Abstract

Valuing global public goods like the Amazon rainforest by stated preference surveys of a representative sample of the global population would be very costly and time consuming. We explore the use of the Delphi Method in contingent valuation (CV) by asking a panel of 49 European environmental valuation experts in two rounds what they think would be the result if a European CV survey of Amazon Rainforest protection plans was conducted. The experts’ best guess for the mean willingness-to-pay (WTP) by European households for preserving the current Amazon Rainforest, and thus avoiding a predicted loss in forest area by 2050 from currently 85% to 60% of the original forest in the 1970s, was 28 € per household annually as an additional income tax. Aggregated over all European households this amounts to about 8.4 billion € annually. This preliminary estimate indicate that WTP of distant beneficiaries is substantial, and could justify preservation of global ecosystem services where aggregated benefits of the local population often do not exceed the opportunity costs of preservation in terms of lost income from commercial activities. The income elasticity of WTP with respect to per-capita income in the European countries is 0.5–0.6. Recognizing the limitations and assumptions of the Delphi CV method, it could still be a time saving and cost-effective benefit transfer tool for providing international donors with much needed order-of-magnitude estimates of the non-use value of ecosystem services of global significance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With 15% of the Amazon rainforest area being lost since the 1970s, the effects of further substantial forest loss in the Amazon could be dramatic. A significant fraction of trees in the Amazon basin could dry out and die, converting large swaths of land from forest to savannah. The ecosystem of the Amazon basin, which currently supplies our planet with more than 20% of its oxygen and freshwater, might change dramatically. This would likely affect the climate of the entire South American region, and beyond. Numerous species might disappear, including many not yet discovered.

Due to the significance and uniqueness of the Amazon as a provider of ecosystem services of global importance, more comprehensive and reliable estimates of the economic loss to the global community associated with forest loss in the Amazon are called for. The Amazon rainforest is perhaps the canonical global public good. Furthermore, while there have been substantial efforts to map more direct local and regional impacts of Amazon forest losses (see e.g. May et al. 2013), little is known about the global non-use value of protecting tropical rainforests in general and the Amazon in particular.

Carson (1998) discusses ethical and practical constraints to applying contingent valuation (CV) techniques for estimating non-use values of tropical rainforests as global public goods. Kramer and Mercer (1997) claim to have overcome these constraintsFootnote 1 in their 1992 national CV survey of US households’ willingness to pay (WTP), to increase the percentage rainforest preserved globally from 5 to 10%, equivalent to protecting an additional 110 million acres of rainforest (about the size of California, or Sweden). Mean WTP per household was found to be US $ 21–31 as a one-time amount (for the Dichotomous Choice (DC) and Payment Card (PC), respectively), which aggregated over the 91 million US households at the time, amounted to $ 1.9–2.8 billion for the entire U.S. This corresponds to 26–39 2012-€ per household,Footnote 2 and 2.4-3.5 billion 2012-€ for all US households. The payment vehicle was a hypothetical voluntary contribution to a hypothetical United Nations “Save the Rainforests Fund”. However, the incentive compatibility of this payment vehicle may be questioned, as shown by Carson and Groves (2007) and Veisten and Navrud (2006). Hypothetical donations might cause strategic behavior in terms of respondents overstating their WTP in order to get the project financed by the fund, whereas actual donations cause underestimation of “true” WTP due to free-riding behavior.

Horton et al. (2002, 2003) is the only household CV survey in high-income countries on Amazon rainforest preservation comparable to our study. 407 households were surveyed in Italy and the United Kingdom in 1999 in order to elicit their annual WTP to preserve 5 and 20% of the Brazilian Amazon. Mean WTP was found to be UK £30 and 39 per household per year (on average for Italy and the UK) for preserving 5 and 20%, respectively. If we apply the standard procedure of assuming people’s WTP to increase at the same rate as the Consumer Price Index (in the UK), and use the purchase power parity (PPP) corrected exchange rate between UK £ and € in 2012 this corresponds to 52 and 62 2012-€, respectively.Footnote 3 Aggregated across households, an annual fund to conserve 5% of Brazilian Amazonia as strictly protected areas could then yield an annual amount of about 1 billion 2012-euro in the UK and a similar amount in Italy. These results clearly show that the ecosystem services of the Amazon could be of global significance to distant beneficiaries.Footnote 4

Most benefits of preserving the Amazon rainforest, to individuals outside the Amazon region are likely non-use (existence and bequest) values, as most people have never visited nor plan to visit the Amazon rainforest. Even if such non-use values could be small per household, the global population is much larger and on average wealthier than that of the Amazon region. Thus, non-regional non-use value could easily constitute a substantial or even decisive fraction of the aggregated, global benefits of avoiding further Amazon forest loss. Obtaining analytically sound estimates of the global non-use values, even if imprecise, could therefore be important for mobilizing additional economic resources to reduce or avoid future Amazon forest losses.

An obvious challenge in assessing non-use values among populations outside of the Amazon region is the lack of relevant WTP data. The economic value of provisional ecosystem services like fruits, berries and fuelwood can be estimated using market price data; regulating services like carbon sequestration can be valued (albeit with considerable uncertainty) by Social Costs of Carbon (SCC) estimates;Footnote 5 and the cultural ecosystem service of recreational use can be valued using Revealed Preference (RP) methods. However, the very nature of the cultural ecosystem service of non-use values precludes the use of RP, and the only viable option is Stated Preference (SP) methods.

Traditionally, SP methods has involved the use of Contingent Valuation (CV)Footnote 6 in face-to-face, mail or telephone surveys of representative samples of affected populations. Over the last decade Choice experiments (CE) have become more widely applied in environmental valuation,Footnote 7 and increasingly both CV and CE surveys are performed as internet surveys.Footnote 8 For global public goods, a SP survey of a representative sample of the global population is needed to assess the global non-use values. Such global surveys are, however, very costly even if performed using the low-cost option of an internet survey.

The aim of this paper is to demonstrate the use of a Delphi CV method to estimate the economic value of ecosystem services of global significance, and provide a preliminary order-of-magnitude estimate of the European part of the global non-use value of avoiding predicted future losses of rainforest areas in the Amazon. As this exercise transfers information from previous valuation studies by the way of experts’ assessments, this Delphi CV exercise also illustrates a potentially new tool in environmental benefit transfer; adding to the existing benefit transfer methods of unit value transfer, benefit function transfer and meta-analysis (Navrud and Ready 2007).

The paper is organized as follows. Section 2 presents and offers justification for the Delphi CV method, while Section 3 describes the design and implementation of the European Delphi CV survey. Section 4 reports the WTP results, and how the characteristics and opinions of the experts as well as the income level of their country affect their predictions for the outcome of a European CV survey. Section 5 concludes, presents aggregated WTP results for Europe, and offers suggestions for future validation of the Delphi CV method.

2 The Delphi Method

Dalkey and Helmer (1963) developed the Delphi method at the RAND cooperation in the 1950s and 1960s as a systematic, interactive forecasting method that relied on a panel of experts. Linstone and Turoff (1975) in their book summarizing the experience from early applications of the Delphi method, provides a very general definition: “Delphi may be characterized as a method for structuring a group communication process so that the process is effective in allowing a group of individuals, as a whole, to deal with a complex problem. To accomplish this “structured communication” there is provided: some feedback of individual contributions of information and knowledge; some assessment of the group judgment or view; some opportunity for individuals to revise views; and some degree of anonymity for the individual responses”.

There are various versions of the Delphi method. A common approach is to face experts with two or more rounds of questionnaires. After each round, a facilitator provides an anonymous summary of the experts’ forecasts from the previous round as well as the stated reasons for their judgments. Thus, experts are encouraged to revise their earlier answers in light of the replies of other members of their panel. This is based on a belief that during this process the range of variation in individual answers will decrease, and the group will converge towards a single, “correct”, answer. The process is stopped after a pre-defined stop criterion has been reached (e.g. number of rounds, achievement of consensus, and stability of results), and the mean and median scores of the final rounds determine the results Rowe and Wright (1996).

Thus, the background, history, and justification for the Delphi Method are different from those for the SP methods. The Delphi method was developed largely as a management decision-making tool, to ensure mutual consistent preferences among a set of participants/managers (Sackman 1975). Thus, it is used to elicit experts’ preferences rather than individuals’ preferences elicited by SP methods. Underlying the method is a belief that the participating experts have considerable useful knowledge about population values not embodied in already available valuation studies.

Delphi studies tend to differ according to whether they ask for the experts’ recommended course of action, or to predict an outcome if some action is taken. Our study falls into this latter category, consistent with the “Oracle of Delphi” providing prophecies.

In our study, a sample of European environmental economists, acquainted with SP methods, were asked to predict the outcome of a CV survey in terms of mean and median WTP per household in their own country and overall for Europe for avoiding specified future forest losses in the Amazon.

To our knowledge, this is the first application of the Delphi Method to predict ecosystem service values, and the first Delphi CV survey of a global environmental good. It is only the second study to apply the Delphi method to value global public goods in general. The first, Carson et al. (2013), valued a global cultural good, surveying 30 European SP experts in-person, at the 1997 annual conference of the European Association of Environmental and Resource Economists (EAERE). They were asked, in two rounds, to predict the mean and median WTP for restoring the Fes Medina in Morocco among households in their own country and in Europe overall. The results showed that SP experts were willing and comfortable in providing their best guess of the outcome of national and European CV surveys of this global public good. The Delphi exercise found a one-time median and mean WTP for European households of about 6 and 12 US $ (1997-US $) per household, respectively.

3 Study Design

Our Delphi CV exercise comprised 49 environmental valuation experts from 20 different European countries. They were selected from the EAERE member list, based on our knowledge about their work and expertise in applying SP methods to value environmental goods. As a token of appreciation for their time and advice provided, the experts were offered 100 euros each upon returning the completed questionnaire (Round 1) and a short follow-up sheet (Round 2). We told experts it would take them about 30–40 min to complete the Round 1 questionnaire, and about 10 min to complete the Round 2 follow-up. In Round 1, experts answered a set of questions providing their “best guess” for the population mean and median annual WTP per household for two preservation plans that would avoid or reduce predicted rainforest losses by 2050 in the Amazon basin. We asked them to predict the outcome of CV surveys of the two preservation plans; in terms of WTP for the population of their own country and among the entire European population.Footnote 9

We defined a reference (or business-as-usual) alternative of further loss of forest area by 2050, resulting in 40% forest loss compared to the 1970s (equivalent to a 25% further loss from the current situation). Then we presented the following two preservation plans to avoid this reference scenario:

-

(i)

Plan A would give no further forest losses by 2050, beyond the current situation, i.e. 15% of the forest area lost relative to the pristine state in the 1970s.

-

(ii)

Plan B would give some further forest losses, and by 2050, 25% will have been lost relative to the pristine state.

Alternative (i) is clearly the better, and more valuable and challenging outcome to achieve.

3.1 The Contingent Valuation (CV) Scenario

The reference scenario and the two preservation plans were presented in terms of both percentage forest area and percentage of species preserved in 2050; relative to the pristine forest in the 1970s. Alternatively, we could have presented the scenario in terms of area and species lost. However, as framing can affect the outcome of a CV survey and WTP is context-dependent, we aimed for a design producing conservative, lower values. For the same reason we told the experts the payment vehicle of the CV survey would be a national tax rather than e.g. hypothetical voluntary cash contributions. Together with information about the policy use of the results, we in this way also sought to increase the consequentiality of the survey. Further, in order to make it realistic that the money would be needed and collected, we stated that the costs of these preservation plans were so large that support from other countries was needed and collected by national taxes. The exact wordings of the CV scenario, together with maps showing the rainforest cover of the Amazon in the reference and two preservation alternatives, are presented below.Footnote 10

There is concern that unless a major preservation effort is undertaken, only 60% of the original Amazon rainforest area will remain in 2050. Currently, 85% remains of the original rainforest area found in the 1970s. Figure 1 shows where the Amazon rainforest will disappear in 2050 with no new preservation measures. If only 60% of the Amazon rainforests remains in 2050, the ecologists’ best guess is that 88% of the species will remain.

The Brazilian Government, in collaboration with experts from international agencies, has developed two different rainforest preservation plans. These preservation plans will be expensive to carry out, since a large number of farmers and other property holders must be compensated for preserving their part of the forest. It cannot be implemented by the Brazilian government without additional sources of support. If the funds raised by the Brazilian government and internationally exceed the costs of the preservation, the plans will be implemented and national taxes will be collected from households in all countries.

With no new preservation measures, only 60% of the rainforest will remain in 2050 (Fig. 1). We would like you to consider the two proposed Amazon rainforest preservation plans.

With PLAN A (Fig. 2) no further deforestation would occur. The current area of the Amazon rainforest will then remain in 2050, so that 85% of the original rainforest, and all (100%) the currently existing species, will be preserved. This is the more ambitious and expensive plan.

With PLAN B (Fig. 3) there will be some further loss in the rainforest area but less than if no measure is taken (Fig. 1). 75% of the rainforest area will be preserved in 2050, and 93% of the species. This is a less ambitious, and also less costly, plan than plan A.

Note that the access to the Amazon rainforest with Preservation plans A and B will be the same as today for national and international tourism, and the indigenous people.

Households will be asked for an annual payment per household in terms of a national tax that would be collected in each country in Europe, and submitted to an international Amazon Rainforest Fund. The Fund will be controlled by the European Commission, and the money will be used exclusively and fully for this Amazon Rainforest Preservation Plan (PLAN A or B). The exact form of the payment vehicle would undoubtedly vary from country to country in order to find payment mechanisms that are plausible. The key factors are: (1) per household rather than individual, (2) annual for all future years rather than a one-time payment (since the Amazon will provide these ecosystem service every year for infinity if the preservation plan is implemented), and (3) payment is coercive (e.g., tax) rather than a voluntary contribution.

FOUR WTP ESTIMATES NEEDED FOR EACH PLAN (PLANS A and B )

All of your estimates should be provided in euro. If your national currency is different from euro; convert to euro using the market exchange rates. Assume that the survey design and the statistical analysis of the data would be done according to what you perceive as the current state-of-the-art. Please assume that the payment card below will be used (in euro), but you are free to state any amount (also a number not on the payment card.)

0 1 3 5 10 15 20 25 30 40 50 60 70 80 100 120 150 200 250 300 500 800 1000 euro/household/year

We will first ask you to state WTP numbers for PLAN A (Fig. 2), which preserves the current Amazon rainforest area of 85 % of the original area, and then for the less ambitious PLAN B (Fig. 3) which preserves 75% of the original area. Both plans should be compared to the 60% preserved if no preservation plan is implanted (Fig. 1)

PLAN A Footnote 11 (Fig. 2; the most ambitious and expensive plan, to fully protect today’s rainforest)

V1. Mean per household WTP (annual payment) in your country

________ euro/household/ year

V2. Median per household WTP (annual payment) in your country

________ euro/household/ year

V3. Mean per household WTP (annual payment) in Europe

___________ euro/household/ year

V4. Mean per household WTP (annual payment) in Europe

________ euro/household/ year

The categories of global welfare gains, accruing to the global population outside of South America, that may result from reduced Amazon rainforest losses, include (i) Carbon storage values, (ii) Recreational values (of “eco-tourism”) for international tourists, and (iii) International non-use values, including the biodiversity value of the forest.

We presume that the carbon storage impacts of forest losses, implied by the two loss scenarios, are assessed separately based on estimates of the Social Costs of Carbon (SCC) in terms of global carbon emissions costs. SP experts were told that they should not consider the carbon storage values when stating their WTP, as we assume this value to be considered separate from the expert survey. Thus, the Delphi CV survey valued the second and third items above (where the third is likely more significant).

4 Results

4.1 Sample of Experts

58 experts were contacted during May and June 2012, and 48 of them (83%) replied in Round 1. Two reminders were issues. 10 did not reply; out of which 2 refused to answer, and 1 was on paternity leave. The remaining 7 decided not to answer, mainly due to lack of time. In Round 2 in June and July 2012 all of the original 48 experts replied, after two reminders. In addition, one more expert replied only in Round 2, making the total number of experts equal to 49 in Round 2. Table 1 shows the distribution of experts by country, reflecting to some extent national numbers of environmental valuation practitioners. We see that 29 of 49 experts come from Northern and Central Europe, 12 from Southern Europe and 8 from Eastern Europe. The table indicates levels and differences in WTP by country, by showing the mean WTP for Plan A in Round 1. The table also shows average income levels in the four regions of Europe; both in terms of regular (unadjusted) incomes, and purchasing power parity (PPP)-adjusted incomes which differ less across regions than the former.

All participating experts except five had the nationality of the country in which they lived and worked. These five were asked to state WTP for their country of origin (where they also had conducted SP studies), or state WTP for the country they now lived; depending on which of these countries had fewest environmental valuation experts (as assessed by us). All respondents were also asked to assess the mean and median WTP for all European households; which are our main targets for assessment. As there were only a handful of participating experts (1–5) from any one country, individual-country estimates are only indicative.

4.2 Willingness-to-Pay (WTP) Results

Tables 2 and 3 report main results from Round 1 for Plans A and B, respectively. Tables 4 and 5 do the same for Round 2. The tables report the mean (and other measures) of the mean and median WTP amounts stated by the experts as their prediction of the outcome of CV surveys of these two plans in their own country, and in Europe overall.

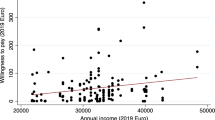

Tables 2 and 3 show that in Round 1 the mean of the experts’ predictions for mean WTP of preserving all of the current Amazon Rainforest (i.e. Plan A where 85% of the original forest is preserved by 2050) among households in Europe overall, is about 32 € per household per year. This is higher than the mean of 26 € for mean WTP predicted by the experts for the less extensive preservation plan B (75% of original forest protected). All experts reported equal or higher WTP for Plan A than for Plan B. The mean estimates of median WTP are lower than for mean WTP, 19 and 15 € for Plans A and B respectively. Thus, the distribution of mean WTP expert estimates is skewed to the left, towards zero WTP, as illustrated in Fig. 1. This is also the case for the median WTP expert estimates in Round 1 (see Fig. 2), and for both mean and median WTP in Round 2 (see Figs. 3 and 4, respectively). Experts’ predictions for both mean and median WTP/household/year for Europe vary a lot in Round 1; from 0 to more than 100 €. Note that these WTP estimates are: (i) marginal WTP for a change in protected rainforest areas rather than total WTP for all of the Amazon rainforest; (ii) not for all of the ecosystem services of the Amazon Rainforest as some e.g. carbon sequestration are not covered, and (iii) not based on all beneficiaries of protecting the Amazon (as there will be WTP also outside of Europe).

Non-parametric tests show that the mean of experts’mean WTP estimates for Plan A is significantly higher (at the 5% level) than for the less extensive protection Plan B. This holds for both Rounds 1 and 2. Thus, overall the experts’ mean WTP estimates pass the scope test.

The mean of experts’ predictions for mean WTP/household/year among their own national population is somewhat (2–3 €) higher than the mean of the predicted mean WTP for all of the European populations. Non-parametric tests show that this difference is significantly different from zero (at the 5% level).Footnote 12

In Round 2, all experts were presented with the results from Round 1 in terms of estimates of mean and median WTP for Europe; shown as the numbers in Tables 1 and 2, and WTP distributions similar to Figs. 1 and 2. In the light of this new information, they were asked to reconsider their own estimates for Europe and their own country; and whether they would like to change their amounts or not.

Tables 4 and 5 show the main results from Round 2. Overall, mean values are lowered somewhat in Round 2; by almost 3 € on average for mean WTP in own country for Plan A, and closer to 5 € for Plan B; with smaller differences for median WTP. For Europe overall mean WTP is reduced by about 4 and 5 € for Plans A and B, respectively. This constitutes a reduction in mean WTP of about 13 and 18% for Plans A and B, respectively. Thus, mean WTP/household/year for Europe after round 2 was 28 and 21 € for Plans A and B, respectively.

Figures 4 and 6 show the frequency distributions of mean WTP for Plans A and B in Europe and own country; from Rounds 1 and 2, respectively. Figures 5 and 7 show the same for median WTP. Both for Europe and experts’ own country the mean WTP distributions narrow from Rounds 1 to 2, as we would expect in a Delphi study.

Table 6 reports percentage shares of experts that changed their WTP estimates of Europe for Plans A and B, from Rounds 1 to 2. We see that more experts retained their original mean WTP estimate for Plan B than for the more extensive Plan A; 59 and 33% respectively. On the other hand, changes were on average greater for Plan B than Plan A. Thus, the average adjustment (up or down) for those that changed their estimates was about 8 € in mean WTP for Plan A, and nearly twice as much (15 €) for Plan B. More experts lowered than increased their mean WTP estimates for both plans. For Plan A, 27% increased their mean WTP while only 8% did so for Plan B. The 1/3 and 1/2 of experts who did not change their estimates from Rounds 1 and 2 for Plans A and B, respectively; have likely felt little pressure towards a consensus.

Those who changed their stated values seemed, overall, to be influenced by the Round 1 results provided to them. However, experts’ experience in conducting SP surveys and other characteristics and attitudes of the experts could not explain why some changed their WTP estimate while others did not.

4.3 What Expert Characteristics Affect WTP Estimates?

In addition to experts’ predictions of WTP, we also asked them about their experience with national and multi-country SP studies (both CV and CE); benefit transfer work; their assessment of the difficulty of carrying out SP studies, and how close the Delphi estimate would be to the results from an actual CV study in Europe (see Table 7). Tables 8 and 9 report the results of regression models trying to explain the variation in experts’ WTP predictions by these characteristics and attitudes of the experts. In Tables 10 and 11 we also use measures of the experts’ country income levels to explain differences in their mean WTP predictions for both their own country and Europe as a whole.

Table 7 shows that experts on average do not consider it more difficult to conduct a CV survey of the Amazon than a CV survey of domestic biodiversity. Both are judged to be close to the middle of a Likert scale from 1 to 10; where 1 is “not at all difficult” and 10 is “very difficult”. When experts are asked to assess how close their estimate is to that of an actual CV survey the average score is 6.3 on a scale from 1 to 10; where I is “Not at all close” and 10 is “Very close”. Thus, experts seem to think it is moderately difficult to value biodiversity, and no more difficult to value biodiversity in their own country than valuing biodiversity abroad among households in their own country. They are also reasonably optimistic about how close their WTP estimate is to the outcome of an actual survey of households.

After eliminating variables that were highly correlatedFootnote 13 we ran log-linearFootnote 14 regressions (with log (WTP+1) in order to include zero responses) to determine how experts’ assessment of the difficulty of performing CV surveys, and their experience and familiarity with SP studies affected their predicted mean WTP estimates for households in their own country and Europe overall for Plans A and B. Table 8 and 9, report the results for Rounds 1 and 2 WTP estimates, respectively. The results show that WTP increase with the expert’s increased experience and familiarity with SP methods; represented by the variables: regularly reading the journal “Environmental and Resource Economics”, percent of own research time spent on CV and CE, and the number of CV and CE papers reviewed the last 5 years. This holds true for both own country and Europe WTP estimates, and for both Rounds 1 and 2, with one exception. In Round 2 only the WTP estimates for Europe, not experts’ own country, were significantly positively affected by the number of CV and CE papers reviewed the last 5 years.

Higher stated WTP predictions among readers of the “Environmental Resource Economics“ journal could be due to greater trust in SP methods from reading about them, and observing that environmental values among the respective populations are in general high.

The variable “Familiarity with the CV literature”, however, is not significant (at the 10% level) in Round 1, but has a significant negative effect on WTP in Round 2. This could indicate that after experts saw the WTP predictions by other experts and were allowed to adjust their own predictions, the pattern that those that were more familiar with CV studies stated lower mean WTP for their own country became clearer.

The expert’s perceived difficulty in implementing CV studies on biodiversity in the Amazon or in their own country, did not have a significant effect on their stated WTP at the 10% level. The same is true for how close they thought their estimates were to those from an actual CV survey.

4.4 Income Elasticity of Willingness-to-Pay (WTP)

The average income in experts’ own country has a significant and positive impact on their predicted mean WTP, both for their own country (Tables 10 and 11) and Europe overall (Table 12). Tables 10 and 11 report estimated income elasticities of WTP, based on the predicted mean WTP by the experts and two measures of income (i.e. regular GDP per capita, and purchasing power parity (PPP) corrected GDP per capita); for plans A and B in both Rounds 1 and 2. Both the “raw” (or gross) elasticities, regressing WTP on the income measure only, and the “corrected” (or net) elasticities from regressions including the explanatory variables in Table 7 are presented.

The number of experts and countries in our survey (48, and 20, respectively) are too small to yield precisely estimated coefficients for the effects of average national income on average national WTP for Amazon forest preservation. However, Table 10 shows that for models with “raw” GDP figures, virtually all estimated elasticities are in the range 0.5–0.6.Footnote 15 As expected, elasticities with respect to PPP-adjusted income in Table 11, are larger and in the 1 – 1.5 range.

We could also possibly expect Round 2 figures to be more “compressed”, and thus yielding lower elasticity than Round 1. However, this may not hold if Round 2 figures are lower on the average, as the fat right tail in the Mean WTP distribution is getting shorter and/or slimmer in Round 2 (according to Tables 3–5, and Figs. 4 and 6). This is reflected in our data, as elasticities are generally higher when based on Round 2 than Round 1 results.

Table 12 presents estimates of experts’ assessments of mean European WTP overall, as functions of per-capita average GDP levels. We find all these elasticities to be negative, meaning that experts in countries with relatively high incomes provided relatively low estimates of the average European WTP. This tendency is, however, far less pronounced for Round 2 answers than for Round 1. The reasons for this are unclear, but one possible explanation is that answers in Round 2 are more qualified and “rational” than those in Round 1 (although they could also potentially be biased by the information given between the two rounds). Another explanation could be that we observe “pessimism” with respect to mean WTP among experts in high-income countries; and/or “optimism” among experts in low-income countries.

As country GDP per-capita is a more clear-cut predictor of own-country WTP rather than of European WTP, it may be argued that the results for the experts’ own country WTP estimates are more appropriate for benefit transfer purposes. Actual CV surveys of the population would, due to the high costs, likely be infeasible in more than a few European countries (like in the Horton et al. (2002, 2003) study). Our approach has the strength that it can exploit the fact that experts may collectively have an idea about the relative values across these countries, even when they do not know the actual values. Our income elasticity estimates of 0.5-0.6, and the benefit transfer method based on unit value transfer with income adjustments (see e.g Navrud 2004; Navrud and Ready 2007), can then be used to infer approximate average population values for countries where population CV surveys are not conducted. While imperfect, this might, arguably, be a fruitful and cost-effective way of testing the validity of the preliminary mean WTP estimates for Europe from this Delphi CV exercise.

5 Conclusions

This study reports assessments among European environmental valuation experts, of mean population WTP for protecting the Amazon rainforest in their own countries and in Europe overall. The answers were provided through two rounds of a Delphi expert survey. In the first round, experts provided WTP estimates, which they could change in the second round after seeing the Round 1 results for all experts. The mean estimates in Round 1 across the 49 European experts for mean annual WTP per European household were 32 and 26 € for preserving 85% (Plan A), and 75% (Plan B), respectively, of the original Amazon rainforest. In the reference, “no-policy” (business-as-usual) alternative only 60% of the original forest would remain by 2050. In Round 2, experts could adjust their initial WTP predictions after seeing summary statistics from Round 1. Mean WTP then dropped to 28 and 21 €/household/year for Plans A and B, respectively.

Income elasticities of WTP are in the range 0.5–0.6 when using regular country GDP per capita as the income measure; and 1–1.5 for PPP-adjusted GDP per capita. Which elasticities are “more correct” to use? As a measure of “true” WTP, both are “equally correct”: the regular GDP measure captures the “relative price” effects between low- and high-income level countries; while the adjusted GDP measure captures “real income” effects and their impact on WTP. One could argue that income elasticities calculated from the regular GDP/capita are more appropriateFootnote 16 for international payments that require (non-corrected) foreign exchange. Income elasticities of WTP and income elasticities of demand are related, but knowing the former is not sufficient to tell whether this is a normal or a luxury good. As Flores and Carson (1997) find that demand luxuries may or may not have income elasticities of WTP which are greater than one, preservation of the Amazon rainforest with income elasticities of WTP below one could still be a luxury good.

The mean WTP estimates per household derived from this Delphi CV exercise are about half of the WTP Horton et al. (2002, 2003) found in their CV survey of British and Italian households. However, the studies are not directly comparable as some survey design features differ between the two studies, including the scope of preservation of the Amazon rainforest; and then Horton et al. (2002, 2003) covers only two European countries.

Assuming that our study permits us to add up these preliminary Delphi CV estimates of annual WTP per household across all European households, and that experts represent their respective populations correctly, we can calculate aggregated WTP. Our results indicate an annual WTP among European households for preserving the current Amazon rainforest (and avoid a reduction from currently 85% to 60 % of the original forest by 2050) of approximately 8.4 billion € annually; i.e. 28 €/household/year times 300 million households in Europe. This estimate assumes that the 49 experts in Round 2 are able to provide a representative estimate of mean WTP for European households. If, however, experts in high income countries overestimated Europe’s WTP (and experts in low income countries likewise underestimated Europe’s WTP), and most experts are from high income countries (where most of the European SP studies have been performed to date); the aggregate WTP is biased upwards. However, the opposite could also be true if the expert puts more weight on European low income countries than justified by the population weights provided in the survey. Thus, we stress that these Delphi CV estimates are highly preliminary. They need to be validated and calibrated by actual CV surveys in Europe.

The results indicates that benefits to distant beneficiaries (primarily non-users) could be substantial for the change in provision of this global public good, but the next question is then whether the global benefits exceed the preservation costs. To our knowledge, there are no estimates of the social costs of the most extensive preservation plan A (nor the less extensive Plan B). However, as an exemplary cost we use the average value of Payment for Ecosystem Services (PES) schemes for set-asides on private forest land implemented by the Brazilian government and local NGOs of US $ 132.73 per ha per year (Banks-Leite et al. 2014; p.1043). This is equivalent to about 122 €Footnote 17 per ha per year or 12,200 € per \(\hbox {km}^{2}\) per year. 5,500,000 \(\hbox {km}^{2}\) of the Amazon rainforest is currently covered by forest, and the most extensive protection plan valued here would thus avoid a loss of 29% (i.e. 25% divided by 85%) of this forest area.This comprises 1,595,000 \(\hbox {km}^{2}\). The exemplary social costs of avoiding a reduction from currently 85% to 60% of the original Amazon rainforest (in the 1970s) is then 19.5 billion annually. Thus, Europeans’ aggregate benefits of 8.4 billion € would not outweigh these costs. However, as the Amazon rainforest is a global public good we also expect other parts of the global population, especially North and South America, Oceania, and parts of Asia to have significant WTP for preserving the Amazon rainforest. Even with a lower level of annual WTP per household among these populations, aggregated global WTP would easily exceed the exemplary annual costs due to the high number of households in these continents.

Notes

Converted to 2012 PPP-€ using the standard procedure of adjusting with the US Consumer Price Index to 2012- US $ (a 64% increase) and using the purchase power parity (PPP)-corrected exchange rate between US $ and euros for the EU-28 countries in 2012 (0.756 from; http://www.oecd.org/std/purchasingpowerparitiespppsdata.htm) in order to make the results comparable to our Delphi CV survey, which was conducted in 2012.

Converted to 2012 PPP-€ using the standard procedure of adjusting with the UK Consumer Price Index to UK 2012-£ (a 46% increase) and using the purchase power parity (PPP)-corrected exchange rate between UK £ and euros for the EU-28 countries in 2012 (1.087; calculated from http://www.oecd.org/std/purchasingpowerparitiespppsdata.htm) in order to make the results comparable to our Delphi CV survey, which was conducted in 2012. Note, however, that the strict assumption of this standard procedure for temporal benefit transfer, i.e. that people’s WTP for this public good has increased at the same rate as the CPI (for private goods), might not hold (Navrud and Ready 2007).

For representative CE studies see Adamowicz et al. (1998), Hanley et al. (1998), and Louviere et al. (2000). Among prominent, more specific and recent, applications to environmental and resource economics, are Bennett and Blamey (2001), Bateman (2002), Holmes and Adamowicz (2003), Rolfe and Bennett (2006), and Bennett and Birol (2010). Note also that Carson and Louviere (2011) in their attempt to develop a common nomenclature for SP methods argue that the distinction between CE and CV is odd as the original meaning of CV was using a survey approach to place an economic value on marginal changes in public goods, and thus encompassing what we currently term Choice Experiments.

Comparative studies of internet surveys and traditional survey modes like face-to-face interviews and mail surveys indicate that internet surveys could perform just as well; especially in countries with high internet penetration and using panels of households recruited for internet surveys by professional survey firms (Lindhjem and Navrud 2011a, b). However, in countries with low internet penetration, internet surveys would have to be replaced or supplemented by the traditional surveys modes of face-to-face interviews or mail in order to secure a representative sample.

For the European WTP estimate, the experts were told to assume that each European household should be given equal weight. Information of the approximate percentage of the European population in the different European countries was provided: Germany 15% , France 12%, UK 12 %, Italy 11%, Spain 9%, Poland 7%, Romania 4%, Netherlands 3%; 2% each for Austria , Belgium, Czech Republic, Greece, Hungary, Portugal and Sweden;, 1% each for Bosnia, Croatia, Denmark, Finland, Ireland, Norway, Serbia, Slovakia, Switzerland, and the Baltic states taken together (Estonia, Latvia and Lithuania). Albania, Cyprus, Iceland, Kosovo, Luxemburg, Macedonia, Malta, Montenegro, Slovenia and other countries made up the remaining 3% of the European population.

The complete questionnaire for Rounds 1 and 2 can be found in Navrud and Strand (2013; Appendices 1 and 2).

The same four estimates were then requested for Plan B.

These differences might be due to experts being more pessimistic with respect to aggregate European WTP than to own-country WTP; but in part also follow from differences in methods of (implicit and explicit) aggregation across European countries by experts themselves; and the fact that countries with high WTP (and income) levels are likely overrepresented among experts.

Eliminating one variable of every pair of variables having a higher correlation (r) than 0.3, as a rule of thumb.

We also ran linear regressions, but these had in general fewer significant variables and lower explanatory power.

Note that we are presenting both “raw” (with only per-capita national income included) and “corrected” calculations (which include a number of relevant background variables some of which are significant; see Table 7).

See Navrud and Strand (2013; Appendix 3) for a formal presentation of this argument.

Using a PPP-corrected exchange rate of 1 US $ =0.92 € (http://stats.oecd.org/Index.aspx?DataSetCode=CPL).

References

Adamowicz W, Boxall P, Williams M, Louviere J (1998) Stated preference approaches for measuring passive use values: choice experiments and contingent valuation. Am J Agric Econ 80:64–75

Banks-Leite C, Pardini R, Tambosi LR, Pearse WD, Bueno AA, Bruscagin RT, Condez TH, Dixo M, Igari AT, Martensen AC, Metzger JP (2014) Using ecological thresholds to evaluate the costs and benefits of set-asides in a biodiversity hotspot. Science 345(6200):1041–1045

Bateman I et al (2002) Economic valuation with stated preference techniques: a manual. Edward Elgar Publishing, Cheltenham

Bennett J, Birol E (eds) (2010) Choice experiments in developing countries: implementation, challenges and policy implications. Edward Elgar Publishing, Cheltenham

Bennett J, Blamey R (2001) The choice modelling approach to environmental valuation. Edward Elgar Publishing, Cheltenham

Carson RT (1998) Valuation of tropical rainforests: philosophical and practical issues in the use of contingent valuation. Ecol Econ 24:15–29

Carson RT (2011) Contingent valuation. A comprehensive bibliography and history. Edward Elgar Publishing, Cheltenham

Carson RT, Flores NE, Meade NF (2001) Contingent valuation: controversies and evidence. Environ Resour Econ 19:173–210

Carson RT, Conaway MB, Navrud S (2013) Preliminary valuation of a cultural heritage site of global significance: a delphi contingent valuation study. Chapter 31. In: Rizzo I, Mignosa A (eds) Handbook on the economics of cultural heritage. Edward Elgar Publishing, Cheltenham, pp 586–611

Carson RT, Groves T (2007) Incentive and informational properties of preference questions. Environ Resour Econ 37:181–210

Carson RT, Louviere JJ (2011) A common nomenclature for stated preference elicitation approaches. Environ Resour Econ 49(4):539–559

Dalkey N, Helmer O (1963) An experimental application of the Delphi method to the use of experts. Manag Sci 9(3):458–467

Flores NE, Carson RT (1997) The relationship between the income elasticities of demand and willingness-to-pay. J Environ Econ Manag 33:287–295

Hanley N, Wright RE, Adamovicz V (1998) Using choice experiments to value the environment. Environ Resour Econ 11:413–428

Holmes TP, Adamowicz WL (2003) Attributed-based methods Chapter. 6. In: Champ PA, Boyle KJ, Brown TC (eds) A primer on nonmarket valuation. Kluwer Academic Publishers, Boston

Horton B, Colarullo G, Bateman I, Peres C (2002), Evaluating non-users’ willingness to pay for the implementation of a proposed national parks program in Amazonia: a UK/Italian contingent valuation study. CSERGE Working Paper ECM 02-01

Horton B, Colarullo G, Bateman I, Peres C (2003) Evaluating non-user willingness to pay for a large-scale conservation programme in Amazonia: a UK/Italian contingent valuation study. Environ Conserv 30(2):139–146

Kramer RA, Mercer DE (1997) Valuing a global environmental good: US residents’ willingness to pay to protect tropical rain forests. Land Econ 73:196–210

Lindhjem H, Navrud S (2011a) Using internet in stated preference surveys: a review and comparison of survey modes. Int Rev Environ Resour Econ 5(4):309–351

Lindhjem H, Navrud S (2011b) Are internet surveys an alternative to face-to-face interviews in contingent valuation? Ecol Econ 70(9):1628–1637

Linstone HA, Turoff M (1975) The Delphi method: techniques and applications. Addison-Wesley Reading, p 616, ISBN 978-0-201-04294-8. http://is.njit.edu/pubs/delphibook/

Louviere J, Hensher D, Swait J (2000) Stated choice methods: analysis and applications. Cambridge University Press, Cambridge

May P, Soares-Filho B, Strand J (2013), How much is the Amazon Worth? Upublished working paper, Development Research Group, World Bank, Washington D.C

Mitchell RC, Carson RT (1989) Using surveys to value public goods: the contingent valuation method. Johns Hopkins Press, Baltimore

Navrud S (2004) Value transfer and environmental policy Chapter 5. In: Tietenberg T, Folmer H (eds) 2004 the international yearbook of environmental and resource economics 2004/2005. A survey of current issues. Edward Elgar Publishing, Cheltenham, pp 189–217

Navrud S, Ready R (eds) (2007) Environmental value transfer: issues and methods. Springer, Dordrect

Navrud S, Strand J (2013) Valuing global public goods. A European Delphi stated preference survey of population willingness to pay for Amazon rainforest preservation. Policy Research Working Paper 6637. The World Bank Development Research Group Environment and Energy Team. http://www-wds.worldbank.org/external/default/WDSContentServer/IW3P/IB/2013/10/04/000158349_20131004083106/Rendered/PDF/WPS6637.pdf

Rolfe J, Bennett J (eds) (2006) Choice modeling and the transfer of environmental values. Edward Elgar Publishing, Cheltenham

Rowe G, Wright G (1996) The impact of task characteristics on the performance of structured group forecasting techniques. Int J Forecast 12:73–89

Sackman H (1975) Delphi critique: expert opinion. Forecasting and group process. D.C. Heath, Lexington

Tol RSJ (2005) The marginal damage costs of carbon dioxide emissions: an assessment of the uncertainties. Energ Policy 33:2064–2074

Tol RSJ (2008) The social costs of carbon: trends, outliers and catastrophes. Economics–The Open–Access, Open-Assessment E-journal. vol 2 (2008-25) August 12-2008 . http://dspace.cigilibrary.org/jspui/bitstream/123456789/28253/1/The%20Social%20Cost%20of%20Carbon%20-Trends%20Outliers%20and%20Catastrophes.pdf?1

Veisten K, Navrud S (2006) Contingent valuation and actual payment for voluntarily provided passive-use values: assessing the effect of an induced truth-telling mechanism and elicitation formats. Appl Econ 38:735–756

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Navrud, S., Strand, J. Valuing Global Ecosystem Services: What Do European Experts Say? Applying the Delphi Method to Contingent Valuation of the Amazon Rainforest. Environ Resource Econ 70, 249–269 (2018). https://doi.org/10.1007/s10640-017-0119-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0119-6

Keywords

- Delphi method

- Stated preference

- Contingent valuation

- Global public goods

- Amazon rainforest

- Ecosystem services

- Non-use value

- Benefit transfer