Abstract

Low- and moderate-income (LMI) households need financial assets to help cope with income and expenditure shocks. Prior research identifies racial differences in wealth and wealth effects. We examined whether these gaps and effects exist for liquid financial assets. Using group invariance tests in structural equation modeling, we assessed the relationship between financial shocks and material hardship, as mediated by liquid financial assets and moderated by race/ethnicity among a sample of LMI tax filers (N = 7544). Though most study participants were employed (71%), average income was only $18,055 and average liquid financial assets was $4701. Black households had $2774 less in liquid financial assets compared to white households (p < .001) after controlling for income and other factors. Model fit for the final moderated mediation model was excellent (RMSEA = 0.026, 90% C. I. [0.020, 0.033], CFI = 0.977). The mediating effect of liquid financial assets was 10.4% for white, but only 3.6 and 4.4% for black and Latino households, respectively. That is, the proportion of the relationship between shocks and hardship mediated by liquid financial assets varied by race/ethnicity. Policies aimed at helping LMI households build emergency savings such as tax refund savings matches may be less likely to benefit black and Latino households than white households, suggesting the need for other policies to address this form of the racial wealth gap.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Negative financial shocks, such as loss of income due to reduced work hours or unexpected large expenses, are common occurrences in low- and moderate-income (LMI) households (Abbi 2012; Acs et al. 2009; Morduch and Schneider 2017). The consequences of such shocks may include LMI households forgoing necessary consumption (Despard et al. 2018; McKernan et al. 2009; Pew Charitable Trusts 2015a) or taking on high-interest rate debt to smooth consumption through the period of the emergency (Pew Charitable Trusts 2012).

Liquid financial assets play an important role in helping households cope with financial shocks, making it less likely that these shocks result in material hardship (Despard et al. 2018; Collins and Gjertson 2013; Gjertson 2016; McKernan et al. 2009). Our prior study confirms that liquid assets mediate the relationship between financial shocks (emergency) and material hardship in LMI households, where 90.5% of the effect of financial shocks on material hardship is direct, and 9.5% of this effect is indirect via assets (Despard et al. 2018).

However, the role that liquid financial assets play with respect to financial shocks and material hardship may not be similar for all LMI households. Racial disparities exist concerning the incidence of, responses to, and consequences of financial shocks (Pew Charitable Trusts 2015a, 2017), liquid financial assets (Haveman and Wolff 2005; Pew Charitable Trusts 2015b), and incidence of and risk for material hardship (Beverly 2001; Sullivan et al. 2008; Pilkauskas et al. 2012). These variables—financial shocks, liquid assets, and material hardship—may be related in different ways among LMI households based on race and ethnicity.

In this study, we build on our prior study to address the following research question: is the mediating role of assets in the relationship between financial shocks and material hardship moderated by race among LMI households? We answer this question using data from a two-wave 2013 Household Financial Survey (HFS) administered to a sample of LMI tax filers. Findings from our study have important implications concerning policies aimed at building greater financial security and economic mobility among LMI households.

Background

Financial Instability and Household Assets

Financial instability is a common experience for LMI households. In one study, 66% of LMI households reported at least one financial shock (e.g., car or home repair, income loss, unemployment, medical expenses) within a 6-month period in a recent study (Grinstein-Weiss et al. 2014). Similarly, Manturuk and Quercia (2007) found that 44% of LMI households experienced a recent financial crisis as result of medical emergencies, the need of car or home repairs, unemployment, or loss of income. The collective impact of these unplanned financial events is not inconsequential for families. Pew Charitable Trusts (2015a) found that the median cost of these events amounts to $2000 for families and places moderate or even severe financial strain on households. Over half (55%) of households reported an inability to make ends meet following their recent financial shock.

LMI households often lack adequate personal savings to cover financial emergencies and typically lack other assets such as stocks, certificates of deposit (CDs), bonds, or investment funds that might be liquidated to cope with emergencies. On average, households earning less than $25,000 have enough liquidity to cover just 6 days’ worth of income if they experience a financial shock (Pew Charitable Trusts 2015b). When LMI families are faced with periods of unexpected expenses, having access to these liquid resources assists them in meeting basic needs and smoothing consumption. Otherwise, many LMI households may turn to high-cost credit (Despard et al. 2017b; Collins and Gjertson 2013). A recent report by Pew Charitable Trusts (2012) underscores the dilemma faced by low-income households: 16% of payday loan users borrowed to cover an unexpected expense (e.g. car repair, hospitalization). Furthermore, households experiencing financial shocks may have few choices but to forgo necessary expenses or bills, increasing the chances of material hardship and reducing family wellbeing (McKernan et al., Pilkauskas et al., Gjertson 2016). As one might expect, the availability of household assets can ease periods of financial instability and offsetting the economic and material consequences for households.

Assets as a Mediator of Financial Shocks and Hardship

Various types of liquid assets (e.g., bank accounts, IRAs, money market funds, certificates of deposit) are associated with lower risk of both financial shocks and material hardship (Short 2005; Lim et al. 2010; Elliott et al. 2013). Having access to at least $500 influenced material hardship equivalent to a threefold increase in household income (Mayer and Jencks 1989). Among households experiencing a financial shock, asset-poor households are 23 percentage points more likely to face material hardship than non-asset-poor families (McKernan et al. 2009). Keating (2012) found that the probability of experiencing material hardship is greatest for asset-poor households in the bottom third of the income distribution. Additionally, households with emergency savings report significantly lower levels of material hardships than households without emergency savings (Collins and Gjertson 2013; Gjertson 2016).

Even modest asset levels can disrupt cycles of instability, avoiding financial shocks and reducing or mitigating hardships. Income shocks are a consistent predictor of material hardship for households (Heflin 2016), yet among low-income households, the presence of up to $2000 in liquid assets reduces the risk of hardship by 5 percentage points compared to households with no assets (McKernan et al. 2009). Additional studies have found reduced odds for material hardship associated with Child Development Account (CDA) participation (Wikoff et al. 2015) and reduced financial strain associated with homeownership (Manturuk et al. 2012) and greater financial assets among low-income households (Rothwell and Han 2010). The available evidence suggests that household assets lessen risk for material hardship and may buffer the impact of financial shocks on hardship.

Differences in Financial Stability by Race and Ethnicity

Race and ethnicity play a central role is predicting a household’s financial stability. Income (Chetty et al. 2018; Semega et al. 2017) and wealth (Keister 2000; Lui 2006; Oliver and Shapiro 2006; Shapiro 2006) gaps between black and Latino and white households have been well studied and documented. Yet, racial and ethnic disparities also exist concerning other indicators of household financial stability. Over two thirds (68%) of white households feel financially secure, compared to 42 and 57% of black and Latino households, respectively (Pew Charitable Trusts 2015a). In a different, nationally representative survey, the proportions of black and Latino households that said they were at least doing okay financially were 12 and 11 percentage points lower, respectively, than white households (Larrimore et al. 2018).

Financial shocks such as a major car repair or hospitalization may disrupt family finances and render households less financially secure. Though families of different races and ethnicities experience similar rates of financial shocks, the availability of resources to cope with these shocks differs by race and ethnicity. Lower proportions of black (52%) and Latino (61%) compared to white (70%) households said they could come up with $2000 for a financial emergency (FINRA Investor Education Foundation 2016). White households have liquid savings equal to an average of 31 days of income, compared to only 5 and 12 days for black and Latino households, respectively (Pew Charitable Trusts 2015b). Black households are twice as likely as white households to lack sufficient liquid assets to cover 3 months of necessary expenses (Haveman and Wolff 2005).

These differences in liquid assets may help explain why black households are at greater risk of experiencing financial or material hardships than white households (Beverly 2001; Sullivan et al. 2008; Pilkauskas et al. 2012). For example, a greater proportion of black and Latino (62%) than white (53%) households said it would be harder to make ends meet for a while following a financial shock (Pew Charitable Trusts 2015a).

Responses to financial shocks also differ by race and ethnicity. When experiencing a financial shock, 27 and 14% of black and Latino households made retirement account withdrawals, respectively, compared to 12% of white households (Pew Charitable Trusts 2017). In addition, compared to white households, black and Latino households are more likely to borrow money from other people and/or turn to alternative financial services like payday loans and less likely to use credit cards in the event of a financial emergency (Pew Charitable Trusts 2015b).

After controlling for income, assets, credit card debt, employment, education, home ownership,budgeting habits, and demographic factors, Roll et al. (2018) found that black and Latino LMI tax filers were more likely than white LMI tax filers to consider high-cost payday and auto title loans when experiencing a financial emergency. These findings may reflect liquidity preferences where black and Latino households prefer not to spend down liquid assets during a financial emergency. Yet, use of high-cost credit in response to financial emergencies erodes income and assets due to loan costs and rollovers (Consumer Financial Protection Bureau 2013; Pew Charitable Trusts 2012) and elevates risk for hardship (Melzer 2011).

Also, black households receive less and give more financial support to their extended families (Goldscheider and Goldscheider 1991), provide more informal financial assistance (O’Brien 2012), and are more likely to have poor family members (Heflin and Pattillo 2002). Therefore, the strain on liquid financial assets may be greater among black households. These assets may do less to reduce risk for hardship because they are also used to help extended family members and are unlikely to be supplemented with financial resources from these family members.

Vulnerability to material hardship may be greater among black and Latino compared to white households independent of liquid assets available to cope with financial shocks. First, the severity and frequency of financial shocks may be greater among black and Latino households rendering each dollar of liquid assets less valuable in mitigating risk for hardship. For example, the median duration of an unemployment spell in 2017 was nearly 4 weeks longer among black compared to white individuals (United States Department of Labor 2018) while job separation incidence is higher among black and Latino compared to white employees (Couch and Fairlie 2010; Couch et al. 2018). Similarly, though rates of uninsurance have recently fallen dramatically following passage of the Affordable Care Act, the uninsurance rate among black and Latino individuals is 4 and 9 percentage points higher compared to white individuals (Artiga et al. 2018). Consequently, the out of pocket costs associated with being hospitalized is likely higher among black and Latino individuals, who also have the two highest rates of preventable hospitalization (Russo et al. 2006). Moreover, municipal fines and fees are more frequent and larger among communities of color compared to white communities (United States Commission on Civil Rights 2017).

Second, differential access to markets by race and ethnicity may diminish the value of liquid assets in forestalling hardship. For example, black and Latino households experienced greater delinquency and default in the aftermath of the housing crisis due to subprime mortgage lending (Bayer et al. 2016; Reid et al. 2016). Persistent racial and ethnic discrimination in rental markets (Hanson and Santas 2014; Turner et al. 2013) may also make it more difficult for black and Latino households to find affordable housing. With fewer affordable options, housing costs may consume a greater proportion of black and Latino households’ income, which may heighten risk for hardship irrespective of liquid financial assets. Similarly, food insecurity may be tougher to forestall with liquid assets for black and Latino households who are more likely to live in food deserts (Bower et al. 2014) and have fewer purchasing choices.

Additionally, greater presence of alternative financial service providers in neighborhoods with higher proportions of black and Latino residents (Barth et al. 2016; Despard et al. 2017a; Fowler et al. 2014; Hegerty 2016; Prager 2014; Temkin and Sawyer 2004) may help explain higher use by black and Latino households of high-cost loans in response to financial emergencies (Roll et al. 2018). Use of these loans may exact financing costs that crowd out purchasing power for meeting basic needs for housing, food, and health care.

The evidence reviewed above suggests that key indicators of financial stability vary by race and ethnicity, even among households with similar incomes. Liquid assets may have a different association with the likelihood of material hardship in the wake of financial shocks based on race and ethnicity. This difference may be due to liquidity preferences, the severity and frequency of financial shocks, and differential access to markets.

Study Purpose and Conceptual Framework

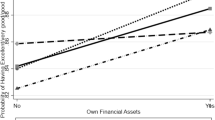

Though liquid financial assets may mitigate the effect of financial shocks on material hardship in households, the evidence reviewed above suggests the possibility this may not hold equally true for households irrespective of race/ethnicity. The purpose of this study is to examine how the role of liquid financial assets in mediating the relationship between financial shocks and material hardship is moderated by race/ethnicity. In a previous study (Despard et al. 2018), we found that the effect of financial shocks on material hardship as mediated by liquid financial assets explained 9.5% of variance. We hypothesize that race moderates this relationship—that the indirect effect we observed in our previous study is conditional and varies based on the race or ethnicity of the respondent (see Fig. 1).

The mediating relationship of liquid financial assets is informed by economic theory concerning precautionary saving in anticipation of unknown future events that might affect household consumption (Carroll and Samwick 1998) and the buffering role of assets with respect to material hardship (Deaton 1991). More specifically, liquid financial assets lessen risk for material hardship among LMI households (Gjertson 2016) including in the wake of financial shocks (McKernan et al. 2009).

The moderating role of race and ethnicity is broadly informed by social stratification (Kerbo 1996; Oliver and Shapiro 2006; Conley 1999), which views racial differences in social and economic indicators as determined by social structures that historically and currently advantage white households. More specifically, the moderating role of race and ethnicity in the conceptual model in Fig. 1 is informed by the evidence reviewed above in the “Differences in Financial Stability by Race and Ethnicity” section that suggests a diminished value of liquid assets in lessening risk for hardship in the wake of financial shocks among LMI black and Latino households.

An additional purpose of this study is to describe differences in liquid financial assets by race/ethnicity among a sample of LMI households to fill a gap in the literature, whereas prior research on the racial wealth gap included illiquid assets and assessed wealth disparities among households of all income levels. Given the elevated risk of material hardship due to a lack of liquid financial assets (Gjertson 2016; McKernan et al. 2009), it is important to assess whether these assets vary by race/ethnicity among LMI households.

Methods

Data and Sample

Data for this study came from the two-wave 2013 Household Financial Survey (HFS), a survey completed by participants in the Refund-to-Savings initiative. Refund-to-Savings participants (n = 680,545) were drawn from a population of 873,026 individuals who used free TurboTax online software to file their federal income tax returns during the 2013 tax filing season (tax year 2012) and were due a refund. Individuals eligible to use this free online tax filing program had an adjusted gross income of under $31,000, received the earned income tax credit (EITC), or were an active-duty member of the military with an adjusted gross income of under $57,000. Participants in the Refund-to-Savings initiative were then randomly assigned to receive messages in the tax filing software encouraging them to save their refunds or to a control group.Footnote 1

From the analytical sample of Refund-to-Savings participants (n = 680,545), 20,813 and 8251 filers chose to complete the HFS1 and HFS2, respectively. Thus, the response rate to HFS1 from a population of LMI tax filers was 3% and the response rate to HFS2 from HFS1 completers was 40%. Because we used two waves of observation, we restricted the sample to participants who completed both the HFS1 and HFS2. No statistically significant differences based on age, filing status, income, and tax refund amounts were observed between the tax filing population and analytic sample, nor between the analytic sample and participants who chose to complete HFS1 (Grinstein-Weiss et al. 2015).

We also restricted the sample to include participants who indicated their race/ethnicity as white, black, or Latino. Prior research on the intersection of race/ethnicity and wealth focuses on differences among these three groups attributed to discriminatory policies and differential access to markets (Oliver and Shapiro 2006; Conley 1999; Haveman and Wolff 2005; Shapiro et al. 2013). We used listwise deletion for missing values on model variables for 120 observations. As such, the final sample analyzed was comprised of 7554 participants, with a deletion of observations with missing data of 1.6%.

The HFS online survey instruments took participants roughly 20 min to complete and included an in-depth set of questions aimed at eliciting participants’ financial behaviors, habits, and circumstances. Participants in this study provided informed electronic consent to participate in the study and the study was approved by the institutional review board of the host university located in the Midwest.

Variables

The exogenous variable in our model was financial shocks, a count of the following four unexpected events experienced by the participant in the 6 months after tax filing: a period of unemployment, a health event requiring hospitalization, a major auto repair, and an event requiring the payment of legal fees. These measures were used to reflect events in which households experienced an unexpected loss of income or an event which required a large and unplanned expenditure (Abbi 2012; McKernan et al. 2009; Pew Charitable Trusts 2015a).

To measure financial shocks, participants were asked the following questions in HFS2, which was administered 6 months after participants filed their taxes: “Has any member of the household experienced a period of unemployment since the last survey?,” “Since the last survey, has any member of the household experienced a health event that required a trip to the hospital?,” “Since the last survey, has the household made a major repair to a vehicle it owns?,” and “Has anyone in the household had to pay legal fees or expenses since the last survey?”. In these questions, the last survey referred to HFS1, which was administered when participants filed their taxes. Responses were coded “1” for yes and “0” for no. Thus, financial shocks had a range of 0 to 4.

The endogenous variable of the model, material hardship, was a count of six distinct types of hardship experiences in the 6 months after filing taxes to create a summative index. At HFS2, participants were asked, “Was there a time since you took the last survey when you…” followed by (1) “did not pay the full amount of the rent or mortgage because you could not afford it”; (2) “ skipped paying a bill or paid a bill late because you did not have enough money”; (3) “needed to see a doctor or go to the hospital but did not go because you could not afford it”; (4) “needed to see a dentist but did not go because you could not afford it”; (5) “could not fill or postponed filling a prescription for drugs when they were needed because you could not afford it”; and (6) “could not afford the type or amount of food you wanted.” These measures were informed by Beverly’s (2001) definition of hardship as difficulty meeting basic living needs and by prior use of similar measures by Mayer and Jencks (1989) and in the Survey of Income and Program Participation (Ouellette et al. 2004). Responses were coded “1” for yes and “0” for no. Thus, material hardship had a range of 0 to 6.

The mediating and endogenous variable of liquid financial assets was modeled as a latent construct. Four types of assets were measured at HFS2, 6 months after tax filing: (1) money in checking accounts; (2) money in savings accounts; (3) cash held in the home; and (4) outstanding value of prepaid cards. Each of these indicators was winsorized; values above the 99th percentile were re-coded at the 99th percentile value and re-scaled at $100. If participants did not want to reveal an exact value of their assets, they were asked to indicate a range of values which contained that amount. In these cases, the median value of the range was substituted to represent the value held in that asset.

Analysis

The primary analytic method employed in this study was structural equation modeling (SEM) with a series of group comparisons. SEM enables researchers to study complex relationships among study variables, such as mediating effects, moderating effects, and moderated mediations (Baron and Kenny 1986; Muller et al. 2005). It permits multiple indicators of latent variables and the ability to estimate and test hypothesized relationships while controlling for random and systematic measurement errors (Bollen 1989).

Our prior study confirmed a mediation model depicting liquid financial assets as mediating the relationship between financial shocks and hardship (Despard et al. 2018). In this study, we add race/ethnicity as a moderator as shown in Fig. 1 and describe differences in liquid financial assets by race/ethnicity in a multivariate framework.

This study employed a group invariance analysis in SEM (Hayes 2013) to test whether the main mediation model is constant across the following three race/ethnicity groups: white, black, and Latino. To implement this analysis, we assessed whether a model constraining structural path coefficients across the three race/ethnicity groups fit the data to an acceptable degree. Specifically, for race/ethnicity as a moderator, we tested the following hypotheses: (1) same form of the relationships among the model variables across groups; (2) same exogenous path coefficients of the association of financial shocks with material hardship and liquid financial assets across groups; and (3) same endogenous path coefficient of liquid financial assets on material hardship across groups (Bowen and Guo 2011). Both the same path coefficient models were compared to the same-form model using the Sattora-Bentler scaled chi-square difference tests. If results indicated a non-significant scaled chi-square difference, then the constrained model being compared was deemed acceptable; otherwise, the constrained structure with the same path coefficient across the three race/ethnicity groups was rejected.

To correct for non-normality of multivariate normal distribution of the study variables, we used a maximum likelihood estimator with robust standard errors and chi-square test statistic in Mplus Version 7 (Muthén and Muthén 1998–2012) to run all structural models. Because the model used MLR, the usual chi-square difference test for group comparison was not appropriate. Hence, we applied the Sattora-Bentler scaled chi-square difference test which applies a scaling correction factor, details of which can be found from the Mplus website (Mplus 2015).

To estimate the standard error of the indirect effect in our model (the relationship between financial shocks and material hardship mediated by liquid financial assets), we used the Sobel (1986) test, where a and SEa represent the unstandardized coefficient and standard error for the financial shocks-liquid financial assets path, respectively, and b and SEb the unstandardized coefficient and standard error for the liquid financial assets-material hardship path:

In large samples, the ratio ab/SEab is subject to a standard normal distribution and the statistical significance of the indirect effect can be determined via a z test.

We used comparative fit index (CFI) and root mean square error of approximation (RMSEA) with a 90% confidence interval to assess model fit based on maximum likelihood estimation using CFI > 0.95 and a RMSEA > 0.06 (90% upper bound confidence interval < 0.08) as thresholds for establishing good fit (Bowen and Guo 2011; Hu and Bentler 1998; Schreiber et al. 2006; West et al. 2012). Chi-square goodness-of-fit was excluded as this indicator is sensitive to large samples (N ≥ 400) and usually statistically significant (Dimitrov 2010; Hoe 2008; Hoyle 1995; Kenny 2014).

The moderated mediation model controlled for covariates on the exogenous variable financial shocks. Covariates included age, income, education, employment status, car ownership, health insurance status, tax filing status, student status, and any dependents. For example, participants with one or more dependents (73%) were more likely than participants without dependents (62%) to have experienced one or more shocks χ2(1, N = 7554) = 101.70, p < .001. Similarly, car ownership was associated with financial shocks (p < .001), which follows as one of the types of shocks we measured was a major vehicle repair. Thus, controlling for factors that affect the likelihood of experiencing financial shocks is important for establishing financial shocks as the exogenous variable in the model (see Fig. 1).

To control for these factors, we calculated propensity score weights (Guo and Fraser 2015) to reflect the probability of having experienced one or more financial shocks conditional on the covariates listed above. A logistic regression model predicted probability p was used to create weights of 1/p for participants who experienced one or more shocks and 1/(1 − p) for those who did not. Subsequently, these weights were used in structural models to test moderated mediation as described above. In addition, unsecured debt was included as an additional variable to describe the sample and was measured as the sum of participants’ winsorized amounts owed on credit cards, unsecured loans from banks, family members and friends, payday loans, and medical and other bills.

We also conducted bivariate and multivariate analyses to describe differences in liquid financial assets by race/ethnicity. For multivariate analyses, we used quantile regression with an inverse hyperbolic sine (IHS) transformation of liquid financial assets (Friedline et al. 2015; Pence 2006) at the median and 25th and 75th percentiles with the following covariates: age, income, education, employment, student status, tax filing status, car ownership, health insurance status, and unsecured debt. A Cook-Weisberg test for heteroskedasticity following an ordinary least squares (OLS) regression with the IHS-transformed liquid financial assets was highly significant (p < .001), indicating the need for a model to address non-normality. Quantile regression addresses high skewness, non-normality, and sensitivity to extreme values of the dependent variable, avoids discarding zero values with log transformation, and helps mitigate heteroskedasticity (Jung et al. 2015; Pence 2006).

Results

Sample Description

The average age of participants was 35.33 years old (SD = 13.17) and average annual income was very low—$18,054.60 (SD = $10,200.04). Concerning race/ethnicity, most participants were white (81%), followed by black (11%), and Latino (8%). Concerning education, 15% of participants had a high school diploma or less, 36% had completed some college, 39% had a college degree or had completed some graduate or professional school, and 11% had a graduate or professional degree. Half (50%) of the participants were employed fulltime, 21% were employed part time, 9% were unemployed and looking for work, and 20% were not employed for various reasons. Nearly a third of participants (29%) were enrolled in post-secondary education.

Most participants listed Single as their filing status (63%). Other filing status categories among participants were Head of Household (20%), and Married Filing Jointly or Separately (17%). More than a third of participants (37%) had at least one dependent in the household. Most participants owned a car (87%) and had health insurance (73%).

Concerning financial experiences, two thirds of participants experienced at least one financial shock in the 6 months after filing their taxes, though the average number of shocks was low—1.05 (SD = 0.97). Participants had an average of 2.07 hardships (SD = 1.87) and had an average of $4700.94 (SD = $11,150.52) in liquid financial assets.

Table 1 displays the sample characteristics described above by race/ethnicity. Statistically significant differences were found across the three race/ethnicity groups for age, education, employment, current enrollment in school, tax filing status, dependents in the household, car ownership, and health insurance.

Concerning model variables, statistically significant differences existed for liquid financial assets and average number of hardship events, but not for unsecured debt or the number of financial shocks. Black participants also had an average of 2.52 different types of hardship events compared to 2.00 and 2.20 for white and Latino participants, respectively (p < .001). Reliability of the six items comprising the count of hardship was α = 0.77.

Differences in Liquid Financial Assets by Race/Ethnicity

White, black, and Latino participants had average liquid financial assets of $5082, $2307, and $4116, F(2, 7554) = 23.49, p < .001. Pairwise differences between white and black participants ($2774) and between black and Latino participants ($1809) were statistically significant at p < .001 and p < .01, respectively, but the pairwise difference between white and Latino participants ($966) was not statistically significant. After controlling for age, income, education, employment, student status, tax filing status, dependents, car ownership, health insurance status, and unsecured debt, black participants still had less liquid financial assets compared to white participants based on quantile regression models assessed at the median and 25th and 75th percentiles (all differences p < .001). Though Latino participants also had less liquid financial assets than white participants in all three quantile regression models, none of these differences were statistically significant.

Model Results: Mediation Moderated by Race/Ethnicity

Table 2 shows results of group comparisons testing the moderated mediation effect among the three race/ethnicity groups. The Sattora-Bentler scaled chi-square results indicate the model that best fits the study data. Results indicate that we can accept a model constraining the exogenous path coefficients (financial shocks to material hardship and liquid financial assets) as equal across the three race/ethnicity groups. However, the model constraining the liquid financial assets to material hardship path as equal was not accepted as the differences from the baseline model were statistically significant, indicating variation by race/ethnicity. This result indicates that the indirect effect of financial shocks on material hardship as mediated by liquid financial assets differs by race/ethnicity.

The final model shows the moderated mediation effects among race groups had an excellent fit to the data: CFI = 0.977, RMSEA = 0.026 with a 90% confidence interval of [0.020, 0.033]. Results confirm the theoretical model. As reflected in the path coefficients, the final model constrained the paths from financial shocks to material hardship and from financial shocks to liquid financial assets across race/ethnicity groups, but the liquid financial assets to hardship path was unconstrained and varied by race/ethnicity group. An additional financial shock was associated with greater likelihood of material hardship and with lower liquid financial assets, regardless of a participant’s race or ethnicity (p < .001). An additional $100 in liquid financial assets was negatively associated with material hardship across all three race/ethnicity groups, yet this relationship was statistically significant only among white participants (p < .001).

Consequently, the proportion of the total effect that was mediated by assets (i.e., indirect effect) varied by race/ethnicity (Fig. 2). That is, race moderated the mediating role of assets; participants experienced different indirect effects when facing financial shocks based on their race or ethnicity. The direct effect of financial shocks on material hardship was highest among black participants (96.4%), followed by Latino (95.6%), and white (89.6%) participants. Conversely, the indirect effect of shocks on hardship as mediated by assets was only 3.6 and 4.4% for black and Latino participants compared to 10.4% for white participants (Table 3).

Discussion

Prior research has established the presence of large racial wealth gaps in the USA; white households have several times the wealth of black and Latino households. This study extends prior work on race and wealth by examining differences in liquid financial assets and in the degree to which these assets mediate the relationship between financial shocks such as a period of unemployment and material hardship, such as skipping bills. Among our sample of LMI tax filers, we find that black households have far less liquid financial assets compared to white households, other things like age, income, education, and employment being equal. Latino households too have fewer liquid financial assets compared to white households, but the difference was not statistically significant.

We also find that liquid financial assets have less of a mediating role between shocks and hardship among black and Latino compared to white households, independent of other factors such as age, income, and having dependents—and despite little difference by race/ethnicity in unsecured debt. Prior research finds that liquid financial assets reduce risk for material hardship among LMI households (Gjertson 2016), yet our findings suggest these assets are less associated with material hardship for black and Latino compared to white LMI households. Put differently, the funds households have in cash, checking, and savings accounts and prepaid debt cards may be less valuable to black and Latino households in coping with financial emergencies.

Our findings build on the literature concerning the racial wealth gap by suggesting that this gap can also be found concerning liquid financial assets and the relationship these assets have with hardship in the face of income and expense shocks. Whereas racial and ethnic differences in income and the link between income and material hardship have been well studied, this study discovers an additional indicator of the elevated risk of economic instability among black and Latino households with low and moderate incomes.

A host of factors may conspire to dampen the role liquid financial assets might play to reduce black and Latino LMI households’ susceptibility to hardship. As reviewed above, these factors include greater demands for providing material assistance for extended family members, less access to additional material resources from these members, greater incidence and severity of financial shocks, and less access to markets that constrain options for forestalling hardships.

Though the results of our study are similar for black and Latino households, it is unlikely that the relationships among financial shocks, liquid assets, and material hardship are the same in these households. Other factors beyond the scope of our study may affect these relationships differently for black and Latino LMI households. These factors include immigration and legal status, anti-immigrant backlash, language and cultural traditions, racial discrimination in housing, employment, and criminal justice, and differences in economic mobility and inter-generational wealth transfers.

Current policy proposals provide tax incentives to help LMI households build liquid financial assets to cope with income volatility and expenditure shocks. For example, the Refund to Rainy Day Savings ActFootnote 2 (S.2797) proposes to offer LMI tax filers the chance to receive a 50% match on amounts up to 20% of tax refunds saved for 6 months (Edin et al. 2015). Similarly, the Financial Security Credit Act of 2015Footnote 3 (H.R. 4236; formerly the Saver’s Bonus), proposes a 50% match of refund amounts up to $500 deposited into one of several eligible savings products (e.g., 529 plan, individual retirement account, savings account).

However, we discover that liquid financial assets have less of a negative association with material hardship among black and Latino compared to white LMI households. We offer reasons why this might be the case, including differential access to markets and network resources. Absent stronger consumer protections and social safety net policies (Moller et al. 2003) and larger structural changes in markets, policy proposals aimed at building emergency savings may be of less benefit to black and Latino LMI households.

Study Limitations

Our study has four key limitations. First, the LMI individuals in our sample who chose to file their taxes online may differ in unobservable ways (e.g., being more technologically savvy) from LMI individuals who do not file their taxes online. Similarly, study participants who completed the surveys may differ in unobservable ways (e.g., more time to complete a survey) from participants who declined the surveys.

Second, we observe financial shocks and material hardship in the 6 months following tax filing and liquid assets 6 months after tax filing. Consequently, we cannot confirm that shocks preceded hardships nor do we observe a change in liquid financial assets over this period, which would be a more direct way of assessing whether spending these assets in response to shocks lessened the likelihood of material hardship. Because of these limitations, we are unable to directly assess the protective function of liquid assets regarding material hardship after experiencing shocks. As such, it is possible that liquid assets play a stronger protective role than we could assess.

Third, we do not measure the frequency or magnitude of shocks (e.g., how long a person was hospitalized and what the out of pocket costs were), which would provide a clearer picture of the relationship between shocks and hardship. Future research should more closely examine whether and how liquid financial assets are used in response to shocks of varying frequency and magnitude, and how this variation in shocks and assets is related to hardship experiences. Lastly, while we observe black-white differences in liquid financial assets, we did not observe the ethnicity of black participants, whereas wealth has been found to vary according to black individuals’ ethnicity (Martin 2009).

Conclusion

In this study, we examine differences in liquid financial assets by race/ethnicity among a sample of LMI households. Though racial wealth gaps have been examined previously, we focus on liquid assets, which are very important to LMI households to help smooth consumption in the face of income and expense shocks. We find that black households have far fewer liquid financial assets than white households—even after controlling for a host of factors. These assets may also be less valuable to black and Latino households with respect to mitigating the impact of income and expense shocks on material hardship, suggesting the need for a broader set of policy and market reforms to address this aspect of stratification.

Notes

Participants not randomly assigned (n = 192,481) had filed their taxes before the start of the experiment on January 31, 2013 or began their tax return in another software program from the sample company.

References

Abbi S. A need for product innovation to help LMI consumers manage financial emergencies. 2012. Retrieved from http://www.d2dfund.org/files/publications/A%20Need%20for%20Production%20Innovation_Jan12.pdf.

Acs G, Loprest P, Nichols A. Risk and recovery: documenting the changing risks to family incomes (brief). Washington, DC: Urban Institute; 2009. http://www.urban.org/publications/411890.html

Artiga S, Foutz J, Damico A. Health coverage by race and ethnicity: changes under ACA (Issue Brief). Menlo Park: The Henry J. Kaiser Family Foundation; 2018. http://files.kff.org/attachment/Issue-Brief-Health-Coverage-by-Race-and-Ethnicity-Changes-Under-the-ACA

Baron RM, Kenny DA. The moderator–mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J Pers Soc Psychol. 1986;51:1173–82. https://doi.org/10.1037/0022-3514.51.6.1173.

Barth JR, Hilliard J, Jahera JS, Sun Y. Do state regulations affect payday lender concentration? J Econ Bus. 2016;84:14–29. https://doi.org/10.1016/j.jeconbus.2015.08.001.

Bayer P, Ferreira F, Ross SL. The vulnerability of minority homeowners in the housing boom and bust. Am Econ J Econ Pol. 2016;8(1):1–27. https://doi.org/10.1257/pol.20140074.

Beverly SG. Material hardship in the United States: evidence from the survey of income and program participation. Soc Work Res. 2001;25(3):143–51. https://doi.org/10.1093/swr/25.3.143.

Bollen KA. Structural equations with latent variables. New York: Wiley; 1989.

Bowen N, Guo S. Structural equation modeling. New York: The Oxford University Press; 2011.

Bower KM, Thorpe RJ, Rohde C, Gaskin DJ. The intersection of neighborhood racial segregation, poverty, and urbanicity and its impact on food store availability in the United States. Prev Med. 2014;58:33–9. https://doi.org/10.1016/j.ypmed.2013.10.010.

Carroll CD, Samwick AA. How important is precautionary saving? Rev Econ Stat. 1998;80(3):410–9. https://doi.org/10.1162/003465398557645.

Chetty R, Hendren N, Jones MR, Porter SR. Race and economic opportunity in the United States: An intergenerational perspective (No. w24441). Natl Bur Econ Res. 2018. https://doi.org/10.3386/w24441.

Collins JM, Gjertson L. Emergency savings for low-income consumers. Focus. 2013;30(1):12–7. http://irp.wisc.edu/publications/focus/pdfs/foc301c.pdf

Conley D. Being black, living in the red: race, wealth, and social policy in America. Berkeley: University of California Press; 1999.

Consumer Financial Protection Bureau. Payday loans and deposit advance products: a white paper of initial data findings (White Paper). Washington DC: Consumer Financial Protection Bureau. 2013. http://files.consumerfinance.gov/f/201304_cfpb_payday-dap-whitepaper.pdf.

Couch KA, Fairlie R. Last hired, first fired? Black-white unemployment and the business cycle. Demography. 2010;47(1):227–47. https://doi.org/10.1353/dem.0.0086.

Couch KA, Reznik GL, Iams HM, Tamborini CR. The incidence and consequences of private sector job loss in the Great Recession. Soc Secur Bull. 2018;78:31–46. https://www.ssa.gov/policy/docs/ssb/v78n1/ssb-v78n1.pdf

Deaton A. Saving and liquidity constraints. Econometrica. 1991;59:1221–48. http://www.jstor.org/stable/2938366

Despard M, Friedline T, Refior K. Can post offices increase access to financial services? A geographic investigation of financial services availability. Lawrence: University of Kansas, Center on Assets, Education, & Inclusion (AEDI); 2017a.

Despard MR, Grinstein-Weiss M, Ren C, Guo S, Raghavan R. Effects of a Tax-Time Savings Intervention on Use of Alternative Financial Services among Lower-Income Households. J Consum Aff. 2017b;51(2):355–79. https://doi.org/10.1111/joca.12138

Despard M, Guo S, Grinstein-Weiss M, Russell B, Oliphant J, de Ruyter A. The mediating role of assets in explaining hardship risk among households experiencing financial shocks. Soc Work Res. 2018. Advance online publication. https://doi.org/10.1093/swr/svy012.

Dimitrov DM. Testing for factorial invariance in the context of construct validation. Meas Eval Couns Dev. 2010;43:121–49. https://doi.org/10.1177/0748175610373459.

Edin K, Greene SS, Halpern-Meekin S, Levin E. The Rainy Day EITC: a reform to boost financial security by helping low-wage workers build emergency savings (Federal Policy Proposal). Washington, DC: Corporation for Enterprise Development; 2015. http://cfed.org/assets/pdfs/The_Rainy_Day_EITC.pdf.

Elliott W, Friedline T, Nam I. Probability of living through a period of economic instability. Child Youth Serv Rev. 2013;35(3):453–60. https://doi.org/10.1016/j.childyouth.2012.12.014.

FINRA Investor Education Foundation. Financial capability in the United States 2016. 2016. http://www.usfinancialcapability.org/downloads/NFCS_2015_Report_Natl_Findings.pdf.

Fowler CS, Cover JK, Kleit RG. The geography of fringe banking. J Reg Sci. 2014;54(4):688–710. https://doi.org/10.1111/jors.12144.

Friedline T, Masa RD, Chowa GA. Transforming wealth: using the inverse hyperbolic sine (IHS) and splines to predict youth’s math achievement. Soc Sci Res. 2015;49:264–87. https://doi.org/10.1016/j.ssresearch.2014.08.018.

Gjertson L. Emergency saving and household hardship. J Fam Econ Iss. 2016;37:1–17. https://doi.org/10.1007/s10834-014-9434-z.

Goldscheider FK, Goldscheider C. The intergenerational flow of income: Family structure and the status of black Americans. J Marriage Fam. 1991;53:499–508. http://www.jstor.org/stable/352915

Grinstein-Weiss M, Perantie DC, Russell BD, Comer K, Taylor SH, Luo L, Key C, Ariely D. Refund to Savings 2013: Comprehensive report on a large-scale tax-time saving program (CSD Research Report 15-06). St. Louis, MO: Center for Social Development, Washington University in St. Louis. 2015. http://csd.wustl.edu/Publications/Documents/RR15-06.pdf. Accessed 13 July 2016.

Grinstein-Weiss M, Russell B, Tucker B, Comer K. Lack of emergency savings puts American households at risk: Evidence from the Refund to Savings Initiative (CSD Research Brief 14- 13). St. Louis, MO: Washington University, Center for Social Development. 2014. http://csd.wustl.edu/Publications/Documents/RB14-13.pdf. Accessed 21 July 2016.

Guo S, Fraser WM. Propensity score analysis: statistical methods and applications. 2nd ed. Thousand Oaks: Sage Publications; 2015.

Hanson A, Santas M. Field experiment tests for discrimination against Hispanics in the US rental housing market. South Econ J. 2014;81(1):135–67. https://doi.org/10.4284/0038-4038-2012.231.

Haveman R, Wolff EN. The concept and measurement of asset poverty: levels, trends and composition for the U.S., 1983–2001. J Econ Inequal. 2005;2(2):145–69. https://doi.org/10.1007/s10888-005-4387-y.

Hayes AF. Introduction to mediation, moderation, and conditional process analysis: a regression-based approach. New York: The Guilford Press; 2013.

Heflin C. Family instability and material hardship: results from the 2008 Survey of Income and Program Participation. J Fam Econ Iss. 2016;37(3):359–72. https://doi.org/10.1007/s10834-016-9503-6.

Heflin CM, Pattillo M. Kin effects on black-white account and homeownership. Sociol Inq. 2002;72(2):220–39. https://doi.org/10.1111/1475-682X.00014.

Hegerty SW. Commercial bank locations and “banking deserts”: a statistical analysis of Milwaukee and Buffalo. Ann Reg Sci. 2016;56(1):253–71. https://doi.org/10.1007/s00168-015-0736-3.

Hoe SL. Issues and procedures in adopting structural equation modeling technique. J Appl Quant Methods. 2008;3:76–83. http://jaqm.ro/issues/volume-3,issue-1/pdfs/hoe.pdf. Accessed 2 Mar 2016.

Hoyle RH. The structural equation modeling approach: Basic concepts and fundamental issues. In: Hoyle RH, editor. Structural equation modeling: concepts, issues, and applications. Thousand Oaks: Sage Publications; 1995. p. 1–15.

Hu LT, Bentler PM. Fit indices in covariance structure modeling: sensitivity to underparameterized model misspecification. Psychol Methods. 1998;3:424–53. https://doi.org/10.1037/1082-989X.3.4.424.

Jung Y, Lee Y, MacEachern SN. Efficient quantile regression for heteroscedastic models. J Stat Comput Simul. 2015;85(13):2548–68. https://doi.org/10.1080/00949655.2014.967244.

Keating ER. The relationship between asset holdings and material hardship following economic shocks in a household. Unpublished thesis Georgetown University, Washington, DC. 2012. Retrieved from https://repository.library.georgetown.edu/bitstream/handle/10822/557795/Keating_georgetown_0076M_11652.pdf?sequence=1&isAllowed=y.

Keister LA. Race and wealth inequality: the impact of racial differences in asset ownership on the distribution of household wealth. Soc Sci Res. 2000;29(4):477–502. https://doi.org/10.1006/ssre.2000.0677.

Kenny DA. Measuring model fit. 2014. Retrieved from http://davidakenny.net/cm/fit.htm.

Kerbo HR. Social stratification and inequality: class conflict in historical and comparative perspective. 3rd ed. New York: McGraw-Hill; 1996.

Larrimore J, Durante A, Kreiss K, Park C, Sahm C. Report on the economic well-being of U.S. Households in 2017 (Report for the Board of Governors of the Federal Reserve System). Washington, DC: Board of Governors of the Federal Reserve System. 2018. https://www.federalreserve.gov/publications/files/2017-report-economic-well-being-us-households-201805.pdf.

Lim Y, Livermore M, Davis BC. Material hardship among banked and unbanked earned income tax credit-eligible families. Journal of Poverty. 2010;14(3):266–84. https://doi.org/10.1080/10875549.

Lui M. The color of wealth: the story behind the U.S. racial wealth divide. The New Press; 2006.

Manturuk K, Quercia R. North Carolina consumers after payday lending: attitudes and experiences with credit options. Chapel Hill: Center for Community Capital, University of North Carolina at Chapel Hill; 2007. Retrieved July 7, 2016 from http://ccc.unc.edu/contentitems/orth-carolina-consumers-after-payday-lending-attitudes-and-experiences-with-credit-options/

Manturuk K, Riley S, Ratcliffe J. Perception vs. reality: The relationship between low-income homeownership, perceived financial stress, and financial hardship. Soc Sci Res. 2012;41:276–86. https://doi.org/10.1016/j.ssresearch.2011.11.006.

Martin LL. Black asset ownership: does ethnicity matter? Soc Sci Res. 2009;38:312–23. https://doi.org/10.1016/j.ssresearch.2008.11.003.

Mayer S, Jencks C. Poverty and the distribution of material hardship. J Hum Resour. 1989;24(1):88–114. http://www.jstor.org/stable/145934

McKernan SM, Ratcliffe C, Vinopal K. Do assets help families cope with adverse events? (Perspectives on Low-Income Working Families Brief No. 10, Urban Institute). 2009. Retrieved July 7, 2016 from the Urban Institute website http://www.urban.org/research/publication/do-assets-help-families-cope-adverse-events

Melzer BT. The real costs of credit access: evidence from the payday lending market. Q J Econ. 2011;126(1):517–55. https://doi.org/10.1093/qje/qjq009.

Moller S, Huber E, Stephens JD, Bradley D, Nielsen F. Determinants of relative poverty in advanced capitalist democracies. Am Sociol Rev. 2003;68:22–51. http://www.jstor.org/stable/3088901

Morduch J, Schneider R. The financial diaries: how Americans cope in a world of uncertainty. Princeton: Princeton University Press; 2017.

Mplus. Chi-square difference testing using the Satorra-Bentler scaled chi-square. 2015. Available from https://www.statmodel.com/chidiff.shtml.

Muller D, Judd CM, Yzerbyt VY. When moderation is mediated and mediation is moderated. J Pers Soc Psychol. 2005;89:852–63. https://doi.org/10.1037/0022-3514.89.6.852.

Muthén LK, Muthén BO. Mplus user’s guide. 7th ed. Los Angeles: Muthén & Muthén; 1998–2012.

O’Brien RL. Depleting capital? Race, wealth and informal financial assistance. Social Forces. 2012;91(2):375–96. https://doi.org/10.1093/sf/sos132.

Oliver ML, Shapiro TM. Black wealth, white wealth: a new perspective on racial inequality: Taylor & Francis; 2006.

Ouellette T, Burstein N, Long D, Beecroft E. Measures of material hardship: final report. Washington, DC: U.S. Department of Health and Human Services, Office of the Secretary, Office of the Assistant Secretary for Planning and Evaluation; 2004. https://aspe.hhs.gov/system/files/pdf/73366/report.pdf

Pence KM. The role of wealth transformations: an application to estimating the effect of tax incentives on saving. B E J Econom Anal Policy. 2006;5(1):1–24. https://doi.org/10.1515/1538-0645.1430.

Pew Charitable Trusts. Payday lending in america: who borrows, where they borrow, and why (Payday Lending in America). Washington, DC. 2012. Retrieved July 23, 2016 from http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2012/pewpaydaylendingreportpdf.pdf.

Pew Charitable Trusts. How do families cope with financial shocks? (Issue Brief). Washington, DC. 2015a. Retrieved July 23, 2016 from http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2015/10/the-role-of-emergency-savings-in-family-financial-security-how-do-families.

Pew Charitable Trusts. What resources do families have for financial emergencies? (Issue Brief). Washington, D.C. 2015b. Retrieved July 7, 2016 from http://www.pewtrusts.org/~/media/assets/2015/11/emergencysavingsreportnov2015.pdf.

Pew Charitable Trusts. Financial shocks put retirement security at risk (Research Brief). Washington, DC. 2017. Retrieved on June 1, 2018 from http://www.pewtrusts.org/~/media/assets/2017/10/rs_financial_shocks_put_retirement_security_at_risk.pdf.

Pilkauskas NV, Currie J, Garfinkel I. The great recession, public transfers, and material hardship. Soc Serv Rev. 2012;86(3):401–27. https://doi.org/10.1086/667993.

Prager RA. Determinants of the locations of alternative financial service providers. Rev Ind Organ. 2014;45(1):21–38. https://doi.org/10.1007/s11151-014-9421-4.

Reid CK, Bocian D, Li W, Quercia RG. Revisiting the subprime crisis: the dual mortgage market and mortgage defaults by race and ethnicity. J Urban Aff. 2016:1–19. https://doi.org/10.1080/07352166.2016.1255529.

Roll S, Despard M, Taylor S, Bufe S, Grinstein-Weiss M. The front lines of financial defense: How low- and moderate-income households manage financial emergencies. Manuscript submitted for publication. 2018.

Rothwell DW, Han CK. Exploring the relationship between assets and family stress among low-income families. Fam Relat. 2010;59(4):396–407. https://doi.org/10.1111/j.1741-3729.2010.00611.x.

Russo CA, Andrews RM, Coffey RM. Racial and ethnic disparities in potentially preventable hospitalizations, 2003 (Statistical Brief #10). Washington, DC: U.S. Agency for Healthcare Research and Quality. 2006. https://www.hcup-us.ahrq.gov/reports/statbriefs/sb10.pdf.

Schreiber JB, Nora A, Stage FK, Barlow EA, King J. Reporting structural equation modeling and confirmatory factor analysis results: a review. J Educ Res. 2006;99:323–38. https://doi.org/10.3200/JOER.99.6.323-338.

Semega JL, Fontenot KR, Kollar MA. Income and poverty in the United States: 2016 (Current Population Reports). Washington, DC: U.S. Department of Commerce, Economic and Statistics Administration, Census Bureau. 2017. https://www.census.gov/content/dam/Census/library/publications/2017/demo/P60-259.pdf.

Shapiro TM. Race, homeownership and wealth. Wash U J L & Pol'y. 2006;20:53.

Shapiro T, Meschede T, Osoro S. The roots of the widening racial wealth gap: explaining the black-white economic divide. Institute on Assets and Social Policy, 1–8. 2013. https://iasp.brandeis.edu/pdfs/Author/shapiro-thomas-m/racialwealthgapbrief.pdf.

Short KS. Material and financial hardship and income-based poverty measures in the USA. Journal of Social Policy. 2005;34(01):21–38. https://doi.org/10.1017/S0047279404008244.

Sobel ME. Some new results on indirect effects and their standard errors in covariance structure model. In: Tuma NB, editor. Sociological Methodology. San Francisco: Jossey-Bass; 1986. p. 159–86.

Sullivan JX, Turner L, Danziger S. The relationship between income and material hardship. Journal of Policy Analysis and Management. 2008;27(1):63–81. https://doi.org/10.1002/pam.20307.

Temkin K, Sawyer N. Analysis of alternative financial service providers. Washington, DC: The Urban Institute. 2004. Retrieved from. http://www.urban.org/sites/default/files/alfresco/publication-pdfs/410935-Analysis-of-Alternative-Financial-Service-Providers.PDF.

Turner MA, Santos R, Levy DK, Wissoker D, Aranda C, Pitingolo R, The Urban Institute. Housing discrimination against racial and ethnic minorities 2012: executive summary. 2013. Retrieved from http://www.huduser.gov/portal/Publications/pdf/HUD-514_HDS2012_execsumm.pdf.

United States Commission on Civil Rights. Targeted fines and fees against communities of color: civil rights and constitutional implications (Briefing Report). 2017. http://www.usccr.gov/pubs/Statutory_Enforcement_Report2017.pdf.

United States Department of Labor. Labor force statistics from the current population study—unemployed persons by age, sex, race, Hispanic or Latino ethnicity, marital status, and duration of unemployment. 2018. https://www.bls.gov/cps/cpsaat31.htm.

West SG, Taylor AB, Wu W. Model fit and model selection in structural equation modeling. In: Hoyle RH, editor. Handbook of structural equation modeling. New York: Guilford Press; 2012. p. 209–31.

Wikoff N, Huang J, Kim Y, Sherraden M. Material hardship and 529 college savings plan participation: the mitigating effects of Child Development Accounts. Soc Sci Res. 2015;50:189–202. https://doi.org/10.1016/j.ssresearch.2014.11.017.

Acknowledgements

Washington University in St. Louis gratefully acknowledges the funders who made the Refund to Savings Initiative possible: the Ford Foundation; the Annie E. Casey Foundation; Intuit, Inc.; the Intuit Financial Freedom Foundation; the Smith Richardson Foundation; and JPMorgan Chase & Co.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Rights and permissions

About this article

Cite this article

Despard, M., Grinstein-Weiss, M., Guo, S. et al. Financial Shocks, Liquid Assets, and Material Hardship in Low- and Moderate-Income Households: Differences by Race. J Econ Race Policy 1, 205–216 (2018). https://doi.org/10.1007/s41996-018-0011-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41996-018-0011-y