Abstract

This study attempts to investigate the relationship among electricity consumption, economic growth, and employment in China. Distinct from most of the previous studies, our empirical research identifies a long-run equilibrium cointegration relationship among the three covariates during the period of 1971–2009 with the recently developed autoregressive distributed lag (ARDL) bounds testing approach. The parameters are estimated through a long-run static solution of the estimated ARDL model and short-run dynamic solutions of the error correction model. The estimated models successfully pass diagnostic tests and both the long-run and short-run elasticities are found to be statistically significant. The study also indicates the existence of short-run and long-run causalities from electricity consumption and employment to economic growth. Results of this study show that electricity serves as an important driver of economic growth. Based on these results, several policy prescriptions on energy use and economic development are suggested for China.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

As the most flexible form of energy, electricity plays a vital role in the modern socioeconomic development (Shahbaz and Lean 2012). In recent years, the nexus of economic growth and electricity consumption has emerged as an issue of immense interest among economists and policymakers. This is largely triggered by the concerns about the increasing demand for electricity around the world, the environmental implications of electricity usage, and the ensuing need for conservation policies (Chandran et al. 2010; Hu and Lin 2008; Narayan and Prasad 2008). As regards policy making, the direction of causal relationship among these variables could have significant bearing (Asafu-Adjaye 2000; Ghosh 2002; Narayan and Prasad 2008; Narayan and Smyth 2005; Yoo 2005). No causality in either direction, or just a unidirectional causality from economic growth or working force to electricity depletion, implies that policies related to electricity conservation would not affect the economic growth. However, if this causal link is found in the reverse direction, then electricity consumption reduction could have a detrimental effect on economic growth and/or employment.

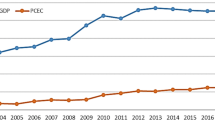

Since the initiation of market reforms in the late 1970s, China’s economy has presented a rapid increase at an annual growth rate of around 9.7%. Together with the rapid economic growth, the demand for electricity has continuously maintained a highly increasing rate. Table 1 shows the trends in electricity consumption and economic growth in China during the period of 1971–2009. Although in the periods of 1980–1985 and 1995–2000, the growth of electricity consumption trends down slightly, it surged ahead at a remarkable pace in the shadow of its average 9.8% economic growth entering the new millennium. With electricity consumption rising from 127.1 TWh in 1971 to 3503.4 TWh in 2009, China has become the second largest electricity consumer in the world, next only to the USA.

China has the world’s third-largest coal reserves behind the USA and Russia, and massive hydroelectric resources. According to the World Energy Council (2010) statistics, China’s verified coal reserves stood at 114.5 billion tons and accounted for 13.3% of the world’s total reserves. Due to China’s resource endowments, the electricity supply structure of China is dominated by coal. As of the year 2009, thermal power accounted for around 80.6% of the bulk of the electricity generated, followed by 16.7% from hydro, 1.9% from nuclear, and less than 0.8% from wind and solar power. China’s coal-dominated energy structure has also led to a serious atmospheric environmental degradation. In 2009, the entire industrially emitted SO2 amounted to 16.94 million tons, 55% of which is emitted from the electricity sector (National Bureau of Statistics of China 2010). Hence, China’s authorities emphasized the importance of the energy efficiency and environmental conservation and they proposed the so-called “20/10” targets, a reduction of 20% of the energy intensity and 10% of the SO2 emission during the 11th 5-year plan. In this situation, there is a need to reconsider the development strategy for the electricity sector of China and suggest a set of policy that can be adaptive to address short- and long-term electricity development by coordinating economic growth and environmental conservation in China.

Literature review

With motivating roots in energy conservation policies, a large body of literature has evolved to explore the causal direction between energy consumption and economic growth. During the last three decades, these studies originated from the paper by Kraft and Kraft (1978) to the recent studies such as Tsani (2010), Wang et al. (2011a, b), and Fuinhas and Marques (2012). Our empirical study is mainly focused on electricity sector, and for this reason, we will solely concentrate on the literature review about electricity consumption-economic growth nexus.

In general, empirical studies on the causality between electricity consumption and economic growth can be divided into two major groups, according to econometric methodologies employed in their analyses. Table 2 presents a summary of the selected empirical studies on the causal relationship between electricity consumption and economic growth. Based on the literature review of earlier empirical studies, the residual-based cointegration test associated with Engle and Granger (1987) and the maximum likelihood test based on Johansen (1988) and Johansen and Juselius (1990) have been widely employed to test for cointegration relationship between the two variables (Odhiambo 2009b). Empirical studies on electricity-growth nexus by employing these conventional econometric methods are summarized in Panel A of Table 2.

Given that these cointegration techniques may not be appropriate if data spans are too short (Lee and Chang 2005), empirical evidences from these studies have been mixed and remain ambiguous even though some of those studies are for the same country or region.

In more recent studies, the bounds testing approach to cointegration within an autoregressive distributed lag (ARDL) framework suggested by Pesaran (Pesaran and Shin 1999; Pesaran et al. 2001) has become a popular approach pertaining to causal relationship investigation. Compared to the Engle and Granger (1987) and Johansen and Juselius (1990) methods, the ARDL bounds testing approach has the advantage particularly when the sample size is small. In this section, we are mainly focused on reviewing the new developments in empirical studies during the last 10 years and bring the literature survey up to date. An overview of the findings of those studies that employ the ARDL approach is provided as follows (Panel B of Table 2).

Narayan and Smyth (2005) employed the ARDL approach to investigate the relationship between electricity consumption, employment, and real income in Australia during the period from 1966 to 1999. They found there to be a Granger causality running from employment and real GDP to electricity consumption. In the same manner, Narayan and Singh (2007) detected in the relation of GDP and the electricity consumption in the Fiji Islands and revealed a long-run unidirectional Granger causality performing from electricity consumption towards GDP. Wolde-Rufael (2006) examined the causal relationship between electricity consumption per capita and real GDP per capita for 17 African countries during the period of 1971 to 2001. His findings identified the Granger causality for only 12 countries—(1) unidirectional causality running from real GDP per capita to electricity consumption per capita in Cameroon, Ghana, Nigeria, Senegal, Zambia, and Zimbabwe; (2) reverse causality in Benin, Congo DR, and Tunisia; and (3) bidirectional causality in Egypt, Gabon, and Morocco. Squalli (2007) investigated the relationship between electricity consumption and economic growth for 11 OPEC member countries from 1980 to 2003, finding evidence of the energy-dependent economy for Indonesia, Nigeria, UAE, and Venezuela, the less energy-dependent economy for Iran, Qatar, and Saudi Arabia, and the energy-independent economy for Algeria, Iraq, Kuwait, and Libya. Ghosh (2009) explored the relationship between electricity supply, employment, and real GDP in India from 1970 to 1971 to 2005–2006, finding a unidirectional short-run causality of growth-led-electricity supply. Odhiambo (2009b) investigated the relationship of the two variables in Tanzania during the period of 1971–2006, reporting the result of causal flow from electricity consumption to economic growth. Chandran et al. (2010) modeled the electricity-growth nexus in Malaysia during the period of 1971–2003, showing a unidirectional causal flow of electricity consumption-led-growth. Ouédraogo (2010) explored the direction of causality between electricity consumption and economic growth in Burkina Faso for the period of 1968–2003, detecting a long-run bidirectional causal relationship between electricity use and real GDP. Other empirical researches include Kouakou (2011), which examined the causal relationship between the electric power industry and the economic growth of Cote d’Ivoire from 1971 to 2008; Ozturk and Acaravci (2011), which explored the short-run and long-run causality between electricity consumption and economic growth in the selected 11 Middle East and North Africa (MENA) countries during the period of 1971–2006; Shahbaz et al. (2011), which reconsidered the relationship among electricity consumption, economic growth, and employment in Portugal for the period of 1971–2009; Jahangir Alam et al. (2012), which examined the dynamic causality among economic growth, depletion of energy resource, electricity requirement, and carbon emissions in Bangladesh during the period of 1972–2006; and Shahbaz and Lean (2012), which re-examined the economic growth and electricity consumption nexus in Pakistan during the period of 1972–2009.

Following the evolvement of these recent researches, the present study employs the ARDL approach within a tri-variate framework to re-examine the electricity-GDP nexus for China. The present study differs from earlier studies in two important aspects. Firstly, to the best of our knowledge, studies on electricity consumption are relatively few for China, limited to Shiu and Lam (2004), Chen et al. (2007), and Yuan et al. (2007). Furthermore, these earlier studies all tested for Granger causality between electricity consumption and real GDP within a bivariate framework. Although bivariate models can be employed when only scarce data are available, recently, its limitation in examining interactions has been criticized for specified bias due to the omission of relevant variables (Asafu-Adjaye 2000; Glasure 2002; Stern 1993, 1997, 2000). The most common approach in more recent studies is to incorporate capital and/or labor variables in modeling electricity consumption and economic growth within a multivariate causality framework. In line with the studies of Narayan and Smyth (2005), our empirical study includes a variable for employment in addition to electricity consumption and real GDP. Second, this study employs the ARDL bounds testing approach to cointegration, which is preferred over other alternative methods such as Engle and Granger (1987) and Johansen and Juselius (1990) cointegration tests for the simple reason that the bounds test has a better performance on small sample and can potentially produce more robust results from data taken over short-time spans. On this understanding, the present study has twofold novelty and its findings should be able to provide recommendations in regard to viable policy options for China.

The remainder of the paper is structured as follows. “Data and methodology” describes the model, econometric methodology, and data used in this study. “Empirical results” presents the unit root test results, the cointegration results, and the Granger causality test results. This is followed by policy analysis in “Policy implications” and finally “Conclusions”.

Data and methodology

Data description

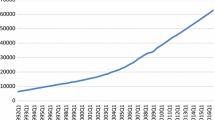

This empirical study adopts annual time series data in China spanning the period of 1971–2009, including total employment, electricity consumption (in kWh), and real GDP (base year 2000) that are denoted as EM, EC, and GDP, respectively. The data on real GDP and electricity consumption series comes from the World Development Indicators database, while the data on total employment series is collected from National Statistics Bureau of China. All variables are transformed into the natural logarithms to make first differences approximating growth rates.

Stationary

Although the ARDL bounds test to cointegration can be applied irrespective of whether the underlying variables are integrated to order I(0) or I(1), unit root tests might still be employed to ensure that none of the variables are integrated to order I(2) or higher. Thus, our analysis conducted the unit root tests by employing the augmented Dickey-Fuller (ADF), Phillips-Perron (PP), and Kwiatkowski-Phillips-Schmidt-Shin (KPSS) methods. In addition to the conventional unit root tests, we also use the Zivot and Andrews (ZA) method (Zivot and Andrews 1992), a structural break unit root test, to access the order of integration of underlying variables and to check the robustness of the results.

Perron (1989) pointed out that many macroeconomic time series with structural breaks indicate stationary fluctuation around a deterministic trend function if allowing a possible change in intercept and slope. Since standard unit root tests fail to test whether the series is a trend stationary process with a structural break, we should take the structural break into account when conducting unit root tests. For this reason, we use the endogenous break unit root test developed by Zivot and Andrews (1992), in order to capture the effect of any possible structural shift of underlying series over the studying period. There are two models used in our empirical study. Model A tests for a unit root against the alternative of a trend stationary process with a structural break in the intercept, while Model C tests for a unit root against the abovementioned alternative in both slope and intercept. Specifically, Model A takes the following form (Eq. (1)):

while Model C has the following form (Eq. (2)):

where Δ denotes the difference operator, εt is a white noise term with variance σ2, and t = 1, ..., T denotes an index of time. The terms Δyt−j allow for serial correlation and ensure that the disturbance term is white noise. DUt and DTt are dummy variables representing mean and trend shifts, respectively; DUt = 1 if t > TB, and 0 otherwise; DTt = t-TB if t > TB, and 0 otherwise. The breakpoint is estimated by the minimum t-statistic on the coefficient of the autoregressive variable (tα). The asymptotic critical values for t statistics are provided by Zivot and Andrews (1992). If the computed t statistics in absolute value are higher than Zivot and Andrews (1992) critical values, one can reject the null hypothesis and conclude that the series is a trend stationary process with a structural break.

Cointegration

The ARDL bounds testing approach is employed to test for cointegration relationship among the variables when the order of integration is I (0) or I (1). An ARDL model is a general dynamic specification that is formulated with the lags in the dependent variable and the lagged and contemporaneous values of the independent variables. In doing so, short-run dynamic effects can be directly estimated and the long-run equilibrium relationship can also be estimated indirectly. For the present study, the ARDL method is adopted in investigating the presence of a long-run equilibrium relationship employing the following unrestricted error correction model (UECM):

Where Δ represents the first difference operator, μ represents the white noise error term, lnGDP denotes the nature logarithm of the real GDP, and similarly for lnEC and lnEM. The parameters α1, ...,3, β1, ...,3, and γ1, ...,3 are the short-run dynamic coefficients, while α4, ...,6, β4, ...,6, and γ4, ...,6 are the corresponding long-run multipliers of the underlying ARDL model.

To determine whether there is a cointegration relationship among the variables, we test for the joint significance of the lagged levels of the variables with the aid of the F test. The null hypotheses of no cointegration among the variables in Eqs. (3), (4), and (5) are H0: α4 = α5 = α6 = 0, β4 = β5 = β6 = 0, and γ4 = γ5 = γ6 = 0 against the alternative hypotheses H1: α4 ≠ α5 ≠ α6 ≠ 0, β4 ≠ β5 ≠ β6 ≠ 0, and γ4 ≠ γ5 ≠ γ6 ≠ 0, respectively. Under the null hypothesis, the computed F statistics are represented as FlnGDP(lnGDP|lnEC, lnEM), FlnEC(lnEC|lnGDP, lnEM), and FlnEM(lnEM|lnGDP, lnEC), respectively.

Pesaran et al. (2001) showed that, under the null hypothesis, the F test has a non-standard distribution. They proposed a set of asymptotic critical F values in each significance level for a large sample size. While Narayan (2005) developed a set of asymptotic critical F values for a small sample size ranging from 30 to 80 observations. It should be emphasized that critical values based on the large sample size deviate significantly from those for the small sample size. Given that the sample size of our empirical study is relatively small and only about 40 observations, we use the critical F values from Narayan (2005) instead of references from Pesaran et al. (2001). A judgment on whether there exists a co-integration relationship between the dependent variable and its regressors is then to be made according to the computed F statistics. If the computed F statistics falls below the lower bounds value, then one fails to reject null hypothesis of no cointegration. If the computed F statistics exceed the upper critical-bound value, then the null hypothesis can be rejected. It could be concluded that there is a co-integrated relationship between the dependent variable and the regressors. However, if the computed F statistics falls between the bounds, then the test for cointegration becomes inconclusive.

If evidence for a long-run equilibrium relationship can be found, the associated ARDL and error correction mechanisms (ECMs) are employed to estimate the long-run and short-run coefficients and examine the existence of Granger causality among the variables.

Long-run and short-run Granger causality

This stage uses augmented constructing standard Granger-type causality tests with a lagged error correction term. When a cointegration relationship exists, a multivariate pth-order vector error correction model (VECM) can be used to investigate Granger causality, as follows.

Where, α, β, and γ are parameters to be estimated; the lag length p is based on Schwarz–Bayesian (SBC) and/or Akaike information criteria (AIC); μt is the serially-uncorrelated error terms; and ECTt−1 is the lagged error-correction term (ECT) obtained from the long-run equilibrium relationship. Theoretically, the coefficient of the ECT should be negative and less than one in absolute value, which ensures the ECT maintains the equilibrium relationship between the cointegrated variables over time. To test for long-run and short-run Granger causality, one can check the F statistics on the lagged explanatory variables of the ECM, which shows the significance of short-run causal effects. Similarly, the t statistics on the coefficients of the lagged error-correction term shows the significance of the long-run causal effect.

Empirical results

Unit root test

As for the time series properties of the underlying variables, we conduct the different unit root tests, namely those listed in “Stationary”, to obtain robust results. It should be noted that the unit root tests vary from different lag structures. Accordingly, the Schwarz information criterion could be applied to the lag selection in unit root test. The ADF and PP tests (but not the KPSS test) have a null hypothesis that the investigated series has a unit root against the alternative hypothesis of stationarity. The null hypothesis of KPSS test, in contrast, states that the variable is stationary.

Table 3 presents the results of the ADF, PP, and KPSS tests on the integration properties of the real GDP (lnGDP), electricity consumption (lnEC), and employment (lnEM) concerning China. As evidence from the results, it turns out that all of the variables are non-stationary in their level data from the three tests (Panel A). After taking the first difference of the variables, nevertheless, the stationary property can be shown at 10%, 5%, or the stricter 1% critical levels (Panel B). Though one conflicting result on the stationary property in the first difference is found for the series lnEM in the intercept and trend model of the KPSS test, in general, the results from conventional unit root tests support the argument that all the variables are integrated at order one (i.e., I(1)).

The results of the ZA Model A and Model C unit root tests for lnGDP, lnEC, and lnEM are reported in Table 4. No additional evidence exists against the unit root hypothesis in the level data. However, a stationary trend with structural break is found in the first difference of the variables at 10% or the stricter 1% critical levels, confirming that all the three series are at I(1).

Bounds cointegration test

Before implementing bound-testing procedures, optimal lag orders on the first difference variables in Eqs. (3)–(5) should be determined from the unrestricted models by following the minimum values of the SBC. The results show that the optimal lags in Eqs. (3)–(5) are all four. With these optimal lag lengths, a bounds F test is applied to examine the long-run equilibrium relationship in Eqs. (3)–(5).

The results of the cointegration bounds test are listed in Table 5, together with the relevant critical value bounds. Concerning Eq. (3), the computed FlnGDP(lnGDP|lnEC, lnEM) is 6.098, and higher than the upper bound critical value at the 1% significance level. This suggests that there exists a long-run relationship between lnGDP, lnEC, and lnEM. The variables lnEC and lnEM can be treated as the long-run forcing variables for the explanation of lnGDP. However, the bounds test indicates that when lnEC and lnEM are the dependent variables FlnEC(lnEC|lnGDP, lnEM) and FlnEM(lnEM|lnGDP, lnEC) are lower than the lower bound critical value at the 10% significance level. It shows that there is no cointegration relationship when the variables lnEC and lnEM are used as dependent variables. From the above test results, we can conclude that there is one single long-run cointegration relationship among the variables under investigation.

Referring to Table 6, the long-run parameters related to real GDP in China present to be positive as expected. Concerning electricity consumption, its long-run impact in real GDP is around 1.00 at statistically significant level of 1%, implying that a 1% growth in electricity consumption will lead to a 1% increase in GDP. Similarly, it is found that employment has a positive impact on real GDP in the long run. The elasticity is around 0.37 with statistically significant level of 1%, implying that a 1% growth in employment will cause a 0.37% increase in GDP. Finally, a battery of diagnostic tests for the underlying ARDL model that includes testing for serial correlation, mis-specification of functional form, normality of the residuals, and heteroscedasticity, do not find any significant evidence for a departure from the standard assumptions.

The short-run equilibrium relationship is derived from the error correction model, and the results are displayed in Table 7. The parameters of short-run elasticities are lower in absolute value than those in the long-run. With the exception of the coefficients of ΔlnGDP(−2) and ΔlnEC(−2), all the other coefficients are statistically significant. As expected, it is found that the lagged error correction term (denoted as ecm(−1) in Table 6) is negative with statistical significance.

This reveals the dynamic of the endogenous variable adapt for changes of the explanatory variables before converging to its equilibrium level. In addition, the results imply that the adjustment to restore equilibrium is greatly effective. In the present study, the relatively high coefficient in absolute magnitude of the error correction term shows a more rapidly adjustment dynamic. According to the coefficient of − 0.32 at a statistically significant level of 1%, it suggests that the process of converging to equilibrium need over 3 years after a shock to GDP in China.

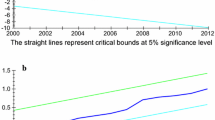

In addition, the stability of the short-run and long-run coefficients is checked through the cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ) tests to confirm the goodness of model fit. Figure 1 shows the plot of CUSUM and CUSUMSQ test statistics that both fall within the critical bounds of the 5% significance level. This implies that the estimated parameters are all stable over time and policy conclusion can be inferred from the model.

Granger causality test

The cointegration among electricity consumption, real GDP, and labor force suggests that there could exist Granger causality at least in one direction. But it could not reveal the concrete direction of causality among those variables. Therefore, we use the error correction mechanism (ECM) to simultaneously test short-run and long-run Granger causality. The results listed in Table 8 show the short-run and long-run causal effects are both significant according to the F statistics on the lagged explanatory variables and the t statistic on the coefficient of the lagged error-correction term. For the short-run causality, the results show that employment and electricity consumption are both significant at 5% or 1% level in the real GDP equation. Besides, the electricity consumption equation which presents real GDP is also significant at the 1% level. Nevertheless, the employment equation presents no significance in real GDP or electricity consumption. It suggests that the bidirectional Granger causality of real GDP and electricity consumption is weak in the short run; and there existed only unidirectional Granger causality from employment towards real GDP.

With regard to the t statistic on the coefficient, the lagged error-correction term is found to be statistically significant in the real GDP equation at 1% level, which confirms the result of the bounds test to cointegration. Since the variables are not cointegrated in Eqs. (4) and (5), a lagged error correction cannot be included when either electricity consumption or employment is used as the dependent variable. The Granger causality test presents that there is no equilibrium in the co-integration relationship, but long-run causality running interactively from electricity consumption and employment to real GDP.

The short-run and long-run Granger causality tests appear to identify a significant impact of electricity consumption on economic growth. Compared to previous works on the direction of causal relationship between electricity consumption and economic growth in China, the evidence of Granger causality from electricity consumption to real GDP in this study appears to be consistent with the research results by Shiu and Lam (2004) and by Yuan et al. (2007). However, the evidence differs from empirical results of Chen et al. (2007), in which no cointegration is found between electricity consumption and economic growth for China while estimated with a single country data set. Considering the evidence of a short-run causal relationship running from real GDP to electricity consumption, our empirical result also differs from the findings by Shiu and Lam (2004) and Yuan et al. (2007). Although there appear differences in the empirical results for the same country, the results in our study appear to be more robust due to the two developments in our model and method used, which have been mentioned in “Literature review”.

Policy implications

The long-run causality suggests that to some extent, China is an energy-dependent country. The implication is that any extreme conservation policy or shock to electricity supplies will have a significantly adverse effect on economic growth. Hence, the measures focusing only on electricity consumption reduction could not be easily implemented in China. Efficient implementation of policies and measures should be considered to balance the electricity consumption reduction and economic growth.

First, electricity consumption has played an important role in China’s economic development. Therefore, policies are required to ensure that the electricity is sufficient to keep regular economic growth. Guaranteeing supply and enhancing security are prerequisite if the functioning of economic activities is to be maintained. China’s increasing demand for electricity needs adequate generating preparation and speeding up nationwide inter-connectivity by upgrading power distribution networks, thereby undertaking increasing electrical supplies.

Second, improving energy efficiency can be a viable policy. China’s current per unit GDP energy consumption is obviously higher compared to international levels (Wang et al. 2017). The energy consumption intensity is 3.8 times of global averages, 4.3 times of that in the USA, and 11.5 times of that in Japan, all of which indicate that there is much space for improvements in energy efficiency. Hence, China could make further efforts through the implementation of the Clean Development Mechanism, focusing on reinforcing technology innovation in the electrical power sector, accelerating popularization of clean production, recycling material, and cascading utilization of heat technologies to improve energy efficiency in the manufacturing sector. In addition, accelerating electricity structure amelioration and optimization can be another positive policy as well. The emphasis placed on cultivating vigorously new energy industry that would not have significant adverse influence in the economy in the long term (Weidou and Johansson 2004). For this reason, China could get over traditional dependence on fossil fuel in the long run by diversifying electricity supplies with a preference for cleaner, renewable, and cost-effective energy such as hydropower, nuclear power, and solar and wind force, to relieve environmental pressure. It is worth noting that China has regarded developing new energy and renewable energy as an effective strategy for national economic and social development and has proposed for the first time the target of improving the non-fossil energy ratio in energy depletion to 15%.

Moreover, to succeed in the sustainability of the economy in the long term, China should adopt an alternative economic growth model and develop new strategic industries to readjust its economic structure. In 2009, secondary and tertiary industries accounted for around 46.3% and 43.4% of the total economy in China while these ratios in the main developed countries accounted for less than 30% and over 70%, respectively. The nature of its economic structure is one of the key reasons why China’s energy consumption intensity is relatively high. Thus, it is important to increase the share of the tertiary sector in aggregate output. In secondary industries, China also needs to improve industrial structure adjustment and technological advance, in an attempt to promote manufacturing industry transformation from the industries highly dependence on energy (such as those involved in ferrous metals, nonferrous metals, textiles, chemicals, and nonmetal mineral products). Thus, if heavy industrialization mode can be transited to a high-efficiency and cleaner production development pattern, energy can be saved with lower gas emission in the course of economic growth.

Conclusions

This article has reassessed the dynamic nexus of economic growth, electricity consumption, and labor force in China during the period of 1971–2009 by the ARDL approach proposed by Pesaran et al. (2001). The contribution of this research to the field of energy-GDP nexus is reflected in two important aspects. First, following recent trends, our empirical study tests the relationship within a multivariate framework instead of using a bivariate model. Second, this study employs a relatively new time-series approach (ARDL) capable of uncovering relationships that might otherwise be missed using conventional estimation techniques.

The results of the bounds testing procedure confirm the presence of cointegration between electricity consumption, labor, and economic growth in China. Over the long run, electricity and labor are key determinants for economic growth. Our empirical study finds a robust result that electricity consumption has a significantly positive impact on economic growth. The magnitude of the impact is 1.00, implying that a 1% increase in electricity consumption leads to 1% increase in GDP. Our empirical results also provide insights on the short-run speed of the adjustment process to restore long-term equilibrium in the real GDP equation. With a coefficient of − 0.32, the significance is that it could take a little over 3 years to restore to an equilibrium after China’s GDP unrest.

The findings presented in this paper imply that electricity serves as an important contributor to economic growth in China and that binding electricity consumption constraints may prevent the economy from moving forward. To tackle this dilemma between energy consumption and economic development in China, the government should concentrate on such aspects as energy efficiency enhancement, electricity structure amelioration, and economic structure optimization, with the premise of enhancing electricity security and guaranteeing electricity supplies.

References

Abosedra S, Dah A, Ghosh S (2009) Electricity consumption and economic growth, the case of Lebanon. Appl Energy 86:429–432

Akinlo AE (2009) Electricity consumption and economic growth in Nigeria: evidence from cointegration and co-feature analysis. J Policy Model 31:681–693

Altinay G, Karagol E (2005) Electricity consumption and economic growth: evidence from Turkey. Energy Econ 27:849–856

Asafu-Adjaye J (2000) The relationship between energy consumption, energy prices and economic growth: time series evidence from Asian developing countries. Energy Econ 22:615–625

Chandran VGR, Sharma S, Madhavan K (2010) Electricity consumption–growth nexus: the case of Malaysia. Energy Policy 38:606–612

Chen S-T, Kuo H-I, Chen C-C (2007) The relationship between GDP and electricity consumption in 10 Asian countries. Energy Policy 35:2611–2621

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Fuinhas JA, Marques AC (2012) Energy consumption and economic growth nexus in Portugal, Italy, Greece, Spain and Turkey: an ARDL bounds test approach (1965–2009). Energy Econ 34:511–517

Ghosh S (2002) Electricity consumption and economic growth in India. Energy Policy 30:125–129

Ghosh S (2009) Electricity supply, employment and real GDP in India: evidence from cointegration and Granger-causality tests. Energy Policy 37:2926–2929

Glasure YU (2002) Energy and national income in Korea: further evidence on the role of omitted variables. Energy Econ 24:355–365

Golam Ahamad M, Nazrul Islam AKM (2011) Electricity consumption and economic growth nexus in Bangladesh: revisited evidences. Energy Policy 39:6145–6150

Ho C-Y, Siu KW (2007) A dynamic equilibrium of electricity consumption and GDP in Hong Kong: an empirical investigation. Energy Policy 35:2507–2513

Hu J-L, Lin C-H (2008) Disaggregated energy consumption and GDP in Taiwan: a threshold co-integration analysis. Energy Econ 30:2342–2358

Jahangir Alam M, Ara Begum I, Buysse J, Van Huylenbroeck G (2012) Energy consumption, carbon emissions and economic growth nexus in Bangladesh: cointegration and dynamic causality analysis. Energy Policy 45:217–225

Johansen S (1988) Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Johansen S, Juselius K (1990) Maximum likelihood estimation and inferences on cointegration with approach. Oxf Bull Econ Stat 52:169–209

Jumbe CBL (2004) Cointegration and causality between electricity consumption and GDP: empirical evidence from Malawi. Energy Econ 26:61–68

Kouakou AK (2011) Economic growth and electricity consumption in cote d'Ivoire: evidence from time series analysis. Energy Policy 39:3638–3644

Kraft J, Kraft A (1978) On the relationship between energy and GNP. Journal of Energy and Development 3:401–403

Kumar Narayan P, Singh B (2007) The electricity consumption and GDP nexus for the Fiji Islands. Energy Econ 29:1141–1150

Lai TM, To WM, Lo WC, Choy YS, Lam KH (2011) The causal relationship between electricity consumption and economic growth in a gaming and tourism center: the case of Macao SAR, the People’s Republic of China. Energy 36:1134–1142

Lee C-C, Chang C-P (2005) Structural breaks, energy consumption, and economic growth revisited: evidence from Taiwan. Energy Econ 27:857–872

Lorde T, Waithe K, Francis B (2010) The importance of electrical energy for economic growth in Barbados. Energy Econ 32:1411–1420

Mozumder P, Marathe A (2007) Causality relationship between electricity consumption and GDP in Bangladesh. Energy Policy 35:395–402

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37:1979–1990

Narayan PK, Prasad A (2008) Electricity consumption-real GDP causality nexus: evidence from a bootstrapped causality test for 30 OECD countries. Energy Policy 36:910–918

Narayan PK, Singh B (2007) The electricity consumption and GDP nexus for the Fiji Islands. Energy Econ 29:1141–1150

Narayan PK, Smyth R (2005) Electricity consumption, employment and real income in Australia evidence from multivariate Granger causality tests. Energy Policy 33:1109–1116

National Bureau of Statistics of China (2010) China Statistical Yearbook 2009. China Statistics Press, Beijing

Odhiambo NM (2009a) Electricity consumption and economic growth in South Africa: a trivariate causality test. Energy Econ 31:635–640

Odhiambo NM (2009b) Energy consumption and economic growth nexus in Tanzania: an ARDL bounds testing approach. Energy Policy 37:617–622

Ouédraogo IM (2010) Electricity consumption and economic growth in Burkina Faso: a cointegration analysis. Energy Econ 32:524–531

Ozturk I, Acaravci A (2011) Electricity consumption and real GDP causality nexus: evidence from ARDL bounds testing approach for 11 MENA countries. Appl Energy 88:2885–2892

Pao H-T (2009) Forecast of electricity consumption and economic growth in Taiwan by state space modeling. Energy 34:1779–1791

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica 57:1361–1401

Pesaran MH, Shin Y (1999) An autoregressive distributed lag modelling approach to cointegration analysis. In: Strom S (ed) Econometrics and economic theory in the 20th century: the Ragnar Frisch Centennial Symposium. Cambridge University Press, Cambridge

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326

Shahbaz M, Lean HH (2012) The dynamics of electricity consumption and economic growth: a revisit study of their causality in Pakistan. Energy 39:146–153

Shahbaz M, Tang CF, Shahbaz Shabbir M (2011) Electricity consumption and economic growth nexus in Portugal using cointegration and causality approaches. Energy Policy 39:3529–3536

Shiu A, Lam P-L (2004) Electricity consumption and economic growth in China. Energy Policy 32:47–54

Soytas U, Sari R (2007) The relationship between energy and production: evidence from Turkish manufacturing industry. Energy Econ 29:1151–1165

Squalli J (2007) Electricity consumption and economic growth: bounds and causality analyses of OPEC members. Energy Econ 29:1192–1205

Stern DI (1993) Energy and economic growth in the USA: a multivariate approach. Energy Econ 15:137–150

Stern DI (1997) Limits to substitution and irreversibility in production and consumption: a neoclassical interpretation of ecological economics. Ecol Econ 21:197–215

Stern DI (2000) A multivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Econ 22:267–283

Tsani SZ (2010) Energy consumption and economic growth: a causality analysis for Greece. Energy Econ 32:582–590

Wang YA, Chen J, Lu GF (2011a) Temporal causal relationship between resource use and economic growth in East China. Chin World Econ 19:93–108

Wang Y, Wang Y, Zhou J, Zhu X, Lu G (2011b) Energy consumption and economic growth in China: a multivariate causality test. Energy Policy 39:4399–4406

Wang Y, Zhang C, Lu A, Li L, He Y, ToJo J, Zhu X (2017) A disaggregated analysis of the environmental Kuznets curve for industrial CO2 emissions in China. Appl Energy 190:172–180

Weidou N, Johansson TB (2004) Energy for sustainable development in China. Energy Policy 32:1225–1229

Wolde-Rufael Y (2006) Electricity consumption and economic growth: a time series experience for 17 African countries. Energy Policy 34:1106–1114

World Energy Council (2010) Survey of Energy Resources 2010. World Energy Council, London

Yoo S-H (2005) Electricity consumption and economic growth: evidence from Korea. Energy Policy 33:1627–1632

Yoo SH (2006) The causal relationship between electricity consumption and economic growth in the ASEAN countries. Energy Policy 34:3573–3582

Yoo S-H, Kwak S-Y (2010) Electricity consumption and economic growth in seven South American countries. Energy Policy 38:181–188

Yuan J, Zhao C, Yu S, Hu Z (2007) Electricity consumption and economic growth in China: cointegration and co-feature analysis. Energy Econ 29:1179–1191

Yuan J-H, Kang J-G, Zhao C-H, Hu Z-G (2008) Energy consumption and economic growth: evidence from China at both aggregated and disaggregated levels. Energy Econ 30:3077–3094

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10:251–270

Acknowledgments

This work was funded by the Fundamental Research Funds for Fujian Province Public-interest Scientific Institution, Grant 2017R1101003-7, and the National Natural Science Foundation of China (NSFC), Grant 40701063. We also sincerely thank Prof. Yusheng Yang of Fujian Normal University for your kind support in this work.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Muhammad Shahbaz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhong, X., Jiang, H., Zhang, C. et al. Electricity consumption and economic growth nexus in China: an autoregressive distributed lag approach. Environ Sci Pollut Res 26, 14627–14637 (2019). https://doi.org/10.1007/s11356-019-04699-w

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-019-04699-w