Abstract

In this study, the relationship between electricity and growth of the economy is investigated by applying the newly-developed bootstrap autoregressive-distributed lag test with a Fourier function to examine both the causality and cointegration for China, India, and the United States (US). While it is not possible to detect a long-term cointegration relation among the economy's electricity and growth, the study findings demonstrate the contingency of the causality. The ensemble method in machine learning performs better than conventional methods as electricity is an independent indicator for forecast economics. Concerning the US, previous electricity consumption has a positive impact on the current nature of economic growth. In contrast, the consumption of electricity is negatively affected by the development of the economy. However, for China and India, positive and negative feedback can be observed, respectively. Due to the increased awareness of the environment's adverse effects, China should promote technologies that conserve energy and boost energy efficiency to achieve sustainable development in both environmental and economic terms. In India's context, broadening access to electricity has significance for residents in rural areas and enhances economic growth. It is recommended that policy-makers promote innovative technologies in the US, as the abundant natural and human resources can make valuable contributions to the society and development of the economy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

In recent years, consistent growth has been observed in terms of the global demand for and consumption of energy (Pablo-Romero et al. 2017). Both developed and developing countries are making efforts to accelerate the growth of their economies. The fast expansion of the population and increased urbanization have become the driving forces behind the rise in global energy usage (Hassan et al. 2019; Xin-gang and Pei-ling 2020; Wang et al. 2019). As stated by the US Energy Information Administration (2020), fluctuations may occur in demand for energy due to annual weather variations; nevertheless, demand patterns, in the long run, are generally based on economic growth. The IEA (2019) claimed that the rise in electricity consumption is primarily caused by industrial production (particularly in China) and home appliances, cooling, and electric automobiles. Furthermore, it is expected that electricity will be one of the only sources of energy that will experience a growth in usage in 2040, largely as a result of electric vehicles, along with the direct usage of renewable energy and hydrogen, while there is a growing trend in terms of renewable energy.

Economic theories do not address the relationship between energy usage and the economy's growth; however, several empirical studies have focused on investigating this subject in the energy economics literature. In particular, a large volume of research validates the presence of a relationship between electricity usage and economic growth. Moreover, the association between energy and economic growth has started to attract the attention of more researchers. The seminal study by Kraft and Kraft (1978) investigated the nexus between energy consumption and development in the US context, where the findings presented empirical evidence that a one-way causality runs from production activity output to the consumption of energy.

Conversely, a country’s economic development is significantly dependent on electricity. Growth in the level of electricity usage, particularly in the industrial sector, is beneficial for its economic progress (Shahbaz et al. 2017; Kahane and Squitieri 1987; Costa-Campi et al. 2018; Jarrett et al. 2019). Hence, electricity is a valuable source of energy as it can facilitate the standard functioning of businesses within supply chains essential for both society and the economy. Consequently, if deficiencies in the supply of electricity occur, this will negatively impact industrial production, which will have a destabilizing effect on the economy. In summary, there is an ongoing debate within the literature on energy economics regarding the direction of the causal relationship between economic growth and energy usage.

The majority of studies in the literature have investigated the relationship between electricity and the growth of the economy via causality and cointegration tests in panel studies and research on particular countries. However, researchers have recently demonstrated that the consideration of structural shifts is a critical factor in causality analysis. According to Enders and Jones (2016), if structural breaks are neglected in time series models, it can create errors of misspecification. Resultantly, conclusions, drawn from Granger causality and cointegration analysis, could be deceptive if structural breaks are not appropriately considered. Concerning time series models, it can be challenging to control for structural breaks and determine the root source of the breaks as a break in one variable can cause a shift in another (Enders and Jones 2016). To resolve this problem and to facilitate the determination of the form of the shifts in addition to the estimation of the amount and dates of breaks that exist in a given time series model, Fourier approximation was employed by Enders and Jones (2016) in a recently conducted study. Hence, when analyzing the relationship between electricity consumption and economic growth, considering gradual and sharp breaks in the time series model is comparatively reliable. Knowledge of the connection and nature of the causal relationship among the consumption of electricity and growth of the economy in a given country through a relatively thorough analysis that takes both gradual and sharp breaks into account can be highly beneficial for policy-makers when developing energy policies.

This research represents one of a limited number of studies that have attempted to investigate the relationship between the consumption of electricity and economic growth with gradual and sharp breaks. Furthermore, to the best of the author’s knowledge, this is the first study aimed at exploring the nexus between relation and causality between the aforementioned variables in the context of the US, Japan, and China in both the long and short run through the application of the innovative bootstrap autoregressive-distributed lag (ARDL) approach with Fourier function (Yilanci et al. 2020). The contributions this study makes to the literature are three-fold. Firstly, the bootstrap ARDL approach is applied, which rectifies the shortcomings identified in Pesaran et al. (2001), and the presence of a cointegration relationship is investigated in greater detail. Secondly, the paper utilizes a Fourier function where the amount and dates of the breaks are not pre-determined. Thirdly, certain management and economic implications emerge from the comparatively reliable findings, which will make a valuable contribution to the literature on energy economics and real-world policies.

The remainder of this study is organized as follows. The literature review is described in Sect. 2. Section 3 presents the data and methodology. The empirical results are presented in Sect. 4, while Sect. 5 includes the research conclusions.

2 Literature

In the literature, four different hypotheses are recognized about the nature of the energy-growth nexus, namely the growth, conservation, feedback, and neutrality hypotheses. In recent years, scholars in social science have been unable to provide clear evidence regarding the causality between the consumption of electricity and the economy's growth. According to the growth hypothesis, the causality is from the consumption of electricity to economic growth, while the conservation hypothesis implies the opposite. However, the feedback hypothesis (two-way) states that economic growth leads to electricity consumption, and the consumption of electricity also leads to economic growth, implying a two-way relationship between the two variables. Lastly, according to the neutrality hypothesis, there is no causality between electricity consumption and the growth of the economy.

Based on the four abovementioned hypotheses regarding the relationship between energy and growth, innovative statistical techniques have been developed to verify the causality between the variables for these hypotheses. In Table 1, the empirical findings of these hypotheses from studies on specific countries are presented. Furthermore, studies in the literature have applied predictions based on machine learning techniques to support econometric methods. This enables decision-makers to predict the potential economic outcomes and therefore implement suitable measures to prevent the system from being impaired.

The development of a society in terms of economic and energy is mainly dependent on citizens' behavior and the decisions taken by policy-makers based on researchers’ estimations of the status of a system in energy or economics. It is recommended that governments take suitable actions according to the predicted levels of electricity consumption or economic decline based on machine learning analysis. Hence, it is possible for power stations, electricity-dependent facilities, and the country as a whole to pre-warned, allowing decision-makers to modify the overall strategies of organizations or the policy that should be adopted by the country. In the economics literature on the subject of predictions, Kozlowski and Sim (2019) implemented parametric and non-parametric models in which logit and artificial neural networks were used to predict economic recessions, and yield spread was employed as the predictor variable. The findings indicated that the mean absolute error was lower in the neural network model than the logit model. In a study by Gründler and Krieger (2016), the relationship between democracy and economic growth was investigated by employing the support vector machine approach supported by econometric techniques. The researchers were able to develop a Democracy Index for 185 nations by applying the support vector machine approach. In contrast, an econometric model was utilized to investigate the nexus between democracy and economic growth. In a study focused on predicting financial distress within the construction sector, traditional and ensemble techniques were implemented to compare the forecasting models’ performance (Choi et al. 2018). The findings indicated that the k-nearest neighbor algorithm as a simple ensemble classifier with a maximum weighted count of errors and correct outperformed the individual classifiers. Artificial neural networks are employed for predicting economic expansion when different factors are concerning the predictor variable, including macroeconomics (Sokolov-Mladenović et al. 2016; Milačić et al. 2017; Kordanuli et al. 2017; Kozlowski and Sim 2019), the environment (Marjanović et al. 2016; Ashin Nishan 2020), energy resources (Cogoljević et al. 2018), and technology aspects (Marković et al. 2017).

The empirical findings of various research studies in different countries are also varied. Firstly, according to the growth hypothesis, the implementation of an electricity policy has a significant impact on regulating the degree of production and output; particular research has provided evidence proving the existence of the growth hypothesis (e.g. Chandio et al. (2019) in Pakistan; Akalpler and Hove (2019) in India; Wu et al. (2019) in India; Pata and Kahveci (2018) in Turkey; Boukhelkhal and Bengana (2018) in Egypt and Morocco; Kahouli (2017) in Lebanon; Kumar et al. (2017) in Austria and Macedonia; Nguyen et al. (2017) in India and China; Bildirici (2016)in Australia, Belgium, Finland, and Japan; Bildirici and Kayikçi (2016) in Romania; Kumar et al. (2015) in South Africa; Kayıkçı and Bildirici (2015) in Iran, Iraq, Kuwait, and Saudi Arabia). In a study by Stern (2000), the author employed an index of final energy use adjusted for quality where electricity consumption was the energy input in the US; the results indicated that causality flows from energy input to income. Akalpler and Hove (2019) explored the relationship between economic growth, energy consumption, CO2 emissions, and trade factors in India by utilizing the autoregressive-distributed lag (ARDL) approach between 1971 and 2014 timespan. The researchers found a long-term relationship between the studied variables, where the causal relationship flows from energy consumption to the growth of the economy in India.

The conservation hypothesis contends that an increase in electricity usage causes the economy to grow, suggesting that it is possible to implement policies and strategies that restrict electricity within an economy without negatively impacting the economy's performance in terms of domestic production. Various studies have supported this hypothesis (e.g., Nepal and Paija (2019) in Nepal; Kumar et al. (2019) in Albania; Nyasha et al. (2018) in Ethiopia; Kahouli (2017) in Israel; Kyophilavong et al. (2017) in Laos; Kumar et al. (2017) in Turkey, Italy, Cyprus, Hungary, Bulgaria, Romania, and Albania; Al-Mulali et al. (2016) in Brazil; Rafindadi and Ozturk (2016) in Japan; Sekantsi and Thamae (2016) in Lesotho; Sekantsi and Okot (2016) in Uganda; Bildirici (2016) in Canada, France, the UK, and the US; Bildirici and Kayikçi (2016) in Albania, Poland, Czech Republic, Hungary, Bulgaria, and Slovakia; Kayıkçı and Bildirici (2015) in Israel and Pakistan for Nepal). Bildirici et al. (2012) examined the relationship between electricity consumption and economic growth for large developing and developed nations by employing the ARDL technique for the period between 1978 and 2010. The researchers found that the causality flows from electricity consumption to GDP for China and the US. Utilizing the ARDL approach, Nguyen et al. (2017) investigated the dynamic associations between energy use, CO2 emissions, and the economy of India and China. Their findings indicated a long-term cointegration relationship when economic growth and energy consumption were employed as the dependent variables; a one-way causality running from energy to growth of the economy was demonstrated for China. In research conducted by Bildirici (2016), the Granger causality test and ARDL model were employed for investigating the nature of the causality among energy consumption and the growth of the economy for significant countries around the world for the timespan between 1980 and 2010. Their findings suggested that a one-way causality runs from economic growth to energy consumption for the US.

According to the feedback hypothesis, policies and strategies aimed at conserving electricity will cause a deterioration of national output as the reduction of economic growth will lessen the electricity demand. A number of different studies on various countries have provided support for the feedback hypothesis (e.g. Zhong et al. (2019) in China; Benkraiem et al. (2019) in Bolivia; Hussain et al. (2019) in Malaysia; Wu et al. (2019) in China and the US; Boukhelkhal and Bengana (2018) in Tunisia; Liu (2018) in China; Kahouli (2017) in Tunisia; Amri (2017) in Algeria; Kumar et al. (2017) in Greece, Slovakia, and Slovenia; Sbia et al. (2017) in the United Arab Emirates; Asumadu-Sarkodie and Owusu (2016) in Ghana; Katırcıoğlu et al. (2016) in Canada; Kayıkçı and Bildirici (2015) in Bahrain, Kuwait, and Syria). In the US, Lee (2006) conducted a study to investigate the association between the consumption of energy and the growth of the economy for principal industrialized nations. The findings revealed a two-way causal relationship between electricity use and real GDP per capita for the US. Zhong et al. (2019) employed the ARDL approach and Granger causality test to explore the dynamic relations between real GDP, electricity consumption, and labor force in China for the timespan between 1971 and 2009. They concluded that a long-term cointegration relationship existed when real GDP was utilized as the dependent variable; a two-way causal relationship between real GDP and energy consumption was demonstrated for China. In research performed by Liu (2018), both ARDL and Granger causality tests based on the vector error correction model were used to investigate the relationship between energy consumption and growth of the economy in China for the period from 1982 to 2015. The findings indicated that a two-way causality exists between the variables in the case of China.

Various researchers have supported the neutrality hypothesis, suggesting no significant directional causal relationship between electricity usage and economic growth. In other words, electricity usage and the development of the economy are not mutually dependent, and a change in one will not impact the other (e.g., Boukhelkhal and Bengana (2018) in Algeria; Faisal et al. (2018) in Iceland; Bah and Azam (2017) in South Africa; Kahouli (2017) in Algeria, Egypt, and Morocco; Wada (2017) in Nigeria; Rahman and Mamun (2016) in Australia; Dogan (2015) in Turkey; Kayıkçı and Bildirici (2015) in Egypt, Jordan, and Tunisia). Payne (2009) concentrated on the causal relationship between energy and the US economy's growth by employing the Toda-Yamamoto Granger causality. He concluded that the causality among the variables in the US was not significant. Although empirical research into the relationship between electricity and economic growth is expanding rapidly, there is no agreement among researchers regarding the direction of causality. The nature of such a causal relationship is found to be different in various countries and areas due to the size of the sample, methodological approach used, and the measurement proxies utilized for electricity consumption and growth of the economy.

While specific researchers have explored the relationship between electricity (energy) and economic growth by employing the Granger causality test and ARDL approach (Pesaran et al. 2001), there has been minimal focus on the use of the bootstrap ARDL with Fourier function (Yilanci et al. 2020). This approach is comparatively reliable and can avoid misleading inferences regarding the associations among variables in both the short and long term (McNown et al. 2018). Additionally, the Fourier approximation's reliability in catching smooth and structural breaks is relatively good when information on the amount and dates of structural breaks in a time series model is naturally available (Enders and Jones 2016). Hence, this study utilizes the innovative model, bootstrap ARDL with Fourier function, to test the cointegration and causality relationships among electricity and growth of the economy, which conventional estimation methods may not detect.

3 Methodology

This research uses bootstrap ARDL with a Fourier function to investigate the long-run cointegration and causal relation between the economy's growth and electricity usage. Pesaran et al. (2001) originally developed the ARDL model, while the Fourier approximation methodology with the bootstrap ARDL cointegration model follows Yilanci et al. (2020). Various factors are critical in the adoption of the bootstrap ARDL test and Fourier approximation. Firstly, unlike the classical ARDL bounded test, the bootstrap ARDL test allows (weak) endogeneity of two or multiple variables, which helps provide feedback from the dependent to the independent variable. Secondly, McNown et al. (2018) applied the bootstrap methodology to the ARDL cointegration tests, determining that it is essential to consider suitable power and size properties when implementing these tests. Thirdly, improvements to the ARDL bound test were made by McNown et al. (2018), who incorporated a lagged independent variable to support the current F and t cointegration tests, as suggested by Pesaran et al. (2001). Fourthly, it was proposed by Gallant (1981) and Gallant and Souza (1989) that the Fourier approximation is capable of capturing both smooth and sharp breaks when the number of breaks is not pre-determined; hence, this research uses a Fourier function rather than the application of dummy variables, as suggested by Yilanci et al. (2020).

According to Pesaran et al. (2001), the ARDL test can differentiate between dependent and independent variables. The error correction representation of the ARDL model is formulated as below:

where \(\Delta \) denotes the first difference operator; p represents the lag length; \(i\) stands for the index of lags; \(i=\mathrm{1,2}, \dots p\); \(t\) represents the time periods; \(t=\mathrm{1,2}, \dots T\);\({e}_{t}\) is the independent identically distributed disturbance term with zero mean and finite variance; \(y\) denotes dependent variable; \(x\) is the independent variable; \({\lambda }_{1}, {\lambda }_{2}, {\delta }_{1}\), and \({\delta }_{2}\) are coefficients of the variable’s lags.

As suggested by Pesaran et al. (2001), the cointegration test necessitates both F- and t-tests for the below hypothesis:

Nevertheless, McNown et al. (2018) proposed a further t-test for verifying the null hypothesis, which refutes the lagged independent variable's existence to support the extant tests developed by Pesaran et al. (2001). To summarise, McNown et al. (2018) proposed that the addition of the three abovementioned tests is required for differentiating between situations of cointegration and non-cointegration. Therefore, the existence of cointegration can be approved based on the rejection of all three null hypotheses:

F-test on all error correction terms is presented as \({H}_{0A}: {\delta }_{1}={\delta }_{2}=0\);

t-test on lagged dependent variable is presented as \({H}_{0B}:{\delta }_{1}=0\);

t-test on lagged independent variable is presented as \({H}_{0C}:{\delta }_{2}=0\);

According to the three abovementioned null hypotheses, two degenerate cases were defined by McNown et al. (2018), although a critical value was only presented for the second case by Pesaran et al. (2001). The construction of these degenerate cases takes the following form: (1) the F- and t-tests on the lagged independent variable have significance, while the t-test on the lagged dependent variable does not; (2) the F- and t-tests on the lagged dependent variable have significance, while the t-test on the lagged independent variable does not.

It is observed that Pesaran et al. (2001) rejected the first degenerate case: consideration was not given to the case by ensuring that the order of the integration of the dependent variable is I(1). Nevertheless, to resolve this issue, McNown et al. (2018) adopted the bootstrap ARDL test as a supplementary test for the coefficients of the lagged independent variable. Additionally, according to Pesaran et al. (2001), no decision can be made regarding whether cointegration exists in the situation where the test statistics are located between the lower and upper bounds. Nonetheless, the bootstrap simulations from McNown et al. (2018) are used to calculate the critical values for each of the tests, which eliminates the presence of indecision. Lastly, as presented by McNown et al. (2018), the bootstrap test outperforms the asymptotic test with respect to the ARDL bounds test in terms of size and power.

Based on Pesaran et al. (2001) and McNown et al. (2018), the four separate cases can be summarised in the following manner:

-

Case 1: Degenerate case #1 materialises when \({H}_{0A}\) and \({H}_{0C}\) are rejected buy \({H}_{0B}\) is not rejected.

-

Case 2: Degenerate case #2 materialises when \({H}_{0A}\) and \({H}_{0B}\) are rejected but \({H}_{0C}\) is not rejected.

-

Case 3: Cointegration materialises if \({H}_{0A}\), \({H}_{0B}\), and \({H}_{0C}\) are rejected.

-

Case 4: No-cointegration materialises when \({H}_{0A}\), \({H}_{0B}\), and \({H}_{0C}\) are not rejected.

According to Gallant (1981) and Gallant and Souza (1989), the Fourier approximation is capable of capturing both smooth and sharp breaks in cases where the number of breaks is not predetermined. To take the structural breaks in the cointegration relation into account, the current study uses a Fourier function instead of the application of dummy variables, following Yilanci et al. (2020). The Fourier function shown below is used:

where \(n\) denotes the amount of frequencies included in the approximation, \(\pi \)= 3.14159, \(k\) represents a specific frequency chosen for the approximation, \(t\) represents the trend, and T denotes the size of the sample. One frequency in the approximation is executed according to past studies by Ludlow and Enders (2000) and Becker et al. (2006). Resultantly, the Fourier function in the present study is formulated as:

Subsequent to the incorporation of the abovementioned Fourier function into Eq. (1), the model is applied as follows:

The optimal value of k is in the range of 0.1–5, and the increment for estimating the minimum sum of squared residuals is set at 0.1. These values are drawn from Christopoulos and Leon-Ledesma (2011), who suggested that temporary and permanent breaks are indicated by an integer and fractional frequencies, respectively.

By utilizing the Granger causality test founded on the bootstrap ARDL model with a Fourier function, it is possible to investigate the short-term causal relationship between electricity usage and economic growth. Subsequent to testing for the long-term relationship, in the situation where there is no cointegration relationship from x to y, the Granger causality test is employed to test from x to y, in which only the lagged differences on x should be included. It is tested whether \({\lambda }_{2}=0\) in Eq. (2). However, if cointegration exists between the dependent and independent variables, a stationary linear combination is formed. In this case, both the lagged differences on x and the lagged level of x should be included in the test for the short-run relationship; in other words, it is necessary to test whether \({\lambda }_{2}=0\) and \({\delta }_{2}=0.\)

3.1 Data

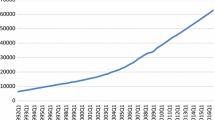

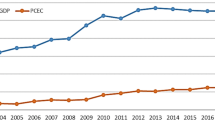

The empirical analysis within this research employs time-series data from the US, India, and China for the timespan between 1971 and 2014. Data for real GDP and per capita electricity usage were sourced from the World Development Indicators Dataset for the abovementioned countries. In this study, per capita, electricity consumption is denoted by average kilowatt-hours of electrical power used per individual. The estimation of real GDP is made according to US dollar prices from 2000. Figure 1 shows the historical patterns for real GDP and per capita electricity consumption in the US, China, and India.

Table 2 presents the overview statistics for both real GDP and electricity usage. It can be observed that the country with the highest real GDP and electricity usage is the US, while the values for both variables in India are lower than the US and China. The time series for real GDP is positively skewed in India and China but negatively for the US. On the other hand, a positive skew is observed in China's electricity usage time series, while the series for the US and India are negatively skewed. According to the Jarque–Bera statistics, only electricity usage has normal distribution for the US across this timespan at 10% significance.

4 Main Empirical Results

4.1 The Unit Root Test

In this study, the unit root tests are performed at level and first difference, the results of which are shown in Tables 3 and 4. Table 3 shows the univariate root test results, incorporating the ADF, PP, and KPSS tests, which are utilized to verify stationarity in the real GDP and electricity consumption series. In China, the US, and India, the real GDP and electricity consumption series are both stationary at the first difference. In particular, the US's electricity usage series is stationary at level, but for China and India, it is stationary at the first difference. The Zivot–Andrews (Z–A) unit root test is employed in the presence of a unit root with an endogenous break (Zivot and Andrews 2002), as shown in Table 4. The findings show sufficient evidence for the null hypothesis to be rejected as the real GDP and electricity usage series have a unit root. Based on the bootstrap ARDL test assumption, all proxy variables must be stationary at either I(0) or I(1). Therefore, the bootstrap ARDL test can be employed to analyze the real GDP and electricity usage series to determine the nature of the short- and long-run relationship between the variables.

4.2 Bootstrap ARDL Test: Cointegration Test

The next section will discuss the real GDP-electricity consumption nexus in terms of the selected countries' long-term relationships by applying bootstrap ARDL with a Fourier function cointegration test. The series is either I(0) or I(1). Both Akaike and Schwarz information criteria are utilized to determine the optimal order lags for the variables at first difference in the error-correction models without restrictions. The bootstrap ARDL function with the Fourier function is used to investigate the critical values, such as F*, t*_dep, and t*_indep, and estimate the statistic values of F, t_dep, and t_indep. It is determined that there is a long-run association between the real GDP and electricity usage series as the bootstrap ARDL with Fourier function shows that each of the statistic values, namely F, t_dep, and t_indep, has statistical significance. The evidence indicates that the real GDP and electricity series are not cointegrated for all three countries, as indicated by Table 5. Some previous studies have found that there is a long-term relationship between the growth of the economy and electricity usage; nevertheless, in the present study, the application of the bootstrap ARDL test with Fourier function did not provide sufficient proof that a cointegration relationship exists between the consumption of electricity and economic growth. Nonetheless, the Granger causality test is employed to investigate the short-run relationships between the real GDP and electricity consumption series.

4.3 Granger Causality Test Result

In Table 6, the empirical findings from the Granger causality test on the causal relationship between real GDP and electricity usage are shown for the selected countries. According to the test results, there is a short-run association between the variables because the independent variable’s coefficient is not zero, where the p value significance is lower than 0.10.

With respect to the US, a positive one-way causal relationship flows from the consumption of electricity to the growth of the economy, suggesting that an increased level of electricity usage stimulates economic growth; on the other hand, there is a negative one-way causal relationship flowing from the growth of the economy to the consumption of electricity, indicating that the consumption of electricity leads economic growth. The use of electricity by businesses triggers the development of the economy. Human-beings who concern the quality of life are conscious of saving energy as the economy of the US is growth.

In the case of China, a negative two-way causality was detected (feedback), implying that the increase (decrease) in the consumption of electricity causes economic development to decline (increase), while the growth in economic development leads to a reduction in the consumption of electricity.

Finally, for India, a positive two-way causal relationship was observed (feedback), indicating that electricity consumption appears to supersede economic growth, whereby the use of electricity enhances economic growth performance.

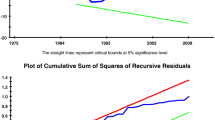

Table 7 indicate whether there is a Fourier function in each of the country’s time series model. Both gradual and sharp breaks are taken into account in the model when the null hypothesis implying that \({\gamma }_{1}\) and \({\gamma }_{2}\) equal to zero is rejected for all the countries. The findings provide significant evidence of the existence of a Fourier function where the significance of the p value was lower than 0.10 in the model used to investigate the relationship between electricity usage and economic growth by employing the cointegration and causality tests for the US, China, and India.

4.4 Granger Causality Test Result Prediction of Growth and Recession in Machine Learning Approaches

The ability to forecast/estimate macro-economic factors, including economic growth, has particular significance for policy-makers. Classification via data mining techniques enables the identification of whether an economy is growing or in a recession. In past works, support vector machine (SVM) (Giovanis 2013; Gründler and Krieger 2016), Bayesian network (BN) (Berge 2015), random forests (RF) (Nyman and Ormerod 2017), logit model (Gogas et al. 2015; Kozlowski and Sim 2019), Random subspace (Boot and Nibbering 2019), adaptive boost (Adaboost) (Aastveit 2019) and iterative classifier optimizer with Adaboost as the iterative classifier have been implemented as classifiers in economic models including to forecast a recession in the economy. Hence, such techniques are employed in the present study to classify the economic conditions (i.e., recession or growth) when electricity is concerned as the indicator in the model. Table 8 presents the setup of the five algorithms in this study.

In recent decades, China's economy has shown consistent growth on an annual basis; in other words, only a single classification of its economic performance exists for the studied timespan. Hence, China’s data is excluded from the analysis. Table 9 shows the empirical findings for India and the US. Each of the classifiers is used to investigate the accuracy under ten-fold cross-validation. For the US, Random subspace, BN, and SVM have the same accuracy (83.72%), which is greater than the logit model (81.40%) and RF (76.74%). For India, the highest accuracy was achieved by the Random subspace, BN, SVM, and logit models (95.35%), which was slightly better than RF (93.02%). In general, for the two datasets, Random subspace, BN, and SVM outperformed the other classifiers. In sum, the electricity that accounts for fundamental input in society and economic development is recommended to predict economic development. From the two methodologies, machine learning is proposed as a complementary approach to Granger causality econometrics. Hence, policy-makers can implement machine learning to predict the economic conditions after the nexus between economics and energy exists in econometrics. The findings can be used as a reference to make additional modifications to the policy direction.

5 Conclusion

This research examines electricity consumption experience in major countries, the countries that have received the least attention. This research applies a relatively novel bootstrap ARDL method with Fourier function to examine the potential of cointegration and causality relationships between electricity consumption and economic growth in major countries. This method enables this study to obtain relatively reliable results when the nexus of electricity consumption and economic growth are mixed from past empirical studies. First, the bootstrap ARDL method revises the drawbacks in traditional ARDL and examines more in-depth the existence of a cointegration relationship. Second, this study uses a Fourier function in which the number and dates of breaks are no need to pre-determined. Third, the methods in machine learning perform high accuracy at the operational level as this study accounts for electricity as an independent indicator to forecast economics. Fourth, relatively reliable results are important references for policymakers in the major countries and economic and management implications contribute to energy economics literature in the real world.

As the development of economic development is attracted to practical and academy, the methods in machine learning are employed for predicting economic expansion. Certain predictor variables such as macroeconomics (Kozlowski and Sim 2019), environment (Ashin Nishan 2020), and technology (Marković et al. 2017) are used to forecast economic expansion. Specific representative methods in machine learning perform well to predict economics as electricity accounts for an independent indicator in this study.

Various energy policy and growth patterns in country-specific facts cause mixed results. For China, the results of this study are similar to Wang et al. (2016). As environmental degradation is conscious, China urges to have sustainable development in the environment and economics. Thus, China should encourage energy-saving technologies and enhance energy efficiency for the concern of environmental problems. The national and local governments should organize the design and implement effective mechanisms to improve the infrastructure for energy usage and further upgrade the mode of economic development. On the other hand, economic growth is expected to increase by the activities of industries that efficiently use energy. The China government is suggested to solve excess supply in energy-intensive industries such as steel industries. The driver of economic growth should not rely on heavy industries in trend. The policy is suggested to adjust the industrial structure where firms should apply new energy-saving technologies and operate innovative business models to enhance the output of quality and quantity (Zhou et al. 2017).

As the economy of the US grows, more electricity is generated from low cost, low carbon renewable technologies because of fiscal policy such as tax credits at the federal level and political intervention such as renewables targets at the state level (Center 2020). The US is setting a benchmark for the electricity generation to transit from non-renewable resources to renewable resources with its rich natural resources such as wind, solar, geothermal, hydro, and biomass. Also, energy-saving technology in the US is state-of-art due to its innovation culture, high financing opportunities, and skilled workforce (International Renewable Energy Agency 2015, 2020). More innovative products addressed in the US with rich natural and human resources contribute the society and economic development. According to a report by Bonlender (2018), in the information and communications technology (ICT) industry, the leading companies such as Amazon, Facebook, Google, Microsoft have increased capital expenditure because explosive growth in cloud computing has radically increased the size and economic impact of the data center. One of the concerns on the data center's location is where the state subsidies electricity because electricity continues the data center's operation without disruption.

In India, the Model Shops and Establishment Bill has launched in 2016. On its face, the service industry shops are permitted to operate 24 h a day, seven days a week. Yet, the business activities rely on the flow of goods in the supply chain where manufacturers in manufacturing industries put more effort into operation. Thus, Bill enhances the burden on utilities to provide more electricity. Consequently, as the activities in society increase, electricity use enhances in industries.

Although using electric appliances leads to certain benefits such as health enhancement and welfare increase in human capital as key components in economic growth, using electric appliances rather than using fuel-based appliance is more common in urban regions than in rural regions in India (Bonan et al. 2014). Thus, electrification is essential not only for households in rural areas but also for India's economic development. For policymakers in India, they are suggested to establish infrastructure such as mini-grids to distribute electricity such that electric appliances are applied in the rural region (Richmond and Urpelainen 2019).

The implications of our study are essential for policies regarding energy and economic development in emerging and developed countries. Further work may consider other control variables to check the interactions between other social and technology in specific issues. Nonetheless, this study provides relatively reliable empirical evidence in the nexus between electricity and economic growth in the condition that structural breaks are ignored or improperly taken into account in a model.

References

Aastveit, M. E. (2019). Predicting recessions using boosting and Bayesian model averaging. Thesis for the degree of Master in Economic Theory and Econometrics. University of Oslo.

Akalpler, E., & Hove, S. (2019). Carbon emissions, energy use, real GDP per capita and trade matrix in the Indian economy-an ARDL approach. Energy, 168, 1081–1093.

Al-Mulali, U., Solarin, S. A., & Ozturk, I. (2016). Biofuel energy consumption-economic growth relationship: An empirical investigation of Brazil. Biofuels, Bioproducts and Biorefining, 10(6), 753–775.

Amri, F. (2017). The relationship amongst energy consumption (renewable and non-renewable), and GDP in Algeria. Renewable and Sustainable Energy Reviews, 76, 62–71.

Ashin-Nishan, M. K. (2020). Role of energy use in the prediction of CO2 emissions and economic growth in India: Evidence from artificial neural networks (ANN). Environmental Science and Pollution Research 1–12.

Asumadu-Sarkodie, S., & Owusu, P. A. (2016). Carbon dioxide emissions, GDP, energy use, and population growth: A multivariate and causality analysis for Ghana, 1971–2013. Environmental Science and Pollution Research, 23(13), 13508–13520.

Bah, M. M., & Azam, M. (2017). Investigating the relationship between electricity consumption and economic growth: Evidence from South Africa. Renewable and Sustainable Energy Reviews, 80, 531–537.

Bastola, U., & Sapkota, P. (2015). Relationships among energy consumption, pollution emission, and economic growth in Nepal. Energy, 80, 254–262.

Becker, R., Enders, W., & Lee, J. (2006). A stationarity test in the presence of an unknown number of smooth breaks. Journal of Time Series Analysis, 27(3), 381–409.

Benkraiem, R., Lahiani, A., Miloudi, A., & Shahbaz, M. (2019). The asymmetric role of shadow economy in the energy-growth nexus in Bolivia. Energy Policy, 125, 405–417.

Berge, T. J. (2015). Predicting recessions with leading indicators: Model averaging and selection over the business cycle. Journal of Forecasting, 34(6), 455–471.

Bildirici, M. E. (2016). Biomass energy consumption and economic growth: ARDL analysis. Energy Sources, Part B: Economics, Planning, and Policy, 11(6), 562–568.

Bildirici, M. E., Bakirtas, T., & Kayikci, F. (2012). Economic growth and electricity consumption: Auto regressive distributed lag analysis. Journal of Energy in Southern Africa, 23(4), 29–45.

Bildirici, M. E., & Kayikçi, F. (2016). Electricity consumption and growth in Eastern Europe: An ARDL analysis. Energy Sources, Part B: Economics, Planning, and Policy, 11(3), 258–266.

Bonan, J., Pareglio, S., & Tavoni, M. (2014). Access to modern energy: A review of impact evaluations. SSRN Electronic Journal. Retrieved July 28, 2020, https://www.researchgate.net/publication/281438819_Access_to_Modern_Energy_A_Review_of_Impact_Evaluations.

Bonlender, B. (2018). State of the data center industry. State of Washington: Department of Commerce, State of Washington.

Boot, T., & Nibbering, D. (2019). Forecasting using random subspace methods. Journal of Econometrics, 209(2), 391–406.

Boukhelkhal, A., & Bengana, I. (2018). Cointegration and causality among electricity consumption, economic, climatic and environmental factors: Evidence from North-Africa region. Energy, 163, 1193–1206.

Center BP (2020) Annual energy outlook 2020. Energy Information Administration, Washington, DC.

Chandio, A. A., Jiang, Y., Sahito, J. G. M., & Ahmad, F. (2019). Empirical insights into the long-run linkage between households energy consumption and eonomic growth: Macro-level empirical evidence from Pakistan. Sustainability, 11(22), 6291.

Choi, H., Son, H., & Kim, C. (2018). Predicting financial distress of contractors in the construction industry using ensemble learning. Expert Systems with Applications, 110, 1–10.

Christopoulos, D. K., & Leon-Ledesma, M. A. (2011). International output convergence, breaks, and asymmetric adjustment. Studies in Nonlinear Dynamics & Econometrics, 15(3), 1–33.

Cogoljević, D., Alizamir, M., Piljan, I., Piljan, T., Prljić, K., & Zimonjić, S. (2018). A machine learning approach for predicting the relationship between energy resources and economic development. Physica A: Statistical Mechanics and its Applications, 495, 211–214.

Costa-Campi, M. T., García-Quevedo, J., & Trujillo-Baute, E. (2018). Electricity regulation and economic growth. Energy Policy, 113, 232–238.

Dogan, E. (2015). The relationship between economic growth and electricity consumption from renewable and non-renewable sources: A study of Turkey. Renewable and Sustainable Energy Reviews, 52, 534–546.

Enders, W., & Jones, P. (2016). Grain prices, oil prices, and multiple smooth breaks in a VAR. Studies in Nonlinear Dynamics & Econometrics, 20(4), 399–419.

Energy Information Administration. (2020). Annual Energy Outlook 2020 with projections to 2050. Retrieved July 28, 2020, https://www.eia.gov/outlooks/aeo/pdf/AEO2020%20Full%20Report.pdf.

Faisal, F., Tursoy, T., Gunsel Resatoglu, N., & Berk, N. (2018). Electricity consumption, economic growth, urbanisation and trade nexus: Empirical evidence from Iceland. Economic Research-Ekonomska istraživanja, 31(1), 664–680.

Gallant, A. R. (1981). On the bias in flexible functional forms and an essentially unbiased form: The Fourier flexible form. Journal of Econometrics, 15(2), 211–245.

Gallant, A. R., & Souza, G. (1989). On the asymptotic normality of Fourier flexible form estimates. Raleigh: Department of Statistics, North Carolina State University.

Giovanis, E. (2013). Application of stationary wavelet support vector machines for the prediction of economic recessions. International Journal of Mathematical Models and Methods in Applied Sciences, 3(7), 226–237.

Gogas, P., Papadimitriou, T., Matthaiou, M., & Chrysanthidou, E. (2015). Yield curve and recession forecasting in a machine learning framework. Computational Economics, 45(4), 635–645.

Gründler, K., & Krieger, T. (2016). Democracy and growth: Evidence from a machine learning indicator. European Journal of Political Economy, 45, 85–107.

Hassan, S. T., Baloch, M. A., Mahmood, N., & Zhang, J. (2019). Linking economic growth and ecological footprint through human capital and biocapacity. Sustainable Cities and Society, 47, 101516.

Hussain, H. I., Salem, M. A., Rashid, A. Z. A., & Kamarudin, F. (2019). Environmental impact of sectoral energy consumption on economic growth in Malaysia: Evidence from ARDL bound testing approach. Ekoloji, 28(107), 199–210.

IEA. (2019). World energy outlook 2019. Retrieved July 28, 2020, https://www.iea.org/reports/world-energy-outlook-2019/electricity#abstract.

International Renewable Energy Agency. (2015). A renewable energy roadmap-REmap 2030.

International Renewable Energy Agency. (2020). Global renewables outlook-energy transformation 2050.

Jarrett, U., Mohaddes, K., & Mohtadi, H. (2019). Oil price volatility, financial institutions and economic growth. Energy Policy, 126, 131–144.

Kahane, A., & Squitieri, R. (1987). Electricity use in manufacturing. Annual Review of Energy, 12(1), 223–251.

Kahouli, B. (2017). The short and long run causality relationship among economic growth, energy consumption and financial development: Evidence from South Mediterranean Countries (SMCs). Energy Economics, 68, 19–30.

Katırcıoğlu, S., Fethi, S., Kalmaz, D. B., & Çağlar, D. (2016). Interactions between energy consumption, international trade, and real income in Canada: An empirical investigation from a new version of the Solow growth model. International Journal of Green Energy, 13(10), 1059–1074.

Kayıkçı, F., & Bildirici, M. (2015). Economic growth and electricity consumption in GCC and MENA countries. South African Journal of Economics, 83(2), 303–316.

Kordanuli, B., Barjaktarović, L., Jeremić, L., & Alizamir, M. (2017). Appraisal of artificial neural network for forecasting of economic parameters. Physica A: Statistical Mechanics and its Applications, 465, 515–519.

Kozlowski, S. E., & Sim, T. (2019). Predicting recessions using trends in the yield spread. Journal of Applied Statistics, 46(7), 1323–1335.

Kraft, J., & Kraft, A. (1978). On the relationship between energy and GNP. The Journal of Energy and Development, 3, 401–403.

Kumar, R. R., Stauvermann, P. J., & Kumar, N. (2019). Exploring the effect of energy consumption on the economic growth of Albania. Engineering Economics, 30(5), 530–543.

Kumar, R. R., Stauvermann, P. J., Loganathan, N., & Kumar, R. D. (2015). Exploring the role of energy, trade and financial development in explaining economic growth in South Africa: A revisit. Renewable and Sustainable Energy Reviews, 52, 1300–1311.

Kumar, R. R., Stauvermann, P. J., Patel, A., & Kumar, N. (2017). The effect of energy on output per worker in the Balkan Peninsula: A country-specific study of 12 nations in the Energy Community. Renewable and Sustainable Energy Reviews, 70, 1223–1239.

Kyophilavong, P., Shahbaz, M., Kim, B., & Jeong-Soo, O. H. (2017). A note on the electricity-growth nexus in Lao PDR. Renewable and Sustainable Energy Reviews, 77, 1251–1260.

Lee, C. C. (2006). The causality relationship between energy consumption and GDP in G-11 countries revisited. Energy Policy, 34(9), 1086–1093.

Liu, X. (2018). Aggregate and disaggregate analysis on energy consumption and economic growth nexus in China. Environmental Science and Pollution Research, 25(26), 26512–26526.

Ludlow, J., & Enders, W. (2000). Estimating non-linear ARMA models using Fourier coefficients. International Journal of Forecasting, 16(3), 333–347.

Marjanović, V., Milovančević, M., & Mladenović, I. (2016). Prediction of GDP growth rate based on carbon dioxide (CO2) emissions. Journal of COssssssss Utilization, 16, 212–217.

Marković, D., Petković, D., Nikolić, V., Milovančević, M., & Petković, B. (2017). Soft computing prediction of economic growth based in science and technology factors. Physica A: Statistical Mechanics and its Applications, 465, 217–220.

McNown, R., Sam, C. Y., & Goh, S. K. (2018). Bootstrapping the autoregressive distributed lag test for cointegration. Applied Economics, 50(13), 1509–1521.

Milačić, L., Jović, S., Vujović, T., & Miljković, J. (2017). Application of artificial neural network with extreme learning machine for economic growth estimation. Physica A: Statistical Mechanics and its Applications, 465, 285–288.

Nepal, R., & Paija, N. (2019). Energy security, electricity, population and economic growth: The case of a developing South Asian resource-rich economy. Energy Policy, 132, 771–781.

Nguyen, D. K., Sévi, B., Sjö, B., & Uddin, G. S. (2017). The role of trade openness and investment in examining the energy-growth-pollution nexus: Empirical evidence for China and India. Applied Economics, 49(40), 4083–4098.

Nyasha, S., Gwenhure, Y., & Odhiambo, N. M. (2018). Energy consumption and economic growth in Ethiopia: A dynamic causal linkage. Energy & Environment, 29(8), 1393–1412.

Nyman, R., & Ormerod, P. (2017). Predicting economic recessions using machine learning algorithms. arXiv:1701.01428.

Pablo-Romero, M. D. P., Pozo-Barajas, R., & Yñiguez, R. (2017). Global changes in residential energy consumption. Energy Policy, 101, 342–352.

Pata, U. K., & Kahveci, S. (2018). A multivariate causality analysis between electricity consumption and economic growth in Turkey. Environment, Development and Sustainability, 20(6), 2857–2870.

Payne, J. E. (2009). On the dynamics of energy consumption and output in the US. Applied Energy, 86(4), 575–577.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Rafindadi, A. A., & Ozturk, I. (2016). Effects of financial development, economic growth and trade on electricity consumption: Evidence from post-Fukushima Japan. Renewable and Sustainable Energy Reviews, 54, 1073–1084.

Rahman, M. M., & Mamun, S. A. K. (2016). Energy use, international trade and economic growth nexus in Australia: New evidence from an extended growth model. Renewable and Sustainable Energy Reviews, 64, 806–816.

Richmond, J., & Urpelainen, J. (2019). Electrification and appliance ownership over time: Evidence from rural India. Energy Policy, 133, 110862.

Sbia, R., Shahbaz, M., & Ozturk, I. (2017). Economic growth, financial development, urbanisation and electricity consumption nexus in UAE. Economic Research-Ekonomska istraživanja, 30(1), 527–549.

Schwert, G. W. (1989). Tests for unit roots: A Monte Carlo investigation. Journal of Business & Economic Statistics, 7(2), 147–159.

Sekantsi, L. P., & Okot, N. (2016). Electricity consumption–economic growth nexus in Uganda. Energy Sources, Part B: Economics, Planning, and Policy, 11(12), 1144–1149.

Sekantsi, L. P., & Thamae, R. I. (2016). Electricity consumption and economic growth in Lesotho. Energy Sources, Part B: Economics, Planning, and Policy, 11(10), 969–973.

Shahbaz, M., Sarwar, S., Chen, W., & Malik, M. N. (2017). Dynamics of electricity consumption, oil price and economic growth: Global perspective. Energy Policy, 108, 256–270.

Sokolov-Mladenović, S., Milovančević, M., Mladenović, I., & Alizamir, M. (2016). Economic growth forecasting by artificial neural network with extreme learning machine based on trade, import and export parameters. Computers in Human Behavior, 65, 43–45.

Stern, D. I. (2000). A multivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Economics, 22(2), 267–283.

Wada, I. (2017). Dynamic causality in energy production and output growth in Nigeria revisited: ARDL bounds test approach. Energy Sources, Part B: Economics, Planning, and Policy, 12(11), 945–951.

Wang, Q., Su, M., Li, R., & Ponce, P. (2019). The effects of energy prices, urbanization and economic growth on energy consumption per capita in 186 countries. Journal of Cleaner Production, 225, 1017–1032.

Wang, S., Li, Q., Fang, C., & Zhou, C. (2016). The relationship between economic growth, energy consumption, and CO2 emissions: Empirical evidence from China. Science of the Total Environment, 542, 360–371.

Wu, C. F., Wang, C. M., Chang, T., & Yuan, C. C. (2019). The nexus of electricity and economic growth in major economies: The United States-India-China triangle. Energy, 188, 116006.

Xin-gang, Z., & Pei-ling, L. (2020). Is the energy efficiency improvement conducive to the saving of residential electricity consumption in China? Journal of Cleaner Production, 249, 119339.

Yilanci, V., Bozoklu, S., & Gorus, M. S. (2020). Are BRICS countries pollution havens? Evidence from a bootstrap ARDL bounds testing approach with a Fourier function. Sustainable Cities and Society, 55, 102035.

Zhong, X., Jiang, H., Zhang, C., & Shi, R. (2019). Electricity consumption and economic growth nexus in China: An autoregressive distributed lag approach. Environmental Science and Pollution Research, 26(14), 14627–14637.

Zhou, X., Zhang, M., Zhou, M., & Zhou, M. (2017). A comparative study on decoupling relationship and influence factors between China’s regional economic development and industrial energy–related carbon emissions. Journal of Cleaner Production, 142, 783–800.

Zivot, E., & Andrews, D. W. K. (2002). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics, 20(1), 25–44.

Acknowledgements

We thank the anonymous reviewers for their careful reading of our manuscript and their many insightful comments and suggestions. We thank resources from Research Center of Hubei Logistics Development, Hubei University of Economics, and Wuchang University of Technology.

Funding

Hubei University of Economics with the grant number of XJ201901; XJ201902;11024225.

Author information

Authors and Affiliations

Contributions

C-FW contributed to the research topic, model, data collection, coding, and writing. S-CH contributed to the literature reviewing, writing, and developed implications. C-CC edited this manuscript, developed implications, and responsible for correspondence. TC and Y-CC contributed to results analysis, literature reviewing, and editing.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Ethical Approval

This article uses secondary data, does not involve the ethical issues of human behavior research, and does not require ethical approval.

Informed Consent

This article uses secondary data, does not involve the ethical issues of human behavior research, and does not require informed consent.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wu, CF., Huang, SC., Chiou, CC. et al. The Relationship Between Economic Growth and Electricity Consumption: Bootstrap ARDL Test with a Fourier Function and Machine Learning Approach. Comput Econ 60, 1197–1220 (2022). https://doi.org/10.1007/s10614-021-10097-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-021-10097-7

Keywords

- Fourier approximation

- Structural breaks

- Bootstrap autoregressive-distributed lag (ARDL)

- Cointegration

- Causality

- Machine learning