Abstract

Much of the literature on household finance tends to focus on relatively objective measures of financial security (e.g., savings, income, financial knowledge), and there has been less research on measures of subjective financial well-being. This gap is due in part to the absence of a common understanding on defining and measuring subjective financial well-being. The Consumer Financial Protection Bureau has recently developed a new Financial Well-Being Scale that provides a comprehensive way to measure this construct. The research on this scale is still scarce and little is known about how subjective financial well-being evolves over time. This paper uses a two-wave survey of low- and moderate-income tax filers to present among the first longitudinal analyses of this scale. Through descriptive analysis and lagged dependent variable regressions, we assess (1) the stability of financial well-being over a six-month period; (2) the extent to which relatively stable household characteristics predict volatility in subjective financial well-being; and (3) the relationship between adverse financial events, including financial shocks and material hardships, and subjective financial well-being. We find that financial well-being scores are extremely stable over the short-term, and that relatively stable household characteristics are not strong predictors of subjective financial well-being changes. We also find that, while adverse financial events like job loss are significantly associated with lower subjective financial well-being scores, the magnitude of these relationships is not large. These results have implications for the use of the financial well-being scale in evaluations of financial security interventions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Research has consistently demonstrated that U.S. households frequently face high levels of financial volatility such as sudden declines in income from job loss or spikes in expenses from health emergencies or car repairs. The scope of this volatility has been highlighted in national survey research that found roughly a quarter of U.S. households reported a job loss in the prior year (Board of Governors of the Federal Reserve System [BoGFRS], 2016) and 60% reported a large expenditure increase (Pew Charitable Trusts, 2015). The consequences of these financial shocks can be considerable, with estimated costs averaging $1,500–$2,000USD (Collins & Gjertson, 2013; Searle & Köppe, 2014). Moreover, financial shocks of this magnitude are associated with a wide array of household hardships (Despard et al., 2018; Despard et al., 2018; Despard et al., 2018; Leete & Bania, 2010; McKernan et al., 2009). Beyond single financial shocks, studies have also consistently documented that households face significant income volatility as a result of changing employment arrangements and unstable work schedules (Hardy & Ziliak, 2014; Hardy et al., 2019).

However, there remains an open question regarding how volatility in a household’s finances may translate to volatility in one’s subjective perception of their personal financial well-being, and it is this question that concerns the present study. It seems intuitive that subjective perceptions of financial well-being would be sensitive to objective changes in financial circumstances; experiences such as financial shocks or hardships can lead to a decline in financial well-being from a cascade of factors, including increased financial anxiety, feelings of helplessness, difficult financial trade-offs, and so on. Yet, while the evidence points toward U.S. households having precarious financial situations, including high levels of financial stress and a lack of resources to offset financial emergencies, these households commonly report leading comfortable financial lives (BoGFRS, 2018). This finding indicates a disconnect between objective, discrete financial circumstances and individuals’ subjective, holistic perceptions of their financial situation and financial well-being.

Historically, research on the relationship between objective measures of financial security and subjective financial well-being has been limited by the absence of an accepted standardized definition and means of assessing an individual’s or household’s overall sense of their financial conditions. In its recent work on financial well-being, the Consumer Financial Protection Bureau (CFPB) defined financial well-being in terms of a household’s control over their day-to-day and month-to-month finances, their capacity to absorb a financial shock, their perception of being on track to meet financial goals, and their financial freedom to make life-enhancing choices (CFPB, 2015). To facilitate the measurement of this construct, the CFPB created a Financial Well-Being Scale to provide a reliable, comprehensive tool for measuring subjective financial well-being (CFPB, 2015).Footnote 1 This operationalization of subjective financial well-being has become increasingly common in research and practice. The available work using the Financial Well-Being Scale has demonstrated that a positive correlation exists between this subjective measure of financial well-being and a variety of objective measures such as income, liquid assets, earning stability, and expense stability (CFPB, 2017b; Sun et al., 2018; Walker et al., 2018).

However, only scarce research has examined the extent to which subjective financial well-being is stable (or unstable) over short periods. Similarly, only limited work has explored the ways in which changes in household circumstances and experiences predict downstream changes in subjective financial well-being. On one hand, a person’s subjective perception of their well-being might depend strongly on intrinsic individual characteristics and remain relatively stable over the life course (Easterlin, 2001). On the other hand, well-being can be subject to short-term fluctuations as a result of various life events and circumstances (Luhmann et al., 2012; Winkelmann, 2014; Winkelmann & Winkelmann, 1998), and more severe life events can affect the long-term trajectory of subjective well-being (Fujita & Diener, 2005). Further, much of the research on subjective financial well-being, including the emerging work around the CFPB’s Financial Well-Being Scale, has not focused on studying the perception of subjective financial well-being in low- and moderate- income (LMI) households. However, because LMI households tend to exhibit higher levels of financial volatility across their lifespans (BoGFRS, 2016; Hardy et al., 2019; Hardy & Ziliak, 2014; Pew Charitable Trusts, 2015), it is important to specifically examine the link between financial volatility (e.g., financial shocks and hardships) and volatility in subjective financial well-being in the LMI population.

To address gaps in existing research, our study descriptively explored the state of subjective financial well-being among LMI individuals and examined the extent to which these individuals’ subjective financial well-being was sensitive to the experience of adverse financial events. Specifically, we explored the following three factors: (a) the extent to which subjective financial well-being is stable over the short-term; (b) whether key household characteristics are predictive of changes in subjective financial well-being; and (c) the relationship between financial volatility indicators (e.g., experiences of financial shocks and hardships) and downstream subjective financial well-being.Footnote 2 Study data were obtained from a longitudinal survey of LMI households administered at two points in 2018: (a) immediately after LMI households completed filing their federal tax returns and (b) 6 months later. These data were examined using several analytical approaches, including descriptive approaches and lagged dependent variable regression models. Thus, this study presents one of the first in-depth looks at the ways in which individuals’ subjective sense of financial well-being changes over the short-term, and our study is also among the few to use the CFPB’s scale to assess self-perceived financial well-being in the LMI population. Given the association of a person’s subjective financial well-being with their overall life satisfaction (Netemeyer et al., 2018), mental health (Rautio et al., 2013; Wilkinson, 2016), and day-to-day issues (e.g., work performance, absenteeism; Kim & Garman, 2004; Kim et al., 2006), understanding the factors that drive changes in financial well-being can help researchers and financial capability professionals better identify and target interventions to at-risk populations. Further, our analysis can help program managers and policymakers determine the suitability of using the CFPB’s scale when evaluating the program effects of interventions such as financial counseling or financial education, which are often evaluated over relatively short time frames (Fernandes et al., 2014).

Literature Review

Assessing Subjective Well-Being

The concept of subjective financial well-being is rooted in years of formative research on the general construct of subjective well-being, which explores the “how and why” individuals experience life satisfaction and positivity (Diener, 1994). To quantify the concept of subjective well-being and life satisfaction, researchers have proposed multiple measures, including the Satisfaction With Life Scale (Diener et al., 1985), the Cantril Self-Anchoring Scale (Deaton, 2008), a single question asking if individuals are satisfied with their lives (Xiao & Li, 2011), and other subjective indicators of quality of life (Sirgy et al., 2006). Research across several disciplines generally supports a positive correlation between individual subjective well-being and objective well-being measures such as poverty (Lever, 2004), income (Deaton, 2008; Easterlin, 2001), and wealth (Jivraj & Nazroo, 2014). Notably, having access to greater levels of economic resources does not completely explain variation in the subjective assessment of life satisfaction (Diener & Biswas-Diener, 2002; Graham, 2009).

A substantial amount of research has considered the ways measures of subjective well-being change over time. In general, this literature has found that even though relatively stable personality traits can be important predictors of subjective well-being (e.g., DeNeve & Cooper, 1998; Diener et al., 2003; Gomez et al., 2009), positive and negative life events can also exhibit independent influence on subjective well-being (Gomez et al., 2009). Diener (1994) postulated that an individual’s self-assessment of their subjective well-being is both volatile and stable: although the individual’s emotional state and life circumstances can potentially affect the state of subjective well-being in the short-run, individuals tend to adapt to various life changes over time. Thus, a comprehensive judgement of an individual’s subjective well-being is likely to remain relatively stable over a long period. Indeed, studies using longitudinal data have indicated measures of general life satisfaction remain stable over a 4-week period (Eid & Diener, 2004) and a strong predictor of an individual’s current well-being is their subjective well-being observed at 3- and 6-months prior (Chamberlain & Zika, 1992). Similarly, Easterlin (2001) observed that although individuals with higher levels of income generally exhibited higher levels of subjective well-being, average subjective well-being did not increase when incomes and economic situations improved over the life cycle. Similar conclusions about the stability of subjective well-being over the life course were reported by Bardo (2017), who focused on domain-specific and global assessments of life satisfaction. Bardo found that different life satisfaction domains exhibited different trends over the life course. For example, an individual’s satisfaction with their family tends to increase in early life stages and then decrease in later life stages. In contrast, an individual’s satisfaction with their health tends to decrease monotonically over the life course. Nevertheless, the long-term changes in life satisfaction in each domain appear gradual and relatively stable, without frequent large-scale fluctuations.

However, other research has revealed nuances in the stability of subjective well-being. These studies have shown that while the measure of life satisfaction remains largely stable in the long-term for most people, some individuals experience large shifts in their life satisfaction over a long time frame, with such shifts potentially occurring because of substantial changes in their life circumstances such as the widowhood or unemployment (Fujita & Diener, 2005; Lucas, 2007). Equally important, different life circumstances can affect immediate and short-term changes in subjective well-being and influence different adaptation rates over time (Diener et al., 2006; Lucas, 2007). A meta-analysis of 188 longitudinal studies exploring how various family events (e.g., divorce) and work events (e.g., unemployment) might affect subjective well-being revealed that rates of adaptation in life satisfaction differ across various life events and circumstances (Luhmann et al., 2012). For example, changes in life satisfaction might be short-lived when it comes to marriage, whereas unemployment was not only found to have a persistent negative impact on general well-being but also found to require a longer period for the process of adaptation. However, Luhmann and colleagues cautioned that their interpretation of the findings might not fully account for anticipatory effects of life events and their influence on baseline well-being measures. Other work has reached a similar conclusion in finding that average life satisfaction starts declining before an individual experiences unemployment, drops significantly at the time of unemployment, and recovers over time but does not return to its initial level until roughly four years after the unemployment event (Winkelmann, 2014). Likewise, researchers who examined the effects of the 2008 global economic crisis reached similar conclusions regarding the negative association between large-scale economic shocks and well-being (Gonza & Burger, 2017; Welsch & Kühling, 2016).

Financial Security and Financial Well-Being

Separate from the literature on general household well-being, a robust body of literature focuses not only on household financial conditions but also the short- and long-term volatility in household financial conditions. The most common approach to assessing household financial conditions relies on objective financial indicators to measure overall financial conditions using metrics such as (a) the percentage of household income used for necessary expenditures (Schanzenbach et al., 2016); (b) whether the household has liquid savings available (Collins & Gjertson, 2013); (c) credit scores and debt levels of adults in the household (e.g., Roll & Moulton, 2019); (d) housing stability (e.g., Gallagher et al., 2019), and (e) households members’ behavior regarding savings and money management (Theodos et al., 2018). Beyond these relatively objective measures, a household’s financial security can be assessed using subjective indicators such as the extent to which households worry about their ability to manage a financial shock (e.g., Abbi, 2012), their level of financial anxiety (e.g., Roll et al., 2016; Shapiro & Burchell, 2012), and their ability to plan and make financial decisions (e.g., Mullainathan & Shafir, 2013).

Although each of these approaches offers valuable insight into different aspects of a household’s financial reality, they do not assess whether a household perceives its own financial conditions holistically. To that end, a substantial literature on subjective financial well-being has focused on measuring and exploring financial satisfaction, which is considered a domain of general well-being and captured as individuals’ contentment with their financial situation (Joo & Grable, 2004). A common approach to measuring financial satisfaction uses a single survey item that asks respondents to use a 10-point scale to evaluate their satisfaction with their current financial situation (Friedline & West, 2016; Joo & Grable, 2004; Plagnol, 2011; Xiao et al., 2014). Other researchers have measured subjective financial well-being using composite scores derived from discrete self-assessed measures of an individual’s financial condition (Kim et al., 2003), or by focusing on satisfaction within specific economically oriented life domains (Roberts & Clement, 2007; Rojas, 2006).

Studies examining how well relatively objective financial circumstances correlate with relatively subjective measures of financial security have found a generally positive relationship between income and financial satisfaction (Friedline & West, 2016; Hsieh, 2004; Joo & Grable, 2004; Plagnol, 2011; Seghieri et al., 2006). At the same time, changes in financial circumstances—such as the experience of negative financial shocks through sudden income declines (e.g., job loss) or large, unanticipated expense increases (e.g., health emergencies)—can potentially have pronounced impacts on a household’s financial security and their subjective perception of their financial well-being. Households experiencing negative financial shocks tend to report lower levels of financial satisfaction (Joo & Grable, 2004; Ryan, 2012), and the effects of these negative shocks on financial satisfaction can persist over time. When asked about their financial recovery following the costliest financial shock they experienced in the past year, more than half of U.S. households said they struggled to make ends meet for at least 6 months following the shock (Pew Charitable Trusts, 2015). In addition, similar to the effects of unemployment on general life satisfaction, the effects of unemployment on financial satisfaction can linger for several years (Ahn et al., 2004). Moreover, even though other studies have not directly measured the experience of financial shocks, they have found those who are unemployed tend to report lower levels of financial satisfaction than employed individuals (Bell & Blanchflower, 2010; Białowolski, 2018; Plagnol, 2011; Vera-Toscano et al., 2006).

Negative financial shocks have also been shown as associated with an array of household hardships, including skipped payments on essential bills (McKernan et al., 2009), food insecurity (Bartfeld & Collins, 2017; Heflin, 2016; Leete & Bania, 2010), foregone or delayed medical care (Despard, Grinstein-Weiss, et al., 2018; Despard, Guo, et al., 2018; Despard, Taylor, et al., 2018), and housing hardship (Heflin, 2016). Several studies have examined whether experiencing these and other material hardships correlated with subjective measures of financial well-being and found a negative association between subjective financial well-being and difficulties in making housing payments (Comerton-Forde et al., 2020), difficulties paying monthly bills (Aboagye & Jung, 2018), or skipping bill payments (Białowolski, 2018).

The research highlighted thus far underscores that negative changes in relatively objective financial circumstances are associated with lower levels of subjective financial well-being. At the same time, short-run fluctuations in subjective financial well-being that occur in response to different financial circumstances and life events might not translate to long-run trends in financial well-being because measures of financial well-being tend to be less volatile over the life course. Indeed, even though income might decline with age, financial satisfaction tends to increase with age (Hansen et al., 2008; Hsieh, 2004; Plagnol, 2011; Plagnol & Easterlin, 2008), thereby implying long-term stability in subjective financial well-being. The positive relationship between financial satisfaction and age has been observed even for the lowest income group after accounting for assets and debt (Hansen et al., 2008). In addition, evidence on subjective financial well-being dynamics in the short- and long-run implies that, similar to general subjective well-being, the construct of financial well-being might be a function of stable personal characteristics (e.g., personality), contextual life circumstances (e.g., life events), and environmental factors (e.g., culture; Diener et al., 2003).

Previous Research Using the CFPB’s Financial Well-Being Scale

As our key outcome, the current study uses the CFPB’s Financial Well-Being Scale, which is a relatively new measure of subjective financial well-being. Since the publication of this scale, several research studies have used the Financial Well-Being Scale to examine the predictors of subjective financial well-being. The foundational work outlining financial well-being dynamics in the United States comes from the CFPB, which conducted a nationwide survey of financial well-being in 2017 (CFPB, 2017b). This study of U.S. households found the average household financial well-being score was 54 on a 0–100-point scale. Moreover, the CFPB found substantial variation in financial well-being scores: those with financial well-being scores in the top 10% of U.S. households had scores that were 35 points higher than those in the bottom 10% of households. This study also found some of the strongest predictors of financial well-being scores were measures that captured either a household’s financial volatility or its ability to buffer against financial volatility. Those who struggled to make ends meet or had a recent experience with material hardship exhibited relatively low levels of financial well-being, whereas those who had high levels of liquid savings or the capacity to absorb unexpected expenses had relatively high levels of financial well-being. Indeed, study findings showed having liquid savings was the single largest differentiator of financial well-being levels. This work also investigated the relationship between financial and demographic characteristics and financial well-being, and found employment, income, age, and education were all related to higher levels of financial well-being. White respondents and those reporting very good health also reported higher levels of financial well-being. However, no differences in financial well-being were observed by gender.

The existing research using the CFPB’s Financial Well-Being Scale has typically examined the state of subjective financial well-being in the general population (e.g., Lee et al., 2020; Nagypál & Tobacman, 2019; Walker et al., 2018), and few studies have focused on the dynamics in subjective financial well-being in the LMI population. Sun et al. (2018) found their LMI sample had a financial well-being score six points lower than the national average (i.e., 48 versus 54), and that LMI individuals exhibited financial well-being patterns that differed by age, education, and race. Specifically, Sun et al. (2018) found the highest levels of financial well-being were reported by both very young and very old LMI respondents whereas middle-aged LMI respondents had the lowest levels of financial well-being. In addition, they found education was negatively correlated with financial well-being. These patterns were almost the inverse of what was observed in studies of financial well-being in the general population (Collins & Urban, 2018; CFPB, 2017), possibly indicating that households in lower-income brackets at higher ages or with higher educational attainment feel particularly vulnerable or insecure in their finances. Another interesting difference in financial well-being patterns in the LMI sample relative to the general population had to do with race and ethnicity. In the LMI sample, non-Hispanic White respondents had the lowest rates of financial well-being, whereas in the CFPB’s general population sample non-Hispanic Whites had the highest rate of financial well-being. In comparison, in Sun et al.’s (2018) sample, LMI non-Hispanic Blacks had the highest levels of financial well-being. However, similar to the CFPB’s general population study, Sun et al.’s (2018) study also found the single strongest predictor of financial well-being levels was a respondent’s ability to manage an unexpected financial emergency.

Dedmond et al. (2019) studied LMI individuals who participated in financial coaching, and found these individuals had an average financial well-being score six points lower than that of the general U.S. adult population. In addition, among this sample of individuals who received financial coaching, those who reported higher levels of financial well-being during the intake for the coaching sessions demonstrated higher levels of achieving their financial goals as compared with their counterparts who had lower baseline levels of financial well-being (Dedmond et al., 2019). This finding suggests individuals with higher levels of subjective financial well-being might have either greater confidence in their ability to achieve financial goals or better means (e.g., income, assets) to reach their goals.

Despite a growing number of studies that have examined the predictors of subjective financial well-being at a given point in time, only relatively scarce research has used the CFPB’s Financial Well-Being Scale to study the trends in subjective financial well-being over time. Collins and Urban (2018) used the cross-sectional CFPB survey to understand the ways in which subjective financial well-being evolves over the life course. They not only found financial well-being scores generally track income, assets, and investment market participation, but also found financial well-being exhibits a positive relationship with age that plateaus around the age of retirement. Conversely, Collins and Urban (2018) also reported that participants’ financial knowledge was not significantly associated with their financial well-being, indicating the construct of subjective financial well-being captures metrics separate from traditional measures of financial knowledge or literacy.

Burke and Perez-Arce (2019) used longitudinal data to assess the stability of subjective financial well-being and to explore the relationship between the financial well-being construct and financial characteristics and circumstances. Over their 2.5-year observation period, Burke and Perez-Arce found subjective financial well-being was relatively stable, although certain financial shocks were associated with large fluctuations in financial well-being. For example, receiving a promotion or obtaining new employment was associated with positive changes in financial well-being scores, whereas financial shocks such as losing a job or incurring a large medical expense were correlated with negative changes in subjective financial well-being. Further, these researchers found no evidence to suggest engaging in protective financial behaviors (e.g., planning for financial emergencies or having liquid savings) reduced the impacts of such shocks on financial well-being. Similarly, in another study that used longitudinal data from a sample of LMI respondents, researchers found that income shocks produced the largest negative impact on financial well-being scores, whereas the effects of expense shocks were substantially lower than income shocks and medical shocks had no measurable effect on financial well-being scores (Bufe et al., 2019). Notably, Bufe et al. observed the adverse effects of income shocks even after accounting for the moderating effects of liquid assets and income.

Research Objectives and Study Hypotheses

As indicated in our overview of the literature, although an individual’s subjective sense of overall well-being—and specifically their sense of financial well-being—tends to be generally stable over time, subjective financial well-being can be unstable in the short-term and fluctuate with changes in financial circumstances (e.g., experience of financial shocks or hardships). Building on this literature, our study had three research objectives: (a) to explore the extent to which an LMI individual experiences a stable sense of financial well-being in the short-run; (b) to examine the ways in which changes in subjective financial well-being are related to baseline household demographic and financial characteristics; and (c) to study the extent to which certain time-varying adverse household experiences (e.g., experience of financial shocks or hardships) are related to changes in subjective financial well-being. Further, our study was guided by three primary hypotheses that corresponded to each of these objectives:

-

Hypothesis 1: We expect subjective financial well-being will exhibit relative stability over short periods.

-

Hypothesis 2: We expect the relatively stable demographic and financial characteristics measured at survey baseline (e.g., race/ethnicity, gender, age) will not be strongly correlated with changes in subjective financial well-being.

-

Hypothesis 3: We expect adverse financial experiences (e.g., financial shocks and hardships) will be significantly associated with decreases in financial well-being over the short-term.

In examining the short-run stability of subjective financial well-being and assessing the short-term sensitivity of subjective financial well-being to changing financial circumstances in an LMI sample, our study makes three primary contributions to the literature. First, only a limited number of studies examining subjective financial well-being dynamics have focused explicitly on LMI populations (e.g., Despard, Grinstein-Weiss, et al., 2018; Despard, Guo, et al., 2018; Despard, Taylor, et al., 2018; Roll et al., 2017; Roll et al., 2016). This gap in the knowledge base is underscored by findinges reported in several studies suggesting the negative relationship between financial shocks, income volatility, material hardship, and financial security tends to be stronger for lower-income families (McKernan et al., 2009; Pew Charitable Trusts, 2015). Second, our study is one of the first to conduct a longitudinal examination of the CFPB’s Financial Well-Being Scale scores. This score is increasingly used as an outcome measure in research and practice; therefore, understanding both the extent to which the CFPB’s Financial Well-Being Scale score is stable over time and the predictors of changes in the score are important in interpreting research findings and program evaluations. Similarly, our third contribution stems from our 6-month examination of changes in subjective financial well-being because this timeframe is commonly used in program evaluations and intervention studies (e.g., Beverly et al., 2006; Duflo & Saez, 2003). Thus, our study’s use of a 6-month timeframe enables us to directly inform future field work using subjective financial well-being as a key outcome of interest.

Data and Methods

Data and Sample

This study used data from the longitudinal 2018 Household Financial Survey (HFS), a two-wave survey offered to a random sample of approximately 200,000 tax filers who used TurboTax Freedom Edition (TTFE) to file their U.S. federal taxes. TTFE is a free tax-filing software offered as part of the Internal Revenue Service (IRS) Free File Alliance program that provides free online tax-filing products to LMI households. To qualify for TTFE in 2018, a non-military household (i.e., no active duty military) was required either to have a 2017 adjusted gross income of less than $33,000 or to qualify for the Earned Income Tax Credit. Looser income restrictions applied to the small minority of households with active duty military.

Wave 1 of the 2018 HFS was administered between January and April 2018 to 15,898 LMI households immediately after they completed their tax filing; of these, 12,563 tax filers completed the HFS survey. Six months after these households completed the Wave 1 HFS survey, respondents were contacted and asked to complete a second survey; 3,911 tax households completed the Wave 2 survey. Both survey waves included a large number of questions about tax household demographics, financial characteristics, tax refund usage, measures of income volatility and financial shocks, experiences of hardships, and financial behaviors. Both waves also included the 10-item CFPB Financial Well-Being Scale. Although the unit of observation in this study was a tax household (hereafter, household), demographic characteristics (e.g., age, gender) and self-assessed financial well-being correspond to those of a tax filer who completed tax filing on behalf of their household. Therefore, the measurement of financial well-being scores represents the level of subjective financial well-being for LMI survey respondents. For the current analysis, we restricted the sample to households that completed both survey waves (N = 3,911) with complete data (i.e., no missing survey data from either wave). These exclusions yielded a final analytical sample of 3,324 households.Footnote 3

Although we drew our sample from a population of online tax filers, all our analyses used weights generated from the Census Bureau’s 2017 American Community Survey (ACS), making our findings generalizable to the U.S. LMI population on observable characteristics.Footnote 4

Dependent Variable

The outcome of interest in this study was subjective financial well-being, which we defined as either (a) the change in subjective financial well-being between Wave 1 of the survey (i.e., at tax filing) and Wave 2 (i.e., 6-months after tax filing), or (b) subjective financial well-being observed at Wave 2. Therefore, our analysis examined short-term patterns in subjective financial well-being over a 6-month period. Both survey waves measured subjective financial well-being using the CFPB’s 10-item Financial Well-Being Scale, which asks respondents to react to the 10 statements outlined in Table 1, Panel A. To derive financial well-being scores from these questions, we followed the procedure specified in the CFPB’s technical report and applied a software-based scoring method that relies on item-response theory (CFPB, 2017a). Normalized financial well-being scores range between 14 and 95 points. The normalized financial well-being score represents survey respondents’ level of perceived financial well-being.

Independent Variables

The study’s independent variables can be considered as two groups. The first group represents demographic and financial characteristics measured at Wave 1, reflecting stable individual traits and capturing a snapshot of a household’s situation. These variables are described in detail in Table 1, Panels B and C. The demographic variables include respondent’s age, gender, race/ethnicity, relationship status, student status, educational attainment, housing status, self-rated health status, and the number of children in a household. The financial variables include respondent’s employment status, health insurance status, and budgeting behaviors; household income, access to emergency funds (i.e., whether the household can access $2,000 in an emergency), and household use of a credit-based alternative financial service provider (e.g., payday loans, title loans, pawn shops) in the prior 6 months. The final financial variable reflects household debt, including credit cards, educational loans, medical bills, or past-due bills in the past six months. Additional details provided in Table 1 include tax variables such as whether a household received a federal tax refund, the amount of the refund, and amount of taxes owed. Although these variables were not central to our analysis, we chose to include them because the Wave 1 survey was conducted at the time households filed taxes and the tax preparation process might have influenced the perceptions of their financial well-being.

The second set of variables, described in Panels D and E of Table 1, reflects households’ experience of financial shocks and hardships (i.e., material, medical, and financial hardships) measured in both waves of the survey. As compared with the first group of variables, variables in the second group represent household experiences and circumstances that not only tend to be more unstable and less predictable but also more likely to adversely affect subjective financial well-being. These variables measured financial shocks such as an unexpected income decline (including job loss or a reduction in pay); unexpected major home or appliance repair; unexpected major vehicle repair; unexpected major medical expense; or eviction, which we defined as someone in the household being forced to move by a landlord when they did not want to move (Panel D, Table 1). The hardships measured included whether households skipped rent or mortgage payments, essential bills, or medical care because they could not afford the payments; whether households overdrafted their bank account; experiences with credit, including credit rejections, receiving lower credit amounts than applied for, or not applying for credit for fear of being turned down; and whether households experienced food insecurity (Panel E, Table 1).

For every indicator of financial shock and hardship (with the exception of food insecurity), respondents were asked whether their households had experienced each of the given adverse financial events in the prior six monthsFootnote 5 (1 = yes, 0 = no). Food insecurity was measured using the U.S. Department of Agriculture’s (USDA) six-item food insecurity screener and reflected food inadequacy experienced over the previous 6 months. Scores from this screener were subsequently collapsed into a dummy variable capturing if the respondent gave a positive response to any food insecurity items in the screener (1 = yes, 0 = no). We based our use of these binary variables on several studies that have used variations of binary measures of financial shocks (e.g., Bartfeld & Collins, 2017; Despard, Grinstein-Weiss, et al., 2018; Despard, Guo, et al., 2018; Despard, Taylor, et al., 2018; McKernan et al., 2009), material and medical hardships (e.g., Despard et al., 2018; Despard, Guo, et al., 2018; Despard, Taylor, et al., 2018; Heflin, 2016; Heflin et al., 2009), financial hardship (BoGFRS, 2016), and food insecurity (e.g., Bartfeld & Collins, 2017; Chang et al., 2014; Heflin, 2016; Heflin et al., 2009).

Descriptive Statistics

Table 2a and b shows the weighted sample incidence of the explanatory variables (Column 1) and the mean financial well-being scores in each survey wave across these variables (Column 2). Table 2a focuses on demographic characteristics and Table 2b focuses on financial characteristics. The majority of our weighted sample was female, White, single, childless, and in good health. Roughly 20% of our sample was enrolled in school (either full- or part-time) and approximately another 20% had attained either a bachelor’s or graduate degree. A minority of respondents owned their homes, with 43% renting and 24% neither owning nor renting (e.g. living with family). The average age of our sample was 34 years. More than a third of the study sample was unemployed, more than half were traditionally-employed (either full- or part-time), and 8% reported some extent of self-employment. More than two-thirds made less than $30,000 in the prior year. Strong majorities of our sample had health insurance (88%), kept a budget (73%), and did not report using a credit-based alternative financial service such as payday loans (89%). In terms of liquidity access, 58% definitely or probably could access $2,000 in the event of an emergency. Two-thirds of our sample reported having credit card debt, 31% reported educational debt, 25% reported medical debt, and 20% reported past-due bills.

Analytical Approach

This study is descriptive in nature and presents findings in three stages that correspond to the three research objectives and hypotheses outlined above. In the first stage, we assessed the stability (or instability) of subjective financial well-being scores in our sample by examining the overall mean change in financial well-being scores between Wave 1 and Wave 2 and the distribution of changes. As part of this analysis, we also examined the extent to which stability or volatility observed in subjective financial well-being was associated with an individual’s initial level of subjective financial well-being. To do so, we categorized households based on the quartile of their Wave 1 financial well-being score and explored changes in individual financial well-being scores between Waves 1 and 2 within each initial financial well-being score quartile.

In the second stage of the study, we analyzed the extent to which relatively stable household demographic and financial characteristics measured at baseline predicted subsequent financial well-being scores observed over a 6-month period, using bivariate analysis and a series of lagged dependent variable ordinary least squares (OLS) regression models. These regressions take the following general form:

where the dependent variable, \(FWB\_2_{i}\) reflects the financial well-being scores of individual i at Wave 2 of the HFS, \(FWB\_2_{i}\) measures the individual’s lagged financial well-being scores at Wave 1 of the HFS, \(Demo_{i}\) is a vector of individual and household demographic characteristics measured at Wave 1, \(Fin_{i}\) is a vector of individual and household financial characteristics measured at Wave 1, and \(\varepsilon\) is the error term.Footnote 6 Demographic and financial predictors are described in Table 1 (Panels B and C, respectively).Footnote 7 In controlling for Wave 1 financial well-being scores when estimating Wave 2 financial well-being scores, the coefficients \(\delta\) and \(\gamma\) correspond to the marginal difference in Wave 2 subjective financial well- attributable to a given variable, holding other factors constant.

In the final stage, we studied the relationship between financial well-being scores and the experience of adverse financial events, including an array of financial shocks and material, medical, and financial hardships. We began by using bivariate analysis to explore changes in financial well-being scores for households that experienced shocks and hardships relative to households without such experiences. We then estimated a series of regression models to assess the extent to which financial shocks and hardships predicted Wave 2 subjective financial well-being. These lagged dependent variable regressions were of the following general form:

where \(Shock\_1_{i}\) and \(Shock\_2_{i}\) are vectors capturing the experience of financial shocks prior to Wave 1 and between Wave 1 and Wave 2, respectively. As described in Table 1 (Panel D), these financial shocks include the unplanned loss of a job or decline in income, car repair, home repair, medical expense, or eviction. The rest of the measures in Eq. 2 are identical to Eq. 1. For our assessment of the relationship between the experience of hardship and subjective financial well-being, the analysis proceeded identically to the estimation in Eq. 2, with a model of the following general form:

where \(Hard\_1_{i}\) and \(Hard\_2_{i}\) are vectors of hardships presented in Table 1 (Panel E), including skipping rent, skipping essential bills, skipping medical care (e.g., doctor’s visits, prescriptions, dental care), experiencing food insecurity, overdrawing an account, and experiencing credit denial. The rest of the measures in Eq. 3 are identical to those of Eq. 1.

Results

Short-Term Stability of Subjective Financial Well-Being

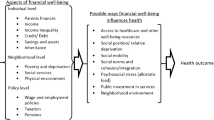

We began the analysis by exploring the extent to which an LMI individual’s perception of financial well-being changed in the short-run (Research Objective 1). Figure 1 shows the distribution of changes in scores of financial well-being across the two survey waves. For the full sample, we generally observed that financial well-being was extremely stable over the short-term. At the time of the Wave 1 survey, the average financial well-being score was 49.04 whereas at Wave 2 the average financial well-being score was 48.96; a mean difference of just -0.08 (SD 9.32). The distribution of changes in financial well-being scores followed an approximately normal distribution, albeit with differences in financial well-being scores clustering around 0.

Distribution of Short-Term Changes in Scores of Financial Well-Being (N = 3,324). The histogram shows the change in financial well-being scores between Wave 1 and Wave 2 of the survey. The bell-shaped curve represents a normal distribution whereas the thick vertical line indicates the mean change (–0.08, 9.32 SD)

Although these results demonstrate a high degree of stability in subjective financial well-being across the analytical sample, it is unclear whether this stability holds across the distribution of financial well-being scores; that is, whether respondents with lower or higher initial levels of financial well-being remain at those levels. Figure 2 illustrates the extent to which respondents’ initial financial well-being scores were associated with downstream changes in subjective financial well-being over the 6-months between the Wave 1 and Wave 2 surveys. Each panel in Fig. 2 shows the distribution of changes in financial well-being scores between survey waves for respondents in a given quartile of Wave 1 financial well-being scores, with the mean change indicated by a thick vertical line. Financial well-being scores for the first quartile of Wave 1 range from 14 to 41, the second quartile scores range from 42 to 51, the third quartile scores range from 52 to 60, and the fourth quartile scores range from 61 to 95. Although the financial well-being scores for the full sample were very stable between the survey waves, Fig. 2 shows respondents at the lowest and highest ends of the score distribution experienced considerable fluctuations in their short-term subjective financial well-being. Between Wave 1 and Wave 2, respondents in the first quartile experienced an average 4.76-point increase in financial well-being scores, whereas respondents in the fourth quartile experienced an average 5.03-point decrease in financial well-being scores. In comparison with the first and fourth quartile respondents, those in the second and third quartiles exhibited little volatility in their subjective financial well-being between Wave 1 and Wave 2.Footnote 8

The Distribution of Short-Term Changes in Financial Well-Being Scores, by Wave 1 Financial Well-Being Score Quartile (N = 3,324). The four histograms illustrate changes in financial well-being in our sample between Wave 1 and Wave 2 of the survey for households in each quartile of the financial well-being score distribution at Wave 1. The bell-shaped curve represents a normal distribution whereas the thick vertical line indicates the mean change in financial well-being scores for each quartile. SFWB = subjective financial well-being

Demographic and Financial Predictors of Subjective Financial Well-Being

Our second research objective focused on the ways in which different demographic and financial characteristics corresponded to short-term changes in subjective financial well-being. First, Table 2a and 2b presents the incidence of the household characteristics examined in this study (Column 1), the mean financial well-being scores in Wave 1 and Wave 2 for households with a given characteristic (Columns 2 and 3), and the difference in mean financial well-being scores between survey waves (Column 4). In Table 2a, Column 4 shows that financial well-being scores in Wave 1 and Wave 2 tended to be very stable across demographic characteristics; differences in financial well-being score across these characteristics never significantly differed from zero at the 5% significance threshold.

As shown in Table 2b, we found notable patterns in subjective financial well-being changes based on household financial characteristics. Households at Wave 1 that confirmed they definitely could access $2,000 in an emergency reported a decline in financial well-being of 1.81 points (p < 0.01) at Wave 2. In contrast, households that indicated at Wave 1 that they probably or definitely could not access $2,000 in an emergency reported directionally higher financial well-being levels at Wave 2. At the same time, households that reported having medical debt and past-due bills at Wave 1 subsequently reported increased financial well-being scores of 2.24 points (p < 0.05) for those with medical debt and 1.69 points (p < 0.05) for those with past-due bills. Last, among households that did not have medical debt at Wave 1, we observed a 0.85 point (p < 0.05) decrease in their financial well-being scores.

Next, Table 3 presents the results of multiple regression analyses exploring the extent to which household demographic and financial characteristics predicted financial well-being scores at Wave 2, as outlined in Eq. 1. The regression estimates in Model 1 controlled for baseline financial well-being scores only. Model 2 examined the relationship between household demographic characteristics at Wave 1 and financial well-being scores at Wave 2, whereas Model 3 examined the relationship between financial characteristics at Wave 1 and financial well-being scores at Wave 2. Last, Model 4 examined the relationship between all demographic and financial variables of interest and financial well-being at Wave 2. We highlight results that were significantly different at the 5% level.

As in the bivariate analysis, demographic and financial characteristics measured at baseline were typically not predictive of subsequent financial well-being scores. The incorporation of each set of variables into the regression models did not notably increase the explanatory power of the regression models beyond simply controlling for financial well-being scores at Wave 1, as in Model 1. At the same time, we found notable patterns in the relationships between the modeled characteristics and financial well-being scores at Wave 2. Focusing on Model 4, which included the full set of demographic and financial variables, when we compared financial well-being scores at Wave 2 of those with some college experience and the scores of those with a high school degree, we found significantly lower financial well-being scores among respondents with some college experience (–1.42; p < 0.05). Relative to White respondents, Hispanic respondents reported significantly lower Wave 2 financial well-being scores (–2.20; p < 0.01). Respondents with higher household incomes in our LMI sample reported higher Wave 2 financial well-being scores compared with respondents with very low incomes (2.23; p < 0.05). In addition, respondents in part-time employment tended to have higher financial well-being scores at Wave 2 than respondents who were unemployed (1.86; p < 0.05). Last, respondents who reported using credit-based alternative financial services at Wave 1 experienced significantly lower levels of subjective financial well-being at Wave 2 as compared with respondents who did not use credit-based alternative financial services (–2.78; p < 0.01).

Experience of Shocks and Hardships and Subjective Financial Well-Being

The third research objective sought to determine the extent to which certain time-varying adverse household experiences (e.g., negative financial shocks or hardships) were related to changes in subjective financial well-being. To accomplish this objective, we first descriptively examined the subjective financial well-being of respondents who did or did not experience a given financial shock or hardship between Wave 1 and Wave 2 of the survey (Table 4). As shown in Table 4, Column 1, our first observation was that over the short-term, financial shocks and hardships (excluding eviction) were relatively common experiences among in our sample. In the 6 months between survey waves, only 1.2% of respondents were evicted, whereas the prevalence of all other shocks ranged between 12.1% (unexpected medical expenses) and 30% (car repairs). The experience of hardships was more common than shocks, with the prevalence of hardship experiences ranging between 11.3% (skipped rent or mortgage payment) and 43.8% (experienced any food insecurity).

Both waves exhibited interesting patterns in the relationship between the experience of adverse financial events and subjective financial well-being. As illustrated in Table 4, we examined these relationships in two ways. First, we conducted a cross-sectional analysis comparing the subjective financial well-being of respondents who had experienced a shock or hardship at Wave 2 with the sense of well-being among respondents who did not experience financial shock or hardships. Second, we examined the relationship by comparing the Wave 1 and Wave 2 subjective financial well-being scores for those did or did not experience a Wave 2 shock. In the cross-sectional analysis, as compared with respondents who had not experienced a shock or hardship, those who reported experiencing a shock or hardship at Wave 2 also reported significantly lower levels of subjective financial well-being at both Waves 1 and 2 of the survey (Table 4, Columns 2 and 3; all relationships significant at the 1% level or higher). We found the shocks of eviction and income declines were the strongest predictors of subjective financial well-being levels whereas skipping housing payments was the hardship most strongly associated with lower levels of subjective financial well-being. Moreover, as compared with all financial shocks, we found all the hardships measured in this study were uniformly and more strongly associated with lower levels of subjective financial well-being. However, when comparing the changes in subjective financial well-being between Wave 1 and Wave 2 (conditioned on the experience of a shock or hardship; see Column 4), we found a high degree of stability between survey waves. The between-waves change in financial well-being scores for all groups ranged between -0.93 for income decline and 1.28 for eviction; all of these changes were non-significant at the 5% level.

Notably, we observed shocks and hardships were strongly correlated with lower levels of financial well-being (in each survey wave) whereas no correlation was observed with the declines in subjective financial well-being that occurred between survey waves. One possible explanation for this observation might be that respondents who were more likely to experience shocks or hardships were also more likely to report lower levels of subjective financial well-being. However, it is also possible that respondents who experienced a shock or hardship between survey waves were also more likely to have experienced adverse financial events in the past, and thus already had lowered subjective financial well-being before participating in our survey. To explore the extent to which prior experience of adverse financial events (i.e. shocks, hardships) governed the relationship between shocks and subjective financial well-being at Wave 2, Tables 5 and 6 present a series of OLS regression models (corresponding to Eqs. 2 and 3) that incorporated control variables in an iterative fashion.Footnote 9 We highlight findings significant at the 5% level.

Model 1 in Table 5 shows the results of an OLS regression that included only indicators for the experience of financial shocks between survey Wave 1 and Wave 2. Unsurprisingly, given the strong relationships between the experience of shocks and lower levels of subjective financial well-being observed in Table 4, the experience of each shock was significantly predictive of lower levels of subjective financial well-being. Coefficient estimates in this model ranged from –3.51 (p < 0.05) for an unexpected home repair expense to –7.82 (p < 0.001) for an unexpected drop in income. However, when we incorporated a respondent’s baseline level of financial well-being in Model 2, all coefficient estimates attenuated substantially and the relationships between several financial shocks and financial well-being scores became insignificant; the only coefficients to remain significant were for an unexpected income drop (–2.16; p < 0.05) and an unexpected medical expense (–2.88; p < 0.001).

Indeed, adding more covariates appears to have a minimal impact on the relationship between Wave 2 shocks and Wave 2 financial well-being scores, after controlling for Wave 1 financial well-being scores. With two exceptions, we did not find notable changes in the coefficients on the financial shocks when we incorporated controls for the Wave 1 experience of financial shocks, baseline demographic characteristics, and baseline financial characteristics (Models 3, 4, and 5, respectively). The first exception was the coefficient on experiencing an unexpected home repair, which became more significant with the inclusion of demographic and financial controls. The second exception was that the coefficient on experiencing an unexpected medical expense lost significance.

The relationship between the experience of hardships between survey waves and financial well-being scores (Table 6) exhibited similar patterns to the relationship between shocks and subjective financial well-being at Wave 2. In Model 1, all modeled hardships, with the exception of a bank account over draft, were significantly related to Wave 2 financial well-being at the 5% level. When we controlled for the baseline level of subjective financial well-being in Model 2, the coefficients on all modeled hardships attenuated and the coefficient on skipping medical care became statistically insignificant. The coefficients on most hardships retained their magnitude and significance when we controlled for the Wave 1 experience of hardship in Model 3, demographic characteristics in Model 4, and financial characteristics in Model 5. The four coefficients that were found to be negative and strongly significant included: (a) the experience of skipping bills, (b) skipping medical care, (c) being rejected for credit, and (d) experiencing food insecurity. Specific to Model 5, the coefficient for skipped bills was –2.92 (p < 0.01), skipped medical care was –2.50 (p < 0.01), being rejected for credit was –2.61 (p < 0.01), and experiencing food insecurity was –3.46 (p < 0.001).Footnote 10

Discussion

To date, few longitudinal studies have examined the patterns of short-term stability in subjective financial well-being. To address this gap, our study used a two-wave longitudinal survey of LMI tax filers to assess the stability of subjective financial well-being over a 6-month period, the key predictors of subjective financial well-being over this period, and the sensitivity of subjective financial well-being to the adverse changes in financial circumstances. The most basic finding in this paper—that, on average, subjective financial well-being was very stable in the short-term—is also one of the most important. Financial well-being in our sample at Wave 1 of the survey was 49.04 and fell slightly to 48.96 at Wave 2; a statistically non-significant difference of –0.08 points. Subjective financial well-being can be relatively unstable for individuals at the high and low ends of the distribution curve of financial well-being score, which might be explained by a regression to the mean of financial well-being scores or a sensitivity to positive or negative events at the extremes of the distribution. However, the change in subjective financial well-being for study respondents in the middle quartiles was flat. This stability confirms Hypothesis 1 and speaks to the reliability of financial well-being as a construct because we would not expect that the average respondent in our sample would experience a large shift in financial well-being in a 6-month period in a relatively stable economic environment. This finding also aligns with conclusions from other studies on general subjective well-being and subjective financial well-being on the short-term stability of subjective well-being measures (e.g., Burke & Perez-Arce, 2019; Chamberlain & Zika, 1992; Eid & Diener, 2004).

In support of Hypothesis 2, in both our bivariate or OLS regression analyses after controlling for prior levels of subjective financial well-being, we observed relatively stable demographic and financial indicators were not strong predictors of subsequent levels of subjective financial well-being. We found some exceptions existed, including identifying as Hispanic, having some college education without a degree, using credit-based AFS in the prior 6 months, and having part-time employment status; however, the magnitudes of these associations were not large. Similar results were observed in Burke and Perez-Arce (2019), who found little association between relatively stable financial characteristics and changes in subjective financial well-being. However, Plagnol (2011), who looked at a longer time frame and employed fixed effects regression models, demonstrated a stronger association between financial satisfaction and some demographic and financial factors.

Last, our analysis reveals consistent negative relationships between certain adverse financial experiences and subjective financial well-being. Although the magnitudes of the coefficients were not large, several financial shocks and hardships were significantly associated with declines in subjective financial well-being, including the experience of unexpected income drops, unexpected home repairs, food insecurity, credit rejection, skipped medical care, and skipped essential bills. By contrast, the experience of eviction, unexpected car repairs, unexpected medical expenses, skipped rent or mortgage, and overdrafting an account were not associated with significant subjective financial well-being declines in the regression framework. As such, we found only partial confirmation of Hypothesis 3, in which we predicted that adverse shocks and hardships would generally be significantly associated with decreases in financial well-being scores.

Although our analysis considered a substantially more expansive array of financial shocks and hardships than many other studies, our findings are generally in line with existing research that has observed precipitous declines in general well-being immediately after individuals experience shocks such as unemployment (Winkelmann, 2014). Our findings also align with those of earlier research showing the negative effects of financial shocks on general well-being can linger for extended periods (Luhmann et al., 2012). Similarly, research that also used the CFPB’s Financial Well-Being Scale found job loss (Burke & Perez-Arce, 2019) and income shocks (Grinstein-Weiss & Bufe, 2019) were related to substantial reductions in the sense of financial well-being in the short run.

Our research findings on the relative stability of subjective financial well-being have important implications for research and practice. In particular, after accounting for the prior level of subjective financial well-being, the stability of subjective financial well-being across relatively stable demographic and financial indicators provides evidence that this measure of subjective financial well-being is measuring a fundamental aspect of an individual’s holistic financial outlook rather than a volatile aspect. This finding speaks to the fact that individual personality characteristics can be important predictors of subjective well-being (e.g., DeNeve & Cooper, 1998; Diener et al., 2003; Gomez et al., 2009). It might also be that low-income individuals who are more prone to experiencing these adverse events might have already factored the eventuality of shocks and hardships when assessing their financial well-being and have developed a sense of resiliency or resignation to negative shocks. Indeed, some research indicates that the sense of resilience can differ across various demographic and economic groups; for example, as compared with Whites with low income, African Americans with low income tend to report higher levels of resilience to large-scale health crises (Graham et al., 2020). Alternately, it is possible that low-income individuals deferred the emotional consequences of adverse financial events beyond our 6-month observation window. For example, it would likely take many months for skipped housing payments to result in an eviction or foreclosure and unexpected medical expenses might not have to be paid immediately. Although the negative effects of these shocks on subjective financial well-being might be felt later on, this explanation cannot fully account for the effects of income declines and food insecurity that are typically experienced immediately such as service shut-offs, reduced buying power, and hunger. All this suggests that researchers seeking to appropriately measure an individual’s subjective financial well-being should complement the use of holistic subjective financial well-being measures with other indicators of financial security, including measures sensitive to individuals’ day-to-day financial circumstances and financial worries as well as objective indicators such as income and assets.

This research provides key implications for the use of the CFPB’s Financial Well-Being Scale in program and policy evaluation. Although the short-term stability of subjective financial well-being in our sample might speak to the reliability of the construct, the coefficient estimates on the relationships between shocks and hardships and subsequent financial well-being (after accounting for the prior level of subjective financial well-being) likely point to a limitation of the scale for use in program and policy evaluation. In our full regression models, the largest significant coefficient on any shock or hardship was –3.46 for the experience of food insecurity. This is roughly 0.37 standard deviations of the change in subjective financial well-being between waves. Other adverse financial events such as a substantial income decline or skipping essential medical care were associated with smaller declines of subjective financial well-being. Given that these major financial events were not strongly associated with changes in subjective financial well-being (at least in the short-term), providing financial assistance through programs or policies that offer financial education, small emergency cash grants, matched savings, modest tax credits, and other forms of assistance might not be sufficient to substantially boost subjective financial well-being over the short-term. As such, using the Financial Well-Being Scale to assess the effects of certain policies and programs may obscure some of the more direct impacts of these policies and programs on household financial security. Therefore, a better assessment of policy and program impact might require using the Financial Well-Being Scale in combination with other measures of well-being and objective economic and financial indicators.

Although this study makes important contributions to understanding the dynamics of subjective financial well-being in the LMI population, it also has limitations that must be considered when interpreting the study findings. First, as a descriptive analysis that estimates the association between household characteristics and adverse experiences with subsequent changes in financial well-being, we cannot assign causation to any of the effects we observe in this study. Second, rather than a sample drawn from the general U.S. population, our sample was drawn from a population of LMI tax filers who used an online tax-filing platform, which limits the generalizability of our findings. Specifically, online tax filers might not be representative of the broad population of LMI households on observed characteristics (e.g., education, number of dependents) and unobserved factors (e.g., tech-savviness). Similarly, as suggested in Table 7 (see Appendix), our sample might have had some non-random attrition across survey waves (e.g., those in the analytical sample had more formal education than those who did not participate in the second survey wave). To address these external validity concerns, we used survey weights based on the Census Bureau’s 2017 ACS to make our findings generalizable to the U.S. LMI population on observable characteristics. As shown in Table 8, the resulting weighted analytical sample resembled the U.S. LMI population sample on many observed characteristics, thus helping us improve the generalizability of our results.

Nevertheless, the sample composition has implications of for our results. For example, a sizeable proportion of our sample was unemployed (34%), students (19%), and/or making $30,000 a year or less (72%). Though other research on similar LMI samples has found the overall financial well-being scores for low-income households were not dramatically lower than those of the general population (Dedmond et al., 2019; Sun et al., 2018), it is unclear how patterns of subjective financial well-being might differ over time between LMI and general population groups. For example, despite having low incomes, students might have high, stable levels of financial well-being because they expect higher earnings in the future. By contrast, persistently poor households might have their sense of financial well-being shaped by years of low income and financial insecurity; as such, their next adverse financial experience might be less harmful to their financial well-being. On the contrary, higher-income households with less experience or less expectation of adverse events might be more sensitive to shocks or hardships. As more robust time series data on general population samples become available, future research should explore these dynamics of financial well-being.

Another study limitation stems from having only two survey waves over 6 months, which is a relatively short timeframe. Although this period allowed us to determine the extent of stability in financial well-being in an intrayear period, a longer observation period or additional survey waves would have enabled us not only to investigate the ramifications adverse financial events for financial well-being over the longer-term but also to better understand stability of financial well-being and its trajectories for different populations. On the other hand, some might consider a 6-month period too long because it could capture some extent of adaptation to new financial circumstances. However, a 6-month timeframe is common in the evaluation of policies and programs that seek to improve financial well-being. For example, many similar initiatives have relied on measuring outcomes at 6-months post-implementation, including evaluations of financial coaching (Theodos et al., 2018), retirement savings interventions (Duflo & Saez, 2003), tax refund savings interventions (Beverly et al., 2006), and child savings account programs (Grinstein-Weiss et al., 2019). Indeed, the average length of time between program implementation and outcome measurement in financial literacy education programs—one of the most prevalent types of programs targeting financial outcomes in LMI households—is less than a year (Fernandes et al., 2014). Reliance on these timeframes indicates that understanding short-term dynamics in the indicators of subjective financial well-being is particularly important in understanding how programs can impact the desired outcomes.

The last study limitation is that we measured only a subset of the shocks and hardships a household might face. Although our measures of these experiences were comprehensive and intersected with income, expenses, health, food, credit, and housing concerns, other negative financial events could occur and have important implications for subjective financial well-being. Relatedly, as shown in Table 9, some of the measured events were strongly correlated with each other and they might not have captured entirely separate financial events. Future research should focus on disentangling the relationship between separate financial events and subjective financial well-being.

Despite these limitations, this work provides important evidence on the dynamics of LMI individuals’ sense of subjective financial well-being over the short-term. While future research should continue to explore how subjective financial well-being changes over longer time horizons and within more general samples, our work offers a unique perspective for researchers, practitioners, and policymakers interested in understanding the impact of policies and programs on LMI participants’ subjective financial well-being in the months following policy and program implementation.

Notes

The goal of developing the CFPB’s Financial Well-Being Scale was to provide a more accurate measure of subjective financial well-being. The scale was developed using large samples of survey respondents and applying rigorous statistical methods such as item response theory techniques. In addition, the CFPB validated the scale against other similar concepts (e.g., financial satisfaction). For more details on scale development and validation, see https://files.consumerfinance.gov/f/documents/201705_cfpb_financial-well-being-scale-technical-report.pdf

The response rate between the waves was 31%. In the Appendix, Table 7 compares characteristics of respondents who dropped out after Wave 1 with respondents who completed both survey waves (i.e., those who constitute our analytical sample). The comparison of weighted samples suggests attrited and non-attrited individuals were similar on observable characteristics.

We restricted the 2017 ACS sample to adults with incomes at 200% of the federal poverty line (FPL) or lower, and developed inverse probability weights based on the respondents’ age, age squared, education, student status, gender, race/ethnicity, and the presence of children in the household. For more details on this weighting process, see Solon et al. (2015). Table 8 (see Appendix) compares the observable characteristics of our sample with those of adult respondents to the 2017 ACS whose incomes did not exceed 200% of the FPL. The comparison shows our weighted sample was quite similar to the population of U.S. adults who are at or below 200% of the FPL.

The one exception to this is the question on eviction, which we ask over the prior 12 months at Wave 1 and over the prior 6 months at Wave 2.

We also estimated these models including controls for state of residence and the date of survey completion. These state and date controls did not appreciably change our estimates.

In the models with financial characteristics, we include the tax-related variables highlighted in Table 1, including whether a household received a refund, the amount of the refund received, and the amount of taxes owed. Because these variables were not central to our analysis, they are not included in the results presented here; however, estimates for these variables are available upon request.

Regressing the Wave 1 financial well-being quartile on the change in financial well-being scores confirms these results. The change in financial well-being scores for the first and fourth quartiles, respectively, was significantly different from the change in all other quartiles, whereas change in financial well-being scores for those in the second quartile did not differ significantly from the change for those in the third quartile (and vice versa).

To appropriately estimate the relationships between shocks and hardships and financial well-being, our models require sufficient intraperson variation in the experience of these shocks and hardships across the two survey waves. Our analysis shows that the proportion of households that either experienced a shock in Wave 2 but not in Wave 1 or experienced a shock in Wave 1 but not in Wave 2 ranged from a low of 3.5% for evictions (n = 115) to a high of 27.5% for auto repairs (n = 924). The proportion of households that either experience a hardship in Wave 2 but not in Wave 1 or vice versa ranges from a low of 8.8% for skipped rent payments (n = 293) to a high of 19.2% for skipping any medical care (n = 638). These results indicate that the amount of intraperson variation in the experience of shocks and hardships in our sample is sufficient to estimate the relationships between these adverse events and financial well-being scores.

Each of the regression models in the main analysis control for the baseline level of subjective financial well-being. This approach enables us to estimate the average subjective financial well-being at Wave 2 across a variety of household characteristics, independent of initial subjective financial well-being levels. As a robustness check, we re-estimated the full OLS models in our main analysis using first differences regression models that did not control for baseline subjective financial well-being. In these models, the dependent variable was the difference between Wave 2 and Wave 1 financial well-being scores, and all household characteristics, shocks, and hardships were measured as in the main analysis. Generally, this estimation strategy did not notably change the results from the main analysis. The vast majority of household characteristics remained unassociated with significant changes in subjective financial well-being, and the relationships between adverse financial events and financial well-being scores exhibited similar coefficient patterns, though the relationships were slightly more attenuated than those in the main analysis. This finding speaks to the validity of using models that control for baseline subjective financial well-being, as in the main analysis, to estimate the relationship between household and individual characteristics and downstream subjective financial well-being. The results from the first differences estimation are available upon request.

References

Abbi, S. (2012). A need for product innovations to help LMI consumers manage financial emergencies. Doorway to Dreams Fund. Retrieved February 28, 2021, from https://buildcommonwealth.org/assets/downloads/ANeedforProductionInnovation_Jan12.pdf

Aboagye, J., & Jung, J. Y. (2018). Debt holding, financial behavior, and financial satisfaction. Journal of Financial Counseling and Planning, 29(2), 208–218. https://doi.org/10.1891/1052-3073.29.2.208.

Ahn, N., García, J. R., & Jimeno, J. F. (2004). The impact of unemployment on individual well-being in the EU (European Network of Economic Policy Research Insitutes, Working Paper 29). Retrieved March 3, 2021, from https://www.ceps.eu/ceps-publications/impact-unemployment-individual-well-being-eu/

Bardo, A. R. (2017). A life course model for a domains-of-life approach to happiness: Evidence from the United States. Advances in Life Course Research, 33, 11–22. https://doi.org/10.1016/j.alcr.2017.06.002.

Bartfeld, J., & Collins, J. M. (2017). Food insecurity, financial shocks, and financial coping strategies among households with elementary school children in Wisconsin. Journal of Consumer Affairs, 51(3), 519–548. https://doi.org/10.1111/joca.12162.

Bell, D. N. F., & Blanchflower, D. G. (2010). UK unemployment in the Great Recession. National Institute Economic Review, 214(1), R3–R25. https://doi.org/10.1177/0027950110389755.