Abstract

Recently, the rapid development of digital finance in China has exerted a subtle influence on many aspects of social and economic development. However, the research on the impact of digital finance on corporate green innovation is rather lacking. In order to fill this gap, this paper uses the “Peking University Digital Finance Index” to evaluate the micro impact of financial innovation development on environmental governance from the firm level. The results show that digital finance can significantly improve the quantity and quality of corporate green innovation, and this effect still exists after considering endogeneity and a series of robustness tests. The promotion effect of digital finance on the quantity and quality of corporate green innovation is more obvious in state-owned, eastern, and mature enterprises. In addition, we find the mechanism behind the positive relationship between digital finance and corporate green innovation: digital finance makes firms more transparent and funds flow more convenient. Overall, this paper provides a micro explanation of environmental governance for the accelerated popularization of digital finance in emerging markets, which is urgently needed for most emerging economies seeking high-quality development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since the reform and opening up in 1978, China has grown from a relatively underdeveloped country to become the world’s second-largest economy with its fastest-growing and most energetic economy; the GDP has grown from 367.8 billion yuan in 1978 to over 90 trillion-yuan threshold in 2018, which created a “Chinese miracle” in the history of economic development (Xu, 2018). Meanwhile, behind the rapid economic development of China, it has also brought about the rapid deterioration of the ecological environment (Elmagrhi et al., 2018), which has severely restricted the people’s pursuit of better welfare. According to a report published by the US Energy Information Administration, China is currently the world’s largest producer and consumer of coal, accounting for 23% of global energy consumption (EIA, 2019), which makes the issue of environmental sustainability becoming a real concern. As the main culprit of regional environmental pollution, enterprises have the indispensable responsibility to balance economic benefit and the environment. Building a green, intensive, and efficient innovation system is an inevitable decision for the sustainability of all companies. Therefore, activating new kinetic energy for corporate development and realizing the transition from the past “resource predatory” development to “resource protection” development, from “rough” development to “green” development, and it is crucial to use green innovation as “nuclear power” as an aid (Abdullah et al., 2016; Miao et al., 2017; Xie et al., 2019; Li et al., 2018). As a new sustainable development model, corporate green innovation has attracted extensive attention from researchers and practitioners (Polzin et al., 2016), seeking a “Harmonious coexistence” with the environment has become a global issue (Li et al, 2019). Existing studies have actively explored the antecedents of corporate green innovation, mainly including market pressure and orientation (Lin et al., 2013a, b; Qiu et al., 2020; Wang, 2020), environmental regulation (Cai et al., 2020; Zhang et al., 2020), government subsidies (Huang et al., 2019), the distance of environmental protection (e.g., the distance between firms and environmental protection organizations) (Hu et al., 2021), knowledge transfer (Awan et al., 2021), and green knowledge sharing (Song et al., 2020).

Compared with ordinary innovation activities, green innovation is a continuous task with higher risk coefficient, a higher possibility of failure, and longer return cycle (Huang et al., 2019; Ren et al., 2021), which requires stable, sufficient, and efficient financial resources as the guarantee. With the support of objective factors such as traditional financial policies and tools, firms have also made some progress in green innovation, which is manifested as a large number of green patent applications but low qualityFootnote 1 (Wang et al., 2021). However, it is undeniable that for most firms in developing countries whose financial markets are not fully developed, such a development model that ignores quality makes green innovation gradually fall into a low-end dilemma and difficult to achieve breakthrough progress. This also shows that the traditional financial system in the process of green innovation of service firms has been stretched out.

The predicament of enterprise development led by traditional finance needs to be solved by a new financial model. In recent years, the emergence of modern technology represented by big data, cloud computing, artificial intelligence, and blockchain deepens the deep integration of traditional finance and modern science and technology, and a new financial model—digital finance emerges at the historic moment (Huang and Huang, 2018; Knaack and Gruin, 2020). Digital finance is the combination of digital technology and traditional finance, aiming to provide more convenient, transparent, and effective financial services for individuals of traditional financial services (Jain and Gabor, 2020). With its features of “wide coverage, deep application, and digitalization,” digital finance develops rapidly, and its economic consequences are gradually affecting many aspects of social development (Li et al., 2020). It has gradually become a key factor to solve problems such as financing difficulties and financial information mismatch (Yang and Zhang, 2020; Tang et al., 2020a, b). At present, most of the research on digital finance focuses on the macro level, and there is little research on the micro-level. In terms of the macro level, digital finance can improve the per capita disposable income of urban and rural residents, promote local tax revenue, and narrow the urban–rural gap (Shrader and Duflos, 2014; Zhang et al., 2019; Liang, 2020). At the micro-level, most of them focus on the impact of digital finance on corporate financing constraints and financing channels (Mollick, 2014; Michalopoulos et al., 2015). Therefore, whether and how digital finance can affect corporate green innovation is unclear. As a new financial model driven by emerging technologies, whether the impact of digital finance on corporate is different from that of traditional finance, so as to achieve the effect of improving both quantity and quality still need to be further discussed. This research aims to fill this gap.

We utilize the listed companies in Shanghai and Shenzhen stock markets in China from 2011 to 2018 as research samples and match the data at the enterprise level with the regional digital finance development data, so as to study the impact of digital finance on corporate green innovation. There are mainly three reasons why we choose Chinese firms to verify our hypothesis. First, as the largest developing country in the world, behind its rapid development in economic construction, China’s environmental problem is becoming increasingly severe, and it has gradually become one of the main contradictions that hinder high-quality economic development, which is also a common problem of most developing countries (Cai et al., 2016). Second, China’s digital finance scale and technology practice is in the leading position in the world (Tang et al., 2020a, b). To study the driving effect of digital finance on corporate green innovation is in line with the practical needs of sustainable development in China and the world at present. Third, China is composed of 34 provincial-level administrative regions and more than 300 prefecture-level administrative regions. Significant spatial and temporal differences (e.g., Beijing and Xinjiang are in different time zones; the land distance between the north and south of China is about 5,500 km), which leads to the diversity of economic and social development, and also makes the supply of financial resources and the development of green innovation in different regions present an unbalanced situation. Therefore, studying the impact of digital finance on corporate green innovation in the context of China can provide more developing countries with empirical solutions to environmental problems.

Our results show that the development of regional digital finance can significantly improve the quantity and quality of corporate green innovation, and this result remains unchanged after a series of robustness tests, such as replacing variable measurement indicators and measurement models. In addition, we also consider that endogenous problems such as missing variables and reverse causality affect the results of the study. We select two variables at the regional level that may have been omitted to add into the regression model and found that the regression results were basically consistent with the benchmark model. Further, we also select two instrumental variables for two-stage least squares (2SLS) regression to alleviate the possible endogeneity problem, and the results remain the same. Therefore, our results also provide a competitive explanation, that is, digital finance is more effective than traditional finance in promoting corporate green innovation.

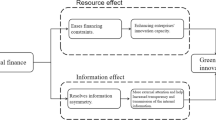

Furthermore, we propose two channels through which digital finance affects the quantity and quality of corporate: transparent channel and convenient channel. We find that digital finance can enhance the information screening ability of regional financial institutions, reduce the information asymmetry within and outside enterprises, and enhance the transparency of enterprises, which also drives enterprises to actively carry out green innovation activities to compensate or avoid the economic losses caused by the amplification of improper environmental behaviors. In addition, we also find that the development of regional digital finance will promote the improvement of the capital flow efficiency of local enterprises. Through digital technology, digital finance breaks the hand-to-hand transaction mode under the traditional financial mode, making financial services no longer subject to the limitation of time and space (Gomber et al., 2017), which greatly improves the convenience of the transfer of financial resources among enterprises and provides a strong guarantee for the improvement of the quality of corporate green innovation.

Compared with the existing literature, the possible contributions of this paper are mainly reflected in three aspects. First, to the best of our knowledge, this paper is the first to explore the impact of digital finance on corporate green innovation. Driving by the traditional financial model, there is a low-end development dilemma of corporate green innovation with large quantity and low quality. This paper tries to reinterpret the corporate green innovation from the perspective of digital finance, as a new financial model which expands the research on the influence of digital finance on corporate strategy. Second, most of the existing studies focus on the input and output of corporate green innovation, and describe corporate green innovation from the two aspects of quantity and quality, which can further illustrate the effect of digital finance on corporate green innovation. Third, this study also provides some enlightenment for the research on environmental issues in developing countries. Compared with developed countries, the financial service system of developing countries is relatively backward, and the environmental governance problem is more urgent. But even in developing countries, digital finance can have a positive impact on corporate green innovation. The driving effect of the development of digital finance in China on the corporate green innovation provides a reference for more developing countries to enable the sustainable development of enterprises through the innovative financial development mode of emerging science and technology.

The remaining structure of this paper is arranged as follows: the “Literature review and hypotheses development” section reviews relevant literature and develops the hypothesis. The “Research design” section presents research design. The “Empirical results” section reports Empirical results, includes robustness test, heterogeneity analysis and mechanism analysis. Conclusion and discussion are given in “Conclusion and discussion” section.

Literature review and hypotheses development

Traditional finance and corporate green innovation

Green innovation is an innovative activity that firms use green intensive innovative methods and technologies to achieve the dual goals of economic performance and environmental performance based on the purpose of improving resource utilization and reducing energy consumption (Rennings, 2000; Barbieri et al., 2020). It is a system engineering involving market, economy, policy, technology, and other factors, which has the typical characteristics of high risk, high cost, and long-term commitment. In addition to the internal factors of enterprises, the effective supply of financial factors is also crucial to the development and implementation of corporate green innovation, and the financial market will directly serve the corporate green innovation (Hottenrott and Peters, 2012). Therefore, it is necessary for us to sort out the studies on the relationship between traditional finance and green innovation, so as to better grasp the research topic of corporate green innovation driven by digital finance.

Most of the existing studies on the impact of traditional finance on corporate green innovation focus on the characteristics of traditional finance and a single financial product. Under the traditional financial model, the banking sector always occupies the dominant position of the financial credit system (Zhong and Wang, 2018; Jin et al., 2021). The continuous expansion of commercial banks and the intensifying competition in the banking industry will have an impact on the innovation decisions of enterprises (Chong et al., 2013), but this impact is also significantly different in the studies of different scholars (Ayyagari et al., 2010; Chava et al., 2013). Aiming at the development of traditional finance and the allocation of bank credit, some scholars have pointed out that when enterprises’ loans to banks reach a certain threshold, the continuous increase of loans can promote corporate green innovation (Huang et al., 2019). Based on this, a series of green financial products derived from the traditional financial model began to appear and gradually serve the corporate green innovation. The emergence of green finance greatly alleviates the financial pressure in the process of corporate green innovation, increases the investment in R&D of enterprises, and promotes the development of corporate green innovation activities (Yu et al., 2021). However, this promoting effect is only limited to the quantity of corporate green innovation, with little effect on the core factor of green innovation quality (Wang et al., 2021), thus generating the low-end dilemma of green innovation.

Undeniably, under the service of a traditional financial model, corporate green innovation has made some progress and development, but it cannot get rid of the low-end dilemma of low innovation quality. Therefore, we urgently need a new financial model to remedy this problem.

China’s digital finance

Digital finance generally refers to a new financial development mode in which traditional financial institutions utilize emerging technologies such as big data and cloud computing to innovate financial products, business processes, and business models and realize financing, payment, investment, and other financial activities (Huang and Huang, 2018). China’s digital finance originated from the launch of Alipay in 2004, but the industry generally regards 2013 as the first year of the development of digital finance. Digital finance is an emerging product in China and even the world. In a short period of more than 10 years, China’s digital finance development has taken the lead in the global scope. In the 2019 Global Fintech 100 list jointly released by KPMG and H2 Ventures, three of the top 10 companies are from China, and Ant Financial, as one of the world’s top five digital finance companies, retained the No. 1 spot in the list. Mobile payment, Internet banking, and other digital financial ecosystems with payment as the core have considerable influence on a global scale.

The rapid rise of digital technology has caused an unprecedented impact on the traditional financial service system. The emerging digital financial service system has imperceptibly changed many aspects of social and economic development and greatly promoted the high-quality development of the global economy. Compared with traditional finance, digital finance mainly has the following advantages: First, digital finance makes use of the scale effect and low cost brought about by the revolution of information technology, enabling users to enjoy more high-quality financial services in many fields, while traditional finance has very few financial services and high cost. Second, the traditional financial on economic development is not obvious, effect on the development of the real economy is not prominent, and digital financial field is applied science and technology in the financial industry, promote the financial innovation activity, make the financial sector more standardization and standardization, changed the way the public’s life work, and improve the quality of life. Third, digital finance is more intelligent and internet-based. With the deep integration of big data, more accurate user data can be obtained and analyzed to make financial services more accurate and professional. This is the way to expand from online to offline. Fourth, compared with traditional financial institutions, which need governance mechanisms such as guarantee mortgage registration and post-loan management, enterprises under digital financial services have a higher degree of marketization, and win trust through the establishment of transparent rules and the establishment of public supervision mechanism. In addition, digital finance makes use of digital advantages to analyze and review a large amount of individual behavioral data. Based on these “behavioral footprints,” it can accurately judge individual credit risks and improve the risk control ability of the financial industry.

With the accelerated evolution of a new round of scientific and technological revolution, digital finance has entered a stage of rapid development, and its economic consequences have attracted more and more attention from scholars (David-West et al., 2018; Buchak et al., 2018; Bollaert et al., 2021). However, it is a pity that due to the lack of measurement indicators for digital finance, part of the research is only carried out from the theoretical level, but cannot provide objective empirical support. It was not until the “Digital Finance Index” released by the research group of the Digital Finance Research Center of Peking University in 2018 that the data basis was provided for the research of digital finance in the context of China (Guo et al., 2020). On this basis, most scholars start to study the economic consequences of digital finance from a macro perspective, focusing on promoting entrepreneurship, improving the level of regional technological innovation, and promoting local economic growth (Zhang et al., 2019). In recent studies, some scholars have gradually begun to explore the role of digital finance in corporate innovation (Tang et al., 2020a, b; Zhao et al., 2021).It can be predicted that with the continuous improvement of the development of digital finance, more and more studies will focus on the enterprise level, so as to better promote the development of the real economy.

Digital finance and corporate green innovation

As discussed above, under the traditional financial model, the quality of corporate green innovation can no longer match the quantity, which can be attributed to the following three reasons: First, green innovation is a strategic activity with a large amount of investment in the early stage. The high transaction cost of capital in the traditional financial market and the cumbersome loan and credit review process may lead to the insufficient supply of financial resources at the critical moment of core technology research and development. Second, the high degree of information asymmetry between lenders and borrowers cannot be effectively solved, resulting in the inability of financial institutions to accurately evaluate enterprises, making it difficult for financial resources to continue to supply green innovation. In addition, there are prominent problems such as bloated scale and low efficiency under the traditional financial model, and the high risk of corporate green innovation cannot be fully guaranteed.

With the rapid rise of modern information technology represented by big data, cloud computing, artificial intelligence, and blockchain, it provides great convenience for financial services to reduce costs, improve efficiency and expand scope (Kshetri, 2016; Gomber et al., 2018), and financial development is gradually moving toward the digital age (Huang and Huang, 2018). We predict that digital finance will affect corporate green innovation in the following two ways.

Based on the theory of information asymmetry, the basis of cooperation is information equivalence. Green innovation is one of the sources of long-term strategic planning and market competitiveness of enterprises. Key information is often hidden by enterprises and cannot be effectively shared. Faced with this huge information asymmetry, financial institutions will greatly reduce the incentive to provide credit for green innovation projects of enterprises (Stiglitz and Weiss, 1981; Yuan et al., 2021). However, the continuous innovation of the financial industry is to better screen enterprises and avoid ineffective and low-end mismatch of financial resources so as to maintain competitiveness (Lin et al., 2013a, b; Laeven et al., 2015), and digital finance coincides with this. First, digital finance improves the transparency of enterprises and the ability of stakeholders to screen information through digital advantages. When the stakeholders have relatively complete behavior information of the enterprise, they can identify the “false green” or even the adverse activities to the environment, thus amplifying the environmental violations of the enterprise to a certain extent. After receiving such signals, the government and the public make mandatory and non-mandatory orders and denunciations to achieve the dual purposes of mandatory governance and social governance. Financial institutions will also reduce enterprise evaluation to a certain extent so that financial resources can be better transferred to enterprises with high evaluation. In this context, enterprises’ motivation for environmental speculation will be weakened, and green innovation, as a pro-social sustainable development behavior, will receive enterprises’ attention (Bendell, 2017). Second, for some enterprises, due to the lack of complete business records, traditional financial institutions cannot objectively evaluate corporate credit, leading to insufficient financial support (Aivazian et al., 2015). Through the information monitoring and evaluation system established by big data technology, digital finance integrates the “digital footprint” of enterprises, so that financial institutions can more accurately match the needs of enterprises and enhance the quantity and quality of enterprise financing. Third, digital finance uses diversified financial service modes such as digital payment and online lending to meet the more flexible and different payment demands of different groups, enrich the financing channels and methods of enterprises, and greatly stimulate the supply vitality of the financial market (Gabor and Brooks, 2017), laying a foundation for corporate green innovation. Therefore, digital finance enables enterprises to live in the “sunshine,” and the supply of financial resources is more diversified and precise, which will help enterprises to carry out green innovation practices. Thus, we propose the following hypothesis:

H1: Digital finance can promote the quantity of corporate green innovation.

Furthermore, while the quantity of green innovation is improved, it is also urgent for enterprises to make efforts in quality (Akcigit et al., 2016; Aghion et al., 2019). Especially in today’s rapid development of digital technology, enterprises’ pursuit of innovation quality becomes more urgent. Due to the prominent problem of low efficiency of traditional financial service mode, it has been unable to meet the objective needs of enterprises to improve the quality of green innovation. Digital finance has gradually begun to show the driving advantage of green innovation quality. First, digital finance breaks the limitation of time and space in a traditional financial model, overturns the value delivery link of hand by hand in a traditional business model, and enables customers to enjoy all-day, contactless remote intelligent transactions (Gomber et al., 2017), which greatly improves the efficiency of capital flow among enterprises and transfers financial resources toward high-quality green innovation projects. Second, the rapid flow of financial resources deepens the cooperation between enterprises and stakeholders expands the positive spillover effect of green innovation (Peng et al., 2021), and helps enterprises to absorb and integrate key knowledge of green innovation. In addition, by analyzing the digital information of enterprises, financial institutions can accurately target the heterogeneous demands among enterprises, provide a set of differentiated financial service processes for different enterprises, and help enterprises identify opportunities and risks in the process of green innovation. On this basis, the cutting-edge technologies and knowledge of various industries should be integrated to realize the optimal allocation of financial resources and avoid the ineffective and low-end financial mismatch (Norden et al., 2014). Deeply process the pain points of corporate green innovation, guide them to make more reasonable green innovation decisions, and thus find the optimal path of green innovation practice (Buchak et al., 2018). Finally, digital finance can screen out low-quality green innovation projects through better screening technology, and then provide more support for high-quality green innovation projects (Beck et al., 2018), so as to achieve the purpose of “survival of the fittest.”

H2: Digital finance can promote the quality of corporate green innovation.

Research design

Sample selection

This paper took the A-share listed firms on the Shanghai and Shenzhen exchanges as the research object, take the prefecture-level cities where firms are registered as the benchmark, and paired them according to the starting year of digital financial index measurement (2011) to form the panel data set during 2011–2018. In order to improve the reliability and validity of the data, we excluded the following firms: firms listed after 2011, firms in the financial industry, firms with ST mark (special treatment), and firms with missing data related to major variables. After screening and matching, 2080 firms and 16,640 observations were used in the analyses.

Among them, we collect patent information from the State Intellectual Property Office of China, including patent application number, applicant, application date, patent type, IPC classification number, and other information. The IPC Classification list of green patents released by World Intellectual Property Organization (WIPO) in 2010 enables us to more accurately screen out corporate green patents from the above information. In view of China’s State Intellectual Property Office (SIPO) patent database does not provide patent citations information, we combine manual retrieval and web crawler technology, and search the green patent numbers matched by sample enterprises in turn to obtain the specific citation information of each green patent. Finally, the number of citations of each patent is summed up to the enterprise level by the application date and year. Corporate financial data was obtained from the China Stock Market & Accounting Research (CSMAR) database. If the CSMAR data is missing, we manually complete it by consulting the annual report of the enterprise. The digital financial index in prefecture-level was collected from the Peking University Digital Financial Inclusion Index (2nd issue, 2011–2018) compiled by the Digital Finance Research Center of Peking University.

Variable measurement

Explained variable: corporate green innovation

We use the number of green patent applications and the number of citations to describe the corporate green innovation, and study the impact of digital finance on the corporate green innovation from the two aspects of quantity and quality. First, based on existing studies (Carrión-Flores and Innes, 2010; Amore and Bennedsen, 2016; Kim et al., 2021), we measure the green innovation quantity by using the number of corporate green patent applications in the current year. To eliminate the problem of a right-biased distribution of the data of green patent applications, we add 1 to the number of green patent applications and take the natural logarithm [\(\mathrm{Ln }(\mathrm{Apply}+1)\)]. A patent often takes 1–2 years from application to authorization, and there is a lag (Kim et al., 2021). In the process of patent applications, enterprises have shown that they are engaged in innovative practices, so the number of patent applications will be reliable than the amount of authorization (Li and Zheng, 2016). The World Intellectual Property Office (WIPO) issued the “IPC Green List” in 2010, which covers more than 200 topics related to environmentally sound technologies and is directly matched with the IPC classification numbers by authoritative experts. Based on this list, all green patented IPC is refined and a total of 3554 classification number locations are collected. Then, according to the classification number, the number of green patents of each enterprise in each issue was retrieved and labeled, so as to measure corporate green innovation quantity more accurately. Of course, we also use the number of green patents authorized as a substitute indicator in the robustness test, and also add 1 to take the natural logarithm (He and Tian, 2013), which is \(\mathrm{Ln }(\mathrm{Granted}+1)\).

Second, there has been no consensus on the measurement standard of innovation quality in the academic community. Existing studies mostly measure innovation quality from R&D investment (Ren et al., 2020) and the number of patents (Liu and Qiu, 2016). However, earnings management behaviors of enterprises often exist in the disclosure of R&D investment, and the data is highly variable and difficult to identify (Chen et al., 2021). There is also a certain degree of speculation in patent applications of enterprises, so as to obtain government subsidies and market monopoly (Hu et al., 2017). Therefore, we drew on another set of literature (Akcigit et al., 2016; Aghion et al., 2019; Hvide and Jones, 2018), using the citation of green patents applied by enterprises to investigate the quality of green innovation. The more times a patent is cited, the more valuable the patent is, and the higher the green innovation quality of the enterprise applying for the patent is. Because patent citation data also has a certain degree of a right-hand distribution problem, we also add 1 to the number of green patent citation times and take the natural logarithm [\(\mathrm{Ln }(\mathrm{Citation}+1)\)]. In addition, due to the temporal truncation bias of patent citations, we control the year effect in the regression to eliminate the possible year accumulation effect. In the robustness test, we use the number of green invention patent applications to the total number of green patent applications (\(\mathrm{InvRatio}\)) as a substitute indicator of green innovation quality (Qi et al., 2018).

Core explanatory variable: digital finance (\({\varvec{I}}{\varvec{n}}{\varvec{d}}{\varvec{e}}{\varvec{x}}\))

In this paper, the “Peking University Digital Financial Index (Phase II, 2011–2018)” compiled by the Center for Digital Finance Research of Peking University was selected as the proxy variable for digital finance (Guo et al, 2020). The index was developed in 2016 by Peking University’s Digital Finance Research Center in collaboration with Ant Financial Group. The researchers used Ant Financial massive financial data, through six business indicators and three secondary indicators of coverage breadth, use depth and digitalization degree, according to mathematical formula reasonable weight, and finally synthesized the digital financial index. In the empirical part of this paper, the digital financial index at the municipal level was used to match the registration place of enterprises. In addition, in the robustness test, we also examine the impact of the two symmetric sub-dimensions of digital finance [coverage width (\(\mathrm{Width}\)) and depth of use (\(\mathrm{Depth}\))] on the quantity and quality of corporate green innovation, and select the digital finance index of provincial caliber as the instrumental variable. In the regression, the indexes of all levels and dimensions of digital finance are normalized.

Control variable

In order to avoid the estimation bias caused by the omission of variables, refer to existing literature (Amore and Bennedsen, 2016; Ren et al, 2020), a number of variables with high correlation with green innovation at the enterprise level was selected as the control variables, which involved two aspects of firm characteristics and corporate governance.

Firm size (\({\varvec{A}}{\varvec{s}}{\varvec{s}}{\varvec{e}}{\varvec{t}}\))

Large enterprises tend to have more resources and capacity to carry out green innovation activities (González‐Benito and González‐Benito, 2010). We use the natural logarithm of total assets at the end of each year as a proxy variable.

Firm age (\({\varvec{A}}{\varvec{g}}{\varvec{e}}\))

The older an enterprise has been established, the stronger its competitiveness becomes (Phelps, 2010). However, due to organizational inertia, firm age will also hinder innovation (Barron et al., 1994). We use the natural logarithm of the number of years the firm has been established.

R&D investment (\({\varvec{R}}\&{\varvec{D}}\))

Existing literature shows that the higher the R&D investment, the more beneficial it is to carry out green innovation activities (Arranz et al., 2020). We control the proportion of enterprise R&D investment in total assets in the model.

Corporate debt (\({\varvec{D}}{\varvec{e}}{\varvec{b}}{\varvec{t}}\))

Debt reflects the asset structure of an enterprise (Chen and Zhao, 2006), and moderate liabilities can make up for the lack of funds (Qi et al., 2018), which may have an impact on green innovation. Therefore, we control for corporate debt and express them as the natural logarithm of total debt (\(\mathrm{LnDebt}\)).

Corporate profitability (\({\varvec{R}}{\varvec{O}}{\varvec{E}}\))

Continuously profitable enterprises will have more funds to invest in research and development, which will significantly promote the development and implementation of green innovation (Arena et al., 2018). We use \(\mathrm{ROE}\) to measure firms’ profitability.

Cash flow ratio (\({\varvec{C}}{\varvec{a}}{\varvec{s}}{\varvec{h}}\_{\varvec{r}}{\varvec{a}}{\varvec{t}}{\varvec{e}}\))

Firms with more internal cash flow are more inclined to invest in R&D (Lyandres and Palazzo, 2016), which is conducive to green innovation. We use cash flow as a percentage of total assets.

Board independence (\({\varvec{I}}{\varvec{n}}{\varvec{d}}{\varvec{e}}{\varvec{p}}\))

Existing studies have found that board independence is closely related to corporate social responsibility and innovation (Chang et al., 2017; Lu and Wang, 2018). We use the independent director/board size ratio to measure board independence (Coles et al., 2008).

Board meetings (\({\varvec{M}}{\varvec{e}}{\varvec{e}}{\varvec{t}}{\varvec{i}}{\varvec{n}}{\varvec{g}}\))

As a channel for board members to communicate with each other, board meetings are conducive to enhancing the communication among them and have an impact on the development and implementation of corporate innovation strategies. Therefore, we took the number of board meetings as a control variable and normalized it. All the variable definitions are shown in Table 1. All continuous variables were winsorized at a 1% level in the empirical regression so as to reduce the interference of outliers.

Summary statistics

In order to more intuitively reflect the actual characteristics of the main variables, we first reported the descriptive statistics of each variable in Table 2 before the logarithm and standardization of the main variables (excluding the control variables). By analyzing the data in the table, it can be seen that (1) the average amount of green patent applications of sample firms is 5.512, the minimum amount of green patent applications is 0, the maximum amount of green patent applications is 116, and the standard deviation is 16.186, indicating that the sample firms have great differences in the transformation of green innovation achievements, which is also in line with the theme of our study. (2) The average value of green patent citation is 6.678, the minimum value is 0, the maximum value is 185, the standard deviation is up to 24.321, and the 75% quantile is 1, indicating that the green patent citation presents the phenomenon of zero value accumulation, which reflects the low quality of green patents and has not yet come out of the low-end plight of “patent bubble” in China. (3) The difference between the maximum value and the minimum value of digital finance is nearly 7 times (maximum value = 291.443, minimum value = 45.660), indicating that the development of digital finance in China is unbalanced, which also provides an ideal scenario for our study. (4) Descriptive statistical results of related control variables and other variables are also presented in the table.

Empirical design

In order to test the impact of digital finance on corporate green innovation quantity (hypothesis 1), we used ordinary least squares to estimate the following model:

Among them, \({\mathrm{Ln}(\mathrm{Apply}+1)}_{\mathrm{i},\mathrm{t}}\) is the explained variable of the model, representing the green innovation quantity of firm i in the t year. \({\mathrm{Index}}_{i,t}\) is the core explanatory variable of the model, which represents the digital financial index of the region where firm \(i\) is located in the year \(t\). \({X}_{i,t}\) contains all the control variables mentioned above in year t of enterprise I, including the control of firm characteristics and corporate governance. \({\mathrm{Industry}}_{t}\) and \({\mathrm{Year}}_{t}\) are dummy variables of industry and year, representing the industry and time fixed effect, respectively. \({\upvarepsilon }_{i,t}\) is the random error term of the model.

In order to test the impact of digital finance on corporate green innovation quality (hypothesis 2), we also used ordinary least squares to estimate the following model:

where \({\mathrm{Ln}(\mathrm{Citation}+1)}_{i,t}\) is the dependent variable that present the green innovation quality of firm \(i\) in year \(t\). The definitions of other variables are the same as formula (1).

Empirical results

Baseline result

Table 3 reports the results from the estimation of our baseline model. Columns (1) and (2) take the green innovation quantity as the dependent variable; column (1) only includes the control variable and column (2) adds the independent variable on this basis. We find that the regression coefficient of digital finance (\(\mathrm{index}\)) is 1.086, which is significantly positive at the 1% level, indicating that digital finance can promote the improvement of corporate green innovation quantity. Hypothesis 1 is verified. This may be because digital finance relies on digital characteristics, and the acquisition of digital footprints has greatly increased corporate transparency and regulatory oversight. In addition, digital technology is used to strengthen information sharing between enterprises and stakeholders, reduce the degree of internal and external information asymmetry, and enable the barrier-free transmission of green innovation knowledge and technology inside and outside enterprises. The regression results of control variables show that firm size, R&D investment, debt, ROE, and cash holding ratio are positively correlated with the green innovation quantity.

Columns (3) and (4) are the regression results of green innovation quality as the dependent variable. The results show that the regression coefficient of digital finance on green innovation quality is 0.847, which is significantly positive at 1% level (\(\upbeta\)= 0.847, p < 0.01), indicating that digital finance can also promote the improvement of corporate green innovation quality. Hypothesis 2 is verified. The reason for its existence may be that digital finance uses its digital characteristics to find out the “track” in the practice of corporate green innovation, integrate and summarize the differences and common points of different types of enterprises, so as to better provide constructive guidance for the corporate green innovation and find the optimal path.

Robustness tests

Alternative measure of variables

In order to ensure the robustness of the results, we use the scores of two symmetric sub-dimensions of the digital finance index (\(\mathrm{width}\) and \(\mathrm{depth}\)) and the provincial-level digital financial index (\(\mathrm{Index}\_\mathrm{p}\)) as the alternative variables of digital finance. The variable data are also from “Peking University Digital Financial Inclusion Index (Second Issue, 2011–2018).” Before regression, we normalize the three variables. The results are shown in Table 4. The regression coefficients of digital finance alternative variables are all significantly positive at the 1% level, which is consistent with the previous conclusion.

Second, we use the number of green innovation patents granted and the proportion of green invention patents as the proxy variables of green innovation quantity and green innovation quality respectively. The results are shown in Table 5. The regression coefficients of the digital finance variable (\(\mathrm{index}\)) are significantly positive, which also supports our hypothesis.

Eliminate some samples

The digital financial index was developed by the Digital Finance Research Center of Peking University in cooperation with Ant Financial, which is headquartered in Hangzhou. Therefore, compared with listed companies in other regions, listed companies in Zhejiang Province may have a more convenient and unimpeded financial inclusion service system, and digital finance may have a more profound impact on Zhejiang Province. In view of this, we excluded the sample of listed companies registered in Zhejiang Province to test whether the role of digital finance in promoting enterprises green innovation was general. The regression results are reported in Table 6. We find that the significance of the coefficient of the digital finance variable (\(\mathrm{index}\)) does not change compared to the baseline regression, but the coefficient increases. It shows that digital finance plays a more significant role in improving the quantity and quality of corporate green innovation in other regions, which supports our hypothesis.

The time-lag effect of green innovation patents

Although the green patent application can reflect the corporate green innovation more reliable than the granted (Li and Zheng, 2016), the green patent application also needs a certain amount of time. Therefore, considering the time delay of patents, the quantity and quality variables of green innovation are treated in advance. Where, \(\mathrm{F}.\mathrm{Ln }(\mathrm{Apply}+1)\), \(\mathrm{F}2.\mathrm{Ln }(\mathrm{Apply}+1)\), \(\mathrm{F}3.\mathrm{Ln }(\mathrm{Apply}+1)\) respectively represent the quantity variables of green innovation in the next period, the next two periods and the next three periods, and the quality variables of green innovation are similar. The results are reported in Table 7. We find that the regression coefficients of digital finance variable (\(\mathrm{index}\)) on the quantity and quality variables of green innovation in the next period, the next two periods and the next three periods are all significantly positive at the 1% level, which indicates that the impact of digital finance on corporate green innovation is sustainable.

Change model

Due to the green innovation data have some years of zero, the pattern of zero value accumulation and positive value coexistence is shown. In view of this data structure, we used the Tobit model to replace the original model for robustness test, the results are shown in Table 8. We find that the size and significance of the regression coefficients of the digital finance (\(\mathrm{index}\)) variables are basically consistent with the baseline regression.

Endogeneity treatment

In the baseline regression, we control the industry fixed effects and year fixed effects, and select some factors that can affect the corporate green innovation, including enterprise characteristics and corporate governance. However, there may still be potential endogeneity problems in our findings. First, we do not control the regional effect and time-varying factors in the model, which may cause estimation bias due to the influence of unobserved factors. Second, macro-factors in the regions where enterprises are located will also affect the development of digital finance and green innovation to a certain extent, and the problem of missing variables will also have a certain impact on the estimation results. In addition, while digital finance affects enterprises green innovation, green innovation may also affect the development of digital finance. When enterprises have a high level of green innovation, it may also drive the development of digital finance in the region. Therefore, our results may also be disturbed by reverse causality. In this section, we use three approaches to address potential endogeneity concerns: controlling for provinces effects and time-varying factors effects, adding macro control variables, and the instrumental variable regression.

Control for province and time-varying effects

We control for industry and year fixed effects in the baseline regression, but some unobservable regional and time-varying factors may cause our estimates to be biased. For example, the difference of resource endowment in different regions may be an important factor affecting the location of enterprises. Over time, changes in the supply and cost of inputs may also prompt firms in certain industries to move to a particular province (Ren et al., 2021). In order to consider geographical location and time-varying variables of industries and regions that change with time, we add province fixed effect, year * industry fixed effect, and year * province fixed effect into the regression model respectively, and report the regression results in Table 9. As can be seen from the regression results in the table, the regression coefficient of digital finance variable (\(\mathrm{index}\)) is still significantly positive, indicating that the driving effect of digital finance on corporate green innovation is not affected by regional and unobserved time-varying factors.

Omitted variables

In the baseline regression, although we control the enterprise characteristics and corporate governance variables in the model, some regional macro factors will also affect digital finance and corporate green innovation, so there will be the problem of omitted variables. In view of this, we add two regional macro variables that may affect the results of the estimate: GDP per capita and year-end loan balance of financial institutions. The regression results are shown in Table 10. In model 1 and model 2, the per capita GDP variable (\(\mathrm{PerGDP}\)) and the year-end loans of financial institutions variable (\(\mathrm{Loans}\)) are not significant, and the regression coefficient of the digital financial variable (\(\mathrm{index}\)) is still significantly positive, indicating that our results are robust.

Instrumental variable analysis

In addition, we also use instrumental variable regression to alleviate possible endogeneity problems. Drawing on existing studies (Tang et al., 2020a, b; Cao et al., 2021), we use the Internet penetration rate of each province (\(\mathrm{Internet}\)) as an instrumental variable. On the one hand, the internet penetration rate, as the infrastructure of digital finance, is closely related to the changes of digital finance and meets the correlation conditions. On the other hand, there is no direct correlation channel between internet penetration rate and enterprises, which satisfies the exogenous conditions. Therefore, Internet penetration rate may become an effective instrumental variable.

The regression results of 2SLS instrumental variables are reported in Table 11. The estimation results of the first stage show that the instrumental variables are positively correlated with the digital financial variable (\(\mathrm{index}\)), indicating that the instrumental variables do meet the correlation condition. The results of \(\mathrm{Kleibergen}-\mathrm{Paap rk LM}\) showed that there was no problem of insufficient identification of instrumental variables, and the \(\mathrm{Kleibergen}-\mathrm{Paap rk Wald F}\) statistic was 7228.263, greater than the critical value of Stock Yogo test at the 10% significance level, indicating that there was no weak instrumental variable problem in the model. Similar to our baseline regression results, the results of two-stage least squares estimation also show that the coefficient of digital financial variable (\(\mathrm{index}\)) is significantly positive at the 1% level. Therefore, these results also further support our hypothesis that digital finance can improve the quantity and quality of corporate green innovation.

Heterogeneity analysis

First, we report the estimated results of state-owned enterprises (SOEs = 1) and non-state-owned enterprises (SOEs = 0) in Table 12. According to the regression results of columns (1) and (2), in the regression analysis of the green innovation quantity, the coefficient of digital finance variable (\(\mathrm{index}\)) has the same significance, and the coefficient seems to be greater in the group of state-owned firms than in the group of non-state-owned firms. However, we find in Chow-texts that there is no statistically significant difference between the two coefficients. Therefore, we cannot deny that the impact of digital finance on the corporate green innovation quantity may be the same in state-owned and non-state-owned firms. According to the regression results of columns (3) and (4), the regression coefficient of digital finance variable (\(\mathrm{index}\)) on the corporate green innovation quality is more significant in the group of state-owned firms (p < 0.01 and p < 0.05), which indicates that the promotion effect of digital finance on corporate green innovation quality is stronger in state-owned firms than in non-state-owned firms, which may also be closely related to the innate resource endowment advantage of state-owned firms in the context of China.

Second, considering the diversity of geographical environment in China, the level of economic development in different regions is quite different. Compared with the traditional less developed central and western regions, the financial market in eastern China is more fully developed (Ren et al., 2021). To further explore whether the impact of digital finance on corporate green innovation is significantly different among different regions, the original sample is divided into two sub-samples according to the provinces where the sample companies are registered, namely the eastern (East) and the central and western (Midwest) provinces,Footnote 2 and the grouping regression test is conducted. Table 13 reports the estimated results for the two regions, respectively. We can see from the results that the regression coefficient of digital financial variable (\(\mathrm{index}\)) on the quantity and quality of corporate green innovation is more significant in eastern region. This also shows that digital finance plays a significant role in promoting corporate green innovation in eastern China.

Third, enterprises in different life cycles will deploy different strategic actions according to their own needs. For enterprises in the growth stage and maturity stage, the effect of digital finance on driving green innovation may also be different. Based on this, we defined 10 years as the limit, the establishment period of more than 10 years defined as mature enterprise (Mature), assigned a value of 1, otherwise 0, to examine the difference in the effect of digital finance in promoting corporate green innovation under different life cycles. Table 13 reports the estimated results for the two periods, respectively. We can see from the results that the regression coefficient of digital financial variable (\(\mathrm{index}\)) on the quantity and quality of corporate green innovation is more significant in mature firms, which shows that the digital finance effects on the mature corporate green innovation activities is bigger. This may be related to the fact that mature enterprises have more human, financial and material resources than those in the growing stage (Table 14).

Potential Channels

In this section, we mainly explore two potential channels through which digital finance influences corporate green innovation: transparent channel and convenient channel. First, as we discussed in “Literature review and hypotheses development” section, we believe that digital finance improves corporate transparency and stakeholders’ ability to sift through information. In this case, corporate speculation in environmental governance will be further amplified. Therefore, digital finance may force enterprises to undertake green innovation activities by enhancing corporate transparency. We use the non-performing loan ratio of regional financial institutions as a proxy variable for corporate transparency. Because the loans of regional financial institutions mostly come from local enterprises, and the higher the non-performing loan ratio may mean that the financial institutions have a worse ability to screen corporate information and a lower transparency of enterprises, the regression results are shown in columns (1) and (2) of Table 15. We can see from the regression results that the regression coefficient of digital finance variable (\(\mathrm{index}\)) to the non-performing loan ratio variable (\(\mathrm{Transparent}\)) of regional financial institutions is significantly negative, indicating that the development of digital finance does improve the transparency of firms.

Second, digital finance promotes the efficiency of capital flow among enterprises through the remote intelligent delivery mode to a certain extent, and realizes the efficient allocation of financial resources, which makes enterprises more capable of equipment transformation and technology upgrading, thus boosting the improvement of green innovation quality. Based on the accounting data provided by CSMAR database, we use fixed asset turnover as the proxy variable of capital flow efficiency, and the regression results are shown in columns (3) and (4) of Table 15. We find that the regression coefficient of digital finance variable (\(\mathrm{index}\)) is significantly positive to the enterprise capital flow efficiency variable (\(\mathrm{Convenient}\)), which fully indicates that the development of digital finance can improve the efficiency of capital flow between enterprises and make the financial resource allocation more convenient.

Conclusion and discussion

We use green innovation quantity and quality to characterize corporate green innovation activities, and link digital finance with corporate green innovation firstly, revealing the effectiveness of digital finance in environmental governance, and filling the research gap in this field. Utilizing the sample of Chinese companies from 2011 to 2018, our results show that:(1) the development of digital finance can not only improve the quantity of green innovation, but also increase the quality of green innovation; (2) this effect is greater in the east enterprises, the state-owned enterprises, and the mature enterprises; and (3) we identify two potential channels for digital finance to drive corporate green innovation: transparent channel and convenient channel. Overall, our research to a certain extent makes up for the regret of the large quantity and low quality of corporate green innovation under the traditional financial model, and provides a micro explanation of environmental governance for the accelerated popularization of digital finance in emerging markets, which is urgently needed for most emerging economies to seek high-quality development.

Our study has several policy implications. First, give full policy support to the integrated development of emerging technology and financial system, vigorously promote the integrated development of digital finance. Strengthen the foundation of digital information technology, establish a complete financial risk assessment mechanism, give appropriate policy preference to new forms of financial services, empower enterprises to make green innovations, and release new vitality for high-quality development of economy.

Second, the government should give full play to the role of “guide,” and provide sufficient innovation policy support to the enterprises with strong financing needs and sufficient innovation vitality, so as to “adapt measures to enterprise conditions.” In addition to guiding the equalization of financial resource allocation and enhancing corporate green innovation willingness, enterprises should be encouraged to put green innovation practice into action.

Data availability

Not applicable.

Code availability

Source codes are available on request.

Notes

By the end of 2018, the number of patent applications processed in China had topped the world for eight consecutive years, almost equal to the total number of applications from the second to the 11th place. However, according to the “2018 Global Innovation Index Report” released by the World Intellectual Property Organization (WIPO) and Cornell University in the United States, China ranked only 17th in innovation The gap also reflects the low quality of Innovation in China.

Eastern provinces include Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian,

Shandong, Guangdong, Guangxi, and Hainan; The central & western provinces include Shanxi, Inner Mongolia, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan, Sichuan, Chongqing, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Ningxia, Qinghai, and Xinjiang.

References

Abdullah M, Zailani S, Iranmanesh M, Jayaraman K (2016) Barriers to green innovation initiatives among manufacturers: the malaysian case. RMS 10(4):1–27

Aghion P, Akcigit U, Bergeaud A et al (2019) Innovation and top income inequality. Rev Econ Stud 86(1):1–45

Aivazian V, Gu X, Qiu J et al (2015) Loan collateral, corporate investment, and business cycle. J Bank Finance 55:380–392

Akcigit U, Baslandze S, Stantcheva S (2016) Taxation and the international mobility of inventors. American Economic Review 106(10):2930–2981

Amore MD, Bennedsen M (2016) Corporate governance and green innovation. J Environ Econ Manag 75(1):54–72

Arena C, Michelon G, Trojanowski G (2018) Big egos can be green: a study of CEO hubris and environmental innovation. Br J Manag 29(2):316–336

Arranz N, Arroyabe M, Li J et al (2020) Innovation as a driver of eco-innovation in the firm: an approach from the dynamic capabilities theory. Bus Strateg Environ 29(3):1494–1503

Awan U, Arnold MG, Gölgeci I (2021) Enhancing green product and process innovation: towards an integrative framework of knowledge acquisition and environmental investment. Bus Strateg Environ 30(2):1283–1295

Ayyagari M, Demirgüç-Kunt A, Maksimovic V (2010) Formal versus informal finance: evidence from China. Rev Financ Stud 23(8):3048–3097

Barbieri, N., Marzucchi, A., Rizzo, U. 2020. Knowledge sources and impacts on subsequent inventions: do green technologies differ from non-green ones? Res Policy, 2020, 49(2), 103901.

Barron DN, West E, Hannan MT (1994) A time to grow and a time to die: growth and mortality of credit unions in New York City, 1914–1990. Am J Sociol 100(2):381–421

Beck T, Pamuk H, Ramrattan R, Uras BR (2018) Payment instruments, finance and development. J Dev Econ 133(7):162–186

Bendell BL (2017) I don’t want to be green: prosocial motivation effects on firm environmental innovation rejection decisions. J Bus Ethics 143(2):277–288

Bollaert. H., de Silanes F. L., Schwienbacher. A. 2021. Fintech and access to finance. J Corp Financ 68, 101941.

Buchak G, Matvos G, Piskorski T, Seru A (2018) Fintech, regulatory arbitrage, and the rise of shadow banks. J Financ Econ 130(3):453–483

Cai X, Lu Y, Wu M et al (2016) Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J Dev Econ 123:73–85

Cai, X., Zhu, B. Z., Zhang, H. J., Li, L., Xie, M. Y. 2020. Can direct environmental regulation promote green technology innovation in heavily polluting industries? Evidence from Chinese listed companies. Sci Total Environ 746(12), 140810.

Cao, S., Nie, L., Sun, H., et al. Digital finance, green technological innovation and energy-environmental performance: Evidence from China's regional economies[J]. J Clean Prod 2021, 327: 129458.

Carrión-Flores CE, Innes R (2010) Environmental innovation and environmental performance. J Environ Econ Manag 59(1):27–42

Chang YK, Oh WY, Park JH et al (2017) Exploring the relationship between board characteristics and CSR: empirical evidence from Korea. J Bus Ethics 140(2):225–242

Chava S, Oettl A, Subramanian A et al (2013) Banking deregulation and innovation. J Financ Econ 109(3):759–774

Chen L, Zhao X (2006) On the relation between the market-to-book ratio, growth opportunity, and leverage ratio. Financ Res Lett 3(4):253–266

Z Chen Z Liu Suárez. Serrato. J. C., et al 2021 Notching R&D investment with corporate income tax cuts in China Am Econ Rev 111 7 2065 2100

Chong TTL, Lu L, Ongena S (2013) Does banking competition alleviate or worsen credit constraints faced by small-and medium-sized enterprises? Evidence from China. J Bank Finance 37(9):3412–3424

Coles JL, Daniel ND, Naveen L (2008) Boards: does one size fit all? J Financ Econ 87(2):329–356

David-West O, Iheanachor N, Kelikume I (2018) A resource-based view of digital financial services (DFS): an exploratory study of Nigerian providers. J Bus Res 88:513–526

Elmagrhi MH, Ntim CG, Elamer AA, Zhang Q (2018) A study of environmental policies and regulations, governance structures, and environmental performance: the role of female directors. Bus Strateg Environ 28(1):206–220

EIA. 2019. International Energy Outlook 2019 With Projections to 2050. Retrieved from: <https://www.eia.gov/outlooks/ieo/pdf/ieo2019.pdf>.

Gabor D, Brooks S (2017) The digital revolution in financial inclusion: international development in the fintech era. New Political Econ 22(4):1–14

Gomber P, Koch JA, Siering M (2017) Digital finance and fintech: current research and future research directions. J Bus Econ 87(5):537–580

Gomber P, Kauffman RJ, Parker C, Weber BW (2018) On the fintech revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J Manag Inf Syst 35(1):220–265

González-Benito J, González-Benito Ó (2010) A study of determinant factors of stakeholder environmental pressure perceived by industrial companies. Bus Strateg Environ 19(3):164–181

Guo F, Wang JY, Wang F, Kong T, Zhang X, Cheng ZY (2020) Measuring China’s digital financial inclusion: index compilation and spatial characteristics. China Econ Q (In Chinese) 19(4):1401–1418

He JJ, Tian X (2013) The dark side of analyst coverage: The case of innovation. J Financ Econ 109(3):856–878

Hottenrott H, Peters B (2012) Innovative capability and financing constraints for innovation: more money, more innovation? Rev Econ Stat 94(4):1126–1142

Hu AGZ, Zhang P, Zhao L (2017) China as number one? Evidence from China’s most recent patenting surge. J Dev Econ 124:107–119

Hu, C., Mao, J., Tian, M., et al. 2021. Distance matters: investigating how geographic proximity to ENGOs triggers green innovation of heavy-polluting firms in China. J Environ Manage 2021, 279: 111542.

Huang YP, Huang Z (2018) The development of digital finance in China: present and future. China Econ Q (In Chinese) 17(4):1489–1502

Huang ZH, Liao GK, Li ZH (2019) Loaning scale and government subsidy for promoting green innovation. Technol Forecast Soc Chang 144(7):148–156

Hvide HK, Jones BF (2018) University innovation and the professor’s privilege. Am Econ Rev 108(7):1860–1898

Jain S, Gabor D (2020) The rise of digital financialisation: the case of india. New Political Econ 25(5):813–828

Jin. Y., Gao. X., Wang. M. 2021. The financing efficiency of listed energy conservation and environmental protection firms: Evidence and implications for green finance in China. Energy Policy, 153: 112254.

Kim. I., Pantzalis. C., Zhang. Z. 2021. Multinationality and the value of green innovation. J Corp Financ 69: 101996.

Knaack P, Gruin J (2020) From shadow banking to digital financial inclusion: china’s rise and the politics of epistemic contestation within the financial stability board. Rev Int Political Econ 2:1–25

Kshetri N (2016) Big data’s role in expanding access to financial services in china. Int J Inf Manage 36(3):297–308

Laeven L, Levine R, Michalopoulos S (2015) Financial innovation and endogenous growth. J Financ Intermed 24(1):1–24

Li D, Zhao Y, Zhang L, Chen X, Cao C (2018) Impact of quality management on green innovation. J Clean Prod 170(1):462–470

Li J, Wu Y, Xiao JJ (2020) The impact of digital finance on household consumption: evidence from china. Econ Model 86(3):317–326

Li, W.A., Zhang, Y.W., Zheng, M.N., Li X.L., Cui, G.Y., Li, H. 2019. Research on green governance of Chinese listed companies and its evaluation. J Manage World (In Chinese), 35(5), 126–133+160.

Li WJ, Zheng MN (2016) Is it substantive innovation or strategic innovation? - Impact of macroeconomic policies on micro – enterprises’ innovation. Econ Res J (In Chinese) 51(4):60–73

Liang XQ (2020) An empirical study on the effects of digital financial inclusion on local tax. J Audit Econ (In Chinese) 35(5):96–104

Lin M, Prabhala NR, Viswanathan S (2013a) Judging borrowers by the company they keep: friendship networks and information asymmetry in online peer-to-peer lending. Manage Sci 59(1):17–35

Lin RJ, Tan KH, Geng Y (2013b) Market demand, green product innovation, and firm performance: evidence from Vietnam motorcycle industry. J Clean Prod 40:101–107

Liu Q, Qiu LD (2016) Intermediate input imports and innovations: evidence from Chinese firms’ patent filings. J Int Econ 103:166–183

Lu J, Wang W (2018) Managerial conservatism, board independence and corporate innovation. J Corp Finan 48:1–16

Lyandres E, Palazzo B (2016) Cash holdings, competition, and innovation. J Financ Quantitat Anal 51(6):1823–1861

Miao C, Fang D, Sun L, Luo Q (2017) Natural resources utilization efficiency under the influence of green technological innovation. Resour Conserv Recycl 126:153–161

Michalopoulos S, Levine R, Laeven LA (2015) Financial innovation and endogenous growth. J Financ Intermed 24:1–24

Mollick E (2014) The dynamics of crowdfunding: an exploratory study. J Bus Ventur 29(1):1–16

Norden L, Buston CS, Wagner W (2014) Financial innovation and bank behavior: evidence from credit markets. J Econ Dyn Control 43(6):130–145

Peng, W., Yin, Y., Kuang, C., Wen, Z., Kuang, J. 2021. Spatial spillover effect of green innovation on economic development quality in china: evidence from a panel data of 270 prefecture-level and above cities. Sustain Cities Soc 69(2), 102863.

Phelps CC (2010) A longitudinal study of the influence of alliance network structure and composition on firm exploratory innovation. Acad Manag J 53(4):890–913

Polzin F, Flotow PV, Klerkx L (2016) Addressing barriers to eco-innovation: Exploring the finance mobilisation functions of institutional innovation intermediaries. Technol Forecast Soc Chang 103:34–46

Qi SZ, Lin C, Cui JB (2018) Do environmental rights trading schemes induce green innovation? Evidence fron listed firms in China. Econ Res J (In Chinese) 53(12):129–143

Qiu L, Hu D, Wang Y (2020) How do firms achieve sustainability through green innovation under external pressures of environmental regulation and market turbulence? Bus Strateg Environ 29(6):2695–2714

Ren S, Wang Y, Hu Y et al (2020) CEO hometown identity and firm green innovation. Bus Strateg Environ 30(2):756–774

Ren, S., Cheng, Y., Hu, Y., et al. 2021. Feeling right at home: Hometown CEOs and firm innovation. J Corp Financ, 66: 101815.

Rennings K (2000) Redefining innovation – eco-innovation research and the contribution from ecological economics. Ecol Econ 32(2):319–332

Shrader, L., Duflos, E. 2014. p. 1. China: a new paradigm in branchless Banking, pp. 1–64. The Consultative Group to Assist the Poor (CGAP).

Song M, Yang MX, Zeng KJ et al (2020) Green knowledge sharing, stakeholder pressure, absorptive capacity, and green innovation: Evidence from Chinese manufacturing firms. Bus Strateg Environ 29(3):1517–1531

Stiglitz JE, Weiss A (1981) Credit rationing in markets with imperfect information. Am Econ Rev 71(3):393–410

Tang, K., Qiu, Y., Zhou, D. 2020a. Does command-and-control regulation promote green innovation performance? evidence from china's industrial enterprises. Science of The Total Environment, 712(4), 136362.

Tang, S, Wu, X.C., Zhu, J. 2020b. Digital finance and enterprise technology innovation: structural feature, mechanism identification and effect difference under financial. Journal of Management World (In Chinese), 36(5), 52–66+9.

Wang CH (2020) An environmental perspective extends market orientation: green innovation sustainability. Bus Strateg Environ 29(8):3123–3134

Wang, M., Li, X., Wang, S. 2021. Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis. Energy Policy, 2021, 154: 112295.

Xie X, Huo J, Zou H (2019) Green process innovation, green product innovation, and corporate financial performance: a content analysis method. J Bus Res 101(8):697–706

Xu T (2018) Investigating environmental kuznets curve in china–aggregation bias and policy implications. Energy Policy 114(3):315–322

Yang L, Zhang Y (2020) Digital financial inclusion and sustainable growth of small and micro enterprises—evidence based on China’s new third board market listed companies. Sustainability 12(9):3733

Yu, C. H., Wu, X., Zhang, D., Chen, S., Zhao, J. 2021. Demand for green finance: resolving financing constraints on green innovation in china. Energy Policy, 153(1), 112255.

Yuan, G., Ye, Q., Sun, Y. 2021. Financial innovation, information screening and industries’ green innovation—Industry-level evidence from the OECD. Technol Forecast Soc Chang 171: 120998.

Zhang J, Liang G, Feng T, Yuan C, Jiang W (2020) Green innovation to respond to environmental regulation: how external knowledge adoption and green absorptive capacity matter? Bus Strateg Environ 29(1):39–53

Zhang X, Wan GH, Zhang JJ, He ZY (2019) Digital economy, inclusive finance and inclusive growth. Econ Res J (In Chinese) 54(8):71–86

Zhao XG, Zhong SH, Guo XX (2021) Digital inclusive finance development, financial mismatch mitigation and enterprise innovations. Sci Res Manage (In Chinese) 42(4):158

Zhong T, Wang CY (2018) Financial development and firm—level innovation output: a perspective of comparing different financing patterns. J Financ Res (In Chinese) 12:127–142

Funding

This study was supported by the National Natural Science Foundation of China (71803171); by the Science and Technology Planning Project of Henan Province (192400410063); by the Social Science Planning Project of Henan Province (2017BJJ052).

Author information

Authors and Affiliations

Contributions

S.R.: conceptualization, data curation, writing original draft. Y.P.: theoretical and empirical analysis, writing original draft. J.H: literature review, formal analysis. X.S.: conceptualization, methodology, funding acquisition, and supervision.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no conflict of interest.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Rao, S., Pan, Y., He, J. et al. Digital finance and corporate green innovation: quantity or quality?. Environ Sci Pollut Res 29, 56772–56791 (2022). https://doi.org/10.1007/s11356-022-19785-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19785-9