Abstract

Households with limited income and wealth often struggle to access the financial liquidity needed to address unexpected expenses or income drops. Emergency savings can act as form of insurance against such economic shocks and reduce the risk of hardships that influence family wellbeing. Prior research has established that threshold amounts of liquid assets can reduce the risk of economic hardship. This study used a measure of self-reported emergency saving behavior to examine whether households who reported saving for emergencies were less likely to experience subsequent economic hardships in a longitudinal sample of households in disadvantaged neighborhoods from the Annie E. Casey Foundation’s Making Connections project. Results across a range of regression models suggest that households who saved for emergencies experienced slightly less overall hardship and were less likely to report several specific hardships, such as food insecurity and having a phone disconnected, three years later. This study supports the idea that small, unrestricted savings may play a protective role for low-income households.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Households with limited income and wealth often struggle to access the financial liquidity needed to address unexpected expenses or income drops. The ability to smooth consumption over time with liquid savings is important because it may help weather economic shocks in order to maintain financial stability and household wellbeing. Many low-income families do not have reserved liquid savings, leaving them financially fragile (Hogarth et al. 2003; Lusardi et al. 2011). With the threshold for adequate emergency savings set at 75 % of 1 month’s income, only half of US households satisfied this condition in the 2010 Survey of Consumer Finances; among households below the poverty line, only 37 % had these funds available (Key 2014). Economically disadvantaged families are especially vulnerable given that reserving funds is difficult if paying for basic necessities consumes a large portion of financial resources. Without adequate savings and with limited access to traditional credit households may rely on social networks or turn to high-cost alternative financial services to meet liquidity demands (Bianchi and Levy 2013; Lusardi et al. 2011).

Economically disadvantaged families have thinner financial cushions. The inability to absorb an economic shock may result in hardships such as housing instability, energy insecurity, food insecurity, and failure to access needed medical care. This study explored whether self-reported emergency saving behavior was associated with household hardship using a longitudinal sample of households in disadvantaged neighborhoods, and specifically examined if households that reported saving for an emergency were less likely to experience subsequent economic hardships. Models estimated the likelihood of hardships based on emergency saving status and demographic and financial characteristics, including saving for other purposes. Results of the empirical analysis suggest that households saving for an emergency experienced slightly less overall hardship and were also less likely to report specific hardships. These results are consistent across a range of estimation strategies.

Literature Review

Saving for an emergency is one only component of financial stability but it may play an important role in the ability to cope with immediate expenses like vehicle or home repairs, medical bills not covered by insurance, an unanticipated income drops like a job loss, an injury or health condition that limits work, or the exit of a working adult from one’s household (Dew and Xiao 2011; McKernan et al. 2009; Mills and Amick 2010). Households with limited income are particularly vulnerable to economic shocks. In a survey of low- and moderate-income US households, the majority (62 %) of respondents reported experiencing an economic emergency in the previous year (Abbi 2012). Consistent with buffer-stock models of saving, preparing for potential short-term income fluctuations has been found to be a primary motive for emergency or precautionary saving (Carroll and Samwick 1997). However, this motive may not always be effective. At least one study suggested that people may not adequately anticipate expenditure shocks. Households in the bottom income quintile, on average, underestimated annual emergency expenses by about $500 (Brobeck 2008). Saving may also be a challenge because the exact timing of such expenses is so uncertain, making putting off saving easy to do.

Saving Behavior

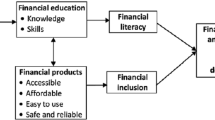

Overall, saving behavior is influenced by many factors. A range of personal and household characteristics, including familial and economic conditions and financial knowledge, contribute to the likelihood of saving and having financial assets (Babiarz and Robb 2014; Bernheim et al. 2001; Beverly et al. 2008; Caskey 1997; Hilgert and Hogarth 2003; Hogarth et al. 2003; Klawitter et al. 2013; Lusardi 2008; Painter and Vespa 2012; Payne et al. 2014; Shapiro and Wolff 2001; Zagorsky 2013). People’s interactions with institutions that have the capacity to alter financial behavior, such as banks, employers, or government programs may also influence saving (Beverly and Sherraden 1999; Sherraden and Barr 2005; Sunstein and Thaler 2008).

Saving is made infinitely more challenging when necessary expenses consume most, or exceed, available income (Schreiner and Sherraden 2007). Within a sample of households with low or moderate income, most (84 %) thought saving was “worth it” but the vast majority (93 %) indicated it was hard to save because funds went to necessities (Blank and Barr 2009). The need to focus on economic survival may shorten time horizons and combined with the increased availability of alternative high-cost credit that may encourage over-borrowing, can make saving a low priority (Laibson 1997; Schreiner and Sherraden 2007; Shah et al. 2012). There are programs that help low-income individuals and families build savings, but these programs typically restrict the use of funds to human capital development activities like homeownership and education, meaning there are financial penalties for withdrawing funds for other uses like financial emergencies (see, for example, Mills et al. 2008; Schreiner and Sherraden 2007). Other barriers to saving for low-income households include a lack of access to useful saving products and asset eligibility limits in public benefit programs (Abbi 2012; O’Brien 2008).

Savings Protect Families

In general, having financial assets is correlated with positive family outcomes including marital stability, adult health and feelings of self-efficacy and future orientation, child education attainment, child behaviors, and adolescent financial behavior (Dew 2007; Page-Adams and Scanlon 2001; Shanks 2007). Of particular relevance to this study, there is evidence that liquid financial assets have protective effects. Low-income households with modest liquid assets are less likely to experience material hardships, miss housing or utility payments, and are more likely to stave off deprivation when faced with an economic shock (Mckernan et al. 2009; Mills and Amick 2010). Mills and Amick (2010) used the Survey of Income and Program Participation (SIPP) to examine income shocks and hardships among low-income households. They found that modest amounts of liquid savings, up to $2,000, reduced instances of material hardship, while larger amounts provided even greater protection. McKernan et al. (2009) also used the SIPP, finding evidence that families with sufficient liquid savings to sustain poverty-level consumption for several months were at less risk for deprivation when faced with an income shock. A study specific to food security found that insufficient assets and liquidity constraint were both associated with an increased risk of food insecurity in the Panel Study of Income Dynamics (PSID) (Chang et al. 2013).

Economic and material hardships have important consequences for family wellbeing. A number of studies have investigated the impact of hardships and deprivation on child wellbeing. There is evidence that such hardships are associated with adverse impacts on a child’s physical health, social-emotional competence, and early development (Gershoff et al. 2007; Kainz et al. 2012; Yoo et al. 2009). The financial stress felt by adult caregivers struggling to make ends meet may also indirectly affect children’s health and development (Conger et al. 2002; Elder et al. 1992; Garasky et al. 2009; Gundersen et al. 2011). Many factors contribute to the occurrence of economic hardships. However, financial preparedness via savings can be a key contributor in a household’s ability to successfully weather a financial emergency.

Mechanism of Interest

Studies of emergency savings have primarily focused on threshold amounts of financial assets such as three months current income or expenses (DeVaney 1995; Greninger et al. 1996). Another strategy has been to measure “asset poverty” or “liquid asset poverty” defined as failing to have assets equivalent to three months’ income at the federal poverty threshold (Brandolini et al. 2010; Gornick et al. 2009; Haveman and Wolff 2005; McKernan et al. 2009). These measures of savings were primarily designed to capture a household’s ability to maintain consumption for several months in the absence of income due to a spell of unemployment or earning volatility. These threshold amounts are somewhat arbitrary and three months of income is likely an unreasonable benchmark for a low-income household. It is possible that smaller amounts of emergency savings could also be important because they afford households the liquidity to cope with relatively small financial shocks. In populations on the margin, such as households in impoverished neighborhoods, the ability to tap a small reserve could stave off economic hardship and prevent the depletion of household wellbeing. However, such funds would likely fluctuate over time as they are used and replenished making them difficult to capture with a point-in-time measurement. In the absence of frequent and detailed income and expenditure data, one possible strategy to capture whether a household has some amount of emergency savings is to measure emergency saving behavior.

This study used a longitudinal panel of households in disadvantaged neighborhoods; data were collected in three waves over a nine-year time span. The data have a measure of emergency saving defined as a household report of whether they are currently saving for an emergency. The hypothesis of the study was that households that reported saving for an emergency would report less economic hardship over the next three-year period compared to similarly situated households that were not saving for an emergency. Prior research indicated that savers and non-savers likely differ with regards to demographic, financial, and personality characteristics that also relate to the likelihood of hardships (Babiarz and Robb 2014; Bernheim et al. 2001; Hilgert and Hogarth 2003; Hogarth et al. 2003; Shapiro and Wolff 2001). Accordingly, emergency saving is endogenous in a model of household hardship. This study contributes to the existing literature on emergency savings and hardship in two ways. It used several strategies that attempt to isolate the impact of emergency savings on hardship: fixed effects estimations that control for some unobserved characteristics, propensity score models that match on observable characteristics, and an instrumental variable estimation. The study also measured emergency savings with emergency saving behavior instead of an accounting of financial assets.

Method

Data

This study used data from the Annie E. Casey Foundation’s Making Connections project, a neighborhood strengthening program initiative and survey of families in disadvantaged neighborhoods in selected US cities. The survey was a collaboration of the Urban Institute, NORC at the University of Chicago, Case Western University, the University of North Carolina at Chapel Hill, and the University of Chicago. The Making Connections neighborhood sites were selected by the Annie E. Casey Foundation to participate in the initiative because they had community support organizations that could sufficiently engage in the project and facilitate the necessary data collection. All of the neighborhood sites were disadvantaged relative to their surrounding metropolitan areas.

Within the neighborhood sites, area probability methods were used to identify sample household addresses. The project focused on families with children and therefore special efforts were made to follow households with children that moved during the study period in order to collect a longitudinal sample. Households without children that moved during the study period were not pursued for data collection. Due to the strategic site selection and data collection process the Making Connections data cannot be used to make inferences at the national level. However, the findings are indicative of some experiences prevalent among residents in many poor urban areas of the US.

Survey data were collected via in-home interviews in English, Spanish, and other languages as determined by local populations. The dataset includes demographic characteristics, income, debt, savings behavior, and economic hardship, as well as information about neighborhood characteristics. The dataset also contains a measure of whether households self-report saving specifically for an emergency, a data point absent from many other surveys. Thus, the Making Connections data are well suited for an exploration of saving for an emergency and experiences of hardship over time among households from communities of concentrated urban poverty.

Data were drawn from the seven sites that participated in all three waves of the project: Denver, Colorado; Des Moines, Iowa; Indianapolis, Indiana; Louisville, Kentucky; Providence, Rhode Island; San Antonio, Texas; and Seattle/White Center, Washington.Footnote 1 The first wave of data collection took place from 2002 to 2004. Subsequent waves of data collection were completed in 2005–2007 and 2008–2011 with an average of 34 months between the first and second wave and 38 months between the second and third wave. The sample used in the analysis is comprised of households that were interviewed in all three waves of the survey. At the third wave, the survey had retained approximately 70 % of the households interviewed at the first wave (response rates across sites ranged from 66 to 87 %) for a sample of n = 1,892. Cases were then dropped if they were missing the key independent variable (emergency saving) or any of the dependent variables (hardship outcomes) resulting in a final sample of n = 1,760 households each observed in three periods.

In the final sample, rates of missing data were below 3 % for all control variables, except income (22 % missing) and debt (10 % missing), which were notably higher. Missing data in all the control variables were imputed with simple mean imputation by wave. Missing values were replaced with the mean (for continuous variables) or modal value (for categorical variables) for that variable. Missing data indicators for each variable with missing data were included in the models. As a result of the higher rate of missing for income and debt, the coefficients on these variables should be interpreted with caution.

Measures

Dependent Variables

Measures of economic hardship that capture access to food, housing, and medical care have long been used as an important supplement to income-based poverty measures (Mayer and Jencks 1989). There is variation across studies in the specific indicators used to measure economic and material hardship; frequently used categories include food hardship, housing hardship, energy hardship, inability to access medical and dental care, and lack of access to a telephone (see for example Danziger et al. 2000; Gershoff et al. 2007; Mills and Amick 2010; Sullivan et al. 2008). This study used measures of hardship that reflect the categories of hardship in the existing literature.

The Making Connections survey captured six indicators of economic hardship that were available in all three waves of the data.Footnote 2 At every survey wave respondents reported whether their household had experienced each of the following hardships within the previous 12 months: they delayed filling a medical prescription because they did not have enough money or insurance that covered the cost; had been unable to pay a mortgage, rent or a utility bill; had been evicted for non-payment; a utility service was disconnected; phone service was disconnected; and there was a time the household did not have enough money to purchase needed food. The survey item that measured missed payment of housing or utility bills did not distinguish whether the respondent missed a housing bill, a utility bill, or both bills. Ideally these hardships would be measured separately due to the differential consequences for missing housing versus utility payments. The combined measure is a limitation of the data. Consistent with prior research exploring economic hardship in the Making Connections data, this study also excluded the measure of eviction because the event was so rare it was not possible to reach meaningful conclusions, resulting in a total of five hardship indicators that were used in the study (Hayes 2005).

A count measure of economic hardship was created by summing the total number of hardship indicators, between zero and five, reported by each household. Due to the binary nature of the survey items, the data captured only whether a household experienced a particular type of hardship at least once, but did not indicate whether a household experienced the same hardship more than once over the course of 12 months. As a result, the measure captured those who experienced at least one instance of any of the five hardship indicators but likely captured only a portion of the variation in total hardship and undercounts the total amount of hardship experienced.

Independent Variables

The key variable of interest was whether households were saving for an emergency. Respondents were classified as emergency savers for a particular survey wave if they reported that they or their partner or spouse were currently saving for an emergency. Information on the amount of emergency savings was not available in the data. However, current saving practice was a reasonable measure of emergency saving because the measure of emergency saving likely captures those with a practice or habit of saving, and can be a proxy for having at least some savings set aside. Prior research has found that low-income people with savings habits were more likely to have emergency savings of greater than $500 (Brobeck 2008).

Models also included a number of basic control variables: age, gender, race and ethnicity (non-Hispanic Black,Footnote 3 non-Hispanic White, Hispanic, and other race), education attainment (less than high school, high school or GED, and at least some college), spouse or partner in the household, children under 18 in the household, home ownership, employment status (whether respondent or spouse was employed), income (total annual household income), debt (total household debt including mortgage debt), having a bank account, and having a credit card. The few individual characteristics represented the respondent (age, gender, race and ethnicity, education attainment), while the remaining variables were captured at the household level. The measurement of income and debt was not consistent across the survey waves and merits a brief discussion. In Wave 1 income and debt were collected via survey items with seven response categories (<$4,999, $5,000–$9,999, $10,000–$14,999, $15,000–$19,999, $20,000–$24,999, $25,000–$29,999, > $30,000). In Wave 2 and Wave 3, income and debt were collected as continuous measures. In order to create consistency across waves, the income and debt measures from Wave 1 were transformed to continuous measures by assigning the mean value of the response category as the income or debt amount. Income and debt amounts from all waves were adjusted to represent 2003 US dollars in order to be comparable across waves. Log measures of income and debt were used in the analyses.

Additional savings variables were also added to the models. Like the emergency savings measure, the remaining saving variables indicated whether a respondent and his or her spouse or partner reported saving for each of the following: a home, a vehicle, education, retirement, or any other savings goal. The amount saved for each category was not available in the data. Because any reserved funds could potentially be tapped in a financial emergency it was important to control for these types of savings. Saving for an emergency is endogenous. These savings variables may have also helped account for some of the characteristics that determine whether or not a person would elect to save money, and therefore help to isolate any impacts of saving for an emergency or hardship.

Empirical Strategy

This study used several estimation strategies to examine the correlation between saving for an emergency and household hardship. This study estimated random and fixed effects regression models using a summed variable of total hardship and individual hardship indicators and as the dependent variables. Models were estimated with the original sample and then with a matched sample created via propensity score matching. An instrumental variable estimation was also conducted as an additional robustness check.

The independent variable of interest in all models was household report of saving for an emergency. Models with the total hardship outcome used generalized least-squares (GLS) regression in the panel data to estimate random effects and ordinary least-squares (OLS) regression with the fixed effects transformation to estimate fixed effects.Footnote 4 To account for the binary nature of the individual hardship variables, logit regression models were used for each of the hardship types (delayed prescription, skipped housing or utility payment, disconnected utility, disconnected phone, and food insecurity). The complete model for all estimations included basic demographic controls and a vector of additional saving controls. Dummy indicators for the imputed missing variables were included in the regression models (coefficients not shown).

Random Effects

The random effects equation (Eq. 1) estimates generalized least-squares (GLS) for total hardship and logit regression models of individual hardships Y it for household i in time t:

Y it indicates the hardship measure: the total number of economic hardships (zero to five) or individual hardship indicator the household i reported in t. \(D_{it}\) represents individual: age, gender, race, and education attainment; and household level characteristics: employment status, home ownership, income, debt, banked status, and having a credit card. \(S_{it}\)represents the saving behavior variables: saving for a home, saving for retirement, saving for a vehicle, saving for education, and another unspecified saving goal. \(E_{it}\)identifies if household i is saving for an emergency in t. The independent variables, \(D_{it}\), \(S_{it}\)and\(E_{it}\) are measured in t-1, the wave prior to the measure of hardships. \(\xi_{it}\)is the error term. The random effects estimates are reported in Models 1, 2, and 3 in Tables 2, 3, 4, and 5.

Fixed Effects

The fixed effects models were estimated as a strategy to account for unobserved time-invariant characteristics. The fixed effects models analyzed the impact of emergency saving on hardship outcomes among households that change emergency saving status over time. Because these models calculated estimates based on the changes in independent variables and hardship between waves, the emergency saving variable, control variables and the hardship outcomes were analyzed without a lag period.

The fixed effects equation (Eq. 2) estimates ordinary least-squares (OLS) with the fixed-effect transformation and fixed-effects logit (also referred to as conditional logit) regression models of individual hardships Y it for household i in time t:

Y it indicates the hardship measure: the total number of economic hardships (zero to five) or individual hardship indicator the household i reported in t. D it represents individual: age and education attainment, and household level characteristics: employment status, home ownership, income, debt, banked status, and having a credit card that change over time. The time invariant characteristics, gender and race, are omitted in the fixed effects estimation. S it represents the saving behavior variables: saving for a home, saving for retirement, saving for a vehicle, saving for education, and another unspecified saving goal. \(E_{it}\) identifies if household i is saving for an emergency in t. Unlike Eq. 1, the independent variables, \(D_{it}\), \(S_{it}\), and \(E_{it}\) are not lagged, estimates are generated from the within-household change in independent and dependent variables over time. \(\xi_{it}\) is the error term. The fixed effects estimates are reported in Model 4 of Tables 2, 3, 4, and 5.

Propensity Score Matching

Despite the many control variables included in the complete model there are likely still important differences between those saving for an emergency and those not emergency saving that are also correlated with hardship. Propensity score matching is one tool to reduce concerns about the observed differences between emergency savers and those not emergency saving. The propensity score matching technique approximated an experiment by creating treatment (saving for an emergency) and control (not saving for an emergency) groups that differed only in their emergency saving status, but otherwise had a similar distribution of all remaining observed covariates.

Propensity score matching with logit regression was used to generate a propensity score for each observation (Guo and Fraser 2010). Analysis was completed in Stata with psmatch2 (Leuven and Sianesi 2012). Emergency saving was estimated as a function of all the covariates in Table 1 using kernel matching which did achieve covariate balance (Guo and Fraser 2010; Morgan and Harding 2006). Kernel matching compares each treated observation with all untreated observations that are weighted according to their distance from the treated cases (Guo and Fraser 2010). Presented analysis used the Epanechnikov kernel with a bandwidth of 0.06 restricted to regions of common support trimmed at 5 %. Appendix Table 7 displays mean statistics for matched and unmatched samples. Matching was also conducted using the Gaussian and Uniform kernels (not shown) with very similar results.

As a robustness check of the main results, the regression models in Eqs. 1 and 2 were estimated with the matched sample following the same procedures as the unmatched sample. Results of analyses with the original sample, referred to as the unmatched sample, are displayed in Tables 2 and 3. Results of analyses with the matched sample are displayed in Tables 4 and 5.

Instrumental Variable Estimation

An instrumental variable estimation was conducted as an additional robustness check. Instrumental variable estimation can be used to help address concerns about omitted variable bias and dual causality. An instrumental variable uses an exogenous source of variation to predict the value of the independent variable of interest. To be valid, an instrumental variable must be correlated with the independent variable of interest and uncorrelated with other determinants of the dependent variable, in addition, the instrument can only affect the dependent variable through the first stage channel (Angrist and Pischke 2008). A plausible instrument in this study is the asset eligibility level for public welfare benefits. Asset limits for public benefits may discourage saving among low-income households (O’Brien 2008; Powers 1998; Sullivan 2006). Because states have some discretion for setting the asset limits there is variation across the sites and over time for the Making Connections survey locations. This study used welfare program (TANF: Temporary Assistance for Needy Families) asset eligibility limits by state and survey year as the instrument for emergency saving. The policy data were obtained from the Welfare Rules Databook, a product of the Urban Institute and the Administration for Children and Families, Office of Planning Research and Evaluation.

First stage results (not shown) suggested the asset limits were a weak instrument for emergency saving. The instrumental variable model was estimated with the limited-information maximum likelihood (LIML) estimator because it is better suited for weak instruments although it is less precise than other instrumental variable estimators and typically has larger standard errors (Angrist and Pischke 2008; Stock and Yogo 2005). The results were suggestive but cannot be used to make causal estimates. The instrumental variable results are presented in Appendix Table 8.

Results

Descriptive Statistics

Consistent with prior research, emergency saving was by far the most reported saving behavior (Carroll and Samwick 1997). Almost half (48 %) of the sample reported saving for an emergency while other saving motives were reported less frequently (retirement, 33 %; education, 16 %; home, 14 %; other unspecified, 15 %; and vehicle, 11 %). Sample means for the total number of hardships indicated that, on average, non-savers reported experiencing more overall hardship (1.1 hardships) than emergency savers (0.8 hardships) (Table 1). Non-emergency savers also reported significantly higher rates of skipping housing or utility bills, utility disconnection, phone disconnection, and food insecurity. Unsurprisingly, there was also evidence of relationships between the individual hardship indicators. Pairwise correlations between hardship types indicate positive relationships between each of the hardship types (Appendix Table 6).

Descriptive statistics of the independent variables indicated there were differences in demographic and financial characteristics between those who saved for an emergency and those who did not. Emergency savers were slightly younger than those not emergency saving, and a greater proportion of emergency saving households had a spouse present. There was not a significant difference between emergency savers and non-savers regarding the presence of children in the home. The emergency saving group had a higher proportion of non-Hispanic White respondents and a lower proportion of Hispanic respondents compared to the group of non-savers. There were not marked differences in the proportion of non-Hispanic Blacks or other races by emergency saving status. On average, emergency savers had higher education attainment and higher rates of employment. Savers also had higher levels of income and debt, as well as higher rates of home ownership. A greater proportion of savers had bank accounts and credit cards. The emergency saver group had much higher rates of saving for all other saving purposes: home, education, vehicle, retirement, and an unspecified saving purpose (see Appendix Table 6 for pairwise correlations of the savings variables). In fact, among those not saving for an emergency only 27 % reported saving for any purpose. It was important to adjust for these observed differences when estimating associations.

Regression Results

The random effects results for the unmatched sample are presented in Table 2. Model 1 is a bivariate regression with emergency saving status as the only independent variable, Model 2 adds the basic controls, and Model 3 includes the extended controls vector of savings variables. Coefficients are reported as the average marginal effects with Huber-White corrected robust standard errors. In Models 1, 2, and 3, the independent variables predicted hardship at the subsequent wave. In Model 1, saving for an emergency was associated with a reduction in hardship (−0.19, p < 0.001). Model 2 added basic control variables of individual and household characteristics. In this model, saving for an emergency, on average, was associated with a reduction in hardship similar to Model 1 (−0.16, p < 0.001). Model 3 included the vector of saving variables. With saving controls in the model, the association between emergency saving and reduced hardship diminished from Model 2 but persisted (−0.09, p < 0.05) and remained significant. This can be interpreted as a roughly 10 % decrease in total hardship given an average of one hardship among the non-emergency savers. Model 3, the full model, had an overall R-squared of 0.135 indicating the model explained about 14 % of the variance in number of hardships.Footnote 5

The final model in Table 2, Model 4, is a fixed effects analysis for households that change emergency saving status. The model included basic and extended controls except that time invariant covariates (respondent’s gender and race) were excluded. Fixed effect estimates also suggested that households had a reduction in total hardship (−0.23, p < 0.001) when observed as emergency savers than as non-savers. The effect in Model 4 was larger in magnitude than the OLS results.

Table 3 contains estimates of emergency saving and the likelihood of reported individual hardships with logit models in the unmatched sample. Like Table 2, Model 1 is unadjusted, Model 2 adds basic controls, Model 3 adds the extended saving controls, and Model 4 is household fixed effects. Coefficients for the logit models are reported with observed information matrix (OIM) corrected robust standard errors. Only coefficients for emergency saving are displayed (full tables available upon request). In Model 3, the complete model, results showed an association between emergency saving and a reduced likelihood of several hardship indicators: a skipped housing or utility payment (−0.26, p < 0.05), phone disconnection (−0.31, p < 0.05), and food insecurity (−0.28, p < 0.05). There were not significant associations between emergency saving and delaying filling a prescription or a utility disconnection, but the coefficients were all in the expected direction (negative).

Fixed effects models estimated the impact of emergency saving only among households that reported a change in emergency saving status from one survey wave to the next. Results in the fixed effect models were larger in magnitude and significant for four of five measured hardship indicators. Results suggest that households had a reduced likelihood of delaying getting a prescription filled (−0.36, p < 0.01); a skipped housing or utility bill (−0.55, p < 0.001); a utility disconnection (−0.59, p < 0.01); and food insecurity (−0.60, p < 0.001) when observed as emergency savers than as non-savers.

Because missing data was imputed for some control variables the analysis was also conducted using a complete case sample as a robustness check. Observations missing on any covariates in any wave were dropped (listwise deletion) for a final sample of n = 586 (33 % of the analysis sample), each observed in three periods. The coefficients for emergency saving predicting hardship in the complete case sample were similar in direction and magnitude to models using imputed data. Results are not shown but are available upon request.

The propensity score matching was employed to estimate emergency saving status by creating a matched sample that balanced emergency savers and non-savers on observed characteristics (Appendix Table 7). The same estimation strategy used with the original (unmatched) sample was repeated using the matched sample. Table 4 contains results of the random effects models for the matched sample. Overall, results from the matched sample were quite similar to results from the unmatched sample. However, in Model 3, the complete model, the association between emergency saving and reduced hardship, with p < 0.06, was no longer statistically significant at conventional levels. In Model 4, the fixed effect estimates were still a −0.23 (p < 0.001) decrease in hardship compared to non-emergency savers.

Table 5 contains estimates of emergency savings, and the likelihood of reporting individual hardships with logit models in the matched sample. Again, results from the matched sample were similar to results from the unmatched sample. In the complete model, Model 3, estimates suggested an association between emergency saving and a reduced likelihood of reporting several hardships: a skipped housing or utility payment (−0.26, p < 0.05), phone disconnection (−0.32, p < 0.05), and food insecurity (−0.28, p < 0.05). In the matched sample, the fixed effect estimates were larger in magnitude than the other models. There were significant associations with reduced likelihood of all five hardships indicators. The matched sample results provided some additional support for an existing, if small, association between saving for an emergency and reduced future hardship.

Results of the instrumental variable analysis are presented in Appendix Table 8. As noted previously, asset limits for public benefits was an imperfect instrument for emergency saving. However, the results were in the expected direction for all versions of the model, with emergency savings negatively correlated with total number of hardships. The results provide additional suggestive evidence but a more robust instrumental variable is needed to address concerns about dual causality and estimate any causal effects of emergency saving on hardship.

Discussion

Households saving for an emergency appear to be, on average, less likely to experience hardship over time than those not emergency saving among a sample drawn from disadvantaged neighborhoods. Small significant associations were found using a measure of total hardship and binary measures of several hardships, specifically skipping a housing or utility bill, having phone service disconnected, or reporting food insecurity. Fixed effects models indicated that a change in emergency saving status was associated with less reported hardship across four of five measured hardship indicators.

Saving for an emergency appeared to have an effect on hardship distinct from other types of saving. Emergency savers may be better prepared to cope with economic shocks over time, as they are able to quickly tap the reserved funds to meet expenses. The economic hardships measured here can have real impacts on family wellbeing. For example, the inability to obtain adequate food impacts health. Skipping housing and utility bill payments can function as a form of short-term credit, paying a fee for extra time. But this practice places a household at risk for eviction and utility service disruption and can also have negative impacts on credit history. Getting households to adopt and maintain an emergency savings habit may contribute to economic stability.

Results from this study should be interpreted in the context of several important limitations. Households electing to save for emergencies are likely different from non-savers in ways not measured in this study that could be impacting results. None the analyses in this study were able to fully overcome concerns about endogeneity and omitted variable bias. Propensity score matching provides a useful robustness check, but was not able to overcome concerns about unobserved characteristics. Fixed effects models can account for unobserved time-invariant characteristics, over time but cannot capture unobserved characteristics that change over time within respondent households. The instrumental variable estimation is somewhat suggestive but a stronger instrument is needed to predict emergency saving in order to estimate any causal effect of emergency savings on hardship. A more robust instrumental variable analysis could also address concerns about dual causality between emergency savings and household hardship.

Second, the Making Connections survey is a unique sample selected from areas of concentrated urban poverty for participation in a neighborhood strengthening initiative that invested additional resources in maintaining households with children in the sample. As a result of these characteristics, findings cannot be generalized to the national population of low-income households.

The inability to generalize from the Making Connections limits the ability to draw meaningful implications for the broader population of low-income households. However, this study, specific to emergency saving, highlights several avenues for future inquiry. Future work should test saving for an emergency in nationally representative samples and use empirical methods with the capacity to estimate the causal effects of emergency saving on hardship. Because money is fungible and savings for different purposes may be held together, there is a need for greater understanding of whether mental accounting or labeling of emergency savings is distinct from saving for other purposes. It will also be important to explore how behavioral characteristics such as financial management influence emergency savings and hardship (Gundersen and Garasky 2012). Finally, future research is needed to examine any impacts of emergency saving on family wellbeing beyond hardship outcomes. Essentially, does emergency saving have the capacity to influence wellbeing outcomes like financial stress, health, mental health, parenting, or child development?

Conclusion

Households may prepare for a financial emergency by setting aside funds, but saving is difficult for families with limited income and many are not able to save for an emergency. This paper explored whether saving for an emergency contributed to household hardship outcomes over time in the Annie E. Casey Foundation’s Making Connections dataset. Results suggest there was a modest association between saving for an emergency and experiencing fewer hardships in future years. The results of this study are consistent with prior research on financial assets and the experience of hardship although it used an alternative measure of emergency savings, self-reported saving behavior, instead of an accounting of financial assets. The sample selection and measurement of emergency saving in the Making Connections data prevent a direct comparison to research with large national samples. However, the common finding is suggestive evidence that reported saving for an emergency affords protection against hardship similar to what has been found with more mechanical measures of financial assets. The study contributes to the existing literature using several estimation strategies that attempt to isolate the affect of emergency savings on hardship looking at change over time in sample of low-income households.

Results of this study have implications for savings programs. The majority of existing programs in the US that promote saving among low-income households emphasize saving for home ownership, post-secondary education and small business development. Such programs often offer matched dollars for saving deposits. Program participants who withdraw funds for other purposes typically forfeit matched dollars or other program benefits. Results of this study suggest that emergency saving can also positively impact household functioning. While longer-term asset development is a laudable goal, low-income families also need funds to cope with income and expense shocks. Savings programs for longer-term asset development could benefit from mechanisms that allow participants to draw on their savings for an emergency but still remain in the program or remain eligible for a portion of the matched dollars. Programs or policy innovations that encourage low-income households to develop an emergency saving behavior or encourage families to save specifically for financial emergencies and allow them to draw on those savings when needed may have particular merit.

Notes

The Making Connections project included a total of ten sites; however, three sites were excluded from this analysis because there was not a third wave of data collection. The excluded site cities were Hartford, Connecticut; Milwaukee, Wisconsin; and Oakland, California.

A measure of whether an item had been repossessed due to non-payment was not used in this analysis because that variable was only collected Wave 1 and Wave 2 of the Making Connections survey.

The term Black represents respondents who identified as Black and respondents who identified as African American.

Random and fixed-effect models were also estimated with a Poisson regression that accounts for the count nature of the total hardship dependent variable. Results for the Piosion regression closely resemble the presented coefficients. Tables are not shown but available upon request.

The mean variance inflation factor (VIF) for the complete model was 3.83 suggesting multicollinearity among the independent variables did not pose a significant problem.

References

Abbi, S. (2012). A need for product innovation to help LMI consumers manage financial emergencies. D2D Fund. Retrieved from http://www.d2dfund.org/publications/needforproductinnovation.

Angrist, J. D., & Pischke, J. S. (2008). Mostly harmless econometrics: An empiricist’s companion. Chichester: Princeton University Press.

Babiarz, P., & Robb, C. A. (2014). Financial literacy and emergency saving. Journal of Family and Economic Issues, 35(1), 40–50. doi:10.1007/s10834-013-9369-9.

Bernheim, B. D., Garrett, D. M., & Maki, D. M. (2001). Education and saving: The long-term effects of high school financial curriculum mandates. Journal of Public Economics, 80(3), 435–465. doi:10.1016/S0047-2727(00)00120-1.

Beverly, S. G., & Sherraden, M. (1999). Institutional determinants of saving: Implications for low-income households and public policy. The Journal of Socio-Economics, 28(4), 457–473. doi:10.1016/S1053-5357(99)00046-3.

Beverly, S., Sherraden, M., Cramer, R., Williams Shanks, T., Nam, Y., & Zhan, M. (2008). Determinants of asset holdings. In S. McKernan & M. Sherraden (Eds.), Asset building and low-income families (pp. 89–151). Washington DC: The Urban Institute Press.

Bianchi, N., & Levy, R. (2013). Know your borrower: The four need cases of small-dollar credit consumers. Center for Financial Services Innovation. Retrieved from http://www.cfsinnovation.com/CFSI_KnowYourBorrower.pdf.

Blank, R. M., & Barr, M. S. (Eds.). (2009). Insufficient funds: Savings, assets, credit, and banking among low-income households. New York: Russell Sage Foundation.

Brandolini, A., Magri, S., & Smeeding, T. M. (2010). Asset-based measurement of poverty. Journal of Policy Analysis and Management, 29(2), 267–284. doi:10.1002/pam.20491.

Brobeck, S. (2008). The essential role of banks and credit unions in facilitating lower-income household saving for emergencies. Consumer Federation of America. Retrieved from http://www.consumerfed.org/elements/www.consumerfed.org/file/Essential_Role_of_Banks_June_2008.pdf.

Carroll, C. D., & Samwick, A. A. (1997). The nature of precautionary wealth. Journal of Monetary Economics, 40(1), 41–71. doi:10.1016/S0304-3932(97)00036-6.

Caskey, J. P. (1997). Beyond cash-and-carry: Financial savings, financial services, and low income households in two communities. Consumer Federation of America. Retrieved from http://www.swarthmore.edu/Documents/academics/economics/beyond_cash_and_carry.pdf.

Chang, Y., Chatterjee, S., & Kim, J. (2013). Household finance and food insecurity. Journal of Family and Economic Issues, 1–17. doi:10.1007/s10834-013-9382-z.

Conger, R. D., Wallace, L. E., Sun, Y., Simons, R. L., McLoyd, V. C., & Brody, G. H. (2002). Economic pressure in African American families: A replication and extension of the family stress model. Developmental Psychology, 38(2), 179–193.

Danziger, S., Corcoran, M., Danziger, S., & Heflin, C. M. (2000). Work, income, and material hardship after welfare reform. Journal of Consumer Affairs, 34(1), 6–30.

DeVaney, S. A. (1995). Emergency fund adequacy among US households in 1977 and 1989. Consumer Interests Annual, 41, 222–223.

Dew, J. (2007). Two sides of the same coin? The differing roles of assets and consumer debt in marriage. Journal of Family and Economic Issues, 28(1), 89–104. doi:10.1007/s10834-006-9051-6.

Dew, J., & Xiao, J. J. (2011). The financial management behavior scale: Development and validation. Journal of Financial Counseling & Planning, 22(1), 43–59. Retrieved from https://afcpe.org/assets/pdf/vol_22_issue_1_dew_xiao.pdf.

Elder, G. H., Conger, R. D., Foster, E. M., & Ardelt, M. (1992). Families under economic pressure. Journal of Family Issues, 13(1), 5–37.

Garasky, S., Stewart, S. D., Gundersen, C., Lohman, B. J., & Eisenmann, J. C. (2009). Family stressors and child obesity. Social Science Research, 38(4), 755–766. doi:10.1016/j.ssresearch.2009.06.002.

Gershoff, E. T., Aber, J. L., Raver, C. C., & Lennon, M. C. (2007). Income is not enough: Incorporating material hardship into models of income associations with parenting and child development. Child Development, 78(1), 70–95. doi:10.1111/j.1467-8624.2007.00986.x.

Gornick, J. C., Sierminska, E., & Smeeding, T. M. (2009). The income and wealth packages of older women in cross-national perspective. The Journals of Gerontology Series B, 64(3), 402–414. doi:10.1093/geronb/gbn045.

Greninger, S. A., Hampton, V. L., Kitt, K. A., & Achacoso, J. A. (1996). Ratios and benchmarks for measuring the financial well-being of families and individuals. Financial Services Review, 5(1), 57–70. doi:10.1016/S1057-0810(96)90027-X.

Gundersen, C. G., & Garasky, S. B. (2012). Financial management skills are associated with food insecurity in a sample of households with children in the United States. The Journal of Nutrition, 142(10), 1865–1870. doi:10.3945/jn.112.162214.

Gundersen, C., Mahatmya, D., Garasky, S., & Lohman, B. (2011). Linking psychosocial stressors and childhood obesity. Obesity Reviews, 12(5), e54–e63. doi:10.1111/j.1467-789X.2010.00813.x.

Guo, S., & Fraser, M. W. (2010). Propensity score analysis. Statistical methods and applications. London: Sage Publications.

Haveman, R., & Wolff, E. N. (2005). The concept and measurement of asset poverty: Levels, trends and composition for the US, 1983–2001. The Journal of Economic Inequality, 2(2), 145–169. doi:10.1007/s10888-005-4387-y.

Hayes, C. (2005). Economic hardship: In making connection neighborhoods. The Urban Institute. Retrieved from http://mcstudy.norc.org/publications/files/Economic%20hardship%20in%20MC%20neighborhoods%2008-2005.pdf.

Hilgert, M. A., & Hogarth, J. M. (2003). Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin. Retrieved from http://www.federalreserve.gov/pubs/bulletin/2003/0703lead.pdf.

Hogarth, J. M., Anguelov, C. E., & Lee, J. (2003). Can the poor save? Journal of Financial Counseling and Planning, 14(1), 1–18. Retrieved from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2265627.

Kainz, K., Willoughby, M. T., Vernon-Feagans, L., & Burchinal, M. R. (2012). Modeling family economic conditions and young children’s development in rural United States: Implications for poverty research. Journal of Family and Economic Issues, 33(4), 410–420. doi:10.1007/s10834-012-9287-2.

Key, C. (2014). The finances of typical households after the Great Recession. In R. Cramer & T. R. Williams Shanks (Eds.), The Assets Perspective (pp. 33–66). New York: Palgrave Macmillian.

Klawitter, M. M., Anderson, C. L., & Gugerty, M. K. (2013). Savings and personal discount rates in a matched savings program for low-income families. Contemporary Economic Policy, 31(3), 468–485. doi:10.1007/s10834-012-9287-2.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. The Quarterly Journal of Economics, 112(2), 443–478. doi:10.1162/003355397555253.

Leuven, E., & Sianesi, B. (2012). PSMATCH2: Stata module to perform full Mahalanobis and propensity score matching, common support graphing, and covariate imbalance testing. Statistical Software Components.

Lusardi, A. (2008). Household saving behavior: The role of financial literacy, information, and financial education programs (No. w13824). National Bureau of Economic Research. Retrieved from http://www.nber.org/papers/w13824..

Lusardi, A., Schneider, D. J., & Tufano, P. (2011). Financially fragile households: Evidence and implications (No. w17072). National Bureau of Economic Research. Retrieved from http://www.nber.org/papers/w17072.

Mayer, S. E., & Jencks, C. (1989). Poverty and the distribution of material hardship. Journal of Human Resources, 24(1), 88–114. doi:10.2307/145934.

McKernan, S. M., Ratcliffe, C., & Vinopal, K. (2009). Do assets help families cope with adverse events? The Urban Institute. Retrieved from http://www.urban.org/UploadedPDF/411994_help_family_cope.pdf?RSSFeed=UI_PovertyandSafetyNet.xml.

Mills, G., & Amick, J. (2010). Can savings help overcome income instability? The Urban Institute. Retrieved from http://www.urban.org/UploadedPDF/412290-savings-overcome-income-instability.pdf.

Mills, G., Gale, W. G., Patterson, R., Engelhardt, G. V., Eriksen, M. D., & Apostolov, E. (2008). Effects of individual development accounts on asset purchases and saving behavior: Evidence from a controlled experiment. Journal of Public Economics, 92(5), 1509–1530. doi:10.1016/j.jpubeco.2007.09.014.

Morgan, S. L., & Harding, D. J. (2006). Matching estimators of causal effects prospects and pitfalls in theory and practice. Sociological Methods & Research, 35(1), 3–60. doi:10.1177/0049124106289164.

O’Brien, R. (2008). Ineligible to save? Asset limits and the saving behavior of welfare recipients. Journal of Community Practice, 16(2), 183–199. doi:10.1080/10705420801998003.

Page-Adams, D., & Scanlon, E. (2001). Research background paper: Assets, health, and well-being: Neighborhoods, families, children, and youth. Center for Social Development, Washington University in St. Louis. Retrieved from http://csd.wustl.edu/Publications/Documents/85.AssetsHealthAndWellBeing.pdf.

Painter, M. A, I. I., & Vespa, J. (2012). The role of cohabitation in asset and debt accumulation during marriage. Journal of Family and Economic Issues, 33(4), 491–506. doi:10.1007/s10834-012-9310-7.

Payne, S. H., Yorgason, J. B., & Dew, J. P. (2014). Spending today or saving for tomorrow: The influence of family financial socialization on financial preparation for retirement. Journal of Family and Economic Issues, 35, 106–118. doi:10.1007/s10834-013-9363-2.

Powers, E. T. (1998). Does means-testing welfare discourage saving? Evidence from a change in AFDC policy in the United States. Journal of Public Economics, 68(1), 33–53.

Schreiner, M., & Sherraden, M. W. (2007). Can the poor save?: Saving & asset building in individual development accounts. Piscataway: Transaction Publishers.

Shah, A. K., Mullainathan, S., & Shafir, E. (2012). Some consequences of having too little. Science, 338(6107), 682–685. doi:10.1126/science.1222426.

Shanks, T. R. W. (2007). The impacts of household wealth on child development. Journal of Poverty, 11(2), 93–116. doi:10.1300/J134v11n02_05.

Shapiro, T. M., & Wolff, E. N. (Eds.). (2001). Assets for the Poor: The benefits of spreading asset ownership. New York: Russell Sage Foundation.

Sherraden, M., & Barr, M. (2005). Institutions and inclusion in saving policy. In N. Retsinas & E. Belsky (Eds.), Building assets, building wealth: Creating wealth in low-income communities (pp. 286–315). Washington DC: Brookings Press.

Stock, J. H., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. In D. W. K. Andrews & J. H. Stock (Eds.), Identification and inference for econometric models: Essays in honor of Thomas Rothenberg, 1. Cambridge: Cambridge University Press.

Sullivan, J. X. (2006). Welfare reform, saving, and vehicle ownership do asset limits and vehicle exemptions matter? Journal of Human Resources, 41(1), 72–105.

Sullivan, J. X., Turner, L., & Danziger, S. (2008). The relationship between income and material hardship. Journal of Policy Analysis and Management, 27(1), 63–81. doi:10.1002/pam.20307.

Sunstein, C. R., & Thaler, R. (2008). Nudge: Improving decisions about health, wealth, and happiness. New Haven: Yale University Press.

Yoo, J. P., Slack, K. S., & Holl, J. L. (2009). Material hardship and the physical health of school-aged children in low-income households. American Journal of Public Health, 99(5), 829. doi:10.2105/AJPH.2007.119776.

Zagorsky, J. L. (2013). Do people save or spend their inheritances? Understanding what happens to inherited wealth. Journal of Family and Economic Issues, 34(1), 64–76. doi:10.1007/s10834-012-9299-y.

Acknowledgments

I am grateful to Lawrence Berger, J. Michael Collins, Ted Gerber, Erik Hembre, and members of the Household Finance Scholars at the University of Wisconsin-Madison for helpful discussions and feedback, and to the anonymous reviewers for their thoughtful comments. The staff at the NORC which houses the Making Connections data provided excellent technical support. All remaining errors are my own.

Conflicts of interest

None.

Ethical Standards

This manuscript contains secondary data analysis of survey data collected by the NORC at the University of Chicago. The survey research was overseen and approved by the NORC’s Institutional Review Board.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Gjertson, L. Emergency Saving and Household Hardship. J Fam Econ Iss 37, 1–17 (2016). https://doi.org/10.1007/s10834-014-9434-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-014-9434-z