Abstract

Financial education sans opportunities for hands-on experience and knowledge operationalization may be insufficient for promoting healthy financial behaviors. Financial capability combines financial education with financial inclusion via a savings account, thereby giving an opportunity translate knowledge into practice. This study used data from the 2012 National Financial Capability Study to examine relationships between the financial capability and financial behaviors of United States Millennials (N = 6865). Compared to their financially excluded peers, Millennials who were financially capable were 176 % more likely to afford unexpected expenses, 224 % more likely to save for emergencies, 21 % less likely to use alternative financial services, and 30 % less likely to carry burdensome debt. Interventions that focus solely on financial education or inclusion may be insufficient for facilitating Millennials’ healthy financial behaviors; interventions should instead develop financial capability.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Young adulthood is a period of the life course commonly characterized by financial fragility. Today’s young adults, referred to as Millennials born between the early 1980s and 2000s (Taylor et al. 2014), earn the lowest incomes of their careers while making financial decisions about attending postsecondary education, living independently from families of origin, finding employment, repaying educational debt, purchasing a home, and saving for retirement (Bell et al. 2007; Hall and Willoughby 2015; Mishel et al. 2012). These decisions require a level of financial knowledge and access to financial products with which Millennials may have limited experience (Lusardi et al. 2010), particularly given their early stage in the life course. Thus, it is unsurprising that Millennials struggle with these decisions and in some cases resort to high-stakes financial behaviors like lacking emergency savings and using alternative financial services (e.g., payday and tax refund lenders). For example, over one-third of Millennials reported high-cost borrowing from alternative financial service providers and almost one-third lacked emergency savings (de Basa Scheresberg 2013). The average Millennial has about $1000Footnote 1 in savings (Friedline and Song 2013), suggesting that many may not be able to afford on their own costly and unexpected expenses like a medical emergency or car repair. The inability to afford unexpected expenses has been defined by Lusardi et al. (2011) as financial fragility. Debt burdens may further constrain their finances. About 85 % of Millennials hold some type of debt and their average debt is $60,000 (Hodson and Dwyer 2014), with the most common debts stemming from credit cards, auto loans, and installment loans (Chiteji 2007). Millennials’ engagement in such high-stakes financial behaviors may have implications for their abilities to achieve financial stability and to accumulate wealth for years to come.

Teaching financial education has been the primary intervention for helping generations of young adults (and the population generally) to become financially knowledgeable so that they can avoid high-stakes financial behaviors (Council for Economic Education 2014; Lusardi and Mitchell 2014). Financial education refers to the passing on of financial knowledge that takes place either individually or in groups through workshops, seminars, trainings, and counseling and planning sessions (Council for Economic Education 2014). From this perspective, high-stakes financial behaviors and financial fragility can be avoided if individuals gain sufficient knowledge. In other words, knowledge is power (Angulo-Ruiz and Pergelova 2015; Garbinsky et al. 2014) and Millennials make healthier financial decisions when they are better educated.

However, financial education in and of itself may be insufficient for shaping financial behaviors, particularly for Millennials who are making these decisions during a volatile macroeconomic era that has limited their options and further complicated their decision-making. Emerging evidence on the effectiveness of financial education suggests that any measureable effects on behaviors may be the result of how information is presented and what individuals believe about that information, rather than the actual content (Bernheim 2014). Any positive effects of this education on financial behaviors are negligible and disintegrate over time (Fernandes et al. 2014). Moreover, during and after the Great Recession, from approximately 2008 to 2011, Millennials entered a labor market with limited opportunities (Rubin 2014), saw higher unemployment rates than the rest of the population (Mishel et al. 2012), experienced greater losses in wealth compared to previous generations (Taylor et al. 2011), and delayed making investments in home ownership (Fry 2013). They also saw mainstream financial institutions take much of the blame for inciting one of the worst economic recessions in recent history as a result of irresponsible lending practices (Mian and Sufi 2014), potentially fostering Millennials’ distrust in mainstream banks and credit unions (Afandi and Habibov 2013). In other words, Millennials make healthier financial decisions when their macroeconomic conditions and institutional arrangements are more favorable.

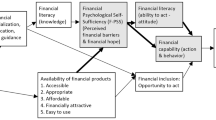

In order to generate better financial decision-making that produces measurable effects on financial behaviors, researchers recommend pairing financial knowledge with financial inclusionFootnote 2 (Sherraden 2013). This pairing means teaching financial education and shaping institutional arrangements by opening savings accounts and or similar financial products that provide opportunities for experiential learning. The combination of financial education and financial inclusion is the definition of financial capability (Sherraden 2013). From this perspective, people behave in optimally financial ways when they have both the knowledge and opportunity to act (Sherraden 2013). Here, financial education is considered insufficient for helping Millennials make good financial choices without also providing them with opportunities to do so via financial inclusion; they need institutional arrangements that provide them with opportunities to operationalize their knowledge. Millennials who receive financial education and financial inclusion via a savings account or other financial product may demonstrate healthier financial behaviors compared to being either financially educated or financially included alone. Millennials with neither financial education nor inclusion are essentially considered to be financially excluded—having neither the knowledge to make informed financial decisions nor the opportunities to do so. Research is needed to determine whether Millennials’ financial capability is associated with their healthy financial behaviors at a time in the life course when these behaviors are essential. Interventions that combine financial education with financial inclusion may be validated if empirical research confirms the existence of the relationship between financial capability and healthy financial behaviors.

This paper asks whether being financially capable—the combination of financial education and financial inclusion via a savings account—is associated with significantly healthier financial behaviors compared to being financially included (having a savings account only), being financially educated (having received financial education only), or being financial excluded (neither having a savings account nor having received financial education) among US Millennials? Five financial behaviors are examined that together are believed to provide an overall picture of Millennials’ financial health and range from emergency savings, debt burden, and financial satisfaction (Emmons and Noeth 2014; Lusardi et al. 2010). Alternative definitions for financial capability and their relationships to Millennials’ financial behaviors are also tested in order to refine how financial capability is operationalized and to drive theoretical development (Taylor 2011). That is, Millennials might be financially capability when they have a checking account or credit card, suggesting that financial capability can be operationalized in other ways aside from having received formal financial education or from being financially included by having a savings account. This paper builds on existing literature and leverages a relevant dataset—the 2012 National Financial Capability Study (NFCS)—to evaluate the potential effects of financial capability for US Millennials who ranged in age from 18 to 34. The paper begins with a brief literature review on financial capability and its relationship to financial behaviors, followed by a presentation of the methods and results. The paper concludes by discussing the findings and considerations for policy.

Literature Review: Is Financial Capability Associated with Better Financial Behavior?

Research has begun to test the relationship between financial capability and financial behaviors, most of which evaluates behaviors like saving and accumulating assets. Much of this research has come from savings programs that typically require financial education and automatically open savings accounts for participants, incentivizing accounts with initial deposits or matches on any additional monies deposited (Schreiner and Sherraden 2007). For example, financial capability has been found to relate to participants’ total savings accumulation in a program that opened tax-benefitted accounts with initial deposits and match incentives and simultaneously required participation in financial education (Mason et al. 2010). In another savings program, up to 10 h of financial education have been associated with participants’ greater savings accumulation (Schreiner and Sherraden 2007). International evidence has suggested that the combination of financial education and inclusion via a savings account was not necessary for improving knowledge and behavior (Jamison et al. 2014); instead, similar outcomes could have been achieved by replacing education with inclusion or vice versa. Qualitative studies with participants in savings programs have found that the combination of financial education and savings accounts helped with the development of healthier financial behaviors like forming a saving habit and accumulating savings (Scanlon et al. 2009; Sherraden and McBride 2010; Wheeler-Brooks and Scanlon 2009); although, it is unclear whether participants’ positive perceptions of their behaviors have been directly attributable to the simultaneous offering of financial education and savings accounts (Sherraden 2013). Despite emerging evidence for a relationship between financial capability and financial behaviors, the majority of research has explored the independent effects of having received financial education or owning a savings account—that is, separately measuring the effects of being financially educated or financially included. The following research reviews these independent effects.

Financial Education

Financial education that is delivered through workshops, seminars, trainings, and counseling and planning sessions has encompassed a range of efforts, including financial education in public school curriculum and in workplace counseling (Bernheim and Garrett 2003; Bernheim et al. 2001; Totenhagen et al. 2014; Urban et al. 2015). The evidence has been mixed regarding the effects of financial education on financial behaviors, independent of opportunities for experiential learning (Fox et al. 2005; Xiao et al. 2014). Surveys involving nationally representative samples of young adults have indicated that financial knowledge scores remained relatively stable over the last 10 years despite growing state and national efforts to incorporate financial education into public school curriculum (Mandell 2008). This suggests that little progress has been made in improving young adults’ financial knowledge via financial education—Millennials may be no better off in terms of their financial knowledge or, at the very least, these efforts have not yet been descriptively reflected in annual scores on these surveys. Taking an instrumental variable approach to evaluate the effects of state financial education mandates, one study has found that those who grew up in states with mandated financial education in high school exhibited healthier saving behaviors in adulthood than those who grew up in states without such a mandate (Bernheim et al. 2001). Similarly, young adults have reported better credit scores and lower delinquency rates when they lived in states whose mandated high school financial education followed standardized and required curriculum (Urban et al. 2015). Though, an analysis exploiting several nationally representative, longitudinal datasets has found no significant effect of state mandates on credit scores, credit card delinquency, bankruptcy, or foreclosure (Cole et al. 2014); instead, math proficiency was a determinant of these financial behaviors. A recent meta-analysis of 201 studies that employed and tested financial education has suggested that any positive effects on financial behaviors were negligible and disintegrated over time (Fernandes et al. 2014); however, the authors have contended that “just-in-time” financial education—education delivered immediately preceding or concurrently with a related and specific financial decision or behavior—proved worthy of investigation. The recommendation for “just-in-time” education that is tied to financial decisions or behaviors substantiates financial capability, where young adults have opportunities to act on the knowledge they have learned.

Financial Inclusion

A savings account is one example of a financial product that provides opportunities to act on financial knowledge and is often an indicator of financial inclusion; that is, whether or not institutional arrangements provide young adults with access to mainstream financial products and services (FDIC Federal Deposit Insurance Corporation 2014). Savings accounts can be held at mainstream financial institutions or opened within the context of savings programs where participants receive incentives and supports to save (Friedline and Elliott 2013; Mason et al. 2010; Schreiner and Sherraden 2007). Research has consistently found significant relationships between bank or savings accounts and healthy financial behaviors, particularly with saving and asset accumulation (Friedline et al. 2014; Friedline and Rauktis 2014; Grinstein-Weiss et al. 2013; Schreiner and Sherraden 2007; Wiedrich et al. 2014). Research from a randomized evaluation of a savings program sans financial education has found that participants who received accounts accumulated significantly more savings compared to those who did not receive accounts (Nam et al. 2013). Outside the context of savings programs, research using data from the NFCS has found that there was an increased likelihood of using alternative financial services when individuals did not have a savings or bank account (Birkenmaier and Fu 2015). Other research has found that young adults were more likely to maintain relationships with mainstream banking institutions, accumulate savings, and diversify their asset portfolios when they had savings accounts in mainstream financial institutions earlier in life compared to those who did not have accounts (Friedline and Elliott 2013; Friedline et al. 2011, 2014; Friedline and Song 2013). This same research found that a savings account almost always preceded or coincided with the acquisition of other financial products like checking accounts and certificates of deposit, suggesting that a savings account is a good proxy for financial inclusion. While savings accounts at mainstream financial institutions may not necessarily be accessible or affordable to young adults given average initial deposits of $25 or $50, minimum balance requirements of $300, and monthly service and withdrawal limit fees ranging from $1 to $15 (Friedline 2013), ownership of these accounts has appeared to be associated with healthy financial behaviors. From this perspective, being financially included may contribute to healthy financial behavior.

The Roles of Individuals and Institutions within Financial Capability

Financial capability goes beyond explaining Millennials’ financial behaviors—and their subsequent financial states of fragility or stability—as purely the result of individual decision making or being better educated. Sherraden (2013) wrote, “…financial capability does not reside solely within the individual. Instead, it captures a relationship between individuals and their social reality; financial capability depends on what is possible for people living in a particular society” (p. 4). From this perspective, the institutional arrangements under which Millennials operate shape their financial capability and their behaviors. Part of shaping Millennials’ financial capability and behaviors, then, includes shaping their institutional arrangements.

Take for example the Millennial who was raised in a family that did not own a savings account nor discuss finances, simultaneously growing up in a community with scant access to mainstream financial institutions like banks or credit unions. Similarly, consider the Millennial who came of age during an economic recession that questioned the sovereignty and legitimacy of mainstream financial institutions for achieving his/her desired financial outcomes (Mills and Monson 2013; Owens and Cook 2013). These institutional arrangements undoubtedly play roles in the financial capability and behaviors exhibited in young adulthood (Grinstein-Weiss et al. 2011). In fact, despite theoretical support for the importance of financial knowledge transmission within the family (Gudmunson and Danes 2011; John 1999; Kim et al. 2011; Shim et al. 2010), the family remains an inadequate institution for transferring financial capability to subsequent generations because families are so unequally capacitated in terms of their own knowledge and opportunities (Friedline and Rauktis 2014). Likewise, communities without geographic access to mainstream banks and credit unions (and even other, basic institutions like quality public education, health care, or public transportation)—or an economic recession that engenders distrust of mainstream banks and credit unions—may lack the institutional arrangements to provide Millennials with opportunities for healthy financial behaviors (Friedline and Rauktis 2014). Even still, mainstream financial institutions whose financial products are not affordable and easily accessible due to hidden or high initial deposits, minimum balances, and maintenance fees may discourage Millennials from owning savings accounts in these institutions (Chan 2011).

Simply educating Millennials about the potential pitfalls of using alternative financial services does little good if they do not have any other financial products to use instead, they do not qualify for opening financial products like savings accounts at mainstream banks or credit unions (perhaps due to inadequate funds to afford minimum balances or poor credit histories), they do not have geographic access to mainstream banks or credit unions in their community, or the macroeconomic context causes skepticism about the use of financial products at the mainstream banks and credit unions that are available to them. Despite individual Millennials’ best intentions to avoid using alternative financial services and opting for healthier financial behaviors, their institutional arrangements may not provide them with opportunities to do so. Financial education may do little good without also being financially included—having affordable and accessible savings accounts to put that knowledge into practice. Thus, while this paper explores individual Millennials’ financial behaviors, financial capability is as much of an institutional approach to improving these behaviors as it is an individual one.

Research Questions

Additional research is needed to test the emerging yet positive associations between financial capability and financial behaviors, particularly among Millennials who are in the midst of complex financial decisions and uncertain macroeconomic times. Moreover, additional research can extend previous findings by moving from testing financial capability’s effects on behaviors like saving and accumulating assets to testing the effects on a range of behaviors like using alternative financial services or saving for emergencies. Along these lines, this paper asks whether being financially capable—having a combination of a savings account and financial education—is associated with Millennials’ financial behaviors including being financially fragile, saving for emergencies, using alternative financial services, carrying too much debt, and being satisfied with their financial condition. Financial capability is compared to financial inclusion, financial education, and financial exclusion. This paper also asks whether alternative definitions for financial capability similarly relate to Millennials’ financial behaviors. Financial products like having a checking account, credit card, or ever having a bank account were used as proxies for financial inclusion and were tested as alternatives to a savings account in the operationalization of financial capability. These financial products were chosen as proxies based on the financial hierarchy of diverse asset portfolios (Friedline et al. 2014; Xiao and Anderson 1997), which contends that a checking account and credit card may be similar to a savings account in terms how they are accessed and used in relation to other financial products like a retirement account or stocks. In other words, like a savings account, a checking account or credit card can be used for day-to-day, short-term expenses. Being financially literate—demonstrating competency on questions about interest rates and savings—is a proxy for financial knowledge gained through means other than having received formal financial education.

Methods

Data

The 2012 National Financial Capability Study was commissioned by the FINRA Investor Education Foundation and was completed online by a sample of 25,509 adults in the United States between July and October 2012, which was nationally representative when population weights were applied. Lusardi (2011) has provided a detailed description of the NFCS and the data can be freely downloaded from the FINRA Investor Education website. Although the NFCS was cross-sectional and causal interpretations of findings produced from the observational data would be ill-advised, the NFCS was one of the few datasets asking detailed questions about financial capability. The NFCS was designed for the express purpose of studying various aspects of financial capability within the population, asking questions that explored financial knowledge, use of financial products and services, and perceptions of financial fragility. Specific questions explored savings, financial education, and financial behaviors. In fact, the NFCS was one of the few datasets to ask questions about both savings and financial education. Thus, the NFCS was ideal for testing this study’s research questions.

Variables

Financial Behavior Outcome Variables

Five self-reported outcomes served as proxies for Millennials’ financial behavior. These outcomes included financial fragility defined as Millennials’ certainty regarding their ability to acquire $2000 in an emergency (probably or certain = 1; probably not or certainly not = 0), emergency savings defined as Millennials’ use of emergency savings to prepare for unexpected expenses (yes = 1; no = 0), alternative finances defined as Millennials’ use of title loans, payday lenders, tax refund advances, pawn shops, or rent-to-own stores (yes = 1; no = 0), debt burden defined as Millennials’ indication of carrying too much debt (yes = 1; no = 0),Footnote 3 and financial satisfaction defined as Millennials’ satisfaction with their current financial condition (ranged from 1 to 10, with higher scores indicating greater satisfaction).

Variable of Interest

Financial capability was the variable of interest and was created by combining measures of savings account ownership and financial education. Millennials were asked whether their households had a savings account, money market, or certificate of deposit—interest-bearing savings accounts held in mainstream financial institutions. They were also asked whether or not financial education was ever offered by their school, college, or workplace and whether or not they ever participated in that financial education.Footnote 4 Responses from these questions were combined to create the four-level financial capability variable (neither savings account nor financial education [financially excluded] = 0; financial education only = 1 [financially educated]; savings account only = 2 [financially included]; savings account and financial education [financially capable] = 3).

Additional questions in the NFCS were used to conduct sensitivity analyses of alternative financial capability definitions. For example, a savings account in and of itself could have been an incomplete definition of financial inclusion. Millennials could have owned financial products like checking accounts or credit cards that provided inclusion. Along these lines, Millennials were asked whether their households had a credit card, checking account, and ever had a savings account and these variables were used as alternative definitions of financial inclusion in the operationalization of financial capability. Likewise, having participated in a financial education class could have been an incomplete measure since their participation in a class did not necessarily guarantee their retention of financial knowledge. Financial knowledge could also be measured by Millennials’ scores on financial literacy questions, giving an indication of their financial competency or proficiency. Millennials were asked a series of questions about interest rates and inflation related to savings accounts and investments in stocks, which measured basic and important concepts related to their financial literacy (Lusardi et al. 2010).

The additional questions regarding financial inclusion and financial education were used to test different definitions of financial capability. In addition to the four-level financial capability variable described above, the following four-level variables were created and tested: savings account and financial literacy (neither savings account nor financially literate = 0; financial literacy only = 1; savings account only = 2; savings account and financial literacy = 3), ever having a bank account and financial education (neither bank account nor financial education = 0; financial education only = 1; ever had a bank account only = 2; ever had a bank account and financial education = 3), checking account and financial education (neither checking account nor financial education = 0; financial education only = 1; checking account only = 2; checking account and financial education = 3), credit card and financial education (neither credit card nor financial education = 0; financial education only = 1; credit card only = 2; credit card and financial education = 3).

Demographic Control Variables

Demographic variables previously found to have associations with savings, financial education, or financial behaviors were controlled for in the study (Fernandes et al. 2014; Sherraden 2013). These variables were recoded from the original questions and included race (White = 1; non-White = 0), gender (male = 1; female = 0), number of dependents (children; ranged from 0 to 4 or more), marital status (married = 1; not married = 0), employment status (employed = 2; full-time student = 1; unemployed = 0), education level (college degree or more = 2; some college = 1; high school diploma or less = 0), household income (ranged in eight categories from <$15,000 to ≥$150,000), welfare receipt (received government assistance = 1; did not receive government assistance = 0), geographic region (west = 3; south = 2; midwest = 1; northeast = 0), and home ownership (owns home = 1; does not own home = 0).

Sample

The study sample included 6865 Millennials ages 18–34. Approximately 53 % of Millennials were White, with the remainder representing non-White Millennials. While the 2012 NFCS data were intended to represent a national sample, the racial composition indicated that the data may not have been representative in this way. Almost equal percentages of Millennials were male (49 %) and female (51 %) and just over one-third reported being married (36 %). A majority of Millennials were employed (57 %) and over one quarter (28 %) were unemployed. The remainder (15 %) reported full-time college student status that superseded any potential reporting of being employed or unemployed. Their average household income ranged somewhere between $15,000 and $35,000. Nineteen percent were financially capable by owning a savings account and having received financial education. Almost half were financially included by owning a savings account only and 6 % were financially educated by having received financial education only. Just over one quarter (27 %) of Millennials reported being financially excluded—neither owning a savings account nor having received financial education. Additional sample characteristics are available in Table 1.

Analysis Plan

Missing Data

The first step was to estimate missing data. Multiple imputation has been recognized as a preferred method for estimating and completing missing data (Little and Rubin 2002). Each variable had less than 20 % missing and, thus, the extent of missing data was suitable for imputation (Table 1). For example, approximately 12 % of the responses were missing on the question about having received financial education and 3 % of the responses were missing on the question about owning a savings account. Four percent of the responses were missing on the question about financial fragility, 5 % missing on the question about emergency savings, 2 % missing on the question about debt burden, 4 % missing on the question about alternative financial services use, and 1 % missing on the question about financial satisfaction. In addition, the sample size dropped to 5562 when listwise deletion was used (81 % of N = 6865), which was less than 20 % of the entire sample. The missing data also met the assumption of being missing at random based on patterns of missingness using STATA’s misstable code and weak correlations between missing and observed responses on all the variables. The Markov Chain Monte Carlo (MCMC) method was used to estimate five completed, or imputed, datasets with no missingness (Saunders et al. 2006; Schafer and Graham 2002). Using STATA code xi mim: (Carlin et al. 2008; Royston 2009), the results were then pooled across the five imputed datasets to reduce bias in the estimations of parametric statistics (Saunders et al. 2006).

Propensity Score Dosages

In the second step, propensity score weighting was conducted with multi-treatments/dosages. Dosages were useful because they all allowed for testing degrees of exposure to different aspects of financial capability and their relationships to Millennials’ financial behaviors. Dosages balanced selection bias between those Millennials, for example, who were exposed to having savings accounts and those who were not based on known covariates (Guo and Fraser 2010; Imbens 2000). Specifically, the sample was checked for covariate balance on the four-level financial capability variable. Next, a multinomial logit regression was estimated predicting multi-group membership using the independent variables found to be significant in the covariate balance checks (Guo and Fraser 2010). The resulting coefficient estimates were used to calculate propensity scores for each group. The inverse of that probability was used to create the propensity score weight to test the effects of the dosages (the average treatment-effect-for-the-treated weight [ATT weight]). This process was repeated for each financial capability variable that was tested (i.e., savings account and financial education, savings account and financial literacy, ever had a bank account and financial education, checking account and financial education, credit card and financial education). The effectiveness of the propensity score weight was evaluated by visually checking the distributions of the propensity scores across the four-level financial capability variable before and after weighting, what is referred to as the area of common support (Guo and Fraser 2010). This evaluation determined that there was sufficient overlap of propensity scores, the results of which are available from the first author upon request.

Covariate Balance Checks

In the third step, covariate balance was tested after applying the propensity score weight. Multinomial logit regression was used to check for covariate balance with financial capability as the dependent variable (Guo and Fraser 2010). The reference group for balance checks was being financially excluded, since this was the primary comparison with which the research question was concerned. This process was also repeated for each financial capability variable that was tested. Results from covariate balance checks indicated that data were better balanced and observed bias was reduced when propensity score weighted; however, education level and employment status remained significant. These variables were only significant among Millennials who were financially included and financially educated. Thus, any significant associations between Millennials’ education level and employment status and their financial behaviors should be interpreted with caution. To conserve space, results from covariate balance checks are not reported in the text and are available from the authors upon request.

Regression

The final step was to use regression as the primary analytic tool to assess statistical significance for the overall relationship between financial capability and Millennials’ financial behaviors. Logistic regression was used to predict Millennials’ financial fragility, emergency savings, alternative financial services, and debt burden. STATA calculated the maximum likelihood estimates necessary for conducting logistic regression (Kutner et al. 2005; Long 1997). Measures of predictive accuracy for logistic regression results are provided through the McFadden’s pseudo R 2 (not equivalent to the variance explained in multiple regression model, but closer to 1 is also positive). Odds ratios (OR) are reported for easier interpretation and as a measure of effect size. Multiple regression was used to predict Millennials’ financial satisfaction, a continuous outcome where higher numbers represented greater satisfaction. The R 2 is used to provide a measure of predictive accuracy. Regression analyses were repeated for each financial capability variable that was tested. In the results Tables 3, 4, and 5, the comparison group for financial capability is financially excluded; however, comparison groups were rotated to compare financial capability to financial inclusion and financial education. These results are reported in the tables’ footnotes.

Results

The results from testing the associations between Millennials’ financial capability and their financial behaviors are presented first, followed by a summary of the results from testing alternative definitions to financial capability. Descriptive information is available in Table 2 and regression results are available in Tables 3, 4, and 5. Results from the alternative definitions of financial capability are reported within the sections for each behavior and are presented in Table 6. A summary of these results is reported in Table 7.

Associations Between Financial Capability and Financial Behaviors

Financial Fragility

Descriptively speaking (Table 2), roughly half of Millennials (48 %) reported being certain or probably certain that they could come up with $2000 if faced with an unexpected expense. Those who earned a high school diploma or less, lived in households with incomes below $35,000, did not own homes, and who only received financial education were the least certain about their ability to locate $2000, suggesting that they were the most financially fragile.

Logistic regression results for financial fragility can be found in Table 3, Model 1. Compared to their counterparts, Millennials who were male, married, had a college degree or more, and owned their homes were significantly more likely to report being certain or probably certain they could find $2000 should an unexpected expense arise. Having more dependents was associated with being significantly less likely (p < .10) to report being certain or probably certain they could find $2000, indicating having more dependents was associated with greater financially fragility.

Being financially capable was associated with a 176 % increase in the likelihood of affording $2000 for unexpected expenses. Being financially included was associated with a 123 % increase and being financially educated was associated with a 40 % increase in the likelihood of affording $2000 for unexpected expenses, compared to being financially excluded. The relationship between financial capability and financial fragility remained significant even when the reference group was changed for comparison to financial inclusion or financial education.

Alternative definitions for financial capability were also tested (Table 6, Model 6). The combinations of a savings account and financial literacy and a credit card and financial education mirrored the aforementioned relationships between financial capability and Millennials’ financial fragility. A checking account and financial education was also consistently related to Millennials’ financial fragility; however, financial education only did not emerge as significantly related to financial fragility in this alternative definition as it did with the others. Financial capability defined as ever having a bank account and financial education was not significantly related to financial fragility.

Emergency Savings

Only about 35 % of all Millennials reported saving for emergencies (Table 2). Among Millennials with a college degree or more, 52 % reported saving for emergencies compared to 34 and 24 % respectively among Millennials with some college or a high school diploma or less. Among Millennials who were unemployed and who had household incomes below $35,000, 20 % and 23 % saved for emergencies respectively.

Logistic regression results for emergency savings can be found in Table 3, Model 2. Compared to their counterparts, Millennials were more likely to save for emergencies when they were male, had a college degree or more, were either a full-time student or employed, had higher levels of household income, and owned their homes. Being White was associated with a decreased likelihood of having emergency savings compared to being non-White, as was having more dependents (children).

Being financially capable was associated with a 224 % increase in the likelihood of saving for emergencies. Being financially included was associated with a 159 % increase and being financially educated was associated with a 44 % increase in the likelihood of saving for emergencies, compared to being financially excluded. The relationship between financial capability and emergency savings remained significant even when the reference group was changed to be compared to financial inclusion or financial education.

Alternative definitions for financial capability were tested as they related to Millennials’ emergency savings (Table 6, Model 7). The combinations of a savings account and financial literacy, a checking account and financial education, and a credit card and financial education were mostly consistent with the aforementioned relationships between financial capability and emergency savings. Financial capability defined as ever having a bank account and financial education was not related to Millennials’ emergency savings.

Alternative Financial Services

Almost half (44 %) of Millennials reported using alternative financial services, defined as services like title loans, payday loans, and tax refund advances (Table 2). Among Millennials with at least one dependent (child), 57 % reported using alternative financial services whereas only 33 % of Millennials without any dependents reported using these services. Among Millennials with a high school diploma or less, 52 % reported using alternative financial services. The highest percentage of alternative financial services use was among Millennials receiving government assistance—67 % reported using alternative financial services compared to only 38 % among Millennials not receiving government assistance.

Logistic regression results for Millennials’ alternative financial services use can be found in Table 4, Model 3. Millennials’ use of alternative financial services was positively associated with being male, having more dependents, being employed, receiving government assistance and living in the south (p < .10) compared to their counterparts. Being White, having some college education or a college degree or more, being a full-time student, and having higher household incomes were negatively associated with Millennials’ use of alternative financial services.

Millennials’ financial capability was negatively associated with using alternative financial services, as was their financial inclusion. Millennials’ financial capability was associated with a 21 % decrease in the likelihood of using alternative financial services. Millennials’ financial inclusion was associated with a 26 % decrease in the likelihood of using alternative financial services. Financial education was not significantly different from financial exclusion. The relationship between financial capability and alternative financial services use remained significant even when the reference group was changed to be compared to financial education; however, the comparison to financial inclusion was not significant. This suggested that Millennials’ alternative financial services use was not significantly different when the financial capability was compared to financial inclusion.

Alternative definitions were tested as they related to Millennials’ use of alternative financial services (Table 6, Model 8). The combinations of a savings account and financial literacy and a checking account and financial education were consistent with the aforementioned relationships between financial capability and alternative financial services use. The relationship of financial capability defined as the combination of a credit card and financial education to alternative financial services was not significant; however, having a credit card only was related to a reduced likelihood of alternative financial services use. Financial capability defined as ever having a bank account and financial education was not significantly related to alternative financial services use.

Debt Burden

One-third of Millennials (33 %) reported that they carried too much debt (Table 2). Among Millennials with at least one dependent, 41 % reported carrying too much debt compared to 25 % among Millennials without any dependents. Among Millennials receiving government assistance, 46 % reported carrying too much debt, compared to only 29 % among those not receiving government assistance.

Logistic regression results for Millennials’ debt burden can be found in Table 4, Model 4. Having more dependents, having some college and a college degree or more, being employed and receiving government assistance were associated with a greater likelihood of reporting carrying too much debt. Higher household incomes were associated with a decreased likelihood of reporting carrying too much debt.

Millennials’ financial capability was negatively associated with carrying too much debt, as was having only a savings account. Millennials’ financial capability was associated with a 30 % decrease in the likelihood of carrying too much debt, compared to financial exclusion. Millennials’ financial inclusion was associated with a 14 % decrease in the likelihood of carrying too much debt, compared to financial exclusion. Financial education was not significantly different from financial exclusion. The relationship between financial capability and debt burden remained significant even when the reference group was changed to be compared to financial inclusion or financial education.

Alternative definitions for financial capability were tested as they related to Millennials’ debt burden (Table 6, Model 9); however, no results from the alternative definitions mirrored those described above. Most definitions were non-significant; however, financial capability defined as ever having a bank account and financial education was related to an increased likelihood of carrying too much debt.

Financial Satisfaction

On a scale ranging from 1 (not at all satisfied) to 10 (extremely satisfied), Millennials on average reported being satisfied with their financial condition at about a 5 (neither satisfied nor dissatisfied; Table 2). Millennials who were married (M = 5.555), had a college degree or more (M = 5.997), lived in households with incomes at or above $35,000 (M = 5.909), and who owned their homes (M = 6.316) reported higher than average financial satisfaction. Those with incomes below $35,000 (M = 4.325) and who were unemployed (M = 4.209) reported some of the lowest average financial satisfaction scores.

Multiple regression results for Millennials’ financial satisfaction can be found in Table 5, Model 5. Compared to their counterparts, being male, being married, being a full-time student or employed, having higher levels of household income, and owning their homes were associated with significantly higher financial satisfaction scores. Millennials who were White versus non-White, had more dependents, had some college education compared to a high school diploma or less, and were living in the west compared to northeast (p < .10) had significantly lower financial satisfaction scores.

Compared to financial exclusion, Millennials’ financial capability was associated with significantly higher financial satisfaction scores, as was their financial inclusion. The relationship between financial capability and financial satisfaction remained significant even when the reference group was changed to be compared to financial inclusion or financial education.

Alternative definitions were tested as they related to Millennials’ financial satisfaction (Table 6, Model 10). The combination of a credit card and financial education were consistent with the aforementioned relationships between financial capability and financial satisfaction. The relationship of financial capability defined as the combination of a savings and financial literacy indicated that a savings account only was related to increased satisfaction, while being only financially literate was related to decreased financial satisfaction. Ever having a bank account and having received financial education was negatively related to financial satisfaction.

Alternative Definitions of Financial Capability

There may be other ways of being financially capable via financial knowledge and experiential opportunities beyond simply having received financial education or owning a savings account. Having a checking account, credit card, and ever having a bank account were tested as proxies for access to financial products aside from having a savings account. Being financially literate—demonstrating competency on questions about interest rates and savings—was tested as a proxy for financial knowledge gained through means other than having received formal financial education. Across all the models (Tables 6, 7), having a checking account or credit card related similarly to young adults’ financial fragility, emergency savings, and financial satisfaction when compared to operationalizing experiential opportunities as having a savings account. Ever having a bank account was inconsistently related to young adults’ financial behaviors compared to these alternative definitions. Having received financial education and being financially literate had similar relationships to young adults’ financial behaviors.

Discussion

Despite enthusiasm for interventions that promote financial capability and aim to improve financial behaviors, a limited number of studies test whether the combination of a savings account and financial education relates to the desired outcomes. This paper examined a key question of inquiry: whether or not Millennials’ financial capability related to significantly healthier financial behaviors. In addition, given the fairly nascent theoretical development, alternative definitions for financial capability were tested. These alternative definitions shed light on whether financial capability can be operationalized in ways other than a savings account and financial education to produce similar effects on young adults’ financial behaviors. If confirmed empirically by future research, findings that are supportive of financial capability may mean that access to a savings account combined with financial education can improve the chances of exhibiting healthier financial behaviors.

Associations Between Financial Capability and Financial Behaviors

Consistently, financial capability was significantly associated with Millennials’ financial behaviors and the strength of these relationships was stronger than either the independent relationships of financial inclusion or financial education. In other words, the combination of a savings account and financial education holds promise for promoting young adults’ healthy financial behaviors and improving stability at this financially precarious stage in their lives. Financially capable Millennials were almost 200 % or three times more likely to report being able to come up with $2000 for an unexpected expense, suggesting that financial capability served as a protective factor against financial fragility. These Millennials were also over 200 % or three times more likely to be saving for emergencies. Financially capable Millennials were less likely to use alternative financial services and to report carrying too much debt. Given these healthy financial behaviors, financially capable Millennials were also significantly more satisfied with their financial condition compared to those who were financially excluded.

Millennials who were financially educated were also 40 % more likely to come up with $2000 for an unexpected expense and 44 % more likely (p < .10) to save for emergencies. However, Millennials who were financially educated were no better off in terms of using alternative financial services, carrying too much debt, or reporting being financially satisfied. In fact, compared to being financially included, Millennials demonstrated riskier financial behaviors when they had only received financial education. It appears that Millennials may be better off when they are financially capable or financially included—being educated on these matters does not appear to make any significant difference.

Alternative Definitions of Financial Capability

Financial capability had similar relationships to Millennials’ financial behaviors, whether it was defined by having received financial education or being financially literate. Financially capable Millennials were more likely to report being able to come up with $2000 in a pinch and saving for emergencies and were less likely to report using alternative financial services. This suggests that financial education and financial literacy may be interchangeable depending on the outcome that is to be affected; however, there were some differences. Financial capability defined by having received financial education was related to a reduced likelihood of carrying too much debt and being more satisfied with one’s financial condition, whereas being financially literate was not. In other words, demonstrating competency on key financial concepts had no bearing on Millennials’ debt burden or their financial satisfaction. These differences could be explained a few ways. The first explanation is one of measurement. The questions gauging Millennials’ financial literacy did not ask about debt or financial satisfaction; rather, questions asked about interest rates and saving. From this perspective, it was of no surprise that this measure of financial literacy was unrelated to outcomes about debt and financial satisfaction. The second and related interpretation is that demonstrated competency in the areas of interest rates and saving were nontransferable to decisions about debt or being satisfied with one’s finances. Instead, Millennials were less likely to carry debt and were more financially satisfied when they received general financial education that may have covered these broad topics.

Having a checking account or credit card related similarly to Millennials’ financial fragility, emergency savings, and financial satisfaction when compared to a savings account. This suggests that having a checking account or a credit card provided Millennials with opportunities for experiential learning and access to financial products that may have been similar to a savings account. Though, while a checking account and a credit card performed consistently with a savings account across most financial behaviors, these operationalizations were unrelated to debt burden. That is, Millennials were no more or less likely to report carrying too much debt when financial capability was defined as having a checking account or a credit card in tandem with having received formal financial education. This suggests that a checking account and a credit card may have protected Millennials from being financially fragile, allowed them to save for emergencies, provided substitutes to alternative financial services, and increased their financial satisfaction. However, in contrast to a savings account that was related to the reduced likelihood of carrying burdensome debt, a checking account and a credit card held no bearing on Millennials’ debt accumulation. As such, a savings account may be a more desirable financial product on the whole for establishing financial capability and promoting healthy financial behaviors.

Compared to other alternate definitions of financial capability, ever having a bank account failed to consistently explain Millennials’ financial behaviors. Millennials also reported a significantly higher debt burden and lower financial satisfaction when experiential opportunities were defined as ever having a bank account. This suggests that ever having a bank account may not provide the same financial inclusion and experiential opportunities as a savings account, checking account, or even a credit card for young adults. Moreover, ever having a bank account insinuates that Millennials may not currently have a bank account, but that they may have had one in the past. Previous financial inclusion may do little to help Millennials demonstrate healthy financial behaviors in the present or the future.

Demographic Controls: Differences by Socio-Economic Opportunity

There is evidence to suggest some Millennials may have healthier financial behaviors than others, over and above the effects of financial capability. The models controlled for demographics that are commonly associated with financial behaviors such as education, employment, and income (Friedline and Rauktis 2014; Lusardi et al. 2012); significant differences on these demographic controls represented differences by young adults’ socio-economic opportunity. For instance, having earned a college degree or more was associated with being more likely to report an ability to find $2000 for an unexpected expense and to save for emergencies and less likely to use alternative financial services; though, the positive relationship with carrying too much debt suggests the cost of their college degree may have placed undue strain on their finances (Assets and Education Initiative 2013). Similar findings for Millennials who reported having some college education suggest that even a few years of post-secondary education without receiving a degree may have had benefits for financial behaviors; however, the costs of leaving college before completing a degree such as limited opportunities in the labor market, stagnated socioeconomic mobility, and higher debt burdens likely outweigh any immediate benefits to financial behaviors (Mishel et al. 2012).

There were also differences by labor market participation. Being employed or a full-time student was associated with being less financially fragile, saving for emergencies, and being satisfied with their financial condition; however, employment was also associated with an increased likelihood of using alternative financial services and carrying too much debt. While employment can provide financial resources and is assumed to translate into healthy financial behaviors, Millennials have been disproportionately affected by the recent economic recession that left them with higher unemployment rates and lower incomes (Mishel et al. 2012). Thus, Millennials in the labor market may have resorted to alternative financial services and debt to meet basic needs. Macroeconomic trends may help explain these findings given that the 2012 NFCS was conducted toward the end of a recession that disproportionately affected Millennials (Bell and Blanchflower 2011).

Not surprisingly, having higher household incomes was associated with healthy financial behaviors and was significant across all models. Millennials with higher incomes came up with $2000 for unexpected expenses and saved for emergencies; they avoided using alternative financial services and carrying too much debt. Having higher incomes was also associated with higher financial satisfaction. Likewise, home ownership was associated with being more likely to report an ability to find $2000 for an unexpected expense, saving for emergencies, and being satisfied with their overall financial condition. Previous research indicates that home ownership is a vehicle for accumulating assets and equity (Grinstein-Weiss et al. 2013), suggesting that Millennials who own their own homes may be able to leverage this asset for establishing financial stability and healthy behaviors.

Notably, the relationships between education level, employment, income, and home ownership to Millennials’ financial behaviors suggests that opportunity—broadly defined—helps to shape financial behaviors. For instance, while the receipt of a college degree could be characterized as an individual decision, institutional arrangements like the family, the quality of primary and secondary education, and the availability of college financing all play a role in opportunities to enroll in college and acquire a degree (Assets and Education Initiative 2013; Currie and Moretti 2003; Yeung and Conley 2008). These arrangements are beyond individual control, yet shape individual decisions and behaviors (Sherraden 1991). Thus, while financial capability holds promise as an intervention for shaping Millennials’ financial behaviors, interventions are also needed to readjust the broader institutional arrangements in society that perpetuate opportunity and advantage for some Millennials, and disadvantage for others.

Policy Considerations

Five policy considerations emerge from this research. These considerations continue to need rigorous empirical testing before adoption or implementation; however, given that this research aligns with existing empirical support for financial capability (Sherraden 2013), these considerations hold promise for expanding financial capability and improving Millennials’ financial health. In other words, these considerations are based on the mounting empirical support for financial capability across multiple studies, not solely on the findings from the research presented here. A first consideration is with regard to financial education interventions that intend to produce positive effects on financial behaviors. Financial education is often a “go-to” intervention for improving financial behaviors and concerns about the financial literacy of the populous have prompted efforts to mandate financial education in high schools (OECD 2014). For instance, only 9 % of 15-year-olds in the United States demonstrate the type of competency on advanced financial knowledge questions that would be necessary for making informed decisions for taking out student loans, interpreting mortgage agreements, or comparing investment portfolios (OECD 2014). Today, more states require high schools to offer a course in financial education than in the past: Nineteen states had financial education requirements in 2014 (Council for Economic Education 2014). Indeed, research suggests that young people have benefitted from the financial education offered in their high schools as a result of state educational mandates (Bernheim et al. 2001; Urban et al. 2015). Such efforts may be less effective for influencing a range of financial behaviors without also providing financial inclusion that offers a real financial product for hands-on experience. While financial capability interventions need to undergo rigorous evaluation to provide evidence of their effects on Millennials’ financial behaviors, educational systems may need to rethink how financial education is offered and whether existing courses sans financial inclusion have the intended effects.

Second, given that financially capable Millennials also exhibit the healthiest or least risky financial behaviors (Sherraden 2013), interventions may be most effective when financial education is combined with financial inclusion. This affirms existing policy and program efforts that support financial capability. A number of policies and programs are geared toward financial inclusion by opening savings accounts for young people that would be paired with financial education. Child Savings Accounts (CSAs; also known as Child Development Accounts [CDAs]) have been proposed as a vehicle for providing savings accounts and financial education directly to young people with emphasis on access for those from lower-income households. The America Saving for Personal Investment, Retirement, and Education (ASPIRE) Act was first introduced into Congress in 2004 and most recently in 2013. The ASPIRE Act proposes to roll out CSAs universally at birth with a $500 initial deposit and additional subsidies for those whose households’ incomes fall below certain thresholds. Accounts would be paired with financial education and the accumulated savings could be used toward expenses like education, home ownership, or retirement (Cramer 2010). The USAccounts: Investing in America’s Future Act was introduced into Congress in 2014 to establish USAccounts, which are similar in design to the CSAs proposed in the ASIPRE Act.

A third consideration—based on the potential ineffectiveness of financial education taught in absence of financial inclusion and policy and program efforts that support financial capability—is that multiple institutions may need to join forces to make financial capability both scale-able and effective. For example, a national, universal policy such as the ASPIRE Act or USAccounts might be more effective at supporting financial capability if teaching financial education was mandatory in school systems across the United States. In this example, educational institutions serve as the delivery system for financial education while, separately, political and financial institutions serve as the delivery system for financial inclusion; however, these separate efforts can be developed intentionally so that they parallel and complement one another to increase each other’s effectiveness. Moreover, if political and financial institutions sought to teach financial education without the cooperation of educational institutions—or likewise if educational institutions sought to improve financial inclusion and capability without the cooperation of political and financial institutions—these efforts undertaken in isolation of one another would be more costly, less scale-able, and potentially ineffective. The promotion of financial capability via CSAs may require the coordination of multiple delivery systems that work in tandem to achieve effectiveness.

A fourth consideration is that mainstream financial institutions may need to develop responsibility for becoming more inclusive. That is, the onus cannot solely be on Millennials to seek out financial inclusion from these institutions; rather, financial institutions themselves need a wider reach. According to the Federal Deposit Insurance Corporation’s (FDIC) 2012 survey of financial institutions’ efforts to serve those on the financial margins, only about 40 % of institutions reported developing products and services for this population. Only 20 % of financial institutions offered “second chance” accounts to consumers whose credit histories might otherwise exclude them from the financial mainstream. While not all Millennials may find themselves on the financial margins and in need of “second chance” products, these examples suggest that financial institutions may not be in the business of inclusion. However, in part as a way to recover the trust that was lost during the economic recession (Afandi and Habibov 2013) and as a way to evolve their service provision to Millennials and future generations, financial institutions may need to be in the business of inclusion.

A final consideration is that financial capability may relate to Millennials’ healthy financial behaviors in ways other than by providing financial inclusion via a savings account. It appears that a checking account or a credit card may also provide Millennials with access to the financial mainstream and develop their financial capability. This is consistent with how financial products including checking and savings accounts and credit cards are accessed and used (Xiao and Anderson 1997). These are often the first financial products acquired and therefore may be somewhat interchangeable. Likewise, demonstrated competency on financial knowledge questions—which may indicate Millennials’ financial literacy—may be substituted for having received formal financial education. Thus, interventions may be able to choose from a range of options for defining and operationalizing financial capability. Though, the results here suggest that financial capability defined as the combination of a savings account and financial education is the most consistent operationalization for relating to Millennials’ healthy financial behaviors.

Limitations

The findings from this paper should be considered in light of several limitations. First, the 2012 NFCS data were cross-sectional, therefore time order between Millennials’ financial capability and their financial behaviors could not be established. While there is reason to believe financial capability can precede financial behaviors (Birkenmaier et al. 2013), the data were limited in that they did not allow for modeling this time order. Therefore, findings only indicated an association between financial capability and financial behaviors. Second, the savings account question in the 2012 NFCS was asked in reference to the household and not the individual. This means that young adults’ households could have owned a savings account, but not young adults themselves. This survey design limitation does not necessarily change the spirit of the research questions or their findings because young adults may still have benefitted when their household had access to a bank account. Though, the results should be interpreted with this limitation in mind because it is unclear the extent to which household financial inclusion translates into Millennials’ financial inclusion. Third, non-randomized observational data like the 2012 NFCS did not allow for causal testing of relationships and this likely introduced bias into the results. While dosages were created and observed bias accounted for using propensity score analyses (Guo and Fraser 2010), unobserved bias could still have been introduced. Fourth, this paper made the assumption that alternative definitions of financial capability may exist when the variables used in the sensitivity analyses perform consistently with a savings account and financial education. However, consistency across the models does not necessarily mean that these variables are perfect substitutes for a savings account and financial education, nor does this mean that a savings account and financial education are the ideal or only definitions of financial capability. These sensitivity analyses were predicated on the accuracy of the original definition of financial capability as a savings account and financial education, which needs to undergo further empirical testing and theoretical development. Despite these limitations, this paper was one of the first to test Millennials’ financial capability defined as the combined effects of a savings account and financial education on an array of financial behaviors.

Conclusion

Attention to financial capability and financial behaviors is especially relevant in an era in which Millennials are making increasingly complex financial decisions. The behaviors that flow from these decisions and their results may have long-term implications for Millennials’ abilities to achieve financial stability and to accumulate wealth. Millennials who save for emergencies, steer clear of high-cost alternative financial services like payday loans and tax advances, and avoid carrying too much debt, may find themselves in more stable financial positions upon which they can leverage to their benefit. Millennials who are more financially stable may also be able to achieve economic mobility across the life course. Millennials who are financially fragile, lack emergency savings, use high-cost alternative financial services, and carry too much debt may likely struggle to save and to be financially stable in the future. These Millennials may struggle to hold on to their financial stability, let alone achieve economic mobility. While these may appear to be purely individual behaviors over which Millennials have ultimate control, they may behave accordingly based on the knowledge and opportunities available to them via institutional arrangements embedded into education, labor market participation, and home ownership. Financial capability recognizes that Millennials’ financial behavior is not purely based on individual knowledge; they also need to be included in the financial mainstream where they have opportunities to carry out healthy financial behaviors (Sherraden 2013). Thus, interventions that provide Millennials with a combination of financial inclusion and financial education may be useful for promoting healthy financial behaviors.

Notes

All monetary values throughout this paper are reported in US dollars.

Sometimes economic inclusion is used interchangeably with financial inclusion; however, this paper intentionally uses financial inclusion. Financial inclusion is a narrower term that can pertain to the use or ownership of financial products like savings accounts, checking accounts, and credit cards. Economic inclusion is a broader term that can pertain to the economy or distributions of income and wealth.

The original question in the 2012 NFCS asked the extent to which respondents agreed that they carried too much debt on a scale of 1 (strongly disagree) to 7 (strongly agree). Young adults were deemed to carry too much debt when they reported a 5 or higher on the scale.

The correlation between financial education and a savings account, while significant at p < .05, was .13. This suggested that there was a weak relationship between financial education and a savings account.

References

Afandi, E., & Habibov, N. (2013). Pre-crisis and post-crisis trust in banks: Lessons from transitional countries. Munich, Germany: Munich Personal RePEc Archive. Retrieved from http://mpra.ub.uni-muenchen.de/46999/1/MPRA_paper_46999.pdf.

Angulo-Ruiz, F., & Pergelova, A. (2015). An empowerment model of youth financial behavior. Journal of Consumer Affairs, Online First. doi:10.1111/joca.12086.

Assets and Education Initiative. (2013). Building expectations, delivering results: Asset-based financial aid and the future of higher education. In W. Elliott (Ed.), Biannual report on the assets and education field. Lawrence, KS: Assets and Education Initiative (AEDI). Retrieved from http://save4ed.com/wp-content/uploads/2013/07/Biannual-Report_Building-Expectations-071013.pdf.

Bell, D., & Blanchflower, D. (2011). Young people and the Great Recession. Oxford Review of Economic Policy, 27(2), 241–267. doi:10.1093/oxrep/grr011.

Bell, L., Burtless, G., Gornick, J., & Smeeding, T. (2007). Failure to launch: Cross-national trends in the transition to economic independence. In S. Danziger & C. Rouse (Eds.), The price of independence: The economics of early adulthood (pp. 27–55). New York: Russell Sage Foundation.

Bernheim, B., D. (2014). Does financial education promote financial competence? Stanford, CA: Stanford University, Stanford Institute for Economic Policy Research. Retrieved from https://www.youtube.com/channel/UCPYXWr4J8t44gCmNYm6ORhw.

Bernheim, B. D., & Garrett, D. M. (2003). The effects of financial education in the workplace: Evidence from a survey of households. Journal of Public Economics, 87(7–8), 1487–1519. doi:10.1016/S0047-2727(01)00184-0.

Bernheim, B. D., Garrett, D. M., & Maki, D. M. (2001). Education and saving: The long-term effects of high school financial curriculum mandates. Journal of Public Economics, 80(3), 435–465. doi:10.1016/S0047-2727(00)00120-1.

Birkenmaier, J., & Fu, Q. (2015). Service usage and financial access: Evidence from the National Financial Capability Study. Journal of Family and Economic Issues, Online First. doi:10.1007/s10834-015-9463-2.

Birkenmaier, J., Sherraden, M. S., & Curley, J. (2013). Financial capability and asset develoment: Research, education, policy, and practice. New York: Oxford University Press.

Carlin, J., Galati, J., & Royston, P. (2008). A new framework for managing and analyzing multiply imputed data in Stata. The Stata Journal, 8(1), 49–67.

Chan, P. (2011). Beyond barriers: Designing attractive savings accounts for lower-income consumers. Washington, DC: New America Foundation. Retrieved from http://assets.newamerica.net/sites/newamerica.net/files/policydocs/chan_beyondbarriers_workingpaper_1.pdf.

Chiteji, N. (2007). To have and to hold: An analysis of young adult debt. In S. Danziger & C. Rouse (Eds.), The price of independence: The economics of early adulthood (pp. 231–258). New York: Russell Sage Foundation.

Cole, S., Paulson, A., Shastry, G.K. (2014). High school curriculum and financial outcomes: The impact of mandated personal finance and mathematics courses. Cambridge, MA: Harvard Business School. Retrieved from http://www.hbs.edu/faculty/Publication%20Files/13-064_c7b52fa0-1242-4420-b9b6-73d32c639826.pdf

Council for Economic Education. (2014). Survey of the states: 2014. Washington, DC: Council for Economic Education. Retrieved from http://www.councilforeconed.org/wp/wp-content/uploads/2014/02/2014-Survey-of-the-States.pdf

Cramer, R. (2010). The big lift: Federal policy efforts to Create Child Development Accounts. Children and Youth Services Review, 32(11), 1538–1543. doi:10.1016/j.childyouth.2010.03.012.

Currie, J., & Moretti, E. (2003). Mother’s education and the intergenerational transmission of human capital: Evidence from college openings. The Quarterly Journal of Economics, 118(4), 1495–1532. doi:10.1162/003355303322552856.

de Basa Scheresberg, C. (2013). Financial literacy and financial behavior among young adults: Evidence and implications. Numeracy: Advanced Education in Quantitative Literacy. doi:10.5038/1936-4660.6.2.5.

Emmons, W., & Noeth, B. (2014). Five simple questions that reveal your financial health and wealth. St. Louis, MO: Federal Reserve Bank of St. Louis. Retrieved from https://www.stlouisfed.org/~/media/Files/PDFs/publications/pub_assets/pdf/itb/2014/In_the_Balance_issue_10.pdf.

Federal Deposit Insurance Corporation. (2012). 2011 FDIC survey of banks’ efforts to serve the unbanked and the underbanked. Washington, DC: FDIC. Retrieved from https://www.fdic.gov/unbankedsurveys/2011survey/2011execsummary.pdf.

Federal Deposit Insurance Corporation. (2014). 2013 FDIC national survey of unbanked and underbanked households. Washington, DC: FDIC. Retrieved from https://www.fdic.gov/householdsurvey/2013report.pdf.

Fernandes, D., Lynch, J, Jr, & Netemeyer, R. (2014). Financial literacy, financial education, and downstream financial behaviors. Management Science, 60(8), 1861–1883.

Fox, J., Bartholomae, S., & Lee, J. (2005). Building the case for financial education. Journal of Consumer Affairs, 39, 195–214. doi:10.1111/j.1745-6606.2005.00009.

Friedline, T. (2013). Children as potential future investors: Do mainstream banks augment children’s capacity to save? (Report III of III). Lawrence, KS: Assets & Education Initiative, University of Kansas School of Social Welfare. Retrieved from https://assetsandedu.drupal.ku.edu/sites/assetsandedu.drupal.ku.edu/files/docs/Mainstream_Banks.pdf

Friedline, T., & Elliott, W. (2013). Connections with banking institutions and diverse asset portfolios in young adulthood: Children as potential future investors. Children and Youth Services Review, 35(6), 994–1006. doi:10.1016/j.childyouth.2013.03.008.

Friedline, T., Elliott, W., & Nam, I. (2011). Predicting savings from adolescence to young adulthood: A propensity score approach. Journal of the Society for Social Work and Research, 2(1), 1–22. doi:10.5243/JSSWR.2010.13.

Friedline, T., Johnson, P., & Hughes, R. (2014). Toward healthy balance sheets: Are savings accounts a gateway to young adults’ asset diversification and accumulation? Federal Reserve Bank of St. Louis Review, 96(4), 359–389.

Friedline, T., & Rauktis, M. (2014). Young people are the front lines of financial inclusion: A review of 45 years of research. Journal of Consumer Affairs, 48(3), 535–602. doi:10.1111/joca.12050.

Friedline, T., & Song, H. (2013). Accumulating assets, debts in young adulthood: Children as potential future investors. Children and Youth Services Review, 35(9), 1486–1502. doi:10.1016/j.childyouth.2013.05.013.