Abstract

Digital finance realizes the combination of finance and technology, makes up for many deficiencies of traditional finance, and brings opportunities for green and innovative development. However, systematic research on regional digital finance and green innovation is still lacking. Based on this, this study aims to analyze the impact of digital finance on the regional level of green innovation. For the analysis, the fixed-effect model, the mediating effect model, and the moderating effect model are used to perform regression on the panel data of Chinese cities. The results show that digital finance can significantly improve the level of regional green innovation. Improving the level of regional green financial services is its main mechanism, but the intermediary role of industrial structure optimization and upgrading fails to pass the test. In addition, the results of heterogeneity analysis show that digital finance plays a greater role in promoting green innovation in areas with high levels of traditional financial supply and Internet infrastructure construction. It is worth noting that digital finance does not really play the role of universal benefit, widening the regional green innovation gap. The main contributions of this study are to prove the positive effect of digital finance on green innovation at the regional level, clarify its transmission mechanism and urban heterogeneity analysis, and find that the current digital finance cannot bridge the gap of regional green innovation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since the reform and opening up, China has experienced nearly 40 years of rapid economic growth, creating a remarkable growth miracle. However, environmental pollution and energy consumption have intensified. According to the 2020 Global Environmental Performance Index (EPI) report, China ranks 120th out of 180 countries and regions participating in the evaluation. The relatively low ranking partly reflects the relatively severe environmental impact of China’s rapid economic growth. The coordinated development of regional economy and environment is not only the core of sustainable development theory (Deng et al. 2021; Wang et al. 2019), but also an urgent problem to be solved in China. Green innovation contributes to economic development while reducing the adverse effects on the environment (Borsatto and Bazani 2020). The regional development theory points out that cities are the industrial agglomeration points of the regional economy and play an important role in regional development and planning (Soja 2015). Therefore, improving the level of green innovation in cities is the key to enhancing the capacity of regional sustainable development and promoting the overall green transformation of China’s economic and social development.

Green innovation requires long-term and stable financial support to succeed (Xiang et al. 2022). Improving the financing convenience of green innovation and broadening the financing channels of green innovation are effective ways to promote green innovation (Brown et al. 2012; Xiang et al. 2022). Recently, China’s commitment to the “dual carbon” target has put forward higher requirements for the development of green innovation in cities, and the corresponding green innovation also has a greater demand for capital (Dong et al. 2022). However, the high risk, poor liquidity, and long investment return period of green innovation do not conform to the investment preference of traditional financial institutions in China. As a result, regional green innovation often faces higher financing constraints, which weakens innovation ability and reduces innovation level. Therefore, in order to get rid of the constraint of regional green innovation financing, a new efficient and sustainable financial model is urgently needed.

In recent years, digital technology continues to penetrate into the financial field, and digital finance, which is highly compatible with the digital economy, emerges at the right moment. China’s digital finance development has always been in an international leading position. Not only has the world’s famous digital financial companies, including Ant Financial, JD Digital, and Du Xiaoman Finance, but also quickly realized the application and popularization of digital currency and online loans. Digital finance has changed the transaction model of traditional finance, lowered the threshold of financial services, expanded the target of financial services, and improved the convenience and inclusiveness of financial services (Cao et al. 2021). Moreover, big data, artificial intelligence, and other information technologies are used in digital finance to reduce information asymmetry, which lowers financial services risks (Dendramis et al. 2018; Kshetri 2016). Therefore, digital finance has brought more financing opportunities and made it possible to improve the level of regional green innovation and narrow the gap. However, systematic studies at the regional level are still lacking. Based on this, this study aims to analyze the impact of digital finance on the regional level of green innovation, realize the analysis of its influence mechanism and heterogeneity effect, and improve the theoretical research on digital finance and green innovation at regional level.

Specifically, our work has made the following three contributions: first, compared with most previous provincial-level regional green innovation research, this paper is based on panel data of Chinese cities, and the research scale is more refined. And the regional green innovation level is divided into high-end innovation and low-end innovation, and the relationship between digital finance and regional green innovation level is more detailed. Second, different from previous studies on digital finance, green financial service level and industrial structure optimization and upgrading are taken as mediating variables to clarify the influence mechanism and transmission path of digital finance and green innovation level at the regional level. In addition, we also consider the impact of different levels of urban traditional financial supply and Internet infrastructure construction on the relationship between digital finance and regional green innovation, so as to explore how to better play the role of digital finance in regional green innovation. Third, further explore whether digital finance can genuinely play its inclusive function and bridge the gap in the level of regional green innovation.

Chapters 2–6 follow this structure: the “Review and hypothesis” section combs literature, presents the research hypothesis, and builds a theoretical model. The “Empirical design” section introduces the collection of research data, selection of variables, and research methods. The “Empirical results and analysis” section conducts empirical tests. The “Further analysis” section examines the impact of digital finance on the green innovation level gap and discusses the results. The “Conclusions” section presents the results and offers policy suggestions as well as research limitations.

Review and hypothesis

Literature review

The theory of sustainable development originated in the 1980s, emphasizing the coordinated development of economy, society, and environment and putting forward higher requirements for the development of human society (Shi et al. 2020). Compared with traditional innovation means, green innovation is not limited to the level of simple economic benefits, but emphasizes the establishment of a coordinated management mode and regulation mechanism between economy and environment (Oduro et al. 2021). Therefore, improving the level of green innovation is an important way to build a resource-saving and environment-friendly society and achieve sustainable development (Song and Yu 2018). At present, many scholars have proved the positive role of green innovation (Yin et al. 2018). Hao et al. (2022) studied that green innovation is conducive to improving enterprise value. Ahmed et al. (2021) believe that green innovation enables high-quality development of the green economy. Razzaq et al. (2021) from the national level prove that green technology innovation can promote economic growth and reduce CO2 emissions. Yang and Roh (2019) demonstrated from the enterprise level that consumers can also make contributions to environmental protection by using green innovative products. This shows green innovation in promoting enterprise value, environmental protection and green economic growth has a positive role.

To better promote green innovation and achieve coordinated development of economy and environment, scholars focus on exploring effective ways to develop green innovation. According to regional innovation theory, studying from the perspective of influencing factors that stimulate or inhibit innovation development is conducive to promoting regional innovation development (Zitek and Klimova 2016). Current studies indicate that in addition to environmental regulation (Borsatto and Bazani 2020; Li et al. 2018), industrial structure (Zhao et al. 2022), foreign direct investment (Song et al. 2015), and government subsidies (Liu et al. 2021b), financial support is also a significant driver of green innovation (Yu et al. 2021). Therefore, we believe that a favorable financing environment for green innovation is of great significance to its development. However, China’s current financial model is still dominated by traditional financial credit, which cannot meet the financing needs of green innovation. Hence, a new financial service model is needed to solve the shortcomings of traditional financial services in promoting green innovation.

In such a situation, digital finance emerges at the historic moment. Digital finance, by combining with information technology, makes up for the shortcomings of traditional finance and provides higher service efficiency and financial support for green innovation projects (Cao et al. 2021; Wang et al. 2020). Liu et al. (2022) pointed out that digital finance can increase R&D investment and promote green innovation by easing corporate financing constraints. Cao et al. (2021) found that digital finance can improve China’s energy and environmental performance by improving the efficiency of green technology. Fan et al. (2022) found that digital finance promotes green innovation in corporate technology by reducing financing costs and increasing financial flexibility. Rao et al. (2022) research pointed out that digital finance can improve the quality and quantity of enterprise green innovation by improving the transparency of enterprise information and accelerating capital flow. Therefore, the emergence of digital finance brings opportunities for the development of green innovation.

To sum up, digital finance has brought a lot of convenience to the development of green innovation. It is very imperative to clarify the impact of digital finance on green innovation to improve the level of green innovation in China. At present, the academic research on green innovation mainly focuses on the national level (Ahmed et al. 2021; Razzaq et al. 2021) and the enterprise level (Yang and Roh 2019; Hao et al. 2022), but lacks the research on the regional level. However, improving the level of regional green innovation is a crucial way to achieve green economic development (Zhou et al. 2021). Therefore, it is of great significance to explore the relationship between digital finance and green innovation at the regional level. Due to different geographical locations, economic development, resource endowment, and digital infrastructure in different regions of China, digital finance development may have different impacts on regional green innovation, and it is not clear whether its universal benefit can be truly realized at present. It can be seen that, based on the perspective of urban heterogeneity, exploring the relationship between the two is conducive to better play the role of digital finance in promoting regional green innovation. In addition, most of the existing research regards financing constraints and technological innovation as the mechanism path of digital finance research, and the applicability of the research on digital finance and green innovation mechanism at the regional level is not high. It is necessary to investigate the mechanism transmission path at the regional level.

Research hypothesis

Base analysis hypothesis

Promoting regional green innovation development is beneficial to reducing environmental pollution and achieving high-quality economic development. Green innovation is inseparable from the support of financial resources. However, the current green credit business of Chinese financial institutions is still dominated by traditional credit models, and diversified project investment such as environmental protection does not meet their investment preferences (Cao and Xing 2018), making it difficult to obtain sustainable, stable, and sufficient financial support for green innovation (Cao et al. 2021; Toxopeus and Polzin 2021). Therefore, a new financial service model is urgently needed to bring stable and sufficient funding sources for the development of regional green innovation.

With the advent of the digital age, digital finance has become an emerging financial service model in recent years, which is different from the operation mode of traditional finance. It not only expands the scope of market participation, but also enriches the types of trading tools (Yao et al. 2018; Yin et al. 2019). Through the combination of financial and information technology to collect and integrate information, alleviate the problem of information asymmetry of transaction objects, reduce the green innovation investment risk, broaden the green innovative financing channels and capital source, and provide adequate financial support for the development of regional green innovation.

First, digital finance can use information technologies such as big data, blockchain, and artificial intelligence to assess consumer credit and risk, match suppliers and demanders of funds (Li et al. 2020), and reduce the risk and cost of data processing (Gomber et al. 2018). In this way, the problems of high risk and high operating costs caused by information redundancy and asymmetry in the traditional financial service transaction process can be improved, the investment risk in green innovation of financial institutions can be reduced (Kshetri 2016; Dendramis et al. 2018), and the green investment of financial institutions can be promoted. Second, digital finance can optimize the allocation of green innovation resources, speed up the transformation from savings to investment, and improve the spatial allocation and utilization of resources (Su et al. 2021). Traditional finance is limited to the allocation of resources in geographical or physical space, while the allocation mode of financial resources under digital finance is different. It relies on the global network and realizes the optimal allocation of resources through data collection, data processing, and data application, and apply blockchain and other information technologies to establish a digital trust and three-dimensional interactive structure, improve the financial service model, and further improve the efficiency of financial resource allocation. Third, the long tail effect of digital financial platform can serve a large number of customers at the premise of lower boundary cost, broaden financing channels for green innovation, and increase financing amount. Digital financial service model not only satisfies the “big customers” favored by traditional financial institutions, but also provides financial services for the “small customers” at both ends of investment and financing, so that the funds of small-scale investors can be utilized and the capital source of green innovation can be expanded. At the same time, digital finance also provides many new financing channels for green innovation, such as intelligent investment consulting, supply chain finance, etc. (Cao et al. 2021), promotes financial innovation, absorbs more financial resources, and lays a solid foundation for improving urban ecological benefits. Therefore, we propose the hypothesis.

Hypothesis 1 (H1). The development of digital finance will have a positive impact on regional green innovation.

Mechanism analysis hypothesis

Green finance combines the financial industry with the environmental protection industry (Wang and Wang 2021; Wang et al. 2021), guides all parties to enter the green industry (Wang and Wang 2021), provides financial support for green projects and technologies, and improves the level of regional green innovation (Yu et al. 2021). However, the current green finance model in China is still dominated by green credit, while “green insurance” and “green securities,” etc. have just started, with limited scale and role. The emergence of digital finance provides an opportunity for the development of green finance.

First, digital finance provides precise service objects for green finance, realizes precise layout of green finance business (Shi et al. 2022), and helps improve the service efficiency of green finance. Digital finance utilizes big data, blockchain, and other information technologies to establish trans-regional, trans-departmental, and trans-industry data fusion channels, integrate historical data and externally acquired data, improve green financial service product standards and customer credit rating standards, enhance the screening capacity of regional financial institutions, accurately identify green financial service objects (Rao et al. 2022), and improve the level of green financial services. Second, digital finance provides an efficient and convenient channel for individuals and enterprises to participate in green finance and expand the supply of green credit and other green financial products (Shi et al. 2022). Digital finance relies on modern information technology to improve the business service process of green finance, reduce the service cost, improve the inclusiveness of financial services, broaden the channels for “small and scattered” investors to participate in green finance, provide sufficient and stable financial support for green innovation projects (Cao et al. 2021; Li et al. 2021), and improve the level of regional green innovation. Third, digital finance improves the risk management ability in the process of green financial services (Norden et al. 2014). Relying on big data and blockchain technology to support the credit system, digital finance strengthens the online collection and real-time analysis of environmental risk information (Fan et al. 2022), improves the ability of macro management and micro supervision, and effectively prevents the default risk of green credit and green bonds. Therefore, we propose the hypothesis.

Hypothesis 2 (H2). Digital finance can indirectly promote the development of regional green innovation by improving the level of regional green financial services.

Developing green industry and accelerate the green transformation of traditional industry is the core content of industrial structure optimization and upgrading. Realizing the optimization and upgrading of industrial structure is conducive to reducing energy consumption (Yu et al. 2018), reducing pollutant emissions (Cole et al. 2005), promoting the optimal allocation of resources, and improving the level of regional green innovation (Xu et al. 2021). The industrial structure adjustment mainly depends on the industry’s own adjustment, administrative intervention, and financial support. With the continuous promotion of the optimization and upgrading of China’s industrial structure, the industrial structure is getting closer and closer, and the degree of influence between industrial structures is becoming more and more obvious. The financial industry as an important part of the tertiary industry, its growing impact on industrial structure adjustment. With the influx of capital, technology, talent, and other resources into the digital finance sector, the development level of China’s digital finance is constantly improving, providing opportunities for the optimization and upgrading of industrial structure.

First, digital finance reduces the financing threshold, brings more capital to green innovation, accelerates the flow of capital and technological factors from low-level industries to high-level industries (Pai 2016), realizes the optimization of industrial structure and diversified development of industry, reduces transaction costs of green industry, and promotes regional green innovation. Second, digital financial applies modern science and technology in financial industry, expand the scope of financial services, improve the external financing environment of enterprises (Pradhan et al. 2015; Brown et al. 2012), provide adequate financial support for enterprise innovation, and accelerate regional industrial structure optimization, promote the development of regional green innovation. Third, with the emergence of digital finance, China’s payment system is constantly developing and upgrading. Not only expanded the coverage of financial services, but also enriches the traditional financial products, to provide more choices for personal financial demanders, stimulate the financial needs of the residents, financial innovation, and the diversification of consumer demand to further promote the optimization of regional industrial structure (Bruhn and Love 2014), for the green innovation to provide more financial support. On this basis, put forward a hypothesis.

Hypothesis 3 (H3). Digital finance can indirectly promote the development of regional green innovation by promoting the optimization and upgrading of the industrial structure.

Heterogeneity analysis hypothesis

The above theoretical analysis shows that digital finance can promote regional green innovation. However, the theory of sustainable development points out that the realization ability of regional sustainable development also needs to consider the relevant factors such as local economy, resources, and culture (Shi et al. 2020; Deng et al. 2021; Wang et al. 2019). Based on this, we reasonably consider whether the impact of digital finance on regional green innovation level is different due to the heterogeneity of cities. Therefore, we intend to further explore the effects of digital finance development on regional green innovation level under the influence of different levels of urban traditional financial supply and Internet infrastructure construction.

Although digital finance integrates finance and modern technology, its development model still follows the fundamental law of financial development and needs the support of conventional finance. First, digital finance lacks financial support in its infancy. Develop traditional financial markets, create favorable financing environment for digital finance development, and provide diversified financing channels such as venture capital and private equity for digital finance development (Haddad and Hornuf 2019; Chakravarty and Pal 2013). Second, traditional finance has a long history of development and a relatively complete theoretical knowledge system, providing knowledge support for digital finance (Chen et al. 2022). Third, cities with sufficient supply of traditional finance have more professional financial talents, consumers have a higher understanding of financial products, and have complete intelligence to support the development of digital finance (Yao et al. 2018; Chen et al. 2022). Based on this, we propose a hypothesis.

Hypothesis 4 (H4). The more adequate the supply of traditional finance, the stronger the role of digital finance in promoting the level of regional green innovation.

Digital finance refers to a new generation of financial services combining the Internet and information technology with traditional financial services (Liu et al. 2021c). Therefore, the level of Internet infrastructure construction is a prerequisite for the development of digital finance. On the one hand, cities with high level of Internet infrastructure construction are conducive to improving the penetration rate and availability of digital finance, reducing the cost of digital access and promoting the development of digital finance (Li et al. 2020; Ozili 2018). On the other hand, the higher the level of Internet infrastructure construction, the more conducive to the formation of connectivity with surrounding cities, the removal of time and space constraints on the development of digital finance, the promotion of the differentiated, independent and coordinated development of digital finance subjects (Liu et al. 2021a), and the promotion of regional green innovation. Based on this, we propose a hypothesis.

Hypothesis 5 (H5). The higher the level of Internet infrastructure construction, the stronger the role of digital finance development in improving the level of regional green innovation.

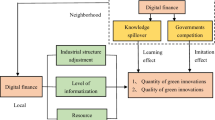

Based on the above analysis, constructs the theoretical model, as shown in Fig. 1.

Empirical design

Sample and data collection

In this paper, major cities in China are selected as the research objects, and the time span is from 2011 to 2019, based on which the panel data set is constructed. Some cities with serious data missing were removed and 283 cities were retained. Finally, 2547 city-time observations were included in the sample of this paper. In addition, in this paper, all continuous variables have been shortened by 1% up and down, so as to avoid the abnormal influence of extreme values on the empirical results to a certain extent.

Relevant data sources involved in this paper are as follows: digital financial index from the “Digital Financial Inclusion Index” released by the Digital Finance Research Center of Peking University, green patent data comes from the China National Intellectual Property Administration, green bond issuance data from Wind database, Internet broadband access user data mainly comes from China Internet Network Information Center, and the local bureau of statistics. Other city-level data mainly come from the China City Statistical Yearbook, the China Regional Economic Statistical Yearbook, the China Statistical Yearbook, the China Environmental Statistical Yearbook, the Statistical Bulletin of National Economic and Social Development, and statistical yearbook of provinces and prefecture-level cities.

Variables

Dependent variables

Regional green innovation level (RGIN). There are two main ways to measure the level of green innovation. One is from the perspective of input, using the level of R&D investment as a proxy variable for green innovation, and the other is from the perspective of output, using green patents as a measure of green innovation (Zhou et al. 2021). In this study, the risk of regional green innovation activities is high, R&D investment is difficult to transform into innovation output, and the level of green innovation measured by R&D investment is easy to be inflated. In addition, green patents are divided into green invention patents and green utility patents. Compared with green utility patents, green invention patents are more innovative (Liu et al. 2020), on the basis of urban green innovation levels can be more fine strands. Therefore, we choose to use the number of urban green patent applications as a proxy variable for regional green innovation level (RGIN), and use green invention patents to characterize regional high-end green innovation (Invt), and green utility patents to characterize regional low-end green innovation (Util). We normalized the metrics to remove dimensional differences between the data.

Independent variables

Digital finance (DIF). The Digital Financial Inclusion Index (city-level) released by Peking University’s Digital Finance Research Center was used as the proxy variable for this digital finance study (Guo et al. 2020). In order to describe the relationship between digital finance and regional green innovation in more detail, this paper also selects digital finance coverage breadth (Bre), digital finance depth (Dep), and inclusive finance digitization degree (Digi) in digital finance index to conduct dimension reduction analysis of digital finance index. Among them, Bre mainly electronic account number representation; Dep is used to measure the actual number of account users and the degree of activity; Digi measures the convenience, cost, and trustworthiness of digital financial services. To eliminate dimensional differences between the data, divide all digital finance-related indices by 100.

Mediating variables

This paper mainly thinks digital financial mechanism path improve the green financial service level and promote the optimization and upgrading of industrial structure and raise the level of regional green innovation. Green financial service level (GF): green bonds are mostly issued by financial institutions and enterprises, which can better represent the green financial service level of cities compared with green credit, carbon finance and green insurance. The issuance of green bonds is taken as the proxy variable of urban green financial service level, and the year of issuance of green bonds is denoted as 1, while the year of unissued green bonds is denoted as 0. Industrial structure optimization and upgrading (ISU): according to Wang et al. (2021), the industrial structure transformation (ISC) expression can be used to determine the production structure, ISC = P + 2S + 3 T, where P, S and T respectively represent the proportion of the added value of the primary, secondary and tertiary industries in the total regional output value, and the difference between the adjacent two years is used as the Industrial structure optimization and upgrading index (ISU).

Moderating variables

The moderating variables include the level of traditional financial supply and the level of Internet infrastructure construction. Traditional financial supply (LOAN): the ratio of outstanding loans of urban financial institutions to GDP, as a proxy variable of urban traditional financial supply level, if the traditional financial supply of the city is higher than the median data of the year, the value is assigned to 1, which is defined as the area with high level of traditional financial supply; otherwise, the value is assigned to 0, which is defined as the area with low level of traditional financial supply. Internet infrastructure construction (UII): the urban Internet infrastructure construction level is represented by the number of Internet broadband access users. If the level of urban Internet infrastructure is higher than the median of the data of the year, the value is assigned to 1 and the area is defined as the area with high Internet infrastructure level; otherwise, the value is assigned to 0 and the area is defined as the area with low Internet infrastructure level.

Control variables

The theory of regional development holds that in addition to natural resources, policy, economy, technological input, and human resources are equally important to regional development (Polyzos and Arabatzis 2008; Soja 2015). Therefore, to ensure the rationality of research results as much as possible and overcome the influence of omitted variables, we refer to existing studies (Ouyang et al. 2020; Fu et al. 2020; Shi and Yu 2021) and select the following control variables from five aspects: urban economic development, degree of opening to the outside world, human capital, government investment in science and technology, and intensity of environmental regulation. Economic level (AGDP): the urban economic development level is represented by the logarithm (lg) of annual per capita GDP. Degree of openness (Trade): the ratio of total import and export to GDP as the proxy variable of the city’s degree of opening to the outside world. Human capital (HC): this represents the accumulation of urban knowledge level and is an important guarantee for regional green innovation. The logarithm (lg) of every ten thousand college students is taken as the proxy variable of urban human capital. Government science and technology expenditure (GOV): government science and technology support is an important support for regional green innovation, the ratio of government science and technology expenditure to general fiscal expenditure as the proxy variable of government science and technology expenditure. Environmental regulation (EI): the comprehensive emission index of major pollutants such as urban industrial wastewater discharge, industrial SO2 discharge and industrial smoke and dust discharge as proxy variables of urban environmental regulation intensity. All variable definitions are shown in Table 1.

Model specification

Fixed effects model

We passed the Hausman test on the research data (Wen et al. 2022) and strongly rejected the original hypothesis because the P value was less than 0.01. The fixed effect model should be used to test the relationship between digital finance and regional green innovation level. The fixed effect model is the main force of applied research in economics; its advantage lies in its ability to control the unobservable confounding factors related to regression factors, and to a certain extent, it can solve the problem of endogeneity (Halder and Malikov 2020). Fixed effect model has been used to examine the impact of digital finance on enterprise green innovation (Rao et al. 2022) and industrial pollution (Wen et al. 2022), which provides a basis for our research. Referring to Lee and Yu (2010), we constructed a bidirectional fixed effect model including time and individual, which can reduce the influence of omitted variables. The model is as follows:

Among them, GI is the dependent variable, including RGIN, Invt, and Util; the independent variable DIF is the digital financial index (city-level); i for city; t for time; Controls denotes all control variables; \(\lambda_{i}\) individual fixed effects; \(\mu_{t}\) time fixed effects, and \(\varepsilon_{i,t}\) is the random disturbance term. In the regression test, robust clustering standard error is adopted to cluster all regressions to the provincial level, which improves the accuracy of coefficient estimators (Lee and Yu 2010).

Mediating effect model

Causal steps approach by Baron and Kenny (1986) is widely used for mechanism path gradually after inspection (Cao et al. 2021; Fan et al. 2022; Wang et al. 2021), its advantage lies in eliminating other intermediary path after the inspection of a single variable intermediary role, and the test results more intuitive. Therefore, based on Hypothesis 2 and Hypothesis 3, we constructed the mediating effect model in this paper:

Among them, Mediator selected the urban green financial service level (GF) and industrial structure optimization and upgrading (ISU), and the rest were the same as those set above.

Moderating effect model

The commonly used heterogeneity analysis methods mainly include grouping regression and moderating effect model (Cao et al. 2021; Li et al. 2021; Feng and Wu 2022; Ma et al. 2018). In addition to testing heterogeneity, the moderating effect model can also test the interaction between moderating variables and independent variables (Feng and Wu 2022; Ma et al. 2018). At this point, after grouping regression, this paper intends to further construct the moderating effect, including the interaction term between digital finance and traditional financial supply, and the interaction term between digital finance and Internet infrastructure construction level into the model, verify Hypothesis 4 and Hypothesis 5, and refer to Feng and Wu (2022) to construct the following model:

Among them, Moderator selects traditional financial supply (LOAN) and Internet infrastructure construction (UII) respectively, and the rest are the same as those set above.

Based on the above analysis, the conceptual model of the research was drawn, as shown in Fig. 2.

Empirical results and analysis

Descriptive statistics

Using Stata15 software panel data analysis, for detailed descriptive statistics variables, refer to Table 2. In Table 2, when we grouped according to different levels of traditional financial supply and Internet infrastructure construction, there was little difference in sample size. Therefore, the basis for this grouping is more reasonable, and there are apparent gaps in the development level of digital finance and the level of regional green innovation under different levels of traditional financial supply and Internet infrastructure construction.

Benchmark regression result

The benchmark relationship of “DIF—Regional green innovation (including RGIN, Invt and Util)” is empirically tested, the results are shown in Table 3. EG1-EG3, only time and individual fixed effect were controlled, and no control variables were added. From the results, it is found that the regression coefficients of DIF on RGIN, Invt, and Util are all positive and significant, indicating that the development of digital finance helps to improve the level of regional green innovation. EG4-EG6 after adding the set control variable, the conclusion remains unchanged. Therefore, Hypothesis 1 is verified. Because this paper focuses on exploring the influence and mechanism of digital finance and regional green innovation level, it does not focus on the discussion of control variables.

To further explore the digital financial impact on the regional green innovation, we will digital financial indicators dimension reduction to digital financial coverage breadth (Bre), digital financial use depth (Dep), and inclusive finance digitization degree (Digi); regression results are shown in Table 4. From EG1-EG3, we find that Bre regression coefficient does not pass the significance test, which cannot prove that the digital financial coverage breadth promotes the development of regional green innovation. EG4-EG6 and EG7-EG9 showed that Dep and Digi regression coefficients passed the significance test respectively, and Dep coefficient was more significant than Digi regression coefficient. Therefore, only increasing the coverage of digital finance cannot promote regional green innovation in a real sense. It is necessary to further explore and improve the convenience and credibility of digital financial services, reduce application costs, and provide financial support for the development of green innovation in the region.

Endogenous processing and robustness testing

To improve the robustness of the above conclusions, we mainly use three methods to test the robustness: replacement model, lagged independent variable regression, and elimination of special samples.

-

1.

Replacement model. RGIN, Invt, and Util, the dependent variables of this study, use urban green patent application as a proxy variable, presenting a mixed feature of coexistence of zero-value accumulation and positive continuous distribution; Tobit model is used to test this data structure. In addition, based on bidirectional fixation of city and time in the basic regression model, the cross-product term of time and economic zones (year × Econ) was added to eliminate the interference of unknown factors, more strictly control the endogenous. As shown in Table 5, DIF is still significant, supporting the original hypothesis.

-

2.

Regression of lagged explanatory variable. Although the development of digital finance has a positive impact on regional green innovation, it may take some time for the green innovation to emerge due to a long cycle; this paper conducts lag treatment for DIF, which can also moderately alleviate the problem of reverse causality and endogeneity. The core explanatory variable DIF lags one-stage (L.DIF), two-stage (L2.DIF), and three-stage (L3.DIF) respectively for regression. The results are shown in Table 6, which still supports the original hypothesis.

-

3.

Excluding the influence of special samples. The research data include municipalities directly under the central government and provincial capital cities, but the data of these two types of cities have great differences in development level compared with general prefecture-level cities. Therefore, we removed the data of these two types of cities and regressed. The results as shown in Table 7 remained significant DIF coefficient, supporting the null hypothesis.

Intermediary mechanism tests

In this section, we mainly discuss two possible channels of digital finance to regional green innovation: improving the service level of green finance and promoting the optimization and upgrading of industrial structure. Among them, the mediating effect of urban green financial service level (GF) is shown in Table 8. EG2 estimation results show that the DIF coefficient is significantly positive, indicating that digital finance will improve the level of urban green financial services. EG3 indicates that after the addition of green financial service level (GF) as an intermediary variable, both DIF and GF coefficients are significantly positive, which indicates that GF plays a partial intermediary role in the promotion of digital finance to the level of urban green innovation, that is, the development of digital finance improves the level of urban green innovation by improving the level of urban green financial services. Hypothesis 2 is confirmed. Further, EG4–EG9 indicates that digital financial development also improves regional high-end green innovation (Invt) and regional low-end green innovation (Util) by promoting the level of urban green financial services.

The mediating effect of industrial structure optimization and upgrading (ISU) is shown in Table 9. In Table 9, DIF is positive to ISU, but fails to pass the significance test. Sobel and Bootstrap tests were further applied, and the results are shown in Table 10, which failed to pass the mediation effect test. This indicates that existing models cannot prove the mediating effect of digital financial development on improving regional green innovation level by promoting industrial structure optimization and upgrading. Therefore, Hypothesis 3 is not validated.

We believe that there are the following reasons for this result. The development of the industrial structure optimization and upgrading is a long-term process (Wang et al. 2021); digital financial development in the short term cannot have an obvious role in promoting industrial structure optimization and upgrading, and optimization and upgrading of industrial structure effect also failed to short-term reflect the improvement of urban green innovation. In addition, existing studies mostly focus on the provincial level (Wang et al. 2021; Wang and Wang 2021; Feng and Wu 2022), while this study focuses on the city level, which is more complex than the provincial level. For example, some cities derive their income mainly from tourism, resulting in a high proportion of added value of the tertiary industry in the city’s total output value. However, science and technology, economy, enterprise green technology development, and other important factors affecting the level of urban green innovation do not match the proportion of added value of the tertiary industry, leading to the inapplicability of industrial structure optimization and upgrading variable measurement method, which is also a direction of our future research.

Heterogeneity analysis

The heterogeneity analysis of the supply level of urban traditional finance is shown in Table 11. EG1-EG3 lists the regression relationship between urban digital finance with low level of traditional finance supply and regional green innovation level (RGIN), regional high-end green innovation (Invt), and regional low-end green innovation (Util). The results show that urban digital finance with low supply level of traditional finance does not significantly promote regional high-end green innovation. For cities with high traditional financial supply level listed in EG4-EG6, under the 1% level significantly DIF coefficient, the regression coefficients are greater than the low supply level of traditional financial city. In order to further verify whether the urban traditional financial supply level and digital financial development play complementary effects in promoting regional green innovation level, regression is carried out based on Formula (5), such as EG7-EG9, DIF*LOAN coefficients which are significantly positive. Therefore, Hypothesis 4 is verified.

The heterogeneity analysis of urban Internet infrastructure construction level is shown in Table 12. EG1-EG3 lists the regression relationship between urban digital finance with low level of Internet infrastructure construction and regional green innovation level (RGIN), regional high-end green innovation (Invt), and regional low-end green innovation (Util). EG4-EG6 lists the regression coefficients of digital finance development on regional green innovation level (RGIN), regional high-end green innovation (Invt), and regional low-end green innovation (Util) for cities with high level of Internet infrastructure construction. DIF coefficients all passed the statistical significance test of 5%, but the various regression coefficients of cities with high level of Internet infrastructure construction were higher than those of cities with low level of Internet infrastructure construction. Preliminary illustrates the digital financial in Internet infrastructure construction level high cities can better play a promoting effect on the level of green innovation. Regression was further carried out based on Formula (5) to verify whether cities with high level of Internet infrastructure construction could better play the promoting role of digital financial development on regional green innovation level, results such as EG7-EG9, DIF*UII coefficients are significantly positive. Therefore, Hypothesis 5 is verified.

Further analysis

Digital finance and regional green innovation level gap

The theory of regional innovation points out that regional innovation is the overall requirement of the whole region, and technical, financial, and institutional support is more needed to make up for the existing deficiencies in the vulnerable regions where the environment is not conducive to the development of innovation, so as to realize the overall regional innovation development (Zitek and Klimova 2016; Eder 2019; McCann and Ortega-Argilés 2016). As far as we know, this article has confirmed the positive impact of digital finance on regional green innovation. However, at present, China should not only promote the development of regional green innovation, but also strive to bridge the regional innovation gap and alleviate the serious differentiation of urban green innovation (Zhang et al. 2022; Wang et al. 2017). Based on this, we need to further explore whether digital finance can really play the inclusive function, provide a more favorable financing environment for green innovation for disadvantaged regions, and then narrow the regional gap in green innovation.

In the previous heterogeneity analysis, it is pointed out that cities with a high level of traditional financial supply and Internet infrastructure construction are more conducive to the promotion of digital finance to the level of regional green innovation. Based on this, we reasonably guess that the emergence of digital finance will increase the regional green innovation gap. To prove this speculation, this paper constructs a regression model of digital finance and regional green innovation gap (Hausman test after, still choose fixed effects model):

Among them, gap_GI includes gap_RGIN, gap_Invt, and gap_Util. In accordance with the common practice in the field of economics, we calculate the dispersion of different indices to measure regional innovation differences, that is, regional green innovation gap (gap_RGIN) = (green innovation level of a city) / (mean value of green innovation of all cities in that year). On this basis, regional high-end green innovation level gap (gap_Invt) and regional low-end green innovation level gap (gap_Util) are calculated; other variables are the same as above. The regression results are shown in Table 13.

As can be seen from the Table 13, all regression coefficients of DIF are positive and pass the significance test, indicating that digital finance will increase the gap of regional green innovation. This shows that digital finance has not really played an inclusive role in promoting regional green innovation, and it still “dislikes the poor and loves the rich” just like traditional finance to a certain extent.

For a more precise evaluation of digital finance’s impact on regional green innovation gap, dimension reduction analysis of digital finance index (dimension reduction content is the same as above) is conducted. Table 14 presents the results. The regression coefficients of Dep and Digi were positive and significant at 1% confidence level, but Bre regression coefficients failed to pass the significance test. This indicates that digital finance widens the gap in regional green innovation level, mainly from the depth of the use of digital finance and the degree of digitalization of inclusive finance, and has a greater impact on regional high-end green innovation. Regional high-end green innovation, to some extent, represents the core green innovation ability and has a greater impact on regional green innovation level. In other words, the gap in regional green innovation level increased by digital finance is more of a real gap. Therefore, it is of great significance to pay attention to how to bridge the regional green innovation gap while giving play to the role of digital finance in promoting the level of regional green innovation.

Discussion

This paper discusses the relationship between digital finance and regional green innovation. Many studies have noted that the emergence of digital finance has a certain impact on green innovation. For example, digital finance can alleviate information asymmetry (Kong et al. 2022) and financing constraints (Liu et al. 2022) in enterprises’ green innovation, and can also improve the quality and quantity of enterprises’ green innovation (Rao et al. 2022). However, as far as existing literature is concerned, the positive effect of digital finance on green innovation is mostly confirmed from the enterprise level. Although Ma et al. (2022) confirmed the promotion effect of digital finance on green innovation at the provincial level, there is still a lack of action mechanism applicable to digital finance and green innovation at the regional level. Accordingly, based on the fine-scale urban panel data, we take green financial service level and industrial structure optimization and upgrading as mediating variables to explore the mechanism of digital finance and green innovation at the regional level. It can be said that the theoretical research on digital finance and green innovation has been perfected from the regional level.

In addition, although existing studies have mentioned that digital finance improves inclusiveness compared with traditional financial models (Cao et al. 2021), it remains to be seen whether such increased inclusiveness can bridge the gap in regional green innovation. Based on this, we confirm the positive effect of digital finance on regional green innovation level through a series of empirical tests, but find that digital finance not only has a positive effect on regional green innovation, but also increases the regional gap. It can be seen that digital finance has not really played its inclusive role in regional green innovation. The above heterogeneity analysis shows that cities with high levels of traditional financial supply and Internet infrastructure construction have a stronger role in promoting regional green innovation of digital finance, which also provides evidence that digital finance increases the gap in the level of urban green innovation. On the one hand, cities with high levels of traditional financial supply and Internet infrastructure construction tend to be economically developed regions, attach great importance to and invest in green innovation, and take a leading position in green innovation. On the other hand, in cities with high levels of traditional financial supply and Internet infrastructure construction, online payment means are widely used, which not only improves the active degree of users’ online payment, but also reduces the cost of digital access (Haddad and Hornuf 2019; Liu et al. 2021c). This will lead to the phenomenon of “the strong get stronger and the weak get weaker,” which increases the gap in the level of regional green innovation. Yao and Ma (2022) pointed out that with the development of digital finance, the income gap within China will continue to widen. Aziz and Naima (2021) believe that although digital financial services can bridge the physical gap of financial services, the inclusive function is not realized due to the current technological connectivity, financial knowledge and social awareness. To a certain extent, their research coincides with our research conclusion, that is, the current digital finance cannot really play its inclusive function, and there is still a situation of “dislike the poor and love the rich.”

It can be seen that we should dialectically view the role of digital finance in promoting regional green innovation. We must not only grasp the advantages of digital finance to improve the level of regional green innovation, but also pay attention to how to narrow the gap of regional green innovation. The study points out that in the Internet age, the inclusion of inclusive finance will still make advantageous areas gain more positive influence by virtue of their original advantages, while low-income areas need to be accompanied by financial education and other supporting inclusive mechanisms if they want to play the inclusive finance (Diniz et al. 2012). It is worth noting that digital finance not only reduces the risk of information asymmetry, but also brings risks such as financial fraud and information leakage. The complexity and changefulness of digital financial technological innovation have resulted in lagging financial supervision (Cao et al. 2021). Therefore, we recognize the “Matthew effect” of digital finance on regional green innovation, which should not only increase the traditional financial supply level of cities in disadvantaged areas, support the construction of Internet infrastructure, but also establish timely financial supervision measures.

Conclusions

Main conclusions

Based on the theories of regional development, regional innovation and sustainable development, and based on the panel data of Chinese cities, this paper systematically studies the relationship between digital finance and regional green innovation level by using fixed effect model, mediating effect model and moderating effect model.

-

(1)

Digital finance has a positive impact on regional green innovation. In particular, the in-depth application of digital finance development and the high degree of digitalization of inclusive finance significantly affect the improvement of urban green innovation.

-

(2)

Digital finance mainly promotes regional green innovation by raising the level of green financial services in the region. However, industrial structure optimization and upgrading have not passed the test of mediating effect.

-

(3)

Heterogeneity analysis shows that cities with better traditional financial supply and Internet infrastructure construction are more conducive to promoting the role of digital finance in regional green innovation. In addition, traditional finance and digital finance play complementary roles rather than substitute roles in improving regional green innovation level.

-

(4)

The depth of digital finance development and the digitalization degree of inclusive finance significantly widen the gap in regional green innovation level. Among them, the gap in the level of regional high-end green innovation has a greater impact.

First, at the regional level, the research results are consistent with the micro level, that is, digital finance has a positive impact on green innovation (Liu et al. 2022; Kong et al. 2022; Rao et al. 2022). Second, it is different from the mediating variables of financial constraint (Liu et al. 2022; Kong et al. 2022), R&D investment (Liu et al. 2022), and quality of corporate information disclosure (Kong et al. 2022; Rao et al. 2022). We confirm the mediating effect of regional green financial service level. Although the mediating effect of industrial structure optimization and upgrading fails, we believe that one of the main reasons is that it takes a long time for industrial structure optimization and upgrading to emerge and play a role in green innovation, which is consistent with Wang et al. (2021). Third, based on existing research, we believe that the current digital finance has not really played its inclusive function, which is similar to the views of Aziz and Naima (2021); Yao and Ma (2022) to some extent.

Policy recommendations

From the above conclusions, we can suggest some useful policy implications.

-

(1)

The Chinese government should strengthen regional cultivation of digital skills and financial literacy, enhance the activity of users of Internet financial services, and strengthen financial infrastructure construction and support for the integration of information technology and finance (Su et al. 2021; Rao et al. 2022), further improve the use depth of digital finance and digital service support (Wen et al. 2022), and strengthen the inclusion of digital finance (Aziz and Naima 2021).

-

(2)

Government investment in Internet infrastructure should focus on digital inclusion strategies (Aziz and Naima 2021). Policy orientation towards less-developed regions, support cities with weak Internet infrastructure, and promote information integration and infrastructure modernization. Governments should also take advantage of the synergistic role of the market and encourage various market players to participate in the construction of Internet infrastructure.

-

(3)

Promote the integration of digital finance and traditional finance, encourage and strengthen support for digital and networked application of traditional financial institutions (Liu et al. 2022), strengthen cooperation with Internet financial companies, and provide more stable financial support for regional green innovation. Meanwhile, the government should bring financial activities into the scope of supervision and guard against financial risks.

-

(4)

Focus on the layout of digital financial center cities, take the construction of 5G and other new infrastructure as an opportunity to strengthen communication and docking between regions, and play the role of central cities as “bridges” and “ties” in the coordinated development of digital financial regions. Realize the “strength to lead the weak” and “interconnection and interaction” effects of digital finance between developed cities and weak cities (Liu et al. 2021a), narrow the development gap of urban digital finance, and then eliminate the Matthew effect of digital finance on the gap in regional green innovation levels.

Limitations and future research

There are three main limitations in this paper.

-

(1)

We found that enhancing the depth of the use of digital finance and the digitalization of inclusive finance is the main direction of the future development of digital finance, but fails to analyze how to realize the depth and digital development of digital finance.

-

(2)

The mediating effect of industrial structure optimization and upgrading can be analyzed theoretically, but the empirical study has not passed the significance test. We believe that the possible reason lies in the lag effect of industrial structure optimization and upgrading (Wang et al. 2021) or the existing studies are mainly based on provincial level (Wang et al. 2021; Wang and Wang 2021; Feng and Wu 2022), leading to the inapplicability of the indicator measurement method at the city level, but we have not conducted an empirical test on this.

-

(3)

This paper proves that current digital finance fails to play its inclusive function and narrow the gap in regional green innovation level. Existing studies point out that effective financial regulatory system (Cao et al. 2021) and supporting inclusive mechanisms such as financial education (Diniz et al. 2012) can play an important role in digital finance’s inclusive function. But we have not tested this empirically, and this is one of our future research directions.

Therefore, in view of the above three shortcomings, the effective ways to explore digital financial development. According to the actual situation of Chinese cities, the index for urban industrial structure optimization and upgrading is constructed to improve the research on digital finance and regional green innovation. In addition, we also need to discuss how to give full play to the function of digital inclusive finance, so as to narrow the gap in regional green innovation level.

Data availability

Data is contained within the article.

References

Ahmed F, Kousar S, Pervaiz A, Trinidad-Segovia JE, Casado-Belmonte MD, Ahmed W (2021) Role of green innovation, trade and energy to promote green economic growth: a case of South Asian Nations. Environ Sci Pollut Res 29(5):6871–6885. https://doi.org/10.1007/s11356-021-15881-4

Aziz A, Naima U (2021) Rethinking digital financial inclusion: evidence from Bangladesh. Technol Soc 64:101509. https://doi.org/10.1016/j.techsoc.2020.101509

Baron RM, Kenny DA (1986) The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol 51(6):1173–1182. https://doi.org/10.1037/0022-3514.51.6.1173

Bruhn M, Love I (2014) The real impact of improved access to finance: evidence from Mexico. Journal of Finance 69(3):1347–1376. https://doi.org/10.1111/jofi.12091

Borsatto JMLS, Bazani CL (2020) Green innovation and environmental regulations: a systematic review of international academic works. Environ Sci Pollut Res 28(45):63751–63768. https://doi.org/10.1007/s11356-020-11379-7

Brown JR, Martinsson G, Petersen BC (2012) Do financing constraints matter for R&D? Eur Econ Rev 56(8):1512–1529. https://doi.org/10.1016/j.euroecorev.2012.07.007

Cao SP, Nie L, Sun HP, Sun WF, Taghizadeh-Hesary F (2021) Digital finance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J Clean Prod 327:129458. https://doi.org/10.1016/j.jclepro.2021.129458

Cao X, Xing ZY (2018) The strategy options of energy-saving and environmental protection industry under incomplete information: a tripartite game analysis of government, enterprises and financial institutions. Econ Comput Econ Cybern Stud Res 52(3): 189–204. https://doi.org/10.24818/18423264/52.3.18.13

Chakravarty SR, Pal R (2013) Financial inclusion in India: an axiomatic approach. Journal of Policy Modeling 35(5):813–837. https://doi.org/10.1016/j.jpolmod.2012.12.007

Chen YX, Chiu JM, Chung HM (2022) Givers or receivers? Return and volatility spillovers between fintech and the traditional financial industry. Financ Res Lett 46(B): 102458. https://doi.org/10.1016/j.frl.2021.102458.

Cole MA, Elliott R, Shimamoto K (2005) Industrial characteristics, environmental regulations and air pollution: an analysis of the UK manufacturing sector. J Environ Econ Manag 50(1):121–143. https://doi.org/10.2139/ssrn.764148

Dong F, Zhu J, Li YF, Chen YH, Gao YJ, Hu MY, Qin C, Sun JJ (2022) How green technology innovation affects carbon emission efficiency: evidence from developed countries proposing carbon neutrality targets. Environ Sci Pollut Res 29(24):35780–35799. https://doi.org/10.1007/s11356-022-18581-9

Dendramis Y, Tzavalis E, Adraktas G (2018) Credit risk modelling under recessionary and financially distressed conditions. J Bank Finance 91:160–175. https://doi.org/10.1016/j.jbankfin.2017.03.020

Deng CN, Li HS, Peng DZ, Liu LS, Zhu QH, Li CJ (2021) Modelling the coupling evolution of the water environment and social economic system using PSO-SVM in the Yangtze River Economic Belt. China Ecological Indicators 129:108012. https://doi.org/10.1016/j.ecolind.2021.108012

Diniz E, Birochi R, Pozzebon M (2012) Triggers and barriers to financial inclusion: the use of ICT-based branchless banking in an Amazon county. Electron Commer Res Appl 11(5):484–494. https://doi.org/10.1016/j.elerap.2011.07.006

Eder J (2019) Peripheralization and knowledge bases in Austria: towards a new regional typology. Eur Plan Stud 27(1):42–67. https://doi.org/10.1080/09654313.2018.1541966

Fan WL, Wu HQ, Liu Y (2022) Does digital finance induce improved financing for green technological innovation in China? Discret Dyn Nat Soc 2022:6138422. https://doi.org/10.1155/2022/6138422

Feng YC, Wu HY (2022) How does industrial structure transformation affect carbon emissions in China: the moderating effect of financial development. Environ Sci Pollut Res 29(9):13466–13477. https://doi.org/10.1007/s11356-021-16689-y

Fu Y, Supriyadi A, Wang T, Wang LW, Cirella GT (2020) Effects of regional innovation capability on the green technology efficiency of China’s manufacturing industry: evidence from listed companies. Energies 13(20):5467. https://doi.org/10.3390/en13205467

Guo F, Wang JY, Wang F, Kong T, Zhang X, Cheng ZY (2020) Measuring China’s digital financial inclusion: index compilation and spatial characteristics. China Economic Quarterly 19(4):1401–1418 (in Chinese). https://doi.org/10.13821/j.cnki.ceq.2020.03.12.

Gomber P, Kauffman RJ, Parker C, Weber BW (2018) On the fintech revolution: interpreting the forces of innovation, disruption, and transformation in financial services. J Manag Inf Syst 35(1):220–265. https://doi.org/10.1080/07421222.2018.1440766

Haddad C, Hornuf L (2019) The emergence of the global fintech market: economic and technological determinants. Small Bus Econ 53(1):81–105. https://doi.org/10.1007/s11187-018-9991-x

Halder SC, Malikov E (2020) Smoothed LSDV estimation of functional-coefficient panel data models with two-way fixed effects. Econ Lett 192:109239. https://doi.org/10.1016/j.econlet.2020.109239

Hao XY, Chen FL, Chen ZF (2022) Does green innovation increase enterprise value? Bus Strateg Environ 31(3):1232–1247. https://doi.org/10.1002/bse.2952

Kong T, Sun RJ, Sun GL, Song YT (2022) Effects of digital finance on green innovation considering information asymmetry: an empirical study based on Chinese listed firms. Emerg Mark Financ Trade 2022https://doi.org/10.1080/1540496X.2022.2083953. Accessed 25 June

Kshetri N (2016) Big data’s role in expanding access to financial services in China. Int J Inf Manage 36(3):297–308. https://doi.org/10.1016/j.ijinfomgt.2015.11.014

Lee LF, Yu JH (2010) Estimation of spatial autoregressive panel data models with fixed effects. Journal of Econometrics 154(2):165–185. https://doi.org/10.1016/j.jeconom.2009.08.001

Li DY, Zhao YN, Zhang L, Chen XH, Cao CC (2018) Impact of quality management on green innovation. J Clean Prod 170:462–470. https://doi.org/10.1016/j.jclepro.2017.09.158

Li GQ, Fang XB, Liu MT (2021) Will digital inclusive finance make economic development greener? Evidence from China. Front Environ Sci 9:762231. https://doi.org/10.3389/fenvs.2021.762231

Li J, Wu Y, Xiao JJ (2020) The impact of digital finance on household consumption: evidence from China. Econ Model 86:317–326. https://doi.org/10.1016/j.econmod.2019.09.027

Liu JM, Jiang YL, Gan SD, He L, Zhang QF (2022) Can digital finance promote corporate green innovation? Environ Sci Pollut Res 29(24):35828–35840. https://doi.org/10.1007/s11356-022-18667-4

Liu SM, Hou P, Gao YK, Tan Y (2020) Innovation and green total factor productivity in China: a linear and nonlinear investigation. Environ Sci Pollut Res 29(9):12810–12831. https://doi.org/10.1007/s11356-020-11436-1

Liu XJ, Zhu JN, Guo JF, Cui CN (2021a) Spatial association and explanation of China’s digital financial inclusion development based on the network analysis method. Complexity 2021:6649894. https://doi.org/10.1155/2021/6649894

Liu YT, Xu H, Wang XJ (2021b) Government subsidy, asymmetric information and green innovation. Kybernetes 2021bhttps://doi.org/10.1108/K-05-2021b-0422. Accessed 9 September

Liu ZQ, Zhang YH, Li HY (2021c) Digital inclusive finance, multidimensional education, and farmers’ entrepreneurial behavior. Math Probl Eng 2021:6541437. https://doi.org/10.1155/2021/6541437

Ma RW, Li FF, Du MY (2022) How does environmental regulation and digital finance affect green technological innovation: evidence from China. Front Environ Sci 10:928320. https://doi.org/10.3389/fenvs.2022.928320

Ma Y, Yin QY, Pan YJ, Cui W, Xin BG, Rao ZQ (2018) Green product innovation and firm performance: assessing the moderating effect of novelty-centered and efficiency-centered business model design. Sustainability 10(6):1843. https://doi.org/10.3390/su10061843

McCann P, Ortega-Argilés R (2016) Smart specialisation, entrepreneurship and SMEs: issues and challenges for a results-oriented EU regional policy. Small Bus Econ 46:537–552. https://doi.org/10.1007/s11187-016-9707-z

Norden L, Buston CS, Wagner W (2014) Financial innovation and bank behavior: evidence from credit markets. J Econ Dyn Control 43:130–145. https://doi.org/10.1016/j.jedc.2014.01.015

Oduro S, Maccario G, De Nisco A (2021) Green innovation: a multidomain systematic review. Eur J Innov Manag 25(2):567–591. https://doi.org/10.1108/EJIM-10-2020-0425

Ouyang XL, Li Q, Du KR (2020) How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 139:111310. https://doi.org/10.1016/j.enpol.2020.111310

Ozili PK (2018) Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev 18(4):329–340. https://doi.org/10.1016/j.bir.2017.12.003

Pai MK (2016) The technical progress and resilience in productivity growth of Korea’s growth-leading industries. Asian Economic Papers 15(2):167–191. https://doi.org/10.1162/ASEP_a_00441

Papadimitratos P, Haas ZJ (2002) Securing the Internet routing infrastructure. IEEE Commun Mag 40(10):60–68. https://doi.org/10.1109/MCOM.2002.1039858

Polyzos S, Arabatzis G (2008) Spatial distribution of natural resources and their contribution to regional development. The case of Greece. J Environ Protect Ecol 9(1): 183–199

Pradhan RP, Arvin MB, Norman NR (2015) The dynamics of information and communications technologies infrastructure, economic growth, and financial development: evidence from Asian countries. Technol Soc 42:135–149. https://doi.org/10.1016/j.techsoc.2015.04.002

Rao SY, Pan Y, He JN, Shangguan XM (2022) Digital finance and corporate green innovation: quantity or quality? Environ Sci Pollut Res 2022https://doi.org/10.1007/s11356-022-19785-9. Accessed 6 April

Razzaq A, Fatima T, Murshed M (2021) Asymmetric effects of tourism development and green innovation on economic growth and carbon emissions in top 10 GDP countries. J Environ Planning Manage. 2021https://doi.org/10.1080/09640568.2021.1990029. Accessed 30 November

Soja E (2015) Accentuate the regional. Int J Urban Reg Res 39(2):372–381. https://doi.org/10.1111/1468-2427.12176

Song ML, Tao J, Wang SH (2015) FDI, technology spillovers and green innovation in China: analysis based on data envelopment analysis. Ann Oper Res 228(1):47–64. https://doi.org/10.1007/s10479-013-1442-0

Song WH, Yu HY (2018) Green innovation strategy and green innovation: the roles of green creativity and green organizational identity. Corp Soc Responsib Environ Manag 25(2):135–150. https://doi.org/10.1002/csr.1445

Su YY, Li ZH, Yang CY (2021) Spatial interaction spillover effects between digital financial technology and urban ecological efficiency in China: an empirical study based on spatial simultaneous equations. Int J Environ Res Public Health 18(16):8535. https://doi.org/10.3390/ijerph18168535

Shi FF, Ding RJ, Li HQ, Hao SL (2022) Environmental regulation, digital financial inclusion, and environmental pollution: an empirical study based on the spatial spillover effect and panel threshold effect. Sustainability 14(11):6869. https://doi.org/10.3390/su14116869

Shi JW, Yu YJ (2021) To advance industrial green technology via environmental governance-evidence from China’s industrial sector. Processes 9(10):1797. https://doi.org/10.3390/pr9101797

Shi LY, Han LW, Yang FM, Gao LJ (2020) The evolution of sustainable development theory: types, goals, and research prospects. Sustainability 11(24):7158. https://doi.org/10.3390/su11247158

Toxopeus H, Polzin F (2021) Reviewing financing barriers and strategies for urban nature-based solutions. J Environ Manage 289:112371. https://doi.org/10.1016/j.jenvman.2021.112371

Wang Q, Yang JB, Chiu YH, Lin TY (2020) The impact of digital finance on financial efficiency. Manag Decis Econ 41(7):1225–1236. https://doi.org/10.1002/mde.3168

Wang WX, Yu B, Yan X, Yao XL, Liu Y (2017) Estimation of innovation’s green performance: a range-adjusted measure approach to assess the unified efficiency of China’s manufacturing industry. J Clean Prod 149:919–924. https://doi.org/10.1016/j.jclepro.2017.02.174

Wang XK, Dong ZC, Xu W, Luo Y, Zhou T, Wang WZ (2019) Study on spatial and temporal distribution characteristics of coordinated development degree among regional water resources, social economy, and ecological environment systems. Int J Environ Res Public Health 16(21):4213. https://doi.org/10.3390/ijerph16214213

Wang XY, Wang Q (2021) Research on the impact of green finance on the upgrading of China’s regional industrial structure from the perspective of sustainable development. Resour Policy 74:102436. https://doi.org/10.1016/j.resourpol.2021.102436

Wang YL, Zhao N, Lei XD, Long RY (2021) Green finance innovation and regional green development. Sustainability 13(15):8230. https://doi.org/10.3390/su13158230

Wen HM, Yue JL, Li J, Xiu XD, Zhong S (2022) Can digital finance reduce industrial pollution? New evidence from 260 cities in China. PLoS ONE 17(4):1–22. https://doi.org/10.1371/journal.pone.0266564

Xiang XJ, Liu CJ, Yang M (2022) Who is financing corporate green innovation? Int Rev Econ Financ 78:321–337. https://doi.org/10.1016/j.iref.2021.12.011

Xu H, Qiu L, Liu BZ, Liu B, Wang H, Lin WF (2021) Does regional planning policy of Yangtze River Delta improve green technology innovation? Evidence from a quasi-natural experiment in China. Environ Sci Pollut Res 28(44):62321–62337. https://doi.org/10.1007/s11356-021-14946-8

Yan GH, Eidenbenz S, Thulasidasan S, Datta P, Ramaswamy V (2010) Criticality analysis of Internet infrastructure. Comput Netw 54(7):1169–1182. https://doi.org/10.1016/j.comnet.2009.11.002

Yang JY, Roh T (2019) Open for green innovation: from the perspective of green process and green consumer innovation. Sustainability 11(12):3234. https://doi.org/10.3390/su11123234

Yao LY, Ma XX (2022) Has digital finance widened the income gap? PLoS ONE 17(2):1–20. https://doi.org/10.1371/journal.pone.0263915

Yao MF, Di H, Zheng XR, Xu XB (2018) Impact of payment technology innovations on the traditional financial industry: a focus on China. Technol Forecast Soc Chang 135:199–207. https://doi.org/10.1016/j.techfore.2017.12.023

Yin JH, Gong LD, Wang S (2018) Large-scale assessment of global green innovation research trends from 1981 to 2016: a bibliometric study. J Clean Prod 197(PT.1): 827–841. https://doi.org/10.1016/j.jclepro.2018.06.169

Yin ZC, Gong X, Guo PY, Wu T (2019) What drives entrepreneurship in digital economy? Evidence from China. Econ Model 82:66–73. https://doi.org/10.1016/j.econmod.2019.09.026

Yu CH, Wu XQ, Zhang DY, Chen S, Zhao JS (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153:112255. https://doi.org/10.1016/j.enpol.2021.112255

Yu SW, Zheng SH, Zhang XJ, Gong CZ, Cheng JH (2018) Realizing China’s goals on energy saving and pollution reduction: industrial structure multi-objective optimization approach. Energy Policy 122:300–312. https://doi.org/10.1016/j.enpol.2018.07.034

Zhang RJ, Tai HW, Cheng KT, Cao ZX, Dong HZ, Hou JJ (2022) Analysis on evolution characteristics and dynamic mechanism of urban green innovation network: a case study of Yangtze River Economic Belt. Sustainability 14(1):297. https://doi.org/10.3390/su14010297

Zhao T, Zhou HH, Jiang JD, Yan WY (2022) Impact of green finance and environmental regulations on the green innovation efficiency in China. Sustainability 14(6):1–17. https://doi.org/10.3390/su14063206

Zhou X, Yu Y, Yang F, Shi QF (2021) Spatial-temporal heterogeneity of green innovation in China. J Clean Prod 282:124464. https://doi.org/10.1016/j.jclepro.2020.124464

Zitek V, Klimova V (2016) Peripheral innovation systems in the Czech Republic at the level of the NUTS3 regions. Agric Econ 62(6): 260–268. https://doi.org/10.17221/170/2015-AGRICECON.

Acknowledgements

We are extremely grateful to editors and anonymous reviews for reviewing this study.

Funding

This work was supported by the National Social Science Fund of China (20FJYB022), the Heilongjiang Province Philosophy and Social Sciences Research Planning Project (21GLA438), and the Heilongjiang Provincial Natural Science Foundation Project (LH2020G004).

Author information

Authors and Affiliations

Contributions

Conceptualization: [Meng Fansheng Zhang Wanyu]; Investigation: [Meng Fansheng Zhang Wanyu]; Resources: [Meng Fansheng]; Writing review: [Meng Fansheng]; Supervision: [Meng Fansheng]; Project administration: [Meng Fansheng]; Funding acquisition: [Meng Fansheng]; Writing-original draft: [Zhang Wanyu]; Software: [Zhang Wanyu]; Methodology: [Zhang Wanyu].

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent for participate

Not applicable.

Consent for publication

Not applicable.

Conflict for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions