Abstract

This article deals with a deteriorated economic production quantity (EPQ) inventory model where the preservation technology is applied to restore the significant loss of items during production. The demand function is unit selling price and stock sensitive, and the production rate is also stock sensitive. Here we assume that the sum of percentage of deterioration and the rate of preservation is 100%. First of all, we develop a profit function for EPQ model under given assumptions, and then, we split the model into three different submodels by considering the unit selling price, unit cost prices and taking both of them as lock fuzzy numbers, respectively. Numerical illustrations are done with the help of a solution algorithm based on \(\alpha -\) cuts of fuzzy numbers, and it has been compared with the results of general fuzzy cases of each of the submodels. Graphical illustrations and sensitivity analysis are made to show the novelty of the new approach. The managerial insights are also discussed followed by a conclusion.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

1.1 Literature review on related inventory model

The word inventory stands not only for stock of goods which may be of three types: raw materials’, semi-finished good and finished good but also its management and operations. Harris (1915) examined the establishment of inventory control problem in field of operation research which was the traditional economic order quantity (EOQ) model. From the improvement in the EOQ model, a great deal of research work has been made on the inventory control problems which also included the economic production quantity (EPQ) model. In practical sense, almost all products loss their utility after certain period which indicates that deterioration is an important factor to study. Ghare and Schrader (1963) were the first who developed an inventory model with constant deterioration. Then, several works (see Li et al. 2010; Tan et al. 2013; Shaikh et al. 2019a, b, Lee et al. 2012; Bhunia et al. 2014; Jaggi et al. 2015) have been reported in this context.

Preservation is an important issue to resist the deterioration of the items. Hsu et al. (2010) first used the concept of preservation technique in the study of inventory control problems. Following this work, more researches (see Pal et al. 2018; Dye and Hsieh 2012; Hsieh and Dye 2013; Dye 2013) had carried out in this direction. Zhang et al. (2014) considered preservation and deterioration for a problem with stock-dependent demand. Also, selling price of items plays a vital role on the demand of product. Mishra et al. (2017) presented a preservation inventory model under the price-dependent demand with shortage. Teng and Chang (2005) proposed a model with stock- and price-dependent demand. Hou and Lin (2006) also introduced a model with the demand related to price and stock of items. Some more research works (see Yang 2012; Yang et al. 2015; Zhang et al. 2016; Pal et al. 2013; Shaikh et al. 2019a, b; Li et al. 2019) are noted in this context. Recently, Rahaman et al. (2020) described a fractional order model with stock- and price-dependent demand and stock-dependent production rate of deteriorated items.

1.2 Recent development of fuzzy decision-making in inventory management problems

Zadeh (1965) introduced the concept of fuzzy set. Subsequently, the concept was utilized by Bellman and Zadeh (1970) in decision-making problems. From that point forward, numerous researches have been occupied by describing the actual nature of the fuzzy set (see Dubois and Prade 1978; Kaufmann and Gupta 1985; Baez-Sancheza et al. 2012; Beg and Ashraf 2014; Deli and Broumi 2015; Kumar 2018). Also, Diamond (1989, 1990) has discussed both k-type fuzzy numbers and star-type fuzzy numbers. A means of finding the membership of general fuzzy numbers was also developed by Chutia et al. (2010). Roychoudhury and Pedrycz (2003) provided the functional relationship among fuzzy complements. In addition, fuzzy control theory was enriched by Bobeylev (1985, 1988) with the help of the Cauchy problem. Buckley (1988) discussed the generalization of fuzzy sets for practical applications. To date, a number of researchers, including Roy and Maji (2010), Molodtsov (1999), Cagman et al. (2011) etc., have studied fuzzy soft sets; fuzzy rough sets were developed by Pawlak (1982), and hesitant fuzzy sets have been improved by Torra (2010), Karmakar et al. (2017a), De and Sana (2015), etc., in real-world final decision-making problems.

Moreover, the concept of integrating the impact of learning experiences into fuzzy sets, namely the triangular dense fuzzy set (TDFS), along with new defuzzification methods, was described by De and Beg (2016a, b), and they also utilized this fuzzy set in philosophical contexts also (see De and Beg 2016a, b). In their observations, the Cauchy sequence was employed, which naturally converges to zero. Using this property, they studied the triangular dense fuzzy set, in which the ambiguity decreases with time. De and Mahata (2016) discussed the cloudy fuzzy set, which is an important extension of the triangular dense fuzzy set using a continuous time variable. Recently, Karmakar et al. (2017b, 2018) studied a pollution control scheme for a sponge iron production plant model utilizing the triangular dense fuzzy rule. Additionally, Rahaman et al. (2021a, b) studied the joint impact of learning and memory on the lot-sizing problem using fuzzy fractional calculus under the dense fuzzy sense. A two-decision-makers single-decision inventory model utilizes the concept of the triangular dense fuzzy lock set. Recently, Rahaman et al. (2021a, b) studied an EOQ model with price-dependent demand rate under memory motivated lock fuzzy scenario.

1.3 Motivation

After brief reviewing the EPQ model, our finding is that (a) stock-, price-dependent demand and production rate, (b) deterioration and preservation technology against deterioration are rarely used in the literature. Focusing this point of view, we develop an EPQ model where (a) demand is a linear function of price and stock; (b) production rate is a linear function of stock; (c) deterioration occurred, (d) preservation technology is applied to prevent deterioration. Again, basic objective of fuzzy theory is to reach the goal under uncertain phenomena. De (2017) introduced the novel idea of lock fuzzy set which enlightens the new aspect of fuzziness. We have used this fact in decision-making for our proposed model which has the capability to give better optimization. Moreover, in a manufacturing farm, if more stock is raised, then it is better to decrease the production rate. Similarly, more selling price of items reduces the interest of customers for certain items. But, the displayed stock in showrooms makes a positive result on demand pattern and some times over stock may reduce the demand. Thus, this is an exceptionally intriguing and needful study relating to the control of stocks of the manufacturing farms.

2 Preliminaries

In this section, some important definitions and known results regarding triangular dense fuzzy set (De and Beg 2016a, b) and triangular dense fuzzy lock set De (2018) are presented here which are needful to describe the fuzzy model.

Definition 2.1

Let \(\tilde{A }\) be fuzzy number whose components are elements of the Cartesian product \({\mathbb{R}}\times {\mathbb{N}}\), (where \({\mathbb{R}}\) and \({\mathbb{N}}\) represent the set of real numbers and natural number, respectively) with membership grade satisfying the functional relation \(\mu :{\mathbb{R}}\times {\mathbb{N}}\to [\mathrm{0,1}]\). If \(\mu (x,n)\to 1\), as \(n\to \infty \), for some \(x\in {\mathbb{R}}\) and \(n\in {\mathbb{N}}\), then \(\tilde{A }\) is called dense fuzzy set.

In particular, if \(\tilde{A }\) is triangular in the above definition, it is called triangular dense fuzzy set (TDFS). Furthermore, if \(\mu (x,n)\) attain the highest membership degree \(1\) for some \(n\in {\mathbb{N}}\), then it is called the normalized triangular dense fuzzy set (NTDFS).

Example 2.1

Let us take a NTDFS as follows.

\(\tilde{A }=<a\left(1-\frac{\rho }{1+n}\right),a, a\left(1+\frac{\sigma }{1+n}\right)>\), where \(\rho ,\sigma \in (\mathrm{0,1})\), \(a\) be a real number and \(n\) be a natural number. Then, its membership function is given by

Definition 2.2

Let \(\tilde{A }=<a,b,c>\) be a TDFS, and if \(\mu (x,n)\nrightarrow 1\), as \(n\to \infty \), for some \(x\in {\mathbb{R}}\) and \(n\in {\mathbb{N}}\) and consequently its index value \(I(\tilde{A })\nrightarrow b\), then \(\tilde{A }\) is called triangular dense fuzzy lock set (TDFLS).

Definition 2.3

Let \(\tilde{A }=<b{t}_{n},b,b{s}_{n}>\) be a sequential form of TDFS, where \({t}_{n}\) and \({s}_{n}\) are two sequence functions. And if \({t}_{n}\to {\delta }_{1}(<1)\) and \({s}_{n}\to {\delta }_{2}\) (> 1) as \(n\to \infty \), then \(\tilde{A }\nrightarrow \{b\}\) and \(\tilde{A }\) is called triangular dense fuzzy lock set (TDFLS).

Definition 2.4

Let the sequential definition of TDFS is \(\tilde{A }=<a\left(1-\rho {t}_{n}\right), a,a\left(1+\sigma { s}_{n}\right)>\), where \(\rho ,\sigma \in {\mathbb{R}}\) and \({t}_{n}\), \({s}_{n}\) are two Cauchy sequence of functions having the point of convergence \(\frac{1}{{k}_{1}}\) and \(\frac{1}{{k}_{2}},\) respectively (\({k}_{1}\) and \({k}_{2}\) are two nonzero real numbers). Then, \(\tilde{A }\) is called triangular dense fuzzy lock set (TDFLS) with double keys \({k}_{1}\) and \({k}_{2},\) respectively, and the keys depend upon \(\rho \) and \(\sigma \).

The membership function of TDFLS defined above is given by

Example 2.2

Let us take a TDFLS as follows. \(\tilde{A }=<a\left(1-\rho (\frac{1}{{k}_{1}}-\frac{1}{1+n})\right),a, a\left(1+\sigma (\frac{1}{{k}_{2}}+\frac{1}{1+n})\right)>\), where \(\rho ,\sigma \in (\mathrm{0,1})\), \(a\) be a real number and \(n\) be a natural number; \({k}_{1}\) and \({k}_{2}\) are two nonzero real numbers. Here, \({k}_{1}\) and \({k}_{2}\) are two keys of the TDFLS. Its membership function is given by

3 Notations and assumptions

To describe our proposed problem, we use the following notations with certain units and description given in Table 1.

3.1 Assumptions

The following assumptions have been considered to be used in the proposed model:

-

i)

The production rate \(K(t)\) is assumed to be a linear function of stock. Considering the intuitive facts that the production is better to be decreased in the presence of large stock is used here. Thus, \(K(t)=\gamma -\delta I(t)\), where \(\gamma ,\delta >0\) and \(I(t)\) is the on-hand inventory or stock.

-

ii)

Demand of the production depends on price and stock. Fact is that the demand increases and decreases according as the selling price is decreases and increases, respectively. Also, the presence of the lot of stock may provide positive or negative impact in demand. Sometimes, more displayed stock attracts customer and increases the demand. However, it also quite possible that customer’s interest on products which are much available in the market is gone decreasing. Therefore, \(D(t)=\eta -\zeta p+\xi I(t),\) where \(\eta ,\zeta \) are positive constant, \(\xi \) is any constant and \(p\) is the price of the product.

-

iii)

Deterioration of the product occurs both in the production and non-production period. Also, to decrease the deterioration, preservation technology is applied to the system. The deterioration rate (\(\theta \)) and preservation rate \((\phi )\) are constants satisfying the relation \(\theta +\phi =1\).

-

iv)

No shortage is allowed.

-

v)

Replenishment rate is infinite, but lot size is finite.

-

vi)

The time horizon is infinite.

-

vii)

Lead time is zero.

4 Defining the EPQ inventory model under several environments

4.1 Formulation of Crisp EPQ model

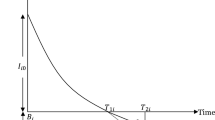

The inventory starts at \(t=0\) with the production rate \(K.\) During the time interval \(0\le t\le {T}_{1}\), the inventory level decreases meeting up the demand at the rate \(D\) and facing a deterioration of the rate \(\phi \). Also, the fresh production and preservation at the rate \(\theta \) make a positive impact on the growth of the inventory level. However, the total combine effect makes a result of decreasing the level of stock during this time interval. At time \({t=T}_{1}\), the production is stopped after reaching the sufficient stock of the product. During the time interval \({T}_{1}\le t\le T\), all the components except the production remain same, and thus, in the second phase (non-productive phase) of the cycle, the stock level decreases gradually, and at the time \(t=T\), the inventory cycle is stopped with zero level of stock after fulfilling the demand. Figure 1 describes the change of inventory with respect to time.

Then, the governing differential equations of the production process are given below:

With

Solving the Eqs. (1) and (2) and by using (3), we get

Also, using the continuity condition at \(t={T}_{1}\) in (4) and (5), we have \(I\left({T}_{1}\right)=J\left({T}_{1}\right)\)

i.e.,

Also, then

Total sales revenue

where \(X={\int }_{0}^{{T}_{1}}I(t)dt+{\int }_{{T}_{1}}^{T}J(t)dt\)

and

Total setup cost \({=c}_{s}\)

Total holding cost,

Total production cost

where

Total deterioration cost

Total preservation cost

So, the total profit per cycle is given by

And thus, total average profit \(TAP=\frac{TP}{T}={F}_{0}{p}^{2}+{F}_{1}p+{F}_{2}\) and the basic problem is given by

4.2 Particular Cases under crisp problem

Case 1: when deterioration is occurred completely in the absence of preservation.

Let, \(\theta \to 0\) then \(\phi \to 1\) and then

where \({{F}_{0}}^{\mathrm{^{\prime}}}=\frac{\left(\xi {B}^{\mathrm{^{\prime}}}-T\right)\zeta }{T}\), \({{F}_{1}}^{\mathrm{^{\prime}}}=\frac{\left(\eta T+\xi {A}^{\mathrm{^{\prime}}}\right)-{c}_{h}\zeta {B}^{\mathrm{^{\prime}}}+{N}^{\mathrm{^{\prime}}}-{c}_{d}\zeta \left\{{B}^{\mathrm{^{\prime}}}\left(1-\xi \right)+T\right\}}{T}\), \({{F}_{3}}^{\mathrm{^{\prime}}}=-\frac{{c}_{s}+{c}_{h}{A}^{\mathrm{^{\prime}}}+{M}^{\mathrm{^{\prime}}}+{c}_{d}\left\{{A}^{\mathrm{^{\prime}}}\left(1-\xi \right)-\eta T\right\}}{T},\) \({A}^{\mathrm{^{\prime}}}=\frac{(\gamma -\eta )}{(1+\delta +\xi )}\left[{T}_{1}+\frac{{{e}}^{-\left(1+\delta +\xi \right){T}_{1}}-1}{\left(1+\delta +\xi \right)}\right]-\frac{\eta }{(1+\xi )}\left[(T-{T}_{1})+\frac{1-{{e}}^{\left(1+\xi \right){(T-T}_{1})}}{\left(1+\xi \right)}\right]\), \({B}^{\mathrm{^{\prime}}}=\frac{1}{(1+\delta +\xi )}\left[{T}_{1}+\frac{{{e}}^{-\left(1+\delta +\xi \right){T}_{1}}-1}{\left(1+\delta +\xi \right)}\right]+\frac{1}{(1+\xi )}\left[(T-{T}_{1})+\frac{1-{{e}}^{\left(1+\xi \right){(T-T}_{1})}}{\left(1+\xi \right)}\right]\)

Case 2: when the demand is independent of the price.

If, \(\zeta \to 0\) then \(TAP={{F}_{0}}^{^{\prime}}{p}^{2}+{{F}_{1}}^{^{\prime}}p+{{F}_{3}}^{^{\prime}}, {I}_{max}=\frac{(\gamma -\eta )}{(\phi -\theta +\delta +\xi )}\left[1-{{e}}^{-\left(\phi -\theta +\delta +\xi \right){T}_{1}}\right]\)

Case 3: when complete preservation confirms no deterioration.

If, \(\phi \to 0\), then \(\theta \to 1\) and then \(TAP={{F}_{0}}^{^{\prime}}{p}^{2}+{{F}_{1}}^{^{\prime}}p+{{F}_{3}}^{^{\prime}}\), \({I}_{max}=\frac{(\gamma -\eta +\zeta p)}{(-1+\delta +\xi )}\left[1-{{e}}^{-\left(-1+\delta +\xi \right){T}_{1}}\right]\), where \({{F}_{0}}^{^{\prime}}=\frac{\left(\xi {B}^{^{\prime}}-T\right)\zeta }{T}\), \({{F}_{1}}^{^{\prime}}=\frac{\left(\eta T+\xi {A}^{^{\prime}}\right)-{c}_{h}\zeta {B}^{^{\prime}}+{N}^{^{\prime}}-{c}_{pr}\zeta \left\{{B}^{^{\prime}}\left(1-\xi \right)+T\right\}}{T}\), \({{F}_{3}}^{^{\prime}}=-\frac{{c}_{s}+{c}_{h}{A}^{^{\prime}}+{M}^{^{\prime}}+{c}_{pr}\left\{{A}^{^{\prime}}\left(1-\xi \right)-\eta T\right\}}{T}\), \({A}^{^{\prime}}=\frac{(\gamma -\eta )}{(-1+\delta +\xi )}\left[{T}_{1}+\frac{{{e}}^{-\left(-1+\delta +\xi \right){T}_{1}}-1}{\left(-1+\delta +\xi \right)}\right]-\frac{\eta }{(-1+\xi )}\left[(T-{T}_{1})+\frac{1-{{e}}^{\left(-1+\xi \right){(T-T}_{1})}}{\left(-1+\xi \right)}\right]\), \({B}^{^{\prime}}=\frac{1}{(-1+\delta +\xi )}\left[{T}_{1}+\frac{{{e}}^{-\left(-1+\delta +\xi \right){T}_{1}}-1}{\left(-1+\delta +\xi \right)}\right]+\frac{1}{(-1+\xi )}\left[(T-{T}_{1})+\frac{1-{{e}}^{\left(-1+\xi \right){(T-T}_{1})}}{\left(-1+\xi \right)}\right]\), \({M}^{^{\prime}}={c}_{p}\gamma {T}_{1}-\frac{(\gamma -\eta ){c}_{p}\delta }{(-1+\delta +\xi )}\left[{T}_{1}+\frac{{{e}}^{-\left(-1+\delta +\xi \right){T}_{1}}-1}{\left(-1+\delta +\xi \right)}\right]\) and \({N}^{^{\prime}}=\frac{\zeta {c}_{p}\delta }{(-1+\delta +\xi )}\left[{T}_{1}+\frac{{{e}}^{-\left(-1+\delta +\xi \right){T}_{1}}-1}{\left(-1+\delta +\xi \right)}\right]\)

Case 4: when deterioration does not occur, and hence, there is no need of preservation.

If, \(\theta , \phi \to 0\) then \(TAP={{F}_{0}}^{^{\prime}}{p}^{2}+{{F}_{1}}^{^{\prime}}p+{{F}_{3}}^{^{\prime}}{I}_{max}=\frac{1}{(\delta +\xi )}\left[1-{{e}}^{-\left(\delta +\xi \right){T}_{1}}\right](\gamma -\eta +\zeta p)\)

Case 5: when deterioration does not occur, and hence, there is no need of preservation and neither demand nor production depends on stock.

If, \(\phi ,\theta ,\delta ,\xi \to 0\) Then \(TAP={{F}_{0}}^{^{\prime}}{p}^{2}+{{F}_{1}}^{^{\prime}}p+{{F}_{3}}^{^{\prime}}\), \({I}_{max}=\underset{\delta \to 0}{\mathrm{lim}}\frac{(\gamma -\eta +\zeta p)}{\delta }\left[1-{{e}}^{-{\delta T}_{1}}\right]=(\gamma -\eta +\zeta p){T}_{1}\), \({{F}_{0}}^{^{\prime}}=-\zeta \), \({{F}_{1}}^{^{\prime}}=\frac{\eta T-{c}_{h}\zeta {B}^{^{\prime}}+{N}^{^{\prime}}}{T}\), \({{F}_{3}}^{^{\prime}}=-\frac{{c}_{s}+{c}_{h}{A}^{^{\prime}}+{M}^{^{\prime}}}{T}\), \({A}^{^{\prime}}=\underset{\delta \to 0}{\mathrm{lim}}\frac{(\gamma -\eta )}{\delta }\left[{T}_{1}+\frac{{{e}}^{-\delta {T}_{1}}-1}{\delta }\right] -\underset{\xi \to 0}{\mathrm{lim}}\frac{\eta }{\xi }\left[(T-{T}_{1})+\frac{1-{{e}}^{{\xi (T-T}_{1})}}{\xi }\right]=\underset{\delta \to 0}{\mathrm{lim}}\frac{(\gamma -\eta )}{{\delta }^{2}}\left[\delta {T}_{1}+{{e}}^{-\delta {T}_{1}}-1\right] -\underset{\xi \to 0}{\mathrm{lim}}\frac{\eta }{{\xi }^{2}}\left[\xi (T-{T}_{1})+1-{{e}}^{{\xi (T-T}_{1})}\right]\), \(=\frac{\left(\gamma -\eta \right){{T}_{1}}^{2}+\eta {(T-{T}_{1})}^{2}}{2}\), \({B}^{^{\prime}}=\underset{\delta \to 0}{\mathrm{lim}}\frac{1}{\delta }\left[{T}_{1}+\frac{{{e}}^{-\delta {T}_{1}}-1}{\delta }\right]+\underset{\xi \to 0}{\mathrm{lim}}\frac{1}{\xi }\left[(T-{T}_{1})+\frac{1-{{e}}^{{\xi (T-T}_{1})}}{\xi }\right]=\underset{\delta \to 0}{\mathrm{lim}}\frac{1}{{\delta }^{2}}\left[\delta {T}_{1}+{{e}}^{-\delta {T}_{1}}-1\right]+\underset{\xi \to 0}{\mathrm{lim}}\frac{1}{{\xi }^{2}}\left[\xi (T-{T}_{1})+1-{{e}}^{{\xi (T-T}_{1})}\right]=\frac{{{T}_{1}}^{2}-{(T-{T}_{1})}^{2}}{2}\) , \({M}^{^{\prime}}={c}_{p}\gamma {T}_{1}\), \({N}^{^{\prime}}=0\).

Case 6: when deterioration does not occur, and hence, there is no need of preservation and demand and stock are constant.

If, \(\phi ,\theta ,\delta ,\xi ,\zeta \to 0\) Then \(TAP={{F}_{0}}^{^{\prime}}{p}^{2}+{{F}_{1}}^{^{\prime}}p+{{F}_{3}}^{^{\prime}}\), \({I}_{max}=\underset{\delta \to 0}{\mathrm{lim}}\frac{(\gamma -\eta p)}{\delta }\left[1-{{e}}^{-{\delta T}_{1}}\right]=(\gamma -\eta ){T}_{1}\), \({{F}_{0}}^{^{\prime}}=0\), \({{F}_{1}}^{^{\prime}}=\frac{\eta T+{N}^{^{\prime}}}{T}\), \({{F}_{3}}^{^{\prime}}=-\frac{{c}_{s}+{c}_{h}{A}^{^{\prime}}+{M}^{^{\prime}}}{T}\), \({A}^{^{\prime}}=\underset{\delta \to 0}{\mathrm{lim}}\frac{(\gamma -\eta )}{\delta }\left[{T}_{1}+\frac{{{e}}^{-\delta {T}_{1}}-1}{\delta }\right] -\underset{\xi \to 0}{\mathrm{lim}}\frac{\eta }{\xi }\left[(T-{T}_{1})+\frac{1-{{e}}^{{\xi (T-T}_{1})}}{\xi }\right]=\underset{\delta \to 0}{\mathrm{lim}}\frac{(\gamma -\eta )}{{\delta }^{2}}\left[\delta {T}_{1}+{{e}}^{-\delta {T}_{1}}-1\right] -\underset{\xi \to 0}{\mathrm{lim}}\frac{\eta }{{\xi }^{2}}\left[\xi (T-{T}_{1})+1-{{e}}^{{\xi (T-T}_{1})}\right]\), \(=\frac{\left(\gamma -\eta \right){{T}_{1}}^{2}+\eta {(T-{T}_{1})}^{2}}{2}\), \({B}^{^{\prime}}=\underset{\delta \to 0}{\mathrm{lim}}\frac{1}{\delta }\left[{T}_{1}+\frac{{{e}}^{-\delta {T}_{1}}-1}{\delta }\right]+\underset{\xi \to 0}{\mathrm{lim}}\frac{1}{\xi }\left[(T-{T}_{1})+\frac{1-{{e}}^{{\xi (T-T}_{1})}}{\xi }\right]=\underset{\delta \to 0}{\mathrm{lim}}\frac{1}{{\delta }^{2}}\left[\delta {T}_{1}+{{e}}^{-\delta {T}_{1}}-1\right]+\underset{\xi \to 0}{\mathrm{lim}}\frac{1}{{\xi }^{2}}\left[\xi (T-{T}_{1})+1-{{e}}^{{\xi (T-T}_{1})}\right]=\frac{{{T}_{1}}^{2}-{(T-{T}_{1})}^{2}}{2}\), \({M}^{^{\prime}}={c}_{p}\gamma {T}_{1}\), \({N}^{^{\prime}}=0\)

That is, \(=\eta p-\{\frac{{c}_{s}}{T}+{c}_{h}\frac{{{\left(\gamma -\eta \right)T}_{1}}^{2}+\eta {\left(T-{T}_{1}\right)}^{2}}{2T}+\frac{{c}_{p}\gamma {T}_{1}}{T}\}\), \({I}_{max}=(\gamma -\eta ){T}_{1}\) and this is the classical EPQ model (the profit maximization sense).

4.3 Formulation of Fuzzy Mathematical Model

In real-life problem, very often it is observed that several cost parameters associated with the problem (19) discussed above are non-randomly uncertain. Thus, we consider selling price and various cost prices as fuzzy parameters. Three types of the fuzzy model may be developed as follows:

-

i)

Unit selling price of the items assumes R-triangular lock fuzzy number.

-

ii)

Only cost prices are assumed to be L-triangular lock fuzzy number.

-

iii)

Selling price of the commodities is assumed to be R-triangular lock fuzzy number, and the cost prices are assumed to be L-triangular lock fuzzy number.

These three models are defined as model-A, model-B and model-C, respectively, and they are describing as follows:

4.4 Model-A

Here, the selling price of the commodities is considered to be the R-triangular lock fuzzy number given \(\tilde{p }\) given by its membership functions

where \({k}_{0}\) is the key.

Other parameters of (19) are assumed to be crisps. Then, right \(\alpha \)-cut of the selling price \(\tilde{p }\) is given by

Then, the fuzzy model is given by

Thus, in terms of \(\alpha \)-cuts our fuzzy problem reduced to equivalent nonlinear problem as

4.5 Model-B

In this second type of problem, we consider all the cost to be the L-triangular lock fuzzy number. The selling price and other parameters in (19) are considered to crisps. The costs are denoted \(\stackrel{\sim }{{c}_{i}}(i=\mathrm{1,2},\mathrm{3,4},5)\), where \(\stackrel{\sim }{{c}_{1}}=\stackrel{\sim }{{c}_{p}}\), \(\stackrel{\sim }{{c}_{2}}=\stackrel{\sim }{{c}_{d}}\), \(\stackrel{\sim }{{c}_{3}}=\stackrel{\sim }{{c}_{h}}\), \(\stackrel{\sim }{{c}_{4}}=\stackrel{\sim }{{c}_{s}}\) and \(\stackrel{\sim }{{c}_{5}}=\stackrel{\sim }{{c}_{pr}}\) and the membership function is given by

The left \(\alpha \)-cut of the costs \(\stackrel{\sim }{{c}_{i}}(i=\mathrm{1,2},\mathrm{3,4},5)\) is given by

where \({k}_{i}(i=1, \mathrm{2,3},\mathrm{4,5})\) are the corresponding keys.

Then, the fuzzy optimization problem will be

Thus, using \(\alpha \)-cuts the fuzzy problem (26) reduces to equivalent nonlinear problem as

4.6 Model-C

In this third type of problem, we consider all the cost to be the L-triangular lock fuzzy number and the selling price to be R-triangular lock fuzzy number and other parameters in (19) are considered to crisps. Then, the fuzzy model will be given by

Then, \(\alpha \)-cuts of the fuzzy functions (28) are given by

Thus, using \(\alpha \)-cuts the fuzzy functions (29) reduces to equivalent nonlinear problem as

4.7 Solution methodology

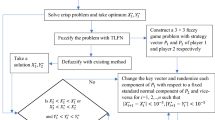

We solve the optimization problem (crisp, general fuzzy and lock fuzzy) using the following algorithm.

4.8 Solution Algorithm

Step-1 Input the values of the parameters corresponding to the crisp problem.

Step-2 Solve the crisp problem and find the total average profit \({TAP}^{*}\) for the crisp problem.

Step-3 Apply the general fuzzy rule considering the following cases:

-

(a)

Only \(p\) to be R- triangular fuzzy number (Model-A)

-

(b)

Only \({c}_{i}\)(\(i=\mathrm{1.2,3},\mathrm{4,5}\)) to be L-Triangular fuzzy number (Model-B)

-

(c)

p to be R- triangular fuzzy number and \({c}_{i}\)(\(i=\mathrm{1.2,3},\mathrm{4,5}\)) to be L-Triangular fuzzy number (Model-C)

Step-4 Find the total average profits \({{TAP}_{fA}}^{*}\), \({{TAP}_{fB}}^{*}\) and \({{TAP}_{fB}}^{*}\) for the Model-A, Model-B and Model-C, respectively.

Step-5 Find \({{TAP}_{f}}^{*}=\mathrm{max}\left\{{{TAP}_{fA}}^{*},{{TAP}_{fB}}^{*} ,{{TAP}_{fC}}^{*}\right\}.\)

Step-6 Check whether \({TAP}^{*}<{{TAP}_{f}}^{*}\). If yes go to Step-7 else go to Step-8.

Step-7 Store \({{TAP}_{opt}}^{*}={{TAP}_{f}}^{*}\). Go to Step-9.

Step-8 Store \({{TAP}_{opt}}^{*}={TAP}^{*}\). Go to Step-15.

Step-9 Apply the lock fuzzy rule considering the following cases:

-

i)

Only \(p\) to be R-triangular lock fuzzy number (Model-A)

-

ii)

Only \({c}_{i}\)(\(i=\mathrm{1.2,3},\mathrm{4,5}\)) to be L-triangular lock fuzzy number (Model-B)

-

iii)

\(p\) to be R- triangular lock fuzzy number and \({c}_{i}\)(\(i=\mathrm{1.2,3},\mathrm{4,5}\)) to be L-triangular lock fuzzy numbers (Model-C)

Step-10 Find the total average profits \({{TAP}_{lA}}^{*}\), \({{TAP}_{lB}}^{*}\) and \({{TAP}_{lC}}^{*}\) for the Model-A, Model-B and Model-C, respectively.

Step-11 Find \({{TAP}_{l}}^{*}=\mathrm{max}\left\{{{TAP}_{lA}}^{*},{{TAP}_{lB}}^{*} ,{{TAP}_{lB}}^{*}\right\}.\)

Step-12 Check whether \({{TAP}_{opt}}^{*}<{{TAP}_{l}}^{*}\). If yes go to Step-13 else go to Step-14.

Step-13 Store \({{TAP}_{opt}}^{*}={{TAP}_{l}}^{*}\). Go to Step-15.

Step-14 Store \({{TAP}_{opt}}^{*}={{TAP}_{opt}}^{*}\). Go to Step-15.

Step-15 End.

The flow chart of the algorithm mentioned above is presented in Fig. 2.

5 Numerical simulation

For numerical illustration, we consider the following values of the input parameters:

-

(1)

For the crisp model, we take \({c}_{h}=3.5\), \({c}_{s}=500\), \({c}_{d}=1.2\), \({c}_{pr}=4.5\), \({c}_{p}=50\), \(p=80\), \(\phi =0.15\), \(\theta =0.85\), \(\gamma =200\), \(\xi =1.8\), \(\zeta =0.001\), \(\eta =50\), \(\delta =0.2\).

-

(2)

For the fuzzy model-A, we take\({c}_{h}=3.5\), \({c}_{s}=500\), \({c}_{d}=1.2\), \({c}_{pr}=4.5\), \({c}_{p}=50\), \({p}_{0}=80\), \(\phi =0.15\), \(\theta =0.85\), \(\gamma =200\), \(\xi =1.8\), \(\zeta =0.001\), \(\eta =50\), \(\delta =0.2,\sigma =0.2\) and the key \({k}_{0}=0.5\) for fuzzy lock values of selling price. Also, taking \({k}_{0}=1\), the model reduces to the corresponding general fuzzy model.

-

(3)

For the fuzzy model-B, we take\({c}_{h0}=3.5\), \({c}_{s0}=500\), \({c}_{d0}=1.2\), \({c}_{pr0}=4.5\), \({c}_{p0}=50\), \(p=80\), \(\phi =0.15\), \(\theta =0.85\), \(\gamma =200\), \(\xi =1.8\), \(\zeta =0.001\), \(\eta =50\), \(\delta =0.2,\sigma =0.2\) and the key vector as\({[{k}_{1}{, k}_{2 }, {k}_{3}, {k}_{4}{,k}_{5}]}^{T}={[0.75, 1, 1.25, 1.5, 1.75]}^{T}\),where \({k}_{i}(i=1, \mathrm{2,3},\mathrm{4,5})\) are the corresponding keys for the fuzzy lock values of production cost, preservation cost, holding cost, set up cost and deterioration cost, respectively. Also, taking \({k}_{1}={k}_{2}={k}_{3}={k}_{4}={k}_{5}=1\) the model is reduced to the corresponding general fuzzy model.

-

(4)

For the fuzzy model-C, we take \({c}_{h0}=3.5\), \({c}_{s0}=500\), \({c}_{d0}=1.2\), \({c}_{pr0}=4.5\), \({c}_{p0}=50\), \({p}_{0}=80\), \(\phi =0.15\), \(\theta =0.85\), \(\gamma =200\), \(\xi =1.8\), \(\zeta =0.001\), \(\eta =50\), \(\delta =0.2,\sigma =0.2\) and the key vector as \({[{k}_{0}{k}_{1}{k}_{2}{k}_{3}{k}_{4}{k}_{5}]}^{T}={[0.5, 0.75, 1, 1.25, 1.5, 1.75]}^{T}\),where \({k}_{i}(i=\mathrm{0,1}, \mathrm{2,3},\mathrm{4,5})\) are the corresponding keys for the fuzzy lock values of selling price, production cost, preservation cost, holding cost, setup cost and deterioration cost, respectively. Also, taking \({k}_{0}={k}_{1}={k}_{2}={k}_{3}={k}_{4}={k}_{5}=1\) the model is reduced to the corresponding general fuzzy model.

The optimum value of the objective function \({TAP}^{*}\) and the values of the decision variables.

\({T}_{1}\), \(T\), \({I}_{max}\) and \(\alpha \) for the above-mentioned models are given in Table 2.

Table 2 gives the optimal results of the proposed model under various scenarios. Throughout the whole table, we see the profit value becomes maximum for the model where all the unit costs as well as unit selling prices are assumed to be lock fuzzy parameters. The range of maximum inventory lies within [105.93, 108.78] units with respect to the production time period zone [1.92, 2.14] months and the cycle time interval [3.015, 3.306] months, respectively. The crisp model is much inferior to all other submodels.

6 Sensitivity analysis

For sensitivity analysis, we consider the model-C with lock fuzzy approach which has given maximum total average profit compared to other models discussed in this study. In Table 3, the changes of the optimal value of total average profit along with the decisions variables with respect to the change (− 30% to + 30%) in value of the key vector for optimal solution are presented.

Table 3 indicates that whenever a positive change up to + 30% is performed the average profit value increases up to + 16.04% and that decreases up to -30%, then the profit value reaches to + 59.79% more with respect to the crisp optimal solution. The values of the other decision variables like maximum inventory, production run time and cycle time get around 105.95 units, 1.92 months and 3.015 months, respectively.

Also, we perform a sensitivity analysis of the same Model- C by considering the individual change of the keys and it is presented in Table 4.

From the sensitivity analysis as shown in Table 4, it is seen that the key vector \({( k}_{0} , {k}_{4} \,and\, {k}_{5} )\) is highly sensitive for the profit function that enhances the range 20.12% to 51.62% exclusively. For the keys\({k}_{1}\;and\; {k}_{3}\), no feasible solution is obtained for the changes + 10% to + 30% alone, and whenever the key \({k}_{2}\) assumes a change − 30% to − 20%, the value of the profit function has also no feasible solution; the other cases give high sensitivity of the profit function explicitly. The values of the other decision variables are kept almost same as per Table 3.

However, we may perform a sensitivity analysis for non- fuzzy parameters which is stated in Table 5.

In Table 5, we see that all the nonfuzzy parameters have restricted feasible zone for which the profit function has no feasible solutions. For the initial demand parameter \(\gamma ,\) no feasible zone is the change + 10%, + 30% and −30%; the parameter \(\xi \) has no feasible zone within the change interval (−30% to + 20%); the parameter \(\zeta \) has no feasibility at + 10% change;\(\eta \) has nonfeasibility in the change range (−30% to −20%); and finally, the parameter \(\delta \) has nonfeasibility at −10% and −30%, respectively. The maximum profit in such cases may be hiked from 0.42% to 89.7%; the maximum inventory enhances from 67.76 to 157.76 units; the production run time assumes values within 1.126–2.876 months, and the cycle time gets the value range 1.904–4.239 months, respectively. The overall study indicates that, in most of the cases, the profit function increases around (20–40) %.

7 Graphical illustrations

In this section, we shall discuss several graphical representations.

In Fig. 3, a comparison on the optimal value of the total average profit for different models under crisp and fuzzy (both general and lock) is presented. Here we see that the crisp model has profit value near $7400; for Model -A, the gap between general fuzzy and the lock fuzzy result covers around $ 1200; for Model B, that gap also reaches to $ 400 approximately; and finally for model-C, it becomes around $ 2000 keeping the highest peak over all the graphs.

Figure 4 shows the change of total average profit with respect to the change (−30% to + 30%) of the key vector with respect to the base values. The lower values of the keys give the higher values of the profit function; around the changes (−10% to + 10%) the profit curve has a sudden fall, but after that the curve gets horizontal for further changes of the keys.

From Fig. 5 and Fig. 6, we see the changes of the total average profit and the maximum inventory level with respect to variation in cycle time, respectively.

In Fig. 5, if we consider the cycle time more than 3.487 months, then the average profit of the model will be always up but within the time span 2.238 to 3.487 months the profit modes around $9500. At 2.069 months of cycle time, the profit decreases to $ 7500 and the time around 2.069 months the profit function gets a ‘V’ shape.

If we see Fig. 6, then we notice that the amount of maximum inventory curve is becoming a monotonic increasing starting from the cycle time 2.069 months with inventory level 70 units on wards. But below that cycle time the inventory level curve gets a decreasing function with bounds (65–80) units exclusively.

Figure 7 expresses a cap like three-dimensional surface representation of the maximum inventory level under the variation in cycle time and the production run time. It is observed that low production run time and high cycle time correspond to the maximum inventory level. But low production run time and low cycle time are associated with low inventory level.

Figure 8 represents a surface like structure of the average inventory profit over the variation in production run time and cycle time. If the production run time assumes value around 2 months and the cycle time assumes value near 3 months, then the average inventory profit becomes minimum. Lower production run time and lower cycle time are also giving the minimum profit, but all other cases always give higher inventory profit alone.

The relational dependency of the maximum inventory level and the total average profit with respect to the cycle time and aspiration level are shown in Fig. 9 and Fig. 10, respectively. Figure 9 gives a spoon-like surface structure; the higher aspiration level (cases of strong fuzzy numbers) and lower cycle time are becoming a part of higher inventory level. A sudden slope has been occurred if the cycle time assumes value within the range 3–4.5 months.

Figure 10 discusses a spoon like surface where the changes of average inventory profit are taken care of with respect to the change of aspiration level and the cycle time. The overall profit due to all strong aspiration level becomes within the range $(13,000–14,000). Taking the cycle time within 1.5–2.5 months, the profit value runs across lower to higher then higher to lower (taking range $7000–11,000) for increasing aspiration levels explicitly.

8 Conclusion

We have studied a deteriorated EPQ model with unit selling price and stock-sensitive demand under the maintenance of preservation technology and fuzzy systems. The novelty of this article is that we have considered a new demand function which is the functions of unit selling price and stock of items and the production rate itself is stock sensitive simultaneously. Then, we extend its basic structures into fuzzy environments. Our findings reveals that the lock fuzzy approach is an intelligent approach with respect to the traditional crisp and fuzzy approaches, respectively, when the unit selling prices and all cost components are assumed to be lock fuzzy numbers. However, the managerial insights are stated as follows:

-

a)

Higher aspiration level and higher cycle time might give more profit and more stock of the model

-

b)

More production run time and low cycle time give more profit and more stock.

-

c)

Lock fuzzy system is the more appropriate approach to follow all the time.

-

d)

Crisp parameters are highly sensitive. So cares should always be taken.

-

e)

General fuzzy system is better but not the best with respect to crisp model.

-

f)

Selling prices and cost prices have to be taken as fuzzy parameters.

Data availability

Not applicable.

References

Baez-Sancheza AD, Morettib AC, Rojas-Medarc MA (2012) On polygonal fuzzy sets and numbers. Fuzzy Sets Syst 209:54–65

Beg I, Ashraf S (2014) Fuzzy relational calculus. Bull Malaysian Math Sci Soc 37:203–237

Bellman RE, Zadeh LA (1970) Decision making in a fuzzy environment. Manag Sci 17:141–164

Bhunia AK, Shaikh AA (2014) A deterministic inventory model for deteriorating items with selling price dependent demand and three-parameter Weibull distributed deterioration. Int J Indus Eng Comput 5:497–510

Bobeylev VN (1985) Cauchy Problem under Fuzzy Control. BUSEFAL 21:117–126

Bobeylev VN (1988) On the reduction of fuzzy number to real. BUSEFAL 35:100–104

Buckley JJ (1988) Generalized and extended fuzzy sets with applications. Fuzzy Sets Syst 25:159–174

Cagman N, Enginoglu S, Citak F (2011) Fuzzy soft theory and its application. Int J Fuzzy Syst 8:137–147

Chutia R, Mahanta S, Baruah HK (2010) An alternative method of finding the membership of a fuzzy number. Int J Latest Trends Comput 1:69–72

De SK (2018) Triangular dense fuzzy lock sets. Soft Comput 22:7243–7254

De SK, Beg I (2016a) Triangular dense fuzzy Neutrosophic sets. Neutrosophic Sets Syst 13:24–37

De SK, Beg I (2016b) Triangular dense fuzzy sets and new defuzzification methods. J Intell Fuzzy Syst 31:469–477

De SK, Sana SS (2015) Multi-criterion multi-attribute decision-making for an EOQ model in a hesitant fuzzy environment. Nat Sci Eng 17:61–68

De SK, Mahata GC (2016) Decision of a fuzzy inventory with fuzzy backorder model under cloudy fuzzy demand rate. Int J Appl Comput Math 126306827

Deli I, Broumi S (2015) Neutrosophic soft matrices and NSM-decision making. J Intell Fuzzy Syst 28:2233–2241

Diamond P (1990) A note on fuzzy star shaped fuzzy sets. Fuzzy Sets Syst 37:193–199

Diamond P (1989) The Structure of Type k Fuzzy Numbers, in the Coming of Age of Fuzzy Logic; Bezdek, J.C., Ed.; WorldScientific Publishing: Seattle, WA, USA, 671–674

Dubois D, Prade H (1978) Operations on fuzzy numbers. Int J Syst Sci 9:613–626

Dye CY (2013) The effect of preservation technology investment on a non-instantaneous deteriorating inventory model. Omega 41(5):872–880

Dye CY, Hsieh TP (2012) An optimal replenishment policy for deteriorating items with effective investment in preservation technology. Eur J Oper Res 218(1):106–112

Ghare PM, Schrader GP (1963) A model for exponentially decaying inventories. J Ind Eng 14:238–243

Harris FW (1915) How many parts to make at once. Fact Mag Manag 10(2):135–136

Hou KL, Lin LC (2006) An EOQ model for deteriorating items with price and stock dependent selling rates under inflation and time value of money. Int J Sys Sci 37(15):1131–1139

Hsieh TP, Dye CY (2013) A production–inventory model incorporating the effect of preservation technology investment when demand is fluctuating with time. J Comput Appl Math 239:25–36

Hsu PH, Wee HM, Teng HM (2010) Preservation technology investment for deterioration inventory. Int J Prod Econ 124(2):388–394

Jaggi CK, Tiwari S, Shafi A (2015) Effect of deterioration on two warehouse inventory model with imperfect quality. Comput Ind Eng 88:378–385

Karmakar S, De SK, Goswami A (2017a) A deteriorating EOQ model for natural idle time and imprecise demand: Hesitant fuzzy approach. Int J Syst Sci Oper Logist 4:297–310

Karmakar S, De SK, Goswami A (2017b) A pollution sensitive dense fuzzy economic production quantity model with cycle time dependent production rate. J Clean Prod 154:139–150

Karmakar S, De SK, Goswami A (2018) A pollution sensitive remanufacturing model with waste items: Triangular dense fuzzy lock set approach. J Clean Prod 187:789–803

Kaufmann A, Gupta MM (1985) Introduction of Fuzzy Arithmetic Theory and Applications. Van Nostrand Reinhold, New York, USA

Kumar RS (2018) Modelling a type-2 fuzzy inventory system considering items with imperfect quality and shortage backlogging. Sadhana 43:163–175

Lee YP, Dye CY (2012) An inventory model for deteriorating items under stock-dependent demand and controllable deterioration rate. Comput Ind Eng 63(2):474–482

Li R, Lan H, Mawhinney JR (2010) A review on deteriorating inventory study. J Serv Sci Manag 3:117–129

Li G, He X, Zhou J, Wu H (2019) Pricing, replenishment and preservation technology investment decisions for non-instantaneous deteriorating items. Omega 84(2019):114–126

Mishra U, Cardenas-Barron LE, Tiwari S, Shaikh AA (2017) An inventory model under price and stock dependent demand for controllable deterioration rate with shortages and preservation technology investment. Ann Oper Res 254(1–2):165–190

Molodtsov D (1999) Soft set theory first result. Comput Math Appl 37:19–31

Pal B, Sana SS, Chaudhuri K (2013) Three stage trade credit policy in a three-layer supply chain–a production-inventory model. Int J Syst Sci 45(9):1844–1868

Pal H, Bardhan S, Giri BC (2018) Optimal replenishment policy for non-instantaneously perishable items with preservation technology and random deterioration start time. Int J Manage Sci Eng Manage 13(3):188–199

Pawlak Z (1982) Rough sets. Int J Inf Comput Sci 11:341–356

Rahaman M, Mondal SP, Shaikh AA, Pramanik P, Roy S, Maity MK, Mondal R, De D (2020) Artificial bee colony optimization-inspired synergetic study of fractional-order economic production quantity model. Soft Comput 24:15341–15359

Rahaman M, Mondal SP, Alam S (2021a) An estimation of effects of memory and learning experience on the EOQ model with price dependent demand. RAIRO-Oper Res 55:2991–3020

Rahaman M, Mondal SP, Alam S, Goswami A (2021b) Synergetic study of inventory management problem in uncertain environment based on memory and learning effects. Sādhanā 46:1–20

Roy AR, Maji PK (2010) A fuzzy soft theoretic approach to decision making problems J. Comput Appl Math 203:412–418

Roychoudhury S, Pedrycz W (2003) An alternative characterization of fuzzy complement functional. Soft Comput Fusion Found Methodol Appl 7:563–565

Shaikh AA, Das SC, Bhunia AK, Panda GC, Khan MAA (2019a) A two-warehouse EOQ model with interval-valued inventory cost and advance payment for deteriorating item under particle swarm optimization. Soft Comput 23(24):13531–13546

Shaikh AA, Panda GC, Sahu S, Das AK (2019b) Economic order quantity model for deteriorating item with preservation technology in time dependent demand with partial backlogging and trade credit. Int J Logistics Syst Manage 32(1):1–24

Tan Y, Weng MX (2013) A discrete in time deteriorating inventory model with time varying demand, variable deterioration rate and waiting time dependent partial backlogging. Int J Social Sci 44:1483–1493

Teng JT, Chang T (2005) Economic production quantity model for deteriorating items with price and stock dependent demand. Comput Oper Res 32(2):297–308

Torra V (2010) Hesitant fuzzy sets. Int J Intell Syst 25:529–539

Yang HL (2012) Two Warehouse partial backlogging inventory models Weibull distribution deterioration under inflation. Int J Prod Econ 138(1):107–116

Yang CT, Dye CY, Ding JF (2015) Optimal dynamic trade credit and preservation technology allocation for a deteriorating inventory model. Comput Ind Eng 87:356–369

Zadeh LA (1965) Fuzzy sets. Inf. Control 8:338–356

Zhang J, Bai Z, Tang W (2014) Optimal pricing policy for deteriorating items with preservation technology investment. J Indus Manage Optimiz 10(4):1261–1277

Zhang J, Wei Q, Zhang Q, Tang W (2016) Pricing, service and preservation technology investments policy for deteriorating items under common resource constraints. Comput Ind Eng 95:1–9

Funding

No funding was provided for the completion of this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Rahaman, M., Mondal, S.P., Alam, S. et al. A study of a lock fuzzy EPQ model with deterioration and stock and unit selling price-dependent demand using preservation technology. Soft Comput 26, 2721–2740 (2022). https://doi.org/10.1007/s00500-021-06598-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-021-06598-0