Abstract

In this paper we investigate the relationship between income shocks and food insufficiency for U.S. households. Using Survey of Income and Program Participation data on U.S. households, we test the importance of both stable and transitory income components in determining food insufficiency. In a logistic regression model, we find that both the level of income and negative income shocks affect the predicted probability of food insufficiency, while positive income shocks do not. Although we do not have a definitive measure of a household’s liquidity constraint status, our work suggests that negative shocks may matter more for households that face liquidity constraints. Understanding the role of income shocks in determining food insufficiency is especially important in light of recent policy changes. It is likely that welfare reform in the U.S. increased the volatility of income in the low-income population. Our findings here suggest that this increase in volatility may not be without consequence.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this paper we investigate the relationship between income shocks and food deprivation for U.S. households. Using Survey of Income and Program Participation (SIPP) data on U.S. households for 2002–2003, we test the importance of both stable and transitory income components in determining food insufficiency. While other researchers have typically focused on the effects of discrete events such as job loss or divorce on household well-being, our approach is more general. We measure income shocks as either positive or negative deviations from mean (or predicted) monthly income. In a logistic regression model, we find that both the level of income and income shocks affect the predicted probability of food insufficiency.

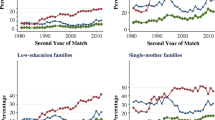

Understanding the role of income shocks that result from income volatility in determining food insufficiency is of special interest in light of policy changes in the last decade. In the U.S., the 1996 welfare reform limited cash assistance as an entitlement, imposed increased work requirements on recipients of cash assistance, eliminated Food Stamp eligibility for some populations, and limited Food Stamp benefit levels for others (among other things).Footnote 1 Food Stamp receipt declined precipitously through the 1990s, not rebounding fully until the 2000s; Ziliak et al. (2003), Currie and Grogger (2001) and Kornfeld (2002), document that these changes were driven by both policy changes and by macroeconomic conditions. It is possible that these policy changes increased the volatility of income in the low-income population: for many households, relatively stable income from AFDC/TANF payments (and Food Stamp benefits) was replaced by potentially less stable earnings from employment. Indeed, there is some evidence of rising income volatility during this time period. Using data from the Panel Study of Income Dynamics, Hacker and Jacobs (2008) find a doubling of the volatility of annual household income between 1969 and 2004, with an increase of nearly 50% since 1998. Bollinger et al. (2009) use data from the Current Population Survey to study the volatility of family income measured annually over the period from 1979 to 2004. They find some increases in volatility during the period from 1979 to 1996, but much larger increases since 1996. Bania and Leete (2009) find increases in monthly household income volatility measured before and after the implementation of welfare reform that are particularly large for lower-income and welfare-at-risk households.

Because mean income levels and material well-being of welfare leavers and recipients have risen little since welfare reform (e.g. Blank 2006; Moffitt and Winder 2003; Bloom et al. 2002; Haskins 2001; Corcoran et al. 2000; Primus et al. 1999; Loprest and Zedlewski 1999), there is little reason to expect that this population has either accumulated savings or has sufficiently high incomes to be able to weather this variability without consequence. Furthermore, if the effect of volatility on food insufficiency (or other measures of deprivation) is asymmetric, with positive and negative income fluctuations having different impacts, then an increase in volatility could have a non-zero impact on food insufficiency measured in the cross-section. Borjas (2002) shows that food insecurity increased as welfare usage declined during this period. However, to our knowledge, in the extensive literature that examines post-reform outcomes for welfare recipients and leavers only a few authors have considered the potential role of income shocks in explaining outcomes.

In the sections that follow, we first discuss the existing literature relating to this line of inquiry. We then develop a conceptual and empirical framework for modeling the relationship between food deprivation and income shocks. We subsequently discuss the data used and provide descriptive statistics on income volatility over time, measures of food deprivation and sample characteristics. This is followed by multivariate logistic regression results explaining food insufficiency, a discussion of sensitivity analyses and an illustration of the impact of the estimated effects. Finally, while we do not have a definitive measure of liquidity constraint, we also experiment with a proxy to distinguish between households that may be more or less constrained. We conclude with a discussion of the findings and their policy implications.

2 Background

Numerous authors have investigated the determinants of food insufficiency (e.g. Gundersen and Oliveira 2001; Jensen 2002; Huffman and Jensen 2003, Rose et al. 1998; Bernell et al. 2006, among others) and relationships have been noted between food insufficiency and a range of correlates, including the level of household income, Food Stamp receipt, demographics, household composition, education, physical and mental health status, and geography. In addition, a few authors have explored aspects of the relationship between income variability and food related programs or outcomes. In a study controlling for family characteristics and household fixed effects, Blundell and Pistaferri (2003) find a negative relationship between annual income variability and food expenditures in the Panel Study of Income Dynamics (PSID) for the years 1978–1992. Along somewhat different lines, Newman (2006) examines the implications of income volatility for participation in the National School Lunch Program, and Farrell et al. (2003) consider the implications of volatility for Food Stamp program participation. Using data spanning 1994–1997 from the SIPP and the Survey of Program Dynamics, Ribar and Hamrick (2003) find that assets, presumed to be indicative of a household’s ability to borrow and save, are important to weathering bouts of poverty without experiencing food insufficiency. While their work implies that income (or expenditure) volatility may be an important underlying determinant, they do not test that hypothesis directly.

Corcoran et al. (2007) and Gundersen and Gruber (2001) have considered the relationship between abrupt changes in income and food insufficiency more directly. In a sample of 600 women from the Michigan Women’s Employment Survey covering the years 1997–1999, Corcoran et al. (2007) find that a significant minority of former and current welfare recipients experience job loss, hours and income reductions, and that job loss in particular is associated with increased food insufficiency. Gundersen and Gruber (2001) develop a dynamic model of household consumption decisions that directly relates income variability to food insufficiency. While they do not use multivariate analysis, they do produce descriptive analysis from the 1991 and 1992 panels of the SIPP showing that food insufficient households have higher monthly income variability, are more likely to have suffered income shocks (such as loss of earnings or Food Stamps) and are less likely to have savings. A more recent paper by Sullivan et al. (2008) finds a weak empirical relationship between the transitory changes in income (measured as the variance of monthly income) and various material hardships, including food insufficiency. However, they do not separately consider the effects of positive and negative income shocks.

Our study extends this literature in several ways. First, we extend the work of Corcoran et al. (2007) in examining income shocks themselves in lieu of indirect measures based on the incidence of discrete events such as job loss or divorce, and by using a nationally representative data set to estimate the effect of income shocks on food insufficiency. While discrete events are clearly important, income measures provide for a more comprehensive picture of the changes occurring in a household. Second, we temporally align income shocks with the incidence of food insufficiency. Thus, we avoid a significant drawback of using summary measures of volatility, such as the transitory variance or the coefficient of variation, which lack the ability to temporally align an income shock with a specific outcome at a particular point in time. Finally, our approach allows us to separately model the effects of negative and positive income shocks on food insufficiency. This is important because our conceptual framework predicts that only negative income shocks will have an effect on food deprivation.

3 Conceptual framework

Although the focus of our paper is on food deprivation, it is helpful to consider a conceptual framework which examines food consumption. Clearly, the two concepts are linked. We assume that food deprivation is a well defined measurable standard which implies that there is a minimum level of food consumption required to avoid deprivation. In general, this food consumption threshold will vary across households and will depend on household size and composition and possibly other household characteristics. To motivate our empirical estimation of the effects of income shocks on food consumption, we adopt a framework in which households choose consumption levels of food and all other goods to maximize their utility. We use this framework to infer the relationship between food consumption and income, income shocks, asset accumulation, and liquidity constraints. It should be noted that avoiding food deprivation and maximizing utility are two distinct objectives which may not coincide. For example, some extremely low-income households might maximize their utility by choosing a level of food consumption that leads to ongoing food deprivation. They might adopt this strategy if avoiding food deprivation meant suffering even more severe deprivation of non-food goods. Alternatively, household income may be so low that any budget allocation results in food deprivation.

We follow the work of Gundersen and Gruber (2001) and Ribar and Hamrick (2003) and adopt a standard utility maximizing framework. While this framework is a fairly standard “off-the shelf” model, this approach nevertheless yields useful insights regarding the asymmetric impact of positive and negative income shocks for liquidity constrained households. Households that face a variable income stream will attempt to smooth their consumption by saving and dissaving, or, for households without assets, by borrowing against future earnings. In this framework, households choose consumption of food and all other goods in order to maximize the expected sum of their utility over a planning horizon that consists of a fixed number of discrete time periods. We further assume that household preferences do not change over time, the relative prices of food and other goods do not change, and that households are subject to a budget constraint which includes both current monthly income and accumulated liquid assets.

We model income shocks by assuming that current monthly income consists of a stable component which does not vary over time and a transitory component (random shock) which varies from period to period. Specifically, income for the i th household in time period t is described by the following equation:

where μ i is a known constantFootnote 2 specific to each household and ξ it has a mean of zero and a known variance of σ 2 i . In any time period t, total household consumption is constrained by the intertemporal budget constraint:

where A it is the i th household’s accumulated assets at the beginning of time period t, P F is the price of food, F it is the quantity of food consumed, and G it is expenditures on non-food goods. Equation 2 says that the household’s ability to finance current consumption depends on the stable portion of their monthly income (μ), an income shock (ξ), and the change in accumulated assets \(\left( {A_{it + 1} - A_{it} } \right)\). Households may or may not be able to borrow against future earnings. Accordingly, if they cannot borrow against future earnings, then we impose an additional constraint that asset balances must always be non-negative. Those households that can borrow do not face this additional constraint.

Our focus is on how the stable portion of income, income shocks, and the change in asset balances affect food consumption and food deprivation. If food is a normal good, an increase in μ i will result in higher food consumption and a decreased probability of food deprivation, ceteris paribus. Further, households will generally optimize by using their asset balances to offset income shocks. Under this model, households will maximize the expected value of the sum of their utility over the time horizon by choosing a smooth consumption pattern. The intuition behind this result is straightforward and familiar, and follows from the assumption of diminishing marginal utility. Thus, in a given time period, households experiencing a positive income shock (ξ it > 0) would be expected to save the extra income (thus, maintaining their optimal level of consumption), while households experiencing a negative income shock (ξ it < 0) can be expected to draw down assets (or borrow) in order to maintain the same level of consumption. But the ability of a household to do the latter depends on whether or not the household is liquidity constrained. We follow Jappelli (1990) and adopt the following definition: a household is liquidity constrained if the combination of their income, assets, and ability to borrow is inadequate to finance their optimal level of consumption, which is the level of consumption that would maximize their utility in the absence of borrowing constraints. Thus, only households that experience a negative income shock, insufficient asset balances, and an inability borrow are liquidity constrained. We consider the cases of liquidity constrained and unconstrained households separately.

Non-liquidity constrained households. In this circumstance, the household will be able to use their asset balances or borrow as a shock absorber to offset any income variability and maintain smooth consumption patterns in all time periods. Households will save positive income shocks and use these assets to offset negative income shocks. Even if they fully exhaust their asset balances, they will be able to borrow against future earnings to maintain smoothed consumption. Therefore because the income shock and the change in asset balances will always sum to zero, the budget for such households constraint simplifies to:

Thus, consumption of food (and other goods) for non-liquidity constrained households depends on the stable portion of income, and will be independent of income shocks (positive or negative). In turn, food deprivation would also be independent of any income shocks.

Liquidity constrained households. Per the definition above, households are only liquidity constrained when they experience a negative income shock and find that their asset balances and ability borrow against future earnings are inadequate to sustain desired consumption (households that experience a positive income shock can not, by definition, be liquidity constrained). In this case, the negative income shock will lead to reduced food consumption (and consumption of other goods) and increase the probability of food deprivation. Thus, we have an asymmetric result for income shocks: Positive income shocks will not affect food consumption or the incidence of food deprivation, while negative shocks will have an effect, but only for liquidity constrained households. In the next section, we describe our empirical tests of this prediction.

3.1 Empirical specification

For each household, we define \( F_{i}^{*} \)as the minimum amount of food consumption required to avoid food deprivation. This level is unique to each household because specific characteristics of the household such as size, composition and health status may affect the level of food expenditures at which the household experiences deprivation. Food deprivation will occur in any time period in which household food consumption falls short of \( F_{i}^{*} \). In our empirical specification, we model the probability that a household suffers food deprivation at time t using a logistic function:

where:

We use various measures of the i th household’s mean or predicted monthly income measured over previous time periods (\( \widetilde{Y}_{i} \)) to approximate the stable component of income μ i , and the deviation (Y * i ) of the current month’s income from \( \widetilde{Y}_{i} \) as a measure of the income shock ξ i . We distinguish between positive and negative income shocks by employing a dummy variable indicating whether or not an income shock is negative (N i ). Other factors may also affect F * and therefore the probability that a household is food insufficient, thus Eq. 5 includes additional control variables (Z i ) such as household size and composition, the presence of a disabled person, and the household’s liquid assets.

Our conceptual model suggests that \( \widetilde{Y} \) will be negatively related to the probability of food deprivation (β1 < 0) for all types of households. However, we expect that the effect of Y * will depend on the degree to which the household is liquidity constrained and whether the shock is positive or negative. Positive income shocks should not affect food deprivation in either case, therefore we expect β2 = 0. Conversely, negative income shocks should have a negative effect on food deprivation for liquidity constrained households only. Among liquidity constrained households, we do not a priori expect the propensity to consume food out of income to differ according to whether that income is transitory or stable, thus for these households we expect β1 = β3 < 0. However, for households which are not liquidity constrained, we expect that β3 = 0. Since our sample contains both liquidity constrained and non-liquidity constrained households, we would expect the coefficient estimates for β2 reflect the mix of households in each category. Thus, we expect β1 < β3 < 0.

4 Data

We use data from the 2001 panel of the Survey of Income and Program Participation (SIPP). This is a nationally representative stratified sample of U.S. households with nine waves of interviews administered at 4 month intervals. Each wave includes a core questionnaire covering income, household composition, human capital, demographics, labor force participation and program participation. In addition, each wave includes a topical questionnaire covering additional subjects; the topical module in Wave 8 of the 2001 panel contains questions relating to food deprivation; topical modules in Wave 6 and 9 include questions pertaining to household assets and liabilities. We draw on data from Waves 1–9 and construct a 36-month data set for each household drawn from the period February 2001 through April 2004.Footnote 3

Our dataset consists of one record per non-elderly (age 18–60) household head in the panel (including those from single-person households) and includes household as well as household-head level characteristics.Footnote 4 This yields a sample of 18,380 households for analysis.Footnote 5 Because we are interested in establishing temporal correspondence between a measure of food deprivation and monthly changes in income, much of our analysis focuses on food deprivation measured in the fourth month of the eighth interview wave, along with key contemporaneous variables defined for that month, e.g. current income and various household characteristics. We refer to this as ‘month 32’. Depending on a household’s rotation group membership, ‘month 32’ will correspond to a calendar month between September and December 2003. However, we also experiment with 4-month food deprivation measures (covering months 29–32). In addition, we use a variety of methods to estimate the stable portion of monthly household income: we compute mean household income over a 12- or 24-month period preceding month 32 (months 20–31, or 8–31, respectively), and we model predicted household income as a function of panel data for months 1 through 32 (or, alternately over months 9–32).

Analysis based on data from multiple waves of the SIPP can lead to concern of seam bias—the saw-toothed pattern in data that results from differential recall bias when data is collected in multi-month waves (e.g. Newman 2006). Our data construction here largely bypasses this problem. Our current monthly income variable (along with most other variables) is taken from the fourth month of the interview wave only, the month in which recall bias should be minimized. Our annual and mean monthly income measures are calculated over 12 or 24 months that are evenly distributed across waves of the panel, so any effects of seam bias should be smoothed. Finally, panel regressions that draw on all 32 months of data include controls for month in the SIPP, as well as for seasonal effects.

Questions on the SIPP allow for the construction of several different measures of food deprivation: a 1-month food insufficiency measure, a 4-month food insufficiency measure and a more broadly defined 4-month food insecurity measure.Footnote 6 Food insufficiency is defined as encompassing households for whom heads report that household members ‘sometimes or often did not get enough to eat’, (e.g. Rose and Oliveira 1997; Gundersen and Oliveira 2001; Ribar and Hamrick 2003), while food insecurity exists when there is ‘limited or uncertain availability of nutritionally adequate and safe foods or limited or uncertain ability to acquire acceptable foods in socially acceptable ways’ (National Research Council 2006). Because we are interested in temporal correspondence between food deprivation and monthly income changes, we focus our analysis on the 1-month food insufficiency measure; however, we utilize both the 4-month food insufficiency and the 4-month food insecurity measures as a robustness check on our results. Researchers have expressed concern that self-reported measures of food deprivation most likely have significant subjective components (e.g. Hamermesh 2004; Gundersen and Ribar 2005). However, self-reported food insufficiency has also been shown to be correlated with poor physical, mental and social health, and some chronic health conditions (Vozoris and Tarasuk 2003) and with lower levels of caloric and nutrient intake (Rose and Oliveira 1997; Rose 1999) among adults.Footnote 7

The SIPP questions regarding food insufficiency are constructed in a two-tier, conditional fashion; a first question inquires whether the household ‘sometimes or often did not get enough to eat’ in any of the past 4 months. If this is the case, subsequent questions ask whether food insufficiency occurred in the first, second, third and/or fourth month of the wave. Thus, a food insufficiency measure for any 1 month may be subject to compounded measurement error (because the question is conditioned on the answer to the ‘all 4 months’ food insufficiency question). As a check, we repeat our analysis using the 4-month food insufficiency measure. However, it is also likely that the observation for the fourth month of the wave is the most accurate among the monthly observations, as recall bias at the time of interview is minimized.

Household income on the SIPP is defined as all sources of money income before taxes. The survey is quite comprehensive and includes earned income (four types of wage and salary income from employment), cash transfer payments (AFDC/TANF, SSI, social security, unemployment benefits, veterans payments), lump-sum and one-time payments (inheritances, insurance settlements, retirement distributions etc.), regular salary or other income from a self-owned business, property income, and interest received on most types of assets (excluding Individual Retirement Accounts, 401(k)s, savings bonds and similar instruments). In addition, we add to household income the cash value of any benefits from Food Stamps or the Women, Infants and Children (WIC) program. The value of any Earned Income Tax Credit (EITC) received, while an important source of income, can not be included here as it is collected on the SIPP only on a calendar year basis. As such, we are unable to attribute EITC payments to a particular month. This omission is unlikely to have much effect on our analysis, however. While EITC recipients have the option of taking an advance payment option to receive incremental payments as a ‘refund’ on their paychecks, Hotz and Scholz (2003) report that in 1998 only 1.1% of recipients took advantage of this option. Instead, 92% of EITC payments are received between February and May of each year as a lump sum payment (or tax credit; Barrow and McGranahan 2000). In our analysis, we relate food deprivation measures to income shocks and other characteristics for month 32, which occurs during calendar months September through December of 2003.

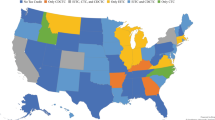

Other controls and characteristics we develop include a measure of family type (married couple with children, single parent with children or no child household), household head characteristics including sex, age, education, employment status, marital status, and race/ethnicity, household location (urban vs. rural and census division), household characteristics including number of adults, number of children, and whether any member of the household was employed or disabled. These are comparable to the lists of controls included by Ribar and Hamrick (2003) and Gundersen and Oliveira (2001).

We define liquid assets as interest earning assets held in banking or other institutions, equity in stocks, mutual fund, IRA, Keogh, 401(k) or thrift savings accounts. However, asset information in the SIPP is available only for the last months of Wave 6 and Wave 9 (months 24 and 36, respectively). We impute a measure of household liquid assets for month 32 via linear interpolation.Footnote 8

5 Determinants of food deprivation

In Table 1 we show the three food deprivation measures used here—1- and 4-month food insufficiency, and 4-month food insecurity. By each of these measures, the rate of food deprivation rises considerably as household income drops; for instance, the rate for households with incomes between 100 and 200% of the poverty line is double the overall rate. These rates are consistent with the levels of food insufficiency and insecurity estimated by other authors (e.g. Rose et al. 1998; Ribar and Hamrick 2003).

Based on the conceptual framework we outlined above, we use multivariate logistic regression to test the relationship between a binary indicator of food insufficiency and transitory and stable components of income.Footnote 9 Our empirical specifications explaining household food insufficiency in month 32 of the data period are based on Eq. 5; additional models explaining the 4-month measures of food deprivation are discussed below, along with other sensitivity analyses. All models are estimated using procedures designed for complex survey data, applying appropriate household weights as well as clustering and sampling weights provided on the SIPP. Unless otherwise stated, all controls are for month 32 of the data period. In Table 2 we provide means and standard deviations of all variables included in our estimated models for the sample of 16,067 households for which there is complete data. Income measures are deflated to December 2003 levels using the monthly CPI-U and measured in hundred dollar increments.

In Table 3, we show three versions of the model, progressing from simpler to more complex specifications. Later we also discuss the results of various sensitivity analyses. In Model 1 in Table 3, the only income variable included is contemporaneous monthly household income for month 32 and we establish that food insufficiency in month 32 is negatively related to this measure of income. In Model 2, we decompose monthly income into its constituent parts. While we consider alternate methods for decomposing income into stable and transitory components below, we begin with mean monthly income for the previous 12 months as an estimate of the stable component of income (\( \widetilde{Y} \)), and we estimate the income shock as the deviation of month 32 income from that mean (Y *). These components of income are nearly orthogonal to one another; the correlation between the mean income and the income deviation in month 32 is −0.03. Coefficients on both components are negative and statistically significant. In absolute value, the point estimate of the coefficient on mean income is somewhat larger than the coefficient on the income deviation (−.045 vs. −.029) and the difference is statistically significant.Footnote 10 In Model 3, we estimate the effects of positive and negative shocks separately. The coefficient on positive income shocks is small and is not different from zero; the coefficient on the negative shocks is negative, as expected, and statistically significant. In this case the absolute value of the point estimate of the coefficient on mean income is somewhat larger than the coefficient on the negative income shock (−.051 vs. −.044), but the difference is not statistically significant. These findings are consistent with the model predictions: positive shocks have no effect on food insufficiency, while the stable component of income and negative income shocks have a negative effect. Moreover, the magnitude of the effect, as measured by the point estimates, is somewhat smaller for negative income shocks, reflecting the mix of liquidity and non-liquidity constrained households in our sample.

All three models include a full complement of control variables including demographic characteristics, liquid assets, home ownership, education, household composition and geographic location. In particular, we see that households headed by men and by those with a college education are less likely to experience food insufficiency, as are those who own their own home or those with more liquid assets; larger households and those with a disabled household member are (ceteris paribus) more likely to be food insufficient; these findings are consistent with those of Gundersen and Oliveira (2001) and Ribar and Hamrick (2003). The coefficients on income and control variables are quite stable across these specifications and across others discussed below.

One concern about these findings is the possibility that our measure of income shocks represents (perhaps in part) measurement error and is not entirely comprised of actual shocks to household income. If this is the case, the coefficient estimates on income shock variables will be biased toward zero—we do not expect erroneously measured income ‘shocks’ to be related to any real outcomes for households. Thus, our results regarding negative income shocks should be robust; if anything, measurement error would dampen the observed impact. However, our finding that positive shocks have no impact on the probability of food insufficiency should be interpreted with caution.

5.1 Sensitivity analysis

The data analysis presented here raises several possible issues. One concern is whether these findings hold for lower-income households that are more likely to experience food deprivation. A second concern is whether data imputation methods employed in the SIPP might systematically alter the results; the presence of imputed data in the sample is somewhat negatively correlated with income. Third, there is the question of measurement error or bias in the construction of the 1-month food insufficiency measure and whether alternate food deprivation measures would yield different results. Fourth, there are a number of possible methods for decomposing current monthly income into its stable and transitory components. Fifth, there is the concern that controls included may not adequately account for the different budgetary demands on households of varying size and composition. And finally, the question of whether or not the results are influenced by the inclusion or exclusion of SIPP complex survey weights. In order to address these concerns, we subject our findings to numerous checks for robustness. Sixteen sensitivity tests are described here and summarized in Table 4, where we show key estimated coefficients (the coefficients on the stable portion of income and on the positive and negative income deviations) from Model 3 of Table 3. We find little variation in results, however, regardless of the robustness check employed.

The first line of Table 4 displays results estimated only on households with incomes below 300% of the poverty line. The results are comparable to our findings for the whole sample, although it is worth noting that the magnitude of the coefficient on the negative income shock increases somewhat for this lower-income group. To address the use of imputed data in the SIPP, we re-estimate the models on four alternate samples. In line 2 of Table 4, we eliminate all households for which any of 70 components of income was imputed for any month of the periods studied, reducing the sample size by two-thirds. In line 3, we impose a somewhat less strict restriction—only eliminating households for whom a component of earnings was imputed for any household member for any month (eliminating about 45% of the original sample). In line 4, we eliminate all households for which a SIPP ‘Z-type’ imputation was performed for any household member for one or more months included in our time period (eliminating about 18% of the sample).Footnote 11 There is a negative relationship between imputation and household income which is strongest for those with any component of total income imputed, less so for those with imputed earnings and weakest for those with Z-type imputations. Thus, the coefficient estimates on mean income and income deviations vary accordingly, with consistently larger magnitude coefficients for lower income samples. Nevertheless, the pattern of results holds precisely with those shown in Table 3. Finally, in line 5 of Table 4 we estimate the model only for those households for whom the answers to the food insufficiency questions are not imputed. Again there is little change in the coefficient estimates.

Two additional specifications (lines 6 and 7) involve substituting the other available measures of food deprivation—the 4-month food insecurity and insufficiency measures—as the dependent variable in the equation. In these specifications, income deviations are defined as the maximum deviation from mean income that occurred during those 4 months, as this is the income event most likely to influence food deprivation.Footnote 12 In either case, the pattern remains the same: mean income and the negative income shock both significantly affect food deprivation, while a positive income shock does not. The somewhat smaller magnitude coefficients in these specifications, however, likely reflect less precise temporal alignment between the food deprivation measure and the timing of income changes.

In the next set of robustness checks, we address the decomposition of current income into stable and transitory components. In specifications discussed thus far, the stable component of current income is estimated as the mean of monthly income in the preceding 12 months. In lines 8 through 10 of Table 4, we check whether these results are sensitive to the exact timing of this construction, altering the mean income to include the current month, to cover 24 preceding months instead of 12, and substituting the median for the mean. In each case, the results change little. In line 11, we also check for sensitivity of results to the timing of the income shock, lagging the shock by 1 month. Here the magnitude of the coefficients of interest decrease some, most likely because of loss of timing correspondence between the experience of food insufficiency and income changes. We also estimate models with income shocks lagged 2, 3 and 4 months with similar result; the magnitude of the coefficients decreases slightly with each additional lag (results available from the authors).

The mean of past income is potentially only a crude approximation of a household’s understanding regarding the stable component of their current income. One strategy for obtaining a more precise estimate of the stable component of income is to estimate a model explaining household income over the full 32 months of data available in the SIPP. The predicted level of household income for month 32 then serves as our estimate of the stable component of income (and correspondingly, the income shock in month 32 is calculated as the deviation of current month 32 income from the predicted value). We follow this strategy and the first-stage model is estimated with two-way fixed effects (for household and time) explaining current monthly income as a function of householder and household demographics, human capital, assets, business cycle, season, and region.Footnote 13 The resulting coefficient estimates from the second-stage model are shown in lines 12 and 13 in Table 4: line 12 displays results based on a linear first-stage model; line 13 displays results based on a semi-log first-stage model, from which predicted household income is exponentiated for use in the second-stage logistic function. Despite the additional information incorporated here in the estimate of the stable component of income, the pattern of results in both lines 12 and 13 is as previously observed.

Finally, a few alternate specifications are also noted in Table 4 with little additional effect: line 14 presents results for a model in which income is defined only as cash income (excluding the value of Food Stamps and WIC), line 15 presents results for a model in which household income is redefined relative to the poverty line (in an effort to better account for different household compositions and budgetary needs), and line 16 shows results for a model estimated without survey and household weighting schemes. Again, none of these specification changes alter the nature of the findings presented here.

5.2 Magnitude of impact

To gauge the magnitude of the effect of negative income shocks on food insufficiency, we calculate the marginal effect of a unit ($100) change in the negative income shock for a given population as the estimated linear probability model coefficient, interpreted at the mean probability of food insufficiency for that population.Footnote 14 We then multiply this effect by the mean negative income shock for a population in order to estimate the impact of a typical negative shock on the expected probability of food insufficiency. We find that typical negative shocks induce meaningful increases in the predicted rates of food insufficiency, particularly among households with structures that may provide for less economic resilience. Among all households, a negative income shock of $1,177 (the mean across all households experiencing a negative shock) will increase the probability of 1-month food insufficiency from the average of 1.7 to 2.5%. The mean negative income shock among single-mother households of $838 will increase the expected probability of food insufficiency for such households from the average of 3.6 to 4.9%. Among households with incomes below 200% of poverty, a typical negative shock of $1,411 would cause the expected rate of food insufficiency to rise from the average of 4.4 to 5.3%; a mean negative shock of $733 for welfare-at-risk households (those with children, headed by a single parent with no more than a high school education) will cause the expected rate of food insufficiency to rise from the mean of 3.5 to 4.6%.

5.3 Liquidity constraints

Our empirical results thus far abstract from the issue of liquidity constraints, yet our conceptual framework suggests that the presence or absence of liquidity constraints on households may be important in mediating the effect of income shocks on food insufficiency. As a final exercise, we experiment with specifications that attempt to distinguish between households that are and are not liquidity constrained. As Jappelli (1990) notes, actually observing such constraints is problematic and most researchers have only inferred liquidity constraints rather than measuring them directly. Using direct evidence on credit approval or denial, however, Jappelli (1990) found about 20% of U.S. households to be liquidity constrained and that current income and assets were among the most important correlates of whether a consumer is denied credit. Along these lines, we develop a proxy for liquidity constraints—the ratio of liquid assets to annual household income. The asset-to-income ratio measures the ready availability of funds relative to the size of the household budget. We operationalize this measure by sorting households into quartiles according to their asset-to-income ratio and estimating the effect of income deviations on food insufficiency separately for each quartile. We expect that households in the lower quartiles are more likely to be liquidity constrained than those in the upper quartiles.

Results using this proxy for liquidity constraint are shown in Table 5. We replicate Models 2 and 3 from Table 3, in each case interacting the liquidity constraint proxy with the measure(s) of income shock. The results are consistent with our model predictions: Income shocks are negatively related to food insufficiency for those households that are more likely to be liquidity constrained, while not for others. When we estimate the effects of positive and negative shocks separately for both types of households, the effects of positive shocks are close to zero and not statistically significant regardless of asset-to-income ratio quartile, while the effects of negative shocks diverge for households in the different quartiles. For households in the lower two quartiles, the effect of a negative shock is statistically significant and comparable in size to the effect of average monthly income (−.048 and −.047). For households in the upper two quartiles, the effect of a negative shock is small and not statistically significant.

While our proxy for liquidity constraint is only a rough approximation, these findings are consistent with the conceptual framework discussed here in suggesting that negative income shocks are related to household food insufficiency when a household is liquidity constrained, but less so otherwise, and that positive income shocks do not affect food insufficiency regardless.

6 Discussion and policy implications

Our analysis demonstrates that both the mean level of income, and negative income shocks have a statistically significant effect on the probability of 1-month food insufficiency among non-elderly U.S. households, such that lower mean income or larger (in absolute value) negative income shocks both lead to a higher probability of food insufficiency. Furthermore, we find that positive income deviations do not have a corresponding effect in lowering food insufficiency. This asymmetric result is consistent with the predictions of a conceptual framework we develop in which households attempt to maximize their utility over multiple time periods. These findings also hold for two alternate measures of food deprivation—4-month food insufficiency and 4-month food insecurity—and are robust to any number of sensitivity analyses and robustness checks.

These results are not meant to suggest that income level itself is not an important determinant of food deprivation, but instead indicate that the volatility of income is also an important consideration. For instance, we find that a mean negative income shock (−$491) for a household at or below 200% of the poverty level will increase that household’s probability of food insufficiency by 20.7%. Similarly, if a single-mother household (of any income level) faces the mean negative shock for her cohort (−$838), her household’s probability of food insufficiency will increase 35.6%.

Our conceptual model also suggests that these results should be sensitive to the degree to which households are subject to liquidity constraints. In particular, we expect that if households are not liquidity constrained, that income fluctuations will not affect their level of deprivation. However, among liquidity constrained households we expect that negative shocks would induce deprivation, while positive shocks would have no effect. While we lack a definitive indicator of the degree to which households are or are not liquidity constrained, using a proxy for the degree of liquidity constraint faced by households, we find results that are precisely consistent with these predictions.

These findings suggest that economic, demographic or policy changes that increase the frequency or size of income shocks experienced by households over time—even while holding mean household income levels constant—have the potential to influence the level of food deprivation for liquidity constrained households. As others have documented, lower income households experienced just such an increase in volatility during the 1990s, perhaps as a result of welfare reform. If lower-income households are also disproportionately liquidity constrained, this kind of change is likely to increase the number of months in which such households experience food insufficiency. Indeed, along the same lines, Borjas (2002) found that the decline in welfare receipt associated with U.S. welfare reform was associated with a rise in food insufficiency in the affected population.

Similarly, if other kinds of economic, demographic, institutional or policy changes alter income volatility or the degree of liquidity constraint experienced by households, changes in the degree of food deprivation experienced might result. For instance, if labor market policies or institutions evolve in a way to promote more variable employment, hours or pay rates (Hajivassiliou and Ioannides 2007), if household compositions change to include fewer working members (i.e. more single parent or single adult households), or if the aging of the labor force increases the number of workers who are subject to more variable health status, one might expect a similar impact. Policies that are likely to smooth household income or consumption (e.g. food assistance, unemployment insurance) should work in the opposite direction (e.g. Gruber 1997; Blundell and Pistaferri 2003). Subject to the exploratory nature of our analysis regarding liquidity constrained households, policies that promote or restrict the availability of credit, particularly for lower-income households, might also be important.

As noted above, the finding that negative income shocks are only important for households with below median asset-to-income ratios suggests that liquidity constraints may play a role in limiting the ability of households to weather variable circumstances. While this paper has focused on the relationship between income shocks and food insufficiency, the relationship between income shocks and other indicators of material deprivation may exhibit similar patterns. For instance, liquidity constrained families may also be at higher risk for evictions, utility shut-downs, loan defaults and repossessions when monthly income drops, even when mean monthly income levels are sufficient to maintain household infrastructure. Thus, the confluence of income volatility, liquidity constraints and access to a social safety net may be more generally important to the well-being of lower income households than previously recognized in this and related literatures.

Notes

The Food Stamp program was renamed the Supplemental Nutrition Assistance Program (SNAP) in October 2008.

Here the stable portion of income is fixed. However, this framework can be generalized to allow for a stable trend component which reflects the age-earnings profile of household members or rising real earnings; we empirically test such a model in our sensitivity testing below.

The 36 months of interviews are actually conducted over 39 calendar months because each SIPP panel is divided into four rotation groups; one-quarter of the interviews are conducted in each calendar month.

The household head is the SIPP ‘reference person’—the person in whose name the home is owned or rented. If the house is owned jointly by a married couple, either the husband or the wife may be listed as the reference person. The household as the unit of analysis is most consistent with the concept of food deprivation put forth by the National Research Council (2006) in their assessment of such measures: “Food insecurity is measured as a household-level concept” (National Research Council 2006, p. 4).

The food insecurity measure was created by the Economic Research Service (ERS) of the USDA for the 2001 SIPP based on five questions in the Wave 8 Topical Module instead of on the standard six- or eighteen-point food insecurity scales used by the ERS. ERS has shown measures based on the latter scales to be reliable and minimally biased (Bickel et al. 2000).

Researchers have put forth several possible reasons for the finding that food insufficiency is predictive of health or nutritional status for adults but not for children: adults may protect the health status of children in their household by skipping meals themselves before depriving their children, or children may have a more robust safety net that includes subsidized meal programs at school, or food at friends houses.

In sensitivity testing, we also generate comparable results using alternative asset measures—either the actual data for months 24 or 36 or the interpolated data for month 32.

Alternatively, these equations could be estimated as probit functions (available from the authors); as noted by Allison (1999, p. 73), estimates based on probit specifications yield comparable results.

Tests for equality of coefficients are conducted using a Wald chi-square test (SAS version 9.2, SURVEYLOGISTIC procedure).

A SIPP ‘Z-type’ imputation is the case were an entire missing interview record for a respondent is replaced with actual data from another respondent who is matched on a variety of demographic characteristics.

In both specifications we also model income shocks as the mean income shock that occurs over the four-month period with little change in the result (results available from the authors).

We thank an anonymous referee for suggesting this approach. Further details of the first-stage panel regression are outlined in an Appendix available from the authors.

Marginal effects are based on Model 3 in Table 3 and (for continuous variables) are computed as dP/dX = P(1 − P) b L, where P is the probability of food insufficiency for a particular population, X is the independent variable of interest, and b L is the logistic coefficient estimate on the independent variable of interest (see Pindyck and Rubinfeld 1981, p. 299).

References

Allison, P. D. (1999). Logistic regression using the SAS system: Theory and applications. Cary, NC: SAS.

Bania, N., & Leete, L. (2009). Monthly household income volatility in the U.S., 1991/92 vs. 2002/03. Economics Bulletin, 29(3), 2096–2108.

Barrow, L., & McGranahan, L. (2000). The effects of the earned income tax credit on the seasonality of household expenditures. National Tax Journal, LIII(4, part 2), 1211–1243.

Bernell, S., Edwards, M., & Weber, B. (2006). Restricted opportunities, unfortunate personal choices, ineffective policies: What explains food insecurity in Oregon? Journal of Agricultural and Resource Economics, 31(2), 193–211.

Bickel, G., Nord, M., Price, C., Hamilton, W., & Cook, J. (2000). Guide to measuring household food security, revised 2000. Alexandria, VA: U.S. Department of Agriculture, Food and Nutrition Service.

Blank, R. M. (2006). What did the 1990s welfare reforms accomplish. In A. Auerbach, D. Card, & J. Quigley (Eds.), Public policy and the income distribution. New York: Russell Sage. Chap. 2.

Bloom, D., Farrell, M., & Fink, B. (2002). Welfare time limits: State policies, implementation, and effects on families. New York: Manpower Demonstration Research Corporation.

Blundell, R., & Pistaferri, L. (2003). Income volatility and household consumption: The impact of food assistance programs. Journal of Human Resources, 38(S), 1032–1050.

Bollinger, C., Gonzalez, L., & Ziliak, J. P. (2009). Welfare reform and the level and composition of income. In J. P. Ziliak (Ed.), Welfare reform its long-term consequences for America’s poor (pp. 59–103). Cambridge: Cambridge University Press.

Borjas, G. (2002). Food insecurity and public assistance. Journal of Public Economics, 88, 1421–1443.

Corcoran, M., Danziger, S., Kalil, A., & Seefeldt, K. (2000). How welfare reform is affecting women’s work. Annual Review of Sociology, 26(1), 241.

Corcoran, M., Heflin, C., & Siefert, K. (2007). Work trajectories, income changes and food insufficiency in a Michigan welfare population. Social Service Review, 81, 3–25.

Currie, J., & Grogger, J. (2001). Explaining recent declines in food stamp program participation (pp. 203–244). Brookings-Wharton papers on urban affairs.

Farrell, M., Fishman, M., Langley, M., & Stapleton, D. (2003). The relationship of earnings and income to food stamp participation: A longitudinal analysis. USDA Economic Research Service, E-FAN-03-011.

Gruber, J. (1997). The consumption smoothing benefits of unemployment insurance. The American Economic Review, 87(1), 192–205.

Gundersen, C., & Gruber, J. (2001). The dynamic determinants of food insufficiency. In M. S. Andrews & M. A. Prell (Eds.), Second food security measurement and research conference (Vol. II: Papers 2001). Washington, DC: Department of Agriculture, Economic Research Service.

Gundersen, C., & Oliveira, V. (2001). The food stamp program and food insufficiency. American Journal of Agricultural Economics, 83(4), 875–887.

Gundersen, C., & Ribar, D. (2005). Food insecurity and insufficiency at low levels of food expenditures. IZA discussion paper no. 1594.

Hacker, J. S., & Jacobs, E. (2008). The rising instability of American family incomes, 1969–2004 evidence from the panel study of income dynamics. EPI briefing paper, Economic Policy Institute, May 29 2008, briefing paper #212.

Hajivassiliou, V., & Ioannides, Y. (2007). Unemployment and liquidity constraints. Journal of Applied Econometrics, 22, 479–510.

Hamermesh, Daniel. (2004). Subjective outcomes in economics. Southern Economic Journal, 71(1), 1–11.

Haskins, R. (2001). Effects of welfare reform on family income and poverty. In R. Blank & R. Haskins (Eds.), The new world of welfare. New York: Russell Sage.

Hotz, V. J., & Scholz, J. K. (2003). The earned income tax credit. In R. Moffitt (Ed.), Means-tested transfer programs in the United States. Chicago: University of Chicago Press. A National Bureau of Economic Research conference report.

Huffman, S., & Jensen, H. (2003). Do food assistance programs improve household food security? Recent evidence from the United States. CARD working paper 03-WP 335. Center for Agricultural and Rural Development, Iowa State University.

Jappelli, T. (1990). Who is credit constrained in the U.S. economy? The Quarterly Journal of Economics, 105(1), 219–234.

Jensen, H. (2002). Food insecurity and the food stamp program. American Journal of Agricultural Economics, 84(5), 1215–1228.

Kornfeld, R. (2002). Explaining recent trends in food stamp program caseloads. Cambridge, MA: Abt Associates. Report submitted to the U.S. Department of Agriculture, Economic Research Service.

Loprest, P., & Zedlewski, S. (1999). Current and former welfare recipients: How do they differ? Assessing the new federalism. Washington, DC: The Urban Institute. Discussion Paper 99–17.

Moffitt, R., & Winder, K. (2003). The correlates and consequences of welfare exit and entry: Evidence from the three-city study. Three-city working paper 03-01. Baltimore: Johns Hopkins University. Available at http://www.jhu.edu/~welfare.

National Research Council. (2006). In G. Wunderlich & J. Norwood (Eds.), Food insecurity and hunger in the United States: An assessment of the measure. Panel to review the U.S. Department of Agriculture’s measurement of food insecurity and hunger. Committee on National Statistics, Division of Behavioral and Social Sciences and Education. Washington, DC: The National Academies Press.

Newman, C. (2006). The income volatility see-saw: Implications for school lunch. USDA, Economic research report no. ERR-23.

Pindyck, R., & Rubinfield, D. (1981). Econometric models and economic forecasts (2nd ed.). New York: McGraw-Hill.

Primus, W., Rawlings, L., Larin, K., & Porter, K. (1999). The initial impacts of welfare reform on the economic well-being of single-mother families with children. Working paper, Center on Budget and Policy Priorities.

Ribar, D. C., & Hamrick, K. (2003). Dynamics of poverty and food sufficiency. Electronic Report from the Economic Research Service, U.S. Department of Agriculture, Food Assistance and Nutrition Research, research report 36.

Rose, D. (1999). Economic determinants and dietary consequences of food insecurity in the United States. The Journal of Nutrition, 129, 517s–520s.

Rose, D., & Oliveira, V. (1997). Nutrient intakes of individuals from food insufficient households in the United States. American Journal of Public Health, 87, 1956–1961.

Rose, D., Gundersen, C., & Oliveira, V. (1998). Socio-economic determinants of food insecurity in the United States: Evidence from the SIPP and CSFII datasets. Food and Rural Economics Division, Economic Research Service, US Department of Agriculture. Technical bulletin no. 1869.

Sullivan, J., Turner, L., & Danziger, S. (2008). The relationship between income and material hardship. Journal of Policy Analysis and Management, 27(1), 63–81.

Vozoris, N., & Tarasuk, V. (2003). Household food insufficiency is associated with poorer health. The Journal of Nutrition, 133(1), 120–126.

Ziliak, J., Gundersen, C., & Figlio, D. (2003). Food stamp caseloads over the business cycle. Southern Economics Journal, 69(4), 903–919.

Acknowledgments

The authors thank Jessica Greene, Craig Gundersen, Kathryn Magnuson, Joe Stone, Parke Wilde, and two anonymous referees, as well as participants at the following workshops for their detailed and useful comments: April 2006 IRP-USDA Small Grants Workshop, October 2006 USDA RIDGE Conference, November 2006 National Poverty Center/ERS-USDA Conference on ‘Income Volatility and Implications for Food Assistance II’ and the Spring 2007 Oregon State University Contemporary Rural Issues Seminar. This work was partially funded by the University of Wisconsin—Institute for Research on Poverty/USDA Small Grants Program under Agreement Number: F184516. Additional funding provided by the National Poverty Center, University of Michigan. An earlier version of this work appeared as a working paper at the University of Wisconsin Institute for Research on Poverty (WP# 1325-07). All remaining errors are the responsibility of the authors, however. The views and opinions expressed herein are those of the authors and do not necessarily reflect those of the Food Assistance and Nutrition Research Program, the Economic Research Service, or the United States Department of Agriculture.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Leete, L., Bania, N. The effect of income shocks on food insufficiency. Rev Econ Household 8, 505–526 (2010). https://doi.org/10.1007/s11150-009-9075-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-009-9075-4