Abstract

In this study, the relationship between carbon dioxide emissions, GDP, energy use, and population growth in Ghana was investigated from 1971 to 2013 by comparing the vector error correction model (VECM) and the autoregressive distributed lag (ARDL). Prior to testing for Granger causality based on VECM, the study tested for unit roots, Johansen’s multivariate co-integration and performed a variance decomposition analysis using Cholesky’s technique. Evidence from the variance decomposition shows that 21 % of future shocks in carbon dioxide emissions are due to fluctuations in energy use, 8 % of future shocks are due to fluctuations in GDP, and 6 % of future shocks are due to fluctuations in population. There was evidence of bidirectional causality running from energy use to GDP and a unidirectional causality running from carbon dioxide emissions to energy use, carbon dioxide emissions to GDP, carbon dioxide emissions to population, and population to energy use. Evidence from the long-run elasticities shows that a 1 % increase in population in Ghana will increase carbon dioxide emissions by 1.72 %. There was evidence of short-run equilibrium relationship running from energy use to carbon dioxide emissions and GDP to carbon dioxide emissions. As a policy implication, the addition of renewable energy and clean energy technologies into Ghana’s energy mix can help mitigate climate change and its impact in the future.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Access to energy is one of the many ways of achieving higher levels of economic productivity in every technological and advancing country (Owusu and Asumadu-Sarkodie 2016). Energy demand and economic development are increasing due to the requirement to meet basic human needs and productivity (Asumadu-Sarkodie and Owusu 2016a; Edenhofer et al. 2011). However, the quest to meet global energy demand has led to the use environmental unfriendly energy sources that impact climate change due to the emission of greenhouse gases (Asumadu-Sarkodie and Owusu 2016b; Asumadu-Sarkodie and Owusu 2016d; Asumadu-Sarkodie and Owusu 2016e). According to Earth System Research Laboratory (2015), the growth rate of carbon dioxide emissions has increased over the past 36 years (1979–2014), “averaging about 1.4 ppm per year before 1995 and 2.0 ppm per year thereafter.” As a result of this, the Sustainable Development Goal 13 focuses on actions that help mitigate climate change and its impacts (United Nations 2015). The causal nexus between environmental pollution and energy consumption as well as between economic growth and environmental pollution has become a global interest (Acaravci and Ozturk 2010; Owusu et al. 2016). Nevertheless, it is inconclusive to recommend national policies without empirical evidence to support it. There are a vast number of studies that have employed modern econometric approaches such as autoregressive and distributed lag (ARDL), GMM, DOLS, FMOLS, and vector error correction model (VECM) to analyze both microeconomic and macroeconomic variables. Table 1 shows a few of the compiled studies that have employed modern econometric approaches.

There are conflicting results pertaining to the causal nexus between GDP and energy consumption/intensity or between energy consumption/intensity and carbon dioxide emissions, which we believe depends on the length of data and the particular location for the study. The outcome of studies by Herrerias et al. (2013) and Apergis and Ozturk (2015) maybe misleading since data employed for the study spans from 1995 to 2009 and 1990 to 2011. Using less than 30 observations becomes problematic in making the current inferences for a particular location. Accordingly, employing a lengthy dataset makes it more statistically useful to make the correct inference. Notwithstanding, almost all the studies are done in European countries (Acaravci and Ozturk 2010; Azhar Khan et al. 2014; Caraiani et al. 2015; Fuinhas and Marques 2012; Ohler and Fetters 2014), Asian countries (Apergis and Ozturk 2015; Asafu-Adjaye 2000; Chang 2010; Chen et al. 2007), and the Middle East countries (Azhar Khan et al. 2014; Ozturk and Acaravci 2011; Sadorsky 2011).

Meanwhile, the trend of CO2 emissions per capita in Africa grew from −7.4 to 6.38 % for the years 1980 and 2008, while per capita income grew from −3.75 to 4.02 % in the same period (Osabuohien et al. 2014). Surprisingly, the debate on CO2 emissions and its impact in Africa have been neglected for quite a long time; it is therefore necessary to draw inspiration from the African context in order to provide additional perspectives to the global debate.

Our study is in line with Hatzigeorgiou et al. (2011) who did a similar study in Greece where a unidirectional causality was established between GDP and energy intensity (EI) and GDP and CO2 emissions. They found a bidirectional relationship between CO2 emissions and EI. Similarly, Hatzigeorgiou et al. (2008) employed a decomposition technique to investigate the factors affecting CO2 emissions. Their findings show that energy intensity is the main factor responsible for the decrease in CO2 emissions while income effect contributes to increasing CO2 emissions.

The causal relationship between carbon dioxide emissions, GDP, and energy use has been sporadic and limited especially in developing countries like Ghana. Ghana’s contribution towards climate change mitigation is eminent. Ghana acceded to the Kyoto protocol by the United Nations Framework Convention on Climate Change (UNFCC) in November 2002 and has been listed in non-annex 1 countries that can only contribute in the clean development mechanism as her contribution to reducing emission levels of her greenhouse gases (UNTC 2015). Ghana as a growing economy from lower middle income to a middle income economy has suffered many hitches in the field of health (Asumadu-Sarkodie and Owusu 2015), water management (Asumadu-Sarkodie et al. 2015a; Asumadu-Sarkodie et al. 2015b), energy management, etc. A limitation in scientific research in these areas makes it difficult for local and private investors to make a decisive decision in their investment in Ghana.

Attempts have been made to make known the developmental issues in Ghana in the scientific arena but are still limited in the scope of climate change mitigation. To the best of our knowledge, only Adom and Bekoe (2012) have employed modern econometric approaches like ARDL and partial adjustment model (PAM) to forecast the 2020 electrical energy requirement for Ghana. Their study concluded that domestic electricity consumption is mainly explained by income factor in Ghana. Nevertheless, their study is different from our study.

Against this backdrop, our study investigates the relationship between carbon dioxide emissions, GDP, energy use, and population growth in Ghana by employing data from 1971 to 2013 by comparing VECM and ARDL which are different and absent from the literature listed in the study. The study is worthwhile to Ghana since it will increase the awareness of sustainable development and serve as a reference tool for integrating climate change measures into energy policies, practices, and planning by the Government of Ghana. The rest of the paper are sectioned into “Methodology,” “Results and discussion,” and “Conclusion” sections with policy recommendations.

Methodology

The study examines the causal nexus between carbon dioxide emissions, energy use, GDP, and population growth in Ghana by comparing VECM and ARDL. A time series dataset from 1971 to 2013 was employed from the World Bank database (World Bank 2015). Four study variables were used in the study which include CO2—carbon dioxide emissions (kt), GDP—gross domestic product (current LCU), EU—energy use (kg of oil equivalent per capita), and P—population growth. World Bank (2015) defines energy use as “the primary energy before transformation into other end-use fuels, which is equal to indigenous production plus imports and stock exchange, minus exports and fuels supplied to ships and aircraft engaged in international transport.”

Let LCO2, LEU, LGDP, and LP represent the logarithmic transformation of carbon dioxide emissions, energy use, gross domestic product, and population, since logarithmic transformation leads to a more stable data variance. Following the work of Asumadu-Sarkodie and Owusu (2016c), the VECM for this study can be expressed as

where LCO2 is the dependent variable; LEU, LGDP, and LP are the explanatory variables in year t; Δ is the difference operator; ECT t − 1 is the error correction term resulting from the long-run co-integration relationship; θs, αs, and βs are the parameters to be estimated; p is the number of lags; and ε t s are the serially independent error terms.

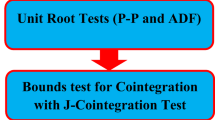

Unlike other econometric techniques that require all variables to be I(1) or I(0) and I(1), Pesaran and Shin (1998) revealed that co-integration among variables can have different number of lag terms and can be estimated as ARDL model with variables in co-integration without pre-requirement of variables to be either I(0) or I(1). Following the work of Adom and Bekoe (2012), Asumadu-Sarkodie and Owusu (2016f), and Ozturk and Acaravci (2011), ARDL model for this study can be expressed as

where α is the intercept, p is the lag order, ε t is the error term, and Δ is the first difference operator. The study employs the F tests in order to test the long-run equilibrium relationship between LCO2, LEU, LGDP, and LP. The ARDL bound test functions under the null hypothesis of no co-integration between LCO2, LEU, LGDP, and LP [H 0 : δ 1 = δ 2 = δ 3 = δ 4 = 0], against the alternative hypothesis of co-integration between LCO2, LEU, LGDP, and LP [H 1 : δ 1 ≠ δ 2 ≠ δ 3 ≠ δ 4 ≠ 0]. According to Pesaran et al. (2001), if the computed F statistic is above the upper bound critical value, then the null hypothesis of no co-integration between LCO2, LEU, LGDP, and LP is rejected. Otherwise, the null hypothesis of no co-integration is accepted if the F statistic lies below the critical values of the lower bound.

Descriptive analysis

This section outlines the descriptive statistical analysis of the variables before logarithmic transformation was applied in the study. Figure 1 shows the trend of the variables after logarithmic transformation was applied. It is evident that the trend of population increases periodically, trend of GDP follows that of CO2 emissions, but trend fluctuations seem to occur in energy use. The descriptive statistical analyses of the variables are presented in Table 2. While CO2, GDP, and P have a long-right tail (positive skewness), EU has a long-left tail (negative skewness). However, as EU and GDP show a leptokurtic distribution, CO2 and P show a platkurtic distribution. Since energy use, CO2, and GDP have been revealed to be collinear for research in several countries, the study tests for multicollinearity among variables of carbon dioxide emissions, energy use, GDP, and population using the variance inflation factor and the correlation matrix of coefficients of the regress model. Evidence from Table 2 shows that all the variance inflation factors are less than 4, an acceptable VIF in existing literature (Pan and Jackson 2008). In addition, the correlation matrix of coefficients of the regression model shows that energy use, GDP, and population are negatively correlated with carbon dioxide emissions, meaning that the variables are free from the problem of collinearity. The study further estimate outliers in the variables using the Grubbs’ test. Evidence from Table 2 shows that the null hypothesis that all data values come from the same normal population cannot be rejected at 5 % significance level.

Unit root test

This subsection focuses on testing stationarity for Johansen’s test of co-integration analysis. According to Mahadeva and Robinson (2004), executing unit root test is vital in minimizing spurious regression and it ensures that variables employed in the regression are stationary by differencing them and estimating the equation of interest through the stationary processes. The study employs the augmented Dickey-Fuller (ADF) (Dickey and Fuller 1979), Kwiatkowski-Phillips-Schmidt-Shin (KPSS) and Vogelsang’s break point unit root tests in order to have robust results. Table 3 presents the results of ADF, KPSS and break point unit root tests. At level, the null hypothesis of unit root cannot be rejected at 5 % significance level but is rejected at first difference. Evidence from Table 3 shows that the null hypothesis of stationarity in the KPSS results is rejected at level but cannot be rejected at first difference based on 5 % significance level. In the same way, since ADF and KPSS may fail to test stationarity in the presence of structural breaks, the study estimates the order of integration with break point unit root test taking into consideration the innovational outlier. Evidence from Table 3 shows that the null hypothesis of unit root in the break point results cannot be rejected at level. However, the study rejects the null hypothesis at first difference based on 5 % significance level. The ADF, KPSS, and break point unit root tests suggest that the variables are integrated at I(1), which satisfies the pre-condition of Johansen’s method of co-integration.

Lag selection for vector error correction model

This subsection focuses on lag selection criteria, which is the first step for Johansen test of co-integration. Table 4 shows the vector autoregression (VAR) lag order selection criteria. VAR lag order selection criteria is used to select the optimal lag for the test of co-integration in the study. The sequential modified likelihood-ratio test statistic (LR), final prediction error (FPE), Akaike information criterion (AIC), Schwarz information criterion (SC), and Hannan-Quinn information criteria (HQ) select 1 as the optimal lag as indicated by “a” in Table 4.

Results and discussion

In this section, the proposed VECM and ARDL models are applied in Ghana for the 1971–2013 period.

Co-integration test and vector error correction model

This subsection focuses on the application of Johansen co-integration test (Johansen 1995) using max-eigenvalue and trace methods. The results for unrestricted co-integration rank tests are presented in Table 5. Using co-integration test specifications, information criteria such as AIC, LogL, and SC select linear intercept and trend for trace and max-eigenvalue tests. Trace and max-eigenvalue tests indicate 2 co-integrating equation at the 5 % significance level, which rejects the null hypothesis of no co-integration between LCO2 , LEU, LGDP, and LP.

Table 6 shows the long-run and short-run multivariate causalities of the error correction model. Results from Table 6 show that the error correction term [L1. _ce1 = − 0.86] is negative and significant at 5 % level, which shows evidence of long-run equilibrium relationship running from LEU, LGDP, and LP to LCO2. In addition, there is evidence of short-run equilibrium relationship running LEU to LCO2, LGDP to LCO2, and LP to LCO2, which is statistically significant at 5 % significance level.

Johansen co-integration reveals the existence of causality among variables but fails to indicate the direction of the causal relationship. It is realistic to ascertain the causal relationships between LCO2, LEU, LGDP, and LP using the Granger causality test (Granger 1988). Granger causality tests based on VECM are presented in Table 7. The null hypotheses that LCO2 does not Granger cause LEU, LCO2 does not Granger cause LGDP, LCO2 does not Granger cause LP, LEU does not Granger cause LGDP, LGDP does not Granger cause LEU, and LP does not Granger cause LEU are rejected at 5 % significance level. In other words, there is a bidirectional causality running from LEU to LGDP and a unidirectional causality running from LCO2 to LEU, LCO2 to LGDP, LCO2 to LP, and LP to LEU. Evidence from the joint Granger-causality shows a unidirectional causality running from LCO2 to a joint of LEU, LGDP, and LP; LEU to a joint of LCO2, LGDP, and LP; and LGDP to a joint of LCO2, LEU, and LP, respectively.

ARDL co-integration test and regression analysis

The study presents the ARDL regression model and bound test co-integration as proposed by Pesaran et al. (2001). Table 8 presents a summary of ARDL bound test co-integration. Bound F test is performed to establish a co-integration relationship between LCO2, LEU, LGDP, and LP. Results from Table 8 show that the F statistic lies above the 10, 5, 2.5, and 1 % critical values of the upper bound, meaning that the null hypothesis of no co-integration relationship between LCO2, LEU, LGDP, and LP is rejected at 10, 5, 2.5, and 1 % significant levels.

Per the existence of co-integration, the next step is to select an optimal model for the long-run equilibrium relationship estimation using the Akaike information criterion. Table 9 presents a summary of the ARDL regression estimation. Results from Table 9 show that the error correction term [ECT(−1) = − 0.90] is negative and significant at 5 % level, meaning that a long-run equilibrium relationship exists running from energy use, GDP, and population to carbon dioxide emissions.

Evidence from the long-run (LR) elasticity estimation in Table 9 shows that a 1 % increase in population in Ghana will increase carbon dioxide emissions by 1.72 %. Though not statistically significant, 1 % increase in GDP in Ghana will increase carbon dioxide emissions by 0.37 and a 1 % increase in energy use in Ghana will increase carbon dioxide emissions by 0.53 %.

The study performs a linear test of parameter estimates using the individual coefficient to analyze a joint effect of the independent variables (LEU, LGDP, and LP) on LCO2. The joint linear test in Table 9 shows evidence of short-run (SR) equilibrium relationship running from energy use to carbon dioxide emissions and GDP to carbon dioxide emissions. The empirical evidence shows that the energy use in Ghana contributes more to carbon dioxide emissions than GDP in the short run. According to Asumadu-Sarkodie and Owusu (2016a) as at December 2013, 1245 MW of the total 2631 dependable capacity for power generation in Ghana came from thermal generation with only 1.9 MW coming from renewable sources. Nevertheless, the recent energy crisis in Ghana as a result of a change in weather patterns leading to low inflows for hydro-power generation has increased Ghana’s dependence on thermal power generation (natural gas and diesel), leading to the increasing rate of carbon dioxide emissions. Moreover, 60 % of Ghana’s energy use comes from biomass consumption in the form of charcoal and firewood (Asumadu-Sarkodie and Owusu 2016a), which over-exploitation of the forest increases the rate of carbon dioxide emissions.

Diagnostic tests for VECM and ARDL models

This subsection presents the diagnostic tests for VECM and ARDL models. Table 10 presents a diagnostic test of VECM.

VEC residual normality was tested using Jarque-Bera test based on the null hypothesis that residuals are normally distributed. Results from the test show that the null hypothesis cannot be rejected at 5 % significance level, meaning that the residuals are normally distributed. VEC residual serial correlation was tested using Lagrange multiplier test based on null hypothesis that no serial correlation exists at lag order h. Results from the test show that the null hypothesis cannot be rejected at 5 % significance level, meaning that no serial correlation exists.

Table 11 presents a diagnostic test of the ARDL model. In the same way, ARDL was subjected to several diagnostic tests. For the ARDL diagnostics, the study employs LM test for autoregressive conditional heteroskedasticity (ARCH), Breusch-Pagan/Cook-Weisberg test for heteroskedasticity, Breusch-Godfrey LM test for autocorrelation, and Ramsey RESET test using powers of the fitted values of D.LCO2. Evidence from Table 11 shows that the null hypothesis of no ARCH effects by the ARCH test cannot be rejected at 5 % significance level, meaning that there is no ARCH effects. The null hypothesis of no serial correlation by the Breusch-Godfrey LM test cannot be rejected at 5 % significance level, meaning that no serial correlation exists at lag order h. The null hypothesis of constant variance by the Breusch-Pagan/Cook-Weisberg test cannot be rejected at 5 % significance level, meaning that the residuals of the ARDL model have a constant variance. In addition, the null hypothesis of no omitted variables in the model by the Ramsey RESET test cannot be rejected at 5 % significance level, meaning that no variables are omitted in the ARDL model.

Variance decomposition

This section focuses on the response of variables to each other in one standard deviation innovations. Results from the co-integrating relation of VECM and ARDL models show a nearly similar trend regarding the nature of co-integration that exists between LCO2, LEU, LGDP, and LP. However, the impulse response function that traces the effect of a shock from one endogenous variable on the other variables is uncertain in both VECM and ARDL models. It is therefore necessary to analyze the variance decomposition to trace these shocks. The variance decomposition provides information about the relative importance of each random innovation in affecting the variables in the VAR.

Table 12 reports the result of the variance decomposition of LCO2, LEU, LGDP, and LP within a 10-period horizon. Evidence from Table 12 shows that 21 % of future shocks in LCO2 are due to fluctuations in LEU, 8 % of future shocks in LCO2 are due to fluctuations in LGDP, and 6 % of future shocks in LCO2 are due to fluctuations in LP.

Moreover, evidence from Table 12 shows that 19 % of future shocks in LEU are due to fluctuations in LP, 17 % of future shocks in LEU are due to fluctuations in LGDP, and 1 % of future shocks in LEU is due to fluctuations in LCO2.

In addition, evidence from Table 12 shows that 20 % of future shocks in LGDP are due to fluctuations in LEU, 6 % of future shocks in LGDP are due to fluctuations in LCO2, and 4 % of future shocks in LGDP are due to fluctuations in LP.

Evidence from Table 12 shows that 17 % of future shocks in LP are due to fluctuations in LGDP, 15 % of future shocks in LP are due to fluctuations in LEU, and 4 % of future shocks in LP are due to fluctuations in LCO2.

Robustness of VECM and ARDL models

Figure 2 shows the inverse root of characteristic polynomial. The root characteristic polynomial is used to check the stability of the VEC model. VEC specification imposes no unit roots outside the unit circle (the eigenvalue of the respective matrix is less than 1); therefore, the VEC model meets the VAR stability conditions.

Figure 3 shows the CUSUM and CUSUM of square tests for the parameter instability from the ARDL model. The CUSUM and CUSUM of square tests are used to ascertain the parameter instability of the equation employed in the ARDL model. Since the plots in CUSUM and CUSUM of square tests lie within the 5 % significance level, the parameter of the equation is stable enough to estimate the long-run and short-run causalities in the ARDL model.

Conclusion

In this study, the relationship between carbon dioxide emissions, energy use, GDP, and population growth in Ghana was investigated from 1971 to 2013 by comparing VECM and ARDL. Prior to testing for Granger causality based on VECM, the study tested for unit roots and Johansen’s method of co-integration. In addition, the study performed a variance decomposition analysis using Cholesky technique, diagnostic, and stability tests.

Evidence from the VECM and ARDL models shows that carbon dioxide emissions, energy use, GDP, and population growth are co-integrated. There was evidence of bidirectional causality running from energy use to GDP and a unidirectional causality running from carbon dioxide emissions to energy use, carbon dioxide emissions to GDP, carbon dioxide emissions to population, and population to energy use. Evidence from the joint Granger-causality shows a unidirectional causality running from carbon dioxide emissions to a joint of energy use, GDP, and population; energy use to a joint of carbon dioxide emissions, GDP, and population; and GDP to a joint of carbon dioxide emissions, energy use, and population, respectively.

Evidence from the long-run elasticities shows that a 1 % increase in population in Ghana will increase carbon dioxide emissions by 1.72 %. Though not statistically significant, 1 % increase in GDP in Ghana will increase carbon dioxide emissions by 0.37 and a 1 % increase in energy use in Ghana will increase carbon dioxide emissions by 0.53 %. In addition, there was evidence of SR equilibrium relationship running from energy use to carbon dioxide emissions and GDP to carbon dioxide emissions.

The ARDL bound test results yield evidence of a long-run relationship between carbon dioxide emissions and energy use, GDP, and population in Ghana. Evidence from the variance decomposition shows that 21 % of future shocks in carbon dioxide emissions are due to fluctuations in energy use, 8 % of future shocks in carbon dioxide emissions are due to fluctuations in GDP, and 6 % of future shocks in carbon dioxide emissions are due to fluctuations in population. Nineteen percent of future shocks in energy use are due to fluctuations in population, 17 % of future shocks in energy-use are due to fluctuations in GDP, and 1 % of future shocks in energy use is due to fluctuations in carbon dioxide emissions. In addition, 20 % of future shocks in GDP are due to fluctuations in energy use, 6 % of future shocks in GDP are due to fluctuations in carbon dioxide emissions, and 4 % of future shocks in GDP are due to fluctuations in population. Seventeen percent of future shocks in population are due to fluctuations in GDP, 15 % of future shocks in population are due to fluctuations in energy use, and 4 % of future shocks in population are due to fluctuations in carbon dioxide emissions.

The results from the variance decomposition have policy implications. It is noteworthy that energy use in Ghana affects carbon dioxide emissions in the long run. In this way, addition of renewable energy and clean energy technologies into Ghana’s energy mix can help mitigate climate change and its impact in the future. In addition, future energy use in Ghana depends on GDP; therefore, efforts by Government towards boosting the economic growth in Ghana are worthwhile. Evidence from the study shows that future growth in GDP will likely depend on the access to energy in Ghana. Therefore, a progressive effort towards increasing the accessibility and supply of energy to meet the growing energy demand in Ghana will boost productivity leading to economic growth.

Based on the results of the study, the following policy recommendations are made:

-

Since, energy-use Granger causes CO2 emissions, the Government of Ghana should increase the share of renewable energy in Ghana’s energy mix.

-

Improving energy efficiency by facilitating access to clean energy and introducing energy management options in the national grid would help reduce the impact of CO2 emissions.

-

As an income effect is the most important factor contributing to increasing CO2 emissions, the Government of Ghana should promote development-oriented policies that create jobs for the people, supporting entrepreneurship, creativity, and innovation, and provide the environment that supports small- and medium-scale enterprises.

-

Providing financial services like subsidies, loan, and grants for energy efficiency measures and renewable energy systems.

Finally, creating awareness on climate change mitigation, impact, adaptation, and early warning signs through the integration of climate change measures into the national policy, planning, and strategies would help reduce climate change and its impacts, thereby fulfilling the thirteenth goal of sustainable development.

Abbreviations

- Chi2 :

-

Chi square

- Parms:

-

Parameter

- df:

-

Difference

- Prob:

-

Probability

- _ce:

-

Co-integrated equation

- Coef.:

-

Coefficient

- _cons:

-

Constant

- Std. Err.:

-

Standard error

- L1._ce:

-

Error correction term

- VECM:

-

Vector error correction model

- ECT:

-

Error correction term

- SR:

-

Short run

- LRE:

-

Long-run elasticities

- LL:

-

Log likelihood

- LR:

-

Sequential likelihood ratio

- AIC:

-

Akaike information criterion

- KPSS:

-

Kwiatkowski-Phillips-Schmidt-Shin

- SC:

-

Schwarz information criterion

- HQ:

-

Hannan-Quinn information criteria

- VIF:

-

Variance inflation factor

- LCUs:

-

Local currency units

- P:

-

Population

- GT:

-

Grubbs’ test

- GMM:

-

Generalized Method of Moments

- FMOLS:

-

Fully-Modified Ordinary Least Squares

- DOLS:

-

Dynamic Ordinary Least Squares

References

Acaravci A, Ozturk I (2010) On the relationship between energy consumption, CO2 emissions and economic growth in Europe. Energy 35:5412–5420

Adom PK, Bekoe W (2012) Conditional dynamic forecast of electrical energy consumption requirements in Ghana by 2020: a comparison of ARDL and PAM. Energy 44:367–380

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecological Indicators 52:16–22. doi:10.1016/j.ecolind.2014.11.026

Apergis N, Payne JE (2011) The renewable energy consumption–growth nexus in Central America. Appl Energy 88:343–347

Asafu-Adjaye J (2000) The relationship between energy consumption, energy prices and economic growth: time series evidence from Asian developing countries. Energy Economics 22:615–625. doi:10.1016/S0140-9883(00)00050-5

Asumadu-Sarkodie S, Owusu P (2016a) A review of Ghana’s energy sector national energy statistics and policy framework. Cogent Engineering. doi:10.1080/23311916.2016.1155274

Asumadu-Sarkodie S, Owusu PA (2015) Media impact on students’ body image. International Journal for Research in Applied Science and Engineering Technology 3:460–469

Asumadu-Sarkodie S, Owusu PA (2016b) Feasibility of biomass heating system in Middle East Technical University, Northern Cyprus Campus. Cogent Engineering 3:1134304. doi:10.1080/23311916.2015.1134304

Asumadu-Sarkodie S, Owusu PA (2016c) Multivariate co-integration analysis of the Kaya factors in Ghana. Environmental Science and Pollution Research. doi:10.1007/s11356-016-6245-9

Asumadu-Sarkodie S, Owusu PA (2016d) The potential and economic viability of solar photovoltaic in Ghana. Energy Sources, Part A: Recovery, Utilization, and Environmental Effects. doi:10.1080/15567036.2015.1122682

Asumadu-Sarkodie S, Owusu PA (2016e) The potential and economic viability of wind farms in Ghana. Energy Sources, Part A: Recovery, Utilization, and Environmental Effects. doi:10.1080/15567036.2015.1122680

Asumadu-Sarkodie S, Owusu PA (2016f) The relationship between carbon dioxide and agriculture in Ghana, a comparison of VECM and ARDL model. Environmental Science and Pollution Research. doi:10.1007/s11356-016-6252-x

Asumadu-Sarkodie S, Owusu PA, Jayaweera HM (2015a) Flood risk management in Ghana: a case study in Accra. Advances in Applied Science Research 6:196–201

Asumadu-Sarkodie S, Owusu PA, Rufangura P (2015b) Impact analysis of flood in Accra, Ghana. Advances in Applied Science Research 6:53–78

Azhar Khan M, Zahir Khan M, Zaman K, Naz L (2014) Global estimates of energy consumption and greenhouse gas emissions. Renewable and Sustainable Energy Reviews 29:336–344. doi:10.1016/j.rser.2013.08.091

Baek J (2015) A panel cointegration analysis of CO2 emissions, nuclear energy and income in major nuclear generating countries. Applied Energy 145:133–138. doi:10.1016/j.apenergy.2015.01.074

Caraiani C, Lungu CI, Dascălu C (2015) Energy consumption and GDP causality: a three-step analysis for emerging European countries. Renewable and Sustainable Energy Reviews 44:198–210. doi:10.1016/j.rser.2014.12.017

Cerdeira Bento JP, Moutinho V (2016) CO2 emissions, non-renewable and renewable electricity production, economic growth, and international trade in Italy. Renew Sustain Energy Rev 55:142–155

Chang C-C (2010) A multivariate causality test of carbon dioxide emissions, energy consumption and economic growth in China. Applied Energy 87:3533–3537

Chen S-T, Kuo H-I, Chen C-C (2007) The relationship between GDP and electricity consumption in 10 Asian countries. Energ Policy 35:2611–2621

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. Journal of the American statistical association 74:427–431

Earth System Research Laboratory (2015) The NOAA Annual Greenhouse Gas Index (AGGI)., http://www.esrl.noaa.gov/gmd/aggi/aggi.html. Accessed October 24, 2015

Edenhofer O et al (2011) Renewable energy sources and climate change mitigation: special report of the intergovernmental panel on climate change. Cambridge University Press

Fuinhas JA, Marques AC (2012) Energy consumption and economic growth nexus in Portugal, Italy, Greece, Spain and Turkey: an ARDL bounds test approach (1965–2009). Energy Economics 34:511–517. doi:10.1016/j.eneco.2011.10.003

Granger CW (1988) Some recent development in a concept of causality. Journal of econometrics 39:199–211

Hatzigeorgiou E, Polatidis H, Haralambopoulos D (2008) CO2 emissions in Greece for 1990–2002: a decomposition analysis and comparison of results using the arithmetic mean Divisia index and logarithmic mean Divisia index techniques. Energy 33:492–499

Hatzigeorgiou E, Polatidis H, Haralambopoulos D (2011) CO2 emissions, GDP and energy intensity: a multivariate cointegration and causality analysis for Greece, 1977–2007. Applied Energy 88:1377–1385. doi:10.1016/j.apenergy.2010.10.008

Herrerias MJ, Joyeux R, Girardin E (2013) Short- and long-run causality between energy consumption and economic growth: evidence across regions in China. Applied Energy 112:1483–1492. doi:10.1016/j.apenergy.2013.04.054

Johansen S (1995) Likelihood-based inference in cointegrated vector autoregressive models OUP Catalogue

Lin B, Omoju OE, Okonkwo JU (2015) Impact of industrialisation on CO2 emissions in Nigeria. Renewable and Sustainable Energy Reviews 52:1228–1239. doi:10.1016/j.rser.2015.07.164

Mahadeva L, Robinson P (2004) Unit root testing to help model building

Ohler A, Fetters I (2014) The causal relationship between renewable electricity generation and GDP growth: a study of energy sources. Energy Economics 43:125–139. doi:10.1016/j.eneco.2014.02.009

Osabuohien ES, Efobi UR, Gitau CMW (2014) Beyond the environmental Kuznets curve in Africa: evidence from panel cointegration. Journal of Environmental Policy & Planning 16:517–538. doi:10.1080/1523908x.2013.867802

Owusu P, Asumadu-Sarkodie S (2016) A Review of Renewable Energy Sources, Sustainability Issues and Climate Change Mitigation. Cogent Engineering. doi:10.1080/23311916.2016.1167990

Owusu PA, Asumadu-Sarkodie S, Ameyo P (2016) A review of Ghana’s water resource management and the future prospect. Cogent Engineering. doi:10.1080/23311916.2016.1164275

Ozturk I, Acaravci A (2010) The causal relationship between energy consumption and GDP in Albania, Bulgaria, Hungary and Romania: Evidence from ARDL bound testing approach. Appl Energy 87:1938–1943

Ozturk I, Acaravci A (2011) Electricity consumption and real GDP causality nexus: evidence from ARDL bounds testing approach for 11 MENA countries. Applied Energy 88:2885–2892. doi:10.1016/j.apenergy.2011.01.065

Pan Y, Jackson R (2008) Ethnic difference in the relationship between acute inflammation and serum ferritin in US adult males. Epidemiology and infection 136:421–431

Pesaran MH, Shin Y (1998) An autoregressive distributed-lag modelling approach to cointegration analysis. Econometric Society Monographs 31:371–413

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. Journal of applied econometrics 16:289–326

Salahuddin M, Gow J, Ozturk I (2015) Is the long-run relationship between economic growth, electricity consumption, carbon dioxide emissions and financial development in Gulf Cooperation Council Countries robust? Renew Sustain Energy Rev 51:317–326

Sadorsky P (2011) Trade and energy consumption in the Middle East. Energy Economics 33:739–749. doi:10.1016/j.eneco.2010.12.012

Seker F, Ertugrul HM, Cetin M (2015) The impact of foreign direct investment on environmental quality: a bounds testing and causality analysis for Turkey. Renewable and Sustainable Energy Reviews 52:347–356. doi:10.1016/j.rser.2015.07.118

United Nations (2015) Sustainable development goals., https://sustainabledevelopment.un.org/?menu=1300. Accessed October 24, 2015

UNTC (2015) United Nations Treaty Collection., https://treaties.un.org/. Accessed November14, 2015

World Bank (2015) Ghana|data., http://data.worldbank.org/country/ghana. Accessed November 12, 2015

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Rights and permissions

About this article

Cite this article

Asumadu-Sarkodie, S., Owusu, P.A. Carbon dioxide emissions, GDP, energy use, and population growth: a multivariate and causality analysis for Ghana, 1971–2013. Environ Sci Pollut Res 23, 13508–13520 (2016). https://doi.org/10.1007/s11356-016-6511-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-016-6511-x

Keywords

- Variance decomposition

- Carbon dioxide emissions

- Ghana

- Multivariate co-integration

- ARDL bound test

- Econometrics