Abstract

This study investigates Real Estate Investment Trusts’ momentum returns in different market states, and explains the momentum phenomenon with a risk-based dividend growth theory of Johnson (Journal of Finance 57:585–608, 2002). Our results show that momentum returns of REITs are higher during up markets. This study finds that winners’ dividend/price ratios are higher than those of losers, and momentum returns are positively correlated with the difference between winners’ and losers’ dividend/price ratios. We also find that momentum returns are higher after the legislation change of REITs in 1992, and that dividend/price ratios of REITs are also higher after 1992, suggesting that a persistent shock to REIT’s dividend/price ratios in 1992 partly explains REITs’ higher momentum returns after 1992. In sum, results of this study suggest that momentum returns of REITs can be jointly explained by a time-varying factor (market state) and a cross-sectional variance in dividend yields.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Jegadeesh and Titman (1993), report a surprising result that the US stock market exhibited significant momentum returns over the past 30 years. The authors define momentum trading strategy as a strategy which buys stocks with the highest past returns (winners), sells stocks with the lowest past returns (losers), and holds the portfolio for 6–12 months. This strategy yields an annual return of 12% from 1965 to 1990 in the US stock market.Footnote 1 Additionally, the authors suggest that these momentum returns are not a result of systematic risk of the securities.Footnote 2 As existing asset-pricing models cannot explain momentum returns, such returns are ‘abnormal’ in the sense that investors can make profits without any net investment. Abnormal returns generated from momentum trading strategies provide strong evidence against the efficient market hypothesis.Footnote 3 Existing research finds pervasive evidence of substantial momentum returns in the USA and worldwide. In particular, Chui et al. (2003) find significant momentum returns in REITs from 1982 to 2000. Momentum returns in REITs are more significant especially during the 1993–2000 period. The momentum phenomenon leads to two interesting questions: How could momentum returns exist for decades with many intelligent investors monitoring the stock markets, and what drives momentum?

This study explains momentum returns in Real Estate Investment Trusts (REITs) with two risk-based theories: cross-sectional dividend yields and time-varying business states. Johnson (2002) suggests that infrequent shocks to business conditions, such as technology innovations and structural changes, cause persistent shocks to dividend growth rates. As a result, increased dividend growth rates cause momentum returns.Footnote 4 However, he argues that cyclical stocks may have higher dividend growth rates during recessions, resulting in higher momentum returns in bear markets. This view is complimentary to Cochrane’s (1999) view that investors have a preference for stocks that provide payoffs during economically stressful (e.g. recessions and market downturn) periods.Footnote 5 There are two aspects to be tested: one, does momentum in REIT stocks follow his expected pattern of being associated with market growth phases, or do REIT shares as defensive stocks follow his expectation that they may be associated with momentum during recessionary periods?

Prior real estate literature indicates that REITs are usually considered as defensive stocks because they are less risky than the general market and exhibit less negative returns than the market during bear markets. We believe this is complimentary to the view of Cochrane and thus provides support for a momentum result of Johnson if dividend changes provide evidence to the market of future changes (in the intermediate but not long-run).Footnote 6 Glascock (1991) reports that real estate stocks exhibit lower betas during bear markets. Glascock (2007) document that REITs have higher betas during bull markets and lower betas during bear markets; thus REITs behave in a manner similar to defensive stocks. Howe and Shilling (1990), Chan et al. (1990), and Glascock and Hughes (1995) document that REITs have lower risks (e.g. lower betas) than the market. Conover et al. (2000) document that a time-varying beta provides good explanations for REIT returns during bull markets. Glascock et al. (2004) show that the value of REITs declined by only about one half that of the overall stock market during the October 1997 stock market decline. Further, it is possible that a significant change in the real estate industry provides explanatory power on momentum returns in REITs found in previous studies. Ambrose and Linneman (2001) argue that the REIT industry went through a fundamental change in the early 1990s. Glascock (2002) indicates that the legislation change in 1992 provided a great opportunity for REITs to grow.Footnote 7

This study hypothesizes that winners and losers differ in their dividend yields, causing momentum returns, and that a positive shock to REITs’ dividend yields in 1992 causes higher momentum returns on REITs during the post-1992 period. We also apply models of up- and down-markets of Cooper et al. (2004). Cooper et al. (2004) defines two states of the market: Up market and down market, using past 3-year market returns. They find that short-term momentum profitability follows “up” markets exclusively. We hypothesize that the momentum patterns of REITs behave oppositely to the prediction of Cooper et al. (2004). Specifically, we propose that due to the unique return behavior of real estate stocks (e.g. higher dividend growth rates and lower volatility in recessions), REITs should generate higher momentum returns during bear markets.

The findings are as follows: First, dividend yields are positively associated with momentum returns, consistent with Johnson’s prediction. Winners have significantly higher dividend yields than losers, causing the momentum phenomenon. Second, REITs’ momentum returns are significantly higher during up markets, consistent with Cooper et. al. Finally, this study finds that momentum returns are higher after the legislation change of REITs in 1992, and there exists a positive dividend growth rate shock in 1992, supporting Johnson’s theory that infrequent and persistent growth rate shocks cause momentum.

The remainder of this paper is organized as follows. The second section describes data, methodology, and hypotheses. The third section presents results. The last section concludes.

Data, Methodology, and Hypotheses

Data

REITs are first identified by the data on National Association of Real Estate Investment Trusts (NAREIT) for the years 1972–2000. Next, this study selects the REITs that have return data available in the Center for Research in Security Prices (CRSP) from 1972 to 2000 sample period. Monthly stock returns for REITs and market index returns over the sample period are obtained from CRSP. The REIT sample includes all the REITs (including equity, mortgage, and hybrid) listed on the NYSE, AMEX, and Nasdaq. In particular, REITs are identified as securities with the following share codes under CRSP’s definitions: 11, 18, and 48. For market index return, this study uses both CRSP equally-weighted and value-weighted indices that include all securities in NYSE/AMEX/Nasdaq as benchmarks for market returns. The sample period begins in 1972 because there were not enough observations to form momentum portfolios before 1972. In 1972, the number of REITs listed in NYSE/AMEX/Nasdaq was 24, and the number increased slightly to 34 in 1982. The number of REITs increased significantly after a legislation change of REITs in 1992. In 2000, there were 172 REITs listed in CRSP.

Define Up- and Down-Markets

Cooper et al. (2004) define a market with two different states: The market is ‘up’ when the 3-year lagged market return is non-negative, and is ‘down’ when the 3-year lagged market return is negative. To increase robustness of testing results, this study uses three methods to define up- and down-markets.

-

(a)

Lagged 3-year market return:

The first method follows the definitions of up- and down-markets of Cooper et al. (2004), and defines markets as up-markets if average lagged 3-year market returns are non-negative. \( r_{t} = {{\left( {{\sum\limits_{i = t - 35}^t {r_{i} } }} \right)}} \mathord{\left/ {\vphantom {{{\left( {{\sum\limits_{i = t - 35}^t {r_{i} } }} \right)}} {36}}} \right. \kern-\nulldelimiterspace} {36} \), where r t is monthly market return. For example, the market on January 1980 is defined as an up-market if the average monthly market return from January 1977 to December 1970 is non-negative.

-

(b)

Lagged 3-year market excess return:

The second method defines markets as up-markets if average lagged 3-year market excess returns are non-negative. \( r_{t} - r_{{f_{t} }} = {{\left( {{\sum\limits_{i = t - 35}^t {{\left( {r_{i} - r_{{f_{i} }} } \right)}} }} \right)}} \mathord{\left/ {\vphantom {{{\left( {{\sum\limits_{i = t - 35}^t {{\left( {r_{i} - r_{{f_{i} }} } \right)}} }} \right)}} {36}}} \right. \kern-\nulldelimiterspace} {36} \), where r t is monthly market return, and \( r_{{f_{t} }} \) is monthly risk-free rate.

-

(c)

Current-month market excess return:

The third method defines the markets as up market if monthly market excess return \({\left( {r_{t} - r_{{f_{t} }} } \right)}\) is non-negative. r t is monthly market return, and \( r_{{f_{t} }} \) is monthly risk-free rate.

Table 1 reports frequencies of up-markets and down-markets during January 1972 to December 2000. The frequency of up-markets using the definition of Cooper et al. (2004) is the highest (76%) among these three definitions, while the third definition (current-month market excess return) reports the lowest frequency (62%) of up-markets.

Form Momentum Portfolios

The convention of forming momentum portfolios is to use techniques of Jegadeesh and Titman (1993).Footnote 8 This study uses two methods to form momentum portfolios: (a) Value-weighted momentum portfolios using techniques of Chui et al. (2003), and (b) Equally-weighted momentum portfolios using techniques of Jegadeesh and Titman (1993).

-

(a)

Value-weighted momentum portfolio:

This study follows the procedure of forming value-weighted momentum portfolios of Chui et al. (2003). The winner (the top 30%) and loser (the bottom 30%) are formed monthly based on 6-month lagged returns and held for 6 months. Monthly compound returns are defined as \( {\left( {{\prod\nolimits_{i = 0}^5 {{\left( {1 + r_{{t - i}} } \right)}} }} \right)}^{{1 \mathord{\left/ {\vphantom {1 6}} \right. \kern-\nulldelimiterspace} 6}} - 1 \), where r is the monthly return of REITs. The securities in the bottom 30% in the ranking are assigned to a loser portfolio, while those in the top 30% are assigned to a winner portfolio.Footnote 9 Winner and loser portfolios are value-weighted monthly, and their respective returns are measured 1-month after the portfolio formation.

Next, we form monthly zero-cost momentum portfolios by entering a long position in winner portfolios and a short position in loser portfolios, and hold the momentum portfolios for 6 months. Momentum portfolios are zero-cost because a momentum trading strategy uses the profits of short-selling losers to purchase winners.Footnote 10

These momentum portfolios are overlapping. For example, the momentum return on December 1972 is the average monthly momentum returns of six momentum portfolios formed on July, August, September, October, November, and December 1972. Two methods are used to calculate monthly momentum returns. The first method calculates the simple average of six monthly momentum returns. \( r_{t} = {{\left( {{\sum\limits_{i = t - 5}^t {r_{i} } }} \right)}} \mathord{\left/ {\vphantom {{{\left( {{\sum\limits_{i = t - 5}^t {r_{i} } }} \right)}} {6 - 1}}} \right. \kern-\nulldelimiterspace} {6 - 1} \), where rt is monthly momentum return. The second method calculates monthly geometric returns. \( r_{t} = {\left[ {{\prod\limits_{i = t - 5}^t {{\left( {1 + r} \right)}_{i} } }} \right]}^{{1 \mathord{\left/ {\vphantom {1 6}} \right. \kern-\nulldelimiterspace} 6}} - 1 \), where r t is monthly momentum return. White’s heteroskedasticity consistent covariances are used to compute the t-statistics.

-

(b)

Equally-weighted momentum portfolio:

This study uses the techniques of Jegadeesh and Titman to form equally-weighted momentum portfolios. Steps of forming equally-weighted momentum portfolios are the same as described in previous section, except that portfolios are equally-weighted.

Methodology and Hypotheses

This study investigates REITs’ momentum returns based on Johnson (2002) and Cooper et al. (2004). The hypothesis statements of this study are as follows. First, dividend-growth shock theory of Johnson (2002) explains REITs’ momentum returns. Second, momentum returns are contingent on market states, i.e., winners and losers have different risk sensitivities to market returns during different market states. Third, the legislation change in 1992 has an impact on REITs’ momentum returns.

The Market Condition Effect

To test the impact of different market conditions on momentum returns, we follow the work of Merton (1981), Henriksson and Merton (1981), Fabozzi and Francis (1977), Cumby and Glen (1990), and Glascock et al. (2007). Equation 1 is used to test changes in portfolio betas during bull and bear markets.

r is the monthly momentum excess return (e.g. momentum return minus risk-free rate), R m is the market excess return, (e.g. return of CRSP market index minus risk-free rate), d = 1 if market is defined as an up market, and d = 0 when market is defined as a down market. The coefficients, α u and β u , correspond to the impact of different market conditions on excess momentum returns. The null hypothesis for β u is that β u ≥ 0, i.e., the relation between momentum excess returns and market excess return is non-negative during up-markets. If the null hypothesis is rejected and β u is significantly negative, it suggests that momentum profits generated from REITs have a smaller sensitivity to market excess returns during up-markets. Similarly, the null hypothesis for the intercept term α u is that α u ≥ 0. If α u is significantly smaller than zero, it suggests that a momentum strategy generates smaller excess returns during up markets.

Winners and Losers

This study uses a dummy variable regression to investigate whether winners and losers have different risk-return behaviors during different market states.

r is monthly excess returns of REITs. d w = 1 if a security is defined as a winner (the top 30%), and d w = 0 if it is a loser (the bottom 30%). R m is the market excess return. If the null hypothesis for β 2 is rejected, it suggests that winners have higher sensitivity (i.e., riskier) to market excess returns than losers. If the null hypothesis for α 2 is rejected, it suggests that winners have higher excess returns than losers.

Structural Change Effect

To test the impact of structural change of REITs in 1992 on momentum returns, we use a dummy variable regression model. A dummy variable is created to represent additional momentum returns after the 1992 structural change.

r is the value-weighted monthly momentum excess return. Dummy variable d s = 1 if an observation is from 1993 to 2000, and d s = 0 otherwise. R m is the market excess return. If the null hypothesis for β 2 is rejected, it suggests that momentum returns have higher sensitivities to market excess returns after the structural change in 1992. Similarly, if the null hypothesis for α 2 is rejected, it suggests that momentum returns are higher after the structural change.

Johnson’s (2002) Dividend Growth Theory

Johnson (2002) predicts that high expected-returns should be associated with high dividend growth rates, and thus there should exist a positive correlation between dividend growth rates and market returns. Johnson (2002) relaxes this assumption for defensive stocks. He predicts that defensive stocks tend to have higher dividend growth rates in recessions. As a result, Johnson’s model predicts that defensive stocks such as real estate securities will have a negative relation between dividend growth rates and stock prices in general, i.e. REITs should have higher dividend growth rates when the overall stock market is in a recession.

Johnson provides a theory model with no empirical work and thus we are the first to test this on a defensive stock. His model has two key aspects for our research. First, his pricing cornel indicates that dividend changes are not predictable but have serial correlation in the medium but not long-term. This means that momentum returns are not risk-free in that there is uncertainty in this process. Second, his theory outcomes fit established momentum empirical work.

-

(a)

Dividend/Price ratio and momentum return

This study uses dividend yields to proxy for dividend growth rates. Dividend yield is defined as D 1/P 0, where D 1 is dollars of dividend paid in current period, and P 0 is stock price in last period. There are two advantages of using dividend yields: First, dividend yields scale dividends with stock prices, as a result, it is meaningful to compare dividend yields among companies. Second, dividend yields are finite and non-negative.

Equation 4 below tests the relation between momentum returns and dividend/price ratios, conditioning on other variables such as market states and structural change in 1992.

$$ r = \alpha _{1} + \alpha _{2} d_{{{\text{up}}}} + \alpha _{3} d_{y} + \beta _{1} {\text{div}} + \beta _{2} R_{m} + \beta _{3} d_{{{\text{up}}}} R_{m} + \beta _{4} d_{y} R_{m} $$(4)where r is the value-weighted monthly momentum return. d u = 1 if the market is defined as an up market. div is the difference between winners’ and losers’ dividend/price yields. d y = 1 if an observation is from 1993 to 2000, and d y = 0 otherwise. R m is the CRSP value-weighted market return. If β 1, the relation between momentum return and dividend/price ratio, is positive, there exists evidence that dividend/price ratios explain momentum returns.

-

(b)

Dividend/Price ratio and market states

To test Johnson’s theory between dividend/price ratios and market returns, this study tests the following regression model.

$$ D \mathord{\left/ {\vphantom {D P}} \right. \kern-\nulldelimiterspace} P = \alpha _{1} + \alpha _{2} d + \beta _{1} R_{m} + \beta _{2} dR_{m} $$(5)Equation 5 studies the relation between REITs’ dividend/price ratios and market returns in different market states. In this equation, D/P is the dividend/price ratio of REITs. d = 1 if R m > 0, and d = 0 otherwise. R m is the market factor. Markets are defined as up-markets if market factors are positive, and are defined as down-markets if market factors are non-positive. If the null hypothesis for α 2 is rejected, it suggests that the D/P ratios of REITs are smaller during up-markets.

-

(c)

Winners and Losers

To investigate whether winners and losers have different dividend/price ratios, we conduct the following two tests. First, use t-statistics to test the equality of the dividend/price ratios of winners and losers. Second, use a dummy variable regression model to test the relation between dividend/price ratios and market returns for winners and losers.

$$ D \mathord{\left/ {\vphantom {D P}} \right. \kern-\nulldelimiterspace} P = \alpha _{1} + \alpha _{2} d_{w} + \beta _{1} R_{m} + \beta _{2} d_{w} R_{m} $$(6)D/P is the dividend/price ratio of REITs. d w = 1 if REITs are defined as winners (the top 30%), and d w = 0 if REITs are defined as losers (the bottom 30%). R m is the market factor. If the null hypothesis for β 2 ≤ 0 is rejected, it suggests that winners’ D/P ratio has higher sensitivity than that of losers. If the null hypothesis for α 2 ≤ 0 is rejected, it suggests that winners’ D/P ratio is higher than that of losers.

-

(d)

Structural change and Dividend/Price ratios

Johnson (2002) argues that innovation shocks, such as technological innovations or business condition changes, may explain momentum returns. Such business condition shocks happen episodically, and increase securities’ dividend growth rates. Johnson assumes that growth rates and risks are positively correlated.Footnote 11 Therefore, higher growth rates caused by fundamental changes will increase both the risks and the returns of securities. As a result, the growth rate shocks explain momentum returns with growth rate risks.

REITs experienced a significant structural change in 1992, which provides a good opportunity to test Johnson’s theory. We use Chow test and t-statistics to test the equality of the dividend/price ratios before and after the structural change.

The Chow (1960) test is constructed by testing whether the sum of squared errors of the pooled sub-samples exceeds the average sum of squared errors of the individual sub-samples. The Chow test follows an F distribution and is defined as:

$$ {\text{Chow}} = \frac{{{{\left( {{\text{SSE}}_{{{\text{whole}}}} - {\text{SSE}}_{{{\text{before}}}} - {\text{SSE}}_{{{\text{after}}}} } \right)}} \mathord{\left/ {\vphantom {{{\left( {{\text{SSE}}_{{{\text{whole}}}} - {\text{SSE}}_{{{\text{before}}}} - {\text{SSE}}_{{{\text{after}}}} } \right)}} K}} \right. \kern-\nulldelimiterspace} K}} {{{{\left( {{\text{SSE}}_{{{\text{before}}}} + {\text{SSE}}_{{{\text{after}}}} } \right)}} \mathord{\left/ {\vphantom {{{\left( {{\text{SSE}}_{{{\text{before}}}} + {\text{SSE}}_{{{\text{after}}}} } \right)}} {{\left( {T - 2K} \right)}}}} \right. \kern-\nulldelimiterspace} {{\left( {T - 2K} \right)}}}} $$SSEwhole, SSEbefore, SSEafter, are the sums of squares of the regression for the whole period, the period before the breakpoint (e.g., legislation change), and the period after the legislation change, respectively. T is the number of observations for the whole period, and K is the number of parameters to be estimated. The Chow test is used to test the following null hypothesis: There is no shock to dividend/price ratios after the legislation change in 1992 (F-statistics is not significant).

Results

Results of this study are summarized as follows: first, momentum returns on REITs are higher during up markets, consistent with Cooper et al. (2004). However, momentum returns are less sensitive to market returns during up markets, when risks are measured by beta coefficients. Second, Johnson’s (2002) dividend growth theory explains momentum returns of REITs. There exists a positive relation between momentum returns and dividend/price ratios. Moreover, winners have significantly higher dividend/price ratios than losers, indicating that higher returns of winners are possibly caused by their higher dividend/price ratios. Finally, REITs experience a significant dividend/price growth increase after the structural change in 1992. This finding is consistent with Johnson’s (2002) dividend growth shock theory, which states that dividend growth shocks are caused by infrequent and persistent structural changes. However, this result do not support Johnson’s view that defensive stocks will perhaps follow this pattern during non-expansion periods—thus, it appears that defensive stocks (to the extent that REITs are a good proxy for such stocks) follow the market in terms of momentum and are not a separate category as Johnson suspected.

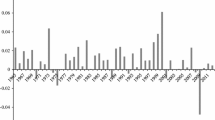

Momentum Returns

Table 2 presents descriptive statistics of value-weighted momentum portfolios using techniques of Chui et al. (2003). During the entire study period from 1972 to 2000, monthly winner portfolios have 23 REITs on average, whereas monthly loser portfolios have 24 REITs on average. Overall, winners have significantly higher returns than losers, and arithmetic monthly returns for winners and losers are larger than those of geometric-average returns. Panel A shows that, from 1972 to 2000, the arithmetic-average monthly momentum return is 0.60%, and the geometric-average monthly momentum return is 0.77%. Using arithmetic approach, winners’ and losers’ returns are both significant during the 1972–2000 period. In contrast, results of geometric-average approach suggest that losers’ geometric-average returns are not significant. Panel B suggests that, from 1983 to 2000, the arithmetic-average monthly momentum return is 0.80%, and the geometric-average monthly return is 1.01%. Panel C and D present momentum returns before and after the structural change of REITs in 1992. The arithmetic-average monthly momentum return during the pre-1992 period is 0.52% (significant at 1% level), whereas the average monthly momentum return during the post-1992 period is 0.81% (also significant at 1% level), suggesting that momentum returns are higher after 1992.

Table 3 presents returns of equally-weighted winner, loser, and momentum portfolios, using the techniques of Jegadeesh and Titman (1993). Results of equally-weighted momentum portfolios are similar to those of value-weighted portfolios.

The Market Condition Effect

Table 4 presents results of momentum returns on Eq. 1. Panel A on Table 4 shows that, using the arithmetic average method, momentum excess returns in REITs are higher during up-markets. α 2 is significantly positive, consistent with findings of Cooper et al. (2004).

Winners and Losers

Table 5 suggests that winners are not riskier than losers, since β 2 is not significantly different from zero. However, winners do exhibit higher returns than losers. Both arithmetic-average and geometric method show that α 2 is significantly positive at 1% level, suggesting. This finding is consistent with Jegadeesh and Titman (1993, 2001), Cooper et al. (2004), and Chui et al. (2003).

Structural Change in 1992

This study hypothesizes that the legislation change in 1992 generates a positive shock to REITs’ momentum returns. Table 6 reports the impact of the structural change on REITs’ momentum returns. α 2 is not significantly at 5% level for both arithmetic and geometric returns, suggesting that momentum returns are not higher after the 1992 structural change.

Dividend Growth Theory

Dividend/Price Ratio and Momentum Returns

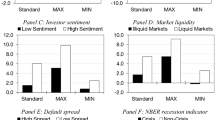

Table 7 reports regression results for Eq. 4 using arithmetic-average approach. Model 1 suggests there exists a positive relation between momentum returns and D/P ratios (β 1 = 0.12 with a p value of 0.044), meaning that momentum returns are higher when the difference between winners’ and losers’ D/P ratios is higher. Additionally, momentum returns are significantly higher during up-markets (α 2 = 0.007 with a p value of 0.018), when up-markets are defined with the 3-year lagged market definition of Cooper et al. (2004). Model 2 in Panel A adds risk sensitivities to market returns in Eq. 4, and it shows similar results as Model 1. Momentum returns are higher during up-markets (α 2 = 0.009 with a p value of 0.002), and are higher when the difference between winners’ and losers’ D/P ratios are higher (β 2 = 0.145 with a p value of 0.016). Momentum returns’ risk sensitivity to market returns, β 2, is not significant. β 3, momentum returns’ risk sensitivity to market returns during up-markets, is not significant, either.

Panel B uses momentum excess return as the dependent variable, and market excess returns as one of the independent variables. Results are similar to those in Panel A.

Panel C uses the most conservative definition of up-markets, current-month market excess return, to increase the robustness of regression results. Model 5 in Panel C shows that momentum returns cannot be explained by D/P ratios or market states. α 2 and β 1 are not significant at 5% level. This result is not surprising because Panel C uses the most conservative method to define up-markets. However, Model 6 suggests that D/P ratios and market states together explain momentum excess returns at 5% level. α 2 equals to 0.008 with a p value of 0.021, and β 1 equals to 0.171 with a p value of 0.020. It suggests that even using the most conservative measure to define up-markets, momentum returns are significantly higher during up-markets, and the difference between winners’ and losers’ dividend yields positively correlates to momentum excess returns. This suggests that Johnson’s thesis about defensive stocks does not hold for our REIT sample.

β 2, the risk sensitivity of momentum return to market return, is not significant. β 3, the risk sensitivity of momentum return to market return during up-markets, is significantly negative at 5% level, suggesting that momentum returns are less sensitive to market returns during up-markets. This is consistent with the expectations of Cochrane (1999) and with the outcomes of Fama and French (1996). Cochrane does not expect momentum returns to be associated with beta risk and Fama and French find that neither beta risk nor other common factors (value less growth and small cap less large cap stock factors).

Merton’s (1971a, b) theory suggests that variables which predict market returns should provide factors that explain cross-sectional returns. But there has been little work in this area. Cochrane (1996) and Jagannathan and Wang (1996) use scaled returns (including a factor of dividend/price ratio adjustments) to provide related tests and find that these provide cross-sectional explanation of the returns. Thus, Johnson’s theory fits in with these expectations and limited outcomes: dividend growth could help explain momentum behavior and does for this sample of REITs—however, it does not work for non-growth periods.

Panel D tests whether the structural change of REITs in 1992 and dividend yields jointly explain momentum excess returns. Model 7 shows that α 3 equals to 0.006 (p value = 0.022), and β 1 equals to 0.145 (p value = 0.019), meaning that momentum returns of REITs are higher after the structural change in 1992, and the difference between winners’ and losers’ dividend yields positively correlates to momentum excess returns. β 2, the risk sensitivity of momentum return to market return, and β 4, the risk sensitivity of momentum return to market return after 1992, are not significant.

Table 8 reports regression results for Eq. 4, using geometric-average momentum return as the dependent variable. Compared to Table 7, the overall significance (F-statistics) in Table 8 improves and all regressions are significant at 1% level. The signs of all coefficients are consistent as those in previous table.

Dividend/price Ratio and Market States

Table 9 shows that using value-weighted market returns, dividend/price ratios of REITs are 0.07% higher during up-markets. α 2 equals to 0.07% and is statistically significant at 5% level.

Winners and Losers

Table 10 presents dividend/price ratios for winners and losers. Winners have a 0.62% dividend/price ratio on average, whereas losers have a 0.56% dividend/price ratio on average. The difference between winners’ and losers’ dividend/price ratios is significantly positive at 5% level. Winners’ average dividend/price ratio is 0.06% higher than that of losers’. This finding supports Johnson’s prediction that winners and losers differ in dividend growth rates.

Table 11 reports results of the relationship between dividend/price ratios and market returns for winners and losers using Eq. 6. It shows that winners have higher dividend/price ratios than losers. The null hypothesis of α 2 is rejected at 5% level. The dividend/price ratios of winners are 0.05% higher than those of losers. The findings support Johnson’s prediction that winners have higher dividend growth rates than losers.

Dividend/Price Ratio and the Structural Change

Finally, to investigate the impact of structural change of REITs in 1992 on Dividend/Price ratios of REITs, we use two methods: a Chow test and an equality test.

Table 12 reports results of the Chow test. F-statistics of Chow-test is 16.7, significant at 1% level, suggesting that dividend/price ratios experienced a significant change after January 1993. Table 13 reports the average dividend/price ratios of REITs before and after January 1993. The equality test suggests that dividend/price ratio of REITs is 0.2% higher after 1992, statistically significant at 1% level.

Overall, results of the Chow test and the equality test of dividend/price ratios before and after January 1993 suggest evidence that dividend/price ratios of REITs experience a structural change after 1992, and the dividend/price ratios are significantly larger after the structural change. This finding is consistent with the finding presented in previous section, which suggests that momentum returns are significantly higher after the structural change. Therefore, higher momentum returns after 1992 are associated with higher dividend/price ratios, consistent with Johnson’s prediction that stocks experienced positive growth rate shocks will have higher future returns.

Conclusion

The results presented in this research support Cooper et al. (2004), who find that momentum returns of US stocks are significantly positive only during lagged 3-year up markets. We find that momentum returns of REITs are higher during up markets. Moreover, we find that higher returns do not accompany with higher risks, consistent with conclusions of previous literature that momentum returns are not explained by risks.

However, unlike Cooper et al. (2004) who explain their findings with the overconfidence theory in behavioral literature, this study explains momentum returns with Johnson’s (2002) risk-based dividend growth theory. Consistent with Johnson’s prediction, we find that winners’ dividend/price ratios are indeed higher than those of losers, and that conditioning on market states, momentum returns are positively correlated with the difference between winners’ and losers’ dividend/price ratios. Further, we report that momentum returns are higher after the legislation change on REITs in 1992, and dividend/price ratios of REITs are also higher after 1992. Conditioning on the structural change, there is a positive relationship between momentum returns and the difference between winners’ and losers’ dividend yields. Therefore, the persistent shock to REITs’ dividend/price ratios in 1992 partly explains REITs’ higher momentum returns after 1992.

The results of this study are not consistent with Johnson’s prediction for cyclical stocks. We find that REITs’ momentum returns are lower during bear markets. The explanation is that REITs’ dividend/price ratios increase with market returns. Our findings suggest that REITs’ dividend/price ratios are positively correlated with market returns. Overall, momentum returns in REITs can be explained jointly by a time-contingent factor, market state, and a cross-sectional variance in dividend yields.

Notes

Jegadeesh and Titman (1993) defines momentum strategy as shorting stocks with the lowest average returns over a 3–12 month period, using the profits from short-sells to buy stocks with the highest average returns over a 3–12 month period, and holding this zero-cost portfolio for 6–12 months.

Fama (1991) defines a market as weakly efficient if all past price information has been reflected in current stock prices, the market is semi-strong efficient if all public information has been reflected in current stock prices, and it is strongly efficient if all inside and public information has been reflected in current stock prices.

Johnson provides a pricing model where dividend changes signal additional dividend changes in the intermediate but not long-run. His purpose is to show in a theory model that momentum could be the result of intermediate serial correlations in dividend changes which are not forecastable in the short run and which do not persist in the long-run. His model has two key features: one the market is rational in its reaction and thus momentum is associated with a (previously) unobserved risk and these effects do not last—thus, this theory model provides expected outcomes consistent with empirical observations in the momentum literature.

Cochrane sees value stocks as a special case of this class of stocks: those that provide ‘safety’ during economically turbulent times. REITs in the Johnson world would also provide such safety—as such they would experience momentum to the extent that their increased dividends have serial correlation in the intermediate but not long-run. The REITs provide safety in two ways: first, the dividend increases show strength in bad times and these dividends allow investors to disinvest (asset reallocate) without selling and facing immediate price effects.

If the market views stocks that are safer during economic hardship times as ‘better’ stocks and thus bids down their returns, we would expect that REITs might fit into this category.

In 1992, the ‘UPREIT’, or Umbrella Partnership REIT, was developed as a vehicle to enable property owners to defer recognition of taxable capital gains on properties contributed to REITs in exchange for partnership units. UPREITs have accounted for nearly two-thirds of all newly formed REITs since 1992. Up to today, over half of the largest REITs are organized as UPREITs.

Jegadeesh and Titman (1993) use overlapping samples and cumulative average returns (CAR) to measure momentum returns. Because cumulative average returns are known to cause an upward bias, this study does not measure momentum returns in terms of CAR.

The convention of momentum studies is to use a 10% breakpoint. However, due to the smaller size of the REIT sample, this study chooses 30% as breakpoint for winners and losers.

Since momentum returns require zero cost, the computation of momentum return may not be meaningful. This study defines momentum returns as investing one dollar in the winner portfolio and shorting one dollar in the loser portfolio.

Cochrane (1999) argues in a similar manner that unobserved risks may be responsible to momentum returns. In particular, Cochrane argues, “Momentum returns have also not been linked to business or financial cycles in even the informal way that I suggested for price based strategies.” However, Johnston provides such a link from dividend growth to business cycles and momentum returns (particularly) in defensive stocks.

References

Ambrose, B., & Linneman, P. D. (2001). Organization and REIT operating characteristics. Journal of Real Estate Finance and Economics, 21, 141–162.

Chan, K.C., Hendershott, P., & Sanders, A. (1990). Risk and return on REITs: Evidence from equity REITs. The Journal of American Real Estate and Urban Economics Association, 18, 431–452.

Chow, G. C. (1960). Test of equality between subsets of coefficients in two linear regression models. Econometrica, 28, 591–605.

Chui, A. C. W., Titman, S., & Wei, K. C. J. (2003). Intra-industry momentum: The case of REITs. Journal of Financial Markets, 6, 363–387.

Cochrane, J. H. (1996). A cross-sectional test of an investment based asset model pricing model. Journal of Political Economy, 104, 572–621.

Cochrane, J. H. (1999). New facts in finance. Working paper no. 490, The Center for Research in Security Prices, University of Chicago, Chicago, June.

Conover, C. M., Friday, H. S., & Howton, S. W. (2000). An analysis of the cross section of returns for REITs using a varying-risk beta model. Real Estate Economics, 28, 141–163.

Cooper, M., Gutierrez, R. C., & Hameed, A. (2004). Market states and momentum. Journal of Finance, 59, 1345–1365.

Cumby, R., & Glen, J. (1990). Evaluating the performance of international mutual funds. Journal of Finance, 45, 197–521.

Fabozzi, F. J., & Francis, J. C.(1977). Stability tests for alphas and betas over bull and bear market conditions. Journal of Finance, 32, 1093–1099.

Fama, E. F. (1991). Efficient capital markets: II. The Journal of Finance, 46, 1575–1617.

Fama, E. F., & French, K. R. (1996). Multifactor explanations of asset pricing anomalies. Journal of Finance, 50, 131–155.

Glascock, J. L. (1991). Market conditions, risk, and real estate portfolio returns: Some empirical evidence. Journal of Real Estate Finance and Economics, 4, 367–373.

Glascock, J. L. (2002). REIT returns and inflation: Perverse or reverse causality effects? Journal of Real Estate Finance and Economics, 24, 301–317.

Glascock, J. L. (2007). Securitized real estate: American REIT experience, history, lessons, and recommendations. Working paper, Cambridge University, Cambridge.

Glascock, J. L., & Hughes, W. T. (1995). NAREIT identified exchange listed REITs and their performance characteristics, 1972–1990. Journal of Real Estate Literature, 3, 63–83.

Glascock, J. L., Michayluk, D., & Neuhauser, K. (2004). The riskiness of REITs surrounding the October 1997 stock market decline. Journal of Real Estate Finance and Economics, 28(4), 339–354.

Glascock, J. L., So, R. W., & Lu, C. (2007). Excess return and risk characteristics of Asian exchange-listed real estate. Working paper, Cambridge University, Cambridge.

Henriksson, R. D., & Merton, R. C. (1981). On market timing and investment performance: Statistical procedures for evaluating forecasting skill. Journal of Business, 54, 513–533.

Howe, J. S., & Shilling, J. D. (1990). REIT advisor performance. Journal of the American Real Estate and Urban Economics Association, 18, 479–500.

Jagannathan, R., & Wang, Z. (1996) The conditional CAPM and the cross-section of expected returns. Journal of Finance, 51, 3–53.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stocks market efficiency. Journal of Finance, 48, 65–91.

Jegadeesh, N., & Titman, S. (2001). Profitability of momentum strategies: An evaluation of alternative explanations. Journal of Finance, 56, 699–720.

Jegadeesh, N., & Titman, S. (2002). Cross-sectional and time-series determinants of momentum returns. Review of Financial Studies, 15, 143–157.

Johnson, T. C. (2002). Rational momentum effects. Journal of Finance, 57, 585–608.

Merton, R. C. (1971a). Optimal consumption and portfolio rules in a continuous time case. Review of Economics and Statistics, 51, 247–257.

Merton, R. C. (1971b). An intertemporal capital asset pricing model. Journal of Economic Theory, 41, 867–887.

Merton, R. C. (1981). On market timing and investment performance, I. An equilibrium theory of value for market forecasts. Journal of Business, 54, 363–406.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Hung, SY.K., Glascock, J.L. Momentum Profitability and Market Trend: Evidence from REITs. J Real Estate Finan Econ 37, 51–69 (2008). https://doi.org/10.1007/s11146-007-9056-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-007-9056-4