Abstract

Innovation in green technologies is a useful strategy for achieving sustainable economic growth. This study used a two-way fixed effects model and a threshold regression model, drawing on data from 282 Chinese prefecture-level cities, to examine the influence and workings of digital financial inclusion on regional green technology innovation between 2011 and 2020. The empirical findings demonstrate that digital financial inclusion significantly boosts regional green technology innovation. In particular, the degree to which digital financial inclusion is used and geographic location-related factors that influence this impact may differ. This study also discovered that regional green technology innovation is mediated by the amount of R&D expenditure made by social and economic actors and moderated by environmental regulations. Furthermore, the threshold regression model’s empirical results point to a single threshold value in the connection between green technology innovation and digital financial inclusion. It is projected that digital financial development greatly encourages green technology innovation below a certain threshold of digital financial inclusion, set at 2.662. In conclusion, this study emphasizes that, particularly in central and western areas, efforts should be made to supplement the deficiencies of the inadequate development of digital services by strengthening the construction of information infrastructure.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

With the increasing environmental pressure, various sectors of the international community have realized the importance and necessity of developing an environmentally friendly green economy. In 2024, China proposed the “new quality productivity” concept, which is led by innovation and focuses on data and technological elements, with high-technology, high-efficiency, and high-quality characteristics. In other words, new productive forces are inevitably environmentally friendly, and the foundation of the new energy system is the new productive forces created by green technology (Hong, 2024). Therefore, accelerating green technology innovation (GTP) is important in developing new quality productivity (Zhou & Li, 2024). However, the high risk, long innovation return period, and low return characteristics of GTP naturally contradict finance's profit-seeking and risk avoidance nature, and the lack of transparency in green information disclosure is widespread. Traditional finance makes it difficult to solve the fundamental deficiencies in information disclosure between banks and enterprises, and there are moral risks and adverse selection problems in the financing process of green innovation for enterprises, resulting in severe financial exclusion (Ba et al., 2022). However, currently relying solely on financial support makes it difficult to meet enterprises’ huge funding needs in green innovation, so financing constraints have become the core element affecting enterprise green innovation (Wu & Liu, 2023). Even worse, the Chinese financial market is facing the problem of command-and-control financial allocation constraints caused by supply and demand imbalances (Deng & Zumulaiti, 2023), which can exacerbate the mismatch of financial resources and trigger systemic financial risks (Feng et al., 2022). In this context, China urgently needs a green finance policy to break information asymmetry and incentivize the market.

Thanks to its technological advantages, the booming of digital inclusive finance (Inf) has brought new hope to areas with severe financial exclusion, such as green finance and rural finance (Wang et al., 2022). The problems of financial exclusion and attribute mismatch exist in traditional finance, but Inf affects inclusiveness. Firstly, Inf can reduce transaction costs, and digital technology can also break through time and space limitations to alleviate information asymmetry and financial exclusion problems, improve the breadth, accuracy, and efficiency of financial services, and make up for the shortcomings of traditional finance (Feng & Zhang, 2024). Secondly, Inf can use big data information platforms to evaluate the credit level of users accurately, achieve rapid credit granting, improve the financing environment, broaden the channels for enterprises to obtain green production funds, and increase users’ adoption of new technologies (Wang & Ma, 2023). Meanwhile, the broader and deeper the scope and degree of financial exclusion, the greater the space for implementing Inf and the more significant the effect of alleviating financial exclusion (Jiang & He, 2023). Therefore, Inf is a financial product based on new productive forces, which can improve the financing situation of GTP, thereby feeding back new productive forces and forming a virtuous economic cycle. The above literature mainly explores the impact of digital finance on financial exclusion, green economic growth, and other aspects. As far as we know, no literature has systematically and deeply analyzed green innovation from the perspective of digital finance. Thus, it is important to clarify the impact and mechanism of digital finance on promoting green innovation and development and clarify this issue for the construction of Digital China.

Drawing on both theoretical and empirical approaches, this study aims to analyze the relationship between GTP and Inf. In addition to offering policy recommendations, this will provide a complete understanding of the current state of China’s green growth.

The marginal contribution of this study reflects the following three aspects: First, it enriches the research related to Inf. Starting from the novel perspective of Inf, this study systematically examines its impact on GTP at the theoretical and empirical levels. It provides a new perspective for understanding the role of digital financial inclusion. With the continuous advancement of Inf, there has been an increase in relevant research. Still, existing studies mainly explain Inf's connotation, framework, development, influencing factors, and effects based on a qualitative analysis. This study breaks through the previous perceptual cognition, combines the theories of financial inclusion and green development, and provides theoretical and empirical support for understanding the effect of Inf. Second, it clarifies the mechanism by which digital financial inclusion promotes GTP. Most existing empirical analyses have separately explored the direct impact of financial development and R&D investment on GTP, ignoring the logical relationship between Inf and R&D investment. This study explores the intermediary role of R&D investment in Inf and GTP. At the same time, we find the dual regulatory role of government environmental regulatory policies concerning corporate R&D investment. It builds a more comprehensive multi-theoretical analysis framework. Third, the conditions required for Inf to exert an innovative effect on green technology are identified. This study examines the direction of the impact of Inf and conducts a heterogeneity analysis based on different regions. While ensuring the richness of the research and providing ideas for analyzing the heterogeneity of the effects of Inf, it also reveals the conditions under which inclusive finance can play a role and provides useful insights for improving the development plan of Inf.

Literature Review

Four categories can be used to categorize the pertinent literature on R&D investment, GTP, and Inf. Firstly, regarding the research on Inf and research and development investment, Qi et al. (2023) found that Inf has a positive spatial spillover effect on the R&D efficiency and achievement conversion efficiency of enterprises, which can motivate them to increase their R&D investment. Based on panel data, Liang et al. (2023) found that Inf helps increase enterprises' confidence and enthusiasm in R&D, reduce financing and transaction costs, and improve R&D productivity. Inf not only helps to create new products but can also strengthen existing products or services. However, several scholars have also noticed some shortcomings. He and Liu (2023) used listed companies on the ChiNext and Science and Technology Innovation Boards as samples. They found that improving the level of Inf weakens the ability of enterprises to use research and development investment to reduce credit risk.

Secondly, regarding the research on Inf and GTP, Zheng et al. (2024), drawing on panel data, found that Inf promotes the transformation and upgrading of industrial structure, effectively promoting green innovation. Wang and Zhan (2023) found that Inf and green finance have a synergistic effect, jointly stimulating GTP and promoting high-quality economic development.

Thirdly, regarding the existing study on R&D investment and GTP, Wang et al. (2023) used the SBM-DEA model and the two-way fixed effects model in their study and found that green innovation efficiency in various regions of China showed a trend of first decreasing and then increasing, mainly due to the large investment of R&D personnel and funds in the early stage, and the effect of R&D investment in the later stage began to emerge. Xiao et al. (2023) found that GTP by enterprises has positive public externalities, and its benefits are difficult-to-bridge R&D costs, which can lead to insufficient R&D investment of firms in GTP, requiring continuous government measures. Xu et al. (2023) manually collected, organized, and studied data on the shareholding ratio and appointed executives of non-state-owned enterprises in state-owned listed enterprises from 2008 to 2019. They found that GTP often involves improvements in production processes, as well as in other processes, thus posing higher R&D risks than general technology innovation. Therefore, more funds are needed to hedge technology risks, and continuous R&D investment is a prerequisite for GTP in enterprises. Finally, regarding environmental regulation and GTP research, Ouyang et al. (2022), who examined heterogeneity effects and spatial spillover perspectives, found that environmental regulations significantly stimulate GTP. There is also a phenomenon of spatial spillover: inter-regional industrial transfer affects the industrial structure and industrialization process of neighboring regions, thereby improving their green innovation output.

The academic community has extensively researched Inf, GTP, research and development investment, and environmental regulations. However, there is still a lack of overall framework research focusing on promoting GTP through Inf. The research on these two aspects does not clarify the mechanism that promotes GTP. Specifically, the research on R&D investment and environmental regulations indicates that only by improving the independent financing ability of enterprises and breaking away from dependence on government R&D support can the promoting effect of R&D investment be realized. Therefore, solving financing constraints and financial exclusion is the key to promoting GTP. We believe that, in this study, we should start with Inf. Still, we cannot ignore the multiple regulatory effects of government environmental regulations on financing, input, and output, as well as the need for enterprises to invest in research and development to promote GTP through independent financing.

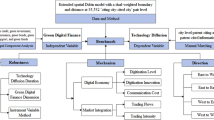

Using a moderated mesomeric effect model as a foundation, this research investigates the connection between R&D investment, Inf, and innovation in green technologies. In the sample, the Chinese nationwide panel data at the city and county level are used, the period is from 2011 to 2020, and the overall framework of how Inf supports GTP is examined. This comes from the Inf index provided by Peking University.

At the same time, we set R&D investment as an intermediary variable and environmental regulation as a moderating variable to study the mechanism by which Inf stimulates GTP more accurately. We study the non-linear characteristics of this impact through threshold regression models. By analyzing the heterogeneity between the North and South regions and the degree of digitization, depth of application, and coverage, we aim to clarify the specific impact of Inf on GTP within the overall framework.

Theoretical Analysis

The Direct Mechanism of Inf and GTP

Firstly, Inf can utilize the capital accumulation effect to adjust the optimal input of industrial development factors (Liu et al., 2023), improve the efficiency of financial resource allocation, convert idle social funds into financial products, and increase the efficiency of social fund utilization (Yang & Guo, 2024), which is conducive to improving enterprise research and development investment and manufacturing GTP efficiency. Secondly, Inf can alleviate the scale and regional biases of financial constraints in enterprises (Liu & Xu, 2023), thereby optimizing resource allocation, especially for private enterprises and small- and medium-sized enterprises with strong innovation capabilities (Pang et al., 2023), as well as promoting GTP. Thirdly, Inf uses the Internet tool and other scientific and technological methods to break through the limitations of time, space, and size of the working population; alleviate the information asymmetry between capital supply and demand; reduce the cost of financing (Wei & Li, 2024); improve financing convenience (Hong, 2023); and increase the availability of credit. Due to this reason, this study puts forward Hypothesis 1:

-

Hypothesis 1: The advancement of Inf fosters innovation in green technologies.

The Indirect Impact of Inf on Innovation in Green Technologies

Under the pressure of environmental regulations, enterprises face the constraints of factor substitution effects. High-productivity enterprises will choose to increase R&D investment to achieve marginal benefits of GTP (Lei & Guo, 2023). Low-productivity enterprises that were originally limited by financial constraints can also obtain funds that match the demand for R&D investment through Inf, carry out GTP, and avoid exiting the market due to passive production. We will increase investment in GTP. Inf can lower the threshold for financial services, broaden financing channels, increase enterprise funds, and promote upgrading the industrial structure (Guo & Jin, 2022). It is worth mentioning that government environmental regulatory policies play a regulatory role in the various stages of inclusive finance affecting corporate green innovation. China is in the development stage of institutional transformation, and the market mechanism cannot yet play a decisive role in allocating innovation resources. The government needs to intervene in the incentive process of innovation activities. Therefore, China mainly adopts administrative command-type or government performance assessment-type environmental regulation methods (Yu & Yin, 2022). China’s finance has a relatively prominent problem of misallocating financial resources (Deng & Zumulaiti, 2023). To a large extent, financial resources need to be allocated through government policy orders. Environmental regulatory policies can encourage financial institutions to develop more green projects and increase green credit; however, to promote green development, the Chinese government has successively implemented different types of environmental regulations, such as the market incentive type, investment type, and government command type (Tian & Hao, 2020). These environmental regulations and policies have greatly affected the amount of inclusive financial funds enterprises invest in green innovation and have a large indirect effect on enterprises’ green innovation. Based on this, in the model, the regulatory role of the government’s environmental regulatory policies for enterprises cannot be ignored.

-

Hypothesis 2: R&D plays an intermediary effect in the process of digital finance affecting GTP, while environmental regulation plays a moderating effect in the process of digital finance affecting GTP.

The Non-Linear Transmission Mechanism of Inf to GTP

The non-linear characteristics of Inf manifest in various fields such as household income (Chen & Chang, 2024) and household consumption (Chen & Zhao, 2023), urban–rural integration (Cui & Zhao, 2023), carbon emissions (Sun & Zhang, 2023), and GTP (Zhang et al., 2022). The main reason for this is that digital technology’s non-linear development leads to Inf’s non-linear development. Digital infrastructure is the cornerstone of Inf (An et al., 2023). In the early stages, the immaturity of digital technology led to high costs of technology research and information acquisition and high costs of digital infrastructure. The development process of Inf was slow. The ability to eliminate information asymmetry was weak, especially because the existence of the “rural finance paradox” and “triple divide” (Xing, 2021) made it difficult to leverage its advantages of low cost and diversification. With emerging technologies such as big data, 5G communication, artificial intelligence, cloud computing, and blockchain, the integration of digital technology and the financial industry continues to deepen. The “network effect” and “connectivity effect” (Wei & Luo, 2023) continue to emerge, and the aggregation of funds, talents, and technology continues to reinforce. The ability of Inf to allocate factors continues to strengthen, and its impact scope continues to expand, improving the promotion of GTP. Therefore, Inf exhibits non-linear characteristics. This paper thus proposes Hypothesis 3:

-

Hypothesis 3: There is a non-linear quality to the way Inf fosters GTP in businesses.

Theoretical Implication

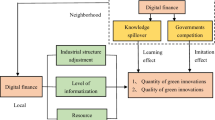

Due to the relatively short introduction of the concept of digital finance in China, research on digital finance has mostly focused on aspects such as household income, economic growth, and the urban–rural income gap. However, few articles explore how digital finance affects green technology innovation and its underlying impact mechanisms. This article reviews existing literature and, based on China’s current strategy of promoting green development and harmonious coexistence between humans and nature, explores the mechanism of how digital finance invests in urban green technology innovation through research and development and how it affects urban green technology innovation under government environmental supervision, using R&D investment as a mediator variable and government environmental regulation as a moderating variable. It enriches the research on how digital finance can better play a role in high-quality green development and has certain theoretical significance. However, Fig. 1 shows how Inf influences the development of GTP.

Indicator Selection and Model Design

Variable Selection

Dependent Variable: Green Technology Innovation (GTP)

Generally speaking, if new products and processes can create value for consumers and businesses, help reduce environmental burdens, or achieve ecological sustainability goals, they can be classified as green innovations. This study adopts the International Patent Classification Green Inventory (IPc Green Inventory) released by the World Intellectual Property Organization (WIPO) in 2010. The classification of green patents in the classification list provides a basis for accurately identifying urban green innovation. Most previous literature used nonparametric DEA and the Solow residual method to measure technological progress. Considering that it is not easy to completely separate the input and output of green elements from general production, this study matches the patent data obtained from the China National Intellectual Property Administration with the IPC code of green patents defined in the above green list. Using the number of urban green patent applications to characterize the level of green innovation (Dong & Wang, 2021), this study focuses on the role of Inf in promoting both the quality and quantity of green innovation. Considering that invention patents are “high-quality” innovative achievements and have higher technological content and innovation than utility model patents, the commonly used practices in the existing literature are adopted (Li & Zheng, 2016; Wang & Wang, 2021). The quality of urban green innovation is measured by the number of green invention patent applications per 10,000 people (Gtp1). The number of green innovations is measured by the number of green utility model patent applications per 10,000 people (Gtp2). This can ensure the accuracy and pertinence of the data and, to some extent, alleviate the impact of other unobservable factors in the macroeconomy.

Independent Variable: Digital Finance (Inf)

The second edition of the “Peking University Inf Index,” created in collaboration with Ant Financial and the Peking University Digital Finance Research Centre, is used in this study as a stand-in for the degree of Inf development (Guo et al., 2020). Simultaneously, Inf_di, Inf _de, and Inf_cov represent the three tiers of Inf, the extent of digitalization, the breadth of coverage, and the depth of application, respectively. Considering the issue of magnitude, the Inf index is processed by dividing it by 100.

Mediating Variable: R&D Investment (R&D)

An essential component of the innovation process is capital investment. This study uses technology expenditure/GDP from different regions to show investment in research and development because prefecture-level statistics on research and experimental development expenditures are lacking (Lin & Tan, 2019; Li et al., 2022; Zhou & Zhang, 2021).

Mediating Variable: Environmental regulation (Envir)

This paper first refers to the practice of Chen and Chen (2018), who use Python software to conduct word segmentation processing on government work reports, and respectively statistics on the word frequency of keywords related to environmental regulation in the government work reports of 317 prefecture-level cities in China from 2011 to 2020 (in two ways: precise word frequency and extended word frequency). However, the impact of government environmental governance on the cities under its jurisdiction varies with the proportion of heavy industry in the cities. Therefore, Zhang and Chen (2021) calculated the proportion of heavy industry in the GDP of prefecture-level cities in the province based on the Database of China Industrial Enterprises, and then cross-referenced it with the frequency of words related to “environmental protection” in the provincial government work report, so as to construct the indicator of environmental regulation intensity of prefecture-level cities.

Control Variables

The following control variables are used in this study to guarantee the robustness of the results: (1) the degree of fiscal decentralization (Finadp); this is measured by the ratio of revenue within the fiscal budget to the fiscal budget. (2) The level of traditional financial development (Tf); this is the equilibrium state of loans from financial institutions to GDP (Omran & Bolbol, 2003). (3) The level of human capital (Hc); given that education is a major determinant of human capital, this study measures the degree of human capital in different locations by focusing on permanent residents and those with a bachelor’s degree or above (Zhang & Huang, 2020; Wang et al., 2020; He et al., 2020). (4) Mi, or institutional quality; based on earlier studies, in this work, the indicators are made up of the score of the relationship between government and market, the development score of non-state-owned economy, the score of product market development, the score of factor market development, the development level of intermediary organizations, and the legal score, and these are calculated using market-oriented indices (Cao et al., 2015; Li & Yu, 2015; Ma et al., 2015) in a thorough evaluation with a strong scientific focus. (5) The road level of transportation facilities; this is characterized by the per capita road area of prefecture-level cities.

Model Establishment

Initially, this study is dependent on the variable GTP, which is measured by the number of green patents granted (GTP1) and the number of declarations (GTP2), and it sets up the following two-way fixed effects model to investigate the direct impact of Inf on GTP:

In Eq. (1), i represents the city, j represents the province, t represents the year, \(Contro{l}_{iJt}\) represents the control variable, \({v}_{i}\) represents the city fixed effects; \({w}_{j}\), represents the province fixed effects, \({\mu }_{t}\) represents the year fixed effects, and \({\varepsilon }_{it}\) represents a random disturbance term.

Then, in order to confirm whether R&D investment intensity acts as a mediator in the impact mechanism of Inf on the invention of green technology, the following model is developed:

Finally, a panel threshold model is developed to investigate the non-linear mechanism of Inf in GTP, given that the effects of varying degrees of Inf development on GTP may not be linear.

Here, \({Z}_{1}\) and \({Z}_{2}\) are the thresholds for Inf, and \(I( )\) is an indicator function. The other variables are dependent, as detailed above.

Data Sources and Descriptive Statistics

This study employs 282 prefectures, municipalities, and autonomous regions in China from 2011 to 2020 (the Tibet Autonomous Region, Hong Kong, Macao, Taiwan, and places lacking data are not considered in this study). The data sources are the National Bureau of Statistics, the China Statistical Yearbook published by Peking University's Inf Research Centre, and the China Inf Index. The median supplements the missing values. Table 1 displays the descriptive statistical findings for every variable. In this study (Gal & Rubinfeld, 2019), all variables are standardized before being entered into the regression equation. The aforementioned continuous variables are then submitted to 1% up and down tailing to ensure that the final outcome is unaffected by the data dimension.

Empirical Analysis Results

Benchmark Regression Results

The benchmark regression results are presented in Table 2 below, where columns (1) and (2) represent the models with and without the control variables, respectively. Drawing inspiration from Hanushek (2013), Becker (1962), Grossman and Helpman (1991), and Romer (1990), we quantify the impact of Inf on GTP using the number of green patent grants. The influence of Inf on GTP is indicated in columns (3) and (4) by the quantity of green patent applications when the control variables are included or excluded. The table shows that, when measuring GTP using the number of green patent grants and applications or considering the control variables, the influence of Inf on such innovation has a statistically significant positive coefficient, with a significance level of 1%. This confirms our first hypothesis by demonstrating that Inf can effectively reduce transaction costs, provide broader funding channels for green enterprises, and address information asymmetry between lenders and borrowers.

Endogenous Testing

The previous empirical test controls the prefecture, city, and time-fixed effects. It can availably solve some endogenous problems caused by omitted variable bias. However, there are still many difficult-to-observe factors that may cause endogenous problems in the model. First, enterprise green innovation is affected by many potential factors. It is difficult to provide a comprehensive list of influencing factors in this article, so missing variables may still cause endogenous problems. Although this study’s independent and dependent variable data are from authoritative databases, measurement errors or endogenous problems caused by people for data aesthetic reasons cannot be avoided. Thirdly, there is an endogenous problem caused by the correlation between Inf-related indices and green innovation, and enterprises with policy preferences in developed regions can also obtain digital financial services more easily through the policy advantages and market advantages obtained (Zhang et al., 2016).

Thus, in order to address endogenous problems, this research employs the following strategies: (1) endogenous problems are solved with the instrumental variable approach. The spherical distance between a city and Hangzhou is used in this study's construction of the tool variable (IV), following the methodologies of Huang et al. (2019) and Jiang et al. (2021). Since the spherical distance in this research is fixed and the data are panel data, Nunn and Qian’s (2014) methodology is followed, and the interaction term between the spherical distance and the prior digital financial index is used as an instrumental variable. (2) A first-order lag is applied to the independent and control variables, which can be utilized to mitigate somewhat the endogenous problem caused by reverse causality. This approach has also been successfully used in this work to ease other endogenous problems.

Table 3 displays the findings of the IV’s two-stage least squares estimation in columns 1–4. The findings of the independent and control variables’ one-stage lag estimates are shown in columns 5 and 6. The variable coefficients of Inf are significantly positive, suggesting that Inf can still greatly encourage an increase in GTP, even after considering the endogenous problem.

Robustness test

The following techniques are also used in this study to carry out robustness testing in order to guarantee the validity of the abovementioned results: First, the municipalities' influence on the regression findings is removed. The regression findings are displayed in columns (1) and (2) in Table 4. Second, the way in which the described variable is measured is changed.

As substitute indicators for the variables discussed, the number of green invention patent authorizations per 10,000 inhabitants in the city and the number of green utility patent authorizations per 10,000 inhabitants are chosen. In Table 4, columns (3) and (4) display the regression findings; the third is used to omit external influence testing. The network infrastructure upgrade of the “Broadband China” pilot is chosen as this study's exogenous policy impact group, and pilot and non-pilot cities serve as the experimental and control groups, respectively. The policy effects of digital financial development are empirically tested using the difference-in-difference (DID) method. In Table 5, the first and second columns display the results; the sample period is changed in the fourth column. According to Huang and Huang (2018), China's digital financial development began in 2013 with the launch of Yu'e Bao. Following that, China’s digital financial industry flourished. This study removes the 2011 and 2012 data to strengthen the conclusion. In columns (3) and (4) in Table 5, the results obtained after re-regressing and changing the sample period to 2012 are displayed.

Since the current GTP in the city may be affected by the previous innovation experience, the lagged first-period variables of green invention patents per 10,000 people and green utility patents per 10,000 people are included in the benchmark regression model. Then, the systematic GMM estimation method is used for a regression analysis, and the regression results are shown in Table 6. The lagged dependent variable is significantly correlated with the current dependent variable at the 1% level, indicating that the model does indeed have some endogeneity. At the same time, Ar1 is significant, whereas Ar2 is not, passing the autocorrelation test. Hansen's test is significant, passing the other test. Therefore, GMM can be used for endogeneity treatment, and the results are still significant.

It can be seen in Tables 4, 5, and 6 that the regression results are consistent with those of a previous article, indicating that the conclusion that Inf can promote urban GTP is robust and reliable.

Analysis of the Mediating Effect

To investigate whether R&D investment mediates the mechanism by which Inf fosters innovation in green technology, this study puts forward a model. Table 7 presents the results of the intermediate effect test. To begin with, the statistics in column (1) in Table 7 show that, at a 1% confidence level, Inf has a considerable favorable impact on R&D contributions, demonstrating a catalytic effect. Next, we look at column (2), where we consider R&D inputs and analyze the impact of Inf on GTP, as indicated by the quality of green patents awarded.

Similarly, column (3) investigates how Inf impacts GTP measured by the quality of green patent applications, considering the intermediaries' R&D inputs. The results in Table 7 demonstrate that, even with the R&D input variables included, the impact of Inf on GTP remains significantly positive. Additionally, at a confidence level of 1%, the impact coefficient of R&D input is likewise significantly positive. Furthermore, the impact coefficient of Inf decreases with the addition of R&D investment, indicating that this investment has an intermediary effect on the influencing mechanism by which Inf supports GTP. Hypothesis 2 has been verified.

Analysis of the Moderating Effect

This study developed a model to examine the moderating effects and the experimental findings are presented in Table 8. The moderating effects of several variables on inclusive finance and corporate green innovation were verified and measured. Firstly, as can be seen in the results in column (1) in Table 8, the impact coefficient of the environmental regulation policy Envir on the innovation of green technologies is significantly negative at a 1% confidence level. This suggests that environmental regulation policies directly affect GTP, and stringent environmental regulations offer limited advantages. Secondly, the other set of models in columns (3) and (4) also found the same results as above. In column (2), the interaction term between inclusive finance and environmental regulation policies is significantly positive for GTP at a confidence level of 1%, suggesting that environmental regulation policies have a significant positive impact on GTP indirectly by regulating Inf. The results in Table 8 demonstrate that the impact of Inf on GTP remains significant at a 1% confidence level when the regulatory effect of environmental regulation policies is included. Hypothesis 2 has been verified.

Additionally, the impact coefficient of Inf decreases when the regulatory effect of environmental regulation policies is included, indicating that environmental regulation policies have a positive regulatory effect on the transmission of Inf. However, the advantages are negligible or even zero when environmental regulatory laws directly impact GTP. GTP has a favorable effect when regulatory impacts are used to convey Inf. The aforementioned phenomena suggest that incentive environmental regulation policies are more effective over time than restrictive ones. Therefore, expediting the development of incentive environmental regulation policies is necessary.

Heterogeneity Testing

Regional Heterogeneity Test

The impact of the digital economy on GTP may lead to variations in its influence across different locations. This study splits the national sample into southern and northern areas for a heterogeneity analysis. The findings, presented in Table 9 below, clearly demonstrate that Inf plays a crucial role in fostering the progress of GTP in both the southern and northern areas. The effect coefficient of Inf in the southern region is 3.228, higher than 0.875 in the northern region, based on the number of inventive patent applications per 10,000 persons. Regarding utility patent applications per 10,000 inhabitants, the southern region has a higher rate of 3.529 than the northern region’s 0.858. This is most likely a result of the disparities in development and industry between the North and South. First, the level of economic development in the South is generally higher than in the North. Since the South has higher levels of education and research than the North, Inf has a greater effect on the number of green patents awarded there. The North’s second industrial structure is primarily heavy industry, in contrast to the South's high-tech enterprise industrial layout. According to Mo and Long (2018), the North has a greater need for GTP, a higher technological spillover effect, and a stronger digital inclusive financing promotion effect on green patent grants.

Inf in Different Dimensions of Heterogeneity

This section splits the application scope into three levels, namely, the degree of digitalization, the depth of application, and the breadth of coverage, to examine the heterogeneity of Inf at different levels. The regression analysis results are presented in Table 10, aiming to explore how Inf sub-indicators influence the impact of technical innovation. The breadth and depth of the usage indices of the digitization index are notably positive, as demonstrated in the table. Regardless of their effect on the quality of green patents awarded or green patent applications, the impact coefficient of the depth of use is observed to surpass that of the breadth of use. The application of digital financial services relies heavily on its breadth, while its depth can better understand the potential of big data and inclusive financial services.

Threshold Effect Test

According to the theoretical study presented above, the influence of Inf on green innovation may not be linear. Thus, threshold regression is used in this study to examine the non-linear mechanism of Inf in GTP (Hansen, 2000). First, regarding the regression threshold, bootstrap is used to determine the threshold value and whether Inf has a threshold effect, and Table 11 displays the findings. As can be observed, the single threshold test was passed by inclusive digital banking at the 1% confidence level. In this case, Inf has a single criterion of 2.6662.

The findings of the threshold existence test in Table 11 indicate that, at the 1% significance level, there is only one threshold impact in the link between Inf and GTP, contingent on the level of development of Inf. The threshold value is estimated to be 2.662. Table 12 displays the panel threshold effect regression findings obtained after passing the threshold existence test. When Inf is less than or equal to 2.622, the promotion impact of Inf on GTP is 0.123, and when Inf is larger than or equal to 2.622, it is 0.253. This result supports Hypothesis 3 and shows how the expansion of Inf reduces the cost of using it, reduces information asymmetry, and increases the effectiveness of financial resource allocation to green businesses. All of these factors increase Inf’s role in fostering the development of GTP.

Conclusions and Recommendations

Conclusions

Panel data from 282 Chinese prefecture-level cities between 2011 and 2020 served as the basis for this research. This research examined the internal mechanism, non-linear transmission path, and regional heterogeneity of the influence of Inf on regional GTP using the mediation effect model and threshold regression model. It also considered the regulatory function of environmental laws, offering new empirical data on the impacts of urban innovation. This study’s main conclusions are: (1) Generally, regional GTP greatly benefits from including Inf. In particular, to various degrees, Inf's scope, intensity, and location can foster local GTP; this fundamental finding remains true following a series of experiments. (2) The R&D investments businesses make mediate regional GTP development. At the same time, indirect environmental regulation based on market incentives plays a positive regulatory role, but direct environmental regulation based on administrative orders will inhibit R&D investment and green technology innovation. Furthermore, the threshold regression model's empirical findings point to a single threshold for connecting GTP and digital banking inclusion. It is anticipated that establishing Inf will considerably boost GTP at a threshold level of 2.662. The promotion effect of Inf on GTP is 0.123 when the threshold value is smaller than 2.662, and the promotion impact is 0.253 when it exceeds 2.662. (3) The impact of Inf on GTP varies, as evidenced by the fact that GTP has a significantly greater empowering effect on northern cities than on other cities. This suggests that the “inclusive effect” of Inf is noteworthy.

Policy Recommendations

This study suggests the following: firstly, to improve the level of digitalization in Inf, the focus should be placed on expanding the breadth and depth of Inf coverage, continuing to strengthen the construction of Inf software and hardware, integrating relevant forces such as financial institutions, communication operators, financial technology platforms, universities, and research institutes. Jointly promoting the construction of Inf infrastructures such as financial data aggregation, transmission, and application facilities and consolidating the hardware foundation for the development of Inf is also necessary. At the same time, the government should improve software support in areas such as risk prevention and customer service for digital-inclusive financial products and services. Secondly, it is suggested that, when developing green innovation to attract R&D investment from enterprises, attention should be paid to leveraging joint efforts, comprehensively improving the urban business environment, and creating a favorable ecology for green innovation while improving resource allocation efficiency and achieving regional differentiated development. Based on the characteristics of different cities, policies tailored to each city should be adhered to, as well as differentiated and tailored Inf development policies that meet the city's needs.

It is also recommended that the government continue increasing investment in education and financial institutions that provide inclusive education and financial services. In addition, it is recommended to deepen the structural reform of the financial supply side, use new-generation digital information technology to guide more financial resources to support technological innovation, and continuously meet the needs of high-quality economic development with high-quality digital inclusive financial services. From product, technology, platform, and regulation channels, the government should aim to create a more comprehensive and efficient digital innovation financial service model, providing one-stop and efficient financing support and diversified risk-sharing solutions for science and technology enterprises. The government should also aim to enhance financial resources’ inclusiveness among market entities of different ownership systems, scales, growth stages, and regions and eliminate unequal opportunities to access financial resources. This can lay the foundation for enhancing urban human capital and urban green innovation capabilities.

This study still has certain shortcomings. Firstly, this article investigates the impact of digital finance inclusivity on regional green technology innovation, focusing on direct mechanisms, R&D investment, government environmental regulation mechanisms, and non-linear effects. However, it does not directly test and analyze other influencing mechanisms, such as the impact of enterprise digital transformation on regional green technology innovation. In future research, the development characteristics of digital finance can be further combined to reveal the role of enterprise digital transformation in regional green technology innovation. Secondly, although this article conducted heterogeneity analysis and testing on the zoning of prefecture-level cities, it did not explore the possible differences in the role of digital finance at different stages of urban development. In future research, taking different stages of urban development as time points, further explore the correlation mechanism between digital finance inclusiveness and regional green technology innovation.

Data Availability

Not applicable.

References

An, Q., Liu, J., & Li, W. (2023). Digital inclusive finance and upgrading of residents’ consumption structure: mechanism of action and empirical evidence. Journal of Yunnan University of Finance and Economics, 39(3), 1–23.

Ba, S., Li, N., & Zhang, J. (2022). Digital finance and corporate green innovation: Exclusion or integration. Research on Financial and Economic Issues, 12, 57–68.

Becker, G. S. (1962). Investment in human capital: A theoretical analysis. Journal of political economy, 70(5), 9–49.

Cao, F., Lu, B., Li, Z., & Xu, K. (2015). Do institutional investors reduce the risk of a share price crash? Accounting Research, 11, 55–61.

Chen, J., & Chang, K. (2024). Mechanism and improvement strategies for digital inclusive finance to promote residents’ consumption. Theoretical Investigation, (1), 144–149.

Chen, S., & Chen, D. (2018). Haze pollution, government control and high-quality economic development. Economic Research, 53(02), 20–34.

Chen, J., & Zhao, D. (2023). Can digital inclusive finance promote urban-rural integrated development?——an empirical test based on the threshold effect model. Inquiry Into Economic Issues, 03, 79–96.

Cui, J., & Zhao, D. (2023). Can digital financial inclusion promote urban and rural integration? Empirical test based on threshold effect model. Economic Problems Exploration, (03), 79–96.

Deng, G., & Zumulaiti, D. (2023). Dilemmas and solutions for rural financial resource allocation. Journal of South China Agricultural University (Social Science Edition), 22(4), 22–28.

Dong, Z., & Wang, H. (2021). Urban wealth and green technology choice. Economic Research Journal, 56(4), 143–159.

Feng, R., Zheng, W., & Zhang, S. (2022). Research on the impact of financial resource allocation efficiency on local systemic financial risks. Academic Research, (5), 98–105.

Feng, S., & Zhang, Z. (2024). Research on the impact of digital financial inclusion on multidimensional poverty vulnerability. Review of Economy and Management, 40(1), 44–57.

Gal, M. S., & Rubinfeld, D. L. (2019). Data Standardization. NYUL Review, 94, 737.

Grossman, G. M., & Helpman, E. (1991). Quality ladders in the theory of growth. The Review of Economic Studies, 58(1), 43–61.

Guo, S., & Jin, Z. (2022). Research on the spatial spillover effect of digital inclusive finance on the upgrading of regional industrial structure. Economic Survey, 39(6), 77–87.

Guo, F., Wang, J., Wang, F., Kong, T., Zhang, X., & Cheng, Z. (2020). Measuring the development of digital inclusive finance in China: Index compilation and spatial characteristics. China Economics Quarterly, 19(04), 1401–1418.

Hansen, B. E. (2000). Sample splitting and threshold estimation. Econometrica, 68, 575–603.

Hanushek, E. A. (2013). Economic growth in developing countries: The role of human capital. Economics of Education Review, 37, 204–212.

He, Y., & Liu, G. (2023). The impact of R&D investment on credit risk of small and medium-sized enterprises - based on the perspective of digital inclusive finance. Forum on Science and Technology in China, 2023(8), 86–96.

He, X., Luo, Q., & Chen, J. (2020). High-quality human capital and the upgrading of urban industrial structure in China: Evidence from “expansion of University Enrollment.” Economic Review, 4, 3–19.

Hong, H. (2023). The impact of digital inclusive finance on the innovation drive of small and medium-sized enterprises in the information technology industry. China Business and Market, 37(12), 68–78.

Hong, Y. (2024). Develop new productive forces and build a modern industrial system. Contemporary Economic Research, (2), 7–9.

Huang, Y., & Huang, Z. (2018). Digital finance development in China: Present and future. China Economic Quarterly, 17(4), 1489–1502.

Huang, Q., Yu, Y., & Zhang, S. (2019). Internet development and manufacturing productivity improvement: Internal mechanism and Chinese experience. China Industrial Economy,(8), 5–23.

Jiang, S., & He, Y. (2023). Research on the impact of digital inclusive finance on credit income of listed commercial banks. Chongqing Social Sciences, 11, 113–128.

Jiang, X., Wang, X., Ren, J., & Xie, Z. (2021). The Nexus between digital finance and economic development: evidence from China. Sustainability, 13(13), 7289.

Lei, Z., & Guo, A. (2023). Can green credit policies affect corporate total factor productivity - Empirical evidence from A-share listed companies. Journal of China University of Geosciences(Social Sciences Edition), 23(6), 100–113.

Li, W., & Yu, M. (2015). Ownership structure and enterprise innovation of privatized enterprises. Journal of Management World, (4), 112–125.

Li, W., & Zheng, M. (2016). Substantive innovation or strategic innovation? - - The impact of macro-industrial policies on micro-enterprise innovation. Economic Research Journal, 51(4), 60–73.

Li, Z., Wang, J., & Wang, Y. (2022). Does economic agglomeration widen the gap of green economy efficiency? – Empirical evidence from urban agglomeration in the Yellow River Basin. Industrial Economics Research, (1), 29–42.

Liang, L., Li, Y., Chen, S. (2023). Examination of the effects and mechanisms of digital inclusive finance in promoting corporate green technology innovation, Statistics & Decision, 39(11), 168–173.

Lin, B., & Tan, R. (2019). Economic agglomeration and green economy efficiency in Chin. Economic Research Journal, 54(2), 119–132.

Liu, C., & Xu, Y. (2023). Does digital financial inclusionInf improve the inclusiveness of green development: the perspective of financial integration and technological innovation. Journal of China University of Geosciences(Social Sciences Edition), 23(06), 81–99.

Liu, M., Fang, X., & He, Qi. (2023). Can digital inclusive finance promote the upgrading of China’s urban industrial structure? Inquiry into Economic Issues, 2023(05), 140–157.

Ma, L., Wang, L., & Zhang, Q. (2015). The preferential choice of mixed ownership: The logic of the market. China Industrial Economics, (7), 5–20.

Mo, C., & Long, X. (2018). Industrial clusters, technology spillovers and enterprise innovation performance. Journal of Xiamen University, (1), 44–54.

Nunn, N., & Qian, N. (2014). US food aid and civil conflict. American Economic Review, 104(6), 1630–1666.

Omran, M., & Bolbol, A. (2003). Foreign direct investment, financial development, and economic growth: Evidence from the Arab countries. Review of Middle East Economics and Finance, 1(3), 37–55.

Ouyang, X., Zhang, J., & Du, G. (2022). Environmental regulation and urban green technology innovation: Influence mechanism and spatial effect. Chinese Journal of Management Science, 30(12), 141–151.

Pang, J., Zhang, H., & Wang, Q. (2023). Digital inclusive finance, financing constraints and high-quality development of the private economy. Statistics & Decision, 39(5), 130–135.

Qi, H., Zhang, J., & Chen, M. (2023). Research on how digital inclusive finance promotes the innovation efficiency of small and medium-sized enterprises - based on the perspective of innovation value chain. Macroeconomics, 2023(10), 23–40.

Romer, P. M. (1990). Endogenous Technological Change. Journal of Political Economy, 98(5), 71–102.

Sun, L., & Zhang, Q. (2023). Research on the impact of digital inclusive finance on corporate carbon emission intensity. Jiangxi Social Sciences, 43(11), 90–101.

Tian, H., & Hao, W. (2020). FDI, environmental regulation and green innovation efficiency. China Soft Science, (08), 174–183.

Wang, L., & Ma, J. (2023). The mechanism and effect of digital inclusive finance affecting agricultural green development. Journal of South China Agricultural University (social Science Edition), 22(6), 14–27.

Wang, X., Ma, X., & He, Q. (2022). Has the use of digital finance promoted the full release of the power of rural consumption? China Rural Economy, 455(11), 21–39.

Wang, Q., Wang, B., & Peng, R. (2020). Talent allocation and Total factor Productivity: On high-quality growth of China’s real economy. Journal of Finance and Economics, 46(1), 64–78.

Wang, X., & Wang, Y. (2021). Research of green credit policy promoting green innovation. Journal of Management World, 37(6), 173–188+11.

Wang, R., & Zhan, S. (2023). Research on the synergistic impact of digital inclusive finance and green finance on high-quality economic development. Modern Economic Research, (7), 59–70.

Wang, S., Lin, X., Zhang, W., & Li, Q. (2023). Research on the impact of green credit on the efficiency of green technology innovation in Chinese industry. Journal of Statistics and Information, 38(4), 88–102.

Wei, M., & Li, J. (2024). The impact of digital inclusive finance on the credit risk of commercial banks—a joint perspective based on deposit and loan structures. On Economic Problems, (2), 32–40.

Wei, B., & Luo, M. (2023). The impact of digital financial inclusionInf on the agricultural service industry—empirical evidence from prefecture-level cities in China. Financial Economics Research, 38(5), 61–74.

Wu, H., & Liu, J. (2023). Digital inclusive finance and green innovation of technology enterprises. Southeast Academic Journal, (02), 135–145.

Xiao, H., Yang, Z., & Wang, X. (2023). Central-regional industrial policy coordination, corporate social responsibility and corporate green technology innovation. Journal of Sun Yat-sen University(Social Science Edition), 63(1), 177–193.

Xing, Y. (2021). The “dividends” and “gaps” of rural digital inclusive finance. Economist, (2), 102–111.

Xu, D., Li, X., & Wang, J. (2023). Can non-state-owned shareholder governance promote green technology innovation in state-owned enterprises? Empirical research based on mixed ownership reform. Management Review, 35(09), 102–115.

Yang, C., & Guo, J. (2024). Research on the impact mechanism and spatial effect of digital inclusive finance on rural relative poverty. On Economic Problems, (3), 61–68.

Yu, Y., & Yin, L. (2022). Evolution of Chinese-style environmental regulation policies and their economic effects: review and prospect. Reform, (03), 114–130.

Zhang, K., & Huang, L. (2020). Trade openness, human capital and capacity for independent innovation. Finance and Trade Economics, 40(12), 112–127.

Zhang, J., & Chen, S. (2021). Financial development, environmental regulation and economic green transformation. Research of Finance and Economics, 47(11), 78–93.

Zhang, J., Yang, L., & Xin, F. (2016). Did real estate holding impeded Chinese innovation? - An explanation based on the maturity structure of loans in the financial system. Journal of Management World, (5), 64–80.

Zhang, J., Shang, J., & Qiao, B. (2022). Research on the impact of digital inclusive finance on green innovation efficiency - Empirical evidence from 280 prefecture-level cities in China. On Economic Problems, 11, 17–26.

Zheng, S., Liu, J., & Yao, T. (2024). Research on the impact and mechanism of digital finance on green technology innovation. On Economic Problems, (2), 41–47+63.

Zhou, W., & Li, J. (2024). New productivity and Chinese modernization. Social Science Journal, (2), 114–124.

Zhou, J., & Zhang, Y. (2021). Foreign direct investment, economic agglomeration and green economy efficiency: Theoretical analysis and Chinese experience. International Economics and Trade Research, 37(01), 66–82.

Acknowledgements

This work was supported by the Research on the formation mechanism and development path of guangzhou's new economy [2020GZGJ121]; the National Natural Science Foundation of China [No. 71971086]; the Guangdong Basic and Applied Basic Research Foundation [No. 2019B151502037]; Social Science Planning Project of Guangdong Province [GD22CYJ06] and Social Science Planning Project of Guangdong Province [GD22XGL24].

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethics Approval

No unethical activities were performed.

Consent to Participate

We (all the co-authors) are informed about this research work and give our consent for publication.

Consent for Publication

We give consent to publish our paper.

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sun, H., Luo, Y., Liu, J. et al. Does the Digital Finance Promote Technological Innovation? Evidence From Chinese Cities. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-02185-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-02185-4