Abstract

To realize “the future we want” proposed by the UN Development Agenda, it is highly necessary for China, which is the largest emitter of carbon dioxide (CO2) emissions, to find ways to boost the green innovation of domestic firms. Digital finance, as an emerging product of the contemporary digital economy, provides a new research perspective for green innovation. Based on 2011–2019 panel data on A-shared listed companies in China, this article establishes a regression model and provides empirical evidence that digital finance can promote green innovation by exerting resource and information effects. Our results reveal that (1) digital finance can stimulate enterprises’ green innovation by increasing the coverage of digital finance and the depth of use. (2) Digital finance can significantly improve the quantity and quality of green innovation by alleviating enterprises’ financial constraints and giving full play to the internal and external information effect. (3) The discussion shows that the effect of digital finance is heterogeneous and can more significantly and effectively stimulate the green innovations of enterprises with lower analyst optimism bias and higher synchronicity.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The Rio + 20 outcome document “The Future We Want” has recently been fully embraced (UN 2012). Energy deletion and environmental degradation are recognized as hard hindrances to achieving sustainable development goals (SDGs), which were originally proposed by the United Nations Agenda for Sustainable Development in 2015. In 2006, China became the largest emitter of carbon dioxide (CO2) emissions in the world (Meng et al. 2016). Therefore, it is an inevitable choice for China to promote energy-environmental performance (EEP) in pursuit of sustainable economic development (Li et al. 2020a, b, c; Awan et al. 2019). However, green innovation is generally accepted as a solution to the contradiction among environmental protection, pollution prevention, resource recovery and economic growth (Bhupendra and Sangle 2015; Kunapatarawong and Martínez-Ros 2016; Lin et al. 2014; Lin et al. 2021). Therefore, boosting green innovation and giving full play to its spillover effect on life and production will be a considerable way to solve this contradiction.

Funding is considered an indispensable element triggering green innovation (Yang and Xi 2019), while the development of digital finance provides a new research perspective for enterprises’ green innovation. Since 2019, China has officially entered the era of smart finance. According to the 2020 Global Fin-tech Index Report released by Findexable, China’s overall fin-tech strength ranks 21st in the world. With the emergence of artificial intelligence, cloud computing and other technologies, digital finance has moved towards the intelligent stage, and the digital financial market is flourishing. In the era of the digital economy, the broad coverage of users is conducive to the transmission of user information, and the in-depth use of credit business and fund financing investment business has directly enhanced the supply-side demand of finance (Guo et al. 2020). It is true that stable capital support can provide important support for enterprises’ innovation activities, whether for general innovation or for green innovation (Ma et al. 2014). The financial industry, as an important medium for the distribution of social funds, can provide support for enterprises’ innovation activities (Brown et al. 2009). Therefore, digital finance, also called digital financial inclusionFootnote 1 as an emerging financial product of the contemporary digital economy, provides a new research perspective for enterprise green innovation.

In general, compared with the traditional financial industry, digital finance can effectively improve the efficiency of the distribution of social funds (Tian, 2019), which is more conducive to solving the problem of the capital constraints of small and medium-sized enterprises and green-friendly enterprises. It can ultimately improve the green innovation performance of group companies and even society (Tang et al. 2020). At the same time, it cannot be ignored that the financial industry, which is part of the tertiary industry, is one of the key areas for environmental improvement, such as emission reduction (Ji et al. 2019). The green characteristic of financial inclusion itself cannot be neglected.

Although previous studies have demonstrated that digital finance can promote general innovation and some scholars have proven that digital finance can improve green innovation by solving enterprise financial constraints (Yin 2020; Yu and Yang 2021; Liu et al. 2022), few articles have studied the relationship between digital finance and green innovation from the perspective of the information effect brought by digital finance. However, since Wiener (1961) proposed the three-factor theory of “matter, energy and information”, in addition to the natural resource of capital, information can eliminate uncertainty and serve as an important resource to promote the green innovation of enterprises. It thus can encourage enterprises to choose to innovate (Ma 2021; Sun and Zhang 2019).

This paper takes A-shared listed companies in China from 2011 to 2019 as research samples to study the impact of digital finance on enterprises’ green innovation output, and it tests the mediating effect of digital finance. The results show that digital finance can improve enterprises’ green innovation by giving full play to the resource effect and information effect.

The possible contributions of this paper are as follows: (1) In addition to analysing the important ways that digital finance solves the financial constraints of enterprises to improve their green innovation, this paper finds that giving full play to the internal and external information effect of enterprises is an important channel through which digital finance improves green innovation. (2) The index of digital finance may be endogenous, so we propose spatial distance as an instrumental variable, with the result that digital finance has a regional impact. (3) After Fisher’s permutation test, we find that the heterogeneity of digital finance can be displayed in different groups with differentiated resources and information transmission, while digital finance can exert a stronger positive impact on groups with resources and information disadvantages.

The remainder of this article is organized as follows. In the second section, the theoretical framework is developed, and hypotheses are proposed. Section 3 constructs the research design, including the description of the variables and the sample. Section 4 demonstrates the impact of digital finance on enterprise green innovation and explains its mediating effect. Next, the robustness of this model is tested. The sixth section further studies the heterogeneity of the driving mechanism of the effect of digital finance on green innovation in different types of enterprises. The last section elaborates the overall conclusion and relevant policy implications of this paper.

Literature review and hypotheses

A green innovation strategy is one of the important ways for a country to cope with the worsening ecological environment and to coordinate the relationship between economic development and the environment. Meanwhile, with the growing green awareness of all human beings, how to combine national conditions with the practical exploration of green innovation has become an important factor for enterprises to gain competitiveness in the market (Yang and Shao 2011; Zhang and Zhang 2011).

At present, the literature on green innovation mainly focuses on the economic consequences and its mediating effect. From the micro level, the economic consequences of green innovation can be divided into economic benefits, risk benefits and market performance. The economic consequences of green innovation are reflected in enterprise performance and competitiveness. Porter and Linde (1995) pointed out that green innovation can reduce the cost of environmental policy penalties and improve the R&D input and output of enterprises, thus improving enterprises’ competitiveness and productivity. From a financial perspective, Banerjee (2001) found that environmental innovation has a positive impact on corporate financial performance by reducing production costs and improving processes and product innovation. From the perspective of enterprise competitiveness, Zhu and Chen (2014) found that green product innovation can improve enterprise performance and competitiveness, while managers’ attention to green products has a positive moderating effect on green product innovation and enterprises’ performance improvement. The risk–benefit view focuses on the dual externalities of green innovation (Cleff and Rennings, 1999) and explains the negative impact of green innovation on corporate profits and competitiveness from the spillover phenomenon of economic performance and product value (Climent and Soriano, 2011). In terms of market performance, Fang and Na (2020) found that green innovation can have a spillover effect on investors by influencing market attention. In summary, the economic consequences of green innovation are positive at the macro level, and there are risk-benefits for enterprises at the micro level. The relationship between green innovation input and enterprise performance is not linear (Yang and Shi 2015).

From the perspective of economic efficiency and enterprise strategy formulation, it is particularly important to gain insight into the driving factors of green innovation (Zhang and Zhang 2013). The literature divides the influencing factors of green innovation into the external drivers of institutional theory and market theory and the internal drivers of enterprises (Yang and Shi 2015). Regarding external driving factors, past studies have proven that environmental problems can change companies’ operational strategies and financial management, while green innovation, as one of the most important green activities, can be included as a response to the external environment (Li et al. 2021; Peng et al. 2022; Lee and Kim 2011). The environmental problem can influence these things directly or indirectly, for example, through macroeconomic change or regulatory change (Yu et al. 2022; Li et al. 2020a, b, c; Shen et al. 2019; Guo et al. 2018). Such theory can be explored based on institutional theory, while scholars mainly study the impact of environmental regulation on green innovation. Under market theory, external drivers mainly come from pressure from stakeholders, including consumers, investors and competition among enterprises (Yang and Shi 2015). The driving factors inside enterprises are mainly divided into green orientation and green ability. Green orientation refers to the internal values and ethical standards of an enterprise’s commitment to environmental protection, including the environmental awareness, behavioural intention, corporate strategy and corporate culture of senior executives. Chan (2010) found that green orientation influenced strategic formulation and promoted green innovation between enterprises and suppliers and between enterprises and customers through cooperation. Green capacity refers to enterprises’ green innovation resources and capabilities. In terms of resources, scholars focus on financial constraints (Yang and Xie 2019) and resource integration ability (Huang et al. 2015). In terms of ability, Huang et al. (2015) divided green ability into organizational learning ability, relational ability and environmental adaptation ability.

In the era of digital finance, digital finance and green innovation have become two hot topics, and the issue of whether digital finance promotes green innovation has naturally been widely considered. At present, the literature has discussed the relationship between digital finance and enterprise innovation, laying a foundation for the study of the relationship between digital finance and green innovation. Studies have examined the driving effect of digital finance on enterprise innovation at the macro and micro levels. Among them, the indirect impact of financial development and consumption upgrading brought by digital financial development on enterprise innovation are discussed at the macro level. Jia (2017) proposed that the imperfect financing function of the capital market limits the promoting effect of the credit market on innovation. Digital finance can improve enterprise innovation by promoting financial development (Tian et al. 2019), improving the credit market (Jia et al. 2017), targeting funding and covering economic subjects in areas with poor financial development (Tang et al. 2020). At the micro level, research elaborates from the perspectives of corporate financing, digital technology and finance. Liang and Zhang (2019) and Chen and Miao (2021) focused on discussing that the development of digital finance can reduce the debt financing cost and relieve the external financial constraints of SMEs, thus promoting the innovative output of enterprises. Wan et al. (2020) believed that the influence of digital finance has structural characteristics and solves the financial constraints of enterprises to promote enterprise innovation from the three dimensions of the coverage, depth of use and degree of digital support services of digital finance. Tang et al. (2020) found that digital finance can improve the technological innovation of enterprises by influencing their internal financial risk indicators.

Apart from improving the internal ability to conduct green innovation, a decision to engage in green innovation should take external demands into consideration. Compared with ordinary enterprise innovation, green innovation is characterized by double externalities and a long payback period (Cleff and Rennings, 1999). Therefore, when enterprises decide whether to engage in green innovation, they should consider not only the economic benefits brought by innovation but also the external demands of stakeholders and the internal demands for building the enterprise image. Therefore, based on the difference between green innovation and ordinary innovation, this paper discusses whether digital finance can promote enterprise green innovation. What plays a mediating role in digital finance and green innovation at the micro level?

At the micro level, existing studies are mainly based on the view of natural resources, and capital is regarded as an important factor of production for green innovation. Yin (2020) believed that digital finance can compensate for the deficiency of the traditional financial market, provide sufficient funds for enterprises’ green innovation and reduce the cost and threshold of financial services to reduce the financial constraints of enterprises, thus promoting their green innovation. At the same time, scholars have also found that digital finance can promote green innovation by enhancing corporate profitability and reducing corporate financial risks (Yu and Yang 2021; Yin 2020). The literature mainly based on the perspective of natural resources suggests that digital finance can bring sufficient capital resources to enterprises.

Since Wiener (1961) proposed the three-factor theory of “matter, energy and information”, information can eliminate uncertainty and serve as an important resource to promote green innovation. However, few articles study the mediating effect of digital finance on green innovation from the perspective of the information effect. As an important factor of production, information, on the one hand, is conducive to a better disclosure of corporate green information and a reduction in adverse selection caused by stakeholders’ misjudgements (Ji and Wang 2005), thus communicating external litigation pressure. It enables environmentally friendly enterprises to gain more social attention. More social attention is conducive to improving enterprises’ green innovation (Ziegler et al. 2007). On the other hand, a good information environment can enable internal supervisors and owners to master more management information and weaken operational risks and principal-agent costs (Yang and Chai 2015), thus promoting enterprise innovation (Ma 2021; Zhang et al. 2019). On this basis, an important question we need to study is whether digital finance can improve enterprises’ green innovation by giving full play to the information effect and by solving financial constraints.

Digital finance, financial constraints and green innovation

Digital finance solves the problem of difficult financing and high financing costs for enterprises, and it enables enterprises to have more sufficient funds to invest in green innovation projects, thus improving the quantity and quality of green innovation. On the one hand, digital finance can make use of big data and cloud computing to mine customer information, establish a loan risk control system and reduce the information asymmetry between financial institutions and enterprises (Demertzis et al. 2018) to solve the loan difficulty of SMEs (Peng et al. 2016). Therefore, the broader financing channels of digital finance break the long-existing 80/20 law of financial services, that is, the financial long-tail customers who have been discriminated against by capital for a long time, and they enable financial services to benefit small enterprises, innovation and entrepreneurship entities and other enterprises that are weak in terms of financing. On the other hand, internet platforms provide customers with fast and simple services at low service fees, reducing the financing costs of enterprises. These aspects enable enterprises, especially SMEs, to obtain sufficient funds to invest in long-term green R&D projects to improve the output quantity and quality of green innovation (Ma and Du 2021). Indirectly, digital finance can even intensify the competition of the financial industry, which helps decrease the overall regional financing cost (Jia et al. 2017; Tian et al. 2019). With lowered financing costs and increased cash in hand, enterprises with the need for green innovation can avoid the problem of fund shortages (Yin 2020; Yu and Yang 2021; Liu et al. 2022). Based on the above analysis, we propose the following:

-

Hypothesis 1: Digital finance can improve green innovation by reducing corporate financial constraints.

Digital finance, information constraints and green innovation

Based on the perspective of information constraints, on the one hand, digital finance can encourage enterprises to actively improve the degree and quality of information disclosure (Huang and Huang 2018) to reduce adverse selection in the market. For example, the open access of equity crowdfunding (ECF) platforms provides entrepreneurs with the incentive to reveal as much information as they can and as accurately as possible because what they provide will be scrutinized by large numbers of potential investors (Estrin et al. 2022). Therefore, green-friendly enterprises and enterprises implementing green innovation strategies can obtain more external attention and resources as they reveal information through platforms (Ziegler et al. 2007), which makes them more capable and willing to carry out green innovation (Yang and Xie 2019). At the same time, platform guidance and the sharing of environmental data with the government can promote public and environmentally friendly enterprises to get closer to achieving green production and the green lifestyle, thus improving the quantity and quality of green innovation (Teng and Ma 2020).

On the other hand, digital finance can improve internal management efficiency by improving information accessibility, information breadth and information sharing. With the development of cloud computing, big data and other technologies, digital finance can accurately obtain information on targeted companies and process data through computer technology, while companies will also voluntarily disclose information, as mentioned before. As more information is revealed and a more transparent working environment is needed, information can be obtained and processed at a lower cost and at a greater breadth (Zhou et al. 2021). For internal stakeholders, internal supervisors will launch more green innovation on account of the weakened operational risk and principal-agent cost brought by a transparent information environment (Qi et al. 2021, Quan et al. 2018; Zhang et al. 2019). In addition, more information related to investment can enable decision-makers to have a greater willingness to initiate more green innovation because a more transparent information environment helps decision-makers discover and prevent risks and decreases the behaviour of avoiding green innovation due to information asymmetry (Zhou et al. 2021). In summary, digital finance can enhance the green innovation of enterprises by giving full play to the external information effect to gain external attention and help as well as by giving full play to the internal information effect to increase the transparency and transmission of information among the departments in a company. Based on the above analysis, we expect the following:

-

Hypothesis 2: Digital finance can improve enterprise green innovation by exerting internal and external information effects.

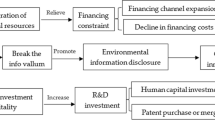

Based on the above theoretical analysis, we summarize the impact of digital finance on green innovation as follows: digital finance improves enterprises’ willingness and ability to initiate green innovation through resource and information effects. It ultimately promotes enterprises’ green innovation. The details are shown in Fig. 1.

Research design

Sample and data

We selected A-shared listed companies in China from 2011 to 2019 as the sample. In the sample selection process, we performed the following screening work: (1) we excluded listed companies in the financial industry and real estate industry; (2) we excluded *ST and ST listed companies; (3) we eliminated the samples with missing data; (4) we excluded companies with an IPO during the period; and (5) to eliminate the interference of extreme values on the research results, continuous variables were winsorized at the 1% and 99% levels. A total of 12,971 samples were finally obtained. The data all came from the CSMAR database.

Measurement

Green innovation

At present, there are three methods of measuring green innovation at the enterprise level: scale design, the number of green patents granted and the number of green patent applications. However, scale design is subjective, and the application time for green patent authorization needs 3–5 years, while they can be cancelled due to the problem of annual fees during the authorization period. Therefore, the number of patent applications is more stable (Zhou et al. 2012).

Considering that patents in China are divided into invention patents and utility model patents, their quality and authorization strictly differ, so the quality of invention patents is higher. Therefore, this article refers to Zhou (2021) and Zhai and Liu (2021), using the sum of the number of invention patent and utility model patent applications (Pat) to reflect the number of green innovations. The number of invention-type green patent applications (Invpat) is taken as the quality of enterprise green innovation. At the same time, the sum of the number of invention patents and utility model patents granted (Pat2) and the number of invention patents granted (Invpat2) were used to replace the variables in the robustness test.

Independent variables

Digital finance

This paper selects the digital financial inclusion index (DFII) obtained by the Financial and Peking University Digital Finance Research Center for the tracking survey of provincial and municipal cities in China to measure the development degree of provincial and municipal digital finance. Considering the time lag and endogeneity of the impact of digital finance on enterprise green innovation, this paper adopts the lagged index as the core explanatory variable. The robustness test was conducted by removing the lagged index.

Intervening variables

Financial constraints (KZ)

Compared with WW and SA, KZ mainly reflects the degree of cash constraints of enterprises (Kaplan and Zingales 1997), while the financial support provided by digital finance for enterprises is mainly cash loans. Thus, this paper uses the KZ index to reflect the financial constraints of enterprises.

Information effect (OIE and IIE)

Bushee and Noe (2000) found that the more corporate information disclosure there is, the higher the shareholding ratio of institutional investors. However, independent investment institutions, including brokers, the security funds and the QFII, have no commercial relationship with companies. Compared with grey institutional investors, including funds, insurance companies, trusts, financial firms, banks and non-finance institutions, they have higher requirements on company information disclosure (Deng et al. 2014). They are more active in supervision (Chen et al. 2007). Therefore, referring to the practices of Deng et al. (2014), Brickley et al. (1988) and Chen et al. (2007), this paper takes the total shareholding ratio (INST) of securities investment funds, social security funds and the QFII as the shareholding ratio of independent institutional investors to reflect the information disclosure level of enterprises. To enrich the mediating effect of financial inclusion, we also take the annual number of following analysts (Analysts_attention) and the annual times that companies’ names are present in news titles (Media_attention) to expand the measurement of the external information effect.

Internal information asymmetry is one of the important causes of internal control failure. Good internal control often represents a better information disclosure and information transmission of enterprises (Doyle et al. 2007). At the same time, investors also have a stronger demand for information on companies with serious agency problems. Therefore, a lower principal-agent cost also represents a more perfect and transparent information mechanism inside a company (Leuz et al. 2009). Better internal information transparency and effective transmission can reduce the principal-agent problems and insufficient innovation investment caused by information asymmetry, thus reducing the risk of innovation activities and improving the innovation effectiveness of enterprises (Wang and Dai 2019). Therefore, based on the practice of Lin and Rao (2009), Li and Chen (2012) and Ye et al. (2015), this article uses the Dib internal control index to reflect the internal control of a company as an internal information effect (ICI).Footnote 2 Moreover, the digital data provided by financial inclusion can make information acquisition and processing easier and cheaper. The innovation process can benefit at the same time (Bartel et al., 2007). Meanwhile, research input can naturally increase since companies are able to respond to and explore opportunities based on incremental information (Parthasarthy and Hammond, 2002). Therefore, research input (RND) is included to measure the internal information effect brought by financial inclusion. RND is measured by the amount of R&D investment divided by the total assets of the previous period.

Other independent variables

Considering the other factors that influence the number of green innovation applications, following the study of Qi et al. (2018), Wan et al. (2020) and Zhai and Liu (2021), this paper selects several control variables covering two aspects: the enterprise level and regional level. Among them, the enterprise micro-level variables include enterprise size (size), which is represented by the logarithm of the total assets of the enterprise. The age of an enterprise (age) is expressed by the logarithm of the establishment years of the enterprise. Enterprise leverage (Lev) is expressed by the current asset-liability ratio of enterprises; sustained profitability growth is expressed by dividing the added value of the current net profit by the net profit of the previous year. Equity concentration (equitycon) is expressed by the shareholding ratio of the largest shareholder. The management expense ratio (mf) is expressed by dividing the current management expense by operating revenue. The size of the board (board) is represented by the logarithm of the total number of board members. The proportion of independent directors (pid) is expressed by the proportion of the number of independent directors in the number of directors on the board of directors. Duality (duality) concerns whether the chairperson of the company also serves as the general manager (dummy = 1 if yes). The variables at the regional level include human capital (labour), which is expressed by dividing the number of students in higher education by the population. The provincial level of financial development (findev) is measured by dividing the total amount of provincial financial loans by the gross regional product of each province (Table 1).

Regression model

This paper investigates the impact of digital finance on enterprise green innovation by constructing a benchmark regression model. The model is constructed as follows:

In Model (1), i, j and t represent the enterprise, province and year, respectively. INNOVATIONi,t is the variable group of green innovation (Pat, Invpat) of enterprise i in year t. DFIIj,t-1 is the digital financial DFII of j province lagged one stage. Controli, j, t are a series of control variables, as described above. εijt is the random error term of the model. In this paper, a typical bidirectional fixed effect model is constructed to control both time fixed effects and industry fixed effects.

To test the mechanism of the influence of digital finance on green innovation, the mediating effect model of Wen et al. (2005) is used for analysis. The regression equation is as follows:

Among them, M represents three mediating variables, including financial constraints (KZ), the outer information effect (INST) and the internal information effect (ICI). Following Baron and Kenny (1986), the direct effects of the core independent variables on the mediating variables were first tested based on Eq. (2), and then, the direct effects of the core independent variables and mediating variables on the dependent variables were tested based on Eq. (3).

Results and analysis

Descriptive statistics

Table 2 lists the descriptive statistical results of all variables. The mean values of green innovation quantity and quality are 0.267 and 0.184, respectively, indicating that the overall green innovation level of enterprises is low. The value in the third quartile is 0, indicating that most enterprises are at a low level of green innovation, and most enterprises have room for improvement. At the same time, there is a large gap between the maximum and the minimum value of Pat, indicating that there is a large gap in the level of green innovation among enterprises. The mean value of digital finance DFII is 204.976, and the standard deviation is 87.147, indicating that there have been some differences and changes in the development of digital finance in various provinces in recent years.

Pearson correlation test

Table 3 shows that the correlation coefficients between the selected variables are almost all less than 0.5, indicating that the selected variables are reasonable and do not have multicollinearity.

Regression analysis

Basic line regression

A benchmark test is conducted on the relationship between digital finance and enterprise green innovation, and the results are shown in Table 4. Table 4 (1) and (2) regresses the quantity and quality of green innovation, respectively, as explained variables. The results show that the regression coefficients between digital finance and the quantity and quality of green innovation are 0.002 and 0.001, respectively, and they are both significant at the 1% level. Based on the composition of the DFII, Table 4 (3)–(8) is divided into three dimensions of coverage breadth, depth of use and the degree of digitalization to discuss the impact on the quantity and quality of enterprise green innovation. The results show that the regression coefficients of coverage breadth and the quantity and quality of green innovation are 0.002 and 0.001, respectively, and both are significant at the 1% level. The regression coefficients between the depth of use index and the quantity and quality of green innovation are both 0.001 and significant at the 1% level. However, the regression coefficients between the digitalization degree index and the quantity and quality of green innovation are both − 0.001, and they are not statistically significant.

According to the interpretation of sub-dimensional data, the driving factors of the impact of digital finance on enterprise green innovation improve the coverage rate of digital finance users and provide payment, investment, credit and other businesses for enterprises and consumers, thus affecting the level of enterprise green innovation. However, the payment facilitation, credit, and mobile and personal affordable loans improved by digital financial services cannot significantly improve the green innovation level of enterprises. This finding indicates that different results may be found if we continue to explore the driving factors of digital finance from different perspectives to help enterprises make use of and give full play to the value of digital finance. Therefore, the following paragraphs further explore the driving factors of digital finance.

The mediating effect test: financial constraints

Table 5 shows the test results of financial constraints as the mediating effect on the influence of digital finance on enterprise green innovation. The regression coefficient between digital finance and financial constraints in Column 1 is − 0.003, which is significant at the 1% level, indicating that digital finance can effectively alleviate corporate financial constraints. In Columns 2 and 3, financial constraints are added to the regression of digital finance on the number of green innovations. The regression coefficient between financial constraints and the number of green innovations is − 0.016 and is significant at the 1% level; the regression coefficient between digital finance and the number of green innovations is 0.002 and is significant at the 1% level. In Column 3, financial constraints are added to the regression between digital finance and the quality of green innovation. The regression coefficient between financial constraints and the quality of green innovation is − 0.011 and is significant at the 1% level. The regression coefficient between digital finance and the quality of green innovation is 0.002 and is significant at the 1% level. The above results indicate that financial constraints have a partial mediating effect on the impact of digital finance on green innovation, which means that digital finance can reduce the financial constraints of enterprises by providing loans to enterprises and improving their cash flow to improve the level of green innovation of enterprises.

The mediating effect test: the information effect

The regression coefficient between the DFII and INST in Column 1 is 0.015 and is significant at the 1% level, indicating that digital finance can increase the shareholding ratio of independent institutional investors in enterprises. In Column 2 and Column 3, after adding INST to the baseline model with the dependent variable Pat, it is found that the regression coefficient between INST and the quantity of green innovation is 0.003 and is significant at the 1% level, and the regression coefficient between the DFII and the quantity of green innovation is 0.002 and is significant at the 1% level. At the same time, the regression coefficient between INST and green innovation quality is 0.003 and is significant at the 1% level, while the regression coefficient between the DFII and green innovation quality is 0.001 and is significant at the 1% level. In Column 4, the coefficient estimate between Analysts_attention and financial inclusion is 0.004 (p value < 0.01). In Columns 5 and 6, Analysts_attention is added to the regression. The coefficient estimates of Analysts_attention are 0.037 (p value < 0.01) and 0.027 (p value < 0.01), respectively. The coefficient estimates of financial inclusion are 0.002 (p value < 0.01) and 0.001 (p value < 0.01), respectively. In Column 7, the estimation value between Media_attention and financial inclusion is 0.002 (p value < 0.01). In Columns 8 and 9, Media_attention is added to the regression. The coefficient estimates of Media_attention are 0.017 (p value < 0.01) and 0.015 (p value < 0.01), respectively. The coefficient estimates of financial inclusion are 0.002 (p value < 0.01) and 0.001 (p value < 0.01), respectively.

The results show that digital finance can give full play to the effect of external information by solving external information constraints and improving the transparency of enterprises. As a result, firms will obtain higher external attention and external supervision from external stakeholders, including institutional investors, analysts and the media, forcing enterprises to carry out more green innovation activities (Table 6).

Table 7 shows the regression results of the mediating effect of the internal information effect on the quantity and quality of digital finance and green innovation. In Column 1, the regression coefficient between digital finance and the internal information effect is 0.001 and is significant at the 1% level, indicating that digital finance can effectively improve the quality of internal control of enterprises. In Column 2 and Column 3, the effect of internal information is added to the regression of digital finance and the quantity and quality of green innovation, respectively. The regression coefficient between the effect of internal information and the quantity of green innovation is 0.137 (p value < 0.01); the regression coefficient between digital finance and the quantity of green innovation is 0.002 (p value < 0.01). The regression coefficient between the effect of internal information and the quality of green innovation is 0.115 (p value < 0.01); the regression coefficient between digital finance and the quality of green innovation is 0.001 (p value < 0.01). In Column 4, the estimation value between research input and financial inclusion is 0.001 (p value < 0.01). In Columns 5 and 6, research input is added to the regression. The coefficient estimates of research input are 5.424 (p value < 0.01) and 4.326 (p value < 0.01), respectively. The coefficient estimates of financial inclusion are both 0.001 and are significant at the 1% and 5% levels, respectively.

The results show that digital finance can increase internal control and research input by giving full play to the internal information effect, which in turn makes enterprises have a growing willingness to carry out more green innovation.

Robustness results

Instrumental variables

Due to the possible influence of omitted variables and reverse causality, we need to adopt the instrumental variable estimation method to correct and maintain the unbiased consistency of the equation estimation.Footnote 3 The geographical distance variable in the regression remains relatively exogenous and is suitable for selection as an instrumental variable. It has nothing to do with the random disturbance term and will not cause an impact on the regression through the omission of variables, which meets the exclusivity constraint (Zhang et al. 2020).

Selecting the spherical distance to Beijing, Shanghai, Shenzhen and Hangzhou is reasonable. In China, the recognized first-tier cities are Beijing, Shanghai and Shenzhen, which can foster digital finance with greater advantages. At the same time, since Alipay, as a representative example of digital finance, originated in Hangzhou, the development of digital finance in Hangzhou is in a leading position. To select an effective geographical distance variable as the IV, Beijing in North China, Shanghai in East China, Shenzhen in South China and Hangzhou in East China are selected as the representatives of the digital centre.Footnote 4 In addition, Zhang et al. (2020) analyse the relationship between the development of digital finance and the growth in household consumption by using the spherical distance between the household region and Hangzhou and the spherical distance between the household region and provincial capital cities.

Therefore, we calculate the closest spherical distance from the provincial capital city based on the province where a company is locatedFootnote 5 to Beijing, Shanghai, Shenzhen and Hangzhou, and we perform regression on digital finance (DFII) to solve the endogeneity problem.

The premise of an IV is the existence of endogenous explanatory variables. According to Table 8, the p value based on the Hausman test is significant at the 1% level. The null hypothesis, which is that all explanatory variables are exogenous, is rejected, indicating that there are endogenous variables in the model. The influence of these endogenous variables should be controlled. After controlling for endogeneity, the coefficient of the DFII is noticeable and positive, indicating that the estimation results are robust, while the endogeneity p values are 0.477 and 0.953 in the models with the core independent variables Pat and Invpat, respectively, indicating that the IV is exogenous.

These results further prove that the closer an enterprise is to an area with a high level of development of digital finance, the stronger the positive effect caused by digital finance will be and the higher the number of green innovations firms will create.

Substitution of the core variables

Columns (1)–(8) of Table 8 show that the two explained variables, the quantity and quality of green innovation, are replaced by the total number of invention and utility model green patents authorized and the number of invention green patents authorized, respectively. Columns (1) and (2) in Table 8 show that the regression coefficients between digital finance and the quantity and quality of green innovation are 0.002 and 0.001, respectively, and both are significant at the 1% level. Based on the composition of the DFII, Columns (3)–(8) in Table 8 are divided into three dimensions of coverage breadth, depth of use and the degree of digitalization to discuss the influence on the quantity and quality of green innovation of enterprises. The results show that the regression coefficients between coverage breadth and the quantity of green innovation and between coverage breadth and the quality of green innovation are 0.002 and 0.001, respectively, and both are significant at the 1% level. The regression coefficients between the depth of use index and the quantity of green innovation and between the depth of use index and the quality of green innovation are both 0.001, and both are significant at the 1% level. The regression coefficients between the digitalization degree index and the quantity and quality of green innovation are both 0.001, and neither of them is statistically significant.

Endogeneity test: high-order joint fixed effects model

In Columns (1) and (2) of Table 9, we add high-order joint fixed effects multiplied by the industry and year, and we adopt the robust standard error by default. After further eliminating the endogeneity of the model, the regression coefficients between digital finance and the quantity and quality of green innovation are both 0.002, and both are significant at the 1% level. The results are the same as above.

Eliminating the impact of stock market disasters

Both digital finance and enterprise innovation are closely related to the overall environment of the financial market, and the fluctuation of the financial market affects the relationship between them to a certain extent. Therefore, exogenous market factors tend to affect the bias of regression results. In this paper, the method proposed by Tang et al. (2020) was used as a reference, and the data samples after 2015, which was the year of the stock market crash in China, were removed to conduct a robustness test. According to Columns (3) and (4) of Table 9, the regression coefficients between digital finance and the quantity and quality of green innovation are both 0.001 after the elimination of data in the year of the stock market crash, and they are both significant at the 5% level. The results are still basically the same as those mentioned above.

Eliminating the influence of municipalities

Compared with other prefecture-level cities, municipalities have a higher administrative level and more resources. The innovation activities of enterprises in this region are relatively active, and the development speed of digital finance is relatively fast. To eliminate the influence of such regional development, this paper deleted the sample data of four municipalities (Beijing, Shanghai, Tianjin and Chongqing) for regression. According to Columns (5) and (6) of Table 9, the regression coefficients between digital finance and the quantity and quality of green innovation are 0.003 and 0.002, respectively, after eliminating the data of municipalities directly under the central government, and both are significant at the 1% level. The results are the same as above (Table 10).

Discussion

Heterogeneity test

Analyst forecasts

Financial analysts, who set external performance benchmarks for companies, will indirectly affect strategy setting and innovation activities (He and Tian 2013). On the one hand, the fact that analysts give overly optimistic long-term earnings forecasts will impose too much pressure on managers and induce myopic behaviour (Dechow et al. 2000; Graham et al. 2005). On the other hand, the companies offered under-optimistic forecasts will suffer lower pressure and then be motivated to focus on long-term innovation. Moreover, under-valued companies will suffer lower capital support based on the characteristics of the financial market. Therefore, it is reasonable to believe that financial inclusion will stimulate the green innovation activities of under-valued companies more than those of companies with optimistic expectations by providing financial support and revealing information.

Following Hovakimian and Saenyasiri (2014), we calculated every company’s annual average of the difference between EPS forecasts for the firm by analysts in every year and the actual EPS in that year, divided by the stock price of the firm in that year as analyst optimism bias. (Prior research usually uses the share price or the EPS as a measure of scale. However, the stock price is often preferred to the EPS because earnings can be negative (Heflin et al. 2003; Richardson et al. 2004; Mohanram and Sunder 2006; Herrmann et al. 2008)). Then, we use the mean value of analyst optimism bias to divide the samples into two groups: companies with lower optimism bias and those with higher optimism bias.

As we start the model that regresses the number of total patents (Pat) in these two groups, we find that the coefficient estimate is 0.003 (p value < 0.01) in the samples with lower optimism bias and is 0.001 (p value < 0.10) in the samples with higher optimism bias. These two parameters show that financial inclusion (DFII) will exert a smaller impact and a less significant impact on green innovations in companies with high expectations. For the two groups, since we use Fisher’s permutation test to sample 1000 times, we construct the empirical distribution of the coefficient difference between the groups and finally obtain the empirical p value through experience samples. The empirical p value between the two groups is 0.029. In Columns 3 and 4, the dependent variable in the model is replaced by the number of invention-type green patent applications, and the empirical p value between the two groups is 0.031. The findings suggest that financial inclusion can help companies with lower expectations increase their green innovation since they can be restricted by financial resources from the market and are under less performance pressure in the short run (Tables 11 and 12).

Firm-specific information disclosure

Durnev et al. (2003) show that firms that exhibit less synchronicity are able to use more external financing and allocate capital more efficiently. The interpretation is that for firms with less price synchronicity, arbitrageurs will focus on the companies’ information, which in turn will decreases these companies’ information asymmetry and thus improve their external financing efficiency (Wurgler, 2000; Durnev et al. 2003). In contrast, firms with high synchronicity may be restricted by information constraints and finance constraints due to the restraint of firm-specific information. Therefore, financial inclusion can give full play to better information and resource effects in samples with higher synchronicity.

Following Piotroski and Roulstone (2004) and Gul et al. (2010), we measure stock return synchronicity in the following way. For each calendar year, we estimate the following linear regression:

where Ri,t denotes the weekly return on A-shares traded on either the Shanghai or Shenzhen Exchange for firm i at time t. Rm,t and RI,t denote the value-weighted A-share market return and industry return, respectively. The A-share market return is based on the composite (value-weighted) A-share index, which reflects A-share price movements in both the Shanghai and Shenzhen Exchanges.

The industry return is created using all firms within the same industry, omitting the weekly return for firm i.Footnote 6 We include lagged industry and market returns to alleviate concerns over potential non-synchronous trading biases (Scholes and Williams 1977; French et al. 1987).

To circumvent the bounded nature of R2 within [0,1], following Morck et al. (2000), we use a logistic transformation of R2i:

where SYNCHi is our empirical measure of annual synchronicity for firm i. A high SYNCH indicates that the firm’s price synchronicity is low and highly related to the market. R2i is the coefficient of determination from the estimation of Eq. (1) for firm i.

After we calculate the SYNCH for each company in our panel data, we divide all samples into two groups by the mean value of SYNCH, including samples with higher synchronicity and with lower synchronicity. When the dependent variable is Pat in Columns 1 and 2, the coefficient estimates are 0.003 (p value < 0.01) and 0.001 (p value > 0.1), respectively, for the two groups. When the dependent variable is Invpat in Columns 3 and 4, the coefficient estimates show the same results, 0.002 (p value < 0.01) and 0.001 (p value > 0.1), respectively, for the two groups. It can be seen directly that financial inclusion (DFII) loses its significance for firms with less synchronicity. For the two groups, since we use Fisher’s permutation test to sample 1000 times, the empirical p values are 0.002 and 0.033. Therefore, the results demonstrate that financial inclusion can encourage samples with higher synchronicity and information asymmetry to use the market by providing financial support and disclosing firm-specific information. In addition, we find that the heterogeneity is more obvious in the total number of applications (Pat), indicating that external funding support will more obviously contribute to the quantity than the quality of green innovation.

Further study

The possible dark side of financial inclusion

We consider that financial inclusion provides various financing channels but possibly causes over-investment or self-serving behaviour due to regulatory tolerance (Zhai et al. 2021; Huang and Huang 2018). The dark side of financial inclusion can have a negative influence on green innovation. On the other hand, financial inclusion can decrease information asymmetry not only between companies and financial industries but also between managers and shareholders. The information effect of financial inclusion enhances the regulatory environment internally and externally, which possibly restrains agency problems.

Therefore, we solve the dark-side problems in two ways: (1) we add inefficient investment (ineff) into the baseline regression to remove the impact of the self-serving behaviour of managers (Riaz and Iqbal, 2015; Malmendier and Tate 2005). (2) We divide the samples into two groups by the mean value of the management expense ratio and then run the basic model with the two samples to perform a heterogeneity test.

First, following Richardson (2006) and Malmendier and Tate (2005), we measure inefficient investment in the following way. For each calendar year, we estimate the following linear regression:

In Model (6), \({\mathrm{Invest}}_{\mathrm{i},\mathrm{t}-1}\) is the current investment scale, \({\mathrm{Size}}_{\mathrm{i},\mathrm{t}-1}\) is the size of the enterprise, \({\mathrm{Lev}}_{\mathrm{i},\mathrm{t}-1}\) is the capital structure, \({\mathrm{Growth}}_{\mathrm{i},\mathrm{t}-1}\) is the growth rate of the main business revenue, \({\mathrm{Age}}_{\mathrm{i},\mathrm{t}-1}\) is the age of the enterprise, \({\mathrm{Ret}}_{\mathrm{i},\mathrm{t}-1}\) is the return rate of stock, \({\mathrm{CFO}}_{\mathrm{i},\mathrm{t}-1}\) is the net cash flow of operating activities and the fixed effect of the industry is simultaneously considered. This study uses Model (6) to calculate the optimal investment scale of the enterprise in the current period and then subtracts the optimal investment scale from the actual investment scale. The absolute value of the residual represents the inefficient investment level of the enterprise.

Second, the level of management expense represents the self-serving behaviour of managers (Benston 1985). The higher the expense is, the more self-serving behaviour managers may have and the poorer the supervision environment of these companies will be. We thus divide the samples by the management expense ratio to test whether financial inclusion can lose its effect in companies with higher management expenses.

Table 13 shows the regression result when we add inefficient investment (ineff) to the baseline regression. The coefficient estimate is 0.002 and is significant at the 1% level when the independent variable is Pat. The coefficient estimate is 0.001 and is significant at the 1% level when the independent variable is Invpat. The results demonstrate that financial inclusion can still exert its effect when considering the impact of managers’ self-serving behaviour. Table 14 shows the regression results for different levels of management expense. When the dependent variable is Pat in Columns 1 and 2, the coefficient estimates are 0.003 (p value < 0.01) and 0.001 (p value > 0.1) for the two groups, respectively. When the dependent variable is Invpat in Columns 3 and 4, the estimate of the coefficient shows the same results, 0.003 (p value < 0.01) and 0.001 (p value > 0.1) for the two groups, respectively. It can be seen directly that financial inclusion (DFII) is significant for firms with a higher management expense ratio. The results demonstrate that financial inclusion cannot only exert resource and information effects when companies contain agency problems but also increase green innovation, especially when the supervision environment in companies is poor.

The spillover effect of financial inclusion on the quality of green innovation

To reveal the spillover effect of financial inclusion on the quality of green innovation, we also control the number of utility model patents (Genpat) in the baseline regression. The reason we do not control the number of total applications is that the geometrical relationship between the number of total applications (Pat) and the number of invention-type applications (Invpat) can affect the estimation results of the baseline regression. When we control for the number of utility model patents, the coefficient estimate of financial inclusion is 0.001 and is still significant at 1%. Meanwhile, we further control for research input in Column 2 to remove the influence of increasing total input. Financial inclusion is still significant at 1%, and the coefficient estimate remains the same. We thus believe that financial inclusion can exert an information effect on the innovation process and additionally help develop more invention-type green innovations, which are recognized as having a higher level of quality and constituting higher barriers to application (Table 15).

Conclusions and policy implications

This paper empirically examines the driving factors of digital finance on enterprises’ green innovation from the perspective of the resource effect and the information effect. It does so by taking A-shared listed companies in China from 2011 to 2019 as samples, and it discusses the heterogeneous impact on different samples with differentiated information and resource constraints. The core conclusions of this paper are as follows:

-

(1)

Digital finance can stimulate green innovation activities by increasing the coverage of digital finance and the depth of use.

-

(2)

Digital finance can significantly improve the quantity and quality of green innovation of enterprises by alleviating financial constraints and giving full play to the internal and external information effect.

-

(3)

The discussion shows that the effect of digital finance is heterogeneous and can more significantly and effectively stimulate the green innovations of samples with lower analyst optimism bias and higher synchronicity.

Based on the research results above, we propose the following policy recommendations.

-

(1)

The Chinese government should accelerate the popularization, development and coverage of digital finance. Digital finance enterprises can develop new technologies and functions that are not limited to facilitating payment, and they can enhance the use of digital finance. For the breadth of coverage, the government can encourage the diversified development of digital financial platforms to lower the threshold of digital financial services. Furthermore, to allow more regions to popularize digital finance at the same time, digital finance enterprises should pay attention to the combination and development of new technologies, such as artificial intelligence and big data. Doing so can not only improve the service efficiency of digital finance but also give full play to the information effect of digital finance by focusing on the information business of digital finance, such as consumer analysis and demand point analysis.

-

(2)

In view of the result that digital finance can exert an information effect to enhance the green innovation of enterprises, it would be wise for enterprises and other users to broaden the use depth of digital finance and improve the digital degree of management and decision-making. Internally, enterprises can try to apply the information effect brought by digital finance to improve management efficiency and decision-making accuracy. Externally, enterprises can use digital finance to increase their information exposure and reduce the problem of unsupported green products caused by information asymmetry.

-

(3)

For the problem of limited equity and firm-specific information disclosure, digital finance enterprises can pay more attention to firm-specific and firm-related information when guiding the allocation of public funds. Doing so can thus help companies with resources and information disadvantages reveal more helpful information and gain more public funds. In addition, enterprises with low financial constraints probably do not need digital finance to obtain funds, but they can flexibly use digital finance to make investment judgements and perform risk management in management and decision-making.

This research should be considered in light of a few limitations. First, the green innovation measure used in the study simply takes patent applications into account, which is only one aspect in depicting a company’s green innovation. Future studies should consider a more comprehensive method to reflect the ability and willingness of a company to engage in green innovation. However, considering the availability of data, we divided green innovation into invention green innovation and general green innovation to enrich the study as much as possible. In addition, our samples are restricted to Chinese listed companies. Our findings are also restricted to the situation of Chinese digital finance to some extent. It is true that digital finance in China cannot operate without some outstanding leading companies such as Alipay. However, we hope that our findings can be used worldwide and that a more diverse organizational form or transnational companies can be used in future studies.

Data availability

The datasets used or analysed during the current study are available from the corresponding author upon reasonable request.

Notes

The report titled Index system and index compilation of financial inclusion in China (2020) pointed out financial inclusion can be defined as a financial system that effectively and comprehensively provides services for all social strata and groups. Its original intention was to emphasize the continuous improvement of financial infrastructure, improve the availability of financial services and realize the provision of low-cost services to people from all walks of life. In particular, less developed areas and low-income people are provided more convenient financial services. We use the term digital finance throughout this article.

The internal control database is the first professional and authoritative internal control information database in China. Based on the perspective of the five elements of enterprise internal control, namely, the internal environment, risk assessment, control activities, information and communication, and internal supervision, it is designed to build an internal control evaluation database. Internal control audit information, defects in the internal control evaluation library, internal control, internal control auditing defects identified in the standard library, internal control, the internal control information disclosure index, the number of internal control defects and the library included in the scope of enforcement of 9 are a database of listed companies. It objectively and truly reflects the internal control level of Chinese listed companies.

The tool variable we selected was the geographical distance between each city and the central city calculated by STATA and Arc GIS.

According to the 2020 Digital China and Digital Economy Development Report released by Tencent Research Institute, Shenzhen, Beijing and Shanghai are among the top cities in China in terms of urban digital economy development, which is a suitable reference system for calculating geographical distance. As for the reason why we choose Shenzhen rather than Guangzhou, because Shenzhen is close to Guangzhou and is also the headquarters of Tencent group, the development level of digital finance is relatively high.

A large proportion of companies will set their headquarters and administration office in provincial capital city of the province they set.

We adopt the 13-industry classification (A–M) system from the China Securities Regulatory Commission (CSRC). For the manufacturing industry (C), we use the two-digit CSRC industry code (C1–C9). Thus, we have 21 industries in total.

References

Awan U, Kraslawski A, Huiskonen J (2019) Progress from blue to the green world: multilevel governance for pollution prevention planning and sustainability. J Handbook of environmental materials management.https://doi.org/10.1007/978-3-319-58538-3_177-1

Banerjee SB (2001) Managerial perceptions of corporate environmentalism: interpretations from industry and strategic implications for organizations. J Journal of Management Studies 38(4):489–513

Baron RM, Kenny DA (1986) The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. Pers Soc Psychol 51(6):1173–1182

Bartel A, Ichniowski C, Shaw K (2007) How does information technology affect productivity? Plant-level comparisons of product innovation, process improvement, and worker skills. J the Quarterly Journal of Economics 122(4):1721–1758

Benston GJ (1985) The self-serving management hypothesis: some evidence. J Account Econ 7(1–3):67–84

Bhupendra KV, Sangle S (2015) What drives successful implementation of pollution prevention and cleaner technology strategy? The role of innovative capability. J Environ Manag 155:184–192

Brickley JA, Lease RC, Smith CW (1988) Ownership structure and voting on anti-takeover amendments. J Financ Econ 20(1):267–291

Brown JR, Fazzari SM, Petersen BC (2009) Financing innovation and growth cash flow J External Equity and the 1990s R&D Boom. Journal of Finance. 64(1):151–185

Bushee BJ, Noe CF (2000) Corporate disclosure practices, institutional investors, and stock return volatility. J Account Res 171–202

Chan RY (2010) Corporate environmentalism pursuit by foreign firms competing in China. J World Bus 45(1):80–92

Chen Y, Miao L (2021) Digital finance, government subsidy and enterprise innovation. Zhejiang Finance 9:10–22

Chen X, Harford J, Li K (2007) Monitoring: which institutions matter? J Financ Econ 86(2):279–305

Cleff T, Rennings K (1999) Determinants of environmental product and process innovation. J Eur Environ 9(5):191–201

Climent F, Soriano P (2011) Green and good? The investment performance of US environmental mutual funds. J J Bus Ethics 103(2):275–287

Dechow P, Hutton A, Sloan R (2000) The relation between analysts’ forecasts of long-term earnings growth and stock price performance following equity offerings. J Contemp Account Res 17:1–32

Demertzis M, Merler S, Wolff GB (2018) Capital markets union and the fin-tech opportunity. Journal Financ Regulation 4(1):157–165

Deng D, Wen S, Pan L, Liu H (2014) Internal control quality, heterogeneity of institutional investors and decision-making: base on the self-selection model. J 26(10) 76–89

Doyle JT, Ge W, McVay S (2007) Accruals quality and internal control over financial reporting. J the Accounting Review 82(5):1141–1170

Durnev A, Morck R, Yeung B, Zarowin P (2003) Does greater firm-specific return variation mean more or less informed stock pricing? J J Account Res 41:797–836

Estrin S, Khavul S, Wright M (2022) Soft and hard information in equity crowdfunding: network effects in the digitalization of entrepreneurial finance. J Small Bus Econ 58(4):1761–1781

Fang X, Na J (2020) Stock market reaction to green innovation: evidence from GEM firms. J Econ Res 55(10):106–123

French K, Schwert GW, Stambaugh R (1987) Expected stock returns and volatility. J J Financ Econ 19:3–30

Graham J, Harvey C, Rajgopal S (2005) The economic implications of corporate financial reporting. R J Account Econ 40:3–73

Gul FA, Kim JB, Qiu AA (2010) Ownership concentration, foreign shareholding, audit quality, and stock price synchronicity: evidence from China. J J Financ Econ 95:425–442

Guo Y, Xia X, Zhang S et al (2018) Environmental regulation, government R&D funding and green technology innovation: evidence from China provincial data. J Sustainability 10(4):940

Guo F, Wang J, Wang F, Kong T, Zhang X, Cheng Z (2020) Measuring China’s digital financial inclusion: index compilation and spatial characteristics. J China Econ Q 19(04):1401–1418

He JJ, Tian X (2013) The dark side of analyst coverage: The case of innovation. Financ Econ 109(3):856–878

Heflin F, Subramanyam KR, Zhang Y (2003) Regulation FD and the financial information environment: Early evidence. Account Rev 78(1):1–37

Herrmann DR, Hope OK, Thomas WB (2008) International diversification and forecast optimism: The effects of Reg FD. Account Horiz 22(2):179–197

Hovakimian A, Saenyasiri E (2014) US analyst regulation and the earnings forecast bias around the world. Eur J Financ Manag 20:435–461

Huang Y, Huang Z (2018) The development of digital finance in China: present and future. J China Econ Q 17(04):1489–1502

Huang X, Hu Z, Fu C, Yu D (2015) The impact of green innovation strategy on firm performance: the mediating effect based on green dynamic capability. J Advances in Science and Technology and Countermeasures 32:104–109

Ji S, Wang J (2005) Green accounting information disclosure from the perspective of information economics. J J Commer Econ 26:54–55

Ji S, Lv W, Meng L et al (2019) Decoupling environmental pressures from economic growth based on emissions monetization: case in Yunnan. China J Journal of Cleaner Production 208:1563–1576

Jia J, Lun X, Lin S (2017) Financial development, corporation innovation and economic growth: empirical analysis from the patent perspective. J J Financ Res 17(04):1489–1502

Kaplan SN, Zingales L (1997) Do investment-cash flow sensitivities provide useful measures of financial constraints? J Q J Econ 112(1):169–215

Kunapatarawong R, Martínez-Ros E (2016) Towards green growth: how does green innovation affect employment? J Res Policy 45(6):1218–1232

Lee KH, Kim JW (2011) Integrating suppliers into green product innovation development: an empirical case study in the semiconductor industry. J Bus Strateg Environ 20(8):527–538

Leuz C, Lins KV, Warnock FE (2009) Do foreigners invest less in poorly governed firms? J Rev Financ Stud 22(8):3245–3285

Li W, Chen H (2012) Internal control and actual corporate tax burden. J Financ Res 9:195–206

Li B, Shi S, Zeng Y (2020a) The impact of haze pollution on firm-level TFP in China: test of a mediation model of labor productivity. J Sustain 12(20):8446

Li J, Wu Y, Xiao J (2020b) The impact of digital finance on household consumption: evidence from China. J Econ Model 86:317–326

Li R, Wang Y, Lu Z (2020c) Does the Internet business model affect the earnings quality of listed firms?—evidence from China’s stock market. J Account Res 10:66–81

Li B, He M, Gao F et al (2021) The impact of air pollution on corporate cash holdings. J Borsa Istanbul Review 21:S90–S98

Liang B, Zhang J (2019) Can the Development of digital inclusive finance stimulate innovation—evidence from Chinese cities and semes. J Mod Econ Sci 41(05):74–86

Lin B, Rao J (2009) Why do listed companies disclose the auditor's internal control reports voluntarily?—an empirical study based on signaling theory in China. Account Res 8(2):45–52

Lin H, Zeng S, Ma H, Qi G, Tam VWY (2014) Can political capital drive corporate green innovation? Lessons from China J Cleaner Prod 64:63–72

Lin H, Chen L, Yu M et al (2021) Too little or too much of good things? The horizontal S-curve hypothesis of green business strategy on firm performance. J Technol For Soc Chang 172:121051

Liu J, Jiang Y, Gan S et al (2022) Can digital finance promote corporate green innovation?. J Environ Sci Pollut Rese 1–13

Ma D (2021) Strategic differences, operational risks and innovation choices of manufacturing firms. J Communication Financ Account 22:44–47

Ma L, Du S (2021) Can digital finance improve corporate risk-taking level? J Economist 5:65–74

Ma G, Liu M, Yang E (2014) Bank lines of credit, credit squeeze and firm R&D. J J Financ Res 7:76–93

Malmendier U, Tate G (2005) Does overconfidence affect corporate investment? CEO overconfidence measures revisited. J Eur Financ Manag 11(5):649–659

Meng F, Su B, Thomson E et al (2016) Measuring China's regional energy and carbon emission efficiency with DEA models: A survey. J Appl Energy 183(1):1–21

Mohanram PS, Sunder SV (2006) How has regulation FD affected the operations of financial analysts?. Contemp Account Res 23(2):491–525

Morck R, Yeung B, Yu W (2000) The information content of stock markets: why do emerging markets have synchronous stock price movements? J Journal of Financial Economics 58:215–260

Parthasarthy R, Hammond J (2002) Product innovation input and outcome moderating effects of the innovation process. J J Engineering Tech Manag 19(1):75–91

Peng P, Xiao B, Li X, Zhu Y (2016) Bank-enterprise relationship, collateral and lending rate decision: an empirical analysis based on small and medium enterprises (SMEs) in China. J Jiangsu Soc Sci 2:27–36

Peng M, Zeng Y, Yang DC et al (2022) The role of smog in firm valuation. J Emerging Markets Financ Trade 58(3):883–895

Piotroski JD, Roulstone RT (2004) The influence of analysts, institutional investors, and insiders on the incorporation of market, industry, and firm specific information into stock prices. J Account Rev 79:1119–1151

Porter ME, Van der Linde C (1995) Toward a new conception of the environment-competitiveness relationship. J J Econ Perspect 9(4):97–118

Qi S, Lin S, Cui J (2018) Do environmental rights trading schemes induce green innovation? Evidence from listed firms in China. J Econ Res 53(12):129–143

Qi Y, Sun C, Wang H (2021) Can corporate core competence reduce the cost of equity capital? Empirical evidence based on text analysis. J Account Res 8:94–106

Quan X, Xu X, Xu R (2018) Management opportunistic behavior in the compulsory disclosure of corporate social responsibility: empirical evidence base on A share listed companies. J J Manag Sci China 21(12):95–110

Riaz T, Iqbal H (2015) Impact of overconfidence, illusion of control, self control and optimism bias on investors decision making; evidence from developing markets . Res J Financ Account 6(11):110–116

Richardson S (2006) Over-investment of free cash flow. J Rev Account Stu 11(2):159–189

Richardson S, Teoh SH, Wysocki PD (2004) The walk‐down to beatable analyst forecasts: The role of equity issuance and insider trading incentives. Contemp Account Res 21(4):885–924

Scholes M, Williams J (1977) Estimating betas from non-synchronous data. J Financ 5:309–328

Shen N, Liao H, Deng R et al (2019) Different types of environmental regulations and the heterogeneous influence on the environmental total factor productivity: empirical analysis of China’s industry. J J Clean Prod 211:171–184

Sun J, Zhang Y (2019) Financial development, agency cost and enterprise innovation strategy. J Res Financ Econ Issue 3:50–59

Tang S, Wu X, Zhu J (2020) Digital finance and enterprise technology innovation: structural feature, mechanism identification and effect difference under financial supervision. J. Manag World 36(05):52–66+9

Teng L, Ma D (2020) Can digital finance help to promote high-quality development? J Stat Res 37(11):80–92

Tian J, Guo Z, Jin J (2019) Analysis of factors affecting the survival status of P2P online loan platforms: empirical analysis based on the data from 3842 P2P online loan platforms. J Western Forum 29(04):53–63

UN (2012) Realizing the future we want for all. R. Report to the Secretary-General. UN System Task Team on the Post-2015 UN Development Agenda, New York

Wan J, Zhou Q, Xiao Y (2020) Digital finance, financial constraint and enterprise innovation. J Econ Rev 1:71–83

Wang Y, Dai W (2019) Does internal control inhibit or promote corporate innovation? The Logic of China. Journal of Audit & Economic 6:19–32

Wen Z, Hau KT, Lei C (2005) A comparison of moderator and mediator and their applications. Acta Psychol Sin 37(2):268–274

Wiener N (1961) Cybernetics, or Control and Communication in the Animal and the Machine, 2nd edn. Cambridge, Mass MIT Press

Wurgler J (2000) Financial markets and the allocation of capital. J Financ Econ 58:187–214

Yang D, Chai H (2015) A review of driving factors of green technology innovation and its effect on firm’s performance. J. China Popul China Popul Res Environ 25(S2):132–136

Yang Y, Shao Y (2011) Review of eco-innovation study and its implications. J Sci Sci Manag of S and T 32(8):107–116

Yang J, Shi J (2015) Research on the curve relationship between enterprise ecological innovation and economic performance. J Sci Tech Prog Policy 32(13):95–99

Yang G, Xi Y (2019) Empirical study on financial constraints of green technology innovation activities of enterprises. J J Ind Tech Econ 38(11):70–76

Yang D, Xie Y (2019) Corporate social responsibility, green innovation capability and corporate environmental performance. J Communication Financ Account 6:100–104

Ye K, Cao F, Wang H (2015) Can internal control information disclosure reduce stock price crash risk. J J Financ Res 2:192–206

Yin F (2020) Impact of digital finance on green innovation efficiency based on spatial measurement model. J J Tech Econ&Manag 11:74–79

Yu D, Yang L (2021) Research on the impact of digital finance on enterprise green innovation: from the perspective of regional heterogeneity. J Credit Reference 39(10):72–79

Yu H, Lv W, Liu H et al (2022) Economic policy uncertainty and corporate bank credits: evidence from China. J Emerging Markets Financ and Trade 1–11

Zhai H, Liu Y (2021) Research on the relationship among digital finance development, financial constraints and enterprise green innovation. J Science & Technology Progress and Policy 38(17):116–124

Zhang G, Zhang X (2011) Review and prospect of green innovation research abroad. J Foreign Econ Manag 33(08):25–32

Zhang G, Zhang X (2013) Driver factors of corporate green innovative strategy based on planning behavior theory. J J Bus Econ 7:47–56

Zhang J, Gen H, Xv G, Chen J (2019) Research on the influence of environmental regulation on green technology innovation. China Popul Resour Environ 29(1):168–176

Zhang X, Yang T, Wang C et al (2020) Digital finance and household consumption: theory and evidence from China. Manage World 36(11):48–62

Zhou X, Chen L, Wang H (2012) Is the higher the level of technological innovation, the better the financial performance of enterprises? An empirical study based on 16 years of patent application data of Listed Pharmaceutical companies in China. J Financ Res 8:166–179

Zhou Z, Zheng Y, Li J (2021) How does the digital finance drive enterprise innovation: from the perspective of financing and information constraints. J Ind Econ Rev 12(04):49–65

Zhu X, Chen W (2014) The effort of green product innovation on organizational performance and competitiveness—the moderating role of managerial environmental concern. J Soft Sci 28(04):53–56+61