Abstract

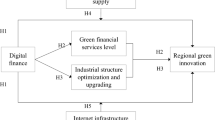

Based on the panel data of 284 prefecture-level cities in China, this paper uses the dynamic spatial Durbin model to explore the impact of digital finance on green innovation from the dimensions of “quantity” and “quality.” The results show that digital finance has a positive impact on both the quality and quantity of green innovation in local cities, but the development of digital finance in neighboring cities has a negative impact on the quantity and quality of green innovation in local cities, and the impact on the quality of green innovation is greater than that on the quantity of green innovation. And after a series of robustness tests, it was shown that the above conclusions are robust. In addition, digital finance can have a positive impact on green innovation mainly through industrial structure upgrading and informatization level. Heterogeneity analysis shows that the breadth of coverage and the degree of digitization are significantly related to green innovation, and digital finance has a more significant positive impact in eastern cities than in mid-western cities.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

At present, green innovation not only accelerates the progress of ecological civilization but also is an important path to high-quality development and has also become a new station for the global new scientific and technological revolution (Dong et al. 2018; Wu et al. 2020). How to promote green technology innovation is an important proposition in academia. Compared to traditional innovation, green innovation requires higher technical standards, higher financing costs, and higher risk bearing (Doran and Ryan 2012), so the threshold standard for achieving green innovation is very high, it is difficult to succeed by relying solely on innovative individuals, and more financial support from outside the main body is needed (Bai et al. 2019). However, traditional finance is limited by space and time constraints, making it difficult for enterprises to finance (Gomber et al. 2018). On the other hand, the information asymmetry of traditional finance is prominent, the contradiction between supply and demand is difficult to alleviate, and the degree of inclusiveness is low, so it is difficult for traditional finance to provide accurate and sufficient financial support (Bharath et al. 2020).

Digital technical means help promote the geographical coverage and depth of inclusive finance (Demertzis et al. 2018). As a new financial technology, it has high efficiency and wide coverage. Digital finance offers many opportunities to address the funding gap for corporate green innovation (Zulfiqar and Thapa 2018). It uses internet technology to break the barriers of time and space and reduce the threshold of accessing financial services. This, in turn, reduces the cost of financial services and improves efficiency (Corrado and Corrado 2017), thereby providing important support for green innovation. Meanwhile, digital finance alleviates the degree of information asymmetry, which can accurately match the flow of funds and capital needs, decrease the probability of resource mismatch (Norden et al. 2014), and reduce innovation costs. Digital finance can contribute to the low-carbon energy transition by strengthening financial regulation, bridging the digital access divide, and optimizing the availability of finance (Li et al. 2023). Digital finance can contribute to sustainable urban development by reducing carbon emissions through technological innovation and improving the energy mix (Sun et al. 2023). From a more micro perspective, digital finance can drive green growth by facilitating the digital transformation of businesses (Razzaq and Yang 2023). It is necessary to research the implications of digital finance for green innovation and the mechanism between the two, which is of great significance for realizing the comprehensive transformation of the economy and accelerating the construction of an innovative country (Reardon 2007).

At present, more literature only pays attention to the quantitative aspects (Wang et al. 2022c; Sun et al. 2022; Zhang and Ma 2021; He et al. 2021; Wang et al. 2023a) and fails to discuss from both the aspects of quantity and quality, and high-quality development is not only to improve the quantity but also to make a big leap in quality, so this paper also pays attention to the increase in quantity and the improvement of quality. There is a great difference between the categories of green patents and granted or not. Therefore, this paper distinguishes the quantity and quality according to the characteristics of green patents based on previous studies. According to the current literature, many studies focus only on the development of digital finance in local cities (Cao et al. 2021; Feng et al. 2022; Liu et al. 2022; Ma et al. 2022a, b; Liu and Chen 2022; Ren et al. 2023b); however, according to Tobler’s First Law, anything correlates closely with other things, but the relationship between near and far is stronger than that of distant things (Tobler 2004; Ma et al. 2022a, b; Rao et al. 2022). The characteristics of open sharing of big data indicate that digital finance must have the characteristics of economic externality. Therefore, when one subject uses digital finance for economic activities, other subjects will also benefit or lose. This impact is also called the spillover effect. Digital finance in one region always affects green innovation activities in another region, so it is inappropriate to ignore spatial spillovers when assessing the effects of digital finance policies (Ying 2003; Wang et al. 2022; Wang et al. 2023b). Therefore, it is inevitable that there will be errors in isolated research on cities, but this paper fully considers the spatial correlation that exists between cities, uses spatial measurement methods to conduct more accurate research on the relationship between the two, and explores the local-neighborhood effect.

By summarizing the previous literature, digital finance can have an impact in terms of financing costs, productivity, and information advantages. This paper finds that the distinction between the quantity and quality in terms of the characteristics of green patent applications and grants needs further reflection. Most of the literature tends to ignore the spatial spillover effect when examining the impact of digital finance leading to errors in the assessment of its impact. Therefore, the main purpose is to further explore the impact of digital finance on green innovation from both quantitative and qualitative perspectives and to investigate whether spatial spillover effects exist between cities.

Therefore, we employ the dynamic spatial Durbin model (DSDM). The main marginal contributions are as follows: first, breaking through the limitations of existing research focusing on the quantitative dimension of green innovation. Unlike previous literature that uses a single indicator to measure green technology innovation per se, this paper makes a quantitative and qualitative distinction between green innovations. This paper puts digital finance endogenously in a green innovation research framework, which expands and deepens the literature in the field of green innovation influencing factors; second, different from previous studies that were limited to the local green innovation effect of digital finance, this paper innovatively starts from the “local-neighborhood” linkage perspective. For the sake of verifying the spatial spillover effect, this paper establishes a dynamic spatial Durbin model. Third, from the perspective of industrial structure, information level, and resource allocation, this paper deduces the internal logic of digital finance affecting green innovation and empirically tests the causal relationship and mechanism of action between the two, which provides policy focus for promoting the progress of digital finance.

The remaining chapters are organized as follows: the “Literature review” section has carried on the literature review, the introduction of the “Theoretical mechanism and hypothesis” section has carried on the theoretical mechanism and put forward theoretical hypotheses, the “Methodology and data” section describes empirical methods and data sources, the empirical results are discussed in the “Empirical results and discussions” and “Analysis of mediation effects” sections, and the “Conclusion and policy implications” section is conclusion and suggestions.

Literature review

Most of the current literature explores the factors affecting green innovation from the viewpoint of the development of financial technology, the effect of environmental regulation, government subsidies, and the development of financial and internet technologies. The improvement of financial service efficiency can reduce the cost (Chen and Peng 2021; Ding et al. 2021; Chen 2020; Lin and Ma 2022), thereby accelerating the speed of green innovation. The development of financial technology can effectively reduce financial friction (Cai 2022), promote the efficiency of information transmission (Sorin et al. 2021; Jia and Wang 2020), and then improve the efficiency of the transformation of green results (Söderlund and Tingvall 2016). In the “regulation” effect, the additional costs caused by environmental regulations will lead to an increase in the cost of enterprises (Dou et al. 2022; Qiao et al. 2022; Cheng and Li 2022), so enterprises have to seek energy-saving and emission-reduction measures (Zhang et al. 2022b; Li and Du 2022). Through the development of green technology research and development, green innovation can obtain an innovation compensation effect (Xie et al. 2021; Fan et al. 2021; Horbach 2008). As a key entity affecting green innovation, government R&D subsidies can bring non-operating income to enterprises (Yang et al. 2021; Fu et al. 2022; Sun et al. 2022; Ren et al. 2023c), thereby reducing the cost of enterprises’ green innovation, and government R&D subsidies can have a “leverage effect” (Bai et al. 2019; Wang et al. 2022b). As an effective way to disseminate information and knowledge (Fang 2022; Guo et al. 2022), internet technology has improved the impact of R&D efficiency from three aspects: collection, communication, and absorption capacity (Viktor 2022; Abderahman et al. 2022). This confirms that the internet can improve a company’s capacity for green innovation (Kafouros 2006; Chetna et al. 2022; Xu et al. 2022).

The positive effects are manifested in several ways. Insufficient corporate credit funds limit enterprises’ R&D investment and reduce their willingness to innovate green (Li and Shen 2022; Zhang et al. 2022c), while digital finance can alleviate corporate financing constraints (Yi et al. 2019; Yu et al. 2022; Ozili 2017; Karaivanov 2011). Modern financial development has an impact on corporate innovation. We know that digital finance can encourage scientific and technological innovation from many studies (Helen et al. 2021; Kristin and Peter 2020; Wang 2018), and the digital economy is an important aid to regional green innovation and development (Demertzis et al. 2018; Zhao and He 2022). Digital finance mainly relies on big data, cloud computing, and other technological means (Alabbasi 2020; Zhao and He 2022). Financial products are rapidly derived, and the supply and demand of funds are accurately matched (Xia et al. 2022; Wu and Huang 2022; Jeanneney and Kpodar 2011), meet the needs of personalized financing, and become a powerful boost for enterprise green innovation (Kapoor 2014; Li 2021). Based on Huang et al. digital finance can obtain more financial and non-financial information (Huang and Li 2015; Oh and Kwon 2020), thereby alleviating the problem of information asymmetry and encouraging enterprises to elevate their ability (Ma et al. 2021; Liu and Chen 2022).

Related studies are mostly limited to the regional and enterprise level (Rao et al. 2022); however, many articles show that green innovation has an obvious spatial spillover effect and agglomeration effect (Yang and Liu 2020; Zhao and Li 2022; Lu et al. 2022). Economic geography is one of the most striking features of the real economy (Zahed and Hashem 2020), where digital financial activities have external spillover effects that affect other entities, organizations, or societies differently (Truffer and Coenen 2012; Zhu et al. 2022; Shen et al. 2021; Ren et al. 2023a). This has a variety of learning effects. Studies have shown that Fintech development can optimize the allocation of local resources (Gilles 1992), thereby improving the factor structure of the financial system in neighboring areas so that it can drive green innovation in surrounding areas (Tian et al. 2017). However, it may also have a siphon effect, hindering green innovation in neighboring areas (Su et al. 2021; Feng and Zhang 2022). As a kind of financial technology, digital finance has reduced the limitations of the geographical structure in promoting green innovation and development (Bernhard 2022), thus showing a strong geospatial spillover effect (Krugman 1991; Ewers 2018). This strong diffusion effect accelerates the imitation effect in local competition (Li 2022). Therefore, it is inappropriate to limit the effect to a region, and the mechanism of space spillover should be studied.

Through the combing of the literature, this paper finds that previous literature rarely takes the existence of spatial overflow into account, so the corresponding discussion and analysis are incomplete. We use the dynamic space Durbin model to probe the local-neighborhood effect. In terms of green innovation indicators, most of the literature only studies quantitative growth from a single perspective. However, this paper considers the prospect of quality development by incorporating quality of green innovation into the framework. The research perspective is more complete.

Theoretical mechanism and hypothesis

Theoretical mechanism

Endogenous economic growth theory is used to explore three intermediary variables (Wang et al. 2022a): industrial structure upgrading, information level, and optimal allocation of resources. We can obtain the following form of production: Y(t) = F[K(t), A(t)L(t)] (Solow 1956).

We have also extended the production function by combining variables such as digital financial inclusion (Lnindex), industrial structure (Indus), economic development level (Lngdp), number of scientific and technological employees (Lnsciemploy), population density (Lnpop), and financial development level (Findev):

Suppose Equation (1) is the Cobb–Douglas form with constant scale returns (Zhao et al. 2020). Combined with the theory in this paper, we set up the following equation:

where σ + τ + υ + ω + ι + κ+ ζ, + η = 1, 0 < σ, τ, υ, ω, ι, κ, ζ, η < 1.

The capital depreciation rate is δ; then the change of capital can be represented as

The growth rates of labor and knowledge remain unchanged, that is:

Among them, Y is the total output, K is the total capital input, and L is the labor input. A ∙ L indicates an effective workforce, Lnindex represents digital finance, Indus represents industrial structure upgrading, Lngdp represents economic growth, Lnsciemploy represents the number of tech workers, Lnpop represents population density, and Findev represents the level of financial development.

Supposing that \(y=\frac{Y}{AL},k=\frac{K}{AL}, lnindex=\frac{Lnindex}{AL}, indus=\frac{Indus}{AL}, lngdp=\frac{Lngdp}{AL}, lnsciemploy=\frac{Lnsciemploy}{AL}, lnpop=\frac{Lnpop}{AL},\mathrm{and}\ findev=\frac{Findev}{AL}\), then Equation (2) can be written as

Assume that k = K/AL, meaning

Hence, Equation (6) can be indicated as follows:

Suppose \(\dot{k}=0\), so that

Then further calculate and simplify

Equation (9) can be further rewritten and simplified as follows:

Supposing \(f\left(k, lnindex, indus\right)=\frac{\left(\delta +g+n\right)\hbox{--} s\sigma {k}^{\sigma -1}{lnindex}^{\upsilon }\ {indus}^{\omega }{lngdp}^{\iota }{lnsciemploy}^{\kappa }{lnpop}^{\zeta }{findev}^{\eta }}{s\omega {k}^{\sigma }{lnindex}^{\upsilon }{indus}^{\omega -1}{lngdp}^{\iota }\ {lnsciemploy}^{\kappa }{lnpop}^{\zeta }{findev}^{\eta }}\)and \(g\left(k, lnindex, indus\right)=\frac{\ s\upsilon {k}^{\sigma }{lnindex}^{\upsilon -1}\ {indus}^{\omega }{lngdp}^{\iota }{lnsciemploy}^{\kappa }{lnpop}^{\zeta }{findev}^{\eta }-1}{s\omega {k}^{\sigma }{lnindex}^{\upsilon }{indus}^{\omega -1}{lngdp}^{\iota }\ {lnsciemploy}^{\kappa }{lnpop}^{\zeta }{findev}^{\eta }}\), then Equation (10) can be further expressed as

According to Equation (11), digital financial inclusion includes the size of f (k, lnindex, indus), g (k, lnindex, indus), and\(\frac{\partial k}{\partial lnindex}\). It is known that digital finance will effectively affect industrial structure upgrading.

Suppose there is an open economy with two sectors and that there is a free exchange between sectors. Both sectors are engaged in green innovation and are represented by C1 and C2 (Wang et al. 2022a). The expression is

C1[Lnindex, ΦIndus(Lnindex)], C2[Lnindex, (1 − ΦIndus(Lnindex)].

It is worth noting that Φ indicates the share of the tertiary industry output value of one sector in the output value of the secondary industry and (1−Φ) indicates the share of another sector.

Supposing C = C1/C2 and in both sides of the deduction of Indus, the following formula is obtained, indicating that the upgrading of industrial structure may have some influence on green innovation:

We can direct both sides of the equation to Lnindex:

Drag Equation (12) combined with Equation (13), and the following equation can be obtained:

From the equations, we can find \(\frac{C_{11}{C}_2-{C}_1{C}_{21}}{C_2^2}\) and \(\frac{\partial C}{\partial \mathrm{Indus}\left(\mathrm{Lnindex}\right)}\frac{\partial \mathrm{Indus}\left(\mathrm{Lnindex}\right)}{\partial \mathrm{Lnindex}}\). Each represents the direct and indirect impact. After that, the industrial structure of the equation is replaced by the level of informatization and the intensity of scientific and technological expenditures. Through the same calculation process, we obtained the following two formulas:

Lninternet stands for the level of informatization, Scitec stands for optimal allocation of resources, and from Equation (15) and Equation (16), we can find that the optimal allocation of informatization and individual resources can be an intermediary variable.

Theoretical hypotheses

Digital finance may have a direct impact on the level of green innovation in the following ways. First, digital finance has expanded financial coverage, facilitated financial services and enriched financial products, which is conducive to alleviating the challenges faced by some companies, and has greatly promoted the advancement of green innovation (Brown et al. 2009). As the service distance of traditional bank outlets is limited to local cities, the cost of collecting and processing borrowers’ information by banks increases, and the problem of information asymmetry becomes more serious (Jiménez et al. 2008). Digital finance is conducive to solving this information asymmetry. It is beneficial to optimize resource allocation and thus drive the output of green innovation. Second, digital finance has brought about the subversive innovation of traditional finance, including business model innovation, financial product innovation, and financial service innovation. Ultimately, it promoted the service quality of the financial industry (Beck et al. 2016), thereby improving the efficiency of the financial industry as a whole and improving the efficiency and growth rate in the service entity industry. Through the above analysis, we put forward the first hypothesis:

-

Hypothesis 1: Digital finance has a positive impact on the quantity and quality of green innovation.

Digital finance may influence green innovation through three intermediary channels. First, digital means can be seen everywhere to promote the evolution of product forms and changes in industrial ecology. The digital information-sharing platform created by digital finance has also stimulated the dissemination of technical knowledge (Ngai and Pissarides, 2007). To obtain a dominant position, enterprises further promote the reduction of costs in the industry, embarking on the road of industrial structure advancement while achieving the purpose of resource conservation and environmental protection. Digital finance uses the internet to integrate digital technology and traditional financial industry (Bruhn and Love 2014), establishes an evaluation system for various projects, and pays more attention to emerging projects with innovative potential and green effects (Rin and Hellmann 2002). Digital finance can reduce the service threshold and service cost, effectively alleviate the problem of financing constraints, continuously improve financing efficiency, and provide backup support for industrial upgrading (Du et al. 2020). The traditional assessment method of the financial sector makes it impossible for enterprises in the rising period to obtain more financial support. Relying on digital financial platforms, the information asymmetry between supply and demand can be solved. It can accurately arrange the flow of funds and then achieve industrial transformation and upgrading (Beck et al. 2002). Differentiated digital financial products and services can drive consumption upgrading (Li et al. 2020), which in turn forces enterprises to innovate in green technology, improve the industrial development model with high energy consumption and low efficiency, and further promote industrial upgrading. Digital finance has satisfied the needs of the “long tail group” in financial markets and thus provided a continuous supply of funds for industrial structure optimization (Demertzis et al. 2018).

Second, the improvement of the informatization level promotes the widespread use of new information technology (Acemoglu and Restrepo 2019). Another advantage of the level of informatization is that it can be accurately controlled and integrated so that various industries can intelligently optimize the layout (Chen and Zhang 2021). With the increase in digital finance application scenarios, the rapid development of new infrastructure has led to an increase in the supply and demand of information technology services, enhanced the degree of support for infrastructure, and enhanced the foundation for green innovation (Ji et al. 2021). To maximize the role of digital finance, we must first build a green and efficient data center, strengthen energy consumption data detection and management, provide underlying basic support for various financial scenarios, and accelerate the pace of technology application, thereby promoting green innovation (Song et al. 2021b). Digital finance can drive the creation and improvement of financial technology facilities, which is applied to many financial service platforms, which can carry out real-time dynamic supervision and timely promotion, providing a real-time dynamic development guarantee (Eugenia and Michele 2022). Digital finance can help build a huge information network between regions, and the construction of information network infrastructure can effectively break the time and space constraints of information exchange and promote exchanges and cooperation among various regions. It also promotes the exchange and spillover of green technology innovation knowledge (Khuong 2011). Digital finance can overcome geographical obstacles by building network infrastructure, improving the extension capacity of inclusive finance, and providing quality services for green innovation (Zheng 2020).

Green innovation activities need to be carried out with a large number of funds, and digital finance can have a full understanding of the internal situation of enterprises through the accurate control of big data, according to which the government, financial institutions, etc. can make reasonable assessments (Takalo and Tanayama 2010), and mobilize enthusiasm for social green innovation through the assistance of technology expenditures. Digital finance has disrupted the way traditional resources are allocated, promoting accurate matching and inclusiveness. Digital finance can mine massive amounts of data, accurately assess risks and benefits, and improve resource allocation efficiency by reducing information asymmetry (Gabor and Brooks 2017). This improves the efficiency of green innovation. The inclusive characteristics of digital finance have enabled financial institutions to provide more credit support for private enterprises (Yue et al. 2022). Digital finance has induced the “catfish effect” and “demonstration effect,” which have activated the vitality of green innovation industries. Thanks to the rapid development of digital financial technologies, resource allocation can directly capture capital needs through the internet economic platform. In terms of inclusiveness, digital finance gives more opportunities to small businesses, broadens the scope of resource allocation, and provided basic support for a wide range of green innovation (Restuccia and Rogerson 2008). The online financial service model has replaced the offline financial service model to a certain extent so that the improvement of the efficiency of resource allocation has improved the level of financial services. It provides a sound environment for green innovation (Wang and Ji 2022). This paper presents a second hypothesis.

-

Hypothesis 2: Digital finance can promote green innovation through industrial structure optimization, information-level construction, and resource allocation optimization.

Due to the geographical proximity of cities, cities within the same cluster are more likely to obtain new ideas and new ideas, and when a city is in an advantageous position in terms of digital finance, it is easy to imitate and learn from other cities (Beaudry and Breschi 2003), so that continuous green innovation can be formed within the cluster. Digital finance technology and green innovation can be maximized and disseminated (Zhang et al. 2022a). The migration of labor can effectively drive the spillover of knowledge of digital finance, which is the engine of sustained growth of local green innovation (Romer 1986), and the city, as a market of natural resources and factors flowing freely, can create more green wealth. Digital finance spillover is more active in the city (Henderson 1986), and it is easier to overflow knowledge in large cities. Its spillover effect is also more pronounced (Gao and Yuan 2022).

Local governments maintain a competitive advantage through green innovation (Zhao et al. 2021), and this competition can obtain more limited resources to drive green economic development. Government finance innovation is an important way to attract all kinds of resources related to green development (Li and Zhou 2005). To gain a competitive advantage in the “championship” of economics, local governments are motivated to develop digital finance, and this effect can spread rapidly in the region (He and Li, 2017). The scientific and technological output indicators in areas with high financial innovation efficiency often have a strong demonstration effect. To catch up with each other, other cities will bring digital financial policy imitations (Su et al. 2022). All of the above suggests that it is necessary to consider the role of spatial spillover when considering the corresponding effects. This leads to a third hypothesis:

Hypothesis 3: The impact of digital finance on green innovation has spatial spillover effects.

Methodology and data

Dynamic spatial Durbin metrology

Due to the significant spatial relevance of green innovation, green innovation is not only affected by local digital financial factors but is also affected by other cities. To investigate whether green innovation is dynamic and continuous, this paper introduces the time lag term of the explanatory variables in the model. According to Elhorst’s (2011) research, a dynamic space Durbin model was established. The general dynamic spatial Durbin model formula is as follows:

Spatial weight matrix

The calculation of spatial autocorrelation needs to rely on the setting of the spatial weight matrix. The setting form of spatial weights mainly includes the adjacency weight matrix, in which the principle is geographical proximity to the city, and the geographical distance weight matrix, which is based on the length of the distance between cities. There is also an economic distance weight matrix. It is calculated according to the differences in economic development levels between cities. How to choose the matrix is mainly to see the needs of the article. The variables in this paper are all related to the level of economic development of the city (Liu and Chen 2022), and the more similar the economic development level, the more economic connections there are, so the more it can show a strong spatial correlation, so we select the economic distance weight matrix for calculation (Shao et al. 2016), and the established weight matrix is usually expressed as follows:

where GDPi represents the average GDP per capita of a city from 2011 to 2019.

Data

Based on the data available in this paper, samples with serious missing data were removed to ensure that the data were reliable. Finally, we use the data of 284 cities from 2011 to 2019 for analysis, and the individual missing values are supplemented by interpolation.

This paper uses the Digital Financial Inclusion Index of the Digital Finance Research Center of Peking University to characterize digital finance (Wen et al. 2022; Pan et al. 2021). The agent index of the number of green innovations is the total number of applications for the number of green patents (Guo et al. 2021, b). Green invention patents are related to green utility model patents and green design patents, which have higher requirements for novelty and originality in patent reviews, and the review is more stringent. Authorized green invention patents refer to the examination of the State Intellectual Property Office. Its technology is in line with the authorization requirements of the patent. The authorized green invention patent is a valid patent, and there is no technical problem, so the quality of the patent that can be authorized is guaranteed.

Based on the existing literature, this paper selects some factors affecting green innovation, so the control variables include the economic situation, the number of scientific practitioners, population size, and the level of financial development. The agent index of the level of economic development is the logarithm of city’s per capita GDP (Zhang et al. 2021a). Scientific practitioners are the number of practitioners in the internet industry, and the scientific research industry is summed up and taken as a logarithm (Song et al. 2021a, b). Population size is mainly measured using the logarithm of the urban household registration population as an agent indicator (Wei et al. 2022), and the level of financial development is measured by the ratio of the sum of deposits and loans of financial institutions to the city’s GDP (Feng et al. 2021).

All green patent data refer to the practices of Dong and Wang (2021). Patent information at the city level is obtained by collecting patent information published by national IP offices and according to the green patent lists and international classification codes provided by the WIPO (Dong and Wang 2021). The data for the remaining variables are derived from the China Urban Statistical Yearbook, the annual statistical bulletin of each city, and the EPS data platform.

Table 1 shows the expression and measurement of the main variables in this paper. Table 2 shows the results of the descriptive statistics of various variables. The variance of the indicators of green innovation quantity and quality is large, indicating that the gap between green innovation levels between cities is larger. The variance between the numbers of scientific researchers is also larger, indicating that the difference between the scientific research levels between cities is also large, so it is meaningful to explore the differences between digital finance and the level of green innovation between cities Fig. 1.

Empirical results and discussions

Spatial metrological tests

To test the spatial correlation between variables, we calculate Moran’s I index of the data. A positive correlation refers to the aggregation of spatial distance; the correlation is significantly enhanced (Cai et al. 2022), and the negative correlation is the opposite; as the spatial position is more and more dispersed, the correlation is significantly enhanced. Therefore, this paper uses Stata 16.0 software to calculate Moran’s I index of green innovation quality and green innovation quantity in Chinese cities from 2011 to 2019, and the calculation results are shown in Table 3. Moran’s I index is significantly positive, so there is a significant spatial correlation between green innovations.

Second, this paper also plots Moran’s scatters for 2011 and 2019. As shown in Fig. 2, the horizontal axis is represented, the vertical axis is indicated, and the distribution of the scatter plot indicates that there is a spatially positive correlation between green innovations between the sample cities.

Moran’s scatterplot of the quantity and quality of green innovation. a Moran’s scatter plot of the number of green innovation in 2011. b Moran’s scatter plot of the number of green innovation in 2019. c Moran’s scatter plot of green innovation quality in 2011. d Moran’s scatter plot of green innovation quality in 2019

Benchmark regression results

To select the appropriate spatial econometric model, we first needed to run the Hausman, LR, LM, and Wald tests. The results of the inspection are shown in Table 4. The double-fixed-effect model should be adopted in this study because it rejects the null hypothesis. The spatial Durbin model cannot degenerate into a spatial lag model or a spatial error model. This suggests that the double-fixed dynamic spatial Durbin model should be applied. The model settings are as follows (Elhorst et al. 2010):

Table 5 shows the results of the benchmark regression, and the regression coefficients of the lag terms of the quantity and quality of green innovation are significantly positive, indicating that green innovation is a dynamic, continuous process with a clear trend. Previous green innovations can contribute to current green innovations. The regression coefficient of digital finance on the quantity and quality of green innovation is significantly positive, indicating that local digital finance can increase the quantity and improve the quality of local green innovation. Cao et al. (2021) also show that the findings are reliable. The rho value is significantly positive, indicating that there is a significant spatial spillover effect on the increase in the quantity of green innovation and the improvement in the quality of green innovation between cities. This indicates the significant presence of spatial effects of green innovation in digital finance. The regression coefficient of the spatial lag term is significantly negative indicating the negative spillover effect of digital finance in neighboring regions on the quantity and quality of green innovation in local cities. Other studies have drawn similar conclusions that digital finance has a significant direct contribution to regional economic growth and negative spatial spillover effects (Ding et al. 2022). The economic significance expressed by the benchmark results is that the development of digital finance in the previous stage can have a catalytic effect on the development of digital finance in the next stage. Digital finance in the local city can have a positive impact on green innovation in the local city. However, when digital finance in other cities flourishes there is a negative impact on local green innovation, there is a negative spatial spillover effect. With the promotion of financial technology, digital finance can reduce the phenomenon of information asymmetry, effectively support small and micro enterprises’ innovation and entrepreneurship, and effectively identify green financing needs (Dupas and Robinson 2013). Digital finance in other cities has promoted the improvement of the city’s infrastructure, the improvement of information structure, and the reduction of risks and costs, thereby enhancing the local market vitality (Zhou et al. 2018) and optimizing local market structure so it can promote the expansion of local market demand. Therefore, through the local market effect, it further expands its own advantages and has a siphon effect on neighboring areas (Wei et al. 2010) so that local digital finance will reduce the quality of green innovation in the surrounding areas.

Robustness

Subsequently, robustness tests were carried out to ensure that the conclusions of this article are reliable (as shown in Table 6).

First, we exclude the samples of the four municipalities (Guo et al. 2021, b), which often have large built-up areas, more residential populations, and an important position in the country’s politics, economy, science, culture, transportation, etc. The municipalities in all of the sample cities have particularities, and after removing the sample city data of the municipalities, this paper still gets the same conclusion.

Second, this paper replaces the agent index of the interpreted variable (Cui and Liu 2022), uses the logarithm of the total number of green patents granted to characterize the number of green innovations, and uses the proportion of green invention patents granted to the total number of green patents granted to characterize the quality of green innovation.

After that, the dynamic spatial autoregressive model (DSAR) is used instead of the DSDM model for regression (Gao et al. 2022), and the results of the test show that the digital finance index still has obvious positive effects on green innovation. The spatial rho value is still positive and significant, which proves that the previous conclusions are stable.

Endogenous test

To further alleviate the endogeneity problem in this paper, the number of landline telephones in China at the end of 1984 is used as an instrumental variable (Bai and Yu 2021). The number of landline telephones serves as a traditional telecommunication tool. Its infrastructure, the level of technology, affects the development of Internet technology in subsequent stages. This instrumental variable satisfies the correlation condition. The number of fixed phones in 1984 as historical data has no influence on green innovation in 2011. Also, the frequency of landline telephone use today is too low to have an impact on regional green innovation development. Therefore, this instrumental variable satisfies the exogeneity condition. In order to avoid the problem of collinearity, the provincial fixed effect was controlled this time (Zhang et al. 2021b). The missing values of some cities have also been eliminated.

In Table 7, the higher the number of landline telephones in 1984, the higher its level of digital finance development. The coefficients of green innovation quantity and green innovation quality are still significantly positive from the regression results of the second stage. It indicates that the conclusions of this paper are still reliable. From the results of the instrumental variable test, this instrumental variable rejects the unidentifiable test and there is no weak instrumental variable.

Heterogeneity analysis and discussion

Regional heterogeneity

There are enormous differences in population size, economic and technological level, and natural environment between the eastern and mid-western cities, so according to Tang (2022), the sample is divided into eastern and mid-western cities. The results in Table 8 show that the digital finance composite index has a significant positive effect on the quantity and quality of green innovations in eastern cities, and for the mid-western regions, the regression coefficient is not significant. The main reason may be that eastern cities have faster economic growth and more various types of enterprises. The speed of technological development and the speed of technological transformation are faster, which is an important engine for green innovation. For several green innovations, itself is in the east and mid-west has spatial spillover effects (Liu et al. 2021b), which may be because of an increase in the number of the requirements of the green innovation technology difficulty is relatively low, the speed of technology spillovers, and fewer barriers (Miao et al. 2021). However, the mid-western green innovation quality rho value was not significant, which may be the cause of the mid-western cities’ own technology research and development strength is low, knowledge spillover is difficult, and government system and market environment are not as good as eastern cities, forming all kinds of communication obstacles (Song et al. 2020).

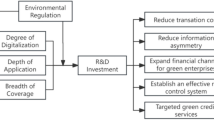

Different dimensions of digital finance

Digital finance can be divided into three subdimensions: breadth of coverage, depth of use, and degree of digitization (Han and Gu 2021; Wen et al. 2022). As the results in Table 9 show, the breadth of digital finance’s coverage has had a positive impact on the increase in the number of green innovations. The expansion of the coverage of digital finance in surrounding cities has a significant inhibitory effect on the improvement of the number of local green innovations, while the other two dimensions are not significant. The degree of digitization can significantly improve the quality of green innovation in a city (Rao et al. 2022), and the other two dimensions show little effect. The reason may be that the larger the industries and regions that digital financial inclusion can cover, and the more perfect the financial infrastructure, the more enterprises can benefit, which can rely on the advantages of big data platforms, get more financial support and other policy preferences, and the more motivated they are to develop their ability (Luo et al. 2022). However, the number of green innovations emphasizes quantitative growth and in some ways will ignore the originality of green innovation, so the coverage breadth of digital finance will make the quantity increase significantly, but it will not necessarily improve the quality. The degree of digitization of digital finance promotes the accessibility and continuity of financial services and can accurately identify the needs of target customers, thereby promoting the balance of resource allocation, reducing traditional risks, and improving operational efficiency (Mikhail et al. 2021), so that for project activities with high-quality green innovation, relying on cutting-edge technology can improve capital availability and technical support.

Analysis of mediation effects

Having validated the intrinsic link between the kernel variables, this paper will analyze the possible influencing factors between them. The model settings are as follows:

Digital finance increases the range of financial availability and financial technology to help with the rapid flow of capital and information. On the other hand, through big data and other functions, so that information visibility is higher, can improve the allocation efficiency of capital, so that capital can be flowed between industries with maximum social benefits, the industrial structure can be effectively adjusted (Liu et al. 2021a).

We use the proportion of the output value of the tertiary industry and the output value of the secondary industry to measure the advanced level of the industrial structure (Zhang et al. 2021a). The regression results of the table show that the regression coefficient of digital finance to the seniority of industrial structure is significantly positive. This shows that digital finance is beneficial to the optimization of industrial structure (Wang et al. 2022a). The high-level industrial structure is reflected in the rapid development of high-tech manufacturing and the increase in enterprise investment in technological research, and the level of urban innovation can be effectively improved (Li and Ma 2021). The advanced industrial structure means that the proportion of value added in the service sector has increased significantly. The service industry has lower energy consumption and a higher technical level than the industrial manufacturing industry, and the urban industrial spatial layout and environmental level can be continuously optimized. The upgrading of the industrial structure means that the green and low-carbon advantageous industries can get better development opportunities (Liang 2020), the level of carbon dioxide emissions has been significantly reduced, and the new field of the green technology industry will become an important economic growth point.

Therefore, digital finance can strengthen the innovation and application of green technology in production and manufacturing through the use of digital intelligence and other means, empower green creation, optimize the urban industrial layout, accelerate the speed of structural green transformation, accelerate the pace of upgrading the industrial structure, and ultimately improve the level of green innovation (Zhong, 2022).

This paper also uses the logarithm of the number of urban internet users to characterize the information support effect of the city (Song et al. 2021a). Digital finance has a significant positive effect on the level of informatization. One possible reason is that digital finance has led to the improvement of various related infrastructures, especially digital finance, which relies on information sharing of various types of big data, to create excellent interaction between online and offline financial platforms, to promote the accurate supply of finance and the satisfaction of personalized needs (Kelikume, 2021). It is necessary to strengthen various types of digital construction and promote the continuous innovation of digital technology, so that the level of informatization in the city will inevitably be greatly improved (Kohli and Melville 2019). The improvement of the level of urban informatization provides a fast way for capital flow and an effective channel for technology sharing, thereby improving the speed of information transmission and technology spillover between R&D departments and production departments, thus providing an information support effect for green innovation (Cindori et al. 2021).

The limitations of time and space have been broken by digital finance due to its own characteristics, expanding the scope of services, reducing transaction costs, and alleviating the problem of information asymmetry, so digital finance can accurately identify different needs, which is more conducive to resource allocation optimization (Cindori et al. 2021). To measure the effect of resource allocation, the indicator we chose is the proportion of science and technology expenditure in local fiscal expenditure. Digital finance has no statistical significance for the regression coefficient of the intensity of scientific research expenditure; the possible reason is that the resources of government science and technology expenditure are not properly allocated. The capital flow needs to be adjusted, and resource allocation needs to be more inclined toward key areas (Hu 2021). Other reasons may also be that scientific and technological expenditure on scientific and technological achievements requires a relatively long research and development process. The improvement of green innovation is not an overnight thing, which requires manpower, material resources, and multifaceted efforts (Spence 2021). The role of local government science and technology spending needs to be observed over time Table 10.

Conclusion and policy implications

As a new format of financial and technological integration and development, digital finance overcomes the drawbacks of traditional finance. This paper uses panel data from 284 cities in China from 2011 to 2019 to analyze the impact of digital finance on green innovation in dynamic space Durbin and examines the three possible intermediary effects of industrial structure adjustment, informatization level, and resource allocation. Heterogeneity analysis and robustness tests are also carried out. The conclusion of this paper is as follows:

-

1.

Digital finance can promote the improvement of the quantity and quality of green innovations in local cities. After deleting some samples, replacing the DSDM model with the DSAR model, and replacing the explanatory variables, three kinds of robustness tests show that the conclusions of this paper are robust.

-

2.

Digital finance in neighboring cities has inhibited local green innovation levels, which may be due to the siphon effect, and the local market effect of neighboring cities is still in play. Compared with the quantity of green innovation, the impact on the quality is more significant.

-

3.

The results of this paper are heterogeneous. The positive impact is more significant in the eastern region with a high economic level, good infrastructure, and good market environment, and in terms of heterogeneity of subdimensions, the positive impact of coverage breadth on the number of green innovations is more significant.

-

4.

Through the testing of the intermediary mechanism, digital finance can positively affect green innovation through the upgrading of the industrial structure and the level of informatization. However, due to the unreasonable allocation of resources, the mediating effect of the resource allocation mechanism does not exist.

We obtain the following suggestions for the research conclusions: first, governments should promote the popularization of digital finance in China, broaden the coverage, and strengthen the degree of digitalization and thus provide a good financial environment. We also confirm the existence of spatial spillover effects, so this is an effective move to strengthen regional cooperation and linkage. The government should exert the leading role of key cities, radiate the development of other cities, and avoid further expansion of the “polarization effect.” Second, the government needs to utilize technology to improve the level of urban informatization, improve relevant infrastructure, deepen the central service level and corresponding technical support of digital finance, rationally allocate government funds, and provide long-term support. Third, according to the heterogeneity analysis results of this paper, high-grade, large-scale cities in the east should continue to exert their advantages and develop digital finance, and low-grade, small-scale cities in the central and western should avoid the expansion of siphon effects, seize opportunities, and develop themselves.

Data availability

Most of the basic data are publicly available, mainly from China Statistical Yearbook, China Energy Statistical Yearbook, China Science and Technology Statistical Yearbook, and provincial statistical yearbooks. Other data are calculated by the authors, and the calculation method is shown in the text of this paper.

References

Abderahman R, Karim R, Mohamad ZSH, Alireza A (2022) Knowledge diffusion of the Internet of Things (IoT): a main path analysis. Wirel Pers Commun 31-31. https://doi.org/10.1007/S11277-022-09787-8

Acemoglu D, Restrepo P (2019) Automation and new tasks: how technology displaces and reinstates labor. J Econ Perspect 33:3–30. https://doi.org/10.1257/jep.33.2.3

Alabbasi Y (2020) Governance and legal framework of blockchain technology as a digital economic finance. Int J Innov Digital Econ (IJIDE) 11:52–62. https://doi.org/10.4018/IJIDE.2020100104

Bai PW, Yu L (2021) Digital economy development and firm’s markup: theoretical mechanisms and empirical facts. China Ind Econ 11:59–77. https://doi.org/10.19581/j.cnki.ciejournal.2021.11.003

Bai Y, Song SY, Jiao JL, Yang RR (2019) The impacts of government R&D subsidies on green innovation: evidence from Chinese energy-intensive firms. J Clean Prod 233:819–829. https://doi.org/10.1016/j.jclepro.2019.06.107

Beaudry C, Breschi S (2003) Are firms in clusters really more innovative? Econ Innov New Technol 12:325–342. https://doi.org/10.1080/10438590290020197

Beck T, Chen T, Lin C, Song FM (2016) Financial innovation: the bright and the dark sides. J Bank Financ 72:28–51. https://doi.org/10.1016/j.jbankfin.2016.06.012

Beck T, Demirguc-Kunt A, Levine R (2002) Law and finance: why does legal origin matter? J Comp Econ 31:653–675. https://doi.org/10.3386/w9379

Bernhard G, Âriel DF, Arthur B, Henry G, Nnaemeka O (2022) Digital finance in Africa: accelerating foundations for inclusive and sustainable local innovation †. Environ Sci Proc 15:66–66. https://doi.org/10.3390/ENVIRONSCIPROC2022015066

Bharath ST, Dahiya S, Hallak I (2020) Corporate governance and loan syndicate structure. J Financ Quant Anal 1–72. https://doi.org/10.1017/s0022109020000745

Brown JR, Fazzari SM, Petersen BC (2009) Financing innovation and growth: cash flow, external equity, and the 1990s R&D Boom. J Financ 64:151–185

Bruhn M, Love I (2014) The real impact of improved access to finance: evidence from Mexico. J Financ 69:1347–1376. https://doi.org/10.1111/jofi.12091

Cai RC (2022) The development of digital finance and corporate’s investment efficient. In: Paper presented at 2022 2nd International Conference on Financial Economics and Investment Management Taiyuan, China. https://doi.org/10.23977/FEIM2022.005

Cai ZY, Yang XH, Lin HX, Yang XY, Jiang P (2022) Study on the co-benefits of air pollution control and carbon reduction in the Yellow River Basin: an assessment based on a spatial econometric model. Int J Environ Res Public Health 19:4537–4537. https://doi.org/10.3390/IJERPH19084537

Cao SP, Nie L, Sun HP, Sun WF, Farhad T (2021) Digital finance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J Clean Prod 327. https://doi.org/10.1016/J.JCLEPRO.2021.129458

Chen HX, Peng J (2021) A study on the dynamic relationship between digital financial development, social consumption and economic growth. J Econ Public Financ 7. https://doi.org/10.22158/JEPF.V7N3P56

Chen SQ, Zhang H (2021) Does digital finance promote manufacturing servitization: Micro evidence from China. Int Rev Econ Financ 76:856–869. https://doi.org/10.1016/J.IREF.2021.07.018

Chen YM (2020) Improving market performance in the digital economy. China Econ Rev 62. https://doi.org/10.1016/j.chieco.2020.101482

Cheng ZH, Li X (2022) Do raising environmental costs promote industrial green growth? A quasi-natural experiment based on the policy of raising standard sewage charges. J Clean Prod 343. https://doi.org/10.1016/J.JCLEPRO.2022.131004

Chetna C, Vinit P, Amandeep D (2022) Linking circular economy and digitalisation technologies: a systematic literature review of past achievements and future promises. Technol Forecast Soc Change 177. https://doi.org/10.1016/J.TECHFORE.2022.121508

Cindori S, Mostafa AMM, Malushko EY, Deryugina TV, Mokhov AA, Aleksandr A, Svetlana B, Oksana D, Sofya P, Elena T (2021) Peculiarities of development of digital financial ecosystem. SHS Web Conf 109:01004. https://doi.org/10.1051/SHSCONF/202110901004

Corrado G, Corrado L (2017) Inclusive finance for inclusive growth and development. Curr Opin Environ Sustain 24:19–23. https://doi.org/10.1016/j.cosust.2017.01.013

Cui XL, Liu H (2022) Establishment of national innovative cities and their regional innovation capability. Sci Res Manage 43:32–40. https://doi.org/10.19571/j.cnki.1000-2995.2022.01.004

Demertzis M, Merler S, Wolff GB (2018) Capital markets union and the Fintech opportunity. J Financ Regul 4:157–165. https://doi.org/10.1093/jfr/fjx012

Ding RJ, Shi FF, Hao SL (2022) Digital inclusive finance, environmental regulation, and regional economic growth: an empirical study based on spatial spillover effect and panel threshold effect. Sustainability 14:4340–4340. https://doi.org/10.3390/SU14074340

Ding YB, Zhang HY, Tang ST (2021) How does the digital economy affect the domestic value-added rate of Chinese exports? J Glob Inf Manag (JGIM) 29:71–85. https://doi.org/10.4018/JGIM.20210901.OA5

Dong KY, Hochman G, Zhang Y, Sun R, Li H, Liao H (2018) CO2 emissions, economic and population growth, and renewable energy: empirical evidence across regions. Energy Econ 75:180–192

Dong ZQ, Wang H (2021) Urban wealth and technology choice. Econ Res 56:143–159 (In Chinese)

Doran J, Ryan G (2012) Regulation and firm perception, eco-innovation and firm performance. Eur J Innov Manag 15:421–441. https://doi.org/10.1108/14601061211272367

Dou JM, Tao ZP, Ji YB (2022) Impact of regional development strategy on the productivity of polluting firms: evidence from China. Front Environ Sci 10. https://doi.org/10.3389/FENVS.2022.831643

Du JM, Wei SW, Wu WY (2020) Does digital financial inclusion promote the optimization of industrial structure. [J]. Comp Econ Soc Syst 06:38–49 (Chinese)

Dupas P, Robinson J (2013) Why don’t the poor save more? Evidence from health savings experiments. Am Econ Rev 103:1138–1171. https://doi.org/10.1257/aer.103.4.1138

Elhorst JP (2011) Dynamic spatial panels: models, methods, and inferences. J Geogr Syst 14:5–28. https://doi.org/10.1007/s10109-011-0158-4

Elhorst P, Piras G, Arbia G (2010) Growth and convergence in a multiregional model with space-time dynamics. Geogr Anal 42:338–355. https://doi.org/10.1111/j.1538-4632.2010.00796.x

Eugenia M, Michele S (2022) Sustainable finance and Fintech: can technology contribute to achieving environmental goals? A preliminary assessment of ‘Green Fintech’ and ‘Sustainable Digital Finance’. Eur Co Financial Law Rev 19:128–174. https://doi.org/10.1515/ECFR-2022-0005

Ewers D, Poon C, Gengler (2018) Creating and sustaining Islamic financial centers: Bahrain in the wake of financial and political crises. Urban Geogr 39:3–25. https://doi.org/10.1080/02723638.2016.1268436

Fan QQ, Qiao YB, Zhang TB, Huang KN (2021) Environmental regulation policy, corporate pollution control and economic growth effect: evidence from China. Environ Chall 5. https://doi.org/10.1016/J.ENVC.2021.100244

Fang MH (2022) The influence of digital inclusive finance on economic development of Henan Province. World Scientific Res J 8. https://doi.org/10.6911/WSRJ.202207_8(7).0111

Feng SL, Zhang R, Li GX (2022) Environmental decentralization, digital finance and green technology innovation. Struct Chang Econ Dyn 61. https://doi.org/10.1016/J.STRUECO.2022.02.008

Feng YJ, Zhang JX (2022) Research on the development of digital inclusive finance under the construction of Hainan free trade port-- analysis of distribution dynamics, regional difference and convergence. World Scientific Research Journal 8. https://doi.org/10.6911/WSRJ.202207_8(7).0078

Feng Y, Nie CF, Zhang D (2021) The effect of broadband infrastructure construction on urban innovation capacity. Stud Sci Sci 39:2089–2100. https://doi.org/10.16192/j.cnki.1003-2053.2021.11.001

Fu T, Yang SY, Jian Z (2022) Government support for environmental regulation: evidence from China. Int Rev Financ Anal 83. https://doi.org/10.1016/J.IRFA.2022.102135

Gabor D, Brooks S (2017) The digital revolution in financial inclusion: international development in the fintech era. New Political Econ 22:423–436. https://doi.org/10.1080/13563467.2017.1259298

Gao D, Li G, Yu JY (2022) Does digitization improve green total factor energy efficiency? Evidence from Chinese 213 cities. Energy 247. https://doi.org/10.1016/J.ENERGY.2022.123395

Gao K, Yuan YJ (2022) Government intervention, spillover effect and urban innovation performance: empirical evidence from national innovative city pilot policy in China. Technol Soc 70. https://doi.org/10.1016/J.TECHSOC.2022.102035

Gilles S (1992) Technological choice, financial markets and economic development. Eur Econ Rev 36:763–781. https://doi.org/10.1016/0014-2921(92)90056-3

Gomber, Kauffman, Parker, Weber (2018) On the Fintech revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J Manag Inf Syst 35:220–265. https://doi.org/10.1080/07421222.2018.1440766

Guo F, Yang SG, Chai ZY (2021) Does the construction of innovative cities improve the quantity and quality of enterprise innovation? Micro-evidence from Chinese industrial enterprises. Res Ind Econ 3:128–142. https://doi.org/10.13269/j.cnki.ier.2021.03.010

Guo H, Gu F, Peng YL, Deng X, Guo LL (2022) Does digital inclusive finance effectively promote agricultural green development?—A case study of China. Int J Environ Res Public Health 19:6982–6982. https://doi.org/10.3390/IJERPH19126982

Han Y, Gu XM (2021) Linkage between inclusive digital finance and high-tech enterprise innovation performance: role of debt and equity financing. Front Psychol 12:814408–814408. https://doi.org/10.3389/FPSYG.2021.814408

He K, Chen WY, Zhang LG (2021) Senior management’s academic experience and corporate green innovation. Technol Forecast Soc Change 166. https://doi.org/10.1016/J.TECHFORE.2021.120664

He YL, Li N (2017) Competition for innovation: A new competitive mechanism of local governments. [J]. Geomatics and journal of Wuhan University (Philosophy and Social Sciences Edition) 70(01):87–96 (Chinese)

Helen B, Florencio L, Armin S (2021) Fintech and access to finance. J Corp Finan 68. https://doi.org/10.1016/J.JCORPFIN.2021.101941

Henderson JV (1986) Efficiency of resource usage and city size. J Urban Econ 19:47–70. https://doi.org/10.1016/0094-1190(86)90030-6

Horbach J (2008) Determinants of environmental innovation—new evidence from German panel data sources. Res Policy 37:163–173. https://doi.org/10.1016/j.respol.2007.08.006

Hu Y (2021) Analysis of factors affecting digital financial inclusion: ecosystem view of 31 provinces in China. Asian Trade Risk Manag (ATRM) 5. https://doi.org/10.22142/ATRM.2021.5.1.2

Huang JW, Li YH (2015) Green innovation and performance: the view of organizational capability and social reciprocity. J Bus Ethics 145:309–324. https://doi.org/10.1007/s10551-015-2903-y

Jeanneney SG, Kpodar K (2011) Financial development and poverty reduction: can there be a benefit without a cost? J Dev Stud 47:143–163. https://doi.org/10.1080/00220388.2010.506918

Ji XM, Wang K, Xu H, Li MC (2021) Has digital financial inclusion narrowed the urban-rural income gap: the role of entrepreneurship in China. Sustainability 13:8292–8292. https://doi.org/10.3390/SU13158292

Jia RP, Wang S (2020) The development and innovation of digital finance. The Frontiers of Society, Science and Technology, p 2

Jiménez G, Salas V, Saurina J (2008) Organizational distance and use of collateral for business loans. J Bank Financ 33:234–243. https://doi.org/10.1016/j.jbankfin.2008.07.015

Kafouros MI (2006) The impact of the Internet on R&D efficiency: theory and evidence. Technovation 26:827–835. https://doi.org/10.1016/j.technovation.2005.02.002

Kapoor A (2014) Financial inclusion and the future of the Indian economy. Futures 56:35–42. https://doi.org/10.1016/j.futures.2013.10.007

Karaivanov A (2011) Financial constraints and occupational choice in Thai villages. J Dev Econ 97:201–220. https://doi.org/10.1016/j.jdeveco.2011.05.002

Kelikume K (2021) Digital financial inclusion, informal economy and poverty reduction in Africa. J Enterp Communities: People and Places in the Global Economy 15:626–640. https://doi.org/10.1108/JEC-06-2020-0124

Khuong MV (2011) ICT as a source of economic growth in the information age: empirical evidence from the 1996–2005 period. Telecommun Policy 35:357–372. https://doi.org/10.1016/j.telpol.2011.02.008

Kohli R, Melville NP (2019) Digital innovation: a review and synthesis. Inf Syst J 29:200–223. https://doi.org/10.1111/isj.12193

Kristin H, Peter MB (2020) Digital entrepreneurship in finance: Fintechs and funding decision criteria. Sustainability 12:8035–8035. https://doi.org/10.3390/su12198035

Krugman P (1991) Increasing returns and economic geography. J Polit Econ 99:483–499. https://doi.org/10.1086/261763

Li DKQ, Shen WT (2022) Regional happiness and corporate green innovation: a financing constraints perspective. Sustainability 14:2263–2263. https://doi.org/10.3390/SU14042263

Li G, Wu H, Jiang J, Zong Q (2023) Digital finance and the low-carbon energy transition (LCET) from the perspective of capital-biased technical progress. Energy Econ 120:106623. https://doi.org/10.1016/j.eneco.2023.106623

Li J, Wu Y, Xiao JJ (2020) The impact of digital finance on household consumption: evidence from China. Econ Model 86:317–326. https://doi.org/10.1016/j.econmod.2019.09.027

Li MJ, Du WJ (2022) Opening the black box of capacity governance: environmental regulation and capacity utilization of microcosmic firms in China. Econ Model 105766. https://doi.org/10.1016/J.ECONMOD.2022.105766

Li SR (2021) Research on the problem of digital finance supporting the development of rural industry. Front Econ Manag 2:247–254. https://doi.org/10.6981/FEM.202108_2(8).0036

Li XY (2022) Local government decision-making competition and regional carbon emissions: experience evidence and emission reduction measures. Sustain Energy Technol Assess 50. https://doi.org/10.1016/J.SETA.2021.101800

Li YJ, Ma KR (2021) Research on the path of digital inclusive finance’s influence on industrial structure upgrade. In: Paper presented at 2021 International Conference on Economic Development and Business Culture (ICEDBC 2021), Xiamen, China. https://doi.org/10.2991/AEBMR.K.210712.014

Li H, Zhou LA (2005) Political turnover and economic performance: the incentive role of personnel control in China. J Public Econ 89:1743–1762. https://doi.org/10.1016/j.jpubeco.2004.06.009

Liang MY (2020) Research on the impact of Chinese digital inclusive finance on industrial structure upgrade—based on spatial Dubin model. Open J Stat 10(5):863–871. https://doi.org/10.4236/ojs.2020.105050

Lin B, Ma R (2022) How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J Environ Manag 320:115833. https://doi.org/10.1016/j.jenvman.2022.115833

Liu JM, Jiang YL, Gan SD, He L, Zhang QF (2022) Can digital finance promote corporate green innovation? Environ Sci Pollut Res Int 2:35828–35840. https://doi.org/10.1007/S11356-022-18667-4

Liu XJ, Zhu JN, Guo JF, Cui CN (2021b) Spatial association and explanation of China’s digital financial inclusion development based on the network analysis method. Complexity 2021. https://doi.org/10.1155/2021/6649894

Liu Y, Chen L (2022) The impact of digital finance on green innovation: resource effect and information effect. Environ Sci Pollut Res Int 29:86771–86795. https://doi.org/10.1007/s11356-022-21802-w

Liu Z, Zhang X, Yang L, Shen Y (2021a) Access to digital financial services and green technology advances: regional evidence from China. Sustainability 13:4927. https://doi.org/10.3390/su13094927

Lu CW, Chen M, Tian GX (2022) Spatial-temporal evolution and influencing factors of urban green innovation efficiency in China. J Environ Public Health 2022:4047572–4047572. https://doi.org/10.1155/2022/4047572

Luo D, Luo M, Lv JM (2022) Can digital finance contribute to the promotion of financial sustainability? A financial efficiency perspective. Sustainability 14:3979–3979. https://doi.org/10.3390/SU14073979

Ma FF, Lei LX, Chen ZY, Wang MC (2021) Digital finance and firm exit: mathematical model and empirical evidence from industrial firms. Discret Dyn Nat Soc 2021. https://doi.org/10.1155/2021/4879029

Ma RF, Liu Z, Zhai PX (2022b) Does economic policy uncertainty drive volatility spillovers in electricity markets: time and frequency evidence. Energy Econ 107:105848

Ma RW, Li FF, Du MY (2022a) How does environmental regulation and digital finance affect green technological innovation: evidence from China. Front Environ Science 10

Miao C, Duan M, Zuo Y, Wu X (2021) Spatial heterogeneity and evolution trend of regional green innovation efficiency--an empirical study based on panel data of industrial enterprises in China’s provinces*. Energy Policy 156:112370. https://doi.org/10.1016/j.enpol.2021.112370

Mikhail L, Natalia U, Aigerim B (2021) Ensuring sustainable development of the national financial market based on digital financial services. SHS Web Conf 93:02029. https://doi.org/10.1051/SHSCONF/20219302029

Ngai LR, Pissarides CA (2007) Structural change in a multisector model of growth. Am Econ Rev 97:429–443. https://doi.org/10.1257/aer.97.1.429

Norden L, Buston CS, Wagner W (2014) Financial innovation and bank behavior: evidence from credit markets. J Econ Dyn Control 43:130–145. https://doi.org/10.1016/j.jedc.2014.01.015

Oh J, Kwon S (2020) Expanding financial inclusion using digital finance. J APEC Stud [ISSN:/ eISSN:2671-5813] 12(1)

Ozili PK (2017) Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev 18(4):329–340. https://doi.org/10.1016/j.bir.2017.12.003

Pan S, Ye DZ, Ye X (2021) Is digital finance inclusive?——Empirical evidence from urban innovation. Economist 3:101–111. https://doi.org/10.16158/j.cnki.51-1312/f.2021.03.011

Qiao S, Zhao DH, Guo ZX, Tao Z (2022) Factor price distortions, environmental regulation and innovation efficiency: an empirical study on China’s power enterprises. Energy Policy 164. https://doi.org/10.1016/J.ENPOL.2022.112887

Razzaq A, Yang X (2023) Digital finance and green growth in China: appraising inclusive digital finance using web crawler technology and big data. Technol Forecast Soc Chang 188:122262. https://doi.org/10.1016/j.techfore.2022.122262

Rao S, Pan Y, He J, Shangguan X (2022) Digital finance and corporate green innovation: quantity or quality? Environ Sci Pollut Res Int 29:56772–56791. https://doi.org/10.1007/s11356-022-19785-9

Reardon J (2007) How green are principles texts? An investigation into how mainstream economics educates students pertaining to energy, the environment and green economics. Int J Green Econ 1(3/4):381. https://doi.org/10.1504/ijge.2007.013067

Restuccia D, Rogerson R (2008) Policy distortions and aggregate productivity with heterogeneous establishments. Rev Econ Dyn 11:707–720. https://doi.org/10.1016/j.red.2008.05.002

Ren X, Liu Z, Jin C, Lin R (2023a) Oil price uncertainty and enterprise total factor productivity: evidence from China. Int Rev Econ Financ 83:201–218. https://doi.org/10.1016/j.iref.2022.08.024

Ren X, Zeng G, Gozgor G (2023b) How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J Environ Manag 330:117125. https://doi.org/10.1016/j.jenvman.2022.117125

Ren X, Zeng G, Zhao Y (2023c) Digital finance and corporate ESG performance: empirical evidence from listed companies in China. Pac Basin Financ J 79:102019. https://doi.org/10.1016/j.pacfin.2023.102019

Rin MD, Hellmann T (2002) Banks as catalysts for industrialization. J Financ Intermed 11:366–397. https://doi.org/10.1006/jfin.2002.0346

Romer PM (1986) Increasing returns and long-run growth. J Polit Econ 94:1002–1037. https://doi.org/10.1086/261420

Shao S, Li X, Cao JH, Yang LL (2016) Economic policy options for haze pollution control in China: based on the perspective of spatial spillover effects. Econ Res J 51:73–88 CNKI:SUN:JJYJ.0.2016-09-007 (In Chinese)

Shen Y, Hu WX, James HC (2021) Digital financial inclusion and economic growth: a cross-country study. Procedia Comput Sci 187:218–223. https://doi.org/10.1016/J.PROCS.2021.04.054

Söderlund B, Tingvall PG (2016) Capital freedom, financial development and provincial economic growth in China. World Econ 40(4):764–787. https://doi.org/10.1111/twec.12391

Solow RM (1956) A Contribution to the theory of economic growth. Q J Econ 70:65–94

Song DY, Li C, Li XY (2021a) Does the construction of new infrastructure promote the ‘quantity’ and ‘quality’ of green technological innovation——evidence from the national smart city pilot. Chinese J Popul Resour Environ 31:155–164 (In Chinese)

Song H, Li MY, Yu KK (2021b) Big data analytics in digital platforms: how do financial service providers customise supply chain finance? Int J Oper Prod Manag 41:410–435. https://doi.org/10.1108/IJOPM-07-2020-0485

Song XL, Jing YG, Akeba’erjiang K (2020) Spatial econometric analysis of digital financial inclusion in China. Int J Dev Issues 20:210–225. https://doi.org/10.1108/ijdi-05-2020-0086

Sorin B, Ghenadie C, Adrian TA, Cristina GC (2021) The Digital Finance – opportunity of development in the new economy. Proc Int Conf Bus Excell 15:392–405. https://doi.org/10.2478/PICBE-2021-0036

Spence MS (2021) Government and economics in the digital economy. J Gov’t Econ 3. https://doi.org/10.1016/J.JGE.2021.100020

Su XF, Liu GL, Xu Y, Ge WF, Shen B, Ran QY, Zhou H (2022) How multi-dimensional local government competition impacts green economic growth? A case study of 272 Chinese cities. Front Environ Sci 10. https://doi.org/10.3389/FENVS.2022.911004

Su YY, Li ZH, Yang CY (2021) Spatial interaction spillover effects between digital financial technology and urban ecological efficiency in China: an empirical study based on spatial simultaneous equations. Int J Environ Res Public Health 18:8535–8535. https://doi.org/10.3390/IJERPH18168535

Sun B, Li J, Zhong S, Liang T (2023) Impact of digital finance on energy-based carbon intensity: evidence from mediating effects perspective. J Environ Manag 327:116832. https://doi.org/10.1016/j.jenvman.2022.116832

Sun XJ, Tang J, Li SL (2022) Promote green innovation in manufacturing enterprises in the aspect of government subsidies in China. Int J Environ Res Public Health 19:7864–7864. https://doi.org/10.3390/IJERPH19137864

Takalo T, Tanayama T (2010) Adverse selection and financing of innovation: is there a need for R&D subsidies? J Technol Transf 35:16–41. https://doi.org/10.1007/s10961-009-9112-8

Tang X, Ding SG, Gao X, Zhao TQ (2022) Can digital finance help increase the value of strategic emerging enterprises? Sustain Cities Soc 103829. https://doi.org/10.1016/J.SCS.2022.103829

Tian X, Ruan W, Xiang E (2017) Open for innovation or bribery to secure bank finance in an emerging economy: a model and some evidence. J Econ Behav Organ 142:226–240. https://doi.org/10.1016/j.jebo.2017.08.002

Tobler W (2004) On the first law of geography: a reply. Ann Assoc Am Geogr 94:304–310

Truffer B, Coenen L (2012) Environmental innovation and sustainability transitions in regional studies. Reg Stud 46:1–21. https://doi.org/10.1080/00343404.2012.646164

Viktor B, Mikhail G, Galina S (2022) Digital tools of the commercial finance market form new institutions of economic development. Electrochemical Soc Trans 107. https://doi.org/10.1149/10701.18523ECST

Wang J (2018) Inclusion or expulsion: digital technologies and the new power relations in China’s “Internet finance”. Commun Public 3:34–45. https://doi.org/10.1177/2057047318755528

Wang Q-J, Tang K, Hu H-Q (2022) The impact of digital finance on green innovation: evidence from provinces in China. Innov Green Dev’t 1:100007. https://doi.org/10.1016/j.igd.2022.100007

Wang TT, Ji C (2022) How does digital finance affect people’s income: evidence from China. Secur Commun Netw 2022. https://doi.org/10.1155/2022/7025375

Wang XY, Sun XM, Zhang HT, Xue CK (2022c) Digital economy development and urban green innovation CA-pability: based on panel data of 274 prefecture-level cities in China. Sustainability 14:2921–2921. https://doi.org/10.3390/SU14052921

Wang X, Wang X, Ren XH, Wen FH (2022a) Can digital financial inclusion affect CO2 emissions of China at the prefecture level? Evidence from a spatial econometric approach. Energy Econ 105966. https://doi.org/10.1016/J.ENECO.2022.105966

Wang ZH, Wang N, Hu XQ, Wang HP (2022b) Threshold effects of environmental regulation types on green investment by heavily polluting enterprises. Environmental Sciences. Europe 34(1). https://doi.org/10.1186/S12302-022-00606-2

Wang Z, Fu H, Ren X (2023a) The impact of political connections on firm pollution: new evidence based on heterogeneous environmental regulation. Pet Sci 20(1):636–647. https://doi.org/10.1016/j.petsci.2022.10.019

Wang Z, Haiqin F, Ren X (2023b) Political connections and corporate carbon emission: new evidence from Chinese industrial firms. Technol Forecast Soc Chang 188:122326. https://doi.org/10.1016/j.techfore.2023.122326

Wen HM, Yue JL, Li J, Xiu XD, Zhong S (2022) Can digital finance reduce industrial pollution? New evidence from 260 cities in China. PLoS One 17:e0266564. https://doi.org/10.1371/JOURNAL.PONE.0266564

Wei SW, Du JM, Pan S (2022) How does digital economy promote green innovation: empirical evidence from Chinese cities. Coll Essayson Financ Econ 6:1–14. https://doi.org/10.13762/j.cnki.cjlc.20220308.001

Wei YD, Yu D, Chen X (2010) Scale, agglomeration, and regional inequality in provincial China. Tijdschr Econ Soc Geogr 102:406–425. https://doi.org/10.1111/j.1467-9663.2010.00621.x

Wu HT, Ren S, Yan G, Hao Y (2020) Does China's outward direct investment improve green total factor productivity in the“Belt and Road”countries? Evidence from dynamic threshold panel model analysis. J Environ Manag 275:111295

Wu YL, Huang SL (2022) The effects of digital finance and financial constraint on financial performance: firm-level evidence from China’s new energy enterprises. Energy Econ 112. https://doi.org/10.1016/J.ENECO.2022.106158

Xia YC, Qiao ZL, Xie GH (2022) Corporate resilience to the COVID-19 pandemic: the role of digital finance. Pac Basin Financ J 74. https://doi.org/10.1016/J.PACFIN.2022.101791

Xie DC, Li XF, Zhou D (2021) Does environmental information disclosure increase firm exports? Econ Anal Policy. https://doi.org/10.1016/J.EAP.2021.12.012

Xu N, Fan XY, Hu R (2022) Adoption of green industrial Internet of Things to improve organizational performance: the role of institutional isomorphism and green innovation practices. Front Psychol. https://doi.org/10.3389/FPSYG.2022.917533

Yang C, Liu S (2020) Spatial correlation analysis of low-carbon innovation: a case study of manufacturing patents in China. J Clean Prod 122893. https://doi.org/10.1016/j.jclepro.2020.122893