Abstract

Financial markets have always been subject to various risk constraints which are necessary for better market prediction and accurate pricing. In this context, we derive stock price distribution subject to first and second moment constraints along with the normalization constraint in terms of the q-lognormal distribution. The derived distribution is validated against six high-frequency empirical datasets. To characterize the extreme fluctuation of empirical stock returns, we derive an analytical expression for complementary cumulative distribution function of the q-Gaussian distribution in terms of Hypergeometric2F1 function. However, for the computation of the non-extensive parameter ‘q’, we provide a precise algorithm. The estimated value of ‘q’ clearly describes the well-known stylized facts such as tail fluctuation, non-Gaussian intra-day returns, and cubic power-law behavior. As the option price depends on the underlying dynamics of the stock price, we derive a accurate and closed expression for option price using q-lognormal distribution.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the present era, the study of financial markets have extensively emerged as a cornerstone for economic growth and prediction. The dynamics of financial markets are uncertain and stochastic in nature due to insufficient information flow among the market participants. The advancements in data acquisition equipment and computational techniques facilitate us to understand the intrinsic dynamics of stock price which help for a better prediction and accurate pricing. AraúJo and Ferreira (2013) proposed a morphological-rank-linear evolutionary technique for stock market prediction which does not follow the random walk principle. Efendi et al. (2018) have presented a new approach for stock market forecasting with the help of random auto-regression time series model. Several authors (Nayak et al. 2020; Verousis et al. 2018; Eholzer and Roth 2017) have applied different techniques to characterize the well-known stylized facts associated with the high-frequency stock price data sets. It has been confirmed from the high-frequency trading (Hasbrouck 2018; Seddon and Currie 2017), that the empirical data of stock return exhibits the power-law (Riyal et al. 2016; Singh and Karmeshu 2014) which creates an interest among various researchers to define a precise model to capture the dynamics of the real data. In this perspective, Gerig et al. (2009) proposed a mixture model for the return distribution to observe the tail behavior through Student’s t-distribution which is associated positive degrees of freedom (df). However, the discrete values of ‘df’ cannot describe the tail fluctuation of high-frequency data. Thus, it becomes necessary to apply the non-extensive concept (Singh and Karmeshu 2014; Singh et al. 2015; Tavayef et al. 2018) to observe the tail behavior of the stock return. As a result, Borland (2002) and Borland and Bouchaud (2004) have used the non-extensive Tsallis’ framework in their corresponding stochastic differential equation (SDE) to capture the long range memory effets. Stanley (2003) and Buchanan (2012, (2013) have noticed that all types of stock market exhibit power-law in the tail region. Pan and Sinha (2008) examined the same for Indian market, whereas, multifractal detrended fluctuation analysis (MF-DFA) has been performed by Kumar and Deo (2009) to analyze Indian market. Jaynes (1957) and Tsallis (2004) have proposed two different entropy concepts where the maximization of Shannon entropy unable to describe tail fluctuation of stock returns. However, maximization of entropy with parameter q, successfully describes the the tail behavior of underlying stock returns. It is significant to observe the convergence of Tsallis entropy to Shannon entropy as q approaches to 1 (Mukherjee et al. 2019; Bebortta et al. 2020). Thus, Senapati and Karmeshu (2016) have proposed the q-Gaussian distribution subject to entropy optimization for intra-day stock returns (IDR) in high-frequency trading. They have also validated their proposed distribution with six intra-day high-frequency stock return data sets.

As the proposed return distribution captures the tail fluctuation, it is worthwhile to calculate the CCDF for the proposed return distribution. Hence in this paper, we present a rationale mathematical expression for the CCDF in terms of Hypergeometric2F1 function to characterize tail fluctuation of underlying returns through different values of the non-extensive parameter ‘q’. We have estimated the parameter‘q’ from empirical data by minimizing the generalized symmetric Jensen Shannon (JS) measure between the return distributions and empirical histograms of six different high-frequency data. For the sake of convenience, this article also presents a precise algorithm for the estimation of parameter parameter‘q’ . Since option price relies on the underlying stock price, we have derived the underlying stock distribution in terms of q-lognormal distribution. For ‘q’ equals to one, this stock distribution also converges to the well-known log-normal distribution. Consequently, we have successfully computed the corresponding non-Gaussian option price. It is interesting to observe, our option pricing model also coincides with the famous Black–Scholes option pricing model (Black and Scholes 1973) as q tends to 1.

The remaining of this paper is organized as follows: Sect. 2, describes the computation of non-Gaussian q distribution using the maximum Tsallis’ entropy framework. Section 3, provides a brief description for the computation of Kullback–Leibler (KL) and JS measure. The next section, deals with the procedure regarding the estimation of ‘q’ parameter for the Powershares QQQ of NASDAQ 100 index high-frequency data set. Section 5 examines the tail fluctuation in five different stocks viz., SPDR S&P 500 ETF, General Motors, Ever-source Energy, Coca-Cola and NQ Mobile Inc., listed in various stock indexes. We provide the stock price distribution and the option pricing model in Sect. 6. Eventually, we conclude this paper in Sect. 7.

2 Entropy Frame Work

2.1 Intra-day Stock Return Distribution

The intra-day stock return is defined as

The non-extensive Tsallis (Tsallis 2004; Senapati and Karmeshu 2016) entropy for the above stock return is expressed as

The first and second moment constraints along with the normalization constraints are given below:

where \({{{\tilde{g}}}_{es}}\left( {R,T} \right) = \frac{{{{\left\{ {{g_q}(R,T)} \right\} }^q}}}{{\int {{{\left\{ {{g_q}(R,T)} \right\} }^q}dR} }}\) defined as the escort probability distribution (Gradojevic and Genay 2011; Namakia et al. 2013; Abe and Bagci 2005). Abe and Bagci (2005) described the difference between the uses of the general probability distribution and the escort distribution. This papers also derives the relation between ordinary expectation and q-expectation for randomly varying quantity. The existence of the power-law distribution under the non-extensive statistical phenomena is well supported by the q-expectation which is validated through their paper. The Lagrangian is defined as

with \(\lambda _1\), \(\lambda _2\) and \(\lambda _3\) being the Lagrangian parameters which are obtained from the above constraints. The corresponding Euler–Lagrange equation is given as

Thus solving the Eq. (5), the maximum entropy probability distribution for IDR can be obtained :

where the Z represents normalization constant.

It is quite significant to observe that, as \(q\rightarrow 1\) the \(g_q(R,T)\) coincide with Gaussian distribution. From the Eq. (6), we can also obtain the CCDF as,

For \(R> > 0\), the asymptotic nature of CCDF is denoted as

where \(\alpha = {\frac{{q + 1}}{{2\left( {q - 1} \right) }}}\), \(\gamma = \frac{{3 - q}}{{q - 1}}\), 2F1 is the Hypergeometric2F1 function, and \(\varGamma (.)\) denotes gamma function.

It is also observed that Eq. (9), exhibits power-law behavior which are in excellent agreement with the empirical data sets (Stanley 2003; Pan and Sinha 2008). It has been interesting to notice that the t-distribution is also capable of describing the power-law behavior of the high-frequency intra-day returns. Therefore in the next subsection, we provide some basic properties of the t-distribution in order to examine the relation between the t-distribution and the q-Gaussian distribution.

2.2 Student’s t-Distribution

The probability distribution function of Student’s-t (Brach and Dunn 2004) is given by,

where ‘a’ represents the degrees of freedom which can takes only non-negative integral values. This Eq. (10), is also used to compute the corresponding CCDF and for the higher values of return, we obtain the asymptotic nature of CCDF as

It is quite obvious from Eqs. (9) and (11), to have a relation between the exponent of the q-Gaussian distribution with the degrees of freedom t-distribution. The relation is as follows

3 Computation of q Parameter

In virtue of q-Gaussian distribution, there is a growing interest among various researchers to examine different low-frequency financial time series such as monthly data, weekly data and the daily data (Gradojevic and Genay 2011; Namakia et al. 2013). For the calculation of parameter ‘q’, Gradojevic and Genay (2011) have first computed the sum of the squares of errors between observed returns distribution with the proposed q-Gaussian distribution and then minimized the error. As a result, the estimated values of the non-extensive parameter ‘q’ found to be 1.51, 1.54 and 1.60 of weekly, monthly and daily respectively for TSE, KS11, SSE, DIJA30, NASDAQ100 and S&P 500 respectively. Similarly, Namakia et al. (2013) have found the values of q corresponding to monthly, weekly and daily empirical data sets as 1.63, 1.64 and 1.62 respectively. However, we have provided the estimation procedure for ‘q’ for different high-frequency stock returns.

3.1 Evaluation of JS Measure

Nishii (1988), has described the estimation technique for parameter ‘q’ when the true distribution is unknown. Generally this type of model appears when data available to a family containing the exact distribution is not sufficient. Following this method, here we compare the proposed q-Gaussian distribution with the histogram of empirical intra-day data sets of stock returns. In this situation, Kullback–Leibler (KL) measure plays an important role where we calculate the distance between two distributions. This paper calculates KL measure between our proposed q-distribution and the observed empirical distribution. According to Naudts (2011), the non-extensive generalized KL measure between the empirical distribution f(R, T) and the proposed distribution \(g_q(R,T)\) is defined as,

The intra-day histogram of return data is treated as the discretized form of the empirical data. Thus discretizing Eq. (13), we have

Thus to overcome the asymmetric nature of KL measure, we use symmetric JS measure (Fuglede and Topsøe 2004) which is expressed as:

We compute the value of parameter ‘q’ by minimizing the JS divergence. The estimated value of non-extensive parameter q provides a close agreement along with the empirical returns. The following formula is used to get the precise value of the parameter ‘q’ from the empirical stock-return distribution.

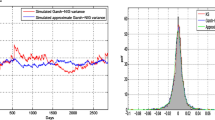

4 Computation of q for NASDAQ Data

The above discussed method is used to determine the value of parameter q for minute wise IDR data of Powershares QQQ of NASDAQ 100 (http://www.futurestickdata.com). For the ease of computation, 30 min of each trading data has been removed from 1.12.2004 to 31.12.2008 (Gerig et al. 2009; Liu et al. 1999). Trend behavior of minute wise data of Powershares QQQ of NASDAQ has been shown in Fig. 1a. From the given data sets, we have calculated the normalized return and the corresponding returns is shown in Fig. 1b. However, to show a comparison between our proposed model and the empirical returns, we need to classify the range of observed data into individual class intervals. For this purpose, we use the famous Struges formula (Martinez and Martinez 2002) for determining the bin number as, \(k = \left\lfloor {{{\log }_2}N} \right\rfloor +1\), where ⌊ ⌋ represents the floor function. Using this formula, we get 25 class intervals for \(N = O({10^6})\) number of observations (Fig. 2). It is observed from Fig. 3, that the JS measure between our proposed distribution and the empirical data attains minimum value at point A. Further, to get an insight, we have presented the computed JS measure values corresponding to different values of q around 1.5 in Table 1. It is clearly observed from the table that the JS measure provides a least value at \(q = 1.513\) i.e \(JS_{QQQ}= 2.9604848\). Thus \(q_{QQQ} = 1.513\) is found to be the minimum value of Powershares QQQ of NASDAQ 100 data. We also provide the probability density functions for stock returns corresponding to ‘q’ viz., 1.0, 1.5 and 1.513. Algorithm 1, describes the successive steps towards the estimation of non-extensive parameter q. We have successfully computed all the values of q corresponding to six different stock data sets with the use of the following algorithm 1.

a Variation of symmetric JS measure of Fig. 2 around q = 1.5. b Variation of JS symmetric measure of Student’s t from empirical Powershares QQQ data

In addition to this, we also described the asymptotic nature of the underlying return distribution at \(q = 1.513\) using the CCDF provided in Eq. (9), for large values of ‘\(\xi\)’ (Bebortta et al. 2020) and we get, \(G_{QQQ}(R)\sim \xi ^{-2.96}\).

It is quite interesting to notice that the negative exponent of high-frequency return distribution describes the stylized phenomena (Stanley 2003; Buchanan 2012) of the cubic law for stock returns. The tabulated JS measure corresponding to the non-extensive parameter q around 1.5 for Powershares QQQ is shown in Table 1. It can be observed, the minimum JS measure provides the minimum value of q. The tabulated JS measure corresponding to the non-extensive parameter q around 1.5 for Powershares QQQ is shown in Table 1. It can be observed, the minimum JS measure provides the required value of q.

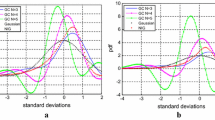

The Fig. 4a, shows the probability density functions of the empirical Powershares QQQ along with the q-Gaussian distributions for \(q= 1.0\), 1.5 and 1.513, Gaussian distribution and Student’s t-distribution.

5 Stylized fact analysis

SPDR S&P 500 ETF, General Motors, Ever-source Energy, Coca-Cola and NQ Mobile Inc., are also examined to observe the cubic law for high-frequency intra-day returns. As discussed earlier, we performed the JS measure between all the given stock intra-day returns data with our proposed distribution. Thereafter, we determine the parameter q for the respective stock returns. JS measures for all the above stock data against different values of ‘q’ lying in the interval (1, 3) are evaluated.

We have also calculated the JS measure for the Student’s-t distribution corresponding to all the underlying data sets. The divergence values for m = 3, are observed to be (1) 2.960543 (QQQ), (2) 5.067457 (SPY), (2) 5.067457 (SPY), (3) 5.176774 (GM), (4) 5.648495 (ES), (5) 4.904609 (KO) and (6) 4.858626 (NQ). Further, tabulated values for the JS divergence are also given to identify the value of parameter q with minimum JS value. For the sake of convenience, the parameter q with minimum JS value is represented through bold form in each table. From the Tables 1, 2, 3, 4, 5, and 6 the minimum values of the JS divergence are found as (1) 2.9604848 (QQQ), (2) 5.0674539 (SPY), (3) 5.1767703 (GM), (4) 5.6484839 (ES), (5) 4.9046019 (KO), and (6) 4.8586260 (NQ) obtained for \(q = 1.513\), \(q = 1.505\), \(q = 1.505\), \(q= 1.508\), \(q = 1.507\), and \(q =1.499\) respectively. So, using these values of ‘q’, we have obtained closed agreements between the empirical data sets and the proposed q-Gaussian distribution. The CCDF obtained in Eq. (9), captures the stylized fact from empirical returns with various negative exponents and can be represented as:

The tabulated JS measure corresponding to the non-extensive parameter q around 1.5 for SPDR S&P 500 ETF is shown in Table 2. It can be observed, the minimum JS measure provides the required value of q. The Fig. 5b, shows the probability density functions of the empirical SPDR S&P 500 ETF along with the q-Gaussian distributions for \(q= 1.0\), 1.5 and 1.513, Gaussian distribution and Student’s t-distribution. The tabulated JS measure corresponding to the non-extensive parameter q around 1.5 for General Motors is shown in Table 4. It can be observed, the minimum JS measure provides the required value of q. The Fig. 5a, shows the probability density functions of the empirical General Motors along with the q-Gaussian distributions for \(q= 1.0\), 1.5 and 1.513 and 1.513, Gaussian distribution and Student’s t-distribution. The tabulated JS measure corresponding to the non-extensive parameter q around 1.5 for Ever Source Energy is shown in Table 3. It can be observed, the minimum JS measure provides the required value of q. The Fig. 5b, shows the probability density functions of the empirical Eversource Energy along with the q-Gaussian distributions for \(q= 1.0\), 1.5 and 1.513, Gaussian distribution and Student’s t-distribution. The tabulated JS measure corresponding to the non-extensive parameter q around 1.5 for Coca-Cola is shown in Table 5. It can be observed, the minimum JS measure provides the required value of q. The Fig. 6a, shows the probability density functions of the empirical Coca-Cola along with the q-Gaussian distributions for \(q= 1.0\), 1.5 and 1.513, Gaussian distribution and Student’s t-distribution. The tabulated JS measure corresponding to the non-extensive parameter q around 1.5 for NQ Mobile Inc. is shown in Table 6. It can be observed, the minimum JS measure provides the required value of q. The Fig. 6b, shows the probability density functions of the empirical NQ Mobile Inc. along with the q-Gaussian distributions for \(q= 1.0\), 1.5 and 1.513, Gaussian distribution and Student’s t-distribution. It is customary to show the CCDF in log-log scale to observe the exponent of power-law from both empirical and theoretical model. The slope of the straight line from the CCDF figure corresponding to each underlying return data set provides respective exponent measure. The existence of power-law behavior for six different stock returns is shown in the Fig. 7 in terms of corresponding CCDFs.

6 Stock Price Distribution with Option Price

It has been observed that Glasserman (2013), stock price is governed by the following stochastic differential equation:

which is associated with a Wiener process W, and the parameters \(\mu\) and \(\sigma\) representing the drift and degree of fluctuation respectively. The solution of the above Eq. (18), gives rise to the Geometric Brownian Motion (GBM) (Albanese and Campolieti 2006) as,

The log-normal distribution of Eq. (19), is given by,

Hull (2006) have provided a famous option pricing model where stock return exhibits Gaussian distribution. However, from the empirical data, it has been shown that returns does not follow the Gaussian distribution which has been studied by Senapati and Karmeshu (2016) through six different stocks. Lahmiri (2016) proposed modeling and forecasting techniques for intra-day stock price which is highly fluctuating and non stationary in nature.

The q-lognormal distribution of stock price can be obtained using Eqs. (1) and (6), as,

Following Černỳ (2009), we use the risk-neutral probability \(\mu = r - \frac{{{\sigma ^2}}}{2}\) in Eq. (21), and we have,

Fig. 8a, shows the plot of the well known lognormal distribution, along with the q-lognormal distribution Eq. (22) for \(q=1\).

Figure 8, represents the plot of q-lognormal distribution Eq. (22), for three different values of parameter q. Now, we wish to determine the non-Gaussian option price corresponding to the given stock price distribution Eq. (22). The European call price (Albanese and Campolieti 2006; Hull 2006) under risk neutral measure Q is given by,

where \({\mathcal {F}}_{t}\) represents filtration which depends on past information up to time T (Albanese and Campolieti 2006) and K is the strike price at time T. The non-Gaussian option price can be obtained by incorporating the proposed q-lognormal distribution Eq. (22) with Eq. (23), as,

Substituting R = \(\log \left( {{{{S_T}} / {{S_0}}}} \right)\), we have,

Let \(y = \frac{{R - \left( {r - \frac{{{\sigma ^2}}}{2}} \right) T}}{{\sigma \sqrt{T} }}\).

The condition for non-zero option implies that the stock price should be greater than the strike price. Thus, we obtain,

Using the above condition, Eq. (26), becomes,

where \({y_1} = \frac{{\log \left( {{K / {{S_0}}}} \right) - \left( {r - \frac{{{\sigma ^2}}}{2}} \right) T}}{{\sigma \sqrt{T} }}\). The option price obtained in Eq. (28), can be represented in it’s closed form as,

where \({A_q}\left( {{y_1}} \right) = \frac{{{e^{ - \frac{{{\sigma ^2}}}{2}T}}\sigma \sqrt{T} }}{Z}\int \limits _{{y_1}}^\infty {{e^{\sigma \sqrt{T} y}}} {\left\{ {1 - \left( {\frac{{1 - q}}{{3 - q}}} \right) {y^2}} \right\} ^{^{\frac{1}{{1 - q}}}}}dy\) and \({B_q} \left( {{y_1}} \right) = \frac{{\sigma \sqrt{T} }}{Z}\int \limits _{{y_1}}^\infty {{{\left\{ {1 - \left( {\frac{{1 - q}}{{3 - q}}} \right) {y^2}} \right\} }^{^{^{\frac{1}{{1 - q}}}}}}}dy\)

Figure 9a, depicts the proposed q-Gaussian option price for the Eq. (29), along with Black–Scholes price for T = 1.

a Call price of Black–Scholes model with q-Gaussian price \((q\rightarrow 1.5)\) for \(T=1\), \(S_{0}=10\), \(\sigma =0.03\), \(r=0.08\), and \(K=50\), b call price of Black–Scholes model with q-Gaussian price \((q\rightarrow 1.5)\) for \(T=0.75\), \(S_{0}=10,\) \(\sigma =0.03\), \(r=0.08\), and \(K=50\)

Figure 9b, shows the proposed q-Gaussian option price Eq. (29), along with Black–Scholes price for T = 0.75. Figure 10a, illustrates the proposed q-Gaussian option price Eq. (29), along with Black–Scholes price for T = 0.5.

a Call price of Black–Scholes model with q-Gaussian price \((q\rightarrow 1.5)\) for \(T=0.5\), \(S_{0}=10\), \(\sigma =0.03\), \(r=0.08\), and \(K=50\), b call price of Black–Scholes model with q-Gaussian price \((q\rightarrow 1.5)\) for \(T=0.25\), \(S_{0}=10\), \(\sigma =0.03\), \(r=0.08\), and \(K=50\)

Figure 10b, depicts the proposed q-Gaussian option price Eq. (29), along with Black–Scholes price for T = 0.25. The convergence of the proposed q-Gaussian option price Eq. (29), for \(q=1\) with the famous Black–Scholes option price for different time periods are shown in Fig. 11.

7 Conclusion and Future Works

It has been an interesting and challenging task to study the dynamical behavior of intra-day high-frequency data. For this purpose, we exploited the significance of the powerful Tsallis’ framework to obtain q-Gaussian distribution for stock return by maximizing Tsallis entropy under first, second moment constraints along with the normalization constraint. The generalized JS divergence phenomena is employed to compute the parameter ‘q’ for various stocks. We have examined six high-frequency datasets listed in different indices for the validation of the proposed distribution through different ‘q’ values. For the sake of convenience, a precise algorithm has been proposed for the estimation of parameter ‘q’. The derived distribution has clearly explained the cubic power-law stylized fact of the above empirical stock returns for the corresponding non-extensive parameter q. For characterizing the tail fluctuation, we have successfully computed the CCDF for the underlying return distribution through Hypergeometric2F1 function. In addition to this, the corresponding stock distribution is derived in terms of q-lognormal distribution which is used to provide the non-Gaussian option price.

References

Abe, S., & Bagci, G. B. (2005). Necessity of q-expectation value in nonextensize statistical mechanics. Physical Review E, 371, 016139.

Albanese, C., & Campolieti, G. (2006). Advanced derivatives pricing and risk management: Theory, tools and hands-on programming application. New York: Academic Press.

AraúJo, R. D. A., & Ferreira, T. A. E. (2013). A morphological-rank-linear evolutionary method for stock market prediction. Information Sciences, 237, 3–17.

Bebortta, S., Senapati, D., Rajput, N. K., Singh, A. K., Rathi, V. K., Pandey, H. M., et al. (2020). Evidence of power-law behavior in cognitive IoT applications. Neural Computing and Applications. https://doi.org/10.1007/s00521-020-04705-0.

Bebortta, S., Singh, A. K., Mohanty, S., & Senapati, D. (2020). Characterization of range for smart home sensors using Tsallis’ entropy framework. In B. Pati, C. R. Panigrahi, R. Buyya, & K.-C. Li (Eds.), Advanced computing and intelligent engineering (pp. 265–276). Berlin: Springer.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637–654.

Borland, L. (2002). A theory of non-Gaussian option pricing. Quantitative Finance, 2, 415–431.

Borland, L., & Bouchaud, J. P. (2004). A non-Gaussian option pricing model with skew. Quantitative Finance, 4, 499–514.

Brach, R. M., & Dunn, P. F. (2004). Uncertainty analysis for forensic science (p. 56). Tucson: Lawyers & Judges Publishing Company.

Buchanan, M. (2012). It’s a (stylized) fact!. Nature Physics, 8, 3.

Buchanan, M. (2013). What has econophysics ever done for us? Nature Physics, 9, 317.

Černỳ, A. (2009). Mathematical techniques in finance: Tools for incomplete markets (p. 144). Princeton University Press: Princeton.

Efendi, R., Arbaiy, N., & Deris, M. M. (2018). A new procedure in stock market forecasting based on fuzzy random auto-regression time series model. Information Sciences, 441, 113–132.

Eholzer, W., & Roth, R. (2017). The role of high-frequency trading in modern financial markets. In R. Francioni & R. Schwartz (Eds.), Equity markets in transition (pp. 337–361). Berlin: Springer.

Fuglede, B., & Topsøe, F. (2004). Jensen–Shannon divergence and Hilbert space embedding. In IEEE international symposium on information theory (p. 31).

Gerig, A., Vicente, J., & Fuentes, M. A. (2009). Model for non-Gaussian intraday stock returns. Physical Review E, 80, 4.

Glasserman, P. (2013). Monte Carlo methods in financial engineering (Vol. 53). Berlin: Springer.

Gradojevic, N., & Genay, R. (2011). Financial applications of nonextensive entropy. IEEE Signal Processing Magazine, 28, 116–141.

Hasbrouck, J. (2018). High-frequency quoting: Short-term volatility in bids and offers. Journal of Financial and Quantitative Analysis, 53(2), 613–641.

Hull, J. C. (2006). Options, futures, and other derivatives. New Delhi: Pearson Education India.

Jaynes, E. T. (1957). Information theory and statistical mechanics. Physical Review, 106(4), 620.

Kumar, S., & Deo, N. (2009). Multifractal properties of the Indian financial market. Physica A, 388, 1593–1602.

Lahmiri, S. (2016). Intraday stock price forecasting based on variational mode decomposition. Journal of Computational Science, 12, 23–27.

Liu, Y., Gopikrishnan, P., Cizeau, P., Meyer, M., Peng, C. K., & Stanley, H. E. (1999). Statistical properties of the volatility of price fluctuations. Physical Review E, 60, 1390–1400.

Martinez, W. L., & Martinez, A. R. (2002). Computational statistics handbook with matlab (p. 264). Boca Raton: Chapman & Hall/CRC.

Mukherjee, T., Singh, A. K., & Senapati, D. (2019). Performance evaluation of wireless communication systems over Weibull/q-lognormal shadowed fading using Tsallis’ entropy framework. Wireless Personal Communications, 106(2), 789–803.

Namakia, A., Koohi Lai, Z., Jafari, G. R., Raei, R., & Tehrani, R. (2013). Comparing emerging and mature markets during times of crises: A non-extensive statistical approach. Physica A, 392, 3039–3044.

Naudts, J. (2011). Contnuity of a class of entropies and relative entropies. Reviews in Mathematical Physics, 16, 809–822.

Nayak, G., Senapati, D., & Bhattacharjee, S. (2020). Option pricing model based on sentiment using the Gram-Charlier expansion. Sustainable Humanosphere, 16(1), 669–677.

Nishii, R. (1988). Maximum likelihood principle and model selection when the true model is unspecified. Journal of Multivariate Analysis, 27, 392–403.

Pan, R. K., & Sinha, S. (2008). Inverse-cubic law of index fluctuation distribution in Indian markets. Physica A, 387, 2055–2065.

Riyal, M. K., Rajput, N. K., Khanduri, V. P., & Rawat, L. (2016). Rank-frequency analysis of characters in Garhwali text: Emergence of Zipf’s law. Current Science, 110(3), 429–434.

Seddon, J. J. J. M., & Currie, W. L. (2017). A model for unpacking big data analytics in high-frequency trading. Journal of Business Research, 70, 300–307.

Senapati, D., & Karmeshu (2016). Generation of cubic power-law for high frequency intra-day return: Maximum tsallis entropy framework. Digital Signal Processing, 48, 276–284.

Singh, A. K., & Karmeshu (2014). Power law behavior of queue size: Maximum entropy principle with shifted geometric mean constraint. IEEE Communications Letters, 18(8), 1335–1338.

Singh, A. K., Pratap, H., & Krmeshu (2015). Analysis of finite buffer queue: Maximum entropy probability distribution with shifted fractional geometric and arithmetic means. IEEE Communications Letters, 19(2), 163–166.

Stanley, H. E. (2003). A theory of power-law distributions in fiancial market fluctuations. Nature, 423, 267–270.

Tavayef, M., Sheykhi, A., Bamba, K., & Moradpour, H. (2018). Tsallis holographic dark energy. Physics Letters B, 781, 195–200.

Tsallis, C. (2004). Non-extensive statistical mechanics: Construction and physical interpretation. In M. Gellmann & C. Tsallis (Eds.), Nonextensive entropy interdisciplinary applications (pp. 1–52). Oxford: Oxford University Press.

Verousis, T., Perotti, P., & Sermpinis, G. (2018). One size fits all? High frequency trading, tick size changes and the implications for exchanges: Market quality and market structure considerations. Review of Quantitative Finance and Accounting, 50(2), 353–392.

Acknowledgements

We are thankful to the Department of Science and Technology (DST) for their continuous financial support.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nayak, G., Singh, A.K. & Senapati, D. Computational Modeling of Non-Gaussian Option Price Using Non-extensive Tsallis’ Entropy Framework. Comput Econ 57, 1353–1371 (2021). https://doi.org/10.1007/s10614-020-10015-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-020-10015-3