Abstract

Environmental and social responsibility has become aspect of the new definition of China’s economy, and the direction of green development has been further clarified. As the financial system is the lifeblood of a substantial economy, the Chinese government proposed to increase the proportion of direct financing, match the financial structure with green innovation, and promote green economic growth. Examining the institutional framework in China from 2004 to 2020, this study empirically investigates the effect of direct finance on regional green development applying moderating effect and spatial error models to three time spans. The findings reveal significant spatial differences in China’s direct financing and regional green development, with a positive impact in central and western regions and a significant negative impact in the eastern region. Finally, under the institutional environment, direct financing in the eastern region significantly promotes the regional green development. Our research provides new insights to advance sustainable green economic development in China through action to strengthen the institutional environment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Sustainable development and climate risk management have become the mainstream of research and discussion on China’s socioeconomic development models (Chai et al. 2021; Ren et al. 2022). The green development framework, represented by environmental security, social responsibility, and governance (ESG), establishes environmental constraints for future economic development as the basis for measuring and assessing the quality of growth and represents a substantial revision of purely price-based assessment systems (Hao et al. 2022; Zhuo et al. 2023). At present, China’s economic development places stronger emphasis on sustainability (Coenen et al. 2021; Mao et al. 2023). To achieve economic development under the ESG framework, the supply structure and mode must undergo a large-scale transformation (Sushchenko et al. 2020; Hao et al. 2023). Therefore, technological change and innovation are the basis and bottleneck of this transformation (Wu et al. 2024). However, based on inherent uncertainty, technological innovation requires considerable investment, necessitating stable financing to support long-term capital investment (Brown et al. 2012). The contemporary financing environment for Chinese enterprises is inadequate. As the key support for large-scale technological transformation, access to indirect financing often faces limitations of the banking industry’s risk positioning, with insufficient financing scale and inconsistent supply structure (Yu et al. 2021). Consequently, direct financing has become an important source for enterprises to obtain risky transformation investment funds. This conclusion suggests that it is essential to investigate the connection between direct finance and green development from a practical perspective.

Direct financing refers to a financing method in which both the supply and demand of funds are directly engaged in transactions without an intermediary, whereas indirect financing requires financial intermediaries (Hallwood 2023; Sarabando et al. 2023). Although indirect financing had an important role in allocating funds in the early stage of industrialization, financial disinter-mediation theory contends that with economic direct financing will become increasingly obvious (Demirgüç-Kunt and Levine 2001; Hester 1969). The scale of direct financing in China has significantly increased, and in 2020, the scale of direct financing reached 43 times that of 2004. Indirect financing led by banks is not conducive to the formation of capital, whereas direct financing allows fund providers and demanders to directly trade, reducing the financing costs for technological innovation through in-depth risk sharing cooperation. This transfers risk expectations through capitalization and contributes to controlling financial risks, which is more conducive to China’s development of an innovation-driven green economy (Low et al. 2018). China’s 14th Five-Year Development Plan and the long-range goals for 2035 proposed that the nation should scale up stock and bond financing, increase the proportion of direct financing, and improve the defects of China’s existing financial system, indicating that direct financing will have a key influence in capital market reform to promote sustainable economic development. Therefore, effective promotion of financial services to entity enterprises and advancing regional green development through direct financing is an urgent problem for theoretical interpretation and empirical research.

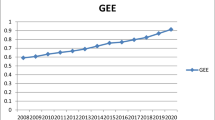

Using data related to China’s direct financing and regional green development, we can roughly demonstrate certain correlation characteristics. From the evident growth rate change trends (Fig. 1), in 2007–2009, 2010–2014, 2015–2017, and 2018–2020, a reverse relationship emerges between direct financing and regional green development growth. Some scholars have asserted that China’s financial mismatch distorted the configuration of market supply and demand (Jiang et al. 2020), ultimately delaying green economic development through the disconnect between factor arrangements and industrial technology (Yao et al. 2023). In 2004–2007, 2009–2010, 2014–2015, and 2017–2018, the growth rate of China’s direct financing and regional green development moved in the same direction, coinciding with the view of some scholars that financial factors promote regional green development. Recent research has contended that expansion in the scale of financial elements can reduce information asymmetry between fund suppliers and demanders in the market, promote the efficiency of fund allocation, achieve precise control over the flow of funds, restrict the flow of resources to highly polluting industries, and promote regional green development (Xu et al. 2022; Zhou et al. 2023a; Qiu et al. 2022). Another strand of research has asserted that financial structure optimization can reduce financial system friction and decrease information collection costs (Chowdhury and Maung 2012), promote technological innovation and promote regional green development from financial deepening, specialization, and other aspects (Liu et al. 2022; Tori and Onaran 2017; Xiao 2021).

High-quality economic development cannot be achieved without a high-quality institutional environment, and the effective operation of financial markets requires the same (Wu et al. 2024; Huang et al. 2023). When the institutional environment is inadequate, the market-oriented financial system is at a disadvantage (Beck et al. 2003); therefore, a high-quality institutional environment is the foundation for financial markets to promote sustainable economic development. Theoretically, regional green development and active direct financing markets can promote one another and ensure high-quality growth; however, there is a decoupling between the monetary market and the development of the real economy, which is based on the production and operation activities of material means. This is exemplified by the real estate boom in China, which affects the capability of direct financing to serve the real economy (Ahmed et al. 2022; Cull and Xu 2005). As an effective financial market constraint norm, a high-quality system strengthens information disclosure, promotes enterprises’ motivation for innovation and production efficiency, guides capital flow toward green industries, enhances green investment efficacy, thus advances direct financing to promote regional green development by fostering the marketization process, improving property rights protection, and increasing the efficiency of contract execution (Yang et al. 2021a; Hanet al. 2021; Qiu et al. 2021).

Minimal research has been conducted on these concerns, particularly regarding the effects of direct finance on green development. Most previous research has focused on issues such as financial development, carbon emissions, or environmental deterioration. Indicators for the banking sector and the stock market have frequently been used to gauge financial development in studies examining how financial development affects green development. Sadorsky (2010) constructed financial development indicators based on the ratio of foreign direct investment to gross domestic product (GDP), bank deposits to GDP, stock market value to GDP, and stock market trading volume to examine the relationship between financial and green development, revealing that financial development will increase carbon emissions. This is consistent with Zhang (2011), who established financial development indicators using credit scale and stock market size, demonstrating that the trajectory of financial development in China will increase carbon emissions. Uddin et al. (2022) measured financial development based on the banking industry, stock market, and overall development. Using data from 23 EU countries for empirical analysis, the study showed that all three financial indicators inhibit energy consumption, and innovation determines the intensity of the inhibitory effect of financial development on energy consumption. De Haas and Popov (2019) proposed the same idea, asserting that financial development will promote green development. The financial development indicators used in this study are private credit and stock market value. The study further determines that the primary reason that financial development promotes green development is the improvement in stock standards, which will promote technological innovation and reduce energy consumption. Examining the effects of Chinese stock market growth on green development, Cao et al. (2021) investigated how financial development affects green development more closely finding that increased stock market size significantly affects green development, with an impact that is much greater than that of financial institution development. The research cited above has established that financial development, as measured by the stock market and stock market size as subindicators, has an impact on green development.

This study asks: does direct financing using stocks as a financial tool affect green development? In addition, Hunjra et al. (2020) introduced the institutional quality indicator into the research framework of financial development level on green development, contending that as the institutional quality of South Asian countries improves, financial development will enhance environmental quality and promote sustainable development. As a developing country, China faces a similar sustainable development dilemma as South Asian countries; however, minimal research has examined the relationship between financial development and green development while also considering China’s institutional environment. Our study seeks to close this gap. In light of previous research, this study endeavors to examine the following questions: is there a link between regional green development and direct funding? Will the influence of direct financing on regional green development change as China’s institutional environment improves? Do regional variances affect how these effects differ? For the Chinese economy to grow steadily and sustainably, this research can serve as a decision-making resource with both theoretical and practical significance.

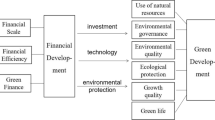

The remaining content of this article is arranged as follows. In Sect. 2, we sort and analyze previous literature. In Sect. 3, we analyze the mechanisms and present our hypotheses. Section 4 introduces the study’s methodology and data sources. Section 5 presents the empirical results regarding direct financing and regional green development, further exploring the impact from the perspective of the institutional environment. Section 6 details our conclusions and policy recommendations. The research framework is illustrated in Fig. 2.

2 Literature review

According to several academics, finance will encourage green growth. In the opinion of Xu et al. (2022), financial scale promotes green development, but it also has a marginal diminishing effect. In their empirical analysis of the impact of stock financing on a reduction of carbon emissions, Shobande and Ogbeifun (2022) used the OECD countries as their observation object. The findings demonstrated that the stock market has both direct and indirect impacts on the reduction of carbon emissions. According to their theories, the amount of stock funding would effectively reduce carbon emissions by reducing energy use, fostering technical advancement, and improving governance. Sustainable innovation demands sustainable financing, which is essential to attaining green development. Stock financing can support the promotion of the improvement of innovation level, according to the findings of Shobande and Asongu (2021). The purpose of the banking sector, according to Ghoniyah et al. (2020), is to raise social standards. They empirically investigate the beneficial effects of bank lending on green development in Indonesia. The same idea was put up by Cai and He (2022), who said that bank credit has a reciprocal impact on corporate social responsibility, which benefits the environment and promotes green development. Considering that both debt and equity financing will influence innovation, Zhang et al. (2019) investigated the effects of these financing types on green development. Equity funding with high risk tolerance fosters innovation more than debt financing, regardless of economic boom or depression.

A different perspective holds that financing impedes green growth. Guo et al. (2019) examined the effect of financing scale on carbon dioxide emissions using the extended STIRPAT model. The findings demonstrated that while stock trading volume can dramatically lower carbon emissions, financing scale has a detrimental impact on carbon dioxide emissions. Alessi et al. (2021), on the other hand, contend that equity financing increases industrial productivity, which impedes green growth by increasing carbon emissions and energy consumption. Shi et al. (2018) made the argument that while financing enables businesses to get additional capital, it also presents information disclosure concerns and innovation limits that impedes internal business innovation and growth.

When businesses seek outside funding through avenues like bank loans, equity financing, and venture capital, they encounter problems like credit discrimination and information asymmetry brought on by banks' biased credit behavior. These issues pose serious financing constraints and will stifle technological innovation, which impedes green development (Tang et al. 2023; Wang et al. 2022a). Most academics agree that green financing may ease financial restrictions and promote environmental development in areas (Zhou et al. 2023b; Lee 2020). Regional green development will be impacted by green finance products, such as green bonds and green credit (Wang et al. 2022b; Tolliver et al. 2019; Jahanger et al. 2022).

From the forementioned examination of the literature, it is clear that numerous authors have studied the relationship between financing and green development, classifying it as debt financing, equity financing, green financing, etc. However, there is still a study void on direct finance and regional green development. To try to make the following advances based on previous research, this work uses the Panel data of 30 Chinese provinces from 2004 to 2020. First, demonstrate the relationship between regional green development and direct financing, and then conduct an empirical examination of that relationship. Second, we empirically analyze direct financing and regional green development using a spatial error model to further show the spatial link between them. Thirdly, this article further explores the mechanism of direct financing and regional green development in institutional environment.

3 Mechanism analysis and hypotheses

In this section, we describe the mechanisms of direct financing, institutional environment, and regional green development. Based on the endogenous growth theory, as a tool for enterprises to obtain capital and innovation investment, financing is bound to have a role in green economic development. The level of financial market liberalization and the extent of environmental protection are both influenced by the institutional environment. This necessitates investigation of the interactions between direct financing, institutional environment, and regional green growth.

3.1 Impact mechanism of direct financing on regional green development

From the national perspective, the negative effect of direct funding on regional green development infrastructure has been attributed to the imbalance between China’s financial market and growth. This is consistent with the perspective of Mankiw and Scarth (2008), who proposed the “capital attraction effect,” which increases demand for traditional energy and Li et al. (2018), who asserted that direct financing curbs the “green effect”. An unsound financial system can lead to moral hazard and information asymmetry, reduce investor risk acceptance (Chowdhury et al. 2016), increase direct financing cost, and diminish available funds for technological research expenditure, which inhibits enterprises’ motivation to innovate and hinders the development of regional green development in China. In addition, as innovative research projects are characterized by high investment, long development cycles, and protracted effectiveness, such efforts require sustained and stable capital investment. However, amid the overriding goal of maximizing corporate profits, a considerable amount of direct financing has not been allocated to effective scientific and technological innovation but has instead been invested in financial capital business. This circumstance aggravates the imbalance of capital allocation in the financial market, boosts many financial foam derivatives, and limits the effective flow of investments to innovative projects (Beck et al. 2014). The trend of enterprise financialization has reduced investment in innovation projects, limiting China’s regional green development.

From the industry perspective, driven by profit-seeking and investment inertia, capital tends to favor industries with high return on investment, while innovative and environment-friendly industries lack advantage in attracting capital due to high cost, long cycles, and inherent uncertainty (Battiati 2019; Sapiains et al. 2021). Therefore, capital will flow to pollution-intensive industries with low production costs, short cycles, and high-income potential, making it easier for low productivity high pollution industries to thrive, and raising resource consumption and environmental pollution. Increased financing capabilities of highly polluting industries have increased the negative effects of industrial structure imbalance and capital mismatch on the environment, hindering regional green development. This assertion coincides with the prominent effect of asset-scale expansion in promoting polluting industries proposed by Sadorsky (2011). Furthermore, the rise of the financial sector has been demonstrated as exerting a detrimental impact on the enhancement of industrial quality, according to Ouyang and Li’s financial growth leading theory (2018).

From enterprises’ perspective, direct financing primarily includes direct debt financing and equity financing. Shareholders and creditors have different corporate investment objectives. Compared with corporate shareholders, who focus on long-term returns, creditors are more sensitive to the enterprise’s immediate market value and more cautious in investing in innovative enterprises (Berry and Pakes 1993). Creditors’ investment tendencies will affect enterprises’ innovative investment decisions; therefore, increasing enterprise debt financing will reduce enterprise scientific and technological innovation, diminishing regional green development. This scenario is like the crowding out effect of debt homogeneity on enterprise innovation proposed by Shahzad et al. (2023). When an enterprise conducts equity financing, dividends are paid after tax, and enterprises must simultaneously bear corporate and personal income tax. This double tax burden increases the cost of enterprises’ capital use, which may crowd out investment in technological research and development (R&D) and inhibit green development. Based on investor bounded rationality theory, regardless of whether the equity structure of an enterprise is dominated or decentralized, small and medium-sized shareholders lack the resources to obtain enterprises’ investment information. This weakens the supervision of business operators, raising the probability of investment practices such as inconsistency between operators’ financing and investment directions and actual innovation needs (Mathers et al. 2020), which diminishes the investment efficiency of technological innovation projects and enterprises’ production efficiency.

Research H1 is proposed based on the above analysis. Direct financing in China inhibits regional green development.

3.2 Impact mechanism of the institutional environment on direct financing

From the perspective of investors’ rights and interests, beneficial returns are the primary driving force of investment. When the institutional environment is inadequate, the capital market is prone to opportunistic behavior, including large shareholders’ exploitation of small and medium-sized shareholders, which prejudices the rights of investors and creditors (Shleifer and Vishny 1997). A high-quality institutional environment has a well-functioning property rights protection mechanism and legal system, imposing strict regulations to control exploitation and information disclosure, reduce opportunities for moral hazard, and provide adequate security for investors and creditors. Therefore, a sound financial development environment with strict regulatory supervision will reduce capital market transaction risk, increase security for investors and creditors, and accelerate the ease of access to the financing market.

From the perspective of financing costs, a mechanism for open information release can lower financing expenditures for businesses (Welker 1995). Strict information disclosure requirements ease the information inequality between investors, creditors, and financing enterprises; provide more accessible information channels for understanding enterprise information; effectively reduce enterprises’ financing constraints. In addition, regions with an adequate institutional environment have strict anti-corruption mechanisms for officials, which can deter enterprises from attempting to obtain excess profits through rent-seeking behavior, which reduces enterprises’ rent-seeking expenditure, increasing the profit space and attracting investors and creditors (Zhou et al. 2022).

From the perspective of resource allocation, a high-quality institutional environment can reduce the financial repression caused by excessive local government administrative intervention, improving the regulatory role of market mechanisms, and optimizing the development of an equitable structure, which can diminish corporate financing constraints (Chan 2021). Moreover, a high-quality system can restrain the profit-seeking practices of enterprise capital, prevent investors and creditors from blindly investing in high-risk financial projects driven by high profits, optimize the investment channels for financial capital, and guide capital from idling to flow into the productive real economy, expanding the development space for enterprises and improving financing capacities.

Based on the above analysis, H2 is proposed. A high-quality institutional environment expands the scale of direct financing.

3.3 Institutional environment coordination mechanism

The institutional environment, which includes property rights protection and information disclosure, can affect the technical attributes and production structure of green development as well as affecting the direct financing market, advancing green development through direct financing. As a result, the institutional environment contributes to the direction and management of green development in a significant way.

Market-oriented economic reform can also affect the development of a green economy. First, such reform can make marketization more effective. The economic environment has an efficient resource allocation function, as production factor resources will flow to departments or enterprises with high-productivity and high-technology levels, which improves resource utilization and promotes green development of the regional economy. Second, market fairness should be promoted, in which market information is highly transparent, as fair and equitable information disclosure can improve the low production efficiency caused by information asymmetry. Finally, when market competition is strengthened, it establishes conditions for Chinese enterprises to learn and absorb foreign advanced technologies. International and domestic talent and technology exchanges can accelerate technological innovation, transformation, and transmission. This generates more extensive and rapid high-tech spillovers, increasing the probability of successful technological absorption in less developed regions from developed regions and promoting China’s technological progress and green development (Han et al. 2021; Wang et al. 2022c).

A clear property rights system advances enterprises’ efficiency in green transformation. When property rights protection is insufficient, enterprises are more inclined to obtain infringement opportunities with extremely low costs, engage in illegal acts of stealing other enterprises’ R&D achievements, and undermine the enthusiasm of other enterprises in the industry for conducting technological innovation (Auriol et al. 2023). In contrast, property rights protections are improved, the cost of infringement will rise, discouraging the stealing of intellectual property achievements, ensuring enterprise innovation technology exclusivity, and establishing a value-added profit space for technological R&D (Fang et al. 2017).A strictly regulated government intellectual property rights protection system will also encourage innovative enterprises to develop more technologies and increase industry competition, further promoting green economic development (Pan et al. 2023; Mao and Failler 2022). In addition, the government has decision-making power in the allocation of resource elements. Unclear property rights can increase enterprises’ rent-seeking motivations, crowding out scientific research investment, inhibiting innovation and hindering regional green development.

Enterprises’ contract execution, technological innovation, and productivity are affected by the efficiency of contract execution. High contract execution efficiency indicates well-functioning contract performance capabilities, which enables enterprises to effectively avoid moral hazard (Ma et al. 2019), reduces transaction costs, raises investment in scientific and technological innovation, and establishes sufficient conditions for enterprises’ green and low-carbon transformation (Xie et al. 2022). In addition, contract execution efficiency deepens the division of specialized labor, improves enterprises’ management efficiency and production levels, and advances enterprises’ green development. Contract execution efficiency is expected to promote green development.

H3 is proposed based on the above analysis. Improvement of the institutional environment has a promotional effect on regional green development.

Figure 3 illustrates the conceptual framework of the above assumptions, directly depicting the mutual influence of direct financing, institutional environment, and regional green development.

4 Materials and methods

4.1 Econometric methodology

4.1.1 Benchmark regression model

Based on the above mechanism analysis of direct financing on regional green development, and the endogenous growth theory, direct financing hinders regional green development. Zhang (2017) built an endogenous growth model for financial and green development, which we expanded in this study by introducing the correlation between direct financing and regional green development. The specific form is expressed as follows:

Here A, L, and K represent the regional green development level, labor, and capital, respectively, and i and t represent the region and time, respectively. Assume that A is a multiple combination including direct financing as follows:

Here, Aio is the initial value, others represent control variables, and α and β represent a parameter that is further transformed as follows:

Taking the logarithm on both sides obtains the following:

Referencing existing relevant research, we introduce industrial structure upgrading (IND), technological innovation (TE), environmental regulation (ER), per capita GDP (PGDP), and urbanization level (UL) into the model as control variables, obtaining the following basic econometric model (Xu and Dong 2023; Zhang et al. 2018; Zou and Zhang 2022; Shang and Liu 2021):

Here Xkit represents the control variables, δi and μt represent region and year fixed effects, respectively, and εit represents the random disturbance term.

4.1.2 Spatial error model

The first law of geography indicates that resources such as capital, technology, and other elements are transferred more frequently across regions with similar economic and physical characteristics (Westlund 2013). This has an impact on the green development of nearby provinces. Neglecting geographical correlation eliminates the consideration of spatial variables for assessing whether there is a spatial correlation between direct financing and regional green development. Therefore, this study constructs a matching spatial panel data measurement model to analyze the correlation between direct financing and regional green development. Since the SEM considers the spatial effect and the degree to which the dependent variable of a province has an impact on the dependent variable of neighboring provinces when impacted by a certain factor over time, the effect of direct financing on regional green development and the spatial dependence are essential to this study, as the SEM is more appropriate, and is expressed as follows:

Here Wijtεit represents the spatial lag of the error term and γ measures the error impact on GDR of the neighboring provinces.

4.1.3 Moderating effect model

The institutional environment guides policy implementation and resource allocation and affects industrial investment, innovation decisions, transformation, and upgrading. A high-quality institutional environment can promote marketization, improve technological innovation, and enhance enterprise management efficiency through property rights protection, affecting regional green development. Direct finance is also influenced by the institutional environment. A high-quality institutional system can protect the rights of investors, lowering direct lending costs, and increasing the effectiveness of capital allocation to promote the expansion of direct financing. Therefore, this section uses the regulatory effect test to judge whether the institutional environment affects the role of direct financing in regional green development. The expression of the regulatory effect test model is as follows:

Here, the institutional environment (IE) is the mediating variable and regional green development (GDR) is the explained variable.

4.1.4 Construction of a spatial weight matrix

China’s governance system encourages cities to imitate each other’s successful economic development models and local environmental policies. Through multi-channel and multi-level mutual learning between local governments, the cities’ economic development models tend to be consistent. Regional green development is expected to be significantly impacted by the convergence of growth strategies among cities; therefore, this study uses the following economic distance matrix as the benchmark matrix:

Here, fi is the average GDP of region i from 2004 to 2020.

4.2 Data

4.2.1 Explained variable: regional green development (GDR)

Compared with traditional sustainable development, regional green development emphasizes inclusivity and pursues the achievement of diverse goals such as economy and ecology. Most recent studies use two categories to evaluate the regional green development (Long et al. 2021). The entropy approach and other methods are used to determine the complete indicators of green development in the first category (Liao and Li 2022). The second category uses green total factor productivity (GTFP) as a proxy for total efficiency, which is more in line with the actual manufacturing process than the first method and is a more accurate way to gauge the degree of green development. GTFP reflects economic development and environmental changes and is a suitable indicator for measuring regional green development. Currently, GTFP is the most common method used in research to gauge the level of regional green development (Ma and Zhu 2022; Wu et al. 2020). DEA first defines a distance function from the viewpoint of input or output, after which it builds productivity indicators based on the distance function. As a result, this study makes use of Xue's methodology (2022), which constructs a data envelopment analysis (DEA) and Malmquist indicator model to evaluate the degree of green development in China's 30 provinces from 2004 to 2020. The formula is as follows:

Here, (At, Bt) and (At+1, Bt+1) represent the input–output vectors for t and t + 1 periods, respectively. We further use input factors, expected outputs, and non-expected outputs to calculate GTFP (Zhao et al. 2022). Referring to the practices of most scholars, the investment factors in this article are capital, labor, and energy (Wang et al. 2023). The expected output is the actual GDP. Environmental pollution was initially seen by Chung et al. (1997) as an unexpected output, which is mainly split into land pollution, water pollution, and air pollution, according to the classification of environmental factors (Fergusson 1982). Referring to previous literature, land pollution is measured by the degree of land desertification, water pollution by chemical oxygen demand (COD), and air pollution by carbon dioxide (CO2) (Suvaryan and Sargsyan 2008; Guo et al. 2014; Cheng and Jin 2022). Additionally, the substantial waste produced by energy use results in waste pollution, which will negatively affect the air, water, and land. To gauge the extent of waste pollution, we employ solid waste and refer to the methodology of Wu et al. (2020). Therefore, the unexpected outputs are land desertification, COD, CO2 emission and solid waste. The data obtained from the China Statistical Yearbook.

(1) Capital investment

This article uses the perpetual inventory method to estimate capital stock, which can be depicted as follows:

Here Iit, ρ, and Qit, respectively, refer to total fixed assets, the depreciation rate, and the fixed assets investment price index. This study uses a 9.6% depreciation rate, employs physical capital stock data from 2000 as the base period, and uses the fixed assets investment price index of each province rather than a price deflator to calculate the actual total fixed asset formation of the current period.

(2) Energy input

This study uses energy sources such as coal, coke, petroleum, liquefied petroleum gas, natural gas, electricity, and kerosene and calculates total regional energy consumption based on the energy conversion standard coal reference coefficient published in the National Statistical Yearbook.

(3) Labor input

This study measures labor input by assessing the number of employed individuals over time in each province, referencing previous studies on green development.

(4) CO2 emissions

Due to the inability to directly obtain data on China’s CO2 emissions, this study primarily refers to the methods of the Intergovernmental Panel on Climate Change (2006) and the China Energy Economy Research Center of Xiamen University to estimate the CO2 emissions in various provinces and regions. The specific formula is as follows:

Here, RC represents the CO2 emissions from various types of energy consumption, Ri represents the total consumption of energy source i, and CRC represents the carbon emission coefficient, which is the product of calorific value, carbon content, and oxidation factor.

(5) Solid waste

The amount of industrial solid waste produced in various regions is used in this article to gauge pollution from waste. Industrial solid waste includes general industrial solid waste and hazardous waste. Among them, general industrial solid waste refers to industrial solid waste generated by enterprises in the industrial production process and not classified as hazardous waste. Hazardous waste refers to waste with hazardous characteristics that is included in the national hazardous waste list or recognized according to the national hazardous waste identification standards and methods. It refers to the actual amount of hazardous waste generated in the industrial production process, including the amount of secondary hazardous waste generated during the utilization and disposal of hazardous waste.

(6) COD

The chemical oxygen demand (COD) method is used in this study to quantify wastewater pollution. The severity of the water contamination problem increases with the COD value. COD refers to the amount of oxygen required to oxidize organic pollutants in water with chemical oxidants. Generally, chemical oxidants are used to oxidize and decompose the oxidizable substances (organic matter, nitrite, ferrous salt, sulfide, etc.) in the wastewater, and then calculate the oxygen consumption according to the number of residual oxidants to indicate the content of organic matter in the wastewater and reflect the degree of organic matter pollution in the water body. The number of organic contaminants in the water increases with COD.

(7) Desertification area

In 1992, the United Nations Conference on Environment and Development proposed that desertification is a phenomenon of land degradation caused by factors such as climate change and unreasonable human economic activities. The area of desertification in different regions is used in this article to gauge land pollution.

(8) Real GDP

The actual GDP calculation formula is as follows:

Here, Dit refers to the GDP deflator of region i.

4.2.2 Core explanatory variable: direct financing (DF)

We use the data of DF in the regional social financing scale published by the People's Bank of China and China Financial Statistical Yearbook. The scale of social financing is a macroeconomic regulation indicator created by the People's Bank of China and posted by the China Financial Statistical Yearbook, which reflect the support of finance to the real economy. The definition of regional social financing scale is the total amount of funds that the real economy receives from the entire financial system in provinces, including on balance sheet loans, off balance sheet loans, direct financing, and other financing. Among them, on balance sheet loans are financial support provided by local financial institutions to the real economy through on balance sheet operations, includes RMB loans and foreign currency-denominated loans; Off balance sheet loans are financial support provided by local financial institutions to the real economy through off balance sheet operations, includes entrusted loans, trust loans, and undiscounted bankers' acceptances; direct financing refers to the direct financing obtained by the local real economy in the formal market using standardized financial instruments, includes government bonds, net financing of corporate bonds and equity financing on the domestic stock market by non-financial enterprises. Other financing refers to financial support provided to the real economy through other means, mainly including insurance company compensation, small loan company loans, and loan company loans. According to the social financing scale classification, we select the data of direct funding in the scale of regional social funding. Government bonds are issued by the government and are generally used in transportation, communications, housing, education, hospitals, sewage treatment systems, and other public facility construction, few flows into the real economy. Therefore, this paper is only concerned with net financing of corporate bonds and equity financing on the domestic stock market by non-financial enterprises. Among them, net financing of corporate bonds involves various types of bonds issued by non-financial enterprises registered in each province, mainly including corporate bonds, medium-term notes, short-term financing bonds, small and medium-sized enterprise collective bonds, corporate bonds, convertible bonds, separable bonds. Equity financing on the domestic stock market by non-financial enterprises refers to the stock financing conducted by non-financial enterprises registered in various provinces through the formal domestic financial market, including A-share initial issuance, public issuance, cash oriented directional issuance, allotment, exercise financing, and B-share financing. The data come from the People's Bank of China, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the Central Treasury Bond Depository and Clearing Co., Ltd,. and the Association of Interbank Market Dealers.

4.2.3 Mediating variables: institutional environment (IE)

The institutional environment covers a broad range of considerations, and there is no standard measurement for the institutional environment in existing research. Most academics evaluate the institutional environment using thorough indices (Li and Wu 2023; Zhou et al. 2021). According to Ashraf et al. (2022), the total of political stability, democratic accountability, the application of the law, and bureaucratic excellence is used. Khan et al. (2022) employ extensive indices of regulatory excellence, political stability, voice and accountability, rule of law, and corruption control. Since political, economic, and market institutional settings all play a role in the quality of institutions, we resort to the method of Shi and Yang (2022) in this study. Indicators of government intervention in the market, social legalization, and marketization are selected as the indicators, in which the percentage of government spending in GDP reflects the level of governmental intervention (Lin et al. 2021). The number of lawyers per capita, or the ratio of attorneys actively practicing law to the entire population of a province, reflects the degree of social legalization (Li and Wu 2023). The marketization index is created using data from Fan et al. (2003), which included the relationship between the market and government, the growth of the non-state-owned economy, the development of product and factor markets, the growth of market intermediary organizations, and the environment of the legal system. We take the degree of government intervention in the market as a negative indicator and the degree of social legalization and marketization indicators as positive indicators, calculating the comprehensive index of the three using the entropy method as our institutional environment indicator. Government expenditure data are obtained from the China Statistical Yearbook, the number of practicing lawyers in each province is sourced from provincial statistical yearbooks, and the marketization index is obtained from the marketization index report for each province.

4.2.4 Other variables

The influencing factors of regional green development include not only DF but also technological innovation, environmental regulation, and other factors that have an impact on regional green development; therefore, the following indicators are selected in this study. The enhancement of production efficiency across industries is one manifestation of the optimization of the industrial structure, as well as the rationalization of the distribution and flow of production elements across industries. Consequently, industrial structure upgrading (IND) is assessed using the weight of the product of the formula of labor productivity of primary, secondary, and tertiary industries and the proportion of each industry in the GDP (Wu et al. 2021). Data sourced from China Statistical Yearbook. Output and inputs are two indices of technological innovation (Deng et al. 2022). R&D investment is the primary indication of investment (Yang et al. 2021b); however, it is challenging to gauge the success rate of innovation investment. Therefore, output is a better way to gauge the degree of technological innovation. Referring to the approach of Liu et al. (2020), technical innovation (TE) is measured using a logarithm of the number of patent grants. Data sourced from China Statistical Yearbook. The intensification of environmental regulation (ER) could result in creative compensatory effects to support regional green growth but could also generate the phenomena of pollution shelters. High polluting enterprises can choose to transfer enterprises to areas with lower ER intensity due to environmental regulation pressure. The resulting bottom-up government effect will impact regional green development. Some academics choose to use policy shocks as variables to quantify environmental control when choosing indicators for it (Pavlyuk et al. 2017). The emission charge system, however, can more accurately indicate the level of environmental regulation given that it is a key component of China's application of environmental management. Referring to the approach of Zhang et al. (2020), we measure ER by the proportion of pollution reduction to GDP. The data are sourced from the provincial statistical yearbooks. Referring to the practices of most scholars (Zaman et al. 2016), the economic development level is expressed as per capita GDP (PGDP). Data sourced from China Statistical Yearbook. Urbanization is related to changes based on population migration as well as an external manifestation of the process of economic transformation (Wu et al. 2022). Urbanization level (UL) is measured by the percentage of urban residents in the overall regional population (Liang and Yang 2019). Data sourced from China Statistical Yearbook. This study also selects the infrastructure level and the level of openness to the outside world as instrumental variables. Infrastructure level (IFL) is measured by per capita road area, and the level of openness (LOP) is measured by the proportion of total imports and exports to GDP (Esaku and Wang 2021). The data are obtained from the China Statistical Yearbook, the China Provincial Yearbooks.

4.2.5 Data sources

This study uses provincial panel data from 30 Chinese provinces from 2004 to 2020. As noted above, the data are obtained from the China Statistical Yearbook, the China Provincial Yearbook, and the official website of the People’s Bank of China. Considering the integrity and reliability of the data, Hong Kong, Taiwan, Macao, and Tibet are not included in this study. Except for the institutional environmental indicators, the data in this study are all standardized. Table 1 presents the descriptive statistics for each variable. We divide the data from 2004 to 2020 into three parts to observe the evolution of statistical characteristics for each variable over time using mean, standard deviation (S.D.), minimum, and maximum values. The average value of GDR is 0.954, indicating that the country’s GDR is inefficient and comparatively low. The average values of DF from 2004 to 2009, 2010 to 2015, and 2016 to 2020 were 4.121, 6.88, and 9.090, respectively, revealing a significant upward trend. The average values of IE in the same year spans are 0.493, 0.647, and 0.705, respectively, indicating that China’s institutional environment is improving annually. The average values of PGDP and IND in 2016–2020 reach three times the average values of 2004–2009, demonstrating the rapid advancement of China’s industrial structure and level of growth. The imbalance in growth across China’s various provinces is reflected in the considerable disparity between the maximum and minimum PGDP values. The average values of TE, UL, and IFL indicated an upward trend from 2004 to 2009, 2010 to 2015, and 2016 to 2020, directly demonstrating China’s gradually improving technological level, urbanization level, and infrastructure level. The average level of ER and openness decreased slightly from 2016 to 2020 compared to 2004 to 2009 and 2010 to 2015.

5 Results analysis

5.1 Spatial autocorrelation test

Moran’s index (Moran’s I) is an indicator used to measure spatial autocorrelation for determining whether there is spatial aggregation in GDR and DF. The specific formula is as follows:

The Moran’s I value of GDR and DF in the sample areas of this article is shown in Table 2, the Moran’s I value of GDR shows a trend of changing from negative to positive, and the Moran’s I value of DF is mostly significantly positive and fluctuates multiple times. The transition from negative to positive indicates that GDR has transitioned from a random state to an agglomeration state. Multiple fluctuations reflect the changes in the degree of agglomeration of DF. The above results indicate that both GDR and DF have spatial autocorrelation. In addition, the Moran’s I value of GDR in 2017–2018 is not significant for two consecutive years. In 2017, eastern cities increased investment in innovative development and environmental legislation was implemented nationwide. The lag in strategic development and input efficiency and tightening environmental regulations has reduced the differences in green development among regions. This makes the GDR distribution in 2017–2018 exhibits a discrete and balanced development trend. Furthermore, the local Moran’s I values of GDR in 2004 indicate that most provinces exist in the second and fourth quadrants, while the local Moran’s I values of GDR in 2020, DF in 2004 and 2020 show that most provinces are distributed in the third quadrant, indicating that both GDR and DF have local aggregation characteristics (Figs. 4, 5).

5.2 Spatial regression estimation

This study first uses the Lagrange multiplier (LM) test to examine the spatial correlation and conducts Wald and likelihood ratio (LR) tests to determine whether the spatial Durban model (SDM) will degenerate into a spatial error model (SEM) or spatial autoregressive model (SAR). The results of the spatial correlation test, Wald test, and LR test (Table 3) show that Moran’s I is significant at the 5% level, once again confirming the spatial correlation of the model, while the LM test is also significant. The LR and Wald test results validate the original hypothesis, indicating that the model can degrade. Furthermore, based on the LR test result, DF has a significant spatial error correlation to GDR. The SEM is obviously more suitable as the spatial econometric model for this study. In addition, considering the limitations of the variables in this study and the universality of the GDR factors involved a dual fixed effect model of region and time is applied. Based on the above discussion and analysis, examination of the relationship between DF and GDR is finally conducted using the double fixed model and the SEM.

This paper uses the fixed effects model (FEM), SAR, SDM, and SEM to conduct an empirical analysis of the correlation between GDR and DF. From the regression results (Table 4), the FEM is significant at the 5% level, the SAR model, SEM, and SDM are significantly negative at the 5% and 1% levels, respectively. The results show that DF significantly hinders GDR, validating H1. The rationale for this is the imbalance between the development of China’s financial market and economic quality, which increases the cost of direct financing. Expanding the scale of direct financing will aggravate the low efficiency of capital allocation and exert a crowding out effect on innovation investment, subsequently affecting regional green development. In addition, given the proclivity for profit-seeking, capital flows to pollution-intensive industries with higher income potential and short cycles also hinder green development. Finally, debt financing reduces enterprises’ tendency to invest in high-risk innovative projects, and equity financing aggravates the burden of capital use and inhibits the productivity of green project investment, which is detrimental to green development.

Furthermore, among the control variables, PGDP is significantly positive at the 5% level, indicating that PGDP significantly promotes GDR. The rationale for this is that regional growth is assessed by PGDP, and regions or industries with high economic development levels have more advantages in attracting talent and sophisticated technology, which promotes scientific innovation and facilitates regional green advancement. UL is significantly negative at the 5% level, indicating that UL significantly inhibits China’s GDR. Most cities in China have not yet achieved high-quality industrial development and upgrading, and the disorder in urbanization is widespread. Consequently, the process of improving green urban economic growth is still accompanied by extensive urban development and deteriorating ecological environments, with a negative effect. The coefficient of IND is negative because of the level of China’s current industrial structure, which has predominantly transformed and upgraded to the secondary industry. Although urban areas can increase production efficiency, the transition from conventional to clean industry is still lagging, resulting in an inability to support green development. The coefficient of TE is positive, primarily because advances in technology improve production efficiency and resource utilization, reduce resource waste and environmental disruption, and foster green economic development. The coefficient of ER is positive. According to the innovation reimbursement phenomenon, businesses’ level of technological innovation will rise when environmental constraints are tightened, which will promote regional green upgrading.

5.3 Heterogeneity analysis

This study seeks to observe the correlation between DF and GDR in different regions of China, dividing 30 provinces into eastern,Footnote 1 western,Footnote 2 and centralFootnote 3 regions for empirical analysis (Table 5). The regression coefficient of DF in the eastern region is significantly negative at the 1% level, indicating that DF has a significant inhibitory effect on GDR. The regression coefficient of DF in the western region and the central region is positive, indicating that DF in the central and western regions has a promotional effect on GDR. Notably, the effect of DF in the eastern region and the central and western regions on GDR is opposite. The rationale for this is that although the western development strategy has gradually shifted the heavy industry from the eastern region to other regions in recent years, it is still a considerable presence in the eastern region, causing up to 60% of China’s emissions. Increases in direct financing scale and capital availability are likely to cause the expansion of the heavy industrial production scale in the eastern region, leading to rising pollutant emissions. Furthermore, a heavy industrial base leads to high environmental subordination costs, which cuts industrial innovation investment and hinders industrial technological innovation. In short, the high sunk cost will lead to the potential benefits of heavy industry transformation offering far less than the cost. Enterprises have no incentive to conduct the transformation independently, and the green development policy cannot be effectively implemented. Taking Hebei Province as an example, the province is rich in mineral resources and has developed heavy industries such as resource mining and processing. Based on the “resource curse”, financing in Hebei Province is more likely to flow to heavy industries with development advantages, resulting in further expansion of heavy industries. In addition, Hebei Province is faced with overcapacity and an insufficient industrial chain, industry upgrading is moving at a slow pace, and the process of financing promoting technological change through promoting enterprise innovation is also lagging, which inhibits regional green development. The central and western regions have the advantage of backwardness, can make full use of the advanced management model and directly enjoy the scientific and technological innovation achievements overflowing from the eastern region to avoid the environmental pollution generated by the extensive development of the eastern region. This increases the possibility of capital flowing into innovative industries and accelerating advanced productivity and resource utilization efficiency. These regions can also fully leverage comparative advantages, adjust industrial layout planning, and drive the tertiary industry growth by taking advantage of central and western support policies such as the western and central region development strategy. Policy guidance to accelerate financing into the tertiary industry promotes the disposition efficiency of resources and reduces environmental pollution, improving the central and western regions’ green development. Taking Xinjiang Province as an example, it has rigorously introduced advanced technologies from the eastern region, prioritizing the development of advantageous industrial clusters with Xinjiang characteristics, such as wine and wind energy. Financing tends to flow to advantageous industries, accelerating the technological R&D of these industries in Xinjiang, further advancing the development of advantageous technologies for these industries, which promotes the green development of Xinjiang.

5.4 Moderating effect

The specific results of the adjustment effect test are presented in Table 6. The coefficient of the interaction term between DF and IE in the eastern region is significantly positive at the 10% level, and the coefficient of IE is significantly positive at the 1% level. The coefficient of the interaction term between DF and IE in the central region is positive, and the coefficient of IE is positive, too. This result indicates that in the institutional environment, DF promotes GDR, verifying H2 and H3. The rationale for these findings is as follows. First, the system has established stable basic rules for coordinating market transactions. High-quality systems ensure the order and transparency of market transactions, the efficiency of execution, and the control of corruption in the process of market transactions. A good institutional environment reduces the uncertainty of capital operation, lowers the accumulation of risk foam, and ensures the effectiveness of capital green innovation investment. In addition, high-quality systems protect the purity of government activities, regulate government corruption, fundamentally suppress enterprises’ rent-seeking motives, and help enterprises increase innovation input. Second, an effective protection mechanism has been developed for coordinating information disclosure. A high-quality institutional environment reduces moral hazard and information asymmetry by improving the financial system, limiting the exploitation of creditors and small shareholders by large shareholders, attracting investors to actively enter the financing market, diminishing direct financing costs, and reducing the crowding out of innovation investment. Strict information disclosure improves the accuracy of investors’ project identification, enhances capital allocation efficiency, and guides financing toward technical innovation projects, and ensures the survival and development of high-productivity industries. A superior information disclosure system broadens the information channels for shareholders to easily understand enterprises’ business operations, strengthens supervision over operators, effectively reduces operators’ inefficient investments, improves enterprises’ technological innovation, and causes direct financing to advance regional green growth. The coefficient of the interaction between DF and IE in the western region is significantly negative at the 1% level, indicating that in the IE, DF in the western region will inhibit GDR, which is inconsistent with the H3. The reason is that the economic development of the western region is still in its infancy, and its technological progress is mainly due to knowledge spillovers in the eastern and central regions. The increasingly perfect institutional environment has driven the improvement of intellectual property protection, increasing the difficulty of the diffusion of technological knowledge in the eastern region. The rise in knowledge spillover costs creates technological barriers between the eastern and western regions, lowering the competitiveness of products in the western region and impeding its development. Moreover, the western region is China's resource-rich region, and the lagging technological level will lead to a tendency toward high pollution and high energy consumption in its growth, affecting the green development of the region.

5.5 Robustness tests

To ensure the reliability of our study’s regression results, we use Diebold–Mariano (DM) and Hausman tests to examine endogeneity issues. The testing process treats DF as endogenous variables, and infrastructure and openness levels as instrumental variables. Table 7 demonstrates that both the DM and Hausman tests do not reject the original hypothesis, and the overidentified Sargan and Hansen tests also accept the original hypothesis. Therefore, no endogeneity issues are evident in this study.

We next replace the benchmark matrix to confirm that the relationship between DF and GDR is robust. According to the results in Table 8, the regression findings following matrix replacement and benchmark regression results do not significantly differ from one another, verifying the benchmark regression setting and the robustness of the results.

5.6 Discussion

Green development is a model innovation based on traditional development, formed under the restrictions of ecological environment capacity and resource carrying capacity, and views environmental conservation as an important pillar to achieve sustainable development. However, creativity is a necessary driving force for new development methodologies. Finance has traditionally provided noteworthy support for encouraging innovation oriented and achieving green development (Chien et al. 2023; Habiba et al. 2022). According to the research findings, DF significantly hinders GDR. This finding is in line with that of Zafar et al. (2021) who conducted research in Asia. This is explained by a fragile financial system (Ojeyinka and Osinubi 2022). Furthermore, depending on the degree of globalization, resource endowment, and institutional environment of a country, the impact may differ (Hunjra et al. 2022; Rani et al. 2022; Le 2020). The research results indicate that IE affects the inhibitory effect of DF on GDR, which is in line with the verdict reached by Amin et al. (2022). According to Platje (2008), institutional environment plays a significant role in the achievement of green development, particularly in areas with greater levels of economic growth (Azam et al. 2021).

6 Conclusions and implications

Regional green development is essential for achieving sustainable and harmonious economic and social development. With ongoing improvements in the economic level, the scale of direct financing in China is gradually increasing. As an important tool for enterprise innovation financing, it is unclear whether the increase in the direct financing scale can affect regional green development. This article uses the SEM to analyze the impact of DF in 30 provinces of China on GDR from 2004 to 2020. The results demonstrate that DF has a significant spatial inhibitory effect on GDR. Moreover, significant differences are evident among regions, with DF in the central and western regions improving GDR, whereas it significantly suppresses GDR in the eastern region. We further consider institutional impact, introducing the institutional environment into the investigation. The results show that under the regulatory effect of IE, DF has a significant promotional influence on GDR in eastern region. The discussion regarding the functional area is also validated.

According to the research conclusions of this paper, the following recommendations are proposed. The government must implement changes to the funding structure and the financial market system. By establishing a financial market with a well-functioning system and efficient resource allocation and raising the proportion of direct financing, China can realize the smooth transmission of direct financing toward enterprises’ innovation projects, increase the efficiency of capital green investment, and scale direct financing for promoting regional green development. The results of this study suggest that China’s direct financing inhibits currently regional green development significantly; therefore, we should promote the market maker system in the stock market, encourage market makers to drive innovative enterprises with high investment risks and long return periods, and vigorously develop strategic emerging sectors. In the bond market, the unification of rules and systems through standardization and unification of the standards for the issuance and registration of corporate credit bonds, rating standards for rating agencies, and information disclosure requirements are essential, in addition to solving the problem of bond market segmentation. Furthermore, policymakers should endeavor to enrich the direct financing market by establishing a comprehensive financing market system that serves enterprises of different types and sizes, continues to advance stock issuance reform, establishes an effective IPO channel system for innovative enterprises, and accelerates the expansion of the green bond market.

Second, regional differentiation policies should be implemented according to different levels of economic development. Through the formation of locally differentiated policies, financial function zoning and dislocation development strategies can be improved, based on local circumstances, and direct financing can be realized to encourage green development. The heterogeneity results demonstrate obvious regional differences between the eastern region and the central and western regions. The center and western regions’ direct financing has an influence on encouraging green development. Policymakers should fully leverage regional advantages to attract direct financing. For example, Chongqing, Kunming, and other western regions have obvious tourism advantages. Xi’an, Zhengzhou, and other central regions are located in transportation hubs, and the transportation industry is highly developed. The government should support advantageous industries according to local conditions and adopt measures such as special funds for advantageous enterprises and long-term mechanisms for financing services to promote regional economic development, attract more financing opportunities, reduce credit dependence, and enhance green development in central and western regions. The eastern region is economically developed, but direct financing exerts a significant inhibiting effect on regional green development. This region should focus on expanding green industries in the region, establishing and improving the industrial green development mechanism, and implementing more green financial development policies. A sound financial cooperation mechanism should be established among regions to raise the effectiveness of capital allocation, coordinate green architecture construction between industry and finance, and encourage the healthy and sustainable advancement of the regional economy.

Third, the results of further examination regarding the regulatory effect demonstrate that the high-quality institutional environment in the eastern region can change the inhibitory effect of direct financing on regional green development. Consequently, the eastern region should promote a high-quality institutional environment, encourage the rational allocation of capital by improving the institutional environment, and guide enterprises to increase innovation activities, which can promote high-quality green economic development. We first suggest improving the reasonable and fair review system, which will stimulate the initiative of market subjects. Deepening the market-oriented reform of factor prices, ensuring the smooth flow and efficient allocation of resource factors, and establishing a more equal, free, and legal economic system will advance China’s green economy. Furthermore, the property rights protection system must be effectively reformed to simplify administration and delegate power, combine decentralization with regulation, and optimize services, and it is crucial to strengthen the development and implementation of legislation protecting property rights. Efforts must be undertaken to strictly regulate irregular patent applications and establish a fair and comprehensive environment for protecting property rights. Finally, policymakers should establish and improve the anti-corruption system, advance the supervision and balance mechanism of public power, and fundamentally prevent enterprises’ rent-seeking practices. For the western region, the optimization of the institutional environment causes direct financing to suppress regional green development. Therefore, this article suggests increasing policy assistance for western development, focusing on providing targeted assistance in the direction of technology and knowledge, and gradually improving the independent technological innovation capacity of the western region.

Although this study answers the questions raised and provides some suggestions for the sustainable development of China’s finance on the green economy, some shortcomings remain in handling the research results. We only examine the spatial effects and do not consider the threshold effects of direct financing on regional green development. In terms of the actual proportion of China’s main direct financing tools, compared to net financing of corporate bonds, equity financing on the domestic stock market by non-financial enterprises accounts for a relatively small proportion (He et al. 2023). Future research can conduct further investigations considering the impact of equity finances and debt financing on green development separately. Air pollution, water pollution, soil pollution, and waste pollution are additional environmental pollution criteria included in this paper to measure green development. However, there are other types of pollution as well, such as noise pollution and radiation pollution. Its pollution level is difficult to quantify, which could result in some biased green development variables.

Notes

The eastern region includes the 11 provinces of Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan.

The western region includes the 11 provinces Guangxi, Shaanxi, Inner Mongolia, Xinjiang, Qinghai, Yunnan, Guizhou, Ningxia, Gansu, Sichuan, and Chongqing.

The central region includes the eight provinces of Heilongjiang, Jilin, Shanxi, Anhui, Jiangxi, Henan, Hubei, and Hunan.

References

Ahmed F, Kousar S, Pervaiz A, Shabbir A (2022) Do institutional quality and financial development affect sustainable economic growth? Evidence from South Asian countries. Borsa Istanbul Rev 22(1):189–196. https://doi.org/10.1016/J.BIR.2021.03.005

Alessi L, Ossola E, Panzica R (2021) What greenium matters in the stock market? The role of greenhouse gas emissions and environmental disclosures. J Financ Stab 54:100869

Amin A, Ameer W, Yousaf H, Akbar M (2022) Financial development, institutional quality, and the influence of various environmental factors on carbon dioxide emissions: exploring the Nexus in China. Front Environ Sci 9:838714

Ashraf J, Luo L, Khan M (2022) The spillover effects of institutional quality and economic openness on economic growth for the belt and road initiative (BRI) countries. Spat Stat. https://doi.org/10.1016/j.spasta.2021.100566

Auriol E, Biancini S, Paillacar R (2023) Intellectual property rights protection and trade: an empirical analysis. World Dev 162:106072

Azam M, Hunjra A, Bouri E, Tan Y, Al-Faryan M (2021) Impact of institutional quality on sustainable development: Evidence from developing countries. J Environ Manag 298:113465

Battiati C (2019) RD, growth, and macroprudential policy in an economy undergoing boom-bust cycles. J Macroecon 59:299–324. https://doi.org/10.1016/j.jmacro.2018.12.007

Beck T, Demirgüç-Kunt A, Levine R (2003) Law and finance: why does legal origin matter? J Comp Econ 31(4):653–675

Beck R, Georgiadis G, Straub R (2014) The finance and growth nexus revisited. Econ Lett 124(3):382–385

Berry S, Pakes A (1993) Some applications and limitations of recent advances in empirical industrial organization: merger analysis. Am Econ Rev 83(2):247–252

Brown J, Martinsson G, Petersen B (2012) Do financing constraints matter for RD? Eur Econ Rev 56(8):1512–1529

Cai L, He C (2022) Corporate environmental responsibility and bank loans. Bus Ethics Environ Responsib 31:741–761

Cao J, Law S, Samad A, Mohamad W, Wang J, Yang X (2021) Impact of financial development and technological innovation on the volatility of green growth—evidence from China. Environ Sci Pollut Res 28:48053–48069

Chai J, Hao Y, Wu H, Yang Y (2021) Do constraints created by economic growth targets benefit sustainable development? Evidence from China. Bus Strateg Environ 30(8):4188–4205

Chan S (2021) Financial repression and financial risk: the case of China. Post-Communist Econ 33(1):119–132

Cheng Z, Jin W (2022) Agglomeration economy and the growth of green total-factor productivity in Chinese Industry. Socio-Econ Plan Sci 83:101003

Chien F, Paramaiah C, Joseph R, Pham H, Phan T, Ngo T (2023) The impact of eco-innovation, trade openness, financial development, green energy and government governance on sustainable development in ASEAN countries. Renew Energy 211:259–268

Chowdhury R, Maung M (2012) Financial market development and the effectiveness of RD investment: evidence from developed and emerging countries. Res Int Bus Finance 26(2):258–272

Chowdhury J, Kumar R, Shome D (2016) Investment–cash flow sensitivity under changing information asymmetry. J Bank Finance 62:28–40

Chung Y, Fare R, Grosskopf S (1997) Productivity and undesirable outputs: a directional distance function approach. J Environ Manag 51:229–240

Coenen J, Bager S, Meyfroidt P, Newig J, Challies E (2021) Environmental governance of China’s belt and road initiative. Environ Policy Gov 31(1):3–17

Cull R, Xu L (2005) Institutions, ownership, and finance: the determinants of profit reinvestment among Chinese firms. J Financ Econ 77(1):117–146

De Haas R, Popov A (2019) Finance and carbon emissions. Available at SSRN 3459987

Demirgüç-Kunt A, Levine R (2001) Financial structure and economic growth: a cross-country comparison of banks, markets, and development. MIT Press, Cambridge

Deng Y, Guang F, Hong S, Wen L (2022) How does power technology innovation affect carbon productivity? A spatial perspective in China. Environ Sci Pollut Res Int 29:82888–82902

Esaku S, Wang M (2021) The short- and long-run relationship between trade openness and economic growth in Uganda. Cogent Econ Finance 9(1):1999060

Fan G, Wang X, Zhang L, Zhu H (2003) Marketization index for China’s provinces. Econ Res J 3:9–18

Fang L, Lerner J, Wu C (2017) Intellectual property rights protection, ownership, and innovation: evidence from China. Rev Financ Stud 30(7):2446–2477. https://doi.org/10.1093/rfs/hhx023

Fergusson J (1982) Inorganic chemistry and the earth. Chemical resources, their extraction, use and environmental impact. Pergamon Press, New York

Ghoniyah N, Hartono S, McMillan D (2020) How Islamic and conventional bank in Indonesia contributing sustainable development goals achievement. Cogent Econ Finance 8(1):1856458

Guo M, Wang J, Bi J (2014) Decomposition analysis of water consumption-related chemical oxygen demand emission in Chinese industrial sectors. Water Policy 16:805–823

Guo M, Hu Y, Yu J (2019) The role of financial development in the process of climate change: Evidence from different panel models in China. Atmos Pollut Res 10:1375–1382

Habiba U, Cao X, Ahsan A (2022) Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renew Energy 193:1082–1093

Hallwood P (2023) Optimal commodity storage: privately and publicly financed storage compared. J Econ Anal 2(1):55–65. https://doi.org/10.58567/jea02010004

Han J, Miao J, Du G, Yan D, Miao Z (2021) Can market-oriented reform inhibit carbon dioxide emissions in China? A new perspective from factor market distortion. Sustain Prod Consum 27:1498–1513. https://doi.org/10.3390/SU131910934

Hao Y, Huang J, Guo Y, Wu H, Ren S (2022) Does the legacy of state planning put pressure on ecological efficiency? Evidence from China. Bus Strateg Environ 31(7):3100–3121

Hao X, Fu W, Albitar K (2023) Innovation with ecological sustainability: Does corporate environmental responsibility matter in green innovation. J Econ Anal 2(3):21–42. https://doi.org/10.58567/jea02030002

He J, Han W, Bi G (2023a) The non linear impact of direct financing structure on economic growth. Chin J Manag Sci 31(1):47–55

Hester D (1969) Financial disintermediation and policy. J Money Credit Bank 1(3):600–617

Huang Q, Fang S, Wang D, Sun W, Zhou Y, Lu F (2023) The impact and mechanism of the relaxation of fertility policy on income distribution: evidence from China’s Selective Two Children Policy. J Econ Anal 2(1):80–93. https://doi.org/10.58567/jea02010006

Hunjra A, Tayachi T, Chani M, Verhoeven P, Mehmood A (2020) The moderating effect of institutional quality on the financial development and environmental quality nexus. Sustainability 12(9):3805

Hunjra A, Azam M, Bruna M, Taskin D (2022) Role of financial development for sustainable economic development in low middle income countries. Finance Res Lett 47:102793

Jahanger A, Bao J, He M (2022) Does green credit promote green sustainable development in regional economies?—Empirical evidence from 280 cities in China. Plos One 17(11):e0277569