Abstract

Energy is among the essential factors for economic development in every field. Nowadays, in addition to increasing energy consumption for countries, the use of flexible energy sources is important for sustainable growth and development. Electricity is a flexible and important energy source that does not directly pollute the air for sustainable growth. The purpose of this study is to analyze the dynamic causality relationship between electricity consumption and growth in Turkey from 1978 to 2013 with a multivariable autoregressive distributed lag (ARDL) and an error correction model (ECM). According to the results of this study, there is a positive unidirectional and statistically significant causality moving from capital, employment, and electricity consumption to short- and long-term economic growth. Electricity plays a role in production as a complementary factor to capital and employment. Reducing electricity consumption affects economic growth negatively. Therefore, Turkey needs to increase electricity consumption, employment, and capital for sustainable development and growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Energy was first introduced into economic theory by the French Physiocrats who focused their studies on agriculture and land usage. They viewed agriculture as the basis of the national economy and always considered it together with energy inputs such as land, rain, and sun (Ayres et al. 2013). There are various theories about energy; however, there are only two basic theories that approach energy from an economic perspective: neoclassical growth theory and biophysical production theory. Neoclassical economists suggest that energy consumption costs account for only a small share of gross domestic product; thus, this consumption does not have an effect on economic growth (Ghali and El-Sakka 2004). These economists consider capital, employment, and land as the main inputs of production whereas energy is an intermediate input. Energy is regarded as an internal factor; therefore, its role in production and economic growth has been downplayed.

According to Stern (1997), energy is an essential factor in production function. Contrary to neoclassical economists, ecological economists consider energy to be an important input in production. Energy is an indispensable factor used directly in the production of final products (Stern 2004). A prominent view of ecological economists is represented by biophysical models that suppose energy as the unique factor affecting economic growth. In biological models, capital and employment are defined as secondary production inputs that operate energy. Some ecological economists argue that developments and technological advancements increase productivity but that this is not important because the most important factor affecting productivity is the use of energy (Stern 2011). According to neoclassical economists, energy is the substitution for capital and employment. Therefore, it is possible to make production without using energy. However, Stern (2011) argued that it is highly unlikely that energy and capital can be substitutes for each other. Energy is a complementary input which increases the efficiency of labor and capital. Hence, energy shortages have a restrictive role on economic development.

Georgescu and Roegen (1979) improved the production function, which treats only capital and employment as the production inputs, and named the new function “Georgescu–Roegen versus Solow/Stiglitz.” Equation (1) shows this function. In the equation, K indicates the capital stock, L indicates the labor supply, Q is the output level, and R represents the natural resources. \(\propto\) + \(\beta\) + u = 1, and each symbol is greater than zero. When labor is constant and natural resources (energy) are left alone, it is possible to minimize these resources by increasing K and keeping \(\bar{L}^{\text{U}}\) constant.

However, the view that energy should not be included in the production function as it provides only a small fraction of gross domestic product does not reflect the reality because increasing capital stock also means increasing energy demand. The importance of energy as a major input in production process can be demonstrated by creating an energy shock when the service and manufacturing sectors are in operation (Stern 2004). Any interruption in a country’s electricity supply will adversely affect food production, finally leading to reduced employment and forcing capital stock to remain.

Technological developments tied to the industrial revolution led to the replacement of labor-intensive production with machinery-intensive industries. Since this period, the importance of energy in production has continuously increased. However, the oil crisis of the 1970s showed the critical role energy plays in the economy. This crisis caused various economic indicators, such as capacity utilization to decrease, leading countries around the world to experience high inflation and recession. After countries understood the impact of energy on economies, they sought ways of diversifying their energy production and consumption.

Electrical energy has been referred to as the second industrial revolution since nineteenth and twentieth centuries (Rosenberg 1998). The production process changed with the introduction of electrical energy and the advancement of technology. In addition to playing a critical role in the industrial revolution, electrical energy is also one of the main factors leading to today’s information age, which started with the development of the computer industry. During the industrial revolution, economic growth rates increased with machines powered by electrical energy.

Environmental pollution and climate change are among today’s major global problems. Energy is necessary for growth and development, but it still stands as a barrier to sustainable development due to its negative environmental effects. Because of the dilemma it creates for world economies, environmentally friendly energy has become a contentious issue in many countries. One of the most important elements of sustainable development is creating a clean environment capable of meeting the needs of future generations. Therefore, countries must observe the needs of the future and use the cleanest energy resources while increasing their production capacities (Harris 2000). Electrical energy is not a primary energy source, which means that it is produced using other sources of energy. Electricity does not cause environmental pollution when it is produced with renewable energy sources such as wind, hydropower, but when it is produced with nonrenewable energy sources such as coal and oil, it pollutes the environment. The place of electricity in total energy consumption is on the rise around the world. Low-income countries use hydropower and oil to produce electricity, while high-income countries use nuclear power and more diverse energy sources (Stern 2011). Nuclear energy is a good alternative energy source for electricity generation because prices are less variable than oil prices and reduce energy dependence on foreign countries (Saidi and Mbarek 2016). Renewable and nuclear energy sources in electricity generation are particularly encouraged by European countries to reduce environmental pollution.

In Turkey, the third most commonly used energy sources for producing electricity are natural gas, coal, and hydro energy, respectively. The use of environmentally friendly energy sources in electricity generation has been increasing. However, the use of coal has also increased due to Turkey’s abundance of coal reserves. Although developed EU member states such as Belgium and France mostly use nuclear energy to derive their electricity, coal is the most widely used energy source for electricity production worldwide. Natural gas is the second most prevalent source of energy (International Energy Outlook 2016). Environmentally friendly electricity generation provided by technological developments increases the demand for electrical energy (Rosenberg 1998). Turkey does not have a nuclear power plant and derives about 40% of its electricity from natural gas, almost all of which is imported. For environmentally friendly electricity generation in Turkey, technological advancement and infrastructural investments are required.

Although Turkey has valuable indigenous coal and renewable energy resources, 80% of its energy sources are imported, which amounts to around 60% of the foreign trade deficit. Electricity consumption increases in Turkey at a very fast pace; in the last 12 years, the country’s electricity consumption doubled (IEA 2016). In 2014, Turkey’s total electricity consumption was 207.4 TWh. 46.2% of energy was consumed by the industrial sector, 30.1% by commercial and public services and agriculture, and 22.3% by the residential sector. In 2015, 38.6% of Turkey’s electricity generation was from natural gas, 28.3% from coal, and 25.8% from hydroelectric power plants. The total share of geothermal and solar energy is <1%. Turkey has stronger renewable energy potential than nonrenewable; however, that potential has not yet been explored. While the share of electricity consumption in many countries’ economies has been decreasing due to the transformation from the industrial sector to the service sector (Ghali and El-Saka 2004), this is not the case in Turkey. In Turkey, the share of services in the economy increases along with the increase in electricity consumption. Almost one in three the country’s electricity consumption is demanded by the service sector.

Turkey’s electrical energy sector has been through a long, three-step transformation process due to certain legal arrangements. Until 1984, generation, transmission, distribution, and trading of electricity were governed by the state. With the enactment in 1984 of Law No. 3096, institutions other than the Turkish Electricity Authority (TEK) were given the authority to generate, transmit, distribute, and trade electricity. Private institutions began to operate in the electricity sector, although the state still regulated all energy production. In 1993, the TEK, which then had monopoly rights over electricity, was restructured into the Turkish Electricity Generation and Transmission Company (TEIAS) and the Turkish Electricity Distribution Company (TEDAS) (IEA 2016). With Law No. 3996 in 1994 and Law No. 4283 in 1997, the sector adopted the build–operate–transfer model. In the following years, the view that public services include electricity was abandoned, and electrical energy was considered a commercial element. The Electricity Market Law No. 4628 adopted in 2001 aimed to ensure that power market operations were carried out under free market conditions. Privatization of the electrical energy sector created the need for an independent supervisory institution; as a result, Law No. 4628 established the Energy Market Regulatory Authority (EPDK). With the establishment of the EPDK, the state retreated from the electricity market. In 2003, TEIAS was split into three companies: The Electricity Generating Company (EUAS), TEIAS, and the Turkish Electricity Trade and Contracting Company (TETAS) (IEA 2016). Finally, with enactment of the New Electricity Market Law No. 6446 in 2013, the government aimed to ensure that commerce in the electricity sector was carried out in a stock exchange environment and made arrangements that would allow for capital transfer to support investments in the sector and provide security (TETAS 2013). In 2002, the private sector’s share in the electricity market was 34%, and the public sector’s share was 66%. In 2015, the shares of the private and public sectors were 72.2 and 27.8%, respectively (TETAS 2016). Since 2015, the shares of the electricity market have been owned by TEIAS (30%), Borsa Istanbul (30%), and other electricity and gas market participants (40%). In the last decade, Turkey managed to increase efficiency and effectiveness in electricity transmission and distribution by means of privatization activities.

The purpose of this study is to examine the relationships between electricity consumption, and economic growth in Turkey with the multivariable growth model framework. This study is organized in five parts. Part two is essentially the literature review, whereas part three defines the data set and the ARDL bounds testing and ECM utilized in the empirical analysis. Part four shows the empirical findings. Finally, part five includes the conclusion and suggestions.

2 Literature review

The first empirical analysis was performed by Kraft and Kraft (1978) to test energy consumption (E)—gross domestic product (GDP) nexus in USA’s economy. Their findings indicated that GDP Granger causes E. Most of the studies testing the causality among electricity consumption (EC) and GDP used only two variables. As indicated in Ozturk’s study (2010), a comprehensive literature review of these two variables, there are a limited number of studies incorporating capital and labor into the testing for causality among E and GDP.

The direction of the causal relation among EC and GDP is of high significance for policy makers. The causality relationship between the two is synthesized into four main hypotheses: (1) According to the conservation hypothesis that GDP Granger causes EC, energy-saving policies can be adopted without hindering economic growth. (2) According to the feedback hypothesis that EC and GDP Granger causes each other, energy conservation policies could damage to the economy. (3) In the neutral hypothesis that there is no Granger causality among these variables, energy conservation policies have no harmful effect on GDP. (4) Finally, according to the growth hypothesis that EC Granger causes GDP, policies promoting electricity consumption increase economic growth, while energy conservation policies damage the economy and energy promotion policies positively affect the economy. Smulders and Nooji (2003) indicated that growth is achieved through increasing inputs of energy and that technological changes are endogenous. They also proved that energy conservation (saving) policies had negative impacts on growth in the long term.

In recent years, some studies have examined the causal link among EC and GDP with the multivariable growth model framework: GDP = f (K, L, EC). Some of the multivariate studies incorporated only capital to the model as a variable, while some others included only employment as a variable. It is possible to divide the multivariate studies conducted on the relationship between GDP and EC into three categories:

-

(1)

Studies that included capital into model as a variable; Ouédraogo (2010) conducted a study using the ARDL bounds testing and ECM on data for Burkina Faso covering the period 1968–2003 and found both capital stock and EC increased GDP in the short run while only EC increased GDP in the long run. Shahbaz et al. (2012) performed a study employing the ARDL bounds testing and Toda–Yamamoto (TY) causality test in Romania from the period 1980–2011 and reported that there was a unidirectional causality from EC and capital stock to GDP in both short run and long run. Hamdi et al. (2014) examined the case of Bahrain from 1980q1 to 2010q4 using the ARDL bounds testing and TY causality test. They found a bidirectional causality among EC and GDP.

-

(2)

Studies that included employment into model as a variable; Narayan and Smyth (2005) performed a study using the ARDL bounds testing and vector error correction model (VECM) for Australia from 1966 to 1999, and they reported that national income and employment increased EC. Narayan and Singh (2007) employed ARDL bounds testing and ECM for Fiji Islands covering the period 1971–2002 and found that employment and electricity consumption increased GDP. Odhiambo (2009) applied the Johansen–Juselius (JJ) cointegration test and ECM for the period 1971–2006 in North Africa and reported the presence of a bidirectional causal relation among EC and GDP, and employment Granger causes GDP. Acaravci and Ozturk (2012) employed the ARDL, bounds testing and Granger causality test for Turkey from 1968 to 2009 and found a unidirectional causality is going from per capita electricity consumption to per capita GDP.

Aslan (2013) used the ARDL bounds testing, FMOLS, DOLS, CCR, and ECM covering the period 1980–2008 for Turkey by including employment as a variable and found a short- and long-run bidirectional causality among EC and GDP.

-

(3)

Studies that included capital and employment into model as a variable; Soytas and Sari (2007) performed the JJ cointegration and VECM from 1968 to 2002 for Turkey and included employment and fixed capital investments in the industrial sector as control variables. They found that industrial electricity consumption increased industrial value added. Lorde et al. (2010) also used the JJ cointegration and ECM covering the period 1960–2004 for Barbados and examined the causality among EC and GDP by including employment, capital stock, and technology into the model as separate variables. They found that both total and residential EC affected GDP positively, but other variables did not have any impact on GDP in the short run. Lean and Smyth (2010) performed the ARDL, JJ cointegration tests, bounds testing, TY causality test, and VECM covering the period 1971–2006 in Malaysia and found that a bidirectional causality among EC and aggregate output. Shahbaz and Lean (2012) also utilized the ARDL, JJ cointegration tests, bounds testing, and VECM covering the period 1972–2009 for Pakistan and found that EC, employment, and capital stock increased GDP in the short run, whereas only EC and capital stock increased GDP in the long run.

Out of 12 multivariate studies in the literature, one supported the validity of conservation hypothesis, four supported the feedback hypothesis, and seven supported the growth hypothesis. Although their findings differ, they all show the significance of EC to GDP. Due to the limited number of studies using multiple variables to investigate the causal relation among these variables, this empirical analysis aims to provide a contribution to the literature.

3 Data and methodology

3.1 Data

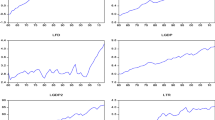

In our empirical study, we investigated the effect of capital, electricity consumption, and employment on GDP using the data for Turkey over the period of 1978–2013. Among the variables, GDP represents gross domestic product; EC represents electricity consumption; K represents gross capital formation; and L represents employment in the service sector as an indicator of employment. The data on GDP and K were obtained from the World Bank’s World Development Indicators database (World Bank 2016) and expressed in constant 2005 millions of dollars. EC was expressed in thousand GWh and obtained from the statistical indicators 1923–2013 issued by the Turkish Statistical Institute (TUIK 2014). L was obtained from the economic and social indicators (2015) issued by the Ministry of Development for the period 1978–2010 and from the database of Sabancı University (2013) for the period 2011–2013, together involving thousands of people. All the variables were log transformed and incorporated into the analysis.

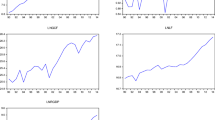

Figure 1 shows that four series are inclined to rise throughout the years. The figure also shows that GDP, EC, and L series increase steadily and gross capital formation is more sensitive to economic shocks. Also, the variables experienced sudden decreases during the years of crisis, i.e., 1994, 2001, and 2009. Electricity consumption increased every year except during the 2009 crisis.

3.2 Methodology

3.2.1 Models

Cobb and Douglas (1928) incorporates only labor and capital as factors of production. In Eq. (2), GDP indicates total production; L indicates labor; K indicates capital; A is the total factor efficiency; and \(\delta \;{\text{and}}\;\mu\) are the marginal product flexibility of L and K, respectively.

As energy became an important factor for economic growth, the Cobb–Douglas production function was improved and energy came to be considered a factor of production. Equation (3) shows the Cobb–Douglas production function used by Lorde et al. (2010) and Shahbaz and Lean (2012) in which energy is included as a factor of production.

Energy (E) has been added to the traditional production function, and technology is held constant. In the equation, \(\delta ,\; \mu ,\;{\text{and}}\;\sigma\) stand for marginal product flexibility of labor, capital, and energy, respectively. They are fixed at a value from zero to one. Equation (4) shows the logarithmic version.

In the equation \(, \delta ,\; \mu ,\; {\text{and}}\;\sigma\) indicate the coefficients of labor, capital, and energy, respectively. Equation (5) shows the model used as the basis for this study. The model was firstly used by Stern (1993), who advocated the biophysical production theory that countered the ideas of neoclassical economists.

This model is similar to Eq. (3). According to Stern, the factors of production in the model, i.e., labor and capital, are not substitutes for each other as suggested by the neoclassical economists but act more as complementary factors of production. Gross domestic product is a function of capital, employment, and energy consumption. In this study, we used Eqs. (3) and (5).

3.2.2 Stationary tests

In the analysis of time series, spurious regression problems may arise, and estimators may become less reliable when the variables included in the analysis have a unit root. Because traditional stationary tests neglect the existence of structural breaks in the variables, the results may be biased (Enders 2015). Thus, the conventional augmented Dickey–Fuller (ADF) (Dickey and Fuller 1981), Phillips–Perron (PP) (Phillips and Perron 1988), and Dickey–Fuller generalized least squares (DF–GLS) (Elliot et al. 1996) stationary tests, which do not account for the existence of structural breaks, and the Zivot–Andrews (Z–A) (Zivot and Andrews 1992) and Lumsdaine–Papell (L–P) (Lumsdaine and Papell 1997) stationary tests, which take structural breaks into account, were used to test the integration of variables. In all five stationary tests, the null hypothesis was that the variables were not stationary, and in the conventional unit root tests, the alternative hypothesis was that the series were stationary without structural breaks. They were stationary with one endogenous structural break in the Z–A unit root test, and they were stationary with two structural breaks in the L–P unit root test. By using five unit root tests, we aimed to define the series’ order of stationarity in a reliable way.

3.2.3 Cointegration test

Pesaran and Shin (1999) and Pesaran et al. (2001) developed the ARDL bounds testing that can be utilized when the series are stationary at level and/or first difference, irrespective of the order of integration properties. Stationary tests were applied to test whether the variables are stationary at I (2). With this cointegration method, effective and reliable results can be obtained in studies with a small sample size. The test is performed in three steps. First, an unrestricted error correction model (UECM) is formulated to test the cointegration among the variables. In the second step the long-term coefficients are estimated. Finally, the short-term coefficients are estimated (Narayan and Smyth 2006). Equation (6) shows the UECM in which the level values of variables are also included to test the cointegration.

In Eq. (6), \(\alpha_{1}\) is the constant term; \(\theta_{1i}\), \(\vartheta_{1i}\), \(\mu_{1i}\), \(\gamma_{1i}\), \(\delta_{1}\), \(\delta_{2}\), \(\delta_{3}\), and \(\delta_{4}\) are coefficients; a, b, c, and d are lag lengths; and \(\varepsilon_{ 1t}\) is the disturbance term. The optimal lag lengths were determined based on Schwarz information criterion (SIC). The Wald test was applied on the one lagged level values of dependent and independent variables to determine whether there was a long-run causal relationship among the variables. The null hypothesis \(H_{0} :\delta_{1} = \delta_{2} = \delta_{3} = \delta_{4} = \alpha_{1} = 0\) stated that there was not cointegration among the variables for case II (restricted intercept, no trend). The alternative hypothesis \(H_{1} : \delta_{1} \ne \delta_{2} \ne \delta_{3} \ne \delta_{4} \ne \alpha_{1} \ne 0\) stated that there was cointegration among the variables. The null hypothesis is accepted when the F-statistics found by the Wald test lower than the critical values in the Narayan (2005) table for sample sizes ranging from 30 to 80 observations can be used in cases where the variables are stationary at I (0) or I (1). When they are larger than the critical values, the null hypothesis is rejected and a long-run cointegration is confirmed to exist between the series.

3.2.4 Error correction model

First developed by Sargan (1964) and then improved by Engle and Granger (1987), the ECM indicates the short-run relationships between variables and estimates to what extent short-run imbalances can be eliminated in the long run. When the null hypothesis was rejected and cointegration was found with the bounds test, the model was established to estimate the long-run coefficients during the second step.

In Eq. (7), \(\alpha_{2}\) is the constant term; \(\theta_{2i}\), \(\vartheta_{2i}\), \(\mu_{2i}\), and \(\gamma_{2i}\) are coefficients; \(\varepsilon_{2t}\) is the disturbance term; and e, f, g, and h are the optimal lag lengths determined using SIC as in the bounds testing. If \(\vartheta_{2i}\), \(\mu_{2i}\), and \(\gamma_{2i}\) are found to be positive and statistically significant, a unidirectional positive long-run causality from the EC, L, and K to GDP is confirmed. In the final step of the ARDL bounds testing, one lagged value of the error term obtained from the equation is added to the ECM as an error correction term (ECT) to analyze the short-run relationships between the variables. Equation (8) shows the ECM formed to estimate the short-run coefficients.

In Eq. (8), \(\alpha_{3}\) is the constant term; \(\theta_{3i}\), \(\vartheta_{3i}\), \(\mu_{3i}\), and \(\gamma_{3i}\) are the coefficients; \(\varepsilon_{3t}\) is the disturbance term; and u, v, s, and t are the optimal lag lengths determined using SIC as in Eqs. (6) and (7). If \(\vartheta_{3i}\), \(\mu_{3i} ,\) and \(\gamma_{3i}\) are found to be positive and statistically significant, a unidirectional positive short-run causality from the EC, L, and K to GDP is confirmed. The coefficient β of the ECT explains to what extent short-run imbalances can be eliminated in the long run. If the ECT is between 0 and −1, the short-run imbalance is expected to be eliminated in the long run.

4 Empirical findings

Table 1 shows the Pearson’s coefficients that were found to be between 0.94 and 0.99 and statistically significant at 1% indicating a strong relationship among GDP and the other three variables. According to the descriptive statistics, probability values obtained from the Jarque–Bera (JB) test indicate that the null hypothesis is accepted and variables are normally distributed. Also, the kurtosis value was close to 0 and skewness was close to 2 indicating that the four variables included in the analysis have normal distribution.

Table 2 shows the findings obtained from the five stationary tests (ADF, PP, DF–GLS, Z–A, L–P). The maximum lag length allowed for choosing the optimal lag length for the stationary tests was calculated employing l 12 = int {12(T/100)1/4} as proposed by Schwert (1989) and found as k max = 12 × (35/100)0.25 = 9. Based on Elliot et al.’s (1996) recommendation, optimal lag lengths were found using the SIC in the ADF, DF–GLS, Z–A, and L–P stationary analyses. According to results of the five stationary tests, the four variables result to be stationary at the level I (1).

Because the series were stationary at I (1), the ARDL bounds testing was performed. First, case II was used to find out whether there was any cointegration among the GDP, K, L, and EC. Because the number of observations was T = 36, the F-statistics obtained from the bounds test were compared with the critical values developed by Narayan (2005). This statistic must be larger than the table critical values to confirm a cointegration. The F-statistic was higher than the upper bounds at 1 and 5% levels of bounds critical values in Table 3 and indicated that the presence of cointegration between the four variables was confirmed.

Table 4 shows the optimum ARDL model used in this study. In the model, four variables and the constant term were found to be positive and statistically significant, except for K(−1) and GDP(−2). Among the diagnostic tests, the white, ARCH, and BGP tests did not show a presence of heteroscedasticity. The LM test showed that there was no autocorrelation, while the findings of the JB test showed that the disturbance term was normally distributed and the estimators were reliable. The Ramsey-Reset test statistics also did not reveal any specification problem. Following the bound testing, which found the existence of cointegration, the long-run coefficients were estimated, and ECM was established by taking one lag of the ECT to estimate the short-run coefficients.

Table 5 shows the short- and long-run coefficients of the model. ∆GDP, ∆K, ∆L, and ∆EC indicate the short-run coefficients; ECT indicates the error correction term; K, L, and EC indicate the long-run coefficients; and C indicates the constant term. The ECM results show that all short- and long-run coefficients were positive and statistically significant at 1%. This shows the presence of short- and long-run positive causality moving from K, L, and EC to GDP. The ECT was also negative and statistically significant; it was found to be −0.86, which means that the imbalance in the system can be eliminated at a rate of 86% in the next term. Empirical findings reveal that employment in service, gross capital stock, and EC positively affect GDP. In the long run, increasing labor by 1% will increase economic growth by 0.59%, while increasing capital and electricity consumption by 1% will increase economic growth by 0.10 and 0.23%, respectively.

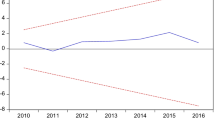

In Fig. 2, the results of Cusum and Cusum-sq tests developed by Brown et al. (1975) show that the estimators are stable for the estimated ARDL model.

5 Conclusion

This study included a multivariate analysis of the causality among electricity consumption and GDP in Turkey covering the period 1978–2013 and was conducted by incorporating gross capital stock and employment in services into the ARDL bounds testing and ECM. At the end of the analysis, we found the presence of cointegration between electricity consumption, employment, capital stock, and gross domestic product. We also found that there is a positive and statistically significant unidirectional causality moving from electricity consumption, gross capital stock, and employment to GDP in the short run and long run. Similar to the findings of Soytas and Sari (2007) and Acaravci and Ozturk (2012), our findings support the validity of the growth hypothesis for Turkey. Electrical energy, employment, and capital are the complementary production inputs. Therefore, any interruption in electricity consumption hinders economic growth. Energy restrictive practices and cuts in electricity consumption adversely affect Turkey’s economy. The positive and statistically significant unidirectional causality from EC to GDP indicates that energy promotion practices are effective for Turkey.

Increased electricity generation and consumption induced by privatization in the electricity market must be sustained, and electricity must be generated from environmentally friendly resources. Turkey draws a great amount of its electricity from coal and natural gas. The country is rich in coal reserves; however, coal is a source of energy that causes air pollution. Almost all of its natural gas is imported, leading the country to experience a current account deficit. For a country like Turkey on its way to membership in the European Union, environmental quality is important. Therefore, the share of coal in electricity generation and the cost of natural gas must be reduced, and hydropower must be used in electricity generation. Additionally, Turkey must begin to use environmentally friendly energy sources such as solar and wind power at much higher levels while incorporating nuclear power as well.

References

Acaravci, A., & Ozturk, I. (2012). Electricity consumption and economic growth nexus: A multivariate analysis for Turkey. Amfiteatru Economic, 14(31), 246–257.

Aslan, A. (2013). Electricity consumption, labor force and GDP in Turkey: evidence from multivariate Granger causality. Energy Sources, Part B: Economics, Planning and Policy, 9(2), 174–182.

Ayres, R. U., Van den Bergh, J. C., Lindenberger, D., & Warr, B. (2013). The underestimated contribution of energy to economic growth. Structural Change and Economic Dynamics, 27, 79–88.

Brown, R. L., Durbin, J., & Evans, J. M. (1975). Techniques for testing the constancy of regression relationships over time. Journal of the Royal Statistical Society, 37(2), 149–192.

Cobb, C. W., & Douglas, P. H. (1928). A theory of production. The American Economic Review, 18(1), 139–165.

Dickey, D. A., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica: Journal of the Econometric Society, 49(4), 1057–1072.

Elliott, G., Rothenberg, T. J., & Stock, J. H. (1996). Efficient tests for an autoregressive unit root. Econometrica, 64(4), 813–836.

Enders, W. (2015). Applied econometric time series (4th ed.). New Jersey: Wiley.

Engle, R. F., & Granger, C. W. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica: journal of the Econometric Society, 55(2), 251–276.

Georgescu-Roegen, N. (1979). Comments on the papers by Daly and Stiglitz. In V. K. Smith (Ed.), Scarcity and growth reconsidered. Baltimore: John Hopkins University Press.

Ghali, K. H., & El-Sakka, M. I. (2004). Energy use and output growth in Canada: A multivariate cointegration analysis. Energy Economics, 26(2), 225–238.

Hamdi, H., Sbia, R., & Shahbaz, M. (2014). The nexus between electricity consumption and economic growth in Bahrain. Economic Modelling, 38, 227–237.

Harris, J. M. (2000). Basic principles of sustainable development. Global Development and Environment Institute Working Paper, 00–04.

IEA. (2016). Energy policies of IEA countries Turkey 2016 review. France: IEA Publications.

International Energy Outlook. (2016). U.S. Energy Information Administration, U.S. Department of Energy. Washington, DC.

Kraft, J., & Kraft, A. (1978). Relationship between energy and GNP. The Journal of Energy and Development, 3(2), 401–403.

Lean, H. H., & Smyth, R. (2010). On the dynamics of aggregate output, electricity consumption and exports in Malaysia: Evidence from multivariate Granger causality tests. Applied Energy, 87(6), 1963–1971.

Lorde, T., Waithe, K., & Francis, B. (2010). The importance of electrical energy for economic growth in Barbados. Energy Economics, 32(6), 1411–1420.

Lumsdaine, R. L., & Papell, D. H. (1997). Multiple trend breaks and the unit-root hypothesis. Review of Economics and Statistics, 79(2), 212–218.

Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from cointegration tests. Applied Economics, 37(17), 1979–1990.

Narayan, P. K., & Singh, B. (2007). The electricity consumption and GDP nexus for the Fiji Islands. Energy Economics, 29(6), 1141–1150.

Narayan, P. K., & Smyth, R. (2005). Electricity consumption, employment and real income in Australia evidence from multivariate Granger causality tests. Energy Policy, 33(9), 1109–1116.

Narayan, P. K., & Smyth, R. (2006). Higher education, real income and real investment in China: Evidence from Granger causality tests. Education Economics, 14(1), 107–125.

Odhiambo, N. M. (2009). Electricity consumption and economic growth in South Africa: A trivariate causality test. Energy Economics, 31(5), 635–640.

Ouédraogo, I. M. (2010). Electricity consumption and economic growth in Burkina Faso: A cointegration analysis. Energy Economics, 32(3), 524–531.

Ozturk, I. (2010). A literature survey on energy—growth nexus. Energy Policy, 38(1), 340–349.

Pesaran, M. H., & Shin, Y. (1999). An autoregressive distributed-lag modelling approach to cointegration analysis. In S. Strøm (Ed.), Econometrics and economic theory in the twentieth century (Chap. 11, pp. 371–413). Cambridge: Cambridge University Press.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Phillips, P. C., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346.

Repuplic of Turkey Ministry of Development. (2015). Economic and social indicators. Available at: http://www.mod.gov.tr/Lists/RecentPublications/Attachments/84/Economic%20and%20Social%20Indicators%20(1950-2014).pdf.

Rosenberg, N. (1998). The role of electricity in industrial development. The Energy Journal, 19(2), 7–24.

Sabanci University. (2013). Available at: http://ref.sabanciuniv.edu/sites/ref.sabanciuniv.edu/files/data_tfp_tur_en.xlsx.

Saidi, K., & Mbarek, M. B. (2016). Nuclear energy, renewable energy, CO2 emissions, and economic growth for nine developed countries: Evidence from panel Granger causality tests. Progress in Nuclear Energy, 88, 364–374.

Sargan, J. D. (1964). Wages and prices in the United Kingdom: A study in econometric methodology. In P. E. Hart, G. Mills, & J. K. Whitaker (Eds.), Econometric analysis for national economic planning. London: Butterworths.

Schwert, G. W. (1989). Tests for unit roots: A Monte Carlo investigation. Journal of Business & Economic Statistics, 7(2), 147–159.

Shahbaz, M., & Lean, H. H. (2012). The dynamics of electricity consumption and economic growth: A revisit study of their causality in Pakistan. Energy, 39(1), 146–153.

Shahbaz, M., Mutascu, M., & Tiwari, A. K. (2012). Revisiting the relationship between electricity consumption, capital and economic growth: Cointegration and causality analysis in Romania. Romanian Journal of Economic Forecasting, 3, 97–120.

Smulders, S., & De Nooij, M. (2003). The impact of energy conservation on technology and economic growth. Resource and Energy Economics, 25(1), 59–79.

Soytas, U., & Sari, R. (2007). The relationship between energy and production: Evidence from Turkish manufacturing industry. Energy Economics, 29(6), 1151–1165.

Stern, D. I. (1993). Energy and economic growth in the USA: A multivariate approach. Energy Economics, 15(2), 137–150.

Stern, D. I. (1997). Limits to substitution and irreversibility in production and consumption: A neoclassical interpretation of ecological economics. Ecological Economics, 21(3), 197–215.

Stern, D. I. (2004). Economic growth and energy. Encyclopedia of Energy, 2(00147), 35–51.

Stern, D. I. (2011). The role of energy in economic growth. Annals of the New York Academy of Sciences, 1219(1), 26–51.

TETAS. (2013). 2012 yılı sektör raporu, Ankara, May 2013.

TETAS. (2016). 2015 yılı sektör raporu, Ankara, May 2016.

TUIK. (2014). İstatistik göstergeler 1923–2013, Ankara, 2014.

World Bank. (2016). World Development Indicators. Available at: http://data.worldbank.org/data-catalog/world-development-indicators.

Zivot, E., & Andrews, D. W. K. (1992). Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. Journal of Business & Economic Statistics, 10(3), 251–270.

Acknowledgements

The authors are grateful for the valuable contributions and constructive comments by anonymous referees. We also thank the Editor-in-Chief: Luc Hens for his assistance. Remaining errors are us.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pata, U.K., Kahveci, S. A multivariate causality analysis between electricity consumption and economic growth in Turkey. Environ Dev Sustain 20, 2857–2870 (2018). https://doi.org/10.1007/s10668-017-0020-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-017-0020-z