Abstract

Distorted allocation of capital factors will lead to the loss of capital market-based soil as the background support for green technology innovation, which will not be able to climb up the value chain and eventually become an economic “colony.” This study empirically investigates the relationship between distorted capital factor allocation and green technology innovation using data from 2005 to 2018 for prefecture-level cities in China. The empirical results show that the distortion of capital factor allocation not only has a significant inhibiting effect on green technology innovation in the city, but also hinders the development of green technology innovation in neighboring cities. Mechanism test analysis suggests that there is negative impact via generating mismatch, crowding out, and rent-seeking effects. Further research shows that the effect of distorted capital factor allocation on urban green technology innovation is more influential in the eastern and western regions. The conclusions of this study have important practical significance for optimizing the rational allocation of factor resources, promoting green technology innovation, and achieving high-quality economic growth.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

As one of the important factors driving high-quality economic growth, especially in China, which relies on an investment-driven economy, capital plays a crucial role in promoting regional and urban innovation and development. In a functioning efficient capital market, the cost of acquiring capital should be the same for different cities. However, capital factors in the process of market operation are affected by mechanisms such as government intervention, imperfect market mechanisms, and information asymmetry, which lead to obstacles or frictions in the free flow of capital factors in the market. The less efficient regions possess a large amount of capital factors, while the more efficient regions possess too little capital, and there are serious differences in the efficiency of capital allocation between different regions. For example, suppose there are two farmers (denoted as X and Y) who have the same basic factors of production (land, labor) but different capital allocations, and both need loans for investment in agricultural technology. The rural financial market in farmer X’s area is more developed and the loan interest rate is low, while the financial market in farmer Y’s area is relatively backward and the loan interest rate is high. According to the cost minimization theorem, assume that both farmers make the marginal output of the final investment equal to their lending rates, and there is a misallocation of capital here. If part of the capital allocated to farmer X with lower marginal output is shifted to farmer Y with higher marginal output, then the total efficiency rises (Zhu et al. 2011). That is, the irrational allocation of capital weakens the total efficiency of technological investment.

According to the China Green Technology Innovation Index Report (2021), the annual number of green patent applications in China has increased from more than 43,000 in 2008 to more than 150,000 in 2021 and up to more than 220,000 in 2020. The number of green patents granted each year in China has been rising steadily, from more than 19,000 in 2008 to more than 184,000 in 2021, with a compound growth rate of 17.5%. Among them, from the beginning of March 2021 to the end of April 2022, the number of new green patent applications in China is nearly 140,000, and the number of new green patents granted is up to 210,000. To a certain extent, this shows that China’s green technology innovation has increased in vitality, and the concept of green development and technology innovation leading is more deeply rooted in the hearts of people. Patent technology is an innovative act with legal effect, which can measure the output of scientific and technological innovation of a city, province, or even a country, and can be regarded as an important vehicle for the transformation of capital elements and human capital into real productivity (knowledge into material form) (Chen and Jiang 2020). To enhance national scientific and technological innovation capacity and strengthen strategic scientific and technological forces, the 19th National Congress of the Communist Party of China proposed that innovation is the first driving force leading development and is a strategic support for building a modern economic system. The 14th Five-Year Plan further calls for the construction of a market-oriented green technology innovation system, the implementation of green technology innovation initiatives, the strengthening of national strategic science and technology forces, and the improvement of the overall effectiveness of the innovation chain. In the process of responding to the national innovation-driven development strategy, local governments at all levels should not only focus on intellectual property protection and tax incentives to support local technological innovation, but also fully consider the distortion of capital factor allocation as a disruptive factor that have direct or indirect effects on the innovation capacity of cities. Therefore, this study deeply explores the impact between the distortion of capital factor allocation and urban green technology innovation and provides the theoretical basis and practical support for the implementation of concrete and effective policy measures to promote the rational allocation of factor resources to support technology innovation.

Based on the change of China’s economic growth model to an innovation-driven growth model, many scholars have begun to focus on the issue of market-based factor allocation in China, especially exploring the impact of capital market distortions on technological innovation. The research related to this issue covers three main areas. Firstly, the causes of capital market distortions are examined. In the process of China’s economic market-oriented transformation, compared with the product market, the reform and marketization of the financial sector are seriously lagging (Allen et al. 2005; Huang 2010). The lag of the marketization process of the financial sector is an important reason for the distortion of capital factor allocation and cross enterprise resource mismatch in China (Jian et al. 2018). Secondly, some scholars analyzed the effect of capital factor mismatches on output or aggregate national productivity (Midrigan and Xu 2014; Moll 2014). Gai et al. (2015) found that if the distortion of the capital market is improved, the total factor productivity of the manufacturing industry can be increased by an average of 57.79% during the sample period, of which the direct impact is increased by 31.46%, and the indirect impact is increased by 26.32%. Bai and Bian (2016) conducted research based on counterfactual testing and found that capital market distortions have a significant positive effect on the loss of innovation productivity, which would increase by 20.55% if capital market distortions are eliminated. Chen et al. (2019) further found that capital factor distortions have seriously exacerbated the current welfare loss of Chinese residents. Thirdly, based on the perspective of the local government management system, scholars have discussed the behavior of poorly allocated capital factors affecting firms in conducting innovative activities. By exploring the cost of capital across Chinese cities, Chen et al. (2017) found that there is a general urban capital bias policy in China, and capital bias is not limited to one or two cities but exists in a series of cities. Specifically, government policy monopolies will bias firms to increase rent-seeking activities, which in turn will discourage firms from investing the capital they receive in R&D activities, and firms will lose the incentive to earn more profits by upgrading their technology (Claessens et al. 2008). In addition, high barriers to investment and inefficient judicial systems can lead to capital market distortions that prevent capital from being well allocated to innovative firms and thus reduce the efficiency of innovation in certain regions (Andrews et al. 2014). Government actions not only lead to the inability of firms to obtain corresponding R&D benefits and compensation in the market, but also firms will preferentially divert capital and talent from R&D activities to rent-seeking or non-productive speculative activities for input-output considerations. The different degrees of undervaluation of capital factors also stimulate firms to use capital factors based on the factor substitution principle, with the result of weakening firms’ incentives or willingness to achieve technological innovation through R&D (Li et al. 2013).

The phenomenon that factor allocation distortions and their resource misallocation as price manifestations lead to substantial total factor productivity losses at the aggregate level is unquestionable and has been widely confirmed by most of the literature (Hsieh and Klenow 2009; Aoki 2012; Gai et al. 2015). However, little attention has been paid to the specific role of capital factors in achieving quality economic growth as a “hotbed” for enhancing the green innovation capacity of cities. Therefore, this research focuses on the following three points: First, this research fills the gaps in theoretical research in this area by examining the effect of China’s capital factor allocation distortions on green technology innovation. Second, this paper integrates capital factor allocation distortions and green technology innovation into the space economic theory, and systematically investigates the internal mechanisms of capital factor allocation distortions influencing green technology innovation based on China’s 283 cities (prefecture-level and above) during 2005–2018. Third, this research further systematically explores the impact, including spillover, of capital factor allocation distortions on green technology innovation with regional heterogeneity.

The paper is organized as follows: the “Mechanism analysis” section discusses the mechanism analysis and theoretical hypotheses; the “Model design and variable description” section discusses the model, variables, and descriptive statistics; the “Spatial metrological inspection and empirical results” section discusses the analysis of econometric results and robustness tests; the “Inspection of influencing mechanisms” section discusses the mechanism inspection; the “Heterogeneity exploration based on the geographic location” section discusses the heterogeneity analysis; and the “Conclusion and policy implication” section discusses the conclusion and policy recommendations.

Mechanism analysis

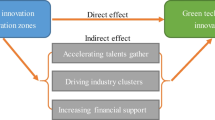

To further explore the pathway of the economic phenomenon of distorted capital factor allocation on green technology innovation in Chinese cities, we propose a comprehensive conceptual framework. The basic logic is that the disturbance of Chinese capital factors by a series of external factors may lead to a distorted state of factor markets such as deviation of their real prices from the equilibrium prices. The distortion of the capital factor market will further interfere with the normal flow of capital and other factors of production, forming external frictions that prevent the effective allocation of innovation resources such as technicians and human capital of enterprises, and thus impede the internal technological transformation and green innovation activities of innovative enterprises. It mainly affects green technology innovation through four mechanisms: mismatch effect, crowding out effect, rent-seeking effect, and spatial spillover effect. The specific transmission mechanism is shown in Fig. 1.

Mismatch effect

Markets are not perfectly competitive and often suffer from imperfect marketization, inadequate mechanisms, market failures, and government control, and distortions in factor markets are common (Comin and Hobijn 2010). Factor market distortions can constrain the free flow of production factors, leading to inter-city factor mismatch problems that severely constrain technological progress and lead to hindered green technology innovation (Hsieh and Klenow 2009). In further detail, the mismatch effect caused by the misallocation of capital is mainly reflected in the differences in capital accessibility among firms of different ownerships and sizes. On the one hand, traditional-type enterprises such as state-owned enterprises and heavy industrial enterprises are pursued by capital due to the biased government support (Cong et al. 2019). Since the production method of traditional enterprises is mainly rough and loose, it is not conducive to the transformation of economic growth from rough and loose to intensive, which in turn inhibits the incentive of cities to carry out scientific and technological innovation. On the other hand, other non-state enterprises and small- and medium-sized enterprises (SMEs) are facing a serious survival situation due to the problem of “difficult financing.” SMEs are an important base for innovative research in China due to their efficiency, mobility, and speed of change. Under the constraint of “difficult financing,” SMEs are bound to be constrained to promote high-tech development (Wang et al. 2018). Local governments at all levels intervene in capital factor market trading activities, resulting in distorted factor price signals, inefficient use of capital factors, and thus mismatch effects (Wu 2018). SMEs do not receive sufficient financial support, and their talent attractiveness and scientific research digestion capacity are weakened, which restricts the upgrading evolution of SMEs to rely on innovation for development, exit from traditional industries, and shift to high-tech industries (Dai and Liu 2016), which is ultimately detrimental to the progress of green innovation technologies.

-

H1: Irrational allocation of capital will lead to a mismatch effect in capital accessibility among enterprises of different ownerships and sizes, resulting in traditional state-owned enterprises locking in an extensive economic development model, while SMEs will be constrained to promote high-tech development under the constraint of “difficult financing,” ultimately inhibiting green innovative technologies.

Crowding out effect

The reallocation of production factors is the intrinsic driving force of green technology innovation and upgrading. However, due to the low degree of marketization, market failure, and government intervention, the flow of production factors is often restricted and cannot be allocated reasonably and effectively. When capital factor allocation is scarce, firms can create a crowding out effect on R&D investment (Boldrin and Levine 2004). That is, if firms have access to more low-cost financing, they will devote more resources to R&D activities. In contrast, high financing costs in a state of distorted capital factor prices due to local protectionism are detrimental to firms’ R&D investment and can inhibit their independent innovation (Silva and Carreira 2012). At the same time, firms will obtain higher returns than R&D investments through other unproductive speculative activities, which in turn will exert crowding out pressure on firms to conduct R&D activities and ultimately discourage them from green innovation production (Acemoglu et al. 2013). In addition, based on the principle of factor substitution, some firms with access to sufficient capital factors may also have a crowding out effect on R&D investment when it loses the incentive and pressure to enhance technological innovation through R&D (Murphy et al. 1993), which in turn inhibits the development of green technology in firms.

-

H2: The high financing cost in the state of distorted capital factor prices due to local protectionism leads to a crowding out effect on R&D activities by firms, which in turn discourages them from green innovative production activities.

Rent-seeking effect

Firms cannot carry out technological innovation activities without the support of financial mechanisms and their effective capital allocation mechanisms. Moreover, financial frictions and their resulting deviation from the “Pareto optimal” state of capital factor allocation will negatively affect the technological innovation effect (Chen and Jiang 2020). Local governments can influence financial sector decisions through credit intervention (Brandt et al. 2013), which in turn provides a high degree of monopoly over factor markets and prevents capital from being rationally allocated according to market mechanisms. As a result, since it is difficult for firms to obtain the appropriate innovation resources (e.g., credit facilities, tax incentives, and government subsidies) according to the market mechanism, firms will be more interested in seeking political connections than building their own innovation capacity, which will inevitably lead to a lot of rent-seeking behavior. The rent-seeking effect is mainly manifested as the negative impact of rent-seeking activities under monopoly conditions on the willingness of enterprises to engage in green technology innovation. Government intervention in the capital market will stimulate “rent-seeking” behavior of enterprises (Claessens et al. 2008), leading to higher operating and transaction costs through “unproductive rent-seeking” activities, which will allow outdated capacity to survive. This is not conducive to the transformation and upgrading of enterprises, and ultimately hinders green technology innovation. Rent-seeking behavior affects entrepreneurship and induces firms to substitute “innovation strategies” with “rent-seeking strategies” (Baumol 1996). Specifically, when firms have easy access to low-cost capital elements or excess profits through rent-seeking relationship, the weakened willingness of firms to invest in R&D will inhibit the incentive to gain benefits from technological innovation and ultimately make it difficult to enhance green technological innovation (Sandleris and Wright 2014).

-

H3: The distortion of capital factor allocation will stimulate the “rent-seeking” behavior of enterprises and induce them to replace “innovation strategy” with “rent-seeking strategy,” which will inhibit the incentive to obtain revenue through green technology innovation and eventually make it difficult to improve the level of green technology innovation.

Spatial spillover effect

Based on the new economic geography theory, there is correlation between any two things in space (Krugman 1991), and capital as a basic factor of production can move between regions. Furthermore, the spatial allocation and mobility of capital factors will lead to the spatial reallocation of enterprises, which in turn will affect the overall efficiency of resource factor utilization and social innovation activities (Baldwin et al. 2003). Specifically, capital market imperfections will distort the entry behavior of potential firms and the technology use decisions of incumbent firms. Distortions in the allocation of capital factors not only prevent the free flow of essential resources needed by firms between regions, but also may prevent firms with high productivity from entering the market, thus undermining the efficiency of firms to carry out their own innovation (Gai et al. 2015). For example, environmentally friendly new energy industries are unable to truly enter the market due to the high cost of acquiring factors such as capital, which in turn prevents regions from making structural changes to their economies and inhibits innovative production activities. In addition, the stronger the regional administrative intervention, the less efficient the allocation of factors such as capital will be. Meanwhile, industry sunk costs reduce the competitive fairness of inter-regional firms, which in turn reduces the incentive for firms to expand their industries to spatially relevant regions, improve production efficiency, and engage in green innovation (Bai and Bian 2016).

-

H4: Constraints in the spatial mobility of capital factors will not only lead to the inability to achieve the free flow of other basic resources required by enterprises between regions, but also weaken the incentive for enterprises to expand their industries to spatially relevant regions, improve their production efficiency, and engage in green innovation.

Model design and variable description

Econometric model setting

Ordinary least square (OLS) panel estimation with both individual and time fixed effects is used to construct the benchmark econometric model. The specific formula is as follows:

where i and t denote city and year, respectively. GP is the number of green invention patent applications granted in China. Dist _ K denotes distortion in the allocation of capital factors. a indicates the constant term. θ1 is the elastic coefficient of Dist _ K, ϕ1~ϕ5 are the elastic coefficients with respective to government intervention (Govern), level of economic development (Pergdp), R&D investment (RD), foreign direct investment (FDI), and level of urban infrastructure development (Infras). Finally, ai is a factor that does not change with time but captures differences among individual cities, while γt is the temporal fixed effect. εit is the error term with an assumption of the normal distribution. It is worth noting that capital factors themselves have unavoidable spatial autocorrelation and spatial spillover effects. While the allocation of capital factors in a region is influenced by its own economic development, it may often also be influenced by the allocation of capital factors in neighboring regions. The OLS regression model assumes that the samples are isolated from each other, ignoring the spatial errors and dependencies of the samples. In contrast, the spatial econometric model organically combines geographic location with spatial linkage, addressing the errors caused by ignoring the spatial correlation and heterogeneity of the samples (Sergio and Brett 1999). If the existence of spatial correlation is neglected in the empirical study, the validity of the research results will be affected to a certain extent, which will lead to biased policy setting. Therefore, we introduce a spatial econometric model to portray and analyze the spatial correlation effect between the distortion of capital factor allocation and green technology innovation. The specific spatial econometric model is set in the following form.

where ρ and φ are the spatial lag and spatial error coefficients, respectively; μi and vt represent the unobserved spatial and temporal effects, respectively; Wij represents the spatial weight matrix; εij is the error term; and X is a vector of the explanatory variables. Equation (2) is a general nested model with spatial interaction effects. In the empirical analysis, according to whether the values of ρ, θ and φ are 0, Eq. (2) can be divided into generalized spatial autoregressive model (SAC), spatial autoregressive (lag) model (SAR), spatial error model (SEM), spatially lagged explanatory variable model (SLX), spatial Durbin error model (SDEM), and spatial Durbin model (SDM). We follow a set of rigorously statistical tests to determine which form of the spatial economic model is the most appropriate one to perform the analysis. According to the test results (Table 3), the space-time fixed effects spatial Durbin model (SDM) is adequate for estimating the econometric model formulated in Eq. (2).

Indicator measurements

Explained variable: green technology innovation (GP)

Considering the uneven quality of green patent applications in China, some of the patent applications cannot measure the level of green technology innovation in a region. Moreover, there is a certain time lag from the beginning of patent application to the granting of patent, so the number of granted green patent applications in prefecture-level cities in China is adopted as the main dependent variable in this paper. The data on patent applications granted are obtained from the State Intellectual Property Office of the People’s Republic of China, and the green patent data are re-calculated based on the International Patent Classification (IPC) green inventory, an online tool for searching patent information specified by the World Intellectual Property Organization (WIPO).Footnote 1 Among them, the “Green List of International Patent Classification” established by the World Intellectual Property Office is divided into seven categories: nuclear power generation; energy conservation; administrative, regulatory or design aspects; waste management; alternative energy production; agriculture/forestry; and transportation. Figures 2 and 3 show the distribution of green patent applications granted in 283 prefecture-level cities in China in 2005 and 2018, respectively. It can be found that the color of the city legend has deepened in 2018 compared with 2005, which indicates that the number of green patent applications granted in China has gradually increased since 2005, and the number is most predominant in the eastern coastal region.

Main explanatory variable: distorted allocation of capital factors (Dist _ K)

The measurement of explanatory variable indicator is based on the transcendental log production function approach proposed by Drucker and Feser (2012). The capital factor price distortion indicator is obtained by measuring the marginal output of the capital element and then dividing the marginal output of the capital element by its actual price. The specific measurement formula is shown as follows.

where t and i are year and city, respectively, λ0 is constant, λ1~λ5 are elastic coefficients, and εit is the random disturbance term. Meanwhile, G is the regional output, characterized by the gross regional product. L is the number of regional labors, expressed as the number of employees in urban units at the end of the year in each region. K denotes the regional capital stock, calculated as Ki, t = (1 − η) Ki, t − 1 + Ft/Ωi, t (Ki, t is the domestic capital stock; η is the annual depreciation rate of 5%; Ft is the fixed asset investment; Ωi, t is the cumulative capital price index). Taking the partial derivative of K in Eq. (3), the marginal output of the capital factor (MPK) is obtained as:

Finally, the degree of capital factor price distortion can be expressed as the ratio of the marginal output of capital to its real price.

where P denotes the real price of capital (set to 0.1).

Other variables

The degree of government intervention (Govern), we choose local government fiscal spending as an indicator of the degree of government intervention. During the period of high economic growth, China’s economic development was distinctly government-led (Jin et al. 2005). By appropriately intervening and guiding the distribution of innovation elements as well as R&D personnel, local governments can thus enhance the efficiency of science and technology innovation while promoting regional synergy (Joo et al. 2018). The level of economic development (Pergdp) of a region, which is characterized by the gross regional product per capita, can effectively incentivize the development of green technology innovation since a higher economic level tends to give certain supporting conditions such as funding and supporting facilities for technology innovation (Stankovic and Popovic 2016). In R&D investment (RD), we select the proportion of science and technology expenditure to total expenditure to reflect the level of technological innovation investment in a region. It has been shown that increasing R&D investment facilitates technological innovation and can directly have a significant positive impact on green technology innovation performance (Hall 1999; Guo et al. 2018). For foreign direct investment (FDI), we use data on FDI flows from 2005 to 2018, convert them to RMB by averaging the annual exchange rate of RMB to USD over the years, and divide by the GDP deflator to characterize FDI. Since China has the innate advantage of cheap production factors, FDI is likely to introduce pollution-intensive enterprises whose products are mainly labor-intensive and resource-intensive, further reinforcing the crude production model (Xu et al. 2021). In addition, the introduction of foreign capital will breed technological dependence of domestic firms on foreign firms, so that domestic firms lack their own incentives to engage in green technology innovation. The level of urban infrastructure development (Infras) is characterized by the urban road area per capita. Urban infrastructure development can promote innovation diffusion and spillovers by facilitating the adequate flow of technology and knowledge in regional innovation systems (Andrea and Chiara 2019).

The research sample in this paper is the panel data of Chinese cities at the prefecture level and above from 2005 to 2018. To ensure the integrity and continuity of the data, nine prefecture-level cities are deleted, including Chaohu, Sansha, Danzhou, Bijie, Tongren, Lhasa, Longnan, Haidong, and Zhongwei. The sample covers 30 provinces, autonomous regions, and municipalities directly under the central government (except Tibet, Hong Kong, Macao, and Taiwan), including 283 prefecture-level cities. City data are mainly from the 2006–2019 China City Statistical Yearbook, China Statistical Yearbook, the State Intellectual Property Office of the People’s Republic of China, and the statistical yearbooks of each province. Although the China Urban Statistical Yearbook and the provincial statistical yearbooks are incomplete due to the lack of published data for individual cities or the lack of indicator data for published cities, it is the only official certified data covering all prefecture-level cities in China (Han et al. 2020). We use provincial-level price indices to adjust the city data. Table 1 reports the descriptive statistics of capital factor allocation distortions, green technology innovation, and other variables for prefecture-level and above cities in China.

Spatial metrological inspection and empirical results

Spatial correlation analysis

Before applying the spatial measures, we need to test for spatial correlation between the explanatory and explained variables. This paper uses Moran’s I index (Moran 1950) to explore the spatial relevance of capital factor allocation distortions and green technology innovation among cities. To accurately measure the spatial correlations among individuals, an appropriate spatial weight matrix needs to be constructed. In the process of spatial measurement model setting, the geographic distance matrix is widely used due to its potential exogeneity (Getis 2009). To accurately portray the spatial characteristics, distribution patterns, and their interconnections of the observed datasets, we borrow the method of Xie et al. (2019) to construct the geographic distance spatial weight matrix using latitude (Latitude) and longitude (Longitude) positions to measure the surface distance between spatial units. The calculation formula is shown below.

where \({d}_{ij}^2\) denotes the distance square of two cities at different geographic locations (i ≠ j); and Wij is the spatial weight matrix. It should be noted that when i equals to j (Wdij is zero), the attenuation parameter is set at 2.

In addition, the spatial linkage between two spatial units with different economic endowments may be through horizontal inter-industry division of labor, when the economic attributes of the two are likely to converge. It is also possible that the spatial linkages arise through vertical intra-industry division of labor when the economic attributes of the two are likely to be increasingly different. We therefore added the gravity model matrix composed of geographical distance and economic endowment to measure the spatial correlation, and the formula is shown below.

where \(\overline{Q_i}\) and \(\overline{Q_j}\) characterize the real GDP per capita of city i and city j, respectively.

Before conducting the spatial measurement analysis, all matrices are standardized so that the sum of the elements of each row is equal to 1. The panel Moran’s I index values of urban green technology innovation based on geographic distance spatial weight matrix and gravitational model spatial weight matrix are measured to be 0.1530 (p < 0.01) and 0.1583 (p < 0.01), respectively. Moreover, the panel Moran’s I index values for distortion in capital factor allocation are 0.6013 and 0.6019 at the 1% significance level, respectively. These results indicate that distortion in capital factor allocation and green technology innovation in China are all highly significantly spatially correlated after controlling for explanatory variables. To reflect the spatial characteristics of capital factor allocation distortions and urban green technology innovation in more detail, we measured the Moran’s I values for each year from 2005 to 2018. The measurement results are shown in Table 2. The Moran’s I index values of distorted capital factor allocation and green technology innovation are significantly greater than 0 under the spatial weight matrix of geographic distance and gravity models, and the coefficient values roughly increase with the year. This further indicates that both the distortion of capital factor allocation and urban green technology innovation in the sample cities have significant spatial clustering characteristics.

Selection of spatial measurement model

The selection of appropriate spatial measures helps to accurately determine the impact of capital factor allocation distortions on green technology innovation and its spatial effects. According to Elhorst (2014), we can estimate the non-spatial effect model to determine whether to use the SAR or SEM model by examining two Lagrange multipliers (LM-lag test and LM-err test) and their robust forms (R-LM-lag test and R-LM-err test). The results in Table 3 show that the Lagrange multipliers and their robust form tests in both the geographic distance matrix and the gravitational model matrix estimates pass the 1% and above significance level. The Lagrange multipliers and their robust form tests point to the selection of the SAR model for both. If the non-spatial effect model is rejected, we use the likelihood ratio test (LR test) to determine whether a temporal or spatial fixed effect exists in the spatial econometric model. The results of the LR test suggest that both spatial and temporal fixed effects should be controlled. Then, we further determine whether the spatial Durbin model adopts random effects or fixed effects by conducting the Hausman test. The Hausman test shows support for a spatial Durbin model with dual fixed effects in space and time. Finally, Wald or LR tests are used to test the hypotheses (\({H}_0^1:\theta =0\) and \({H}_0^2:\theta +\rho \beta =0\)), to determine whether the spatial Durbin model would be reduced to the spatial error model (SEM) or the spatial autoregressive model (SAR). The results of the Wald and likelihood ratio tests show that the spatial Durbin model cannot be reduced to a SAR model or SEM model. The results in Table 3 show that the SDM model with both spatial and temporal fixed effects is the optimal spatial panel econometric model for the research.

Results based on spatial econometric modeling

In this study, the OLS estimation results with both spatial and temporal fixed effects (Model 1 in Table 4) and the spatial Durbin model estimation results under the geographic distance spatial weight matrix and the gravity model spatial weight matrix (Model 2 and Model 3 in Table 4), respectively, are presented. Empirical results from OLS and SDM show consistent negative effects of distortions in capital factor allocation on green technology innovation, and the effects are statistically significant across all the three models. Specifically, in the first fixed effects model, i.e., Model 1 with covariates, the effect of Dist_K on GP is negative with an estimated coefficient of −0.152 at the 1% significance level. Moving onto the spatial Durbin model, namely Model 2 and Model 3, which controls other explanatory variables, the effect of Dist_K remains stable with nearly the same direction and magnitude.

The results in Table 4 show that the estimated values of the spatial autoregressive coefficients ρ under the spatial weight matrix of geographic distance and the spatial weight matrix of gravitational model are 0.406 and 0.401, respectively, and both pass the 1% significance level. This indicates that after controlling for the exogenous spatial interaction effects of explanatory variables on urban green technology innovation, green technology innovation generates endogenous spatial interaction effects among cities and presents a form of spatial agglomeration. That is, there is a spatial spillover effect of green technology innovation. We use the approach of LeSage and Pace (2009) to further estimate the direct, indirect, and total effects of capital factor allocation distortions and other control variables on green technology innovation derived from the SDM (results are shown in Table 5).

The following conclusions can be drawn from the parameter estimation results in Table 5. Whether based on the geographic distance matrix or the gravity model matrix, the distorted capital factor allocation not only has a significant inhibitory effect on green technology innovation in the city (coefficient = −0.099 or −0.108, p<0.01), but also hinders the development of green technology innovation in neighboring cities (coefficient = −0.365 or −0.289, p<0.05). These results reveal that the distortion of capital factors caused by government intervention and market failure will make the capital inclined to traditional enterprises such as state-owned and heavy industries, which will stick to the “rough” production method and restrict them from promoting the development of high technology. It also leads to the high cost of capital factors for small- and medium-sized enterprises, resulting in the crowding out effect and rent-seeking effect on R&D investment, and often through other unproductive speculative activities to obtain higher returns than R&D investment, thus discouraging the city’s enterprises to engage in innovative production activities. In terms of indirect effects, the distortion of capital factor allocation will lead to the inability of capital factors to flow freely between regions. This makes it difficult for enterprises in the neighboring regions to obtain capital, thus preventing the transfer of high-efficiency and high-quality industries, especially new energy industries, to the neighboring regions and undermining the ability of the neighboring regions to carry out independent innovation. Thus, hypothesis 4 (H4) is confirmed.

Regarding control variables, both geographic distance matrix and gravity model matrix, the results of the government intervention suggest that the direct effect is positive (coefficient =0.173 or 0.184), and the indirect effect is also positive (coefficient =0.851 or 0.653), both statistically significant (p < 0.05). The influence of the “visible hand” of local governments on firms’ innovation decisions is extensive. Specifically, in the context of China’s high-quality economy, local governments place a high priority on monitoring the allocation and use of public resources for innovation. Local governments tend to apply financial subsidies, tax breaks, and other incentives to “clean” firms, forcing them to make substantial innovations to meet the central government’s assessment requirements, thus helping to improve the green innovation performance of local firms (Czarnitzki and Licht 2006). Meanwhile, local governments will play a synergistic effect by guiding innovation factors to neighboring cities for undertaking transfer through policy means (e.g., Changsha’s industrial transfer to Ningxiang National Economic and Technological Development Zone), and thus gradually narrow the gap in science and technology innovation capacity between regions. In both the geographic distance matrix and the gravitational model matrix estimation, each unit increase in the level of economic development will significantly increase green technology innovation in the city by about 20% (p<0.01), while there is no effect on neighboring cities. The advantages of cities with high level of economic development, such as population size and large market size, can not only provide good basic conditions for science and technology innovation in the city, but also provide a broad market for the application of science and technology innovation results, which in turn drives the continuous improvement of the level of investment in innovation resources (Stankovic and Popovic 2016). R&D investment is a significant factor that promotes green technology innovation, which is true for all its direct, indirect, and total effects. The increase in R&D investment leads enterprises to increase their own R&D or introduce advanced clean technologies, thus creating a vibrant external innovation environment. Moreover, the knowledge spillover and technology spillover effects brought about by sharing innovation resources and information infrastructure among enterprises further enhance the green innovation performance of the city and neighboring cities. Whether direct or indirect, the roles of FDI and urban infrastructure construction on green technology innovation are far smaller than the other controlling factors.

Robust tests

To test the robustness of the estimated effects of Dist_K on GP in the SDM, we performed three major procedures with their corresponding results shown in Table 6. Here, the robustness of the estimations is tested from three aspects: (1) excluding sub-sample estimates of municipalities (Model A), (2) using alternative green technology innovation indicators (Model B), and (3) changing the spatial measurement model (Model C).

Sub-sample estimation excluding municipalities

Considering the possible differences in access to capital factor market policies and resource distribution, etc. between the four municipalities directly under the central government of Beijing, Shanghai, Tianjin, and Chongqing and the general prefecture-level cities, as well as the characteristics that municipalities directly under the central government have the advantages of green innovation and technology development, we exclude the influence effect of municipalities directly under the central government, limit our examination to the general prefecture-level city level (279 cities), and perform spatial measurement estimation based on a spatial weight matrix of geographic distances. From the regression results of Model A in Table 6, the influencing degree of distortion of capital factor allocation persists even when the municipality is excluded, with a statistically significant coefficient of −0.146. This further demonstrates the robust effects of distortion of capital factor allocation on green technology innovation.

Alternative measurement of explained variable

In this study, we regress the number of green utility model patent applications as the dependent variable, and the estimation results are shown in Model B of Table 6. For instance, the coefficient of distortion of capital factor allocation is −0.063 (p < 0.05), suggesting a strong robustness level even with an alternative green technology innovation indicator. Similar outcomes are also observed for the three control variables: government intervention, the level of economic development, and R&D investment.

Spatial lag explanatory variable model (SLX)

Distortions in capital factor allocation can affect urban green technology innovation, and the enhancement of urban green technology innovation is likely to have an impact on local governments’ capital factor allocation as well. We use a spatially lagged explanatory variable model based on a spatial weight matrix of geographic distances with dual fixed effects in space and time to try to address the possible linkage endogeneity between distortions in capital factor allocation and urban green technology innovation. From Eq. (2), when ρ = 0, θ ≠ 0, φ = 0, the general nested model of spatial measurement is the spatial lag explanatory variable model (SLX), which is shown in the following equation.

Among them, θ is the elasticity coefficient of the spatially lagged term of the explanatory variable. As shown in Model C of Table 6, the parameter estimate of capital factor allocation distortions is −0.113 (p<0.01). Comparatively, the estimated value of the SLX model increases, further verifying the robustness of the previously estimated results.

Inspection of influencing mechanisms

According to the mechanism analysis, distorted allocation of capital factors can degrade green technology innovation by generating mismatch, crowding out, and rent-seeking effects. To test the mechanisms, we conduct individual and temporal fixed effects econometric regressions by constructing interaction terms for the mismatch effect, the crowding out effect, and the rent-seeking effect with distortions in capital factor allocation, respectively. The specific variables are expressed as follows.

-

1)

Mismatch effect (Mis). We use the ratio of real estate investment to GDP to characterize the mismatch effect. Local governments reaching fiscal and economic performance during their tenure will tend to invest fiscal funds in the real estate sector with rapid results, thus crowding out science and technology expenditures and eventually presenting a capital mismatch.

-

2)

Crowding out effect (Crowd). Based on the database of Chinese industrial enterprises during 2005–2013, this paper measures the crowding out effect by the proportion of the export delivery value of each enterprise to the industrial sales output value and aggregates it to the prefecture-level city level. When the capital factor market is distorted, the cost paid by firms to obtain capital increases significantly, which restrains the motivation of firms to invest in independent innovation at home, thus forcing them to make foreign direct investment and international resource allocation.

-

3)

Rent-seeking effect (Rent). This variable is characterized by the year-end loan balance of financial institutions as a percentage of GDP. Government policy monopolies or biases can lead to stronger incentives for SMEs to establish political ties with the government to access credit facilities and government subsidies (Faccio 2006).

From the regression results of Models (1)–(3) in Table 7, the parameter estimates of the interaction term of Dist_K and mismatch effect (lnDist _ K ∗ ln Mis), crowding out effect (lnDist _ K ∗ ln Crowd), and rent-seeking effect (lnDist _ K ∗ ln Rent) are −0.160, −0.044, and −0.051 respectively, both statistically significant (p < 0.05). This suggests that Dist_K can inhibit the promotion of urban GP by generating mismatch, crowding out, and rent-seeking effects. This verifies hypothesis 1 (H1), hypothesis 2 (H2), and hypothesis 3 (H3).

Heterogeneity exploration based on the geographic location

Given the differences in financial policy support, economic conditions, and resource endowments among eastern, central, and western regions, the effect of capital factor allocation distortions on urban green technology innovation may also differ. The following analysis draws on the method of Xie et al. (2019) to classify the sampled cities into those in eastern, central, and western regions, and then regresses them with the spatial Durbin model separately.

In the eastern region, compared with the indirect effect that is insignificant, the direct effect is more significant, with the coefficient of −0.108 at the 5% significance level (Table 8). When the market achieves “Pareto optimality,” capital factors are better allocated from non-innovative firms to innovative firms (Kogan et al. 2017), which helps innovative firms to have priority access to resources. Distortions in the allocation of capital factors will lead to the failure of the market mechanism. Since different local governments have different priorities for urban development in China, the more priority is given to urban development, the more likely it is that there is an oversupply of capital in its cities, which is an essential reason for the distortion of urban capital allocation in the eastern region. The eastern region caught in the distortion of capital factor allocation will make the process of capital allocation from non-innovative firms to innovative firms blocked, which in turn inhibits the realization of green technology innovation by innovative firms. However, due to their proximity to international markets, enterprises in the eastern region have a higher degree of economic externality and more international experience. With known distortions in the local capital factor market, enterprises in neighboring cities are more likely to choose to “go out” and invest overseas, substituting overseas investment for domestic investment and obtaining more international innovation factor resources, international technology spillover, and technology feed-back effect. Therefore, the spatial spillover effect of the neighboring cities in the eastern region is not significant.

In the western areas, the direct (coefficient = −0.196) and indirect (coefficient = −0.486) effects of Dist_K are all significantly negative on GP. Due to the slow economic development and backward infrastructure construction in the western region, the capital flow between cities in the region is more stagnant, leading to a higher degree of distortions in the allocation of capital factors. It further leads to the shortage of capital for enterprises with strong innovation and R&D capabilities, which affects the ability of enterprises to acquire the ability to improve their own production processes and absorb external technological spillovers, and ultimately weakens the level of green technological innovation overall. For the significant spatial spillover effect in the western region, this is since the Dist_K will directly inhibit the free flow of capital factors between different cities, which leads to “environment-friendly” new energy enterprises in neighboring cities being unable to enter the market due to the high cost of obtaining capital factors, thus reducing the efficiency of GP. Meanwhile, industry sunk costs will decrease the competitiveness of enterprises between cities, which in turn will weaken the incentive for enterprises to expand their industries, improve production efficiency and carry out green innovation in neighboring cities, and ultimately hinder the improvement of GP in neighboring cities.

A distinguishable regional difference is reflected from the total effect of Dist_K on GP. Compared to eastern and central regions where the total effect is not significant, the western region shows a significant negative effect (coefficient = −0.682, p <0.1) as strengthened by the direct and indirect effects (both negative). The total effect is the sum of the direct effect and the indirect effect.

Conclusion and policy implication

In the context of severe factor supply bottlenecks and green development contradictions, it is particularly critical to explore the connection between distorted capital factor allocation (Dist_K) and urban green technology innovation (GP) to effectively transform the economic development model and promote high-quality economic growth. Based on a dataset of 283 prefecture-level and above cities in China during 2005–2018, this study investigates how distorted capital factor allocation impacts urban green technology innovation and explores the associated mechanisms as well as regional heterogeneity. According to the spatial Durbin estimation, we find that the capital factor allocation distortions can directly reduce green technology innovation, with significant spillover effects. Dist_K is found to influence GP mainly through generating mismatch, crowding out, and rent-seeking effects. There exist substantial regional differences among the eastern, western, and central cities regarding the effects of Dist_K on GP. Specifically, the effect of distorted capital factor allocation on urban green technology innovation is more prominent in the eastern and western regions. Robustness tests are conducted by using sub-sample estimation with the municipality removed, replacing the explanatory variable measures, and spatial lagged explanatory variables model (SLX), and show that the results derived from the model estimation are strongly robust. Based on the above empirical research, policy suggestions regarding capital factor allocation are as follows.

In the previous conceptual framework, we formulated hypothesis 4 that capital factor allocation distortions have spatial spillover effects on green technology innovation, and it was verified in the empirical analysis. Constraints in the spatial mobility of capital factors will not only lead to the inability to achieve the free flow of other basic resources required by enterprises between regions, but also weaken the incentive for enterprises to expand their industries to spatially relevant regions. Based on the above, one recommendation is to promote the reform of the financial system and continuously improve the price formation mechanism of commodities and factor resources. With price and competition as signals, the market plays a determinant role in resource allocation, while weakening government intervention. The marketization process of the financial system should be accelerated to further remove barriers to the flow of capital between regions, enhance the efficiency of capital allocation, and weaken the negative effects on neighboring regions.

According to hypothesis 1, hypothesis 2, and hypothesis 3 mentioned in the “Mechanism analysis” section, we found that capital factor distortions generate mismatch effect, crowding out effect, and rent-seeking effect on firms’ technological innovation, which in turn inhibits the development of green technological innovation. As one of the important factors driving high-quality economic growth, capital provides essential support for economic activities and has an influence on economic operation. The green invention patent technology, as a landmark innovation behavior with legal effect, reflects the overall competitiveness of industry, city, and even national independent innovation. Therefore, while optimizing the efficiency of capital factor allocation, policymakers should help invest capital factors in innovative R&D activities of core technologies such as energy conservation and emission reduction. In this way, the quality of innovation output can be enhanced, thus improving the overall technology level of the country, and further achieving coordinated and sustainable development of economy, society, and environment.

In the heterogeneity analysis, the effect of distorted capital factor allocation on urban green technology innovation is more influential in the east versus the west. It is suggested that in capital market reform, local governments should pay attention to local conditions and need to dynamically adjust the corresponding reform measures according to the stage in which the regional level of green technology innovation is located. Specifically, in the eastern region, policymakers need to focus more on the direct effect of capital factor allocation distortions on urban green technology innovation. It is necessary to continuously improve capital factor markets and accelerate the marketization process, thus improving the efficiency of local capital market allocation. To strengthen the overall efficiency of the nation’s economic operation, more emphasis should be placed on the western region, where capital factor distortions are relatively severe. It is essential to consider the effects of capital factor distortions on the region as well as the neighboring areas. The government should increase preferential policies for cities in the western region to optimize the sharing of infrastructure and resources between local and neighboring regions. Meanwhile, it is crucial to promote capital market reform efforts to attenuate the degree of capital market distortions.

Data availability

The datasets used and/or analyzed during the current study can be provided on reasonable request.

References

Acemoglu D, Akcigit U, Alp H et al (2013) Innovation, reallocation and growth. National Bureau of Economic Research, Cambridge, MA

Allen F, Qian J, Qian M (2005) Law, finance, and economic growth in China. J Financ Econ 77:57–116. https://doi.org/10.1016/j.jfineco.2004.06.010

Andrea C, Chiara DB (2019) Smart innovative cities: the impact of smart city policies on urban innovation. Technol Forecast Soc Change 142:373–383. https://doi.org/10.1016/j.techfore.2018.07.022

Aoki S (2012) A simple accounting framework for the effect of resource misallocation on aggregate productivity. J Jpn Int Econ 26:473–494. https://doi.org/10.1016/j.jjie.2012.08.001

Baldwin R, Forslid R, Martin P et al (2003) Economic geography and public policy. Princeton University Press

Baumol WJ (1996) Entrepreneurship: productive, unproductive, and destructive. J Bus Ventur 11:3–22. https://doi.org/10.1016/0883-9026(94)00014-X

Boldrin M, Levine DK (2004) Rent-seeking and innovation. J Monet Econ 51:127–160. https://doi.org/10.1016/j.jmoneco.2003.07.006

Brandt L, Tombe T, Zhu X (2013) Factor market distortions across time, space and sectors in China. Rev Econ Dyn 16:39–58. https://doi.org/10.1016/j.red.2012.10.002

Chen Y, Henderson JV, Cai W (2017) Political favoritism in China’s capital markets and its effect on city sizes. J Urban Econ 98:69–87. https://doi.org/10.1016/j.jue.2015.10.003

Claessens S, Feijen E, Laeven L (2008) Political connections and preferential access to finance: the role of campaign contributions. J Financ Econ 88:554–580. https://doi.org/10.1016/j.jfineco.2006.11.003

Comin D, Hobijn B (2010) An exploration of technology diffusion. Am Econ Rev 100:2031–2059. https://doi.org/10.1257/aer.100.5.2031

Cong LW, Gao H, Ponticelli J, Yang X (2019) Credit allocation under economic stimulus: evidence from China. Rev Financ Stud 32:3412–3460. https://doi.org/10.1093/rfs/hhz008

Czarnitzki D, Licht G (2006) Additionality of public R&D grants in a transition economy, the case of Eastern Germany. Econ Transit 14:101–131. https://doi.org/10.1111/j.1468-0351.2006.00236.x

Drucker J, Feser E (2012) Regional industrial structure and agglomeration economies: an analysis of productivity in three manufacturing industries. Reg Sci Urban Econ 42:1–14. https://doi.org/10.1016/j.regsciurbeco.2011.04.006

Elhorst JP (2014) Matlab software for spatial panels. Int Reg Sci Rev 37:389–405. https://doi.org/10.1177/0160017612452429

Faccio M (2006) Politically connected firms. Am Econ Rev 96:369–386. https://doi.org/10.1257/000282806776157704

Getis A (2009) Spatial weights matrices: spatial weights matrices. Geogr Anal 41:404–410. https://doi.org/10.1111/j.1538-4632.2009.00768.x

Guo Y, Xia X, Zhang S, Zhang D (2018) Environmental regulation, government R&D funding and green technology innovation: evidence from China provincial data. Sustainability 10:940. https://doi.org/10.3390/su10040940

Han W, Zhang X, Zheng X (2020) Land use regulation and urban land value: evidence from China. Land Use Policy 92:104432. https://doi.org/10.1016/j.landusepol.2019.104432

Hsieh C-T, Klenow PJ (2009) Misallocation and manufacturing TFP in China and India. Q J Econ 124:1403–1448. https://doi.org/10.1162/qjec.2009.124.4.1403

Huang Y (2010) China’s great ascendancy and structural risks: consequences of asymmetric market liberalisation. Asian-Pac Econ Lit 24:65–85. https://doi.org/10.1111/j.1467-8411.2010.01250.x

Jin H, Qian Y, Weingast BR (2005) Regional decentralization and fiscal incentives: federalism, Chinese style. J Public Econ 89:1719–1742. https://doi.org/10.1016/j.jpubeco.2004.11.008

Joo H-Y, Seo Y-W, Min H (2018) Examining the effects of government intervention on the firm’s environmental and technological innovation capabilities and export performance. Int J Prod Res 56:6090–6111. https://doi.org/10.1080/00207543.2018.1430902

Kogan L, Papanikolaou D, Seru A, Stoffman N (2017) Technological innovation, resource allocation, and growth. Q J Econ 132:665–712. https://doi.org/10.1093/qje/qjw040

Krugman P (1991) Increasing returns and economic geography. J Polit Econ 99:483–499. https://doi.org/10.1086/261763

Midrigan V, Xu DY (2014) Finance and misallocation: evidence from plant-level data. Am Econ Rev 104:422–458. https://doi.org/10.1257/aer.104.2.422

Moll B (2014) Productivity losses from financial frictions: can self-financing undo capital misallocation? Am Econ Rev 104:3186–3221. https://doi.org/10.1257/aer.104.10.3186

Moran PAP (1950) Notes on continuous stochastic phenomena. Biometrika 37:17. https://doi.org/10.2307/2332142

Murphy KM, Shleifer A, Vishny RW (1993) Why is rent-seeking so costly to growth? Am Econ Rev 83:409–414

Sandleris G, Wright MLJ (2014) The costs of financial crises: resource misallocation, productivity, and welfare in the 2001 Argentine crisis. Scand J Econ 116:87–127. https://doi.org/10.1111/sjoe.12050

Sergio JR, Brett DM (1999) US regional income convergence: a spatial econometric perspective. Reg Stud 33:143–156. https://doi.org/10.1080/00343409950122945

Silva F, Carreira C (2012) Do financial constraints threat the innovation process? Evidence from Portuguese firms. Econ Innov New Technol 21:701–736. https://doi.org/10.1080/10438599.2011.639979

Stankovic L, Popovic A (2016) Market size as a determinant of Serbian national competitiveness. Marketing 47:191–205. https://doi.org/10.5937/markt1603191S

Wu GL (2018) Capital misallocation in China: financial frictions or policy distortions? J Dev Econ 130:203–223. https://doi.org/10.1016/j.jdeveco.2017.10.014

Xie R, Yao S, Han F, Fang J (2019) Land finance, producer services agglomeration, and green total factor productivity. Int Reg Sci Rev 42:550–579. https://doi.org/10.1177/0160017619836270

Xu S-C, Li Y-F, Zhang J-N et al (2021) Do foreign direct investment and environmental regulation improve green technology innovation? An empirical analysis based on panel data from the Chinese manufacturing industry. Environ Sci Pollut Res 28:55302–55314. https://doi.org/10.1007/s11356-021-14648-1

Andrews D, Criscuolo C, Menon C (2014) Do resources flow to patenting firms? Cross-country evidence from firm level data. OECD Economics Department Working Papers

Bai J, Bian Y (2016) Factor market distortion and the efficiency losses of Chinese innovative production. China Ind Econ 39–55. https://doi.org/10.19581/j.cnki.ciejournal.2016.11.005

Chen J, Jiang N (2020) The transmission mechanism of Chinese OFDI affecting technological innovation. J Financ Res:74–92

Chen S, Liu C, Feng B (2019) Capital allocation efficiency, city-size distribution and social welfare analysis. Econ Res J:133–147

Dai K, Liu Y (2016) How factor market distortion affects innovation performance. J World Econ 54–79

Gai Q, Zhu X, Chen M, Shi Q (2015) Factor market’s distortion, markup and TFP. Econ Res J:61–75

Hall BH (1999) Innovation and Market Value. SSRN Electron J 130. https://doi.org/10.2139/ssrn.151912

Jian Z, Xu Y, Lv D, et al (2018) Capital misallocation across firms in China: financial frictions or insitution bias of credit allocation. China Ind Econ 24–41

LeSage J, Pace L (2009) Introduction to spatial econometrics. Chapman Hall/CRC

Li Y, Wang Y, Meng X (2013) Does factor market distortions barrage international technology spillovers? J Financ Res 140–153

Wang Y, Li W, Dai Y (2018) How do zombie firms affect innovation? -Evidence from China’s industrial firms. Econ Res J 99–114

Zhu X, Shi Q, Ge Q (2011) Misallocation and TFP in rural China. Econ Res J 86–98

Funding

This work was supported by the Hunan Provincial Innovation Foundation for Postgraduate in 2020 (CX20200471).

Author information

Authors and Affiliations

Contributions

Siling Yao contributed to data curation, formal analysis, writing—original draft, and writing—review and editing. Shenghua Yu contributed to conceptualization, methodology, and writing—review and editing. Wentao Jia contributed to conceptualization, methodology, formal analysis, and supervision. All the authors read and approved the manuscript.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Yao, S., Yu, S. & Jia, W. Does distorted allocation of capital factors inhibit green technology innovation in Chinese cities? An empirical analysis based on spatial effect. Environ Sci Pollut Res 30, 19234–19249 (2023). https://doi.org/10.1007/s11356-022-23419-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-23419-5