(2).

Knight, J., Lizieri, C., & Satchell, S. (2005). Diversification when it hurts? The joint distributions of real estate and equity markets 1. Journal of Property Research, 22(04), 309–323.

Kwon, Y.K. (1985). Derivation of the capital asset pricing model without norMality or quadratic preference: a note. The Journal of Finance, 40(5), 1505–1509.

Lizieri, C., & Satchell, S. (1997a). Interactions between property and equity markets: An investigation of linkages in the United Kingdom 1972–1992. The Journal of Real Estate Finance and Economics, 15(1), 11–26.

Lizieri, C., & Satchell, S. (1997b). Property company performance and real interest rates: a regime-switching approach. Journal of Property Research, 14(2), 85–97.

Lizieri, C., Satchell, S., & Zhang, Q. (2007). The underlying return-generating factors for REIT returns: an application of independent component analysis. Real Estate Economics, 35(4), 569–598.

Longin, F., & Solnik, B. (2001). Extreme correlation of international equity markets. Journal of Finance pp 649–676.

Low, R.K.Y., Alcock, J., Faff, R., & Brailsford, T. (2013). Canonical vine copulas in the context of modern portfolio management: Are they worth it? Journal of Banking & Finance, 37(8), 3085–3099.

Merton, R.C. (1987). Presidential address: a simple model of capital market equilibrium. Journal of Finance, 42, 483–510.

Newey, W.K., & West, K.D. (1987). A simple, positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica, 55(3), 703–708.

Newey, W.K., & West, K.D. (1994). Automatic lag selection in covariance matrix estimation. The Review of Economic Studies, 61(4), 631–653.

Pai, A., & Geltner, D. (2007). Stocks are from Mars, real estate is from Venus Journal of Portfolio Management p 134.

Patel, K., & Nimmanunta, K. (2009). Tail dependence in REIT returns. Tech. rep., European Real Estate Society (ERES).

Patton, A.J. (2004). On the out-of-sample importance of skewness and asymmetric dependence for asset allocation. Journal of Financial Econometrics, 2(1), 130–168.

Post, T., & Van Vliet, P. (2006). Downside risk and asset pricing. Journal of Banking & Finance, 30(3), 823–849.

Rong, N., & Trück, S. (2010). Returns of REITs and stock markets: Measuring dependence and risk. Journal of Property Investment & Finance, 28(1), 34–57.

Simon, S., & Ng, W.L. (2009). The effect of the real estate downturn on the link between REITs and the stock market. Journal of Real Estate Portfolio Management, 15(3), 211–219.

Skiadas, C. (1997). Conditioning and aggregation of preferences. Econometrica, 65(2), 347–367.

Stapleton, R.C., & Subrahmanyam, M.G. (1983). The market model and capital asset pricing theory: a note. The Journal of Finance, 38(5), 1637–1642.

Sun, L., Titman, S.D., & Twite, G.J. (2015). REIT and commercial real estate returns: A postmortem of the financial crisis. Real Estate Economics, 43(1), 8–36.

Zhou, J., & Anderson, R.I. (2012). Extreme risk measures for international REIT markets. The Journal of Real Estate Finance and Economics, 45(1), 152–170.

Zhou, J., & Anderson, R.I. (2013). An empirical investigation of herding behavior in the US REIT market. The Journal of Real Estate Finance and Economics, 47(1), 83–108.

Zimmer, D.M. (2015). Asymmetric dependence in house prices: evidence from usa and international data. Empirical Economics, 49(1), 161–183.

Author information

Authors and Affiliations

Corresponding author

Appendix: Robustness Tests

Appendix: Robustness Tests

Rights and permissions

About this article

Cite this article

Alcock, J., Andrlikova, P. Asymmetric Dependence in Real Estate Investment Trusts: An Asset-Pricing Analysis. J Real Estate Finan Econ 56, 183–216 (2018). https://doi.org/10.1007/s11146-016-9593-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-016-9593-9