Abstract

Discounting future costs and benefits is a crucial yet contentious practice in the appraisal of long-term public projects with environmental consequences. The standard approach typically neglects that ecosystem services are not easily substitutable with market goods and often exhibit considerably lower growth rates. Theory has shown that we should either apply differentiated discount rates, such as a lower environmental discount rate, or account for increases in relative scarcity by uplifting environmental values. Some governments already integrate this into their guidance, but empirical evidence is scarce. We provide first comprehensive country-specific evidence, taking Germany as a case study. We estimate growth rates of 15 ecosystem services and the degree of limited substitutability based on a meta-analysis of 36 willingness to pay studies in Germany. We find that the relative price of ecosystem services has increased by more than four percent per year in recent decades. Heterogeneity analyses suggest that relative price changes are most substantial for regulating ecosystem services. Our findings underscore the importance of considering relative price adjustments in governmental project appraisal and environmental-economic accounting.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recent decades are characterized by unparalleled growth of market goods and by the degrowth of ecosystem services (IPBES 2019; IPCC 2021; UNEP 2021).Footnote 1 Standard approaches for the economic appraisal of public projects capture the growth of market goods as a justification for discounting future consumption, but often do not explicitly reflect or completely neglect the stagnation or degrowth of ecosystem services and their limited substitutability when discounting future comprehensive consumption flows.

Sterner and Persson (2008) have put a spotlight on the detrimental effects of climate change on non-market ecosystem services, such as the loss of biodiversity or environmental amenities. Sterner and Persson (2008) and subsequent work (Bastien-Olvera and Moore 2021; Drupp and Hänsel 2021) have studied how the increasing scarcity and limited substitutability of ecosystem services vis-à-vis market goods affects optimal climate policy via good-specific discount rates or relative price changes (RPCs).Footnote 2 Drupp and Hänsel (2021), for instance, estimate that relative prices of non-market goods increase by around 2 to 4 percent per year, leading to a social cost of carbon that is more than 50 percent higher as compared to a case where goods are perfectly substitutable. Accounting for such RPCs may thus be crucial for the appraisal of public projects with environmental consequences.

A limited number of governmental guidelines on project appraisal have already started to reflect the increasing relative scarcity of ecosystem services. The Netherlands and the UK, for instance, consider increasing relative prices of ecosystem services by uplifting future willingness to pay (WTP) estimates of ecosystem services or air pollution damages of 1 and 2 percent per year, respectively. Other institutions, such as the Asian Development Bank, instead suggest the use of lower discount rates for ecosystem services (Groom et al. 2022). The guidelines in The Netherlands also allow for differentiated RPCs that deviate from 1 percent if ecosystem services exhibit very different growth rates or if ecosystem services are much more or much less substitutable. A key obstacle for a more systematic and widespread adoption is that empirical evidence to inform relative price adjustments or differentiated discount rates is very scarce. This paper seeks to help fill this gap.

The contribution of this paper is to provide comprehensive and consistent estimates of RPCs of non-market ecosystem services at a country-level, considering Germany as a case study. To this end, we build on the literature on environmental discounting and relative price change (e.g., Baumgärtner et al. 2015; Drupp 2018; Gollier 2010; Guesnerie 2004; Hoel and Sterner 2007; Traeger 2011; Weikard and Zhu 2005) that builds on similar work by Malinvaud (1953) and Krutilla (1967). This literature has shown that the change in relative prices of ecosystem services over time is given by the inverse of the elasticity of substitution and the difference in the two good-specific growth rates in the workhorse model of discounted Utilitarianism and constant-elasticity-of-substitution preferences. Relative prices increase over time if the two goods are less than perfect substitutes and if ecosystem services grow at a lower rate as compared to market goods.

Previous studies have estimated RPCs of non-market goods by calculating the elasticity of substitution via the income elasticity of WTP as estimated based on non-market valuation studies (Baumgärtner et al. 2015; Drupp 2018) and by estimating good-specific growth rates either based on historical time series (Baumgärtner et al. 2015) or as endogenous outcomes in global integrated climate-economy assessment models (e.g., Drupp and Hänsel 2021). Baumgärtner et al. (2015) were the first to estimate RPCs for the global level and for selected countries (Brazil, Germany, India, Namibia, and the UK). They apply national growth rates for the country-level results but assume that the elasticity of substitution is constant across all countries and ecosystem service types. Specifically, they derive the elasticity of substitution based on a single meta-analysis by Jacobsen and Hanley (2009), who estimate an income elasticity of WTP for global biodiversity conservation. On this basis, Baumgärtner et al. (2015) estimate a constant yearly relative price increase of ecosystem services of 0.91 ± 0.35 percent at the global level and of 0.73 ± 0.48 percent in Germany.Footnote 3 Due to a lack of country-specific estimates of substitutability, such global-level estimates have subsequently been integrated into governmental policy guidance, notably in The Netherlands (e.g., Groom and Hepburn 2017; Koetse et al. 2018).

Our paper is motivated by the policy need for country-specific estimates of RPCs, and we provide first comprehensive and consistent evidence on RPCs of ecosystem services for Germany. Specifically, we derive an elasticity of substitution between market goods and ecosystem services by relying on a theoretical result of Ebert (2003) that specifies an inverse relationship between the constant elasticity of substitution and the constant income elasticity of the WTP for ecosystem services. To this end, we conduct a meta-regression analysis based on 36 German WTP studies for ecosystem services to estimate the income elasticity of the WTP for a comprehensive basket of ecosystem services, equivalent to the analysis of Jacobsen and Hanley (2009) that has focused on global biodiversity conservation. This yields an estimate of the income elasticity of WTP of 2.96 ± 1.29 when considering all publications and 3.36 ± 1.46 when considering peer-reviewed publications only, suggesting mean elasticities of substitution of 0.34 and 0.30. This is close to the degree of complementarity assumed by Sterner and Persson (2008) and much lower than the value of 2.63 used by Baumgärtner et al. (2015). We further update and extend the estimates of growth rates of ecosystem services and market goods for Germany. Specifically, we assess aggregate ecosystem services growth based on the development of 15 ecosystem services. In line with the global trend, ecosystem service provision is under pressure in Germany: climate change threatens both forests’ health and agricultural production (e.g., Brasseur et al. 2017; BMEL 2019). Also, local biodiversity loss is, in parts, severe and natural groundwaters are strongly polluted due to extensive agriculture (e.g., Nausch et al. 2011; BUND 2019; Seibold et al. 2019). On aggregate, our data suggests that ecosystem services are declining by 0.31 ± 0.47 percent per year based on the whole time span and by 0.08 ± 0.70 in the current trend. This is close to the decline rate of 0.13 ± 0.55 estimated by Baumgärtner et al. (2015).

Combining all elements, including estimation errors and their propagation, we estimate an average yearly change in relative prices of ecosystem services of between 4.06 ± 3.84 percent and 4.60 ± 4.35 percent for Germany, depending on the specification. This contrasts with an estimate of RPCs of only 0.73 ± 0.48 percent for Germany by Baumgärtner et al. (2015). Heterogeneity analyses indicate, among others, that RPCs are most substantial for regulating ecosystem services, such as climate or water regulation, which show the largest rates of degrowth and tend to be complementary to market goods. Overall, our analysis suggests that Germany, among other countries, should consider introducing relative price adjustments of environmental values to reflect the increasing relative scarcity of ecosystem services in project appraisal and environmental-economic accounting. Beyond that, our estimates indicate that relative price adjustments should likely be larger than previously estimated (cf., Baumgärtner et al. 2015; Drupp 2018) and thereby confirm Baumgärtner et al.’s (2015) hypothesis that their results likely provide a conservative estimate of RPCs of ecosystem services.

The remainder of this paper is structured as follows: Section 2 provides the theoretical background, while Sect. 3 presents the data and estimation approaches to gather empirical estimates of the good-specific growth rates and the elasticity of substitution. In Sect. 4, we present the results and combine these elements to provide empirical estimates of RPCs for Germany. Section 5 discusses limitations, while Sect. 6 concludes.

2 Theoretical Background

The standard approach to social discounting considers a single consumption good, commonly defined in terms of comprehensive consumption equivalents that include a host of goods and services that are not traded on markets, such as environmental amenities, health, or cultural goods. In practice, these non-market goods are often disregarded when calibrating social discount rates. As we detail below, this is problematic even if the social discount rates are solely used to evaluate market goods over time. To consider non-market goods explicitly and derive dual discount rates or RPCs, we rely on a utility function that features ecosystem services as a direct source of utility, U \(\left({\text{C}}_{\text{t}}\text{,}{\text{ E}}_{\text{t}}\right)\). Using dual discount rates or adjusting relative prices of ecosystem services vis-à-vis market goods at each point in time and then using a single discount rate are equivalent except in the special case of perfect complements (Weikard and Zhu 2005). One approach adjusts the denominator (using dual discount rates) of the net-present value equation, the other the numerator (using RPCs). We showcase and derive both approaches and their equivalence below, following the previous literature (e.g., Weikard and Zhu 2005; Baumgärtner et al. 2015).

First, for the derivation of the dual discounting model, we consider an intertemporal welfare function in the standard approach of time-discounted Utilitarianism in a deterministic setting, which is given by:

where U \(\left({\text{C}}_{\text{t}}\text{,}{\text{ E}}_{\text{t}}\right)\) is an instantaneous utility function that reveals the agent’s preferences over the consumption of a composite market good, \({\text{C}}_{\text{t}}\text{,}\) and a composite non-market ecosystem service, \({\text{E}}_{\text{t}},\) at time t. The (constant) rate of pure time preference is represented by δ > 0, which is the rate at which utility is discounted. It is assumed that the function U (·, ·) has standard properties, meaning that it is twice continuously differentiable, exhibits strictly positive and decreasing marginal utility in both arguments, and is concave. \({\text{U}}_{\text{C}}\) and \({\text{U}}_{\text{E}}\) stand for the first partial derivatives, and \({\text{U}}_{\text{CC}}\), \({\text{U}}_{\text{CE}}\), \({\text{U}}_{\text{EE}}\), \({\text{U}}_{\text{EC}}\) for the second. The good-specific discount rates for the market good, \({\text{r}}_{\text{C}}\), and ecosystem service, \({\text{r}}_{\text{E}}\), are given by (cf., Weikard and Zhu 2005; Heal 2009; Traeger 2011):

Equation (2) clarifies that determining social discount rates for market goods, \({\text{r}}_{\text{C}}\), while ignoring non-market goods, such as in the standard simple Ramsey Rule \(\left( {r_{C} = \delta - \frac{{U_{CC} \left( {C_{t} } \right)C_{t} }}{{U_{C} \left( {C_{t} } \right)}}\frac{{dC_{t} /d_{t} }}{{C_{t} }}} \right)\), is only valid in special cases. Specifically, it is valid only if non-market goods consumption does not affect marginal utilities of market goods consumption, see the second term in Eq. (2), and if ecosystem services are stagnant across the whole time horizon or if the cross-elasticity between the two goods is zero, see the third term in Eq. (2).

By contrast, a single social discount rate is adequate when RPCs are already appropriately reflected in the monetized current and future benefits of non-market goods. These benefits can be estimated using non-market valuation techniques, potentially coupled with explicit approaches to address changing relative (shadow) prices over time. RPCs are then derived as the change in the marginal rate of substitution over time:

We now make a further assumption on the structure of utility that yields the workhorse expression of dual discounting and of RPCs. Specifically, we assume that the utility function is characterized by constant-elasticity-of-substitution (CES) preferences between market goods and the ecosystem service in instantaneous consumption, and a constant intertemporal elasticity of substitution of comprehensive consumption (isoelastic utility):

where γ stands for the relative weight of market goods consumption in instantaneous aggregate consumption, σ denotes the elasticity of substitution between market goods and ecosystem services in instantaneous utility, and 1/η denotes the elasticity of intertemporal substitution of comprehensive consumption. If σ > 1 (σ < 1) [= 1], market goods and ecosystem services are substitutes (complements) [Cobb Douglas]. The difference between good-specific discount rates, equivalent to the change in relative prices, can be written as (e.g., Baumgärtner et al. 2015; Hoel and Sterner 2007; Traeger 2011):

Equation (6) shows that the difference in discount rates across both goods, \(\Delta r\), and the RPC depends on the elasticity of substitution, σ, and the difference in growth rates of market goods, \({\text{g}}_{\text{C}}\), and ecosystem services, \({\text{g}}_{\text{E}}\). In general, discount rates for market goods and ecosystem services differ, \(\Delta r \ne 0\), when market goods and ecosystem services are no perfect substitutes in consumption, σ < + ∞, and the growth rates for both goods diverge, \(g_{C}\) \(\ne g_{E}\). Specifically, the discount rate for ecosystem services is lower than for market goods, \(\Delta r\) > 0, if the two goods are imperfect substitutes and the consumption of ecosystem services grows at a lower rate than that of market goods, \({\text{g}}_{\text{C}}\) > \({\text{g}}_{\text{E}}\). Conversely, the discount rate for ecosystem services is higher, \(\Delta r < 0\), if the two goods are no perfect substitutes in consumption, σ < + ∞, and the consumption of ecosystem services grows at a larger rate than the consumption of market goods, \({\text{g}}_{\text{C}}\) < \({\text{g}}_{\text{E}}\). The special cases of perfect substitutability between market goods and ecosystem services, σ = + ∞, and (or) equal growth rates of market goods and ecosystem services, \({\text{g}}_{\text{C}}\) = \({\text{g}}_{\text{E}}\), yield the same good-specific discount rates and no change in relative prices over time: \(\Delta r = 0\). Equation (6), and the assumptions underlying it, establish our theoretical background for estimating RPCs for Germany in the subsequent sections.

3 Data Analysis

3.1 Data

3.1.1 Estimating the Elasticity of Substitution via the Income Elasticity of WTP

Estimating the elasticity of substitution between market goods and ecosystem services is challenging, and so far, no study has proposed a direct method of estimating it. Nevertheless, the literature has suggested an indirect approach of inferring it via its relationship to the income elasticity of the WTP for ecosystem services (Baumgärtner et al. 2015, 2017a; Yu and Abler 2010), which is denoted as \({\epsilon }_{W}\) and given by:

where y stands for income, and W is a “bid function” for WTP (Flores and Carson 1997; Hökby and Söderqvist 2003). Based on an earlier result of Kovenock and Sadka (1981), Ebert (2003) has shown that for constant-elasticity-of-substitution preferences, the income elasticity of the WTP for ecosystem services, \(\epsilon_{W} ,\) has an inverse relationship to the constant elasticity of substitution, σ, i.e., \(\epsilon_{W} = 1/\sigma\). This relationship implies that the income elasticity of the WTP for ecosystem services is smaller (larger) unity if market goods and ecosystem services are substitutes (complements). Our key equation for estimating RPCs thus boils down to \(RPC_{t} = \epsilon_{W} \left( {g_{{C_{t} }} - g_{{E_{t} }} } \right)\).

The literature provides several individual estimates for the income elasticity of the WTP for ecosystem services. Baumgärtner et al. (2015) build on a global meta-analysis on the income effects of global biodiversity conservation by Jacobsen and Hanley (2009). Jacobsen and Hanley (2009) bring together the results of 46 contingent valuation studies that focus on non-use values of biodiversity or habitat conservation and that were carried out across six continents. Similar analyses, for instance, refer to the WTP for ecosystem services in Sweden (Hökby and Söderqvist 2003), global marine ecosystem services (Liu and Stern 2008), or global values of threatened species (Subroy et al. 2019).

To estimate the elasticity of substitution between market goods and ecosystem services via the income elasticity of WTP, we take a similar approach and conduct a meta-analysis based on German WTP studies for ecosystem services. For this, we seek to include as many WTP estimates for ecosystem services as possible to derive the elasticity of substitution for a composite ecosystem service.

3.1.1.1 Search, Screening, and Data Collection for Meta-Analysis

The first step in a meta-analysis is a systematic search. In August 2019 as well as in April 2020, we conducted an online search for studies investigating the WTP for ecosystem services within Germany. Studies eligible for selection were peer-reviewed and non-peer-reviewed journal articles but also books, book sections, and dissertations. We chose this broad scope to ensure a sufficient amount of data for the analysis. We searched for studies via “Google Scholar”, “Scopus”, and “Web of Science”. We used the keywords “willingness to pay environment Germany” (or in German: “Zahlungsbereitschaft für Umweltgüter”). After this initial search, we replaced the term “environment” with more precise search-terms such as “CO2 reduction”, “biodiversity”, or “forests”. In addition, we identified studies via backward-search, that is, through referencing in other studies. The search also made use of a literature review focusing on forest valuation studies (Elsasser et al. 2016). We requested studies that were not freely available via the researchers’ platform “ResearchGate”. If this was not possible, we contacted the authors directly. Almost all of these e-mails received positive replies. This search- and gathering-process yielded more than 100 studies for deeper scrutiny.Footnote 4

In the second step, we screened studies for mean WTP estimates and net household income data of the sample. Many studies provided more than one WTP estimate. In general, we took up all WTP values, as long as they referred to the valuation of an ecosystem service.Footnote 5 If the study did not provide mean WTP values, we dropped the study from the overall sample.Footnote 6 Many studies did not provide net household income as a sample mean value. Yet, in many cases, net household income was provided through percentage shares of income categories (e.g., Achtnicht 2011). In these cases, we calculated the mean sample income by weighting the midpoints of the income range by the percentage sizes. When net household income was provided as monthly income, we multiplied it by twelve to obtain annual income values. For two studies, income was provided as gross household income. In these cases, we used German basic tax rates of the respective years to calculate net income (BMF 2019). We clarified with authors directly if it was unclear whether reported income data referred to net household values.

In the third step, we excluded all studies that were run before the year 2000 to focus on reasonable recent estimates that may more adequately reflect current attitudes of the German population. Ultimately, the search and subsequent screening process yielded 36 studies providing 159 individual mean WTP estimates for ecosystem services. As Table B.1 in the Appendix shows, the majority of WTP studies use the contingent valuation method and choice experiments, but they also include three framed field experiments. We inflated all monetary values to 2019 price levels using the German consumer price index by DESTATIS (2019a).Footnote 7

3.1.1.2 Explanatory Variables

We focus on the effect of income on WTP to derive the income elasticity of the WTP for ecosystem services and, thus, inversely also the elasticity of substitution. Therefore, income is the main explanatory variable in our analysis. We identify two primary sources for variation in the income variable. First, variation stems from studies relying on different, often non-representative, subsamples within the German population, where sizeable regional income differences persist (Seils and Pusch 2022). Second, variation is due to income changes over time based on (moderate) German economic growth since 2000 (DESTATIS 2023). Analyzing different regional and temporal subsamples of our dataset suggests that income variation is primarily due to regional income contrasts.Footnote 8 We further collected data on additional explanatory variables to control for study and sample characteristics of the individual studies.

We list all explanatory variables in Table 1.Footnote 9 We introduce explanatory variables based on different study and sample features. First, we observe basic characteristics of sample data. Second, we collect data on the study approach and design. Third, we gather data on the ecosystem service under study and, in particular, create dummy variables to distinguish between different ecosystem service types (e.g., climate change mitigation).

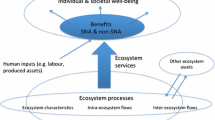

3.1.2 Measuring Good-Specific Growth Rates

We draw on the framework of the Millennium Ecosystem Assessment (MEA) (MEA 2005) to categorize ecosystem services and to measure their growth rate, as this allows for a better comparability with previous results (e.g., Marzelli et al. 2014; Baumgärtner et al. 2015; TEEB DE 2017).Footnote 10 The MEA framework allocates 24 specific ecosystem services to three major categories: provisioning, regulating, and cultural services. Provisioning services refer to the direct or indirect provision of products by ecosystems (e.g., food production). Regulating services refer to services that impact ecosystem components and processes for human benefit (e.g., climate regulation). Cultural services provide nature-based channels such as for personal development, leisure activities, and spiritual development (e.g., recreation and ecotourism).

3.1.2.1 Indicators for Measuring Growth Rates of Ecosystem Services

For representing the development of specific ecosystem services, according to the categorization of the MEA, we searched for time-series on appropriate indicators or proxies. The indicators had to cover a time span of at least 10 years to guarantee a minimum level of accuracy. Generally, we preferred longer time-series to increase the level of accuracy. The oldest data refers to the year 1951, and the most current data is for the year 2018.

Table 2 shows the 24 specific ecosystem services of the MEA categorization.Footnote 11 Beyond that, Table 2 presents the selected indicators for representing the development of the specific ecosystem services. It also provides the units of measurements and the time spans of the indicators, as well as the sources from which indicators were retrieved. In total, we assessed the development of 15 of the 24 specific ecosystem services introduced in the MEA framework.Footnote 12 We retrieved indicators from four different sources: the Food and Agriculture Organization (FAO) provided the majority of the data. In particular, FAO offers long time-series on indicators for food production and fiber provision. The German Federal Environmental Agency (UBA), the German Federal Statistics Office (DESTATIS), and the World Bank provided additional indicators. While indicators for food and wood production are readily available, it is less straightforward to select and find good data for the development of regulating and cultural services. We build on Baumgärtner et al. (2015) and additionally choose indicators deemed as capturing the most appropriate channels for the growth of ecosystem services (see Appendix I for more details).

3.2 Empirical Approach

3.2.1 Estimating Substitutability

To estimate the income elasticity of WTP and thus inversely the elasticity of substitution, we rely on a meta-analysis, following Jacobsen and Hanley (2009). We conduct several tests to find the appropriate model and specification for the data. First, we test for a panel structure. Usually, a panel represents different observations of one unit over time. However, in this case, a panel refers to the various WTP estimates provided by a single study (cf. Rosenberger and Loomis 2000). To test for a panel structure, we rely on the following regression model:

where WTPi j constitutes the ith observation of the jth strata (in this case of a WTP study), α is a constant, xij denotes a vector of explanatory variables, with a panel effect \(\mu_{ij}\) and an error \(\epsilon_{i} \sim N (0, \sigma_{{}}^{2} )\). We conduct the Breusch and Pagan Lagrange multiplier test to test whether \(\mu_{ij}\) = 0, i.e., where a panel structure is appropriate. To this end, we use a random-effects model with annual income as the only explanatory variable. Second, we apply different models to determine which model provides the best fit. We make the random-effects model our main specification because it is plausible that the true effect size varies from one WTP study to the next, suggesting that a random-effects model is more appropriate (see also Jacobsen and Hanley (2009) for an a-priori argument in favor of a random-effects model). However, we still conduct Hausman tests to investigate the degree to which a random versus a fixed-effect model provides a better fit across our different model runs. Third, we conduct Ramsey’s Regression Specification Error Test to investigate which specification on the WTP-income relationship produces the best results. We test four specifications based on the model with annual income as the only explanatory variable: a linear, a quadratic, a semi-log, and a log–log version.

We then apply the random-effects log–log models with income as the only explanatory variable to the full sample as well as to various subsamples to investigate the income elasticity of the WTP for ecosystem services. Primarily, we apply the model to the full sample with all publications and the subsample including only peer-reviewed studies to estimate the overall income elasticity. We report these two versions throughout. While peer-review provides a clear quality threshold, also considering non-peer-reviewed estimates is common in meta-analyses due to potential publication bias (see, e.g., Havranek et al. 2015). In addition, we apply the model on three split samples to investigate heterogeneity in income elasticity estimates based on study- and good specific characteristics. First, we consider two subsamples split across payment types (i.e., one-shot and repeated payments). Second, we split the sample based on elicitation methods (i.e., choice experiments and contingent valuation studies). Finally and most importantly, we apply the model on three subsamples split across the ecosystem service categories introduced within the MEA (i.e., provisioning, regulating, and cultural services).

3.2.2 Measuring Good-Specific Growth Rates

3.2.2.1 Growth Rates of Ecosystem Services

To measure good-specific growth rates, we follow the approach of Baumgärtner et al. (2015) and perform a couple of adjustments to the raw data gathered from the sources listed in Table 2. First, if there is rivalry in consumption for a specific ecosystem service, as for crop production, we divide the yearly values by the population sizes of the respective years to obtain the per-capita values.Footnote 13 When there is no rivalry in consumption for a specific ecosystem service (e.g., for climate regulation), we use absolute values. Second, we use the diagram tool of Numbers to fit an exponential line to the yearly values. From this, we read out the average annual indicator growth rates. When it is possible to identify a recent growth trend via eye’s inspection,Footnote 14 we derive growth rates of the current trends as well.

In the third step, we calculate mean growth rates of the three groups (i.e., provisioning, regulating, and cultural services) by taking unweighted arithmetic means based on all the specific ecosystem services.Footnote 15 We then calculate the growth rate for the aggregate ecosystem service as the unweighted arithmetic mean based on the mean growth rates of the three groups. For food provision growth, we take the unweighted arithmetic mean from the growth rates of the more specific services (e.g., crop production, livestock production). We apply the same approach to derive the mean growth rates of fiber provision and climate regulation. When there are two indicators for a specific ecosystem service (e.g., for recreation and ecotourism), we use the unweighted mean of the two to derive the growth rate of the specific ecosystem service.

3.2.2.2 Growth Rates of Market Goods

The framework of the MEA includes some provisioning services that are included within GDP (i.e., agriculture, livestock production, fisheries, and forestry). To avoid double-counting with respect to these specific ecosystem services, we derive an adjusted GDP to represent market good consumption growth (cf., Baumgärtner et al. 2015). Specifically, we subtract the yearly shares of agriculture, forestry, and fishery from yearly GDP.Footnote 16 We then divide the adjusted values by the population sizes of the respective years to obtain per capita values. Finally, we derive mean yearly market good consumption growth by fitting an exponential line to the data.

3.2.2.3 Estimation Errors

Regarding estimation errors, we follow Baumgärtner et al. (2015) in assuming that the respective subgroups constitute independent measurements. This means that we treat the growth rates of crop production, livestock production, fishery production, and aquaculture production as independent measurements of food production, and the growth rates of food production, fiber provision, genetic resources and fresh water as independent measurements of provisioning services. Further, we define provisioning, regulating, and cultural services as independent measurements of the growth rate of the aggregate ecosystem service. We then calculate Δx as the standard error of the individual growth rates from the mean growth rates:

where n is the number of services, \({\text{x}}_{\text{i}}\) is the growth rate of service i, and \(\stackrel{\mathrm{-}}{\text{x}}\) refers to the mean growth rate of the respective category.

4 Results

4.1 Substitutability

We find that a panel approach is appropriate for estimating the income elasticity of WTP and thus the elasticity of substitution across all models considered. For our full sample model, the Breusch and Pagan Lagrange multiplier test shows that a model with equal effects is clearly rejected (p < 0.001, n = 159, j = 36). We rely on the random-effects model for our main analysis for a priori-reasons in line with Jacobsen and Hanley (2009).Footnote 17 To estimate the constant income elasticity of WTP consistent with the standard theoretical model, we rely on a double-log specification. A Ramsey’s Regression Specification Error Test shows that a linear and a semi-log specification provide an even better fit to the data than the log–log specification, which suggests that the assumption of a constant income elasticity of WTP is an approximation.Footnote 18 Table 3 shows the results of the random-effects log–log model with income as the only explanatory variable based on two different samples: all publications and peer-reviewed only. Based on all publications, the income elasticity of WTP amounts to 2.96 ± 1.29 (p = 0.022) and to 3.36 ± 1.46 (p = 0.021) when considering peer-reviewed studies only.Footnote 19

Table 4 presents the results of the random-effects log–log model with income as the only explanatory variable based on the three sample splits. The first sample split refers to the payment type. It shows that one-shot payments mainly drive the significant income effect on WTP obtained in the full sample. Including only one-shot estimates into the analysis yields a significant income effect, whereas focusing on estimates based on repeated payments produces insignificant results. The second sample split focuses on elicitation methods. Here, we find that using only choice experimental data yields a significant income effect, whereas the effect is insignificant for contingent valuation. The third split refers to the category of ecosystem service. We find a large income elasticity of WTP for regulating services of 4.81 (p = 0.058 for both samples). For provisioning services, our estimates also tend to suggest a complementary relationship, but evidence is mixed: the estimate based on peer-reviewed studies is 4.12 (p = 0.068), while the estimate based on the full sample is smaller and insignificant, with 2.57 (p = 0.124). The estimates for cultural services are lowest and range from 1.61 to 1.75, while only the estimate based on the full sample is statistically distinguishable from zero (p = 0.290).

We use the model results based on all publications and based on the peer-reviewed studies to estimate the overall income elasticity of the WTP for ecosystem services. Thus, our main result for the income elasticity falls into the range of 2.96 ± 1.29–3.36 ± 1.46. With \(\epsilon_{W} = 1/\sigma\), the income elasticity of 2.96 ± 1.29 maps into a mean value for the elasticity of substitutability of 0.34 and a value range from 0.24 to 0.60. The income elasticity of 3.36 ± 1.46 yields a mean value for the elasticity of substitutability of 0.30 and a value range from 0.21 to 0.53. These values suggest that market goods and ecosystem services have a complementary relationship and cannot be easily substituted by each other.Footnote 20

While it is not possible to make direct comparisons to the results of other studies because this is the first meta-study that investigates the income elasticity of the WTP for an aggregate ecosystem service within Germany, we observe that related meta-analysis derived estimates of the income elasticity of the WTP that were mostly below unity, thus, indicating a regressive distribution of ecosystem services instead (e.g., Hökby and Söderqvist 2003; Liu and Stern 2008; Chiabai et al. 2011; Lindhjem and Tuan 2012; Subroy et al. 2019). Baumgärtner et al. (2015), for instance, use the estimate of an income elasticity of WTP of 0.38 from Jacobsen and Hanley (2009) on global biodiversity conservation, which suggests an elasticity of substitutability of 2.63. At the same time, estimates of our meta-analysis match much better with complementarity assumptions made in applied modeling (e.g., Sterner and Persson 2008).

4.2 Good-Specific Growth Rates

Table 5 shows the mean growth rates of the aggregate ecosystem service and of the three ecosystem service subgroups, both based on total time spans and current trend data.Footnote 21 Minimum and maximum denote the respective minimum and maximum growth rates that were found in the respective categories. Note that as Δx provides the standard error of the estimation, the estimated mean yearly growth rate \({\text{x}}_{0}\) with error reads: x = \({\text{x}}_{0}\) ± Δx.

Table 5 reveals that based on the total time span data, the aggregate ecosystem service shows a negative growth rate of − 0.31 ± 0.47 percent, whereas degrowth is somewhat smaller based on current trend data, with − 0.08 ± 0.70 percent. These results are similar to those of Baumgärtner et al. (2015), who obtain current trend data for ten ecosystem service categories and find a growth rate of − 0.13 ± 0.55 percent for German aggregate ecosystem service development. For both datasets, we find that the growth rates are not significantly different from zero. Considering growth rates across the three sub-groups of ecosystem services, we find that regulating services are declining substantially for both cases, while results for provisioning services are ambiguous. Cultural services’ growth remains constant among both time spans, as we could not identify a current growth trend for any specific cultural service (see Appendix K). We furthermore calculate the mean growth rate of adjusted GDP per capita as 1.29 percent (measured in PPP-adjusted 2011-US$, based on a time span from 1991 to 2017).Footnote 22

4.3 Computing Relative Price Changes (RPCs)

Combining the estimates of the degree of substitutability and of good-specific growth rates allows for a straightforward computation of RPCs of ecosystem services vis-à-vis market goods for Germany based on Eq. (6). Table 6 shows the two cases (all publications and peer-reviewed only) of the RPC referring to the aggregate ecosystem service.Footnote 23 In both cases, we rely on the current trend growth of the aggregate ecosystem service to estimate \({\text{g}}_{\text{E}}\) and use the adjusted GDP per capita to estimate \({\text{g}}_{\text{C}}\) (see Appendix L for the equivalent results for total time span growth rates). Table 6 highlights that both versions lead to RPCs of substantial magnitude: the RPC estimate based on all publications amounts to 4.06 ± 3.84 percent, while the RPC based on the peer-reviewed sample amounts to 4.60 ± 4.35 percent. This contrasts with a previous, much lower, estimate of the RPC for Germany by Baumgärtner et al. (2015) of 0.73 ± 0.48 percent, which relies on an income elasticity of WTP from a global meta-study for biodiversity conservation (cf. Jacobsen and Hanley 2009) and trend data for ten ecosystem services up to 2009. Baumgärtner et al. (2015) already note that, i.a., a lack of additional data has likely yielded an underestimate of the RPC. Notable for both estimates are the relatively large standard errors, indicating considerable uncertainty around RPC estimates that mainly stem from the estimation of the degree of substitutability. According to Baumgärtner et al.’s (2015, Sect. 3.8) notion of significance, both estimates differ significantly from zero, suggesting that relative price adjustment is warranted.

In Table 7, we disaggregate the RPCs of the aggregate ecosystem service into the three prominent ecosystem service categories of the MEA (2005). Again, we report the RPCs for income elasticities derived from both the peer-reviewed sample and for all publications, and now apply the current trend growth rates of the three respective ecosystem service categories. We find RPCs between 1.38 and 1.51 percent per year for cultural services, while RPCs for provisioning services range from 1.29 to 2.06 percent per year. RPCs for regulating services are an order of magnitude higher, amounting to more than 13 percent per year. Provisioning and cultural services are experiencing slight (current trend) growth, however, provisioning services are perceived as more complementary to market goods. Overall, the resulting RPCs of these two categories come close to those from the recent literature based on global or more aggregate estimates of substitutability (Baumgärtner et al. 2015; Drupp 2018). In contrast, regulating services exhibit substantial degrowth and turn out to be highly complementary to market goods, leading to very large RPCs.

Finally, we consider a qualitative cross-validation of our finding of considerable RPCs over time. To this end, we examine the role of the study year as an explanatory variable for (ln)WTP, as RPCs can also be understood as the percentage by which ecosystem services’ WTP values should be uplifted per year. Table J.1 in the Appendix provides multivariate regressions of ln(WTP) in large and medium semi-log models, including ln(income) and additional explanatory variables introduced within Table 1. Using the full study sample, we find an insignificant but positive coefficient for study year of 0.11, suggesting a RPC of 11 percent per year, which is close to our regulating services estimate. Using the peer-reviewed sample only, we find a significant and considerably larger coefficient for study year. Overall, the cross-validation provides qualitative confirmation on positive, and likely substantial, RPCs.

5 Discussion

In this section, we discuss key assumptions and analysis choices in our estimation of RPCs of ecosystem services. We hereby focus on the estimation of the degree of substitutability and the computation of environmental growth rates.

5.1 Estimating the Elasticity of Substitution

Our estimation of the elasticity of substitution hinges on four factors: the inverse relationship to the constant income elasticity of WTP, the quality of the input data on WTP and income, the inclusion criteria for our meta-analysis and elicitation method-specific biases. First, the straightforward inverse relationship between the (constant) elasticity of substitution between a composite market good and a composite ecosystem service and the (constant) income elasticity of WTP for that ecosystem service (cf. Kovenock and Sadka 1981; Ebert 2003) depends on a common but specific preference structure, namely, constant-elasticity-of-substitution preferences between two goods. The relationship between the income elasticity of WTP and the elasticity of substitution becomes more complex once we consider multiple non-market goods (cf., Ebert 2003) and if the preference structure differs from constant-elasticity-of-substitution preferences, such as when there is a subsistence requirement in the consumption of ecosystem services (Baumgärtner et al. 2017b; Drupp 2018).Footnote 24 We are neither aware of any study that explicitly tests to what extent constant-elasticity-of-substitution preferences are a good representation of preferences over ecosystem service and market good consumption nor of studies that perform a horse-race test in comparing different structural utility approaches. One implication of constant-elasticity-of-substitution preferences is that the income elasticity of WTP is constant along different income levels too. However, several studies find that the income elasticity of the WTP is not constant. For instance, Barbier et al. (2017) provide evidence that the income elasticity of the WTP for eutrophication control diverges between low-income and high-income respondents. They argue that this may be driven by technological effects so that it is unclear how strongly one may weigh this evidence as a falsification of constant-elasticity-of-substitution preferences. Also, based on our tests, we find that other specifications provide a somewhat better fit to the data than the log–log relationship between income and WTP. In sum, the adequacy and robustness of the widely used preference structure that we rely on needs to be further investigated in future studies.

Second, we consider the quality of the input data on income and WTP, both of which are far from perfect. Income levels are mostly self-reported in the WTP studies and may be biased. Also, many WTP studies only provide income data in the form of percentage shares of stepwise categories. In these cases, we calculate the mean sample income by weighting the midpoints of the income ranges by their percentage shares. Two studies only provide gross income values, so that we approximated net income values by using income tax levels according to the German basic tax table. Finally, when no usable income data could be attained, and it seemed appropriate based on the respective sample characteristics, we used the average income of the survey area as the mean income value of the sample.Footnote 25

Third, a particular characteristic of our meta-analysis is that it does not include restrictions regarding the type of ecosystem service as well as in terms of the valuation methodology. While there are clear benefits to such a comprehensive approach, it is at the same time debatable how comparable individual WTP estimates are across a diverse set of ecosystem services and across different environmental valuation methods.Footnote 26We mitigate this concern by reporting disaggregated results by goods categories and elicitation methods in our main results section. However, this still leaves room for substantial heterogeneity, as within ecosystem services categories due to diversity in the units of measurement for ecosystem services.Footnote 27

Fourth, elicitation method specific biases may affect our results. For example, since our meta-analysis is mainly based on stated-preference studies, it also includes their respective shortcomings, such as hypothetical bias. Schläpfer (2008, 2009) provides a critical discussion of how such biases may affect the estimation of income elasticities via contingent valuation studies, for which we do not find significant income effects. Further studies that compare income elasticity estimates for similar ecosystem services across elicitation methods would help to shed light on how method-specific biases may affect such estimates.

Finally, the much larger income elasticity (smaller elasticity of substitution) relative to previous work, such as by Jacobsen and Hanley (2009), is noteworthy and requires further systematic investigation. Three key differences between the two studies concern the elicitation methods included, the types of ecosystem services considered as well as the studies’ geographic and temporal frame. For instance, in contrast to Jacobsen and Hanley (2009), we also include choice experimental data in our derivation of the income elasticity, and find that estimates based on contingent valuation studies alone yield a smaller (and insignificant) estimate (see Table 4). Likewise, we consider a much broader set of ecosystem services, and find, for instance, that estimates overall are considerably larger than those for cultural ecosystem services only, which played a major role in Jacobsen and Hanley’s meta-analysis (2009). Our foci on a wealthy country, like Germany, and more recent studies could be additional factors, which we cannot assess here and leave for future research that should systematically assess differences in estimates of income elasticities across all of these dimensions.

5.2 Measurement of Ecosystem Services’ Growth

We took the framework of the MEA as a basis for the search for suitable indicators for the specific ecosystem services. Finding indicators to represent the specific ecosystem services and their (de-)growth is a key challenge for analyses such as ours because those indicators ultimately determine the growth rate of the aggregate ecosystem service. We measured 15 of the 24 ecosystem services introduced in the categorization of the MEA. Thus, our analysis had a broader scope for the German case than the analysis of Baumgärtner et al. (2015), as we could include more ecosystem services (cf., Appendix H). Nonetheless, the availability of suitable indicators constitutes a considerable problem. While indicators on food production were readily available and of good quality, finding data for regulating and cultural services was often difficult. In particular, we could not assess the development of some regulating services, such as water and disease regulation, so we had to exclude these from the analysis. The straightforward approach to indicate the development of a specific ecosystem service is to measure the growth of the good or service (the production quantity) itself. Yet, this was not possible for all specific ecosystem services because corresponding data was lacking. As better data become available on more ecosystem service indicators, the estimate of ecosystem services’ growth or decline should be updated and extended.

Based on the calculation of the growth rates of the specific individual ecosystem services, we calculate unweighted arithmetic means to derive the mean growth rates of the three categories of ecosystem services (e.g., provisioning services). We then calculate mean aggregate ecosystem service growth as the unweighted arithmetic mean based on the three categories. This procedure relies on certain theoretical assumptions. First, taking the variable \({\text{E}}_{\text{t}}\) as an indicator for a bundle of ecosystem services, the arithmetic mean of growth rates \({\text{g}}_{\text{i}}\) of individual ecosystem service quantities \({\text{E}}_{{\text{i}}{\text{t}}} , {\text{i}}\text{ = 1,}\text{ . . . , }{\text{n}} \,\) is the appropriate statistics for \({\text{g}}_{\text{E}}\) if and only if

Thus, we assume that the elasticity of substitution between the different ecosystem services is unity (Cobb–Douglas). This implies that if ecosystem services could be bought on markets, their expenditure shares would be equal and that different ecosystem services’ WTP values would align for similar quantities. Relatedly, we assume that all specific ecosystem services have the same elasticity of substitution towards market goods (cf., Baumgärtner et al. 2015). We partially relax these assumptions by reporting results separately for the three ecosystem service categories.

We investigate further sensitivity of our results to using arithmetic means for the aggregation of growth rates. In Appendix N, we report the corresponding results when using a geometric mean. Note that we can only calculate geometric mean growth for the regulating service category because this is the only category for which all individual service growth rates have the same (negative) sign. Taking the geometric mean of the specific regulating ecosystem services’ trend growth rates yields a mean current trend regulating service growth of − 0.85 ± 0.77. Regulating service degrowth, based on the geometric mean, is thus considerably lower in absolute terms as when using the arithmetic mean, which yields a value of − 1.46 ± 0.69. The corresponding RPC based on the geometric mean amounts to 10.29 ± 9.14 percentage points. Nevertheless, when using the geometric mean, the resulting RPC is still very sizable and far exceeds any values currently used in governmental guidelines.

6 Conclusion

This paper provides first comprehensive and consistent country-specific evidence on relative price changes of ecosystem services for Germany based on a meta-study of 36 environmental valuation studies and the growth rates of 15 ecosystem services. Across different estimation approaches, we find relative price changes of ecosystem services of around four percent per year on aggregate. These estimates exceed those of Baumgärtner et al. (2015) considerably, which relied on country-specific growth rates but used a global meta-study to inform the degree of limited substitutability of ecosystem services. Thus, we confirm Baumgärtner et al.’s hypothesis that their results likely provide a conservative estimate due to systematic limitations. Despite considerable uncertainty in the estimation, a key conclusion is that the relative scarcity of ecosystem services vis-a-vis market goods has very likely been increasing substantially in Germany in recent decades. The economic appraisal of public projects with environmental consequences can account for this by using relative price adjustments to "uplift" real WTP estimates of ecosystem services in future years.Footnote 28

Heterogeneity analysis further reveals that predominantly WTP values from choice experiments and for one-shot payments drive the large estimates of the income elasticity of WTP and thus the overall complementary estimate of ecosystem services vis-à-vis market goods. In terms of heterogeneity across different categories of ecosystem services, we find that regulating ecosystem services experience the strongest degrowth and exhibit the highest degree of complementarity vis-à-vis market goods, leading to very large relative price changes of more than 13 percent per year. In contrast, relative price changes of provisioning and cultural ecosystem services are more limited, with point estimates between 1.29 and 2.06 percent per year. While this heterogeneity analysis is based on very small samples and should be treated with caution, it highlights that it is likely important to not only rely on country-specific estimates to inform overall relative price changes but to also consider the heterogeneity across different ecosystem service types or categories both in terms of growth rates and limited substitutability. The guidance in The Netherlands, for instance, already provides provisions for such a more disaggregated analysis. Their guidance from 2020 states, among others, that relative price adjustments of more than 1 percent can be considered "if there are hardly any substitution possibilities and/or the growth rate lags far behind consumption growth" (Dutch Ministry of Finance 2020; own translation). More studies are required to inform guidance that is both country-specific and disaggregated by different types of ecosystem services. Also, more research is needed to empirically determine the extent to which ecosystem services’ limited substitutability as inputs to production processes may drag down the growth rate of human-made goods (cf. Zhu et al. 2019). Beyond that, empirical studies are necessary to assess the degree to which behavioral or policy responses can limit ecosystem service degrowth and, thus, also relative price effects, which we estimate here based on constant (exogenous) growth rates (cf. Drupp and Hänsel 2021).

Our results furthermore highlight that the estimation of income and substitution elasticities as well as the computation of relative price changes are subject to considerable uncertainties reflected in large error ranges that surround our main estimates. While this suggests the need for further empirical studies, uncertainty surrounding elasticities and growth rates should not be used as a rationale to neglect relative price changes but rather as an argument to make them an integral feature in future extensions. For instance, Gollier (2010) studies uncertainty about growth rates and Gollier (2019) considers uncertainty about the income elasticity of WTP. While uncertainty about growth rates likely has a relatively minor effect, uncertainty about the income elasticity of WTP (the inverse of the elasticity of substitution) likely leads to much larger relative price changes. Future work may shed more light on to what degree this uncertainty is irreducible or may be reduced with improved empirical approaches and as more data becomes available.

Overall, our results suggest that current governmental practice in many countries, to neither discount ecosystem services differently nor to make respective relative price adjustments, likely yields considerable intertemporal inefficiencies, leaving future generations with too low levels of ecosystem services. Our findings, thus, underscore the need to consider potentially sizable relative price adjustments of environmental values in public project appraisal, as pioneered by a few countries already, and in environmental-economic accounting.

7 Appendix A: Exclusion and Selection Criteria of WTP Estimates

This Appendix provides further information regarding the exclusion and selection criteria of WTP estimates. Firstly, note that we generally avoided averaging values. However, when WTP results were split among different quantities of the same ecosystem services or regarding the consideration of response uncertainty, we used average values (see, e.g., Meyerhoff et al. 2012, 2014). Secondly, note that, in general, when a special mean WTP estimate was provided in which the bids of respondents that refused to pay (zero-bids) were removed to exclude protest bids, we chose this estimate. Thirdly, note that when a study provided different mean WTP values based on different statistical models, we tried to identify the standard model and included only that value. Fourthly, note that when overall mean WTP values were provided, we excluded WTP values referring to subsamples. Fifthly, note that we excluded WTP values that were merely multiplied versions of marginal WTP estimates provided before (WTP estimates referring to the same good and unit of measurement but to a larger supply level). Sixthly, note that we only included positive WTP values. Seventhly, note that we excluded WTP estimates based on pretests.

8 Appendix B:List of Willingness to Pay Studies Used for the Meta-Analysis

9 Appendix C: Assignment of Elected Studies to Different Categories of Ecosystem Services

Table 9 shows the selected studies assigned to the specific ecosystem services introduced within the framework of the MEA (2005). Table 9 reveals that studies could be assigned to only 6 of the 24 specific ecosystem services (e.g., genetic resources). However, the Table also shows that studies could be assigned to all the three categories of ecosystem services (e.g., provisioning services). Moreover, Table 9 reveals that the largest share of WTP estimates used for this meta-analysis refers to cultural services.

In the following, we provide further information on Table 9. Firstly, note that we assigned some studies, like Segerstedt and Grote (2015), to different specific ecosystem services because they value different ecosystem services. Secondly, we assigned the respective WTP estimates provided by Segerstedt and Grote (2015) and Völker and Lienhoop (2016) to both freshwater and water regulation. Thirdly, note that the studies by Frey and Pirscher (2018), Enneking (2004), Clucas et al. (2015) are not listed in Table C.1 because they only value animal welfare, which is not captured within the framework of the MEA. Fourthly, note that we listed the cultural services aesthetic values and recreation and ecotourism together in this Table because, in most studies, it was not differentiated between aesthetics and recreation. Fifthly, note that for food and fiber provision, there are commonly no stated preference studies conducted because crop, livestock, fish, timber, cotton, hemp, silk, and wood fuel are private goods for which prices can be derived based on market transactions. Finally, note that for some WTP estimates the decision to which specific ecosystem service they should be assigned to was ambiguous. In these cases, we assigned the estimate to the service we deemed most appropriate.

10 Appendix D: Visualization of the Data

Figure 1 provides a visualization of the data of the meta-analysis. Each dot represents a WTP value. Also, a linear regression line is provided. The regression equation reads: Willingness to pay = − 28.18 + 0.0023 Income (R2 = 0.05).

11 Appendix E: Summary Statistics of the Meta-Analysis

12 Appendix F: Verbal Overview of the State of Ecosystem Services in Germany

This Appendix provides a verbal overview of the state of ecosystem services in Germany. The first section focuses on provisioning services, the second section on regulating services, and the third section on cultural services. Generally, the overview concentrates on ecosystem services that are particularly relevant for Germany. A more comprehensive verbal assessment of the state of ecosystem services in Germany can be found in TEEB DE (2017).

12.1 Provisioning Services

Agricultural food production is sometimes of industrial scale in Germany (TEEB DE 2017, p. 24). However, livestock produced is of occasionally questionable quality. For instance, a recent study found more than every second piece of broiler meat from discounters to be contaminated with multiresistant germs (Benning 2019).

Drinking water production is enormous. More than 3.7 billion cubic meters per year were provided to endusers in 2016 (DESTATIS 2018). There were no problems with drinking water shortages yet, but regional and temporal shortages could eventually arise due to increasing levels of climate change (TEEB DE 2017, p. 24).

Wood production is a key economic factor for Germany because wood is a versatile raw material for energy, building material, and for paper production (TEEB DE 2017, p. 26). Its significance is even increasing further because its production is almost CO2 neutral, requires relatively little energy, and wood is being completely recyclable. However, on the other side, forests’ health is increasingly threatened due to climate change (BMEL 2019; Julius-Kühn-Institut 2019).

In line with the global trend, the pool of available genetic resources is deteriorating more and more in Germany (BfN 2020; WWF 2020). For example, as a recent study by Seibold et al. (2019) has shown biomass abundance and number of species within German grasslands and forests are in dramatic decay.

12.2 Regulating Services

The ability of German waters bodies to regulate themselves (i.e., to degrade, filter out, and store contaminants) is currently overextended. Germany’s industrial production, combustion of fossil fuels, traffic, and agriculture, in particular, are polluting the groundwaters, surface water bodies, and oceans with nitrogen and phosphate in levels that deal serious harm to groundwater quality (e.g., Nausch et al. 2011; BUND 2019).

German soil regulation is pressured by the scale and way of agricultural production. For instance, the overuse of fertilizers and heavy machines yields an increasingly compacted soil that threatens the foundation for future agricultural production. Moreover, the degradation of peripheral elements, e.g., hedges, generates wind and water erosion (TEEB DE 2017, p. 25).

Pollination is a key regulating service to German food production. That is because 84 percent of the major European crop plants directly rely on insect pollination (e.g., Williams 1994, 2002). However, also in Germany, pollination is increasingly under pressure as the biodiversity of pollination populations decreases due to environmental toxins and the elimination of near-natural structures (TEEB DE 2017, p. 31).

Local climate regulation is under pressure. Within the last decade, Germany has seen some of the hottest summers since the recordings started, and even higher temperatures are to be expected (e.g., Sévellec and Drijfhout 2018; UBA 2019a). In particular, hot summers threaten agricultural production capacities (e.g., Brasseur et al. 2017). Beyond that, in particular, so-called urban “heat-islands” can harm human health severely (e.g., Gabriel and Endlicher 2006; Bunz and Mücke 2017; UBA 2019b). Being the sixth largest CO2 emitter in the world (as of 2019), Germany can contribute to global climate regulation by reducing its greenhouse gas emissions (World Bank 2019d). Besides, Germany can increase the CO2 sequestration abilities by afforestation and peatland restoration (e.g., Barthelmes et al. 2005).

12.3 Cultural Services

Many leisure activities in Germany are directly connected to nature. For instance, a survey by the German Hiking Association found that “experiencing “ nature is the crucial element for hikers (BMWi 2010). Further, Germans generally hold the opinion that the conservation of nature is important for individual recreation and health (BMU/BfN 2020). This opinion is reflected in the significant increase in the amount of nature protected landscapes throughout the last decades that add both aesthetic- and recreational value to the area of Germany (BfN 2019).

Also, Germany’s tourism industry depends on a healthy natural environment. However, excessive tourism can also be a source of environmental degradation if it is not done in an environmentally friendly manner (e.g., BMU 2010). Beyond that, extraordinary kinds of German landscapes as the Black Forest, or the Bavarian Alps, provide a feeling of home and identity towards many Germans (TEEB DE 2017, p. 38).

13 Appendix G: Graphical Presentation of the Time Series Data

This Appendix provides the graphical presentation of the time series data based on which we calculated the growth rates of the specific ecosystem services. Further, the Appendix presents the total time spans and, if we calculated a current trend, the time spans we used to calculate the current trend. If we did not calculate a current trend, the current trend period equals the total time span (see, e.g., crop production).

See Figs. 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16 and 17.

14 Appendix H: Comparison of Indicators with Baumgärtner et al. (2015)

Table 11 compares our indicators to that of Baumgärtner et al. (2015). Note that we always chose indicators to represent the specific ecosystem services introduced within the MEA (2005, p. 7) framework. In contrast, Baumgärtner et al. (2015) assign some indicators, such as forest area, to broader subcategories such as “other regulating services “. Beyond that, they do not include any subcategories for cultural services but simply use indicators that match into the general cultural services category. On this basis, Baumgärtner et al. (2015), for instance, include the national biodiversity indicator within both the regulating and cultural service category. We did not include the national biodiversity indicator in these categories because, based on the description of specific ecosystem services within the MEA (2005, p. 7), the national biodiversity indicator does not fit any of the specific ecosystem services included within the regulating and cultural service categories very well.

15 Appendix I: Explanation of the Chosen Indicators

To represent the development of genetic resources, we used data from the German national biodiversity indicator. For estimating the development of air quality regulation, we relied on data on the forest area within Germany (see Baumgärtner et al. 2015). We used data on CO2 emission removals of trees to represent the service of global climate regulation. We employed German climate data to approximate the effectiveness of regional and local climate regulation over the years: the availability of a moderate climate was estimated via the inverse value of the number of hot days per year (i.e., days with a maximum temperature of above 30 degrees Celsius). We used the development of the overall area of organic soils as a proxy for erosion regulation. We made this decision on the basis that organic soil is particularly valuable for agricultural production because it contains nutrient and mineral-rich elements (FAO 2019l).

To represent the cultural service of aesthetic values, we followed the approach of Baumgärtner et al. (2015): they use the inverse value of the road-density in Germany to estimate landscape-connectedness. However, they used data on German road-networks, which was not available anymore so that instead, we took data on the German track-network. In our analysis, two indicators represent the development of the service recreation and ecotourism. The first indicator is based on a time-series of the hectare size of tree covered and grassland area and is a proxy for the size of natural areas in Germany. The second indicator is based on data on the development of the overall size of designated recreation areas in Germany and, thus, includes recreation possibilities based on nature within urban areas.

The categorization of the MEA also comprises ecosystem services relevant for Germany for which we could not find suitable indicators within this analysis. These ecosystem services include, among others, water regulation and disease regulation. On the other hand, there are also ecosystem services that do not, or only very sparely, add to Germans’ well-being. There are no natural sites in Germany that are generally accepted to be of invaluable spiritual worth to individuals as, for example, the Uluru (Ayers-Rock) in Australia is to the Aboriginals.

16 Appendix J: Large and Medium Random-Effects Semi-Log Models

The large random-effects semi-log model includes ln(income) and all the control variables introduced in Table 1. The medium random-effects semi-log model contains ln(income) and only control variables that are significant at the 5 percent level within the large model and stay so within the medium model.

See Table

12.

17 Appendix K: Growth Rates of Specific Ecosystem Services

18 Appendix L: Relative Price Changes (RPCs) Based on Total Time Span Data

19 Appendix M: Standard Rules for the Calculation of Error Propagation

When we used multiple error-laden estimates to calculate \(\Delta r\), we applied the standard rules for the calculation of error propagation, where the absolute standard error of a sum is the sum of the absolute standard errors of all summands, and the relative standard error of a product is the sum of the relative standard errors of its factors (cf., Baumgärtner et al. 2015). These rules are specifically given as:

and

Notes

We use the term ‘ecosystem service’ throughout and as interchangeably with the term ‘environmental good’.

A recent survey among experts on social discounting has shown that accounting for limited substitutability is one of the key issues missing in the standard workhorse approach (Drupp et al. 2018).

Drupp (2018) extends the global analysis using income elasticities from multiple primary WTP studies and meta-analyses to calibrate the elasticity of substitution and estimates RPCs of similar magnitude.

As a cross-check, we also verified that we have included all, according to our search and selection criteria, suitable WTP values from the recent database by Förster et al. (2019), who have conducted a comprehensive literature review collecting monetary values for environmental service changes in Germany.

Appendix A introduces the exclusion and selection criteria of mean WTP estimates in more detail.

We did not include median WTP values, such as reported, e.g., in Bronnmann et al. (2020).

See Appendix B for a full list of the studies. See Appendix C for an assignment of the elected studies towards the different categories of ecosystem services. See Appendix D for a graphical representation of the data. See Appendix E for the summary statistics of the meta-analysis.

Annual sample mean income is 2,455 € higher for Western German samples than for Eastern German samples and 1,879 € higher for urban samples than for rural ones. In contrast, for studies conducted after 2011, which is the rounded study year average, the mean income is only 584 € larger than for studies conducted before.

There are insufficient data to include other relevant explanatory variables, such as the average education level.

See Appendix F for a descriptive overview of the state of ecosystem services in Germany. See Appendix G. for a graphical representation of the development of the specific ecosystem services.

Appendix H provides a comparison of the indicators used here and those used by Baumgärtner et al. (2015). Appendix I provides explanations for the chosen indicators.

We took data on German population development over the years from the UN (2019).

Here, a trend refers to the stringent development in the same direction for a time span of at least 10 years.

For those ecosystem services for which we did not identify a current trend, we used the growth rates calculated based on the complete time spans for the derivation of the current trend mean values of the groups.

Beyond that, the Hausman test fails to reject the random-effects model under all testable model runs.

Ramsey’s Regression Specification Error Test yields: Log–log model: χ2 = 5.26 with p = 0.022, linear model: χ2 = 6.63 (p = 0.010), quadratic model: χ2 = 6.82 (p = 0.033), semi-log model: χ2 = 6.17 (p = 0.013).

Moreover, we calculate two models including control variables to check for the robustness of the overall income elasticity. First, a large random-effects semi-log model including ln(income) and all control variables. Second, a medium model containing ln(income) and all control variables that are significant at the 5 percent level within the large model and stay so within the medium model. The income elasticity varies somewhat among the different models (see Appendix J). For the full sample, it increases to 3.50 ± 1.54 (p = 0.023) in the large model, while falling to 2.80 ± 1.24 (p = 0.023) in the medium model. For peer-reviewed only, it decreases to 3.06 ± 1.83 (p = 0.094) for the large model, while for the medium model, it increases to 3.80 ± 1.41 (p = 0.007). Also when considering standard errors, the income elasticity is always larger than unity for the large and medium models, strengthening the evidence for complementarity.

We additionally conduct tests against the null hypothesis of an income elasticity equal to or smaller than unity. We find that the income elasticity is higher than unity for the full sample with p = 0.064, and with p = 0.053 for the peer-reviewed only sample, providing evidence for complementarity. For the subset of regulating services, we find slightly weaker evidence for complementarity (p = 0.067), while results are ambiguous for provisioning services, as a substitutive relationship cannot be ruled out (p = 0.173 and p = 0.083).

We provide details for the growth rates of the specific ecosystem services in Appendix K.

We only include data from 1991 onwards here, as this is the time span for which the World Bank (2019c) provides the yearly shares of agriculture, forestry, and fishery which are required to calculate the adjusted GDP. Including data from before 1991 would yield a higher adjusted GDP growth rate (see Baumgärtner et al. 2015), and thus larger RPCs.

Note that when we used multiple error-laden estimates to calculate the RPC, we applied the standard rules for the calculation of error propagation (cf. Baumgärtner et al. 2015). Details can be found in Appendix M.

Drupp (2018), for instance, shows that in the presence of a subsistence requirement in terms of ecosystem services, the RPC is generally non-constant and increases over time with declining ecosystem services.

Appendix C shows that the meta-analysis includes WTP estimates for provisioning, regulating, and cultural services, whereas most WTP estimates refer to cultural services.

Alternatively, policy guidance may rely on differentiated discount rates, using a discount rate for ecosystem services that is 4 percentage points lower than the rate for market goods. In this case, both good-specific discount rates would need to be adjusted. Given the current overall social discount rate of 1 percent for Germany (Bünger and Matthey 2018), this likely means to discount ecosystem services at a negative discount rate.

Abbreviations

- DESTATIS:

-

German Federal Statistics Office

- FAO:

-

Food and Agriculture Organization of the United Nations

- MEA:

-

Millennium Ecosystem Assessment

- RPC:

-

Relative price change

- UBA:

-

German Federal Environmental Agency

- WTP:

-

Willingness to pay

References

Achtnicht M (2011) Do environmental benefits matter? Evidence from a choice experiment among house owners in Germany. Ecol Econ 70:2191–2200. https://doi.org/10.1016/j.ecolecon.2011.06.026

Achtnicht M (2012) German car buyers’ willingness to pay to reduce CO2 emissions. Clim Change 113:679–697. https://doi.org/10.1007/s10584-011-0362-8

Andor MA, Frondel M, Horvath M (2021) Consequentiality, elicitation formats, and the willingness to pay for green electricity: evidence from Germany. Land Econ 97:626–640. https://doi.org/10.3368/WPLE.97.3.092618-0130R1

Andor MA, Frondel M, Vance C (2017) Germany’s energiewende: a tale of increasing costs and decreasing willingness-to-pay. Energy J 38:211–228. https://doi.org/10.5547/01956574.38.SI1.MAND

Barbier EB, Czajkowski M, Hanley N (2017) Is the income elasticity of the willingness to pay for pollution control constant? Environ Resour Econ 68:663–682. https://doi.org/10.1007/s10640-016-0040-4

Barthelmes A, Joosten H, Kaffke A et al (2005) Erlenaufforstung auf wiedervernässten Niedermooren

Bastian O, Stein C, Lupp G et al (2015) The appreciation of nature and landscape by tourism service providers and visitors in the Ore Mountains (Germany). Landsc Online 41:1–23. https://doi.org/10.3097/LO.201541

Bastien-Olvera BA, Moore FC (2021) Use and non-use value of nature and the social cost of carbon. Nat Sustain 4:101–108. https://doi.org/10.1038/S41893-020-00615-0

Baumgärtner S, Drupp MA, Meya JN et al (2017a) Income inequality and willingness to pay for environmental public goods. J Environ Econ Manag 85:35–61. https://doi.org/10.1016/J.JEEM.2017.04.005

Baumgärtner S, Drupp MA, Quaas MF (2017b) Subsistence, substitutability and sustainability in consumption. Environ Resour Econ 67:47–66. https://doi.org/10.1007/S10640-015-9976-Z

Baumgärtner S, Klein AM, Thiel D, Winkler K (2015) Ramsey discounting of ecosystem services. Environ Resour Econ 61:273–296. https://doi.org/10.1007/s10640-014-9792-x

Benning R (2019) Analysis of chicken meat for antibiotic-resistant pathogens

Bertram C, Meyerhoff J, Rehdanz K, Wüstemann H (2017) Differences in the recreational value of urban parks between weekdays and weekends: a discrete choice analysis. Landsc Urban Plan 159:5–14. https://doi.org/10.1016/j.landurbplan.2016.10.006

BfN (2019) Nature Conservation Areas. https://www.bfn.de/en/activities/protected-areas/nature-conservation-areas.html. Accessed 10 Oct 2019

BfN (2020) Rote Liste der Tiere, Pflanzen und Pilze Deutschlands

BMEL (2019) Ergebnisse der Waldzustandserhebung 2019

BMF (2019) Das Bundesministerium der Finanzen: Lohn- und Einkommensteuerrechner. https://www.bmf-steuerrechner.de/ekst/eingabeformekst.xhtml. Accessed 10 Oct 2019