Abstract

Our study investigates the market-wide herding behavior in the U.S. equity REIT market. Utilizing the quantile regression method, we find that herding is more likely to be present in the high quantiles of the REIT return dispersion. This implies that REIT investors tend to herd under turbulent market conditions. Our results also support the asymmetry of herding behaviors, that is, herding is more likely to occur and becomes stronger in declining markets than in rising markets. In addition, our findings show that the current financial crisis has caused a change in the circumstances under which herding can occur, as we find that during the current crisis REIT investors may not start to herd until the market becomes extremely turbulent whereas during the relatively normal period before the crisis, investors tend to herd when the market is moderately turbulent. Finally, we find that compared with the case of the ‘pre-modern’ era, REIT investors are more likely to herd in the ‘modern’ era, during which herding usually occurs when the market becomes tumultuous. This implies that the switch of REITs from passive externally managed entities into active self-managed ones has made the investors more responsive to market sentiment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the recent finance literature, empirical analysis of herding behavior has received considerable attention. Herding is typically described as a behavioral tendency for investors to follow the actions of others rather than their own beliefs. Investigating herding behaviors is of importance to practitioners, academia and policymakers. For practitioners, herding could drive stock prices away from fundamental values and present profitable trading opportunities. For academia, herding contradicts the rational asset pricing theory, which accentuates the importance of fundamentals on stock pricing and thus has important theoretical implications for asset pricing models (Christie and Huang 1995). For policymakers, herding could destabilize markets and increase the fragility of the financial system. Therefore, it is in policymakers’ best interest to curtail herding (Bikhchandani and Sharma 2001).

The academic literature on herding can be separated into theoretical and empirical studies. On the one hand, theoretical studies have mainly focused on the causes and implications of herding. The main consensus is that herding can be construed as being either a rational or irrational form of investment behaviors. According to Devenow and Welch (1996), the irrational view focuses on investor psychology where investors disregard their prior beliefs and follow others blindly, while the rational view focuses on the principal-agent problem in which investors mimic the actions of others and completely ignore their own private information to maintain their reputational capital in the market (Bikhchandani and Sharma 2001). On the other hand, empirical studies have mostly concentrated on detecting the existence of herding behaviors. Two streams of empirical studies have emerged. The first focuses on group-wide herding, that is, the herding activities among certain groups of investors, such as mutual fund managers and financial analysts. This type of analysis requires detailed records of investors’ trading activities. For instance, Lakonishok et al. (1992) measured herding as the average tendency of a group of pension fund managers to buy or sell particular stocks at the same time, relative to what could be expected if the managers make their decision independently. Their findings did not support herding. Other notable studies of group-wide herding include Clement and Tse (2005), Gleason and Lee (2003), Graham (1999), Trueman (1994), Welch (2000), and Wermers (1999), etc. Unlike the first stream of empirical studies, the second stream focuses on market-wide herding, that is, the collective behaviors of all investors towards the market view. As well as group-based herding, market-wide herding can cause mispricing of individual assets. It is usually examined through the concept of cross-sectional dispersion of stock returns. Dispersion is expected to decline upon the occurrence of herding, which causes individual stock returns to cluster around the overall market return. As such, investigating the relation between dispersion and market return provides insights for the existence of herding. Studies along this line produce mixed evidence. For instance, Christie and Huang (1995, hereafter CH), which used the cross-sectional standard deviation of stock returns to measure dispersion, found that dispersion is higher during periods of market stress in the U.S. stock market. This offers evidence against market-wide herding. A later study of Chang et al. (2000, hereafter CCK) extended the CH study by introducing nonlinearity into the relationship between dispersion and market return. CCK’s results did not show evidence for herding in U.S.—a finding consistent with CH, but they did show significant evidence of herding in South Korea and Taiwan. Following the approach of CCK, recent studies of Tan et al. (2008) and Chiang et al. (2010) produced evidence in favor of herding for the Chinese stock markets. In summary, the existing literature tends to suggest that herding is more likely to take place in emerging markets than in developed markets.

In this paper, we investigate the herding behavior in the REIT market. As an asset class, REITs have become increasingly important since the early 1990s. According to the National Association of Real Estate Investment Trusts (NAREIT), the market capitalization of REITs in U.S. has grown from $8.7 billion in 1990 to $389 billion in 2010. Despite their growing importance, we observe a very thin herding literature for REITs. To the best of our knowledge, no one has formally tested for herding in the REIT market. This study makes a first attempt. We believe this to be quite important for several reasons. First, for individuals and many small institutions, REITs often make up the majority of their alternative investment holdings, which is typically in the 10% range. So understanding herding behavior has profound implications for portfolio construction. Secondly, due to their unique structure (i.e. 90% pay-out of their income in the form of dividends) and distinct characteristics (small cap stocks and low trading volumes), REIT herding needs to be independently examined. Such need is further motivated by some recent papers which have shown that REITs tend to display different market behaviors than the general equity markets. For instance, Anderson et al. (2010) showed that REITs are more volatile to unexpected changes in monetary policy than the broad equity markets. They found that an unanticipated monetary shock has nearly twice the impact on REITs relative to the general equity markets during high-variance regimes. Zhou and Anderson (2010) showed that the REIT markets display significantly higher extreme risks, as measured by value at risk and expected shortfall, than the general equity markets. Together, these studies suggest it worthwhile to study herding for REITs.

We focus on market-wide herding. For group-wide herding—the other branch of empirical herding studies, we leave it for future research due to its higher data demands. To carry out our investigation, we follow the approach of CCK. Simple yet powerful, this approach has been widely applied in the literature (see e.g. Demirer and Kutan 2006; Tan et al. 2008 and Chiang et al. 2010). It tests for herding by examining whether the cross-sectional return dispersion decreases or increases at a decreasing rate as the market return increases. While in most applications researchers used ordinary least square (OLS) regression, our paper opts to use quantile regression (QR) (Koenker and Bassett 1978). In comparison with OLS, QR is more suitable for our topic. First, it can perform the regression analysis over the entire distribution of the dependent variable. As such, it offers a more complete view of how herding fares over different quantiles. Herding, as expected, is more likely to exist in the high quantiles of the distribution (i.e. during periods of market tumult) than in the low ones. Using OLS which is a mean-based regression method, we cannot distinguish between different quantiles and may overlook herding that exists only in certain quantiles. Second, as Barnes and Hughes (2002) argued, QR alleviates some of the statistical problems plaguing OLS, such as non-normal distributions, sensitivity to outliers, errors-in-variables, and omitted variable bias. In our study, the ability of QR to cope with a non-normal distribution is worth special mention. As will be seen later, our dependent variable—the return dispersion is not normally distributed as it shows significant skewness and kurtosis. In the case of non-normal distributions, QR leads to more efficient estimators than OLS (Buchinsky 1998). Despite its advantages over OLS, QR has not yet been applied to REIT studies, according to our knowledge. As such, this study constitutes the first application, which can be considered an additional contribution.

We carry out the study for U.S. equity REITs. Our data source is CRSP/Ziman Real Estate Data series. We obtain all equity REITs that have traded on the three primary exchanges (NYSE, AMEX and NASDAQ) since the start of 1980. By having the universe of equity REITs, our study avoids survivorship bias. Our data sample spans from January 1980 to December 2010. This gives us a total number of 383 equity REITs. After applying QR to the equity REITs under the framework of CCK, we have the following major results:

-

(1)

Based on the full sample, herding is found to be present only in the high quantiles of the distribution of return dispersion. Because dispersion at high quantiles corresponds to large price movements, this implies that herding tends to occur when the market is experiencing turbulent conditions. Furthermore, we find that when herding is present, the more turbulent the market, the stronger the herding effect. These findings suggest that during periods of market tumult investors tend to suppress their own beliefs and are more likely to herd. We also find that in contrast with the case of high quantiles, at low quantiles, dispersion increases at an increasing rate with absolute aggregate returns. This finding does not support herding, but like herding it contradicts the predictions of the rational asset pricing models. It implies that when market is tranquil, investors will place more emphasis on market fundamentals than what the rational asset pricing models suggest. Finally, for some intermediate quantiles, dispersion is shown to increase linearly with absolute aggregate return. This result is consistent with the rational asset pricing models. It is worth noting that our above results are robust to the sampling frequencies of data (daily, weekly & monthly). To put our findings into proper perspective, we also test for herding for U.S. non-REIT small cap stocks over the same time period using the same regression method. We detect strong evidence of herding at high quantiles—a finding consistent with those of REITs, but at the same time herding also occurs at some very low quantiles—a finding not observed for REITs. These findings indicate that in the general equity market, investors herd not only when the market is turbulent, but also when it is quiet.

-

(2)

Overall, herding is more likely to occur in down markets when the aggregate REIT return is falling than in up markets when the return is rising. Moreover, herding, if it exists, appears to be stronger in down markets than in up markets. These findings point to the asymmetry of herding behavior under different market conditions. In addition, our results suggest that during the current crisis REIT investors may not start to herd until the market becomes extremely turbulent (i.e. above the 90% quantile) whereas during the relatively normal period before the crisis, investors tend to herd when the market is moderately turbulent (i.e. over the 50–80% quantiles). This implies that the ongoing financial crisis has substantial impacts on herding: it leads to a change in the circumstances under which herding can occur.

-

(3)

Through the analyses of the ‘pre-modern’ and ‘modern’ REIT eras, which are separated by the initial public offering (IPO) of Kimco Realty Corporation held in late 1991, we show that compared with the case of the ‘pre-modern’ era, REIT investors are more likely to herd in the ‘modern’ era, during which herding usually occurs when the market becomes turbulent. This result implies that the switch of REITs from passive externally managed entities into active self-managed ones has caused investors to be more responsive to market sentiment.

The remainder of this paper is organized as follows. The following section discusses the methodology to detect herding behavior. After that, we describe the data to be used. Then we present the findings, and discuss the implications. The final section concludes.

Detection of Market-Wide Herding and Quantile Regression

As mentioned earlier, Christie and Huang (1995, CH) and Chang et al. (2000, CCK) have proposed methods to detect herding behavior in a market setting. The two methods are similar in spirit. For ease of exposition, it is informative to start with the CH method. CH suggested using the cross-sectional standard deviation of returns (CSSD) to represent return dispersion. CSSD is defined as

where R i,t is the return of stock i at time t, and R m,t is the cross-sectional average return of the N stocks in the market portfolio at time t. CH argued that during normal periods, rational asset pricing models predict that return dispersion would increase with the absolute value of the market return because individual stocks differ in their sensitivity to the market return. However, during periods of extreme market movements, the dispersion would decrease. The reason is that during those times, individuals tend to suppress their own beliefs and base their investment decisions on the collective actions of the market. As a result, stock returns will not deviate too far from the overall market return. Put differently, herding, which is presumably more prevalent under market stress, can lead to a lower return dispersion. So in conclusion, CH contended that rational asset pricing models and herding provide conflicting implications for CSSD. Given this rationale, CH used the following equation to test for herding:

where \( D_t^L \) and \( D_t^U \) are dummy variables. \( D_t^L = 1 \) if the market return at time t lies in the extreme lower tail of the distribution, and \( D_t^L = 0 \) otherwise. Similarly, \( D_t^U = 1 \) if in the extreme upper tail, and \( D_t^U = 0 \) otherwise. As can be easily seen, the two dummies are used to distinguish between extreme market periods and normal periods. Given the specification of Eq. 2, a finding of negative significant values for β L & β U would indicate the presence of herding. Though intuitive, the CH approach has drawbacks. It requires defining the extreme returns first. In their study, CH used small percentages like 1% and 5% to identify extreme values. This method is rather arbitrary. In practice, investors may differ in their opinions as to what constitutes an extreme return. Furthermore, CH’s model can only be used to study herding during periods of market stress. It ignores the fact that herding could also take place during normal periods (Hwang and Salmon 2004).

The CH method has later been extended by Chang et al. (2000, CCK). Instead of using CSSD to measure dispersion, CCK used the cross-sectional absolute deviation of returns (CSAD), which is calculated as

CSAD is preferred over CSSD because it is less sensitive to return outliers. In addition, CCK considered the nonlinearity inherent in the relationship between dispersion and market return, and set up a new equation to test for herding:

As compared with Eq. 2, Equation 4 introduces a nonlinear item \( R_{m,t}^2 \). The rationale, as argued by CCK, is that under normal conditions the relationship between return dispersion and market return, as dictated by the rational asset pricing models, is not just an increasing function but more importantly it is linear. However, such a linearly increasing relationship no longer holds in the presence of herding. Instead, herding causes the relationship to be nonlinear: either decreasing or increasing at a decreasing rate, both of which indicate that dispersion would be lower if herding occurs. So a nonlinear item should enter the testing equation. Furthermore, if the coefficient (γ 2) of the nonlinear item is found to be negative significant, then herding is said to occur.

It is worth noting that CCK estimated Eq. 4 using OLS. According to our previous discussions, OLS may be inappropriate to investigate herding. To overcome the drawbacks of OLS, we use the quantile regression (QR) proposed by Koenker and Bassett (1978). In what follows, we offer a brief description for QR. For more technical expositions, readers can refer to Koenker (2005). Simply speaking, QR estimates a collection of conditional quantile equations, for which a generic form can be written as

where y i is the dependent variable, x i is a vector of independent variables, β θ is a vector of parameters and u θi is the error term. The subscript θ ∊ (0, 1) indicates the quantile. The θ th conditional quantile of y given x is defined as \( Quan{t_{\theta }}\left( {{y_{i}}|{x_{i}}} \right) = x_{i}^{\prime }{\beta _{\theta }} \). As θ increases continuously, the conditional distribution of y given x is traced out. The QR estimator (\( {\hat{\beta }_\theta } \)) can be found by minimizing a weighted sum of absolute errors:

This minimization problem can be solved through a linear programming. It can be shown that \( \sqrt {n} \left( {{{\hat{\beta }}_\theta } - {\beta_\theta }} \right)\mathop { \to }\limits^d N\left( {0,{\Omega_\theta }} \right) \). The variance-covariance matrix Ω θ can be estimated in several ways. The most commonly used is the one suggested by Buchinsky (1995), which can be implemented using the software Stata. Once \( {\hat{\Omega }_\theta } \) is obtained, we can perform hypothesis testing for \( {\hat{\beta }_\theta } \) based on the normal distribution with asymptotic justification.

Data

This study uses the CRSP/Ziman Real Estate Data series. This source provides price data for all REITs that have traded on the three primary exchanges (NYSE, AMEX and NASDAQ). We collect REIT prices from January 1980—the very beginning of the data source to December 2010. Among the three REIT categories (equity, mortgage, & hybrid), we observe that for mortgage and hybrid REITs the number of cross sections (i.e. REITs existing at a given point of time) remains pretty small.Footnote 2 Without a reasonably large number of cross sections, we cannot ensure that the cross-sectional dispersion (CSAD) is measured with precision. Due to this reason, we restrict our attention to equity REITs, for which the cross-sectional number is found large enough.Footnote 3 For equity REITs, prices are readily available at daily and monthly frequencies. With daily frequency, our sample has 7822 observations and with monthly frequency, 371 observations. Based off the daily data, we further construct a series of weekly prices by picking the first available observation of each week. By doing so, we intend to explore whether herding behavior is robust across sampling frequencies. For weekly data, there are 1564 observations. With individual REIT prices in place, we calculate R m,t as the cross-sectional average return and then CSAD t of Eq. 3 as the measure of cross-sectional return dispersion.

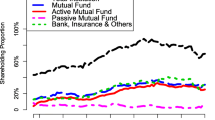

Table 1 presents the summary statistics of the two variables at the three data frequencies. As shown in the table, the mean of the aggregate return R m remains negative, regardless of data frequencies, and the return dispersion CSAD, as expected, increases with sampling frequency. In addition, CSAD exhibits significant skewness and kurtosis, and is hence not normally distributed. This indicates a need of using a robust estimation method to test for herding. Figure 1 plots the time series of R m,t and CSAD t , both of which clearly display a spike towards the end of the sample. Apparently this is caused by the ongoing financial crisis.

Time series plots of Rm and CSAD. This figure plots Rm (the cross-sectional average returns) and CSAD (the cross-sectional absolute deviations of the returns) for U.S. equity REITs at three data frequencies (daily, weekly, and monthly). The data are obtained from the CRSP/Ziman Real Estate Data Series. They range from the start of 1980 to the end of 2010

Empirical Findings

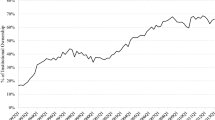

Table 2 presents the estimation results of herding based on Eq. 4. Our focus is on the herding coefficient γ 2, as a significant negative value of γ 2 suggests the existence of herding. First, look at the OLS results. They indicate that γ 2 is positive and significant. Such a finding holds across the three sampling frequencies (daily, weekly & monthly). Also note that the magnitudes of γ 2 are comparable across frequencies. So based on the OLS results, we do not find evidence in support of herding in the equity REIT market. Second, look at the QR results. We find that the significance and sign of γ 2 change across quantiles and γ 2 achieves negative significance at high quantiles. More specifically, at daily frequency (Panel A of Table 2), γ 2 is found to be positive and significant at the bottom half of the quantiles (e.g.τ = 10%, 25% & 50%). It then loses statistical significance at some intermediate quantiles (e.g.τ = 75%), and after that it regains significance at some extreme quanitles (e.g.τ = 90%) with its sign switching from positive to negative. A similar pattern of changes in γ 2 can also be found when lower-frequency data—weekly (Panel B) & monthly (Panel C) are being used. The only difference appears to be the quantile level at which γ 2 switches significance and/or sign. To have a more detailed view of the quantile-varying feature of γ 2, we resort to a visual tool called quantile plots, which show how γ 2—the herding coefficient varies across quantiles. They are displayed in Panel A of Fig. 2. It becomes quite apparent from the plots that γ 2 starts with positive significance, then undergoes an intermediate stage of being insignificant, and finally ends up with negative significance.

Quantile plots of the herding coefficients for the equity REIT and non-REIT small-cap stock market. These plots show γ2—the herding coefficient as estimated in Eq. 4: \( CSA{D_t} = {\gamma_0} + {\gamma_1}\left| {{R_{m,t}}} \right| + {\gamma_2}R_{m,t}^2 + {\varepsilon_t} \), where CSAD is the cross-sectional absolute deviations of the returns, and Rm is the cross-sectional average return. The solid line represents the point estimates of γ2, and the dotted lines bound the 95% confidence intervals

So combining the QR results from Table 2 and the quantile plots (Panel A) from Fig. 2, we conclude that REIT return dispersion increases at an increasing rate in the lower range of the dispersion, but at a decreasing rate in the upper range, and in between the increase appears to be linear. Because the high-quantile dispersion is typically associated with large market-wide price movements,Footnote 4 these results imply that herding behavior exists only when the market is experiencing volatile conditions. This is a very interesting finding. It suggests that during periods of market tumult, investors tend to suppress their own beliefs and are thus more likely to herd.Footnote 5 Moreover, in the case when herding is present, the more turbulent the market, the stronger the herding effect. This can be verified in Panel A of Fig. 2: at the right tail of the dispersion distribution the absolute value of γ 2 increases with the quantile level. As such, it is safe to say that herding becomes more pronounced when the market becomes more turbulent. However, we notice that herding does not always exist. When the market turbulence diminishes to a certain level, herding disappears. At this point, the return dispersion would behave in a way as predicted by the rational asset pricing models, that is, it increases linearly with aggregate returns. Finally, when the market becomes further tranquil, the dispersion would increase at a more-than-proportional rate with aggregate return. This means that investors place more emphasis on the market fundamentals than the rational asset pricing models suggest. Like herding, this situation also contradicts the predictions of the rational asset pricing models.

To put our above findings into proper perspective, we also test for herding for U.S. non-REIT small cap stocks using the same regression methods. REITs, despite their enormous growth since the early 1990s, are still, on average, of the size of small cap stocks. Empirical studies (e.g. Falzon 2002; Clayton and MacKinno 2003, and Anderson et al. 2005) have shown that the two share a strong relationship. We present the corresponding estimation results for non-REIT small cap stocks in Table 3, and the quantile plots in Panel B of Fig. 2.Footnote 6 Consistent with our results for REITs, we find strong evidence of herding for non-REIT small cap stocks at high quantiles: γ 2 is negative and significant at τ = 90% for daily and τ = 99% for monthly as shown in Table 3. Such a point is further confirmed by looking at the quantile plots in Panel B of Fig. 2. This suggests that herding can take place in the stock market when the market is tumultuous. This is a new finding, as previous studies did not find evidence of herding in the U.S. stock market. This also illustrates the benefits of using QR to study herding: it can offer a more detailed and complete picture of the herding behaviors, and as a result, different conclusions may be drawn. One point worth noting is that if we follow the previous studies that use OLS, we would reach a conclusion that no herding exists (see the OLS results in Table 3). In addition to the herding found at high quantiles, the quantile plots indicate that it also occurs at some very low quantiles (e.g.τ = 5% for daily and monthly). This is something that we do not see for equity REITs. It suggests that in the stock market, investors still herd when the market is quiet. This is in accordance with the argument of Hwang and Salmon (2004) that suggest that herding can take place under tranquil market conditions.

Herding Under the Up and Down Markets

A number of studies have demonstrated the asymmetric characteristics of asset returns, that is, return dispersion or correlation tend to behave differently in rising and falling markets (see, e.g. Bekaert and Wu 2000; Duffee 2000; Longin and Solnik 2001). Given this, it is interesting to see whether herding presents an asymmetric reaction on days when the market is up vis-à-vis days when the market is down. Such an analysis allows us to gain additional insights for herding. To fulfill this purpose, we generalize Eq. 4 as follows:

where the dummy variable D = 1 if R m,t < 0 and D = 0 if otherwise. Note that this equation considers asymmetry in both linear and nonlinear terms.

Table 4 reports the estimation results of herding in the up and down markets based on Eq. 7. Overall we find that herding is more likely to occur in down markets than in up markets, which is indicative of the asymmetry of herding behavior. As shown by the QR results of Table 4, a negative significant herding coefficient is observed more frequently in down markets (γ 4) than in up markets (γ 3). More convincing evidence for this point can be obtained by a visual check of Fig. 3 which depicts the quantile plots of γ 3 and γ 4. As seen from there, γ 4 (Panel B) is negative significant over a wider distribution range than its counterpart γ 3 (Panel A). This is particularly true in the weekly and monthly cases when γ 3 seems never to achieve negative significance over the entire distribution but γ 4 is able to do so over certain ranges. Furthermore, we find that the herding effect, whenever it exists, appears to be stronger in down markets than in up markets. This can be seen from the overall larger size (in the sense of absolute value) of γ 4 relative to γ 3 when both are negative, though the statistical tests for the equality of the two herding coefficients (γ 3 = γ 4), as shown in the last column of Table 4, do not reveal their difference is statistically significant. As a final note, for comparison purposes, we perform a similar analysis for the small cap stock market. The results also confirm the asymmetry of herding behaviors. To save space, the results are not reported but available from us.

Quantile plots of the herding coefficients for the up and down equity REIT markets. These plots show the herding coefficients – γ3 for the up markets and γ4 for the down markets as estimated based on Eq. 7: \( CSA{D_t} = {\gamma_0} + {\gamma_1}\left( {1 - D} \right)\left| {{R_{m,t}}} \right| + {\gamma_2}D\left| {{R_{m,t}}} \right| + {\gamma_3}\left( {1 - D} \right)R_{m,t}^2 + {\gamma_4}DR_{m,t}^2 + {\varepsilon_t} \). The solid line represents the point estimates of the coefficients, and the dotted lines bound the 95% confidence intervals

The Impact of the Current Financial Crisis on Herding

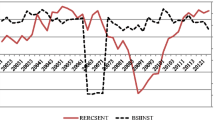

In addition to the asymmetry of herding behaviors, we are also interested in examining how financial crises affect herding. This topic is of practical relevance. We are currently undergoing a crisis, which has caused significant market turbulence. Given this background, it is worthwhile to investigate whether herding will be different under the new economic climate compared to before. To carry out such an investigation, we first need to define the crisis period. To this end, we resort to the idea of structural breaks. The logic is that economic crises often cause structural breaks in time series. Given this, if structural breaks were found, we could use them to split the full sample into subsamples (Bai and Perron 1998, 2003). In this study, to detect the structural breaks we utilize the OLS-CUSUM procedure proposed by Ploberger and Kramer (1992) due to its simplicity and effectiveness.Footnote 7 After applying the procedure to|R m,t |, which proxies the volatility of aggregate REIT returns, we detect a single break point located at the date of Jul 1, 2008. Footnote 8Based on this date, we divide the sample into two subsamples (see Table 5). Our main focus is on the second one (July 1, 2008 to the sample end), which corresponds well with the current crisis period. Our sample partitioning makes sense, as a visual check of Panel A (Rm) of Fig. 1 reveals that unusually high levels of volatility in the aggregate REIT returns (Rm) appear near the end of the sample and continue into the end. Apparently, this phenomenon is caused by the current crisis. It is in sharp contrast with the previous subperiod, during which the aggregate returns are found overall tranquil.

Based on the two subperiods, we estimate the following equation

where the dummy variable D = 1 if t is after July 1, 2008 and D = 0 if otherwise. The estimation results for some selected quantiles are reported in Table 5, and the quantile plots of the herding coefficients are displayed in Fig. 4. We find that the herding coefficient for the current crisis period (γ 4) is negative and significant at extreme quantiles (e.g. τ = 95% in Table 5). A further check of the quantile plots reveals that γ 4 starts to show negative significance from the 90% quantile, and this herding pattern is quite robust across the three sampling frequencies. In contrast, the herding coefficient for the pre-crisis period (γ 3) is found to be negative and significant only at some intermediate quantiles (e.g. τ = 50% & 75% in the daily case, and τ = 75% in the weekly case). Moreover, the herding behaviors are not robust across frequencies: the range of quantiles for a negative significant γ 3 shrinks as the level of temporal aggregations increases (note that the range completely disappears in the monthly case). These findings provide new insights for REIT herding. They suggest that REIT investors, presumably under constant market pressure during the recent crisis, may not start to follow other people’s actions until the market becomes extremely turbulent (i.e. above the 90% quantile). It is plausible that under this new climate they become quite sensitive to those highly unusual market conditions. On the contrary, during relatively normal periods, investors tend to herd when the market is moderately turbulent (i.e. over the 50–80% quantiles according to Panel A of Fig. 4). This finding is consistent with that of (Hwang and Salmon 2004) which argues that herding can also take place during non-extreme market conditions. So based on above findings, we conclude that the ongoing financial crisis has substantial impacts on herding: it leads to a change in the circumstances under which herding can occur. Similar conclusions can be made for small cap stocks. Once again the results are obtainable upon request but are not reported here.

Quantile plots of the herding coefficients for the current crisis period and the period before. These plots show the herding coefficients—γ3 for the period before and γ4 for the current crisis period as estimated based on Eq. 8: \( CSA{D_t} = {\gamma_0} + {\gamma_1}\left( {1 - D} \right)\left| {{R_{m,t}}} \right| + {\gamma_2}D\left| {{R_{m,t}}} \right| + {\gamma_3}\left( {1 - D} \right)R_{m,t}^2 + {\gamma_4}DR_{m,t}^2 + {\varepsilon_t} \),where the dummy variable D = 1 if t is after July 1, 2008 and D = 0 if otherwise. The solid line represents the point estimates of the parameters, and the dotted lines bound the 95% confidence intervals

Herding in the ‘Pre-Modern’ and ‘Modern’ REIT Eras

An important market event in the evolution of U.S. REITs is the initial public offering (IPO) of Kimco Realty Corporation held in late 1991. The IPO of Kimco and the following IPOs by others ushered in a fundamental change in REITs, which switched from passive, externally managed pools of public equity to fully integrated, product focused operators managing a diverse base of capital on behalf of public and private equity investors. So in this sense, the IPO of Kimco is said to mark the dawn of the ‘modern’ REIT era. Considering this, it is interesting to see whether herding behaviors differ between the ‘pre-modern’ and ‘modern’ era.Footnote 9

Using November 1991 as the boundary between the two eras,Footnote 10 we estimate the following equation:

where the dummy variable D = 1 if t is no earlier than November 1991 and D = 0 if otherwise. As such, γ 4 is the herding coefficient for the ‘modern’ REIT era while γ 3 for ‘pre-modern’ era. The estimation results for select quantiles are reported in Table 6, and the quantile plots of the herding coefficients are displayed in Fig. 5. The most noticeable point is that between the two REIT eras, the “modern” era exhibits herding behaviors closely resembling those of the full sample (Table 2 & Panel A of Fig. 2). That is, the herding coefficient (γ 4 for the ‘modern’ era) is found to be consistently negative and significant at high quantiles (τ = 95% and above). But such a pattern does not hold for the ‘pre-modern’ era, for which we observe that the herding coefficient γ 3 achieves negative significance only sporadically at some low and intermediate quantiles (e.g.τ = 10% & 60% for daily, and τ = 10% for weekly). The discrepancy in the herding behaviors between the two eras comes as no surprise, as some studies (e.g. Ambrose and Linneman 2001, and Case et al. 2010) already argued that the 1991 switch has caused significant differences in REIT market behaviors. Our finding here simply suggests that compared with the case of the ‘pre-modern’ era, during the ‘modern’ era REIT investors are more likely to herd, and herding usually occurs when the market becomes turbulent. This implies that the transformation of REITs from passive externally managed entities into active self-managed ones has caused investors to be more responsive to market sentiment.

Quantile plots of the herding coefficients for the “pre-modern” and “modern” REIT era. These plots show the herding coefficients—γ3 for the “pre-modern” era (Jan 1980-Oct 1991) and γ4 for the “modern” era (Nov 1991–Dec 2010), as estimated based on Eq. 9: \( CSA{D_t} = {\gamma_0} + {\gamma_1}\left( {1 - D} \right)\left| {{R_{m,t}}} \right| + {\gamma_2}D\left| {{R_{m,t}}} \right| + {\gamma_3}\left( {1 - D} \right)R_{m,t}^2 + {\gamma_4}DR_{m,t}^2 + {\varepsilon_t} \),where the dummy variable D = 1 if t is no earlier than Nov 1, 1991 and D = 0 if otherwise. The solid line represents the point estimates of the parameters, and the dotted lines bound the 95% confidence intervals

Conclusions and Implications

Herding arises when investors suppress their own beliefs and follow the actions of others. It has important implications for practitioners, academia and policymakers. In this paper, we conducted an investigation of market-wide herding in the U.S. equity REIT market. To carry out the investigation, we follow the approach proposed by Chang et al. (2000, CCK). This approach tests for herding by examining whether the cross-sectional return dispersion decreases or increases at a decreasing rate in response to an increase in the aggregate market return. In the implementation of the CCK approach, we opt to use the quantile regression (Koenker and Bassett 1978) instead of following the common practice to use OLS. The reason is that relative to OLS, QR provides a more complete view of herding behavior, and helps alleviate some statistical problems plaguing OLS.

Applying QR to the U.S. equity REITs yields the following results: (1) Based on the full sample, herding is found to be present only in the high quantiles of the distribution of return dispersion. Furthermore, we find that when herding is present, the more turbulent the market, the stronger the herding effect. These findings suggest that during periods of market tumult investors tend to suppress their own beliefs and are thus more likely to herd. For the benefits of comparison, we show that consistent with the findings for REITs, U.S. non-REIT small cap stocks also display strong herding behaviors at high quantiles, but at the same time they witness herding at some very low quantiles—a finding not observed for REITs. These findings indicate that in the stock market, investors herd not only when the market is turbulent, but also when it is quiet. (2) We confirm the asymmetry of herding behaviors: herding is found to be more likely to occur in down markets than in up markets, and moreover, herding, if it exists, appears to be stronger in the down markets than in the up markets. We also show that during the current crisis REIT investors may not start to herd until the market becomes extremely turbulent whereas during the relatively normal period before the crisis, investors tend to herd when the market is moderately turbulent. As such, we conclude that the ongoing crisis has brought a change in the circumstances under which herding can occur. Finally, we find that compared with the case of the ‘pre-modern’ era, REIT investors are more likely to herd in the ‘modern’ era, during which herding usually occurs when the market becomes turbulent. This result implies that the switch of REITs from passive externally managed entities into active self-managed ones has caused the investors to be more responsive to market sentiment.

Notes

Although our test of herding is similar to that of CCK, our measure of CSAD t differs from their. Their measure was derived from the conditional version of the CAPM, whereas ours follows the method used by (Christie and Huang 1995) and Gleason et al. (2004), which does not require the estimation of beta. This avoids the possible specification error associated with the asset pricing model.

During the period of 1980–2010, a total of 107 mortgage REITs have ever existed. However, the number of cross sections for mortgage REITs is small: it ranges from 4 to 43. This means that at some days, only 4 mortgage REITs exist. Further, we find for half of our sample period, the number of cross sections does not exceed 20 for mortgage REITs. The situation is even worse for hybrid REITs, for which a total of only 40 have ever existed. As can be imagined, for some extended periods of time the number of cross sections had been zero.

There have been a total of 383 equity REITs ever existing over our sample period. Given this, the number of cross sections remains sufficiently large: it ranges from 46 to 202.

It has been shown in the financial literature (e.g. Goyal and Santa-Clara 2003) that cross-sectional dispersion and time series volatility are significantly positively correlated, and they tend to move together. Such a point can be verified in this study. To do so, we first need to estimate the time series of market volatility. There are two alternative measures suitable for our study (e.g. Cotter and Stevenson 2008 and Zhou 2011): one is the power transformations of the market returns (e.g. absolute returns or squared returns), and the other is the conditional volatility obtained from GARCH-type models. Following the first alternative, the most apparent proxy for market volatility in our study is the absolute aggregate REIT return, i.e. |R m,t | . Using it, we find that the correlation coefficient between market volatility and CSAD are highly positive and significant: 0.70 for daily, 0.75 for weekly, and 0.79 for monthly. Similar results are found when the second alternative is followed (i.e. using volatility generated from a GARCH(1,1) model of R m,t ).

As noted by an anonymous reviewer, the reported results could be explained by an alternative hypothesis. That is, market sensitivities are unstable and they could become smaller during times of market stress. To test for the changes in market sensitivities, we first estimated the time-varying β for each equity REIT based on the capital asset pricing model (CAPM) through the application of the commonly used rolling window method. Then we run a fixed-effect panel regression: \( {\beta_{i,t}} = {a_1} + {a_2}{D_{i,t}} \), where i represents the ith REITs, t is the time index, and D is a dummy variable indicating whether market is under stress. To define D, we follow Christie and Huang (1995): D i,t = 1 if the aggregate REIT market return (R m ) at time t lies in the extreme tails, which is usually identified by using small percentages (e.g. 1% or 5% of the return distribution). Given the above setting and using the 5% measure for the tails (the results are similar using the 1% as tails), we run the panel regression based on the daily data and find a 1 = 0.684 (0.000) and a 2 = 0.048 (0.000), where p-values are in parenthesis. As can be seen, a 2 is positive and significant. This suggests that during stressful times, market sensitivities turn out to be larger than under usual times. So the alternative hypothesis is not supported. It is worth noting that a window of 252 days (one-trading year) is used to obtain the time varying β in the above regression. However, further experiments show that our results are robust to different sizes of the window ranging from one trading quarter to 5 years and even alternative methods of beta estimation. Further, when weekly and monthly data are used, we find the results are qualitatively unchanged.

To define small cap stocks, we follow the common practice to use deciles. Specifically, we use deciles 8–10 to define small cap stocks. This practice is consistent with those of some empirical studies (e.g. Sa-Aadu et al. 2010), and also with the size based indices kept at Professor French’s data page (http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html) where indices are classified as low 30 (the smallest 30% of stocks, i.e. small cap), med 40 (the intermediate 40% of stocks, i.e. mid cap), and high 30 (the largest 30% of stocks, i.e. large cap). For the above defined small cap stocks (REITs excluded), their daily and monthly price data are obtained directly from the Center for Research in Security Prices (CRSP) over the period of January 1980 through December 2010. The weekly data are constructed by us in the same way as we did for REITs.

The OLS-CUSUM procedure tests for structural breaks based on the cumulated sum (CUSUM) of the OLS residuals within a time series regression framework. The rationale is that CUSUM tends to drift off following a structural break. So if CUSUM is found to become too large (i.e. crossing some predefined critical lines), structural breaks could be said to occur. Thanks to Zeileis et al. (2007), this procedure can now be easily implemented in R using the ‘Strucchange’ package.

As a robustness check, we experiment with different break dates which are either several months before or after July 1, 2008. The estimation results are similar to those reported here. To save space, they are not presented but are available upon request.

We thank an anonymous reviewer for bringing up this suggestion.

According to its annual reports, Kimco held its IPO in November 1991.

References

Ambrose, B. W., & Linneman, P. (2001). REIT organizational structure and operating characteristics. Journal of Real Estate Research, 21, 141–162.

Anderson, R., Clayton, J., Mackinnon, G., & Rajneesh, S. (2005). REIT returns and pricing: the small cap value stock factor. Journal of Property Research, 22, 267–286.

Anderson, R. I., Guirguis, H, & Bony, V. (2010). The impact of switching regimes and monetary shocks: An empirical analysis of REITs. Working paper, University of Denver.

Bai, J., & Perron, P. (1998). Estimating and testing linear models with multiple structural changes. Econometrica, 66(1), 47–78.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18, 1–22.

Barnes, M., & Hughes, A. W. (2002). A quantile regression analysis of the cross section of stock market returns. Working Paper, Federal Reserve Bank of Boston.

Bekaert, G., & Wu, G. (2000). Asymmetric volatility and risk in equity markets. Review of Financial Studies, 13, 1–42.

Bikhchandani, S., & Sharma, S. (2001). Herd behavior in financial markets. IMF Staff Papers, 47, 279–310.

Buchinsky, M. (1995). Estimating the asymptotic covariance matrix for quantile regression models: a Monte Carlo study. Journal of Econometrics, 68, 303–338.

Buchinsky, M. (1998). Recent advances in quantile regression models: a practical guideline for empirical research. Journal of Human Resources, 33, 88–126.

Case, B., Yang, Y., & Yildirim, Y. (2010). Dynamic correlations among asset classes: REIT and stock returns, forthcoming. Journal of Real Estate Finance and Economics.

Chang, E. C., Cheng, J. W., & Khorana, A. (2000). An examination of herd behavior in equity markets: an international perspective. Journal of Banking and Finance, 24, 1651–1679.

Chiang, T. C., Li, J., & Tan, L. (2010). Empirical investigation of herding behavior in Chinese stock markets: evidence from quantile regression analysis. Global Finance Journal, 21, 111–124.

Christie, W. G., & Huang, R. D. (1995). Following the pied piper: do individual returns herd around the market? Financial Analysts Journal, 51, 31–37.

Clayton, J., & MacKinno, G. (2003). The relative importance of stock, bond and real estate factors in explaining REIT returns. Journal of Real Estate Finance and Economics, 27, 39–60.

Clement, M. B., & Tse, S. Y. (2005). Financial analyst characteristics and herding behavior in forecasting. Journal of Finance, 60, 307–341.

Cotter, J., & Stevenson, S. (2008). Modeling long memory in REITs. Real Estate Economics, 36, 533–554.

Demirer, R., & Kutan, A. M. (2006). Does herding behavior exist in Chinese stock markets? Journal of International Financial Markets, Institutions and Money, 16, 123–142.

Devenow, A., & Welch, I. (1996). Rational herding in financial economics. European Economic Review, 40, 603–615.

Duffee, G. R. (2000). Asymmetric cross-sectional dispersion in stock returns: Evidence and implications. Berkeley: Working Paper U.C.

Falzon, R. (2002). Stock market rotations and REIT valuation. Prudential Real Estate Investors, October 1–10.

Gleason, C. A., & Lee, C. M. C. (2003). Analyst forecast revisions and market price discovery. The Accounting Review, 78, 193–225.

Gleason, K. C., Mathur, I., & Peterson, M. A. (2004). Analysis of intraday herding behavior among the sector ETFs. Journal of Empirical Finance, 11, 681–694.

Goyal, A., & Santa-Clara, P. (2003). Idiosyncratic risk matters! Journal of Finance, 58, 975–1008.

Graham, J. R. (1999). Herding among investment newsletters: theory and evidence. Journal of Finance, 54, 237–268.

Hwang, S., & Salmon, M. (2004). Market stress and herding. Journal of Empirical Finance, 11, 585–616.

Koenker, R. W. (2005). Quantile regression. Cambridge University Press.

Koenker, R. W., & Bassett, G., Jr. (1978). Regression quantiles. Econometrica, 46, 33–50.

Lakonishok, J., Shleifer, A., & Vishny, R. W. (1992). The impact of institutional trading on stock prices. Journal of Financial Economics, 32, 23–44.

Longin, F., & Solnik, B. (2001). Extreme correlation of international equity markets. Journal of Finance, 56, 649–676.

Ploberger, W., & Kramer, W. (1992). The CUSUM test with OLS residuals. Econometrica, 60, 275–285.

Sa-Aadu, J., Shilling, J., & Tiwari, A. (2010). On the portfolio properties of real estate in good times and bad times. Real Estate Economics, 38, 529–565.

Tan, L., Chiang, T. C., Mason, J., & Nelling, E. (2008). Herding behavior in Chinese stock markets: an examination of A and B shares. Pacific-Basin Finance Journal, 16, 61–77.

Trueman, B. (1994). Analyst forecasts and herding behavior. Review of Financial Studies, 7, 97–124.

Welch, I. (2000). Herding among security analysts. Journal of Financial Economics, 58, 369–396.

Wermers, R. (1999). Mutual fund herding and the impact on stock prices. Journal of Finance, 54, 581–622.

Zeileis, A., Shah, A., & Patnaik, I. (2007). Exchange rate regime analysis using structural change methods. Working Paper, Department of Statistics and Mathematics, WU Vienna University of Economics and Business

Zhou, J. (2011). Multiscale analysis of international linkages of REIT returns and volatilities. forthcoming. Journal of Real Estate Finance and Economics.

Zhou, J., & Anderson, R. I. (2010). Extreme risk measures for international REIT markets. forthcoming. Journal of Real Estate Finance and Economics.

Acknowledgements

We thank the Editor and two anonymous referees for their valuable comments and suggestions. We also thank Joshua Harris for his research assistance. All errors remain our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhou, J., Anderson, R.I. An Empirical Investigation of Herding Behavior in the U.S. REIT Market. J Real Estate Finan Econ 47, 83–108 (2013). https://doi.org/10.1007/s11146-011-9352-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-011-9352-x