Abstract

Africa is currently experiencing both financial and human development challenges. While several continents have advocated for financial development in order to acquire environmentally friendly machinery that produces less emissions and ensures long-term sustainability, Africa is still lagging behind the rest of the world. Similarly, Africa’s human development has remained stagnant, posing a serious threat to climate change if not addressed. Building on the underpinnings of the environmental Kuznets curve (EKC) hypothesis on the nexus between economic growth and environmental pollution, this study contributes to empirical research seeking to promote environmental sustainability as follows. First, it investigates the link between financial development, human capital development and climate change in East and Southern Africa. Second, six advanced panel techniques are used, and they include (1) cross-sectional dependency (CD) tests; (2) combined panel unit root tests; (3) combined panel cointegration tests; (4) panel VAR/VEC Granger causality tests; and (5) combined variance decomposition analysis based on Cholesky and generalised weights. Our finding shows that financial and human capital developments are important in reducing CO2 emissions and promoting environmental sustainability in East and Southern Africa.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

This study investigates whether financial and human capital developments matter for climate change. In more perspective, the study examines whether financial development and human capital are a nightmare in the East and Southern African regions. The extant literature is unsettled on nexuses between globalisation, financial development and other macroeconomic variables in environmental sustainability (Adebayo 2020; Kirikkaleli and Adebayo 2020; Odugbesan and Adebayo 2020; Le and Ozturk 2020; Kirikkaleli et al. 2021; Adebayo and Odugbesan 2021; Baloch et al. 2021). The link between financial and human developments is apparent in the famous environmental Kuznets curve (EKC). While the hypothesis has provided an empirical framework for analysing the connection between economic growth and the danger of climate change, findings remain controversial. In a series of studies, Shahbaz et al. (2012, Shahbaz et al. 2013, 2015) provide support for the EKC hypothesis. Odhiambo (2020) and Menyah and Wolde-Rufael (2010) are consistent for South Africa. In contrast, Tamazian et al. (2009) maintain that these studies’ findings are incomplete as they have failed to account for financial development. Tamazian and Rao (2010) recognised that access to finance could affect potential growth as well as environmental sustainability. This unsettled issue remains a critical concern for East and Southern Africa (Dafe 2020). It is unclear whether in the attendant regions financial and human capital developments are relevant for environmental sustainability as apparent in the literature (Asongu et al. 2017, 2018; Bekhet et al. 2017). The rationale for this study is therefore to investigate whether financial development and human capital matter for environmental sustainability in East and Southern Africa. Hence, the study aims to provide information that can help policy makers take informed decisions.

Four reasons call for the positioning of an inquiry on East and Southern Africa. First, many reports have linked finance and human development to slow economic growth and vulnerability to climate change. The reports have shown that nearly 73% of the adults in Kenya are financially excluded (Van Hove and Dubus 2019). This is similar to the report in Tanzania and Uganda as 56% and 46% of the adult population in respective countries are yet to benefit from formal financial services (Demirguc-Kunt et al. 2017; Demirgüç-Kunt et al. 2020; Beck et al. 2007). A similar experience has been documented for Kenya and other East and Southern African countries (Asuming et al. 2019). Second, poor access to finance has been linked to the ease of doing business among African countries (Beck et al. 2007; Asongu et al. 2020). For example, the inability of farmers to access finance needed for smart technology required to improve agricultural output may result in environmental degradation (Liu et al. 2021; Khalid et al. 2021; Bigger and Webber 2021). Lack of access to finance has affected the ability of farmers to explore modern technology in order to enhance their agricultural produce (Asongu 2018a, 2018b; Asongu and Acha-Anyi 2017; Asongu et al. 2016a, 2016b, 2017). Possibly, increase in their CO2 emissions and vulnerability to climate change could be explained by their inability to access financial resources that are essential for the acquisition of smart agricultural technology. This ultimately leads to heavy reliance on old agricultural practices and environmental degradation. Third, the poor state of education across East and Southern African countries has increased the concern of their vulnerability to climate change. Many reports have already shown that human capital development in East and Southern Africa deserves an urgent intervention owing to health risk and poor educational systems in the region, which may likely endanger the environment (IPCC 2014; Pachauri and Reisinger 2007). Fourth, the current call for ensuring improved economic welfare, sound financial reform and a sustainable environment constitute priorities of post-2015 Sustainable Development Goals (SDGs). Such priorities require adequate planning and understanding of the means by which attendant programs would be funded. Hence, financial development is a critical element to be considered. Human capital development for environmental sustainability will further strengthen the relevance of SDGs in rescuing Africa from the danger of climate change (Asongu et al. 2019a, 2019b; Asongu and Odhiambo 2019d, 2020a, 2020b, 2020c; Zivin and Neidell 2012; Zaidi et al. 2019; Xing et al. 2017; Xiong and Qi 2018; Zafar et al. 2019). Additionally, the overwhelming evidence on the consequences of climate change has shown that East and Southern Africa are vulnerable and policy makers need information on the basis of which they can tailor appropriate policies to avert crises related to CO2 emissions. Fifth, the dearth of empirical studies on finance in East and Southern Africa, make the present study timely.

Our study is related to the empirical literature on the nexus between financial development and environmental degradation, notably Shahbaz et al. (2016); Bekhet et al. (2017); Shahbaz, Tiwari and Nasir (2015) and Lu (2018); Zaidi et al. (2019); Nathaniel and Iheonu (2019); and Asongu and Odhiambo (2019a, 2019b, 2019c, 2019d). These empirical studies have revealed interesting results that have provided a deeper understanding of the link between financial development and CO2 emissions. It is important to investigate a similar effort for the East and Southern African experience.

Our study contributes to empirical literature as follows: (1) it investigates whether financial development and human development can help in promoting environmental sustainability in East and Southern Africa; (2) the study is framed with a panel Granger causality approach and uses statistical procedures to uncover information that can be leveraged by policy makers to rescue East and Southern Africa from the unavoidable danger of climate change. First, it explores the previous information on the behaviour of the series using the Levin, Lin and Chu (2002) (hereafter LLC) and Im et al. (2003) tests. Second, it combines the statistical intuition from Pedroni (2002) and Kao (1999) panel cointegration tests to assess the long-run prospects of the series. Third is the panel VAR/VEC Granger causality approach helps to uncouple the short- and long-run dynamics among the variables. The results show that human and financial developments are critical for mitigating CO2 emissions in East and Southern Africa.

This study is novel in several ways. (a) By controlling for confounders, the study shows the implication of financial development, human capital and environmental sustainability. (b) The study provides evidence on the key social investment needed to achieve environmental sustainability in the African continent. (c) While the study is empirically motivated, the findings on the causation link between factors provide vital information that can aid in the development of policy frameworks to reduce carbon emissions in the short and long terms.

The paper is organised as follows. ‘The related literature’ section presents the literature review and hypothesis testing; ‘Data and methodology’ section describes the data and methodology used. The ‘Empirical results’ section covers the results, while the ‘Concluding implications and future research directions’ section concludes with policy recommendations.

Related literature

This section presents empirical literature on the link between financial development, human capital and environmental sustainability. It begins by exploring arguments in the literature and ends with two research questions.

Financial development and environment

The survey begins with the most recent study by Odhiambo (2020) on the dynamic relationship between financial development, income inequality and CO2 emissions for a panel of 39 sub-Saharan Africa countries (SSA) between 2004 and 2014. The scholar has combined three main indicators (the Gini coefficient, the Atkinson index and Palma ratio), using the generalised method of moments (GMM) and reported a negative impact of financial development on CO2 emissions in SSA. Shahbaz et al. (2016) examined the asymmetric impact of financial development on environmental quality in Pakistan from1985 to 2014. They reported that financial development through investment in the energy sector is crucial for environmental quality. The findings of the studies are relevant to this present one but differ in approach.

Chen et al. (2019) examined the dynamic relationship between financial development, energy consumption, income level and ecological footprints in Central and Eastern European Countries (CEECs) for the period 1991 and 2014, combining the feasible generalised least squares (FGLS), GMM, and Dimitrscue and Hurlin (D-H) panel causality and reported that financial development significantly contributes to environmental degradation. Their finding and approach are relevant to this present study. Asongu and Odhiambo (2020a, 2020b, 2020c) assess whether improving governance standards affect environmental quality in 44 countries in sub-Saharan Africa between 2000 and 2012 using GMM and bundled as well as unbundled governance dynamics and reported that governance matters for environmental sustainability in the region. Tamazian et al. (2009) investigated the link between financial development, economic growth and environmental quality from 1992 to 2014 and reported that economic and financial developments are crucial for environmental quality in the BRIC (Brazil, Russia, India and China) nations.

Guo et al. (2019) examine the role of financial development in climate change in China and its provinces between 1975 and 2015. Their study has used an extended STIRPAT model and reported that financial development is crucial for mitigating climate change. Similarly, Mesagan et al. (2019) explore the role of capital investment as a channel for promoting environmental quality in Brazil, Russia, India, China and South Africa (BRICS) countries using the fully modified and dynamic ordinary least squares (DOLS and FMOLS) approaches and reported that it is relevant to complement capital investment with renewable energy to reduce the impact of climate change. Shahbaz et al. (2019) examine the link between foreign direct investment (FDI) and carbon emissions in North African countries using the GMM and Granger causality approaches and reported that FDI cause CO2emissions. Shahbaz et al. (2013) examined whether financial development reduced CO2 emissions in Malaysia between 1971 and 2011 using the autoregressive distributed lag model and reported that long-run relationships exist among the variables. Their results further show a bidirectional relationship between financial development and CO2 emission during the period. Abid (2017) investigate the link between financial and institutional development for the EU (European Union) and MEA (Middle East and Africa) countries using the GMM approach and discovered a monotonically increasing relationship between CO2 emission and income.

Asongu and Odhiambo (2019b) investigate how doing business affects inclusive human development in 48 sub-Saharan African countries for the period 2000–2012, using fixed effects and GMM regressions. They reported that increasing constraints to the doing of business have a negative effect on inclusive human development. Ansah and Sorooshian (2019) examine the private sector’s response to addressing climate change and reported that access to finance is a major challenge distorting the response of the private sector. Asuming et al. (2019) conduct a comparative analysis of financial inclusion in 31 sub-Saharan African countries using the Global Findex database for the period 2011 to 2014 and reported that financial inclusion policies should be promoted across the population.

Human development and environment

A study by Sen (1979) provides a remarkable framework for assessing human development and environmental sustainability. Sen (1985) widened the human development hypothesis to account for the need for social investment in the form of education, health and a higher standard of living, as means of preserving the environment. While much research has been done on the relationship between human development and the environment, the results have been mixed. For example, Costantini and Monni (2008) examined the links between the environment, human development and economic growth. They concluded that investing in human development will help achieve a path to long-term growth and environmental sustainability. Sheraz et al. (2021) have assessed the effect of globalisation on financial development, energy consumption, human capital and carbon emission for a panel of G-20 countries using the Driscoll–Kraay standard error approach and Dumitrescu and Hurlin panel Granger causality test. They have established that human capital is negatively correlated with CO2 emission. Bano et al. (2018) analysed the link between human capital and CO2 emission for Pakistan and confirmed a long-run relationship among the factors.

Economic growth and environment

The carrying capacity hypothesis’ main argument provides an intuition for explaining the relationship between economic growth and the environment. As a result, an environmental policy must take into account preservation in the pursuit of economic growth. Although the theory has produced a large body of literature, the evidence is still inconclusive and contested (Arrow et al. 1995; Panayotou 2016). For example, several studies have acknowledged that a continuous quest for economic growth tends to cause environmental degradation (Guo et al. 2018; Boggia et al. 2014; Siva et al. 2016). Another group of studies suggested the need to limit growth in order to improve the environment and maintain environmental quality (Yang et al., 2016; Yu et al. 2015; Twerefou et al. 2017; Acar and Lindmark 2017). For example, Twerefou et al. (2017) examined the environmental effects of economic growth and globalisation for a panel of 36 sub-Saharan African countries over the period 1990–2013, using a system-generalised method of moments and reported that environmental quality tends to deteriorate as a result of economic growth and globalisation. Acar and Lindmark (2017) analyse the convergence in CO2 and economic growth for the Organisation for Economic Co-operation and Development (OECD) members from 1973 to 2010 and reported that the environment degrades as economic growth increases. Safi et al. (2021) examined the impacts of financial instability and consumption-based carbon emission in E-7 countries along with the mediating role of trade and economic growth. They confirmed the existence of cross-sectional dependence among variables as well as factor cointegration. Özokcu and Özdemir (2017) investigate the link between income and CO2 emissions in 26 OECD countries and provide support for EKC hypothesis.

Trade openness and environment

The correlates between trade openness and the environment are discussed within the haven hypothesis. According to the theory, trade openness causes emissions as a result of weak environmental policy. While the theory has generated a substantial amount of literature, the evidence has been mixed. For example, Zamil et al. (2019) applied the autoregressive distributed lag (ARDL) model for Oman between 1972 and 2014 and reported a positive relationship. Frutos-Bencze et al. (2017) investigated whether trade openness affected carbon emissions using ARDL and discovered a positive influence of trade openness on carbon emission. Udeagha and Ngepah (2019) empirically examined the link between trade and environmental quality in South Africa from 1980 to 2012 and confirmed the existence of a haven hypothesis in South Africa. Menyah et al. (2014) assessed the causal relationships between financial development, trade openness and economic growth for a panel of 21 African countries and reported that financial development unidirectionally Granger cause trade openness.

Agriculture and environment

Agriculture is one of the most important sources of biomass for human society, but it is also one of the most significant contributors to anthropogenic ecosystem degradation through negative impacts on biodiversity, ecosystem integrity, climate change, and ecosystem services (Foley et al. 2011; Weinzettel et al. 2019; Penna 2014). Human appropriation of net primary production has been proposed as a socioeconomic and ecological indicator of human interference with natural ecosystems (Haberl et al. 2014: Kastner et al. 2015). Likewise, many studies have shown that increased agricultural activities impact environmental quality (Dai et al. 2012; Hu et al. 2019).

Obviously, a cursory look at the existing empirical studies shows that considerable effort has been made. Most of the studies have provided a valuable contribution to the literature on environmental sustainability in the chosen strands. However, the scholars’ findings are still inconsistent and controversial. Hence, further information is required to reach a consensus on the relationship between financial development indicators and environmental sustainability. At best, the fact that the long-run relationship is reported with controversy in the short-run prospects (Shahbaz et al. 2013, 2016) motivates the present study to provide more insights into the nexuses.

In the proceeding paragraphs, we have beamed light on the arguments in the existing literature on the link between financial development, human capital and environmental sustainability. Based on the arguments, we anticipate that financial development should hurt environmental sustainability while human capital should have the opposite incidence. Addressing the hypothetical concerns will provide more information to make informed policies needed for combating climate change. The concerns are deemed important for East and Southern Africa, especially when the region is presented with the dual problem of financial exclusion and poor educational system.

Data and methodology

This study investigates whether financial and human capital developments matter for environmental sustainability for a panel of 12 East and Southern African countries between 2000 and 2018. The data used are sourced from the World Development Indicators (WDI) and Penn World Table. We use CO2 per capita to capture environmental sustainability which conforms to previous studies (see Shobande and Shodipe 2019; Asongu and Odhiambo 2019a, 2020a; Shahbaz et al. 2013, 2016; Shobande and Enemona 2021). The financial development variable is captured with private domestic credit by deposit money banks (DMBs) (see Shobande and Lanre 2018; Shobande and Shodipe 2019; Asongu and Odhiambo 2019a, 2020b; Shahbaz et al. 2013, 2016; Tchamyou 2019, 2020, 2021; Tchamyou et al. 2019). The human development index (knowledge, longevity and well-being) available in the Penn World Table is used to proxy for human capital. Since it is reasonable to capture the level of economic activity as it is likely to affect environmental quality through CO2 emission, agricultural value added (% GDP) from WDI is used. Shahbaz et al. (2013, 2016) stresses the importance of trade openness to capture globalisation. Based on the appeal, trade (import + export) per capita is also used. Since we have placed some importance on environmental sustainability, it is reasonable to account for demographic factors. The use of urbanisation conforms to existing empirical studies (Ahmed et al. 2020; Nathaniel & Iheonu, 2019; Nathaniel, 2020). Also, investment is captured with the real domestic absorption (real consumption plus investment) and GDP per capita captures the income level (see Asongu and Odhiambo, 2019a, b, c, d, 2020a, b, c; Shahbaz et al., 2013, 2016).

Empirical model

The augmented STIRPAT framework, which adapts to other factors connecting financial development and environmental sustainability, is used, and it is specified as:

In our model, CO2 denotes carbon emissions per capita as an indicator of environmental sustainability; Fin is private domestic credit (DMBs which represents an indicator for financial development); Hdi or human development index constitutes knowledge, longevity and well-being indicators; GDP captures income per capita; Tr is trade openness or an indicator for globalisation; Urb is a demographic variable; Agr is agricultural value added (% of GDP) which determines economic activity in the East and Southern Africa; and investment is captured with the real domestic absorption (real consumption plus investment).

Equation 1 is linearised to capture the stochastic properties in the STIRPAT model and is stated as:

As before, i is the index of countries, t is time, α0 is the intercept parameter, α1 − 6 are not the only parameters associated with the variable but also constitute elasticity, while v is the unobserved.

Panel modelling

The empirical strategy of our study is framed as a panel VAR/VEC Granger causality model. The approach has gained empirical research superiority across multidisciplinary studies (see Haavelmo, 1944; Holland, 1986; Spanos, 1989; Pindyck & Rotemberg, 1990; Reboredo, 2013). Two reasons motivated the use of the research approach. First, it helps to break down the dynamic relationship among the factors into short- and long-run effects. Second, it provides a yardstick for understanding prior behaviour of each series used. Third, it enables the convergence speed of the variables to their equilibrium position, which helps in facilitating cross-country common policies for the East and Southern African countries investigated. Our VAR/VEC Granger causality is model as follows (3–10).

In Eqs. 3–10, α10, α2, α30, β40, α50, α60, α70, α80, are taken as intercepts associated with an individual model for each variable; α11 − 18, α21 − 28, α31 − 38, α41 − 48, α51 − 58, α61 − 68, α71 − 78,α81 − 88 are parameters and elasticities for each model associated with endogenous factors; p is the lag length which is selected using the AIC, SC, and HQ criteria; μ1i, t, μ2i, t, μ3i, t, μ4i, t, μ5i, t, μ6i, t, μ7i, t, μ8i, t are shocks arising from each variable transmitted to climate change from each endogenous model; Δ is the difference operator; ϕ is the short-run dynamic coefficient to be estimated and the serially uncorrelated error term is εi, t ; q is the optimal lag length reduced by 1; ϕ is the speed of adjustment parameter with a negative sign; and ECTt−1 is the error correction term, which is the lagged value of the residuals obtained from the cointegration regressions of the dependent variable on the regressors. Thus, the past disequilibrium term (i.e. ECT) determines if the long-run causality holds.

Empirical results

This section discusses the empirical results and offers a thorough explanation of the findings. It also contrasts findings with previous studies.

Preliminary analysis

Descriptive statistics

This section presents the summary statistics of the series. The goal is to have prior information on the series’ past behaviour before undertaking any serious analysis. Table 1 presents the summary statistics of the variables.

Table 1 displays the summary statistics of the data. The average value (standard deviation) of CO2 emission and its corresponding long term is 0.32 (0.1). Meanwhile, the mean (standard deviation) for financial development and human capital development is 0.47(0.21) and 47.8 (20.7), respectively.

Correlation matrix

This section reports the correlation matrix of the variables used. The analysis aims to discover the nature of the relationship between the variables, and the outcome is reported in Table 2.

Based on the correlation results, agriculture is partially correlated with GDP per capita and trade openness, whereas trade openness is partially correlated with GDP per capita.

Cross-section dependence and homogeneity tests

It is important to check the cross-sectional dependence among the variables in panel before any meaningful analysis is carried out. Econometrically, nonstationary panel data have attracted considerable empirical research, given the importance of the series’ potential. Similarly, statisticians have developed various panel unit root and cointegration tests to circumvent the problem (Liven & Lin, 1993; Quah, 1994; McCoskey & Kao, 1998; Chiang and Kao, 2002). Despite the efforts by applied econometricians, it appears that the panel unit root test cannot provide an appropriate account of the cross-sectional dependence problem (Gao et al., 2020; Su & Chen, 2013; Pesaran & Yamagata, 2008; Ando & Bai, 2015; Breitung et al., 2016; Dikgraaf & Vollebergh, 2005). Breusch and Pagan (1979) and Pesaran (2004) are often implemented to resolve the problem. Two unforgiven problems arise if the issue of cross-sectional dependency is overlooked. The first is the loss of efficiency and essential information that would have helped understand the dataset’s prior behaviour. The second arises from spurious data that do not follow a normal distribution leading to the insignificance of the t-statistics. Three main statistical methods have been implemented to investigate cross-sectional dependence in our dataset, notably Breusch and Pagan (1980) and LM, Pesaran (2004, 2015). The results of the cross-sectional dependence are provided in Table 3.

Null hypothesis: No cross-section dependence (correlation) in residuals.

The results show the presence of cross-sectional dependence among the variables. Both the Breusch and Pagan LM, Pesaran Scaled LM and Pesaran CD admitted the presence of cross-sectional dependence in each variable investigated. There are two consequences of the results observed. First, a shock in one country is likely to transmit to the other. Precisely, agriculture which has been the major economic activity in the East and Southern African countries may have a consequence for climate change. However, this depends on the level of agricultural activities and the degree of CO2 emissions. Fortunately, the result conforms with the existing report that East and Southern African countries are likely to experience a major public health crisis (Owen et al., 2011); no intervention program is designed to rescue the region from climate change. Second, the highly integrated trading network within the region reflects the outcome of the CD test.

Panel unit root tests

The next step is to conduct the panel unit root test of the variables before further analysis. The initial investigation of the unit root properties of the data used is deemed crucial since spurious data is unlikely to provide good estimates. Similarly, knowing the series’ prior behaviour provides complementary information to justify the CD test’s previous evidence. To assess the stationary properties of the series, we have implemented the first-generation panel unit root test by combining the LLC (2002) and the IPS methodology, and Table 4 presents the results.

Interestingly, the combined LLC and IPS panel unit root tests results indicate that the variables are not stationary at level. To ensure the variables are stationary, we have transformed the variables by taking their first differences. After the transformation, all the variables are stationary. Fortunately, both the LLC and IPS panel unit root tests admitted that the variables are indeed stationary.

Hypothesis Tested:

Null hypothesis: Panel contains unit roots.

Alternative: Panel is stationary.

One main challenge with the LLC and IPS panel unit roots tests is that they do not account for the cross-sectional problem. Thus, the study implemented second-generation panel unit root tests that account for the cross-sectional problem, notably (a) cross-sectional ADF and augmented cross-sectional IPS (CIPS) (Im, Peseran, & Shin) (Pesaran, 2007). Table 5 presents the results of the robust panel unit root tests.

Lag selection criteria

In the prior section, we have conducted a preliminary check of our dataset using the CD and panel unit root tests. The result confirmed that the series are stationary after first differencing. Next, it is important to check the lag length to determine how the variables respond. The Akaike (AIC), Schwartz Bayesian (SC), and Hannan-Quinn (HQ) information criteria were used. Details of these criteria are provided in Table 6.

According to Table 6, there is agreement among the criteria on the appropriate optimal lag length. Luckily, the AIC, SC and HQ admitted one lag selection.

Panel cointegration tests

Testing cointegration in panels has gained considerable support in the empirical literature. Some empirical studies have shown that a variable can have a unit root and still does not exhibit a long-run relationship (Levin et al., 2002; Chang & Nguyen, 2012; Pesaran & Yamagata, 2008; Ando & Bai, 2015; Baltagi & Kao, 2001; Baltagi et al., 2016, 2017). This justifies the need to examine whether the series can converge to their long-term mean. Two cointegration approaches have been used. The Pedroni (1999, 2001, 2004) panel cointegration and Kao (1999) tests were used. The Pedroni (1999) residual-based panel cointegration test is built on seven criteria, which can be specified as follows.

Pedroni (1999, 2002) describes the seven statistical criteria as follows.

-

(a)

Panel v − statistic

$$ Panel\ v:{T}^2{N}^{\raisebox{1ex}{$2$}\!\left/ \!\raisebox{-1ex}{$3$}\right.}{\left(\sum \limits_{i=1}^N\sum \limits_{t=1}^T{\overset{\sim }{L}}_{11i}^{-2}{\overset{\sim }{e}}_{\mathrm{i},\mathrm{t}-1}^2\right)}^{-1} $$ -

(b)

Panel ρ − statistic

$$ T\ \sqrt{N}{\left(\sum \limits_{i=1}^N\sum \limits_{t=1}^T{\overset{\sim }{L}}_{11i}^{-2}{\overset{\sim }{e}}_{\mathrm{i},\mathrm{t}-1}^2\right)}^{-1}\sum \limits_{i=1}^N\sum \limits_{t=1}^T{\overset{\sim }{L}}_{11i}^{-2}\left({\overset{\sim }{e}}_{\mathrm{i},\mathrm{t}-1}-\Delta {\overset{\sim }{e}}_{\mathrm{i},\mathrm{t}}-{\overset{\sim }{\lambda}}_i\right)(b) $$

\( {\left({\overset{\sim }{s}}_{N,T}^2{\sum}_{i=1}^N{\sum}_{t=1}^T{\overset{\sim }{L}}_{11i}^{-2}{\overset{\sim }{e}}_{\mathrm{i},\mathrm{t}-1}^2\right)}^{\raisebox{1ex}{$-1$}\!\left/ \!\raisebox{-1ex}{$2$}\right.}{\sum}_{i=1}^N{\sum}_{t=1}^T{\overset{\sim }{L}}_{11i}^{-2}\ \Big({\overset{\sim }{e}}_{\mathrm{i},\mathrm{t}-1}-\Delta {\overset{\sim }{e}}_{\mathrm{i},\mathrm{t}} \))

The panel t and panel ρ are called within dimension residual-based cointegrated tests, while the group panel dimension is the group t and group ρ.

The null hypothesis of no panel cointegration in each statistic is expressed as:

The alternative hypothesis of the between dimension based on the statistics procedure is stated as:

where a similar value of θI = θ is not essential.

Tables 7 and 8 present the results of the cointegration tests with the associated hypothesis.

Hypothesis Tested:

Null hypothesis: No panels are cointegrated.

Alternative: all panels are cointegrated.

Kao Cointegration tests results

Null hypothesis: No panels are cointegrated.

Alternative: all panels are cointegrated.

According to the panel cointegration test results, both Pedroni (1999, 2001) and Kao (1999) admitted that the variable is cointegrated. To confirm the results of the first-generation panel cointegration and account for cross-sectional independency, we applied the second-generation Westerlund panel cointegration approach and results are presented in Table 9. The findings confirmed that the variables were cointegrated.

The result has a serious implication for the East and Southern African countries. First, it implies that climate policy must be long term or tailored towards a long-term prospect. Second, the driving factors of CO2 emissions in these East and Southern African countries need to be carefully managed.

Panel VAR/VEC Granger causality/block exogeneity Wald

As earlier stated, this study is framed on the panel Granger causality approach which has been widely used in many empirical studies for multidisciplinary analysis (Granger, 1969; Bressier & Seth, 2011; Dimitrescu & Hurlin, 2012; Kuruppuarachchi & Premachandra, 2016). Two reasons justify the use of this approach. First, it provides an avenue to determine the short and long dynamics of the variables. Second, it revealed the vector error correction term (VEC), which determines the convergence speed of the variables to their equilibrium position. Table 10 summarises the results of the VAR/VEC Granger causality approach implemented.

The results of the panel VAR/VEC Granger causality applied are discussed as follows.

First, the variable has long- and short-run relations and the speed of convergence is relatively sluggish. Second, financial development (Fin), human capital (Hdl), and GDP per capita unidirectionally Granger cause CO2 emissions, which conform with earlier findings (Ahmed et al., 2020, Shahbaz, 2013, 2016). Second, bidirectional causality runs through agriculture, urbanisation and CO2 emissions. The error correction term (ect) that determines the convergence speed among the variables was negative and significant but sluggish for most of the estimated models. Third, GDP per capita, globalisation (Tr) and urbanisation unidirectionally Granger cause agriculture. The medium through which financial development and human development affect environmental sustainability has been identified as agriculture associating factors such as globalisation and urbanisation. Our results are consistent with prior studies in other regions and confirmed the IPCC (2014) report for the East and Southern African on access to finance, poor human capital development and vulnerability to climate change.

Four main implications can be deduced from the results. First, the presence of long- and short-run prospects among the climate indicators reflects that policy needed to mitigate CO2 among countries in the East and Southern Africa must be tailored towards the long term. This is important as the short-term prospect might endanger the future potential human capital in the region due to a foreseeable accumulated effect of CO2 on the population. Second, the unidirectional causality running from financial development to human capital and CO2 emissions indicates that investment in human capital development and access to finance can help the East and Southern African countries reduce CO2 emissions and avert the unavoidable consequence of climate change.

Second, the bidirectional Granger causality observed between agriculture, urbanisation and CO2 raises several concerns. East and Southern African regions are predominately agricultural-driven. The urban area is a centre of tourism, and hence, intervention programs through smart agricultural technology are urgently needed to promote environmental sustainability.

VAR forecasting error variance decomposition

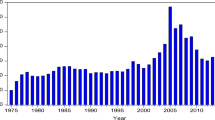

In this section, we present the various variance decompositions of the variables. The goal is to determine the contributions of each variable to the other in the autoregressive process. One major importance attached to variable decomposition is the ability to reveal more information on each variable’s aggregate contributions that can be by shocks from other variables. Table 11 presents the results of the variance decomposition and impulse response function using Cholesky in Figs. 1, 2, 3, 4 and 5.

Table 11 shows the variance decomposition variables. It displays the effects of unit shocks that are applied separately to the error of each VAR equation. The past value of CO2 has a stronger influence on itself as it contributed higher to the forecasting error compared to other factors in short term. Similarly, there is never a shock of more than 10% of the series’ contribution to carbon emissions from other factors with agriculture having the highest. Figures 1, 2, 3, 4 and 5 show the impulse response analysis and variable decomposition using the Cholesky one deviation innovation. The impulse response function traces the long-run response in the equation system for each variable to one standard deviation shocks. Agricultural value-added and real GDP appear to contribute more to the shocks observed in carbon emission but differ in magnitude.

Concluding implications and future research directions

The STIRPAT paradigm provides a rich framework for inference policy making regarding how financial development and human capital influence reduction in CO2 emissions and by extension, informs policy making for environmental sustainability, despite having an unavoidable consequence on the global population. This study has combined the STIRPAT framework and advanced panel VAR/VEC Granger causality tests to examine the underlying relationship in order to make relevant contributions to the extant literature. We have investigated the criticality of financial development and human capital in reducing CO2 emissions in East and Southern Africa. The study has also used six advanced panel applications which include (a) the cross-sectional dependency test (Breusch & Pagan, 1979), LM (Pesaran, 2004), scaled LM (Pesaran, 2004) CD tests; (b) combined LLC (2002) and IPS (2003) panel unit root tests; (c) combined Pedroni (1999, 2004) and Kao (1999) panel cointegration tests; (d) different lag criteria ranging from the AIC, SC and HQ for selecting the optimal lag lengths of the variables; (e) implementing an advanced panel VAR/VEC Granger causality approach to uncouple the short- and long-run relationships among the factors; (f) employing variance decomposition within the framework of Cholesky in order to explore the contributory information of each variable in the autoregressive process. Our finding shows that financial development and human capital development are crucial factors in carbon abatement. The channels through which financial development and human can affect CO2 have been identified as agriculture and urbanisation. Our result is consistent with previous finding in other regions of the world (Asongu et al., 2020; Shahbaz, 2013, 2016; Odhiambo, 2020).

Two policy measures are urgently required to promote financial development and human capital development in East and Southern Africa. First, financial inclusion among the unbanked population needs to be promoted urgently, and this should not be related to bank profitability but to the fundamental role of the bank in financial intermediation which is to facilitate the transformation of mobilised deposits into credit for both clients with bank accounts and a previously unbanked population. Second, the study recommends critical investments in social change through greater access to knowledge, financial services, and loanable funds, opening up investment opportunities, and fostering well-being.

Policy recommendations pertaining of the above frameworks of financial development and human capital improvements should be considered by policy makers concurrently with agricultural and urbanisation measures which have been established in this study as the main channels by which human capital and financial development influence CO2 emissions. It follows that the attendant financial development and human capital measures should be oriented toward favouring more environmental-friendly agricultural and green urbanisation. Financial development and human capital improvements for green urbanisation and sustainability of the environment should therefore be the main policy framework.

It would be worthwhile for future studies to assess the relevance of established findings in other regions of Africa and, by extension, other regions in the developing world. Moreover, engaging other variables of financial development, human capital and environmental sustainability would also provide more insights into what is known so far about the established nexuses.

References

Abid M (2017) Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of EU and MEA countries. J Environ Manag 188:183–194

Acar S, Lindmark M (2017) Convergence of CO2 emissions and economic growth in the OECD countries: did the type of fuel matter? Energy Sources Part B 12(7):618–627

Adebayo TS (2020) Revisiting the EKC hypothesis in an emerging market: an application of ARDL-based bounds and wavelet coherence approaches. SN Appl Sci 2:1945. https://doi.org/10.1007/s42452-020-03705-y

Adebayo TS, Odugbesan JA (2021) Modeling CO2 emissions in South Africa: empirical evidence from ARDL based bounds and wavelet coherence techniques. Environ Sci Pollut Res 28:9377–9389

Ahmed Z, Nathaniel SP, Shahbaz M (2020) The criticality of information and communication technology and human capital in environmental sustainability: evidence from Latin American and Caribbean countries. J Clean Prod 125529

Ando T, Bai J (2015) A simple new test for slope homogeneity in panel data models with interactive effects. Econ Lett 136:112–117

Ansah RH, Sorooshian S (2019) Green economy: private sectors’ response to climate change. Environ Qual Manag 28(3):63–69

Arrow K, Bolin B, Costanza R, Dasgupta P, Folke C, Holling CS, Jansson BO, Levin S, Mäler KG, Perrings C, Pimentel D (1995) Economic growth, carrying capacity, and the environment. Ecol Econ 15(2):91–95

Asongu SA (2018a) ICT, Openness and CO2 emissions in Africa. Environ Sci Pollut Res 25(10):9351–9359

Asongu SA (2018b) CO2 emission thresholds for inclusive human development in sub- Saharan Africa. Environ Sci Pollut Res 25(26):26005–26019

Asongu SA, Acha-Anyi PN (2017) ICT, conflicts in financial intermediation and financial access: evidence of synergy and threshold effects. Netnomics 18(2-3):131–168

Asongu SA, Odhiambo NM (2019a) Challenges of doing business in Africa: a systematic review. J Afr Bus 20(2):259–268

Asongu SA, Odhiambo NM (2019b) Doing business and inclusive human development in Sub-Saharan Africa. Afr J Econ Manag Stud 10(1):2–16

Asongu SA, Odhiambo NM (2019c) How enhancing information and communication technology has affected inequality in Africa for sustainable development: an empirical investigation. Sustain Dev 27(4):647–656

Asongu SA, Odhiambo NM (2019d) Governance and social media in African countries: an empirical investigation. Telecommun Policy 43(5):411–425

Asongu SA, Odhiambo NM (2020a) Economic development thresholds for a green economy in Sub-Saharan Africa. Energy Explor Exploit 38(1):3–17

Asongu SA, Odhiambo NM (2020b) Governance, CO2 emissions and inclusive human development in sub-Saharan Africa. Energy Explor Exploit 38(1):18–36

Asongu SA, Odhiambo NM (2020c) The role of globalization in modulating the effect of environmental degradation on inclusive human development. Innovation:1–21. https://doi.org/10.1080/13511610.2020.1745058

Asongu SA, Tchamyou VS (2014) Inequality, finance and pro-poor investment in Africa. Brussels Econ Rev 57(4):517–547

Asongu SA, El Montasser G, Toumi H (2016a) Testing the relationships between energy consumption, CO2 emissions, and economic growth in 24 African countries: a panel ARDL approach. Environ Sci Pollut Res 23(7):6563–6573

Asongu SA, Nwachukwu JC, Tchamyou VS (2016b) Information asymmetry and financial access dynamics in Africa. Rev Develop Finance 6(2):126–138

Asongu SA, le Roux S, Biekpe N (2017) Environmental degradation, ICT and inclusive development in Sub-Saharan Africa. Energy Policy 111(December):353–361

Asongu SA, le Roux S, Biekpe N (2018) Enhancing ICT for environmental sustainability in sub-Saharan Africa. Technol Forecast Soc Chang 127(February):209–216

Asongu SA, Iheonu CO, Odo KO (2019a) The conditional relationship between renewable energy and environmental quality in sub-Saharan Africa. Environ Sci Pollut Res 26:36993–37000

Asongu SA, Nwachukwu JC, Pyke C (2019b) The comparative economics of ICT, environmental degradation and inclusive human development in Sub-Saharan Africa. Soc Indic Res 143:1271–1297

Asongu SA, Agboola MO, Alola AA, Bekun FV (2020) The criticality of growth, urbanization, electricity and fossil fuel consumption to environment sustainability in Africa. Sci Total Environ 712:136376

Asuming PO, Osei-Agyei LG, Mohammed JI (2019) Financial inclusion in sub-Saharan Africa: recent trends and determinants. J Afr Bus 20(1):112–134

Baloch MA, Ozturk I, Bekun FV, Khan D (2021) Modeling the dynamic linkage between financial access, energy innovation, and environmental quality: does globalization matter? Bus Strateg Environ 30(1):176–184

Baltagi BH, Kao C (2001) Nonstationary panels, cointegration in panels and dynamic panels: a survey. In: In Nonstationary panels, panel cointegration, and dynamic panels. Emerald Group Publishing, Limited

Baltagi BH, Feng Q, Kao C (2016) Estimation of heterogeneous panels with structural breaks. J Econ 191(1):176–195

Baltagi BH, Kao C, Liu L (2017) Estimation and identification of change points in panel models with nonstationary or stationary regressors and error term. Econ Rev 36(1-3):85–102

Bano S, Zhao Y, Ahmad A, Wang S, Liu Y (2018) Identifying the impacts of human capital on carbon emissions in Pakistan. J Clean Prod 183:1082–1092

Beck T, Demirgüç-Kunt A, Levine R (2007) Finance, inequality and the poor. J Econ Growth 12(1):27–49

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial access in GCC countries: Dynamic simultaneous equation models. Renew Sust Energ Rev 70(April):117–132

Bigger P, Webber S (2021) Green structural adjustment in the World Bank’s Resilient City. Ann Am Assoc Geogr 111(1):36–51

Boggia A, Rocchi L, Paolotti L, Musotti F, Greco S (2014) Assessing rural sustainable development potentialities using a dominance-based rough set approach. J Environ Manag 144:160–167

Breitung J, Roling C, Salish N (2016) Lagrange multiplier type tests for slope homogeneity in panel data models. Econ J 19(2):166–202

Bressler SL, Seth AK (2011) Wiener–Granger causality: a well-established methodology. Neuroimage 58(2):323–329

Breusch TS, Pagan AR (1979) A simple test for heteroscedasticity and random coefficient variation. Econometrica 47(5):1287–1294

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Chang Y, Nguyen CM (2012) Residual based tests for cointegration independent panels. J Econ 167(2):504–520

Chen S, Saud S, Saleem N, Bari MW (2019) Nexus between financial access, energy consumption, income level, and ecological footprint in CEE countries: do human capital and biocapacity matter? Environ Sci Pollut Res 26(31):31856–31872

Chiang MH, Kao C (2002) Nonstationary panel time series using NPT 1.3–A user guide. Center for Policy Research, Syracuse University

Costantini V, Monni S (2008) Environment, human development and economic growth. Ecol Econ 64(4):867–880

Dafe F (2020) Ambiguity in international finance and the spread of financial norms: the localization of financial inclusion in Kenya and Nigeria. Rev Int Polit Econ 27(3):500–524

Dai L, Vorselen D, Korolev KS, Gore J (2012) Generic indicators for loss of resilience before a tipping point leading to population collapse. Science 336(6085):1175–1177

Demirguc-Kunt A, Klapper L, Singer D (2017) Financial inclusion and inclusive growth: a review of recent empirical evidence. The World Bank

Demirgüç-Kunt A, Klapper L, Singer D, Ansar S, Hess J (2020) The Global Findex Database 2017: measuring financial inclusion and opportunities to expand access to and use of financial services. World Bank Econ Rev 34(Supplement_1):S2–S8

Dijkgraaf E, Vollebergh HR (2005) A test for parameter homogeneity in CO2 panel EKC estimations. Environ Resour Econ 32(2):229–239

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460

Foley JA, Ramankutty N, Brauman KA, Cassidy ES, Gerber JS, Johnston M, Mueller ND, O’Connell C, Ray DK, West PC, Balzer C, Bennett EM, Carpenter SR, Hill J, Monfreda C, Polasky S, Rockström J, Sheehan J, Siebert S, Tilman D, Zaks DP (2011) Solutions for a cultivated planet. Nature 478(7369):337–342

Frutos-Bencze D, Bukkavesa K, Kulvanich N (2017) Impact of FDI and trade on environmental quality in the CAFTA-DR region. Appl Econ Lett 24(19):1393–1398

Gao J, Xia K, Zhu H (2020) Heterogeneous panel data models with cross-sectional dependence. J Econ 219(2):329–353

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37(3):424–438

Guo Q, Wang J, Yin H, Zhang G (2018) A comprehensive evaluation model of regional atmospheric environment carrying capacity: model development and a case study in China. Ecol Indic 91:259–267

Guo M, Hu Y, Yu J (2019) The role of financial access in the process of climate change: evidence from different panel models in China. Atmosph Pollut Res 10(5):1375–1382

Haavelmo T (1944) The probability approach in econometrics. Econometrica 12:iii–115

Haberl H, Erb KH, Krausmann F (2014) Human appropriation of net primary production: patterns, trends, and planetary boundaries. Annu Rev Environ Resour 39:363–391

Holland PW (1986) Statistics and causal inference. J Am Stat Assoc 81(396):945–960

Hoover WG (2012) Computational statistical mechanics. Elsevier

Hu Y, Zheng J, Kong X, Sun J, Li Y (2019) Carbon footprint and economic efficiency of urban agriculture in Beijing——a comparative case study of conventional and home-delivery agriculture. J Clean Prod 234:615–625

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115(1):53–74

IPCC (2014) Mitigation of climate change. In: Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change, p 1454

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econ 90(1):1–44

Kastner T, Erb KH, Haberl H (2015) Global human appropriation of net primary production for biomass consumption in the European Union, 1986–2007. J Ind Ecol 19(5):825–836

Khalid K, Usman M, Mehdi MA (2021) The determinants of environmental quality in the SAARC region: a spatial heterogeneous panel data approach. Environ Sci Pollut Res 28(6):6422–6436

Kirikkaleli D, Adebayo TS (2020) Do renewable energy consumption and financial access matter for environmental sustainability? New global evidence. Sustain Dev. https://doi.org/10.1002/sd.2159

Kirikkaleli D, Adebayo TS, Khan Z, Ali S (2021) Does globalization matter for ecological footprint in Turkey? Evidence from dual adjustment approach. Environ Sci Pollut Res 28:14009–14017

Kuruppuarachchi D, Premachandra IM (2016) Information spillover dynamics of the energy futures market sector: A novel common factor approach. Energy Econ 57:277–294

Le HP, Ozturk I (2020) The impacts of globalization, financial access, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ Sci Pollut Res 27:22680–22697

Léon F, Zins A (2020) Regional foreign banks and financial inclusion: evidence from Africa. Econ Model 84:102–116

Liu Y, Ji D, Zhang L, An J, Sun W (2021) Rural financial access impacts on agricultural technology innovation: evidence from China. Int J Environ Res Public Health 18(3):1110

Menyah K, Wolde-Rufael Y (2010) Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ 32(6):1374–1382

Mesagan EP, Isola WA, Ajide KB (2019) The capital investment channel of environmental improvement: evidence from BRICS. Environ Dev Sustain 21(4):1561–1582

Odhiambo NM (2020) Financial access, income inequality and carbon emissions in Sub-Saharan African countries: a panel data analysis. Energy Explor Exploit 38(5):1914–1931

Odugbesan JA, Adebayo TS (2020) The symmetrical and asymmetrical effects of foreign direct investment and financial access on carbon emission: evidence from Nigeria. SN Appl Sci 2:1982. https://doi.org/10.1007/s42452-020-03817-5

Owens OC, Okereke C, Webb J (2011) Climate change and health across Africa: issues and options. United Nations Economic Commission for Africa (UNECA), p 48

Özokcu S, Özdemir Ö (2017) Economic growth, energy, and environmental Kuznets curve. Renew Sust Energ Rev 72:639–647

Pachauri RK, Reisinger A (2007) IPCC fourth assessment report. IPCC, Geneva, p 2007

Panayotou T (2016) Economic growth and the environment. In: The environment in anthropology, pp 140–148

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf Bull Econ Stat 61(S1):653–670

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometr theory 20(3):597–625

Penna AN (2014) The human footprint: a global environmental history. John Wiley & Sons

Pesaran HM (2004) General diagnostic tests for cross-sectional dependence in panels. University of Cambridge, Cambridge Working Papers in Economics, p 435

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Econ Rev 34(6-10):1089–1117

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econ 142(1):50–93

Pindyck, R. S., & Rotemberg, J. J. (1990). Do stock prices move together too much? (No. w3324). National Bureau of Economic Research.

Ramsey JB (1969) Tests for specification errors in classical linear least-squares regression analysis. J R Stat Soc Ser B Methodol 31(2):350–371

Reboredo JC (2013) Modeling EU allowances and oil market interdependence. Implications for portfolio management. Energy Econ 36:471–480

Safi A, Chen Y, Wahab S, Ali S, Yi X, Imran M (2021) Financial instability and consumption-based carbon emission in E-7 countries: the role of trade and economic growth. Sustain Produc Consump 27:383–391

Sen A (1979) Personal utilities and public judgements: or what’s wrong with welfare economics. Econ J 89:537–558

Sen A (1985) A sociological approach to the measurement of poverty: a reply to Professor Peter Townsend. Oxf Econ Pap 37(4):669–676

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013) Does financial access reduce CO2 emissions in the Malaysian economy? A time-series analysis. Econ Model 35:145–152

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial access and environmental quality: the way forward. Energy Policy 98:353–364

Sheraz M, Deyi X, Ahmed J, Ullah S, Ullah A (2021) Moderating the effect of globalisation on financial access, energy consumption, human capital, and carbon emissions: evidence from G20 countries. Environ Sci Pollut Res:1–19

Shobande OA, Enemona JO (2021) A multivariate VAR model for evaluating sustainable finance and natural resource curse in West Africa: evidence from Nigeria and Ghana. Sustainability 13(5):2847

Shobande OA, Lanre IR (2018) Do financial inclusion drive boom-bust cycles in Africa? J Econ Bibliogr 5(3):159–174

Shobande OA, Shodipe OT (2019) Carbon policy for the United States, China and Nigeria: an estimated dynamic stochastic general equilibrium model. Sci Total Environ 697:134130

Siva V, Gremyr I, Bergquist B, Garvare R, Zobel T, Isaksson R (2016) The support of Quality Management to sustainable development: a literature review. J Clean Prod 138:148–157

Spanos A (1989) On rereading Haavelmo: a retrospective view of econometric modeling. Econometr Theory 5(3):405–429

Su L, Chen Q (2013) Testing homogeneity in panel data models with interactive fixed effects. Econometr Theory 29(6):1079–1135

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ 32(1):137–145

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial access lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253

Tchamyou VS (2019) The role of information sharing in modulating the effect of financial access on inequality. J Afr Bus 20(3):317–338

Tchamyou VS (2020) Education, lifelong learning, inequality and financial access: evidence from African countries. Contemp Social Sci 15(1):7–25

Tchamyou VA (2021) Financial access, governance and the persistence of inequality in Africa: mechanisms and policy instruments. J Public Aff 21. https://doi.org/10.1002/pa.2201

Tchamyou VS, Erreygers G, Cassimon D (2019) Inequality, ICT and financial access in Africa. Technol Forecast Soc Chang 139(February):169–184

Twerefou DK, Danso-Mensah K, Bokpin GA (2017) The environmental effects of economic growth and globalisation in Sub-Saharan Africa: a panel general method of moments approach. Res Int Bus Financ 42:939–949

Udeagha MC, Ngepah N (2019) Revisiting trade and environment nexus in South Africa: fresh evidence from new measure. Environ Sci Pollut Res 26(28):29283–29306

Van Hove L, Dubus A (2019) M-PESA and financial inclusion in Kenya: of paying comes saving? Sustainability 11(3):568

Weinzettel J, Vačkářů D, Medková H (2019) Potential net primary production footprint of agriculture: A global trade analysis. J Ind Ecol 23(5):1133–1142

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

Xing T, Jiang Q, Ma X (2017) To facilitate or curb? The role of financial access in China’s carbon emissions reduction process: a novel approach. Int J Environ Res Public Health 14(10):1–39

Xiong L, Qi S (2018) Financial access and carbon emissions in Chinese provinces: a spatial panel data analysis. Singap Econ Rev 63(2):447–464

Yu C, Li Z, Yang Z (2015) A universal calibrated model for the evaluation of surface water and groundwater quality: model development and a case study in China. J Environ Manag 163:20–27

Zafar MW, Saud S, Hou FJ (2019) The impact of globalization and financial access on environmental quality: evidence from selected countries in the Organization for Economic Co-operation and Development (OECD). Environ Sci Pollut Res 26:13246–13262

Zaidi SAH, Zafar MW, Shahbaz M, Hou FJ (2019) Dynamic linkages between globalization, financial access and carbon emissions: evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 228(August):533–543

Zamil AM, Furqan M, Mahmood H (2019) Trade openness and CO2 emissions nexus in Oman. Entrep Sustain 7(2):1319–1329

Zhang YJ (2011) The impact of financial access on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Zivin JSG, Neidell MJ (2012) The impact of pollution on worker productivity. Am Econ Rev 102(7):3652–3673

Acknowledgement

The authors are indebted to the editors and reviewers for constructive comments.

Availability of data and materials

The data for this paper is available upon request.

Author information

Authors and Affiliations

Contributions

OAS and SAA participated in the drafting of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical approval and consent to participate

This article does not contain any studies with human participants or animals performed by the authors.

Consent to publish

Not applicable.

Competing interest

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

East and Southern African countries examined | |||

|---|---|---|---|

1 | Kenya | 8 | South Sudan |

2 | Tanzania | 9 | Mozambique |

3 | Uganda | 10 | Zambia |

4 | Ethiopia | 11 | Mauritius |

5 | Rwanda | 12 | Burundi |

6 | Djibouti | ||

7 | Madagascar | ||

Rights and permissions

About this article

Cite this article

Shobande, O.A., Asongu, S.A. Financial development, human capital development and climate change in East and Southern Africa. Environ Sci Pollut Res 28, 65655–65675 (2021). https://doi.org/10.1007/s11356-021-15129-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-15129-1