Abstract

Finance has a strong role in promoting green development; however, there are very few studies quantifying this relationship. To this end, based on the official green development indicator system of the Chinese government and province-level data from 2006 to 2017, the quantile regression model was used to analyze quantitatively the impact of finance on green development. The results show that financial development contributed significantly to green development, and furthermore, financial efficiency and green finance have a strong positive effect with the increase of the quantile, and financial scale also has a significant positive effect, but a diminishing marginal effect. In addition, the impact of financial development on green development has regional differences. In the eastern region, the finance factors can promote green development, but the financial scale and the green finance promotion function weaken along with the quantile increase. The financial scale and green finance do not support green development significantly in the central region. Financial scale, efficiency, and green finance support green development in the west region.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

China has made remarkable strides in economic development through its more than 40 years since reform and opening-up in 1978. But these achievements mainly rely on an unsustainable economic growth model characterized by “high input, high consumption, high pollution.” The decades of rapid economic growth with comparatively low-efficiency growth model have caused over-exploitation of natural resources, creating intense environmental and ecological pressures. Although China has focused on fighting pollution and environmental improvement since the early 2010s, the ecological and environmental quality issues are still serious. According to the Report on the State of the Ecology and Environment in China 2018 published by China’s Ministry of Ecology and Environment, only one-third of the cities at or above prefecture level in 2018 met national air quality standards; the total area covered by acid rain was above 0.5 million km2, taking up 5.5% of China’s total land area; only 13.8% of monitored groundwater met the Grade I ~ III water quality standard; and areas with relatively poor or poor eco-environmental quality took up 31.6% of the total area.

One fundamental approach applied by China to improve eco-environmental quality since 2017 is to transform the economic growth model to high-quality economic development (Fan and Zhang, 2019). Green development is one important aspect of the high-quality development. As early as July 2013, the Chinese central government adopted the policy for green development into its national strategy. China then included green development as one of the core developmental goals and policies in its 13th Five-Year Plan (2015–2020), and it has become the guiding ideology and policy of its 14th Five-Year Plan (2021–2025). The government also proposed specific targets to facilitate green development, such as a 13.5% reduction in energy consumption per unit of GDP in the period of the 14th Five-Year Plan. In the report of the 19th National Congress of the Communist Party in 2017, China further emphasized that “we should promote green development, solve prominent environmental problems, intensify the protection of ecosystems, reform the environmental regulation system, and work to develop a new model of modernization with humans developing in harmony with nature.” Therefore, green development should and must be a type of development that is able to relieve the tension between economic growth and constraints of natural resources and environment by reducing depletion of natural resources and effecting environmental protection in China, in order to improve the win–win ability of environmental protection and economic development (Wang and Feng, 2021a, b).

Although China has taken policy initiatives and invested in green development projects, China’s green development level is still lower than some other countries in the world. For example, Feng et al. (2017) found that the green development level in China during 2000–2014 is comparable to the Republic of Korea, but much lower than Japan and Western European countries.

Meanwhile, through the leverage of capital, financial development is important for green development in China and other countries. At the Politburo Meeting of the CPC Central Committee held in 2018, technological innovation and financial development were cited as the two most important factors to achieving high-quality economic development and green development in China. Theoretical and empirical studies also support a significant relationship between finance and green development (e.g., Xie and Liu, 2019; Yang et al., 2021; Zhou et al., 2022). First, although the causal relationship between financial development and economic growth is still debatable, financial development is, without doubt, important to economic growth. Second, financial development also affects the utilization of natural resources and environmental quality (e.g., Zhou and Xu, 2022; Zhang et al., 2022).

However, few studies focus on the relationship between financial development and green development. Prior studies have examined a variety of influence factors of green development, such as public participation and regulatory compliance (Fu and Geng, 2019), environmental taxes (e.g., Hao et al., 2021), renewable energy and human capital (e.g., Hao et al., 2021), specific policy (e.g., Clean Air Action) effects on green development in China (Lin and Zhu, 2020), and the effect of the Belt and Road initiative (e.g., Cheng and Ge, 2020; Huang and Li, 2020). The most recent studies on the relationship between finance and green development are from Yuan et al. (2019), and they found that financial agglomeration promoted green development in both focus and surrounding cities in China. Yuan et al. (2020) further found that high-level financial agglomeration had a stronger positive effect on local green development than medium- and low-level financial agglomeration. Since green development is attracting increasing attention from government, business, and the public in China, there is an urgent need to study this topic.

The object of this paper is to contribute to the literature by studying the role of financial development in influencing China’s green development. The level of green development is measured by the Green Development Index System developed by the Central Government of China. We use financial scale, financial efficiency, and green finance to measure financial development to fully reflect the multi-dimensional impact of finance on China’s green development. China is well known for its regional disparities in economic development, and therefore, a more comprehensive picture of the effect of the influence factors on China’s green development can be obtained by applying quantile regression compared to conventional mean conditional regression models. We apply quantile regression models to study the relationship between finance and green development based on a panel data set of 30 provinces in China over the period of 2006–2017.

The contribution of this paper is threefold. First, considering the three indicators of financial development, this study quantifies the effects of financial scale, financial efficiency, and green finance on China’s green development. Second, this study applies a comparatively comprehensive indicator officially published by China to measure green development. To our knowledge, only a few studies studying influence factors use a comparatively comprehensive measurement of green development (e.g., Huang and Li, 2020).

Third, quantile regression is able to reveal the possible differing impacts of an influence factor across conditional quantiles of green development. Although quantile analysis has been applied in the general area of energy and environmental economics (e.g., Zhang et al., 2015; Xu and Lin, 2016), to our knowledge, only one study by Lin and Benjamin (2017) applied the quantile method to study China’s green development. However, they focused on comparing the patterns of green development among China’s regions but not influence factors of green development.

The rest of this paper is organized as follows. Section 2 reviews the connotation and measurement of green development and the relationship between finance and green development. Section 3 introduces the methodology applied to empirically investigate the relationship between finance and green development. Section 4 presents the estimated results from the regression models developed in this study. Section 5 concludes the study with policy implications.

Literature review

The meaning of green development

The meaning of green development is closely related to sustainable development and several other similar concepts developed by international organizations. UNEP launched its Green Economy Initiative in 2008. It defined a green economy as one that “results in improved human well-being and social equity, while significantly reducing environmental risks and ecological scarcities. In its simplest expression, a green economy can be thought of as one which is low carbon, resource efficient and socially inclusive. At the OECD Ministerial Council Meeting in June 2009, member countries achieved an agreement that the OECD should develop a green growth strategy bringing together economic, environmental, technological, financial, and development aspects into a comprehensive framework (UNESCAP, 2012). The OECD has since then become a major proponent of green growth. According to Green Growth Indicators 2017 published by OECD, four main features of green growth are: the environment and resource productivity of the economy, the natural asset base, the environmental dimension of quality of life, and economic opportunities and policy responses.

The meaning of green development has its own distinctions according to existing studies. Lin and Benjamin (2017) considered green development a more proactive way than sustainable development to benefit future generations because it emphasized the serious effects of environmental pollution. Weng et al. (2020) considered green development as an updated version of sustainable development with more extensive elements, such as legal institutions and policy subsystem, living subsystem, production subsystem, human, mountains, water, forests, farmland, lakes, grassland. The green development concept incorporates natural resources, socioeconomic factors, green product development, green technology, and green behavior (Wang et al., 2018). Hu (2017) emphasized the environmental ethics embodied in green development.

Therefore, green development is not only a concept used by international organizations and governments to achieve certain policy goals, but it has its theoretical foundation and support from empirical studies (e.g., Albrizio et al., 2018) that it is possible to reach a win–win situation of improving environmental quality while sustaining economic growth, especially through productivity improvement induced by stricter environmental policies. The theoretical basis of green development stems from ecological economics, which emphasizes that the economic system is a subsystem of the ecosystem; economic growth is constrained by the ecological environment and the irreplaceability of natural capital (Daly, 2013).

The measurements of green development

Empirical studies developed various indicators to measure green development from different perspectives. From the efficiency perspective, green development means that technological progress is promoting output growth while reducing pollution emissions. The method of data envelopment analysis (DEA) (e.g., Wu et al., 2020; Tian and Feng, 2021) is a typical measurement of green development from this perspective.

Applying the DEA approach to green development emphasizes economic production efficiency, which is often further operationalized as green total factor productivity by considering environmental pollutants as undesirable outputs (e.g., Lin and Benjamin, 2017; Feng and Wang, 2019; Qiu et al., 2021). The DEA approach uses mathematical models to evaluate the performance of certain decision-making units in terms of efficiency, with data on various input and output elements from different sectors (Zhu, 2009). Lin and Benjamin (2017) used the DEA approach to generate a green development growth index, which includes SO2, solid waste, wastewater, and CO2 as environmental pollutants. Feng et al. (2017) developed a green development performance index based on DEA to estimate the global patterns of green development and its influence factors. They measured three main aspects of green development: resource-conserving activities, environmentally friendly behaviors, and economic development. Feng et al. (2017) only included reduction ratios of economic output, energy consumption, and environmental emissions to measure green development. Xie and Liu (2019) measured green development in China by estimating green total factor productivity with a directional distance function and a Malmquist-Luenberger index over the period 2006–2017. Cheng et al. (2020) applied the Malmquist-Luenberger index to measure green total factor productivity, which is used as the economic green growth index. Lin and Zhu (2020) used the DEA method to construct a green production efficiency index that captures the effect of achieving economic growth while efficiently using energy and reducing pollutant discharges to measure green development. One limitation of applying DEA to measure green development is that it focuses narrowly on efficiency without much consideration for other perspectives (e.g., society and policy) of green development.

From the perspective of comprehensive evaluation, many studies have a comprehensive measure of green development and then usually focus on comparing green development levels in different periods and regions (e.g., Yang et al., 2019). In order to compare green development levels in Chinese mineral-resource-based cities, Yang et al. (2019) developed a green development evaluation system with 19 indicators under three dimensions: environment, economy, and society to reflect “the principles of the improvement of resource utilization rate, the reduction of environmental damage and waste, and the development of the economy and society.” Fang et al. (2020) developed a green development index with five dimensions (population, resources, environment, development, and satisfaction) and 30 indicators to evaluate the green development level in the Yangtze River Delta in China. Li et al. (2020) evaluated green development with five dimensions (living environment, treatment and utilization of pollutant, ecological efficiency, economic growth, innovation potential) and 18 indicators based on an S-type cloud model.Footnote 1 Weng et al. (2020) developed a “Five-Circle Model” indicator system to evaluate green development, which included five elements: economic advancement, resource utilization, ecological environment, social progress, and environmental governance and then 39 third-level indicators measured the five second-level indicators. Zhang et al. (2020) studied regional differences and the convergence tendency of green development competitiveness in China with province-level panel data by developing a green development competitiveness evaluation index that contained five aspects: green high-quality growth, resource conservation and emissions reduction, urban ecological environmental quality, green lifestyle, and green investment.

The relationship between finance and green development

Although the academic literature has paid attention to China’s green development process, there is very limited theoretical discussion on the relationship between finance and China’s green development. But the theories underpinning the relationship between financial development, economic growth, and environmental quality can be applied to understand this relationship.

Theoretically, financial development and economic growth are closely related, even though empirical studies have shown varying relationships between them. An effective financial system promotes economic growth by increasing the efficiency of allocating resources. Financial systems play a crucial role in reducing market transaction costs and frictions and therefore influencing investment decisions, technological innovation, and long-run economic growth rates (McKinnon, 1973). Demirgüç-Kunt and Levine (2008) also emphasized the overall function of a financial system in reducing information and transactions costs of an economic system, and they summarized five core functions of a financial system: (1) producing investment information; (2) monitoring investments and improving corporate governance; (3) facilitating transactions and risk management; (4) mobilizing and pooling savings; and (5) reducing transaction costs.

Empirical studies have found varying relationships between financial development and economic growth. Some studies found a non-linear relationship between finance and economic growth. For example, Beck et al. (2014) found that credit expansion had a positive effect on economic growth only up to a point. The studies for China also show varying results. Zhang et al. (2012) found financial development was positively associated with economic growth using data from 286 Chinese cities over the period of 2001–2006. However, an earlier study by Liang and Teng (2006) showed unidirectional causality from economic growth to financial development over the period 1952–2001.

Financial development can support green development by allocating investments to green industries (e.g., Zhou et al., 2022). It also can improve green development indirectly through supporting technological innovation (e.g., Samargandi and Sohag, 2022). Moreover, financial development provides the resources needed for a transition to green development, and it is highly emphasized by the studies from international organizations. The financing required for a green economy transition is substantial. The UNEP 2016 Adaptation Gap Report estimated that annual adaptation costs to mitigate climate risks range from US$140 billion to US$300 billion annually from 2017 to 2030 for developing countries, and the costs would be higher for developed countries.

In recent years, scholars have concluded that technological innovation is the core force of economic development based on empirical findings (e.g., Pradhan et al. 2018; Jiang et al. 2020). From the perspective of green development, financial development is able to facilitate innovation and therefore improves production efficiency. Financial development is able to promote the development of energy-saving technologies by which energy consumption is reduced (Zhang, 2011). It can also promote renewable energy development. Qu et al. (2020a, b), using dynamic spatial econometric models, found that financial agglomeration could significantly improve China’s energy efficiency. Xie and Liu (2019) found that green credit could promote green economic growth in China mainly through technological progress, and technological progress improved the level of advancement and rationalization of industrial structure and reduced the proportion of coal in energy consumption.

Empirical studies showed varying results for the relationship between finance and environmental quality (e.g., CO2 emissions, natural resources). Some studies showed a positive relationship between financial development and CO2 emissions (e.g., Shahbaz et al., 2016; Bekhet et al., 2017). Other studies showed that financial development reduced CO2 emissions (e.g., Abbasi and Riaz, 2016). Xu and Tan (2020) found that financial development had a positive impact on natural resource use efficiency. Some studies also found differing effects of financial development on environmental quality. For example, Guo et al. (2019) showed that financial development efficiency had positive impacts on CO2 emissions, but financial scale had negative impacts on CO2 emissions based on the extended STIRPAT model with province-level panel data over the period of 1997–2015.

In sum, finance affects green development through three mechanisms: providing investments, increasing technology and the efficient use of resources, and promoting environmental governance. In order to quantify these effects, we use the official green development indicator system to formulate an overall estimate of China’s green development level and then analyze the impact of finance on China’s green development using the panel quantile regression method.

Methods

Model

The advantage of using quantile regression is that it is able to show the possible asymmetric and non-linear effects of the independent variables on the dependent variable in econometric models (Baur, 2013); the quantile model includes a set of regression curves that vary across different quantiles (percentiles) on the conditional distribution of the dependent variable (Koenker and Hallock, 2001, Koenker, 2005). Finance and green development may show different relationships with quantile analysis.

Assume the linear function of q quantile of the conditional distribution y|x is

where βq is the q quantile regression coefficient, and the estimate \(\stackrel{\wedge }{\beta }q\) minimizes the function in Eq. (2):

We developed regression model (3) as the base model of our empirical study in order to test the relationship between finance and green development. Other important influence factors (i.e., energy structure, environmental governance, industrial structure, and company regulations) of green development found in empirical studies are also included in the model. The variables are log-transformed to reduce heterogeneity.

where subscripts i and t refer to province and year; ɑ0 is the intercept, and εit refers to the error term. LnGD refers to green development level; LnFS financial scale, LnFE financial efficiency, and LnGCLgreen credit are three variables used to reflect financial development; control variables are Ln(Listed_ratio), LnEPI, LnCR, and Lnindustry, which respectively refer to company regulation, environmental governance, energy structure, and industrial structure.

Data and variables

Green development index

We apply a green development index to measure green development in China. In the literature review section, we saw that empirical studies have constructed their own green development indicator systems according to the interpretation of green development. However, in order to form a unified green development indicator system, the Chinese government promulgated the official green development indicator system (GDIS) in 2016. Therefore, we use this index system to estimate the level of China’s green development. This system includes weights of indicators, a weights method, and six first-class indicators: natural resources utilization, environmental governance, environmental quality, ecological protection, growth quality, and green life.

We adapt this official GDIS according to the data we have. We follow three principles to modify it. First, we try to keep the original indicators if the data are available. The following indicators are therefore dropped because their data are not available: the per capita energy consumption reduction rate of public institutions, the market share of green products, the growth rate of the ownership of new electric vehicles, and the proportion of urban green buildings in new building construction. Second, we replace some indicators with proxy indicators due to data availability issues, and we keep the weights for the first-class indicators the same as the official weights. And three second-class indicators are supplemented to reflect the green life: water usage per capita, park green land per capita, special vehicle equipment for city appearance and sanitation per person. Third, we replace two second-class absolute indicators with relative indicators, which are energy consumption growth rate and total water consumption growth rate. These replacements are to better represent China’s policies to control the general energy consumption growth rate.

Official GDIS includes 55 s-class indicators, but we have 47 s-class indicators after our modification (see Table 1); 42 s-class indicators are directly from the official indicators, the other 5 are replaced with proxy indicators. So we have not fundamentally changed the country’s official GDIS and its basic structural framework.

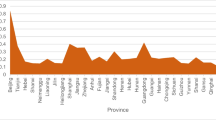

The data is at the provincial level with 30 provinces in China excluding Tibet, Hong Kong, Macau, and Taiwan due to data availability issues. The data cover the period of 2006–2017. All the data for the 47 indicators of GD are from the China Statistical Yearbook, China Industrial Statistical Yearbook, China Environmental Statistical Yearbook, and China Energy Statistical Yearbook published by the China National Bureau of Statistics, and statistical yearbooks and environmental reports published by provinces. We apply linear interpolation to deal with the small number of missing data. All nominal variables including per capita GDP and income are converted into real variables based on the 2006 CPI.

The green development level can be calculated with Eq. (4):

where GD is the green development index, Yi refers to standardized indicators, N is the number of indicators, and Wi is weights.

Various methods are used to determine green development index weights, such as entropy method, Delphi method, and DEA. The DEA method only focuses on efficiency, and the Delphi method is a subjective method that does not exclude personal preferences. Entropy value/weight method (Wang et al., 2018; Yang et al., 2019; Cheng and Ge, 2020) is an objective weighting method obtained by calculating the information entropy of the index and determining the weight of the index, as well as eliminating the interference of human factors via comparison with the subjective weighting method. Some studies use an equal weight method to calculate green development index (e.g., Huang and Li, 2020). The justification for an equal weight method is that the objective weighting methods such as Principal Component Analysis (e.g., Fang et al., 2020) and the entropy method are very much influenced by the sample data used in the particular study. Since the GDIS used in this study is published by Chinese government, we use their weights and weight method directly.

Explanatory variables

The financial system is a complex system, and therefore there are various ways to measure financial development in empirical studies. Some studies apply comparatively comprehensive methods to measure financial development. For example, Zhang et al. (2022) constructed an index to measure green financial development. However, some studies use few variables (e.g., Samargandi and Sohag, 2022; Abbasi and Riaz, 2016) to measure financial development. Following the simpler way of measurement (e.g., Abbasi and Riaz, 2016), we use the following three indicators to reflect financial development (FD): financial scale, financial efficiency, and green finance. Financial scale reflects the volume of financial market development; financial efficiency reflects the performance of the use of financial resources; and green finance reflects the ability of finance to support green development. Based on the previous theoretical discussion in Sect. 2.3, they affect green development through three channels: investment, technology/efficiency, and environmental governance (see Fig. 1).

Financial scale (FS) is measured by the ratio of loan balance of financial institutions to GDP. We exclude the loan balances of six energy-intensive industries in constructing FS in order to reduce a potential multicollinearity issue. Financial efficiency (FE) is measured by the ratio of loan balance to deposit of financial institutions because China’s financial market is dominated by financial institutions. The level of green finance is measured by green credits issued by financial institutions. China’s green financial market is mainly composed of the green credits issued by commercial banks and other financial institutions, and therefore this indicator is a proper measurement of China’s green finance. However, the data for green credits are not available at the provincial level. Existing studies used alternative measurements to measure green credits in China. For example, Xie and Liu (2019) applied the ratio of the interest expenditures generated from the six most energy-intensive industries to the total interest expenditures generated from industrial GDP at the provincial level. We use similar measurement to those used by Xie and Liu (2019); however, we use the six non-energy-intensive industries to measure green credit level (GCL). The higher the GCL the higher the level green finance is in a province, and the equation is

where Ii refers to the ith industry’s interest expenditures, and I refers to the total sum of industrial firms’ interest expenditures.

The control variables included in this study are: company regulation, environmental governance, energy structure, and industrial structure (see Table 2). Company regulation is measured by the ratio of public-listed companies to total number of industrial companies; this variable is included because publicly listed companies have high transparency, and so their behaviors have a great influence on the implementation of green development strategy. Environmental governance is measured by the ratio of the investment in reducing environmental pollution to GDP. Industrial structure is measured by the ratio of value added in manufacturing to GDP. Energy structure is the proportion of coal consumption.

Results

Results from random effects models

Using Stata 14.0, estimates show how the effects of independent variables (EC, BPC, and TGC) varied across different levels of the dependent variable (GD). Table 3 shows estimates from conventional panel data models: OLS, RE, and FE.

The p value for the Hausman test is 0.163, which means that random effects (RE) is the preferred model comparing to the fixed effects (FE) model due to its higher efficiency. The following analysis is therefore based on the estimates from the RE model. The coefficient for financial scale (LnFS) is 0.083, and it is statistically significant at the 1% level, which indicates that financial scale facilitates green development in China; this means that the increased financial scale is able to provide more funds to invest in environmental-protection-related activities and projects. The coefficient for financial efficiency (LnFE) is 0.0241 and statistically significant, which implies that a 1% increase in financial efficiency would increase the level of green development by 0.0241%. The coefficient for green finance (LnGCL) is 0.0639 and statistically significant at the 1% level. The effect of green finance on green development is straightforward; funds are distributed directly to green projects from banks and other financial institutions.

Examining control variables, the estimated coefficient for company regulation (ln(Listed_ratio)) is negative and statistically significant, which implies that company regulation decreases the level of green development. We offer two possible explanations. First, there are ever more regulations such as executive orders, administrative penalties, and administrative rules on green-development-related activities of the publicly listed companies. Second, publicly listed companies are subject to more pressure to make profits from the market, and therefore they may have less incentive to invest in environmentally friendly technologies and projects. In China, command and control environmental policy has been the most common public policy to facilitate green development, and this type of policy is likely to decrease a company’s profits (Si et al., 2021).

The coefficient of investment in environmental pollution is positive and statistically significant, which implies that more projects aimed at environmental quality are able to increase the level of green development. The coefficient of energy structure is − 0.1026, which conforms to the expectation that a greater proportion of coal in the energy consumption structure leads to more environmental and natural resources issues. The coefficient of industrial structure is negative, which indicates that the industrial structure of China is still heavily dependent on natural environment and resources. The transformation to a less energy-intensive and resource-intensive industry is the national plan of the Chinese central government, and this negative effect of industrial structure on green development is likely to decrease in the future.

Results of quantile regression

We followed Chen’s (2014) approach and compared the panel quantile regression estimate with the OLS estimate, thus further reflecting the significance of the panel quantile regression for our study. Results from the quantile regression (obtained from Stata 14.0) are in Table 4, which include five quantiles of the conditional distribution of green development. The estimated coefficients for financial scale are positive under all five quantiles; however, the coefficient becomes smaller from the 0.15 quantile to the 0.85 quantile. This decreasing influence of financial scale along with the increasing level of green development is reasonable because financial resources are less likely to be invested in green development projects if the level of green development is already high. The coefficients for financial efficiency show an opposite effect compared to financial scale. Financial efficiency has a higher impact on green development if the level of green development is high. This also make sense; a high level of green development may likely be further improved if the financial resources are efficiently used to improve projects of green development. Green credits show a similar effect to that of financial efficiency, which is that green finance affects green development if the level of green development is already high. This finding follows the same logic as the relationship between financial efficiency and green development.

The effects of the control variables are similar to the estimated effects from the random effects model in general. Publicly listed companies are more likely to decrease green development, and this effect decreases if the level of green development is high. The effect of environmental pollution investment is not statistically significant. The effect of energy structure and industrial structure show that they decrease green development, and this effect does not decrease with the level of green development.

Analysis of regional differences

China’s regional difference is well known and well investigated by empirical studies (e.g., Sun et al., 2018). The differences in geology, public policy, and ecology all affect green development and financial development. This study follows conventional regional categorization and divides data into the east, central, and west regions. The eastern region includes Beijing, Fujian, Guangdong, Hainan, Hebei, Jiangsu, Liaoning, Shandong, Shanghai, Tianjin, Zhejiang provinces, the central region includes eight provinces of Anhui, Heilongjiang, Henan, Hubei, Hunan, Jiangxi, Jilin and Shanxi, and the west region includes the 11 provinces of Chongqing, Gansu, Guangxi, Guizhou, Inner Mongolia, Ningxia, Qinghai, Shaanxi, Sichuan, Xinjiang, and Yunnan.

Table 5 presents the results of quantile regressions for the three regions. The control variables are not included in the quantile regions because we mainly focus on the difference of financial impact on regional green development.

Results show that financial scale shows a positive statistically significant effect in the east and west regions, but not in the central region. This result does not show a general pattern among Chinese regions. The economic development level is increasing from the west to the east. However, factors other than economic development dominate the effect of financial scale on green development. Financial efficiency shows a positive statistically significant effect on green development in general, and the effect is particularly strong in the central region. The effect forms an inverted-U-shape relationship between the effect of financial efficiency on green development and regions. Green credits show a positive statistically significant effect on green development in all regions as expected. The results also show that green credits have a stronger effect on green development in east and west regions compared to the central region. In sum, the effects of the three main explanatory variables all show certain pattern in regions in China. The east region has the highest economic development level, and its financial resources are invested more towards green-development-related projects compared to the other regions. The central region has been emphasizing economic growth, and therefore its financial resources are allocated more to traditional industries. The west region of China has the lowest economic development level but is rich in natural resources, and its ecological environment is key to the natural environment of all of China. The west government of China therefore should pay particular attention to the green development in the other regions. This policy attention is likely to align the west’s financial development more to green development.

Conclusions and policy implications

Based on panel data from 2006 to 2017 for 30 provinces, this paper analyzes the influence of financial scale, financial efficiency, and green finance on the level of green development by using the panel quantile method compared to the traditional OLS method. The main conclusions are as follows.

First, financial development has significantly promoted the growth of green development. The positive effect of financial efficiency and green finance on green development is stronger with the increase in quantiles, while the financial scale is also positive and significant but diminishes at the level of each quantile, which is a result that traditional OLS methods cannot reveal. The proportion of listed companies, coal-based energy structure, and industrial structure play a negative role in the development of the green economy. The impact of environmental investment is not significant.

Second, we should pay attention to regional differences in the relationship between financial development and green development in China. In the eastern region, financial development has significantly promoted the growth of green development, while the financial scale and the role of green finance have weakened with the increase of quantile; in the central region, the financial scale and green credit have not significantly supported green development.

Therefore, we should attach great importance to the financial sector in the green development process. On the one hand, it is necessary to expand the financial scale and provide more relaxed financial conditions for green development; on the other hand, it is necessary to prevent the diminishing marginal effects of such development by increasing the efficiency in the use of financial resources and, at the same time, expand green finance growth in a powerful way.

Although this study applied a comparatively comprehensive index to measure green development, one major shortcoming of this study is the measurement of financial development. Only three variables are used to measure three aspects of financial development: financial scale, financial efficiency, and green finance. In the future, a more comprehensive measurement of financial development can be used to study its relationship with green development in China.

Data Availability

The data that support the findings of this study are collected based on the published data by the China National Bureau of Statistics. They are available from the corresponding author on reasonable request.

Notes

Based on statistical mathematics and fuzzy mathematics, cloud model unifies the randomness and fuzziness between uncertain linguistic value and accurate value, and realizes the natural conversion between qualitative linguistic value and quantitative value.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114

Zhou H, Xu G (2022) Research on the impact of green finance on China’s regional ecological development based on system GMM model Resource Policy 75. https://doi.org/10.1016/j.resourpol.2021.102454

Albrizio S, Kozluk T, Zipperer V (2018) Environmental policies and productivity growth: Evidence across industries and firms. J Environ Econ Manag 81:209–226. https://doi.org/10.1016/j.jeem.2016.06.002

Baur DG (2013) The structure and degree of dependence: a quantile regression approach. J Bank Finance 37(3):786–798

Beck R, Georgiadis G, Straub R (2014) The finance and growth nexus revisited. Econ Lett 124(3):382–385

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sustain Energy Rev 70:117–132

Chen Q (2014) Advanced econometrics and STATA applications (second edition). China High Educ Press

Cheng Z , Liu L , Liu J (2020) Natural resource abundance, resource industry dependence and economic green growth in China Resour Policy 68. https://doi.org/10.1016/j.resourpol.2020.101734

Daly HE (2013) A further critique of growth economics. Ecol Econ 88:20–24

Danish, Ulucak R (2020) How do environmental technologies affect green growth? Evidence from BRICS economies Sci Total Environ 712 https://doi.org/10.1016/j.scitotenv.2020.136504

Eren BM, Taspinar N, Gokmenoglu KK (2019) The impact of financial development and economic growth on renewable energy consumption: empirical analysis of India. Sci Total Environ 663:189–197

Fang G, Wang Q, Tian L (2020) Green development of Yangtze River Delta in China under population-resources-environment-development-satisfaction perspective Sci Total Environ 727. https://doi.org/10.1016/j.scitotenv.2020.138710

Fan G, Zhang X (2019) Toward high-quality development in the People’s Republic of China. ADB East Asia Working Paper Series No.18

Feng C, Wang M (2019) Journey for green development transformation of China’s metal industry: a spatial econometric analysis. J Clean Prod 225:1105–1117

Feng C, Wang M, Liu G, Huang J (2017) Green development performance and its influencing factors: a global perspective. J Clean Prod 2017(144):323–333

Hu A (2017) The theory of green development. In: China: Innovative Green Development. Springer, Singapore. https://doi.org/10.1007/978-981-10-2806-9_2

Guo M, Hu Y, Yu J (2019) The role of financial development in the process of climate change: evidence from different panel models in China. Atmos Pollut Res 10(5):1375–1382

Huang M, Li S (2020) The analysis of the impact of the Belt and Road initiative on the green development of participating countries Sci Total Environ 722. https://doi.org/10.1016/j.scitotenv.2020.137869

Jiang M, Luo S, Zhou G (2020) Financial development, OFDI spillovers and upgrading of industrial structure. Technol Forecast Soc Chang 155

Li X, Du J, Long H (2019) Theoretical framework and formation mechanism of the green development system model in China. Environ Develop 32

Li Y, Chen Y, Li Q (2020) Assessment analysis of green development level based on S-type cloud model of Beijing-Tianjin-Hebei, China. Renew Sustain Energy Rev 133

Liang Q, Teng J (2006) Financial development and economic growth: evidence from China. China Econ Rev 17(4):395–411

Lin B, Benjamin NI (2017) Green development determinants in China: a non-radial quantile outlook. J Clean Prod 162:764–775

Lin B, Zhu J (2020) Policy effect of the Clean Air Action on green development in Chinese cities J Environ Manage 258. https://doi.org/10.1016/j.jenvman.2019.110036

Koenker R, G Bassett G (1978) Regression quantiles. Econometrica 46(1):33–50

Pradhan RP, Arvin MB, Bahmani S (2018) Are innovation and financial development causative factors in economic growth? Evidence from a panel Granger causality test. Technol Forecast Soc Chang 132:130–142

Qiu S, Wang Z, Liu S (2021) The policy outcomes of low-carbon city construction on urban green development: evidence from a quasi-natural experiment conducted in China. Sustain Cities Soc 66

Qu C, Shao J, Cheng Z (2020a) Can embedding in global value chain drive green growth in China’s manufacturing industry? J Clean Prod 268:121962

Qu C, Shao J, Shi Z (2020b) Does financial agglomeration promote the increase of energy efficiency in China? Energy Policy 146. https://doi.org/10.1016/j.enpol.2020b.111810

Samargandi N, Sohag K (2022) The interaction of finance and innovation for low carbon economy: evidence from Saudi Arabia EnergStrat Rev 41. https://doi.org/10.1016/j.esr.2022.100847

Shahbaz M, Shahzad SJH, Ahmad N et al (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Si S, Lyu M, Lawell C, Chen S (2021) The effects of environmental policies in China on GDP, output, and profits Energy Economics 94. https://doi.org/10.1016/j.eneco.2020.105082

Sun Y , Ding W (2020) Measuring China’s regional inclusive green growth Sci Total Environ 713. https://doi.org/10.1016/j.scitotenv.2019.136367

Sun C, Tong Y, Zou W (2018) The evolution and a temporal-spatial difference analysis of green development in China. Sustain Cities Soc 41:52–61

Tamazian A, Rao B (2010) Do economic, financial and institutional developments matter for environmental degradation? Evid Transit Econ Energy Econ 32(1):137–145

Zhang H, Geng Z , Yin R, Zhang W (2020) Regional differences and convergence tendency of green development competitiveness in China J Clean Prod 254. https://doi.org/10.1016/j.jclepro.2019.119922

Tian C, Feng C (2021) The effect of resource abundance on Chinese urban green economic growth: a regional heterogeneity perspective. Growth Chang 52(3):1680–1700

Zhou G, Zhu J, Luo S (2022) The impact of fintech innovation on green growth in China: mediating effect of green finance Ecol Econ 193. https://doi.org/10.1016/j.ecolecon.2021.107308

Wang M, Zhao H, Cui J, Fan D, Lv B, Wang G, Li Z, Zhou G (2018) Evaluating green development level of nine cities within the Pearl River Delta, China. J Clean Prod 174:315–323. https://doi.org/10.1016/j.jclepro.2017.10.328

Wang M, Feng C (2021a) The win-win ability of environmental protection and economic development during China’s transition. Technol Forecast Soc Change 166 No. 120617

Wang M, Feng C (2021b) Revealing the pattern and evolution of global green development between different income groups: a global meta-frontier by-production technology approach. Environ Impact Assess Rev 89 No. 106600

Weng Q, Qin Q, Li L (2020) A comprehensive evaluation paradigm for regional green development based on “five-circle model”: a case study from Beijing-Tianjin-Hebei J Clean Prod 277. https://doi.org/10.1016/j.jclepro.2020.124076

Wu J, Lu W, Li M (2020) A DEA-based improvement of China’s green development from the perspective of resource reallocation. Sci Total Environ 717(15). https://doi.org/10.1016/j.scitotenv.2020.137106

Xie T, Liu J (2019) How does green credit affect China’s green economy growth? China Populat Resour Environ 9

Xu B, Lin B (2016) A quantile regression analysis of China’s provincial CO2 emissions: where does the difference lie? Energy Policy 98:328–342

Yang Y, Guo H, Chen L, Liu X, Gu M, Ke X (2019) Regional analysis of the green development level differences in Chinese mineral resource-based cities. Res Policy 61:261–272

Yang Y, Su X, Yao S (2021) Nexus between green finance, fintech, and high-quality economic development: empirical evidence from China Resour Policy 74. https://doi.org/10.1016/j.resourpol.2021.102445

Yuan H, Feng Y, Lee J, Liu H, Li R (2020) The spatial threshold effect and its regional boundary of financial agglomeration on green development: a case study in China J Clean Prod 244. https://doi.org/10.1016/j.jclepro.2019.118670

Yuan H, Zhang T, Feng Y, Liu Y, Ye X (2019) Does financial agglomeration promote the green development in China? A spatial spillover perspective J Clean Prod 237. https://doi.org/10.1016/j.jclepro.2019.117808

Zhang Y (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Zhang J, Wang L, Wang S (2012) Financial development and economic growth: recent evidence from China. J Comp Econ 40(3):393–412

Zhang Y, Peng H, Liu Z, Tan W (2015) Direct energy rebound effect for road passenger transport in China: a dynamic panel quantile regression approach. Energy Policy 87:303–313

Zhang H, Geng C, Wei J Coordinated development between green finance and environmental performance in China: the spatial-temporal difference and driving factors. J Clean Prod 346. https://doi.org/10.1016/j.jclepro.2022.131150

Funding

We gratefully acknowledge the following financial support: the Youth Program of National Social Science Fund of China (17CJL014), the Special Fund Program of China Postdoctoral Science Foundation (2017T100525), the Soft Science Research Project of Henan Province (212400410523), and the major project of the School of Economics in Henan University “Research on ecological civilization economy in the new era.”

Author information

Authors and Affiliations

Contributions

GX: wrote the draft of the paper. HC: built the model and ran the software. HY: part of literature review, modified and polished language. PS: supervision.

Corresponding author

Ethics declarations

Ethics approval

Not applicable, because this article does not contain any studies with human or animal subjects.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Communicated by Nicholas Apergis.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Xu, G., Chang, H., Yang, H. et al. The influence of finance on China’s green development: an empirical study based on quantile regression with province-level panel data. Environ Sci Pollut Res 29, 71033–71046 (2022). https://doi.org/10.1007/s11356-022-20856-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-20856-0