Abstract

Wealth is a durable economic resource and it is typically held by individuals over the long-term. Measuring the wealth-type resources held by families, lends important information about the financial security of children. Following others, we argue that wealth provides additional information regarding child well-being, complementing traditional income-based measurements. In this paper, we extend the traditional income measure of child poverty in Canada to include wealth, by defining and presenting two measures of low-assets, or asset poverty. We present a novel estimation of child asset poverty in Canada and the first known estimation of child-level asset poverty more broadly. Focusing specifically on the measurement of asset poverty among children, we find that rates of asset poverty are two to three times as large as rates of income poverty. Prior literature highlights that higher asset levels are strongly associated with better outcomes for children, and families. The high levels of asset poverty in Canada, relative to other comparable nations, has implications for indicators of child well-being and the welfare of Canadian children.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Decades of research have shown that experiencing low income in early childhood is correlated with behavioural problems and poor school performance in children, as well as low educational attainment, low earnings, and poor health in adults (Alexander et al. 2014; Duncan et al. 2010; Duncan and Brooks-Gunn 1997; Pascoe et al. 2016). These correlations highlight the long-term social costs associated with low income in childhood. The relationship between low income and child development is complex (Burton et al. 2012; Cunha and Heckman 2009; Currie and Stabile 2003; Duncan et al. 2010), and, due to this complexity, there is a need for multiple measures of economic deprivation at the child and family levels. Wealth (otherwise referred to as assets) is one indicator of economic resources that provides important information regarding family welfare, complementing traditional income-based indicators. Wealth is conceptually and tangibly different from income as an economic resource (Keister and Moller 2000; Spilerman 2000); it is what individuals or families own that can be sold or traded through exchange,Footnote 1 accumulated and grown over a lifetime, and earned and passed down through generations. Importantly, wealth can be used to create opportunities, insure against risk, transmit class status, and secure a desired standard of living fundamentally different from those opportunities, risks, statuses, and standards created by and through income (Killewald et al. 2017; Pfeffer and Killewald 2015). Shaprio and Oliver (2006) argue that, because of this, “the command over resources that wealth entails is more encompassing than is income or education, and closer in meaning and theoretical significance to our traditional notions of economic well-being and access to life chances” (p. 2).

The extent of wealth (asset) poverty among children has been relatively understudied. This study aims to provide new insight for the growing field of child indicators research by addressing a number of knowledge gaps about the wealth resources available to children. We build on earlier resource theory scholarship (Diener and Fujita 1995) by distinguishing which types of resources matter for children. Our focus is on the distinction between income and assets as material resources. We examine the distribution of child-level asset poverty and how it compares to child income poverty. We then examine the demographic and social forces that shape the distribution of child-level asset poverty. Exploiting microdata from two cross sections of a nationally representative Canadian dataset, we present a novel estimation of child-level asset poverty in Canada and the first known estimation of child-level asset poverty more broadly.

Our study begins with a review of theory and data on child poverty and poverty measurement. We then describe our methods for estimating the prevalence of child-level income poverty and asset poverty over a 13-years period in Canada (1999–2012). Through multivariate analysis, we examine how age, family structure, gender, immigration status, and geography shape asset poverty and how these relationships differ from a standard measure of income poverty. Because assets are a key indicator of current well-being and future opportunities in ways that income is not, we argue that more attention should be paid to asset poverty measurement for households with children.

1 Background

1.1 Child Poverty

Early childhood experiences, determined in large part by the quality of support, nurturance, and stimulation children receive from parents and other caregivers, are predictive of later life outcomes (Maggi et al. 2010), and children who grow up in materially and economically deprived environments may lack the kind of support they need from their parents or environments to develop optimally (Cunha and Heckman 2009). Compared to their non-low income peers, children who grow up in low income environments are, on average, more likely to: begin school academically behind their peers, attain lower levels of education, exhibit anti-social behaviour, become teen parents, report lower health statuses, and come into contact with child welfare authorities (Berger and Waldfogel 2011; Hertzman and Boyce 2010; Hill and Duncan 1987; Magnuson and Votruba-Drzal 2009). Furthermore, the experience of childhood economic disadvantage increases the chances for experiencing hardship across the life course. Child poverty is associated with lower likelihood of school completion and full employment, and higher likelihood of incarceration (Duncan et al. 2010; Pascoe et al. 2016). Because of child poverty’s strong association with later life well-being, understanding the prevalence of low income (or poverty)Footnote 2 among children is a high priority of policymakers and researchers.

There are no official estimates of poverty in Canada, as the term “low income” is preferred by Statistics Canada (Felligi 1997). There are, however, three measures of low income: the Low Income Measure (LIM, a fully relative measure), the Low Income Cut Off (LICO, a quasi-relative measure), and the Market Basket Measure (MBM, an absolute measure). Children are more likely than the average Canadian to live in a low-income household (Corak 2005; Statistics Canada 2013; UNICEF 2012). Child poverty reduction has been a stated Canadian policy priority since 1989, when an all-party motion in the House of Commons sought to eliminate it by 2000. This strong commitment was further supported by Canada’s ratification of the Convention on the Rights of the Child in 1991. In the 25-years period since, federal policies have focused on increasing the self-sufficiency and income of working families (Albanese 2010; Jenson 2004). Despite these efforts, child low-income rates have remained stubbornly high for Canada as a whole (Chen and Corak 2008; Crossley and Curtis 2006). Using National Longitudinal Survey of Children and Youth (NLSCY) data, Burton et al. (2014) found that 2.4% of Canadian children spent their entire childhood in the bottom fifth of the income distribution. Similar to poverty prevalence estimates in many industrialized countries, Indigenous children, recently immigrated children, and children who live in female lone-parent households are more likely to be low income (Albanese 2010; Burton and Phipps 2017). A 2014 review of Canadian research found that income had a significant, but minor causal influence on child development, and that the length and severity of low income had greater effects on development (McEwen and Stewart 2014). A recent UNICEF report, using 60% of the median income as a poverty threshold, found that one in five Canadian children were income-poor in 2011 and that income-poor Canadian children had sunk deeper into poverty after the recession (UNICEF Office of Research 2014).

1.2 Assets and Children

Assets are theorized to have important effects on well-being that are independent of income. This theoretical conjecture rests strongly on the assumption that income and assets are loosely correlated. Testing this assumption, Killewald et al. (2017) estimated the Pearson correlation coefficient between total household net worth and total household income using the Survey of Consumer Finances (SFC) and the Panel Study of Income Dynamics (PSID). They found that, while the correlation between income and wealth was sensitive to different variable transformations such as top-coding net worth, the correlation was approximately 0.65 in the SCF, 0.60 using 10 years of the PSID, and 0.55 using single-year PSID data. Results showing a moderate correlation between income and wealth are similar in Canada. In her examination of the 2005 Survey of Financial Security, Robson (2013) found that the correlation between a family’s net worth (assets minus debts) and their income was similarly modest (r = .56, p = .001). Thus, the theoretical position that wealth is distinct from income is empirically grounded.

Although there is not an extensive literature tracing the outcomes of children who grow up asset poor, a growing body of work has examined the positive effects of asset holding on child development. Using longitudinal and nationally representative US data, Shanks (2007) showed that greater household wealth (net worth) was significantly negatively related to problem behaviour scores in school-aged children. Homeownership has been shown to be related to higher math scores, higher reading achievement, and lower problem behaviour scores in children (Haurin et al. 2002). Compared to renters, home-owning parents were more likely to show engaged parenting practices such as reading to their children, being involved with school activities, participating in organized activities, and encouraging lower screen or TV time (Grinstein-Weiss et al. 2010). Children randomly assigned to enrollment in a wealth-building child development account (CDA) program scored significantly higher on a measure of social-emotional development compared to children who were not enrolled in a CDA (Huang et al. 2014). Additionally, there is a growing body of work finding that assets have an independent, positive effect on the educational outcomes of children (e.g., Elliott and Friedline 2013; Elliott and Sherraden 2013; Huang 2013).

Scholars have theorized the direct and indirect effects of assets on child development in at least five ways. First, theoretically, assets affect child well-being by protecting against economic shocks. Without a sufficient cushion to buffer against a sudden income or asset loss, families might be subjected to a series of negative events (Grinstein-Weiss et al. 2014). Those events, such as residential displacement, have the potential to negatively impact child development. Liquid assets may serve as a protective factor against the loss of homes and net worth after an income shock, which in turn relate to the capabilities of parents to invest in their children (Elliott 2013). Second, assets directly impact the level of resource and time investments parents can make in their children. Undoubtedly, family income impacts the resources available to children, but scholars have theorized that wealth may be a better indicator of the long-term investments parents make in their children (Shanks 2007; Sherraden 1991). For example, a family might invest in activities for their children with greater frequency if they don’t have to worry about paying off significant debts or if they have investment income to rely on. Parents with higher levels of wealth might think differently about their children than those without wealth, as they may be able to view investments in their children from a perspective oriented towards the future (Shanks 2007). Third, assets might indirectly impact child development by mediating family stress (Rothwell and Han 2010). Without a solid buffer against economic shocks, or with constant economic stress due to low savings, familial contexts can deteriorate, and family stress levels may rise. Thus, assets may directly buffer against the negative effects of economic stress such as marital conflict, low marital warmth, and low parental nurturing (Grinstein-Weiss et al. 2014). Fourth, assets may change attitudes and expectations that parents have for children, and that children have for themselves. Parents who save for higher education for their children may be more likely to expect that their children attend and complete post-secondary education (Elliott and Sherraden 2013). Children’s expectations for themselves may change in reaction to the possibilities offered to them through parental asset holding or as a response to their own asset accumulation, as well. Identity-Based Motivation theory asserts that assets and family resources are likely to impact children’s school-focused goals in three identity-based ways: (1) if school feels relevant and congruent with a child’s social identity, (2) if a child feels able to accomplish relevant behavioural tasks (like studying), and (3) if a child can interpret difficulty in a productive/important way (Destin and Oyserman 2009; Oyserman 2013, 2015). Finally, the social consequences of asset holding may matter for children. Consider the early work on resource theory by Diener and Fujita (1995), who studied the relative importance of material, social, and personal resources on subjective well-being (SWB). While they found that SWB was more closely related to social resources than material resources, important social resources such as self-confidence, position of authority, social skills, and influential connections may be partially explained by prior asset holding. Sherraden (1991) described this mechanism as a virtuous cycle whereby asset holding promotes the cultivation of social engagement and political influence and, in turn, the world responds to reinforce these social and personal resources.

1.3 Asset Poverty Measurement

A measure of poverty assumes a valid indicator (or indicators) of deprivation that identifies the poor among a population and then aggregates these individuals into an index. Poverty measures should be accessible, defensible, feasible (Brady 2003), indicate something meaningful about the social reality of deprivation, and help to identify the effects of social welfare policies. All poverty measures involve some arbitrary or subjective decisions around resources and thresholds of need (Blank 2008; Rainwater and Smeeding 2003). Despite some subjectivity, poverty measurement matters, both in terms of identifying the most disadvantaged and in terms of policy response.

There are numerous ways to define and measure poverty as a construct, and debates around poverty measurement are deep and longstanding (see, for example: Brady 2003; Foster et al. 2010; Ravallion et al. 2009; Ravallion 1996; Sen 1976, 1983, 1999; Townsend 1954). Corak (2005), distilled choices leading to different poverty measures into three main categories: (1) a definition and measure of economic resources, (2) an established threshold distinguishing the poor from the non-poor, and (3) a count or index of the poor. Below we briefly discuss these three categories.

1.3.1 Economic Resources

Economic resources can include income (before or after tax), in-kind benefits, near cash social welfare benefits, direct consumption of resources, or assets. These resources are generally measured for a specified period, e.g., through earnings or purchases on a monthly or yearly basis. Conceptually, like income, assets can be measured with various indicators. First, there are tangible and intangible assets, with most of the asset-based literature focused on tangible assets (Midgley 1995). Tangible assets include savings, financial securities (stocks, bonds, etc.), real estate, other property (automobiles, jewelry, art, etc.), equipment and machines, natural resources, household goods, and copyrights or intellectual properties. Intangible assets include access to credit and human, social, cultural, political, or organizational capital (Nam et al. 2008). Tangible assets comprise the components of financial assets and net worth.

1.3.2 Thresholds

A poverty threshold establishes a judgment point about need whereby the unit of analysis is either above or below. Thresholds take two common forms: an absolute level of resources and a level of resources that is relative to the overall population. Used most often to measure poverty in European countries,Footnote 3 relative poverty thresholds are tied to the distribution of resources. For example, 50% or 60% of a country’s median income distribution can be considered relative poverty. Absolute thresholds are common in developing countries, and represent “absolute levels of living—how many people cannot attain certain pre-determined consumption needs” (Ravallion 2010, p. 27).

Related to a threshold is the issue of household member equivalence. Equivalence scales weigh the economic needs of individuals in a family differentially to account for economies of scale as families grow larger. In other words, equivalence scales adjust the poverty threshold to account for the real needs of households. A common equivalence scale is the square root scale, which divides household income by the square root of the household size.

1.3.3 Indices

The question of how to aggregate individuals to an index of poverty has different answers, largely based on different theoretical perspectives (Corak 2005). The most common index of poverty is the headcount ratio, or the proportion of a given population that falls below a given threshold in relation to those who do not fall below the threshold. The headcount ratio treats individuals with one unit less than the threshold the same as individuals with no resources at all. Despite its well-known limitations (Brady 2003), the strength of the headcount ratio lies in its simplicity and wide application to social policy. In this paper, we use both income and assets as economic resources, combined with relative thresholds and an equivalence scale to define our headcount ratio measurement of poverty.

In this study, we ask two broad questions: First, what is the distribution of child-level asset poverty, and how does it compare to child income poverty? Second, what are the demographic and social forces that shape the distribution of wealth poverty? We hypothesize that child-level asset poverty rates are higher than income poverty and that households with children have higher rates of poverty than households without children. We further hypothesize that certain socio-demographic household head characteristics (female, aged 18–29, and those with low education) are associated with higher rates of child-level asset poverty.

2 Method

2.1 Data and Sample

We examined cross-sections of household- and individual-level microdata from the most recent 2012 Survey of Financial Security (SFS) collected by Statistics Canada and compared it to data from 1999. The SFS samples households drawn mostly from the Labour Force Survey (LFS) sampling frame (Statistics Canada 2001). The LFS sampling frame targets an estimated 98% of the Canadian population (Statistics Canada 2005a). To ensure both feasibility and representativeness, the LFS sampling frame is stratified and clustered by geographical area. In the SFS, high-income households were oversampled to ensure representativeness of the survey as high-income families tend to own a “disproportionate share of net worth” and have higher non-response rates (Pensions and Wealth Surveys Section, Statistics Canada 2005, p. 15). In the 1999 SFS, approximately 23,000 dwellings were sampled, and the overall response rate was 75.7%; in 2012 the corresponding figures were 20,000 and 68.6% (Pensions and Wealth Surveys Section, Statistics Canada 1999, 2015). The sampling structure of the SFS requires the use of sample weights to achieve nationally representative results. We used sample weights in all analyses.

Data were collected for the SFS during a personal interview with one household member aged 15 or older who responded on behalf of all household members. Follow-up interviews were conducted with additional household members when necessary. The SFS has the greatest accuracy and depth of any dataset regarding the assets and liabilities of Canadians. Asset and debt information was collected at the household level, and the reported value is the respondent’s assessment at the time of the interview (Statistics Canada 2005a). Asset variables available in the SFS include: savings deposited in a bank, mutual funds, stocks, bonds, tax-preferred savings (such as a Registered Retirement Savings Plan or Registered Home Ownership Savings Plan), real estate holdings, vehicles, other durables, and business equity, among others. Debt information was also collected at the household level and included liabilities related to mortgages, credit lines, credit cards, student loans, and vehicle loans. Demographic information was collected at the person level for each individual in the household.

For both the 1999 and 2012 SFS, we linked the household (or economic family) data files to the individual (or person) data files. The major income earner identified by the survey respondent was chosen as the reference person for each economic family. Our analyses were further limited to households with a head under the age of 65 and over the age of 18 (excludes retirement-aged individuals and very young household heads). This restriction reduced the analytic sample by approximately 20% in both of our analytic samples from the 1999 SFS and the 2012 SFS. We present descriptive demographic statistics on the analytic sample for both years in Table 4 in the Appendix.

2.2 Measurement

In this study, three economic resources (income, financial assets, and net worth) were measured at the household level. Following standard procedures, we analyzed demographic correlates by focusing on the characteristics of the major income earner in each household.

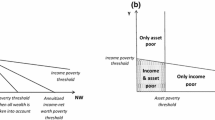

2.2.1 Poverty

We began by testing three different thresholds of poverty (40, 50 and 60%) of the median after-tax income in the weighted sample distribution for the respective year. This yielded a fully relative poverty threshold. This study follows and expands on the method of asset poverty measurement advanced by Haveman and Wolff (2004) and implemented in Canada by Rothwell and Robson (in press). Specifically, we defined an asset poverty threshold as a fraction of the relative income poverty threshold. The fraction represents the minimum level of assets a family would need to survive for various amounts of time, at various subsistence levels, if they had no income. Where a family’s assets are greater than the poverty threshold, they are defined as non-poor, and vice versa. Our method deviates from previous research in that we explicitly focused on the rate of child poverty and the independent influence of children in the household on the probability of poverty.

Three binary variables were created based on three types of family-level economic resource indicators: income, liquid assets, and net worth. The income indicator was based on equivalized after-tax disposable household income. Both asset indicators are tangible assets. Theoretically, liquid assets can be easily monetized and represent a family’s “emergency fund” that would enable them to “get by” for a period of time (Haveman and Wolff 2004, p. 151). Net worth (with or without pension income included) represents “wealth as a store of value that can be liquidated in a short period of time” and thus represents a source of potential consumption and stability (Haveman and Wolff 2004, p. 151). The liquid asset poverty indicator variable comprised the total amount of non-pension financial assets at the household level divided by the poverty threshold. The second indicator of assets is net worth, which was calculated two ways. First, we summed the total non-pension financial assets and durable assets (i.e., the subtotal of deposits, non-retirement; the subtotal of bonds, non-retirement; the subtotal of stocks, non-retirement; the subtotal of accumulation of mutual funds and investment funds, non-retirement; the value of the principal residence; and the subtotal of all real estate other than the principal residence). Then we subtracted total debts (i.e., the amount owed on the principal residence mortgage, other mortgage debts, line of credit debt, vehicle loan debt, the subtotal of credit card debt, student loan debt, and other debts not already reported).Footnote 4 Following established practice in asset poverty measurement, we focused on non-pension financial assets as our primary measure of net worth. Pension subtotals are typically excluded from measures of asset poverty due to the restrictions placed on their liquidation.

2.2.2 Covariates

We defined and analyzed seven discrete covariates. (1) Age may influence asset accumulation in a non-linear fashion (Killewald et al. 2017; Modigliani 1966). Age was limited to four categories in our analyses, roughly corresponding to quartiles: 18–29, 30–39, 40–49, and 50–64. (2) Gender of the major income earner can influence lifetime income and asset accumulation (Deere and Doss 2006; Ruel and Hauser 2013) and was coded dichotomously. (3) Marital status may influence or be influenced by the pooling of wealth in the household and wealth accumulation (Schneider 2011; Vespa and Ii 2011). It was coded as a nominal variable with four categories: married, cohabitating/common law married, widowed/separated/divorced, and single/never married. (4) Education may also influence or be influenced by wealth levels in the household (Emmons and Noeth 2015; Pfeffer 2016). Education was coded as an ordered variable with four categories indicating the survey respondent’s educational level: less than high school, high school diploma, post-secondary certification or some college, and a university degree or greater. Those with degrees greater than a bachelor’s were collapsed into the final category, as they were a smaller subsample (e.g., less than 7% of the total sample in 2012). (5) Immigration history is likely to impact asset accumulation and savings behaviour, and foreign-born individuals have been found to have lower asset levels than the native-born in many countries (Bauer et al. 2011; Cobb-Clark and Hildebrand 2006). We coded an individual as an immigrant if they had any landed or non-landed immigration history from another country to Canada in their lifetime. The variables listed above are included in previous studies of asset poverty (e.g., Aratani and Chau 2010; Azpitarte 2012; Haveman and Wolff 2004; Kim and Kim 2013). We then included two more variables. (6) Because there are significant documented differences with respect to poverty prevalence and wealth inequality by province/region in Canada (Chawla 2004; Plante and van den Berg 2011), region was coded as a categorical variable representing: British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Quebec, and the Atlantic provinces. (7) Location of residence with respect to community size may matter to asset accumulation, particularly if the household is rural (Fisher and Weber 2004). Therefore, we included rural residence location as a dichotomous covariate.

2.3 Data Analysis

To properly estimate the predictors of asset poverty for families, the population of interest was limited to those families with a major income earner under 65 years of age, as very few household heads over the age of 65 had children under the age of 18. In 2012, this restriction reduced the unweighted sample size by approximately 19% percent. Following standard procedure for estimating child poverty, child-level descriptive analyses were weighted using the household survey weight multiplied by the number of children in the household (Luxembourg Income Study 2012). We could not examine the effect of children in a household on the rates of or probability of poverty using the child weight, as this weighs households without children as zero. Therefore, we used the regular household weight in analyses that compared households with and without children.

We first described child poverty across time, using different poverty thresholds. We estimated child income poverty using 40, 50 and 60% of median income as a threshold for 1999 and 2012. We compared those rates to financial asset and net worth poverty rates estimated using 40, 50 and 60% of median income for 1, 3 and 6 months in 1999 and 2012. We then examined how rates of child poverty differed from population rates and examined within-group composition of poor children by socio-demographic characteristics. To study the association between variables, we conducted bivariate Wald tests and present second-order Rao-Scott corrected F statistics. The significance level was lowered using the Bonferroni method to reduce the probability of a type I error (i.e., falsely identifying statistical significance). Association p values of <5 × 10−3 were considered statistically significant. We focused on the descriptive patterns of difference that we observed in multiple comparisons between poor and non-poor children or households.

In our multivariate analyses, we estimated a series of multiple logistic regression models and their associated average marginal effects for three dependent variables: income poverty (50% of median), financial asset poverty (50% of median income for 3 months), and net worth poverty (50% of median income for 3 months). The general form model equation is given by:

where P is the probability of poverty, α is the intercept of poverty, βs are slope predictors, and Xs are the covariates (children, age categorical, gender, marital status, education categorical, immigration history, province region, and rural/urban residence). We introduced the covariates into the model in blocks to examine how covariates impacted the probability of poverty and how that probability changed when correlates were controlled for. Because logistic regression log-odds or log-odds are difficult to interpret (King et al. 2000) and because they cannot be compared across models due to unobserved heterogeneity (Mood 2010), we present the average marginal effects in our logistic regression models, given for an individual covariate by the equation:

where βx1 is the estimated log-odds ratio for covariate x1, and f(βxi) is the probability density function of the logistic distribution with regard to the log-odds ratio for a given covariate x1. The average marginal effect estimates we present are the average effect of a given covariate (at its observed values) on the probability of poverty (i.e., the mean of all individual derivatives, see Mood 2010). Multivariate results were confirmed through sensitivity testing using alternative covariate specifications, and logistic regression model coefficient estimates (as well as their corresponding average marginal effects presented in this paper) were found to be robust. All analyses were conducted using Stata 14’s survey commands, which account for complex sampling (StataCorp 2015).

3 Results

Table 1 presents child poverty rates based on income and assets in Canada for 1999 and 2012 using six different thresholds. For asset poverty, we calculated rates across the distributional thresholds (40, 50 and 60% of the median) and imposed three different time periods (1, 3 and 6 months). We found that the child-level rates of asset poverty are two to three times as large as rates of income poverty. Approximately 15% (15.4%) of Canadian children lived in households with less than half the median annual income, while approximately half of all Canadian children (51.4%) lived in households with financial assets less than half of the median income for 3 months. Using demographic estimates of children age 0–18 in 2012 (Statistics Canada 2017), this means that approximately 1.1 million children were income poor (50% of median), compared to 3.8 million children living in financial asset poor conditions (50% of median for 3 months). We found that the poverty threshold substantially impacts the proportion of children identified as poor. There was greater variation in the proportion of children identified as asset poor using three different thresholds for financial asset poverty compared to net worth poverty. In 2012, financial asset poverty rates ranged from a low of 32.5% (40% of median for 1 month) to a high of 68.2% (60% of median for 6 months). Correspondingly, net worth poverty rates ranged from a low of 26.2% (40% of median for 1 month) to a high of 33.0% (60% of median for 6 months).

Table 1 shows a 13-years trend of declines across all measures of poverty. For example, in 1999, 26.2% of Canadian children were estimated to live in low-income households at the 60% threshold, while the corresponding percentage in 2012 was 23.4%. For financial asset poverty, the proportion of children living in households unable to survive at a minimal subsistence level (50% of the median income) for 1 month was 42.6% in 1999 and 35.0% in 2012. Similar declines in asset poverty were evident between 1999 and 2012, using various thresholds (40, 50 and 60% of the median income for 1-, 3-, and 6-months periods of time). Across poverty indicators, it appears that the extent of children experiencing poverty has decreased.

To assess whether or not households with children were at greater or lower risk of poverty than the average household, we examined the proportion of poor households with children and compared those rates to the Canadian population. Figure 1 (estimates also available in Table 5 in the Appendix) shows that families with children had higher rates of financial asset and net worth poverty (50% of median income for three-months threshold), compared to the average Canadian household. However, families with children did not have correspondingly higher rates of income poverty.

We examined child poverty rates by socio-demographic characteristics of the household head, which yielded a more complex story. Table 2 shows that children living in households with young (aged 18–29) household heads had significantly higher financial asset and income rates of child poverty in 1999 and 2012, compared to children with older parents. However, the rates of net worth poverty for these younger-headed households were not significantly greater in 2012 compared to 1999. Poverty rates for all children were lowest when headed by an older adult (aged 50–64) or a male. Family structure appeared to matter, as child income poverty was relatively low for married families (10.9% in 2012) compared to never married families (47.2% in 2012). Though higher in never married families compared to other family types, the rates of income and asset poverty declined in never married households over the 13-years period. Even for married families, the prevalence of financial asset poverty was high; we found that 44.4% of children living in married households did not have enough liquid assets to survive at half the median income for a three-months period. Both net worth and financial asset child poverty rates monotonically decreased with the increasing educational attainments of household heads.

Figure 2 compares the rates of child poverty for a set of socio-demographic characteristics associated with poverty disadvantage in 1999 and 2012. The first row of graphics display rates of child poverty for households headed by an individual aged 18–29 and for those with less than a high school education. The second row shows rates of child poverty for households headed by women and never married individuals. These disadvantaged groups had rates of financial asset, income, and net worth poverty that were comparatively high in 1999. Though child poverty rates largely decreased for these four disadvantaged groups by 2012, financial asset child poverty rates rose for households headed by an individual aged 18–29 (from 78.2 to 81.4%) and for those with less than a high school education (from 79.4 to 83.5%); net worth child poverty rates also rose for those with less than a high school education (from 48.8 to 60.1%).

To test if households with children differed in the probability of poverty compared to those without children, we conducted multiple logistic regression analyses. We present average marginal effects estimates resulting from our nine multiple logistic regression models for 2012Footnote 5 (see Table 3). Covariates from Table 2 were entered into the regression in two blocks: the first block included our covariate of interest, children in the household, and the second block contained the rest of the variables from Table 2. Block three included all the variables in block two, as well three additional control variables: immigration history, province/region, and rural/urban residence (estimates not shown but available upon request). The presence of children in the household was associated with a lower probability of both income and asset poverty (9% for income, 1% for financial asset, and 9% for net worth) without controlling for socio-demographic variables. Multivariate analyses revealed that the presence of children in the household increased the probability of income, financial asset, and net worth poverty. The probabilities of income poverty and of net worth poverty increased by 3 and 2% respectively if a child was present in the household (Models 2, 3, 8, and 9), though this change in probability was not significantly different from zero. In comparison, the probability of financial asset poverty significantly increased by 6% for families with children compared to families without children (Models 5 and 6).

For all types of poverty, having a very young (18–29) household head significantly increased the probability of being poor; household heads aged 18–29 had a 19% higher probability of poverty than household heads aged 50–64, after controlling for block two and three variables. In fact, the probabilities of financial asset poverty were significantly higher for all age groups compared to householders aged 50–64, but the probability of poverty decreased with increasing age. (Household heads aged 30–39 had a 16% higher probability and household heads aged 40–49 had a 6% higher probability of financial asset poverty compared to household heads aged 50–64.) Patterns in the probability of poverty by age category were substantively similar for net worth poverty, whereas the probability of income poverty was significantly higher only for those in the youngest age group. Probabilities of poverty were also significantly higher for non-married household heads, compared to married couples, across poverty type. There was a steeper educational gradient associated with asset poverty than income poverty, with those who had lower educational levels having significantly higher probabilities of asset poverty, compared to those who had at least a Bachelor’s degree. Among household heads without a high school diploma, the risk of poverty was significantly higher than those that had a bachelor’s degree (BA) or more (22, 40 and 33% for income, financial asset, and net worth poverty, respectively). Overall, our findings suggest that the significantly lower poverty risks for households with children (Models 1, 3, 6) were driven largely by omitted socio-demographic variables, rather than by the presence of children alone.

4 Discussion

Our findings add precision to earlier studies on resource theory and depth to the recent literature on financial insecurity plaguing families in developed economies. We find that, despite large reductions in poverty over the period from 1999 to 2012, over half of Canadian children are financially insecure and live in households that lack the assets to sustain a basic level of consumption for a short period. The base probability of asset poverty is higher for households with children, in both 1999 and 2012, compared to the average Canadian household. Given recent cutbacks in employment insurance, the lingering impacts of the 2008–2009 recession, and threats to the profitability of the oil and gas sector of the economy, the low levels of asset holding in Canada are concerning. Although we find the rates of child net worth poverty (29.2% in 2012) lower than the corresponding figures for financial asset poverty (51.4% in 2012) in Canada, we suspect that this may be due to the higher levels of homeownership in families with children have compared to those without children. In 2012, this difference in homeownership was around 15%. The higher rate of child-level financial asset poverty translated into a significantly higher probability of financial asset poverty for families with children after socio-demographic variables were controlled for in our multivariate models. Although it is plausible that parents are choosing to invest their income in their children’s current well-being over longer-term concerns, it is also plausible that families are, in general, consuming more than they are saving.

Families who experience severe income shocks are likely to draw on assets to maintain household stability (Elliott et al. 2013). Low-income households that have even small amounts of emergency savings have been found to be less likely to experience material hardships (Gjertson 2014). Without easily accessible financial assets to draw upon, the 51.4% of children in Canada that are financial asset poor might be living with parents who are at risk of having to leverage tangible assets (such as a home), take on debts using alternative financial services, or rely on help from friends and social assistance in the case of an emergency. Living close to the margins raises the possibility of financial catastrophe for these families, which may escalate to the loss of a home, causing significant loss of overall family and household stability (Sandstrom and Huerta 2013). Even the smaller tradeoffs families may have to make (e.g., paying one bill over another) by living without an economic cushion could be damaging. Material hardship has been shown to be a key component of the mechanism by which income poverty results in negative child outcomes (Gershoff et al. 2007). Additionally, the high rates of financial asset poverty we observe may represent risks to household stability that are more than just liquidity. Nearly 25 years ago, Sherraden (1991) theorized that asset holding had distinct psychological effects, including future orientation. Since then, a growing body of literature has found that

the individual attitudes and long-term perspective that allow parents to accumulate and maintain wealth are also the attitudes and perspective that allow them to plan for their children’s futures and provide opportunities that make them more likely to achieve success as they enter adulthood. (Shanks 2007, p. 98)

Our results underscore the uniqueness of wealth as an indicator of well-being. We find that increased age is associated with lower probabilities of child-level asset poverty but not income poverty, that the education gradient is steeper for child-level asset poverty than child income poverty, and that gender is more strongly associated with income poverty, compared to asset poverty. First, unlike income, wealth tends to be markedly cumulative over the life course. The strong connection between advancing age and increasing assets corresponds to the age correlations we calculated. More work should examine the effects of asset poverty at different ages, as it is possible that the effects of being asset poor at age 60 are different than being income poor at the same age. Second, we find a steeper education gradient for child-level asset poverty compared to income poverty. The educational gradient of asset poverty may be related to intergenerational wealth inequality. Higher levels of parental education can lead to wealth accumulation that can then be used to invest in education for children. Wealth’s connection to educational attainment may be both a cause and a mechanism of the intergenerational transmission of advantage (Pfeffer 2016). Finally, our results suggest that gender does not matter as much in terms of probability of asset poverty compared to income. Poverty scholars have long observed a significantly higher probability of low income for women, dubbed the “feminization of poverty” (Bianchi 1999). Though our results with respect to gender and asset poverty differ from this prior work, they correspond to findings in the United States that show a strong connection between marital arrangements and asset levels (Schneider 2011; Zagorsky 2005). Supporting our original hypothesis, our work shows distinct differences in the demographic factors associated with child asset and child income poverty.

4.1 Measurement Implications

As our results testing different thresholds and time periods indicate, different poverty measures result in substantially different conclusions about the welfare of Canadian children. We find that measures based on income yield lower rates of poverty compared to measures based on assets. Replicating findings in other countries (e.g., Aratani and Chau 2010; Azpitarte 2012; Caner and Wolff 2004; Haveman and Wolff 2004; Kim and Kim 2013), we find that Canadian asset poverty measures yield poverty rates two to three times greater than income measures. Unlike the risk of income poverty, families with children are at greater risk of being financial asset poor than those without children. While the socio-economic factors associated with asset and income poverty for families with children were found in this study to be largely similar, that magnitude and significance of these associations were not. Differences in association of socio-demographic factors with the risk of poverty underscore the need for multiple measures of economic deprivation and well-being.

Unidimensional measures of income poverty operationalize deprivation as a failure to meet basic consumption needs. However, deprivation as a measurement construct is related not only to subsistence, but also to vulnerabilities, opportunities, possibilities, and capabilities. The prevailing poverty measurement focus on income may unintentionally minimize the economic hardships and insecurities that many families face. It may also oversimplify the story of poverty. Worldwide, a growing movement has begun to broaden poverty measurement by also examining social exclusion and multidimensional poverty. In Canada, there is a stated focus on combatting social exclusion in many provincial anti-poverty policies, though these policies measure their impact through income. Researchers in Quebec have developed a multidimensional deprivation index (Pampalon et al. 2009; Pampalon and Raymond 2000); however, to our knowledge there is no provincial focus on measuring assets as dimensions of deprivation or social exclusion. Not only is measurement of wealth, in addition to income, a facile way to gauge the long-term economic health of a household, but there is also a clear theoretical justification for an association between social exclusion and assets. More work should be done to add asset and debt measures to household surveys to allow child research to better investigate economic well-being.

Future work on this topic would benefit from analyzing changes in the distribution of income and wealth in households with children over time, compositional changes in the child population over time, and the impact of child age on poverty risk. In this work, we have examined asset poverty from a relative perspective and index poverty based on headcount ratio. Poverty researchers have long levied serious critiques against the simplicity of the headcount ratio (Brady 2003). The measures we use in this study do not explore inequality among the poor, depth of poverty, or the average poverty gap. Future work should expand upon these poverty measurement approaches. The Haveman-Wolff method to estimate asset poverty, as used in this study, is unable to shed light on truly relative asset poverty, the depth of asset poverty, or dimensions of asset inequality. Given that wealth has a highly skewed distribution and that wealth inequality is greater than income inequality (Chawla 2008; Oliver and Shapiro 1990), future asset poverty measurement should also aim to capture dimensions of relative poverty such as depth, length, and recurrence. Comparative research across countries will help identify the compositional and institutional drivers of asset poverty rates, and the recent release of comparable cross-national data from the Luxembourg Wealth Study will allow researchers to pursue this goal (Jäntti et al. 2008; LIS Cross-National Data Center in Luxembourg n.d.). Future work must also continue to consider the impact of multiple measures of childhood disadvantage on outcomes both in childhood and across the life course. Few studies (outside of those that use the PSID) have examined the impact of asset poverty on child outcomes, and more work must be done to examine the relationship between wealth and child outcomes in diverse contexts.

4.2 Limitations

The estimates presented in this paper are descriptive and correlational only, and have three primary limitations. First, lack of information on the race/ethnicity of respondents within the SFS is a real limitation of the data. We are unable to measure trends in or factors associated with income and wealth by race/ethnicity. Second, income and wealth in the SFS are self-reported by survey respondents, introducing potential measurement error. Income and wealth measurement error caused by self-report is a well-known data limitation in social science. One way to reduce this error is to average an individual’s wealth and income over two time points (Bound and Krueger 1991; Killewald et al. 2017; Pfeffer and Killewald 2015). However, because the SFS is cross-sectional, we are limited to single time point estimates of assets and income. Third, some populations with high risks of asset poverty are not represented in our results. The SFS did not sample those who live on-reserve, those living in institutions, or those without a home.

5 Conclusion

This study presents the first known description of an asset poverty measure for children. We find that a large proportion of children are affected by asset poverty. The introduction of the asset poverty measure for children is a valuable supplement to indicators of economic well-being that focus income alone. Because child well-being in the present and children’s development over time are influenced by a myriad of social, familial, and environmental factors, measurement of only one economic resource likely does not capture the causal mechanisms between poverty and child outcomes. Thus, low asset measures may be particularly important in terms of both measuring and intervening in childhood economic disadvantage.

Notes

In this paper, we use the terms “low income” and “poverty” interchangeably.

Most countries do not have official poverty measures that are estimated by the state (Citro & Michael, 1995).

As a sensitivity test, we also calculated a net worth variable using the same financial resources plus pensions valued at an ongoing concern basis minus all debts. Results did not vary meaningfully compared to the net worth minus pensions variable.

Results from 1999 were not substantively different compared to 2012. Logistic regression model odds-ratios are presented in the Appendix in Table 6.

References

Albanese, P. (2010). Child poverty in Canada. Don Mills: Oxford University Press.

Alexander, K. L., Entwisle, D. R., & Olson, L. S. (2014). The long shadow: Family background, disadvantaged urban youth, and the transition to adulthood. New York: Russell Sage Foundation https://muse.jhu.edu/book/30869. Accessed 19 Sept 2017.

Aratani, Y., & Chau, M. (2010). Asset poverty and debt among families with children (brief). New York: National Center for Children in Poverty.

Azpitarte, F. (2012). Measuring poverty using both income and wealth: A cross-country comparison between the U.S. and Spain. Review of Income and Wealth, 58(1), 24–50. https://doi.org/10.1111/j.1475-4991.2011.00481.x.

Bauer, T. K., Cobb-Clark, D. A., Hildebrand, V. A., & Sinning, M. G. (2011). A comparative analysis of the nativity wealth gap. Economic Inquiry, 49(4), 989–1007. https://doi.org/10.1111/j.1465-7295.2009.00221.x.

Berger, L. M., & Waldfogel, J. (2011). Economic determinants and consequences of child maltreatment (no. 111). Paris: OECD. https://doi.org/10.1787/5kgf09zj7h9t-en.

Bianchi, S. M. (1999). Feminization and juvenilization of poverty: Trends, relative risks, causes, and consequences. Annual Review of Sociology, 25(1), 307–333. https://doi.org/10.1146/annurev.soc.25.1.307.

Blank, R. M. (2008). Presidential address: How to improve poverty measurement in the United States. Journal of Policy Analysis and Management, 27(2), 233–254. https://doi.org/10.1002/pam.20323.

Bound, J., & Krueger, A. B. (1991). The extent of measurement error in longitudinal earnings data: Do two wrongs make a right? Journal of Labor Economics, 9(1), 1–24. https://doi.org/10.1086/298256.

Brady, D. (2003). Rethinking the sociological measurement of poverty. Social Forces, 81(3), 715–751. https://doi.org/10.1353/sof.2003.0025.

Burton, P., & Phipps, S. (2017). Economic well-being of Canadian children. Canadian Public Policy. https://doi.org/10.3138/cpp.2017-039.

Burton, P., Phipps, S., & Zhang, L. (2012). From parent to child: Emerging inequality in outcomes for children in Canada and the US. Child Indicators Research, 6(2), 363–400. https://doi.org/10.1007/s12187-012-9175-1.

Burton, P., Phipps, S., & Zhang, L. (2014). The prince and the pauper: Movement of children up and down the Canadian income distribution. Canadian Public Policy, 40(2), 111–125. https://doi.org/10.3138/cpp.2012-034.

Caner, A., & Wolff, E. N. (2004). Asset poverty in the United States, 1984–99: Evidence from the panel study of income dynamics. Review of Income and Wealth, 50(4), 493–518. https://doi.org/10.1111/j.0034-6586.2004.00137.x.

Chawla, R. K. (2004). Wealth inequality by province. Perspectives on Labour and Income, 5(9). http://www.statcan.gc.ca/studies-etudes/75-001/archive/2004/5018661-eng.pdf.

Chawla, R. K. (2008). Changes in family wealth. Perspectives on Labour and Income, 15–24. Retrieved from http://www.statcan.gc.ca/pub/75-001-x/2008106/article/10640-eng.htm.

Chen, W.-H., & Corak, M. (2008). Child poverty and changes in child poverty. Demography, 45(3), 537–553. https://doi.org/10.1353/dem.0.0024.

Cobb-Clark, D. A., & Hildebrand, V. A. (2006). The wealth and asset holdings of U.S.-born and foreign-born households: Evidence from SIPP data. Review of Income and Wealth, 52(1), 17–42. https://doi.org/10.1111/j.1475-4991.2006.00174.x.

Corak, M. (2005). Principles and practicalities for measuring child poverty in the rich countries (discussion paper series no. 1579). Bonn: The Institute for the Study of labor.

Crossley, T. F., & Curtis, L. J. (2006). Child poverty in Canada. Review of Income and Wealth, 52(2), 237–260. https://doi.org/10.1111/j.1475-4991.2006.00186.x.

Cunha, F., & Heckman, J. J. (2009). The economics and psychology of inequality and human development. Journal of the European Economic Association, 7(2–3), 320–364. https://doi.org/10.1162/JEEA.2009.7.2-3.320.

Currie, J., & Stabile, M. (2003). Socioeconomic status and child health: Why is the relationship stronger for older children? American Economic Review, 93(5), 1813–1833.

Deere, C. D., & Doss, C. R. (2006). The gender asset gap: What do we know and why does it matter? Feminist Economics, 12, 1–2), 1–50. https://doi.org/10.1080/13545700500508056.

Destin, M., & Oyserman, D. (2009). From assets to school outcomes: How finances shape children’s perceived possibilities and intentions. Psychological Science, 20(4), 414–418. https://doi.org/10.1111/j.1467-9280.2009.02309.x.

Diener, E., & Fujita, F. (1995). Resources, personal strivings, and subjective well-being: A nomothetic and idiographic approach. Journal of Personality and Social Psychology, 68(5), 926–935. https://doi.org/10.1037/0022-3514.68.5.926.

Duncan, G. J., & Brooks-Gunn, J. (1997). Consequences of growing up poor. New York: Russell Sage Foundation.

Duncan, G. J., Ziol-Guest, K. M., & Kalil, A. (2010). Early-childhood poverty and adult attainment, behavior, and health. Child Development, 81(1), 306–325. https://doi.org/10.1111/j.1467-8624.2009.01396.x.

Elliott, W. (2013). The effects of economic instability on children’s educational outcomes. Children and Youth Services Review, 35(3), 461–471. https://doi.org/10.1016/j.childyouth.2012.12.017.

Elliott, W., & Friedline, T. (2013). “You pay your share, we’ll pay our share”: The college cost burden and the role of race, income, and college assets. Economics of Education Review, 33, 134–153. https://doi.org/10.1016/j.econedurev.2012.10.001.

Elliott, W., & Sherraden, M. (2013). Assets and educational achievement: Theory and evidence. Economics of Education Review, 33, 1–7. https://doi.org/10.1016/j.econedurev.2013.01.004.

Elliott, W., Friedline, T., & Nam, I. (2013). Probability of living through a period of economic instability. Children and Youth Services Review, 35(3), 453–460. https://doi.org/10.1016/j.childyouth.2012.12.014.

Emmons, W. R., & Noeth, B. J. (2015). Education and wealth (no. 2). Federal Reserve Bank of St. Louis.

Felligi, I. P. (1997). On poverty and low income. Statistics Canada. http://www.statcan.gc.ca/pub/13f0027x/13f0027x1999001-eng.htm?contentType=application%2Fpdf.

Fisher, M., & Weber, B. A. (2004). Does economic vulnerability depend on place of residence? Asset poverty across metropolitan and nonmetropolitan areas. The Review of Regional Studies, 34(2), 137–155.

Foster, J., Greer, J., & Thorbecke, E. (2010). The Foster–Greer–Thorbecke (FGT) poverty measures: 25 years later. The Journal of Economic Inequality, 8(4), 491–524. https://doi.org/10.1007/s10888-010-9136-1.

Gershoff, E. T., Aber, J. L., Raver, C. C., & Lennon, M. C. (2007). Income is not enough: Incorporating material hardship into models of income associations with parenting and child development. Child Development, 78(1), 70–95. https://doi.org/10.1111/j.1467-8624.2007.00986.x.

Gjertson, L. (2014). Emergency saving and household hardship. Journal of Family and Economic Issues, 37, 1–17. https://doi.org/10.1007/s10834-014-9434-z.

Grinstein-Weiss, M., Shanks, T. R. W., Manturuk, K. R., Key, C. C., Paik, J.-G., & Greeson, J. K. P. (2010). Homeownership and parenting practices: Evidence from the community advantage panel. Children and Youth Services Review, 32(5), 774–782. https://doi.org/10.1016/j.childyouth.2010.01.016.

Grinstein-Weiss, M., Shanks, T. R. W., & Beverly, S. G. (2014). Family assets and child outcomes: Evidence and directions. Future of Children, 24(1), 147–170.

Haurin, D. R., Parcel, T. L., & Haurin, R. J. (2002). Does homeownership affect child outcomes? Real Estate Economics, 30(4), 635–666. https://doi.org/10.1111/1540-6229.t01-2-00053.

Haveman, R., & Wolff, E. N. (2004). The concept and measurement of asset poverty: Levels, trends and composition for the U.S., 1983–2001. The Journal of Economic Inequality, 2(2), 145–169. https://doi.org/10.1007/s10888-005-4387-y.

Hertzman, C., & Boyce, T. (2010). How experience gets under the skin to create gradients in developmental health. Annual Review of Public Health, 31(1), 329–347. https://doi.org/10.1146/annurev.publhealth.012809.103538.

Hill, M. S., & Duncan, G. J. (1987). Parental family income and the socioeconomic attainment of children. Social Science Research, 16(1), 39–73. https://doi.org/10.1016/0049-089X(87)90018-4.

Huang, J. (2013). Intergenerational transmission of educational attainment: The role of household assets. Economics of Education Review, 33, 112–123. https://doi.org/10.1016/j.econedurev.2012.09.013.

Huang, J., Sherraden, M., Kim, Y., & Clancy, M. (2014). Effects of child development accounts on early social-emotional development: An experimental test. JAMA Pediatrics. https://doi.org/10.1001/jamapediatrics.2013.4643.

Jäntti, M., Sierminska, E., & Smeeding, T. M. (2008). How is household wealth distributed? Evidence from the Luxembourg wealth study. In: Growing unequal? Income distribution and poverty in OECD countries (pp. 253–78). Paris: OECD Publishers.

Jenson, J. (2004). Changing the paradigm: Family responsibility or investing in children. The Canadian Journal of Sociology, 29(2), 169–192. https://doi.org/10.1353/cjs.2004.0025.

Keister, L. A., & Moller, S. (2000). Wealth inequality in the United States. Annual Review of Sociology, 26(1), 63–81. https://doi.org/10.1146/annurev.soc.26.1.63.

Killewald, A., Pfeffer, F. T., & Schachner, J. N. (2017). Wealth inequality and accumulation. Annual Review of Sociology, 43(1), 379–404. https://doi.org/10.1146/annurev-soc-060116-053331.

Kim, K., & Kim, Y. M. (2013). Asset poverty in Korea: Levels and composition based on Wolff’s definition. International Journal of Social Welfare, 22(2), 175–185. https://doi.org/10.1111/j.1468-2397.2011.00869.x.

King, G., Tomz, M., & Wittenberg, J. (2000). Making the most of statistical analyses: Improving interpretation and presentation. American Journal of Political Science, 44, 341–355.

LIS Cross-National Data Center in Luxembourg. (n.d.). LWS list of datasets. http://www.lisdatacenter.org/our-data/lws-database/documentation/lws-list-of-datasets/.

Luxembourg Income Study. (2012). Self-Teaching Package. http://www.lisdatacenter.org/wp-content/uploads/2011/03/C3-3-6-3-self-teaching-stata.pdf.

Maggi, S., Irwin, L. J., Siddiqi, A., & Hertzman, C. (2010). The social determinants of early child development: An overview. Journal of Paediatrics and Child Health, 46(11), 627–635. https://doi.org/10.1111/j.1440-1754.2010.01817.x.

Magnuson, K. A., & Votruba-Drzal, E. (2009). Enduring influences of childhood poverty. In M. Cancian & S. H. Danziger (Eds.), Changing poverty, changing policies (pp. 153–179). New York: Russell Sage Foundation.

McEwen, A., & Stewart, J. M. (2014). The relationship between income and children’s outcomes: A synthesis of Canadian evidence. Canadian Public Policy, 40(1), 99–109.

Midgley, J. (1995). Social development: The developmentalist perspective in social welfare. Thousand Oaks: SAGE Publications Inc..

Modigliani, F. (1966). The life cycle hypothesis of saving, the demand for wealth and the supply of capital. Social Research, 160–217.

Mood, C. (2010). Logistic regression: Why we cannot do what we think we can do, and what we can do about it. European Sociological Review, 26(1), 67–82. https://doi.org/10.1093/esr/jcp006.

Nam, Y., Huang, J., & Sherraden, M. (2008). Asset definitions. In S.-M. McKernan & M. Sherraden (Eds.), Asset building and low-income families (pp. 1–32). Washington, DC: The Urban Institute Press.

Oliver, M. L., & Shapiro, T. M. (1990). Wealth of a nation. American Journal of Economics and Sociology, 49(2), 129–151. https://doi.org/10.1111/j.1536-7150.1990.tb02268.x.

Oyserman, D. (2013). Not just any path: Implications of identity-based motivation for disparities in school outcomes. Economics of Education Review, 33, 179–190. https://doi.org/10.1016/j.econedurev.2012.09.002.

Oyserman, D. (2015). Pathways to success through identity-based motivation. New York: Oxford University Press.

Pampalon, R., & Raymond, G. (2000). A deprivation index for health and welfare planning in Quebec. Chronic Diseases in Canada, 21(3), 104–113.

Pampalon, R., Hamel, D., Gamache, P., & Raymond, G. (2009). A deprivation index for health planning in Canada. Chronic Diseases in Canada, 29(4), 178–191.

Pascoe, J. M., Wood, D. L., Duffee, J. H., Kuo, A., Committee on Psychosocial Aspects of Child and Family Health, & Council on Community Pediatrics (2016). Mediators and adverse effects of child poverty in the United States. Pediatrics, 137(4), e20160340. https://doi.org/10.1542/peds.2016-0340.

Pensions and Wealth Surveys Section, Statistics Canada. (1999). 1999 Survey of Financial Security: public use microdata file user guide, (no. 13F0026MIE — No. 002) (p. 28). Ottawa: Statistics Canada http://www23.statcan.gc.ca/imdb-bmdi/document/2620_DLI_D3_T22_V2-eng.pdf.

Pensions and Wealth Surveys Section, Statistics Canada. (2005). 2005 Survey of Financial Security: Public use microdata file user guide, (no. 13F0026MIE — No. 001) (p. 31). Ottawa: Statistics Canada http://www23.statcan.gc.ca/imdb-bmdi/document/2620_DLI_D3_T22_V2-eng.pdf.

Pensions and Wealth Surveys Section, Statistics Canada. (2015). 2012 Survey of Financial Security: public use microdata file user guide (p. 29). Ottawa: Statistics Canada http://sda.chass.utoronto.ca/sdaweb/dli/sfs/sfs12/more_doc/SFS2012ENgid.pdf.

Pfeffer, F. T. (2016). Growing wealth gaps in education (pp. 16–869). Ann Arbor: Population studies center, University of Michigan http://www.psc.isr.umich.edu/pubs/pdf/rr16-869.pdf.

Pfeffer, F. T., & Killewald, A. (2015). How rigid is the wealth structure and why? Inter- and multi-generational associations in family wealth (pp. 15–845). Ann Arbor: Population studies center, University of Michigan http://www.psc.isr.umich.edu/pubs/pdf/rr15-845.pdf.

Piketty, T. (2014). Capital in the twenty-first century. (A. Goldhammer, Trans.). Cambridge: Belknap Press of Harvard University Press.

Plante, C., & van den Berg, A. (2011). How much poverty can’t the government be blames for? A counterfactual decomposition of poverty rates in Canada’s largest provinces. In: Statistiques sociales, pauvreté et exclusion sociale: hommage à Paul Bernard (pp. 163–175). Montreal: Les Presses de l’Université de Montréal.

Rainwater, L., & Smeeding, T. M. (2003). Poor kids in a rich country: America’s children in comparative perspective. Russell Sage Foundation.

Ravallion, M. (1996). Issues in measuring and modelling poverty. Economic Journal, 106(438), 1328–1343.

Ravallion, M. (2010). The debate on globalization, poverty, and inequality: Why measurement matters 1. In S. Anand, P. Segal, & J. E. Stiglitz (Eds.), Debates on the measurement of global poverty (pp. 25–41). Oxford: Oxford University Press http://www.oxfordscholarship.com/view/10.1093/acprof:oso/9780199558032.001.0001/acprof-9780199558032-chapter-2.

Ravallion, M., Chen, S., & Sangraula, P. (2009). Dollar a day revisited. The World Bank Economic Review, 23(2), 163–184. https://doi.org/10.1093/wber/lhp007.

Robson, J. (2013). Does Canada have a hidden “wealthfare” system? The policy history and household use of tax-preferred savings instruments in Canada. Ottawa: Carleton University.

Rothwell, D. W., & Han, C.-K. (2010). Exploring the relationship between assets and family stress among low-income families. Family Relations, 59(4), 396–407.

Rothwell, D. W., & Robson, J. (in press). The prevalence and composition of asset-poverty in Canada: 1999, 2005, and 2012. International Journal of Social Welfare. https://doi.org/10.1111/ijsw.12275/full.

Ruel, E., & Hauser, R. M. (2013). Explaining the gender wealth gap. Demography, 50(4), 1155–1176. https://doi.org/10.1007/s13524-012-0182-0.

Sandstrom, H., & Huerta, S. (2013). The negative effects of instability on child development: A research synthesis. Washington, DC: The Urban Institute http://www.urban.org/publications/412899.html.

Schneider, D. (2011). Wealth and the marital divide. American Journal of Sociology, 117(2), 627–667. https://doi.org/10.1086/661594.

Sen, A. (1976). Poverty: An ordinal approach to measurement. Econometrica, 44(2), 219–231. https://doi.org/10.2307/1912718.

Sen, A. (1983). Poor, relatively speaking. Oxford Economic Papers, 35(2), 153–169.

Sen, A. (1999). Development as freedom, first anchor books edition. New York: Knopf.

Shanks, T. R. W. (2007). The impacts of household wealth on child development. Journal of Poverty, 11(2), 93–116. https://doi.org/10.1300/J134v11n02_05.

Shaprio, T., & Oliver, M. (2006). Black wealth/white wealth: A new perspective on racial inequality, 10th Anniversary Edition. New York: Routledge.

Sherraden, M. (1991). Assets and the poor: A new American welfare policy. Armonk: M.E. Sharpe.

Spilerman, S. (2000). Wealth and stratification processes. Annual Review of Sociology, 26(1), 497–524. https://doi.org/10.1146/annurev.soc.26.1.497.

StataCorp. (2015). Stata statistical software: Release 14 (Version 14.1 SE). College Station: StataCorp LP.

Statistics Canada. (2001). Survey of Financial Security interview questionnaire, (no. 13F0026MIE-01001) (p. 86). Ottawa: Statistics Canada.

Statistics Canada. (2005). Guide to the Labour Force Survey, (no. 71–543–GIE) (p. 34). Ottawa: Statistics Canada http://www.statcan.gc.ca/pub/71-543-g/71-543-g2005001-eng.pdf.

Statistics Canada. (2013). Table 202–0802: Persons in low income families, annual. Ottawa: Statistics Canada http://www5.statcan.gc.ca/cansim/a05.

Statistics Canada. (2017). Table 109–5355 : Estimates of population (2011 Census and administrative data), by age group and sex for July 1st, Canada, provinces, territories, health regions (2015 boundaries) and peer groups, annual (number)(1,2,3,4). http://www5.statcan.gc.ca/cansim/a47.

Townsend, P. (1954). Measuring poverty. The British Journal of Sociology, 5(2), 130–137. https://doi.org/10.2307/587651.

UNICEF. (2012). Measuring child poverty (UNICEF Innocenti research Centre report card). Florence: UNICEF Innocenti Research Centre http://www.unicef-irc.org/publications/pdf/rc10_eng.pdf.

UNICEF Office of Research. (2014). Children of the recession: The impact of the economic crisis on child well-being in rich countries. Florence: UNICEF http://www.unicef-irc.org/publications/pdf/rc12-eng-web.pdf.

Vespa, J., & Ii, M. A. P. (2011). Cohabitation history, marriage, and wealth accumulation. Demography, 48(3), 983–1004. https://doi.org/10.1007/s13524-011-0043-2.

Zagorsky, J. L. (2005). Marriage and divorce’s impact on wealth. Journal of Sociology, 41(4), 406–424. https://doi.org/10.1177/1440783305058478.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Blumenthal, A., Rothwell, D.W. The Measurement and Description of Child Income and Asset Poverty in Canada. Child Ind Res 11, 1907–1933 (2018). https://doi.org/10.1007/s12187-017-9525-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12187-017-9525-0