Abstract

While recent experimental frameworks for national ecosystem service accounting have shown substantial progress, in our view some crucial methodological issues remain that deserve further consideration before setting final standards. In response to the landmark work of Obst et al. (Environ Resour Econ 64:1–23, 2016. doi:10.1007/s10640-015-9921-1), we provide arguments with regard to the suitability of particular valuation approaches. Generally, we agree that respective valuation methods need to produce values that are consistent with national accounting standards such as representing exchange values. However, we disagree with their conclusions regarding specific valuation techniques. Firstly, the circumstance that methods used for estimating shadow prices can also be used to derive consumer surplus does not justify the general exclusion of all shadow pricing methods for valuation of ecosystem services for national accounts, especially for public ecosystem services. Secondly, that preference-based methods can also be used to assess welfare changes does not imply that cost-based methods are generally better suited for ecosystem accounting. To the contrary, we see an essential need for preference information in accounting contexts. Thirdly, that accounting standards use a written-down replacement cost approach, does not mean ecosystem accounting requires to employ a replacement cost approach. To the contrary, we argue that assessing ecosystem degradation through restoration costs would be in line with writing down depreciation, but we also point to its limits.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

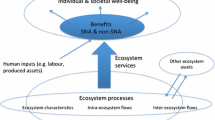

The importance of natural capital and ecosystem services for human well-being have been clearly recognized in recent years, most prominently by the Millennium Ecosystem Assessment (MEA) (2005), The Economics of Ecosystems and Biodiversity (TEEB) (2010), and the UK National Ecosystem Assessment—UKNEA (2014). A large part of the literature on ecosystem services focuses on how information about (marginal) changes in their provision can be used to support environmental policy making on various organizational levels (local, national, regional, global). This has led, among other things, to an interdisciplinary debate on how to properly estimate the economic value of ecosystem services and how to include it in accounting systems (Banzhaf and Boyd 2012; Bartelmus 2014, 2015; Dasgupta 2009; Mäler et al. 2008; Obst et al. 2016; Remme et al. 2015).

This debate has two parts: first, there is the welfare economic part, in which the focus is on the development of intertemporal indices of welfare and sustainability (Arrow et al. 2004; Hamilton and Clemens 1999; UNU-IHDP and UNEP 2014) and on the question of their relationship with conventional accounting measures (Asheim 2000; Dasgupta and Mäler 2000; Weitzman 1976). Second, there is the accounting practice part, in which central attention is paid to develop ways of including natural capital and ecosystem services in national accounting systems of economic activity (Obst et al. 2016; United Nations et al. 2014a, b). For some scholars (Heal and Kriström 2005), these two parts are somewhat detached from each other—despite sharing the goal of providing a sound informational basis for sustainability management decisions (United Nations et al. 2014b).

It should be noted, however, that since the two strands have somewhat different purposes, it is understandable that their approaches to measuring, valuing and aggregating natural capital and ecosystem services differ in some respects. Especially, accounting practice approaches have to adhere to standards defined within the UN system of national accounts (SNA) (United Nations et al. 2008) and the system of environmental-economic accounting (SEEA) (United Nations et al. 2014b). Nonetheless, there is ample opportunity for fruitful cross-fertilization between the two research strands. Thus, in our view, a further scholarly debate is needed in order to identify the most suitable approaches to serve the purpose of the SEEA experimental ecosystem accounting (SEEA-EEA) (United Nations et al. 2014a) to link ecosystem changes with economic activity and provide the informational base for assessing relevant trade-offs and making sustainable management decisions. A central question in this context is: which valuation methods and (aggregate) measures are appropriate for what purpose and under which conditions? With the goal of contributing to this debate, we discuss Obst et al. (2016), their arguments regarding techniques for valuation of non-SNA ecosystem services, and the appropriateness of methods which they tend to exclude: (i) shadow price estimates in lieu of exchange value proxies for non-marketed goods (Sect. 2), (ii) stated preference (SP) methods to obtain exchange value proxies (Sect. 3), and (iii) measurement of ecosystem degradation through restoration costs (Sect. 4). Thereby, we attempt to disentangle the sometimes confounding detachment between welfare and national accounting, in particular with respect to measures and methods for the valuation of ecosystem services and natural capital.

2 On the Relation of Exchange Values and Shadow Prices

The distinction between exchange values (which normally mean market prices) and shadow prices plays an important role in the context of ecosystem service accounting, especially as Obst et al. (2016, p. 6) argue that the latter “are not well suited to national accounting purposes”. We argue that shadow prices and exchange values are not necessarily identical but especially given the absence of (surrogate) markets, a shadow price for a public and non-marketed good may well serve as a suitable exchange value proxy. In what follows we elaborate on these value concepts and show why their relation allows to employ shadow price estimates for non-market ecosystem services.

The exchange value concept is based on the neoclassical notion of relative scarcity of commodities which basically defines the value (price) at which they are traded (Eatwell 1998). According to Obst et al. (2016, p. 5), it is “the value at which goods, services and assets are exchanged regardless of the prevailing market conditions,” which is consistent with the definition by Farber et al. (2002, p. 388): “[t]he exchange value of ecosystem services is the trading ratios for those services”. Such definitions require to assess prices in terms of market exchange values or surrogates. In a pure sense exchange values originate from the price of recorded transactions of tradeable goods. For goods and services that are not traded in any market or are not efficiently tradeable because of their public nature—such as many regulating and cultural ecosystem services (Costanza 2008)—alternative methods have to be employed to impute their contribution to the national economy.

Shadow prices, on the other hand, reflect the marginal contributions of goods to utility and thereby have a similar rooting in relative scarcity and utilitarianism as do exchange values (Farber et al. 2002). According to the new Palgrave dictionary of economics, shadow prices or accounting prices are “prices that reflect social costs and benefits [which] are to be used in lieu of the actual market prices” (Kanbur 1998, p. 316). Hence, external effects are included in shadow prices, as they are hypothetical prices that would hold in perfect markets (in which all externalities are internalized and no other inefficiencies occur). Therefore, even when an actual market transaction occurs, shadow prices may be computed to assess its social costs. Thus, the main difference is that the exchange value of a marketed good may be distorted by market conditions while shadow prices account for distortions such as external effects by design. But this does not mean, contrary to the understanding implied by Obst et al. (2016), that shadow prices produce different values for buyer and vendor such that accounts would be unbalanced. Rather, shadow prices constitute prices that would have occurred if there was a perfect market, since in such a scenario market prices would exactly reflect the marginal contribution to utility (Arrow and Debreu 1954) and thus represent a balanced state of the economy which is in equilibrium. In a situation where there is no existing market, such as in the case of many public ecosystem services, there are no buyers and vendors. Thus, as long as both producer prices, like ecosystems production costs, and buyer prices, like the national economy benefits or the societies marginal WTP, are estimated with the same method, the accounts would be balanced.

Therefore, the choice of method remains and the exact relation of exchange values and shadow prices may help to clarify the applicability of both concepts for non-traded ecosystem services. Let \(\lambda \) denote the shadow price, reflecting marginal social costs and benefits, let p denote the market price, representing the exchange value, and let \(\epsilon \) denote all the distortions prevalent in any market. Given that shadow prices include external effects but market prices do not, the relationship between them can be defined as the market price p equaling the shadow price \(\lambda \) plus the distortion \(\epsilon \) (Eq. 1). In the case of a perfect market with no distortion whatsoever (\(\epsilon = 0\)) p equates \(\lambda \)

When there are distorting market conditions the equality between market price and shadow price does not hold. When ecosystem services are traded or represent an intermediate and ascertainable input to a market good, there is a market price and one could well argue to employ the market price (or a portion thereof) to account for the exchange value (which may include distortions). But in the case of ecosystem goods and services that are public in nature or are not traded, there is no market. Under such conditions, initially we do neither know \(\lambda \), nor p, nor any distortion \(\epsilon \).

The SEEA-EEA aims “to value the quantity of ecosystem services at market prices that would have occurred if the services had been freely traded and exchanged” (United Nations et al. 2014a, para. 5.20). We agree with Obst et al. (2016) that in the context of national accounting alternative proxies have to correspond with the exchange value concept in order to provide a consistent and comparable value estimation basis for values of different goods and services ranging from private to public. However, given that the SEEA-EEA approach to ecosystem service valuation refers to a scenario that assumes trade and thus requires exchange value estimates, shadow prices are, under specific conditions, consistent with accounting standards. When there is no actual trade of ecosystem services in question, there is no reason to assume that in a hypothetical market \(\epsilon \) is different from nil. Thus, \(p = \lambda \). We therefore argue that for ecosystem services that are not marketed the shadow price is a suitable value estimate for approximating a hypothetical exchange value. This is particularly important since the purpose the SEEA-EEA approach to value ecosystem services is an attempt to assess external effects of economic activity on the productive capacity of ecological systems (cf. United Nations et al. 2014a, para. 5.7). Thus, the effects of economic activity have to be properly priced. How can such anthropogenic externalities be valued if not by their marginal contribution to human well-being—which in the end is their marginal contribution to happiness, felicity or utility?

3 On the Need for Preference Information

Understanding the source of value is of utmost importance for any economic assessment—not just for the sake of methodological stringency but also for scientific rigor in its application. Obst et al. (2016, p. 8) argue that methods that include consumer surplus (CS), “such as stated preference methods,” are unfit for accounting purposes and inconsistent with the SNA exchange value concept, and argue for the use of cost-based methods or revealed preference methods. At the same time, the SEEA-EEA states that “[SP methods] can be used to quantify non-use values of an ecosystem in monetary terms [...] [although they] typically incorporate consumer surplus” (United Nations et al. 2014b, para. 5.107). At least the latter is not a general rejection of the potential use of SP methods for estimating prices of marginal changes that are consistent with the exchange value concept. Also, Obst et al. (2016) do not seem to be skeptical of preference-based methods in general, as they explicitly include revealed preference methods in their list of valuation techniques admissible for accounting purposes. We argue that SP methods should not be excluded from but adapted for application in a national accounting setting in order to provide marginal values.

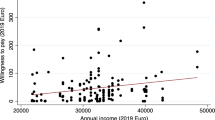

Economic valuation is founded on Hicksian theory of consumer demand (Hicks 1943), which was adapted to the valuation of environmental amenities by Mäler (1974). Economic value (including market prices) is based upon marginal changes in the status of affairs and the value of a good or service derives from the demand for an additional unit which results, ceteris paribus, in people’s marginal willingness to pay (WTP) for that unit. The latter also depends on the budget limitations and other constraints people are facing. Furthermore, value is co-determined by opportunity costs: it generally is the result of trade-offs in choices people have to make between different but potentially substitutable goods with the presumed goal of maximizing their utility; the corresponding trading ratios determine the price of a good. Together with (relative) scarcity in supply and corresponding production costs of the good in question, demand determines the (shadow or market) price. For goods for which no market exists proxies are needed.

The idea behind preference-based methods is to derive values of ecosystem goods and services from consumer choices, actual or hypothetical. Two groups of preference-based methods can be employed. First, we have revealed preference methods, which are consistent with accounting standards, according to Obst et al. (2016). These rely on market data, from which the economic value of ecosystem services or their intermediate contribution to the price of a market good can be derived. The two common types of revealed preference methods are hedonic pricing and travel cost method, which give either average values or marginal values if a second stage of analysis is undertaken (cf. Brouwer et al. 2009; Loomis and Hof 1985). Second, there are SP methods, which Obst et al. (2016) reject in the context of accounting. Although they are also used to compute the value of discrete changes and CS, they can be used to infer marginal WTP for environmental (public) goods by means of questionnaires (Dasgupta 2001; Zhang and Li 2005; Brouwer et al. 2009). In fact, while contingent valuation (CV) studies do in many cases estimate CS, the increasingly popular (Adamowicz 2004; Mahieu et al. 2014) discrete choice experiments (CE) are specifically so designed as to provide marginal values (Hoyos 2010).

The concept of marginal WTP obtained through SP methods is, from a economic perspective, equivalent to a market price estimate. Therefore, it appears safe to assume that SP methods can provide SNA-consistent exchange value proxies for non-marketed goods or services (cf. Dasgupta 2001; Brouwer et al. 2009; Defra and ONS 2014). To clarify this consumer-preferences based argument formally, let V denote the value function with regard to utility U and consumption C. Assuming that the marginal utility of consumption \(U'(C)\) equals marginal WTP, its multiplication with quantity of C corresponds to the value determined by (market) price p times quantity q (Eq. 2, adapted from Dasgupta 2009, Eq. 20)

We therefore argue that as long as \({ marginal}\) WTP are obtained from SP analyses of ecosystem service benefits, the resulting estimates are consistent with the SEEA-EEA concept of value.Footnote 1 Thus, for non-SNA ecosystem services, for which no markets exist, the assessment of marginal WTP via SP provide a price estimate that can be used in lieu of estimates generated by revealed preference methods and cost-based methods promoted by Obst et al. (2016). Of course, as they rightly point out, it should be discriminated between CS estimates (not SNA-consistent) and marginal WTP estimates (SNA-consistent). Studies that assess welfare changes do not always explicitly report the marginal WTP but aggregate CS and the usability of such studies for national ecosystem accounting purposes remains limited (see e.g. Costanza et al. 1997, 2014). Therefore, we would argue for more explicit reporting standard in welfare studies—such that marginal WTP are provided—rather than for exclusion of any particular preference-based methods from national ecosystem accounting. If economic value is based upon satisfaction of preferences why should we discard methods directly reflecting those preferences?

4 On the Measurement of Ecosystem Degradation

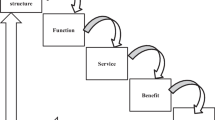

One of the main motivations for the SEEA-EEA is to link economic activity with changes in ecosystems, including their degradation (United Nations et al. 2014a, para. 1.12, 1.16). Degradation is a change in the value of the natural capital stock and results in a reduced capacity of the ecosystem to provide future flows. Therefore, changes in both ecosystem stocks (the ecosystem asset) and flows (the services) are to be measured and valued with suitable methods. In this context, Obst et al. (2016) do not deem restoration cost methods fit for accounting for degradation. In contrast to that, we argue that their proposal, viz., the use of replacement costs, is not just a weak proxy for an exchange value but also omits important information upon substitutability—which depends on demand—and critical thresholds in supply—which depends on ecological conditions. Starting from the general purpose of estimating ecosystem asset values, we elaborate on the cost-based methods in question, critically review Obst et al.’s (2016) interpretation, and argue why and how far restoration cost methods provide reliable ecosystem degradation values estimates.

Generally, the balance sheets of national accounts report both the value and the consumption of capital stocks (United Nations et al. 2008). In order to assess the sustainability of economic development at large the valuation of the stocks of productive capital is essential. Fixed capital, such as man-made productive assets, only has a certain life-time in which it produces goods and services and the closer its age to its life-time, the lower its value. If such de-valuation is not accounted for in the balance sheets, there is no indication on the consumption of capital stocks or a decline in wealth. According to SNA standards the first-best option to assess the value of a capital stock is via market prices and its changes in value through depreciation. For goods for which no market prices exist, a second-best and commonly employed practice in accounting to measure the asset value by calculating the net present value of future flows (United Nations et al. 2014a, para. 5.51), or the change in the value of future flows to measure depreciation. Accordingly, “ecosystem degradation is measured most straightforwardly as the change in value of expected ecosystem service flows over an accounting period” (United Nations et al. 2014a, para. 6.33). So far, we agree and our criticism is restricted to the usage of cost-based methods for the change in non-marketed ecosystem asset stock values: mitigation or avoided damage cost, replacement cost and restoration cost methods. While there is some hesitance to include defensive expenditures in accounting systems (Hamilton 2007; Heal and Kriström 2005; Leipert 1989), the avoidance cost debate is beyond the scope of our response. Thus, we will only focus on the differentiation between replacement costs—which Obst et al. (2016) promote—and restoration costs—which we argue for.

In the context of measuring the depreciation of produced assets within the SNA replacement costs are equivalent to the written-down value of an asset (i.e. how much would it cost to replace an asset in the same (depreciated) condition).Footnote 2 This requires an important distinction to make: replacements may happen via a substitute technology or via re-installing the same technology. We would interpret the SNA approach to be more in accordance with estimating depreciation via a replacements of the same kind but not via a substitute (technology) of the asset—which would rather be an investment. Restoration cost methods measure the degradation of an ecosystem asset via the cost of restoring an ecosystem to some past level of condition, say the same level of functionality and diversity. This approach, too, implies a similar notion: it estimates the value of ecosystem degradation through costs of restoring the same asset but not through costs of any substitute (technology). In this way, there is an important similarity between replacing a man-made asset and restoring an ecosystem: it is the cost of reconditioning an asset to its state at a particular point in time. But there is also an important distinction to make: written-down replacement costs are the price of the asset at a given condition. Restoration costs are the change in value of an ecosystem asset that is to say the price of the change in condition, say degradation, but not the price of the asset. In this sense restoration costs are equivalent to the depreciation of an asset over an accounting period—which represent also the change in value but not the asset price.

In line with our understanding, the SEEA-EEA accepts restoration costs because they “resemble the approach commonly used in the estimation of the value of public goods in the national accounts” (United Nations et al. 2014a, para. 6.36).Footnote 3 This however, seems to be a contested interpretation. Obst et al. (2016, p. 14) do not find a restoration cost method admissible for valuing ecosystem degradation for national accounting purposes because it “does not provide an accounting equivalent to the measurement of the depreciation of produced assets”. Their main argument to support this claim is, in our view, mistaken and their conclusion would lead to biased estimates. They argue that replacement costs refer to the condition of the asset in any accounting period—which in turn relates to the discounted value of the services it produces until the end of its life-time. We agree. Regarding the costs of restoration Obst et al. (2016) argue that these do not relate to the “future income” (p. 15), i.e. the discounted value of future flows of ecosystem services. This is also right. Here is where we think they are mistaken: restoration costs are not directly related to the ecosystems net present value because restoration costs are not the price of an ecosystem asset but the change in the ecosystem asset’s value. Restoration costs are not related to future income in the same way depreciation is not related to future income. Only the price of the asset at a given condition is closely related to its current value, but the change in value from one period to the other is not. Furthermore, and far more substantially, Obst et al.’s (2016) conclusion that replacement costs are better suited is misleading in the sense that they argue in favor of replacement costs as in the “value of an single ecosystem service on the basis of the costs of man-made alternatives for that service” (Obst et al. 2016, p. 15). This is misleading in two ways: (i) we have argued that written-down replacement costs do not imply substitution but rather the cost of replacing it with an asset of the same technology in the same condition. The economic replacement cost method that Obst et al. (2016) argue for implies substitution of a ecosystem service with a man-made alternative and is thus only a weak proxy for an exchange value since it refers to the value of another (though similar) good or service—which is at most a third-best option; (ii) replacement costs—even if full substitutability is dubiously assumed—can only be used to assess the change in an assets value if the costs for the production of the lost quantity of all services foregone are properly aggregated.

While we are in clear favor of employing restoration costs, if the choice is between restoration and replacement costs, we would nevertheless proceed by arguing that there are restrictions to the use of any cost-based methods. The restrictions originate from two dimensions: (i) substitutability given societal preferences and (ii) non-linearities given ecological characteristics such thresholds. Regarding the societal dimension, a welfare economic perspective offers well-founded criticism regarding cost-based methods, especially with respect to the need for knowing actual preferences, which cannot be uncovered by means of these methods (Bockstael et al. 2000; Pearce 1998). That is to say without knowing whether a population would actually be willing to accept a measure and pay accordingly, employing a cost-based method may not necessarily produce reliable value estimates (Freeman et al. 2014; National Research Council 2005; Swinton et al. 2007). While Obst et al. (2016, p. 8) briefly acknowledge this argument, they still promote the use of cost-based methods instead of preference-based approaches. Since we elaborated on the need for preference information in the valuation of non-market ecosystem services in Sect. 3, we refrain from repeating it but only stress the need for assessing whether there is an actual demand before employing cost-based measures. Without knowing societal preference, and in the best case a marginal WTP at given quantities, a cost-based balance sheet value estimate of an ecosystem asset may be biased in the following sense: (i) it may be falsely assumed that an ecosystem degradation is a loss in case restoration costs are applied to an ecosystem asset for which services there is no demand, (ii) it may be falsely assumed that the asset is substitutable if economic replacement costs are used—which may omit certain ecosystem service characteristics that the substitute does not have. Regarding the ecological dimension, ecosystems exhibit characteristics such as regenerability, which differentiates them fundamentally from man-made capital stocks and non-renewable natural resources. Ecosystem assets are a renewable resource and have the capacity to provide a constant flow of services when managed sustainably.Footnote 4. Restoration cost may account for such a situation of sustainable use since the condition of the ecosystem asset would not worsen and thus no restoration costs apply. Under conditions of an unsustainable use, however, restoration costs may account for degradation over time, although the aggregation would require to set one particular state of the ecosystems as the reference point for assessing the restoration costs and their changes over time (restoration to pristine, to cultural landscape status, or just an arbitrary starting point in time state). The critical point, however, is that ecosystems may have ecological thresholds which may cause a rapid and irreversible loss of the entire system when crossing tipping points. While the life-time of a fixed capital asset is normally known or set by standards, there is no such knowledge on the ecological thresholds easily available yet. Even if the threshold is exactly known, restoration costs may approach infinity once the ecosystem condition comes closer to the threshold. Under such conditions, additional information on society’s preferences and marginal WTP may again help to increase plausibility of degradation value estimates.

Hence, once again, if we aim to account for degradation of ecosystem assets, how can we do so without knowing their contribution to human well-being and thus societal values of the services lost if not by taking into account the preferences of beneficiaries?

5 Conclusion

In this reply, we have raised three contentious issues regarding the conclusions of Obst et al. (2016) about the unfitness of particular ecosystem (service) valuation methods in the context of environmental-economic accounting.

\({ First}\), we find a misconception about the concept of shadow prices. While Obst et al. (2016) argue that shadow prices are inconsistent with national accounting standards, in particular with the exchange value concept. The SEEA-EEA approach is to estimate the price of ecosystem services as if traded but there are ecosystem services which are not marketed. In our view, there is no reason to assume any distortion in the non-existing market. Under such a condition, shadow prices would equal hypothetical market prices. Thus, for (public) ecosystem services for which there is no market, in our view, shadow prices resonate with an exchange value and can perfectly be used in national accounting without any inconsistency.

\({ Second}\), the rejection of SP methods omits a large portion of the utilitarian roots of economic valuation and thus essential information about value resulting from marginal utility. Contrary to what is claimed in the article we reply to, SP methods are by no means restricted to estimation of CS. A SP market price surrogate in terms of marginal WTP would therefore, in our view, be consistent with the exchange value concept. We argue that SP methods can therefore be used in lieu of the cost-based methods advocated by Obst et al. (2016) to approximate the marginal value of public ecosystem services for accounting purposes.

\({ Third}\), we argue that restoration costs are a value estimate for ecosystem degradation that is in line with the depreciation of fixed capital as changes in written-down replacement cost approach since it both account for the value of a change in an assets value from one point in time to the other. The economic replacement cost methods that Obst et al. (2016) promote which assume that the ecosystem asset may be substituted by man-made alternatives for the production of its services is misleading and would bias the estimates. Nevertheless, even the restoration costs approach may not under all conditions provide reliable estimate since it may omit demand-side considerations and in particular may fail close to ecological thresholds of total ecosystem asset loss. Thus without additional preference information regarding the ecosystem asset and its services in question the restoration costs approach may still be biased.

Summarizing our critique on a meta-level: the SNA standard clearly states that market prices may well be distorted and that externalities may occur (cf. United Nations et al. 2008, para. 3.119). In order to incorporate some of these externalities, accounting for depletion of natural resources and degradation of ecosystems is the prime motivation for both the SEEA and the SEEA-EEA. To link these measures of consumption of natural capital to standard national accounts appropriate valuation methodology is essential. If properly done, aggregate measures may provide information on the entire capital stock’s value, give insights into the origins of growth or decline such as ecosystem service values changes and thus inform sustainable management decisions for the societally preferable bundle of goods and services. From our perspective, this can hardly be achieved if non-traded ecosystem services are not valued at their social cost, without knowing how much people would actually be willing to pay for them, or by valuing natural capital assets at their substitute’s prices.

Notes

A compatible market price proxy “is such that the revealed prices reflect the truthful responses of the market participants” (United Nations et al. 2014a, para. 5.44). Despite the focus on \({ revealed}\) prices in this sentence, we read this paragraph not against but in favor of SP methods since it is elsewhere stated that SP methods can be suitable (cf. United Nations et al. 2014b, para. 5.107).

Note, however, that in a non-accounting world the economic replacement cost valuation technique for ecosystem services is based on the cost of replacing the services with a man-made alternative (and human inputs)—which implies substitutability and is a different concept than measuring the depreciation through changes in written-down replacement costs.

See Defra and ONS (2014, p. 16) for a similar perspective.

This is already reflected to some extent in the different framing for consumption of capital assets: man-made capital depreciates due to use (Vanoli 2005, p. 327), non-renewable natural capital depletes due to extraction (Edens 2012), and renewable natural capital only degrades when overused (MEA 2005).

Abbreviations

- CE:

-

Discrete choice experiment

- CS:

-

Consumer surplus

- CV:

-

Contingent valuation

- MEA:

-

Millennium ecosystem assessment

- SEEA:

-

System of environmental economic accounting

- SEEA-EEA:

-

SEEA 2012 experimental ecosystem accounting

- SNA:

-

System of national accounts

- SP:

-

Stated preference

- TEEB:

-

The economics of ecosystems and biodiversity

- UK:

-

United Kingdom of Great Britain and Northern Ireland

- UN:

-

United Nations

- WTP:

-

Willingness to pay

References

Adamowicz WL (2004) What’s it worth? an examination of historical trends and future directions in environmental valuation. Aust J Agric Resour Econ 48(3):419–443. doi:10.1111/j.1467-8489.2004.00258.x

Arrow KJ, Debreu G (1954) Existence of an equilibrium for a competitive economy. Econometrica 22(3):265–290. doi:10.2307/1907353

Arrow K, Dasgupta P, Goulder L, Daily G, Ehrlich PR, Heal G, Levin S, Mäler KG, Schneider S, Starrett D, Walker B (2004) Are we consuming too much? J Econ Perspect 18(3):147–172. doi:10.1257/0895330042162377

Asheim GB (2000) Green national accounting: why and how? Environ Dev Econ 5(1):25–48. doi:10.1017/S1355770X00000036

Banzhaf HS, Boyd J (2012) The architecture and measurement of an ecosystem services index. Sustainability 4(4):430–461. doi:10.3390/su4040430

Bartelmus P (2014) Environmental-economic accounting: progress and digression in the SEEA revisions. Rev Income Wealth 4:887–904. doi:10.1111/roiw.12056

Bartelmus P (2015) Do we need ecosystem accounts? Ecol Econ. doi:10.1016/j.ecolecon.2014.12.026

Bockstael NE, Freeman AM, Kopp RJ, Portney PR, Smith VK (2000) On measuring economic values for nature. Environ Sci Technol 34(8):1384–1389. doi:10.1021/es990673l

Brouwer R, Barton D, Bateman I, Brander L, Georgiou S, Martín-ortega J, Navrud S (2009) Economic valuation of environmental and resource costs and benefits in the water framework directive: technical guidelines for practitioners. AquaMoney

Costanza R (2008) Ecosystem services: multiple classification systems are needed. Biol Conserv 141:350–352. doi:10.1016/j.biocon.2007.12.020

Costanza R, Arge R, Groot RD, Farber S, Hannon B, Limburg K, Naeem S, Neill RVO (1997) The value of the world’s ecosystem services and natural capital. Nature 387:253–260. doi:10.1038/387253a0

Costanza R, de Groot R, Sutton P, van der Ploeg S, Anderson SJ, Kubiszewski I, Farber S, Turner RK (2014) Changes in the global value of ecosystem services. Glob Environ Change 26:152–158. doi:10.1016/j.gloenvcha.2014.04.002

Dasgupta P (2001) Human well-being and the natural environment. Oxford University Press, Oxford

Dasgupta P (2009) The welfare economic theory of green national accounts. Environ Resour Econ 42(1):3–38. doi:10.1007/s10640-008-9223-y

Dasgupta P, Mäler KG (2000) Net national product, wealth, and social well-being. Environ Dev Econ 5:69–93. doi:10.1017/S1355770X00000061

Defra, ONS (2014) Principles of ecosystems accounting. Department for Environment, Food and Rural Affairs (Defra) and the Office for National Statistics (ONS), London

Eatwell J (1998) Absolute and exchange value. In: Eatwell J, Milgate M, Newman P (eds) The new Palgrave dictionary of economics. Palgrave Macmillan, Basingstoke, pp 3–4

Edens B (2012) Depletion: bridging the gap between theory and practice. Environ Resour Econ. doi:10.1007/s10640-012-9601-3

Farber SC, Costanza R, Wilson MA (2002) Economic and ecological concepts for valuing ecosystem services. Ecol Econ 41(3):375–392. doi:10.1016/S0921-8009(02)00088-5

Freeman AM, Herriges JA, Kling CL (2014) The measurement of environmental and resource values: theory and methods, 3rd edn. Resources for the Future, Washington, DC

Hamilton C (2007) Measuring sustainable economic welfare. In: Atkinson G, Dietz S, Neumayer E (eds) Handbook of sustainable development. Edward Elgar, Cheltenham, pp 307–318

Hamilton K, Clemens M (1999) Genuine savings rate in developing countries. World Bank Econ Rev 13(2):333–356

Heal G, Kriström B (2005) National income and the environment. In: Mäler KG, Vincent JR (eds) Handbook of environmental economics, vol 3. Elsevier, Amsterdam, pp 1147–1217. doi:10.1016/S1574-0099(05)03022-6 (Chap. 22)

Hicks JR (1943) The four consumer’s surpluses. Rev Econ Stud 11(1):31–41. doi:10.2307/2967517

Hoyos D (2010) The state of the art of environmental valuation with discrete choice experiments. Ecol Econ 69(8):1595–1603. doi:10.1016/j.ecolecon.2010.04.011

Kanbur R (1998) Shadow pricing. In: Durlauf SN, Blume LE (eds) The new Palgrave dictionary of economics, 2nd edn. Palgrave Macmillan, Basingstoke, pp 316–317

Leipert C (1989) Social costs of the economic process and national accounts: the example of defensive expenditures. J Interdiscip Econ 3(1):27–46. doi:10.1177/02601079X8900300104

Loomis JB, Hof JG (1985) Comparability of market and nonmarket valuations of forest and rangeland outputs, research, n edn. USDA Forest Services, Washington, DC

Mahieu PA, Andersson H, Beaumais O, Crastes R, Wolff FC (2014) Is choice experiment becoming more popular than contingent valuation? a systematic review in agriculture, environment and health. Working paper 2014.12, FAERE - French Association of Environmental and Resource Economists

Mäler KG (1974) Environmental economics: a theoretical inquiry. Johns Hopkins University Press, Washington, DC

Mäler KG, Aniyar S, Jansson A (2008) Accounting for ecosystem services as a way to understand the requirements for sustainable development. Proc Nat Acad Sci USA 105(28):9501–9506. doi:10.1073/pnas.0708856105

MEA (2005) Ecosystems and human well-being: synthesis. Island Press, Washington, DC

National Research Council (2005) Valuing ecosystem services: toward better environmental decision-making. National Academies Press, Washington, DC

Obst C, Hein L, Edens B (2016) National accounting and the valuation of ecosystem assets and their services. Environ Resour Econ 64:1–23. doi:10.1007/s10640-015-9921-1

Pearce D (1998) Auditing the earth: the value of the world’s ecosystem services and natural capital. Environ Sci Policy Sustain Dev 40(2):23–28. doi:10.1080/00139159809605092

Remme RP, Edens B, Schröter M, Hein L (2015) Monetary accounting of ecosystem services: a test case for Limburg province, The Netherlands. Ecol Econ 112:116–128. doi:10.1016/j.ecolecon.2015.02.015

Swinton SM, Lupi F, Robertson GP, Hamilton SK (2007) Ecosystem services and agriculture: cultivating agricultural ecosystems for diverse benefits. Ecol Econ 64(2):245–252. doi:10.1016/j.ecolecon.2007.09.020

TEEB (2010) The economics of ecosystems and biodiversity: mainstreaming the economics of nature: a synthesis of the approach, conclusions and recommendations of TEEB. TEEB. www.teebweb.org/publication/mainstreaming-the-economics-of-nature-a-synthesis-of-the-approach-conclusions-and-recommendations-of-teeb/

UKNEA (2014) The UK national ecosystem assessment: synthesis of the key findings. UNEP-WCMC, Cambridge

United Nations, European Commission, IMF, OECD, World Bank (2008) System of national accounts 2008. UN, New York

United Nations, European Commission, FAO, OECD, World Bank Group (2014a) System of environmental-economic accounting 2012: experimental ecosystem accounting. UN, New York

United Nations, European Union, FAO, IMF, OECD, World Bank (2014b) System of environmental-economic accounting 2012: central framework. UN, New York

UNU-IHDP, UNEP (2014) Inclusive wealth report 2014: measuring progress towards sustainability. Cambridge University Press

Vanoli A (2005) A history of national accounting. IOS, Amsterdam

Weitzman ML (1976) On the welfare significance of national product in a dynamic economy. Q J Econ 90(1):156–162

Zhang Y, Li Y (2005) Valuing or pricing natural and environmental resources? Environ Sci Policy 8(2):179–186. doi:10.1016/j.envsci.2004.09.005

Acknowledgements

We thank Jasper Meya and our colleagues at the Department of Economics at the UFZ - Helmholtz Centre for Environmental Research for helpful discussions. Furthermore, we are grateful for the comments of two anonymous referees which helped greatly to improve our manuscript. Any remaining errors remain our sole responsibility.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Droste, N., Bartkowski, B. Ecosystem Service Valuation for National Accounting: A Reply to Obst, Hein and Edens (2016). Environ Resource Econ 71, 205–215 (2018). https://doi.org/10.1007/s10640-017-0146-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-017-0146-3