Abstract

To assess and explain the United States’ gender wealth gap, we use the Wisconsin Longitudinal Study to examine wealth accumulated by a single cohort over 50 years by gender, by marital status, and limited to the respondents who are their family’s best financial reporters. We find large gender wealth gaps between currently married men and women, and between never-married men and women. The never-married accumulate less wealth than the currently married, and there is a marital disruption cost to wealth accumulation. The status-attainment model shows the most power in explaining gender wealth gaps between these groups explaining about one-third to one-half of the gap, followed by the human-capital explanation. In other words, a lifetime of lower earnings for women translates into greatly reduced wealth accumulation. After controlling for the full model, we find that a gender wealth gap remains between married men and women that we speculate may be related to gender differences in investment strategies and selection effects.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A burgeoning body of literature has found that women do not accumulate as much wealth as men, resulting in a gender wealth gap (Deere and Doss 2006; Denton and Boos 2007; Ozawa and Lee 2006; Warren et al. 2001; Yamokoski and Keister 2006). A limitation acknowledged by this body of research is that gender is confounded with marital status, making it difficult to assess and explain the size of the gender wealth gap. In other words, wealth is an attribute of families; assets accumulated by men or women in the same household tend to be conflated both in reality and by data-collection methods. For example, the Panel Study of Income Dynamics asks the household head about assets owned by the family. The head is defined as a man, even in cohabitating households; therefore, women usually report on assets only when they are single, confounding gender and marital status.

The Survey of Consumer Finances (SCF), the best data source on wealth, and the Health and Retirement Study (HRS) both ask the household member who is the best financial reporter (BFR) to report on the family’s assets. In married households, men were more likely to claim to be the BFR (Lindamood and Hanna 2005; Wilmoth and Koso 2002). Among older married households, husbands with more education and higher incomes than their wives were more likely to be the financially knowledgeable member and decision maker for 65 % of couples aged 51–61, suggesting an association between BFR status and being in charge of finances—not just a reporter (Elder and Rudolph 2003).

This raises the issues of selection effects and error. Is the gender of the BFR associated with the level of accumulated wealth: that is, are men more risk-tolerant in their investing? Or, if the respondent is not the BFR (non-BFR), there may be substantial reporting error in the asset values and liabilities reported. Our goal in this article is to assess the level of the interhousehold gender wealth gap and explain it substantively while attempting to eliminate or reduce the selection effects and reporting error confounds. We recognize that there may be inequalities in households as to who has access to the wealth (Deere and Doss 2006), but that is beyond the scope of this article.

The Wisconsin Longitudinal Study (WLS) can be used to overcome many of these limitations in that it asks a sample of men and women to report on their family’s asset values, regardless of marital status and BFR status. We ask what the size of the gender wealth gap is and what might explain it. The sample consists of a cohort of men and women who graduated high school in 1957. This provides us greater control in understanding wealth accumulation because there are no cohort or period effects to account for. We might expect a gender wealth gap between a cohort of men and women who all graduated from high school in the same year but who never married, given the gender earnings gap. We might also expect that married men and women would accumulate more wealth compared with never-married men and women. We would not expect to find, however, a gender wealth gap between a cohort of married men and women high school graduates.

This article contributes to the literature on social stratification by examining wealth from a population perspective. Wealth is an important measure of social stratification because it captures intergenerational inequality as well as a more nuanced understanding of the privileges and disadvantages individuals and groups experience in a stratified social system. This article will broaden our understanding of how one generation has accumulated wealth over nearly a 50-year span. More importantly, we address gender stratification, which has been a topic of import for several decades. Last, we contribute to an understanding of some of the methodological issues involved in estimating and measuring wealth among the general population.

Background

Wealth Accumulation

Wealth accumulation is a function of inheritances and transfers from family, earnings, savings, and investment strategy. Inheritances account for approximately half of wealth accumulation, and are the most direct route through which families transmit wealth between generations (Gale and Scholz 1994). The family of origin can also provide children with quality education, help with the purchase of a home, and minimize debt through inter vivos transfers.

This leaves earnings, savings, and investments over the life course to explain the remaining wealth accumulation. The traditional status-attainment model explains variation in households’ ability to save (Blau and Duncan 1967; Duncan et al. 1972; Sewell et al. 1970). Status attainment is affected by both achieved factors (such as educational and occupational attainment) and ascribed factors (such as family-of-origin income and resources). Those with higher levels of education earn larger incomes and, in turn, accumulate more wealth (Anderson 1999; Land 1996; Wolff 2000). Working individuals accumulate about two to three times the wealth of those not working (U.S. Census Bureau 2001). Those working in stable, full-time higher prestige occupations will consistently earn greater income, which improves their ability to save (Dietz et al. 2003; Wolff 2000).

Savings are also a function of investment knowledge and of risk aversion (Sierminska et al. 2010). Investing accumulated wealth in high-return assets will lead to even greater wealth accumulation. Education and school performance may well reflect the ability and skills needed to invest assets well (Bernheim and Garrett 2003; Ozawa and Lum 2001). Beyond education is the notion of risk aversion. High returns are associated with greater risk of loss of capital, making it important to have an understanding of investment. Those with higher risk aversion will invest in more secure but lower-return investments, leading to lower wealth accumulation, on average, over the life course (Watson and McNaughton 2007).

Gender Wealth Gap

Existing research has found gender differences in wealth accumulation despite the difficulty in distinguishing gender and marital status. Some have found that single-headed households accumulate less wealth than married households (Schmidt and Sevak 2006). Others find that single male-headed households and cohabitating households differ little from traditional married households in wealth accumulation (Ozawa and Lee 2006; Yamokoski and Keister 2006). Grinstein-Weiss et al. (2008), however, found that male-headed and female-headed households with at least one child accumulate 9 % and 15 % less wealth, respectively, than do married-parent households. A number of researchers have found that single women with children have the lowest overall asset levels (Grinstein-Weiss et al. 2008; Ozawa and Lee 2006; Warren et al. 2001; Yamokoski and Keister 2006). Finally, marital disruption penalizes wealth accumulation (Warren et al. 2001).

These studies clearly demonstrate the difficulty of distinguishing between gender, marital status, and family status. There is no tidy gender wealth gap story. Women-headed households, especially those with children, tend to accumulate less wealth than other types of households, in part because of their low incomes (Ozawa and Lee 2006). Yet, among the easiest group from which to ascertain the gender wealth gap, the never-married, there have been mixed findings. In one study, never-married women accumulated wealth equivalent to that of never-married men (Warren et al. 2001). However, in another study, never-married women accumulated less wealth (Yamokoski and Keister 2006).

Explaining the Gender Wealth Gap

Transfers and inheritances, as well as the timing and extent of family formation, may lead to a gender wealth gap. There are few gender differences in inheritances in the United States; and inter vivos transfers, while also fairly equally distributed, differ by socioeconomic status (SES) of the family. Low-SES families are more likely to transfer resources to their daughters, whereas higher-SES families are more likely to transfer resources to their sons (Cox 2003). Thus, although inheritances and transfers contribute to wealth accumulation, their contribution to the gender wealth gap should be explained by family-of-origin SES.

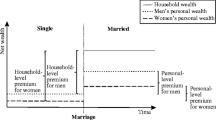

Marriage is the most important family-formation status for wealth accumulation. Married families accumulate more wealth than do single-headed households, and marital disruption penalizes wealth accumulation (Ozawa and Lee 2006; Schmidt and Sevak 2006). Same-aged men and women form families at different points in the life course and have children at different ages, with women tending to get married two years earlier, on average (Gibson et al. 2006). Women also tend to marry an older spouse and have their first child at a younger age, compared with men from the same cohort (Marini 1978; Rodgers and Thornton 1985). Marrying an older man may lead to increased wealth because the spouse will already be working and potentially saving (Grinstein-Weiss et al. 2008). Alternatively, older spouses may have less education than the graduates, which would have a negative effect on the female graduate’s wealth accumulation given that men are the breadwinners for this generation. Because the female graduates in this study were all aged 64–65 in 2004, husbands will be older than 65, on average. They may have retired some years ago, and the family may already be spending down their wealth, which would contribute to a gendered wealth gap between the female and male cohort members.

Status-attainment explanations focus on women’s lower labor force attachment and lower wages (Blau and Kahn 2007). The differential-exposure hypothesis suggests that the gendering of both work and family means that women are disadvantaged or have less exposure to the structural elements (i.e., stable employment, occupational prestige, and income) that are needed for wealth accumulation (Denton and Boos 2007; Hardy and Shuey 2000). Women are typically employed in occupations and industries that pay less, on average, than the occupations and core industries in which men are more likely to be employed, leading to a wage gap.

Thus, labor-market inequality leads to earnings inequality, which, in turn, leads to wealth inequality. Over a lifetime, then, as women earn lower wages compared with men, they will accumulate fewer assets of all kinds than men (Warren et al. 2001). For example, a recent German study found that the €50,000 gender wealth gap is primarily attributable to differences in labor force attachment and income (Sierminska et al. 2010). Additionally, Ginn and Arbor (1996) found that differences in wages and length and discontinuity of job tenure lead women to have lower pension wealth.

One problem with the status-attainment model is that it should not explain the gender wealth gap between married households of the same cohort that differ only on the gender of the reporter of asset and liability values, net of other explanations. One would not expect systematic differences by gender for married households, all of whom graduated from high school in 1957. Yet, differences have been found. Wilmoth and Koso (2002) analyzed marital history and wealth accumulation for men and women using the HRS. All couple households in which the female was the financial reporter related significantly less wealth. This suggests that there could be selection effects and reporter error confounding the gender wealth gap. That is, not all of the gender wealth gap may be true differences. There is likely to be greater error in the wealth reports and greater nonresponse on asset items if the study is speaking to the non-BFR. This clearly confounds real gender differences in wealth accumulation with differences in asset reports. This confound can be eliminated by controlling for whether the wealth reporter is the BFR or the non-BFR, or focusing solely on those who are the BFR.

Ascertaining selection effects is more difficult. The reasons why and when women are the BFR are not clear. Research suggests that men are in charge of finances when they have more education and income than their wives (Elder and Rudolph 2003), but this may also be a sign of greater family-of-origin wealth. Men may be in charge of finances when there is existing accumulated wealth to be invested, whereas women may be in charge when there is little to no wealth to be invested—that is, when being in charge of finances is more about handling bills and debts. To account for this selection effect, we will have to control for family-of-origin SES and inheritance although we recognize the limits of this approach.

What if, after controlling for methodological and substantive explanations, there remains a gender wealth gap? What might explain it? It may be that we have not fully accounted for selection effects because we do not have the spouses’ family of origin included. It may also be due to gender differences in investment strategy that we cannot test. Research has found that women tend to be more risk averse, and those who are risk averse tend to choose investments that are less rewarding (Bajtelsmit and Bernasek 1996; Hanna and Lindamood 2005; Sunden and Surette 1998; Watson and McNaughton 2007). Thus, over a 50-year period, differences in investment strategy could lead to a gender wealth gap between households in which the woman is investing, compared with households in which the man is investing.

Hypotheses

In this article, we estimate the extent of the wealth gap between men and women BFR differentiated by marital status. We limit the analyses to men and women BFR because we assume reporting error among the non-BFR, and we wish to provide an analysis that is as simple and distraction-free as possible. Thus, we include only non-BFR in upcoming Table 2.Footnote 1 We expect women to accumulate less wealth than men. We also expect the currently unmarried and those with a marital disruption to accumulate less wealth than the married, although we do not adjust wealth for the number of adults in the household. Next, we examine potential explanations for the gender wealth gap, such as selection or family-of-origin SES and inheritance, human-capital formation, family formation, and status attainment. We hypothesize the following:

-

1.

Women BFR will accumulate less wealth over the life course than men regardless of marital status.

-

2.

The not currently married will accumulate less wealth over the life course than the married, regardless of gender.

-

3.

Those experiencing a marital disruption will accumulate less wealth over the life course than those who never experienced a marital disruption.

-

4.

A remarriage may offset the marital disruption wealth-accumulation penalty.

-

5.

If inheritances and early family SES explain the gender wealth gap, then there are selection effects.

-

6.

Controlling for human-capital formation, such as education and ability, will significantly attenuate the gender wealth gap.

-

7.

Controlling for family formation will attenuate the gender wealth gap among the currently married.

-

8.

Status attainment variables—such as work, earnings, and savings over the life course—will explain the largest part of the gender wealth gap.

Data and Methods

The WLS is a long-term study of a one-third random sample (N = 10,317) of men and women who graduated from Wisconsin high schools in 1957 (Sewell et al. 2004). Survey data were collected in 1957, 1964, 1975, 1992–1993, and 2003–2004. These data provide a comprehensive record of the life trajectory of its graduates. The WLS includes many variables concerning the participants’ early family life, their abilities, their own family formation, education, career histories, health, aging, and wealth. In the 2004 wave of data collection, the graduates were 64–65 years old. Among surviving graduates to the 1993 surveys (85 % response rate), 7,063 completed the 2004 phone interview (81 %). The sample that we use includes 6,821 white graduates who responded to both the 1993–1994 and the 2003–2004 phone and mail interviews. When we drop the currently married graduates who are non-BFR, our sample is reduced to 4,864.

The WLS sample is not representative of all strata of society. All members of the primary sample graduated from high school, compared with an estimated 75 % of Wisconsin youth in the late 1950s. There are few African American, Hispanic, or Asian persons in the sample. In each of the post-1957 waves of the study, about two-thirds of graduates have lived in Wisconsin.

The WLS sample does otherwise appear to be broadly representative of white, non-Hispanic American men and women who have completed at least a high school education. Of all Americans aged 50–54 in 1990 and 1991, approximately 66 % are non-Hispanic white persons who completed at least 12 years of schooling. Furthermore, approximately the same portion of the WLS sample is of farm origin, similar to persons born throughout the United States in the late 1930s.

Measures of 2004 Wealth

Wealth is measured as net worth. The WLS asks a series of wealth questions on both real and financial assets. Instructions to the participants state, “The next section covers different types of assets that you or your spouse may have, such as real estate, motor vehicles and financial investments,” making it clear that they are asking for all assets owned by both or either partner in the marriage (for those who are married). For real assets, the WLS asks the following questions: (1) Do you own your own home (farm/business, other real estate, and vehicles)? (2) How much do you think your home (farm/business, other real estate, and vehicles) would sell for now? (3) How much, if anything, do you owe on your home (farm/business, other real estate, and vehicles)? To reduce nonresponse, the WLS asked a series of bracketing questions: (4) Is it worth more or less than $X dollars or about $X dollars? The WLS also varied the entry point into the series of bracketing questions (the value of X varied randomly) to control for anchoring biases (Hurd 1999). Bracketing substantially increases response rates (Chand and Gan 2003; Hauser and Willis 2005; Hurd 1999; Hurd and Rodgers 1998). This is important because, consistent with data collection on wealth in many other data sets, there are considerable missing data on each of the assets and liabilities that make up net worth. We imputed the missing asset information, using regression procedures that assume data is not missing at random. We created five versions of the imputed wealth data to preserve variation in net worth.

After the data were imputed, we created equity measures for the four real assets by subtracting the loan amount from the value of the asset. For those who did not own a home, farm/business, other real estate, or vehicles, the values were set at zero.

To ascertain the value of financial assets, the WLS asks about the value of unsecured debts, savings, investment, and retirement accounts, and other assets. Bracketing questions are used for those who do not respond to the continuous value.

Net worth is constructed by summing all real asset equities with the values of all financial assets less debt. To eliminate skewness, net worth values are truncated at zero (n = 55 cases with zero wealth, and 21 with negative wealth) and then log transformed with a starting value of 5,000 and top coded at 3 standard deviations above the mean. This means that point estimates are roughly equivalent to median values; the distribution of net worth is roughly normal after transformation. It also means that we have reduced the gender wealth gap, given that women reporters are twice as likely to be at the bottom of the distribution and men are overrepresented at the top of the distribution.

If patterns of nonresponse are related to gender, methods used to deal with nonresponse—such as imputations—may be inflating the gender wealth gap. We checked this carefully and found that non-BFR women were more likely to have missing responses compared with the other groups. The imputation procedures did not inflate the gender wealth gap, however. Instead, it narrowed the gender wealth gap minimally (results available upon request).

In a separate study (Ruel and Hauser 2007), we compared the WLS wealth measures with several other wealth data sources and found that it compared quite well. The WLS has slightly higher average net worth compared with the SCF and considerably more net worth compared with the HRS. Although home equity is comparable across all three data sets, the WLS reported far higher average liquid assets compared with both the HRS and SCF. As we would expect, given the homogeneity of the WLS sample compared with the SCF, there is less inequality in the WLS distribution of net worth. The WLS does a better job of representing the working class and lower- to upper-middle-class white distribution than the very wealthy.

Explanatory Variables

The intersection of gender, marital, and BFR statuses are important status variables for this study, and we use them to create 12 dummy variable groupings. Table 1 presents the groups and the indicator variables used to create them. The first row consists of the four groups of those not currently married: never-married women, never-married men, previously married women, and previously married men. There are four groups of currently married men and women who are the BFR for their families: women married once, men married once, women married more than once, and men married more than once. The last row contains the same four groupings of married men and women non-BFR that we examine only in the upcoming Table 2. Never-married men make up the reference category for analyses of the not currently married, and men BFR married once make up the reference category for the currently married analyses.

We create several measures of family-of-origin SES. A measure of inheritances and gifts received since 1993 consists of the amount ever inherited plus gifts received from parents for the graduate and spouse. The amount is logged with a starting value of $1,000. We control for the graduates’ socioeconomic background at age 16 by including whether the graduate hails from a farm background (Sewell et al. 1969) or not (farm = 0). Last, as a proxy for wealth in the family of origin, we include a measure of the graduate’s perception of family economic standing in 1957, which has five categories, where 1 is considerably below average and 5 is considerably above average compared with others who live in the same community.

We use four measures of academic success: the Henmon-Nelson IQ test, high school rank, and men’s and women’s years of education completed. The Henmon-Nelson Test of Mental Ability (Henmon and Nelson 1954) was given to all juniors and most freshman attending Wisconsin high schools. Test scores are converted to percentiles among Wisconsin students on whom the test had been normed, and the percentiles are then transformed into the standard metric of IQ. High school rank, obtained from each high school’s records, is expressed as a percentile and transformed into the IQ metric. Both variables were divided by 10; thus, a one-unit change is a 10-unit change in the original metric. Because we make an argument concerning gender differences in family formation that may explain the gender wealth gap for the currently married, it is necessary to convert all graduate and spouses’ variables into male and female versions. Thus, for education, we create a man’s years of education variable, which consists of the graduate’s reported educational level if the respondent is a male graduate, or the spouse’s reported educational level if the respondent is a female graduate. Likewise, we create a comparable woman’s years of education variable. Years of educational attainment for both men and women range from 1 (all graduates are high school graduates) to 26 (doctorate or professional degree). Recall that the WLS sample consists of high school graduates, many of whom attended college.

Family-formation variables consist of age at first marriage, age difference with current spouse, age at first birth, and total number of children. For the currently not married, we include only the total number of children in the regression models.

For status attainment, we include dichotomous measures of full or part-time work status, self-employment status, and retirement status. Again for the currently married, we start with the graduate and spousal responses to these items and create male and female versions of them. For example, the variable “woman working part-time” is 1 under either of the following conditions: if the respondent is a female graduate working part-time, or if the respondent is a male graduate whose spouse works part-time. The work-status variables were assessed in 2004/2005, the same time that wealth was collected leading to a potential endogeneity problem. Analyses using 1992/1993 work status are very similar to the ones presented here but are from 11 years in the past; thus, because we are interested in explaining the gender wealth gap and not wealth accumulation, we deem the 2004 work-status variables optimal because they are most proximate and apply to the current spouse.

We measure family income as the sum of all income types from wages and salaries to interest income for both the graduate and the spouse in 1975 and 1993. For 2004, we examine only earnings in order to minimize endogeneity. All are adjusted to 2004 U.S. dollars using the consumer price index (CPI).

Analysis

There are missing responses, although few, on most independent variables. We impute values for all missing cases on the independent variables using multiple imputation procedures in SAS, creating five complete data sets. Each is analyzed by using standard statistical procedures, and the estimates are combined to yield pooled estimates and their standard errors using SAS v9.2 PROC MIANALYZE. This procedure results in valid statistical inferences that properly reflect the uncertainty attributable to missing values (Yuan 2000).

We assess explanations of the gender wealth gap using five nested ordinary least squares (OLS) regression models separately for the not currently married and the currently married BFR. The first model presents the unconditional differences of gender and marital status on 2004 wealth. Model 2 assesses selection effects of family of origin. Model 3 introduces human-capital characteristics, Model 4 introduces family-formation variables, and Model 5 introduces status attainment variables as explanations of the gender wealth gap.

All continuous explanatory variables are centered on their mean. This means that the intercept should not vary tremendously as we introduce new variables into the models, and the changes to the gender wealth gap should be clear. We employ post-sampling weights to correct for nonresponse bias over time.

Results

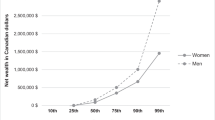

The top two rows of Table 2 present unconditional average wealth accumulation for men and women. The gender wealth gap is large and significant, at more than $100,000. The remaining rows in the table present average wealth accumulation for each gender by marital and BFR status group (12 groups) and the group size. Men BFR married once have accumulated the most wealth. Analysis of variance models (ANOVA) are conducted comparing each group with men BFR married once, which will test Hypotheses 1–4. Women BFR married once have accumulated significantly less wealth than men BFR married once, as have never-married men, previously married men, and men BFR married more than once. Consistent with prior research, we find support for the four hypotheses that women accumulate less wealth than men; that married individuals accumulate more wealth than unmarried individuals; and that there is a marital disruption cost to wealth accumulation, which is attenuated somewhat by remarriage.

The groups of men and women non-BFR by marital status are included at the bottom of the table. Their average reported wealth accumulations are not consistent with either the men BFR or women BFR reported wealth values; instead, they lie somewhere in the middle. We find, however, that women non-BFR report greater 2004 net worth than do men non-BFR or women BFR, although not nearly as high as men BFR. Because the level of measurement error is probably quite high and not estimable for the non-BFR, we drop them from any further analysis, and for simplicity, focus on the best reporters.

Next we examine the explanatory variables. Table 3 presents descriptive statistics of the sample for men and women BFR broken out by current marital status. As expected, there are no differences, on average, between men and women in logged inheritances and gifts received. Twenty percent of both men and women hail from a farm background. Both men and women report an average family-of-origin economic standing of just over 3, with no significant differences between them. There is no gender difference in the Henmon-Nelson test. Women, on average, ranked higher in their class than men. There is little difference in educational attainment for the not currently married. Among the married, however, the male graduates (14.50) have attained 1.5 years more education than the female graduates (13.04). Among the spouses, the females (13.23) have greater educational attainment than the males (12.55). Note that male graduates and their spouses have much higher educational attainment compared with female graduates and their spouses.

Almost 80 % of both currently married men and women are married to their only spouse. Only 14 % of women and 24 % of men never married. Women tended to marry for the first time, on average, at age 21.2 compared with age 23.9 for men. Average age of first birth was 23.4 and 26.2 for women and men, respectively. Of those currently married, female graduates have an average of 2.64 children compared with men’s average of 2.36 children. Not currently married men and women average fewer children. Average age differences between graduates and their spouses are 2.8 and −2.9, respectively, for female and male graduates.

For the not currently married, women are more likely to be working full- or part-time (50 %) compared with men (41 %), but men are more likely to be self-employed or retired. Men have earned more on average than women until 2004. Among the currently married, 85 % of the male spouses are working full- or part-time compared with 50 % of male graduates. Female spouses are more likely to be working full- or part-time (74 %) compared with female graduates (42 %). Thus, there are distinct work patterns in male graduates’ households compared with female graduate households. For all three income measures, men report higher average family income or earnings than women, on average.

Explaining the Gender Wealth Gap Among Unmarried Men and Women

Table 4 presents the nested regression models of logged 2004 net worth for the not currently married men and women. Model 1 presents the unconditional group differences among the never-married men (the intercept), never-married women, previously married men, and previously married women. Both never-married women and previously married women report significantly lower logged net worth (b = −0.434, and b = −0.460, respectively) than never-married men. Previously married men do not report significantly lower wealth than never-married men across all five models.

Model 2 adjusts for measures of family-of-origin SES, such as inheritances, owning a farm, and perception of family’s relative wealth. Family of origin explains 6 % (b 1 – b 2 / b 1) of the wealth gap for never-married women, reducing the coefficient for never-married women from 0.434 logged units to 0.408 logged units. For previously married women, the wealth gap with never-married men is reduced by 12 %.

Model 3 adds human-capital variables, including years of education, IQ, and high school rank. Surprisingly, the gender wealth gap between never-married men and women widens from 0.408 to 0.438 net of human capital, suggesting a suppression effect. Yet, human capital explains 10 % of the gender wealth gap between never-married men and previously married women.

Model 4 introduces number of children into the model given that female-headed households with children have been shown to accumulate the least wealth. The wealth gap for never-married women is virtually unchanged, but the wealth gap for previously married women is entirely eliminated. Those previously married have more family-formation variables than just the number of children. In other analyses limited only to the previously married, age at first marriage, age difference with spouse, and age at first birth were added. The number of children was the only significant family-formation variable predicting wealth accumulation among the previously married. Results are available upon request.

Model 5 controls for status attainment as an explanation for the wealth gap. The remaining gender wealth gap between never-married men and women is eliminated (b = −0.294). However, a gender wealth gap between never-married men and previously married women (b = -0.317) becomes large and significant, net of status attainment, once again indicating a suppression effect. Previously married women have attained only 13.23 years of education, on average, compared with never-married women’s 14.4 years. Perhaps the previously married women interrupted their educational attainment after marriage, which might explain this confusing finding.

In sum, no wealth gap exists between never-married men and previously married men, despite the differences shown in Table 2. Wealth accumulation returns to human capital are lower for women. There is a substantial wealth gap between never-married men and never-married women that is primarily explained by work, earnings, and savings. Thus, gendered earning differences over a lifetime will lead to a substantial gender wealth gap for those women who never married. Thirty percent of the wealth gap between never-married men and previously married women is explained, but a significant wealth gap remains. This suggests the accumulation of income differences, as well as a marriage penalty, that makes this group most vulnerable to aging into poverty.

Explaining the Gender Wealth Gap Among Married Men and Women BFR

Table 5 presents nested regression models of 2004 net worth accumulation for currently married men and women. Model 1 presents the unconditional group differences between the men BFR married once (the intercept), women BFR married once, and men and women BFR married more than once, to be explained. Significant wealth-accumulation gaps are noted between all groups and men BFR married once. Women BFR married more than once have accumulated the least wealth (b = −0.723), on average, and women BFR married once have accumulated the next lowest level of wealth (b = −0.551). Men BFR married more than once also have accumulated significantly less wealth (b = −0.191), on average, than men BFR married once.

Model 2 introduces family-of-origin explanation for the wealth gap. Controlling for these variables attenuates the wealth gap slightly for women BFR married once (4.9 %) and increases the gender wealth gap for women BFR married more than once (5.7 %), compared with men BFR married once.

Model 3 introduces human capital for both the graduate and the current spouse as an explanation for the wealth gap. Controlling for human capital reduces the wealth gap between men BFR married once and women BFR married once by 29 % (b = −0.376), and women BFR married more than once by 23 % (b = −0.592). This is consistent with the differences in educational attainment between the households of male and female graduates. The gap between men BFR married once and those married more than once has stayed fairly stable across the first two explanatory models.

Model 4 introduces family formation variables as a further explanation, including age of first marriage, age difference between the spouses, age at first birth, and number of children. Similar to what occurred among the not married, family formation operates as a suppressor rather than an explanation of the gender wealth gap. Controlling for family formation increases the wealth gap between men married once and all three groups. We find no support for Hypothesis 7 that family formation variables will attenuate the gender wealth gap for the currently married.

Model 5 introduces status-attainment variables for the graduate and current spouse to explain the remaining wealth gaps. The status attainment variables explain much of the gendered wealth gap, although it does not eliminate it. The wealth gaps between men BFR married once and women married once and women married more than once are reduced by 39 % and 26 %, respectively. Status attainment does not explain the gap between men married once and men married more than once.

In sum, across all five models, 53 % of the wealth gap between men married once and women married once is explained. However, none of the gap between men married once and men married more than once is explained. Finally, 38 % of the gap between men married once and women married more than once is explained. Significant wealth gaps remain despite Model 5, explaining 33 % of the variation in wealth accumulation.

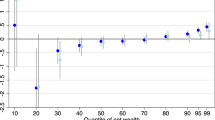

We have mixed support for Hypothesis 5 that family of origin will attenuate the gender wealth gap: there are reductions for all except women married more than once. As a selection-effect control, the family-of-origin measures we use are only partly effective. There is mixed support for Hypothesis 6, human-capital formation, as well. It attenuates the gap for the married and previously married women groups but not for the never-married. We reject Hypothesis 7 that family formation will attenuate the gender wealth gap for the currently married. We find evidence to support Hypothesis 8 that work, earnings, and savings will attenuate the gender wealth gap for both the married and unmarried groups. Although we eliminated the wealth gap between never-married men and women, the wealth gaps remain for previously married women as well as currently married women and men BFR married once. This can be seen graphically in Fig. 1, which presents changes in wealth for all groups across Models 1–5 from Tables 4 and 5. The gaps between men and women married once or more than once, while decreasing beginning with the human-capital model, remain quite large throughout. The not currently married men and women have a similar wealth-gap pattern but at a lower level of wealth accumulation. By Model 5, the wealth-accumulation gaps, while much smaller, remain.

Discussion

We assessed the gender wealth gap disaggregated by marital status and BFR status. The WLS has followed a cohort of men and women since they graduated from high school in 1957 until retirement age in 2004, giving them almost 50 years to accumulate wealth. We found, as have others, that there is a gender wealth gap, a marital wealth gap, and a marital disruption penalty to wealth accumulation (Grinstein-Weiss et al. 2008; Ozawa and Lee 2006; Schmidt and Sevak 2006; Warren et al. 2001; Yamokoski and Keister 2006). We demonstrated the importance of decomposing the sample of men and women into their various marital and BFR statuses before attempting to analyze the gender wealth gap. Not accounting for BFR status will suppress a portion of the wealth gap because of the large amount of error found in non-BFR self-reports.

After almost 50 years of working and savings, the unconditional wealth gaps between never-married men and women is more than $94,000, and between men and women BFR married once is more than $245,000. After we estimated the full model (Model 5), the wealth gap between men and women married once was reduced to $93,500, and the gender gap between the never-married was no longer significant. This amount is consistent with the €50,000 gender wealth gap found in a recent German study (Sierminska et al. 2010).

Our primary purpose was to explain the gender wealth gaps, particularly that between a cohort of married men and women BFR who graduated high school in the same year. One would not expect systematic differences in wealth accumulation for this group, yet it exists and is very large. We developed and tested several possible explanations for the gender wealth gap, including family-of-origin SES, human-capital formation, family formation, and status attainment.

Family of origin was used to proxy for selection effects, and it appears that there was some mixed support for selection effects: it explained 6 % and 12 % of the never-married and previously married gender gaps, respectively. It also explained 4 % and 6 % of the gaps between men married once and women married once and more than once. Most research has shown that inheritances are bestowed equally on both genders and that gifts go to the neediest of the offspring, and we found no gender differences in gifts and inheritances in our sample (Cox 2003).

Human-capital formation increased the gap between never-married men and women. The jobs typically available to women, such as nursing and teaching, require advanced education but do not pay very well. Thus, there is often low association between women’s human capital and the income they receive (Marini 1989; J. R. Warren et al. 1998). Education and ability did explain a large portion of the gaps among the married, however. The spouses of female graduates and female graduates themselves attained much less education compared with male graduates.

Family formation showed a surprising lack of power as an explanation for the gender wealth gap for married groups. In fact, not controlling for it suppressed the gender wealth gap. It should be noted, however, that we were not able to address selection into marriage with this data.

Of all the explanations we tested, status attainment appears to have the most power. It explained the entire remaining wealth gap between never-married men and women, and the majority of the wealth gaps between men married once and women married once and more than once, which is consistent with prior research (Ginn and Arbor 1996; Sierminska et al. 2010). We recognize, however that we explained only 33 % of wealth accumulation more generally with our full model. Income explained wealth accumulation: those with larger incomes accumulate more wealth (Anderson 1999; Land 1996; Wolff 2000). We can attribute a good portion of the gender wealth gap, then, to a lifetime of living with a gender income gap. Until 1980, the gendered income gap was about 40 cents but declined to about 20 cents after 1980 (Blau and Kahn 2007). The gender wage gap has a detrimental effect on single women’s ability to prepare for retirement and old age.

We were unable, despite a comprehensive coverage of several possible explanations, to explain away the gender wealth gaps for married men and women and previously married women. The remaining gaps may be artificial, resulting from the fact that this is a unique, nonrepresentative sample: a cohort of white, Wisconsin 1957 high school graduates. It is impossible to completely capture selection effects with the limited family-of-origin variables we used. Nor does BFR status necessarily reflect financial decision-making power. It may be as well that we have measurement error in our theoretical explanations because of the large time gaps between data-collection points. For example, including a work history variable may have eliminated the gender gap for the married sample.

We speculate that it is possible that men are their family’s BFR when there is more initial wealth, and women are more likely to be in charge of finances when there is less wealth. If this is the case, then controlling for family-of-origin SES should capture much of this. The fact that family of origin explains little of the gender wealth gaps does not support this, or it means that we poorly captured this type of selection effect.

If there are gendered differences in investment risk, men and women may start with the same level of wealth but could, over a lifetime, develop a gendered wealth gap because men invest their family’s resources more aggressively. There is some evidence for a gendered investment-risk aversion. Sunden and Surette (1998) found that men and women had very different bond and stock choices in their retirement accounts. Hanna and Lindamood (2005) found that in married couples, women show greater risk intolerance than do men. Of course, a respondent saying he or she is the family BFR does not mean he or she has the power to make financial decisions; this is another area where additional research is needed.

Although this study is not particularly representative of the United States, accumulated wealth in the WLS is comparable to the SCF and HRS, and we did replicate more representative studies in having a gender wealth gap and showing that status attainment is the main predictor. We replicated earlier research showing that single female-headed households are at greater risk of aging into poverty compared with single male-headed households and married households. However, households in which women are the BFR are also at risk because of significantly lower wealth accumulation. More research is needed to understand why this is the case if we are to intervene and keep these households from aging into poverty as well.

Also, because the WLS is not representative, we cannot say whether more recent cohorts behave similarly or whether women from younger cohorts are better prepared to manage finances and/or are less risk adverse in their investments. It will be a while before new cohorts will have managed to accumulate wealth over a 50-year span. Moreover, research by Kapteyn et al. (2005) found that past economic conditions, rather than differences in preferences, explain why generations differ in their wealth holdings. Despite these limitations, this work makes an important contribution to our understanding of the social-stratification process by broadening our understanding of how one cohort has accumulated wealth over an almost 50-year span, and the strength of various explanations for the gender wealth gap in that generation.

Notes

Other tables that include the non-BFR are available from the lead author by request.

References

Anderson, J. M. (1999). The wealth of U.S. families: Analysis of recent census data. Chevy Chase, MD: Capital Research Associates.

Bajtelsmit, V. L., & Bernasek, A. (1996). Why do women invest differently than men? Financial Counseling and Planning, 7, 1–10.

Bernheim, B. D., & Garrett, D. M. (2003). The effects of financial education on the workplace: Evidence from a survey of households. Journal of Public Economics, 87, 1487–1519.

Blau, F. D., & Kahn, L. M. (2007). The gender pay gap. Economists’ Voice, 4(4), 5.

Blau, P. M., & Duncan, O. D. (1967). The American occupational structure. New York: John Wiley and Sons.

Chand, H., & Gan, L. (2003). The effects of bracketing in wealth estimation. The Review of Income and Wealth, 49, 273–287.

Cox, D. (2003). Private transfers within the family: Mothers, fathers, sons and daughters. In A. H. Munnell & A. Sunden (Eds.), Death and dollars: The role of gifts and bequests in America (pp. 168–216). Washington, DC: The Brookings Institution.

Deere, C. D., & Doss, C. R. (2006). The gender asset gap: What do we know and why does it matter. Feminist Economics, 12(1–2), 1–50.

Denton, M., & Boos, L. (2007). The gender wealth gap: Structural and material constraints and implications for later life. Journal of Women & Aging, 19, 105–119.

Dietz, B. E., Carrozza, M., & Ritchey, P. N. (2003). Does financial self-efficacy explain gender differences in retirement saving strategies? Journal of Women & Aging, 15, 83–96.

Duncan, O. D., Featherman, D. L., & Duncan, B. (1972). Socioeconomic background and achievement. New York: Seminar Press.

Elder, H. W., & Rudolph, P. M. (2003). Who makes the financial decisions in the households of older Americans? Financial Services Review, 12, 293–308.

Gale, W. G., & Scholz, J. K. (1994). Intergenerational transfers and the accumulation of wealth. Journal of Economic Perspectives, 8, 145–160.

Gibson, J., Le, T., & Scobie, G. (2006). Household bargaining over wealth and the adequacy of women’s retirement incomes in New Zealand. Feminist Economics, 12, 221–246.

Ginn, J., & Arbor, S. (1996). Patterns of employment, gender and pensions: The effect of work history on older women’s non-state pensions. Work, Employment and Society, 10, 469–490.

Grinstein-Weiss, M., Yeo, Y. H., Zhan, M., & Pajarita, C. (2008). Asset holding and net worth among households with children: Differences by household type. Children and Youth Services Review, 30, 62–78.

Hanna, S. D., & Lindamood, S. (2005, October). Risk tolerance of married couples. Paper presented at the meeting of the Academy of Financial Services, Chicago, IL.

Hardy, M. A., & Shuey, K. (2000). Pension decisions in a changing economy: Gender structure, and choice. Journal of Gerontology, Social Sciences, 55, S271–S277.

Hauser, R. M., & Willis, R. J. (2005). Survey design and methodology in the health and retirement study and the Wisconsin Longitudinal Study. In L. J. Waite (Ed.), Aging, health, and public policy: Demographic and economic perspectives (pp. 209–235). New York: Population Council.

Henmon, V. A. C., & Nelson, M. J. (1954). The Henmon-Nelson tests of mental ability. Manual for administration. Boston, MA: Houghton-Mifflin.

Hurd, M. D. (1999). Anchoring and acquiescence bias in measuring assets in household surveys. Journal of Risk and Uncertainty, 19, 111–136.

Hurd, M. D., & Rodgers, W. (1998). The effects of bracketing and anchoring on measurement in the health and retirement study. Ann Arbor: Institute for Social Research, University of Michigan.

Kapteyn, A., Alessie, R., & Lusardi, A. (2005). Explaining the wealth holdings of different cohorts: Productivity growth and social security. European Economic Review, 49, 1361–1391.

Land, K. C. (1996). Wealth accumulation across the adult life course: Stability and change in sociodemographic covariate structures of net worth data in the survey of income and program participation, 1984–1999. Social Science Research, 25, 426–462.

Lindamood, S., & Hanna, S. D. (2005, October). Determinants of the wife being the financially knowledgeable spouse. Paper presented at the Academy of Financial Services Meeting, Chicago, IL.

Marini, M. M. (1978). The transition to adulthood: Sex differences in educational attainment and age at marriage. American Sociological Review, 43, 483–507.

Marini, M. M. (1989). Sex differences in earnings in the United States. Annual Review of Sociology, 15, 343–380.

Ozawa, M. N., & Lee, Y. (2006). The net worth of female-headed households: A comparison to other types of households. Family Relations, 55, 132–145.

Ozawa, M. N., & Lum, Y. S. (2001). Taking risks in investing in the equity market: Racial and ethnic differences. Journal of Aging & Social Policy, 12, 1–12.

Rodgers, W. L., & Thornton, A. (1985). Changing patterns of first marriage in the United States. Demography, 22, 265–279.

Ruel, E., & Hauser, R. M. (2007). Gender, education and wealth: A prospective study (CDE Working Paper 2007–003). Madison: Center for Demography and Ecology, University of Wisconsin–Madison.

Schmidt, L., & Sevak, P. (2006). Gender, marriage, and asset accumulation in the United States. Feminist Economics, 12, 139–166.

Sewell, W. H., Haller, A. O., & Ohlendorf, G. W. (1970). The educational and early occupational status attainment process: Replication and revision. American Sociological Review, 35, 1014–1027.

Sewell, W. H., Haller, A. O., & Portes, A. (1969). The educational and early occupational attainment process. American Sociological Review, 34, 82–92.

Sewell, W. H., Hauser, R. M., Springer, K. W., & Hauser, T. S. (2004). As we age: The Wisconsin Longitudinal Study, 1957–2001. In K. Leicht (Ed.), Research in social stratification and mobility (Vol. 20, pp. 3–111). London, UK: Elsevier.

Sierminska, E. M., Fricky, J. R., & Grabka, M. M. (2010). Examining the gender wealth gap. Oxford Economic Papers, 62, 669–690.

Sunden, A. E., & Surette, B. (1998). Gender differences in the allocation of assets in investment savings plans. The American Economic Review, 88, 207–211.

U.S. Census Bureau. (2001). Household net worth and asset ownership, 1995 (No. 70–71). Washington, DC: U.S. Department of Commerce, Economics and Statistics Administration.

Warren, T., Rowlingson, K., & Whyley, C. (2001). Female finances: Gender wage gaps and gender asset gaps. Work, Employment and Society, 15, 465–488.

Warren, J. R., Sheridan, J. T., & Hauser, R. M. (1998). Choosing a measure of occupational standing: How useful are composite measures in analyses of gender inequality in occupational attainment? Sociological Methods & Research, 27, 3–76.

Watson, J., & McNaughton, M. (2007). Gender differences in risk aversion and expected retirement benefits. Financial Analysts Journal, 63(4), 52–62.

Wilmoth, J., & Koso, G. (2002). Does marital history matter? Marital status and wealth outcomes among preretirement adults. Journal of Marriage and Family, 64, 254–268.

Wolff, E. N. (2000). Recent trends in the size distribution of household wealth (Working Paper No. 300). Annandale-on Hudson, NY: Bard College, Jerome Levy Economics Institute.

Yamokoski, A., & Keister, L. A. (2006). The wealth of single women: Marital status and parenthood in the asset accumulation of young baby boomers in the United States. Feminist Economics, 12(1–2), 167–194.

Yuan, Y. C. (2000). Multiple imputation for missing data: Concepts and new development (SAS Paper P267–25). Cary, NC: SAS Institute.

Acknowledgments

We would like to thank Dawn Baunach and Meredith Greif for commenting on an early draft of this article. The research reported herein was supported by the National Institute on Aging (R01 AG-9775, P01-AG21079 and T32-AG00129), by the William Vilas Estate Trust, and by the Graduate School of the University of Wisconsin–Madison. The opinions expressed here are those of the authors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ruel, E., Hauser, R.M. Explaining the Gender Wealth Gap. Demography 50, 1155–1176 (2013). https://doi.org/10.1007/s13524-012-0182-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13524-012-0182-0